| |

Caution often makes you feel stoopid 'cuz while you stand aside, everyone still out there looks like a money making genius. But when bad stuff DOES happen, you look like a genius. Therefore, the object of the exercise is not to let caution dig you too deep a hole while you wait for your turn to look smart...

Saturday, April 21, 2007, 02:32 PM

Charts and tables up. more to come... 4/25/07 I'm back up to 90% stock/10% cash as of the end of today. The market keeps teaching a lesson that many market participants don't want to learn. That lesson is that it is not going to go down until it is good and ready to.

It obviously doesn't care too much about the fuss over housing, slowing retail sales, persistent inflation, a weak dollar and cooling economic growth. The market is focused on generally good earnings reports, and it doesn't much matter if you think that is reasonable or not.

The market is so frustrating and so potentially lucrative mainly because it is not easy to understand. I can seldom remember a time when there have been more bears scratching their heads over the persistent strength than we have now. Despite downright compelling logic, we just keep on working higher.

Of course, in the perverse manner that the market works, the fact that so many doubt that we can keep going is probably keeping things going as it ensures a healthy supply of cash on the sidelines to serve as support.

Reverend Shark from Real Money

There's money being made and not by me. That's enough of that! Deal me in... But I might still be late to the party. So I'll hang out by the door and I'll be especially ready to bail out on a moments notice...      ( 3.1 / 1371 ) ( 3.1 / 1371 )

It's Tuesday after lunch sidereal time and I'm rubbin' my eyeball across some charts and tables when I had this thought.....

Saturday, April 14, 2007, 02:57 PM

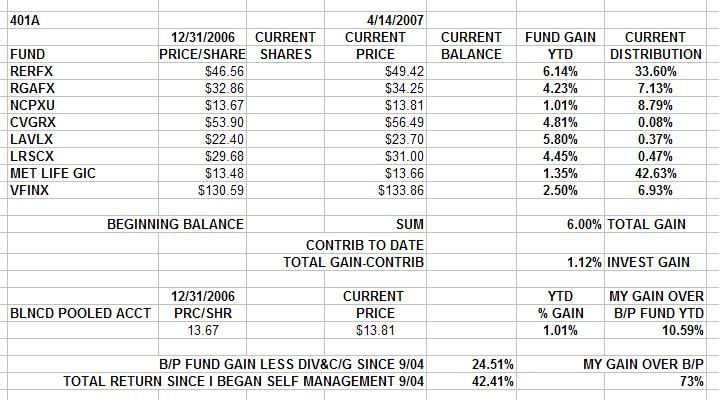

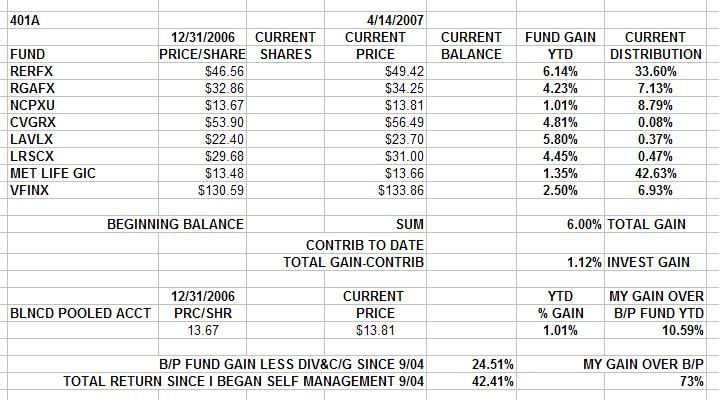

Check it out...Clickonnit!  I'm not doing very well so far this year for all my efforts. So it goes. There's this housing bubble that's just starting to unwind in some US real estate markets, and there's big time deficit spending by a Republican president that's lookin' like it has the possibility to crater the economy. A lot of the world's manufacturing has long since gone to China and as our economy slows, raw material prices rise because we no longer are the main driver of the world economy. Hell, US housing is feeling the pain and copper prices are up. China's on the come and India has just put it's head down. Yeah, i know, mixed metaphors, and it used to be when the good ol' US of A sneezed, the rest of the world caught a cold. Now when we sneeze, everyone else partys on... Basic materials and energy now have a life without US. Besides, oil is up and the established political and economic order in the US is going to hell big time because we are bogged down in a land war in Southeast Asia and and... Oops! FLASHBACK!!! FLASHBACK!!! Too many drugs for too many years!! Or just maybe it's not a flashback. Maybe it's just this generation's version of living with a stonewalled and holed up Nixon Administration goin' down in flames... I meant to say " the established political and economic order in the US is going to hell big time because we are bogged down in a land war in the Mideast." Anyway, The price of leaving the party too soon is to be stuck outside watching everyone else party on. My portfolio performance is pretty limp as of April and I got my nose pressed to the window watchin' everyone else party on.... The possible upside of sobering up on the lawn is being able to walk home on your own a little later while everyone else goes to the slammer on their way home... If bad things happen, I'll be able to get back in to the market at much lower prices. There's an election coming and there may be one more pop before we work this out. Or not. I'm pretty much in a holding mode while I wait for clarity. I'm no longer 100% up over the Balanced Pooled Fund and my advantage is bleeding away. But I can live with that because I'm long in the tooth enough to have sat through the earlier version of this movie before and it didn't end well.... The future will tip its hand in the next few weeks. Stay tooned.....      ( 3.1 / 1506 ) ( 3.1 / 1506 )

Earnings reports start next week. click.click.click.click.click.click.click.click OVER THE TOP!! YEEHAAAA!!!!!!

Sunday, April 8, 2007, 04:15 PM

Charts and tables up. Taxes done. So here's what I see....

As per the COFG ESSAYS elsewhere on my site, there was this dotcom bubble and the ensuing dotcom blow up. I was on the periphery of all that. I was working in the southbay and I worked OT hours out the wazoo with a thousand others at wafer fabs, chip tool makers, and server farms. Server farms being built in one of the highest priced real estate areas in the USA and the one area with the most expensive and unreliable electric power systems??!!!? Castles built on sand, ya know... My middle son was a dotcommie at a startup and worked side by side with future dotcom millionaires. It was an amazing once in a lifetime time event.

It was unsustainable and the whole thing crashed. We had the dotcom depression in the Bay Area. The first guys in and out made it away with millions or jail sentences. I met a friend of my son's who looked like a barefoot hippie less the flowers and long hair. He was a millionaire at 26. My son was 9 months late to the party and ended up just an ordinary working guy and the company he worked for melted down. The stock market bottomed in 2003 and there was blood in the streets (Wall Street) and everybody figured ya couldn't even sell the country to the Japanese since they'd crashed the previous decade and it didn't look like they'd ever come back. The Japanese took rates to below zero and they couldn't get anything going even after a decade of that. It was a commonplace worry that the USA was going to that particular hell too. The Fed panicked and drove interest rates down to one percent and started to inflate the national real estate bubble in place of the local internet bubble. In other words, the Fed spiked the punch bowl.

So we had us a real estate party. In 2005 the house next door sold for 80% more than we'd paid for ours five years earlier and 30% more than a nearly identical hose on the next block went for the same week. That was fun bubble time too.

That was about when we had the first fight at the Real Estate party and the first throwing up passed out guest on the couch. Things started to go south early/mid last year, but ya party on cuz it feels so good. Ya gotta job, ya can get a loan, ya can buy a house or three. If ya can't get a loan, ya get a liar's loan. or, someone get's you a loan. Or the builder loans you the money. Over the last 6 months, it's become apparent that we've been listening to sirens and not the band and that ain't more party goers knockin', "Tha's the COPS (hic)!!!!!

So the subprime and alternate A market are throwing off bankruptcies. A sizable portion of the economy (housing) is beset with 8 months of inventory and worst case, we could see three to four times the yearly sustainable demand in housing up for sale at the same time. And there is the matter of an estimated $565 billion of development loans outstanding between the developers and the banks. This could get real bad. At the least, we have a year or two of declining earnings growth in much of the economy and that probably will lead to a lot of future value priced into stocks coming out of the price. Or we could have a bank crisis like the Savings and Loan crisis of the 90's.

The question is, given that the US no longer drives the world economy like it used to because it ain't the same world, has the game changed enough to pull us through this rough spot with just a little turbulence? I dunno.

But I don't trust that forward guidance will be good enough for the companies about to report. So I'm in mostly cash instead of exposed to domestic stocks, until I get clarity. And I'm moderately exposed to foreign equities because there are a lot of people in a lot of places who are hankering for the middle class dream and a lot of already rich and powerful guys are going to get a lot more rich and powerful helping them get there.

Of course, I could be wrong. If so, I'll see that it's not working and change directions before too much damage is done. Or maybe it's just my timing and I'll just need to pull in my horns for a while. Regardless, I gotta plan and the tools to get it realized as well as the ability to turn on a dime if that's the smart move. So for now, i'm waiting and seeing...

[ view entry ] ( 1059 views ) [ 0 trackbacks ] permalink      ( 3 / 1492 ) ( 3 / 1492 )

Spring has sprung, Iran is holding Western hostages,oil prices are up, real estate and lending are goin' down, bad loans are ticking in the banks. we're bogged down in an overseas civil war, we have a Republican government imploding, the Demo's are about to have a bloody campaign between non-compelling candidates. Welcome to 1969,70,72,'76,'80,84,91 and a lot of other bad years.

Saturday, March 31, 2007, 02:55 PM

"Life is tough, but it's tougher when you're stupid."

-- John Wayne

Charts and tables up. I've been almost exclusively long from 9/04 to 2/07 and I'm up 40% to show for it. Now I'm at 70% cash down from 90% cash to 60%cash back to 70% cash all as of last week. And it's all because I'm concerned about the future...

It's time to think and write about creating a framework of expectations for the near and far future. With the expectations set down on paper, a plan as to what to do will pretty much follow. Then I gotta see what's achually gonna be comin' down. That'll measure how well my expectations are bein' met. And that will be the key as to figgarin'out whether or not executing my plan will cross that fine line between brilliant and stoopid. Stay tooned. Doin' my taxes take priority...

[ view entry ] ( 1019 views ) [ 0 trackbacks ] permalink      ( 3.1 / 1415 ) ( 3.1 / 1415 )

What everybody wants is to be given is the key to always winning with minimal effort. What they get is....

Sunday, March 25, 2007, 04:35 PM

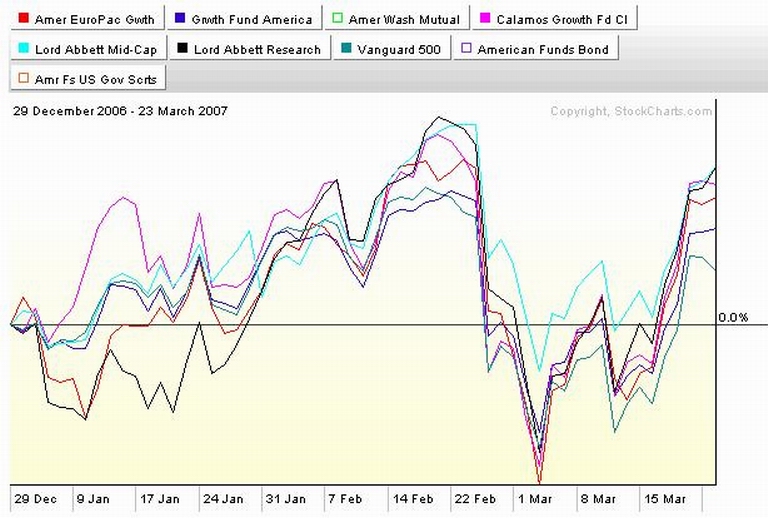

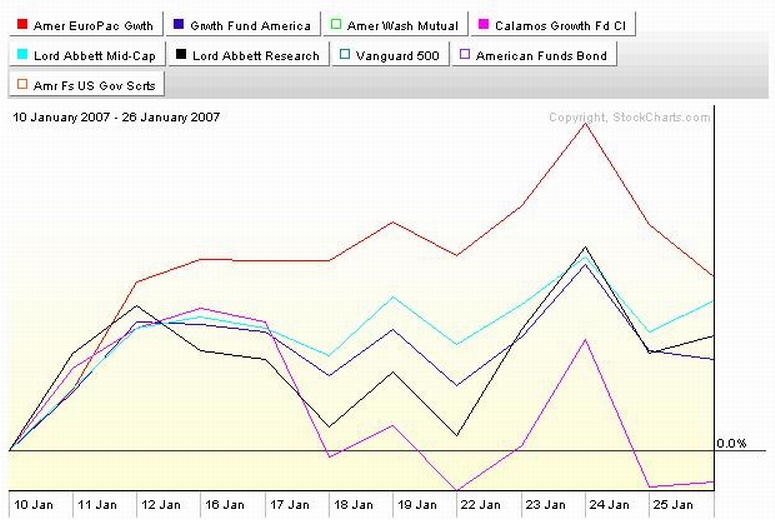

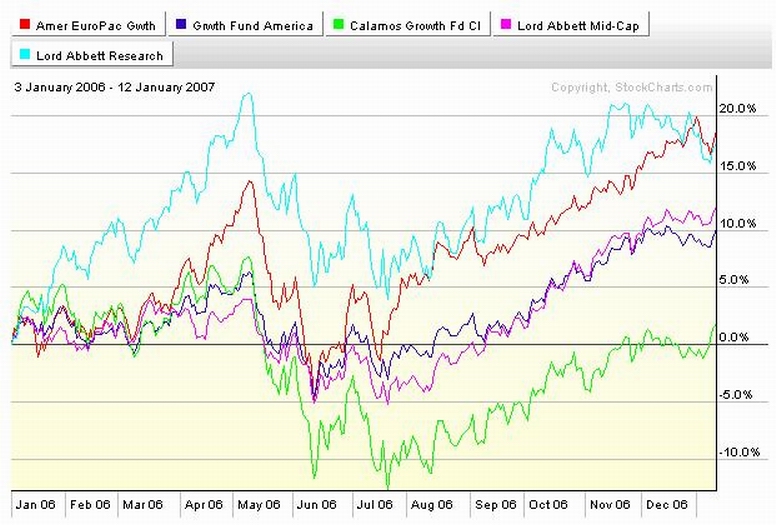

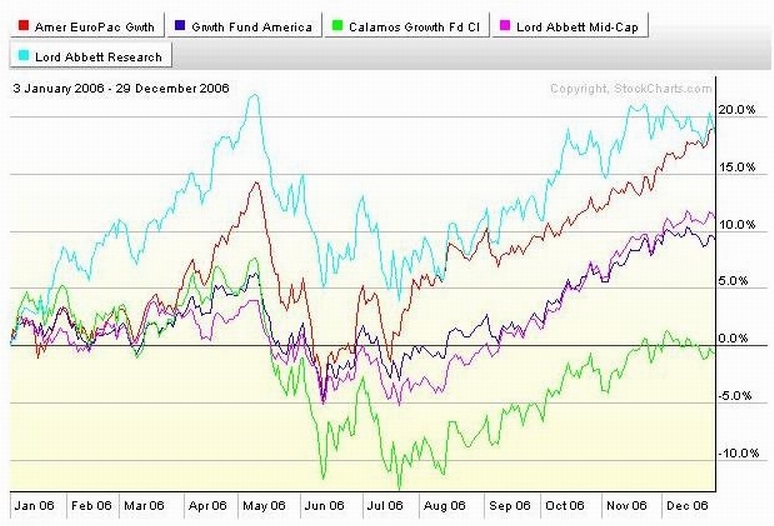

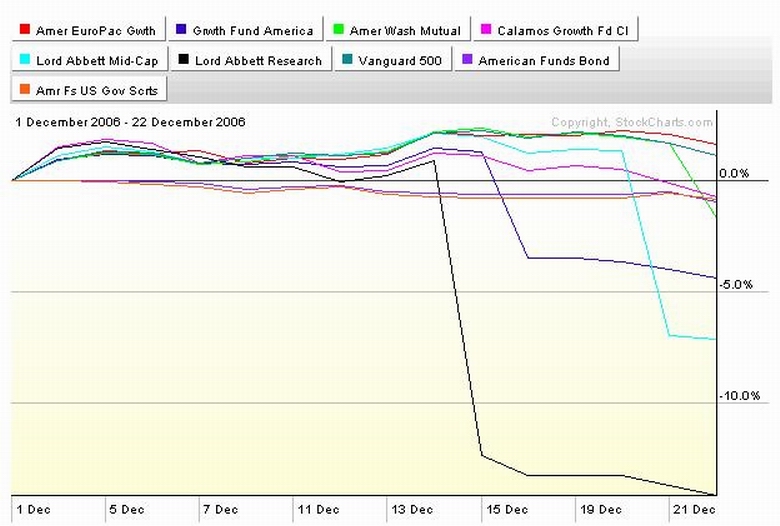

Charts and tables up. At the end of last week I went from 90% cash to 60% cash. The rapid trading rules locked me out of my preferred funds for another week. But there still was a way for me to get back in the market with effective exposure to the current upside movement. Here's how it's done....(CLICK IT)  Note that Europacific and LA research have been smokin' hot. I've been big but not exclusive there. Risk and all that. American Growth has been hot but has not been stellar lately. So I've lightened up there recently. Vanguard has lagged overall but has heated up recently. I've not been there because there have been better places to be. So both funds were available for me to invest in when we got the Fed induced updraft last week. So I put 1/3 of my cash into the those funds. Check out what's been happening this year...(CLICK IT)  We had a whoosh down the last week of February. Was it going to be as big as last year's whoosh? We don't know that yet. Soo... I prepared for the possibility. I went to cash with the ability to immediately get back into the market if it was a false alarm. I'm equivocal about what kind of alarrm it was so I'm 1/3rd back in. Iran, housing, interest rates, credit, White House under siege, etc on the downside. World growth being a runaway locomotive, new technologies, new data distribution paradigms on an industrial and investment level, revolutionary changes in media and politics, on the upside. Whatcha gonna do? Stay tooned....      ( 3 / 1476 ) ( 3 / 1476 )

Da Saturday website an' blog thing 'n all that that entails, I mean, ya know what I mean?

Saturday, March 17, 2007, 03:04 PM

"The master in the art of living makes little distinction between his work and his play, his labor and his leisure, his mind and his body, his information and his recreation, his love and his religion. He hardly knows which is which. He simply pursues his vision of excellence at whatever he does, leaving others to decide whether he is working or playing. To him he's always doing both."

James A. Michener

Charts and tables ready.

But this time it's the 3rd party website creation/editor service that I'm usin' with my host site that's down. Bummer, dude, I mean it's all negative downer kinda stuff an' all that an' it's hangin me up...

Chartz and tablez up.

More to come....

[ view entry ] ( 959 views ) [ 0 trackbacks ] permalink      ( 3.1 / 220 ) ( 3.1 / 220 )

Tuesday, March 13, 2007, 07:38 PM

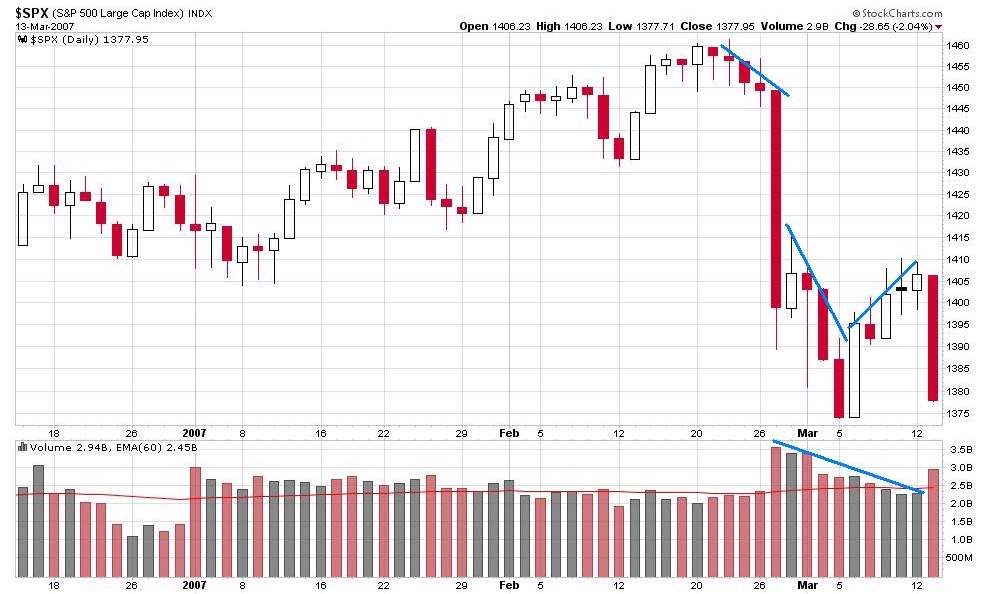

Kinda saw that one coming....Click onna chart...  Notice when the downturn started and how volume stayed steady... Notice the one huge drop on 2/27 and the big volume that day as a lot of people bailed... Notice the low volume bounce. The market started back up but on declining participation... There was no real enthusiasm and a lot of trepidation... Then today.... the other shoe dropped and a lotta people sold. I'm still cash big time. This has NOT played all the way out. I'm watching.... I will buy back in. It'll be when I think it's the right time and at my pace and on my terms. Stay tooned. See ya at the hall.      ( 3 / 1405 ) ( 3 / 1405 )

Never A Dull Moment. GUARANTEED!!! Watch This...........

Saturday, March 10, 2007, 01:40 PM

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all." -- Harry Schultz Chartz and tablez nowhere. For once it is not K and G hangin' me up. This time my charting service is installing a new UPS for their servers.CHARTS AND TABLES UP!A buddy of mine went to about 90% cash in mid Feb. Another buddy went to cash on the first bounce. I went partially to cash Jan 10 and then in and out for a while and finally all the way to cash on 2/28, the first big LOOOK OOUT BEELOooow!!!!!.... I've been basically all cash since 2/28 and as a result I missed some of the downside and all of the bounce. It's cost me between $60 and $100 in lost opportunity as of today. It bought me at least a coupla grand worth of peace of mind. Every day you hold cash or bonds, you shoulder inflation risk as the return on your money does battle with inflation and fees. Every time you own stock, you shoulder investment risk as your stocks might go down and fees eat at your balance. Every time you are out of the market, you shoulder opportunity risk as what you could have had if you had made more right than wrong decisions is lost forever. It gets really hairy if you invest in offshore stuff. International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

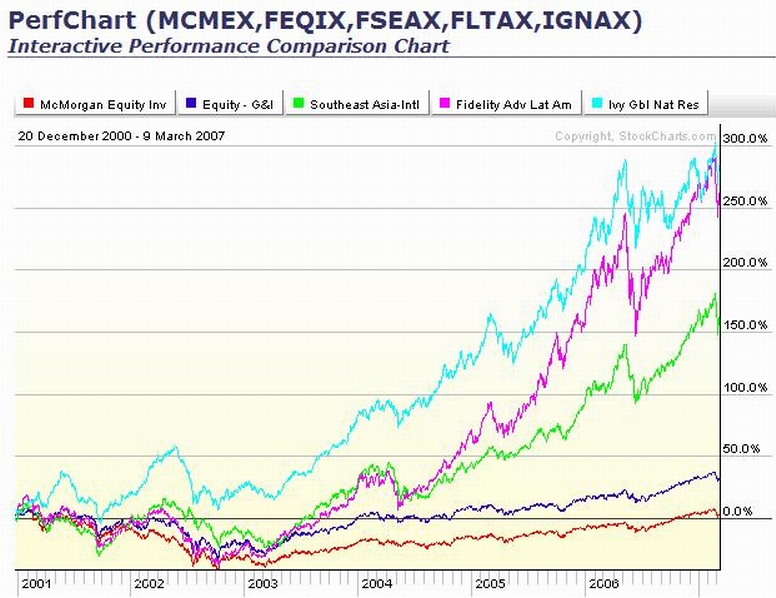

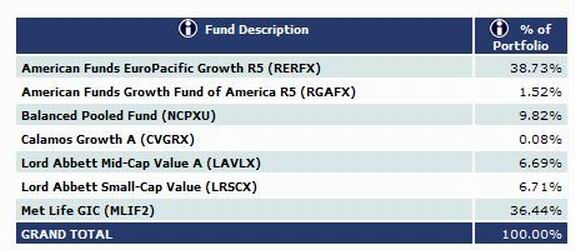

--Howard Simons But ya ain't gonna live happily now and happily ever after on passbook rates unless you're already retired and well off, so you have to choose what risk you want to shoulder and when it makes sense. So if you follow what I post, you'll see that I have tended to be fairly overweight in the RERFX foreign stock fund choice in our 401a. In fact when I started to go to cash the first time this year, at one time the RERFX was the only fund I kept. Here's why; AMG Data Services provided fund flows for the week ending 1/31/07 record that domestic equity funds excluding ETF's had a net cash outflow of $55 billion dollars and non domestic funds had a net cash inflow of $2.56 billion. This is not atypical. I've been watching money flow overseas for a while now. Big money and smart money and hot money has been in natural resources and the hottest international economies since the dotcom crash. You don't think they rode out the crash all the way to the bottom here, did you? That's the little guy's job. Check out the chart of the McMorgan big cap equity fund vs a Fidelity big cap, South East Asia and Latin America funds, and a natural resources fund... CLICK ONNIT!!  First off, finding that the Fidelity fund is a better preforming fund than McMorgan is no surprise. Second, check out this chart and the ones on my website. The action has been better some places than others. Specifically, and until recently, away from the big caps. That's why the American Funds EuroPacific and the Lord Abbet Small Cap have excelled. And that's where I've been leaning the hardest. But that's not the only place I'm putting my money down. The word risk is all over the page here and I try to listen to people I respect. That's why I've avoided the losers and underperformers and put my money in more than one winner. I'd have made more if I only had money in the best performing fund. Instead, I've trailed the very best two funds despite being heavily invest in them. That's the price of discipline and diversification. And discipline is why I'm in cash now. Another key to what I'm doing is the word "flow" as in "fund flows". Fund flows in drives up prices and create a self reinforcing dynamic. Think homes in Palm Beach. http://www.palmbeachpost.com/business/c ... _0226.html Fund flow statis creates a whole lot of tension and pretty quickly creates flow out. Fund flows out drive prices down and create their own dynamic. Every game comes to an end. There will come a time when the flow of funds out will scragmaul what they built up in a relative eyeblink. Think homes in Palm Beach. So you get while the getting is good and look away from your money at your risk. You can't do that with your home. Some things ya gotta ride out the ebb and flow. But depending on circumstances and inclination, and little time and energy reacting to the ebb and flow in the 401a can be well spent. I'm kinda expecting some more downside. But cash is for buyin' so I'm looking for an opportunity to do so. It's the ebb and flow thing, ya know? If we don't go to zero, we'll go up and there'll be an other opportunity to make money. And then when they go down, we'll get an opportunity to sell and keep some money. The wheels on the bus go 'round and 'round..... See ya at the hall.

[ view entry ] ( 1146 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1090 ) ( 2.9 / 1090 )

The Bad News Is, Ya Ain't Seen Nothin' Yet. The Real Bad News Is, I Think It's Just Started...

Saturday, March 3, 2007, 02:18 PM

Just remember one thing: there are no good stocks. They all suck. Even those that are making you money are going to turn on you sooner or later. The only stock you should say anything good about is the one you no longer own that made you money.

--Reverend Shark

Charts and tables are up. Our "SPECIAL" day from last week continues to repeat like a bad burrito. Look at the charts for our funds since June of last year. We made a very nice return and the overriding direction for the funds was up. There was little to no give and take, the swings in price (volatility) were muted, and those down side moves were stored up for the future and did not fade away into the aether. So all the medium size swings around the mean we haven't had have wound up and finally been delivered all at once and the direction is down. Successful investors with profits to protect and fresh money invested as of the new year are puking the positions back out NOW and going to cash or bonds. There is a lot of fear and the call is "Get Me Out NOW, I don't care about the price!!!! And it is world wide. It started in China and is washing in waves around the world. At the same time, all the talking heads and pundits that talk to the individual investor are advising caution, not to panic, and to hold on for the long run. "Don't react, ignore the man behind the curtain, everything will be fine once this is over.". That's all fine and dandy to those to whom that makes sense. Me, I'm 80% cash as of last week and going to even more cash tomorrow (Tues). That's saved me a tidy sum as of today.

Selling when it makes sense is the other side of buying when it makes sense and the alternative to not just making my 401a a one decision thing. This is what I gotta do. I believe our sticking with McMorgan as our sole money manager for so many years cost us big time and I'm putting in the time and effort now that I should have put in then.

[ view entry ] ( 954 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1435 ) ( 2.9 / 1435 )

SO FAR, SO GOOD....OOPS!!

Wednesday, February 28, 2007, 01:36 AM

Well, wasn't today special. I've got a full plate tonight and I'm busier than a long tailed cat in a rocking chair factory. But I've had the time to set up the trade to go to 80% cash in the 401a at the close of the market tomorrow. I expect to check the market at lunch tomorrow and decide whether to let the trade trigger. There's always the chance for a miracle. But I'll most likely let the trade go through.

I've been 100% long at times since 9/04 and mostly very heavily long most of the time.

I expect to balance my WFO long positions when the market is red hot with my best tortoise imitation when the market is not, or in the bomb shelter when the market is looking for blood...like now.

I've got the ways and means to put it all back in the market in a day if it works out to be the best thing to do. So I'm not risking much opportunity to be out of the market for a day, a week , a month or longer at this point, and I'm definitely avoiding falling stocks when I'm mostly cash. I'm focussed on keeping what I've earned since 9/04 and not leaving any more money than I have to on the table...

This ain't my first dance and I understand that stocks aren't GDP futures and are on occasion only tenatively related to the state of the country's or the company's business. So it ain't necessarily the end of life as we know it. Although it might be. It definitely is a smoking crater. I'll hafta see what it looks like down the road. So I've got a mission and a plan and the mindset to see it through. And I'll write about it here. See ya at the hall.

2/28/07

We had a bounce. Looking at my IRA's and my trading acount and the 401a, I'm unimpressed. The bleeding stopped, but the bounce may be a dead cat (parrot) variety. The market character has changed. Since summer of last year, anything but blind commitment to buying and holding made you a loser. Yesterday that changed. I suspect a lot of investors/traders still want out and are waiting to get even before they leave. I think they will capitulate over the next month or so and sell, especially if the market drifts down... I think there will be mutual fund redemptions coming in over the transom this weekend. More selling Monday. I've got a lot of buying power and after the selling stops, whenever that is, I'm going to use the buying power to start the whole investing/trading process over again.

Or, there's many tons of US investor money overseas. (More about this this weekend) If that money comes back immediately and goes into the domestic market, it might counter the selling and send the market up bigtime. In that case, I'm back in as soon as the money shows up and the market lifts. There's a lot of different possibilities. I think about them all, but I only play the ones that actually happen.

My returns on my 401a are excellent. It looks like they would have been even better if I'd just dumped all my money into the Aggressive Portfolio and left it alone. But there are times when I feel real cautious. Like when I went partially to cash January 10TH. So I act on it and sell. It's cost me some money each time I did that before. Regardless, I think it's the right thing to do. Let's see how it works out this time

[ view entry ] ( 1050 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1479 ) ( 2.9 / 1479 )

Another week, another battle. First, to minimize risk and second, maximize return.

Saturday, February 10, 2007, 02:16 PM

"Success in almost any field depends more on energy and drive than it does on intelligence. This explains why we have so many stupid leaders."

-- Sloan Wilson

Charts and table up....

Another week, another battle. First, to minimize risk and second, to maximize return. Understand that when I'm talking about risk, I'm talking about two kinds of risk. The first kind of risk is outright losing money for no good reason other than laziness and ignorance. Like when we lost approximately 25% of our pension funds between 2000 and 2003 by not knowing that our money manager was underperforming. Or by being long stocks regardless of whether or not that is working. The second kind of risk is not making money for no good reason other than laziness and ignorance. Like being heavily invested in bonds when that is an inappropriate allocation of funds for your particular circumstances. When I'm talking about maximizing return, I'm taking about making the effort to take care of the pension savings that you worked for. If you recount the money you get when you cash your check and when you get change, fix the roof when it leaks, and change the oil when it's time, taking care of your 401 is more of the same. And not much more work.

I've way over performed since 9/04 as per the charts on my site. That was easy. Now it gets harder.Again as per the tables, I'm allocated to primarily one stock fund and 30% cash. It's cost me return to date, as my personal account is lagging the returns of all the individual stocks funds.

It's like buying insurance. The insurance premiums are a waste of money... hopefully. Some times you are unfortunate enough to have the insurance pay off. I judge that the risks in the domestic market are outsize to the downside, so it's about cash. If I'm right, I'll make up some of the returns I've missed out on. If not, I've traded a lttle money for peace of mind. It's not like I haven't been on the other side of the trade before.

[ view entry ] ( 1033 views ) [ 0 trackbacks ] permalink      ( 3 / 1379 ) ( 3 / 1379 )

Testing...Testing...One, Two, Three....Anybody out there?

Monday, January 29, 2007, 12:40 AM

"Change has a considerable psychological impact on the human mind. To the fearful it is threatening because it means that things may get worse. To the hopeful it is encouraging because things may get better. To the confident it is inspiring because the challenge exists to make things better." -- King Whitney, Jr. Charts and tables up late on a Sunday night....Yet another Katastrophic Komputer Katastrophe this weekend. I'm switching over to a new system later this week. Makin' a change....ya know. Things will probably be quiet until I'm 100% up....Or not. Check out the chart. This is the performance of the funds in my 401a since I went big to cash, heavy on the rerfx, and a just a little here and there in the other funds. CLICKONNIT to see it better...  So far, so good. There's a lotta year left to go. Eyes open, readin' and thinkin', ready to play what I think offers the best reward with the least risk. And don't EVER think that doing nothing reduces the risk. Events around the recent election got me to calculating what sticking with McMorgan as our sole investment agent cost us versus some more responsible investment strategies. Did we even CONSIDER making a change? 1/31/06 Moved about 10% outta cash and into LAVLX.      ( 3 / 1352 ) ( 3 / 1352 )

Can there be any doubt about the '08 elections?

Saturday, January 13, 2007, 04:51 PM

Charts and tables up. There's big stuff going to start appearing here starting this week. I'll start with a new approach to running the 401a when things get volatile. We had a big hiccup in May and a very solid and unwavering run up into year's end starting in July. There is every reason for investors to lock in profits if they get spooked and there are a lot of reasons they may get spooked. Read the papers. Also realize that they need to cash out of current positions to buy new ones. Even if things go OK, once enough people start to lock in profits, it can get ugly and precipitous. Been there done that. Check out the chart. Looks like at least a short term top and like things are starting to roll over to me. I've got something to protect.  I moved six of seven positions to almost all cash or all cash. I've only stayed with one heavily invested position. I'm locked out from reinvesting in five funds for 30 days as per the rapid trading rules. Did I do the right thing? I dunno.... Do I know what to do if it was the right thing to do? Yup. Do I know what to do if it was the wrong thing to do? Yup. Stay tuned and we'll all find out what the future brings. Check here this upcoming week.....      ( 3 / 1385 ) ( 3 / 1385 )

Back to the same ol' same ol'. The new year is here and it looks a lot like the old one.......

Saturday, January 6, 2007, 05:08 PM

Charts and tables up. The numbers always look a little wonky for the first month or so; The B/P fund is down a tad and I'm down about 1%. So my percentage is 659.7893% worse than the B/P Fund over the three trading days of this week. That'll change. I manage my family IRA's and so I take a look at more of the market than most people. I may step to the sidelines for a spell. You'll read about it here if and when.... Stay tuned. I had a Kataclysmic Komputer Katastrophe this weekend. I lost a portion of the boot sector on my hard drive and all access to the internet and my files. I've gotten almost all the way back but at the cost of a coupla 3-1/2 hour of sleep nights. So I gonna be curt. I'm not comfortable about what I'm seeing in the market and the geopolitical arena. I'm situated much closer to mostly cash than usual. More about why later. I may not make this month's Union meeting behind this either. Or not. We'll see... What did and where I am is shown below...       ( 3 / 1369 ) ( 3 / 1369 )

Saturday, December 30, 2006, 03:21 PM

Charts and tables up. I've been locked in a death struggle with a virus or two for the last two weeks. I'm still alive AND slightly less miserable. So there may be a future in which I can see across the room and get up and walk there without taking a nap before and after. Or maybe not. Screw it. I'll have all the time in the world to rest in about 45 years. I'll catch up then. In the meantime, there's a ton of updating and new stuff to do on the site for the new year. I'll post updates here as I make progress. There's a new entry on the COFGBLOG ESSAYS page of the site, there'll be an update to the downloadable EXCEL spreadsheet, more stuff on the REFORMING A PENSION FROM THE INSIDE page, and I gotta get together a primer on HOW TO FIGURE OUT WHAT JOE FACER'S DOING AND WHY IT WORKS FOR HIM (and what makes you different and how that would affect what you'd do if you wanted to do something like it). Stay tooned for more stuff to appear this weekend. I've gotten a lot of housekeeping stuff done as of 1/1/06 noonish. I've editted almost every page. There's more to come... Cap gains have been paid and posted to the 401a accounts. The charts have dealt with it and they look like they are supposed to without the cliffs at the end of the year. The B/P Fund did pretty well this year and set the crossbar up pretty high for self management. I'm pleased with where I stand. But I'm not that pleased... Goals in investing can be dangerous. That's how all these famous hedge fund blow ups like Long Term Capital and Amarenth happen. Someone figures out a system to make money regardless of how the market does, they open up a hedge fund, and they promise high returns to smart money(meaning BIG money that demands quality active investment and real returns rather than excuses). They either name a figure or their strategy gives them superb results for a while. The funds seem to end up levering up big at some point because they either sense the chance to score big or because otherwise they won't meet their promises or match their records and smart money does't stick around to hear the excuses, it walks. And the hedge funds get handed their head by the market just like it does to everyone every so often. The hedge fund and the partners lose money, the partners take their money, if there's any left and walk, the funds close up shop and careers end. The markets are like the ocean. You can be smart about currents and winds and you can make the most of what you've got to work with and at times shine like a star. But you always have to remember that there will be times when being still afloat with almost all of what you had last year will be a brilliant victory. Take it and be proud of still being in the game. The goal I have is to do the smart thing as often as I can and make good progress whenever the wind is at my back, and if what I'm doing isn't working, stop doing it before I get hurt too badly and figure out what will work. I try hard to make money and I try hard to break even as the alternative. I try to be allergic to losing any money When I first looked at this year's numbers, I was disappointed. So after all that setup, was last year a huge disaster? Nah. Over the last two and a quarter years, I've gotten 9%,13% and 11% returns. The 9% return over 4 months was not half shabby. The other two full year's returns were pretty damn good. The Balanced Pooled Fund did 5%,5%, and 9% over that same period. So I didn't double what the B/P Fund did this time like I've done twice before. I'm still up around 40% over the 2-1/4 years and way ahead of the B/P Fund. I was up 19% over what the B/P Fund did in '06. I just got a lesson in perspective. I did good. So'd the B/P Fund. You just don't stand as tall when the other guy ain't lying down... Could I've done way better? Sure. Check out (Click On) the chart.  If I'd been 100% in the top two funds and I'd played the May/Aug hiccup better, I'd a been up around 40% for the year. So what. That stuff happens only a coupla three four times in a decade and it involves real risk. I've done it before. But I didn't do it here this year. I didn't even try. I'm my own client and I know what's possible and what's smart. Up 40% in two and a quarter years is good enough. If I don't give it back and I can do well enough in future years, that kind of performance will be huge for me compounded 10 or 20 years out. On to next (this) year. I've gotta figure what to do next (now) about my 401a and about the Defined Benefit Plan. Stay tooned. See ya at the Hall...      ( 3 / 1290 ) ( 3 / 1290 )

Seasons Greetings... A Festivus for the rest of us? Gimme a break and a gingerbread man and another egg nog while you're up.

Saturday, December 23, 2006, 04:11 PM

Here's what the current charts show for cap gains hiccups. It's a PITA, but better to have gains than not...Know what I mean,Vern?  Figure that the American Fund EuroPacific Fund does it's thing in the last days of the year, so there's more to come. Charts and tables up. With qualifications... Some of the dividends and cap gains have been paid and the numbers are good. Some may be history but the numbers may not/don't reflect it yet. Complicating the whole ball o' wax is that the markets are a touch flakey right now. So are the down numbers cap gains or the market? It's been a good, but a tough year. There was a huge whoosh down in May. If you were all guts and no brains, you bought back in in August and you look like a genius today for riding the whoosh back up. If you were smart, you waited to see that the re-launch upward of the market was for real and you waited for the first substantial pull back to get in at a reasonable price. That first substantial pull back happened last week. So you looked like an idiot for waiting for the next to last week of the year to make up for the previous 11-1/2 months. the longer you waited, the more you left on the table. This is why you stage the buys. So this week, everybody not in a 401a (k) faced this dilemma... If you were brave (foolhardy), you look like a genius. Now you wait until January to sell and avoid the tax hit this year, assuming everybody else does too. Or if you were late to the party and have damn little to show for it, you wait to sell so what you did make looks as good as it can. Of course, if someone tries to beat the selling rush and sells late in December, they pay the taxes but they may avoid the next whoosh down. Or start the whoosh as everyone tries to crowd out the door first. So expect another whoosh down in January as everybody or only the people who left it until too late left lock in profits. Unless it happens in December. Of course if enough money pours in to the stock market due to the Santa Claus effect or the strong late year run, it may cause a very substantial bounce back from the December selling, if there is any, or swamp the January selling, which there will be some of. Or not. Either way. Most likely. Now if some of the money managers were able to hedge their portfolios with options, then they will be able to .... Nah, I think I'll go shopping instead. If this was easy, everybody would be rich... So anyway, we'll have to wait for the statements to finally get the whole story... and wrestle with what to do about it... I've moved a dollar or two around but I'm standing pretty pat other than bailing on RGAFX to try to game the Dec/Jan sales and putting another dollar back into LAVLX because they might be through with their recent spell of underperformance. We'll see. I'm getting my account balance up where I can't move much of a percentage around without triggering tading restrictions. I feel strongly about it both ways. Finally, there were some thing i was going to do as a Trustee if I got elected. I'm making a list and checking it twice to get started on it. Don't confuse lack of motion with nothing going on. Watch the site. I bumped my contribution up for next year. Hopefully you did too. If you want to know what more there is to do to prepare for your future, get a fast connection, a large monitor, find out when I got a Saturday free, round up about ten other brothers and sisters, and rattle my cage about showing you what I do and why. Iff'n that don't happen........See ya at the hall.      ( 3 / 1336 ) ( 3 / 1336 )

I want to thank everyone for their support in the recent election. I'm still going to get the job done. But it'll be done from the outside. Phase Two starts today..... Check out www.joefacer.com /Reforming a Pension Plan

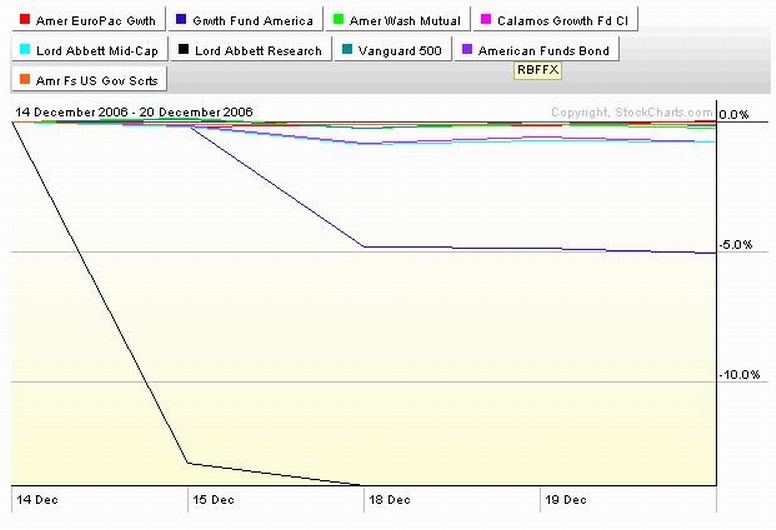

Saturday, December 16, 2006, 01:25 PM

Some charts and tables up. Either the Lord Abbett Small Cap went down in flames big time 13%) in one day (pretty unlikely) or it paid a VERY substantial dividend or capital gains. (PFL). ===It was the latter case, the div/cap gains were $4.531 per share.=== I'll post my account charts and tables when I get it all plumb square and level... Which will be when I can get info on if and what the dividend/cap gains were from KandG or another source. ===Still waiting on this one for the very final good as gold number.=== But, if ya just CAN'T wait, figure Lord Abbett is buying you new shares at the price of 30.07. This works out to about one new share for each six you now hold. Call it about 13-15% capital gains this year. For those who are unclear on what happened; the typical mutual fund has one portfolio of stocks/bonds but many different classifications. Some investors pay a load (commission) upfront, some pay it later on sales, some pay a higher commission, some pay a lower commision, etc. Some of the holders of the fund have to pay taxes on capital gains and some don't. Pension funds tend to use the institutional classification shares of the fund and so probably, most likely, pretty much everyone in this "r or x " classification fund, like 342 members, is in a nontaxable income/capital gains situation. But maybe not everyone. To make the whole thing easier and somewhat transparent, especially given that taxable and nontaxable entities may be in every class of fund, every year about this time, the fund takes the capital gains and dividends made over the past year out of each account in each classification, subtracting the value from the NAV (net asset value). So the price per share takes a hit. In the next coupla three or four days after, they rebate the capital gains/dividend taken out of each account back into the same account but in shares instead of dollars, at the price that the fund was when they subtracted the cap gains... After it is all over, you have the same amount of money but in more shares of a less expensive fund and the goverment and you have the capital gains reported in terms of a dollars/shares number if you indeed have to pay taxes on it. For the 401a, it ain't no big thing. You pay no taxes, you do nothing. For the taxable accounts, they use the cap gains number to report. Note it and stay cool. But it'll get your heart pumping the first time you see it, until you look at the calender. Expect to see it happen once in each fund, providing there are indeed capital gains to report. +++ Growth Fund of America paid on the 19th @1.10 per share.+++ ---EuroPacific pays on or about the 27th.--- Figure that the numbers are somewhat flakey until after it has occurred in each fund and has been recorded and acknowledged. Or you can look away until 2007. The charts look like this... Ya can squint or clickonnit, but then ya gotta  LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY LOOK AWAY!!!!!!! Is Local 342 one of the investing proletariat? The excerpt below is from the link below that... "But they don't seem to be disturbed by the inequality inherent in the financial markets in good times. So long as common stocks are rising and their money isn't obviously stolen -- that is, so long as the proletariat enjoys steady, if unspectacular, returns on its capital -- the investment lower class is surprisingly docile. It's as if the pleasure of any return at all has distracted investors from a comparatively low rate." http://www.bloomberg.com/apps/news?pid= ... nist_lewisWith a $300,000,000 pension fund, given that there are limitations to what we can and should do with retirement money, are our funds being invested to give us the highest return with the greatest safety? Or is there a sizeable "tip" already worked into the tab when it hits the table because we know them and they know us and it's goin' on the union members card where they'll never see it? Good readin' http://online.wsj.com/public/article/SB ... ?mod=blogs     ( 3 / 1302 ) ( 3 / 1302 )

TWO WEEKS UNTIL THE ELECTIONS. SHOW UP AND MAKE YOUR VOICE HEARD.

Saturday, November 25, 2006, 02:33 PM

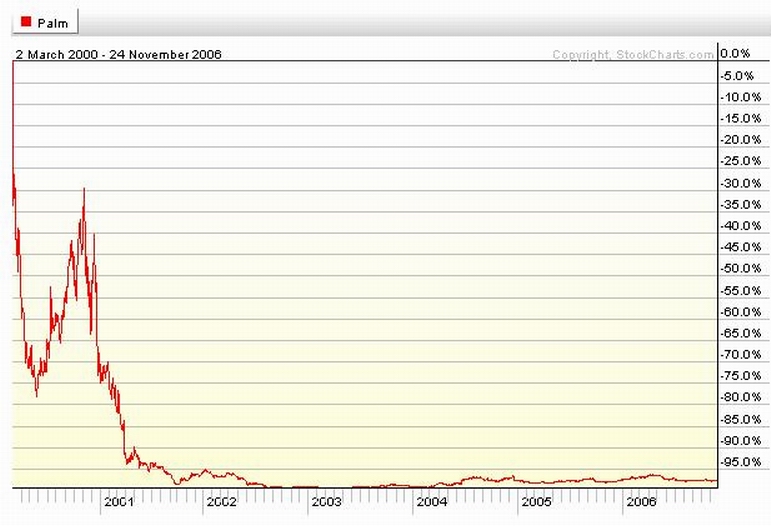

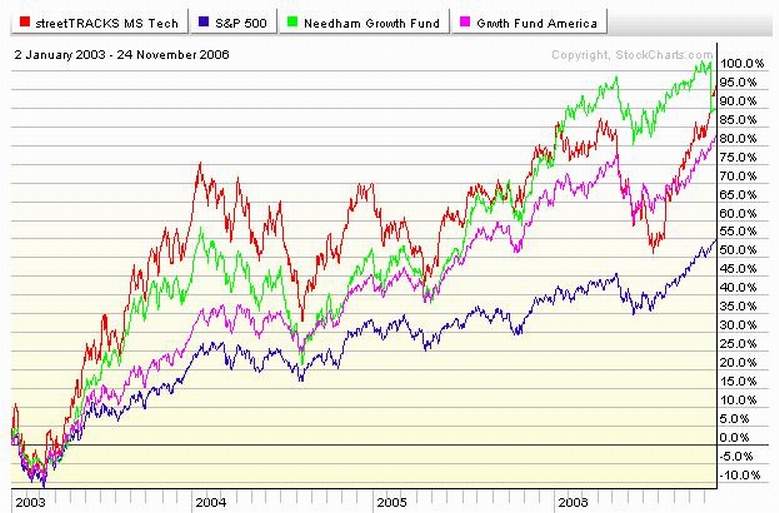

Charts and tables up. I've got a full plate for the weekend. There may be more posted here.....but no promises. My 401 account is long and strong, the return is smokin' and if I keep my head screwed on and don't get greedy, I'll keep most of it if the market starts to go south. I'll keep an eye on it all and let you know. So at the meeting last week, Mike Mammini, the head honcho at our 401 plans showed how it makes very good sense to commit a substantial portion of your savings to the 401 plan. For late starters like me, it makes sense to commit the max. On a good year, that comes out somewhere between $15K and $25K placed in the 401a. He also says that you probably should look at it at least once a year, but probably not more often. After 5 years, that's about $80K to $140K that you've invested in financial instruments that are not guaranteed and have a history of going way up and way down real suddenly over the past coupla centuries. During that time, investing in stocks and bonds has made some people fabulously wealthy and beggared others. What makes YOU more uncomfortable, the thought of having to do a half hour a week of homework to make sure that that nothing bad happens to $100K plus of your money, or the thought that you might not catch a bad thing happening in time to save a substantial portion of your savings from going away forever? Is once a year often enough to look at something so important? If once a year isn't often enough to get your teeth checked, why is it often enough to look at your 401a? The guy from McMorgan tried to scare members with TALES FROM THE STOCK MARKET, stories of tech investments gone bad. His example was PALM, where an investor could have lost 99% of his investment. SCARY!!!!! it's a good thing that McMorgan resisted requests to give us a tech fund to invest in...or maybe not... Check out the charts of Palm and Apple below...CLICKONNIT   Put all your money in PALM and lose 98% of your money. Put 5% of your money in PALM and 5% of your money in AAPL, lose all the money in Palm provided you go deer in the headlights for the two years it takes PALM to go from $1000 to $3, and make 1000%+ (ten times your original investment) in AAPL by holding on for four years. I'll do that any day. It's called diversification and reducing risk to match the reward. It's what a smart mutual fund manager does. And a smart mutual fund manager wouldn't have ridden PALM all the way down FROM $1000 TO $3 and lost all the OPM (Other People's Money) along the way, charging them a fee to do so. Click on the link below. http://bigpicture.typepad.com/and then click on "Protect Your Assets" under "The Apprenticed Investor" section on the right. Learn how it's done. In 50 years of reading a lot of disparate stuff, reading this article is one of the best spent chunk of time I can remember. CHECK IT OUT! Check out the chart below. CLICKONNIT!  Shown is a tech Exchange Traded Fund (ETF) and a tech mutual fund vs our 401a growth fund and the S&P 500. I'm still not clear why we can't have a good tech fund available rather than tech funds used as something to be taken out of the closet every so often to scare us with. And we gotta reconcile Kim asking us to double check our hours monthly because it is the responsible thing to do, and Mike telling us to look away from our investments for year at a time or longer because .... Well I can't figure out why because.      ( 3 / 1444 ) ( 3 / 1444 )

===THE AFTERMATH=== Whatchur left with after all the addition/subtraction/multiplication/ and goezintas are done.

Saturday, November 18, 2006, 01:53 PM

The chart service is working right again. Charts and tables up like their supposed to be. Be that as it may, the Special Called Meeting came down and it was a major success in all ways. The attendance was as great or greater than a typical union meeting and a lot of people stayed to the end. At a few spots emotions ran high, a lot of good information got put out in front of the members, some existing misinformation got corrected, some new misinformation got out and some of it got corrected on the spot. Some more information is still need or is forthcoming. Time will take care of the rest. What's not ta like?

The meeting provided me with some new information and some updates on some existing info. Some of it changed my mind about some things, some of it gave me a new perspective what I already was pretty comfortable with, and some of it further supported my beliefs. You'll be seeing changes in the info on this site and in my campaign literature to reflect that.

Ah got stuff to do, but iff'n the good Lord's willin' an' the creek don't rise, I'll be back this weekend with more right chere, all ya all.

[ view entry ] ( 946 views ) [ 0 trackbacks ] permalink      ( 3 / 1352 ) ( 3 / 1352 )

It's a $400,000 day in the Bay Area. Indian summer and days like today are why your house is worth $400K more than one where the weather is going bad...

Saturday, October 28, 2006, 01:31 PM

Charts and tables up. If you check out my percentages in the various funds you will see that I committed a little more money into stocks and outa cash last week. The last two and a half years, I was pretty much head down and WFO in five stock funds and everything was fine. I was all GIC a coupla three weeks into the May crater '06 and that was cool. But I got overly cautious when we hit bottom and the Mid East went up in flames. I was late getting back in and the last six months have been pretty limp. Again, if things had gone to hell in a handbasket, my discipline woulda seen me through. But the market is on fire, I caught some of it and there may be more to go into the holiday season. So I've edged more into stocks and less in cash. But the last GDP number was pretty limp too. So if business gets soft, maybe the Fed will cut or at least not raise any more. And that'll mean a soft dollar. And that brings us to another issue. Look at the charts and this year's 401a worksheet on my web page. I've let 5 funds carry the load for the last two years. Two of them have been my main horses and I'm heavy into them going into this year's holiday season. But the EuroPacific fund is almost as hot as the small cap and hotter than the domestic growth fund and a falling dollar would give the return a boost. So it got the nod. But I'm concentrated in three funds and that means I gotta watch and act immediately and ruthlessly if the market turns on me. So, up 34% in a little over two years means I gotta go the extra mile to keep it as well as to make it. That's the way the world I live in works. Know what I mean, Vern? Nomination time. See ya at the hall.

[ view entry ] ( 1006 views ) [ 0 trackbacks ] permalink      ( 3 / 1346 ) ( 3 / 1346 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar