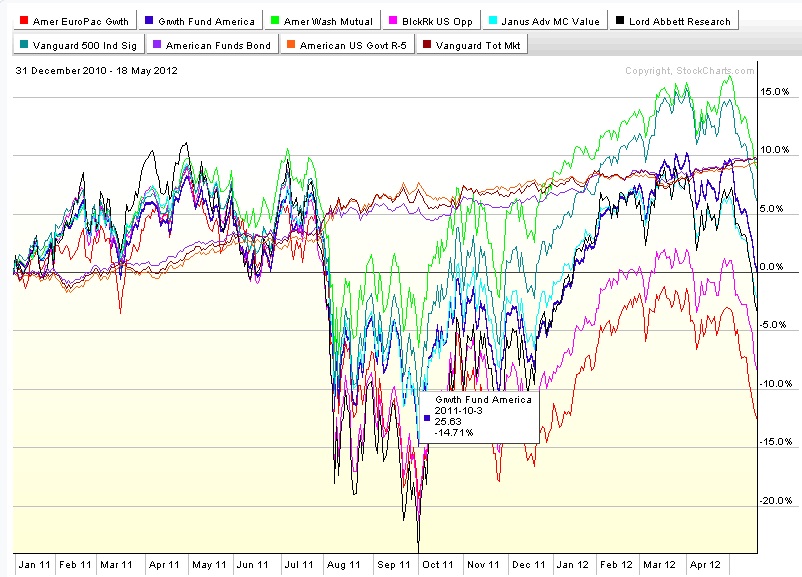

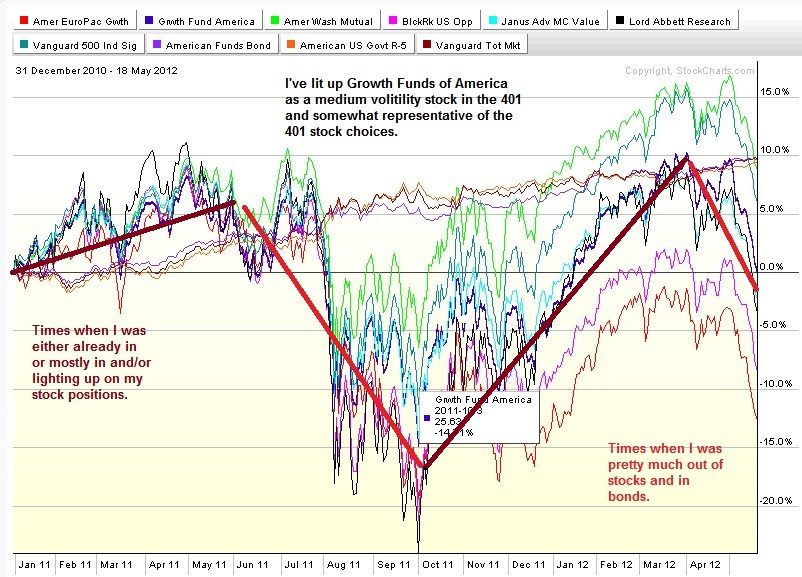

There Is No Point To Making Money In The 401 If After Every Rip, I Give It Right Back On The Next Dip. "Deer In The Headlights" And Passive Acceptance Are Not My Preferred Modes Of Operation....

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

Chartz And Table Zup @ www.joefacer.com

Links

Home

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

Contact Me

Stats

MY WEBSITE

joefacer.com

NEWS AND VIEWS

TheStreet.com

Money

CHARTS

Stockcharts.com

Big Charts

DATA

Morningstar

BLOGS

The Big Picture

Shark Investing

The Reformed Broker

Dash of Insight

This a BLOG about my Union 401 Defined Contribution Plan.

Login

| « | March 2017 | » | ||||

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |

| 02/05/2026 | ||||||

The 1971 version of the Allman Bros Band...The sound board tapes from the F'mo East and West are incendiary. You owe it to yourself....

How's it goin'? Well it's goin' like this....

When The World's Spiraling Down, Save The Best Of What's Still Around... Like Lindley And Cooder.

The Cold and Darkness of the CDO blizzard just starting on the outside vs the Warmth and Light of the holidays in full roar on the inside. Go with what you have today. Tomorrow will wend its own way....

Yee HAAAAA!!! (Famous Chinese Rodeo Cowboy. Son Of Waa Hoooo.)

How's it goin'? Well it's goin' like this....

When The World's Spiraling Down, Save The Best Of What's Still Around... Like Lindley And Cooder.

The Cold and Darkness of the CDO blizzard just starting on the outside vs the Warmth and Light of the holidays in full roar on the inside. Go with what you have today. Tomorrow will wend its own way....

Yee HAAAAA!!! (Famous Chinese Rodeo Cowboy. Son Of Waa Hoooo.)

Total: 121

Today: 102

Yesterday: 19

Today: 102

Yesterday: 19

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... and his 401 Defined Benefit Plan.

Jes' Yer Friendly Neighborhood Ol' Broked Down Retahr'd Union Pipefitter...... And His Defined Benefit 401 Plan

joefacer.com/pblog - Page Generated in 0.0214 seconds | Site Views: 121

Calendar

Calendar