"De do do do, de da da da, Is all I want to say to you".... The Police ...... From the lost episode of DRAGNET

The first step to making money is not losing it."

-- Ed Easterling

Charts and tables up. More to come, Here and at my wwwebsite, ya know.... There's stuff I gotta think about and I gotta decide what I'm gonna do.....even if I do nothing. Which is a decision and an action , even if it don' look like it. Here's the problem;

The market's looks tough if you only look at certain portions of the 401a.CLICKONNIT!

"

"

Up 4.3% YTD by parking in the do nothing Balanced/Pooled Fund.

Up .76% YTD in the Conservative (watching your money bleed away while your health, energy, and food costs skyrocket) Model

Up 1.7% YTD in the Moderate (I hope nothing bad happens) Model

Up 3.76% YTD in the Aggressive (let's jump in the deep end) Model.

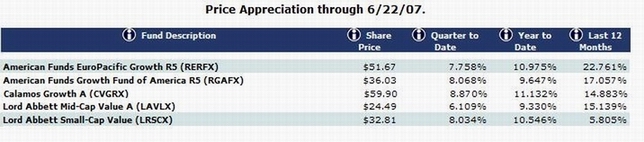

Four choices. Double the risk and worse results for the Agressive model vs the B/P Fund. A 1.5% projected annual return for 2007 for the conservative model(horrible compared to CD rates). Two moderate allocations (Moderate vs B/P) but with one returning 250% more than the other and neither looking very good compared to CD rates. It looks pretty wacky to me. Especially since we have five funds in the 401 that are showing over 9% return YTD. CLICKONNIT

I know. It's all about the long run and in 20 or 30 years it'll all work out. Sounds good for my grandchildren. Explain to me again why I should wait until I'm 90 for it to work out.....

I'm up 31% YTD on my family IRA's and my trading acct at my broker. How can I not go to cash in all those accounts tomorrow? I could then kick back and cherry pick at only the least risky opportunities for the rest of the year during the traditionally difficult summer and fall and then feel like a genius come winter even if things don't pick up... But IF I go to cash in the IRA's and trading account because of the risk, how can I justify leaving my 401a money on the table in stocks?

I've just taken advantage of a major rally in stocks in my IRA's and trading account. Being conservative and holding a lot of the Met Life GIC has cost me return YTD in the 401. Going all in now to try to catch up feels like totally the wrong thing to do. Kinda like going down the long dark stairs in the old haunted house to find out what that noise is. The kids used to ask why anybody would do anything that stoopid. I'd say, " 'Cuz it's a movie and it's in the script." In real life, anybody with a functioning brain'd be long gone two reels ago.... Stay tooned...

-- Ed Easterling

Charts and tables up. More to come, Here and at my wwwebsite, ya know.... There's stuff I gotta think about and I gotta decide what I'm gonna do.....even if I do nothing. Which is a decision and an action , even if it don' look like it. Here's the problem;

The market's looks tough if you only look at certain portions of the 401a.CLICKONNIT!

Up 4.3% YTD by parking in the do nothing Balanced/Pooled Fund.

Up .76% YTD in the Conservative (watching your money bleed away while your health, energy, and food costs skyrocket) Model

Up 1.7% YTD in the Moderate (I hope nothing bad happens) Model

Up 3.76% YTD in the Aggressive (let's jump in the deep end) Model.

Four choices. Double the risk and worse results for the Agressive model vs the B/P Fund. A 1.5% projected annual return for 2007 for the conservative model(horrible compared to CD rates). Two moderate allocations (Moderate vs B/P) but with one returning 250% more than the other and neither looking very good compared to CD rates. It looks pretty wacky to me. Especially since we have five funds in the 401 that are showing over 9% return YTD. CLICKONNIT

I know. It's all about the long run and in 20 or 30 years it'll all work out. Sounds good for my grandchildren. Explain to me again why I should wait until I'm 90 for it to work out.....

I'm up 31% YTD on my family IRA's and my trading acct at my broker. How can I not go to cash in all those accounts tomorrow? I could then kick back and cherry pick at only the least risky opportunities for the rest of the year during the traditionally difficult summer and fall and then feel like a genius come winter even if things don't pick up... But IF I go to cash in the IRA's and trading account because of the risk, how can I justify leaving my 401a money on the table in stocks?

I've just taken advantage of a major rally in stocks in my IRA's and trading account. Being conservative and holding a lot of the Met Life GIC has cost me return YTD in the 401. Going all in now to try to catch up feels like totally the wrong thing to do. Kinda like going down the long dark stairs in the old haunted house to find out what that noise is. The kids used to ask why anybody would do anything that stoopid. I'd say, " 'Cuz it's a movie and it's in the script." In real life, anybody with a functioning brain'd be long gone two reels ago.... Stay tooned...

Calendar

Calendar