| |

TWO WEEKS UNTIL THE ELECTIONS. SHOW UP AND MAKE YOUR VOICE HEARD.

Saturday, November 25, 2006, 02:33 PM

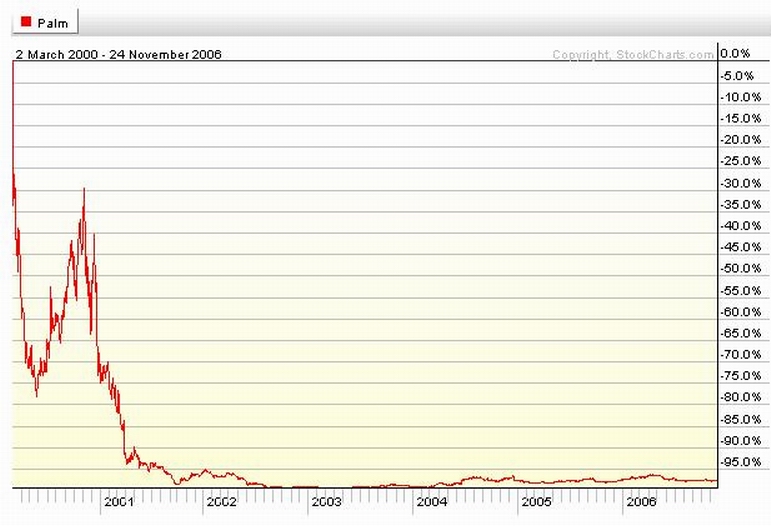

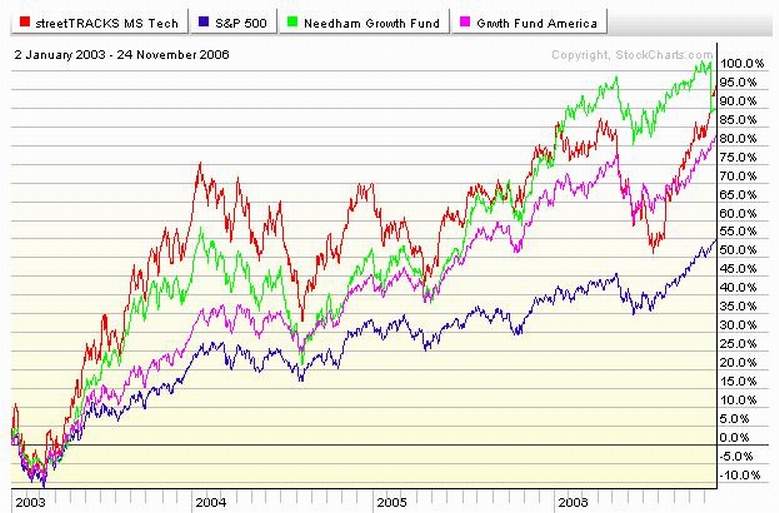

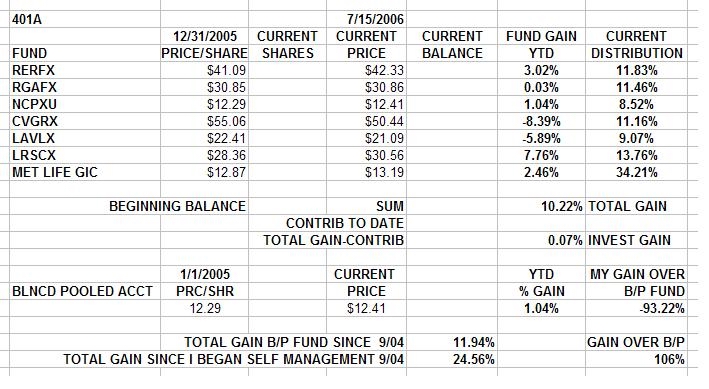

Charts and tables up. I've got a full plate for the weekend. There may be more posted here.....but no promises. My 401 account is long and strong, the return is smokin' and if I keep my head screwed on and don't get greedy, I'll keep most of it if the market starts to go south. I'll keep an eye on it all and let you know. So at the meeting last week, Mike Mammini, the head honcho at our 401 plans showed how it makes very good sense to commit a substantial portion of your savings to the 401 plan. For late starters like me, it makes sense to commit the max. On a good year, that comes out somewhere between $15K and $25K placed in the 401a. He also says that you probably should look at it at least once a year, but probably not more often. After 5 years, that's about $80K to $140K that you've invested in financial instruments that are not guaranteed and have a history of going way up and way down real suddenly over the past coupla centuries. During that time, investing in stocks and bonds has made some people fabulously wealthy and beggared others. What makes YOU more uncomfortable, the thought of having to do a half hour a week of homework to make sure that that nothing bad happens to $100K plus of your money, or the thought that you might not catch a bad thing happening in time to save a substantial portion of your savings from going away forever? Is once a year often enough to look at something so important? If once a year isn't often enough to get your teeth checked, why is it often enough to look at your 401a? The guy from McMorgan tried to scare members with TALES FROM THE STOCK MARKET, stories of tech investments gone bad. His example was PALM, where an investor could have lost 99% of his investment. SCARY!!!!! it's a good thing that McMorgan resisted requests to give us a tech fund to invest in...or maybe not... Check out the charts of Palm and Apple below...CLICKONNIT   Put all your money in PALM and lose 98% of your money. Put 5% of your money in PALM and 5% of your money in AAPL, lose all the money in Palm provided you go deer in the headlights for the two years it takes PALM to go from $1000 to $3, and make 1000%+ (ten times your original investment) in AAPL by holding on for four years. I'll do that any day. It's called diversification and reducing risk to match the reward. It's what a smart mutual fund manager does. And a smart mutual fund manager wouldn't have ridden PALM all the way down FROM $1000 TO $3 and lost all the OPM (Other People's Money) along the way, charging them a fee to do so. Click on the link below. http://bigpicture.typepad.com/and then click on "Protect Your Assets" under "The Apprenticed Investor" section on the right. Learn how it's done. In 50 years of reading a lot of disparate stuff, reading this article is one of the best spent chunk of time I can remember. CHECK IT OUT! Check out the chart below. CLICKONNIT!  Shown is a tech Exchange Traded Fund (ETF) and a tech mutual fund vs our 401a growth fund and the S&P 500. I'm still not clear why we can't have a good tech fund available rather than tech funds used as something to be taken out of the closet every so often to scare us with. And we gotta reconcile Kim asking us to double check our hours monthly because it is the responsible thing to do, and Mike telling us to look away from our investments for year at a time or longer because .... Well I can't figure out why because.      ( 2.9 / 1475 ) ( 2.9 / 1475 )

===THE AFTERMATH=== Whatchur left with after all the addition/subtraction/multiplication/ and goezintas are done.

Saturday, November 18, 2006, 01:53 PM

The chart service is working right again. Charts and tables up like their supposed to be. Be that as it may, the Special Called Meeting came down and it was a major success in all ways. The attendance was as great or greater than a typical union meeting and a lot of people stayed to the end. At a few spots emotions ran high, a lot of good information got put out in front of the members, some existing misinformation got corrected, some new misinformation got out and some of it got corrected on the spot. Some more information is still need or is forthcoming. Time will take care of the rest. What's not ta like?

The meeting provided me with some new information and some updates on some existing info. Some of it changed my mind about some things, some of it gave me a new perspective what I already was pretty comfortable with, and some of it further supported my beliefs. You'll be seeing changes in the info on this site and in my campaign literature to reflect that.

Ah got stuff to do, but iff'n the good Lord's willin' an' the creek don't rise, I'll be back this weekend with more right chere, all ya all.

[ view entry ] ( 952 views ) [ 0 trackbacks ] permalink      ( 3 / 1373 ) ( 3 / 1373 )

It's a $400,000 day in the Bay Area. Indian summer and days like today are why your house is worth $400K more than one where the weather is going bad...

Saturday, October 28, 2006, 01:31 PM

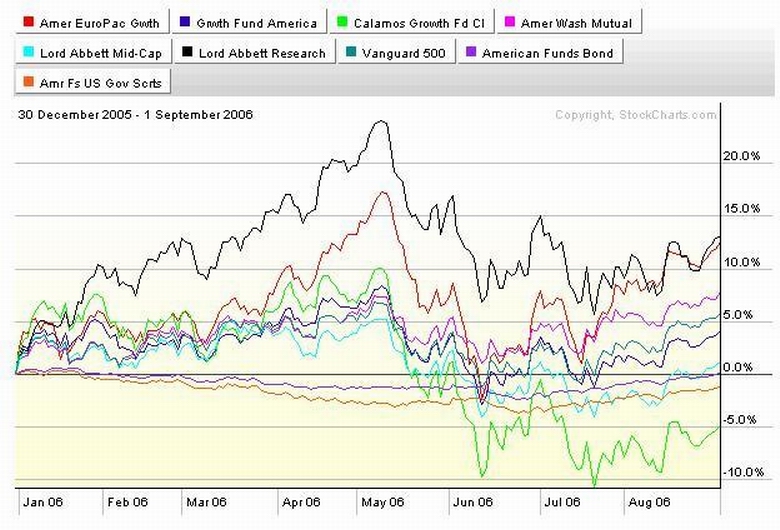

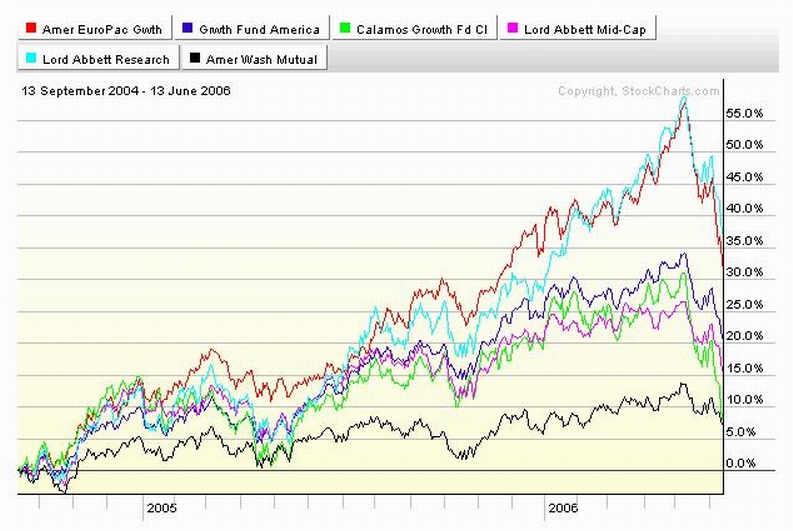

Charts and tables up. If you check out my percentages in the various funds you will see that I committed a little more money into stocks and outa cash last week. The last two and a half years, I was pretty much head down and WFO in five stock funds and everything was fine. I was all GIC a coupla three weeks into the May crater '06 and that was cool. But I got overly cautious when we hit bottom and the Mid East went up in flames. I was late getting back in and the last six months have been pretty limp. Again, if things had gone to hell in a handbasket, my discipline woulda seen me through. But the market is on fire, I caught some of it and there may be more to go into the holiday season. So I've edged more into stocks and less in cash. But the last GDP number was pretty limp too. So if business gets soft, maybe the Fed will cut or at least not raise any more. And that'll mean a soft dollar. And that brings us to another issue. Look at the charts and this year's 401a worksheet on my web page. I've let 5 funds carry the load for the last two years. Two of them have been my main horses and I'm heavy into them going into this year's holiday season. But the EuroPacific fund is almost as hot as the small cap and hotter than the domestic growth fund and a falling dollar would give the return a boost. So it got the nod. But I'm concentrated in three funds and that means I gotta watch and act immediately and ruthlessly if the market turns on me. So, up 34% in a little over two years means I gotta go the extra mile to keep it as well as to make it. That's the way the world I live in works. Know what I mean, Vern? Nomination time. See ya at the hall.

[ view entry ] ( 1019 views ) [ 0 trackbacks ] permalink      ( 3 / 1376 ) ( 3 / 1376 )

Election Countdown...Only a coupla three four or five or more weeks to go...

Saturday, October 21, 2006, 01:54 PM

Charts and tables up. I'm shooting for a new post to the " ELECT ME TO THE BOARD OF TRUST OF LOCAL 342 THIS DECEMBER" page on the website and blog this weekend. Check it out. Stay tooned for more to come.      ( 3 / 1492 ) ( 3 / 1492 )

How's it goin'? Well it's goin' like this....

Sunday, October 8, 2006, 01:35 AM

"Energy and persistence conquer all things." -- Benjamin Franklin Charts and tables up. Let's look at where I stand after two years and a coupla three four weeks of running my own 401 money versus leaving the money in the default choice; the "Balanced Pooled Fund" (BPF). My goal is to beat the BPF's rate of return by enough to justify the effort I'm putting into taking care of my retirement money, and to protect my self against losing money because of not putting enough effort into taking care of my retirement money. Why do I even have to take care of my retirement money? Isn't 342 paying people to do that for all of us? They are supposed to be. I know better. The people watching our money are baby sitting it for us. The baby sitters/investment advisors/custodians earn fees first, for not doing anything stupid and second, for doing well enough not to lose us as clients and thereby losing the ability to charge us fees. You can't expect much from this set up and sure enough at times we haven't gotten even that. Read elsewhere on this site how they have been doing with your money. Suffice it to say that I wouldn't be doing this if all I had to do was let my money pile up in the 401 and the pension fund and grow itself into a fortune and a lifetime of easy living for me. So... How my doin'? Pretty damn good. Check out my tables at http://joefacer.com/id11.html. I averaged almost 12% return/year over the first 16 months, from 9/04 through 12/05. Bull markets make almost everybody look like a genius and I was there to let it do its magic for me. My unstated until now goal is to get to the point where my investment return is substantially greater than my contribution. At that point, the hard work is done and my yearly investment returns start to approach what would make a really nice pension check. That makes living happily ever after a real possibility. I flirted with that kinda return in 2004 and 2005. 2006 is a different story. Check out the charts. Everything went great up until May. I stepped off the elevator just as it hit the top and went to almost all cash. This is the "not losing money" part of my "timing the market" plan. I started to get back in as stocks found a bottom but got scared back out by the Mideast war, rising interest rates, a slowing economy, the collapse of the housing industry and housing prices, and a desire to protect my gains from '04 and '05. In the meantime, stocks went up while I sat on the sidelines and waited for something major to tell me to get back in. I never heard the whistle and so for this year I'm hoping that the seasonal year end stock rally will show up like it usually does and get me back close to the 20+% up for the first half of the year that I had in my pocket in May. I may get there, I may not. And either way that's OK... Having a workable plan and the discipline to stick with it is how you deal with not being able to tell the future and not being perfect on every move every day. I diversified among funds and it kept me from being totally invested in the two top funds, but it also kept me from having any money in the three or four worst funds and from having much money in the so-so funds. Getting out when it looked like the top cost me a litte performance here and there when I bailed out a little early for a month or two here and there, but it had me out during most of the downdraft from May to July. Being nervous from August to date has kept me with one foot in and one foot out of the market and has cost me some gains, but that's all part of the price of having a plan and discipline. And having the plan is the key to being confident about boosting the amount I'm putting into the 401 plan, going heavily to stocks at times, and sleeping well every night. I'm up close to twice what the BPF is and I don't mean 3% for me compared to 1.8% for the BPF either. I'm up over 30%+ in two years. I've gotten both the "deer in the headlights" fear of the market going down and the "the week that stocks doubled when I sold out" fear burned out of me along the way and that's good too. It ain't all good all the time, but it's pretty damn good most of the time and ... "No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some." -- Ken Keyes, Jr So YEAH, I'm getting my money's worth outa running my own money. The more I put in and the more I earn, the greater the payoff. The quicker I stop the bleeding in a down market, the quicker I get back to even and start making progress again. But you know that. You read it on my webpage. See ya at the hall....     ( 3 / 1386 ) ( 3 / 1386 )

if you don't find it out here, ya ain't gonna find it out.

Saturday, September 30, 2006, 02:50 PM

Charts and tables posted. You'll find more here and on http://joefacer.com/id19.html by the end of this weekend. Copy it and get it out to the membership. Local 342 Brothers and Sisters will be glad you did....      ( 3.1 / 1478 ) ( 3.1 / 1478 )

Successful investing is a lot like surfing; You can't make the ocean do what you want it to do. Instead you catch a ride to where it is going on its own and avoid getting wiped out on the way. Substitute "market" for" ocean".

Saturday, September 23, 2006, 11:41 AM

"Careful. We don't want to learn from this."

--Calvin & Hobbes comic strip

Charts and table up. Cross currents are what it's all about. There were three bubbles. The dotcom bubble, the housing bubble, the energy and other commodity bubble. The dotcom bubble created and destroyed a huge amount of wealth, especially in the Bay Area. The Fed drove interest rates to 1% and created the housing bubble to prevent the bursting of the dotcom bubble from driving us into a deep recession. Low rates and available money combined with the development of Brazil, Russia, India, and China to drive the price of commodities to sky high levels and create the commodity bubble. Politics in the MidEast added a $20 risk premium to oil. And corporate profits expanded like mad across the world. Then the Fed and other central banks, notably Japan's, took back what they had given. Rates went up and liquidity was withdrawn. But there was a lot of momentum in the world economy and the economic activity resisted the pull of gravity. But rates and gravity are relentless. The housing bubble is history and maybe the commodity bubble is too. The house next door went at the peak of the market and today an equivalent house can be had for 20% less. My neighbor is WAY underwater on her mortgage. GM is imploding and might be partnered with a French auto manufacturer?!!?!? Ford and GM merging? Chrysler in trouble too? Three year fixed and interest rate only mortgages are about to reset. There is seven months worth of housing inventory nationwide. Housing prices are going down in flames.

But...Energy prices are on the way down too and so are other commodities. Natural gas is down 66% from last winter and cluttering up the landscape. A warm winter may mean shutting down production even at the price of damaging the wells 'cuz storage is FULL. Oil is down from $78/bbl to under $60. It may go to $40 if the MidEast politics cooperates. That puts money in everyone's pockets. Base metals are down too. A lot of people have jobs and it doesn't look like they will lose them soon. The bond futures are predicting a rate cut next year. Are we going to have a soft landing of the economy? Will we see a replay of the 80's when my union had a ton of work and travel cards from all over the country while the unemployment rate was 12% nationwide? Probably not. This time everywhere else seems to have a ton of work on the books too. I just don't know. Maybe yes and maybe no. Could China blow up or the Mideast explode? Would that create a world wide economic crisis? Is there another bubble out there waiting to happen or just rate cuts and a Goldilocks economy advancing at a walking pace for years to come? I feel strongly about it both ways and neither either. That's why I'm 40% cash and 50% stocks in the three funds I like in the 401 and ready to add to stocks big time or bail out to all cash. I'm anted up and protecting profits and waiting for the next card to be dealt. You play what you're dealt when it's dealt. Only then can you make a rational choice between folding or going all in or someplace in between.

We may yet see the special called meeting on the pension in a month or two. Or not. Stay tuned.

[ view entry ] ( 983 views ) [ 0 trackbacks ] permalink      ( 3 / 1454 ) ( 3 / 1454 )

The stock market is about to get really really bad or really good real soon, or not, Probably. Or so I've been told by a lot of experts who disagree with each other.

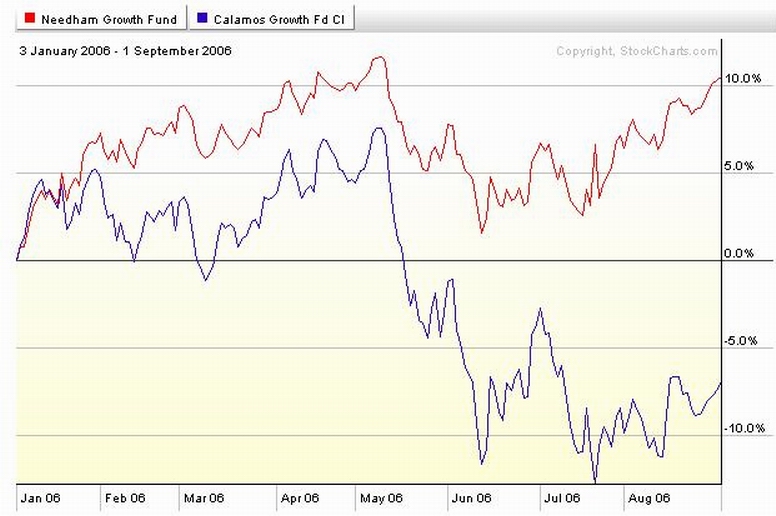

Saturday, September 2, 2006, 02:55 PM

Charts and tables up. Check out the AlarmFund.com tables. That and the stock charts and the real estate and international news tells a story I'll want to think and write about and act upon...talk to me about it at the hall this month. significant stuff in the news... http://www.slate.com/id/2148344/http://www.crooksandliars.com/2006/08/3 ... -rumsfeld/Click on it. I'm reminded of the period near the end of Jimmy Carter's first and last term. You could feel that his claim on the electorate was dissipating by the day. He was not hated, he was not a bad man, he was just becoming irrelevant to what the country's voters wanted from its leadership and Ronald Reagan was waiting in the wings. Carter was crushed in the election and IIRC, he conceded the election with the West Coast polls still open and sent/kept a lot of demos home with state and local candidates/issues still being contested. Kinda the very last pratfall. I sense the same absolute irrelevance building about what the Bush administration represents as far as what the country's voters would like to see. The 9/11 covers everything message is starting to get old, especially since it doesn't appear to be working or even very truthful. Unfortunately, I don't see the Democratic Ronald Reagan equivalent in the wings and the Republicans seem to have a much higher quality political operatives than the Carter/Demo administration had/has. Still, I think the upcoming economic situation will deteriorate for many as the '08 presidential election approaches and that's going to count for a lot. I just don't see the democratic alternative falling into place. Hope springs eternal.... Back to the 401a. Check out the chart (Clickit if ya wanna...)  Since the correction in May, the trend is up, but it's just barely there in some funds and very weak in others. Something big has changed. It appears that we've had the last harrah in housing and the reversion to the mean is well under way. Read the Sunday paper. Any Sunday paper. There are other things going on that will have profound and long lasting effects on the ecomomy and the stock market and the 401a. I've written about the '03 recovery getting long in the tooth and it may have come to pass. Here's some links that I found of interest... http://bigpicture.typepad.com/comments/ ... _wron.htmlhttp://www.marketwatch.com/news/story/S ... mp;siteid=What was right in 04 and 30% return in two years ago, is no more. Unless of course, oil drops in price by 20% to 30%, peace breaks out in the Mid East, or China goes up in flames without negative consequences to the US. Barring that, I'm 40% in cash and looking to do the right thing. So here's what I think I need to do. We've come through a time when free money (1%) made almost every bet a winner. For years almost every one of our 401a funds was something of a winner. If one or more lagged or one or more excelled, they all pretty much made made money at least most of the time. The rising tide ain't there no more. Money anyplace on the table isn't an automatic winner. Now there are winners and losers and maybe a lot more losers than winners. Look at the difference between our high octane high growth growth stock fund and another growth fund that I've been invested in in the past.  It's all about having more winners and fewer losers and being able to hedge. I want to see more alternatives like NEEGX. One fund a sector aint enough when the going gets tough. I want to choose not only among sectors, I want to chose a better (at least for now) fund from more than one offering per sector. Do you? If not, why not? It all starts with asking for a choice. That's how we got more than just McMorgan's dog of a fund. I asked. See ya at the hall. It might be a big one...      ( 3 / 1727 ) ( 3 / 1727 )

Time To Play Catch Up On The BLOG. Hang On. Here's Where We Start To Pick Up Momentum.

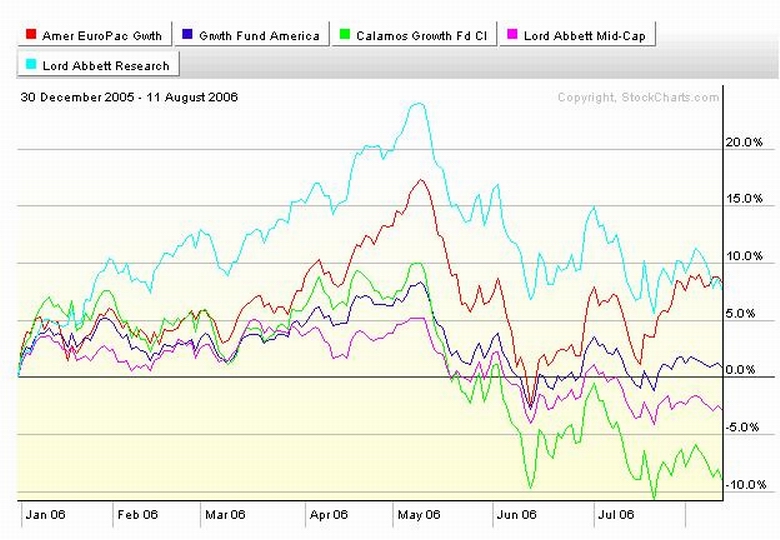

Saturday, August 12, 2006, 03:51 PM

I've been busy. But that's no excuse, it just is what it is... I've scoped out the new Defined Benefit set up post McMorgan and you'll hear more about that soon. Stay tooned for the Special Called Meeting on the pension plans for September that was moved and accepted on the floor at the last meeting. This may be the one of the most important meetings in a long time. Spread the word to the members who aren't online... Back at the ranch.... A coupla three months ago I attempted to finesse the post earnings pull back/correction of May. I did a pretty good job. I sold up and bought back lower. Then Hizballah got a coupla hostages, the Israeli's did their best to put the fear of consequences back in their opponents and oil prices skyrocketed and everybody started to puke up stocks. Then the long string of interest rate increases finally started to kick in, housing and new mortgages and resetting mortgages slowed and got toppy and earnings and next quarter guidance got squishy and stocks flattened out and went down. Damn. Not what I'd hoped to see. Early this year I was up 40% since I started managing my self managed 401a. That was then and this is now. I'm still up twice what I'd have earned if I was only in the Balanced Pooled Fund and I'm up 26% over two years. Not as good as I'd have done if I could've predicted the future, but I gotta live in this world where I can't. Being down 13% and still up 13% a year over a two year period makes it hard to whine, so I won't. Now what?  Check it out. CLICK IT for a larger version. CVGRX is pretty volatile. When it's hot, its a good performer. But when it's not, it goes down as hard as it goes up. Like recently. The overall market trend is down. Monday I'm dumping almost all of my Calamos. I can reenter at will and will not be charged a fee under the rapid trading rules. I'm mostly out of Lord Abbett Midcap (LAVLX) because of poor recent performance. And, after all, the overall trend is down. But I can reinvest at will, because my withdrawal(s) did not trigger the rapid trading rules. I've triggered the rapid trading rules in RERFX, so I'm standing pat at 12%. I can withdraw more at will, I can reinvest a limited amount at will, and invest an unlimited amount in a month, but the trend is down, so it's 12% until further notice... I'm at 12% in RGAFX, the rapid trading rules haven't been triggered, so I can reinvest at will if the trend changes, but right now the tr.. you know. I triggered the rapid trading rules in LRSCX, so I can withdraw more at will, but I'm stuck at 13% for 30 days which is not a bad place to be since the trend, you know? And, if the market takes off, I can get exposure to the market elsewhere, if not in LRSCX. I'll be at about 50% in the GIC Monday evening, which is not a bad place to be at a 26% return over two years when the tre.... It's said that 80% of the money is made over 20% of the time. The rest of the time you lose/break even, assuming you don't do anything stupid. That's the task in front of me now; Avoid Stupidity. It'll be hard, but I'll try. It ain't pushing the envelope, but 50% cash and an eye on the exit while watching the trend is aggressive enough for me here and now. Because, after all, ta da, ta da, ta da. If it gets as bad as the bears say it could be, I'll go to almost all cash when I figure it out. If the downtrend ends and is replaced with an uptrend, I'll probably buy some stocks and try to figure out if it's a bear market rally or the resumption of a bull market. You'll read about it here There's issues to deal with though, in the meantime. Think about this prior to the Sept meeting; The GIC was great when rates were low. Would we get a better return if we had a Money Market Fund option open to us? And as working men and women, we need the KandG.com site up on weekends when we have the time and inclination to use it. Dead from Friday until Monday ala last weekend isn't acceptable. See ya at the hall.....      ( 3 / 1378 ) ( 3 / 1378 )

PLEASE STANDBY. I'M CURRENTLY EXPERIENCING TECHNICAL DIFFICULTIES....

Saturday, August 5, 2006, 01:45 PM

The KandG 401 website is down. I've got a monthly contribution to check on and allocate, and stock fund performances to tally and post to www.joefacer.com. I can get the fund prices from other places, but shares and contributions in my account are what matters. Until I can get in to the site and my account, there's not much to do...... But...Ah'l be back. SUNDAY; Early Afternoon. Still can't get into the 401 website. Some charts up...some tables up....The rest not. There's some stuff to cover but I'm gonna wait until all the data is available. Stay Tooned. MONDAY; KandG back up. A buddy tells me that he tried to rebalance last week and he thinks it didn't happen. That's not right. Does anyone at KandG check to see that the site is up 24/7? If not, why not?      ( 3 / 1451 ) ( 3 / 1451 )

Wow!!!!! That Sure Didn't Work Out Like I Wanted It To!!

Sunday, July 16, 2006, 08:45 PM

"It's tough to make predictions, especially about the future." Yogi Berra "No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some." -- Ken Keyes, Jr. Sometime things work out your way, sometimes they don't. Oh Well. I did a nice little finesse move; I looked at how long the market had gone without a correction, I listened to the Fed jawbone inflation, I saw the stock market start to break in the second week of May, and I sold. In May I got mostly out and in June/July I got back in. I sold high and bought back lower. Then the deadline for Iran to respond to the UN's ultimatum came up on the calender, and the Iran backed Hezbollah in Lebanon invaded Israel, killed eight Israeli soldiers and kidnapped two soldiers. And now the Israelis are exacting a price from Hezbollah to send a message that the withdrawal from Gaza and a retreat behind the Wall doesn't necessarily mean that it is open season on Israelis. http://www.msnbc.msn.com/id/13884768/ The Iran nuclear issue is now off the front pages and in the back of the paper on the lower half of page 12. What's up on the front page is expanding warfare in the Middle East threatening to spiral out of control and a possible threat to the world's oil supply at a time when prices are already at all time highs. There is a lot of fear and uncertainty and every quick trigger finger near the sell button is now leaning on it. Politics looks dark. Economics don't look that bad. There haven't been much in the way of lowered earnings preannouncements. The economy may be cooling, but business as a whole still looks OK, if not really strong. However our particular business sector looks really strong. And we've got a nice contract. That's encouraging. And the Fed finally sounds like it may be near a pause, if only a temporary one. The Fed is also likely to see the Mid East situation as a headwind to continued economic expansion and may not want to pile on right now. So I have gone to cash with the maximum allowable under the rapid trading rules as of Friday and I'll let the rest ride. Maybe it'll work out. September of '04 was an incredibly right time to go all in in stocks. Now the risks are huge. Forty percent up, to thirty percent up, and back down to 25% up in a month. The Mid East riff came up too fast. These things have come up recently on Union meeting night and I've been a day or two late to move. I've fallen behind the Balanced Pooled Fund for the first time this year. But I'm feelin' OK about what I own right now. I'd rather have bought Friday than two weeks ago... but for the moment, I'm standing pat heading into an earnings season that may surprise to the upside. Let's see if it works. Special Called Meeting going down in September. The Defined Benefit and the Defined Contribution Funds will be discussed at that meeting. I'm going to present some of the information I've developed and shown here as well as additional information regarding our Pension Funds. We will have representatives of the Fund managers available to answer to questions raised by the presentation. See ya there....      ( 3 / 1452 ) ( 3 / 1452 )

I'd Like To Think I'm Starting To Get Traction On This 401a Thing. Talk To Me About It At The Next Meeting...

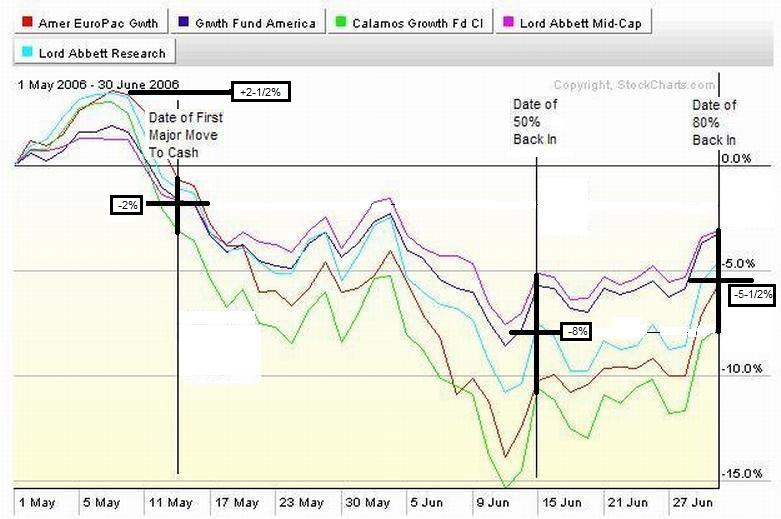

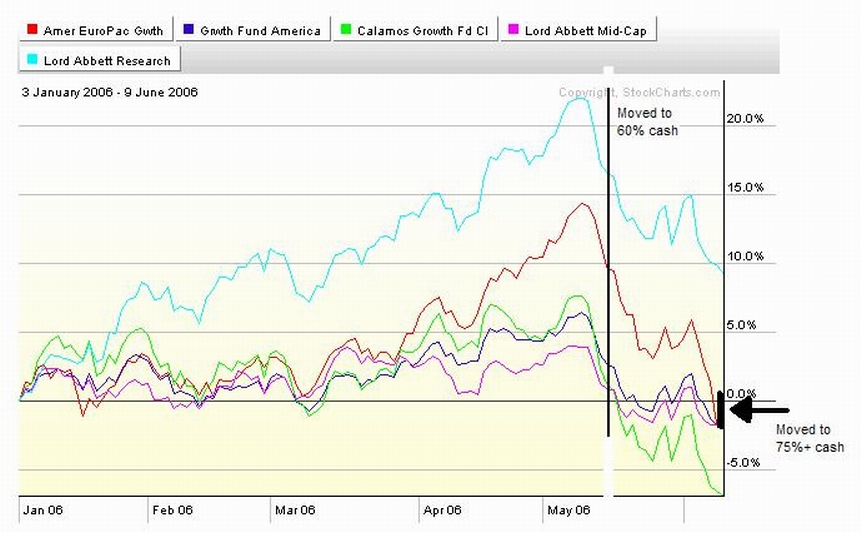

Saturday, July 1, 2006, 01:18 PM

"The primary objective of leadership is to help those who are doing poorly to do well and to help those who are doing well to do even better." -- Jim Rohn Charts and Tables up. The Conclusion of "My Most Gnarley Mutual Fund Adventure" So, to sum up my FPRAX/IDETX affair: 1) No game goes on forever. If you buy, you are almost guaranteed to have to/want to sell given time. It was 12 years for FPRAX and 12 months for IDETX for me. When the game is over, you need to leave the table and go somewhere else or lose what you've gained. 2) It's the manager, not the fund. Or it's the era, not the fund. Or the economy. Or the world economy. Or national politics. Or world politics. Or whatever. Good funds can be totally wrong at any given time for a number of reasons. When things change, you change. Or pay the price. 3) Price and trend are what's important to you. Every day something happens somewhere that can meaningfully affect your investment. Often it can, but it doesn't. Price and trend will always tell you what is really going on. It's the only unequivocal, direct, and elemental information that you can get. Unfortunately, it is about the past and not the future. No one said that this was easy. 3) You need to direct a self directed plan and you need information to do that. Given that there are pro's in place at the funds applying their knowlege, experience, and judgement on your behalf, you still are making a decision every day or every week or every month as to whether or not they will continue to do so. Is what they are doing working? Go back to the chart pages on my web site if you have any doubt that YOU CAN NOT AFFORD NOT TO KNOW THAT ANSWER. There's always something you need to know. You need to learn how to get the information and apply it. Get used to it. 4) No one cares about your money the way you do. The investment industry cares that your money shows up and stays so that it generates the fees to pay their salary. The legal authorities care that laws about managing your money are not broken. There is no law that says it is illegal for you to lose your money in bad investments or for fees and piss poor management to fritter away your future. The market doesn't care about your money, your hopes, or your dreams. It doesn't care about anything, whatsoever, period. You are the only one who REALLY cares about your hard earned money and the return it should earn you. And only you will make the hard choices that need to be made when the time comes. Do you really expect a money manager to fire himself because making you money or stopping you from losing money is more important than him keeping his job? 5) It's not a sin to be wrong. That's why there are erasers and whiteout openly for sale and not behind the counter. I screw up, the President screws up, surgeons and street sweepers screw up, everybody screws up. It IS a sin to STAY wrong. It cost Bill Sams his job and FPRAX and IDETX my money. That's why McMorgan no longer is our only pension fund advisor. Don't let the possibility of being wrong paralyze you. But the idea of being wrong and staying wrong should cause you to break out in a cold sweat. When I look back at the McMorgan era, I do... 6) The investment industry will tell you to stay fully invested at all times; you might miss a money making opportunity and cost them some fees if you don't. Notice how nothing is ever said about missing out on falling into a crater and not losing most of your investment by not being fully invested when it all turns to shit? That would cost the money managers some fees. Besides, you probably may most likely do OK or even well in the long run if you stay long and are lucky and things work out and anyway, they get their fees that way. And besides, they can't charge you fees and take your money if you don't stay the course. It's all about the fees, see... Of course if you look at the charts for FPRAX and IDETX, you'll see that during certain times, having the money in cash in a coffee can or in a money market fund was brilliant investing at its best compared to buy and hold investing. More about this later. The chart is live. CLICKONNIT  The chart shows my moves into cash and back into stocks since May 1st. I declared victory a coupla months early in March and went partially to cash and it cost me a little in missed performance. Or not. I really don't know or care. It was not worth tallying up. I declared victory three days too late in May and it cost me substantially; a quarter of my return since 9/04 went away in four days time before I went to mostly cash. But I caught most of the move right and I protected 75% of my profits earned since 9/04. I booked a 30% profit in under two years and smoked what I'da done by staying in the B/P Fund. By the middle of May, the market coulda dropped like a stone and I'd have had it mostly covered. By June 9th, I was totally faded; I was pretty much all cash and maximally protected against losses. I was totally protected from profits on the way back up, but that's the way it goes. As described below, on June 16th I went 50% back in. That worked out OK, and as of Friday afternoon, I'm 80% back in. If you rub your eyeball on the chart above, you see that my moves 1) Bought me piece of mind during a brutal and bloody downdraft that had the pro's bleeding from the gums. The drop was very ugly in terms of the rate of fall and the lack of any respite on the way down. The lack of any short term bounce made it a very unusual occurrance. And I was in cash for almost all of it. 2) It made me a dollar, too. If you postulate that I was equally represented in each fund, then you can estimate that the midpoint of each heavy vertical bars on the chart represents my positions. It looks like I sold most of my positions at about 5% down from the peak in early May and about 2% in the hole in terms of the price as of the 1st of May. It also looks like I bought back half the positions at about 6% below that. It looks like I spent most of the remaining cash getting back in at 3-1/2% below where I sold. Just as an eyeball guess, I'd say that by selling when things got hairy and buying back when things looked better, that I'd bought not only peace of mind and safety in the case of a severe and prolonged crash, but made back some of the money I'd left on the table by not bailing out earlier. Far out. See ya at the Hall. We gotta vote on the contract and money allocation if we pass on it. And of course we've gotta move on a special called meeting on the pension plans.... My motion to do so is still outstanding and it's time to firm the meeting up.      ( 3 / 1459 ) ( 3 / 1459 )

Never A Dull Moment When It's All About Your Life's Savings...

Saturday, June 24, 2006, 01:57 PM

Tables and Charts up. I've spent some time polishing the third and sixth pages. They're done for a while. The biggest change is that I finally got around to putting up link to the New York Times "THE END OF PENSIONS" article. I consider it a must read. If the company specific pension system goes down, as taxpayers and participants in a hopefully healthy and surviving pension plan, we might end up picking up some unexpected passengers. The conclusion of My Most Gnarley Mutual Fund Adventure; The IDETX Chapter. Monetary policy had been loose in the late 90's; cash was there to be had, but the rates were going higher. The market as a whole was not doing well at the end of the nineties. Much of the economy was suffering under the high rates, but most of the loose cash had run downhill and was piling up in the corner that held telecom, tech, and the internet where a good old fashioned stock bubble was underway. So there was this money management company called Janus and one of their funds was called Janus Twenty Fund. It was/is a hard charging, concentrated, high risk fund. It held twenty or thirty of the hottest stocks. No safety in diversification, but a lot of horsepower if they got it right. When the market narrowed in the late 90's and fewer and fewer stock went higher and higher, they were RIGHT. CLICKONNIT!  Other funds in the Janus family saw what was going on and bought in to the same scenario. Other funds in other families did likewise. During the last stages of the bubble, it was amazing where you could find those same hot stocks. Sector funds totally away from tech etc held these stocks (very quietly) because it was the only way to show any performance and without performance, the client's money went away. These stocks were bought and bought and bought. Many funds acquired outsized positions because these stocks worked, money came in, and it was a no brainer move to buy more of what got ya there. Enter my position in IDETX. The Idex Fund family runs a lot of funds and contracts with outside advisors. My alternate fund to FPRAX was Idex JCC Growth (IDETX). The "J" stood for Janus. I had traded in my value fund for a ride with the Janus hot money boyz. I rode Idex and their Janus hot money clone fund up to the top along with everyone else who held the same hot money stocks. When we all hit the top as per "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine (Google it), I figured that the Idex managers would step off at the top just as the elevator started to go down. Sell the top, book the profits, and I'd live happily ever after. Instead, the managers at Idex actually were only hired hands who owned the same stocks big time back at the ranch. Actually everybody on the Street owned the same stocks and the doorway out was not wide enough to let everybody out at once. I coulda sold my IDETX in the time it took to get a letter with a signature guaranty downtown. Instead I stood by for part of the ride down as everybody bled their positions into the market, driving the prices lower over more than a year. Opps! I just ran outa weekend. Stay tooned. No change in the 401a portfolio pending developmnents. Fifty two percent cash. Enuf said.      ( 3.1 / 1403 ) ( 3.1 / 1403 )

You feel like a hero when you break even....

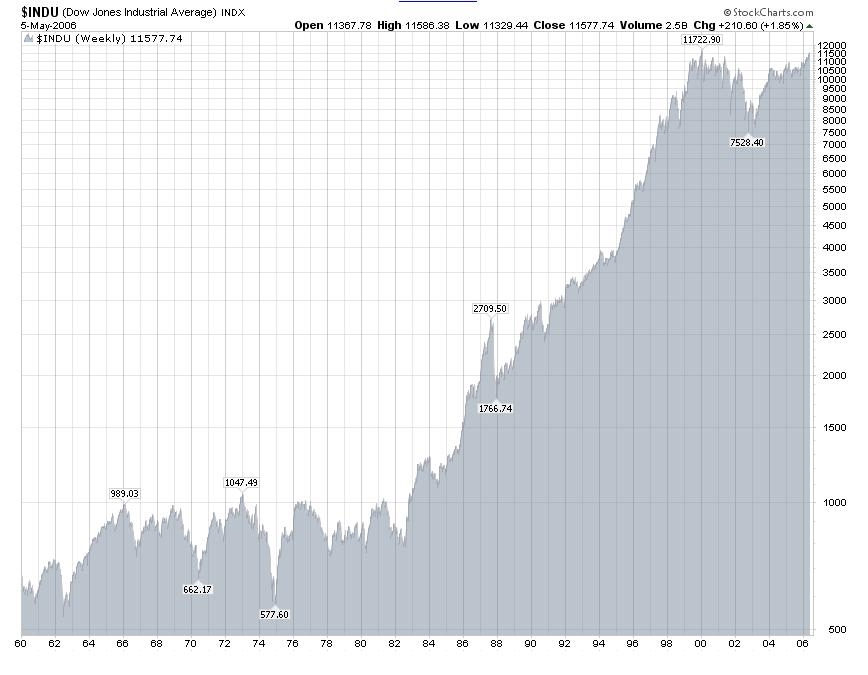

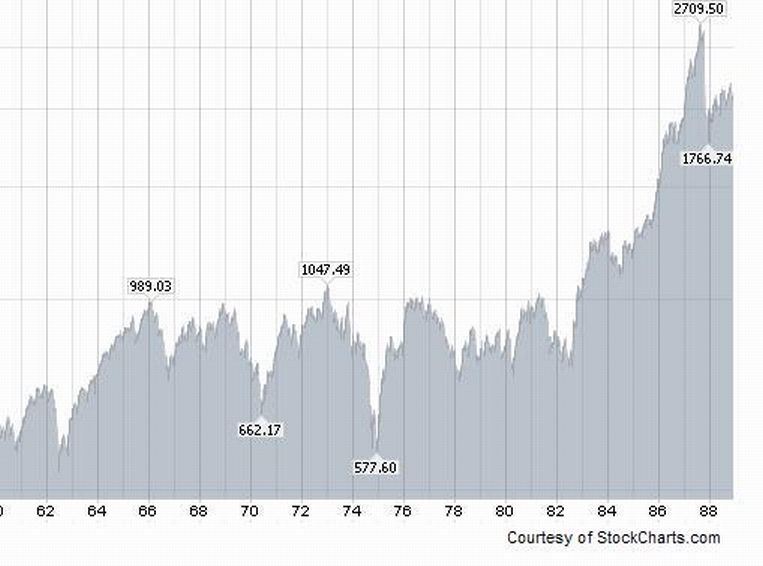

Saturday, June 17, 2006, 03:20 PM

Charts and tables up. . Here's where I was going with the FPRAX and IDETX riff; "Buy and hold", "Be patient, it'll always come back, it always does", "These are world class quality American companies, stay with them, you can't go wrong in the long run," is horse exhaust. CLICKONNIT.  Check this out. Above are the Dow Industrials; 30 of the Great American Companies. Over the long run the trend is up. Check the chart. Forty six years of "in the long run" progress is shown. Of course, in the long run we're all dead. CLICKONNIT.  Check this out. Above is the Dow between '62 and '88. Check out '66 to '83. Seventeen years and breaking even for the fifth time. Not much to show for buy and hold and having patience. Of course if you sold a little on the highs and bought a little on the lows, you did better. Still... We're currently in another period where we have flat performance;six years and counting... We'll undoubtedly get back to even in the long run. It helps to be 22 and have 40 years to go. That's the long run. But it sucks to be 50 and already thinking about taking the first step out the door to retirement. Six to seventeen years of flat performance? That is way too much of a long run...especially given where I'm coming from and going to. Anyway, think bonds are the answer once you get close to retirement? Check the charts on our bond funds against what fuel/housing/food and medical care inflation have been. So....if not buy and hold or bonds, What? What worked so well for me when Bill Sams was running my money in FPRAX was that he was trading stocks. He ran a small fund, some where about $50-$150 Mil when I started with him in '82 and around $700 Mil in '98, as I remember. In '82 interest rates were sky high. He kept a lot of funds in cash and made a good return on it in the 80's. He had maximum flexibility to roll the money between stocks and cash. He bought when stocks were down and he saw an opportunity and he sold when they went up to where the upside was limited. Then he did it again. You always had to take into account that he was doing very well considering his performance was accomplished with a cash cushion. It was especially good performance once interest rates came down. If stocks went to zero, he'd still have cash to return to investors. Most other funds are 100% invested. Bill Sams had the ability to bail out of either a winning or a losing position quickly because he carried relatively small positions; no bleeding a huge position into the market for many long months along with all the other giant mutual funds, trying to get out as fast as possible without destroying the stock price. He was playing a value game, looking for diamonds in the dirt. He bought stocks that were going down or already down and were going to go up. He was right for years. Then he was not. Due to the Thailand baht crisis, the Long Term Capital crisis, the Russian bond crisis and other financial crises of the 90's, the Fed flooded the market with dollars and lowered rates. Bill saw inflation on the way and set up for it in gold, commodity stocks, and other defensive positions and stayed the course, regardless. Instead of driving gold and oil up, the money went into the "new economy", dot coms, telecoms, etc and it was FPRAX that blew up. There came a time for me to trade the trader. Whether or not Bill Sams was right in the long run was meaningless. He was costing me big time. "It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong." George Soros So I stopped the losses. I moved on. I had bought and so I sold. I got impatient. I got short runnish. Bill stayed the course, sure he was right. He was. Ultimately, gold, oil and metals soared, eight years later in 2005/6. Bill Sams was "retired" shortly after I was out of FPRAX, in 2000, but long before he was proven right. Management of FPRAX was given to the managers of FPA Perennial Fund FPPFX, a fund that was/is run similarly to FPRAX. Hell, Bill may have trained his replacements. Regardless, the market stayed irrational longer than Bill Sams could stay employed. CLICKONNIT.  Check this out. Pretty good performance since 2000. Last I looked both FPPFX and FPRAX were carrying about 30% cash. So...FPRAX was right, then it was wrong, and now it's right. What does it mean? YOU CAN'T LOOK AWAY FROM YOUR MONEY. IT'LL GO AWAY IF YOU DO SO LONG ENOUGH. No money manager is always right. No system works all the time under all circumstances. No money manager is above regular review and everyone is subject to replacement if the performance isn't there. It all falls back onto the individual who invested the money. You can't expect a money manager to fire himself. That's your job. There are times when they don't even admit that they've been wrong. Been there. Listened to that on the phone. It's about understanding that it is NEVER a no brainer to give your money to someone else to manage. You have to understand what he is doing, and whether or not it is working. If you get lazy about it, you can end up being the no brainer if/when your money goes away. Can this even be done? Isn't this a huge amount of work? Don't you have to know what your money managers are holding every single day? Isn't it a huge risk? I think so. No. No. I don't think so. In that order I think that I can successfully manage my 401a right here with the tools I've got on this site and reading up on the market and economy. Bill Sams was responsible for making me a dollar. That was very good. Teaching me that it is my responsibility to see that I kept, it that was great. Next week, lessons learned from IDETX. Over the past month, Japan has removed $50 billion of liquidity from the markets. Other central banks are tightening rates or policy or both. The carry trade appears to have been ended. The Fed has sprayed grumpiness from the lip all over the landscape, lobbed threats all over the horizon, and promised the end of life as we know at the very minimum if they eyeball even a trace of pricing power, much less inflation. Markets, portfolio's, and hope have been crushed. My trading account and IRA's are a smoking ruin. Death and destruction and the crimson wing of doom o'er shadowing all, as Darkness and Dispair loom o'er their new domain.... It's Really Very Very Cool. I love the special effects. The Fed has reinstituted fear in the marketplace, hammered speculators flat, flattened out commodities, and served notice, all between meetings and without raising rates. All while I was mostly in cash in the 401a too. It takes the sting out of the other nastiness in my other accounts. The economy still appears to be OK, the cooling of commodities may extend the post dot com/9-11 crash run, and if the political risk comes out of oil, we may just get by quite nicely. Markets backed and filled Friday after two big short squeeze big time up days. Things look brighter in the short run. I put half my cash back in on Friday, pretty much across the board. See the charts and tables. Yeah, it's kinda cowboy. But look at the charts. If everything turn out for the better, I've bought back in at near Jan 1st levels and I've got no obligation to ride the positions down into oblivion. I'm half cash in case it doesn't work out, so my risk is half what it could be. I have cash to commit on a dip if one occurs so I can get in even cheaper. Ammunition is alway a good thing to have plenty of when things are uncertain. If it goes straight up without me and I only got a half a position on, I can live with that. It won't necessarily be easy as it is a new game as of last month. But no one said it would be easy. It's all about the economy. And that it's still strong gives me hope. Understand, hope is not my strategy, it's a result of my observation and judgement. Maximizing my opportunity and controlling my risk is my strategy. See ya at the hall. Contract vote coming up...      ( 3 / 1402 ) ( 3 / 1402 )

Concentrated Triple Double Compounded Ugly ... Revised 6/13

Monday, June 12, 2006, 10:58 PM

The title bar says it. Weeping and wailing and gnashing of teeth. I lost too much money Monday for being 75% cash and my only remaining sizeable stock exposure in LRSCX was the culprit. The fear on the Street is huge. Stocks are a sea of red. I suspect that scared investors still holding stocks will shovel them out on any bounce up. Compound that with the typically slow summer season, the withdrawal of liquidity from markets worldwide, and the possibility of a recession and continued high energy prices bleeding away discretionary spending and I'll risk getting stuck in cash if the markets bounce, cuz I don't have any idea how far down a bottom is. I've got the bulk of my remainng stock exposure set to exchange for the GIC Tuesday when the market closes. I check the market midday and if it looks bad, I'll let the exchange happen. I may let it happen regardless. Cash is a good place to be. 6/13/06; It went through: Screw it. Cash is NOT trash. Here's what I've got; I'm holding less than 6% stock funds not including the B/P Fund. I'm at 85% GIC, tracking positions in the investible funds, and the rest is the B/P Fund, which is more bonds than stocks. CLICK ONNIT...  I'm just flat ....' amazed. The market is cascading down seemingly without pause. I've been selling losers and holding on to winners in my trading account and I've still been ....' hammered flat. It feels like stocks are going to zero. Check this out; CLICK ON DE CHART  Six months to a year's gains gone in almost all the funds in 3 weeks. AMAZING! Bob Mamini was right that RWMFX is stable and highly resistant to price movement under almost any circumstances. I'm still not clear how a stock fund that won't go up OR down is a good thing. Twenty nine percent up in 20 months and feelin' like the work really paid off. Stay tooned....      ( 3 / 1517 ) ( 3 / 1517 )

I'm listening to Freddie King's "Going Down", It seems appropriate...

Saturday, June 10, 2006, 03:15 PM

"No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some." -- Ken Keyes, Jr. Charts and Tables up. I talked to some brothers and sisters at the Union meeting and got some input. I've edited some of the pages slightly, no biggie. But the site IS a constantly evolving work. Take a spin through it once in a while and see what's new. Continued from 5/27/06 ..... Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. Every so often, I'd ask Jack if he had any other names like Bill Sams and Paramount. He'd give me the name of a different fund in a different sector, a quality fund from a well known investment house, and I'd put some money in. They'd do OK, Bill'd do as well, they'd have a so-so stretch and I'd put the money back in Paramount. The latest fund was IDEX JCC Growth (IDETX). Suddenly, the money there had doubled. Click on the picture below.  Between '96 and '98, IDETX had doubled my money. I took everything out of Paramount and put it in IDEX JCC Growth. Between 1998 and the first quarter of 2000, IDEX made back the money lost in FPRAX and then some; it doubled again. In the meantime I'd read an article called "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine. Go ahead and Google it. It's archived and still available and free besides. The article predicted the mechanism of the downfall and end of the dot com era. I'd been around long enough to have witnessed the 1980's end of the energy and real estate/savings and loan eras and I knew that it was only a matter of time until the same thing happened again to the dot coms. Obviously the JCC advisors of the IDEX Fund were smart guys and they would ride the bubble to the top and step off the elevator when it started to go down.(I love to sprinkle mixed metaphors willy skelter.) Here's what happened to my investment in the IDEX JCC Growth Fund, Click onnit;  My wife and I took some of the FPRAX/IDETX money and bought our house in mid 2000 on the first leg down of the collapse of the Dot Com bubble. We got a really lucky break on a house and we had the money thanks to IDETX and we moved on it. We weren't about to let that opportunity go away. I rode the rest of the IDETX money part way down and I bailed out of a one time winning mutual fund that was now in the process of destroying my savings. AGAIN. Now I was REALLY pissed. There was something going on that was giving me excellent gains and then taking them away and I didn't understand why. So I got busy. Next week; Some of what I learned about mutual fund investing. (To be continued) This week I went from 60% cash to 76% cash by putting this month's contribution in LRSCX and clearing out of RERFX. Click on the chart.  I had pretty much moved to cash except for LRSCX, RERFX, and RGAFX as of 5/15 because: 1)The American Funds have limitations on withdrawals and reinvestments. I withdrew what I could without triggering the rapid trading restrictions. 2)I thought the foreign markets would be insulated somewhat. 3)I think that LRSCX could still do well, relatively. But RERFX reaccelerated down and Friday I bailed out most of the rest of the way, trading restrictions be damned. I suspect that a significant amount of the money out there in euro/asian land may be US in origin and on its way home, markets are determined at the margin and a US slow down may be more feared than I thought, and the foreign markets appear to be going through their own rough patches. So I'm frozen out of the RERFX fund for 30 days as the price of holding on to what I've made in the last 20 months. I can tolerate that. To recap; I've declared victory and gone substantially to cash a second time this year; I was early the first time and close enough the second time. I've got 30% gains over 20 months, 3.86% YTD, and I'm 252% up on the Balanced Pooled Fund. I was up 40% over 19 months and up 11% from Jan 1st YTD, but my inability to predict the future resulted in giving part of my gains back. Again, I can tolerate that. "The first step to making money is not losing it." -- Ed Easterling "It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong." George Soros I currently have residual amounts (tracking positions) in the funds that I see as investable at this time. I'm frozen out of one of the funds for the next 30 days. The economy remains stronger than most people realize and especially strong in the sector we work in. The markets may be predicting a recession. They predict more recessions than occur. This may only be a correction in a demonstably overheated market with a resumption of the market as usual just down the pike. Or not. Regardless, there has been an unholy carnage in the market as a whole that is masked by the popular indices. That will take a while to unwind. Trapped longs, levered positions being unwound by margin clerks, hedge fund closures, and mega mutual fund pull backs and redeployment in alternative sectors accomplished, in process or still to come? You can make a case a buncha different ways. Recession ahead or correction mostly accomplished, I'm way ahead and as safe as I can be. Seventy six percent of my funds earning four percent annual return with no downside has a possible recession covered. The GIC is ahead of the Balanced Pooled Fund at this point. Pretty Cool. I've got time to grab a figurative samich and brew. I've also got the flexibility to watch for the possible end of the short sharp shock of an overdue 10% correction instead of an upcoming recession because I've made five years progress during the last two. What's not to like? Special called meeting very likely in the next three weeks. Contract Time. See ya at the hall.      ( 3 / 1510 ) ( 3 / 1510 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar