I want to thank everyone for their support in the recent election. I'm still going to get the job done. But it'll be done from the outside. Phase Two starts today..... Check out www.joefacer.com /Reforming a Pension Plan

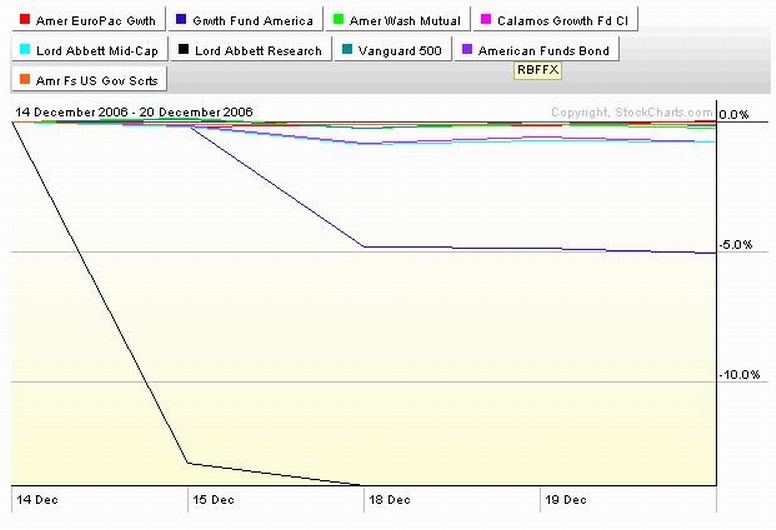

Some charts and tables up. Either the Lord Abbett Small Cap went down in flames big time 13%) in one day (pretty unlikely) or it paid a VERY substantial dividend or capital gains. (PFL).

===It was the latter case, the div/cap gains were $4.531 per share.===

I'll post my account charts and tables when I get it all plumb square and level... Which will be when I can get info on if and what the dividend/cap gains were from KandG or another source.

===Still waiting on this one for the very final good as gold number.===

But, if ya just CAN'T wait, figure Lord Abbett is buying you new shares at the price of 30.07. This works out to about one new share for each six you now hold. Call it about 13-15% capital gains this year.

For those who are unclear on what happened; the typical mutual fund has one portfolio of stocks/bonds but many different classifications. Some investors pay a load (commission) upfront, some pay it later on sales, some pay a higher commission, some pay a lower commision, etc. Some of the holders of the fund have to pay taxes on capital gains and some don't. Pension funds tend to use the institutional classification shares of the fund and so probably, most likely, pretty much everyone in this "r or x " classification fund, like 342 members, is in a nontaxable income/capital gains situation. But maybe not everyone. To make the whole thing easier and somewhat transparent, especially given that taxable and nontaxable entities may be in every class of fund, every year about this time, the fund takes the capital gains and dividends made over the past year out of each account in each classification, subtracting the value from the NAV (net asset value). So the price per share takes a hit. In the next coupla three or four days after, they rebate the capital gains/dividend taken out of each account back into the same account but in shares instead of dollars, at the price that the fund was when they subtracted the cap gains... After it is all over, you have the same amount of money but in more shares of a less expensive fund and the goverment and you have the capital gains reported in terms of a dollars/shares number if you indeed have to pay taxes on it. For the 401a, it ain't no big thing. You pay no taxes, you do nothing. For the taxable accounts, they use the cap gains number to report. Note it and stay cool. But it'll get your heart pumping the first time you see it, until you look at the calender. Expect to see it happen once in each fund, providing there are indeed capital gains to report.

+++ Growth Fund of America paid on the 19th @1.10 per share.+++

---EuroPacific pays on or about the 27th.---

Figure that the numbers are somewhat flakey until after it has occurred in each fund and has been recorded and acknowledged. Or you can look away until 2007.

The charts look like this... Ya can squint or clickonnit, but then ya gotta

LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY!!!!!!!

Is Local 342 one of the investing proletariat? The excerpt below is from the link below that...

"But they don't seem to be disturbed by the inequality inherent in the financial markets in good times. So long as common stocks are rising and their money isn't obviously stolen -- that is, so long as the proletariat enjoys steady, if unspectacular, returns on its capital -- the investment lower class is surprisingly docile. It's as if the pleasure of any return at all has distracted investors from a comparatively low rate."

http://www.bloomberg.com/apps/news?pid= ... nist_lewis

With a $300,000,000 pension fund, given that there are limitations to what we can and should do with retirement money, are our funds being invested to give us the highest return with the greatest safety? Or is there a sizeable "tip" already worked into the tab when it hits the table because we know them and they know us and it's goin' on the union members card where they'll never see it?

Good readin'

http://online.wsj.com/public/article/SB ... ?mod=blogs

===It was the latter case, the div/cap gains were $4.531 per share.===

I'll post my account charts and tables when I get it all plumb square and level... Which will be when I can get info on if and what the dividend/cap gains were from KandG or another source.

===Still waiting on this one for the very final good as gold number.===

But, if ya just CAN'T wait, figure Lord Abbett is buying you new shares at the price of 30.07. This works out to about one new share for each six you now hold. Call it about 13-15% capital gains this year.

For those who are unclear on what happened; the typical mutual fund has one portfolio of stocks/bonds but many different classifications. Some investors pay a load (commission) upfront, some pay it later on sales, some pay a higher commission, some pay a lower commision, etc. Some of the holders of the fund have to pay taxes on capital gains and some don't. Pension funds tend to use the institutional classification shares of the fund and so probably, most likely, pretty much everyone in this "r or x " classification fund, like 342 members, is in a nontaxable income/capital gains situation. But maybe not everyone. To make the whole thing easier and somewhat transparent, especially given that taxable and nontaxable entities may be in every class of fund, every year about this time, the fund takes the capital gains and dividends made over the past year out of each account in each classification, subtracting the value from the NAV (net asset value). So the price per share takes a hit. In the next coupla three or four days after, they rebate the capital gains/dividend taken out of each account back into the same account but in shares instead of dollars, at the price that the fund was when they subtracted the cap gains... After it is all over, you have the same amount of money but in more shares of a less expensive fund and the goverment and you have the capital gains reported in terms of a dollars/shares number if you indeed have to pay taxes on it. For the 401a, it ain't no big thing. You pay no taxes, you do nothing. For the taxable accounts, they use the cap gains number to report. Note it and stay cool. But it'll get your heart pumping the first time you see it, until you look at the calender. Expect to see it happen once in each fund, providing there are indeed capital gains to report.

+++ Growth Fund of America paid on the 19th @1.10 per share.+++

---EuroPacific pays on or about the 27th.---

Figure that the numbers are somewhat flakey until after it has occurred in each fund and has been recorded and acknowledged. Or you can look away until 2007.

The charts look like this... Ya can squint or clickonnit, but then ya gotta

LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY!!!!!!!

Is Local 342 one of the investing proletariat? The excerpt below is from the link below that...

"But they don't seem to be disturbed by the inequality inherent in the financial markets in good times. So long as common stocks are rising and their money isn't obviously stolen -- that is, so long as the proletariat enjoys steady, if unspectacular, returns on its capital -- the investment lower class is surprisingly docile. It's as if the pleasure of any return at all has distracted investors from a comparatively low rate."

http://www.bloomberg.com/apps/news?pid= ... nist_lewis

With a $300,000,000 pension fund, given that there are limitations to what we can and should do with retirement money, are our funds being invested to give us the highest return with the greatest safety? Or is there a sizeable "tip" already worked into the tab when it hits the table because we know them and they know us and it's goin' on the union members card where they'll never see it?

Good readin'

http://online.wsj.com/public/article/SB ... ?mod=blogs

Calendar

Calendar