| |

Update(s) for this week...

Monday, July 2, 2007, 09:10 PM

Like so many things in the market, you can embrace the holiday trading phenomena and try to make some money, or try to fight it and hope you don't suffer too much pain while waiting for folks to come to their senses once again.

Rev Shark

It's about reflexivity and being reactionary. There are so many reasons for stocks to mark time or to fall. There are so many reasons to get conservative especially after the big first half, when the many factors that should have sent the market down didn't. There's a lot to fear, especially since what we expected to happen, didn't....yet. BUT

There is what the market does rather than what it should do. Ya gotta watch that if you expect to make some money. I've not got a lot of confidence in the market going up. But the charts don't look bad, liquidity continues to look good and you gotta ask what's the hardest trade? It's to go with what got ya here, to see that for all there is to worry about, not much REALLY bad has happened and to stay long.

And Monday turns out to have been an up day worth 2.4% for my trading account and 1% in the 401a.

[ view entry ] ( 1096 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1477 ) ( 2.9 / 1477 )

A change in the character of the market....Or not. But probably.....

Saturday, June 30, 2007, 12:28 PM

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight. Reverend Shark Charts and tables up. If you read the entrys below, you have a laundry list of things that I am concerned about. Regardless, the first half of the year, dispite my misgivings, has been smokin'. I went to cash on the 401a in Feb and that was a mistake. It's one I can afford, because THE VERY MOST IMPORTANT THING IN THE WHOLE WIDE WORLD, IS TO KEEP YOUR SAVINGS AND INVESTMENT INTACT. THOU SHALT NOT PISS AWAY YOUR SAVINGS AND INVESTMENT GAINS!! I've had some great gains since we reworked the 401a investment choices in 9/2004 and standing still when I think the risks are large does not hurt at all....as long as I don't leave too much on the table out of a failure to recognize what's in front of me. By mid/late March, my mistake was obvious to me and I got back in. It helps that I am working hard to repair the damage done to my IRA's as well as to my 401a. I'm not as restricted in the IRA's as the 401a and I have no restrictions on my trading account so I get a much better sense of the investment markets since I spend a fair amount of time on it. So I have a definite opinion about my going to cash in Feb. I was either wrong or early..... and I don't now which... So check this out;  I suspect I was early.... Or I may have been wrong. But if we're on our way to hell in a handbasket, it won't happen over night. So, as per the Shark up above, I gotta plan on what to do if only good things happen ever after, and I got a plan if it all turns to shit. I've just got to keep my eyes open and recognize what is going on in front of me. Check this out... it doesn't hurt to be informed. http://bigpicture.typepad.com/comments/ ... ubpri.htmlSee ya at the hall...      ( 3 / 1484 ) ( 3 / 1484 )

"De do do do, de da da da, Is all I want to say to you".... The Police ...... From the lost episode of DRAGNET

Saturday, June 23, 2007, 03:15 PM

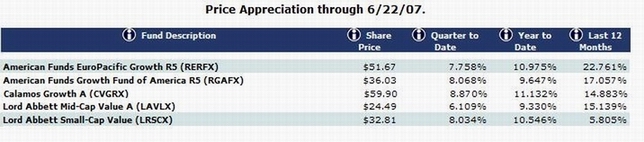

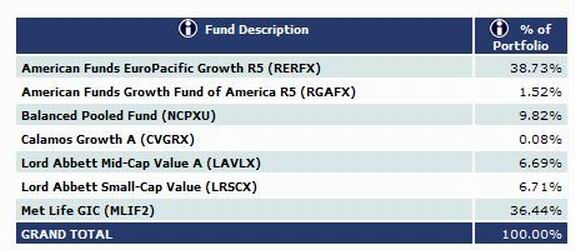

The first step to making money is not losing it." -- Ed Easterling Charts and tables up. More to come, Here and at my wwwebsite, ya know.... There's stuff I gotta think about and I gotta decide what I'm gonna do.....even if I do nothing. Which is a decision and an action , even if it don' look like it. Here's the problem; The market's looks tough if you only look at certain portions of the 401a.CLICKONNIT!  " Up 4.3% YTD by parking in the do nothing Balanced/Pooled Fund. Up .76% YTD in the Conservative (watching your money bleed away while your health, energy, and food costs skyrocket) Model Up 1.7% YTD in the Moderate (I hope nothing bad happens) Model Up 3.76% YTD in the Aggressive (let's jump in the deep end) Model. Four choices. Double the risk and worse results for the Agressive model vs the B/P Fund. A 1.5% projected annual return for 2007 for the conservative model(horrible compared to CD rates). Two moderate allocations (Moderate vs B/P) but with one returning 250% more than the other and neither looking very good compared to CD rates. It looks pretty wacky to me. Especially since we have five funds in the 401 that are showing over 9% return YTD. CLICKONNIT  I know. It's all about the long run and in 20 or 30 years it'll all work out. Sounds good for my grandchildren. Explain to me again why I should wait until I'm 90 for it to work out..... I'm up 31% YTD on my family IRA's and my trading acct at my broker. How can I not go to cash in all those accounts tomorrow? I could then kick back and cherry pick at only the least risky opportunities for the rest of the year during the traditionally difficult summer and fall and then feel like a genius come winter even if things don't pick up... But IF I go to cash in the IRA's and trading account because of the risk, how can I justify leaving my 401a money on the table in stocks? I've just taken advantage of a major rally in stocks in my IRA's and trading account. Being conservative and holding a lot of the Met Life GIC has cost me return YTD in the 401. Going all in now to try to catch up feels like totally the wrong thing to do. Kinda like going down the long dark stairs in the old haunted house to find out what that noise is. The kids used to ask why anybody would do anything that stoopid. I'd say, " 'Cuz it's a movie and it's in the script." In real life, anybody with a functioning brain'd be long gone two reels ago.... Stay tooned...      ( 3 / 1436 ) ( 3 / 1436 )

There is nothing so important, so critical, so meaningful, so vital, that it cannot have the basic principles and tenets of procrasination applied to it....that is, if I could just get around to it.....

Saturday, June 16, 2007, 11:18 AM

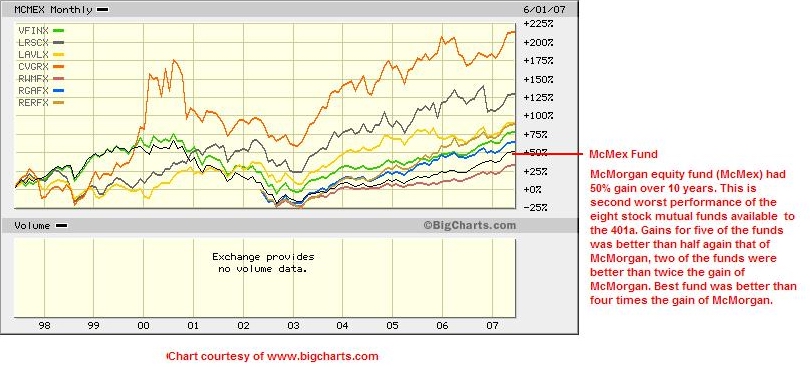

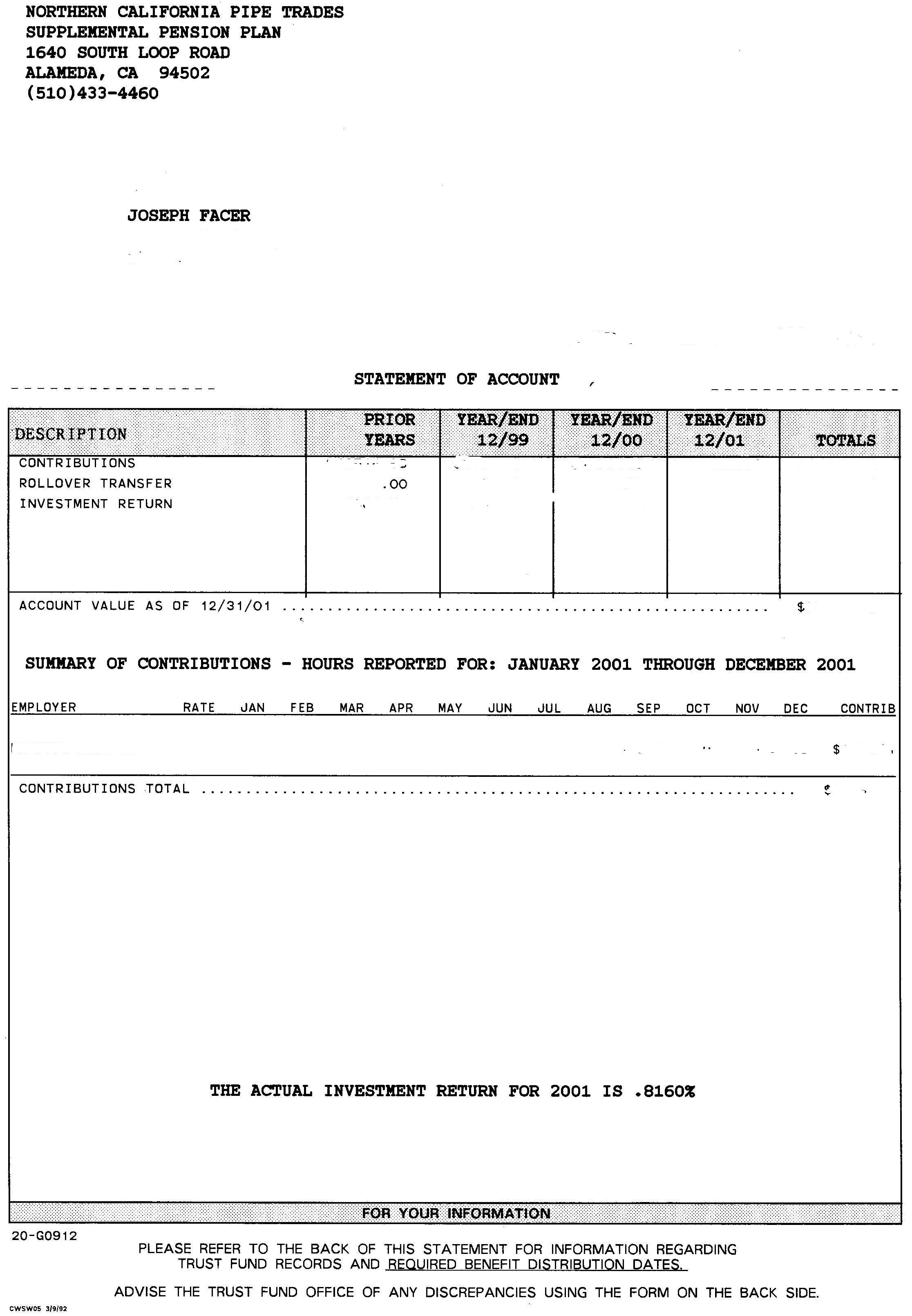

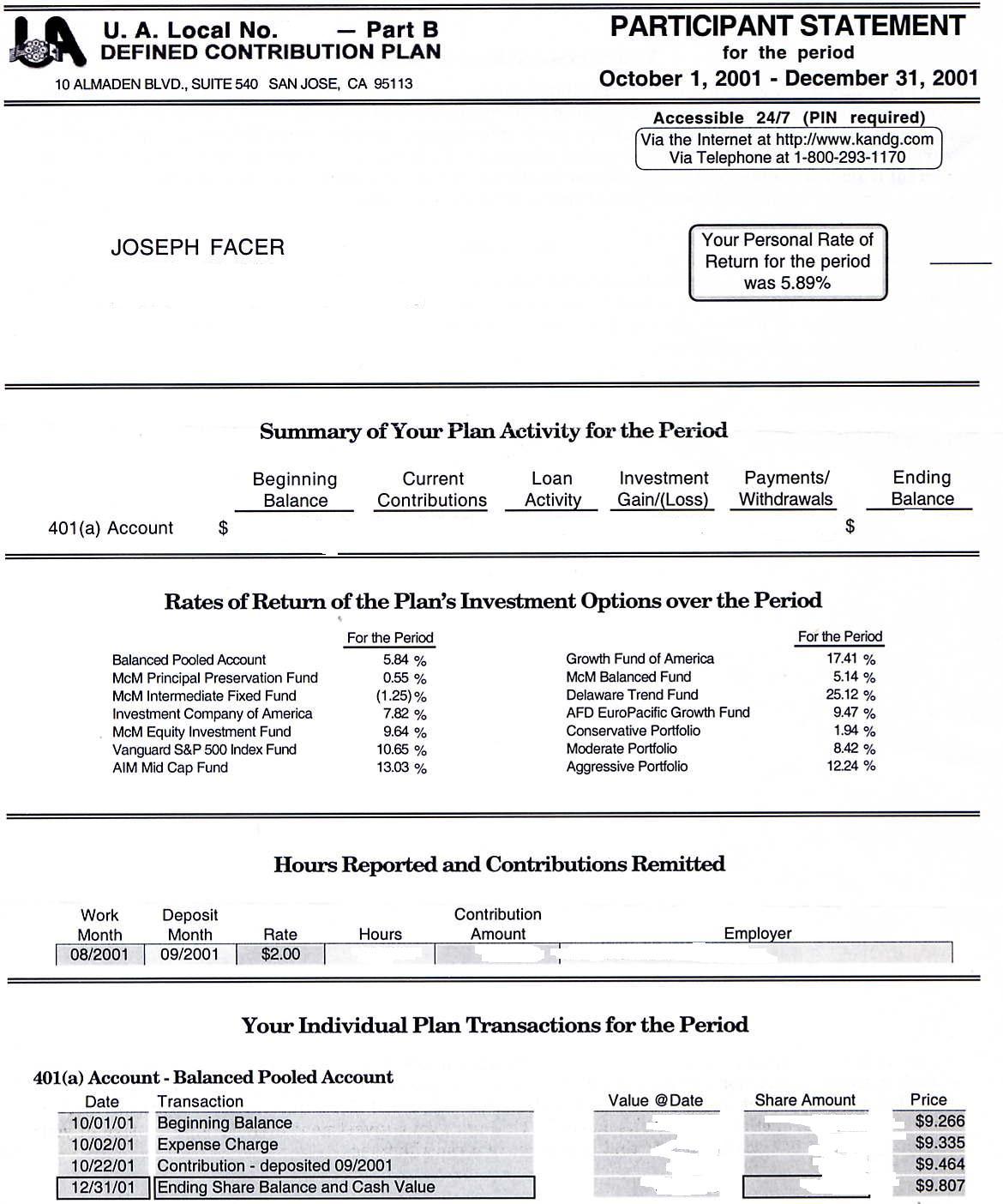

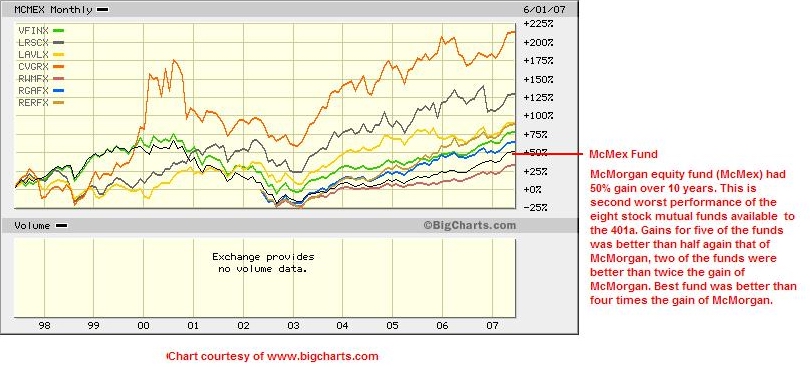

Like we say in the sewer, "Time and tide wait for no man." -- Ed Norton Charts and tables up! I'm of the opinion that the members of our local have been poorly served by the Board of Trust(BOT). I believe that over at least the last fifteen years, the BOT has pursued a particularly risky and ultimately costly to the members investment strategy for the pension plans. After meeting with me in 2003, the BOT instituted sweeping changes in both of the pension plans. However, there remain elements to the pension plans that I deem to be consistent with the prior flawed strategy and in need of change. The BOT disagrees with me, and thinks they have been doing a fine job and continue to do a fine job. I am not comfortable with this situation. I've retained a lawyer who is experienced in ERISA law to help me answer the questions that still concern me. The lawyer has reviewed the material which I've presented here and additional material that I have not made public. He has suggested that there is additional material that needs to be reviewed and we are in the process of obtaining that from the pension plans and will be reviewing that material in the near future. I'll keep you updated here and on my website as to the what, whys, and wherefores of what's goin' on... Stay tooned. Here's the chart from a coupla weeks ago. CLICKONNIT!  "It looks at the 10 year performance of the mutual funds available to us now in the 401. This is the kind of data that can be life changing. It's pretty damn obvious that something highly significant is going on and that something needs to be done. It's data like this in this form that got me moving to talk to someone about how BAD the pension situation was, and it was data like this that launched me in the new 401a funds when they became available in 2004. If you can't see the data or can't see the data in a useable format, you stay in the dark. Check out the 4th quarter of 2001 reports for my 401a below CLICKONNIT ================================================================  ================================================================ //////////////AND///////////////// ================================================================  ================================================================ Check out the numbers..... Oh, right, only one report has data in a useable format after my data is stripped out. Again, only one report shows that there is something going on. Thanks to the reforms instituted in 2004 and my website, this issue has gone away for the 401a. Do YOU have all the pension data for the defined benefit plan that you NEED available to you in a useable format? That includes enough data to figure out where you are and how and who got you there? This week's investment data is pretty much on the web site in the charts and tables. I got a full plate and I'm gonna be busy this weekend. Suffice it to say that I'm carrying significant cash (too much by way of a miskey) in the 401 and my trading account and I'm STILL making significant coin. I'm STILL concerned about everything I've written about below. I'm 33% in energy stocks in my trading account because of the Middle East politcal situation and the possibility of a religious war on the Straits of Hormuz. You gotta make money when you can and in the 401 that is reduced to being long when it's good and out when it is bad. But it was a lot easier being 200% long with money borrowed on a credit card in the trading account in 2003 than it is being 80% long in the 401a here and now. Still......      ( 3 / 1343 ) ( 3 / 1343 )

Saturday, June 9, 2007, 08:21 PM

Charts and tables up. more to come....

I'm standing pat for the moment with money allocated as shown in the table on my site. I've got some exposure, 'n some cash, an the exposure is where I'm more comfortable, if not really actually comfortable... I'm expecting more volatility as stocks start to move two directions instead of just up amd investors get vertigo and whipsawed by the boyz in the pits, da big money, and the hit and run artists. In other word , it's gonna be business as usual. I suspect I'll at least start thinking about making the next change in allocation, whatever that is, in the next coupla days.

More to come on what a 401a particpant could 'n shoulda had in his account if the Board of Trust had moved in '97 instead 0f '04-'05.

[ view entry ] ( 1013 views ) [ 0 trackbacks ] permalink      ( 3 / 1412 ) ( 3 / 1412 )

Thursday, June 7, 2007, 10:36 AM

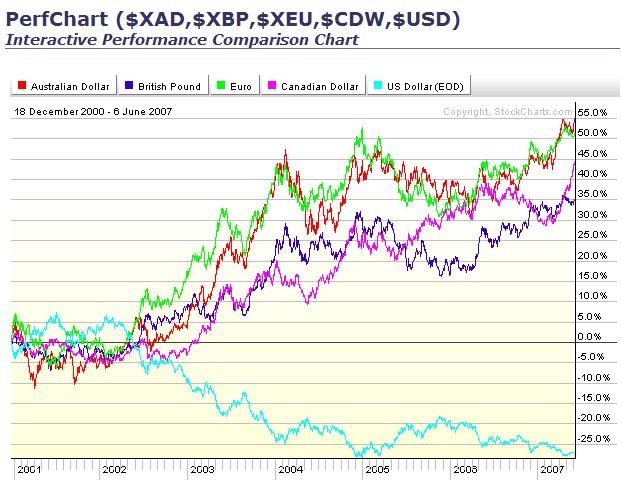

I'm still addin' to last week's post. But this needs to get posted here. Check 'em all out... How Saudi Arabia is running our economyhttp://www.thestreet.com/_tscs/newsanal ... 60736.htmlANDHere's why ya gotta be (shoulda been) thinkin' offshore investments. CLICKONNIT!  . It's great for exporters, it's why we had a greater quarter in the indexes. Our stuff is cheap overseas. The dollar worth o' stuff sent over is sold and if it take 4 months between shipping and payment, the drachmas we get for the merchandise buys more (cheaper dollars)when it comes back to the USA. But it also means that we are buying stuff overseas with constantly depreciating dollars. It makes imports really expensive. Why is oil REALLY at $60 plus and steel so expensive? It also works for investing. It's why I'm/have been overweight euroasia. there's more....but not here not now... Wed the 6th I went to 28% GIC (Met Life)and I may go a lot more. I think stocks are going to be in free fall for a while. A day, a week, a month, a little bit all at once, a lot over a long period. Or maybe not. There is a growing awareness that as rates rise in the rest of the world (ROW) and the dollar depreciates (see the charts above), we're screwed (a technical term that condenses too much stuff to cover here). But it means that we might have to pay the piper for the last 6 years of methamphetamine/monetary run. I'm up 50% over 2-1/2 years and there is a feeling of a seasonal turning point on/over the horizon. There's still the presidential cycle, the inventory cycle, the information revolution, ROW growth etc. But my favorite bright sunny days are in the fall when oncoming winter crispens up the morning and makes for cold clear nights, and it ain't no secret what's on the horizon... Of course I could be wrong and imagining ghosts in the shadows... or not. Heightened caution about whats going on in the other rooms at the party and a heightened awareness of where the door is, is how I'm going to play it.      ( 3 / 1470 ) ( 3 / 1470 )

Google "Ghost Rider Stockholm Upsalla" Too crazy for me. Still.....

Friday, June 1, 2007, 09:34 PM

"This has been a great year for preventive worrying. Seldom in recent history have so many people worried about so many things that haven't happened." -- James Reston Charts and tables up; I'm not done.... Like last week, stuff will/may appear now and then over the next one to seven days.....Why? Onna 'counta 'cuz, that's why!! Here's a chart showing the 10 year performance of the 401a mutual funds that became available to us in late 2004. Also shown is the performance of the McMorgan equity fund for that same period. If we had diversified from the one McMorgan Fund in 1997 to the current basket of funds in the 401a, would it have been a responsible and prudent thing for the Trustees to have done? It would have required initiative and some additional work on the part of the Trustees. Would it have benefited the members of the Local? Could or should your 401a fund REALLY have somewhere between half again or twice as much money in it? Would the dollar amount, if any, have justified the trustees doing the homework? Since McMorgan also managed the defined benefit pension as well as the 401a, would the charts for your "real" pension look better or worse than the 401a charts? Did the Trustees leave a substantial amount of money on the table through inexperience, naivete, or complacency? Answering that would require some more homework and just lead to even more questions. Click onna chart...  Chart courtesy of BIGCHARTS.COM This market's a real head case and it will make you a head case. Nothing has changed since I went cautious in the 401a in March. If anything, things have gotten even toppier. We've gone beyond the need for a correction. It now appears that we are in overdrive. I'm thinking that we now are looking more like a blowoff top instead of a correction.; Things could get crazy, stock prices could spike up, the last of the bears becoming rugs (we're there now), Time magazine could have the "New Age Of Permanent High Stock Prices" on the cover, everyone in China might quit their job to trade stocks, all the real estate salesmen in CA and Az and FL might become daytraders, the ten year bond might go to 8% and everybody'll be reassuring everyone else that "It's different this time, now it doesn't matter. THEN it'll prolly end and end badly. It always does. Like you could have a kickass party without having an unholy mess to clean up after... http://articles.moneycentral.msn.com/In ... Hurts.aspxBut there is opportunity risk along with market risk all the way to the peak. And ya can't pretend it doesn't exist. Look at the chart up above. That's what happens when you are oblivious to opportunity risk. You give up the upside and keep the downside. I've had that happen to my pension and I'm NOT happy with the results; You don't make much, but you can still lose a lot. So.... I'm all in again. Check out the worksheet page on joefacer.com. I'm back up over the B/P Fund for the year. I've crossed over the 50% gains mark since the new funds became available for the first time. I'm hoping to see up 100% over the Balanced Pooled fund again. I'm still long the ROW (Rest Of the World) play. The great overseas earnings are what's keeping the US market strong. There's serious growth in housing ,cars, energy, tech, commodities and consumer goods. Just not here. But ya can't have Americans selling over there and not do some good right here. So I'm in domestic stuff too. A lot of the time the hardest play to make is the best one. and having it all hangin'out is hard... It's all about the future, only some of it is about the here and now. It's also all about the different little cycles that are ongoing and the big ones too. So I'm long on fear and trepidation 'cuz ya gotta make the money when the cycles are working, when you can, not when you would be more comfortable or when you have to. I'm just bearly a reluctant bull, and that makes me squirrely. I keep selling outa well-founded fear and that costs me money each time I do it. But I'm limber and practiced at selling 'cuz one of these times, it'll be the right move... If you're smart and lucky and hard working, the markets can treat your 401a well. If you are not, you depend on the Trustees to do the right thing. Everyone has his own place somewhere between total self reliance and letting others do the job for them. I''ve found my comfort spot in that regard. Ya only get one chance to make it right. Time is NOT very respectful of regrets. It hasn't run backwards yet and it won't if ya run short during your retirement. Speaking of regrets, Supposedly one of the trustee's was stuck on McMorgan because the costs were low. I think I've identified somewhere around $100,000 a year in fees for which the participants in the plan receive nothing, according to the last Trustee's report I saw. That's worthy of some homework since it appears that this amount doubles as of 4/30/07. I'm going to be reviewing some Plan records soon and I'll let you know what I find...      ( 3 / 1335 ) ( 3 / 1335 )

Life gives you what it will. It's not necessarily what you'd ask for, or what you'd work best with. But it's what you're gonna get. So get used to the idea and get something done...

Saturday, May 26, 2007, 01:30 PM

"Stubbornness does have its helpful features. You always know what you're going to be thinking tomorrow." -- Glen Bearnan Charts and tables up. What do Modern Portfolio Theory, The Modern Jazz Quartet, and Joe Facer have in common? If you've got that answer, you know why I'm approaching a 50% return over 3 years and why I expect there are going to be major changes occurring around and about the 401a and defined benefit pension plans. Stay tooned... What Iím gonna be doing with my 401a on Tuesday, Wednesday, etc? Now for something completely different. I donít know what is going to happen and Iím uneasy. Iíve pontificated, elucidated, and articulated my concerns about the market and the economy for much of this year. See entrys below. I and some of the guys who are following along with me were in cash by March. It seemed to be the smart thing to do. I tried to do the same thing in a couple of IRAís and a trading account I have, but I pretty much failed. I expected the market to be a runaway steamroller and I had no desire to try to pick up pennies laying in front of it. I thought I was going to unwind all my leverage and option positions and go heavy to cash and defensive stocks. Instead, what I saw was an opportunity to pick up some serious cash while risking the steamroller. I saw some things I wanted to buy because they were going to go up. So I dialed back the wild eyed cowboy and dialed up the squint eyed card shark. I hit and ran, scalped, and I locked in profits with sales. I got to the other side of the street with a handfulla cash and totally unmashed. Iíve had a good three months and Iíve made my year. Being smart aggressive and lucky, (not necessarily in that order) in combination with the right circumstances makes you feel pretty good about yourself. Of course as good as I looked in my trading account, I looked just as bad in the 401a. Being in cash caught me on the wrong side of the trade and cost me some money. But earnings season is over. First quarter profits were good for international corporations but forward guidance is lousy for domestic players, the wrong stocks are leading, the economy is slowing, we have a significant case of inflation that we canít fix without throwing way too many people out of work, and the easy fix is nowhere in sight. And regardless of how well I did playing in front of the steamroller, it shows more luck, pluck and determination than brains. And now it's raining on the steamroller, the street is slippery and too dark to see if there is money in the puddles on the ground or not.... I don't like the risk reward nearly as well..... Anyway I got back into the market in the 401A as I started getting ahead in my other accounts and getting left behind by the B/P Fund. It was too late. I donít have much to show for it other than a handfulla stocks and no catalyst for profits that I can see. And I donít see the market letting me make it up here and now. Cash is starting to have a real strong attraction again. Makiní money is fun. Losing money is a bummer. Making it and keeping it is the mostest fun. I'm still nearly fully invested and I'm definitely uncomfortable about it. Whatever I do, youíll read about it hereÖ.. Hey!!! My depost into the 401a from last month is about 30 days late....Check your acct....5/30/07 The market is whacko. I sold some more stuff in my personal accounts today on limit and market orders while I was at work. I left a lot of money on the table, and I STILL did really good. Caution, reasonableness, responsibility, and all things proper and decorious mean nothing in this market. Wanna be an investing hero? Buy everything you can, buy on dips, buy on spikes, sell to get the cash to buy more. The quote below lives taped facin me on my desk. It's from Jim "Reverend Shark" De Porre writing on Real Money...

If you trade stocks in the short term, one of things that you need to be very aware of is that sometimes the action that seems extremely stupid is the best way to make money.

If a lot of people with a lot of money are chasing grossly overvalued stocks, it can feel pretty dumb to throw caution to the wind and join the party.

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term.

In fact, there can be a complete disconnect between the two for very long periods of time.

If you are going to trade in the short term, you need to decide whether you are willing to do the dumb things that make money or are you going to stick to the "facts" and stand aside while the idiots run prices up and down.

It's all about sentiment, mood and psychology in the short term ,and it doesn't pay to think too hard about fundamentals if you are playing in the short term."

What's this got to do with investing in my 401a? Not much!! ya see... "The idiots are running prices up and down."And we who have 401a accounts ain't among 'em We've got rules against rapid trading. We've got a small handful of investment choices that are a basket of someone else's ideas. And we aren't allowed to know what we are buying and selling and we've got to wait up to 24 hours after we make the decision to make the buy/sale. That's the way the game is structured, that how we play the game, those are the rules etc. So be it. Ignore the talking heads. "Things are going down the toobs".... while the idices post record highs. "Buyout fever is making investors in the right stocks rich!".... But we aren't and can't be there with them. "It will all end and end badly".... It always does. But it is wrong to have money at risk and not garner any reward. It is wrong to miss out on gains and maxize losses by avoiding the market when it is going up and staying in it when it is going down. it's just lazy. SO..... there's a lotta territory between the year when I made approximately 700 trades in my trading account and ran with the idiot's pushing prices up and down, and making one decision, one time, sticking with it for a lifetime, looking at the statements a coupla times a year and expecting to do really well. What I've done is to find something that works for me somewhere in that territory. I stay within the rules and work them,trying to maximise return and minimize risk. I know the costs and keep a running tally of the benefits. Hopefully, everyone finds a way to deal with their 401 that works as well for them. See ya at the hall.      ( 3 / 1500 ) ( 3 / 1500 )

Saturday, May 12, 2007, 02:33 PM

Charts and table up. More to come.....

International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

Howard Simons

So's here's where I am and how I got here. As noted below, I'm aggressively set up in how I invest my 401a money. My pension is not what I think it should be, my IRA's got dinged in the dotcom meltdown, and I'm intent on doing something about it. So I'm using some readily available stock tools to chose what I feel are the best 401a funds and I'm concentrating my money there.

Risk and reward are the two faces of the same coin. My 401a results have been smokin' to date. That's the reward part. But what goes up like a rocket also comes down like a rocket. That's the risk part. So, as much as I want to be big time in up markets in the best performing funds, I also want to be out of the market when it goes down. So I have gone heavily to cash a handful of times over the last 2-1/2 years. Most of those times have been short term and of a secular bent; like times of political risk like elections and financial scandals, and times of greater risk of terrorist activities, etc. Some of those times, I went to cash because of junior cycles; the end of the holiday season, the end of a particularly good earning season, summer time, when I was looking for a hot market to consolidate etc. Lately I've been looking for a big cycle downturn; like the beginning of a recession or an overall downturn in the economy. Recoverys tend to average about three years in length and the current recovery is about four years old. The downturn looked to be here in February.

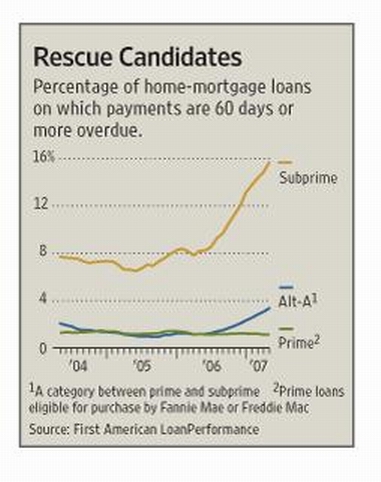

Greenspan launched the bubble of 2000 with too much money and he countered its' popping with even more money and way lower rates. This led to the inflation of the real estate bubble and drove the car manufacturers into a lather, making cars and houses cheap in terms of monthly payments. That came to an end last year and we are now seeing it unravel. That led to the subprime, Alt A, securitized mortgage bond bruhaha of Feb-March and major pain in Ford and GM. That combined with the end of the holiday season to start a whosh down in Feb. I got outa Dodge and outa harms way at the end of Feb. It turned out to be unnecessary and cost me some significant money. Check out the charts. Stocks went right back up like a rocket in the face of just horrible news and my 401a returns looked absolutely limp. Why? Well....

Part of it is too much money chasing return. Only heros and fools are putting money in real estate nowadays. But retirement investors amd big money investors have money that they have to do something with and are putting it somewhere and that appears to be in stocks. It's all about hedge funds, private equity and takeovers too. And the dollar has turned to mush over the last quarter. So away from cars and real estate, the economy is doing OK as there is a ton of momentum built in. When company's stocks go down they get bought out at a premium as buyout money litters the landscape, and big corporations who invested a pile of dollars in the world economy last year are getting paid back in cheaper(more) dollars on top of what they made. So corporate earnings, the kind that makes headlines, have been burning up the reports. AND the Republican administration is pumping up a war economy without taxing to pay for it. So I'm almost all the way back in the market as of a week or two ago and making money again.

But I've got no confidence that this can last. We're prolly gonna have a recession and it's prolly gonna be ugly. I just don't know when. As a worshipper at the Church of What's Happenin' Right Now This Very Second, I'm partyin' like it's 1999. But I've seen that movie and I didn't like the ending. So I'm next to the door and listenin' for sirens and footsteps. I thought I heard something in Feb. But I was wrong. I'm still listening....

[ view entry ] ( 1052 views ) [ 0 trackbacks ] permalink      ( 3 / 1469 ) ( 3 / 1469 )

Caution often makes you feel stoopid 'cuz while you stand aside, everyone still out there looks like a money making genius. But when bad stuff DOES happen, you look like a genius. Therefore, the object of the exercise is not to let caution dig you too deep a hole while you wait for your turn to look smart...

Saturday, April 21, 2007, 02:32 PM

Charts and tables up. more to come... 4/25/07 I'm back up to 90% stock/10% cash as of the end of today. The market keeps teaching a lesson that many market participants don't want to learn. That lesson is that it is not going to go down until it is good and ready to.

It obviously doesn't care too much about the fuss over housing, slowing retail sales, persistent inflation, a weak dollar and cooling economic growth. The market is focused on generally good earnings reports, and it doesn't much matter if you think that is reasonable or not.

The market is so frustrating and so potentially lucrative mainly because it is not easy to understand. I can seldom remember a time when there have been more bears scratching their heads over the persistent strength than we have now. Despite downright compelling logic, we just keep on working higher.

Of course, in the perverse manner that the market works, the fact that so many doubt that we can keep going is probably keeping things going as it ensures a healthy supply of cash on the sidelines to serve as support.

Reverend Shark from Real Money

There's money being made and not by me. That's enough of that! Deal me in... But I might still be late to the party. So I'll hang out by the door and I'll be especially ready to bail out on a moments notice...      ( 3.1 / 1394 ) ( 3.1 / 1394 )

It's Tuesday after lunch sidereal time and I'm rubbin' my eyeball across some charts and tables when I had this thought.....

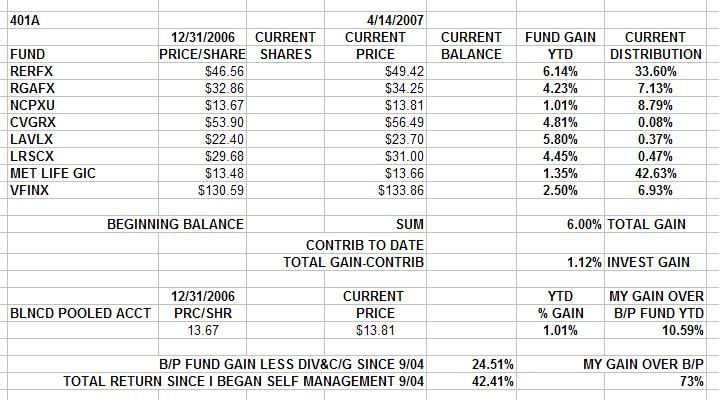

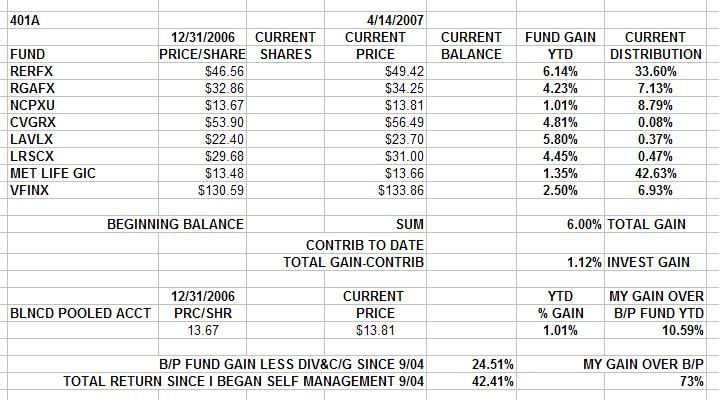

Saturday, April 14, 2007, 02:57 PM

Check it out...Clickonnit!  I'm not doing very well so far this year for all my efforts. So it goes. There's this housing bubble that's just starting to unwind in some US real estate markets, and there's big time deficit spending by a Republican president that's lookin' like it has the possibility to crater the economy. A lot of the world's manufacturing has long since gone to China and as our economy slows, raw material prices rise because we no longer are the main driver of the world economy. Hell, US housing is feeling the pain and copper prices are up. China's on the come and India has just put it's head down. Yeah, i know, mixed metaphors, and it used to be when the good ol' US of A sneezed, the rest of the world caught a cold. Now when we sneeze, everyone else partys on... Basic materials and energy now have a life without US. Besides, oil is up and the established political and economic order in the US is going to hell big time because we are bogged down in a land war in Southeast Asia and and... Oops! FLASHBACK!!! FLASHBACK!!! Too many drugs for too many years!! Or just maybe it's not a flashback. Maybe it's just this generation's version of living with a stonewalled and holed up Nixon Administration goin' down in flames... I meant to say " the established political and economic order in the US is going to hell big time because we are bogged down in a land war in the Mideast." Anyway, The price of leaving the party too soon is to be stuck outside watching everyone else party on. My portfolio performance is pretty limp as of April and I got my nose pressed to the window watchin' everyone else party on.... The possible upside of sobering up on the lawn is being able to walk home on your own a little later while everyone else goes to the slammer on their way home... If bad things happen, I'll be able to get back in to the market at much lower prices. There's an election coming and there may be one more pop before we work this out. Or not. I'm pretty much in a holding mode while I wait for clarity. I'm no longer 100% up over the Balanced Pooled Fund and my advantage is bleeding away. But I can live with that because I'm long in the tooth enough to have sat through the earlier version of this movie before and it didn't end well.... The future will tip its hand in the next few weeks. Stay tooned.....      ( 3.1 / 1528 ) ( 3.1 / 1528 )

Earnings reports start next week. click.click.click.click.click.click.click.click OVER THE TOP!! YEEHAAAA!!!!!!

Sunday, April 8, 2007, 04:15 PM

Charts and tables up. Taxes done. So here's what I see....

As per the COFG ESSAYS elsewhere on my site, there was this dotcom bubble and the ensuing dotcom blow up. I was on the periphery of all that. I was working in the southbay and I worked OT hours out the wazoo with a thousand others at wafer fabs, chip tool makers, and server farms. Server farms being built in one of the highest priced real estate areas in the USA and the one area with the most expensive and unreliable electric power systems??!!!? Castles built on sand, ya know... My middle son was a dotcommie at a startup and worked side by side with future dotcom millionaires. It was an amazing once in a lifetime time event.

It was unsustainable and the whole thing crashed. We had the dotcom depression in the Bay Area. The first guys in and out made it away with millions or jail sentences. I met a friend of my son's who looked like a barefoot hippie less the flowers and long hair. He was a millionaire at 26. My son was 9 months late to the party and ended up just an ordinary working guy and the company he worked for melted down. The stock market bottomed in 2003 and there was blood in the streets (Wall Street) and everybody figured ya couldn't even sell the country to the Japanese since they'd crashed the previous decade and it didn't look like they'd ever come back. The Japanese took rates to below zero and they couldn't get anything going even after a decade of that. It was a commonplace worry that the USA was going to that particular hell too. The Fed panicked and drove interest rates down to one percent and started to inflate the national real estate bubble in place of the local internet bubble. In other words, the Fed spiked the punch bowl.

So we had us a real estate party. In 2005 the house next door sold for 80% more than we'd paid for ours five years earlier and 30% more than a nearly identical hose on the next block went for the same week. That was fun bubble time too.

That was about when we had the first fight at the Real Estate party and the first throwing up passed out guest on the couch. Things started to go south early/mid last year, but ya party on cuz it feels so good. Ya gotta job, ya can get a loan, ya can buy a house or three. If ya can't get a loan, ya get a liar's loan. or, someone get's you a loan. Or the builder loans you the money. Over the last 6 months, it's become apparent that we've been listening to sirens and not the band and that ain't more party goers knockin', "Tha's the COPS (hic)!!!!!

So the subprime and alternate A market are throwing off bankruptcies. A sizable portion of the economy (housing) is beset with 8 months of inventory and worst case, we could see three to four times the yearly sustainable demand in housing up for sale at the same time. And there is the matter of an estimated $565 billion of development loans outstanding between the developers and the banks. This could get real bad. At the least, we have a year or two of declining earnings growth in much of the economy and that probably will lead to a lot of future value priced into stocks coming out of the price. Or we could have a bank crisis like the Savings and Loan crisis of the 90's.

The question is, given that the US no longer drives the world economy like it used to because it ain't the same world, has the game changed enough to pull us through this rough spot with just a little turbulence? I dunno.

But I don't trust that forward guidance will be good enough for the companies about to report. So I'm in mostly cash instead of exposed to domestic stocks, until I get clarity. And I'm moderately exposed to foreign equities because there are a lot of people in a lot of places who are hankering for the middle class dream and a lot of already rich and powerful guys are going to get a lot more rich and powerful helping them get there.

Of course, I could be wrong. If so, I'll see that it's not working and change directions before too much damage is done. Or maybe it's just my timing and I'll just need to pull in my horns for a while. Regardless, I gotta plan and the tools to get it realized as well as the ability to turn on a dime if that's the smart move. So for now, i'm waiting and seeing...

[ view entry ] ( 1061 views ) [ 0 trackbacks ] permalink      ( 3 / 1509 ) ( 3 / 1509 )

Spring has sprung, Iran is holding Western hostages,oil prices are up, real estate and lending are goin' down, bad loans are ticking in the banks. we're bogged down in an overseas civil war, we have a Republican government imploding, the Demo's are about to have a bloody campaign between non-compelling candidates. Welcome to 1969,70,72,'76,'80,84,91 and a lot of other bad years.

Saturday, March 31, 2007, 02:55 PM

"Life is tough, but it's tougher when you're stupid."

-- John Wayne

Charts and tables up. I've been almost exclusively long from 9/04 to 2/07 and I'm up 40% to show for it. Now I'm at 70% cash down from 90% cash to 60%cash back to 70% cash all as of last week. And it's all because I'm concerned about the future...

It's time to think and write about creating a framework of expectations for the near and far future. With the expectations set down on paper, a plan as to what to do will pretty much follow. Then I gotta see what's achually gonna be comin' down. That'll measure how well my expectations are bein' met. And that will be the key as to figgarin'out whether or not executing my plan will cross that fine line between brilliant and stoopid. Stay tooned. Doin' my taxes take priority...

[ view entry ] ( 1022 views ) [ 0 trackbacks ] permalink      ( 3.1 / 1434 ) ( 3.1 / 1434 )

What everybody wants is to be given is the key to always winning with minimal effort. What they get is....

Sunday, March 25, 2007, 04:35 PM

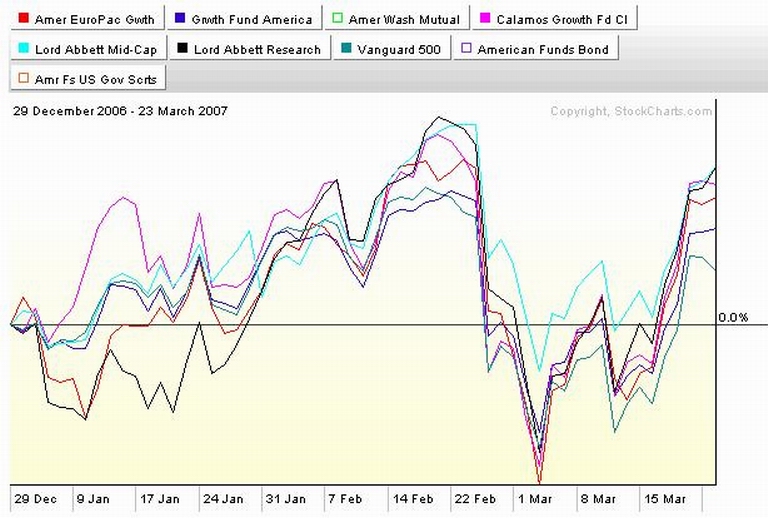

Charts and tables up. At the end of last week I went from 90% cash to 60% cash. The rapid trading rules locked me out of my preferred funds for another week. But there still was a way for me to get back in the market with effective exposure to the current upside movement. Here's how it's done....(CLICK IT)  Note that Europacific and LA research have been smokin' hot. I've been big but not exclusive there. Risk and all that. American Growth has been hot but has not been stellar lately. So I've lightened up there recently. Vanguard has lagged overall but has heated up recently. I've not been there because there have been better places to be. So both funds were available for me to invest in when we got the Fed induced updraft last week. So I put 1/3 of my cash into the those funds. Check out what's been happening this year...(CLICK IT)  We had a whoosh down the last week of February. Was it going to be as big as last year's whoosh? We don't know that yet. Soo... I prepared for the possibility. I went to cash with the ability to immediately get back into the market if it was a false alarm. I'm equivocal about what kind of alarrm it was so I'm 1/3rd back in. Iran, housing, interest rates, credit, White House under siege, etc on the downside. World growth being a runaway locomotive, new technologies, new data distribution paradigms on an industrial and investment level, revolutionary changes in media and politics, on the upside. Whatcha gonna do? Stay tooned....      ( 3 / 1498 ) ( 3 / 1498 )

Da Saturday website an' blog thing 'n all that that entails, I mean, ya know what I mean?

Saturday, March 17, 2007, 03:04 PM

"The master in the art of living makes little distinction between his work and his play, his labor and his leisure, his mind and his body, his information and his recreation, his love and his religion. He hardly knows which is which. He simply pursues his vision of excellence at whatever he does, leaving others to decide whether he is working or playing. To him he's always doing both."

James A. Michener

Charts and tables ready.

But this time it's the 3rd party website creation/editor service that I'm usin' with my host site that's down. Bummer, dude, I mean it's all negative downer kinda stuff an' all that an' it's hangin me up...

Chartz and tablez up.

More to come....

[ view entry ] ( 966 views ) [ 0 trackbacks ] permalink      ( 3.1 / 244 ) ( 3.1 / 244 )

Tuesday, March 13, 2007, 07:38 PM

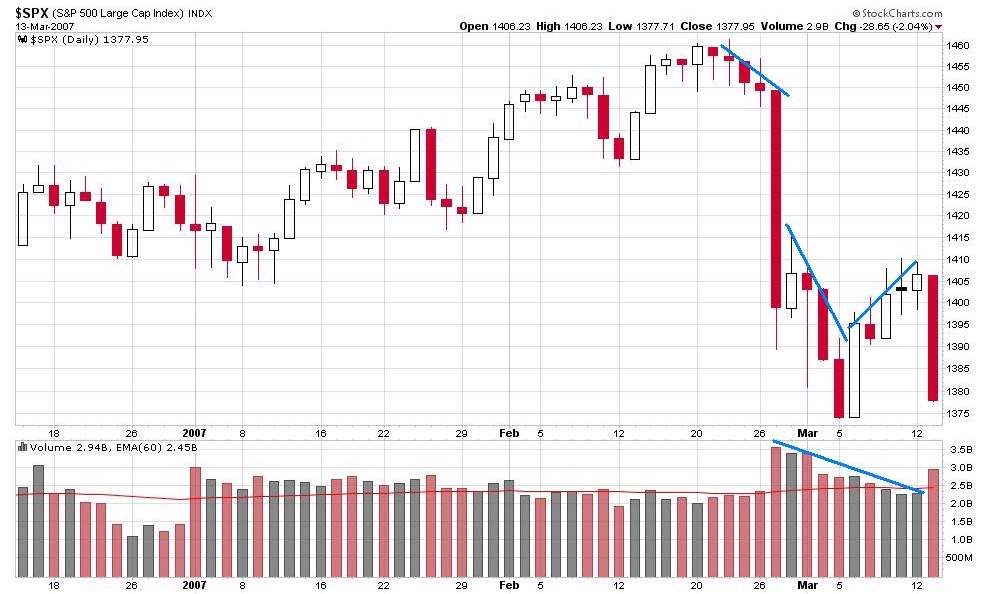

Kinda saw that one coming....Click onna chart...  Notice when the downturn started and how volume stayed steady... Notice the one huge drop on 2/27 and the big volume that day as a lot of people bailed... Notice the low volume bounce. The market started back up but on declining participation... There was no real enthusiasm and a lot of trepidation... Then today.... the other shoe dropped and a lotta people sold. I'm still cash big time. This has NOT played all the way out. I'm watching.... I will buy back in. It'll be when I think it's the right time and at my pace and on my terms. Stay tooned. See ya at the hall.      ( 3 / 1424 ) ( 3 / 1424 )

Never A Dull Moment. GUARANTEED!!! Watch This...........

Saturday, March 10, 2007, 01:40 PM

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all." -- Harry Schultz Chartz and tablez nowhere. For once it is not K and G hangin' me up. This time my charting service is installing a new UPS for their servers.CHARTS AND TABLES UP!A buddy of mine went to about 90% cash in mid Feb. Another buddy went to cash on the first bounce. I went partially to cash Jan 10 and then in and out for a while and finally all the way to cash on 2/28, the first big LOOOK OOUT BEELOooow!!!!!.... I've been basically all cash since 2/28 and as a result I missed some of the downside and all of the bounce. It's cost me between $60 and $100 in lost opportunity as of today. It bought me at least a coupla grand worth of peace of mind. Every day you hold cash or bonds, you shoulder inflation risk as the return on your money does battle with inflation and fees. Every time you own stock, you shoulder investment risk as your stocks might go down and fees eat at your balance. Every time you are out of the market, you shoulder opportunity risk as what you could have had if you had made more right than wrong decisions is lost forever. It gets really hairy if you invest in offshore stuff. International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

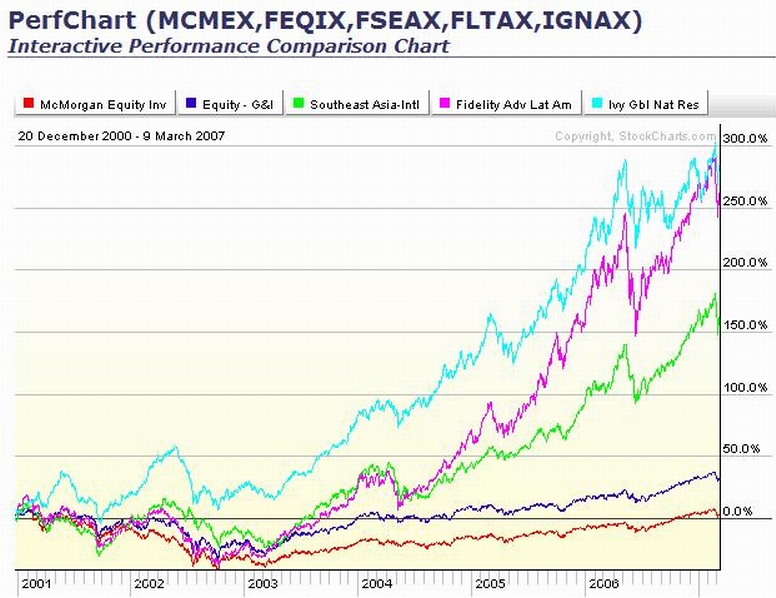

--Howard Simons But ya ain't gonna live happily now and happily ever after on passbook rates unless you're already retired and well off, so you have to choose what risk you want to shoulder and when it makes sense. So if you follow what I post, you'll see that I have tended to be fairly overweight in the RERFX foreign stock fund choice in our 401a. In fact when I started to go to cash the first time this year, at one time the RERFX was the only fund I kept. Here's why; AMG Data Services provided fund flows for the week ending 1/31/07 record that domestic equity funds excluding ETF's had a net cash outflow of $55 billion dollars and non domestic funds had a net cash inflow of $2.56 billion. This is not atypical. I've been watching money flow overseas for a while now. Big money and smart money and hot money has been in natural resources and the hottest international economies since the dotcom crash. You don't think they rode out the crash all the way to the bottom here, did you? That's the little guy's job. Check out the chart of the McMorgan big cap equity fund vs a Fidelity big cap, South East Asia and Latin America funds, and a natural resources fund... CLICK ONNIT!!  First off, finding that the Fidelity fund is a better preforming fund than McMorgan is no surprise. Second, check out this chart and the ones on my website. The action has been better some places than others. Specifically, and until recently, away from the big caps. That's why the American Funds EuroPacific and the Lord Abbet Small Cap have excelled. And that's where I've been leaning the hardest. But that's not the only place I'm putting my money down. The word risk is all over the page here and I try to listen to people I respect. That's why I've avoided the losers and underperformers and put my money in more than one winner. I'd have made more if I only had money in the best performing fund. Instead, I've trailed the very best two funds despite being heavily invest in them. That's the price of discipline and diversification. And discipline is why I'm in cash now. Another key to what I'm doing is the word "flow" as in "fund flows". Fund flows in drives up prices and create a self reinforcing dynamic. Think homes in Palm Beach. http://www.palmbeachpost.com/business/c ... _0226.html Fund flow statis creates a whole lot of tension and pretty quickly creates flow out. Fund flows out drive prices down and create their own dynamic. Every game comes to an end. There will come a time when the flow of funds out will scragmaul what they built up in a relative eyeblink. Think homes in Palm Beach. So you get while the getting is good and look away from your money at your risk. You can't do that with your home. Some things ya gotta ride out the ebb and flow. But depending on circumstances and inclination, and little time and energy reacting to the ebb and flow in the 401a can be well spent. I'm kinda expecting some more downside. But cash is for buyin' so I'm looking for an opportunity to do so. It's the ebb and flow thing, ya know? If we don't go to zero, we'll go up and there'll be an other opportunity to make money. And then when they go down, we'll get an opportunity to sell and keep some money. The wheels on the bus go 'round and 'round..... See ya at the hall.

[ view entry ] ( 1150 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1119 ) ( 2.9 / 1119 )

The Bad News Is, Ya Ain't Seen Nothin' Yet. The Real Bad News Is, I Think It's Just Started...

Saturday, March 3, 2007, 02:18 PM

Just remember one thing: there are no good stocks. They all suck. Even those that are making you money are going to turn on you sooner or later. The only stock you should say anything good about is the one you no longer own that made you money.

--Reverend Shark

Charts and tables are up. Our "SPECIAL" day from last week continues to repeat like a bad burrito. Look at the charts for our funds since June of last year. We made a very nice return and the overriding direction for the funds was up. There was little to no give and take, the swings in price (volatility) were muted, and those down side moves were stored up for the future and did not fade away into the aether. So all the medium size swings around the mean we haven't had have wound up and finally been delivered all at once and the direction is down. Successful investors with profits to protect and fresh money invested as of the new year are puking the positions back out NOW and going to cash or bonds. There is a lot of fear and the call is "Get Me Out NOW, I don't care about the price!!!! And it is world wide. It started in China and is washing in waves around the world. At the same time, all the talking heads and pundits that talk to the individual investor are advising caution, not to panic, and to hold on for the long run. "Don't react, ignore the man behind the curtain, everything will be fine once this is over.". That's all fine and dandy to those to whom that makes sense. Me, I'm 80% cash as of last week and going to even more cash tomorrow (Tues). That's saved me a tidy sum as of today.

Selling when it makes sense is the other side of buying when it makes sense and the alternative to not just making my 401a a one decision thing. This is what I gotta do. I believe our sticking with McMorgan as our sole money manager for so many years cost us big time and I'm putting in the time and effort now that I should have put in then.

[ view entry ] ( 959 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1451 ) ( 2.9 / 1451 )

SO FAR, SO GOOD....OOPS!!

Wednesday, February 28, 2007, 01:36 AM

Well, wasn't today special. I've got a full plate tonight and I'm busier than a long tailed cat in a rocking chair factory. But I've had the time to set up the trade to go to 80% cash in the 401a at the close of the market tomorrow. I expect to check the market at lunch tomorrow and decide whether to let the trade trigger. There's always the chance for a miracle. But I'll most likely let the trade go through.

I've been 100% long at times since 9/04 and mostly very heavily long most of the time.

I expect to balance my WFO long positions when the market is red hot with my best tortoise imitation when the market is not, or in the bomb shelter when the market is looking for blood...like now.

I've got the ways and means to put it all back in the market in a day if it works out to be the best thing to do. So I'm not risking much opportunity to be out of the market for a day, a week , a month or longer at this point, and I'm definitely avoiding falling stocks when I'm mostly cash. I'm focussed on keeping what I've earned since 9/04 and not leaving any more money than I have to on the table...

This ain't my first dance and I understand that stocks aren't GDP futures and are on occasion only tenatively related to the state of the country's or the company's business. So it ain't necessarily the end of life as we know it. Although it might be. It definitely is a smoking crater. I'll hafta see what it looks like down the road. So I've got a mission and a plan and the mindset to see it through. And I'll write about it here. See ya at the hall.

2/28/07

We had a bounce. Looking at my IRA's and my trading acount and the 401a, I'm unimpressed. The bleeding stopped, but the bounce may be a dead cat (parrot) variety. The market character has changed. Since summer of last year, anything but blind commitment to buying and holding made you a loser. Yesterday that changed. I suspect a lot of investors/traders still want out and are waiting to get even before they leave. I think they will capitulate over the next month or so and sell, especially if the market drifts down... I think there will be mutual fund redemptions coming in over the transom this weekend. More selling Monday. I've got a lot of buying power and after the selling stops, whenever that is, I'm going to use the buying power to start the whole investing/trading process over again.

Or, there's many tons of US investor money overseas. (More about this this weekend) If that money comes back immediately and goes into the domestic market, it might counter the selling and send the market up bigtime. In that case, I'm back in as soon as the money shows up and the market lifts. There's a lot of different possibilities. I think about them all, but I only play the ones that actually happen.

My returns on my 401a are excellent. It looks like they would have been even better if I'd just dumped all my money into the Aggressive Portfolio and left it alone. But there are times when I feel real cautious. Like when I went partially to cash January 10TH. So I act on it and sell. It's cost me some money each time I did that before. Regardless, I think it's the right thing to do. Let's see how it works out this time

[ view entry ] ( 1052 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1492 ) ( 2.9 / 1492 )

Another week, another battle. First, to minimize risk and second, maximize return.

Saturday, February 10, 2007, 02:16 PM

"Success in almost any field depends more on energy and drive than it does on intelligence. This explains why we have so many stupid leaders."

-- Sloan Wilson

Charts and table up....

Another week, another battle. First, to minimize risk and second, to maximize return. Understand that when I'm talking about risk, I'm talking about two kinds of risk. The first kind of risk is outright losing money for no good reason other than laziness and ignorance. Like when we lost approximately 25% of our pension funds between 2000 and 2003 by not knowing that our money manager was underperforming. Or by being long stocks regardless of whether or not that is working. The second kind of risk is not making money for no good reason other than laziness and ignorance. Like being heavily invested in bonds when that is an inappropriate allocation of funds for your particular circumstances. When I'm talking about maximizing return, I'm taking about making the effort to take care of the pension savings that you worked for. If you recount the money you get when you cash your check and when you get change, fix the roof when it leaks, and change the oil when it's time, taking care of your 401 is more of the same. And not much more work.

I've way over performed since 9/04 as per the charts on my site. That was easy. Now it gets harder.Again as per the tables, I'm allocated to primarily one stock fund and 30% cash. It's cost me return to date, as my personal account is lagging the returns of all the individual stocks funds.

It's like buying insurance. The insurance premiums are a waste of money... hopefully. Some times you are unfortunate enough to have the insurance pay off. I judge that the risks in the domestic market are outsize to the downside, so it's about cash. If I'm right, I'll make up some of the returns I've missed out on. If not, I've traded a lttle money for peace of mind. It's not like I haven't been on the other side of the trade before.

[ view entry ] ( 1036 views ) [ 0 trackbacks ] permalink      ( 3 / 1391 ) ( 3 / 1391 )

Testing...Testing...One, Two, Three....Anybody out there?

Monday, January 29, 2007, 12:40 AM

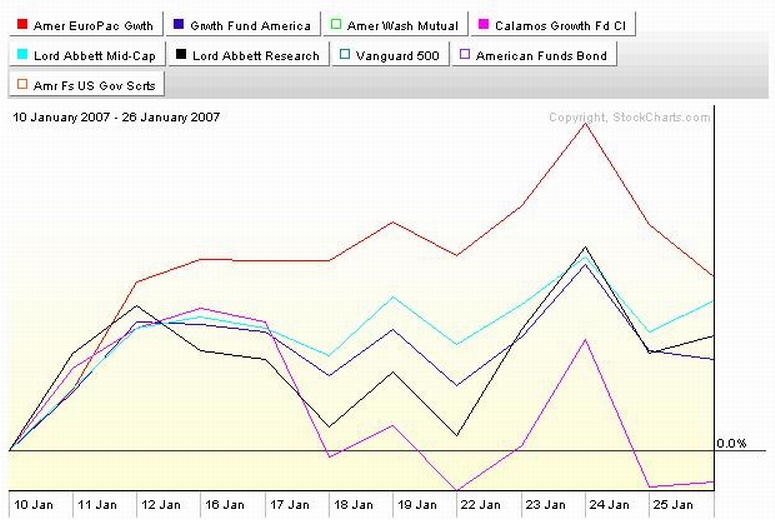

"Change has a considerable psychological impact on the human mind. To the fearful it is threatening because it means that things may get worse. To the hopeful it is encouraging because things may get better. To the confident it is inspiring because the challenge exists to make things better." -- King Whitney, Jr. Charts and tables up late on a Sunday night....Yet another Katastrophic Komputer Katastrophe this weekend. I'm switching over to a new system later this week. Makin' a change....ya know. Things will probably be quiet until I'm 100% up....Or not. Check out the chart. This is the performance of the funds in my 401a since I went big to cash, heavy on the rerfx, and a just a little here and there in the other funds. CLICKONNIT to see it better...  So far, so good. There's a lotta year left to go. Eyes open, readin' and thinkin', ready to play what I think offers the best reward with the least risk. And don't EVER think that doing nothing reduces the risk. Events around the recent election got me to calculating what sticking with McMorgan as our sole investment agent cost us versus some more responsible investment strategies. Did we even CONSIDER making a change? 1/31/06 Moved about 10% outta cash and into LAVLX.      ( 3 / 1368 ) ( 3 / 1368 )

Can there be any doubt about the '08 elections?

Saturday, January 13, 2007, 04:51 PM

Charts and tables up. There's big stuff going to start appearing here starting this week. I'll start with a new approach to running the 401a when things get volatile. We had a big hiccup in May and a very solid and unwavering run up into year's end starting in July. There is every reason for investors to lock in profits if they get spooked and there are a lot of reasons they may get spooked. Read the papers. Also realize that they need to cash out of current positions to buy new ones. Even if things go OK, once enough people start to lock in profits, it can get ugly and precipitous. Been there done that. Check out the chart. Looks like at least a short term top and like things are starting to roll over to me. I've got something to protect.  I moved six of seven positions to almost all cash or all cash. I've only stayed with one heavily invested position. I'm locked out from reinvesting in five funds for 30 days as per the rapid trading rules. Did I do the right thing? I dunno.... Do I know what to do if it was the right thing to do? Yup. Do I know what to do if it was the wrong thing to do? Yup. Stay tuned and we'll all find out what the future brings. Check here this upcoming week.....      ( 3 / 1403 ) ( 3 / 1403 )

Back to the same ol' same ol'. The new year is here and it looks a lot like the old one.......

Saturday, January 6, 2007, 05:08 PM

Charts and tables up. The numbers always look a little wonky for the first month or so; The B/P fund is down a tad and I'm down about 1%. So my percentage is 659.7893% worse than the B/P Fund over the three trading days of this week. That'll change. I manage my family IRA's and so I take a look at more of the market than most people. I may step to the sidelines for a spell. You'll read about it here if and when.... Stay tuned. I had a Kataclysmic Komputer Katastrophe this weekend. I lost a portion of the boot sector on my hard drive and all access to the internet and my files. I've gotten almost all the way back but at the cost of a coupla 3-1/2 hour of sleep nights. So I gonna be curt. I'm not comfortable about what I'm seeing in the market and the geopolitical arena. I'm situated much closer to mostly cash than usual. More about why later. I may not make this month's Union meeting behind this either. Or not. We'll see... What did and where I am is shown below...       ( 3 / 1382 ) ( 3 / 1382 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar