So The Fed Left The Punch Bowl Out Too Long An' Wall Street And Real Estate Fell In. And What Ya Knew Was Gonna Happen, Happened. Then The Fed An' The Government Borrowed The Public's Credit Card And Refilled The Punch Bowl. Pourin' Alky Down A Drunk's Throat Never Ends Well. Sobering Up Gets Postponed And Worsened. Don't Stand In Front, Stand To The Side.

Saturday, February 13, 2010, 04:33 PM

My philosophy for trading is -- understand why something is happening economically and then look at the price action. If both of them works, go trade. If one of them is starting to fall apart, get out. And if both fall apart, get short,

-- Dennis Gartman

Chartz and Table Zup @ www.joefacer.com. Check it out!

Hell, good enuf to make it two weeks inna row.

http://www.youtube.com/watch?v=Sy7vnwXg ... r_embedded

Larry Faucette on congas

Freddie Smith on sax

Buddy Miles on drums

Mike Finnigan on keyboards

Mike was the SF connection. I used to see his band play at a club in Mill Valley.

Also on the LP were Jack Cassady/Stevie Winwood, coupla guys who also played good music elsewhere at the time.

The guitar player was pretty good too. The first time I saw him, he headed the bill at Winterland with Albert King and John Mayall's Blues Breakers. Two sets each starting at 8:00 and JH played until 2:15...

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.ritholtz.com/blog/2010/02/st ... al-policy/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.newsweek.com/id/233519

http://www.ritholtz.com/blog/2010/02/be ... ing-gifts/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... hIeftRVyvE

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... Xq1qk1ll9M

http://www.ritholtz.com/blog/2010/02/ho ... al-crisis/

http://www.ritholtz.com/blog/2010/02/in ... -expected/

http://online.wsj.com/article/SB1000142 ... 53714.html

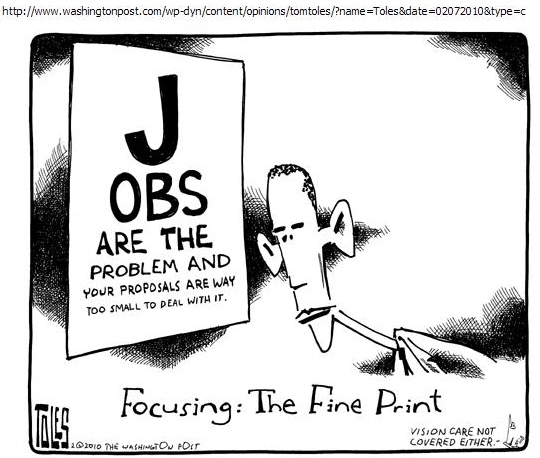

The Obama administration's starting out with health care reform instead of financial reform was a fuck up of enormous proportion. Newsweek's current riff is that it was necessary but still wrong. That news has been out a while. So health care reform is bogged down big time. And Too Big To Fail financials are fewer names but even bigger entities with the taxpayer an unwilling participant in the fun and games. Obama signed on to Bush's program and left the suspects and persons of interest in place and buried them in taxpayer's money. Which they passed around while the jobs just kept disappearing....

So Main Street sees Wall Street getting healthy enough on Main Streets money to be back to the big bonuses spread among fewer names while Main Street continues south. We are still losing jobs at a time when we need well over 100,000 new jobs a month just to stay even. Estimates for this year project 133,000 new jobs a month. That leaves 30,000 new jobs a month to eat into a very real 17% un and underemployed employment rate. Expect the "official" unemployment rate to float between 9.5% and 10% this (election)year as new persons will step on to the pier as someone falls off the other end...

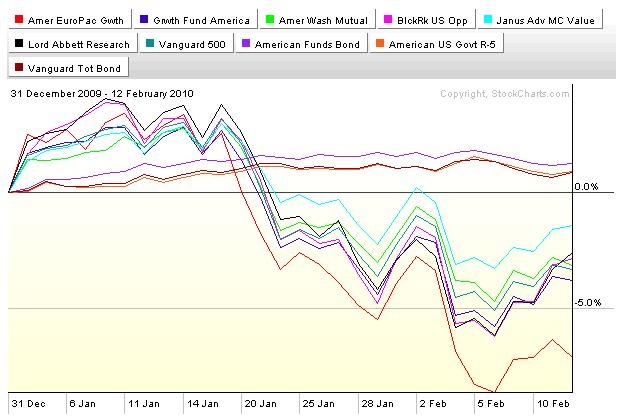

So Intel and Apple posted good reports for the fourth quarter and they and other great names rolled over and started south mid January. Check out the chartz.

The weekly chart shows perspective, the daily chart shows where we are in the domestic big cap market, the 401a funds show where my choices stand with/against the markets...

The suspicion has been that Europe is in worse shape than the US for about a year and a half. Now it is starting to show. The markets are herky jerky between fear of serious bad things and the pronouncements that there exists the firm intentions of the EU to seriously consider that something needs to be done and that they may consider that it may become necessary for them to think about who should do it, if they can do it, and are willing to do so.

In the meantime, commodities and stocks go down and it appears that money is leaving stocks and going to bonds and that money is leaving bonds and going to cash and that money is leaving commodities and going someplace...

I'm standing to the side in the 401a. And it ain't an easy choice. All last year, the stock market made "V" shaped recoveries from every rough patch and maybe it will do it again. But that was last year and this is this year. And bonds are promises to pay and not the most comfortable place to be when promises and the future are suspect.

Still, business will be done. It's just that the developed nations are buried under debt and going no place for the time being. It is the emerging nations that will be doing business, but less of it and under some uncertainty.

So for now it looks like rips and dips in stocks as the emotions of fear and greed will jerk the market around the existing trend. And the trend that I see is down.

So I consider that 401a money is not real nimble and that I have to respect the trend.

http://www.ritholtz.com/blog/2010/02/jo ... e-to-last/

http://www.ritholtz.com/blog/2010/02/be ... more-51652

Oh, yeah... 100% GIC and Bonds until further notice.

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... MJFT2dMyIU

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.msnbc.msn.com/id/35367044/ns ... swer_desk/

http://www.ritholtz.com/blog/2010/02/pr ... -earnings/

http://www.msnbc.msn.com/id/35406859/ns ... d_economy/

Stay tooned....

Comments are not available for this entry.

Calendar

Calendar