| |

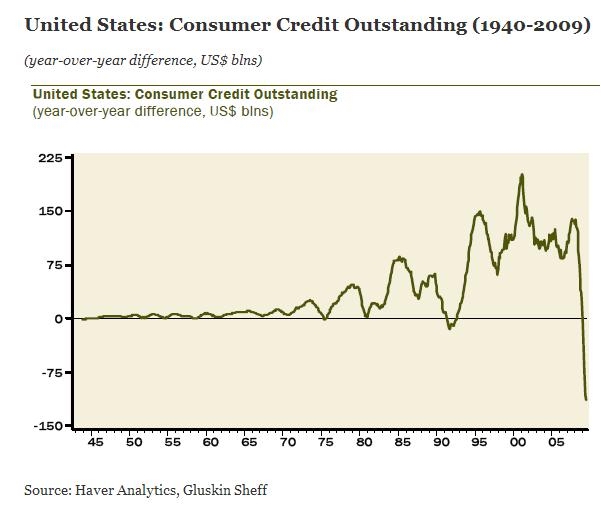

So The Fed Left The Punch Bowl Out Too Long An' Wall Street And Real Estate Fell In. And What Ya Knew Was Gonna Happen, Happened. Then The Fed An' The Government Borrowed The Public's Credit Card And Refilled The Punch Bowl. Pourin' Alky Down A Drunk's Throat Never Ends Well. Sobering Up Gets Postponed And Worsened. Don't Stand In Front, Stand To The Side.

Saturday, February 13, 2010, 04:33 PM

My philosophy for trading is -- understand why something is happening economically and then look at the price action. If both of them works, go trade. If one of them is starting to fall apart, get out. And if both fall apart, get short,

-- Dennis Gartman

Chartz and Table Zup @ www.joefacer.com. Check it out!

Hell, good enuf to make it two weeks inna row.

http://www.youtube.com/watch?v=Sy7vnwXg ... r_embedded

Larry Faucette on congas

Freddie Smith on sax

Buddy Miles on drums

Mike Finnigan on keyboards

Mike was the SF connection. I used to see his band play at a club in Mill Valley.

Also on the LP were Jack Cassady/Stevie Winwood, coupla guys who also played good music elsewhere at the time.

The guitar player was pretty good too. The first time I saw him, he headed the bill at Winterland with Albert King and John Mayall's Blues Breakers. Two sets each starting at 8:00 and JH played until 2:15...

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.ritholtz.com/blog/2010/02/st ... al-policy/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=11

http://www.newsweek.com/id/233519

http://www.ritholtz.com/blog/2010/02/be ... ing-gifts/

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... hIeftRVyvE

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... Xq1qk1ll9M

http://www.ritholtz.com/blog/2010/02/ho ... al-crisis/

http://www.ritholtz.com/blog/2010/02/in ... -expected/

http://online.wsj.com/article/SB1000142 ... 53714.html

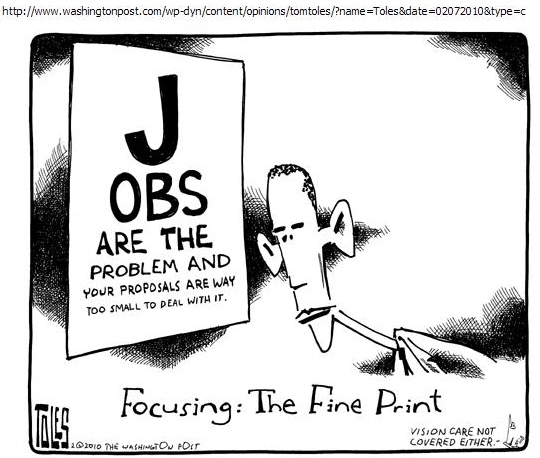

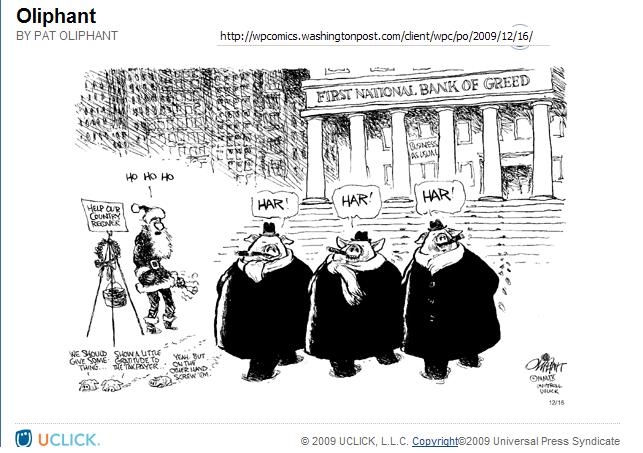

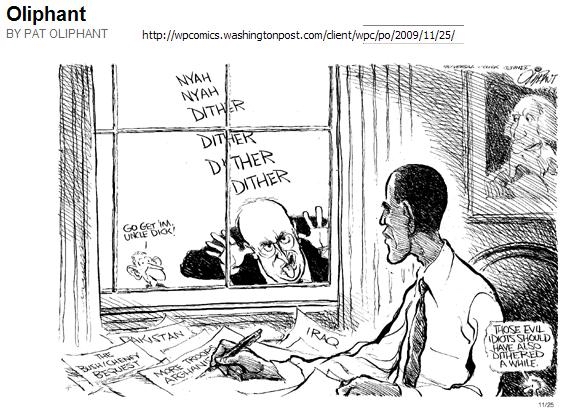

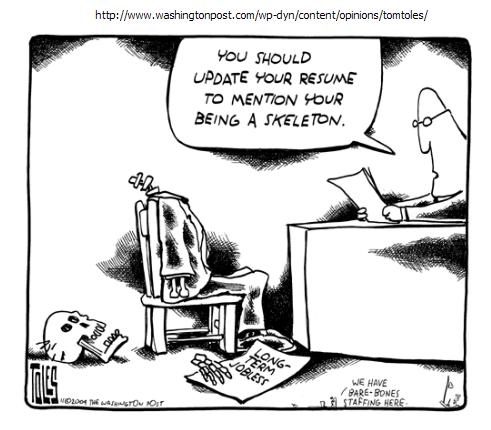

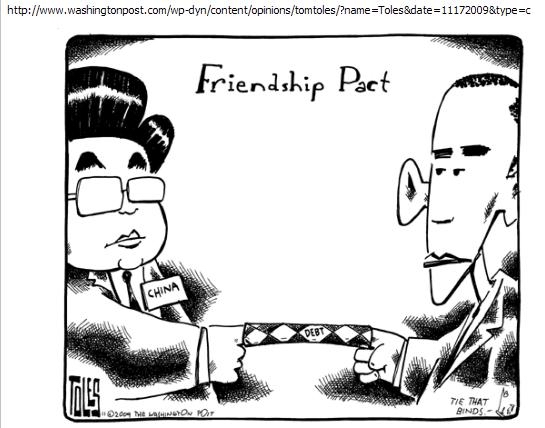

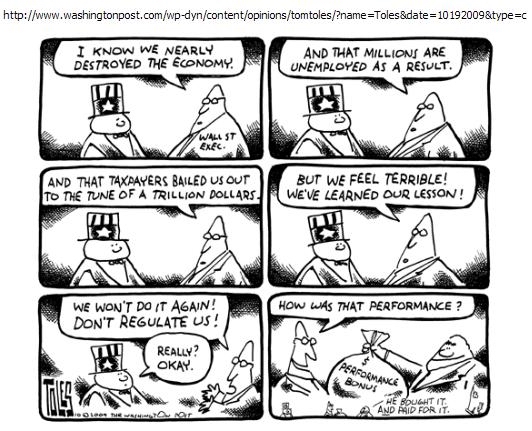

The Obama administration's starting out with health care reform instead of financial reform was a fuck up of enormous proportion. Newsweek's current riff is that it was necessary but still wrong. That news has been out a while. So health care reform is bogged down big time. And Too Big To Fail financials are fewer names but even bigger entities with the taxpayer an unwilling participant in the fun and games. Obama signed on to Bush's program and left the suspects and persons of interest in place and buried them in taxpayer's money. Which they passed around while the jobs just kept disappearing....

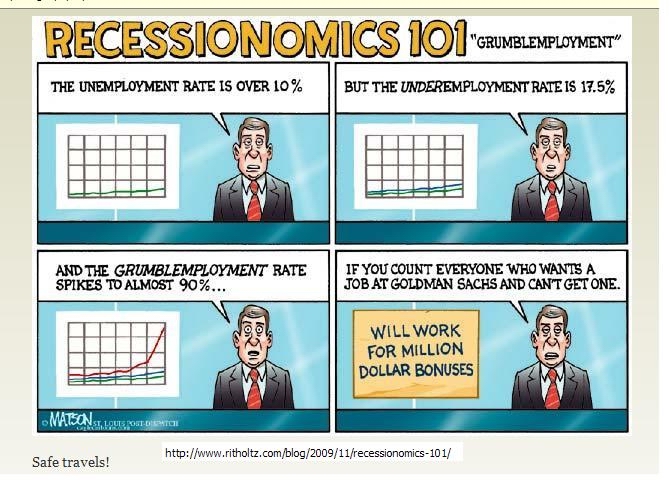

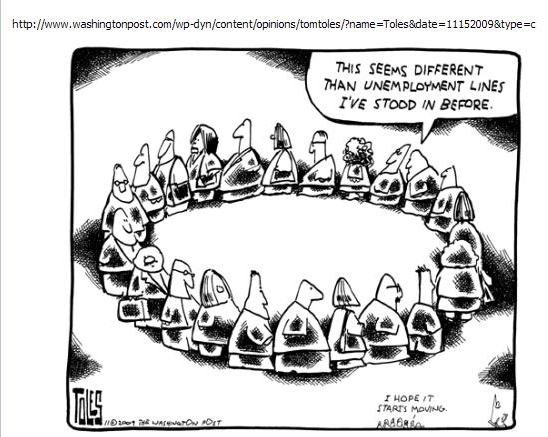

So Main Street sees Wall Street getting healthy enough on Main Streets money to be back to the big bonuses spread among fewer names while Main Street continues south. We are still losing jobs at a time when we need well over 100,000 new jobs a month just to stay even. Estimates for this year project 133,000 new jobs a month. That leaves 30,000 new jobs a month to eat into a very real 17% un and underemployed employment rate. Expect the "official" unemployment rate to float between 9.5% and 10% this (election)year as new persons will step on to the pier as someone falls off the other end...

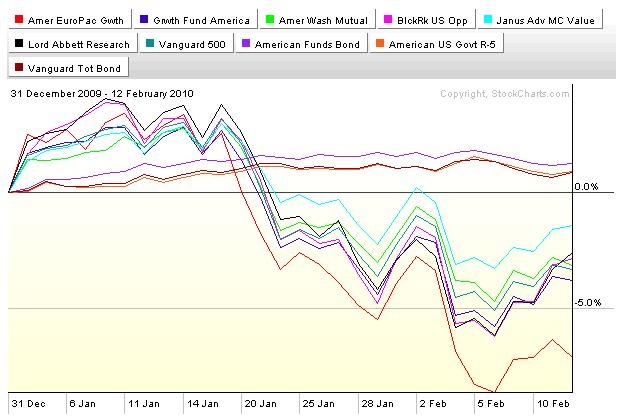

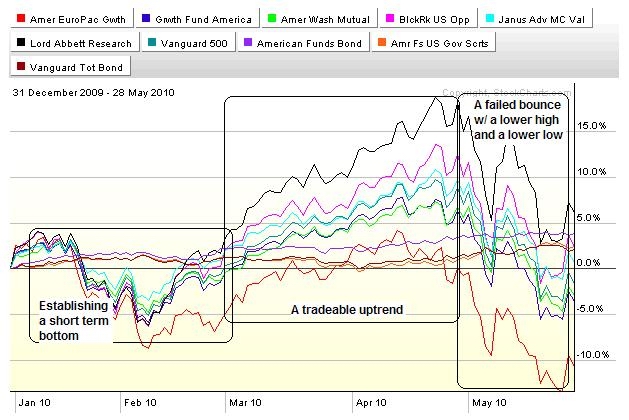

So Intel and Apple posted good reports for the fourth quarter and they and other great names rolled over and started south mid January. Check out the chartz.

The weekly chart shows perspective, the daily chart shows where we are in the domestic big cap market, the 401a funds show where my choices stand with/against the markets...

The suspicion has been that Europe is in worse shape than the US for about a year and a half. Now it is starting to show. The markets are herky jerky between fear of serious bad things and the pronouncements that there exists the firm intentions of the EU to seriously consider that something needs to be done and that they may consider that it may become necessary for them to think about who should do it, if they can do it, and are willing to do so.

In the meantime, commodities and stocks go down and it appears that money is leaving stocks and going to bonds and that money is leaving bonds and going to cash and that money is leaving commodities and going someplace...

I'm standing to the side in the 401a. And it ain't an easy choice. All last year, the stock market made "V" shaped recoveries from every rough patch and maybe it will do it again. But that was last year and this is this year. And bonds are promises to pay and not the most comfortable place to be when promises and the future are suspect.

Still, business will be done. It's just that the developed nations are buried under debt and going no place for the time being. It is the emerging nations that will be doing business, but less of it and under some uncertainty.

So for now it looks like rips and dips in stocks as the emotions of fear and greed will jerk the market around the existing trend. And the trend that I see is down.

So I consider that 401a money is not real nimble and that I have to respect the trend.

http://www.ritholtz.com/blog/2010/02/jo ... e-to-last/

http://www.ritholtz.com/blog/2010/02/be ... more-51652

Oh, yeah... 100% GIC and Bonds until further notice.

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... MJFT2dMyIU

http://www.bloomberg.com/apps/news?pid= ... amp;pos=10

http://www.msnbc.msn.com/id/35367044/ns ... swer_desk/

http://www.ritholtz.com/blog/2010/02/pr ... -earnings/

http://www.msnbc.msn.com/id/35406859/ns ... d_economy/

Stay tooned....

( 3 / 1345 ) ( 3 / 1345 )

AoxoMoxoA... Palindrome Or Conundrum? Threat Or Menace? Juvenile Jackanapes? Or Is It Just Retibulent Praecidualism?

Saturday, December 19, 2009, 02:35 PM

For a substantial portion of the American business and professional class, a book entitled "Life Without Lawyers" must surely conjure some of the same feelings evoked in faithful readers of the Harlequin romances, a sort of vicarious fantasy filled by the joy of liberation from burdens, strictures, and anxieties that have come to define quotidian existence. Such people are, in my experience, called clients.

-- Charles N.W. Keckler,

Chartz And Table Zup @ www.joefacer.com

Seeya Raht Here Later This Weekend....

Meantime....

( 3 / 1472 ) ( 3 / 1472 )

Saturday, November 28, 2009, 03:01 PM

Surprise, surprise, surprise!

-- Gomer Pyle

Chartz and Table Zup @ www.joefacer.com

Another Kick Ass Cover Of A Kick Ass Eddie Cochran Song....

http://www.lala.com/#song/360569479529542632 Click On 20 Flight Rock

http://en.wikipedia.org/wiki/Twenty_Flight_Rock

Click It!!

Three year weekly chart. We just had two weeks where we opened up, went up , and finished the week badly. We've done it before during this rally and then gone higher. But valuations are higher and we are coming to the end of the year, and this market is the most hated rally in memory for a reason. I've been overly cautious for much of the year and I'll be right about it sometime. So the idea will be not to get caught too far extended when it does roll over....

The first three days of the week were up and I pretty much lightened up on stocks in my 401a and went to cash and bonds. I really lightened up in my IRA's and trading account.

It worked out well when I wandered out late in the AM Friday and saw what had happened over Thanksgiving Day. It was all about Dubai and some overdue whackage. I dodged the downdraft sleeping off Thanksgiving and lit up the screens near the top of the bounce. I had time to read enough to develop some ideas about what I wanted to do. So I bought some stocks halfway down the last red bar and some more stocks at the bottom of the bar. I gotta plan...

Stay Tooned. More to come this weekend....

Meanwhile, Back At The Ranch...

http://www.time.com/time/nation/article ... -1,00.html

http://www.debka.com/headline.php?hid=6394

http://www.nytimes.com/2009/11/29/busin ... f=business

http://www.slate.com/id/2236708/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.thestreet.com/story/10634076 ... tdown.html

http://www.msnbc.msn.com/id/34176802/ns ... _business/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.businessweek.com/magazine/co ... op+stories

http://www.unews.utah.edu/p/?r=112009-1

http://online.wsj.com/article/SB125934519959366715.html

http://www.theglobeandmail.com/report-o ... le1380944/

( 3 / 1435 ) ( 3 / 1435 )

The Holiday Season Starts With Thanksgiving. If You have Looked Over The Edge As Many Of Us Have, You Know That Every Yesterday, Today, And Tomorrow Is a Gift. Get The Most Out Of Them And Spread The Largesse Around. Have A Kick Ass Thanksgiving....

Saturday, November 21, 2009, 02:56 PM

Excuses change nothing but make everyone feel better.

-- Mason Cooley

Chartz And Table Zup @ www.joefacer.com.

Goin Down.....

http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

Lookie Here....

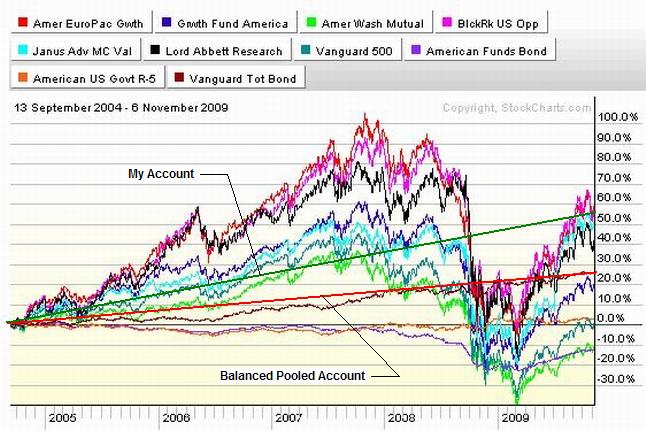

Check out this 3 year weekly chart on the S&P. We established a downtrend in late '07 and then went into a precipitous cascade down starting in October '08. The freefall quickly slowed into a sickening dive that ended in March '09. That was a huge oversold panic drop that led to markets and equities priced for the end of time by the end of '09.

You don't need inventory or employees going into the end of time so businesses got really lean really sudden and the reduced revenues from people who still had jobs, savings, or credit, went straight to the bottom line. There were profits to report. The Fed and the Treasury cranked up the presses and flooded the world with cash at 0%. Nobody wanted to fund businesses or buy real estate so the money went into liquid (financial and commodity) paper assets. Everything got a bid. The markets went up on low volume and in an atmosphere of fear. As markets went up, participants were dragged in kicking and screaming, one at a time, moving the markets up more. Wash,rinse, repeat... It is still ongoing...

The weekly trend is up and continues up. There have been consolidations and corrections, but if you weren't long, you were wrong. I am now pretty much long stocks pretty much late in the year and pretty late in the move...

Check out this 8 month daily chart. The trend is still up, but we have had a coupla touches of the uptrend line with relaunches from there. We've also had a major reset at the end of October. The technicals still look good and Monday we gapped up hard in the AM. The economy hasn't mattered since March. Someday it will matter again. The longer it doesn't, the sooner it will. The reset was a first crack in the wall. The almost daily confirmation that the Fed and Treasury have the economy on a high pressure force fed diet of free cash and is aware of the risk of slowing the flows for even a moment is keeping what launched the economy off the bottom in place. It is The Infinite Intervention vs The Great Unwind at the start of an election year. The risks are huge. I reduced my exposure to stocks Friday and I may do so again even with the markets up.

When it's late and the party is really really wild, ya gotta edge toward the door whether you can hear the sirens yet or not....

Meanwhile, Back At The Ranch...

http://www.bloomberg.com/apps/news?pid= ... sHAD0w1egE

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.istockanalyst.com/article/vi ... id/3633323

http://www.ritholtz.com/blog/2009/11/ho ... of-the-us/

Why I've been in too much cash/bonds and not not enough stock...

http://cohort11.americanobserver.net/la ... final.html

http://www2.debka.com/headline.php?hid=6384

http://www.msnbc.msn.com/id/34067419/ns ... ssweekcom/

http://www.bloombergnews.com/apps/news? ... &pos=7

http://www.dailymail.co.uk/sciencetech/ ... world.html

http://www.bloomberg.com/apps/news?pid= ... tisP2sqI2I

http://www.msnbc.msn.com/id/34103722/ns ... ork_times/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.ritholtz.com/blog/2009/11/bi ... -failures/

These Links Help You To Understand What I See....

http://www.aspousa.org/index.php/2009/1 ... eally-bad/

http://peakwatch.typepad.com/peak_watch ... round.html

http://www.ritholtz.com/blog/2009/11/do ... s-soaring/

http://mpettis.com/2009/11/lecturing-ea ... -on-trade/

http://www.ritholtz.com/blog/2009/11/ex ... ap-condos/

http://www.ritholtz.com/blog/2009/11/th ... americans/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.ritholtz.com/blog/2009/11/th ... t-veteran/

http://www.marketwatch.com/story/15-sig ... 2009-11-24

Stay Tooned....

( 3 / 1405 ) ( 3 / 1405 )

Must Be Gettin' On Later In the Year.... I Find Myself Planking Salmon And Searing Steak Inna Cold And Dark. Real Manly Adventure With The Flavor Of White Hot Coals And Ice Cold Gin.

Saturday, October 24, 2009, 03:58 PM

Retail sales themselves are the best indicator of consumer sentiment as no device peers so deeply into the recesses of the human soul as the cash register.

--Howard Simons

Chartz And Table Zup @ www.joefacer.com

Or They Will Be When I Can Get On To The 401a Site...Is It Me? Or Is it Everybody? Good Excuse To Find Somethin' Else To Do Today....

http://www.youtube.com/watch?v=FMcjPZgK ... re=related

http://www.ritholtz.com/blog/2009/10/an ... more-42096

http://www.ritholtz.com/blog/2009/10/80-oil/

http://www.ritholtz.com/blog/2009/10/fd ... lures-106/

http://www.google.com/hostednews/ap/art ... gD9BI75DO0

http://www.ritholtz.com/blog/2009/10/re ... omed-wamu/

http://www.ritholtz.com/blog/2009/10/n- ... -eye-view/

http://www.msnbc.msn.com/id/33479888/ns ... _business/

http://www.bloomberg.com/apps/news?pid= ... GuYWlHyRDU

http://www.ritholtz.com/blog/2009/10/co ... d-records/

http://www.bloomberg.com/apps/news?pid= ... tUrQ343suM

http://www2.debka.com/headline.php?hid=6341

Stay Tooned.

TUESDAY

I've gone into capital preservation mode. Outside down days in key stocks, interday reversals in key stocks and indices, stocks going down on bad news/good news/no news/first class earnings beats, and then the few stocks that went up on first class earnings end up going down, That's A Deal Breaker.

I'm 73% bonds and GIC and the remainder mostly long AsiaPacific as a materials/growing economy thing. I may get all the way lighter on the little bit of domestic stocks I own in the 401a and lighter yet on the RERFX stuff. Stay Tooned...

My readings as posted here over the last 2 years made me way too cautious way too early and I missed most of the run up. I listened to Main Street and the more cautious parts of Wall Street and I saw the steam roller coming while it was still 8 miles away and I got out of its way. And stood around. I don't have the tools here in the 401a to pick up the few pennies still on the road and expect to get away cuz now I hear the steamroller and feel the rumblings. Man up, face up to a lost opportunity and get back to the curb.

Norway, Australia, Brazil, and India as of this evening seeing the end of the financial crisis on their turf and putting new fiscal and monetary policies in place in the weeks and months ahead. Prolly more nations doing so over the next few months. It is NOT the US leading worldwide policy response to our financial crisis. This is us facing the great unwind of the Money For Nothing , Cash For Free policy in a less benign set of circumstances and less control than we are used to.

I can't think of a lousier set of circumstances to start into the Holiday Season with short of being at war. oh, yeah.....

http://www.manufacturing.net/article.aspx?id=224838

http://www.bloomberg.com/apps/news?pid= ... A4qY0M7Xyw

http://www.theonion.com/content/news/u_ ... e_building

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

http://www.norges-bank.no/templates/art ... 75658.aspx

http://www.ft.com/cms/s/0/38164e12-c330 ... ck_check=1

http://www.bloomberg.com/apps/news?pid= ... T5HaOgYHpE

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

Bad News

Set up for some serious downside. I'm all but out of stocks and getting outa bonds....

Stay Tooned....

( 3 / 1393 ) ( 3 / 1393 )

Tick Tick Tick..... Earning Season Starts Inna Middle O' Da Week. Is My Strategy Deer Inna Headlights? A Rational Approach To A Critical Juncture Of Risk And Reward? Or The Result Of Random Neural Output From The Brain Of An Old Broken Down Pipefitter With Too Many Nights Of Sex, Drugs, And Rock 'n Roll And Too Many Days Of Twistin' The Wrist An' Chasin' Down The Racer Ahead And Runnin' From The Racer Behind...?

Saturday, October 10, 2009, 04:52 PM

It's all fun and games until someone gets hurt.

-- Mom

Chartz An' Table Zup @ www.joefacer.com.

We are half a week from a fulcrum point. Think of a hallway with a door at each end. Ya open the door, walk through to the other door , open it, and walk through. Now think of the hallways set up in haunted mansions as death traps. Hinged in the middle, they are as solid as can be for step after step, until you take the first step past the middle. Then you are fucked. Think of Wednesday as getting close to the middle of the hallway. There are three hinges on the far door. Is there one inna middle of the floor?

Alcoa made 4 cents a share last quarter instead of the 9 cents a share loss that the street expected. The revenue was higher that Wall Street expected by 1.5%. But it was still down by 33% from a year ago. So the profit was made by grinding suppliers, closing plants, and laying people off. There is demand and there is a worldwide recovery under way. China is the difference. There will be more profits and more business done. Demand and prices will rise for raw materials and finished goods. The question is, will there be a national recovery here too and will future business and profits support the current US stock prices? It's a consumer economy (70%) in this country. Do you see a recovery ahead?

What it means here.... http://www.ritholtz.com/blog/2009/10/on ... ntraction/

The writers I read have given up on rationality. It looks like the internet and housing bubble to them. The thoughts are that this will end badly. Or maybe not. Things looked great at the start of 2000 and 2005 and looked like hell in March of 2009. How it looks to you today depends. The question is, is it 1998 or 2000? Is it 2002 or 2006? How long until employment launches skyward or stock prices implode? What would you do if you knew the answer? What would you do if you didn't?

Solid Gold Place To Start For The 401a Participant. http://www.thestreet.com/story/10608336 ... riend.html

http://www2.debka.com/headline.php?hid=6313

http://www.bloomberg.com/apps/news?pid= ... ZfOLKO2Zpk

http://www.msnbc.msn.com/id/33212991/ns ... d_economy/

http://www.cnas.org/blogs/abumuqawama

http://www.jconline.com/article/2009100 ... /910070345

http://www.msnbc.msn.com/id/33157665/ns ... vironment/

http://money.cnn.com/2009/10/08/news/ec ... /index.htm

Pretty much describes where my head is at....

http://www.ritholtz.com/blog/2009/10/th ... t-history/

Extremely thought provoking for the buy and hold 401a participant. It is not without holes, but I've read this book before and I can fill some of them in myself and interpret my way past others.

http://www.ritholtz.com/blog/2009/10/ho ... more-39371

Tick Tick Tick...

http://www.bloomberg.com/apps/news?pid= ... p2WcXs3fP4

http://www.bloomberg.com/apps/news?pid= ... z0hsBTTR4A

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://online.wsj.com/article/SB125530360128479161.html

Main St vs Wall Street

http://www.ritholtz.com/blog/2009/10/li ... nightmare/

I'm watching and waiting....

I've moved my 401a to an outsized position in cash for safety during a potentially very volatile time and for quick deployment back to stocks if an end of year run up starts. I have a smaller proportion in bonds for safety and income. I'm about 1/8 in EuroAsia as a weak dollar/commodity/growth play, and a tag end in small cap cuz I stopped one or two exchanges short. My Website has details to 4 decimal places.

Waiting....

FULCRUM DAY

You better be conservative or ready to turn onna dime.

http://www.ritholtz.com/blog/2009/10/getting-better/

It might be that things "Have Got To Get Better Inna Little While". If so there will be plenty of time for me to get way long then.

WED AM

Intel and JPM report good quarters and good/mixed forecasts. Economically, it is not ragingly bullish. But markets spike up. Fifty percent of S&P 500 revenues come from overseas. There will be profits and revenue. But domestic jobs, government spending, and housing are not going to move strongly in the right direction for a while. I think that realization has yet to be fully appreciated by investors. If the rest of the world raises interest rates or we have a lousy Christmas economy/housing drops another increment when rising rates make the FED/Treasury stop printing money, we could see a serious dip down. The near/long term upside is limited. Downside is less limited. It's about potentials, not imperatives. Listening to what the markets say and being ready to react to protect what you have today is as important as ever. I'm thinking about what to do with the 401a later today.

WED Afternoon....

Definitely feels toppish.

That said, I'm leaning toward tossin' in some 401a

money on the year end run up...

Stay tooned. To be continued....

( 3 / 1501 ) ( 3 / 1501 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar