"This has been a great year for preventive worrying. Seldom in recent history have so many people worried about so many things that haven't happened."

-- James Reston

Charts and tables up; I'm not done.... Like last week, stuff will/may appear now and then over the next one to seven days.....Why? Onna 'counta 'cuz, that's why!!

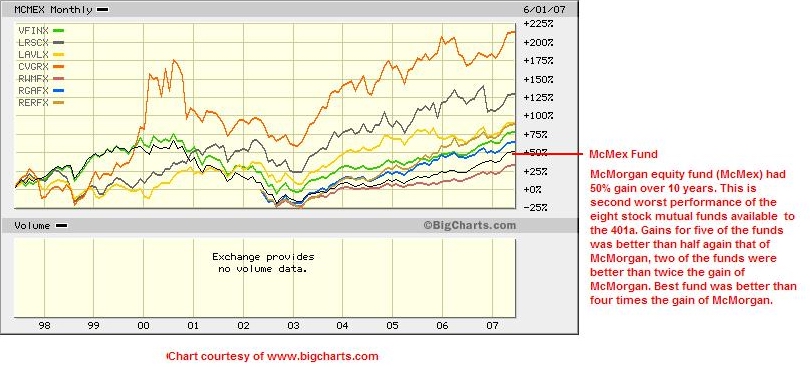

Here's a chart showing the 10 year performance of the 401a mutual funds that became available to us in late 2004. Also shown is the performance of the McMorgan equity fund for that same period. If we had diversified from the one McMorgan Fund in 1997 to the current basket of funds in the 401a, would it have been a responsible and prudent thing for the Trustees to have done? It would have required initiative and some additional work on the part of the Trustees. Would it have benefited the members of the Local? Could or should your 401a fund REALLY have somewhere between half again or twice as much money in it? Would the dollar amount, if any, have justified the trustees doing the homework? Since McMorgan also managed the defined benefit pension as well as the 401a, would the charts for your "real" pension look better or worse than the 401a charts? Did the Trustees leave a substantial amount of money on the table through inexperience, naivete, or complacency? Answering that would require some more homework and just lead to even more questions. Click onna chart...

Chart courtesy of BIGCHARTS.COM

This market's a real head case and it will make you a head case. Nothing has changed since I went cautious in the 401a in March. If anything, things have gotten even toppier. We've gone beyond the need for a correction. It now appears that we are in overdrive. I'm thinking that we now are looking more like a blowoff top instead of a correction.; Things could get crazy, stock prices could spike up, the last of the bears becoming rugs (we're there now), Time magazine could have the "New Age Of Permanent High Stock Prices" on the cover, everyone in China might quit their job to trade stocks, all the real estate salesmen in CA and Az and FL might become daytraders, the ten year bond might go to 8% and everybody'll be reassuring everyone else that "It's different this time, now it doesn't matter. THEN it'll prolly end and end badly. It always does. Like you could have a kickass party without having an unholy mess to clean up after...

http://articles.moneycentral.msn.com/In ... Hurts.aspx

But there is opportunity risk along with market risk all the way to the peak. And ya can't pretend it doesn't exist. Look at the chart up above. That's what happens when you are oblivious to opportunity risk. You give up the upside and keep the downside. I've had that happen to my pension and I'm NOT happy with the results; You don't make much, but you can still lose a lot. So....

I'm all in again. Check out the worksheet page on joefacer.com. I'm back up over the B/P Fund for the year. I've crossed over the 50% gains mark since the new funds became available for the first time. I'm hoping to see up 100% over the Balanced Pooled fund again. I'm still long the ROW (Rest Of the World) play. The great overseas earnings are what's keeping the US market strong. There's serious growth in housing ,cars, energy, tech, commodities and consumer goods. Just not here. But ya can't have Americans selling over there and not do some good right here. So I'm in domestic stuff too. A lot of the time the hardest play to make is the best one. and having it all hangin'out is hard... It's all about the future, only some of it is about the here and now. It's also all about the different little cycles that are ongoing and the big ones too. So I'm long on fear and trepidation 'cuz ya gotta make the money when the cycles are working, when you can, not when you would be more comfortable or when you have to. I'm just bearly a reluctant bull, and that makes me squirrely. I keep selling outa well-founded fear and that costs me money each time I do it. But I'm limber and practiced at selling 'cuz one of these times, it'll be the right move...

If you're smart and lucky and hard working, the markets can treat your 401a well. If you are not, you depend on the Trustees to do the right thing. Everyone has his own place somewhere between total self reliance and letting others do the job for them. I''ve found my comfort spot in that regard. Ya only get one chance to make it right. Time is NOT very respectful of regrets. It hasn't run backwards yet and it won't if ya run short during your retirement.

Speaking of regrets, Supposedly one of the trustee's was stuck on McMorgan because the costs were low. I think I've identified somewhere around $100,000 a year in fees for which the participants in the plan receive nothing, according to the last Trustee's report I saw. That's worthy of some homework since it appears that this amount doubles as of 4/30/07. I'm going to be reviewing some Plan records soon and I'll let you know what I find...

-- James Reston

Charts and tables up; I'm not done.... Like last week, stuff will/may appear now and then over the next one to seven days.....Why? Onna 'counta 'cuz, that's why!!

Here's a chart showing the 10 year performance of the 401a mutual funds that became available to us in late 2004. Also shown is the performance of the McMorgan equity fund for that same period. If we had diversified from the one McMorgan Fund in 1997 to the current basket of funds in the 401a, would it have been a responsible and prudent thing for the Trustees to have done? It would have required initiative and some additional work on the part of the Trustees. Would it have benefited the members of the Local? Could or should your 401a fund REALLY have somewhere between half again or twice as much money in it? Would the dollar amount, if any, have justified the trustees doing the homework? Since McMorgan also managed the defined benefit pension as well as the 401a, would the charts for your "real" pension look better or worse than the 401a charts? Did the Trustees leave a substantial amount of money on the table through inexperience, naivete, or complacency? Answering that would require some more homework and just lead to even more questions. Click onna chart...

Chart courtesy of BIGCHARTS.COM

This market's a real head case and it will make you a head case. Nothing has changed since I went cautious in the 401a in March. If anything, things have gotten even toppier. We've gone beyond the need for a correction. It now appears that we are in overdrive. I'm thinking that we now are looking more like a blowoff top instead of a correction.; Things could get crazy, stock prices could spike up, the last of the bears becoming rugs (we're there now), Time magazine could have the "New Age Of Permanent High Stock Prices" on the cover, everyone in China might quit their job to trade stocks, all the real estate salesmen in CA and Az and FL might become daytraders, the ten year bond might go to 8% and everybody'll be reassuring everyone else that "It's different this time, now it doesn't matter. THEN it'll prolly end and end badly. It always does. Like you could have a kickass party without having an unholy mess to clean up after...

http://articles.moneycentral.msn.com/In ... Hurts.aspx

But there is opportunity risk along with market risk all the way to the peak. And ya can't pretend it doesn't exist. Look at the chart up above. That's what happens when you are oblivious to opportunity risk. You give up the upside and keep the downside. I've had that happen to my pension and I'm NOT happy with the results; You don't make much, but you can still lose a lot. So....

I'm all in again. Check out the worksheet page on joefacer.com. I'm back up over the B/P Fund for the year. I've crossed over the 50% gains mark since the new funds became available for the first time. I'm hoping to see up 100% over the Balanced Pooled fund again. I'm still long the ROW (Rest Of the World) play. The great overseas earnings are what's keeping the US market strong. There's serious growth in housing ,cars, energy, tech, commodities and consumer goods. Just not here. But ya can't have Americans selling over there and not do some good right here. So I'm in domestic stuff too. A lot of the time the hardest play to make is the best one. and having it all hangin'out is hard... It's all about the future, only some of it is about the here and now. It's also all about the different little cycles that are ongoing and the big ones too. So I'm long on fear and trepidation 'cuz ya gotta make the money when the cycles are working, when you can, not when you would be more comfortable or when you have to. I'm just bearly a reluctant bull, and that makes me squirrely. I keep selling outa well-founded fear and that costs me money each time I do it. But I'm limber and practiced at selling 'cuz one of these times, it'll be the right move...

If you're smart and lucky and hard working, the markets can treat your 401a well. If you are not, you depend on the Trustees to do the right thing. Everyone has his own place somewhere between total self reliance and letting others do the job for them. I''ve found my comfort spot in that regard. Ya only get one chance to make it right. Time is NOT very respectful of regrets. It hasn't run backwards yet and it won't if ya run short during your retirement.

Speaking of regrets, Supposedly one of the trustee's was stuck on McMorgan because the costs were low. I think I've identified somewhere around $100,000 a year in fees for which the participants in the plan receive nothing, according to the last Trustee's report I saw. That's worthy of some homework since it appears that this amount doubles as of 4/30/07. I'm going to be reviewing some Plan records soon and I'll let you know what I find...

Calendar

Calendar