| |

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan.

Saturday, March 5, 2016, 01:19 PM

Hope is the expectation that something outside of ourselves, something or someone external, is going to come to our rescue and we will live happily ever after.”

-- Dr. Robert Anthony

Yet Anudder Voice...

Robert Reich

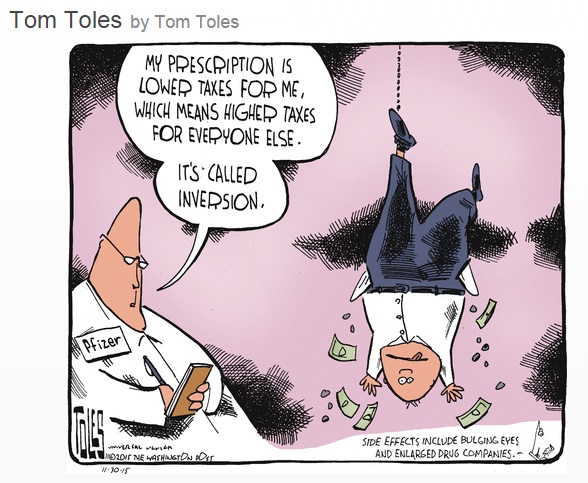

I got a call this morning from a Democratic operative, seeking suggestions for how Hillary Clinton could fix her economic message. I told him that the problem wasn't her economic message. It was her economic strategy, and her dependence for campaign funding on big donors.

Her economic strategy consists of lower taxes for companies that create jobs, higher taxes on companies that outsource them, investments in education and job training and infrastructure, paid leave, lightly re-regulating Wall Street but not resurrecting Glass-Steagall or breaking up the biggest banks. This strategy is a continuation of Bill Clinton’s and Barack Obama’s economic strategy. That Clinton-Obama strategy also included free trade, deregulation of Wall Street, a huge taxpayer bailout of the Street, and free rein to big corporations to grow much larger, give their CEOs exorbitant pay packages, and screw their workers.

Democratic presidents have presided over 16 of the last 24 years yet most people don’t feel better off. The middle class is smaller now, and the ranks of the working poor have grown. An economic strategy that continues those previous strategies doesn’t address the elephant in the room -- the increased concentration of wealth and political power at the top, and the rigging of the economy.

Promising half a loaf is unconvincing to people who want to take back the bakery.

Yet More Josh....

http://fortune.com/2016/03/07/the-most- ... ll-street/

The Most Horrendous Lie on Wall Street

by Joshua Brown @reformedbroker MARCH 7, 2016, 12:42 PM EST

And House Speaker Paul Ryan is helping spread it.

There’s a horrendous lie being told by the brokerage industry and its army of lobbying groups. It goes something like this:

“Middle-class Americans are not worth serving if we can’t charge them egregious fees and sell them products that they do not need.”

They’re not using that exact language, but this is precisely what they’re saying. This message disgusts me personally and I’m in a unique position to comment on it professionally. As I documented in my book Backstage Wall Street, the business model of selling investment products to investors is hopelessly rife with conflicts.

For the first half of my career, I was a cog in the machine, working at third-tier broker-dealers and selling products to the masses. I saw these conflicts firsthand. Over the years since, I’ve tried to get the truth out there about what I’d seen when Wall Street and Main Street collide. But the incentives that create bad behavior are still there. Under the current compensation regime, even the best intentioned brokers are continually put in a situation where what’s best for their own paycheck is not always what’s in their clients’ best interest. Brokers are routinely compensated the most heavily for selling the products that cost their clients the most in fees and lost performance.

In other industries, higher-priced products are typically superior in both quality and efficacy—think luxury watches and cars, or the difference between a roadside motel and the Ritz-Carlton. With financial services products, however, it works in exactly the opposite way. Virtually every single piece of academic research ever produced on the topic says that the less you pay for an investment product, and the simpler it is, the better off you’ll be over the long-term.

Wall Street knows this for a fact. It’s undeniable that high fees and excessive trading costs damage the long-term potential of a retirement account and work against investors. Unfortunately, the brokerage business is predicated on selling the higher cost solutions because that’s where the profit margins are. The incentives paid by fund companies to brokerage firm sales forces across the country are a cancer that must be rooted out. This built-in conflict between advisor and client is partially responsible for the nation’s looming retirement crisis. It also plays a role in the finance industry’s almost universally negative perception among Americans.

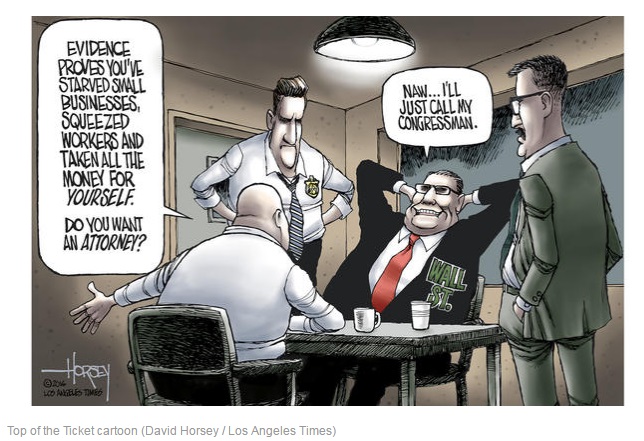

The good news is, we are at a crossroads. There’s a push right now from the Obama administration to extend a “Fiduciary Standard” across the industry. The Department of Labor is proposing this standard would take the place of the weaker and more nebulous “Suitability Standard” that now exists and leads to unsatisfactory outcomes for regular people. New legislation is now before congress that would force brokers to act as non-conflicted fiduciary advisors when helping investors with their retirement accounts. Any normal person with a functioning brain would agree that this is obviously the way things should work.

But when it comes to politics, we’re not always dealing with normal people. The brokerage industry is powerful and its lobbying groups play the game fiercely. The Council of Economic Advisors (CEA) estimates that the current suitability standard costs U.S. households some $17 billion in excess fees and adverse performance. A combination of ten independent studies estimates that the true cost is likely between $8.5 billion and $33 billion! There is a lot of money on the line, so the opposition to new rules should not come as a shock.

What’s shocking, however, is the tack they’re taking in framing this as a debate over what is best for the investor class. Last week, Speaker of the House Paul Ryan gave Wall Street an assist by slamming the Obama administration’s proposal, claiming, along with others, that the fiduciary rule will lead to so much excess regulation and red tape that brokerage firms will have to give up on servicing smaller investor accounts.

On his official blog, Ryan lashed out at the Fiduciary Standard rule with this mock definition:

fi·du·ci·a·ry rule [fi-doo-shee-er-ee rool], noun (2016)

: regulation, Department of Labor.

1 : A one-size-fits-all regulation from the Obama administration. 2 : Creates more paperwork and costly record-keeping requirements for financial planners, restricting access to quality investment advice for upwards of 7 million Americans with IRAs. 3 : Results in higher costs for people seeking financial advice, disproportionately hurting families with smaller bank accounts.

Example Sentences:

The Obama administration’s fiduciary rule will hurt millions of hardworking Americans trying to plan for their retirements and save for the future.

House Republicans, led by Reps. Ann Wagner (R-MO), Phil Roe (R-TN), and Peter Roskam (R-IL), are working to protect families from the harmful fiduciary rule.

Democrats and Republicans agree that the administration should abandon this proposal and go back to the drawing board.

See also, Obamacare, Dodd-Frank

The logic here is astounding. The argument is literally that some people need to be taken advantage of in order for them to be worthwhile clients. I believe Ryan is on the wrong side of this issue and on the wrong side of history. But more than that, his argument—that somehow conflicted advice is better than none at all—is wrong for at least two reasons.

For starters, it’s cynical to the point of being downright un-American. We don’t allow any other industry in this country to operate this way, openly or otherwise.

The much bigger problem, though, is this: It’s a lie. A horrendous lie.

In 2016, we live in an age of unparalleled financial technology innovation. It has never been a better time to be an investor. The modern buyer of stocks and bonds has a nearly unlimited array of options by which to obtain extremely efficient and incredibly low-cost exposure to the investment markets. Fees and trading costs have been dropping precipitously while, at the same time, a Cambrian Explosion of sorts has given rise to all manner of automated advice services and exchange traded fund products.

The notion that an investor needs to pay upfront fees of in excess of 5% to buy an A-share mutual fund from a broker is laughable to anyone with even a passing familiarity with the modern-day options that exist.

Vanguard is now managing in excess of $3 trillion dollars in low-cost index funds that cost investors a fraction of what full-service brokers charge for the funds they are incentivized to sell. And again, the grand irony is that there are virtually no high-cost funds available to the retail public that have been able to outperform them over any objectively meaningful timeframe. The weight of the evidence here is so staggeringly one-sided that it’s not even worth citing individual studies—there’s never been one that’s been able to say otherwise.

There are two well-known automated advisory services, or robo-advisors, called Betterment and Wealthfront. After only a few years of operation, each is managing more than $3 billion in goal-oriented investor portfolios. Charles Schwab is now offering this same service with the interesting wrinkle that they are charging clients nothing other than a tiny bit of interest on cash balances.

As we move up the ladder a bit, there are slightly more hands-on services being offered by firms like Personal Capital and Fidelity, where investors can be assigned a human advisor but pay a very low cost because of how much the workflow can be automated.

And then there are traditional advisory firms like mine. We are a registered investment advisory (RIA) catering primarily to high-net-worth and ultra-high-net-worth investors. We used to shudder whenever we had to turn down a middle-income investor who was asking for our help. It is now a point of pride for us that technology has allowed us to launch a robo-advisory service of our own, which offers portfolios to households that we would not have previously had the capacity to service. Within five years, my best guess is that every RIA of scale will have a similar solution for investors who would have, in another era, been forced to seek help from a hopelessly conflicted brokerage firm.

We are a nation that has always strived to find new ways of doing things. Entrenched interests like the brokerage industry can thrive once they admit that there are other ways to accomplish something we all want—a healthy and thriving retirement system that offers acceptable choices for Americans of all walks of life. Fortunately, these choices currently exist and are becoming more robust by the day.

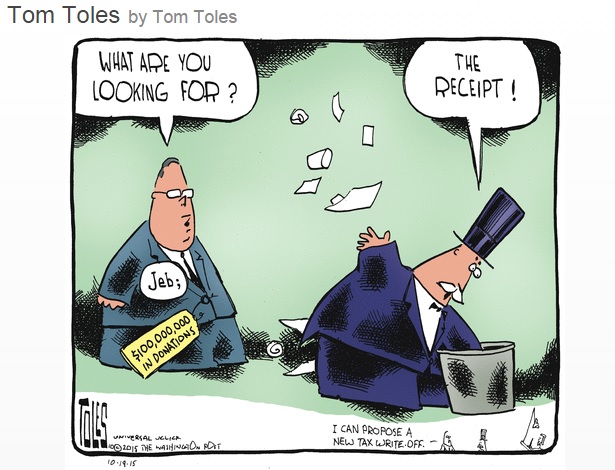

Unfortunately, there is a long and profitable tradition of selling high-cost products of dubious quality to the investing public. It’s also very hard to become an elected official without taking money from the financial services industry, no matter which party you’re affiliated with or which region of the country you hail from. Insurance companies, broker-dealers, mutual fund companies, and other backers of the status quo will not go down without a fight.

Even now, Wall Street is hard at work concocting alternatives to the proposed Fiduciary Standard rule, which they claim is unduly onerous on the industry. One Orwellian phrase I heard recently was “Best Interests Standard,” which true fiduciary investment advisors are wincing at because it draws a false equivalency that muddies the waters even further among the unsophisticated investors, who already have difficulty understanding the difference between advisers and brokers.

It doesn’t have to be this way. It’s entirely possible for a fiduciary standard to work to both the satisfaction of financial advisers and their clients. We have a living, breathing example right across the Atlantic.

In 2006, the United Kingdom conducted a “Retail Distribution Review” or RDR to look at how ordinary investors were being affected by conflicted financial advice. The recommendations produced by the RDR were put into effect in 2013. Notably, retail brokerage commissions for the sale of investment products were made extinct.

In the lead up to this rule change, The City—London’s version of Wall Street—kicked and screamed about how change would represent the end of financial advice for millions of investors. Mass layoffs would ensue and the regulations would make it impossible for well-meaning advisors to do their jobs. Three years later, it’s apparent that all of the worst predictions have been proven false. There are fewer advisers registered with the Financial Services Authority, than there were in 2011—31,000 vs. 40,000. But at least some of that is because of the national attrition that all sectors facing reform and increased scrutiny go through. The widely feared “guidance gap” has not materially grown. Modern technology is allowing U.K. customers more access to advice from the advisers who cleaned up their acts and committed to providing a non-conflicted service model.

It is too early to tell which side will win in the fiduciary standard debate, or whether or not there will be a compromise in place of a true change in the standard of care. Regardless of what plays out, the industry will eventually be forced to abandon the horrendous lie that conflict is a requirement for service. Technological innovation and the relentless force of American capitalism will find a way to improve the state of financial advice profitably, just as it always does.

Joshua Brown is the CEO of Ritholtz Wealth Management, which last year launched a robo-advisory service. He is also the author of the popular finance blog The Reformed Broker.

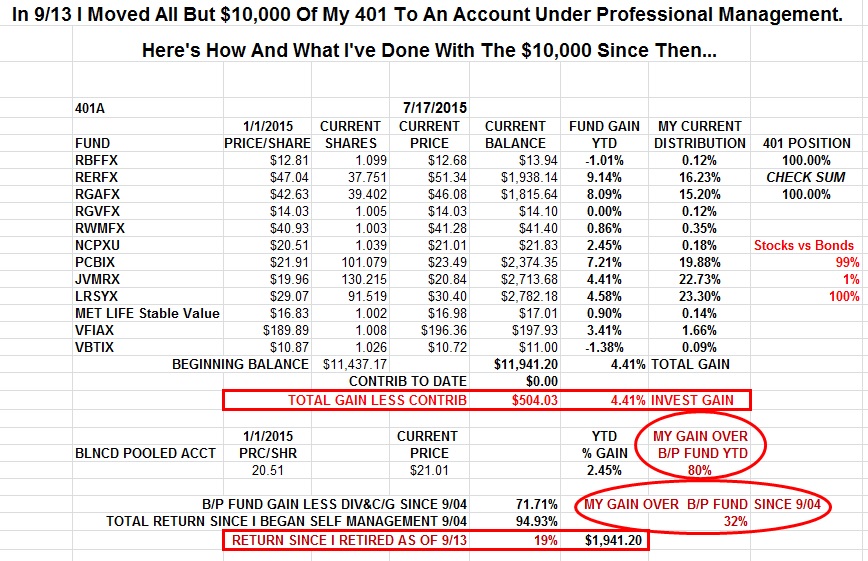

( 3 / 2006 ) ( 3 / 2006 )

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan.

Wednesday, March 2, 2016, 11:14 AM

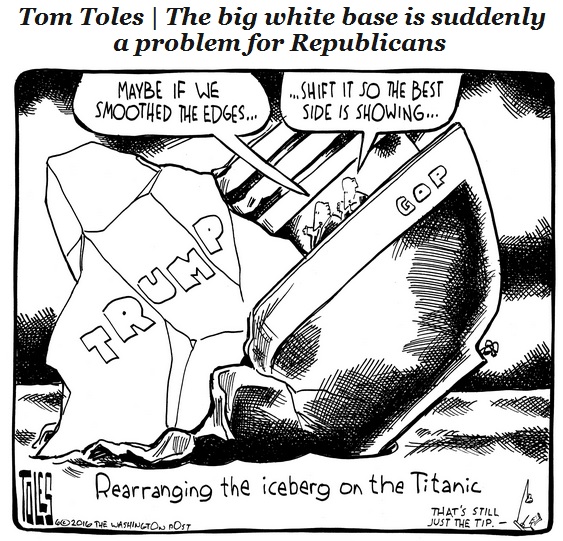

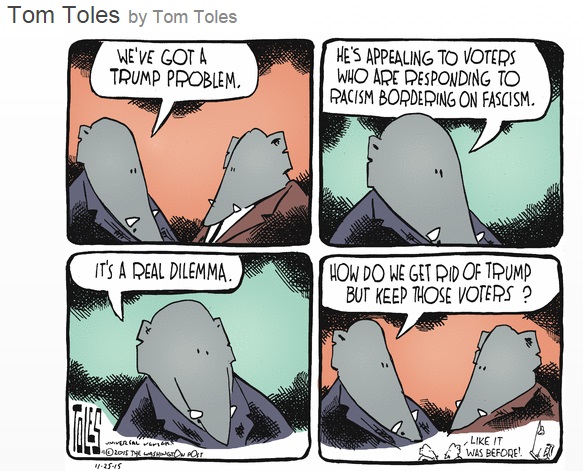

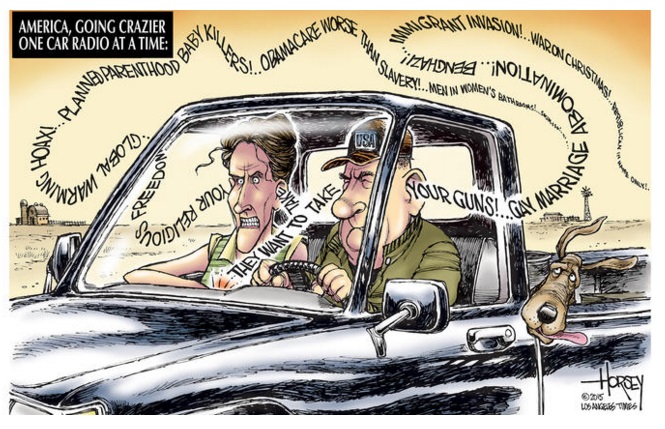

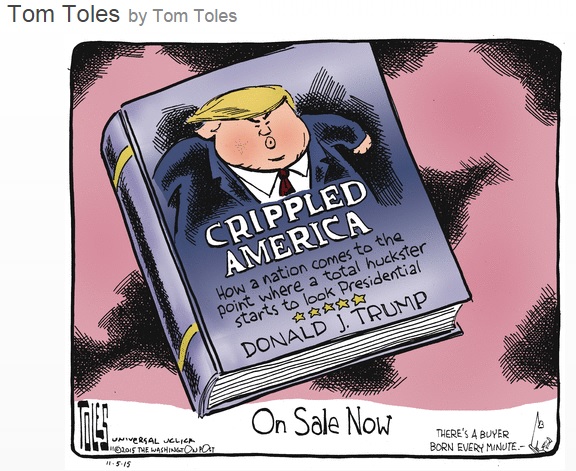

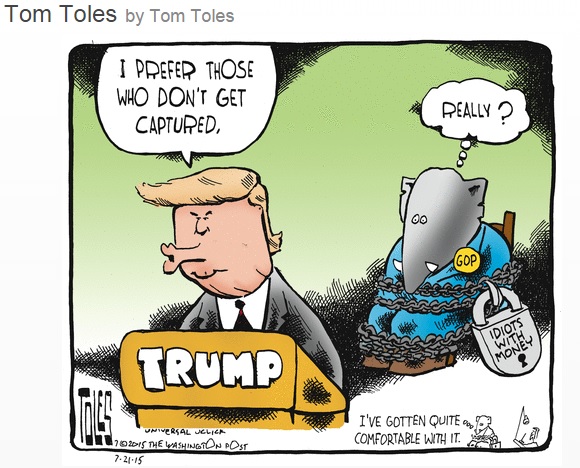

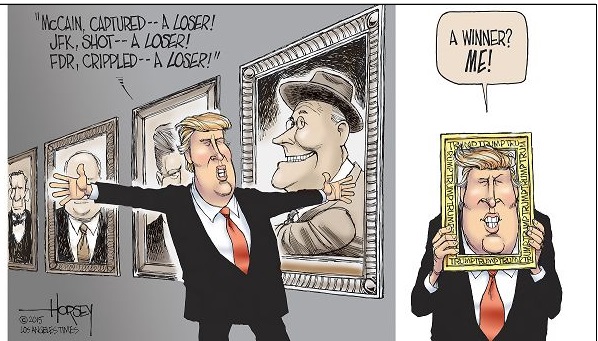

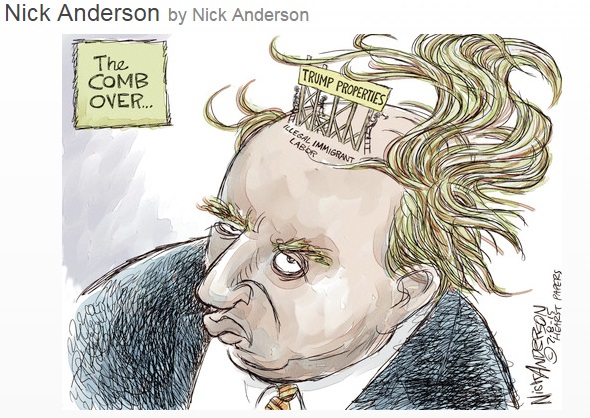

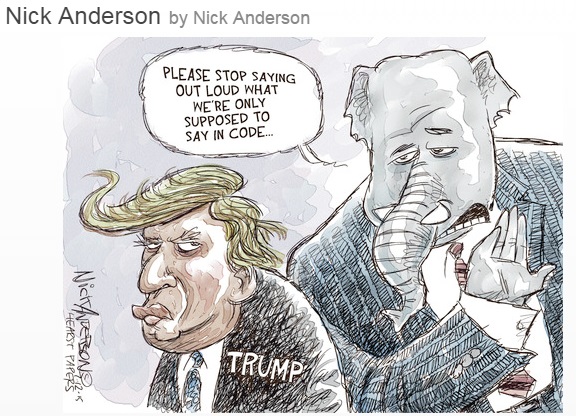

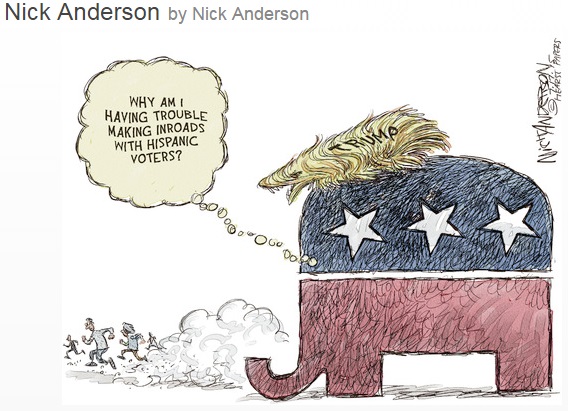

But Washington is freaking out about Trump in a way they never did about Bush. Why? Because Bush was their moron, while Trump is his own moron.http://readersupportednews.org/opinion2 ... e-to-trump

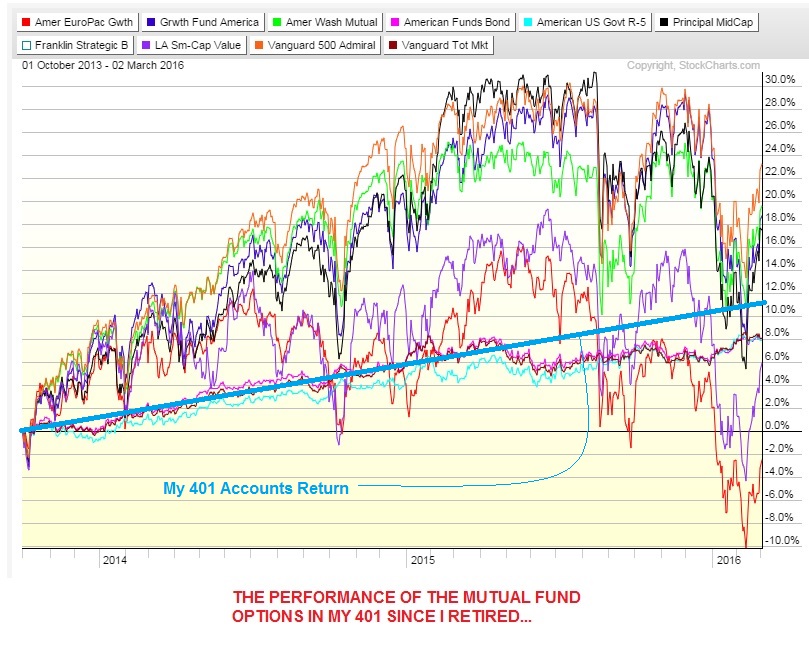

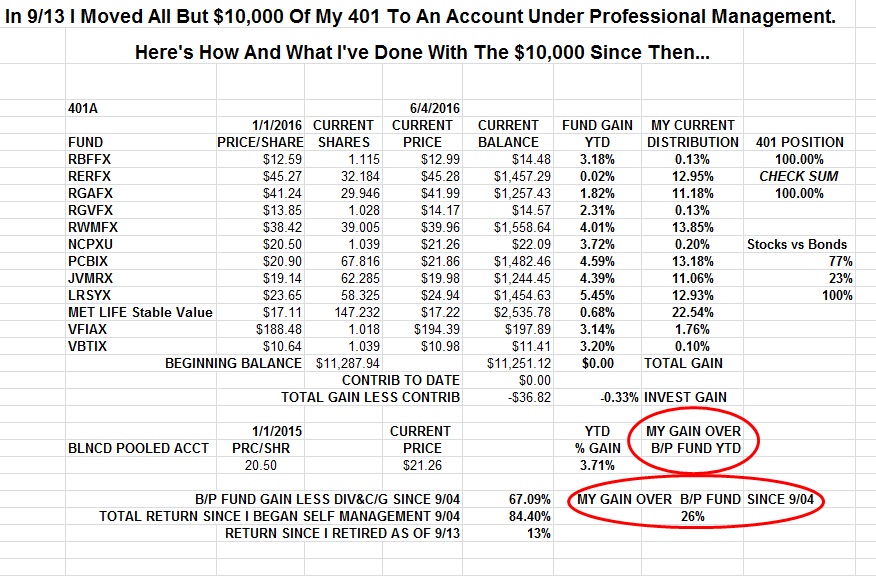

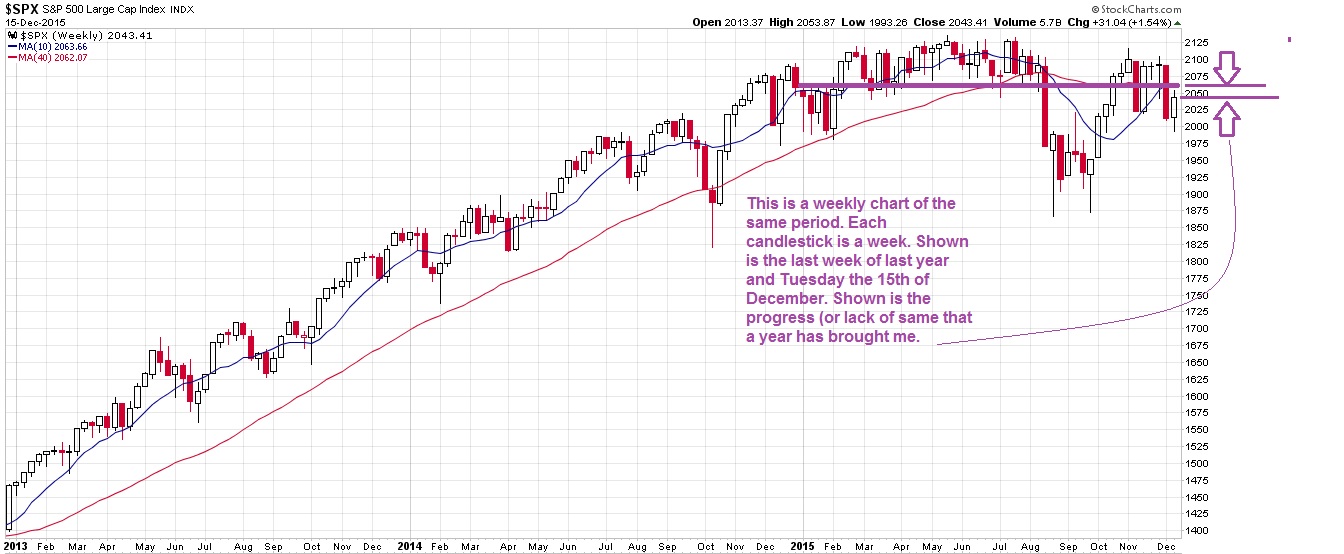

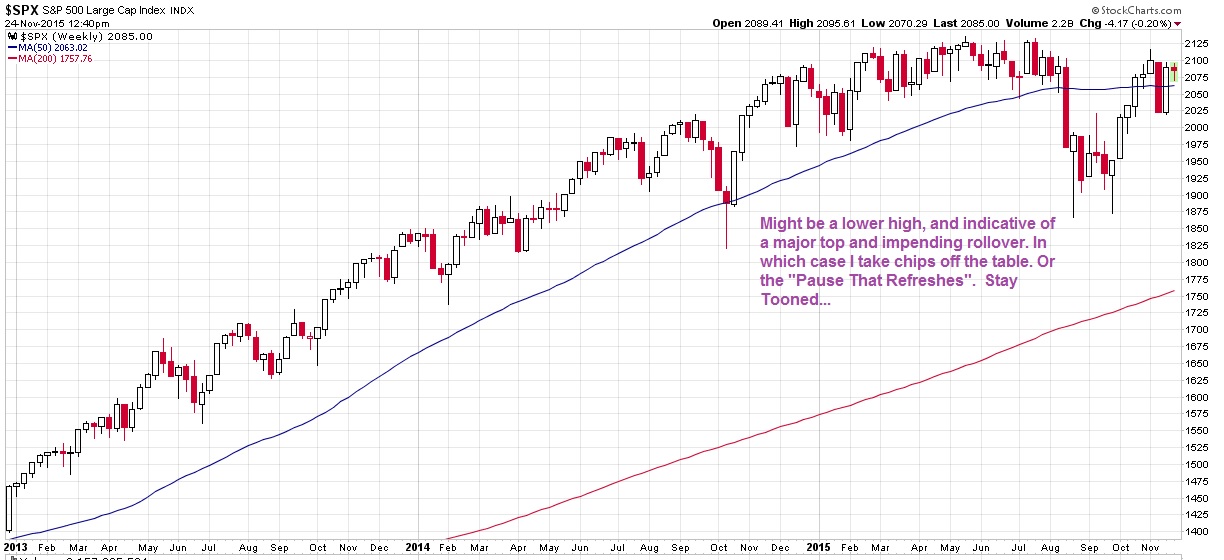

One of the worst starts to a calendar year in stock market history. The S&P 500 plunges straight out of the gate and is now 11% off its record high set last year.

Volatility brings out the most counterproductive behavior in investors and, almost without fail, brings out the worst sort of advice. Farcical advice, the kind that would be laughed out of the room in the company of wealthy people or successful investors who’ve been around for a few cycles.

Some of the more disturbing nonsense I’ve seen over the last few days has concerned what people should be doing with their 401(k) accounts, of all things. Why day traders and aspiring hedge fund startups feel compelled to weigh in on how ordinary people ought to handle their defined contribution retirement plan accounts is beyond my understanding.

The gist of what I’m hearing, mostly from people who are utterly unequipped and unqualified, is that:

a) the market’s been falling and it seems like it will continue to fall because of ______

b) therefore, the responsible thing to do is to liquidate your 401(k) and sit in cash until it’s over

To which I would remark the following:

The average investor has no ability to put any kind of technical or quantitative data to work regularly – even if it was shown to be completely effective (which it hasn’t) – in order to time the market.

daisy

401(k) accounts are not about P&L, they’re an accumulation vehicle designed to allow the capital markets to do their job over time, which is translating the risks of the present into the returns of the future. Interfering with this process by flipping into and out of cash literally defeats the purpose.

If an investor manages to get one shift into cash right because they had a hunch or they happened to read the right blog post that day, this doesn’t mean they’ll be able make the shift back at an opportune time.

Even if they get out and back in once, can they do it twice? Thrice? Can they do this always?

storm

More than likely, they cannot do this always. What is more likely (some would say guaranteed) is that an investor will get some shifts right and others wrong and the misses will negate much of the benefit of the hits. Or worse. Selling when volatility spikes and then buying when “the coast is clear” essentially guarantees the kind of “sell low, buy high” strategy that’s sure to result in massive underperformance of one’s own investments.

Many independent traders do not have access to employer-owned 401(k) plan accounts so it may not occur to them that there can be fees for moving funds around. There are freezes that prevent one’s ability to buy and sell and buy back again. It’s not that you can’t trade in a 401(k), it’s that you weren’t meant to and it is against the spirit of the thing.

Volatility is not risk, it is the source of future returns. Drawdowns should be embraced, not fled from. If anything, a better timing tool would be to up one’s allocation in times like these, or to skew one’s elections further toward equities to take advantage of a temporary decline. This is a passive way to exploit events that are beyond our control, and there is the added benefit that it actually works.

A working-age person between the ages of 20 and 65 could conceivably be looking at anywhere from three to seven decades during which they’ll need to live on their savings. They’re going to need stock market exposure to do this unless their financial plan involves hitting the Powerball or inventing The Facebook. The idea that side-stepping a bear market is of equal importance to the steady accumulation of risk assets is, in this context, a giant joke.

Being fully in cash warps your mind and does not allow you to think straight. It’s sure to result in emotional problems as well. Plus, it’s a money loser. I explained this during the last bout of nasty volatility when everyone was panicking to cash back in October 2011. There are people who “flipped to cash” then that have still not gotten back in. Believe me, we see their portfolios sent in to us every week.

TRUST ME

The person telling you to liquidate your retirement investments is most likely uninformed about retirement investing in general, even if they are a good trader or have a great understanding of the macro situation or whatever. A well-meaning person can give bad advice just as easily as an attention-seeking charlatan can. Don’t judge the speaker, judge the actions they’re advocating.

If you’re a do-it-yourself investor, you probably don’t have the sophistication or the time to be running your money tactically. You might think you do, but it’s not a matter of being smart or “understanding the market.” It’s a matter of having the separation between your money, which represents your freedom and future happiness, and your emotions about these things. It is very hard to untie your own feelings from your money. This is why wealthy people pay a financial advisor to create this separation. Investment advice is about having good counsel, only a fool thinks it’s about picking a lineup of ETFs.

bb8

Historically, less than 15% of all ten-year periods offer losses to investors in the stock market. That’s not the best part. Over rolling twenty-year periods – starting in any month of any year over the last century – you’ve never lost money in stocks. Didn’t happen in the 20’s, 30’s, 40’s, 50’s, 60’s, 70’s, 80’s, 90’s or the 2000’s. Some twenty-year rolling periods have been better than others, but none have been outright losers. You’re welcome to go to cash, wagering that your savings years will break that streak, but it’s a pretty low-percentage bet.

If you cannot parse the difference between volatility and risk (which I define as the chance of a permanent capital loss), then at least accept the fact that risk is a given no matter what. But you have a choice: You can decide when to take the risk, today or in the future. Rational investors would prefer to take investment risk today, accumulating assets while coping with drawdowns and fluctuations in value. Only an insane person would choose to take their risk at the back end of their life – being short of money in old age when it is nearly impossible to earn more money.

You can risk the volatility today or the chance of being broke later, your choice, but you must choose. Sitting in cash may temporarily feel better because there is a sense of security that comes over us when the value of our account ceases to fluctuate. But you’re not safe, you’re merely gaining the stability of a unit of currency in exchange for the risk of losing future purchasing power.

Here’s Helen Keller: “Security is mostly superstition. It does not exist in nature, nor do the children of men as a whole experience it. Avoiding danger is no safer in the long run than outright exposure. The fearful are caught as often as the bold.”

3po

Let me wrap this up: 401(k) accounts are sacred, but they are not magic. They require a thoughtful person making decisions and behaving logically in order to work. The 401(k) users who have persevered through the large drawdowns of 15 and 7 years ago, while continuing to plug away with fresh contributions, are doing better than ever. Vanguard and Fidelity have reported record balances and have noted specifically that it’s the people who have made the least allocation changes that now have the most to show for it. Act accordingly and ignore people who don’t know any better, even if they think they’re helping.

( 2.9 / 328 ) ( 2.9 / 328 )

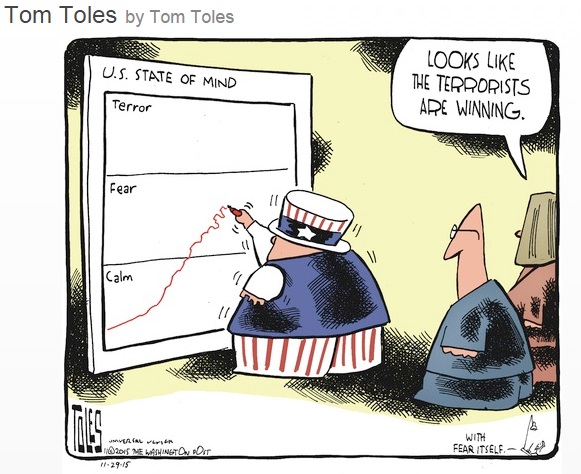

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Plan. Post France ISIS Attack

Sunday, November 15, 2015, 05:45 PM

The most valuable assets in life are those that hold no monetary value. Health, friends and family…

-- Joe Terranova

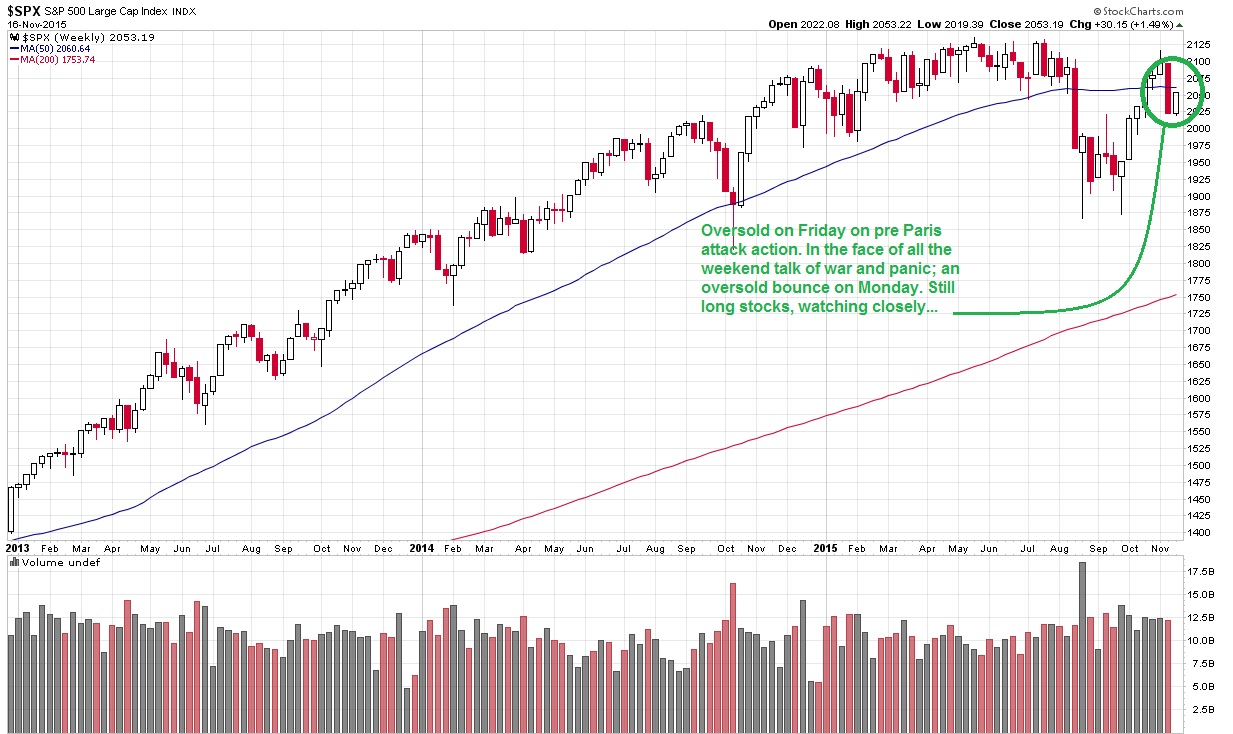

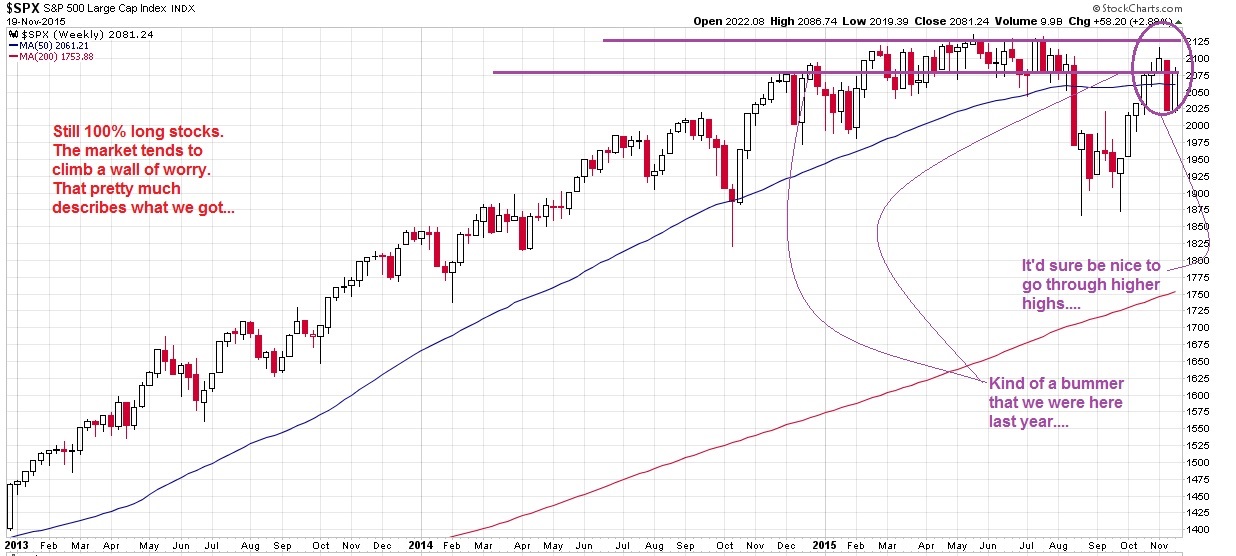

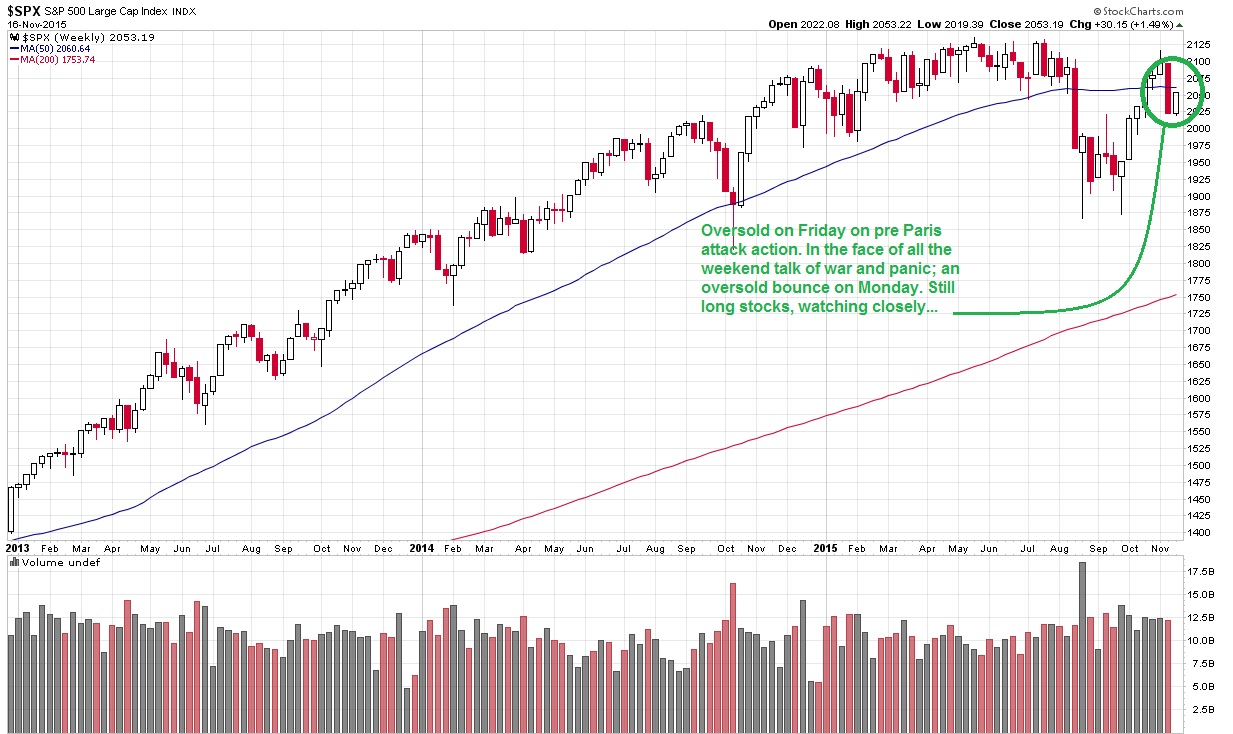

Good Post ISIL/Paris Monday Morning Inna Markets Material From Dan.

http://stockmarketmentor.com/2015/11/th ... ovember-1/

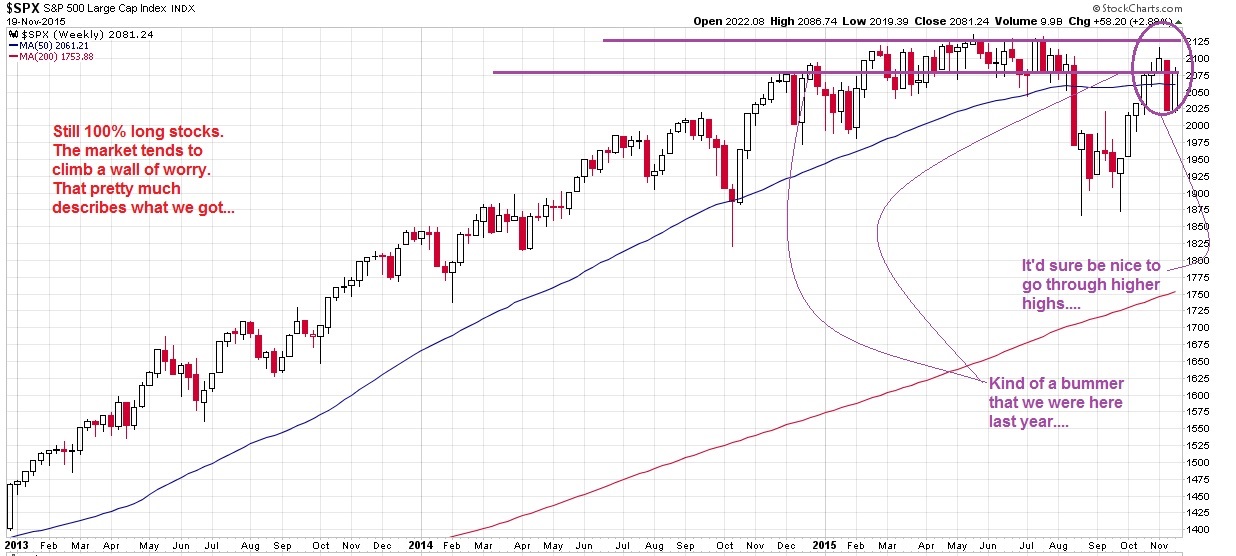

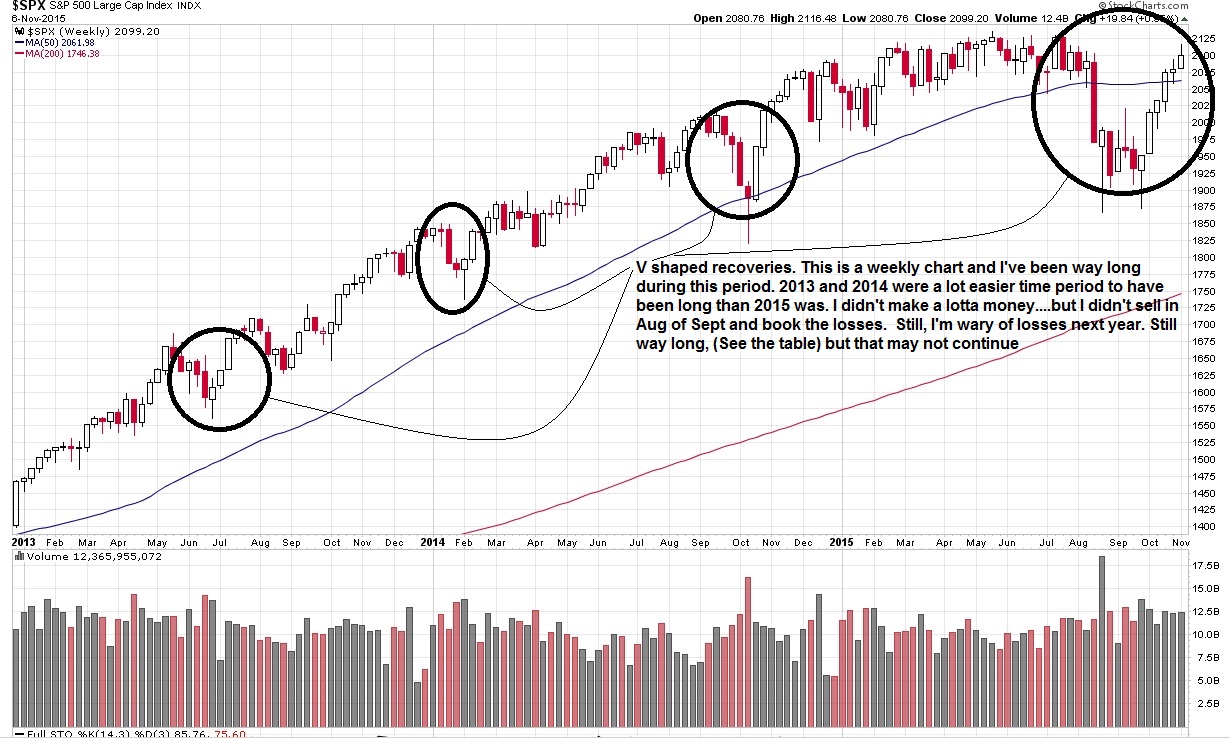

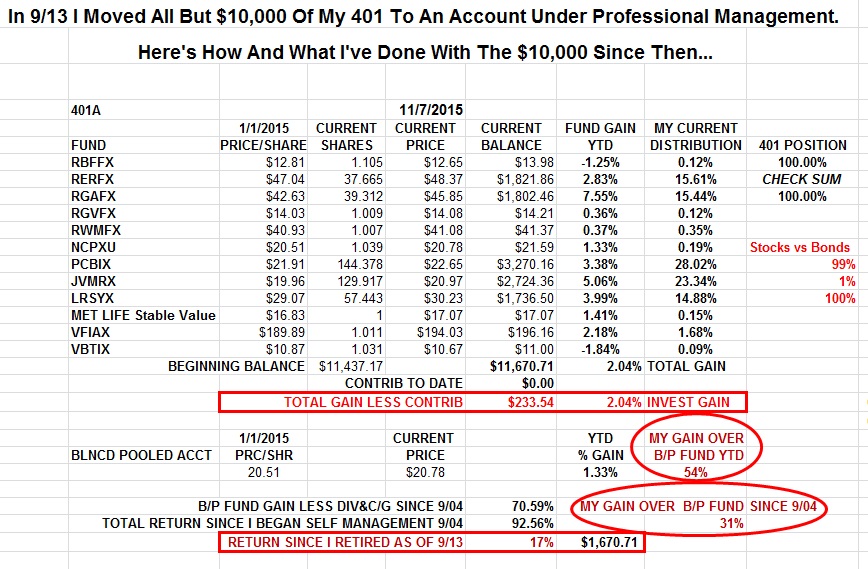

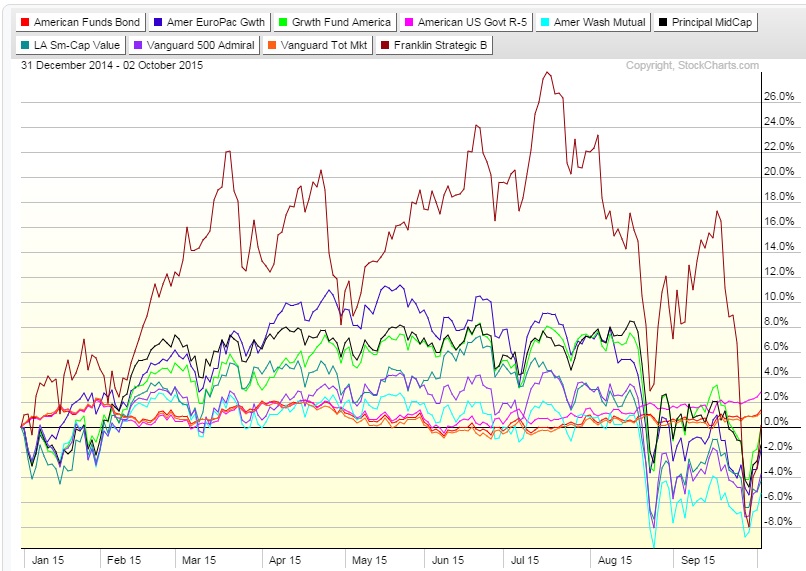

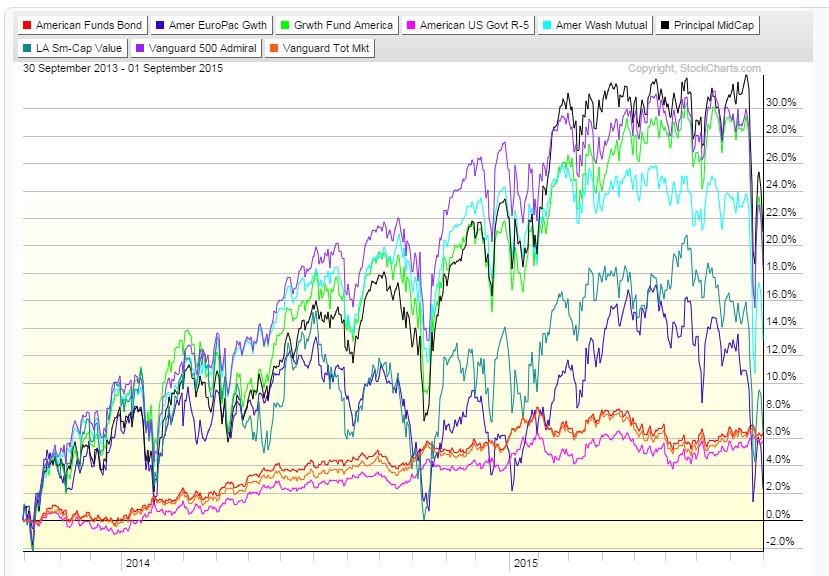

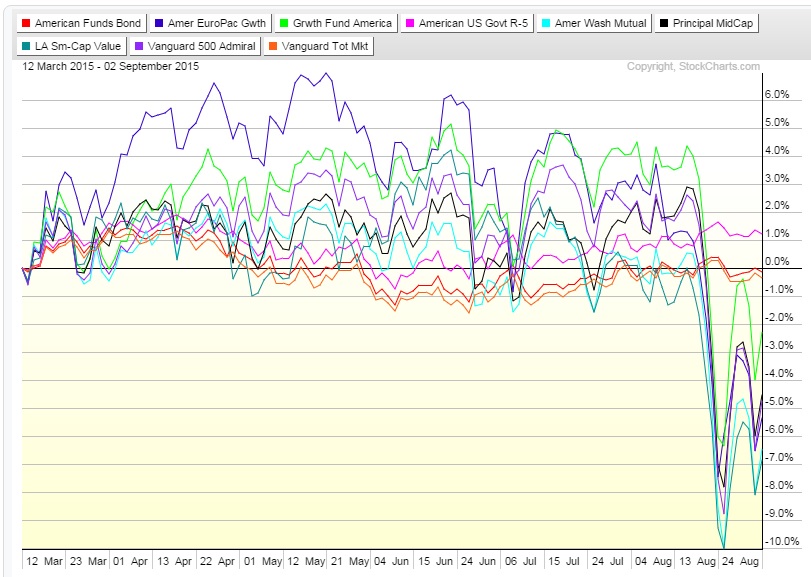

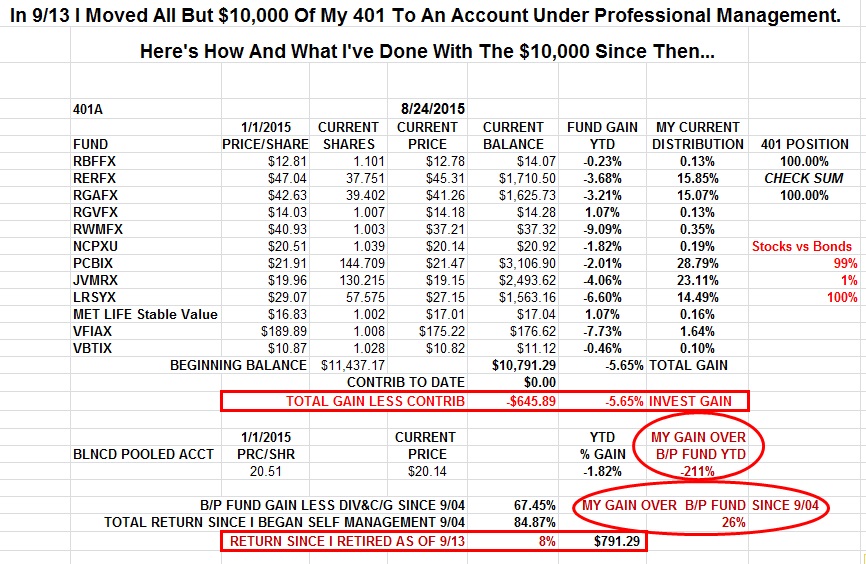

Still 99% long stocks.....

I was going to start trading in 2001 and was sitting in cash. I witnessed the markets reaction to 9/11 starting with the disaster in downtown Manhattan and the closing of the American financial markets. Once they opened, a week later, it was Down Down Down every day for a week until the markets were totally washed out. Then they started to climb back. Coupla three four years later my wife and I were leaving for a ten day cruise one morning and I was busy with prep. Finally, totally ready, I sat down to wait for the ride and I opened up the computer mid East Coast afternoon. The horror of the Madrid Rail bombing was all over the monitor; I'd missed the first 4-5 hours of the market. I opened the trading account only to discover my account was up 10%.

???

But, that's how the world works; that was then and this is now. And I don't know what this now today is now like now. But I will. When Mondays now is over, I'll have it figured out .

I'll know what I'm going to do with the 401 Monday at noon.

Stay tooned...

What makes it hard to invest; being comfortable with your personal narrative...regardless of the real reality.

http://fivethirtyeight.com/features/the ... elieve-it/

The local story can be negative; I live in the center of yet another $Bay$ $Area$ $boom$. But for an old retired guy, the city I loved as a kid is toast. It's gone. Friends and relatives who didn't get serious early and stay serious about retirement are bleeding from the eyeballs. Every negative in the above story is somewhat true in SF for people of my generation. And the future is less about the many and more about the few. I got kids and grandkids and I'm concerned. But I worked hard to become one of the few. And my 401 was a major part of that. So I'm 99% long today and will probably be the same tomorrow. The long term move is pretty much always for the better. Just because there are a lot of reasons to become a bitter, resentful, fearful, querulous old man does not make it right, fun, productive, or in any way enjoyable to me. Fuck it. Get over it and get it on. So I'm 99% long and staying that way this evening. That will change someday.. But the western world was at war with ISIL last Monday. This Monday is not different. I'm always at least a little cautious. Sometimes REAL cautious. Never fearful. Not as long as aggressive pays off.

Tuesday...

http://thereformedbroker.com/2015/11/17 ... o-be-good/

Wednesday....

https://vimeo.com/146175584

( 3 / 270 ) ( 3 / 270 )

<Back | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next> >>

|

|

Calendar

Calendar