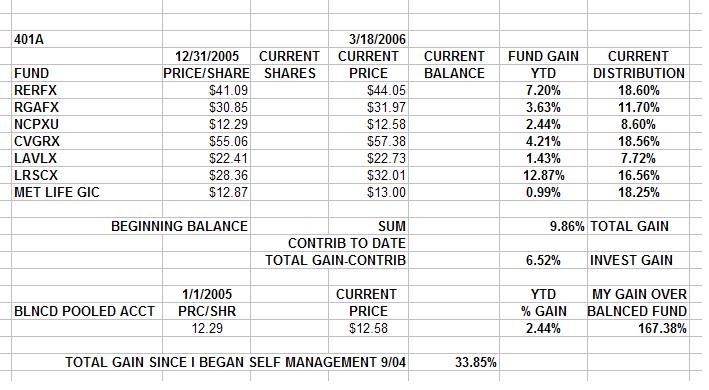

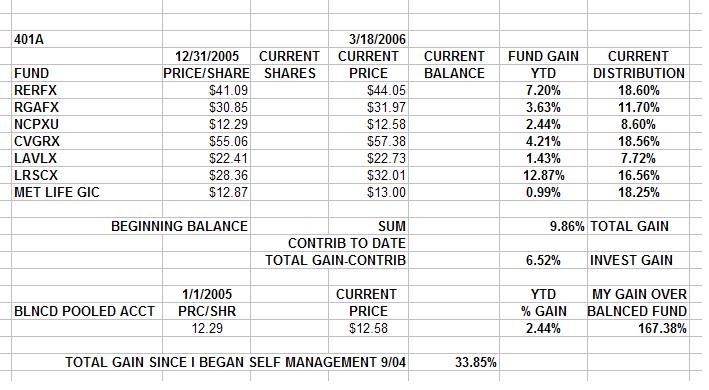

Whoa! Pretty good week all around. Even with close to 30% of my account in the cash equivalent GIC, I'm still at a smokin' 34% gain in 18 months. That's equal to the high water mark of the last coupla weeks. Of course, my performance for the week coulda been a fifth again what it was, if only I'd stayed with 100% stocks. Oh well. I feel strongly about that both ways. Check out the chart below.

So it's all about cyclicality. Life is about seasons and cycles. Things get good and things get bad... Spring to Summer to Autumn to Winter...And then back to Spring... youth to old age to death and rebirth...boom to bust to boom...recession to recovery to recession...there is a season, turn turn, turn ...philosophy kinda like the monologue in the middle of a good ol' fashion Country an' Western song, iff'n ya all know what ah mean... So if there is a time to buy and hold, say like April '97 to say April-October 2000 on the chart above, then there is a time to SELL. Like say July 2000 until April '03 on the same chart.

But it's never that easy. If you are used to selling, used to leaving ten or twenty dollars on the table in order to take $100 home, it CAN be that easy. But if you can't do that/never have done that, it's really hard. Say you bought in January '99 at 1200 on the chart above. Say you watched the markets run up and the money roll in. Say that you figured out that all you have to do now to make money is to buy stocks and hold them because it's working so well, and besides that, you heard and believed that it's just a matter of buy and hold because the market always comes back. Say that, based on the above, you decided to hold on to your stocks regardless. Say that you watched the market go to the high of 1500, up 25%, and then watched it go back down to 1200. Say that after a year of watching your profits bleed away , you've had enough. You decide that you finally want out, but not until you see it back near the previous high of 1500 so as to get back what at least some of the profits you've lost. Say that the market goes down even more, to 1100, then bounces hard but only gets to 1150, not even where it was when you decided to sell. Then the market rolls over and keeps going down, but you keep the faith, determined to sell at least near breakeven at 1200. And then it continues down. You've lost the profits that you made between 1200 and 1500 and now you're well underwater. How can you lose your profits AND the money you started with? You can't take the loss and it's drivin you up the wall. Now you're just waiting for a chance to sell anywhere close to 1200, just to kinda sorta break even. But say you see 800 first. It never gets close to 1200 that year or the next. Why, that's when you finally realize you're screwed, but good. You're down 33% from where you started and down almost 50% from the highs. Huge Bummer. Maybe you sell then, at the very worst time; you lock in the losses. Really Huge Bummer. Even if you don't sell and hang on after it finally turns up, you won't get back to even for 2 more years. That's still a bummer, but at least it's only a middlin' size one, compared to bailing out at the very bottom.

But suppose you were as practiced at selling as you were at buying. Say you sold a little on the dips on the way up and you bought what you sold back when stocks bounced up. Say you were determined to book part of your profits on a regular basis and cut your exposure when things got bad. Why, then you would have started selling when the market rolled over at 1500 and started down. You might have bought some back on the way down on the bounces, but as the market descended, you'd sell and you'd have less and less stocks and more and more cash the lower it went. You'd have a lot of cash to buy stocks when they finally bottomed and started back up. Eight hundred to 1200 would be up 50%, not finally back to even. Hey! That'd Be Most Excellent. That'd be a good thing indeed.

So I'm not that unhappy that I sold earlier this week. I was still 70% invested in stocks, still making good money, and now I've gotten some recent practice selling. And that's a very very good thing indeed.

So this Sunday PM late, I moved a little money back into RERFX and LRSCX. After all, RERFX is where a falling dollar and growth outside the US will do me some good, and LRSCX is where I can invest in companies growing 20%-30% unlike Microsoft, GM, and Intel. See below.

But nothing fundamental has changed and I'm still almost 20% cash and ready to get sellicious if and when. If the doom and gloomers are right, it'll be a long ride down over years and I've got the mindset, intention, and tools not to ride my money all the way to the bottom. In the meantime, I'm still earning my retirement. And if it turns out to be sweetness and light and not darkness and despair, I'm dialed in and ready for that too. See ya at the hall this week. We have stuff to do there.

So it's all about cyclicality. Life is about seasons and cycles. Things get good and things get bad... Spring to Summer to Autumn to Winter...And then back to Spring... youth to old age to death and rebirth...boom to bust to boom...recession to recovery to recession...there is a season, turn turn, turn ...philosophy kinda like the monologue in the middle of a good ol' fashion Country an' Western song, iff'n ya all know what ah mean... So if there is a time to buy and hold, say like April '97 to say April-October 2000 on the chart above, then there is a time to SELL. Like say July 2000 until April '03 on the same chart.

But it's never that easy. If you are used to selling, used to leaving ten or twenty dollars on the table in order to take $100 home, it CAN be that easy. But if you can't do that/never have done that, it's really hard. Say you bought in January '99 at 1200 on the chart above. Say you watched the markets run up and the money roll in. Say that you figured out that all you have to do now to make money is to buy stocks and hold them because it's working so well, and besides that, you heard and believed that it's just a matter of buy and hold because the market always comes back. Say that, based on the above, you decided to hold on to your stocks regardless. Say that you watched the market go to the high of 1500, up 25%, and then watched it go back down to 1200. Say that after a year of watching your profits bleed away , you've had enough. You decide that you finally want out, but not until you see it back near the previous high of 1500 so as to get back what at least some of the profits you've lost. Say that the market goes down even more, to 1100, then bounces hard but only gets to 1150, not even where it was when you decided to sell. Then the market rolls over and keeps going down, but you keep the faith, determined to sell at least near breakeven at 1200. And then it continues down. You've lost the profits that you made between 1200 and 1500 and now you're well underwater. How can you lose your profits AND the money you started with? You can't take the loss and it's drivin you up the wall. Now you're just waiting for a chance to sell anywhere close to 1200, just to kinda sorta break even. But say you see 800 first. It never gets close to 1200 that year or the next. Why, that's when you finally realize you're screwed, but good. You're down 33% from where you started and down almost 50% from the highs. Huge Bummer. Maybe you sell then, at the very worst time; you lock in the losses. Really Huge Bummer. Even if you don't sell and hang on after it finally turns up, you won't get back to even for 2 more years. That's still a bummer, but at least it's only a middlin' size one, compared to bailing out at the very bottom.

But suppose you were as practiced at selling as you were at buying. Say you sold a little on the dips on the way up and you bought what you sold back when stocks bounced up. Say you were determined to book part of your profits on a regular basis and cut your exposure when things got bad. Why, then you would have started selling when the market rolled over at 1500 and started down. You might have bought some back on the way down on the bounces, but as the market descended, you'd sell and you'd have less and less stocks and more and more cash the lower it went. You'd have a lot of cash to buy stocks when they finally bottomed and started back up. Eight hundred to 1200 would be up 50%, not finally back to even. Hey! That'd Be Most Excellent. That'd be a good thing indeed.

So I'm not that unhappy that I sold earlier this week. I was still 70% invested in stocks, still making good money, and now I've gotten some recent practice selling. And that's a very very good thing indeed.

So this Sunday PM late, I moved a little money back into RERFX and LRSCX. After all, RERFX is where a falling dollar and growth outside the US will do me some good, and LRSCX is where I can invest in companies growing 20%-30% unlike Microsoft, GM, and Intel. See below.

But nothing fundamental has changed and I'm still almost 20% cash and ready to get sellicious if and when. If the doom and gloomers are right, it'll be a long ride down over years and I've got the mindset, intention, and tools not to ride my money all the way to the bottom. In the meantime, I'm still earning my retirement. And if it turns out to be sweetness and light and not darkness and despair, I'm dialed in and ready for that too. See ya at the hall this week. We have stuff to do there.

Calendar

Calendar