The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight.

Reverend Shark

Charts and tables up. If you read the entrys below, you have a laundry list of things that I am concerned about. Regardless, the first half of the year, dispite my misgivings, has been smokin'. I went to cash on the 401a in Feb and that was a mistake. It's one I can afford, because THE VERY MOST IMPORTANT THING IN THE WHOLE WIDE WORLD, IS TO KEEP YOUR SAVINGS AND INVESTMENT INTACT. THOU SHALT NOT PISS AWAY YOUR SAVINGS AND INVESTMENT GAINS!! I've had some great gains since we reworked the 401a investment choices in 9/2004 and standing still when I think the risks are large does not hurt at all....as long as I don't leave too much on the table out of a failure to recognize what's in front of me. By mid/late March, my mistake was obvious to me and I got back in.

It helps that I am working hard to repair the damage done to my IRA's as well as to my 401a. I'm not as restricted in the IRA's as the 401a and I have no restrictions on my trading account so I get a much better sense of the investment markets since I spend a fair amount of time on it. So I have a definite opinion about my going to cash in Feb.

I was either wrong or early..... and I don't now which...

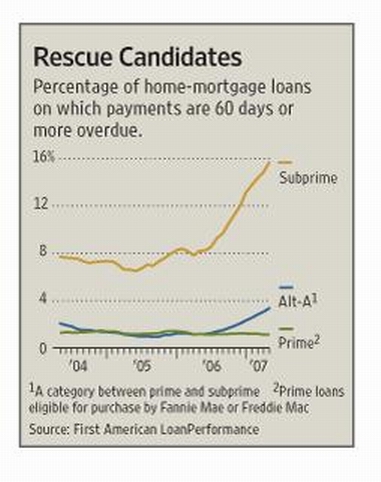

So check this out;

I suspect I was early.... Or I may have been wrong. But if we're on our way to hell in a handbasket, it won't happen over night.

So, as per the Shark up above, I gotta plan on what to do if only good things happen ever after, and I got a plan if it all turns to shit. I've just got to keep my eyes open and recognize what is going on in front of me.

Check this out... it doesn't hurt to be informed.

http://bigpicture.typepad.com/comments/ ... ubpri.html

See ya at the hall...

Reverend Shark

Charts and tables up. If you read the entrys below, you have a laundry list of things that I am concerned about. Regardless, the first half of the year, dispite my misgivings, has been smokin'. I went to cash on the 401a in Feb and that was a mistake. It's one I can afford, because THE VERY MOST IMPORTANT THING IN THE WHOLE WIDE WORLD, IS TO KEEP YOUR SAVINGS AND INVESTMENT INTACT. THOU SHALT NOT PISS AWAY YOUR SAVINGS AND INVESTMENT GAINS!! I've had some great gains since we reworked the 401a investment choices in 9/2004 and standing still when I think the risks are large does not hurt at all....as long as I don't leave too much on the table out of a failure to recognize what's in front of me. By mid/late March, my mistake was obvious to me and I got back in.

It helps that I am working hard to repair the damage done to my IRA's as well as to my 401a. I'm not as restricted in the IRA's as the 401a and I have no restrictions on my trading account so I get a much better sense of the investment markets since I spend a fair amount of time on it. So I have a definite opinion about my going to cash in Feb.

I was either wrong or early..... and I don't now which...

So check this out;

I suspect I was early.... Or I may have been wrong. But if we're on our way to hell in a handbasket, it won't happen over night.

So, as per the Shark up above, I gotta plan on what to do if only good things happen ever after, and I got a plan if it all turns to shit. I've just got to keep my eyes open and recognize what is going on in front of me.

Check this out... it doesn't hurt to be informed.

http://bigpicture.typepad.com/comments/ ... ubpri.html

See ya at the hall...

Calendar

Calendar