Consider This And The Last Two Posts To Be Of a Cloth... Notice How Old Guys Use Archaic Expressions? The Expressions And The Old Guys Didn't Start Out Archaic.....

A man must not swallow more beliefs than he can digest.

-- Havelock Ellis

Chartz And Table Zup @ www.joefacer.com

http://www.msnbc.msn.com/id/31265283/ns ... nd_energy/

http://www.bloomberg.com/apps/news?pid= ... B3ytMcNUW4

http://www.bloomberg.com/apps/news?pid= ... LaaXr3qinM

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.msnbc.msn.com/id/31193659/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

Look about 6 and a half minutes in for a financial commentator revealing stress...

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/nikkei-do-75-off/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/un ... nt-friday/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/co ... m-problem/

http://www.ritholtz.com/blog/2009/06/io ... al-estate/

http://www.ritholtz.com/blog/2009/06/foreclosure-up-18/

http://www.ritholtz.com/blog/2009/06/we-still-love-you/

http://www.ritholtz.com/blog/2009/06/sc ... communist/

http://www.ritholtz.com/blog/2009/06/vi ... sm-waning/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/bu ... ventories/

http://www.newsweek.com/id/201523

BLOW YER MIND....

http://www.telegraph.co.uk/finance/fina ... rvive.html

http://www.msnbc.msn.com/id/31354296/ns ... _business/

Wed

http://www.cnn.com/2009/WORLD/meast/06/ ... index.html

http://www.msnbc.msn.com/id/31403377/ns ... al_estate/

http://www.newsweek.com/id/202323

From the 6/13/09 Economist;

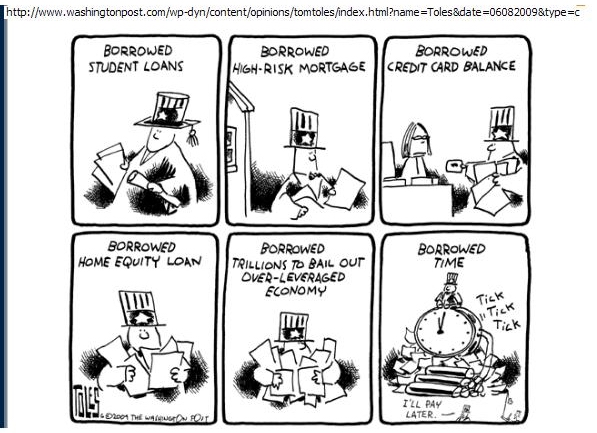

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

So it's like this.....ya gotta have a thesis.

Mine is that

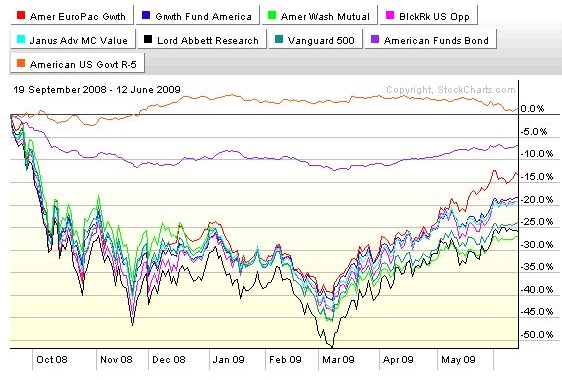

the low of March this year was a panic low. The problems of 2007 supposedly had been fixed for good by early 2008 and by the time the Fall of 08 came around and things were headed for hell in a free fall pretty much everywhere, some serious downside momentum was in place. Coupla lower lows washed out all the sellers and left only shorts to sell.

Came the second week of March and people began to realize that even at 10 percent unemployment, 90 percent of the people would still be working, the employed and the unemployed would still be buying stuff, the government was shoveling money out of Ben's helicopters, and at some point inventories would be too low and products would have to be made and sold. Plus profit expectations had been driven into the ground by blind panic. So brave souls bought a little stock and the stretched to the downside rubber band snapped into motion. I caught a little of the move but missed that reality was ahead of expectations and I sold before the 1st quarter reports came out. DAMN!!! The reports were Better Than Expected. Stocks continued up without me and I fought myself over being late to the party vs arriving just as it cratered.

What now?

Well... stocks go too low and then go too high. There is a ton of money on the sidelines that missed the rally so far and CAN NOT MISS ANY MORE. There exist buyers desperate to buy. And interest rates are still fairly low. And the administration is cheer leading and papering over any signs of distress. And some places are still doing business and the rates of decline are slowing, possibly signaling a bottom and the headlines are about the bottom and the turn. But is it THE bottom...? Or just the end of a panic downdraft and the start of a long recession and extended trip across a flat economic landscape?

The rally looks tired. Stock prices pretty much discount a sizeable recovery. But the FED printed money like mad and now it has to borrow to fund what it printed. Bond buyers are offering less, fearing inflation, and that drives interest rates up and makes bonds a harder sell. That means that higher rates are needed on the bonds to raise the desired amount of money. That'll slow down refi's and new mortgages. The Fed will have to print more money and buy bonds to drive prices up and rates down, increasing fears of inflation. Which is the cause and not the cure. The Fed and administration have announced a flurry of plans, most of which are going nowhere. We have a ton of real housing inventory and an unknown amount of shadow inventory. The Fed offers the banks free money to start earning their way out of trouble. But the money is getting more expensive for the Fed to borrow and show me where the new business is for the banks to fund. Housing? Malls? Factories? Energy? Maybe... Wanna loan yourself some money through the government for a voucher to buy a new Chrysler SUV after you loan GMAC some money to fund your loan for the SUV? How about a house? Who's gonna buy your trade in? The Fed has entered into repo agreements with banks, taking toxic assets from them and giving back treasuries/cash. The mechanism by which the Fed can unload or make better the crap on its balance sheet and give it back to the banks/other investors is not apparent to me. The Great Unwind is still gotta happen and we're closer to the beginning than the end of flushing the crap away...

Check it out;

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

BLOW YER MIND...

http://www.telegraph.co.uk/finance/fina ... rvive.html

So my thesis is that we're going nowhere while things play out. I don't see a clearer road substantially up or down and I see a lot of resistance higher and a lot somewhat lower. But markets don't stand still. Fear and Greed and Hope and Despair will cause the markets to slosh around within a range. For how long? A week? A month? A year?

Check it out...

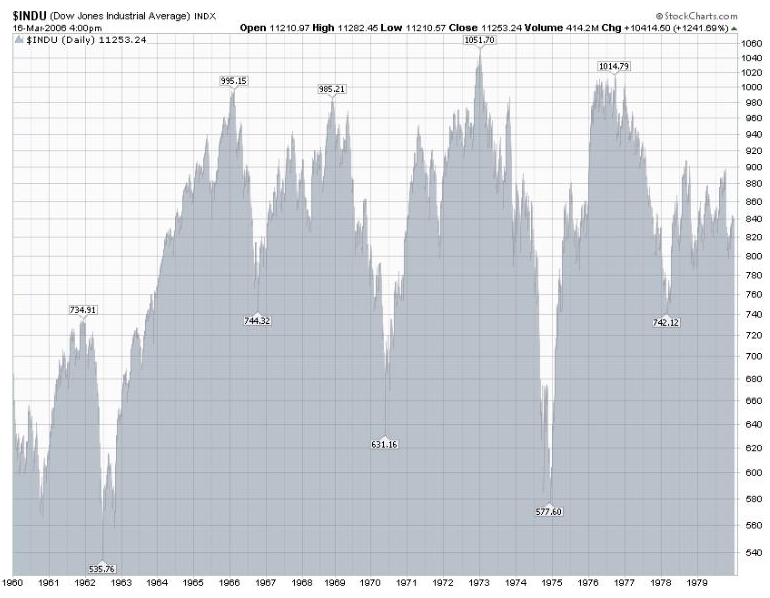

The Dow 30 was at 740 four times in 16 years and a ways above and below it. Buy and Hold? GIMME A BREAK!!!!! Tryin' to work with what the market gives me? Buy the dips and sell the rips? Make money that way? Prolly.... I'm gonna try

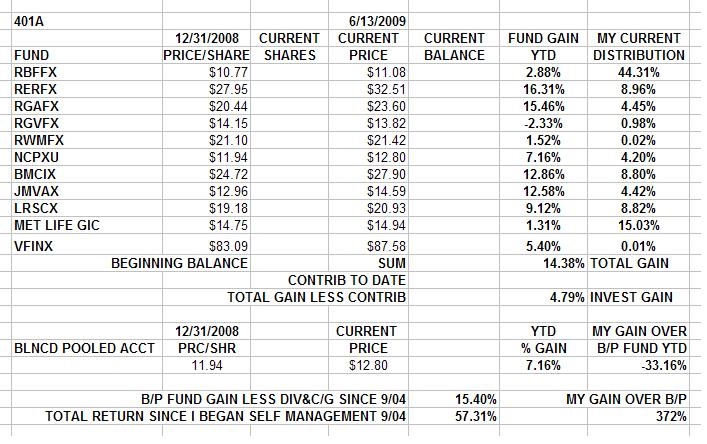

I committed a significant amount of my account to stocks earlier in the month to get back inna game. It didn't look that good, but I needed to re-engage my interest. So I made a dollar or two last week. Lately, not so much. I moved some money outa stocks and into the GIC this Friday, leaving some in stocks. There are buyers still trying to get into the party when the door opens for someone to leave... There may be a little more to go. But the easy money and a lot of it has already been made. The resistance seems greater to the upside than the downside and I'm more likely lighten up on stocks than buy more.

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

BLOW YER MIND...

http://www.telegraph.co.uk/finance/fina ... rvive.html

Calendar

Calendar