Your Life Is A One Act Play And You Are The Author. I'm Writing My Life As An Adventure and A Light Hearted Comedy. What Choo You Doin' Wit' Your Lifes?

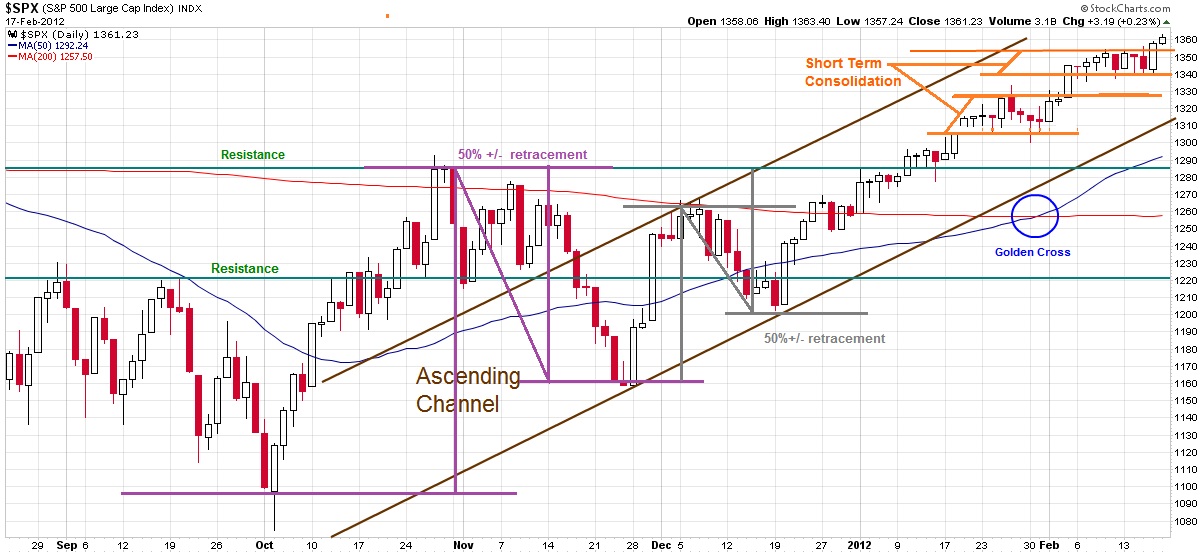

It has always been my view that Technical Analysis is an art, and like art, there are a lot of really bad examples of it out there.

Chartz and Table Zup @ www.joefacer.com.

Fuckin "A" Tweetie Bird!!!!

Links

Home

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

| « | March 2017 | » | ||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

| 02/20/2026 | ||||||

Doo Wah Diddy.... Having Said That, It Pretty Much Brands Me As The Anti- Millennial...

Saw Bonamassa Last Night.The Wife And I Were As Impressed W/ The Drummer As Joe. Mostly Elderly Crowd; Almost As Old As I Am... A Few Were Convinced That The Program Was Their's, Coulda Been Worse...

I Was Around When It Was JFK And LBJ. Kind Of An Object Lesson In What You Wish For And How Things Can Get REALLY Beyond What You Can Imagine. Oh Well. Life Goes On...

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Another week, another battle. First, to minimize risk and second, maximize return.

Saw Bonamassa Last Night.The Wife And I Were As Impressed W/ The Drummer As Joe. Mostly Elderly Crowd; Almost As Old As I Am... A Few Were Convinced That The Program Was Their's, Coulda Been Worse...

I Was Around When It Was JFK And LBJ. Kind Of An Object Lesson In What You Wish For And How Things Can Get REALLY Beyond What You Can Imagine. Oh Well. Life Goes On...

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Another week, another battle. First, to minimize risk and second, maximize return.

Total: 593

Today: 95

Yesterday: 158

Today: 95

Yesterday: 158

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

joefacer.com/pblog - Page Generated in 0.0486 seconds | Site Views: 593

Calendar

Calendar