"God I hope I break even...I could really use the money." A good sign that you're not gonna make it as either a professional gambler or investor

CHARTZ AND TABLE ZUP.

Things are not at all what they seem. Film at eleven and a big bin of ones and zero's sent over the pipes of the interweb to magically appear here as arcane financial 401a blather later on this long weekend.

I'm told that a number of union locals across the country are rumored to be experiencing major issues with their pension funds. Some have frozen contributions/redemptions/withdrawals until it gets figured out. Kinda not surprising given what's going on at this site and in the mortgage market nationally. We aren't faced with that here currently (although that could change) but eternal vigilence is the price of financial freedom.

I've changed my 401a allocation again and again recently because I believe we are in transition between a bull market and a bear market. It won't be neat and discrete. It'll be sloppy and choppy. It'll be more like surfing that like a record run at Bonneville. There'll be a lotta hack and hew as I alternate between making money and not losing it.

BUT WAIT!!! THAT'S NOT ALL.........CLICKONNIT!!!

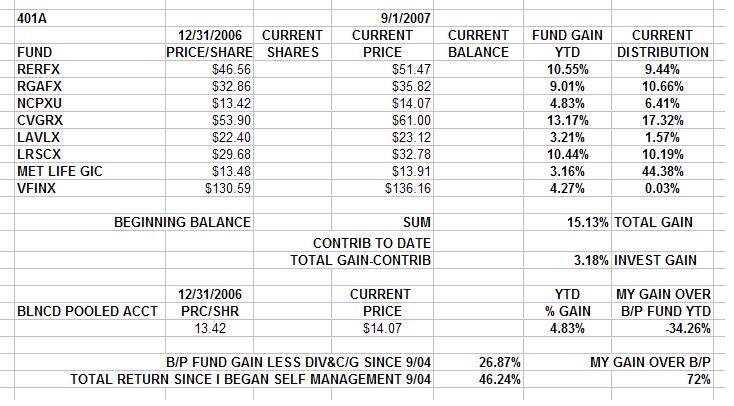

So anyway, Check It Out an' say....WTF? According to the charts on my website, www.joefacer.com, I'm tallying a 45% return over just about three years time, or about 15% per year and around double what the B/P Fund is doing. Yet when you click on the table above, you see that this year I'm showing a pretty limp return of under 4% and trailing the B/P Fund substantially. Also the funds I prefer to invest in are showning returns pretty much between 9% and 13% YTD. Whatzup?

Well.....You make hay while the sun shines. When the market is going up and I'm feeling good about it, I'm pretty aggressive. I have no problem w/ going 100% invested in the hottest funds available. On the straights, twist the wrist, stretch the throttle cable, and ride way out on the front end to keep the front tire near the ground... if possible. You don't endure the risk and expense of racing to deliberately finish last. Riding as hard as you can is the only sensible thing to do out on the track. But we're talking championship (and retirement) here, and to finish first, first you have to finish (Get the best return you can and hold any losses to the absolute minimum). So you gotta deal with the turns and investment risks differently than the straights and clear sailing. So when things feel risky to me I can go to 100% cash almost as quickly as I can go to 100% stocks. Two sides to the coin and all that.

I've been wrong to get worried and go big time to cash every time I've done it to date. It's cost me significant coin each time. But there is a big difference between making less money than you could have and actually losing money. I'm pretty sure that a big time opportunity to lose money is here and it's made me nervous. As a general rule, you can't short,hedge, or play options with retirement money. There are exceptions, but they're pretty limited. So I answer nervousness and losses by selling stocks and buying cash until I can sleep. Check out the Fundz YTD chart on the Chart page of my site. http://joefacer.com/id10.html and my current allocation http://joefacer.com/id11.html. Down about 4% from the peak of the market during the first week of July and hangin at about fifty percent in cash has me resting comfortably. See ya at the hall.

Things are not at all what they seem. Film at eleven and a big bin of ones and zero's sent over the pipes of the interweb to magically appear here as arcane financial 401a blather later on this long weekend.

I'm told that a number of union locals across the country are rumored to be experiencing major issues with their pension funds. Some have frozen contributions/redemptions/withdrawals until it gets figured out. Kinda not surprising given what's going on at this site and in the mortgage market nationally. We aren't faced with that here currently (although that could change) but eternal vigilence is the price of financial freedom.

I've changed my 401a allocation again and again recently because I believe we are in transition between a bull market and a bear market. It won't be neat and discrete. It'll be sloppy and choppy. It'll be more like surfing that like a record run at Bonneville. There'll be a lotta hack and hew as I alternate between making money and not losing it.

BUT WAIT!!! THAT'S NOT ALL.........CLICKONNIT!!!

So anyway, Check It Out an' say....WTF? According to the charts on my website, www.joefacer.com, I'm tallying a 45% return over just about three years time, or about 15% per year and around double what the B/P Fund is doing. Yet when you click on the table above, you see that this year I'm showing a pretty limp return of under 4% and trailing the B/P Fund substantially. Also the funds I prefer to invest in are showning returns pretty much between 9% and 13% YTD. Whatzup?

Well.....You make hay while the sun shines. When the market is going up and I'm feeling good about it, I'm pretty aggressive. I have no problem w/ going 100% invested in the hottest funds available. On the straights, twist the wrist, stretch the throttle cable, and ride way out on the front end to keep the front tire near the ground... if possible. You don't endure the risk and expense of racing to deliberately finish last. Riding as hard as you can is the only sensible thing to do out on the track. But we're talking championship (and retirement) here, and to finish first, first you have to finish (Get the best return you can and hold any losses to the absolute minimum). So you gotta deal with the turns and investment risks differently than the straights and clear sailing. So when things feel risky to me I can go to 100% cash almost as quickly as I can go to 100% stocks. Two sides to the coin and all that.

I've been wrong to get worried and go big time to cash every time I've done it to date. It's cost me significant coin each time. But there is a big difference between making less money than you could have and actually losing money. I'm pretty sure that a big time opportunity to lose money is here and it's made me nervous. As a general rule, you can't short,hedge, or play options with retirement money. There are exceptions, but they're pretty limited. So I answer nervousness and losses by selling stocks and buying cash until I can sleep. Check out the Fundz YTD chart on the Chart page of my site. http://joefacer.com/id10.html and my current allocation http://joefacer.com/id11.html. Down about 4% from the peak of the market during the first week of July and hangin at about fifty percent in cash has me resting comfortably. See ya at the hall.

Calendar

Calendar