Chaos And Entropy Abound. Planned Events Go Awry and Random Events Effect Change Far Beyond Rational Expectation: Finally!!!! Something I Can Work With......

One of the most difficult investing skills to master is being persistent and confident while not crossing the line to being stubborn and obstinate. It is a very fine line and you will never get it quite right now matter how hard you try.

Reverend Shark

Chartz and Table Zup @ www.joefacer.com

Stay Tooned....

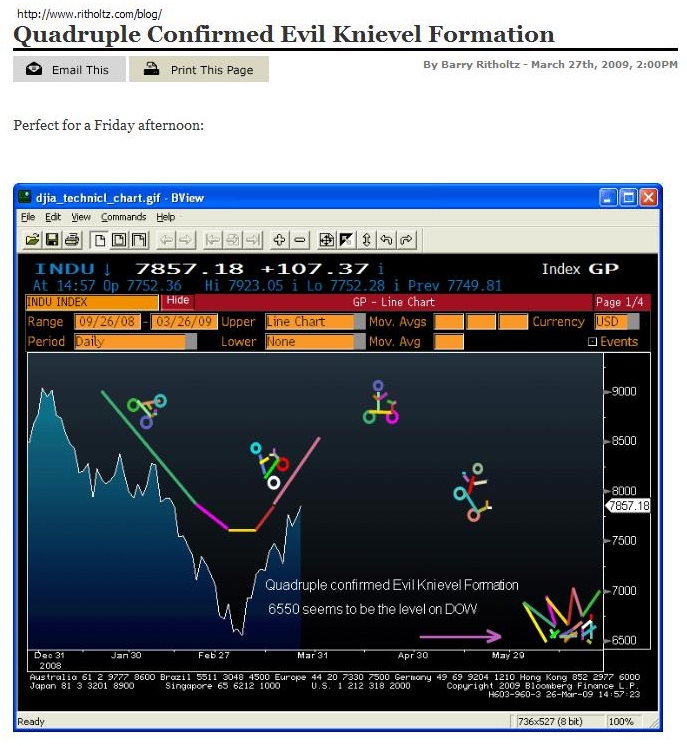

Here's A Good Chart... A Variation Onna Double Top or Rounded Bottom....

Livin' Inna USA.... Somebody Get Me A CHEEZEBurger!!!!!

http://www.ritholtz.com/blog/2009/03/pp ... more-22802

http://www.ritholtz.com/blog/2009/03/kr ... itization/

http://www.ritholtz.com/blog/2009/03/wh ... ith-bonds/

http://www.rollingstone.com/politics/st ... g_takeover

http://www.ritholtz.com/blog/2009/03/ne ... uary-2009/

http://www.ritholtz.com/blog/2009/03/bu ... out-money/

http://www.ritholtz.com/blog/2009/03/in ... d-housing/

http://www.ritholtz.com/blog/2009/03/ho ... tion-work/

http://www.ritholtz.com/blog/2009/03/in ... d-housing/

http://www.ritholtz.com/blog/2009/03/gr ... s-amnesia/

http://www.bloomberg.com/apps/news?pid= ... refer=home

SUNDAY

More to come; But for now suffice it to say that investment risk is markedly less than in the recent past. Things have ALREADY gone to hell. We're half way to zero. We've seen a bottom and I reallocated 50% back to stocks. Check it out below in previous week's posts....

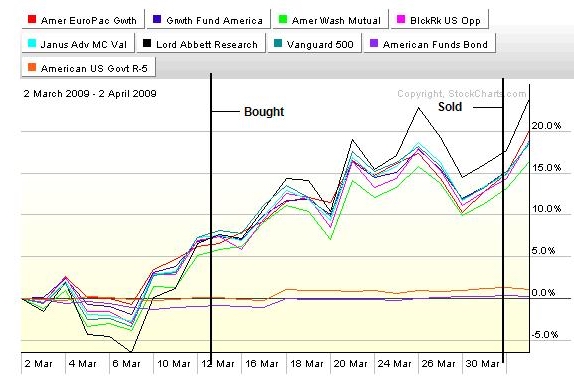

But then on Friday, I pretty much cut my exposure to stocks by 50% to 25% and put my money where I had been very wary of doing so, in MET Life. Here's what it looks like...

We've seen A bottom, but maybe not THE bottom. Earnings will be terrible. The economy is still going down... not as fast as it was, but down is still the direction. There is a bunch of mortgages being applied for.... but they are refi's. The stock of new houses and repos is still huge. The FED is pushing on a string. There are still jobs to be lost. Stimulus dollars to the state are being spent on subsidies to promote social issues and to paper over budget issues; job creation are still hanging fire. The Bad News on GM and Chrysler is gonna hit tomorrow (Monday) and it may not suit Wall St. (or me) This minute I'm more interested in keeping what I made than losing out on further gains. CHECK IT OUT.

The red line is what I've missed by being in cash and the green line is what I've made by being in stocks. CLICKIT!!!! There will be a time and place when I'm looking for more exposure to stocks. Here and now ain't it. I'm still concerned about MET LiFE's safety. But by now I'm willing to bet that the tax payers will back them up.... Stay tooned.....

Oh, yeah....There's two couples that I've been talkin' to that need to pull the trigger on the refi's. You know who you are!!!!!

MONDAY

AMAZING!!!!

I had no idea we could afford to do this....

http://money.cnn.com/news/specials/stor ... index.html

WEDNESDAY

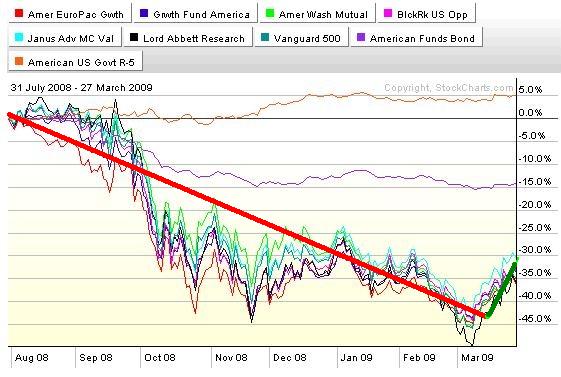

Lookie Where We Came From....

I reallocated further toward a larger cash/smaller stock position today. The trend is still down, the economy is deteriorating more slowly but still deteriorating, the news is still equivocal, there are corporate and employment issues, and although we are getting closer to a bottom and a recovery..... there still is a substantial risk of revisiting recent lows. I've managed to avoid losing a huge percentage of the 401a. I'm gonna go with what has been working.

See how long and far we went down? I don't think we are going back up so fast that I won't be able to reallocate back to stocks in time to make a dollar.

THURSDAY

Look at the chart above. Smokin' upside move in a month. Now look at the same run up onna chart above that. Not so smokin'... What's wid dat? People are giddy over the move. "End of the Bear" an stuff... Or maybe not. Maybe things are still bad and getting worse and this was a bear market bounce. Too much of the move is non-rational in terms of the economy. More unemployment, more retrenching for the consumer, fewer bucks spent, more saved, less produced, less transparency with the relaxing of mark to market, the stimulus money not yet out to the public, and other stuff yet to come.

"Buy the dips and sell the rips"

Easier said than done. That was a BF dip we had goin' for the last year. Buyin' the "dip" too soon woulda ripped your face off and sellin' the "rip" after the long way down woulda left you still buried in a shallow grave.

Easier to buy the start of the rip and lock in some profits while you still have them or cut the losses quick if you were wrong about it beein' a rip.

Should I have held on? Dunno. We'll see. So many stocks up 10%-30% on no good economic news or objective improvement in business conditions. Not that it doesn't make me uneasy to be out of the market. Just not all THAT unesy.

So I'm out for now.

Stay tooned...

More to come; But for now suffice it to say that investment risk is markedly less than in the recent past. Things have ALREADY gone to hell. We're half way to zero. We've seen a bottom and I reallocated 50% back to stocks. Check it out below in previous week's posts....

But then on Friday, I pretty much cut my exposure to stocks by 50% to 25% and put my money where I had been very wary of doing so, in MET Life. Here's what it looks like...

We've seen A bottom, but maybe not THE bottom. Earnings will be terrible. The economy is still going down... not as fast as it was, but down is still the direction. There is a bunch of mortgages being applied for.... but they are refi's. The stock of new houses and repos is still huge. The FED is pushing on a string. There are still jobs to be lost. Stimulus dollars to the state are being spent on subsidies to promote social issues and to paper over budget issues; job creation are still hanging fire. The Bad News on GM and Chrysler is gonna hit tomorrow (Monday) and it may not suit Wall St. (or me) This minute I'm more interested in keeping what I made than losing out on further gains. CHECK IT OUT.

The red line is what I've missed by being in cash and the green line is what I've made by being in stocks. CLICKIT!!!! There will be a time and place when I'm looking for more exposure to stocks. Here and now ain't it. I'm still concerned about MET LiFE's safety. But by now I'm willing to bet that the tax payers will back them up.... Stay tooned.....

Oh, yeah....There's two couples that I've been talkin' to that need to pull the trigger on the refi's. You know who you are!!!!!

MONDAY

AMAZING!!!!

I had no idea we could afford to do this....

http://money.cnn.com/news/specials/stor ... index.html

WEDNESDAY

Lookie Where We Came From....

I reallocated further toward a larger cash/smaller stock position today. The trend is still down, the economy is deteriorating more slowly but still deteriorating, the news is still equivocal, there are corporate and employment issues, and although we are getting closer to a bottom and a recovery..... there still is a substantial risk of revisiting recent lows. I've managed to avoid losing a huge percentage of the 401a. I'm gonna go with what has been working.

See how long and far we went down? I don't think we are going back up so fast that I won't be able to reallocate back to stocks in time to make a dollar.

THURSDAY

Look at the chart above. Smokin' upside move in a month. Now look at the same run up onna chart above that. Not so smokin'... What's wid dat? People are giddy over the move. "End of the Bear" an stuff... Or maybe not. Maybe things are still bad and getting worse and this was a bear market bounce. Too much of the move is non-rational in terms of the economy. More unemployment, more retrenching for the consumer, fewer bucks spent, more saved, less produced, less transparency with the relaxing of mark to market, the stimulus money not yet out to the public, and other stuff yet to come.

"Buy the dips and sell the rips"

Easier said than done. That was a BF dip we had goin' for the last year. Buyin' the "dip" too soon woulda ripped your face off and sellin' the "rip" after the long way down woulda left you still buried in a shallow grave.

Easier to buy the start of the rip and lock in some profits while you still have them or cut the losses quick if you were wrong about it beein' a rip.

Should I have held on? Dunno. We'll see. So many stocks up 10%-30% on no good economic news or objective improvement in business conditions. Not that it doesn't make me uneasy to be out of the market. Just not all THAT unesy.

So I'm out for now.

Stay tooned...

Calendar

Calendar