| |

300 channels and nothing to watch? Buy a Tivo and quitcher whinin'. (revised afternoon of 2/26)

Saturday, February 25, 2006, 02:19 PM

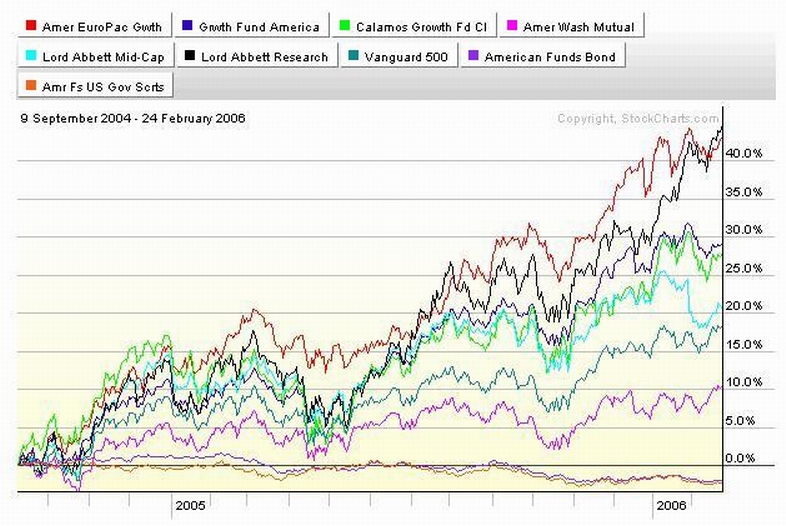

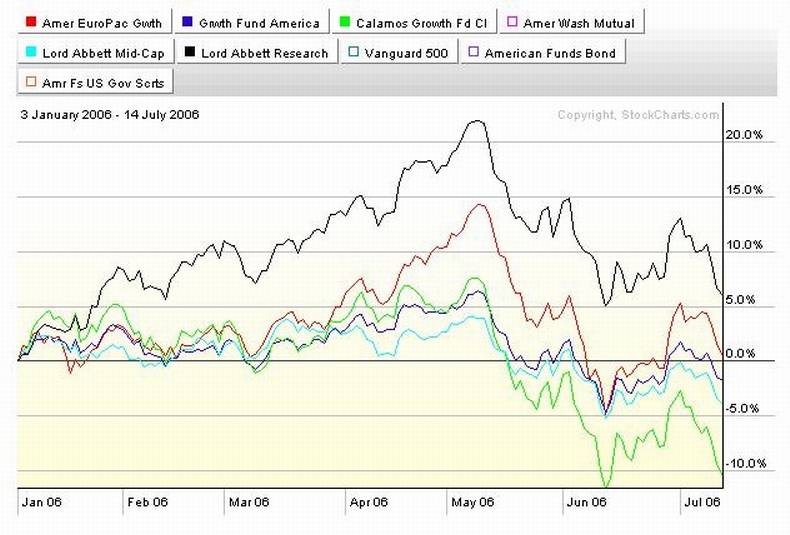

Last week I wrote about increasing political and economic dangers. This week Al Queda got way too close to a major source of petro product for much of the world. The world exists in a big tank of oil and if someone pokes a hole in it, all the oil in the tank starts to head for the low spot. Oil prices are up and there is a sea change under way. More and more people know what the Hubbert Peak is. State owned oil companies are buying up fields in foreign countries and it looks like a national security move to me. Major oil companies are starting to unobtrusively count tar sands and liqufiable natural gas as oil reserves. The money and oil industries are chattering about increased drilling but there is not a whole lot of talk about anything but incremental additions to reserves. And the work of fiction that is the Consumer Price Index, that is carefully constructed to delay and minimize signs of inflation, is starting to show signs of inflation as rising energy prices and interest rates begin to leak through the barriers. Finally, the same idiot that told Michael Brown of FEMA that, "You're doing a hell of a job, Brownie." during the Katrina/New Orleans imbroglio, reads in the newspaper about the transfer of administrative control of six of our seaports to an Arab country owned company and rushes to insist that he's satisfied that there are no security risks to the deal. This guy is a uniter, not a divider. He's got all the Republicans and all the Democrats united against him. Will wonders never cease. So what about my 401a? Steady as she goes. Refer to the charts. ....click on them if ya feel lucky....punk:   In the first chart, look at the progress I've made by being in stocks. Last week I made money in my 401a, my IRA's and my trading account by being in stocks, so that's still working for me. So I'm going to stay in stocks. Look at the second chart; big gains in the first two weeks in all the funds, and since then three maintained, one dropped, and one continued to rise. I've picked up some gains in the Balanced Pooled Fund as the stocks in it appreciated. I'm stuck with the $5K minimum there but anything over that can find its way elsewhere. This week I'll shift some of the excess over $5K over to the Calamos Growth fund because I think I'm a little too light there. The Lord Abbett Research Fund guy appears to have the hot hand and it's weighted right about at where I want it to be, so if nothing changes, I'll put next month's contribution there. These are incremental changes, nothing more. I'm still more or less equally represented in four of the five best stock funds available to me and I've got a small stake in the fifth fund as a place holder. I'm one day from safety at any time (see last week's post), I'm making money while I can, and I'm going with what got me here; up 32% in 18 months. See ya at the hall.      ( 3 / 1647 ) ( 3 / 1647 )

Long Weekend, Just Not Long Enough.

Saturday, February 18, 2006, 06:48 PM

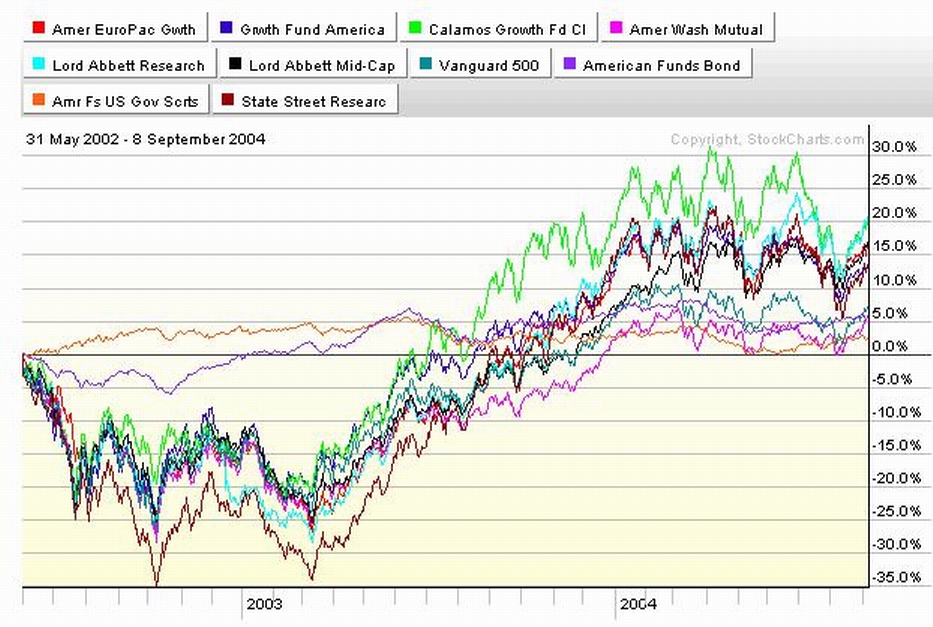

Opportunity knocks, but it has never been known to turn the knob and walk in." English Proverb The sellers finished selling and the dip buyers bought when they saw prices stop falling or when they were low enough to look good. So markets went back up. Somewhat. I'm finding that good ideas that can make me money NOW are getting somewhat harder to find or ideas that can make me money later seem to be hard to get comfortable with now. The markets seem to be getting narrow and somewhat herky jerky. So it's time to figure what to watch out for, just to be safe. It's hardly very complicated. I just look for the markets in general and my accounts in particular to start losing money in a sustained and accelerating manner so I can respond properly. I'm back up to 30% plus return over 18 months in my 401a. I've got to be thinking of protecting that as much as I've got to be thinking of continuing to make money. Interest rates are still going up, political and economic strains are getting more pronounced and dangerous, inflation is starting to show through the barrier between energy and food and the core numbers, and seasonality is running against me. Time to visualize the possibility of stepping off the elevator because we may be near or approaching the top. Or maybe not. We might just be near a brief intermediate top. Or an extended period of consolidation. Or the end of the game as we know it, leading to death, darkness, and despair. Or not. The markets might explode up instead of down. What's important is that I am always one business day away from safety. When my concern about risk becomes overwhelming I can transfer everything to bonds or the GIC, except for the $5K that is stuck in the Balanced Pooled Fund (BPF). And only about half of that is in stocks, so I can get big time safe in a hurry. Should it only be a mild case of gas and not the end of time, I can get back in the Lord Abbett Funds and the Vanguard Fund whenever I want to. And the Calamos trading and market timing rules are not overly onerous. And even the American Funds funds can be reentered 31 days after an over $5K withdrawal occurs. Pretty kewl.... I met with some members of the Board of Trust a coupla weeks ago. The comment was made that maybe the way the 401a was set up was cramping my style. I jumped on that; Thirty percent up in 18 months is pretty uncrampy. The comment was made that it'd be nice if I could show how something like that could be done. Fair enough. Here's what I did. I looked up our fund choices in the FundAlarm tables and the Morningstar.com website and used the Stockcharts.com website to evaluate the choices. The chart below is a close approximation to one that I used.... If the chart below is too small to see clearly, try clicking on it. It should be a live link...  I decided against the bond funds for reasons I don't care to discuss at length here and now, but that I'll cover in more detail later. Suffice it to say that the time to be in bonds is when stocks are falling and the time to be out is when stocks are rising. Look at the chart. Enuf said. Given that the Vanguard S&P500 fund is a proxy for the market as a whole and a decent actively managed fund oughta be able to do better than that at least some of the time and hopefully most of the time, I rejected it. The washmutt fund wasn't doing nearly as well as the Vanguard Fund, so it got tossed. I had a bad experience with a poorly managed foreign stock fund years ago so I tossed the American Fund foreign stock fund. I put most of my available funds in the remaining choices, with some money in the GIC just because I wanted to be at least a little conservative. When the State Street/Blackrock Fund underperformed, I exited it. When I saw how well the American Fund foreign fund was doing, I put money there. I looked at my account every week to evaluate how I was doing and I shifted a small portion of my funds from time to time. I allocated those funds and my monthly contribution to where I was getting the best performance or where I thought I was a little light and it would be a good idea to even things out. When I was sure the trend was my friend, I pulled most of the money from the GIC and put it into into the best performing stock funds and got from there to here. Of course the saying goes that 80% of the money is made over 20% of the time. When I did the above, interest rates were at all time lows for this era, oil was relatively cheap, Iraq was "mission accomplished", etc. I did some smart stuff at the right time and I got rewarded for it. That was then and this is now. But I think what I described is still a good thing to do. It's just that different circumstances may lead to different decisions and they WILL lead to different results. More to come      ( 2.9 / 1788 ) ( 2.9 / 1788 )

Another day older and deeper in debt. (Showin' my age by cracky...)

Sunday, February 12, 2006, 02:57 AM

"However beautiful the strategy, you should occasionally look at the results."

--Sir Winston Churchill

Bloody week in the market. For a couple of days my trading screens were bleeding red off the monitor and onto the floor as the momo boyz (momentum traders) blew out of last quarter's red hot stocks, locked in profits, and gave those late to the game a chance to buy stocks low in the morning, lower in the afternoon and even lower the next day. Charts for Apple, Amgen, Genentech, Walgreen, Yahoo, and just about all the housing stocks as well as just about all of the oil and gas stocks looked like hammered horse exhaust. But there is always more than meets the eye. If you were where the action wasn't or in the luke warm stocks or where the story is now rather than then, it wasn't bad at all. Check out the charts for my 401a funds and the table for my account. It's not as good as two weeks ago but it's not bad and it's not even close to making a dent in what I made last year. Stocks go up, stocks go down, and the wiggles are noise. But out of the noise comes the trend. If the trend is up, I stay the course. And if the trend goes down, I cut my exposure. I'll wait and see. Paying attention is what cuts the risk and enhances the reward. I'm standing pat 'cuz I gotta have a trend change proven to me, especially when the trend has been working so well for me since 9/04.

Speaking of risk vs reward, I got asked by Kenny P if I was in the aggressive program for the 401. I couldn't even start to answer the question. It was a good question if you got your investing info from a typical investment advisor because it leans on a lot of basic assumptions they start you off with. But it has nothing to do with the world I live in. Check out my site's longest term chart for all the funds. Eyeball the bond funds. The bond funds are "conservative" in that you probably won't lose your principle. There is not much risk. Neither is there much reward. You'll only make the coupon, and if you're really lucky, a dollar or two on appreciation, if they sell the bonds for you at the right time. There's little reward and little risk. And it is totally defensible. But last year you lost the chance to make money if you were heavily in the bond funds. And anybody in the Balanced Pooled Fund was 50% bonds. Most amazingly, you even lost money in bonds when a lot of other investors were making money in stocks. I'm not sure that is conservative. Last year I just didn't see any reason why I should be in bonds and and especially in bond funds. The charts tell you I was right. Set up an opportunity for me to do a presentation to a small group and I'll explain why.

Stock funds are considered "aggressive" in that you can make or lose a lot of money. There's CAN be a lotta risk and a lotta reward. But if stocks are in a long term uptrend and you pick the right stocks or funds and keep one eye on the trend and one eye on the exit door, AND you are willing to book profits and step off the elevator near the top, either on the way up or on the way down, the risk goes down. If the reward is high and you lower the risk, I'm not sure that is "aggressive". It's not so much that everything you've been told is wrong, it's just that it's not quite as simple or as direct as you've been told. Or so I believe. Of course I could be wrong. Oh, yeah. I also believe that you get told what serves someone else's purpose and not necessarily your own. What does "Modern Portfolio Theory" and the Modern Jazz Quartet have in common? More than you'd think. See ya at the hall.

[ view entry ] ( 1107 views ) [ 0 trackbacks ] permalink      ( 3.3 / 283 ) ( 3.3 / 283 )

Just a little quickie blurb

Sunday, January 29, 2006, 11:48 PM

The charts tell the story. The last Friday's big crash lasted as headline material for one day, and the end of life as we know it probably will come to pass, but it didn't happen last week. I stood pat and at 100% invested in stocks in my 401. Last week, and actually all of January were very good indeed. 5.71% gain for the month gives me about half of what I'd call a very respectable year right out of the box. I've regained what last weeks big down Friday took and a little more. The 32% plus up in 17 months since I've been actively managing my 401 continues to give me a cushion of confidence and something to protect at the same time. Maybe I'll get more loquacious about all and sundry in the next post. On the docket is why I'm in only four of six stock funds, why I'm in no bond funds, why I do this website in the first place, what protecting gains means, etc. But that's it for now cuz I'm busier than a long tailed cat in a rocking chair factory. Ya know, if you talk to me and we can set up a face to face rundown for a small group of whatfor and howcome and onaccountawhy interaction it'd be much more to my liking. Writing takes time and effort and talking doesn't. See ya at the hall.

[ view entry ] ( 1106 views ) [ 0 trackbacks ] permalink      ( 3 / 1698 ) ( 3 / 1698 )

When the green flag drops, the extraneous verbiage stops.

Saturday, January 21, 2006, 06:30 PM

"If you keep thinking about what you want to do or what you hope will happen, you don't do it, and it won't happen."

-- Joe DiMaggio

I'm still not up to speed on the Web tools; I'm doing my regular weekend financial rituals, then doing screen shots of spreadsheets and graphs, capturing them to files, excerpting cropped data to new temporary files, stripping out some stuff, cleaning them up with an image editting program, sizing and resizing them, uploading them, posting them into a Web site based editting and preview program, swearing a blue streak potent enough to make a 4th year boilermaker apprentice blush, dumping everything and starting all over. Not necessarily in that order. I shouldn't have to buy my own beer as long as I'm in the trade. But eventually it gets done. So the site is updated for this week. If you've been to a recent presentation, you oughta be 90% up to speed just by dragging your eyeball across the screen. If not, you're missing all the background. You know what to do about it.

So stick a fork in it, the toast has left the building, and the fat lady just clocked the bouncer with the drumset. This is where I stop for now. Except to say, I'm heavily invested in the best four out of six stock mutual funds available to Local members and I jumped on them the week that they became available to me. I was there for much of the recovery out of post dotcom crash/Iraq war (PDCIR) period and as of last week I was up 30%+ since the McMorgan Funds were replaced with something more to my liking. Every week I do the graphs to make sure the trend is up, I use FundAlarm.com to make sure the funds are exceeding their benchmarks and are above the 50th percentile on a long term basis, and I don't sweat the noise.

The radio and print is full of hysteria over the stock market blowup last week and the end of life as we know it. But only until the next headline comes along or the market goes up. What it means to me is that instead of being up 30% since 9/04, now I'm only up 28% over the last 16 months. I've got enough of a cushion to give me a sense of calm about Monday's stock market. I kinda figure it'll probably go down. Or not. Whatever. You gotta make the money while you can and I just had a great run. Now I gotta see if there is anything left to this post PDCIR recovery. They average around 36 months and this one started in Fall of 2002. Do the math. But then, each time somebody sez, "It's different this time." Mostly it isn't. But it is never ever exactly the same either. So I'm stayin' the course. There is a real possibility that all we are seeing is a change of leadership and not a crash. If that is true and our funds are in the right place, we're cool. But if my money starts to fade away any further, I'll take some or all of it off the table and maybe change casino's or park it with the desk while I get something to eat. I've tried the wallflower strategy and the deer in the headlight strategy and didn't care for them. So I've changed the program. I like this one better.

This here's one of those internet interactive blog thingies. If ya got a comment or question ya can post it and then wait and see if I've got the time and inclination to answer it. Pretty neat, huh? See ya at the hall.

[ view entry ] ( 1047 views ) [ 0 trackbacks ] permalink      ( 3 / 1753 ) ( 3 / 1753 )

SO THE MAIN THING IS, SEE....

Monday, January 16, 2006, 10:40 PM

Much of my website is given over to my 401a. No, not a 401k, a 401a. It is a multiemployer union participant run retirement plan rather than a company run plan. So if you belong to my union, you can watch me run my 401 with an open hand; cards face up on the table, posted once a week, unless something noteworthy occurs. So you can see what I do and follow along and maybe learn something. There are some very good reasons for doing this this way and if we do a face to face, you'll find out how and why. If you just happened across this blog or my website, your benefit, interest, or entertainment derived from it will be pretty low level. Oh well. If you have no direct relationship with this material and you still gotta see what happens, go for it. I'm happy to provide something positive in your life. Or not.

[ view entry ] ( 1058 views ) [ 0 trackbacks ] permalink      ( 3 / 1651 ) ( 3 / 1651 )

Actually, this IS my first dance..

Monday, January 16, 2006, 04:09 PM

A coupla three weeks ago I decided to finally pull the trigger on my own website/blog. I ran my audio manufacturing business starting back in '83 with one of the earliest IBM PC"S, a PCII. It had an upgraded motherboard that would accept 256K memory rather than 64K like the old ones and came with two half height two sided double density 360K 5-1/4" floppy drives so I could ultimately go to four 5-1/4" floppy drives or maybe something else in the space, Lord knows what. I ended up using Lotus 123 to write my own business management software and automated my accounting/inventory control/invoice printing etc. But I closed the business in '89 and that was a lifetime ago. This new internet stuff was something I used as a participant in list serves and as a website surfer, so once again I'm entering new territory. I talked it over with my son and he told me,"Think of it this way. You're where every 12 year old kid was in 1998." I can accept that. Be patient, hang on, and let's see what comes down. To get back to where ya probably came from, click joefacer.com under "Links" to the right. See ya at the hall.

[ view entry ] ( 5072 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1692 ) ( 2.9 / 1692 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 |

|

|

Calendar

Calendar