"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around [the banks], will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered."

I've spent years and years in a single day waiting to get out of school when I was in 5th grade and about an hour between my 59th and 60th birthdays. The Relativity Of Time Becomes Clearer As I Age....

"...in an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes. What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention and a need to allocate that attention efficiently among the overabundance of information sources that might consume it"

-- Herbert Simon

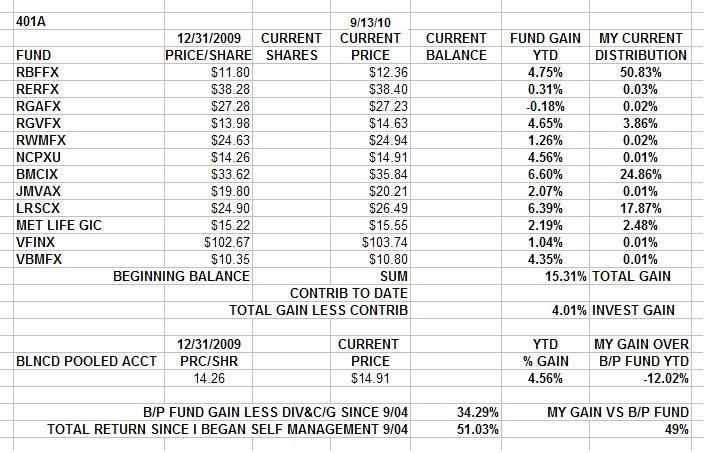

Chartz And Table Zup @ www.joefacer.com

This always went along whenever somebody got experienced for the first time.....

http://www.youtube.com/watch?v=oxpcZrQQM-4

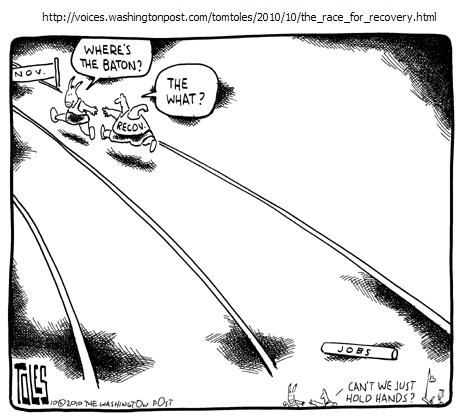

Tough week. End o' the year levitation vs too far too fast, China's coolin' inflation down and domestic reality setting in.

You gotta front row seat (in the cage) on the cage match between these dead economists...

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.bloomberg.com/news/2010-11-1 ... ate1-.html

http://www.stratfor.com/analysis/201011 ... r_and_g_20

http://www.msnbc.msn.com/id/40136417/ns ... l_finance/

http://redtape.msnbc.com/2010/11/in-new ... html#posts

http://www.bloomberg.com/news/2010-11-1 ... kfire.html

http://www.bloomberg.com/news/2010-11-1 ... egion.html

http://www.bloomberg.com/news/2010-11-1 ... -says.html

Bloody week in and of itself....in perspective, not so much. I've got friends still 100% inna GIC because they can't deal with the volatility of the markets once they get some serious balances in their 401a. Weekly gains can be overwhelmed and forgotten by serious down days. It can be breathtaking. No knock on them. If you haven't experienced it, you haven't got a glimpse down inta the abyss. Stocks go up on the escalator and can go down like falling down the elevator shaft.....

That said....This week was not good and Friday was a bloody nose. But it was on top of a good two months gains... correction and digestion before the next leg up or change in trend and the start of the markets rolling over?

Now... Don't fight the FED vs domestic reality vs China's interest rate bumps vs end of the year Wall Street money manager contract renewals, vs Holiday spirits vs get the last of what's on the table cuz it's been good so far and more is better vs declare victory and leave the table a guaranteed winner. This ain't an easy choice... Stay long and strong and make some more or lose most or all of what I've made, take half off the table and get 50% of the gains but risk only half losses? Or leave the table and call 12% return a pretty good year, which it really is?

I just don't think the year's highs for the market are in....although they might be. Monday will tell the tale. Standing pat, ready to react, and waiting for the market to tell me what it's gonna do and what I should do...

http://www.ritholtz.com/blog/2010/11/ro ... eposition/

http://www.ritholtz.com/blog/2010/11/fi ... r-the-bar/

http://www.msnbc.msn.com/id/40182444/ns ... l_finance/

Monday night....

TUESDAY

70+% cash and bonds, getting smaller in stocks tomorrow. Locking in profits....reducing risk....

http://www.ritholtz.com/blog/2010/11/th ... ry-policy/

http://www.bloomberg.com/news/2010-11-1 ... -u-s-.html

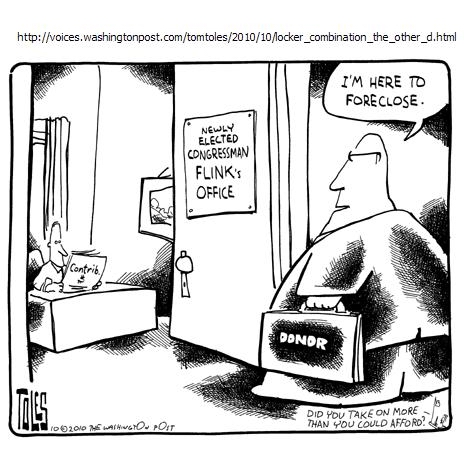

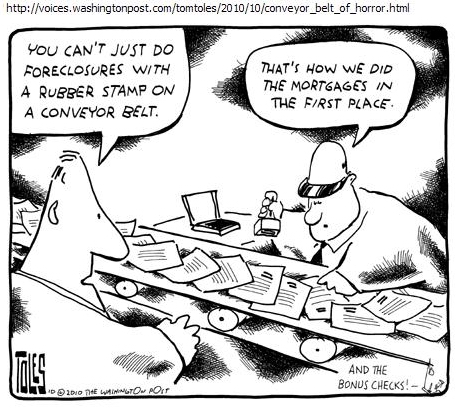

http://www.ritholtz.com/blog/2010/11/do ... udclosure/

http://www.bloomberg.com/news/2010-11-1 ... stein.html

http://www.msnbc.msn.com/id/40238859/ns ... l_finance/

http://www.ritholtz.com/blog/2010/11/we ... aggerated/

http://www.ritholtz.com/blog/2010/11/th ... eraging-2/

http://www.bloomberg.com/news/2010-11-1 ... ccord.html

http://www.bloomberg.com/news/2010-11-1 ... rkets.html

http://www.ritholtz.com/blog/2010/11/wh ... -its-debt/

Stay tooned. More To Come Later....

See Ya @ The Hall... I Get A Piece Of Paper Commemorating That 35 Years Ago I Became An Apprentice Steamfitter.... Time Flies When Yer Having Fun....

"One does not leave a convivial party before closing time."

-Winston Churchill

Chartz and Table Zup @ www.joefacer.com

I learned my geography from Top 40 Radio. Fer Instance; Boston is known for it's rivers of frustrated wimmen.....

http://www.youtube.com/watch?v=5apEctKw ... re=related

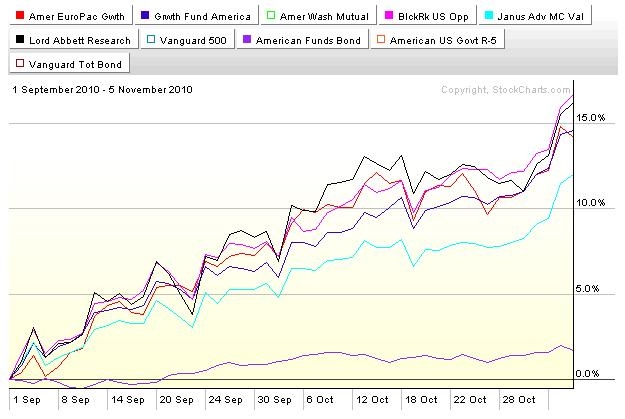

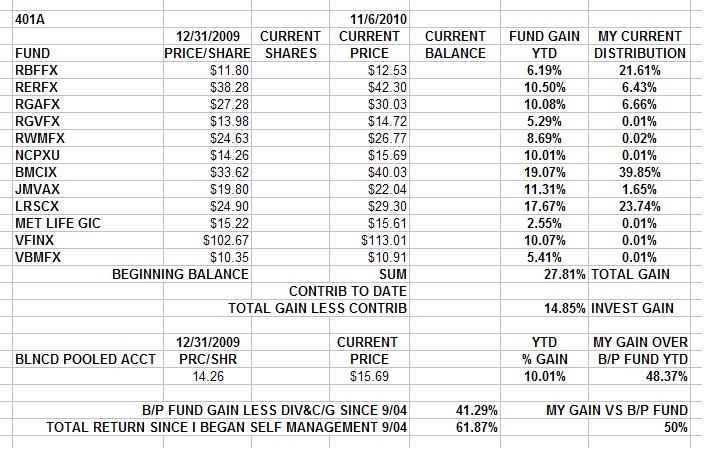

As per Barry (The MAN) Ritholtz, think of it as asset allocation and risk control instead of market timing.

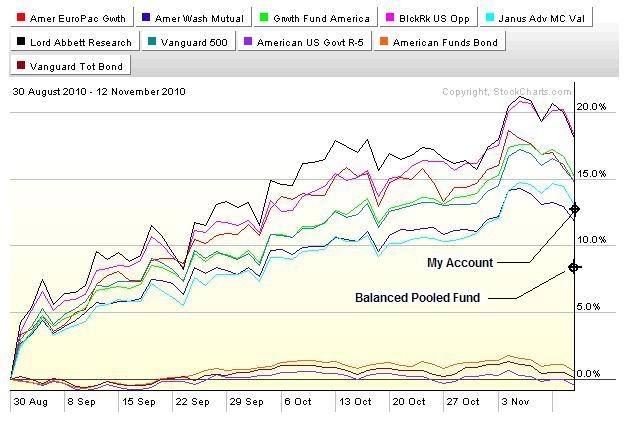

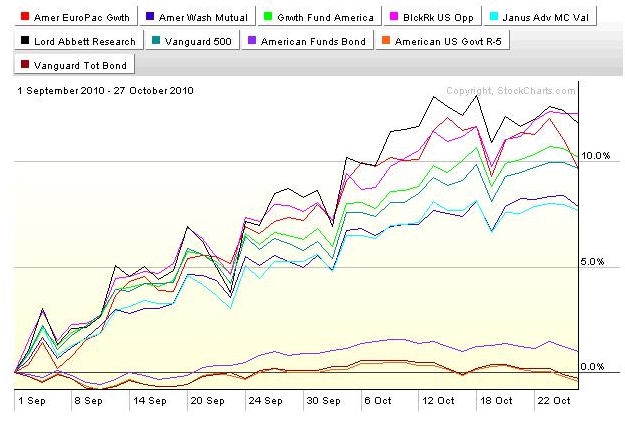

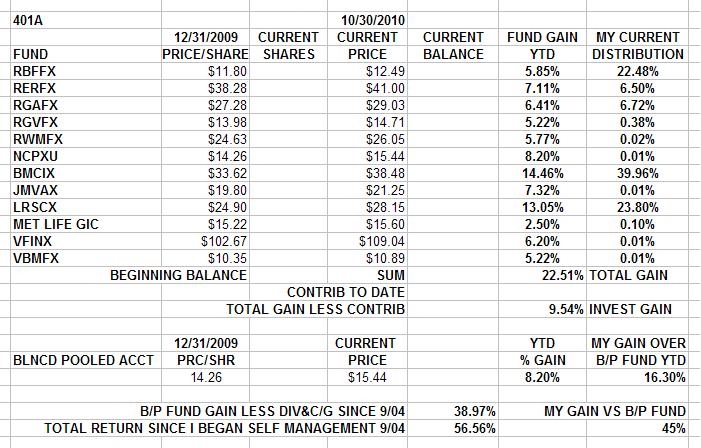

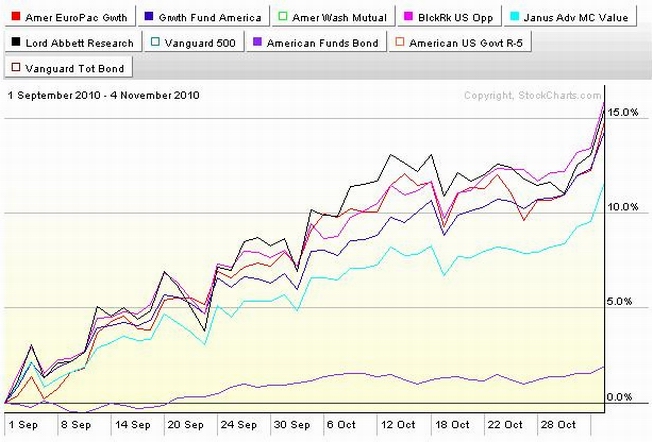

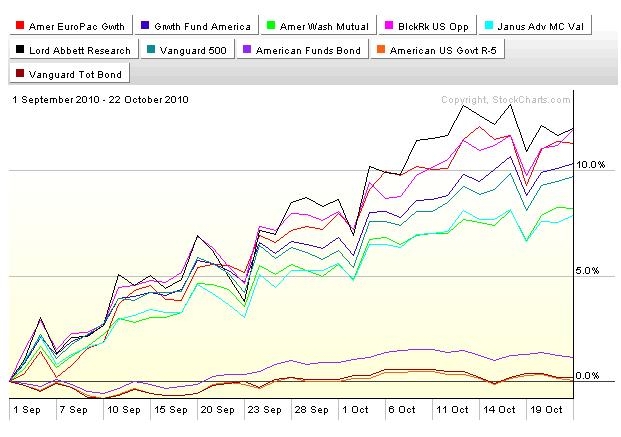

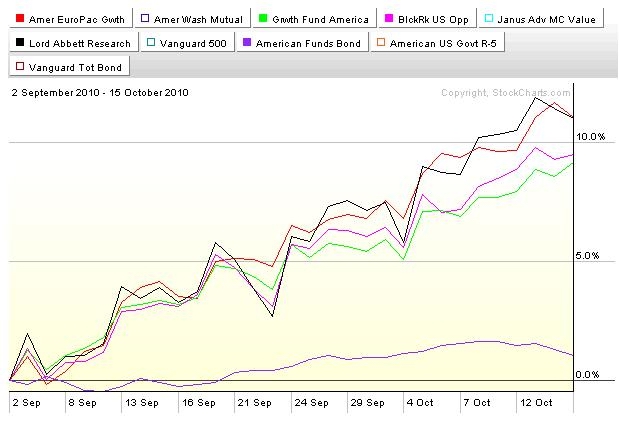

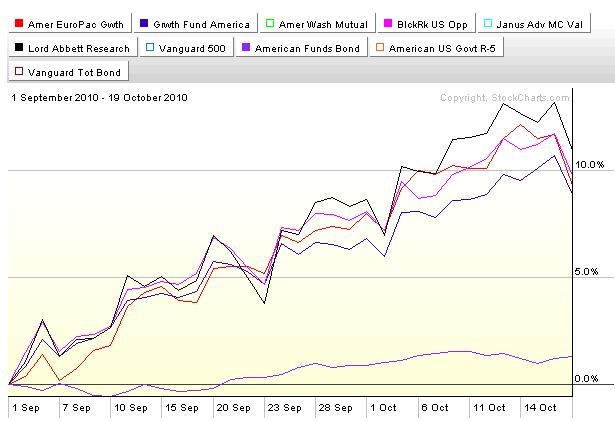

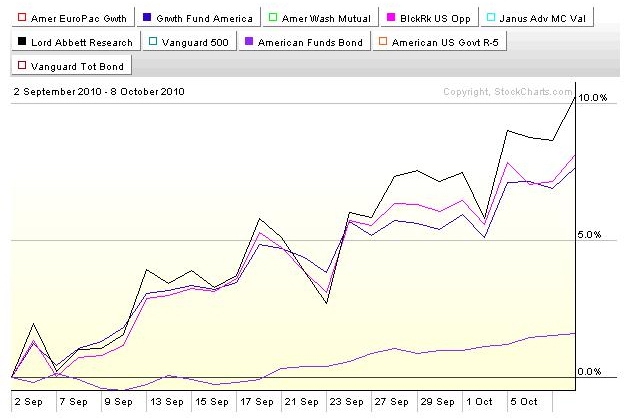

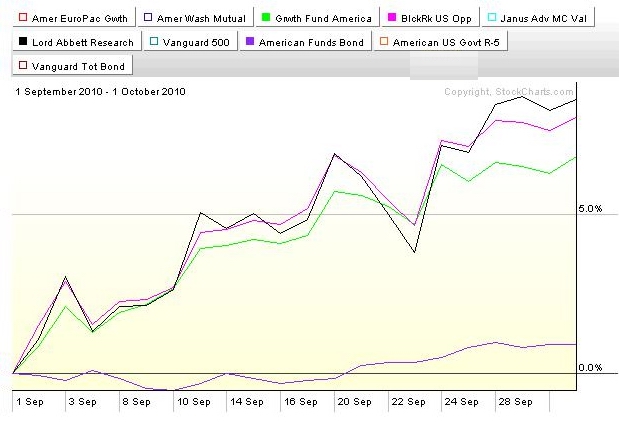

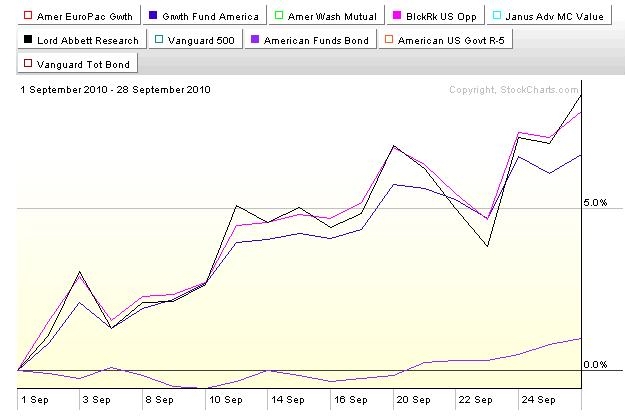

For the first two thirds of the year I was thinking that the big risk was down and the little risk was missing the upside. I allocated conservatively. I was way bonds and some cash. On or about Sept 1st, my thinking changed and I reallocated and went pretty aggressively into stocks as allowed without tripping the rapid trading penalties inna 401a. It's worked out pretty nicely, so far.... still long, still strong, but now I'm leaning toward reallocating when risks to the downside become predominant. If ya catch my meaning an' get my drift........ Still, I gonna stick wit da trend. It's been workin' so far.....

http://www.ritholtz.com/blog/2010/11/th ... istration/

http://www.ritholtz.com/blog/2010/11/el ... more-60276

http://www.msnbc.msn.com/id/39990043/ns ... d_economy/

http://www.bloomberg.com/news/2010-11-0 ... stove.html

http://www.ritholtz.com/blog/2010/11/su ... vents-115/

http://www.ritholtz.com/blog/2010/11/fo ... s-monthly/

http://www.ritholtz.com/blog/2010/11/ghwb-syndrome/

http://www.ritholtz.com/blog/2010/11/nfp-151k/

http://www.ritholtz.com/blog/2010/11/th ... osure-zoo/

http://www.ritholtz.com/blog/2010/11/el ... e-economy/

http://www.ritholtz.com/blog/2010/11/60298/

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.newsweek.com/2010/11/06/obam ... -awol.html

http://www.ritholtz.com/blog/2010/11/ch ... rey-swans/

http://www.ritholtz.com/blog/2010/11/th ... ity-traps/

Three incredibly accurate and depressing evaluations....

http://www.nytimes.com/2010/11/07/opini ... ef=opinion

http://www.ritholtz.com/blog/2010/11/th ... istration/

http://www.ritholtz.com/blog/2010/11/el ... e-economy/

Stay Tooned....

When it comes to the future, there are three kinds of people: those who let it happen, those who make it happen, and those who wonder what happened."

--Hossein Arsham

Chartz and Table Zup @ www.joefacer.com

Saturday Afternoon TV in black and white....Was There, Watched That...

http://www.youtube.com/watch?v=CyX8j3qQ ... re=related

http://blogs.laweekly.com/westcoastsoun ... bal_he.php

http://www.youtube.com/watch?v=2C_riQMImJM

Pretty sweet 40 days.... However the market is spring loaded. Terrorism/elections/holiday season/earnings/fund managers make or break time/pretty much the kitchen sink. Breakout or breakdown? I'll make a move either way.... when it does.

http://www.sfgate.com/columns/reich/

http://www.msnbc.msn.com/id/39918900/ns ... al_estate/

http://debka.com/article/9114/

http://www.msnbc.msn.com/id/39849329/ns ... inessweek/

http://lifeinc.todayshow.com/_news/2010 ... k-on-a-pig

http://debka.com/article/9117/

http://www.msnbc.msn.com/id/39914211/ns ... inessweek/

http://www.ritholtz.com/blog/2010/10/pe ... e-awesome/

http://www.ritholtz.com/blog/2010/10/st ... cs-game-5/

http://www.ritholtz.com/blog/2010/10/bo ... oceedings/

http://www.ritholtz.com/blog/2010/10/fo ... is-weekly/

http://www.bloomberg.com/video/64100308/

http://debka.com/article/9116/

Pretty Smokin' Day.....Pretty Smokin' Week. I'm buyin' the job lunch tomorrow...

Stay tooned....

Scars Are Tattoos That Are More About Where Ya Been and Less About Decoration. Memories Are Better Than Last Decade's Intentions, Last Decade's Missed Opportunities, And This Decade's Regrets....

"The best way to destroy the capitalist system is to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens."

-John Maynard Keynes

Chartz And Table Zup @ www.joefacer.com

There was always a dichotomy between the Bill Graham/'Mo Auditorium live extended/jam/conceptual compositions/performances and the tight top 40 two minute/plus pop music. De 'Mo Vs Longshoreman's Hall. Sometimes the short stuff said what it had to say and then shut the fuck up. Check out the hair/Höfner bass etc. Way period...

http://www.youtube.com/watch?v=jJR_KGZO4U0

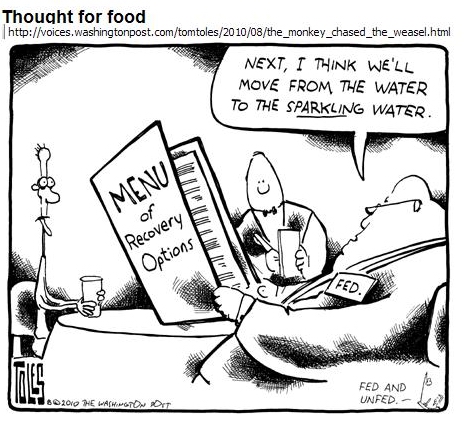

Tom Graff of Real Money sez that the Fed wants to see a little more inflation and to achieve that, they are willing to risk a lot more inflation. That's pretty much what I see. Having lived and worked through a big stagflation episode when the oil companies were throwing money left an' right an' I was there to catch my share, ('80-'85) I'm less than sanguine about doing it over again as a retiree when the banks/government are the ones with the cash (mine and yours used as collateral for loans) and I ain't inna path o' the geyser of cash......

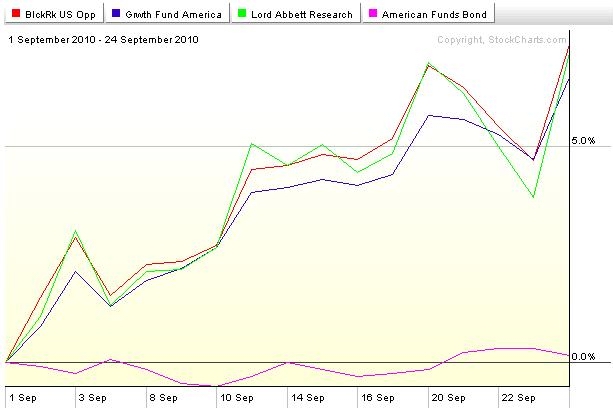

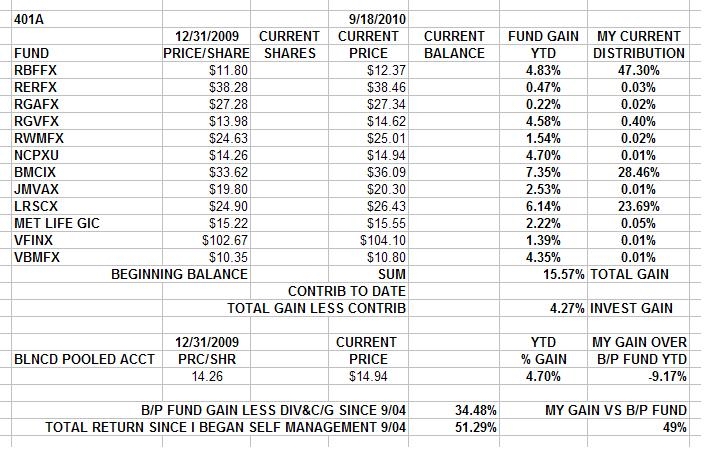

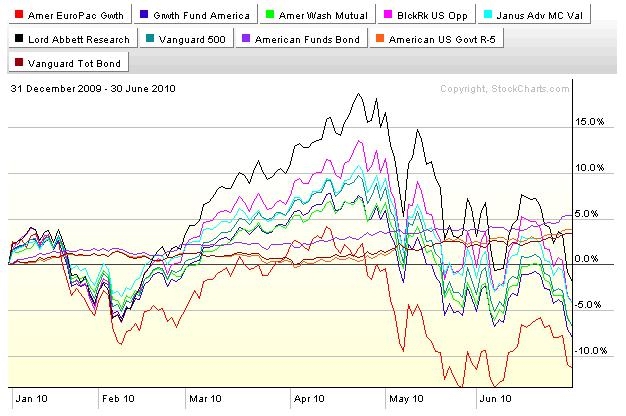

My current 401a riff is still working. Fine tuning it now. Check out the percentages on my website. Buy an' Sell. Nailed one. Hope to nail the other. Tick...Tick...Tick........

http://www.newsweek.com/2010/10/23/a-py ... rance.html

http://www.bloomberg.com/news/2010-10-1 ... vanec.html

http://www.ritholtz.com/blog/2010/10/mo ... -linkfest/

http://www.msnbc.msn.com/id/39801398/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-2 ... -baum.html

http://www.ritholtz.com/blog/2010/10/fo ... re-nation/

http://www.ritholtz.com/blog/2010/10/du ... ng-fracas/

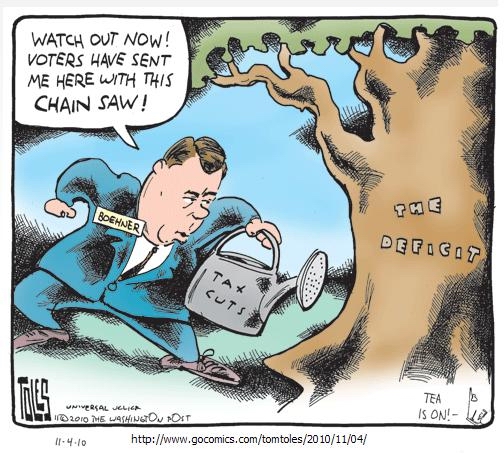

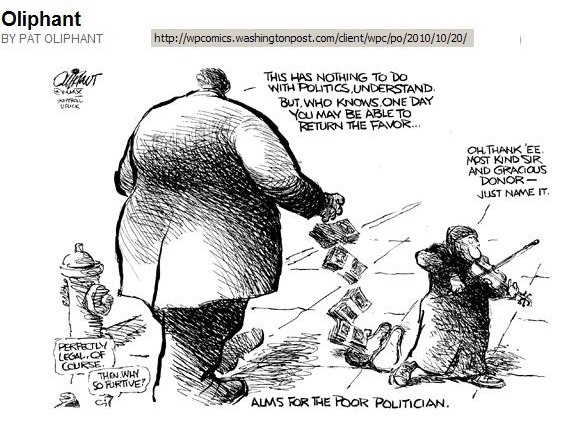

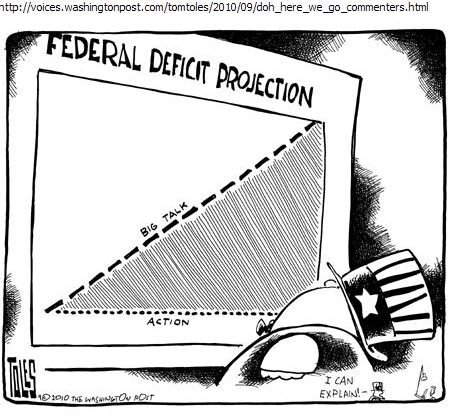

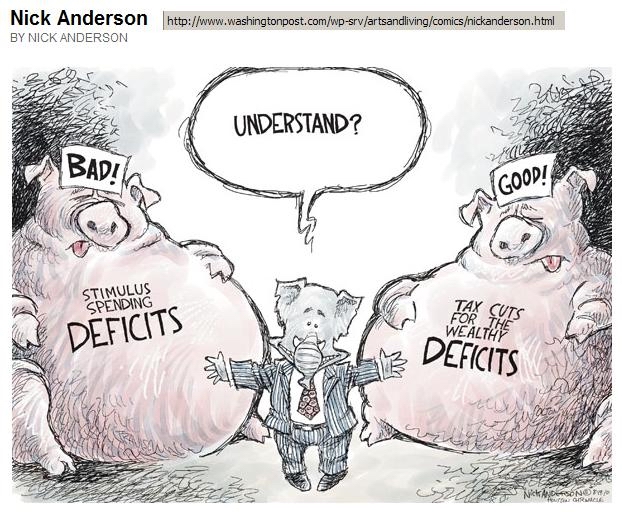

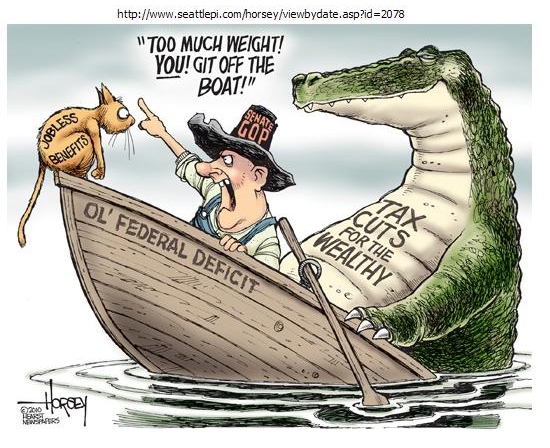

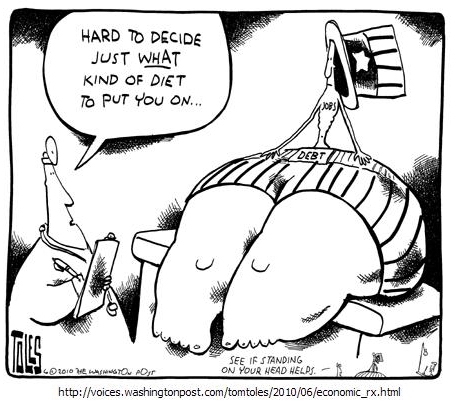

Washington says nothing can be done. There's no money left.

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

http://www.sfgate.com/cgi-bin/article.c ... 1FV3LE.DTL

[/4]

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

"Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing ever happened."

-- Sir Winston Churchill

Chartz and Table Zup @ www.joefacer.com

Every Two Bit Garage Band played Louie Louie, Gloria, The Midnight Hour, And Wipeout, But Ya Had To Have A Keyboard Player W/ A Vox Continetal To Do 96 Tears Justice. You Could Fake It W/A Farfisa... But The Vox Made It Authentic. Speaking Of Authentic, Here's The Original Band.....

http://www.youtube.com/watch?v=XeolH-kzx4c

http://www.youtube.com/watch?v=YrCTgpSP ... re=related

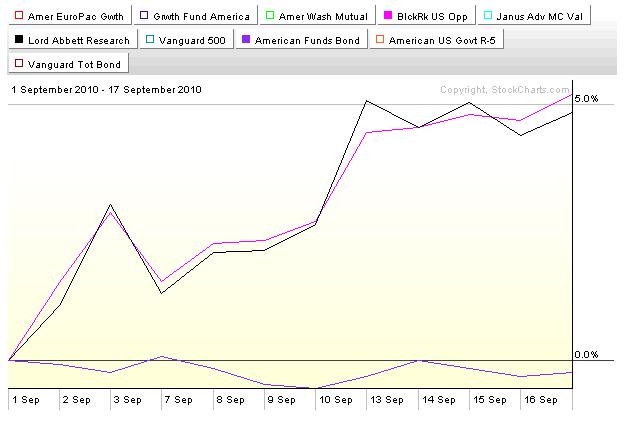

I Went 50% Long Stocks Starting On 9/2. Workin' Pretty Good So Far. Roll Over in Bonds? Anticipating What This Weeks Lousy Numbers Portend?

Stay Tooned... Possible Sea Change Comin'..

http://www.washingtonpost.com/wp-dyn/co ... 06541.html

http://www.nytimes.com/2010/10/17/busin ... .html?_r=1

http://www.newsweek.com/2010/10/17/has- ... ricks.html

http://www.msnbc.msn.com/id/39710702/ns/us_news-life/

http://www.ritholtz.com/blog/2010/10/th ... cle-act-2/

http://www.msnbc.msn.com/id/39648608/ns ... al_estate/

http://www.ritholtz.com/blog/2010/10/th ... n-cowboys/

http://www.bloomberg.com/news/2010-10-0 ... -baum.html

http://www.ritholtz.com/blog/2010/10/in ... n-context/

http://www.ritholtz.com/blog/2010/10/ba ... mortgages/

http://www.msnbc.msn.com/id/39620896/ns ... etirement/

Standing Pat. Market Was Too Far Up Too Fast. Traders Lock In Profits On Any Less Than Stellar Move. Buying Opportunity? Up Trend Prolly Still Intact. We'll See. I'm Still Aheada The Game... Gotta Stay Ahead Though....

More Here Soon....

So Much Good Music In My Library, So Many Good Musicians Gone. (Listening To Little Feat Late 90's Concerts w/ Richie Hayward) So Greatful For So Many Recordings Available To Fill The Day With Great Music.

"If a man is offered a fact which goes against his instincts, he will scrutinize it closely, and unless the evidence is overwhelming, he will refuse to believe it. If, on the other hand, he is offered something which affords a reason for acting in accordance to his instincts, he will accept it even on the slightest evidence."

-- Bertrand Russell

Chartz and Table Zup @ www.joefacer.com

Yet Another Moldy Oldie

http://www.youtube.com/watch?v=_FA85RO8 ... re=related

I Started To Go Long Sept 2nd As Per The Rapid Trading Rules And Restrictions Of The 401a, Based on What I Read, What I Studied, What I Thought, And The Healthy Portion Of Good Luck I Earned By Workin' Hard. Pretty Kool 26 Days, Huh? Let's See If I Can Make Some More If It Stays Strong And Keepmost of It If It Don't....

http://www.msnbc.msn.com/id/39562824/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-0 ... rcome.html

http://www.msnbc.msn.com/id/39592653/ns/politics/

http://www.bloomberg.com/news/2010-10-0 ... chers.html

http://www.bloomberg.com/news/2010-10-0 ... -war-.html

http://www.ritholtz.com/blog/2010/10/pr ... hire-5000/

http://www.ritholtz.com/blog/2010/10/su ... events-10/

http://www.ritholtz.com/blog/2010/10/he ... clawbacks/

http://www.ritholtz.com/blog/2010/10/th ... ial-wmd-2/

http://www.ritholtz.com/blog/2010/10/th ... ring-herd/

http://www.ritholtz.com/blog/2010/10/ex ... amp-usage/

http://www.ritholtz.com/blog/2010/10/ce ... -buy-corn/

Stay Tooned.....

Retail sales themselves are the best indicator of consumer sentiment as no device peers so deeply into the recesses of the human soul as the cash register.

--Howard Simons

Chartz And Table Zup @ www.joefacer.com

Moldy Oldie....

http://www.youtube.com/watch?v=MHF558u6 ... re=related

http://www.bloomberg.com/news/2010-09-3 ... r-coy.html

http://www.bloomberg.com/news/2010-09-3 ... lewis.html

Another Week, Still Moving Inna Right Direction. Still So Far, So Good.....

http://debka.com/article/9061/

http://www.rollingstone.com/politics/ne ... how_page=0

http://www.newsweek.com/blogs/kausfiles ... appen.html

http://www.newsweek.com/2010/10/01/bailout-winners.html

http://www.ritholtz.com/blog/2010/10/tw ... leftovers/

http://www.ritholtz.com/blog/2010/10/fd ... sings-129/

Stay Tooned.

Some people regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon.

—Winston Churchill

Chartz and Table Zup @ www.joefacer.com

Wish I Could Play...

http://www.youtube.com/watch?v=pAf3gqdCrDs

http://www.ritholtz.com/blog/2010/09/su ... -events-8/

http://www.ritholtz.com/blog/2010/09/se ... more-59110

http://www.bloomberg.com/news/2010-09-2 ... rlson.html

http://www.bloomberg.com/news/2010-09-2 ... -baum.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-2 ... worse.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-1 ... -hunt.html

Pretty Good So Far....I Gotta Chart A Course That Balances The Aggressive "Get Some More" And The Conservative "Keep What I Got"....

Stay tooned....

Wuz Werkin'.... Still Is Werkin'.....

Stay Tooned......

Wish I Could Play...

http://www.youtube.com/watch?v=pAf3gqdCrDs

http://www.ritholtz.com/blog/2010/09/su ... -events-8/

http://www.ritholtz.com/blog/2010/09/se ... more-59110

http://www.bloomberg.com/news/2010-09-2 ... rlson.html

http://www.bloomberg.com/news/2010-09-2 ... -baum.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-2 ... worse.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-1 ... -hunt.html

Pretty Good So Far....I Gotta Chart A Course That Balances The Aggressive "Get Some More" And The Conservative "Keep What I Got"....

Stay tooned....

Wuz Werkin'.... Still Is Werkin'.....

Stay Tooned......

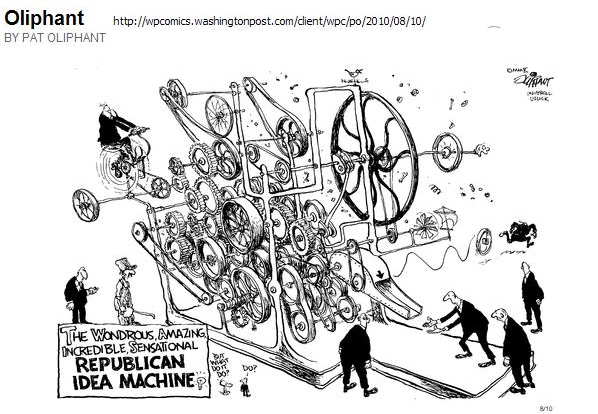

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz And Table Zup @ www.joefacer.com

Buddy Miles instead of Nick Gravenites. A litle rough....but we all were in those days.

http://www.youtube.com/watch?v=4bdQ5re4 ... re=related

And When It's Dialed In, It's Monsterously Good.

http://www.youtube.com/watch?v=y7hbworRWUg&NR=1

Good month for me so far. I'm half in the high horsepower stock funds inna 401a and the rest is corporates.

I really should write about it, and maybe I will too.

http://www.bloomberg.com/news/2010-09-1 ... o-cut.html

http://www.ritholtz.com/blog/2010/09/pr ... n-payment/

http://www.bloomberg.com/news/2010-09-1 ... looms.html

http://bayarearealestatetrends.com/2010 ... -bailouts/

http://www.newsweek.com/2010/09/15/lehm ... esson.html

http://www.newsweek.com/2010/09/16/our- ... ng-us.html

http://www.msnbc.msn.com/id/39230668/ns ... tn_africa/

CHECK IT OUT

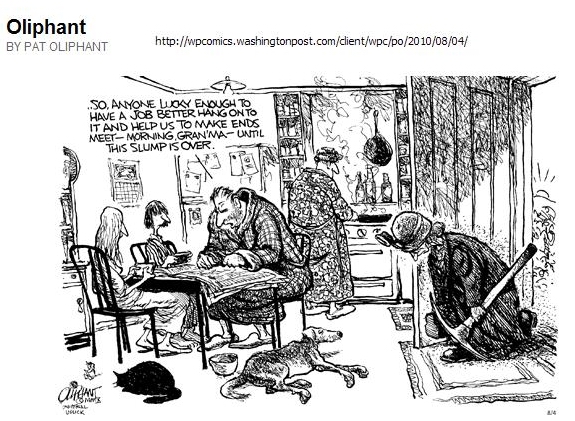

Increased saving is not only being used to repay debt but also to rebuild 401(k)s. Fidelity Investments found that in the second quarter, 5.3% of participants raised their contribution while 2.9% reduced them.... Conventional monetary ease is now impotent with the federal funds rate close to zero , the money multiplier collapsed and banks sitting on hoards of cash (Chart 12) and over $1 trillion in excess reserves. Sure, large banks report to the Fed that they are easing lending standards for small business, but after the intervening financial crisis, many fewer potential borrowers are deemed creditworthy than in the loose lending days. Furthermore, the small business trade group, the National Federation of Independent Business, reports that 91% of small business owners have had their credit needs met or business is so slow that they don’t want to borrow. The Fed is pushing on the proverbial string.

http://www.ritholtz.com/blog/2010/09/58967/#more-58967

<iframe src="http://videos.mediaite.com/embed/player/?layout=&playlist_cid=&media_type=video&content=TD1Z7H1579MF23QC&widget_type_cid=svp" width="420" height="421" frameborder="0" marginheight="0" marginwidth="0" scrolling="no" allowtransparency="true"></iframe>

The Howard Simons mentioned in the post below is a gentleman that I have followed, spoken to, and corresponded with over the last ten years. He has my utmost respect. The report he authored is not directly actionable, but it pretty much confirms what I've seen anecdotally... The Kotok piece is part of my input and IS actionable as part of a strategy. YMMV

http://www.ritholtz.com/blog/2010/09/p-t-f-s-d/

Stay tooned....

Short Sleeve Shirtz, White Belt, Polyester Pantz Pulled Half Way Up My Chest And Driving A Buick? If That's Retirement, Hell No I Ain't Ready!!!!!

"If money is your hope for independence you will never have it. The only real security that a man will have in this world is a reserve of knowledge, experience, and ability."

-Henry Ford

Chartz And Table Zup @ www.joefacer.com

Blue Deck Shoes, White Levi's And Madras Shirts, A Blue Sport Coat And A Pink Crustacean...

http://www.youtube.com/watch?v=T8__EwAT ... xt_from=ML

Whither Goes European Banking?

Is There Yet Another Shoe To Drop In The Millipedian Financial Crisis?

http://www.ritholtz.com/blog/2010/09/be ... fts-bonds/

http://www.newsweek.com/2010/09/12/fine ... -dems.html

http://www.bloomberg.com/news/2010-09-1 ... -debt.html

Lookie Here! Bonds been up and stocks been down. I bin thinkin' that'll change seasonally and cyclically. So i moved some money around.... I'm thinking of these as rented positions and I'm running a cognitive and subjective trailing stop based on holidays and elections and the ebb and flow of the market. This is not without risk. Stay tooned.....

Win as if you were used to it, lose as if you enjoyed it for a change.

-- Ralph Waldo Emerson

Chartz And Table Zup @ www.joefacer.com

One With And One Without

http://www.youtube.com/watch?v=3PBH78ae ... re=related

http://www.youtube.com/watch?v=HF2d8f1w ... re=related

http://www.msnbc.msn.com/id/38941692/ns ... etirement/

http://www.bloomberg.com/news/2010-09-0 ... pesek.html

http://www.msnbc.msn.com/id/38770102/ns ... al_estate/

http://www.bloomberg.com/news/2010-09-0 ... worse.html

http://www.newsweek.com/2010/08/31/ceo-crybabies.html

http://www.ritholtz.com/blog/2010/09/wh ... t-layoffs/

http://www.bloomberg.com/news/2010-09-0 ... -ages.html

http://www.msnbc.msn.com/id/38994476/ns ... e_economy/

http://www.bloomberg.com/news/2010-09-0 ... eport.html

http://www.bloomberg.com/news/2010-09-0 ... eview.html

http://www.bloomberg.com/news/2010-09-0 ... iring.html

http://www.msnbc.msn.com/id/39013379/ns ... ork_times/

http://www.ritholtz.com/blog/2010/09/re ... -agencies/

http://www.sfgate.com/cgi-bin/article.c ... 1F8GEL.DTL

http://www.bloomberg.com/news/2010-09-0 ... -says.html

http://www.bloomberg.com/news/2010-09-0 ... rowth.html

http://www.msnbc.msn.com/id/39055199/ns/business/

http://www.ritholtz.com/blog/2010/09/th ... more-58608

http://www.vanityfair.com/business/feat ... table=true

I put some 401a money to work in stocks this week. More later. But this is part of what I'm thinking.... I'll elaborate later.

http://www.ritholtz.com/blog/2010/09/the-apathy-trade/

Heard On MSNBC: "The Economy Is Down To Seeds And Stems." Proof It's All About MahMahMah Generation......Hope I Die Before I Get Bald.....

"Your last recourse against randomness is how you act -- if you can't control outcomes, you can control the elegance of your behavior. You will always have the last word."

-- Nassim Nicholas Taleb

Chartz And Table Zup @ www.joefacer.com

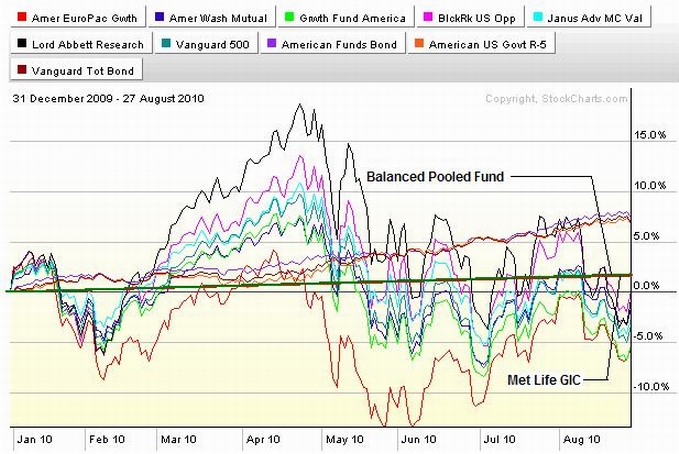

Friday was a very good day for stocks and a turn down for bonds. The chart puts it in perspective.

I'm still all bonds and a little cash inna 401a. That too will change. Prolly not Monday or Tuesday either. More to come this weekend...

HOW OBAMA GOT ROLLED BY WALL ST.

http://www.newsweek.com/2010/08/29/how- ... treet.html

http://www.bloomberg.com/news/2010-08-1 ... japan.html

http://www.msnbc.msn.com/id/38783832/ns ... etirement/

http://www.bloomberg.com/news/2010-08-2 ... -says.html

http://www.bloomberg.com/news/2010-08-2 ... -says.html

http://www.bloomberg.com/news/2010-08-2 ... -rise.html

http://www.msnbc.msn.com/id/38870575/ns ... e_economy/

http://www.bloomberg.com/news/2010-08-2 ... lbert.html

http://www.bloomberg.com/news/2010-08-2 ... robed.html

http://www.msnbc.msn.com/id/38903955/ns ... tn_africa/

http://www.bloomberg.com/news/2010-08-1 ... y-xie.html

Last 100 days....Don't look too good.......

http://lifeinc.msnbc.msn.com/_news/2010 ... t-exactly-

Market Forces...Like My Daddy Always Used To Tell Me, "Son, The Bigger They Are, The Harder They Hit..."

"The first step to making money is not losing it."

-- Ed Easterling

Chartz And Table Zup @ www.joefacer.com

Open The Doors

http://www.youtube.com/watch?v=ZDN9y2vTdUs

My All Cash/Bonds Low Risk Position Is Back Up Marginally Over Any And All Stocks And The Balanced Pooled Fund Again. I've Been 100% Stocks Before And I Will Be Again When I Get Paid For The Risk. There Is Only One Letter's Difference Between Hero And Zero And Champ And Chump. Safety In The Face Of Risk Is Working For Now.

More Here Later This Weekend.....

“What we had was a government-prescribed course of amphetamines (to keep it up), antibiotics (to prevent infection) and antidepressants (to make it feel better). It endured regular steroid injections from both monetary and fiscal authorities. And it still has no real muscle.”

Caroline Baum: Bloomberg

http://www.ritholtz.com/blog/2010/08/ec ... -fly-list/

http://www.thenation.com/article/153929 ... ut-scandal

http://www.newsweek.com/2010/08/11/is-t ... llets.html

http://www.msnbc.msn.com/id/38695101/ns ... e_economy/

http://www.bloomberg.com/news/2010-08-1 ... ports.html

http://www.bloomberg.com/news/2010-08-1 ... -debt.html

http://www.ritholtz.com/blog/2010/08/ta ... as-of-gdp/

http://www.bloomberg.com/news/2010-08-1 ... -debt.html

http://blogs.wsj.com/economics/2010/08/ ... isnt-free/

http://moneywatch.bnet.com/economic-new ... tural/744/

http://www.newyorker.com/talk/financial ... surowiecki

http://www.ritholtz.com/blog/2010/08/cp ... deflation/

http://www.ritholtz.com/blog/2010/08/co ... jail-time/

http://www.ritholtz.com/blog/2010/08/bo ... tes-11-2b/

http://www.bloomberg.com/news/2010-08-1 ... -weil.html

http://www.ritholtz.com/blog/2010/08/lu ... a-backing/

http://www.msnbc.msn.com/id/38715258/ns ... e_economy/

http://www.msnbc.msn.com/id/38692233/ns ... e_economy/

http://www.ritholtz.com/blog/2010/08/th ... nanke-put/

http://www.ritholtz.com/blog/2010/08/as ... l-economy/

http://www.ritholtz.com/blog/2010/08/the-flations/

http://www.ritholtz.com/blog/2010/08/fo ... on-prices/

http://www.ritholtz.com/blog/2010/08/th ... -disaster/

Now that the value of information has gotten to be about zero, there's an overload, and I think what's gonna be the end result is the value of expertise is gonna go to infinity. Because it's harder and harder for people to digest all these inputs, let alone make sense out of them, let alone translate them into investment decisions.

- Wilbur Ross, CNBC, Dec. 1, 2009

Chartz and Table Zup @ www.joefacer.com

Can't Get Enuf o' Rory..

http://www.youtube.com/watch?v=UozMdhPhS48

http://www.ritholtz.com/blog/2010/08/ho ... the-world/

http://www.brookings.edu/opinions/2010/ ... _gale.aspx

http://www.ritholtz.com/blog/2010/08/un ... boom-bust/

http://www.nytimes.com/2010/08/03/scien ... .html?_r=1

http://www.bloomberg.com/news/2010-08-0 ... louts.html

http://www.ritholtz.com/blog/2010/08/re ... our-brain/

http://www.ritholtz.com/blog/2010/08/fo ... es-hiring/

http://www.bloomberg.com/news/2010-08-0 ... overy.html

http://www.ritholtz.com/blog/2010/08/fe ... more-57983

http://www.scribd.com/doc/34895648/GMO-Montier-26Jul

http://www.ft.com/cms/s/2/1a8a5cb2-9ab2 ... ab49a.html

http://www.ritholtz.com/blog/2010/08/su ... ks-events/

http://www.ritholtz.com/blog/2010/08/dr ... d-meeting/

http://www.newsweek.com/2010/08/09/has- ... tions.html

http://www.newsweek.com/2010/08/09/fann ... nting.html

http://www.msnbc.msn.com/id/38629548/ns ... e_economy/

http://www.newsweek.com/2010/08/11/is-t ... llets.html

Stay Tooned. More to appear later ... Bank Onnit.

Still All In Inna 401a In Corporate Bonds (RBFFX), Federal Securities (RGVFX), An' The GIC (Met Life). Details about Why And How And What'd Make Me Change Dat To Follow....

Chartz And Table Zup @www.joefacer.com

Stay Tooned....

Chartz And Table Zup @www.joefacer.com

Stay Tooned....

Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair

Chartz And Table Zup. @ www.joefacer.com

Have Some More Tuna...

http://www.youtube.com/watch?v=lUseW_yJkpg

http://www.youtube.com/watch?v=ltDMr7IV ... re=related

http://www.youtube.com/watch?v=BFdRSrTJ ... re=related

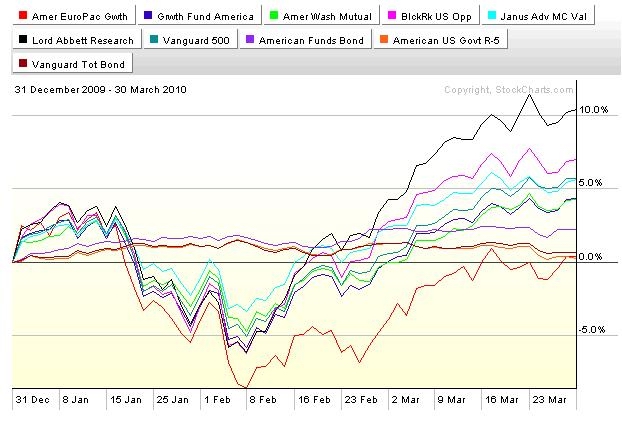

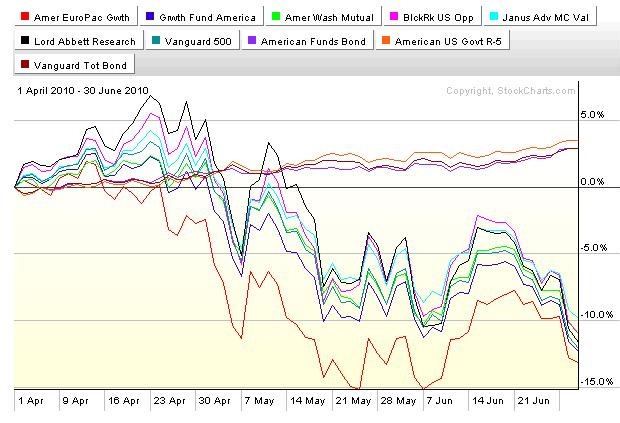

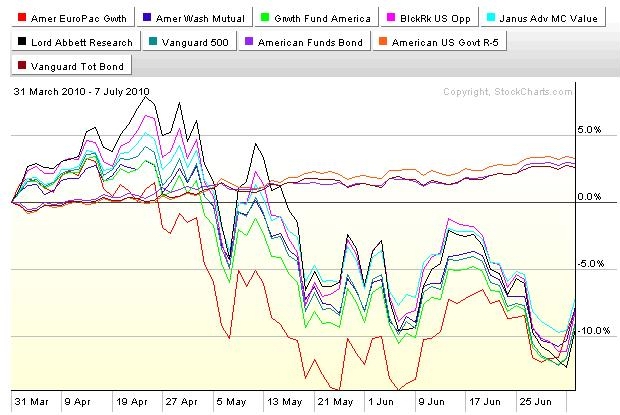

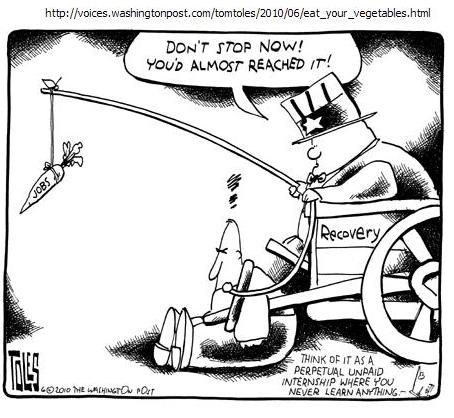

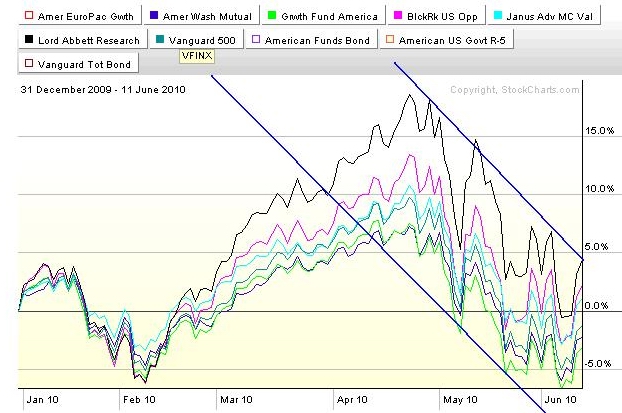

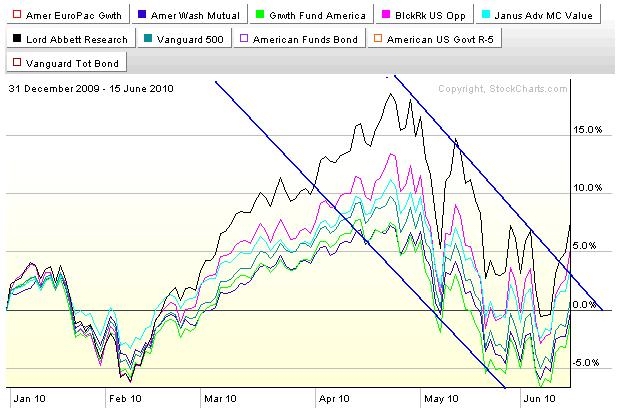

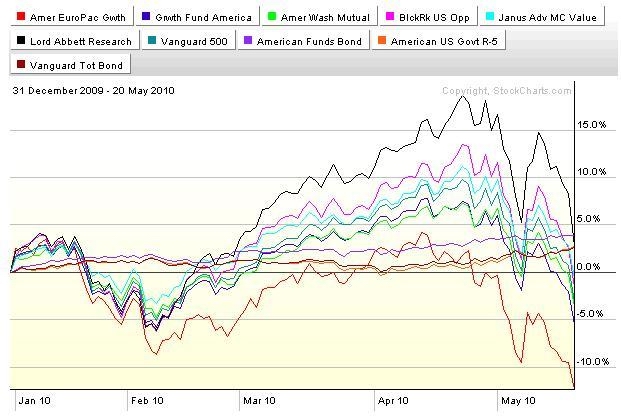

The First Quarter Looked Pretty Good

The Second Quarter Looked Pretty Bad

That's What Your Quarterly Statements Show You. But How Can You Figure Out Where You Stand Over All By Looking At Stills Of The Action Four Times A Year? You Can't See A Cumulative Picture Or A Running Total. You Need To See The Whole Picture And The Bottom Line.

Ya Can See The Whole Picture Or Any Particular Part of It By Using Charts And/or A Worksheet Like The Ones On My Website.... It Makes Decisions On Asset Allocation A Lot Easier...

http://www.scribd.com/doc/33784769/BP-Article

http://www.ritholtz.com/blog/2010/07/fd ... n-program/

http://www.ritholtz.com/blog/2010/07/gl ... l-part-96/

http://www.ritholtz.com/blog/2010/07/ja ... no-return/

http://paul.kedrosky.com/archives/2010/ ... ntitl.html

Stay Tooned...

Started At A New Site This Week.... During The 70's and 80's Oil Crisis, I Worked The Refineries And Oil Field Module Sites And Got Some Of My Gas Money Back. Now I'm At A Solar Cell Producer's Facilty And I'm Getting Stimulus (Borrowed) Money From The Feds That I'll Pay For With Higher Taxes/ Higher Inflation/And Higher Bond Interest Inna Future. Whatever Goes Around, Comes Around.....

"More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly."

-- Woody Allen

Chartz and Table Zup @ www.joefacer.com.

It's Not Easy....He Just Makes It Look That Way....

http://www.youtube.com/watch?v=DDOIL5Oq ... re=related

http://www.ritholtz.com/blog/2010/07/li ... th-unites/

http://www.ritholtz.com/blog/2010/07/20 ... n-dollars/

http://www.nytimes.com/2010/07/12/busin ... .html?_r=1

http://www.ritholtz.com/blog/2010/07/fo ... effectual/

http://www.ritholtz.com/blog/2010/07/su ... ic-assets/

http://www.ritholtz.com/blog/2010/07/ly ... about-oil/

http://www.ritholtz.com/blog/2010/07/it ... w-bitches/

http://www.nytimes.com/2010/07/18/magaz ... f=magazine

http://www.ritholtz.com/blog/2010/07/ma ... ty-debate/

Stay Tooned....

Earnings Season!!!! Think A Medieval Castle With A Hinged Corridor. One Moment Everything Is OK, The Next , You're One Step Over Center And Gone....or Not. We'll See

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

- George Soros

Chartz and Table Zup @ www.joefacer.com

Hot Tuna; I saw an acoustic show @ Bimbo's and an electric show at the Hells Angels benefit for the VD Clinic at the Longshoreman's hall. Same band, quite a range of approaches...

http://www.youtube.com/watch?v=mjfhsLuO ... re=related

http://www.youtube.com/watch?v=_rts3noH ... re=related

http://www.musicman.com/rt/hells.html

Was this last week only a typical bear market bounce or the start of a lift off the bottom as the market predicts a solid earning season and good forward guidance?

Stay tooned....

Earning Interest And Clipping Coupons In Bonds And Cash Is Always Better Than Watching Stocks Go Down.... Unless You Can Short.

The ultimate result of shielding men from the effects of folly is to fill the world with fools.

--Herbert Spencer

Chartz And Table Zup @ www.joefacer.com

Freddie King was a favorite of EC's. Not hard to figure out why. The first link can be found on CD too...

http://www.youtube.com/watch?v=7nNYD2LY ... re=related

http://www.youtube.com/watch?v=GGLmZCZ1 ... re=related

REEALY IMPORTANT Links....

http://www.ritholtz.com/blog/2010/07/th ... really-is/

http://www.businessweek.com/magazine/co ... 358596.htm

http://noir.bloomberg.com/apps/news?pid ... .24zLg0I2E

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.ritholtz.com/blog/2010/07/sw ... evolution/

http://www.ritholtz.com/blog/2010/07/sh ... c-outlook/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.nytimes.com/2010/07/04/weeki ... wanted=all

http://www.economist.com/node/16485318? ... extfeature

http://www.businesscycle.com/news/press/1887/

http://www.nytimes.com/2010/07/04/busin ... wanted=all

http://www.ritholtz.com/blog/2010/07/oi ... 93-part-9/

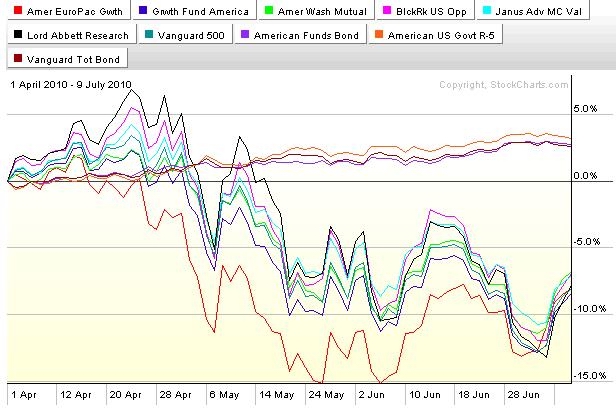

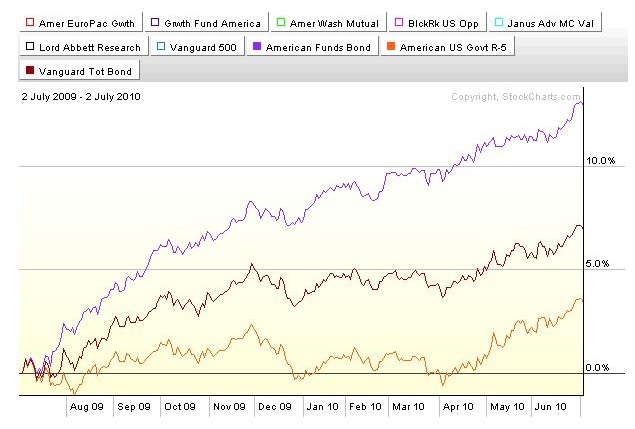

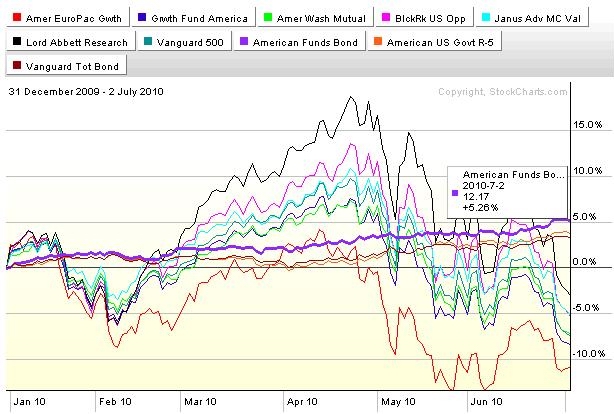

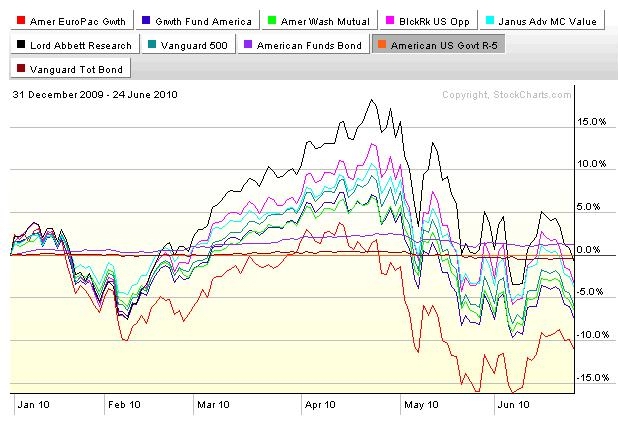

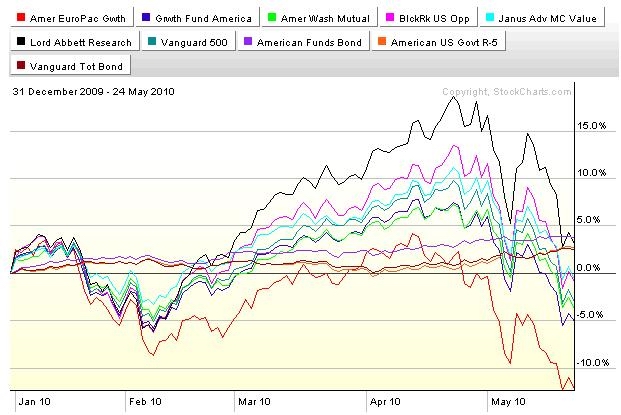

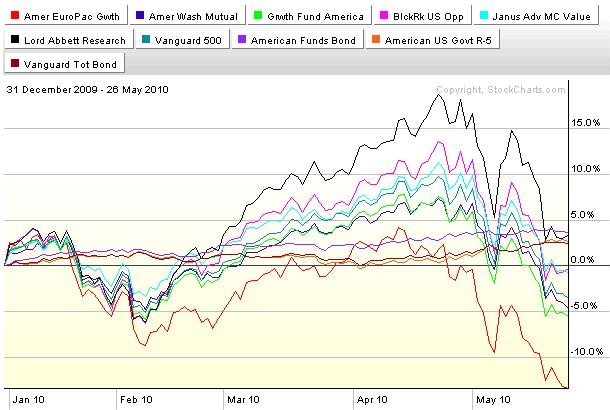

Fun With Chartz....

A year's worth of returns in the bond funds of my 401a. Not half shabby.

Under certain conditions, bond returns can smoke stocks.

But it's never really a no brainer. The corporate bond fund's out performance is rooted in the fact that in late 2008, investors tossed corporate bonds overboard because they feared that corporate America was going belly up. The catchup looked great. Especially if you didn't know that they started the climb inna hole.

http://noir.bloomberg.com/apps/news?pid ... 18JewR.Dag

http://noir.bloomberg.com/apps/news?pid ... &pos=7

http://noir.bloomberg.com/apps/news?pid ... &pos=2

http://www.msnbc.msn.com/id/38034014/ns ... d_economy/

http://www.ritholtz.com/blog/2010/07/economic-data-32/

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://noir.bloomberg.com/apps/news?pid ... &pos=4

http://www.ritholtz.com/blog/2010/07/nf ... -jobs-83k/

http://www.ritholtz.com/blog/2010/07/eu ... erform-us/

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.newsweek.com/2010/07/05/tough-case.html

http://www.ritholtz.com/blog/2010/07/fcic-hearings-2/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.msnbc.msn.com/id/38087780

http://noir.bloomberg.com/apps/news?pid ... amp;pos=15

http://www.latimes.com/news/local/la-me ... paign=Feed:+latimes/mostviewed+%28L.A.+Times+-+Most+Viewed+Stories%29

Pretty really Serious links....

http://www.telegraph.co.uk/finance/comm ... -1932.html

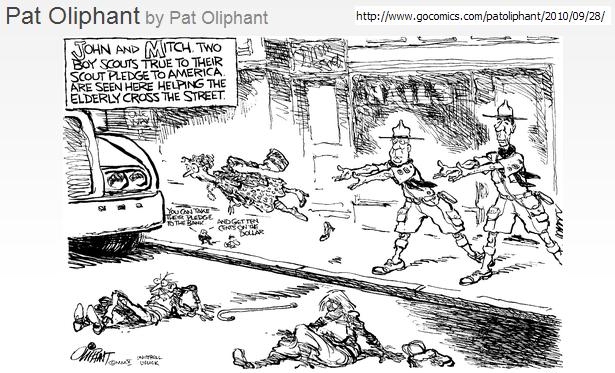

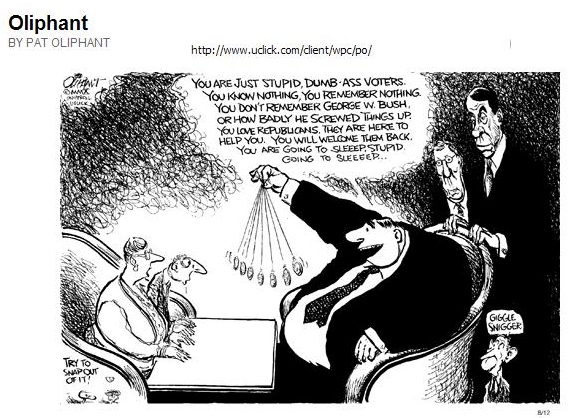

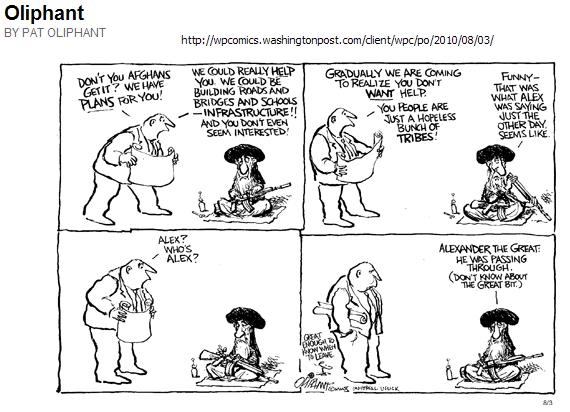

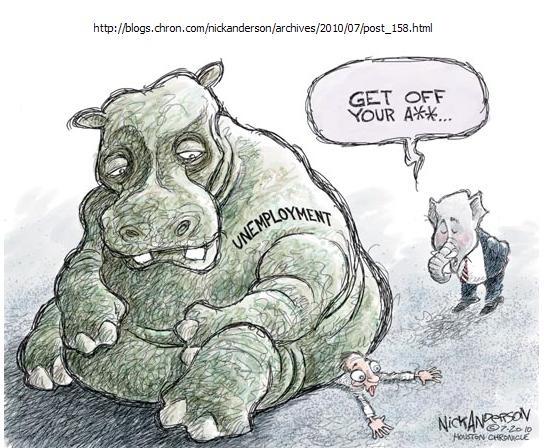

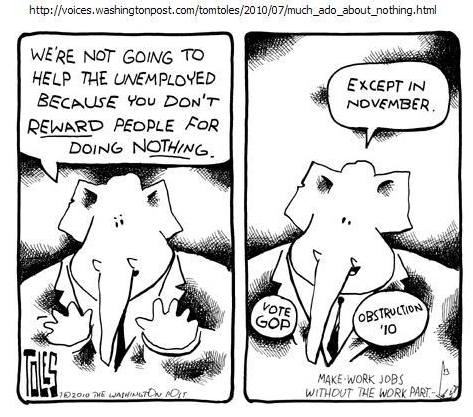

Last week, forty Republican Senators and one Democrat blocked action on extended unemployment benefits. This week, three GOP Senators were absent for the roll call but the end result was the same -- no relief for the long-term unemployed. By the time those 41 lawmakers return from their Fourth of July recess, 2 million Americans will have spent their final unemployment check. Republicans, however, will not shed crocodile tears over the pain inflicted on the jobless. Instead they will cheer every vote cast that diminishes, delays or denies help to the 31 million Americans idled by this Grave Recession. During the Bush administration, those same Republicans supported policies that are the proximate causes of our economic turmoil -- deficit financing of tax cuts for the wealthy, deregulation of the financial market place and the de-industrialization of America in the name of free trade. But rather than accept responsibility for their own disastrous policies, the GOP started a vendetta against the jobless. Republican attacks on America's jobless are neither random acts of meanness nor the ravings of a lunatic fringe. They are hostile acts in a partisan strategy. By attacking the powerless, Republican lawmakers hoped to align their party with the powerful, capture control of the next Congress and, ultimately, win back the White House.

Occasionally, Republican law makers telegraph their deep disdain for the unemployed. Senator Jim Bunning (R-KY) did so with his one-man filibuster against extended unemployment. Senator John Kyl (R-TX) suggested unemployment acted as "a disincentive for them to seek new work." Senator Orrin Hatch (R-UT) felt the jobless should be drug tested in order to qualify for unemployment insurance. And Congressman Dean Heller (R-NV) used the word "hobos" to demean those on unemployment.

http://www.huffingtonpost.com/rick-sloa ... 33217.html

Everything looks awful. And the recent drop and unemployment numbers are fear inspiring. But we've had 9 outta the last ten days down and everybody is leaning the same direction. Look for an oversold bounce/ counter trend move sooner rather than later. It'll sting if you are in cash or bonds. But ask, "Has anything changed? Or is this part of the markets not being simple or easy?" A trend is a trend until it isn't, and I'll have to have a reason before I allocate back into equities. Cash and bonds fer now....

Wednesday.....

That stung..... Smokin' hot upward day....

But on low volume and ya gotta look at it in perspective....

Stay tooned....

Last week, forty Republican Senators and one Democrat blocked action on extended unemployment benefits. This week, three GOP Senators were absent for the roll call but the end result was the same -- no relief for the long-term unemployed. By the time those 41 lawmakers return from their Fourth of July recess, 2 million Americans will have spent their final unemployment check. Republicans, however, will not shed crocodile tears over the pain inflicted on the jobless. Instead they will cheer every vote cast that diminishes, delays or denies help to the 31 million Americans idled by this Grave Recession. During the Bush administration, those same Republicans supported policies that are the proximate causes of our economic turmoil -- deficit financing of tax cuts for the wealthy, deregulation of the financial market place and the de-industrialization of America in the name of free trade. But rather than accept responsibility for their own disastrous policies, the GOP started a vendetta against the jobless. Republican attacks on America's jobless are neither random acts of meanness nor the ravings of a lunatic fringe. They are hostile acts in a partisan strategy. By attacking the powerless, Republican lawmakers hoped to align their party with the powerful, capture control of the next Congress and, ultimately, win back the White House.

Occasionally, Republican law makers telegraph their deep disdain for the unemployed. Senator Jim Bunning (R-KY) did so with his one-man filibuster against extended unemployment. Senator John Kyl (R-TX) suggested unemployment acted as "a disincentive for them to seek new work." Senator Orrin Hatch (R-UT) felt the jobless should be drug tested in order to qualify for unemployment insurance. And Congressman Dean Heller (R-NV) used the word "hobos" to demean those on unemployment.

Let us all be happy, and live within our means, even if we have to borrow the money to do it with.

-- Artemus Ward

Chartz and Table Zup @ www.joefacer.com

Hopefully It Just a Song, Smokin' Though It May Be....

http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

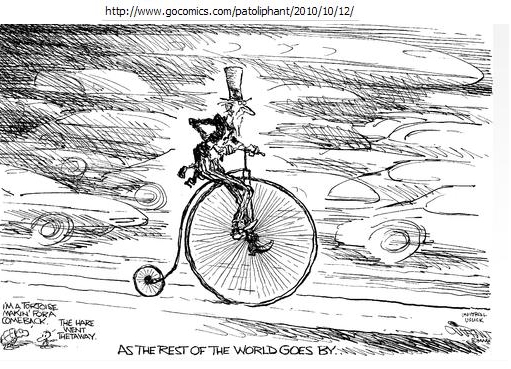

Europe sees it's problem as having borrowed way too much money and spending it on keeping the economy going and raising everyone's standard of living and burying themselves in debt. They see the solution as being to stop spending money that they don't have and to pay down the debt. The unintended result will be a slowing long term economic grind with lost jobs and misery. The bright side will be that the falling value of the Euro will make exports cheaper leading to the inevitable and eventual resolution of the problem.

The US sees it's problem as having borrowed way too much money and burying itself in debt. We see the solution as borrowing more money and spending it on keeping the economy going and maintaining everyone's standard of living so as to avoid a slowing economy and lost jobs. The unintended consequence will be that at some point, borrowing more money will raise the cost of the money making the problem even worse. Of course part of the solution is for Europe to spend money, borrowed money if necessary, on buying our goods so as to allow us to export our way out of the problem.

I see a conflict.

http://www.msnbc.msn.com/id/37954067/ns/business/

I also see the virtue of having my 401a in almost all cash and bonds for much of the near future. I see being able to make a dollar or two on stock market volatility at one time or another some time inna future. What I don't see a a short clear path to a healed economy, plenty of jobs, a new bull market and looking like a genius by buying and holding...

http://www.slate.com/id/2258099/

http://noir.bloomberg.com/apps/news?pid ... &pos=3

http://noir.bloomberg.com/apps/news?pid ... &pos=5

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://www.msnbc.msn.com/id/37827936/ns ... al_estate/

http://mpettis.com/2010/06/what-might-h ... ek-crisis/

http://www.ritholtz.com/blog/2010/06/gr ... ry-reform/

http://www.ritholtz.com/blog/2010/06/wa ... a-suffers/

http://www.ritholtz.com/blog/2010/06/ta ... f-the-day/

http://www.ritholtz.com/blog/2010/06/st ... -last-one/

http://www.ritholtz.com/blog/2010/06/2n ... n-housing/

http://www.ritholtz.com/blog/2010/06/is ... exhausted/

http://www.msnbc.msn.com/id/37953358/ns ... ork_times/

http://www.ritholtz.com/blog/2010/06/th ... ll-street/

http://www.ritholtz.com/blog/2010/06/gr ... n-america/

http://www.ritholtz.com/blog/2010/06/fa ... gislation/

http://www.ritholtz.com/blog/2010/06/ba ... ly-report/

http://www.ritholtz.com/blog/2010/06/do ... escalates/

http://www.ritholtz.com/blog/2010/06/wh ... -of-macro/

http://www.msnbc.msn.com/id/37980441/ns/us_news-life/

http://www.msnbc.msn.com/id/37954067/ns/business/

http://noir.bloomberg.com/apps/news?pid ... &pos=2

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://noir.bloomberg.com/apps/news?pid ... ztsSkSVw_A

http://noir.bloomberg.com/apps/news?pid ... &pos=8

Bond Funds and EuroAsia Fund scrubbed; Cash and bonds inna 401a.

Wed

Last 47 days. Cash and bonds inna 401a. Interest beats losing money....

http://noir.bloomberg.com/apps/news?pid ... 18JewR.Dag

http://noir.bloomberg.com/apps/news?pid ... &pos=7

http://noir.bloomberg.com/apps/news?pid ... &pos=2

Stay Tooned....

Still Waitin For Clarity. The Time To Pin it Is When You're Sure You Ain't Gonna Bin It. It's A Roadracer Sorta Thing.....

Strong feelings do not necessarily make a strong character. The strength of a man is to be measured by the power of the feelings he subdues, not by the power of those which subdue him.

-- William Carleton

Chartz and Table Zup @ www.joefacer.com

Fusion is a young man's game....

http://www.youtube.com/watch?v=MtSIEkPqVgk

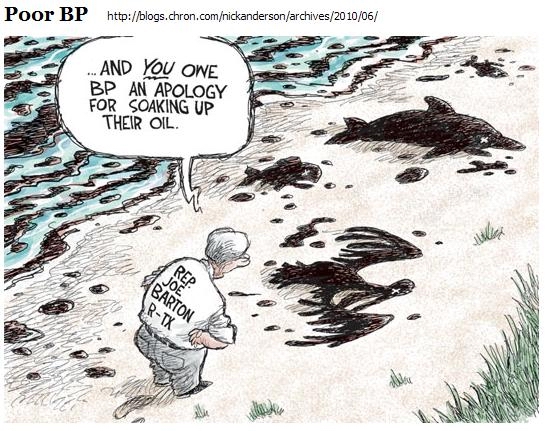

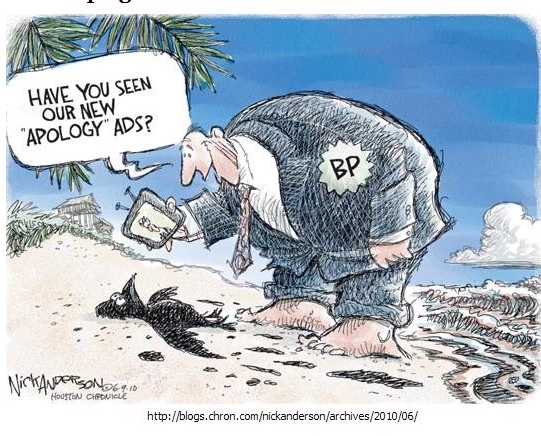

JEEZUS. What Was BP Thinking Was Gonna Happen If They Kept Rollin' The Dice...

http://www.ritholtz.com/blog/2010/06/wh ... -landfall/

http://www.ritholtz.com/blog/2010/05/de ... horizon-2/

http://www.nola.com/news/gulf-oil-spill ... st_of.html

Check out the precursor.... http://en.wikipedia.org/wiki/Texas_City ... _explosion

http://www.ritholtz.com/blog/2010/06/td ... nt-future/

http://www.ritholtz.com/blog/2010/06/th ... ave-given/

http://www.msnbc.msn.com/id/37798908/ns ... ork_times/

http://online.wsj.com/article/SB1000142 ... Collection

Sure as hell, all this is gonna come into play in terms of investor's mindset, and therefore the market, and therefore the performance of my 401a....

http://oldprof.typepad.com/a_dash_of_in ... posts.html

http://www.msnbc.msn.com/id/37798908/ns ... ork_times/

http://www.greentechmedia.com/articles/ ... Content%29

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... er_3TXsr3Q

http://paul.kedrosky.com/archives/2010/ ... ism_i.html

http://www.interfluidity.com/v2/862.html

http://paul.kedrosky.com/archives/2010/ ... egrat.html

http://www.bloomberg.com/apps/news?pid= ... amp;pos=12

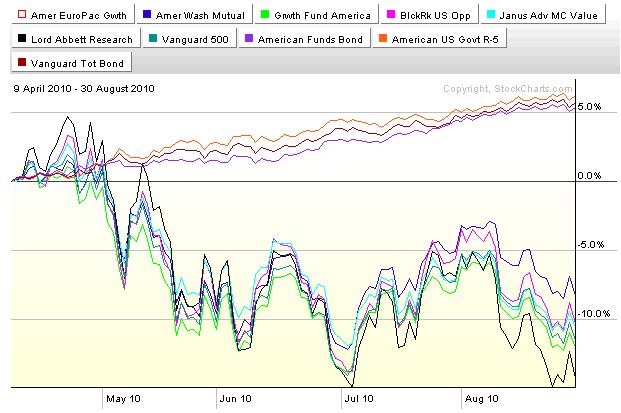

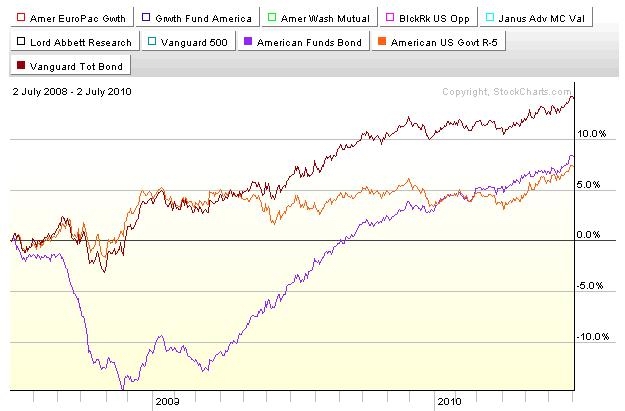

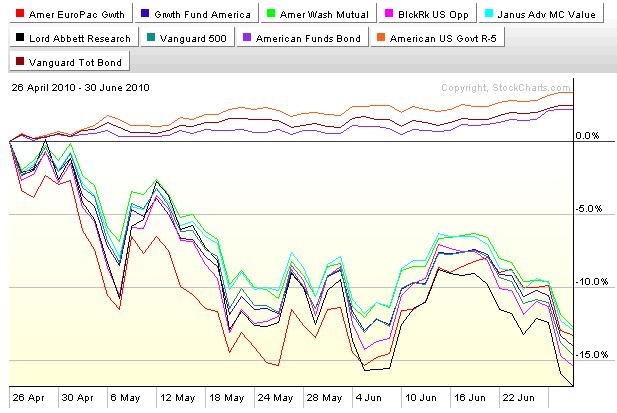

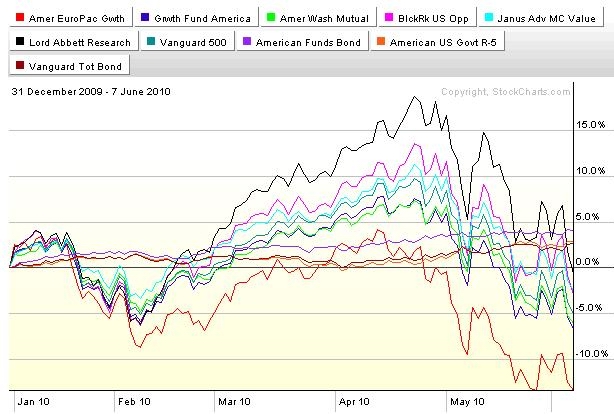

Again I've flushed the smoking crater that is the Euro/Asian Fund and ditched the bond funds too... We're inna downtrend. Still. I'm outa stocks totally and in the GIC and Corporate Bonds. Still.

This is the full boat of funds, this time referenced against the US Gov Securities, the safest of the safe. Notice that all but one fund is a money loser vs the Gov Sec.and that all but one of the stock funds is inna hole for the year. I'm concerned and playing it conservative....

More To Come.... Stay tooned.

"Don't tell me that worry doesn't do any good. I know better. The things I worry about don't happen."

--Unknown

Chartz and Table Zup @ www.joefacer.com

My Version Of The Old People Sitting Home Onna Saturday Night Watchin' Geezers From Back Inna Day Onna Toob.

You Know, Kinda My Version Of The Lawrence Welk Show...

http://www.youtube.com/watch?v=OqH4PctI ... re=related

http://www.youtube.com/watch?v=fEQ-0-tN ... re=related

http://www.youtube.com/watch?v=PWRI1vApXQ8

http://www.msnbc.msn.com/id/37665192/ns ... gton_post/

http://www.msnbc.msn.com/id/37602308/ns ... e_economy/

http://marketplace.publicradio.org/disp ... money-now/

http://www.nybooks.com/articles/archive ... ing-short/

http://money.cnn.com/2010/06/09/news/co ... /index.htm

http://www.reuters.com/article/idUSTRE65A3VP20100611

http://www.reuters.com/article/idUSTRE65A3VP20100611

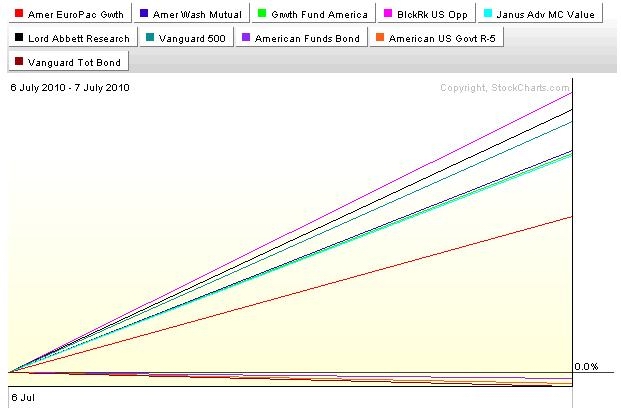

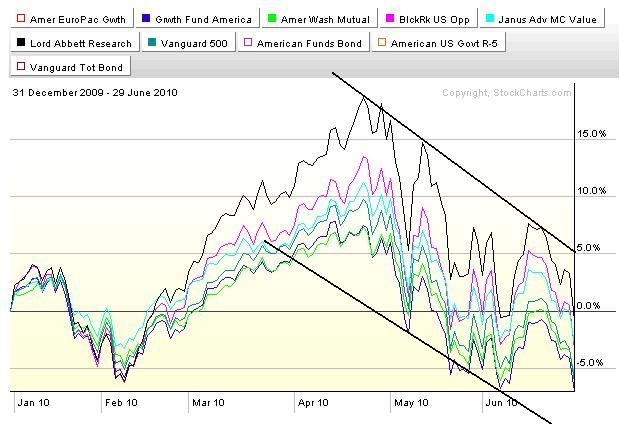

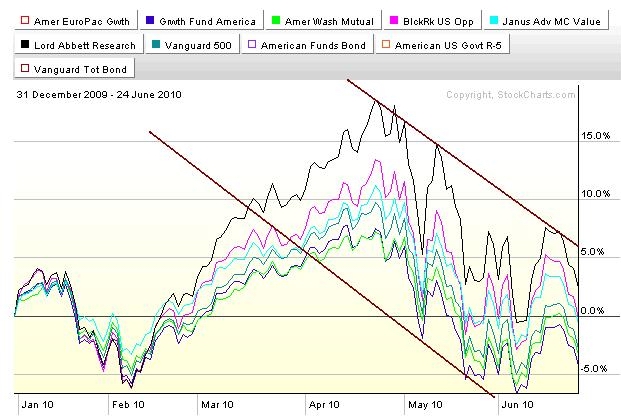

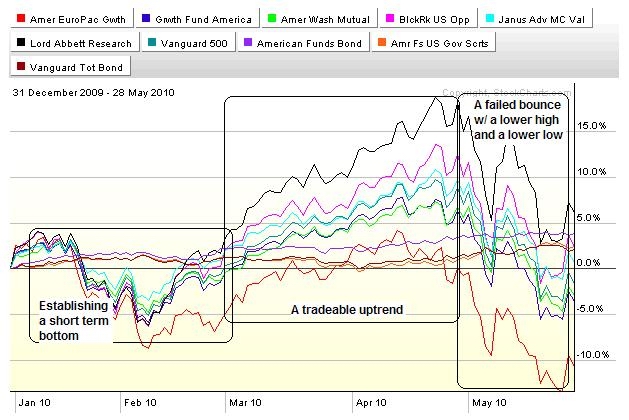

I dropped the bonds funds and the smoking crater that is Europe and drew some lines around what was left inna 401a on a "since 12/31/09" chart.

We're in a downtrend but an upside breakout is a possibility. So is a bounce off resistance and resumption of the downtrend. I can't predict the future very well, but I do know what to do with a trend when one appears, how to press a winning hand, and how to honor stops. I'm still all cash and bonds, as of tonight. So stay tooned.

Tuesday Eve

Upside breakout? Follow through would confirm it. Or it could be a bull trap...

I'll hafta think about it...

My Version Of The Old People Sitting Home Onna Saturday Night Watchin' Geezers From Back Inna Day Onna Toob.

You Know, Kinda My Version Of The Lawrence Welk Show...

http://www.youtube.com/watch?v=OqH4PctI ... re=related

http://www.youtube.com/watch?v=fEQ-0-tN ... re=related

http://www.youtube.com/watch?v=PWRI1vApXQ8

http://www.msnbc.msn.com/id/37665192/ns ... gton_post/

http://www.msnbc.msn.com/id/37602308/ns ... e_economy/

http://marketplace.publicradio.org/disp ... money-now/

http://www.nybooks.com/articles/archive ... ing-short/

http://money.cnn.com/2010/06/09/news/co ... /index.htm

http://www.reuters.com/article/idUSTRE65A3VP20100611

http://www.reuters.com/article/idUSTRE65A3VP20100611

I dropped the bonds funds and the smoking crater that is Europe and drew some lines around what was left inna 401a on a "since 12/31/09" chart.

We're in a downtrend but an upside breakout is a possibility. So is a bounce off resistance and resumption of the downtrend. I can't predict the future very well, but I do know what to do with a trend when one appears, how to press a winning hand, and how to honor stops. I'm still all cash and bonds, as of tonight. So stay tooned.

Upside breakout? Follow through would confirm it. Or it could be a bull trap...

I'll hafta think about it...

Considering Your Life As A One Act Play, Ya Wanna Star Inna Tragedy For The Ages, Or A Pretty Damn Entertaining Comedy?

In general, your target is not to beat the market. It is to beat zero. As I have written for years, the investors who win in this market are the ones who take the least damage.

-- John Mauldin

Chartz and Table Zup @ www.joefacer.com

http://www.johncipollina.com/mp3/cobra.mp3

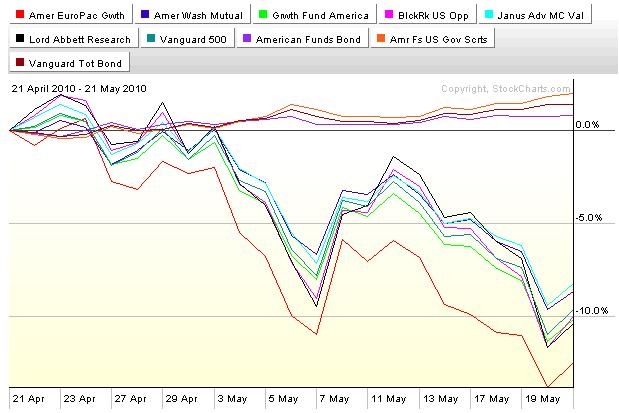

Rough Week for a lotta people. But I've been in capital preservation mode for a while; half cash and half bonds in the 401a, cash and short in the IRA's and trading accounts and I'm pretty sanguine about it all..... unless I'm reading Lakshman Achuthan.

Volatility is up, the trend is down, We're below the flash crash spike down, it all seems pretty clear to me....

http://www.businesscycle.com/news/press/1846/

http://www.msnbc.msn.com/id/37510854/ns ... e_economy/

http://www.businesscycle.com/news/press/1851/

http://www.businesscycle.com/news/press/1852/

http://oldprof.typepad.com/a_dash_of_in ... dream.html

http://www.businesscycle.com/news/press/1853/

http://www.theatlantic.com/business/pri ... lar/57696/

“If everyone’s expecting to export their way out of trouble, who will be buying?”

Alvin Liew

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://oldprof.typepad.com/a_dash_of_in ... rries.html

http://www.nytimes.com/2010/06/06/us/06peak.html?ref=us

http://topics.nytimes.com/top/reference ... classifier

http://www.risk.net/credit/news/1652759 ... -interview

http://paul.kedrosky.com/archives/2010/ ... e_inf.html

http://paul.kedrosky.com/archives/2010/ ... r_the.html

http://www.nytimes.com/2010/06/06/us/06spill.html?hp

http://www.telegraph.co.uk/finance/fina ... years.html

http://www.nybooks.com/articles/archive ... tion=false

http://www.bloomberg.com/apps/news?pid= ... &pos=6

What do you think the catalyst for this to change will be?

When will it arrive?

Do you have any interest in being part of this for the time being?

Half cash and half bonds inna 401a.....

http://www.ritholtz.com/blog/2010/06/ho ... t-support/

Stay tooned.

The complete lack of evidence is absolute proof that the conspiracy is working successfully.

-- Unknown.

Chartz and Table Zup @ www.joefacer.com

Obligatory Old Fart Music Link: http://www.youtube.com/watch?v=bqVVnExlX9c

John Cipollina's Stack: http://www.johncipollina.com/rockAmpStack.htm

Sell In May And Go Away...Fuckin' "A"!!!

Pretty much self explanatory. The market is NOT healthy and playing the bounces in a down trend (bear market bounces are notoriously viciously fast and steep) can be very profitable IF you are aggressive, quick, nimble, leveraged, selective, and steely eyed. Which I am. But that is NOT a description of something workable with a 401a. I'm still all cash and bonds.

Four BUMMERS, Coupla Laughers

http://www.ritholtz.com/blog/2010/05/si ... -clean-up/

http://www.ritholtz.com/blog/2010/05/oi ... -chutzpah/

http://www.ritholtz.com/blog/2010/05/bp ... on-valdez/

http://www.blacklistednews.com/?news_id=8878

http://www.ritholtz.com/blog/2010/05/co ... y-lost-1m/

http://www.ritholtz.com/blog/2010/05/ne ... -for-ceos/

http://www.ritholtz.com/blog/2010/05/gs ... -millions/

http://www.ritholtz.com/blog/2010/05/un ... linquency/

http://www.ritholtz.com/blog/2010/05/cy ... slation-3/

http://www.ritholtz.com/blog/2010/05/da ... -thoughts/

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://www.ritholtz.com/blog/2010/05/in ... al-crises/

http://www.ritholtz.com/blog/2010/05/wh ... g-and-why/

http://www.ritholtz.com/blog/2010/05/si ... more-56374

Back inna day, we tried the "self regulation" that a lotta "free marketers" rattle on about. It was at a place called "Altamont"....

A MOST MASSIVE MISSIVE:

http://www.ritholtz.com/blog/2010/05/th ... trading-2/

Almost as good...

http://www.ritholtz.com/blog/2010/05/ch ... etirement/

http://www.ritholtz.com/blog/2010/05/ja ... reak-free/

So it goes...

http://www.nytimes.com/2010/05/30/us/30 ... wanted=all

As Richard Feynman, the physicist, once observed, “For a successful technology, reality must take precedence over public relations, for nature cannot be fooled.”

Indeed, think of all the planes grounded for nearly a week in northern Europe last month, as a volcano poured ash in the atmosphere. There was no technological fix, and many passengers couldn’t believe it. Said Mr. Kohut, of Pew Research, “The reaction was: ‘Fix this. Fix this. This is outrageous.’ ”

http://www.nytimes.com/2010/05/30/weeki ... l?src=tptw

http://www.msnbc.msn.com/id/37432881/ns/gulf_oil_spill/

http://www.msnbc.msn.com/id/37423584/ns ... tn_africa/

http://www.newsweek.com/blogs/the-gaggl ... ians-.html

http://www.newsweek.com/2010/05/28/the- ... -west.html

http://www.newsweek.com/2010/05/30/in-d ... urope.html

http://www.msnbc.msn.com/id/37435289/ns/gulf_oil_spill/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... &pos=9

http://blogs.reuters.com/great-debate/2 ... t-decades/

http://blogs.reuters.com/great-debate/2 ... t-decades/

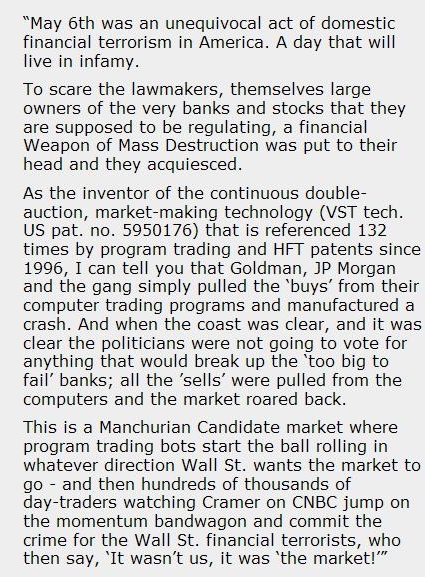

This is the second time I've seen this material. It's kinda too scary to contemplate. Black helicopters at Area 51 to the max...

I've seen a lot of this kinda stuff disproved over the years. Hopefully this too is another bad acid trip. Still...

http://www.ritholtz.com/blog/2010/05/se ... e-bp-leak/

http://www.ritholtz.com/blog/2010/05/si ... -clean-up/

http://www.ritholtz.com/blog/2010/05/is ... g-america/

Check out the 2nd comment....

http://www.ritholtz.com/blog/2010/05/oi ... more-56415

http://www.ritholtz.com/blog/2010/05/oi ... more-56415

http://paul.kedrosky.com/archives/2010/ ... roduc.html

TUESDAY

http://paul.kedrosky.com/archives/2010/ ... _goes.html

Ahl Be Back....

Indeed, think of all the planes grounded for nearly a week in northern Europe last month, as a volcano poured ash in the atmosphere. There was no technological fix, and many passengers couldn’t believe it. Said Mr. Kohut, of Pew Research, “The reaction was: ‘Fix this. Fix this. This is outrageous.’ ”

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

--Herm Albright

Chartz and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=m6SQ1A0kvc0

Smokin' Lead Guitar By Ian Cruikshank....

The Trend Is DOWN. Protect Whatcha Got....

Check Out the first COFG Essay on my website. It'll lay the foundation for where I think I'm goin'from here.....

Barry Is THE MAN!!!

http://www.ritholtz.com/blog/2010/05/le ... investor3/

http://www.ritholtz.com/blog/2010/05/sp ... raw-downs/

http://www.msnbc.msn.com/id/37302178/ns ... _business/

http://paul.kedrosky.com/archives/2010/ ... _ahea.html

http://www.ritholtz.com/blog/2010/05/fd ... titutions/

Subtle.... Like an elephant in heat.....

http://www.ritholtz.com/blog/2010/05/a- ... -internet/

http://www.nytimes.com/2010/05/23/world ... nted=print

http://www.ritholtz.com/blog/2010/05/th ... xperiment/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=15

Round Trip. What stocks made after the New Year, they lost after the New Year. Will it get worse or better?

http://www.bloomberg.com/apps/news?pid= ... DwwghB5ZXg

Even after the floor dropped out in the AM on Tues and the indices turned back up to even in the last two hours Tues, the trend is still down.

Covered my shorts to eliminate risk and lock in profits with my tradin' account, That's one issue and a short term and adrenaline and personal one at that.

For the 401a, which is what this is mostly about....I'm all cash and bonds. The trend is your friend if you are on the right side of it and the low risk side is my side here and now...

Stay Tooned......

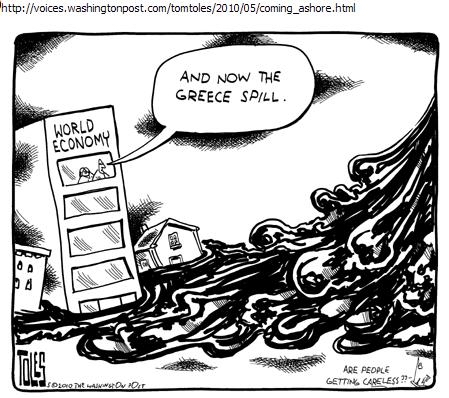

If The European Union Has Too Much Debt, How Is A Trillion Dollar TARP A Solution? And If The Euro Depreciates 20%, And The Dollar Gets Expensive, How Do We Bring Back Manufacturing And Export Our Way Back To Full Employment?

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have it, it requires 10 times as much skill to keep it.

-- Ralph Waldo Emerson

Chartz and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=e3LEhfbK ... re=related

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://www.bloomberg.com/apps/news?pid= ... &pos=7

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... CjGqGASv9E

http://paul.kedrosky.com/archives/2010/ ... t_the.html

http://pragcap.com/the-usa-does-not-hav ... um=twitter

http://chovanec.wordpress.com/2010/05/1 ... -on-ordos/

http://blogs.nature.com/news/thegreatbe ... oking.html

http://www.nytimes.com/2010/05/16/busin ... ef=general

http://www.nytimes.com/2010/05/16/us/16 ... f=business

401a in cash and bonds. Trading account all in short. Lotta risk out there....

Wed Eve...

http://www.ritholtz.com/blog/2010/05/tr ... -symptoms/

Thursday Eve...

Fuckin' "A" there's a lotta risk out there!!!!!

35%/65% GIC/Corporate Bonds Inna 401a.

Goin' to 45%/55% Corporates over GIC tomorrow Afternoon....

Makin' The Effort To Manage My Own Destiny; Like Someone Else Is Gonna Put In The Same Effort And Care As I Would? Gimme A Break...

My philosophy for trading is -- understand why something is happening economically and then look at the price action. If both of them works, go trade. If one of them is starting to fall apart, get out. And if both fall apart, get short,

-- Dennis Gartman

Chartz And Table Zup @ www.joefacer.com

Reeelly Important

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.cnas.org/blogs/abumuqawama/2 ... ation.html

http://www.jsonline.com/business/92418964.html

http://www.msnbc.msn.com/id/37037022/ns ... ws-europe/

http://www.msnbc.msn.com/id/37028501/ns ... gton_post/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.bloomberg.com/apps/news?pid= ... &pos=5

The spike down Thursday is NOT the story. Here's the last thirty days with the spike down drawn in in a different color. Detect a trend? One thousand points down in 9 days within which is one thousand point down and back up in 15 minutes. Which do YOU think bears more weight?

MORE REEEELLY IMPORTANT

http://www.ritholtz.com/blog/2010/05/de ... aming-hft/

Here what a play by play of the spike down sounded like...

http://www.ritholtz.com/blog/2010/05/be ... er-taking/

http://www.ritholtz.com/blog/2010/05/wa ... a-mistake/

http://www.ritholtz.com/blog/2010/05/ap ... -old-news/

http://www.ritholtz.com/blog/2010/05/ar ... ed-orders/

http://www.ritholtz.com/blog/2010/05/th ... nnot-hold/

http://www.ritholtz.com/blog/2010/05/nfp-post-mortem/

http://www.msnbc.msn.com/id/37048718/ns ... d_economy/

MONDAY EVE...

http://www.bloomberg.com/apps/news?pid= ... OKSoGY6hLs

http://www.washingtonpost.com/wp-dyn/co ... 0050704340

http://www.thestreet.com/story/10750843 ... l=dontmiss

http://www.boston.com/bostonglobe/edito ... _tank?pg=1

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.bloomberg.com/apps/news?pid= ... amp;pos=13

http://us.ft.com/ftgateway/superpage.ft ... 1531051380

Find all of the article in the link below. I discount conspiracy theories pretty deeply, but...

http://ampedstatus.com/high-frequency-t ... ted-states

Stay Tooned.

More here this weekend.

Where I Screwed Up, Where I Did Good, What's Next....

Still in cash and bonds. The Financial Times Gateway link above

and the increasing liklyhood of a double dip recession keep me cautious...

The genius of investing is recognizing the direction of a trend -- not catching highs and lows.

-- James Koford

Last dribble of stocks inna 401a closed out today. All in bonds and GIC. The 900 points down is of passing interest. The possibility of not being able to postpone the consequences the run up of the globes sovereign credit card is of huge interest... we were down midday before the spike down and we closed way down off the open...

Down 300 means there is major uncertainty. I'm prepped for a reflexive bounce... but I think there may be more downside to come as long as the uncertainty exists.

http://www.ritholtz.com/blog/2010/04/po ... zed-souls/

http://preview.bloomberg.com/news/2010- ... slows.html

http://blog.al.com/live/2010/04/deepwat ... _memo.html

http://www.msnbc.msn.com/id/36972794/ns ... ce/page/2/

http://paul.kedrosky.com/archives/2010/ ... _real.html

http://blogs.ft.com/energy-source/2010/05/06/61536/

Stay Tooned

A Raging Inferno of Coruscating Incandesence. Fire And Flames Triumphant; A Crimson Wing Of Doom, O'er Shadowing And Searing Filleted Raw Flesh... It's BBQ And Grilling Season Here At The Homestead. Good Times Around Here. Not So Good Times At Times Square And On The Gulf Coast ....

Calendar

Calendar