There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term. James "Rev Shark" DePorre

Rick: Your cash is good at the bar.

Banker: What? Do you know who I am?

Rick: I do. You're lucky the bar's open to you.

--Casablanca

UPDATE; 5/22. I CUT MY EQUITY EXPOSURE IN HALF!!! WAS IT WAS A BEAR MARKET BOUNCE AND NOW IT'S OVER? WE'LL SEE...

Chartz and Table Zup!

I'm lookin' at buyin' my first $100 tank of gas.

I'm lookin' at a coupla dollars change left from a $20 bill to fill up the bike.

I'm readin' about the upcoming pass through of food costs to the consumer.

I'm reading that Afghan poppy farmers are starting to switch crops. Wheat is commanding a price where growing the feedstock for smack, a long and successful local tradition, is losing it's risk/reward mojo.

CLICKIT

I'm readin' about the inability of the US Gov to subsidize corn farmers into meeting ethanol production in the upcoming years, no matter how much of my money is spent or borrowed against. Corn into fuel is expected to reach 46% of the US crop in 2015. Which is stoopid. Currently it takes between 3 and 8 pounds of corn to produce a lb of meat animal. What will the subsidy have to be when food costs world wide explode with the emerging of a number of developed markets whose society and eating preferences mirrors the US? See the Afghan farmers above... Currently a barrel of ethanol from corn is $80. A barrel of ethanol from sugarcane is $35. The sugarcane lobby is a lot weaker than the corn lobby. If it wasn't, we'd be growing/importing sugarcane. Any doubt which way US energy production is driving food costs and why it smacks of gasoline on the fire of food cost inflation?

Hey, did you know that natural gas and energy are the main feedstocks of fertilizer? So that adding new arable lands from less preferable farmland to replace the good stuff lost to subdivisions built with subprime....nah, not goin' there... costs bigtime in energy and takes years to get up to speed productionwise depending on how much fast costs? Get used to oil/gas/energy and food costs running in parallel for the foreseeable future. Also for productivity to fail to match historical norms. The Sacramento delta farm land is becoming Stockton and ain't comin' back. Think food cost inflation.

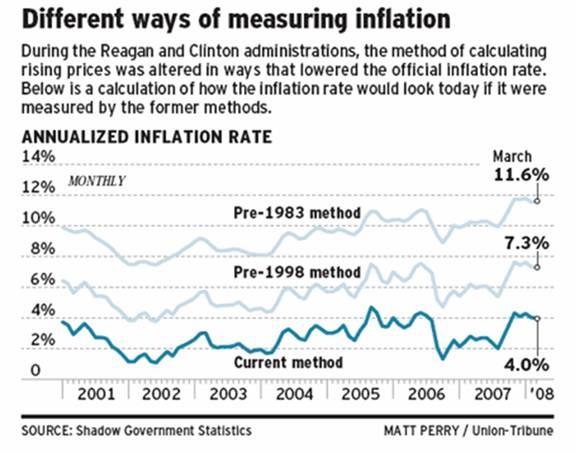

CLICKIT

Maybe this explains why I'm not taking my pension early and locking in a large portion of my future income to a fixed amount for an extended period of time.

CLICKIT

I can't hardly contain my concern. Maybe being informed is the problem. Maybe if I just trust that other people know better and they will do what is best for me. Ya think?

Early retirement does beckon though. If I could predict the future, I'd be a lot more confident about how early is too early. Ya see, I expect to eat, stay warm and cool and drive too. The risks of running out of pension early may be huge.

Thanks to John Mauldin and Barry Ritholtz, who like the white rabbit used to do, "feed my head."

COFG

Calendar

Calendar