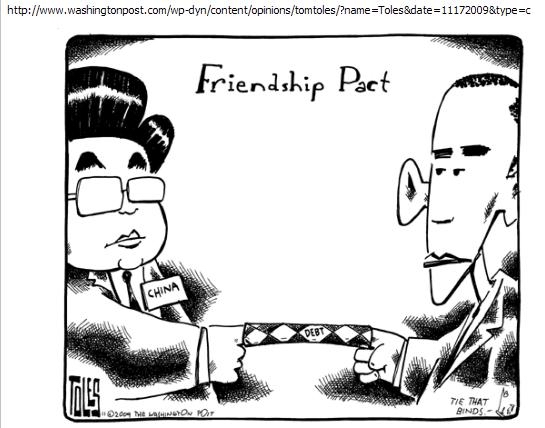

If The European Union Has Too Much Debt, How Is A Trillion Dollar TARP A Solution? And If The Euro Depreciates 20%, And The Dollar Gets Expensive, How Do We Bring Back Manufacturing And Export Our Way Back To Full Employment?

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have it, it requires 10 times as much skill to keep it.

Chartz and Table Zup @ www.joefacer.com

Fuckin' "A" there's a lotta risk out there!!!!!

Makin' The Effort To Manage My Own Destiny; Like Someone Else Is Gonna Put In The Same Effort And Care As I Would? Gimme A Break...

My philosophy for trading is -- understand why something is happening economically and then look at the price action. If both of them works, go trade. If one of them is starting to fall apart, get out. And if both fall apart, get short,

-- Dennis Gartman

Chartz And Table Zup @ www.joefacer.com

Reeelly Important

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.cnas.org/blogs/abumuqawama/2 ... ation.html

http://www.jsonline.com/business/92418964.html

http://www.msnbc.msn.com/id/37037022/ns ... ws-europe/

http://www.msnbc.msn.com/id/37028501/ns ... gton_post/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.bloomberg.com/apps/news?pid= ... &pos=5

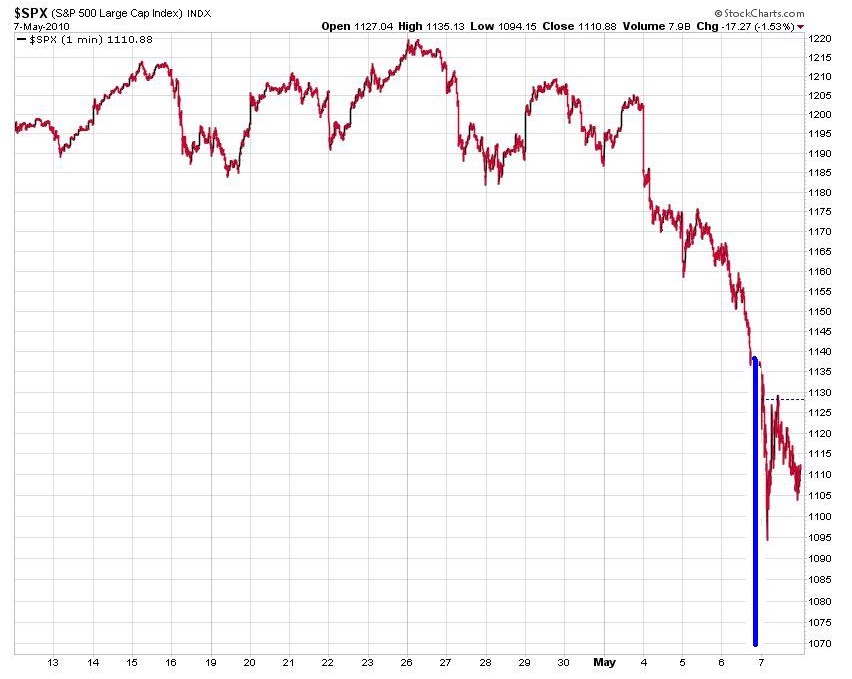

The spike down Thursday is NOT the story. Here's the last thirty days with the spike down drawn in in a different color. Detect a trend? One thousand points down in 9 days within which is one thousand point down and back up in 15 minutes. Which do YOU think bears more weight?

MORE REEEELLY IMPORTANT

http://www.ritholtz.com/blog/2010/05/de ... aming-hft/

Here what a play by play of the spike down sounded like...

http://www.ritholtz.com/blog/2010/05/be ... er-taking/

http://www.ritholtz.com/blog/2010/05/wa ... a-mistake/

http://www.ritholtz.com/blog/2010/05/ap ... -old-news/

http://www.ritholtz.com/blog/2010/05/ar ... ed-orders/

http://www.ritholtz.com/blog/2010/05/th ... nnot-hold/

http://www.ritholtz.com/blog/2010/05/nfp-post-mortem/

http://www.msnbc.msn.com/id/37048718/ns ... d_economy/

MONDAY EVE...

http://www.bloomberg.com/apps/news?pid= ... OKSoGY6hLs

http://www.washingtonpost.com/wp-dyn/co ... 0050704340

http://www.thestreet.com/story/10750843 ... l=dontmiss

http://www.boston.com/bostonglobe/edito ... _tank?pg=1

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=13

http://us.ft.com/ftgateway/superpage.ft ... 1531051380

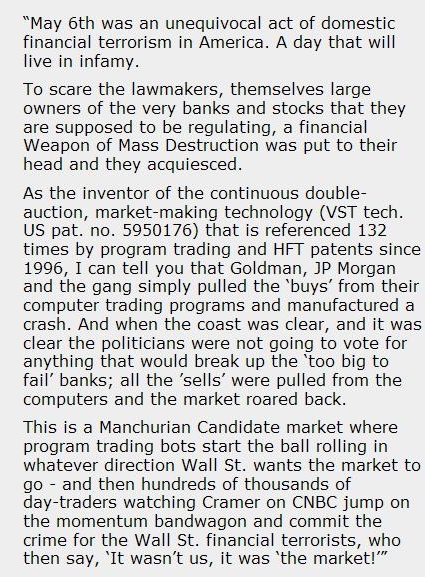

Find all of the article in the link below. I discount conspiracy theories pretty deeply, but...

http://ampedstatus.com/high-frequency-t ... ted-states

Stay Tooned.

More here this weekend.

Where I Screwed Up, Where I Did Good, What's Next....

Still in cash and bonds. The Financial Times Gateway link above

and the increasing liklyhood of a double dip recession keep me cautious...

The genius of investing is recognizing the direction of a trend -- not catching highs and lows.

-- James Koford

Last dribble of stocks inna 401a closed out today. All in bonds and GIC. The 900 points down is of passing interest. The possibility of not being able to postpone the consequences the run up of the globes sovereign credit card is of huge interest... we were down midday before the spike down and we closed way down off the open...

Down 300 means there is major uncertainty. I'm prepped for a reflexive bounce... but I think there may be more downside to come as long as the uncertainty exists.

http://www.ritholtz.com/blog/2010/04/po ... zed-souls/

http://preview.bloomberg.com/news/2010- ... slows.html

http://blog.al.com/live/2010/04/deepwat ... _memo.html

http://www.msnbc.msn.com/id/36972794/ns ... ce/page/2/

http://paul.kedrosky.com/archives/2010/ ... _real.html

http://blogs.ft.com/energy-source/2010/05/06/61536/

Stay Tooned

A Raging Inferno of Coruscating Incandesence. Fire And Flames Triumphant; A Crimson Wing Of Doom, O'er Shadowing And Searing Filleted Raw Flesh... It's BBQ And Grilling Season Here At The Homestead. Good Times Around Here. Not So Good Times At Times Square And On The Gulf Coast ....

Some People Are Like a Slinky; They Are Not Really Good For Anything. But They Do Bring A Smile To Your Face When They Are Pushed Down The Stairs.

-- Unknown

Chartz And Tables Zup @ www.joefacer.com

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=15

http://www.bloomberg.com/apps/news?pid= ... amp;pos=15

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://www.msnbc.msn.com/id/36858911/ns ... om/page/2/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... F_5VH7azKU

http://preview.bloomberg.com/news/2010- ... cials.html

http://preview.bloomberg.com/news/2010- ... osits.html

http://preview.bloomberg.com/news/2010- ... escue.html

Gulf Coast Details....

http://www.drillingahead.com/forum/topi ... -horizon-1

Monday

http://www.ritholtz.com/blog/2010/05/vo ... ss-orders/

http://www.ritholtz.com/blog/2010/05/oil-slickonomics/

I'm edging back into stocks as of today in the 401a. Five percent stocks today. It's too little too late and I'll bail inna heartbeat if I see what I expect to see on the bearish side, but the risk is small.

http://www.ritholtz.com/blog/2010/05/sh ... arge-cost/

http://www.ritholtz.com/blog/2010/05/ba ... more-55721

Tuesday

Getting outa stocks; There is more risk than upside...

http://preview.bloomberg.com/news/2010- ... -says.html

Stay Tooned

Surprise, surprise, surprise!

-- Gomer Pyle

Chartz And Table Zup @ www.joefacer.com

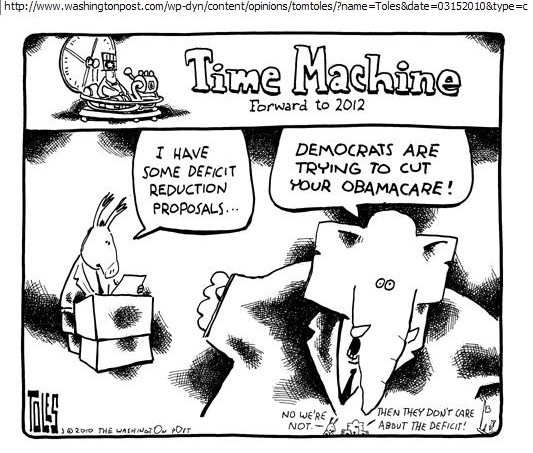

The Only Tea Party Stat You Need to Know

http://www.ritholtz.com/blog/2010/04/th ... d-to-know/

This Was NOT A Surprise...

http://www.msnbc.msn.com/id/36612092/ns ... ork_times/

http://blog.newsweek.com/blogs/wealthof ... apiro.aspx

http://www.bloomberg.com/apps/news?pid= ... 2BBUru4.hM

http://www.msnbc.msn.com/id/36603564/ns ... igan_show/

http://www.telegraph.co.uk/finance/econ ... ments.html

http://www.cnas.org/blogs/abumuqawama/2 ... istan.html

http://www.msnbc.msn.com/id/36382787/ns ... ork_times/

http://www.msnbc.msn.com/id/36283460/ns ... e_economy/

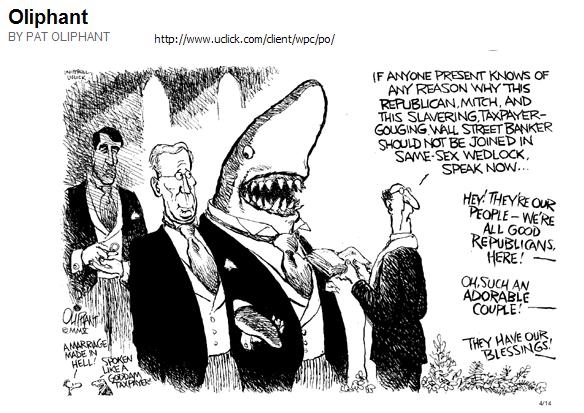

http://www.ritholtz.com/blog/2010/04/jo ... waps-tbtf/

http://www.newsweek.com/id/236523

http://www.bloomberg.com/apps/news?pid= ... &pos=5

Hell! Gotta Have Some Fun....

http://www.ritholtz.com/blog/2010/04/pixels/

http://www.ritholtz.com/blog/2010/04/an ... lout-math/

www.ritholtz.com/blog/2010/04/dumb-research-of-the-day-dicks-good-bjs-bad/

http://money.cnn.com/2010/04/15/news/co ... /index.htm

http://www.ritholtz.com/blog/2010/04/qu ... man-sachs/

Interesting and interestinger.....

http://www.ritholtz.com/blog/2010/04/sec-kiss-of-death/

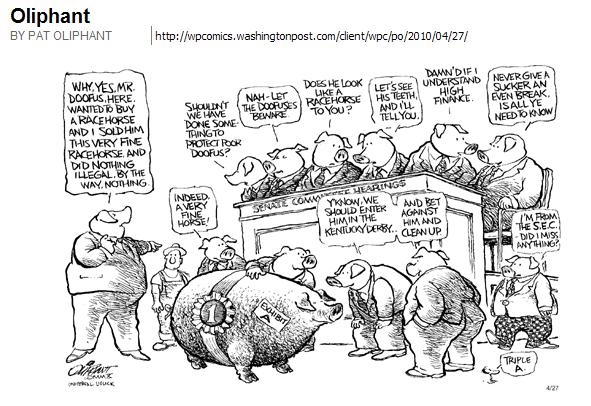

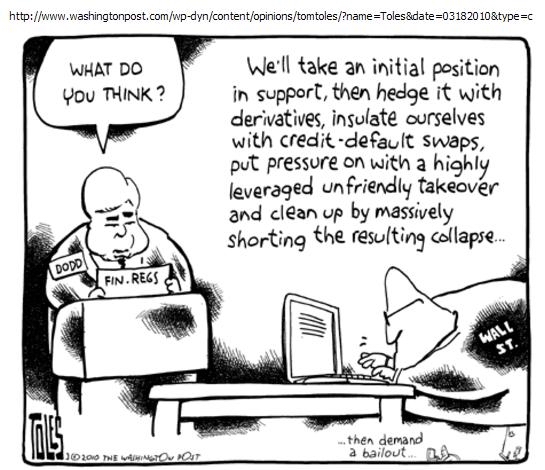

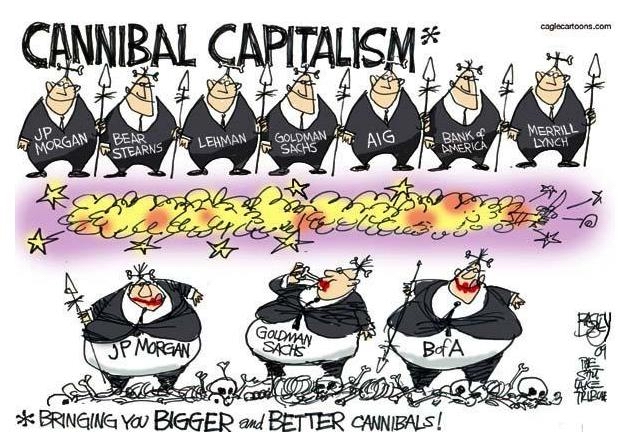

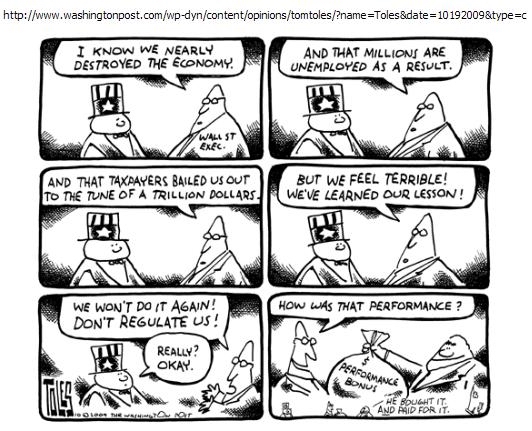

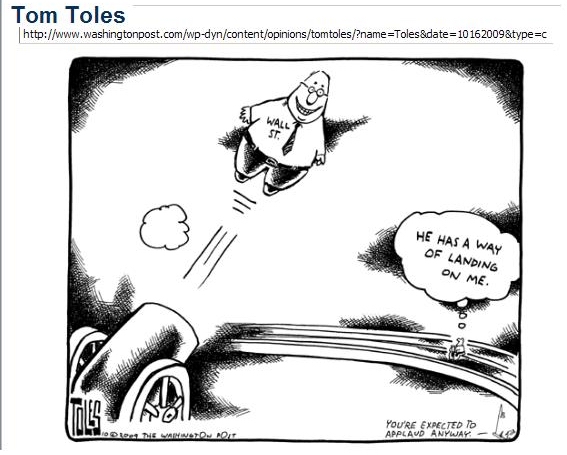

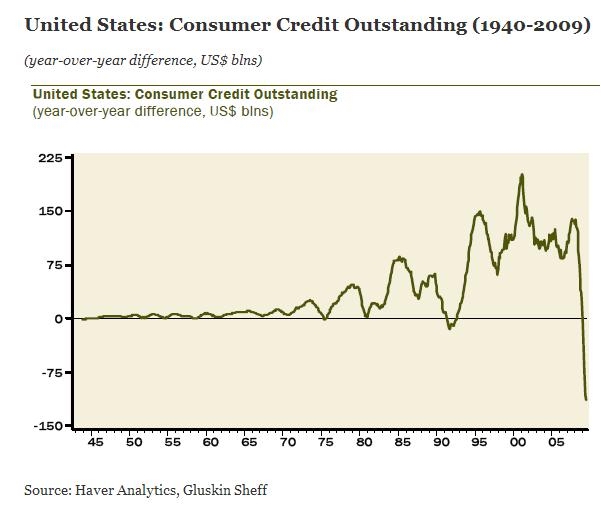

So I gotta deal with reality. Three banks failed in 2007, twenty five failed in 2008, and 140 failed in 2009. Fifty have gone down this year to date. Employment sucks, the European Union may fold and that may drive the dollar up and drive the global economy down. How can the United States become a manufacturer again and export our way to prosperity with a high dollar and massive unemployment and higher interest rates? Good question.

Regardless,the long term market trend is up and overextended or not, anticipating a top has left way too much money on the table...

Goldman Sachs has reintroduced volatility into the market. Time to hold my nose and cautiously buy back in on a drop. It'd a been better if I'd been 100% long and held it since a year ago, but Oh Well! We got problems to work through and I expect the markets to reflect the uncertainty. The markets will go up and down. I gotta match exposure to risk. Starting with a cautious buy This week. Or not. Stay tooned....

CDO 's explained....

http://marketplace.publicradio.org/disp ... king_cdos/

SEC/Goldman explained.....

http://marketplace.publicradio.org/disp ... r-goldman/

Make ya wanna puke....

http://www.ritholtz.com/blog/2010/04/ho ... more-55145

Tuesday

http://www.ritholtz.com/blog/2010/04/ru ... practices/

Change Of Strategy; There Is Still A Ton Of Scrap Metal Inna Air From The Blow Up. I Gotta Stop Worryin' About It Enough To Make Some Money Onnit While The Fed Is Runnin' Up The National Debt

The trouble with opportunity is that it's always more recognizable going than coming

Jerry Byrne

Chartz and Table Zup @ www.joefacer.com

http://www.ritholtz.com/blog/2010/03/ge ... mandments/

I Bin Readin'

Reeley Important...

http://finance.yahoo.com/tech-ticker/mo ... 53648.html

http://www.shirky.com/weblog/2010/04/th ... ss-models/

http://www.ritholtz.com/blog/2010/04/q2 ... he-ny-fed/

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.bloomberg.com/apps/news?pid= ... p.Sf7cvYvU

http://www.bloomberg.com/apps/news?pid= ... 7vxobpVgYo

http://www.bloomberg.com/apps/news?pid= ... xSP8Wb3iW8

http://www.ritholtz.com/blog/2010/03/grants-conference/

http://www.businesswire.com/portal/site ... ewsLang=en

http://www.ritholtz.com/blog/2010/03/mo ... es-please/

http://www.clearonmoney.com/dw/doku.php ... ot_slowing

http://www.ritholtz.com/blog/2010/03/ny ... bank-tool/

http://www.ritholtz.com/blog/2010/03/ex ... he-shorts/

http://www.msnbc.msn.com/id/36071933/ns/business-autos/

http://www.ritholtz.com/blog/2010/03/ex ... ve-higher/

http://www.ritholtz.com/blog/2010/03/ha ... ty-peaked/

http://online.wsj.com/article/SB1000142 ... 22940.html

http://www.ritholtz.com/blog/2010/03/wh ... an-to-you/

http://www.bloomberg.com/apps/news?pid= ... 5VIVI5AFJ0

http://www.ritholtz.com/blog/2010/03/ho ... uncle-sam/

http://www.msnbc.msn.com/id/36086019/ns ... ork_times/

http://www.bloomberg.com/apps/news?pid= ... &pos=8

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://www.bloomberg.com/apps/news?pid= ... JKoFUkPD.c

http://www.nytimes.com/2010/03/29/opini ... batty.html

http://www.ritholtz.com/blog/2010/03/mi ... al-crisis/

http://www.theatlantic.com/business/arc ... ies/38004/

http://www.ritholtz.com/blog/2010/03/50 ... 09-plunge/

http://www.msnbc.msn.com/id/36093984/ns ... ork_times/

http://www.bloomberg.com/apps/news?pid= ... L0qQmZ7k0c

http://www.bloomberg.com/apps/news?pid= ... &pos=7

http://www.bloomberg.com/apps/news?pid= ... amp;pos=14

http://mpettis.com/2010/04/how-will-us- ... nsumption/

http://www.nytimes.com/2010/04/02/busin ... ndex.jsonp

http://money.cnn.com/2010/03/30/news/ec ... /index.htm

http://www.creditwritedowns.com/2010/03 ... -rate.html

http://northerntrust.com/kasriel/0910/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.ritholtz.com/blog/2010/03/10 ... reformers/

http://www.ritholtz.com/blog/2010/03/th ... e-flipper/

http://www.ritholtz.com/blog/2010/03/di ... ust-cycle/

http://www.ritholtz.com/blog/2010/03/wi ... -in-march/

http://www.ritholtz.com/blog/2010/03/ch ... recession/

http://www.ritholtz.com/blog/2010/03/30 ... aking-out/

http://www.ritholtz.com/blog/2010/03/gr ... day-after/

http://www.ritholtz.com/blog/2010/03/co ... ar-buyers/

http://www.ritholtz.com/blog/2010/03/th ... more-54839

http://www.ritholtz.com/blog/2010/03/ad ... sappoints/

http://www.ritholtz.com/blog/2010/03/ch ... ppoints-2/

http://www.ritholtz.com/blog/2010/03/gl ... o-respect/

http://www.ritholtz.com/blog/2010/04/a-foolish-rally/

http://www.economist.com/specialreports ... extfeature

No Person Is Ever Totally Without Worth. There Is Always A Need For An Example Of What Happens When You Go Ahead And Do It Anyway.

"We discriminate against stupid and we have no intention of stopping."

--Sean Clarke

Chartz and Table Zup @ www.joefacer.com.

http://www.youtube.com/watch?v=BKY8KIt9 ... re=related

http://www.cbsnews.com/video/watch/?id=6298082n

http://www.cbsnews.com/video/watch/?id= ... photovideo

http://ftalphaville.ft.com/blog/2010/03 ... sustained/

http://blogs.ft.com/energy-source/2010/ ... -refining/

http://paul.kedrosky.com/archives/2010/ ... emand.html

http://rick.bookstaber.com/2010/03/gold-bubble.html

http://blog.newsweek.com/blogs/thegaggl ... crats.aspx

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.bloomberg.com/apps/news?pid= ... &pos=7

http://www.bloomberg.com/apps/news?pid= ... aPsHEnNAuY

http://www.bloomberg.com/apps/news?pid= ... muvpo9Oy0U

http://www.ritholtz.com/blog/2010/03/sa ... -or-crash/

http://www.ritholtz.com/blog/2010/03/th ... more-54634

Of Special Interest If You Are A Californian. Or A Taxpayer. You're An Involuntary Shareholder Of A Lot Of Banks,GM And Chrysler, Wanna Own Part Of Some States?

http://www.iimagazine.com/Popups/PrintA ... ID=2442415

http://www.nytimes.com/2009/07/07/scien ... .html?_r=2

http://paul.kedrosky.com/archives/2010/ ... ation.html

http://www.latimes.com/business/la-fi-p ... ull.column

http://www.risk.net/credit/news/1597219 ... dip-threat

http://www.ritholtz.com/blog/2010/03/ex ... greenspan/

http://www.ritholtz.com/blog/2010/03/se ... by-design/

http://www.nytimes.com/2010/03/21/magaz ... f=magazine

Ya Gotta Laff...

http://jeffmatthewsisnotmakingthisup.bl ... e-car.html

http://dmarron.com/2010/03/19/how-much- ... form-cost/

Stay tooned....

Our activity as investors is not to try to identify tops and bottoms - it is to constantly align our exposure to risk in proportion to the return that we can expect from that risk, given prevailing evidence.

-- John Hussman

Chartz and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=BUxx3mdb ... eature=fvw

http://www.ritholtz.com/blog/2010/03/ma ... -concerns/

http://www.msnbc.msn.com/id/35839839/ns ... al_estate/

http://www.msnbc.msn.com/id/35822798/ns ... forbescom/

http://www.msnbc.msn.com/id/35841591/ns ... s-careers/

http://www.cnas.org/blogs/abumuqawama/2 ... -amos.html

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://www.bloomberg.com/apps/news?pid= ... ylss..voRM

http://www.ritholtz.com/blog/2010/03/vo ... -politics/

http://www.ritholtz.com/blog/2010/03/se ... al-crisis/

http://www.ritholtz.com/blog/2010/03/di ... -collapse/

http://www.bloomberg.com/apps/news?pid= ... 1SiG4&

http://www.snl.com/interactivex/article ... 0380-12086

http://www.businessweek.com/magazine/co ... 300122.htm

WTF!!!!

http://money.cnn.com/2010/03/09/pf/reti ... /index.htm

http://www.ritholtz.com/blog/2010/03/ac ... s-the-sec/

Coroners Report On Lehman

http://www.ritholtz.com/blog/2010/03/co ... on-lehman/

Smoking Gun...

If you can't handle 2200 pages:

http://www.ritholtz.com/blog/2010/03/le ... -round-up/

Smoking Gun...

http://www.nakedcapitalism.com/2010/03/ ... fraud.html

Another Smoking Gun?

If you were raised Catholic:

http://www.aolnews.com/world/article/se ... 2F19398262

Stay tooned...more to come later this weekend.

It's Amazing How When You Are On A Roll, Things Just Break Your Way. And When You Are Not On A Roll, You'd Miss The Floor If You Fell Down...

"It's no wonder that truth is stranger than fiction. Fiction has to make sense."

-- Mark Twain

Chartz And Table Zup @ www.joefacer.com.

Stay Tooned....

The charm of history and its enigmatic lesson consist in the fact that, from age to age, nothing changes and yet everything is completely different.

-- Aldous Huxley

Chartz and Table Zup @ www.joefacer.com

Check it Out...

http://www.youtube.com/watch?v=ihvvf1R_vWo

http://www.ritholtz.com/blog/2010/02/he ... put-backs/

http://www.ritholtz.com/blog/2010/02/co ... ble-ahead/

http://www.bloomberg.com/apps/news?pid= ... &pos=7

http://www.bloomberg.com/apps/news?pid= ... 3FNswDlTkw

http://www.voxeu.org/index.php?q=node/4659

http://www.newsweek.com/id/233942?

http://www.ritholtz.com/blog/2010/02/wh ... er-valued/

http://www.ritholtz.com/blog/2010/02/ma ... gage-mods/

http://www.ritholtz.com/blog/2010/02/du ... -it-seems/

http://www.ritholtz.com/blog/2010/02/be ... lled-them/

http://www.msnbc.msn.com/id/35601041/ns ... al_estate/

http://www.bloomberg.com/apps/news?pid= ... LH3zOdh4ro

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.newsweek.com/id/233844

http://www.wired.com/magazine/2010/02/f ... ithm/all/1

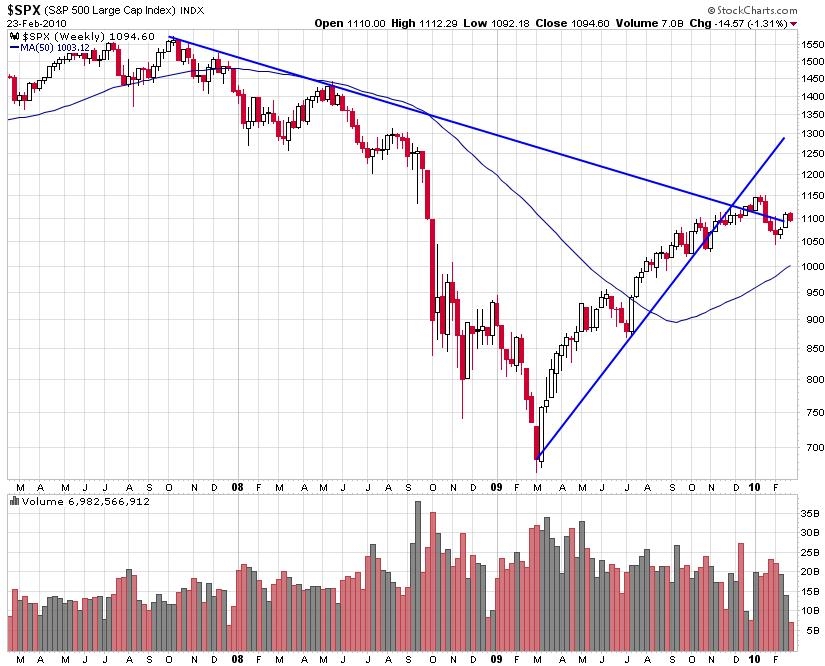

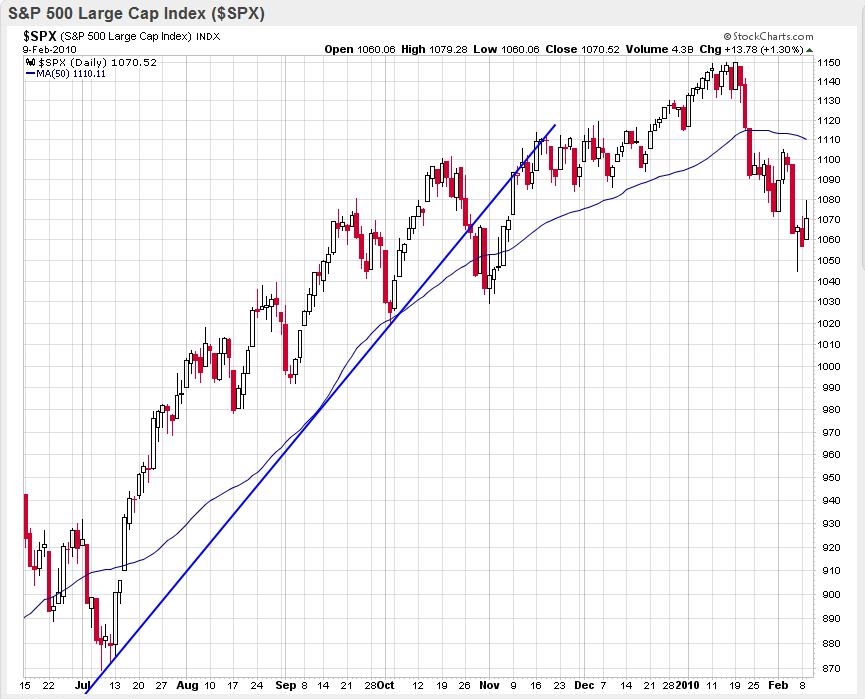

Panic Low, Bounce Offa The (Generational?) Bottom, Recovery To The Pre Panic Down Trend Line, Support At The 20 Day Moving Average, Overhead Resistance @ 1110 And The 200 Day Moving Average. I Expect Market To Break One Way Or The Other... I'm In Cash/Bonds Until I Figure Out Which...

http://www.ritholtz.com/blog/2010/02/th ... more-52719

http://news.bbc.co.uk/2/hi/8539198.stm

http://www.nytimes.com/2010/02/27/your- ... money.html

http://www.economist.com/world/europe/d ... _commented

Stay Tooned.

"The future is here. It's just not widely distributed yet."

-- William Gibson

Chartz and Table Zup @ www.joefacer.com

I never understood why everyone considered John Mayer a great or even a good guitarist, because I only heard him on his own material. After hearing these cuts, I hear an excellent rock guitarist stuck with a serviceable voice for soft rock, locked into his pop mentality, trying to get out and only able to do it on other peoples material...

http://www.youtube.com/watch?v=a81NgSvR ... re=related

http://www.youtube.com/watch?v=Mj2yzsgFtgw

http://www.youtube.com/watch?v=6sPmTgPv ... re=related

http://www.youtube.com/watch?v=Zh4n1bZi ... re=related

Stay tooned. Some chart work and reading ongoing, soon to appear here..

We've bounced from the Jan/Feb low about half

the way back on declining volume... Not much to be confident about there...

Still all cash and bonds....

So The Fed Left The Punch Bowl Out Too Long An' Wall Street And Real Estate Fell In. And What Ya Knew Was Gonna Happen, Happened. Then The Fed An' The Government Borrowed The Public's Credit Card And Refilled The Punch Bowl. Pourin' Alky Down A Drunk's Throat Never Ends Well. Sobering Up Gets Postponed And Worsened. Don't Stand In Front, Stand To The Side.

My philosophy for trading is -- understand why something is happening economically and then look at the price action. If both of them works, go trade. If one of them is starting to fall apart, get out. And if both fall apart, get short,

-- Dennis Gartman

Chartz and Table Zup @ www.joefacer.com. Check it out!

Hell, good enuf to make it two weeks inna row.

http://www.youtube.com/watch?v=Sy7vnwXg ... r_embedded

Larry Faucette on congas

Freddie Smith on sax

Buddy Miles on drums

Mike Finnigan on keyboards

Mike was the SF connection. I used to see his band play at a club in Mill Valley.

Also on the LP were Jack Cassady/Stevie Winwood, coupla guys who also played good music elsewhere at the time.

The guitar player was pretty good too. The first time I saw him, he headed the bill at Winterland with Albert King and John Mayall's Blues Breakers. Two sets each starting at 8:00 and JH played until 2:15...

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.ritholtz.com/blog/2010/02/st ... al-policy/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.newsweek.com/id/233519

http://www.ritholtz.com/blog/2010/02/be ... ing-gifts/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... hIeftRVyvE

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... Xq1qk1ll9M

http://www.ritholtz.com/blog/2010/02/ho ... al-crisis/

http://www.ritholtz.com/blog/2010/02/in ... -expected/

http://online.wsj.com/article/SB1000142 ... 53714.html

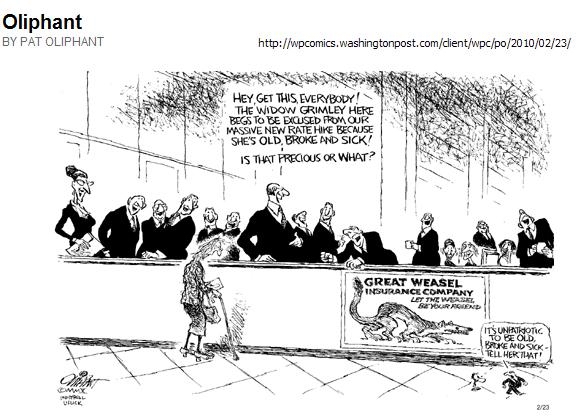

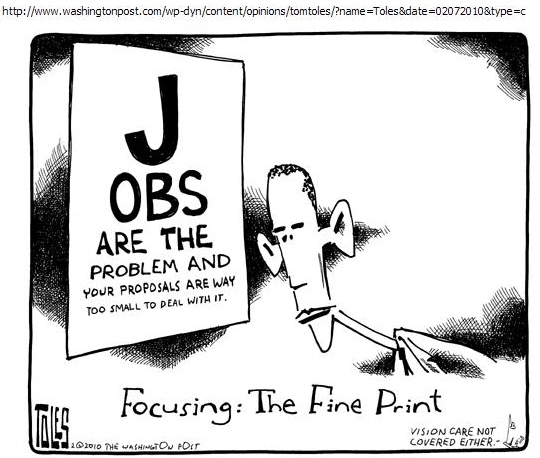

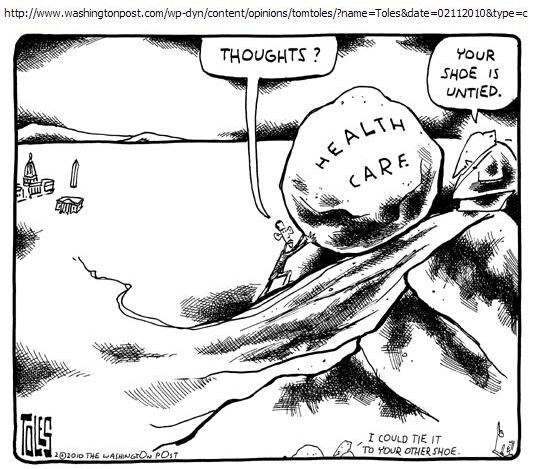

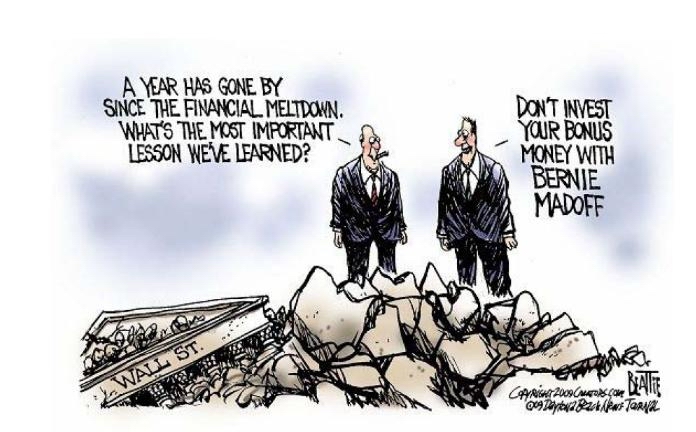

The Obama administration's starting out with health care reform instead of financial reform was a fuck up of enormous proportion. Newsweek's current riff is that it was necessary but still wrong. That news has been out a while. So health care reform is bogged down big time. And Too Big To Fail financials are fewer names but even bigger entities with the taxpayer an unwilling participant in the fun and games. Obama signed on to Bush's program and left the suspects and persons of interest in place and buried them in taxpayer's money. Which they passed around while the jobs just kept disappearing....

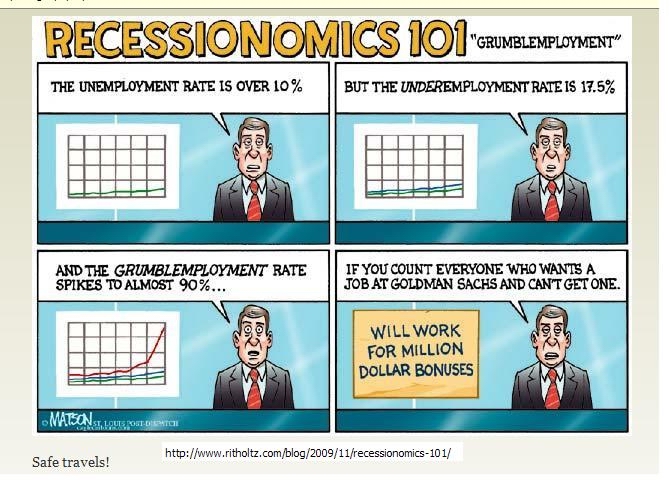

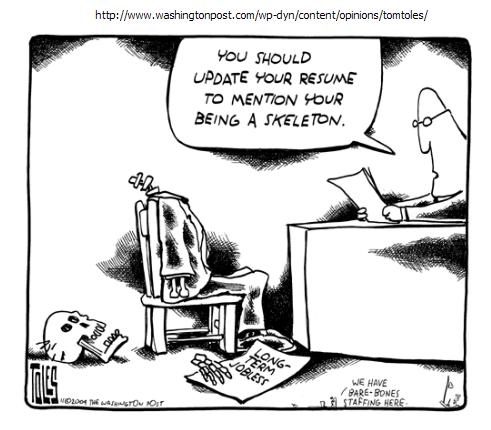

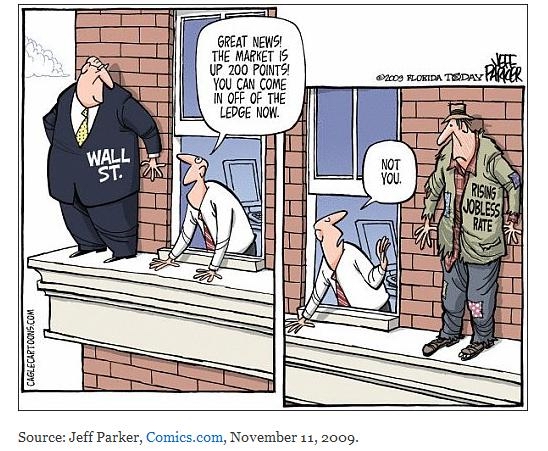

So Main Street sees Wall Street getting healthy enough on Main Streets money to be back to the big bonuses spread among fewer names while Main Street continues south. We are still losing jobs at a time when we need well over 100,000 new jobs a month just to stay even. Estimates for this year project 133,000 new jobs a month. That leaves 30,000 new jobs a month to eat into a very real 17% un and underemployed employment rate. Expect the "official" unemployment rate to float between 9.5% and 10% this (election)year as new persons will step on to the pier as someone falls off the other end...

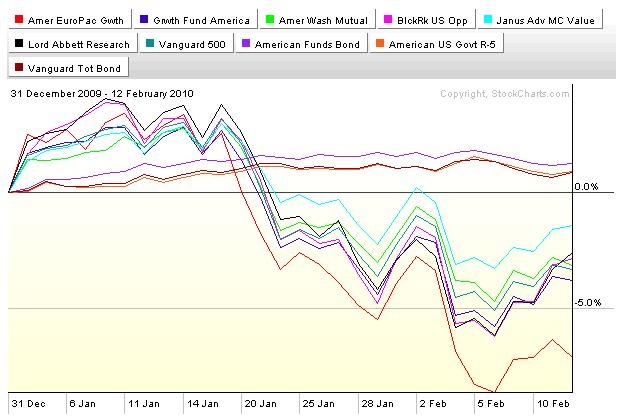

So Intel and Apple posted good reports for the fourth quarter and they and other great names rolled over and started south mid January. Check out the chartz.

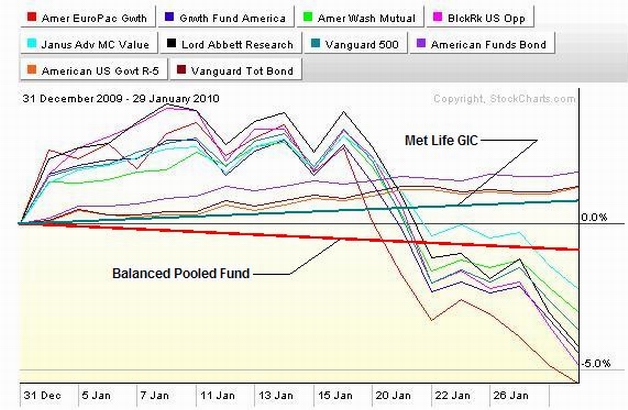

The weekly chart shows perspective, the daily chart shows where we are in the domestic big cap market, the 401a funds show where my choices stand with/against the markets...

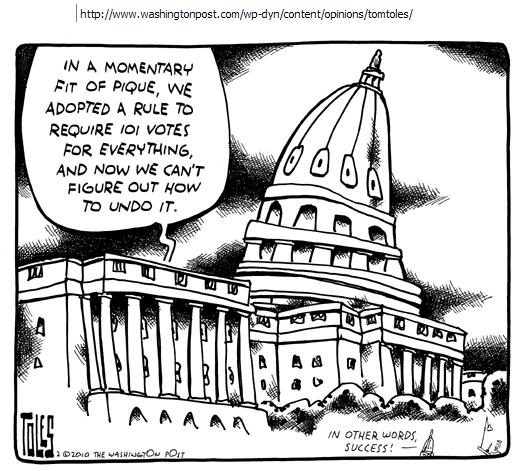

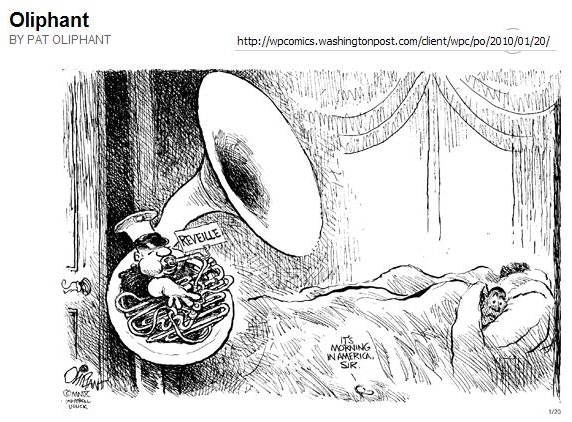

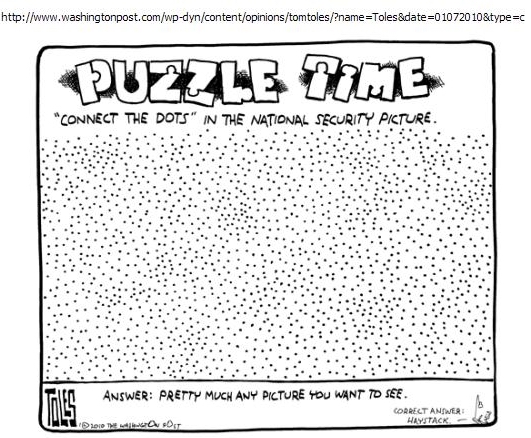

The suspicion has been that Europe is in worse shape than the US for about a year and a half. Now it is starting to show. The markets are herky jerky between fear of serious bad things and the pronouncements that there exists the firm intentions of the EU to seriously consider that something needs to be done and that they may consider that it may become necessary for them to think about who should do it, if they can do it, and are willing to do so.

In the meantime, commodities and stocks go down and it appears that money is leaving stocks and going to bonds and that money is leaving bonds and going to cash and that money is leaving commodities and going someplace...

I'm standing to the side in the 401a. And it ain't an easy choice. All last year, the stock market made "V" shaped recoveries from every rough patch and maybe it will do it again. But that was last year and this is this year. And bonds are promises to pay and not the most comfortable place to be when promises and the future are suspect.

Still, business will be done. It's just that the developed nations are buried under debt and going no place for the time being. It is the emerging nations that will be doing business, but less of it and under some uncertainty.

So for now it looks like rips and dips in stocks as the emotions of fear and greed will jerk the market around the existing trend. And the trend that I see is down.

So I consider that 401a money is not real nimble and that I have to respect the trend.

http://www.ritholtz.com/blog/2010/02/jo ... e-to-last/

http://www.ritholtz.com/blog/2010/02/be ... more-51652

Oh, yeah... 100% GIC and Bonds until further notice.

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... MJFT2dMyIU

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.msnbc.msn.com/id/35367044/ns ... swer_desk/

http://www.ritholtz.com/blog/2010/02/pr ... -earnings/

http://www.msnbc.msn.com/id/35406859/ns ... d_economy/

Stay tooned....

This Week, The Unemployment Rate Number Is Down To 9.7% on 20,000 Additional Jobs Lost. They Are Just Numbers Unless You Understand How They Were Generated And What They Do And Don't Mean...

Our activity as investors is not to try to identify tops and bottoms - it is to constantly align our exposure to risk in proportion to the return that we can expect from that risk, given prevailing evidence.

-- John Hussman

Chartz and Table Zup @ www.joefacer.com

I never got around to sewing these two tracks together... maybe soon. In the meantime...

http://www.youtube.com/watch?v=Sy7vnwXg ... r_embedded

All bonds and GIC in the 401a. Make no mistake, I'm being defensive yet again

Is this the establishment of a downtrend or a quick shakeout like June of last year? Will I see 1025 before I see 1100, or will the market reverse on the way to new 12 month highs? I dunno. But I judge the risk of missing out on a possible spike up that is too fast to climb aboard to be less than the risk losing money riding a possible downtrend into losses.....

It's about asset allocation and risk management.

http://www.bloomberg.com/apps/news?pid= ... amp;pos=14

http://www.msnbc.msn.com/id/35284034/ns ... d_economy/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.msnbc.msn.com/id/35254011/ns ... d_economy/

Good Day. Does it mark the end of the down trend? Or is it a oversold bounce? Coupla more days will tell the tale....

Still all cash and bonds in the 401a...

More later

In general, your target is not to beat the market. It is to beat zero. As I have written for years, the investors who win in this market are the ones who take the least damage.

-- John Mauldin

Chartz And Table Zup @ www.joefacer.com

Ninety seven percent corporate bonds (American Funds Bond/RBFFX) and Met Life GIC in my 401a.

'Nuf said fer now...

Stay tooned, I'll have more to say later this weekend/week.......

http://www.newsweek.com/id/232796

http://www.msnbc.msn.com/id/35163844/ns ... ork_times/

http://www.msnbc.msn.com/id/35148862/ns ... al_estate/

http://www.bloomberg.com/apps/news?pid= ... RsJycboEUE

http://www.msnbc.msn.com/id/35169512/ns ... vironment/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.ft.com/cms/s/0/772748d6-0e94 ... ck_check=1

http://www.bloomberg.com/apps/news?pid= ... &pos=9

http://www.bloomberg.com/apps/news?pid= ... RsJycboEUE

Sunday Eve

Monday Eve; Low Volume Bounce That's Gonna Soon Fail or The Market Turns Back Up Into 52 Week Highs Again?......Tick Tick Tick...

http://www.ritholtz.com/blog/2010/02/di ... o-default/

http://www.bloomberg.com/apps/news?pid= ... n8uHc.dmcc

http://www.ritholtz.com/blog/2009/11/fi ... -to-power/

http://www.ritholtz.com/blog/2010/02/di ... o-default/

http://www.ritholtz.com/blog/2010/02/u- ... nable-gap/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

Thurs Eve

All the way out of stocks in my 401a. The down trend is pretty much been established; There is a fast closing window on re-establishing the up trend. Next level of support is in the 1025 to 1030 range. If we close below that Friday or Monday, it'll be real ugly real quick.....

Once we hit 2010, we rolled over, stuttered for a coupla three four days, bounced into resistance, and rolled over hard. I was too cautious last year and I left a lot of gains on the table. What cost me gains last year appears to have protected my capital this year. I'm down wid dat.....

The four most dangerous words in investing are, "This time it's different."

-- Sir John Templeton

No Chartz Or Tablez Until Next Sat.

Haven't had the energy to do much besides sleep and be sick. Still, I went to 16% stock/84% bonds/GIC Friday.

It's not a bad place to be at all under the circumstances.

Stay tooned and watch for signs of recovery.

Me, not the market. I think the path is clearer for me than the market.

Seeya here.

Thursday

Down to 3% Stocks/ 97% Bonds and GIC By This EVE....

http://thehousinghelix.com/2010/01/25/i ... re-blog-2/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.huffingtonpost.com/2010/01/2 ... 38933.html

http://www.msnbc.msn.com/id/35083918/ns ... ite_house/

Stay Tooned.

Instead of seeing the rug being pulled from under us, we can learn to dance on a shifting carpet.

-- Thomas Crum

Chartz and Table Zup @ www,joefacer.com

Stay tuned.... prolly gonna sell some stock funds to buy some bond funds.....

http://www.bloomberg.com/apps/news?pid= ... T3l8AcKR14

http://www.bloomberg.com/apps/news?pid= ... E9Z4fJhiAg

http://www.bloomberg.com/apps/news?pid= ... bLawRCfYBk

http://www.nytimes.com/2006/09/24/magaz ... wanted=all

http://www.cnas.org/blogs/abumuqawama/2 ... oblem.html

http://www.cnas.org/blogs/abumuqawama/2 ... rones.html

http://www.cnas.org/blogs/abumuqawama/2 ... ocess.html

http://www.msnbc.msn.com/id/34909250/ns ... d_economy/

http://www.ritholtz.com/blog/2010/01/re ... ord-fraud/

http://www.ritholtz.com/blog/2010/01/se ... -bailouts/

http://www.ritholtz.com/blog/2010/01/td ... t-bonuses/

http://www.ritholtz.com/blog/2010/01/la ... -closures/

Stay tuned.... prolly gonna sell some stock funds to buy some bond funds.....

http://www.bloomberg.com/apps/news?pid= ... T3l8AcKR14

http://www.bloomberg.com/apps/news?pid= ... E9Z4fJhiAg

http://www.bloomberg.com/apps/news?pid= ... bLawRCfYBk

http://www.nytimes.com/2006/09/24/magaz ... wanted=all

http://www.cnas.org/blogs/abumuqawama/2 ... oblem.html

http://www.cnas.org/blogs/abumuqawama/2 ... rones.html

http://www.cnas.org/blogs/abumuqawama/2 ... ocess.html

http://www.msnbc.msn.com/id/34909250/ns ... d_economy/

http://www.ritholtz.com/blog/2010/01/re ... ord-fraud/

http://www.ritholtz.com/blog/2010/01/se ... -bailouts/

http://www.ritholtz.com/blog/2010/01/td ... t-bonuses/

http://www.ritholtz.com/blog/2010/01/la ... -closures/

Yes.... I'm back. Between the holidays and family and work and fun and just plain goofing off and getting my daily adult requirement of sitting and staring, I've blown away two/three weeks of time. Back inna traces agin, par'ner.

When you’re wounded and left on Afghanistan’s plains,

And the women come out to cut up what remains,

Just roll to your rifle and blow out your brains,

And go to your God like a soldier.

Excerpt From

The Young British Soldier

By Rudyard Kipling

Chartz and Table Zup @ www.joefacer.com for '09

Lemme get it together and be totally caught up by next week.

meanwhile, back at the ranch.....

http://www.msnbc.msn.com/id/34767759/ns ... rossroads/

http://www.msnbc.msn.com/id/34708120/ns ... big_money/

http://www.msnbc.msn.com/id/34704789/ns ... al_estate/

http://www.newsweek.com/id/229404

http://www.msnbc.msn.com/id/34663078/ns ... ork_times/

http://www.msnbc.msn.com/id/34633553/ns ... d_economy/

AoxoMoxoA... Palindrome Or Conundrum? Threat Or Menace? Juvenile Jackanapes? Or Is It Just Retibulent Praecidualism?

For a substantial portion of the American business and professional class, a book entitled "Life Without Lawyers" must surely conjure some of the same feelings evoked in faithful readers of the Harlequin romances, a sort of vicarious fantasy filled by the joy of liberation from burdens, strictures, and anxieties that have come to define quotidian existence. Such people are, in my experience, called clients.

-- Charles N.W. Keckler,

Chartz And Table Zup @ www.joefacer.com

Seeya Raht Here Later This Weekend....

Meantime....

The TV business is a cruel and shallow money trench along plastic hallways where thieves and pimps run free and good men die like dogs. There's also a negative side.

Hunter S. Thompson

Chartz And Table Zup @ www.joefacer.com

Real Busy This Week....

Readin' This...

http://www.lala.com/#song/360569479529542632

http://www.bloomberg.com/apps/news?pid= ... amp;pos=15

http://www.npr.org/templates/story/stor ... =121087285

http://www.ritholtz.com/blog/2009/12/th ... more-45426

http://www.nytimes.com/2009/12/06/busin ... .html?_r=1

http://online.wsj.com/article/SB1000142 ... 98298.html

http://www.ritholtz.com/blog/2009/12/sa ... n-version/

http://www.ritholtz.com/blog/2009/12/wh ... us-dollar/

http://www.cnas.org/blogs/abumuqawama/2 ... hower.html

http://www.ritholtz.com/blog/2009/12/sa ... n-version/

http://www.nytimes.com/interactive/2009 ... trics.html

http://www.ritholtz.com/blog/2009/12/be ... more-45383

http://www.ritholtz.com/blog/2009/11/fo ... ord-highs/

http://www.ritholtz.com/blog/2009/12/ji ... -bernanke/

Bob worked along side Bill Sams. Read this and check out Mutual Fund Lessons on my web page....

http://www.bloomberg.com/apps/news?pid= ... QR.jbVgmFE

lookin' at this

Consolidating for a push higher?

The pause at the end of the bounce before it rolls over and plummets?

I'm lightening up on stocks a little each day.

Stay Tooned.....

Surprise, surprise, surprise!

-- Gomer Pyle

Chartz and Table Zup @ www.joefacer.com

Another Kick Ass Cover Of A Kick Ass Eddie Cochran Song....

http://www.lala.com/#song/360569479529542632 Click On 20 Flight Rock

http://en.wikipedia.org/wiki/Twenty_Flight_Rock

Click It!!

Three year weekly chart. We just had two weeks where we opened up, went up , and finished the week badly. We've done it before during this rally and then gone higher. But valuations are higher and we are coming to the end of the year, and this market is the most hated rally in memory for a reason. I've been overly cautious for much of the year and I'll be right about it sometime. So the idea will be not to get caught too far extended when it does roll over....

The first three days of the week were up and I pretty much lightened up on stocks in my 401a and went to cash and bonds. I really lightened up in my IRA's and trading account.

It worked out well when I wandered out late in the AM Friday and saw what had happened over Thanksgiving Day. It was all about Dubai and some overdue whackage. I dodged the downdraft sleeping off Thanksgiving and lit up the screens near the top of the bounce. I had time to read enough to develop some ideas about what I wanted to do. So I bought some stocks halfway down the last red bar and some more stocks at the bottom of the bar. I gotta plan...

Stay Tooned. More to come this weekend....

Meanwhile, Back At The Ranch...

http://www.time.com/time/nation/article ... -1,00.html

http://www.debka.com/headline.php?hid=6394

http://www.nytimes.com/2009/11/29/busin ... f=business

http://www.slate.com/id/2236708/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.thestreet.com/story/10634076 ... tdown.html

http://www.msnbc.msn.com/id/34176802/ns ... _business/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.businessweek.com/magazine/co ... op+stories

http://www.unews.utah.edu/p/?r=112009-1

http://online.wsj.com/article/SB125934519959366715.html

http://www.theglobeandmail.com/report-o ... le1380944/

The Holiday Season Starts With Thanksgiving. If You have Looked Over The Edge As Many Of Us Have, You Know That Every Yesterday, Today, And Tomorrow Is a Gift. Get The Most Out Of Them And Spread The Largesse Around. Have A Kick Ass Thanksgiving....

Excuses change nothing but make everyone feel better.

-- Mason Cooley

Chartz And Table Zup @ www.joefacer.com.

Goin Down.....

http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

Lookie Here....

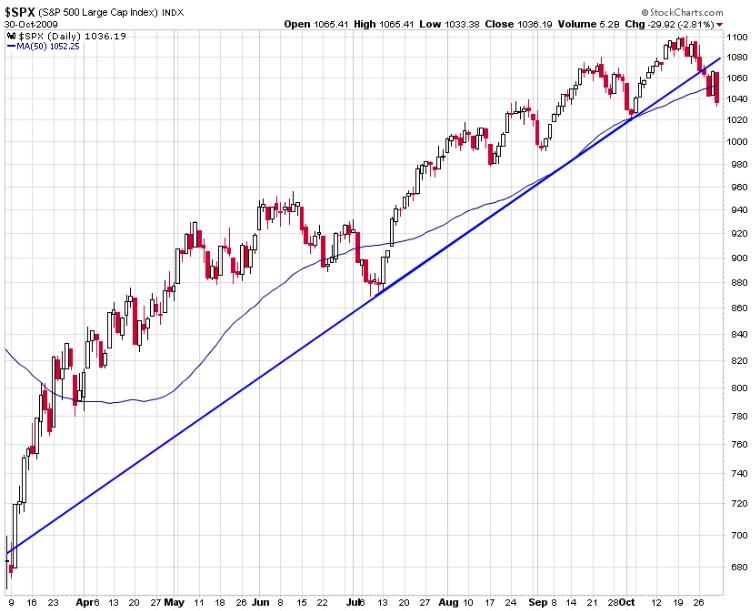

Check out this 3 year weekly chart on the S&P. We established a downtrend in late '07 and then went into a precipitous cascade down starting in October '08. The freefall quickly slowed into a sickening dive that ended in March '09. That was a huge oversold panic drop that led to markets and equities priced for the end of time by the end of '09.

You don't need inventory or employees going into the end of time so businesses got really lean really sudden and the reduced revenues from people who still had jobs, savings, or credit, went straight to the bottom line. There were profits to report. The Fed and the Treasury cranked up the presses and flooded the world with cash at 0%. Nobody wanted to fund businesses or buy real estate so the money went into liquid (financial and commodity) paper assets. Everything got a bid. The markets went up on low volume and in an atmosphere of fear. As markets went up, participants were dragged in kicking and screaming, one at a time, moving the markets up more. Wash,rinse, repeat... It is still ongoing...

The weekly trend is up and continues up. There have been consolidations and corrections, but if you weren't long, you were wrong. I am now pretty much long stocks pretty much late in the year and pretty late in the move...

Check out this 8 month daily chart. The trend is still up, but we have had a coupla touches of the uptrend line with relaunches from there. We've also had a major reset at the end of October. The technicals still look good and Monday we gapped up hard in the AM. The economy hasn't mattered since March. Someday it will matter again. The longer it doesn't, the sooner it will. The reset was a first crack in the wall. The almost daily confirmation that the Fed and Treasury have the economy on a high pressure force fed diet of free cash and is aware of the risk of slowing the flows for even a moment is keeping what launched the economy off the bottom in place. It is The Infinite Intervention vs The Great Unwind at the start of an election year. The risks are huge. I reduced my exposure to stocks Friday and I may do so again even with the markets up.

When it's late and the party is really really wild, ya gotta edge toward the door whether you can hear the sirens yet or not....

Meanwhile, Back At The Ranch...

http://www.bloomberg.com/apps/news?pid= ... sHAD0w1egE

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.istockanalyst.com/article/vi ... id/3633323

http://www.ritholtz.com/blog/2009/11/ho ... of-the-us/

Why I've been in too much cash/bonds and not not enough stock...

http://cohort11.americanobserver.net/la ... final.html

http://www2.debka.com/headline.php?hid=6384

http://www.msnbc.msn.com/id/34067419/ns ... ssweekcom/

http://www.bloombergnews.com/apps/news? ... &pos=7

http://www.dailymail.co.uk/sciencetech/ ... world.html

http://www.bloomberg.com/apps/news?pid= ... tisP2sqI2I

http://www.msnbc.msn.com/id/34103722/ns ... ork_times/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.ritholtz.com/blog/2009/11/bi ... -failures/

These Links Help You To Understand What I See....

http://www.aspousa.org/index.php/2009/1 ... eally-bad/

http://peakwatch.typepad.com/peak_watch ... round.html

http://www.ritholtz.com/blog/2009/11/do ... s-soaring/

http://mpettis.com/2009/11/lecturing-ea ... -on-trade/

http://www.ritholtz.com/blog/2009/11/ex ... ap-condos/

http://www.ritholtz.com/blog/2009/11/th ... americans/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.ritholtz.com/blog/2009/11/th ... t-veteran/

http://www.marketwatch.com/story/15-sig ... 2009-11-24

Stay Tooned....

I'm Gonna Bop Into The Local Woolworths An' Pick Up A Skate Key An A Handfulla Church Keys For The Be In At The Park This Weekend....

Some people regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon.

—Winston Churchill

Chartz and Table Zup @ www.joefacer.com

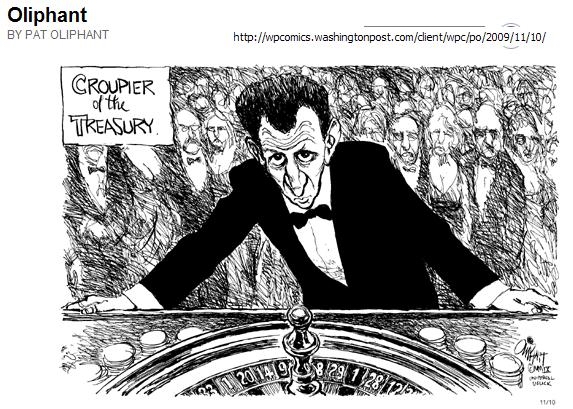

Too Big To Fail; It Ain't Workin' Out like Ya'd Think.....

Spin Yer Down Home MidWestern Salt O Da Earth Head Around....

http://www.washingtonpost.com/wp-dyn/co ... tml?sub=AR

http://labs.timesonline.co.uk/blog/2009 ... e-sharing/

http://www.overthinkingit.com/2008/09/2 ... ood-songs/

http://www.shirky.com/weblog/2009/03/ne ... thinkable/

http://www.ritholtz.com/blog/2009/11/ny ... -buy-hold/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=13

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://money.cnn.com/2009/11/11/news/ec ... tm?cnn=yes

http://www.bloomberg.com/apps/news?pid= ... S_5nNfZ9WM

http://www.newsweek.com/id/222561

http://www.ritholtz.com/blog/2009/11/st ... s-plummet/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.msnbc.msn.com/id/33863804/ns ... big_money/

http://www.ritholtz.com/blog/2009/11/ec ... 1964-2009/

http://www.msnbc.msn.com/id/33913477/ns ... l_finance/

http://www.bloomberg.com/apps/news?pid= ... ZgGg448K3E

http://www.bloomberg.com/apps/news?pid= ... FrABqiPBHI

http://www.bloomberg.com/apps/news?pid= ... amp;pos=14

http://www.bloomberg.com/apps/news?pid= ... BXE1cFSiIw

http://www.msnbc.msn.com/id/33766513/ns ... n_turmoil/

OUCH OUCH OUCH!!!

On Wall Street, Unemployment Is A Lagging Indicator.....

On Main Street, Unemployment Is A Leading Indicator.....

http://www.ritholtz.com/blog/2009/11/if ... more-43777

Infuckingcredible.

http://www.youtube.com/watch?v=Zxa6P73Awcg&

Embarrassing and Pathetic"

http://www.ritholtz.com/blog/2009/11/au ... g-bailout/

http://www.ritholtz.com/blog/2009/11/us ... -overseas/

Sez It All....

http://www.istockanalyst.com/article/vi ... id/3646069

http://www.telegraph.co.uk/finance/comm ... onomy.html

http://markettalk.newswires-americas.com/?p=6216

http://www.counterpunch.org/whitney11032009.html

http://online.wsj.com/article/SB125840904423151209.html

http://markettalk.newswires-americas.com/?p=6195

http://www.counterpunch.org/whitney11032009.html

http://www.foreclosuretruth.com/blog/se ... -stimulus/

On this weekly three year chart, I'm looking at possible resistance on the downtrend line.

On this daily 8 month chart, I'm looking at repeated drops to support on earnings announcements followed by steep uptrends. Lately I see an up first two weeks of the month and down last two weeks of the months. I'm also seeing a drop through support and and testing resistance. That will resolve soon and determine what I'll do with the 401a. I'm 70%/30% stocks/bonds. At this late date it's got more risk that I'm comfortable with, but asset allocation and risk management means seeking return and matching risk and reward. We'll see.....

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://www.ritholtz.com/blog/2009/11/ho ... of-the-us/

Stay Tooned...

My Website Has The Hood Up And Code Layin' All Over Everywhere For A Week As The Host Transmogrifies The Servers From Coal/Water Wheel power To Nuclear/Solar Cogen. The COFGBLOG Is Live During This Time...

Money was invented so we could know exactly how much we owe."

—Cullen Hightower

No Current Chartz And Tablez @ www.joefacer.com For A Week..Or So.

But there will be some to be had here....

http://milwaukee.bizjournals.com/milwau ... ily59.html

http://www.msnbc.msn.com/id/33732266/ns ... d_economy/

http://www.msnbc.msn.com/id/33621222/ns ... l_finance/

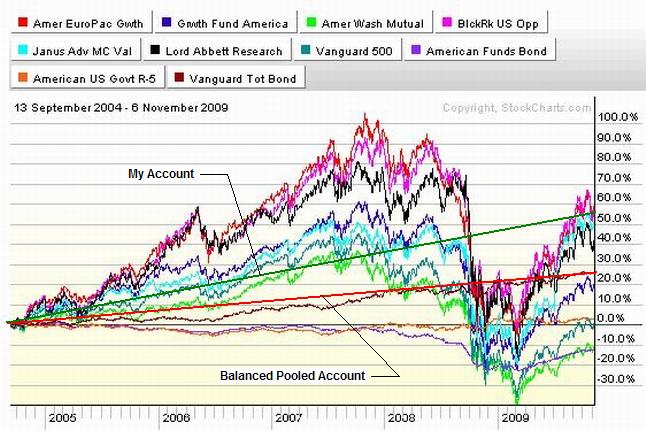

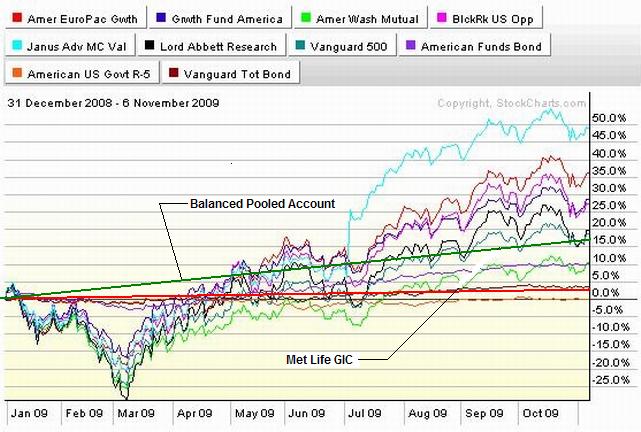

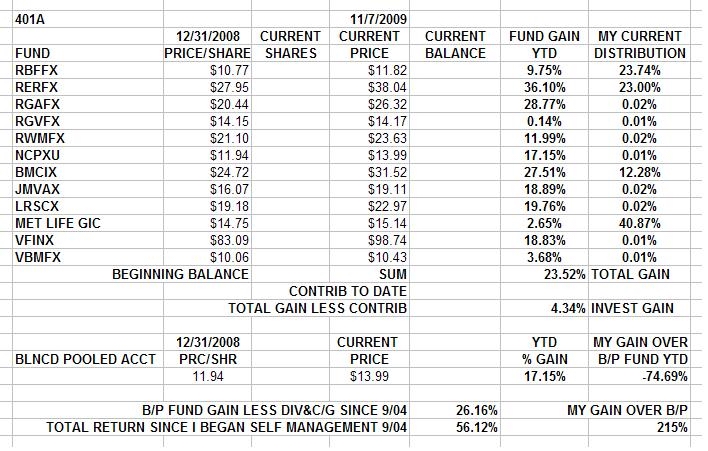

Later This Week End; Using Perfcharts to Plan 401a Asset Allocation...

Yesterday is a canceled check; tomorrow is a promissory note; today is the only cash you have -- so spend it wisely.

-- Kay Lyons

Chartz And Table Zup @ www.joefacer.com.

I'm All Hunkered Down. I'm almost outa almost all stocks; see my chartz and tablez on my site. I'm filing outa the RERFX in an orderly manner. For all that it is an off shore fund, It sure tracks US equities closely. I'd sure like to see a counter trend in the future to feel better that it was a good alternative if the US markets are goin' down. Bonds are another problem. More this weekend.

This could get a a lot uglier, real quick....

http://www.lala.com/#song/360569479529542632

Cut 8 "Paper Money"

That said, I'm not in a bad space; I'm still running 11% a year returns since the hall straightened out the 401a options. I coulda done a lot better this year. Can't win 'em all. But I can live with winning most of them.

CLICK THESE

Technical Stuff;

First two chartz;

S&P 500

Nasdaq

Broken uptrend lines

No areas of consolidation support/resistance

Bear Market Bounce? We'll find out.

Third chart

Apple

Most Loved tech and momentum play.

Red circles are start of earnings reports

A is an uptrend off the bottom with a hiccup.

B is a consolidation going into earnings.

C is a steeper uptrend off good earnings.

D is consolidation going into earnings.

E is a spike after good earnings and then running into something bad.

I've posted links to what I'm reading and thinking about.

http://www.thestreet.com/stock-market-n ... ation.html

http://www.bloomberg.com/apps/news?pid= ... g02NI0x4wA

http://www.bloomberg.com/apps/news?pid= ... lpEiqrgpQ#

http://www.ritholtz.com/blog/2009/10/wo ... ng-strong/

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://money.cnn.com/2009/10/30/news/ec ... 2009103022

http://www.newsweek.com/id/220163

http://www.pimco.com/LeftNav/Featured+M ... vember.htm

Fundamentals and technicals align....

MAXIMUM CAUTION! PROTECT WHAT YOU HAVE!

http://www.mcclatchydc.com/227/story/77791.html

McClatchy's inquiry found that Goldman Sachs:....

The firm benefited when Paulson elected not to save rival Lehman Brothers from collapse, and when he organized a massive rescue of tottering global insurer American International Group while in constant telephone contact with Goldman chief Blankfein. With the Federal Reserve Board's blessing, AIG later used $12.9 billion in taxpayers' dollars to pay off every penny it owed Goldman.

http://www.ritholtz.com/blog/2009/10/jo ... t-on-tbtf/

http://www.msnbc.msn.com/id/33576310/ns ... _business/

http://www.bloomberg.com/apps/news?pid= ... R4KXaGwxd8

http://www.newsweek.com/id/220516

http://www.theglobeandmail.com/blogs/je ... le1343977/

http://www.reuters.com/article/ousivMol ... H420091030

http://money.cnn.com/2009/11/01/markets ... tm?cnn=yes

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.msnbc.msn.com/id/33575706/ns ... _business/

http://www.msnbc.msn.com/id/33573988/ns ... ss/page/2/

http://money.cnn.com/2009/11/01/markets ... tm?cnn=yes

http://www.theglobeandmail.com/blogs/je ... le1343977/

http://tonto.eia.doe.gov/oog/info/twip/ ... print.html

http://www.reuters.com/article/newsOne/ ... 26?sp=true

http://paul.kedrosky.com/archives/2009/ ... th_11.html

http://www.bloomberg.com/apps/news?pid= ... W1nX0i4L40

http://online.wsj.com/article/SB125712303877521763.html

http://www.ritholtz.com/blog/2009/11/is ... g-to-fail/

http://www.ritholtz.com/blog/2009/11/st ... ing-banks/

http://www.ritholtz.com/blog/2009/11/wh ... more-42942

http://www.ritholtz.com/blog/2009/11/am ... t-america/

http://www.ritholtz.com/blog/2009/11/wh ... -the-buck/

http://www.bloomberg.com/apps/news?pid= ... CVGLt3daN8

Stay Tooned. More onna way....

Must Be Gettin' On Later In the Year.... I Find Myself Planking Salmon And Searing Steak Inna Cold And Dark. Real Manly Adventure With The Flavor Of White Hot Coals And Ice Cold Gin.

Retail sales themselves are the best indicator of consumer sentiment as no device peers so deeply into the recesses of the human soul as the cash register.

--Howard Simons

Chartz And Table Zup @ www.joefacer.com

Or They Will Be When I Can Get On To The 401a Site...Is It Me? Or Is it Everybody? Good Excuse To Find Somethin' Else To Do Today....

http://www.youtube.com/watch?v=FMcjPZgK ... re=related

http://www.ritholtz.com/blog/2009/10/an ... more-42096

http://www.ritholtz.com/blog/2009/10/80-oil/

http://www.ritholtz.com/blog/2009/10/fd ... lures-106/

http://www.google.com/hostednews/ap/art ... gD9BI75DO0

http://www.ritholtz.com/blog/2009/10/re ... omed-wamu/

http://www.ritholtz.com/blog/2009/10/n- ... -eye-view/

http://www.msnbc.msn.com/id/33479888/ns ... _business/

http://www.bloomberg.com/apps/news?pid= ... GuYWlHyRDU

http://www.ritholtz.com/blog/2009/10/co ... d-records/

http://www.bloomberg.com/apps/news?pid= ... tUrQ343suM

http://www2.debka.com/headline.php?hid=6341

Stay Tooned.

TUESDAY

I've gone into capital preservation mode. Outside down days in key stocks, interday reversals in key stocks and indices, stocks going down on bad news/good news/no news/first class earnings beats, and then the few stocks that went up on first class earnings end up going down, That's A Deal Breaker.

I'm 73% bonds and GIC and the remainder mostly long AsiaPacific as a materials/growing economy thing. I may get all the way lighter on the little bit of domestic stocks I own in the 401a and lighter yet on the RERFX stuff. Stay Tooned...

My readings as posted here over the last 2 years made me way too cautious way too early and I missed most of the run up. I listened to Main Street and the more cautious parts of Wall Street and I saw the steam roller coming while it was still 8 miles away and I got out of its way. And stood around. I don't have the tools here in the 401a to pick up the few pennies still on the road and expect to get away cuz now I hear the steamroller and feel the rumblings. Man up, face up to a lost opportunity and get back to the curb.

Norway, Australia, Brazil, and India as of this evening seeing the end of the financial crisis on their turf and putting new fiscal and monetary policies in place in the weeks and months ahead. Prolly more nations doing so over the next few months. It is NOT the US leading worldwide policy response to our financial crisis. This is us facing the great unwind of the Money For Nothing , Cash For Free policy in a less benign set of circumstances and less control than we are used to.

I can't think of a lousier set of circumstances to start into the Holiday Season with short of being at war. oh, yeah.....

http://www.manufacturing.net/article.aspx?id=224838

http://www.bloomberg.com/apps/news?pid= ... A4qY0M7Xyw

http://www.theonion.com/content/news/u_ ... e_building

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

http://www.norges-bank.no/templates/art ... 75658.aspx

http://www.ft.com/cms/s/0/38164e12-c330 ... ck_check=1

http://www.bloomberg.com/apps/news?pid= ... T5HaOgYHpE

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

Bad News

Set up for some serious downside. I'm all but out of stocks and getting outa bonds....

Stay Tooned....

There Was A Time When 50% Of America Disapproved Of Rock 'n Roll And Only 5% Listened To It. Now It's Elevator Music. Fifty Percent Of Post WWII Industrial Production Was In America. Then It Was G-3, G5, G7, Now It's G20. Twenty Nations That We Coordinate Our Monetary Policy Wit'. And Australia Raises Rates 1/4% And The US Goes, "Uh-Oh..." Things Change Over Time.. But Now The Changes Are Really Gonna Pick Up Speed...

International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

-- Howard Simons

Chartz And Table Zup @ www.joefacer.com

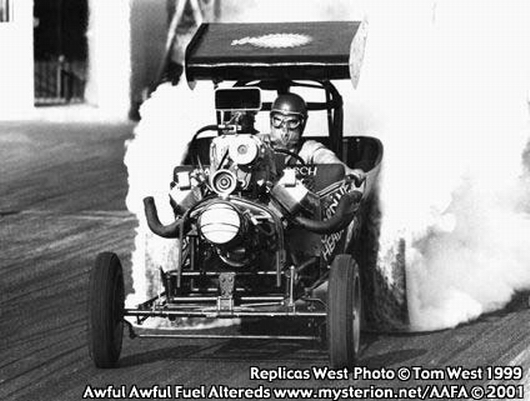

The Original Wild Willie

http://www.rodandcustommagazine.com/the ... index.html

http://www.nhra.net/50th/top50/W_Borsch34.html

A Replica Of The Car That Qualified For Top Fuel At The WinterNationals....

http://www.youtube.com/watch?v=wFOmGkv6Dn8

I got stuff to say about what I've done this week and what I'm gonna do next week w/ my 401a......

It'll start w/ this chart o' the dollar over the last six months.

It's value has dropped around 15% in 6 months. Things we buy overseas like oil and metals and finished goods cost more because the dollar is cheaper and buys less. Our stuff becomes cheaper for overseas buyers because their currency buys more. Profits in drachma and simoleons and shekels earned overseas by US companies get inflated when converted back to dollars because they can buy more dollars with the foreign currency than they could six months ago. That is part of the excellent return earned by the EuroPacific Fund recently. A cheaper dollar hurts at the cash register but it can help exporters big time and also investors in the 401a. Gonna have to think about that. And write about it here.

Wed Eve/Thurs....

http://www.ritholtz.com/blog/2009/10/hi ... es-to-lag/

http://money.cnn.com/2009/10/20/real_es ... /index.htm

http://www.msnbc.msn.com/id/33405209

http://www.ritholtz.com/blog/2009/10/we ... er-letter/

http://money.cnn.com/2009/10/21/autos/a ... 2009102109

http://www.bloomberg.com/apps/news?pid= ... g4uV.mo1kw

Tick Tick Tick..... Earning Season Starts Inna Middle O' Da Week. Is My Strategy Deer Inna Headlights? A Rational Approach To A Critical Juncture Of Risk And Reward? Or The Result Of Random Neural Output From The Brain Of An Old Broken Down Pipefitter With Too Many Nights Of Sex, Drugs, And Rock 'n Roll And Too Many Days Of Twistin' The Wrist An' Chasin' Down The Racer Ahead And Runnin' From The Racer Behind...?

It's all fun and games until someone gets hurt.

-- Mom

Chartz An' Table Zup @ www.joefacer.com.

We are half a week from a fulcrum point. Think of a hallway with a door at each end. Ya open the door, walk through to the other door , open it, and walk through. Now think of the hallways set up in haunted mansions as death traps. Hinged in the middle, they are as solid as can be for step after step, until you take the first step past the middle. Then you are fucked. Think of Wednesday as getting close to the middle of the hallway. There are three hinges on the far door. Is there one inna middle of the floor?

Alcoa made 4 cents a share last quarter instead of the 9 cents a share loss that the street expected. The revenue was higher that Wall Street expected by 1.5%. But it was still down by 33% from a year ago. So the profit was made by grinding suppliers, closing plants, and laying people off. There is demand and there is a worldwide recovery under way. China is the difference. There will be more profits and more business done. Demand and prices will rise for raw materials and finished goods. The question is, will there be a national recovery here too and will future business and profits support the current US stock prices? It's a consumer economy (70%) in this country. Do you see a recovery ahead?

What it means here.... http://www.ritholtz.com/blog/2009/10/on ... ntraction/

The writers I read have given up on rationality. It looks like the internet and housing bubble to them. The thoughts are that this will end badly. Or maybe not. Things looked great at the start of 2000 and 2005 and looked like hell in March of 2009. How it looks to you today depends. The question is, is it 1998 or 2000? Is it 2002 or 2006? How long until employment launches skyward or stock prices implode? What would you do if you knew the answer? What would you do if you didn't?

Solid Gold Place To Start For The 401a Participant. http://www.thestreet.com/story/10608336 ... riend.html

http://www2.debka.com/headline.php?hid=6313

http://www.bloomberg.com/apps/news?pid= ... ZfOLKO2Zpk

http://www.msnbc.msn.com/id/33212991/ns ... d_economy/

http://www.cnas.org/blogs/abumuqawama

http://www.jconline.com/article/2009100 ... /910070345

http://www.msnbc.msn.com/id/33157665/ns ... vironment/

http://money.cnn.com/2009/10/08/news/ec ... /index.htm

Pretty much describes where my head is at....

http://www.ritholtz.com/blog/2009/10/th ... t-history/

Extremely thought provoking for the buy and hold 401a participant. It is not without holes, but I've read this book before and I can fill some of them in myself and interpret my way past others.

http://www.ritholtz.com/blog/2009/10/ho ... more-39371

Tick Tick Tick...

http://www.bloomberg.com/apps/news?pid= ... p2WcXs3fP4

http://www.bloomberg.com/apps/news?pid= ... z0hsBTTR4A

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://online.wsj.com/article/SB125530360128479161.html

Main St vs Wall Street

http://www.ritholtz.com/blog/2009/10/li ... nightmare/

I'm watching and waiting....

I've moved my 401a to an outsized position in cash for safety during a potentially very volatile time and for quick deployment back to stocks if an end of year run up starts. I have a smaller proportion in bonds for safety and income. I'm about 1/8 in EuroAsia as a weak dollar/commodity/growth play, and a tag end in small cap cuz I stopped one or two exchanges short. My Website has details to 4 decimal places.

Waiting....

FULCRUM DAY

You better be conservative or ready to turn onna dime.

http://www.ritholtz.com/blog/2009/10/getting-better/

It might be that things "Have Got To Get Better Inna Little While". If so there will be plenty of time for me to get way long then.

WED AM

Intel and JPM report good quarters and good/mixed forecasts. Economically, it is not ragingly bullish. But markets spike up. Fifty percent of S&P 500 revenues come from overseas. There will be profits and revenue. But domestic jobs, government spending, and housing are not going to move strongly in the right direction for a while. I think that realization has yet to be fully appreciated by investors. If the rest of the world raises interest rates or we have a lousy Christmas economy/housing drops another increment when rising rates make the FED/Treasury stop printing money, we could see a serious dip down. The near/long term upside is limited. Downside is less limited. It's about potentials, not imperatives. Listening to what the markets say and being ready to react to protect what you have today is as important as ever. I'm thinking about what to do with the 401a later today.

WED Afternoon....

Definitely feels toppish.

That said, I'm leaning toward tossin' in some 401a

money on the year end run up...

Stay tooned. To be continued....

GAWD!!! This Is A Mess! An Amazing Bear Market Rally, Mutual Funds, Hedge Funds, And Private Investors Who Missed It, End Of The Year Three Months Away, One Last Chance To Look Good, And A Dawning Awareness That 26 Million Unemployed And Underemployed Ain't Gonna Make For A Merry Christmas Shopping Season. Could The Markets Be Up At Years End? We'll See.

"The Financial Instability Hypothesis suggests that over periods of prolonged prosperity, capitalist economies tend to move from a financial structure dominated by hedge finance (stable) to a structure that increasingly emphasizes speculative and Ponzi finance (unstable)."

-- Hyman Minsky

Chartz And Table Zup @ www.joefacer.com

Smokin', Kick Ass, And Just Plain Silly....

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://link.brightcove.com/services/pla ... 1337502001

http://www.ritholtz.com/blog/2009/10/st ... ty-python/

http://robertreich.blogspot.com/2009/10 ... ember.html

http://www.ritholtz.com/blog/2009/10/th ... -they-get/

http://www.ritholtz.com/blog/2009/10/an ... more-40077

http://www.ritholtz.com/blog/2009/10/th ... ecoveries/

http://www.bloomberg.com/apps/news?pid= ... oQJ14iSlWg

http://www.msnbc.msn.com/id/33135910/ns ... d_economy/

http://www.ritholtz.com/blog/2009/10/we ... ember-200/

http://www.bloomberg.com/apps/news?pid= ... ZinRhF5tlA

http://www.msnbc.msn.com/id/33122449/ns/business-autos/

http://www.msnbc.msn.com/id/33150671/ns ... ork_times/

http://www.msnbc.msn.com/id/33122485/ns ... e_economy/

http://www.ritholtz.com/blog/2009/10/ki ... rns-south/

http://www.bloomberg.com/apps/news?pid= ... owSDAJbML4

http://www.msnbc.msn.com/id/33093637/ns ... d_economy/

http://www.msnbc.msn.com/id/33138126/ns ... d_economy/

http://www.msnbc.msn.com/id/33088930/ns ... al_estate/

I've gone to bonds and cash with a little tag end in the small cap 'cuz I forget to move it and a small chunk in the Euro Pacific option as a weak dollar play. See www.joefacer.com.

The cash is quickly deployable for a yearend run if it comes to that. The bonds is a fear thing. And if you know me, you know I ain't a very fearful kinda guy. But if you read what I do, you understand that I respect the possibilities.

"I can dodge folly without backing into fear."

Nero Wolfe

"I can dodge folly without backing into fear."

Nero Wolfe

Stay Tooned.

Ya Can't Always Be The Best There Is, But If You Can Have A Lot of Fun Doin' It, That Goes A Long Way Too.

Calendar

Calendar