| |

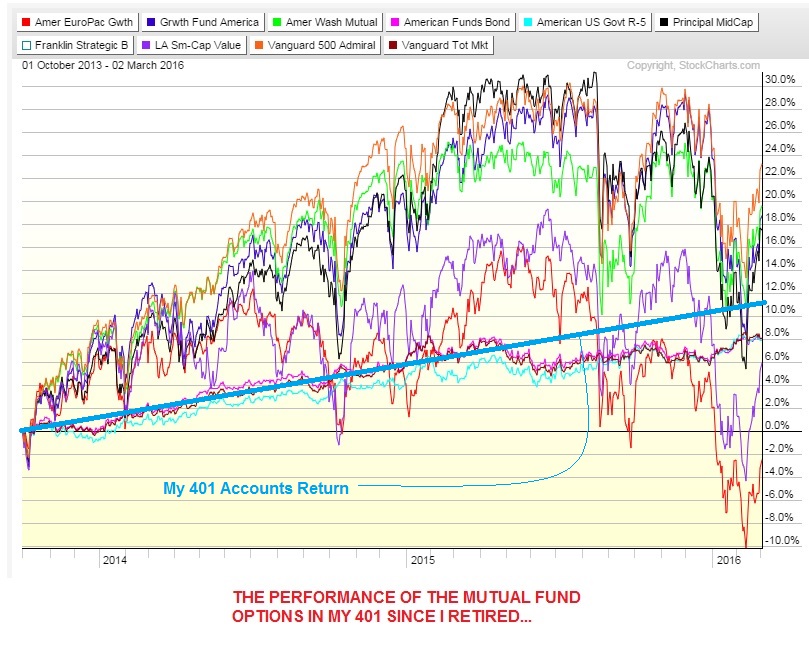

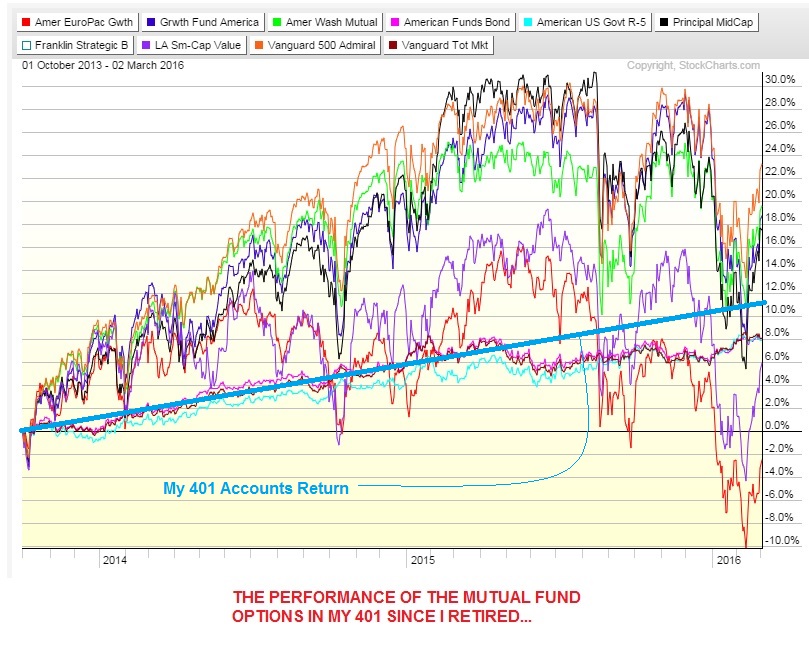

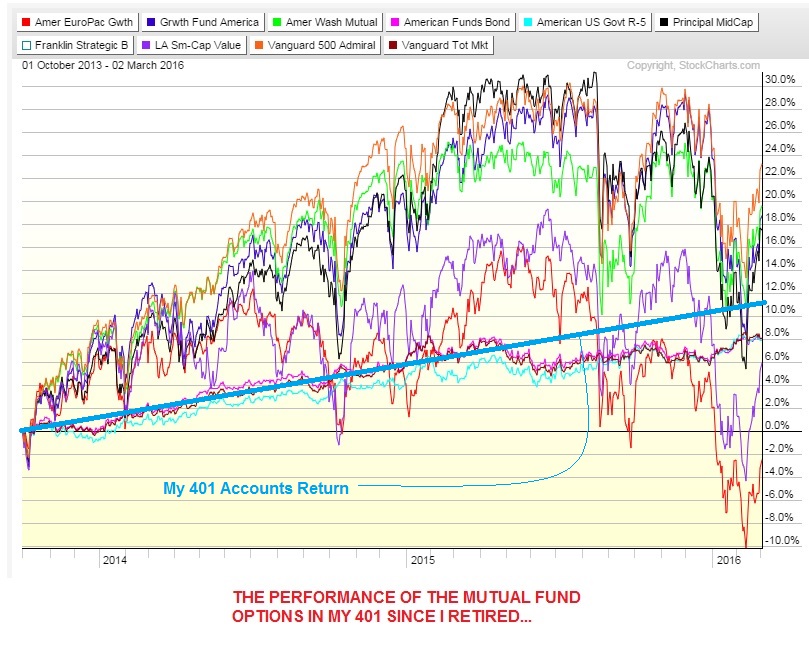

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan.

Wednesday, March 2, 2016, 11:14 AM

But Washington is freaking out about Trump in a way they never did about Bush. Why? Because Bush was their moron, while Trump is his own moron.http://readersupportednews.org/opinion2 ... e-to-trump

One of the worst starts to a calendar year in stock market history. The S&P 500 plunges straight out of the gate and is now 11% off its record high set last year.

Volatility brings out the most counterproductive behavior in investors and, almost without fail, brings out the worst sort of advice. Farcical advice, the kind that would be laughed out of the room in the company of wealthy people or successful investors who’ve been around for a few cycles.

Some of the more disturbing nonsense I’ve seen over the last few days has concerned what people should be doing with their 401(k) accounts, of all things. Why day traders and aspiring hedge fund startups feel compelled to weigh in on how ordinary people ought to handle their defined contribution retirement plan accounts is beyond my understanding.

The gist of what I’m hearing, mostly from people who are utterly unequipped and unqualified, is that:

a) the market’s been falling and it seems like it will continue to fall because of ______

b) therefore, the responsible thing to do is to liquidate your 401(k) and sit in cash until it’s over

To which I would remark the following:

The average investor has no ability to put any kind of technical or quantitative data to work regularly – even if it was shown to be completely effective (which it hasn’t) – in order to time the market.

daisy

401(k) accounts are not about P&L, they’re an accumulation vehicle designed to allow the capital markets to do their job over time, which is translating the risks of the present into the returns of the future. Interfering with this process by flipping into and out of cash literally defeats the purpose.

If an investor manages to get one shift into cash right because they had a hunch or they happened to read the right blog post that day, this doesn’t mean they’ll be able make the shift back at an opportune time.

Even if they get out and back in once, can they do it twice? Thrice? Can they do this always?

storm

More than likely, they cannot do this always. What is more likely (some would say guaranteed) is that an investor will get some shifts right and others wrong and the misses will negate much of the benefit of the hits. Or worse. Selling when volatility spikes and then buying when “the coast is clear” essentially guarantees the kind of “sell low, buy high” strategy that’s sure to result in massive underperformance of one’s own investments.

Many independent traders do not have access to employer-owned 401(k) plan accounts so it may not occur to them that there can be fees for moving funds around. There are freezes that prevent one’s ability to buy and sell and buy back again. It’s not that you can’t trade in a 401(k), it’s that you weren’t meant to and it is against the spirit of the thing.

Volatility is not risk, it is the source of future returns. Drawdowns should be embraced, not fled from. If anything, a better timing tool would be to up one’s allocation in times like these, or to skew one’s elections further toward equities to take advantage of a temporary decline. This is a passive way to exploit events that are beyond our control, and there is the added benefit that it actually works.

A working-age person between the ages of 20 and 65 could conceivably be looking at anywhere from three to seven decades during which they’ll need to live on their savings. They’re going to need stock market exposure to do this unless their financial plan involves hitting the Powerball or inventing The Facebook. The idea that side-stepping a bear market is of equal importance to the steady accumulation of risk assets is, in this context, a giant joke.

Being fully in cash warps your mind and does not allow you to think straight. It’s sure to result in emotional problems as well. Plus, it’s a money loser. I explained this during the last bout of nasty volatility when everyone was panicking to cash back in October 2011. There are people who “flipped to cash” then that have still not gotten back in. Believe me, we see their portfolios sent in to us every week.

TRUST ME

The person telling you to liquidate your retirement investments is most likely uninformed about retirement investing in general, even if they are a good trader or have a great understanding of the macro situation or whatever. A well-meaning person can give bad advice just as easily as an attention-seeking charlatan can. Don’t judge the speaker, judge the actions they’re advocating.

If you’re a do-it-yourself investor, you probably don’t have the sophistication or the time to be running your money tactically. You might think you do, but it’s not a matter of being smart or “understanding the market.” It’s a matter of having the separation between your money, which represents your freedom and future happiness, and your emotions about these things. It is very hard to untie your own feelings from your money. This is why wealthy people pay a financial advisor to create this separation. Investment advice is about having good counsel, only a fool thinks it’s about picking a lineup of ETFs.

bb8

Historically, less than 15% of all ten-year periods offer losses to investors in the stock market. That’s not the best part. Over rolling twenty-year periods – starting in any month of any year over the last century – you’ve never lost money in stocks. Didn’t happen in the 20’s, 30’s, 40’s, 50’s, 60’s, 70’s, 80’s, 90’s or the 2000’s. Some twenty-year rolling periods have been better than others, but none have been outright losers. You’re welcome to go to cash, wagering that your savings years will break that streak, but it’s a pretty low-percentage bet.

If you cannot parse the difference between volatility and risk (which I define as the chance of a permanent capital loss), then at least accept the fact that risk is a given no matter what. But you have a choice: You can decide when to take the risk, today or in the future. Rational investors would prefer to take investment risk today, accumulating assets while coping with drawdowns and fluctuations in value. Only an insane person would choose to take their risk at the back end of their life – being short of money in old age when it is nearly impossible to earn more money.

You can risk the volatility today or the chance of being broke later, your choice, but you must choose. Sitting in cash may temporarily feel better because there is a sense of security that comes over us when the value of our account ceases to fluctuate. But you’re not safe, you’re merely gaining the stability of a unit of currency in exchange for the risk of losing future purchasing power.

Here’s Helen Keller: “Security is mostly superstition. It does not exist in nature, nor do the children of men as a whole experience it. Avoiding danger is no safer in the long run than outright exposure. The fearful are caught as often as the bold.”

3po

Let me wrap this up: 401(k) accounts are sacred, but they are not magic. They require a thoughtful person making decisions and behaving logically in order to work. The 401(k) users who have persevered through the large drawdowns of 15 and 7 years ago, while continuing to plug away with fresh contributions, are doing better than ever. Vanguard and Fidelity have reported record balances and have noted specifically that it’s the people who have made the least allocation changes that now have the most to show for it. Act accordingly and ignore people who don’t know any better, even if they think they’re helping.

( 2.9 / 312 ) ( 2.9 / 312 )

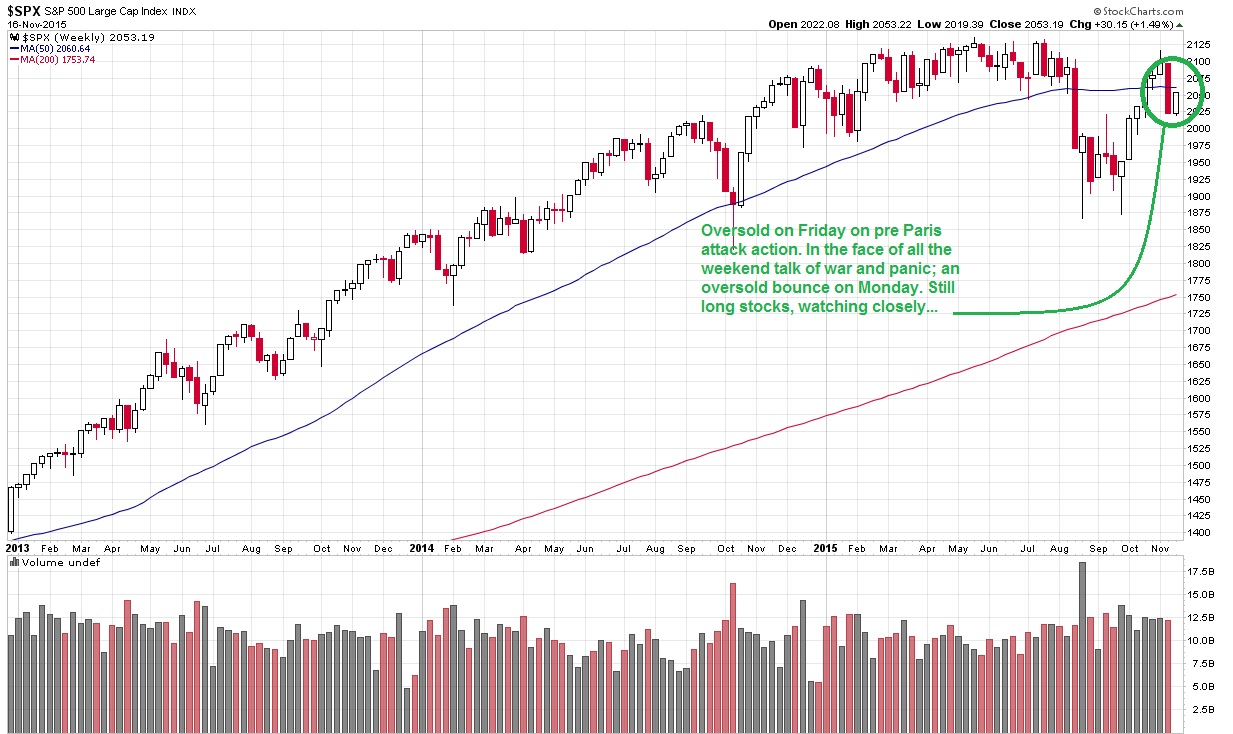

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan. Post France ISIS Attack

Sunday, November 15, 2015, 05:45 PM

The most valuable assets in life are those that hold no monetary value. Health, friends and family…

-- Joe Terranova

Good Post ISIL/Paris Monday Morning Inna Markets Material From Dan.

http://stockmarketmentor.com/2015/11/th ... ovember-1/

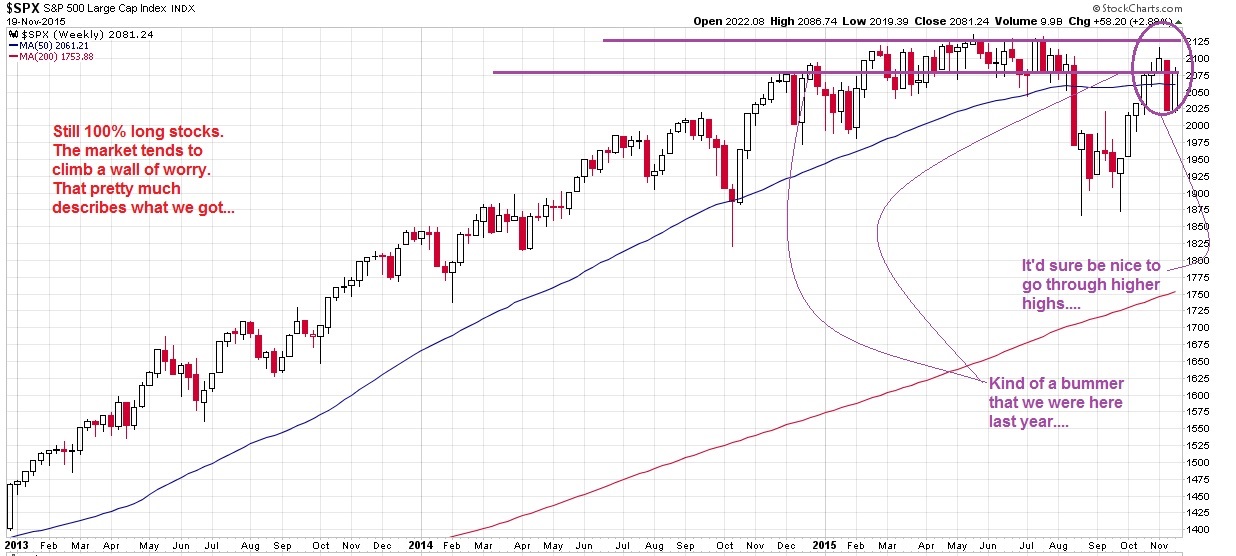

Still 99% long stocks.....

I was going to start trading in 2001 and was sitting in cash. I witnessed the markets reaction to 9/11 starting with the disaster in downtown Manhattan and the closing of the American financial markets. Once they opened, a week later, it was Down Down Down every day for a week until the markets were totally washed out. Then they started to climb back. Coupla three four years later my wife and I were leaving for a ten day cruise one morning and I was busy with prep. Finally, totally ready, I sat down to wait for the ride and I opened up the computer mid East Coast afternoon. The horror of the Madrid Rail bombing was all over the monitor; I'd missed the first 4-5 hours of the market. I opened the trading account only to discover my account was up 10%.

???

But, that's how the world works; that was then and this is now. And I don't know what this now today is now like now. But I will. When Mondays now is over, I'll have it figured out .

I'll know what I'm going to do with the 401 Monday at noon.

Stay tooned...

What makes it hard to invest; being comfortable with your personal narrative...regardless of the real reality.

http://fivethirtyeight.com/features/the ... elieve-it/

The local story can be negative; I live in the center of yet another $Bay$ $Area$ $boom$. But for an old retired guy, the city I loved as a kid is toast. It's gone. Friends and relatives who didn't get serious early and stay serious about retirement are bleeding from the eyeballs. Every negative in the above story is somewhat true in SF for people of my generation. And the future is less about the many and more about the few. I got kids and grandkids and I'm concerned. But I worked hard to become one of the few. And my 401 was a major part of that. So I'm 99% long today and will probably be the same tomorrow. The long term move is pretty much always for the better. Just because there are a lot of reasons to become a bitter, resentful, fearful, querulous old man does not make it right, fun, productive, or in any way enjoyable to me. Fuck it. Get over it and get it on. So I'm 99% long and staying that way this evening. That will change someday.. But the western world was at war with ISIL last Monday. This Monday is not different. I'm always at least a little cautious. Sometimes REAL cautious. Never fearful. Not as long as aggressive pays off.

Tuesday...

http://thereformedbroker.com/2015/11/17 ... o-be-good/

Wednesday....

https://vimeo.com/146175584

( 3 / 260 ) ( 3 / 260 )

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan...Special Warriors NBA Finals Edition II.

Saturday, June 13, 2015, 02:49 PM

The most valuable assets in life are those that hold no monetary value. Health, friends and family…

-- Joe Terranova

Yer Funeral, My Trial....

https://www.youtube.com/watch?v=zCuCtU0tGi4

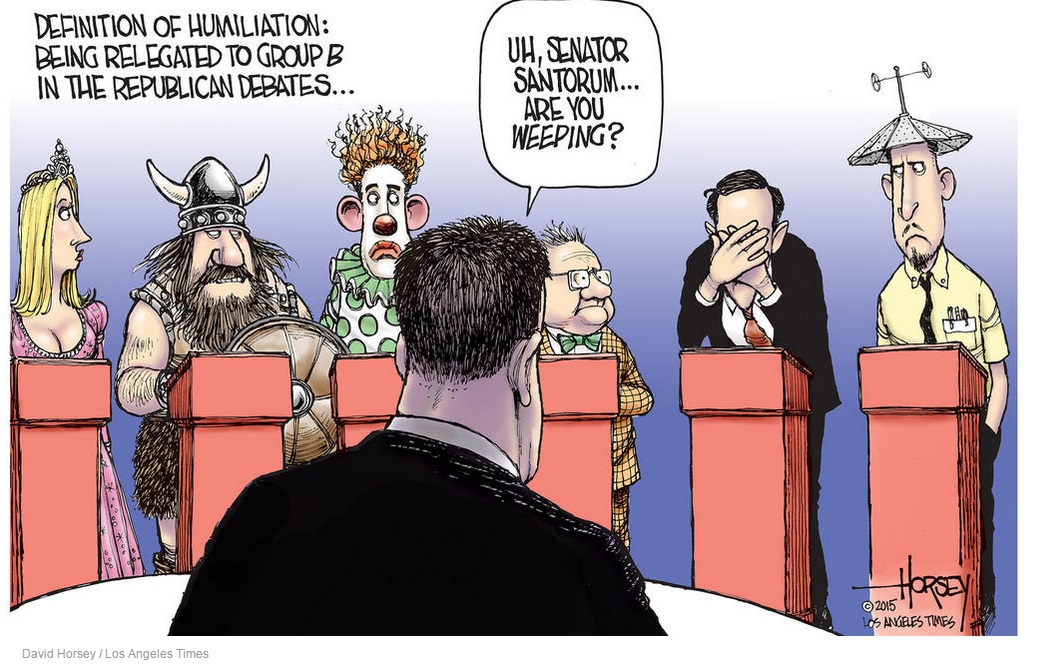

Ah Dearly Love The 18 Month Election Year...

http://www.businessinsider.com/marco-ru ... kes-2015-6

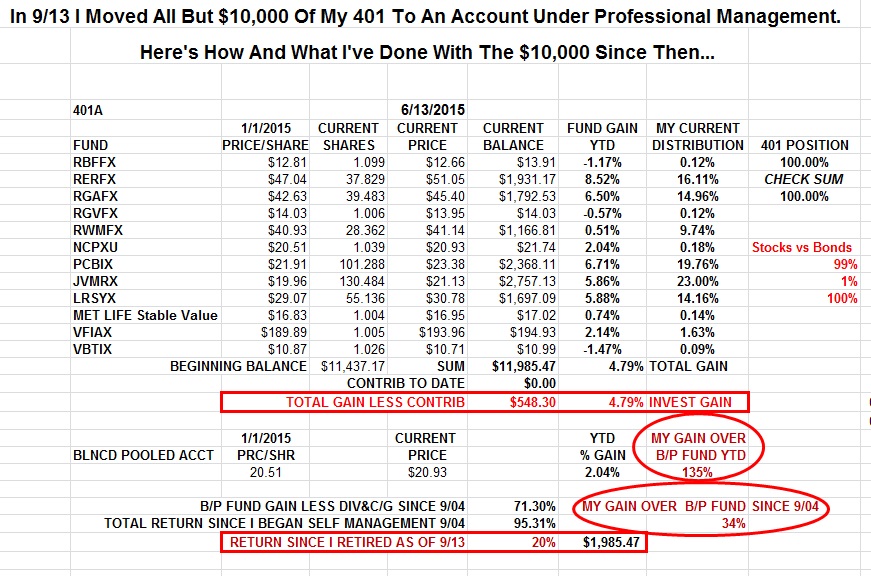

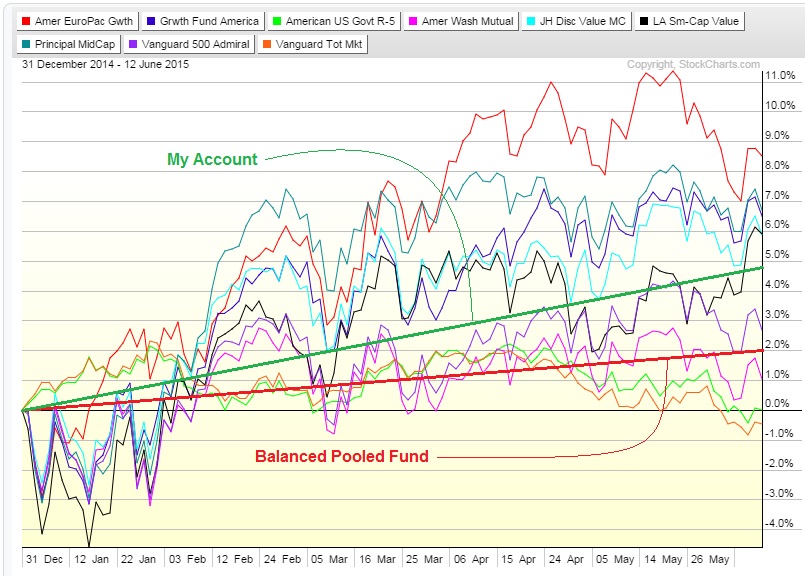

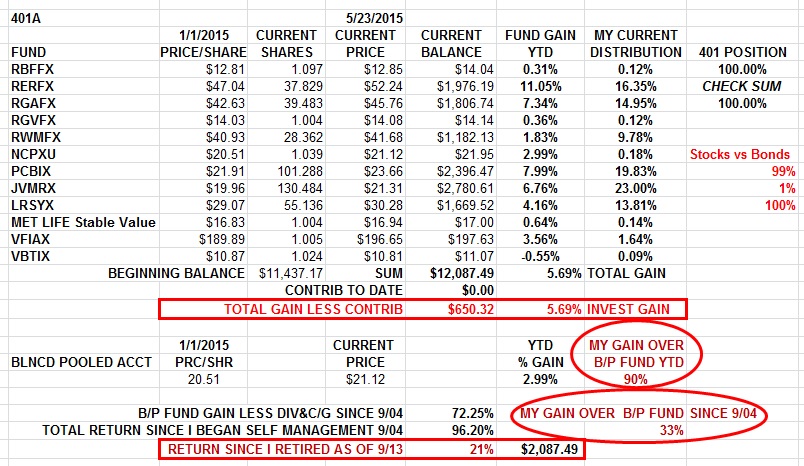

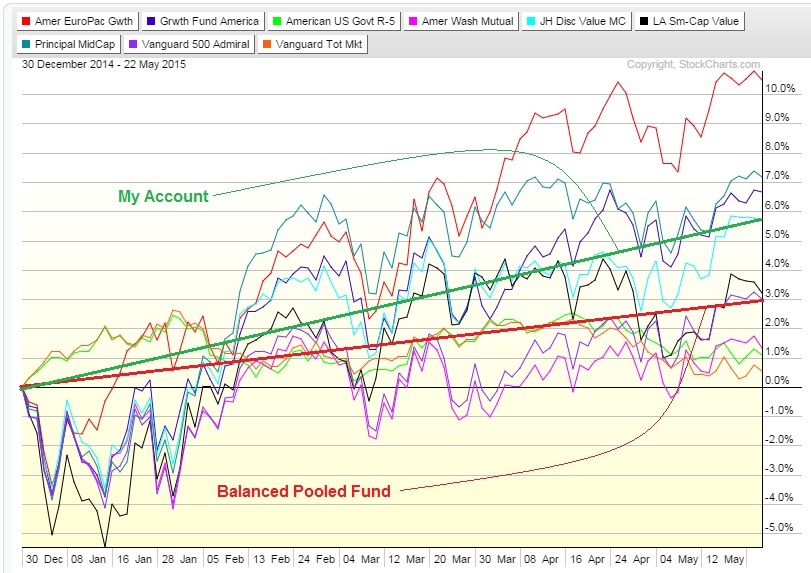

You'll Note; Kinda Bond Free... How It's Workin' Shown Below....

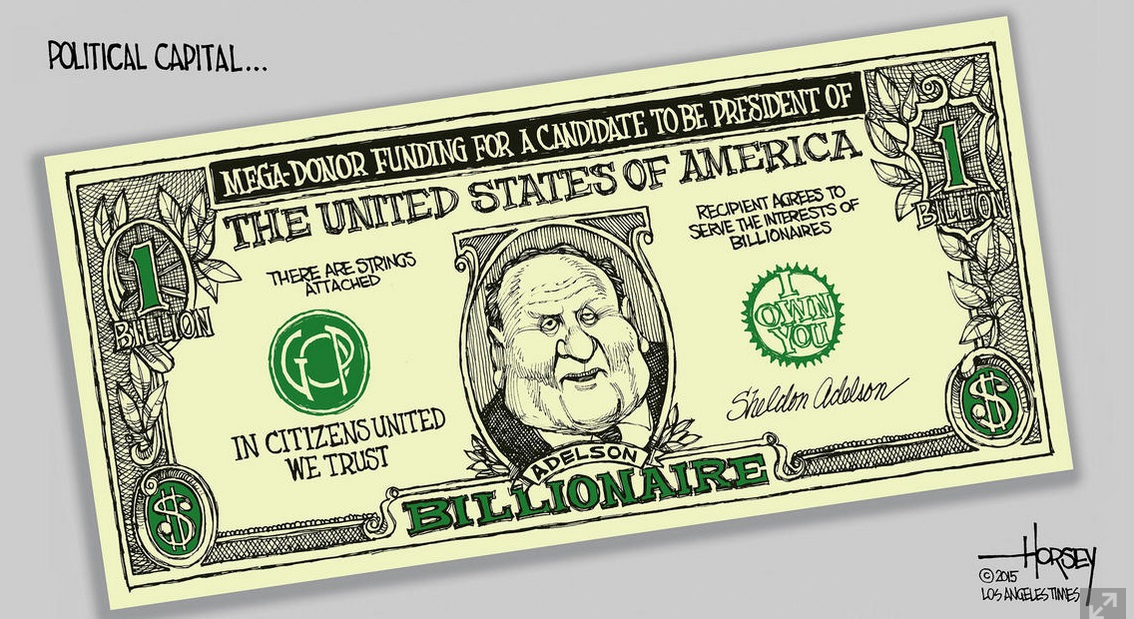

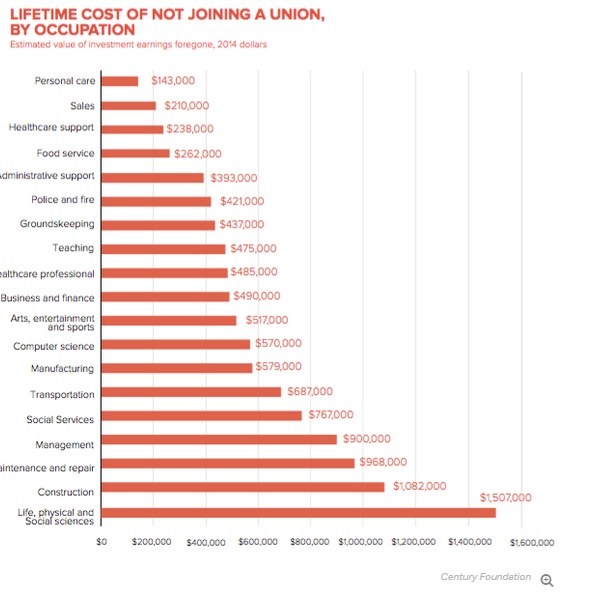

Cuz Ahm A Union Man From Way Back; Teamster, AFL-Cio, United Association. I've Provided For my Family, I Have A Comfortable Retirement, A Health Plan, And Some Neat Toys...

Click Here To Get The Details....

( 3 / 1383 ) ( 3 / 1383 )

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan

Saturday, May 23, 2015, 07:30 PM

People will go to extraordinary lengths to rationalize market action and make it fit their narrative. This year wasn’t 1929, or 1987, or even 2007. It was in fact, 2014.

-- Jon Boorman

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

I'm all in in stocks because of what I read, what I've learned, and most especially, because I'm prepared to harvest gains and minimize losses when the time comes. YMMV.

Gawd, I love campaign season....

http://www.businessinsider.com/mike-huc ... fox-2015-5

( 3 / 1398 ) ( 3 / 1398 )

<Back | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next> >>

|

|