Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair

'nother week, 'nother post. Stocks go up/stocks go down. Look at the charts. It was a down 1st half the week and short but up last half of the week. I made back(Wed/Thurs)some of what I lost(Mon/Tues). Taking a step back, the midterm 18 month uptrend still appears intact and built of a buncha zigs up and smaller zags down. Was Thursday's zig up complete or is there more to come Monday? Is it the start of bigger zags down and small zigs up? We'll see. The risk of losing what I've gained so far is greater than it was, but so what? Earnings season is upon us and I think it'll be a good one for the right stocks. A sell the news reaction? Probably. But right stocks might go up after that if the forward guidance is good. We'll see. I've been buying. I'm ready to consider selling. I'm waiting for more information. Will the right stocks go up? Do the 401 fund's own them? Do I own the right funds? I'll let ya know next week.

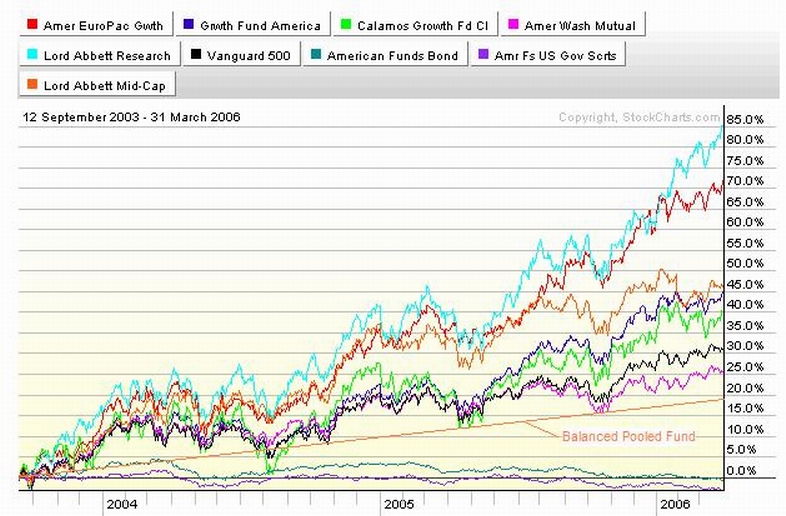

Oh yeah...One more time ya need to see the opportunity cost of the Balanced Pooled Fund. This is the chart from a coupla three weeks ago, so make sure you look on the chart page to see the latest.

See ya at the hall.

-- Gary Ryan Blair

'nother week, 'nother post. Stocks go up/stocks go down. Look at the charts. It was a down 1st half the week and short but up last half of the week. I made back(Wed/Thurs)some of what I lost(Mon/Tues). Taking a step back, the midterm 18 month uptrend still appears intact and built of a buncha zigs up and smaller zags down. Was Thursday's zig up complete or is there more to come Monday? Is it the start of bigger zags down and small zigs up? We'll see. The risk of losing what I've gained so far is greater than it was, but so what? Earnings season is upon us and I think it'll be a good one for the right stocks. A sell the news reaction? Probably. But right stocks might go up after that if the forward guidance is good. We'll see. I've been buying. I'm ready to consider selling. I'm waiting for more information. Will the right stocks go up? Do the 401 fund's own them? Do I own the right funds? I'll let ya know next week.

Oh yeah...One more time ya need to see the opportunity cost of the Balanced Pooled Fund. This is the chart from a coupla three weeks ago, so make sure you look on the chart page to see the latest.

See ya at the hall.

Calendar

Calendar