This Week, The Unemployment Rate Number Is Down To 9.7% on 20,000 Additional Jobs Lost. They Are Just Numbers Unless You Understand How They Were Generated And What They Do And Don't Mean...

Saturday, February 6, 2010, 04:59 PM

Our activity as investors is not to try to identify tops and bottoms - it is to constantly align our exposure to risk in proportion to the return that we can expect from that risk, given prevailing evidence.

-- John Hussman

All bonds and GIC in the 401a. Make no mistake, I'm being defensive yet again

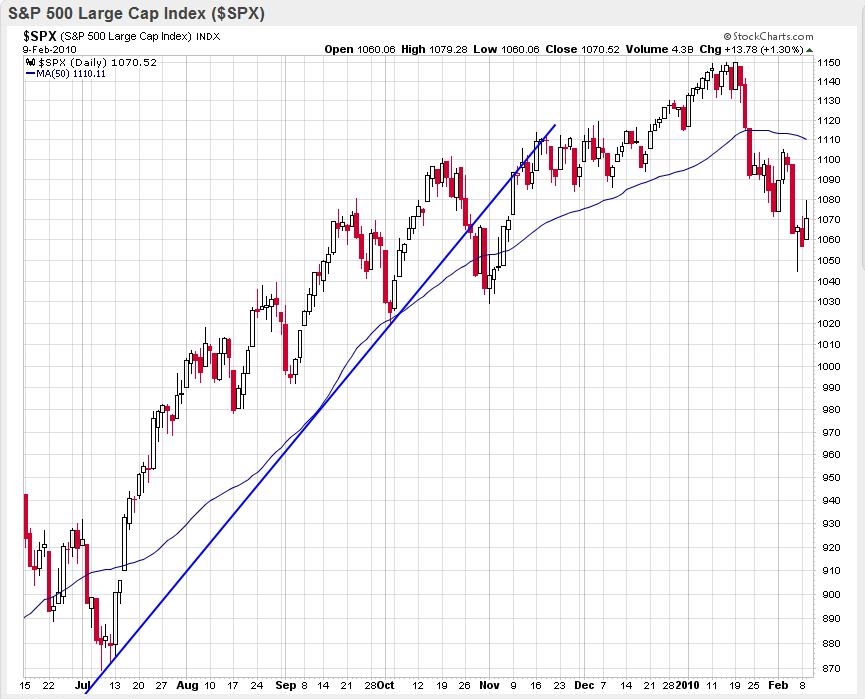

Is this the establishment of a downtrend or a quick shakeout like June of last year? Will I see 1025 before I see 1100, or will the market reverse on the way to new 12 month highs? I dunno. But I judge the risk of missing out on a possible spike up that is too fast to climb aboard to be less than the risk losing money riding a possible downtrend into losses.....

It's about asset allocation and risk management.

http://www.bloomberg.com/apps/news?pid= ... amp;pos=14

http://www.msnbc.msn.com/id/35284034/ns ... d_economy/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.msnbc.msn.com/id/35254011/ns ... d_economy/

Good Day. Does it mark the end of the down trend? Or is it a oversold bounce? Coupla more days will tell the tale....

Still all cash and bonds in the 401a...

More later

Comments are not available for this entry.

Calendar

Calendar