| |

I Do NOT Like What I See Inna Charts.... Been Lookin' At Some Bond Charts. Prolly Cover It At Some Point Below.....

Friday, July 5, 2013, 12:02 PM

It makes me cringe to have 'experts' tell us not to fear the Fed. You don't fear the Fed but you do fear a market that fears the Fed. If the rest of the world is selling because they are afraid, justified or not, you respect the price action and move out of the way.

-- James “Reverend Shark” DePorre

I bought both DVDs.

Clapton said that Freddie was the most challenging to play live with. "He'd tear you up."

http://www.youtube.com/watch?v=mTU6cffChsU

Clapton told JJ Cale that he loved his song, "Cocaine." Cale laughed and said, "You should! It's your song!"

http://www.youtube.com/watch?v=DVl-oXi-TpY

Think "Sunshine Of Your Love".

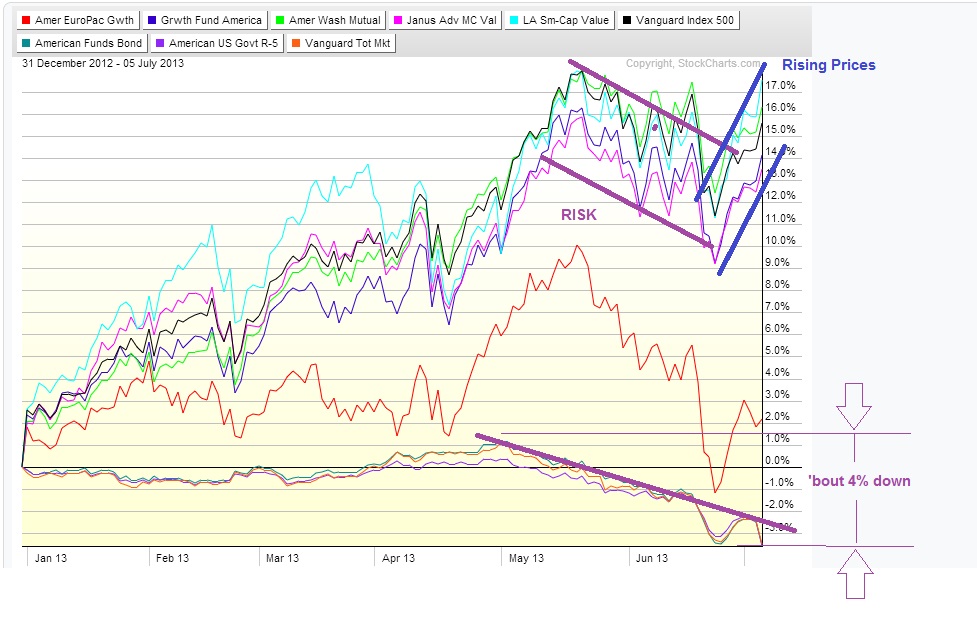

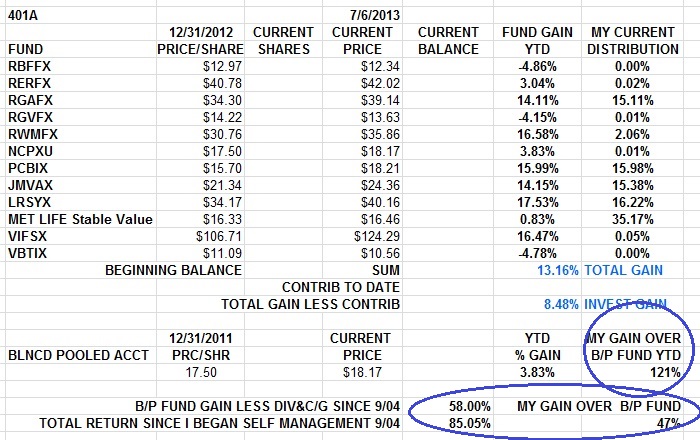

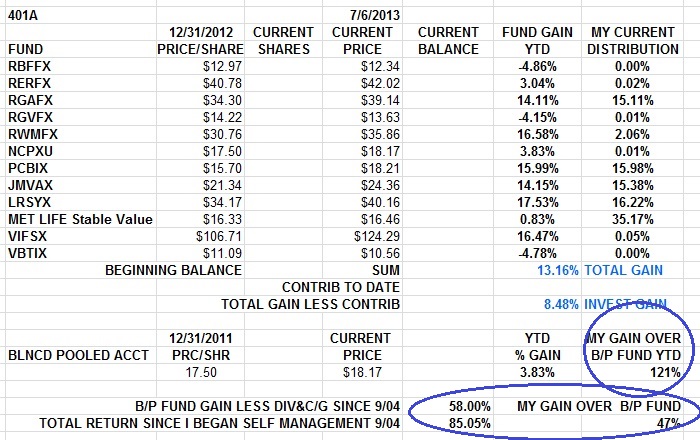

A month or two ago I reduced stock exposure into risk. I reduced bond exposure into risk about 6 weeks ago. I've been re-establishing stock exposure into rising prices. Some of this I got pretty extreme about. It Appears To Be Working. Real Well. I Like The Numbers.

So Far, So Good....

http://www.nytimes.com/2013/07/05/opini ... e&_r=0

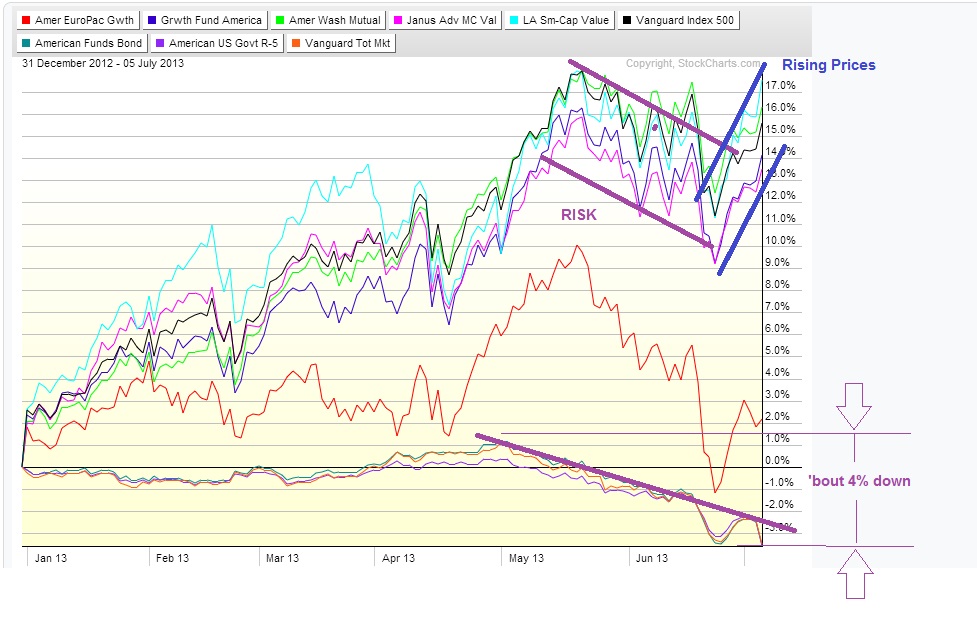

Here's The Chart Alluded To Inna Title...

This is a 10 year Treasury Note chart. Yields (pay out) have been dropping for the whole duration of the chart. If, in late '94, you'd bought a new 10 Year Note, you'd have gotton a yield of say, 80. By late 2002, the new 10 year yields were down to around 40. Your old note's US government rate was twice the yield of the new notes. That meant that not only was it throwing off interest payments at a fabulous rate, if you had to sell it, it yielded as highly as very risky bonds... with none of the risk. Much higher interest rate than the equivalent 2 year note, which is what ya got left onna original 10 year note.

Now it looks like the run is starting to unwind. Every bond you hold in yer bond fund will prolly yield less or equal to one you can buy next month or next year. Want ta get out of the bonds you hold, like to get into something else that's doin' better or pay the groceries? That means dropping the price you get to where it looks like a value to somebody who will get a better deal the longer they wait. Lookit the first chart.

The best way to invest in bonds is the buy them outright. Which I did inna 80's. I bought bonds paying 12% double tax free. Every year bond interest paid by new bonds dropped and while my bonds became worth less because they got one year closer to being called, they became worth more because they paid better than newer bonds. Pretty cool. I held them until they were called and got all the interest and more than my money back. (I bought them at a discount). When you invest in a bond fund, you go in with all the other investors. If they bail wholesale,the fund sells inventory into a falling market and you lose despite holding firm.

That's why I'm inna stable value. For now... 'Course I'm just an old broke down pipefitter and this is just only what I'm doin' wit my own money. Someone smart 'll tell ya something else. YMMV.

http://www.debka.com/article/23101/Obam ... otherhood-

The pain trade...

http://www.businessinsider.com/treasuri ... ade-2013-7

http://noahpinionblog.blogspot.com.au/2 ... -what.html

http://www.bloomberg.com/news/2013-07-0 ... actor.html

http://www.businessinsider.com/its-up-t ... omy-2013-7

http://www.thereformedbroker.com/2013/0 ... g-volumes/

http://www.businessinsider.com/rosenber ... ger-2013-7

http://www.bloomberg.com/news/2013-07-1 ... sales.html

http://www.bloomberg.com/news/2013-07-1 ... sales.html

http://pragcap.com/so-this-is-happening ... ate-market

Another "V" shaped recovery. Bounce off the 50 day ma, chatter along it, power dive through it, flush out the cautious and profit takers, drop through another level of resistance, close below it for almost a week, suck in the bears, AND TURN AROUND AND GO ALMOST UP FOR 11 DAYS OUT OF TWELVE. Then to add insult to injury, gap open a buncha days and hold that level all day, so that all the gains come overnight, so they tell you nothing about the health of the market.

The best way to make money in this market is to be insanely aggressive, mostly oblivious of risk, too unsophisticated to realize that markets devour the unsophisticated, and too lazy to take profits on the way up. Sometimes, fate and the markets play into my strengths.

Stay Tooned

Comments

Comments are not available for this entry.

|

|

Calendar

Calendar