Charts and tables up. .

Here's where I was going with the FPRAX and IDETX riff; "Buy and hold", "Be patient, it'll always come back, it always does", "These are world class quality American companies, stay with them, you can't go wrong in the long run," is horse exhaust. CLICKONNIT.

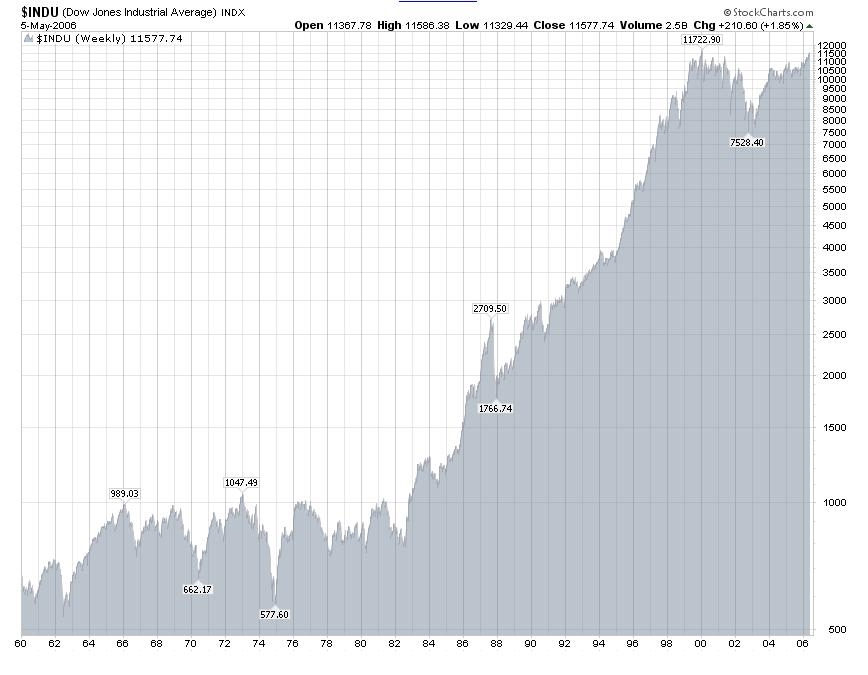

Check this out. Above are the Dow Industrials; 30 of the Great American Companies. Over the long run the trend is up. Check the chart. Forty six years of "in the long run" progress is shown. Of course, in the long run we're all dead. CLICKONNIT.

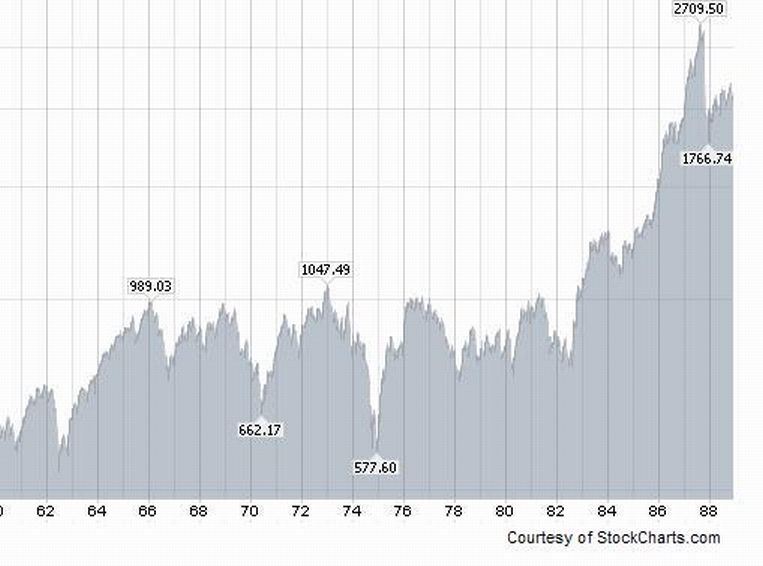

Check this out. Above is the Dow between '62 and '88. Check out '66 to '83. Seventeen years and breaking even for the fifth time. Not much to show for buy and hold and having patience. Of course if you sold a little on the highs and bought a little on the lows, you did better. Still... We're currently in another period where we have flat performance;six years and counting... We'll undoubtedly get back to even in the long run. It helps to be 22 and have 40 years to go. That's the long run. But it sucks to be 50 and already thinking about taking the first step out the door to retirement. Six to seventeen years of flat performance? That is way too much of a long run...especially given where I'm coming from and going to. Anyway, think bonds are the answer once you get close to retirement? Check the charts on our bond funds against what fuel/housing/food and medical care inflation have been. So....if not buy and hold or bonds, What?

What worked so well for me when Bill Sams was running my money in FPRAX was that he was trading stocks. He ran a small fund, some where about $50-$150 Mil when I started with him in '82 and around $700 Mil in '98, as I remember. In '82 interest rates were sky high. He kept a lot of funds in cash and made a good return on it in the 80's. He had maximum flexibility to roll the money between stocks and cash. He bought when stocks were down and he saw an opportunity and he sold when they went up to where the upside was limited. Then he did it again. You always had to take into account that he was doing very well considering his performance was accomplished with a cash cushion. It was especially good performance once interest rates came down. If stocks went to zero, he'd still have cash to return to investors. Most other funds are 100% invested. Bill Sams had the ability to bail out of either a winning or a losing position quickly because he carried relatively small positions; no bleeding a huge position into the market for many long months along with all the other giant mutual funds, trying to get out as fast as possible without destroying the stock price. He was playing a value game, looking for diamonds in the dirt. He bought stocks that were going down or already down and were going to go up. He was right for years. Then he was not.

Due to the Thailand baht crisis, the Long Term Capital crisis, the Russian bond crisis and other financial crises of the 90's, the Fed flooded the market with dollars and lowered rates. Bill saw inflation on the way and set up for it in gold, commodity stocks, and other defensive positions and stayed the course, regardless. Instead of driving gold and oil up, the money went into the "new economy", dot coms, telecoms, etc and it was FPRAX that blew up. There came a time for me to trade the trader. Whether or not Bill Sams was right in the long run was meaningless. He was costing me big time.

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros

So I stopped the losses. I moved on. I had bought and so I sold. I got impatient. I got short runnish. Bill stayed the course, sure he was right. He was. Ultimately, gold, oil and metals soared, eight years later in 2005/6. Bill Sams was "retired" shortly after I was out of FPRAX, in 2000, but long before he was proven right. Management of FPRAX was given to the managers of FPA Perennial Fund FPPFX, a fund that was/is run similarly to FPRAX. Hell, Bill may have trained his replacements. Regardless, the market stayed irrational longer than Bill Sams could stay employed. CLICKONNIT.

Check this out. Pretty good performance since 2000. Last I looked both FPPFX and FPRAX were carrying about 30% cash. So...FPRAX was right, then it was wrong, and now it's right. What does it mean?

YOU CAN'T LOOK AWAY FROM YOUR MONEY. IT'LL GO AWAY IF YOU DO SO LONG ENOUGH. No money manager is always right. No system works all the time under all circumstances. No money manager is above regular review and everyone is subject to replacement if the performance isn't there. It all falls back onto the individual who invested the money. You can't expect a money manager to fire himself. That's your job. There are times when they don't even admit that they've been wrong. Been there. Listened to that on the phone. It's about understanding that it is NEVER a no brainer to give your money to someone else to manage. You have to understand what he is doing, and whether or not it is working. If you get lazy about it, you can end up being the no brainer if/when your money goes away.

Can this even be done? Isn't this a huge amount of work? Don't you have to know what your money managers are holding every single day? Isn't it a huge risk? I think so. No. No. I don't think so. In that order

I think that I can successfully manage my 401a right here with the tools I've got on this site and reading up on the market and economy. Bill Sams was responsible for making me a dollar. That was very good. Teaching me that it is my responsibility to see that I kept, it that was great. Next week, lessons learned from IDETX.

Over the past month, Japan has removed $50 billion of liquidity from the markets. Other central banks are tightening rates or policy or both. The carry trade appears to have been ended. The Fed has sprayed grumpiness from the lip all over the landscape, lobbed threats all over the horizon, and promised the end of life as we know at the very minimum if they eyeball even a trace of pricing power, much less inflation. Markets, portfolio's, and hope have been crushed. My trading account and IRA's are a smoking ruin. Death and destruction and the crimson wing of doom o'er shadowing all, as Darkness and Dispair loom o'er their new domain.... It's Really Very Very Cool. I love the special effects.

The Fed has reinstituted fear in the marketplace, hammered speculators flat, flattened out commodities, and served notice, all between meetings and without raising rates. All while I was mostly in cash in the 401a too. It takes the sting out of the other nastiness in my other accounts. The economy still appears to be OK, the cooling of commodities may extend the post dot com/9-11 crash run, and if the political risk comes out of oil, we may just get by quite nicely. Markets backed and filled Friday after two big short squeeze big time up days. Things look brighter in the short run. I put half my cash back in on Friday, pretty much across the board. See the charts and tables. Yeah, it's kinda cowboy. But look at the charts. If everything turn out for the better, I've bought back in at near Jan 1st levels and I've got no obligation to ride the positions down into oblivion. I'm half cash in case it doesn't work out, so my risk is half what it could be. I have cash to commit on a dip if one occurs so I can get in even cheaper. Ammunition is alway a good thing to have plenty of when things are uncertain. If it goes straight up without me and I only got a half a position on, I can live with that. It won't necessarily be easy as it is a new game as of last month. But no one said it would be easy. It's all about the economy. And that it's still strong gives me hope.

Understand, hope is not my strategy, it's a result of my observation and judgement. Maximizing my opportunity and controlling my risk is my strategy. See ya at the hall. Contract vote coming up...

Here's where I was going with the FPRAX and IDETX riff; "Buy and hold", "Be patient, it'll always come back, it always does", "These are world class quality American companies, stay with them, you can't go wrong in the long run," is horse exhaust. CLICKONNIT.

Check this out. Above are the Dow Industrials; 30 of the Great American Companies. Over the long run the trend is up. Check the chart. Forty six years of "in the long run" progress is shown. Of course, in the long run we're all dead. CLICKONNIT.

Check this out. Above is the Dow between '62 and '88. Check out '66 to '83. Seventeen years and breaking even for the fifth time. Not much to show for buy and hold and having patience. Of course if you sold a little on the highs and bought a little on the lows, you did better. Still... We're currently in another period where we have flat performance;six years and counting... We'll undoubtedly get back to even in the long run. It helps to be 22 and have 40 years to go. That's the long run. But it sucks to be 50 and already thinking about taking the first step out the door to retirement. Six to seventeen years of flat performance? That is way too much of a long run...especially given where I'm coming from and going to. Anyway, think bonds are the answer once you get close to retirement? Check the charts on our bond funds against what fuel/housing/food and medical care inflation have been. So....if not buy and hold or bonds, What?

What worked so well for me when Bill Sams was running my money in FPRAX was that he was trading stocks. He ran a small fund, some where about $50-$150 Mil when I started with him in '82 and around $700 Mil in '98, as I remember. In '82 interest rates were sky high. He kept a lot of funds in cash and made a good return on it in the 80's. He had maximum flexibility to roll the money between stocks and cash. He bought when stocks were down and he saw an opportunity and he sold when they went up to where the upside was limited. Then he did it again. You always had to take into account that he was doing very well considering his performance was accomplished with a cash cushion. It was especially good performance once interest rates came down. If stocks went to zero, he'd still have cash to return to investors. Most other funds are 100% invested. Bill Sams had the ability to bail out of either a winning or a losing position quickly because he carried relatively small positions; no bleeding a huge position into the market for many long months along with all the other giant mutual funds, trying to get out as fast as possible without destroying the stock price. He was playing a value game, looking for diamonds in the dirt. He bought stocks that were going down or already down and were going to go up. He was right for years. Then he was not.

Due to the Thailand baht crisis, the Long Term Capital crisis, the Russian bond crisis and other financial crises of the 90's, the Fed flooded the market with dollars and lowered rates. Bill saw inflation on the way and set up for it in gold, commodity stocks, and other defensive positions and stayed the course, regardless. Instead of driving gold and oil up, the money went into the "new economy", dot coms, telecoms, etc and it was FPRAX that blew up. There came a time for me to trade the trader. Whether or not Bill Sams was right in the long run was meaningless. He was costing me big time.

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros

So I stopped the losses. I moved on. I had bought and so I sold. I got impatient. I got short runnish. Bill stayed the course, sure he was right. He was. Ultimately, gold, oil and metals soared, eight years later in 2005/6. Bill Sams was "retired" shortly after I was out of FPRAX, in 2000, but long before he was proven right. Management of FPRAX was given to the managers of FPA Perennial Fund FPPFX, a fund that was/is run similarly to FPRAX. Hell, Bill may have trained his replacements. Regardless, the market stayed irrational longer than Bill Sams could stay employed. CLICKONNIT.

Check this out. Pretty good performance since 2000. Last I looked both FPPFX and FPRAX were carrying about 30% cash. So...FPRAX was right, then it was wrong, and now it's right. What does it mean?

YOU CAN'T LOOK AWAY FROM YOUR MONEY. IT'LL GO AWAY IF YOU DO SO LONG ENOUGH. No money manager is always right. No system works all the time under all circumstances. No money manager is above regular review and everyone is subject to replacement if the performance isn't there. It all falls back onto the individual who invested the money. You can't expect a money manager to fire himself. That's your job. There are times when they don't even admit that they've been wrong. Been there. Listened to that on the phone. It's about understanding that it is NEVER a no brainer to give your money to someone else to manage. You have to understand what he is doing, and whether or not it is working. If you get lazy about it, you can end up being the no brainer if/when your money goes away.

Can this even be done? Isn't this a huge amount of work? Don't you have to know what your money managers are holding every single day? Isn't it a huge risk? I think so. No. No. I don't think so. In that order

I think that I can successfully manage my 401a right here with the tools I've got on this site and reading up on the market and economy. Bill Sams was responsible for making me a dollar. That was very good. Teaching me that it is my responsibility to see that I kept, it that was great. Next week, lessons learned from IDETX.

Over the past month, Japan has removed $50 billion of liquidity from the markets. Other central banks are tightening rates or policy or both. The carry trade appears to have been ended. The Fed has sprayed grumpiness from the lip all over the landscape, lobbed threats all over the horizon, and promised the end of life as we know at the very minimum if they eyeball even a trace of pricing power, much less inflation. Markets, portfolio's, and hope have been crushed. My trading account and IRA's are a smoking ruin. Death and destruction and the crimson wing of doom o'er shadowing all, as Darkness and Dispair loom o'er their new domain.... It's Really Very Very Cool. I love the special effects.

The Fed has reinstituted fear in the marketplace, hammered speculators flat, flattened out commodities, and served notice, all between meetings and without raising rates. All while I was mostly in cash in the 401a too. It takes the sting out of the other nastiness in my other accounts. The economy still appears to be OK, the cooling of commodities may extend the post dot com/9-11 crash run, and if the political risk comes out of oil, we may just get by quite nicely. Markets backed and filled Friday after two big short squeeze big time up days. Things look brighter in the short run. I put half my cash back in on Friday, pretty much across the board. See the charts and tables. Yeah, it's kinda cowboy. But look at the charts. If everything turn out for the better, I've bought back in at near Jan 1st levels and I've got no obligation to ride the positions down into oblivion. I'm half cash in case it doesn't work out, so my risk is half what it could be. I have cash to commit on a dip if one occurs so I can get in even cheaper. Ammunition is alway a good thing to have plenty of when things are uncertain. If it goes straight up without me and I only got a half a position on, I can live with that. It won't necessarily be easy as it is a new game as of last month. But no one said it would be easy. It's all about the economy. And that it's still strong gives me hope.

Understand, hope is not my strategy, it's a result of my observation and judgement. Maximizing my opportunity and controlling my risk is my strategy. See ya at the hall. Contract vote coming up...

Calendar

Calendar