Never a Dull Moment. Life Is a Never Ending Series Of Thrills Interrupted Only By Moment Of Ecstasy and Bliss.

"No emergency can justify a return to inflation. Inflation can provide neither the weapons a nation needs to defend its independence nor the capital goods required for any project. It does not cure unsatisfactory conditions. It merely helps the rulers whose policies brought about the catastrophe to exculpate themselves."

-Ludwig von Mises

CHARTZ AND TABLE ZUP

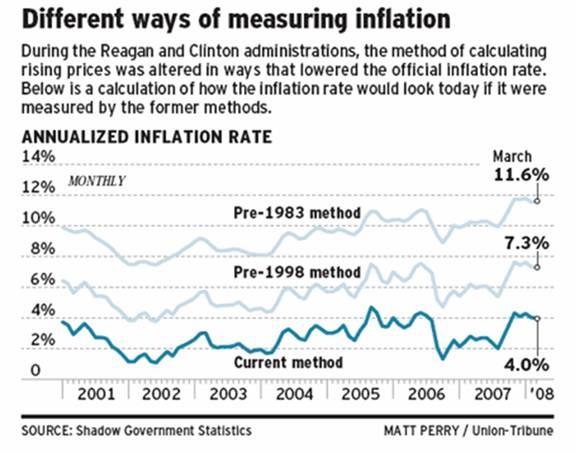

Our government is less than forthcoming (read "lies")about inflation. To whose advantage do you think the modified statistical measures work out?

Checkitout!

http://bigpicture.typepad.com/comments/ ... res-o.html

You know how it goes; Chartz and Table Zup Fri evening or Saturday morning and more here as time an' inclination permit. Long weekend this time around. Ahl prolly take advantage o' it. Know what Ah mean, Vern? Stay tooned....See ya here at the end o' the Memorial Day Holiday. Which is MOST DEFINITELY NOT about the shopping experience many would like it to be.

So I'm here and the weekend is over.

Log on to the K&G 401a website.

Under "My Account" click on "Investment Funds"

Click on "Met Life Stable Value"

Check out that the "Stable Value" (cash equivalent) fund is actually some equities but mostly bonds and not strictly the highest quality bonds either.

Just so you know. As stated and related below, this ain't my first dance and I've seen Chaos and Cratered Financial Markets before.

When I "went to cash" on my personal investments in the 80's when things also got gnarly, I went to a Franklin Federal Money Market Fund. The fund held only US Gov securities with an average maturity of less than a week. It held interest paying securities of an entity that had a standing army and the right to tax. THAT was secure.

I've currently "gone to cash" for 75% of my 401a in the Met Life Fund. The Met Lfe Fund is secure because they say it is.

They "guarantee" (read promise) to pay principal and interest even if they have no money.

I'm down wid' dat onna 'counta the Fed. The Fed has said that regardless of the idiocy and self dealing of any and all financial entities, if your big enough, YOU WILL NOT FAIL. Regardless of how much money they have to print or what the inflation rate is. They say that the public will make it good. That's good enuf fer me. So why am I so heavy in cash?

We've entered a new phase.

Previously;

The cratering of financial markets and real estate pretty much left all other areas of the economy unaffected.

Now;

The cratered financial sector and the cratered dollar and food and oil inflation is affecting the economy. The stock and bond market participants have just figured it out. I'm pretty much set up for the end of a bear market bounce and I may go farther "to cash". I'm thinking "Get Defensive".

And this ain't no time for "The best defense is a good offense.

Of course, I may be wrong. I'll figure that out pretty quickly once it becomes apparent. Until then...

Calendar

Calendar