| |

Jes' Yer Friendly Neighborhood Retahr'd Ol' Pipefitter......

Friday, March 7, 2014, 02:06 PM

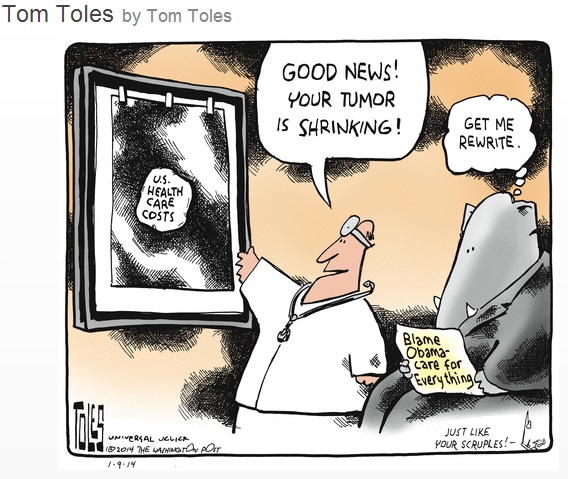

Humility, along with the ability of those who have been wrong to acknowledge their mistakes, are at all-time lows and, sadly, trending lower still. Ideology can apparently hold sway against reason, facts, and data for longer than I’d imagined.

-- Invictus

Miles to go. Tutu.

http://www.youtube.com/watch?v=_dq1dv6xY6w

'Masa RCFP

http://www.youtube.com/watch?v=EKnwgPdfeA4

Back Inna Day, We were All Cold Blooded...

http://www.youtube.com/watch?v=cLb6rUZlJ7A

http://www.youtube.com/watch?v=cHWLpJRlBYA#t=11 Tha'sjes 'na whayetizzzz..... Greezel.

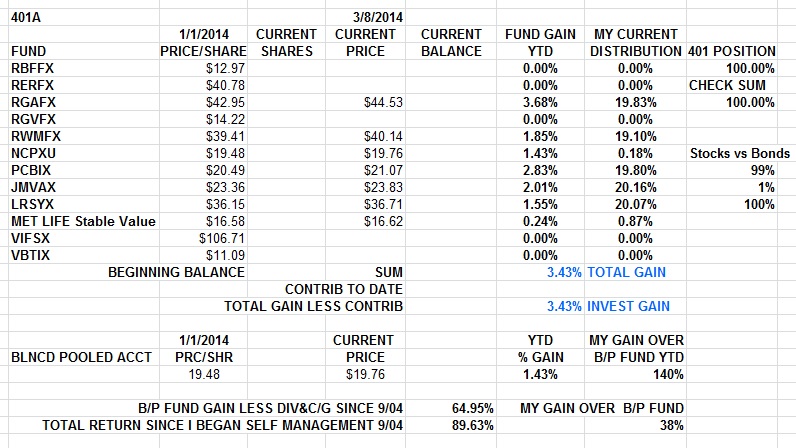

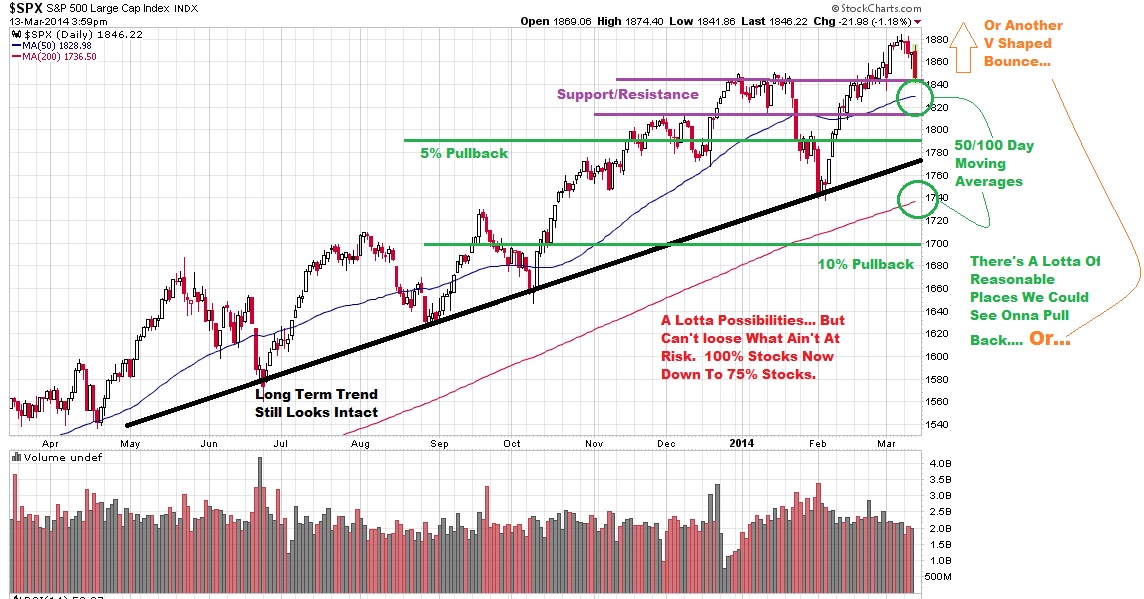

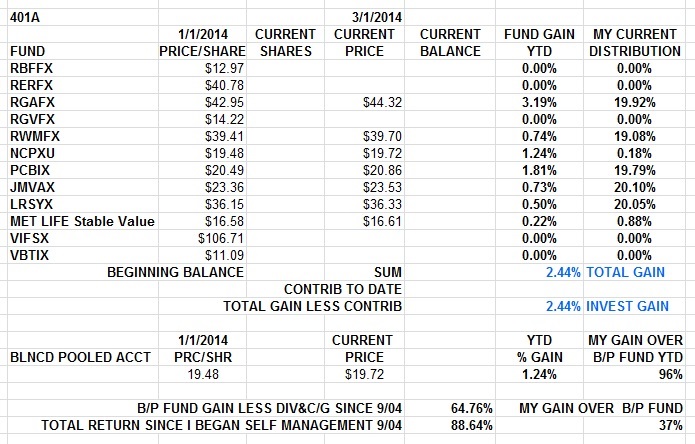

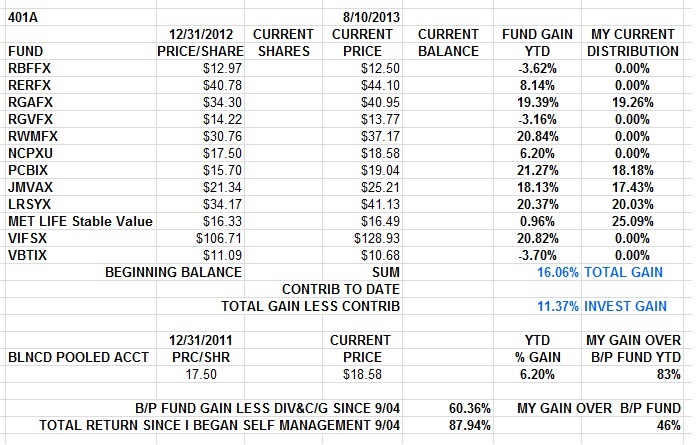

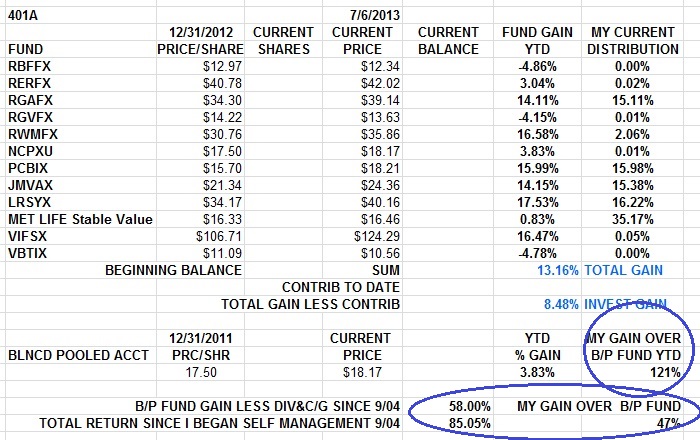

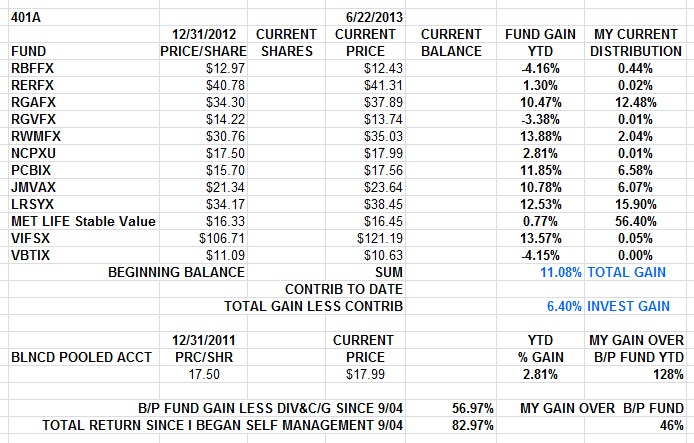

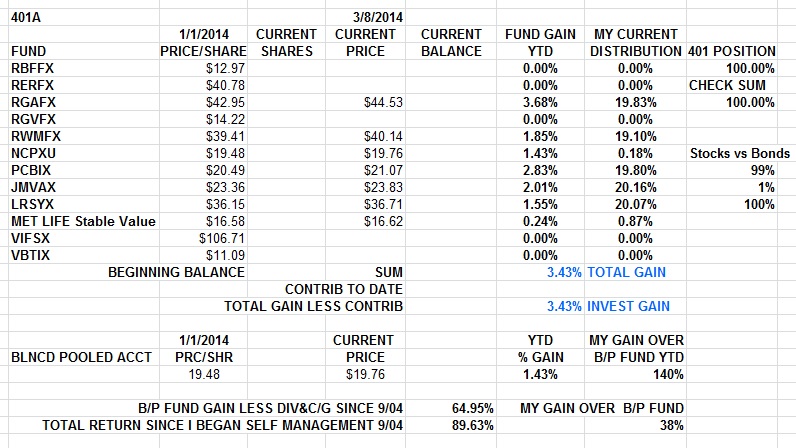

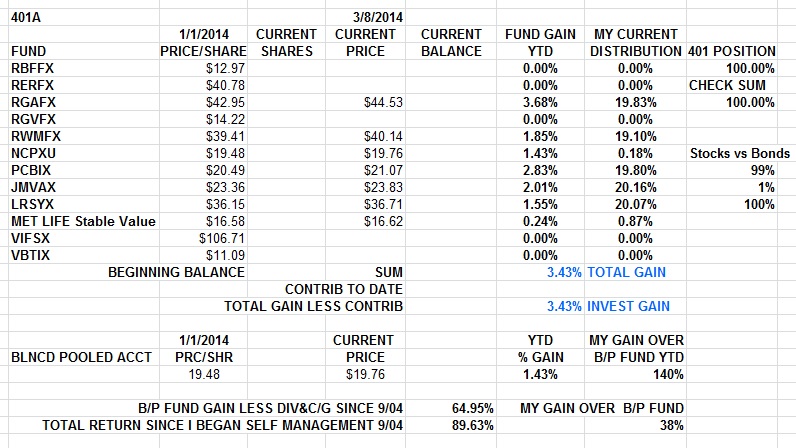

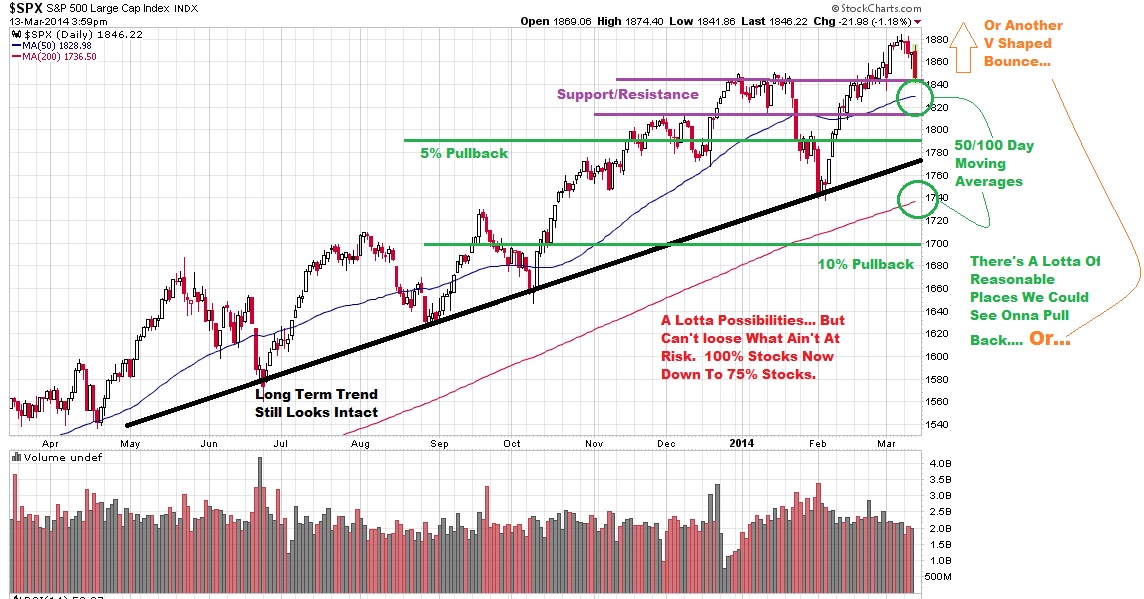

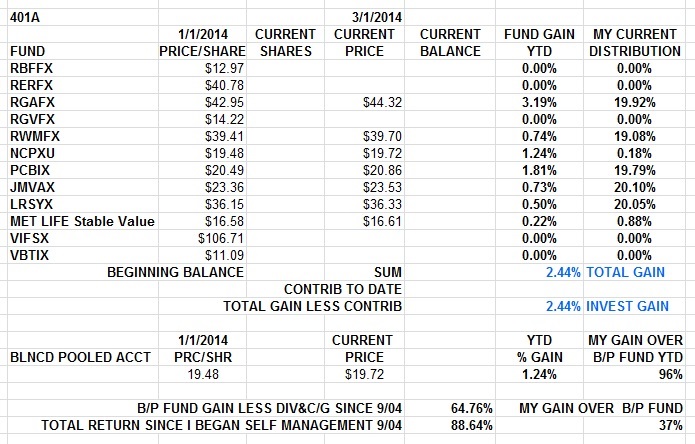

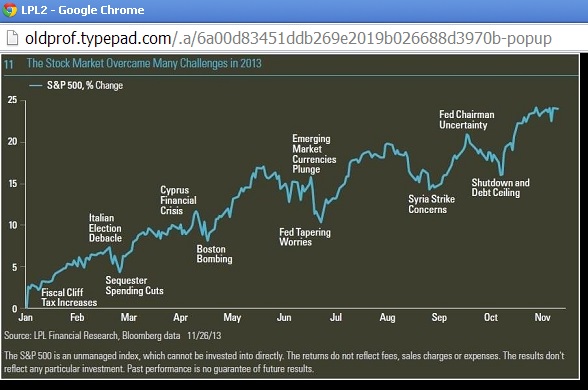

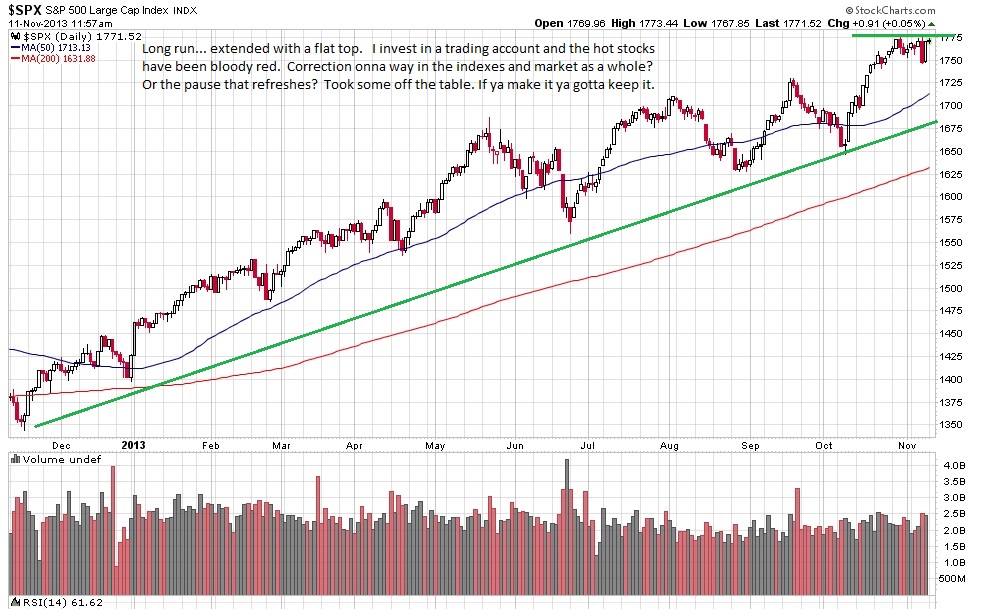

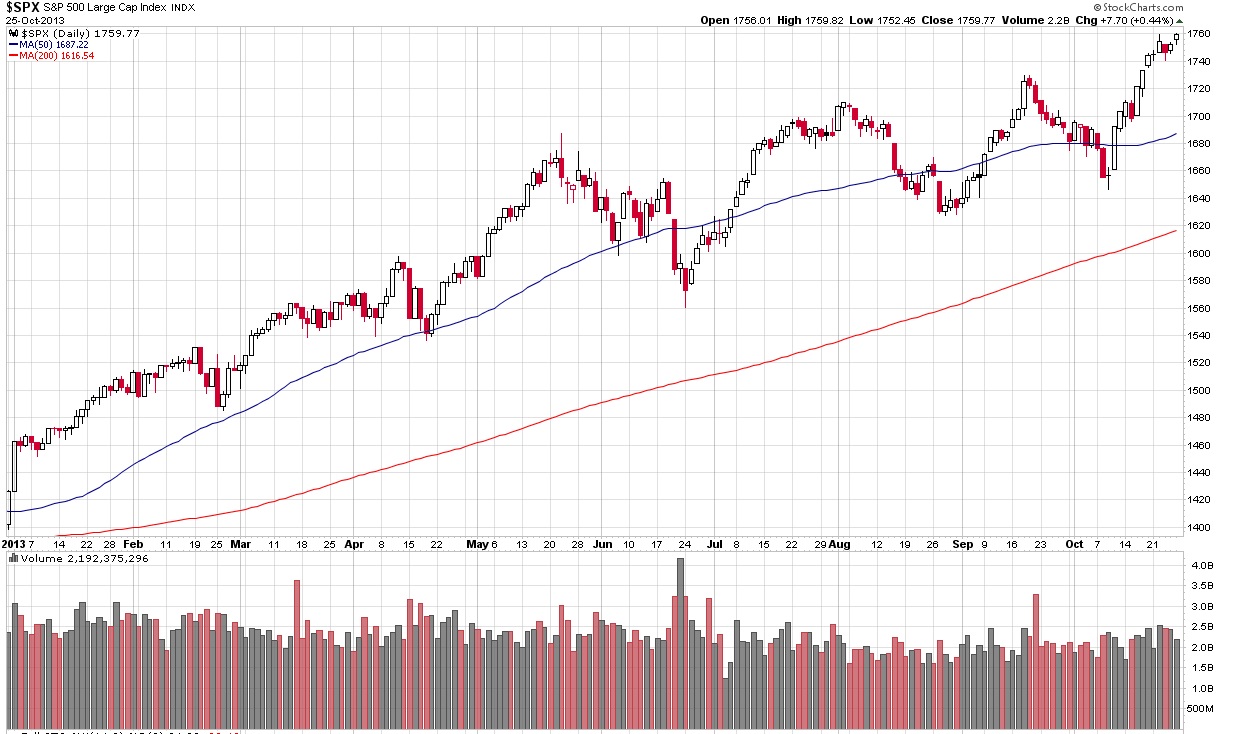

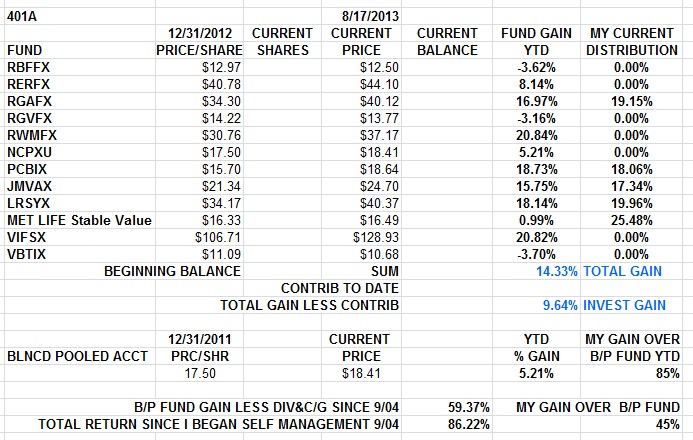

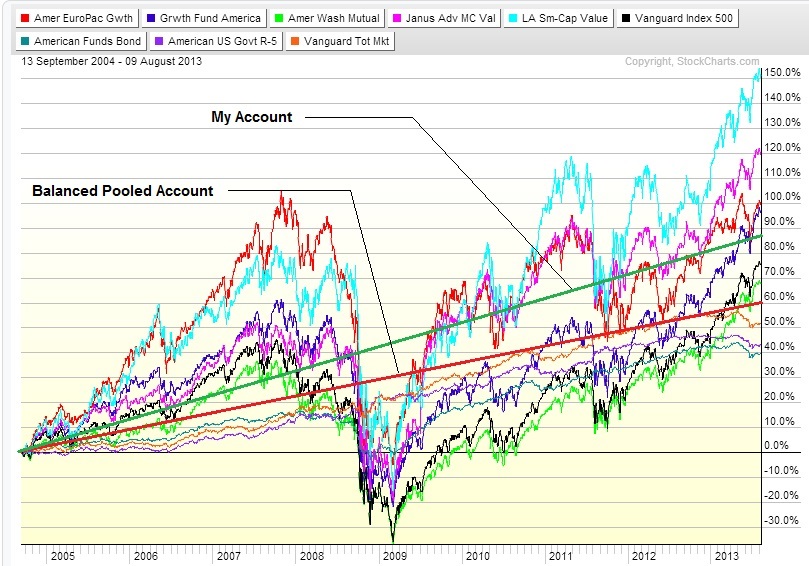

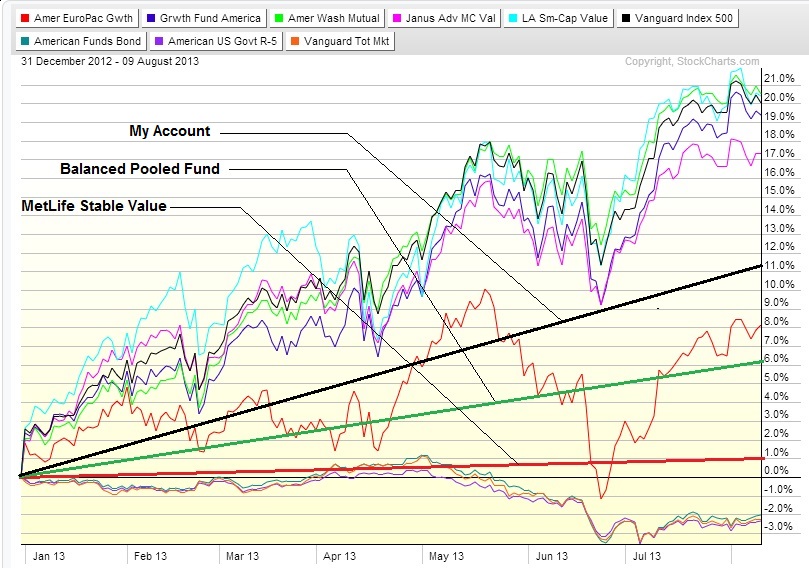

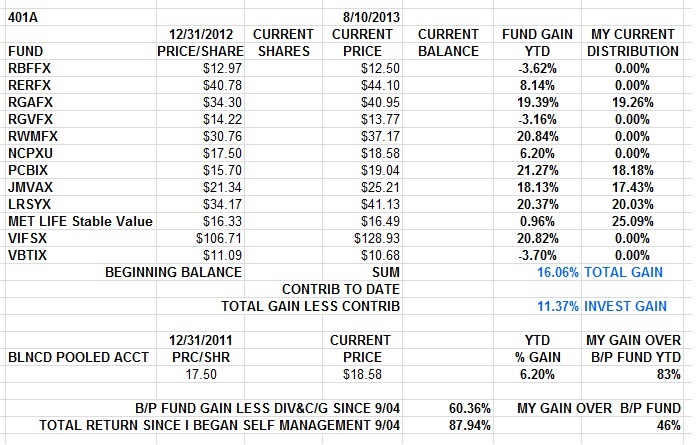

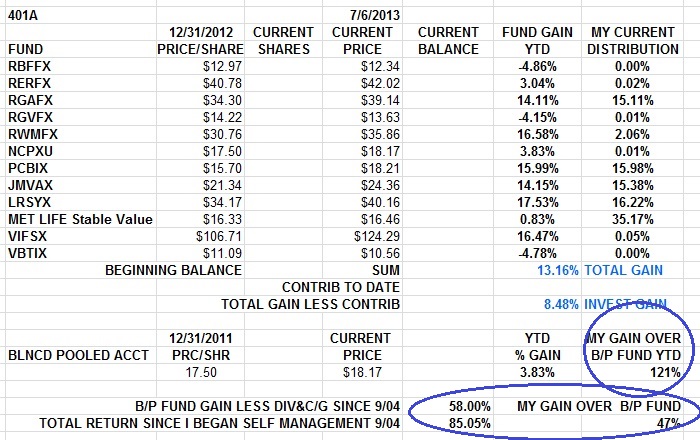

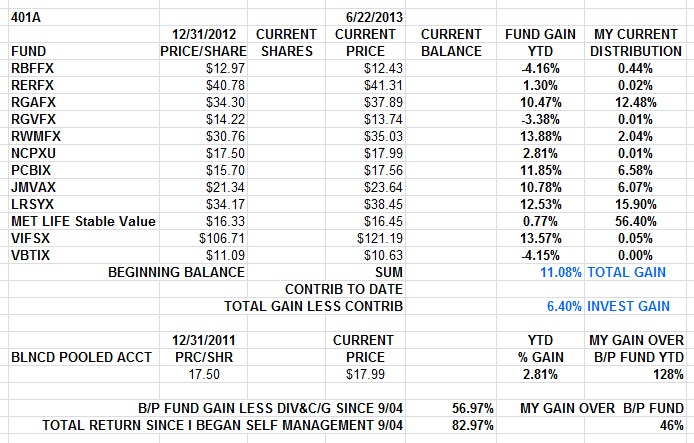

I retired in September of 2013. I started managing my 401 in 2004, after leaving it untended since its inception in 1993. I had straightened out a coupla IRA's after the dotcom-9/11 financial crash and as an afterthought, applied the same evaluation to my 401 and found it and my defined benefit pension fund in desperate straights. I was able to help turn both around. In part, that story is on my website. Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I'm kept and am managing $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year, and how Ive done since I started managing my 401 in 2003.

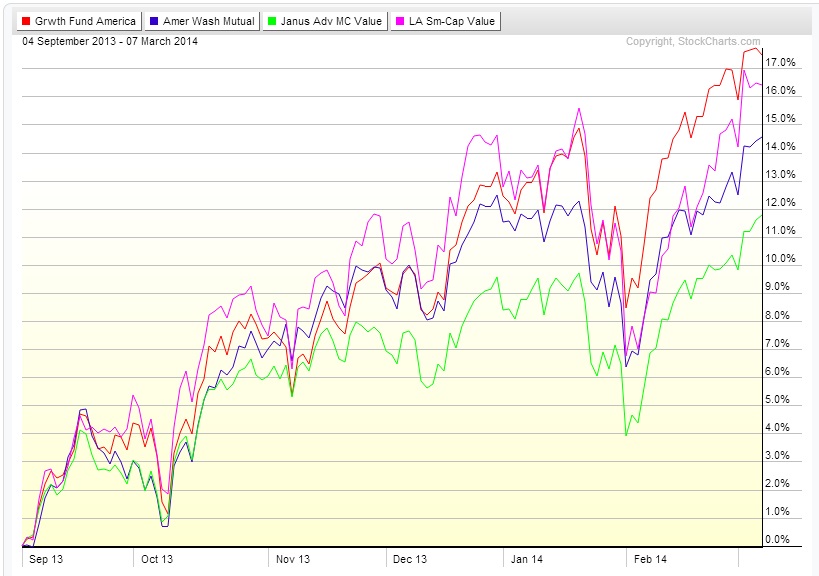

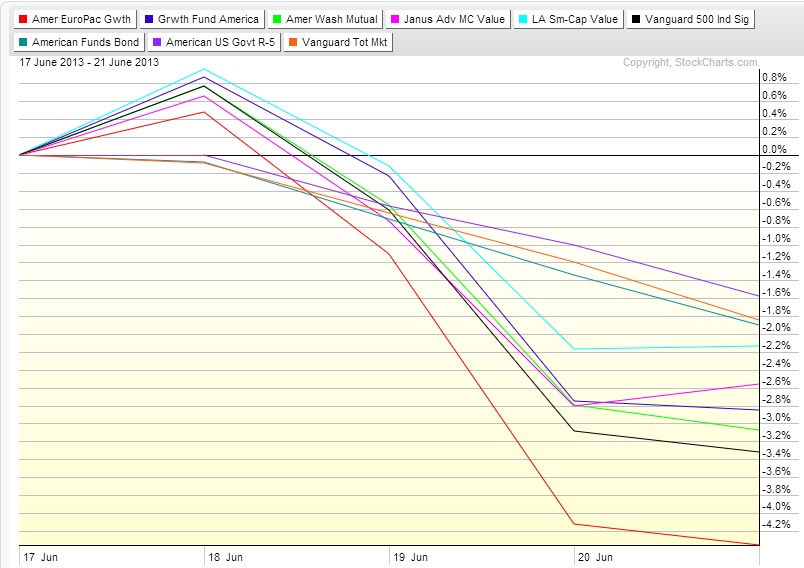

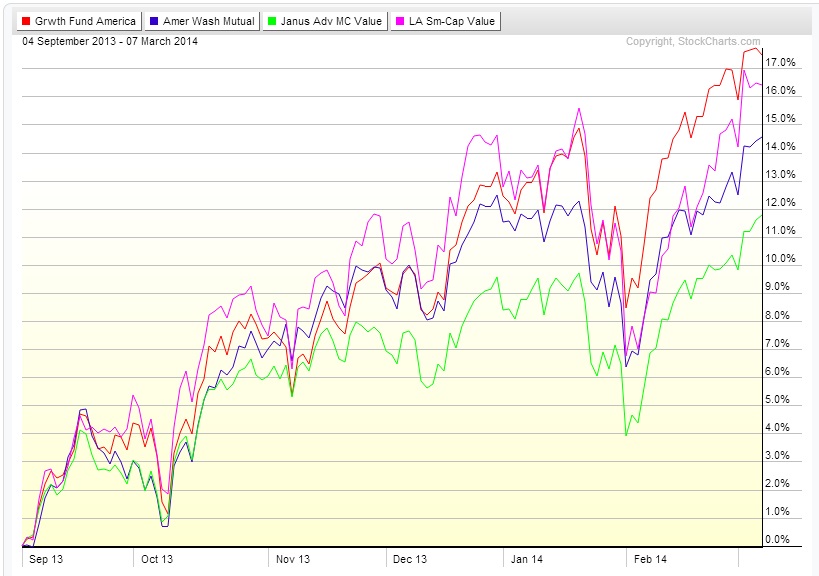

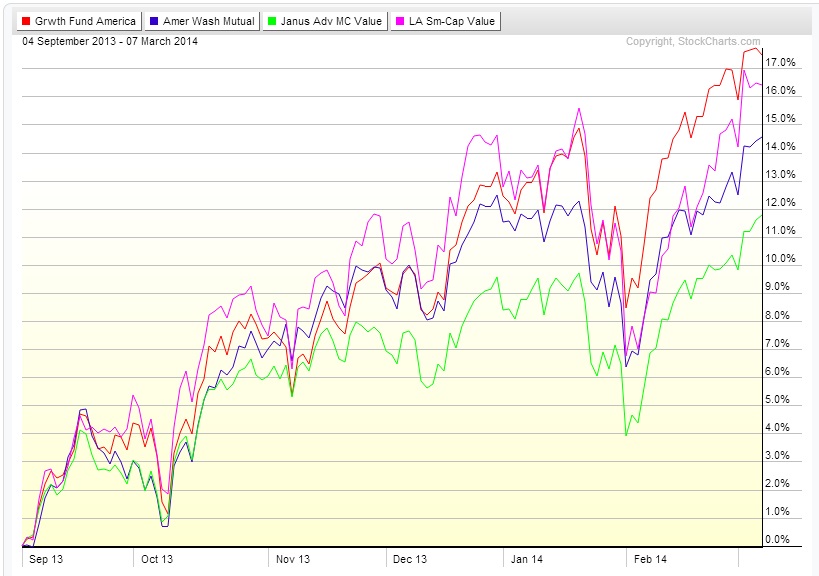

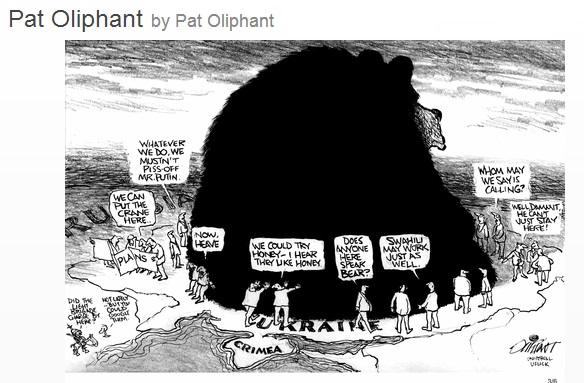

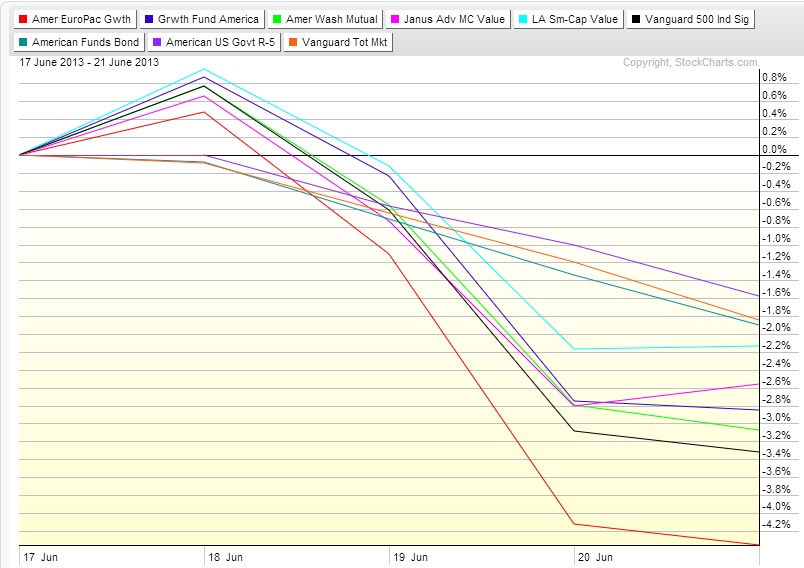

Here's an Interactive Performance Chart of the funds I have available to me in the 401 and how they've done since 9/1/13.

I've made a copy of the Excel spreadsheet I use to track my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience. I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination compel based on what I read and some professional level subscription data.

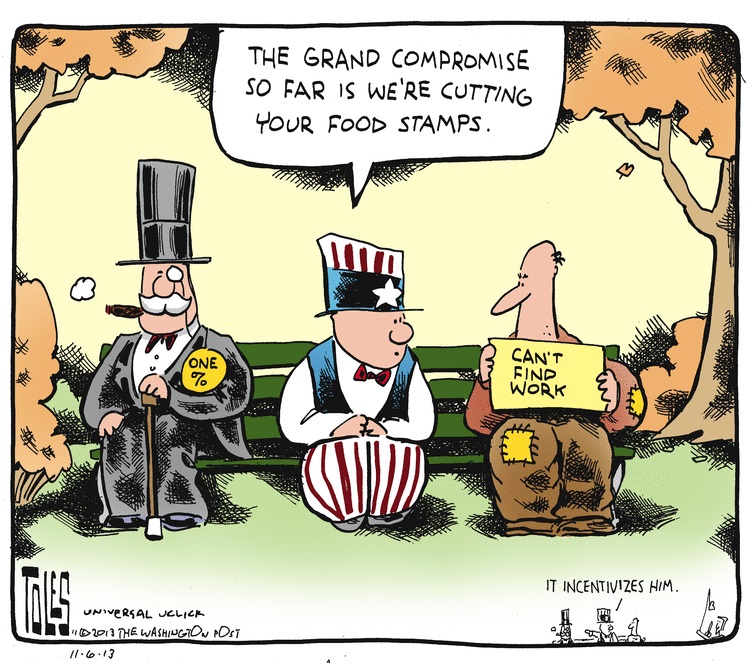

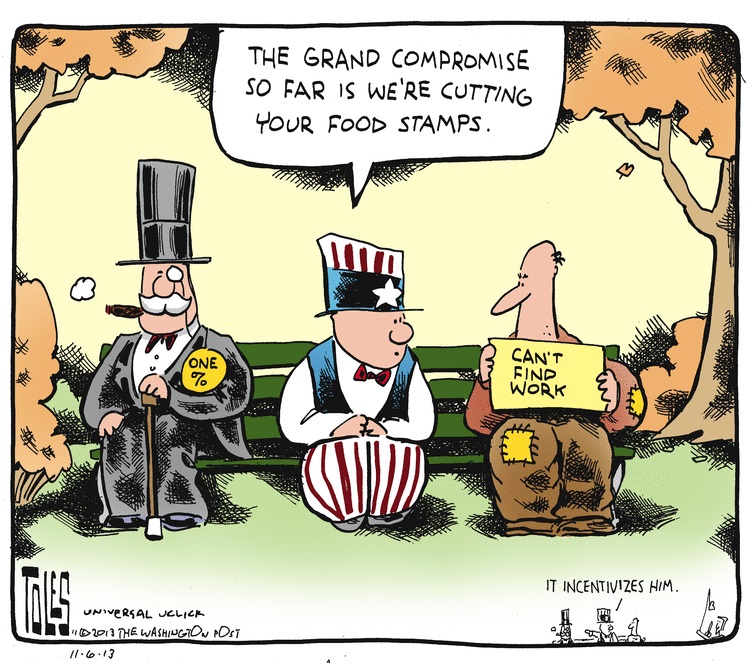

Food fer thought...

http://schaefferstradingfloor.com/why-t ... r-15-years

If Could Only Read And Act On One Post A Week...

http://oldprof.typepad.com/

Major Seriousness About 401's

http://www.washingtonpost.com/business/ ... story.html

Monday

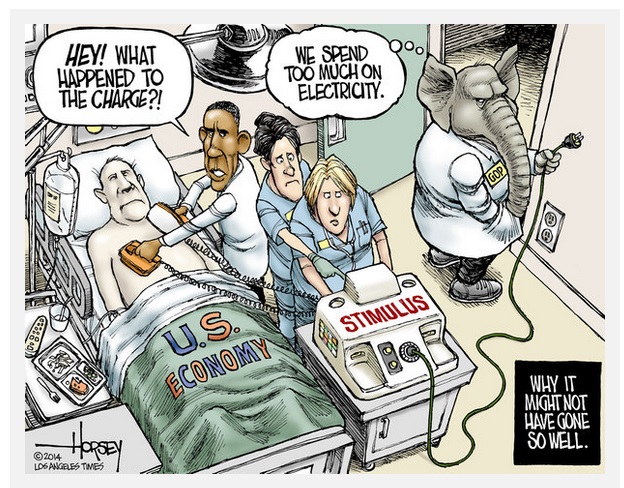

Ya Think????

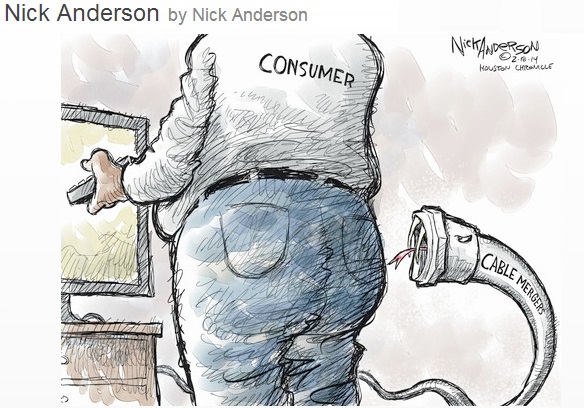

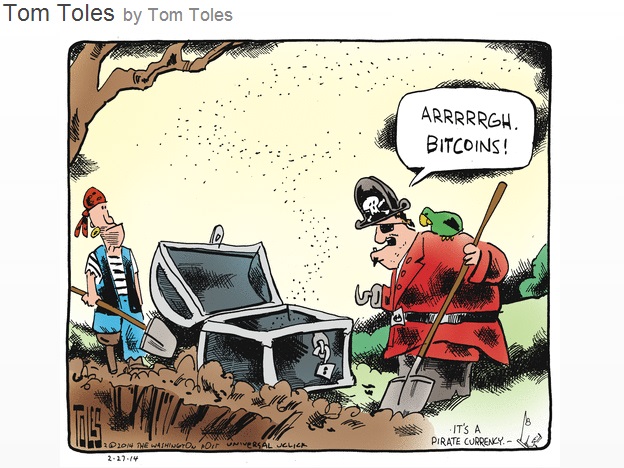

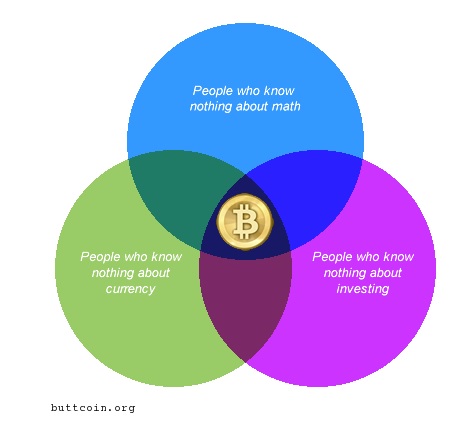

http://www.businessinsider.com/ponzicoin-2014-3

Thursday.

Nothing is as it seems....

http://www.businessinsider.com/update-o ... ght-2014-3

( 3 / 1406 ) ( 3 / 1406 )

It's Exciting Getting Old. Everyday It's A Brand New World!!!

Saturday, March 1, 2014, 02:55 PM

“What you do speaks so loudly that I cannot hear what you say.”

-- Ralph Waldo Emerson

Hollywood Fats Band

I first heard Fats (Michael Mann) at the The Boarding House in SF. He was backing up Jimmy Witherspoon and GAWD He Was Smokin' Hot!!!! Super tight band, kick ass backing for 'Spoon and when Fats stepped up, it was incendiary. Yeah, that is "The Mole",on bass. Check out the SRV and Albert King riffs in the text on these You Tube entries. I had a tape of the Blues Afternoon from the Monterey Jazz Festival where Fat's was on his own and later backed up Etta James and then Eddie "Cleanhead" Vinson. I wore the tape out.Hollywood Fats died way too soon. He is missed.

http://www.youtube.com/watch?v=HquyEt8UXvY

http://www.youtube.com/watch?v=R6s8khM5wO4

http://www.youtube.com/watch?v=pANbCHSd4Tc

http://www.youtube.com/watch?v=Nlzk10Cq85o

http://www.youtube.com/watch?v=ST2-28u3mds

http://www.youtube.com/watch?v=7ivX5ECliEU

I just acquired Canned Heat at the Parr Meadows 10 year Woodstock celebration. It was recorded for the King Biscuit Flour Hour. Fats was Heat's guitarist at the time and it is one of the best examples of his talent available. Missing is the small club/theatre dynamics and interplay with a vocalist on serious blues, but in his genre and era, that ain't to be had, 'cepting cassete tapes and obscure TV footage.

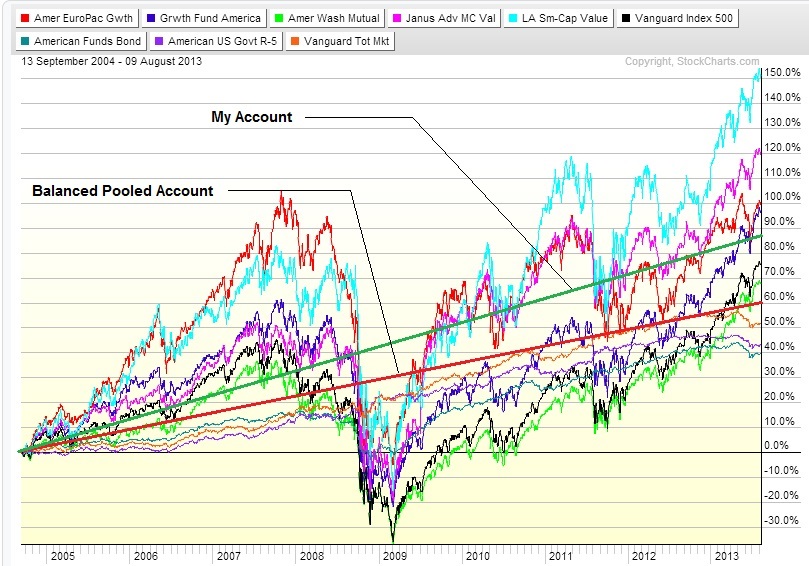

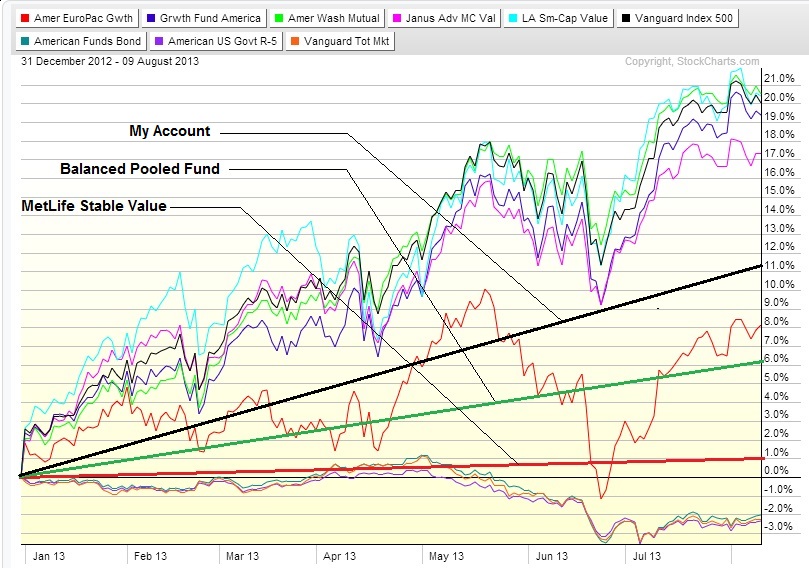

I retired in September of 2013. I started managing my 401 in 2004, after leaving it untended since its inception in 1993. I had straightened out a coupla IRA's after the dotcom-9/11 financial crash and as an afterthought, applied the same evaluation to my 401 and found it and my defined benefit pension fund in desperate straights. I was able to help turn both around. In part, that story is on my website. Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I'm kept and am managing $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's how I've done this year, and since I started managing my 401 in 2003.

I've made a copy of the Excel spreadsheet I use to track my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience. I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination compel based on what I read and some professional level subscription data.

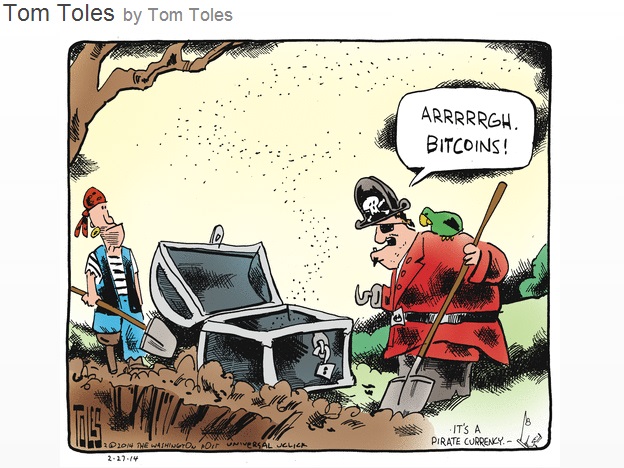

http://buttcoin.org/extended-dormancy-mt-gox-erupts

http://www.ritholtz.com/blog/2014/03/truisms/

Monday...

Wed

http://www.bloomberg.com/news/2014-03-0 ... -jobs.html

Josh is a guy I listen to and put money with. Stuff like this is in part why.

http://www.thereformedbroker.com/2014/0 ... explained/

( 2.9 / 1429 ) ( 2.9 / 1429 )

Still Your Friendly Neighborhood Brokedown Retired Ol' Pipefitter....

It makes me cringe to have 'experts' tell us not to fear the Fed. You don't fear the Fed but you do fear a market that fears the Fed. If the rest of the world is selling because they are afraid, justified or not, you respect the price action and move out of the way.

-- James “Reverend Shark” DePorre

I was channel surfing for some old Lawrence Welk music videos when I found these. They are not quite as old but still appeal to the senior citizen I've become.

http://www.youtube.com/watch?v=-rdmG0k8S8k

http://www.youtube.com/watch?v=eHbNU9WuVgw

SIGNIFICANT

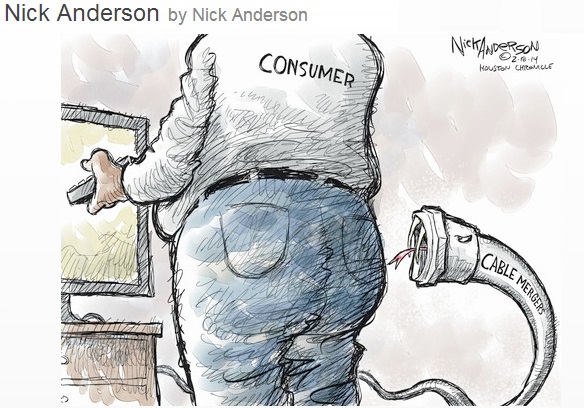

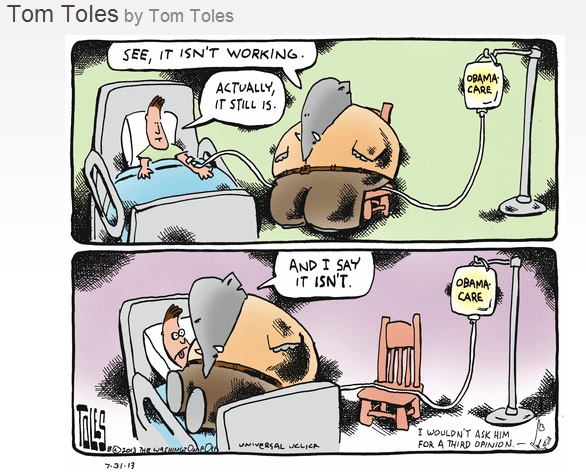

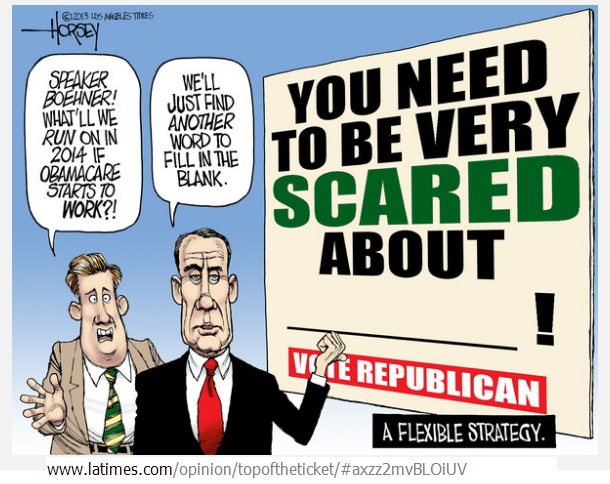

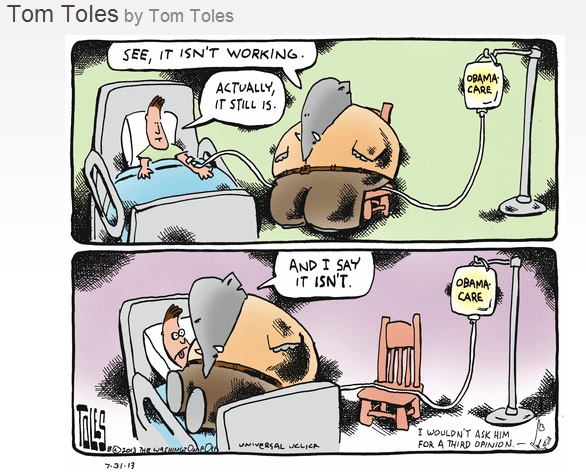

She may or may not know that, but the editors of the Wall Street Journal certainly do, and for them to put her story out as if her insurance problems would disappear if only the Affordable Care Act ceased to exist is nothing short of malpractice.

http://www.latimes.com/business/hiltzik ... z2kD0Uesyb

http://www.businessinsider.com/why-this ... an-2013-11

Debka... 30% Crazy Shit, 30% YOU'LL Never Be Connected Enough To Find Out If This Is True Or Not.... and 30% Seen There A Day Or A Month Before Major News Sources...

http://www.debka.com/article/23434/Iran ... d-is-bare-

http://www.businessinsider.com/details- ... or-2013-11

http://www.ritholtz.com/blog/2013/11/ab ... revisited/

http://www.grantland.com/story/_/id/990 ... al-history

http://www.nytimes.com/2013/11/03/magaz ... l&_r=0

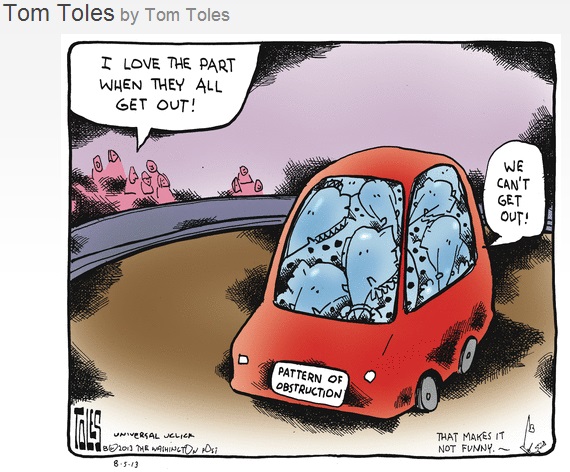

Nest Of Snakes

http://www.businessinsider.com/the-hous ... al-2013-11

Wed

http://www.nytimes.com/2013/11/17/magaz ... ;_r=1&

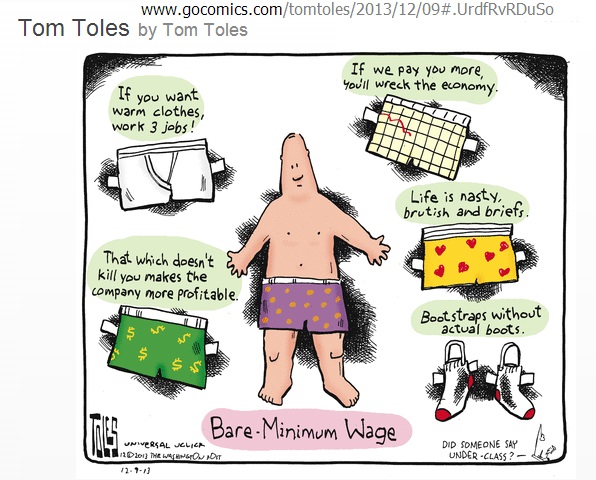

Do I Think Of My Self As One Of The Almost Gone Generation Where The Floor, When All Else Failed, Was To Show Up Every Day At A So So Job, Still Be Able To Buy A House, Raise Kids, And Retire With Dignity? Some Times...

http://www.npr.org/2013/11/12/242999770 ... revolution

http://www.businessinsider.com/actually ... an-2012-10

Fuckin' "A" Tweetie

http://www.salon.com/2013/11/12/elizabe ... ext_phase/

( 3 / 1407 ) ( 3 / 1407 )

Gone Fishing... Got my Trout Grenades and my net.

Saturday, October 12, 2013, 04:59 PM

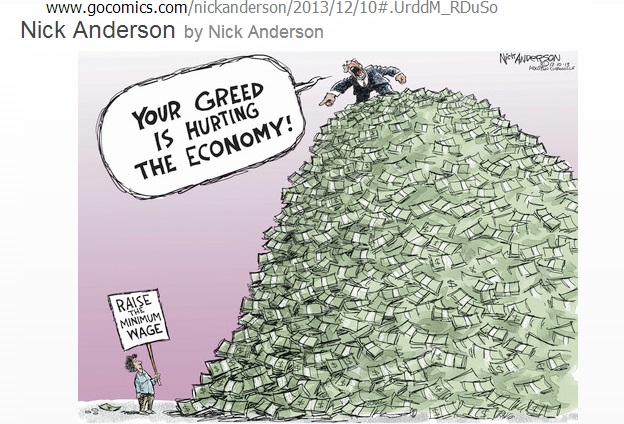

"Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone."

-John Maynard Keynes

Interesting... But I didn't read the last coupla paragraphs... Too long; Lost interest.

http://thelastpsychiatrist.com/2013/09/ ... ate_t.html

Sunday

http://www.thereformedbroker.com/2013/1 ... the-taper/

http://www.newyorker.com/talk/financial ... um=twitter

Twelve years ago, I asked the General Contractor at the Cell Genesis job for the MSDS on the epoxy floor coating being installed. The rep brought back a one page copy from what was supposed to be a multi page document, indicating that the product was benign. The page was from the MSDS for latex paint. The box holding the flooring epoxy components said "Do Not Open Product Unless You Are Wearing A Respirator Suitable To The Chemistry Of The Product." I can relate it to this NFL riff. There were dollars involved vs health and safety. I know what some people think takes precedence.

http://www.ritholtz.com/blog/2013/10/league-of-denial/

Anybody else have a problem with this?

http://www.washingtonpost.com/opinions/ ... story.html

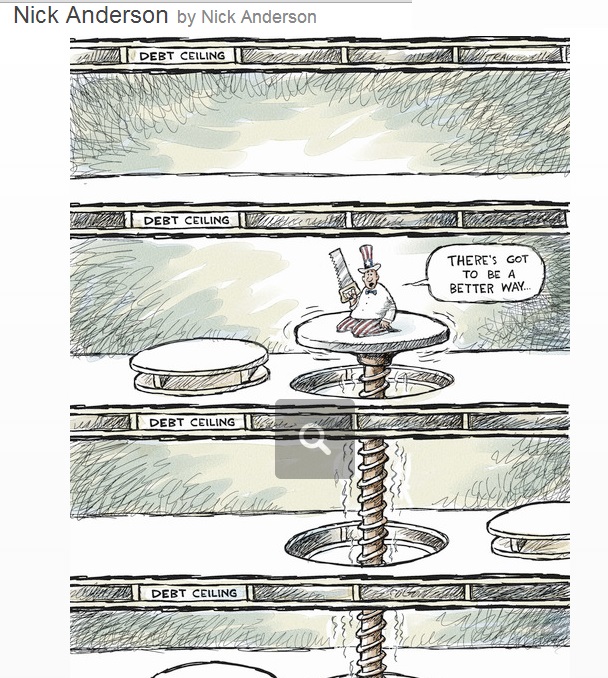

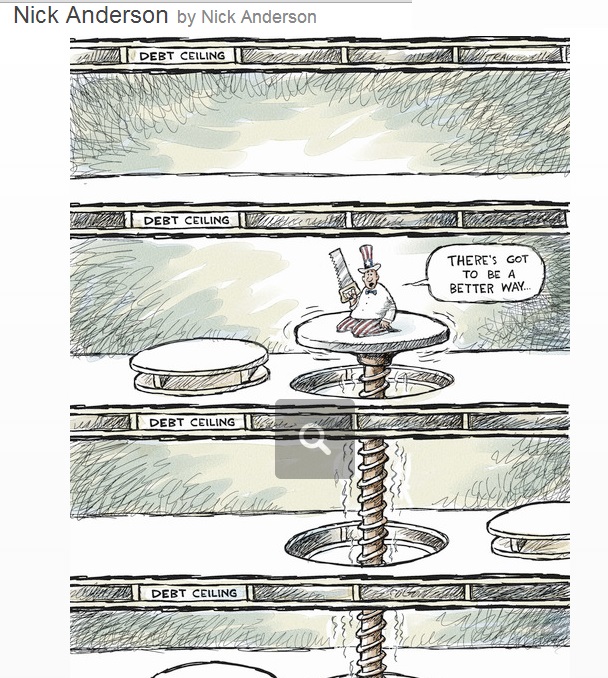

Schedule for Armageddon...

http://blogs.wsj.com/washwire/2013/10/0 ... -due-when/

Mon

Bill McBride is da man...

http://www.calculatedriskblog.com/2013/ ... o-see.html

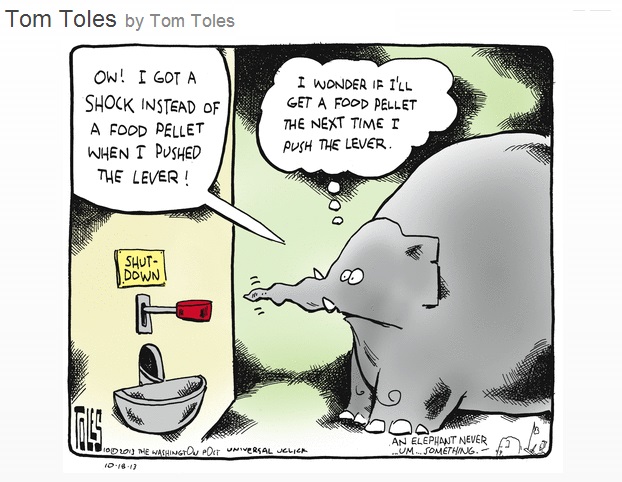

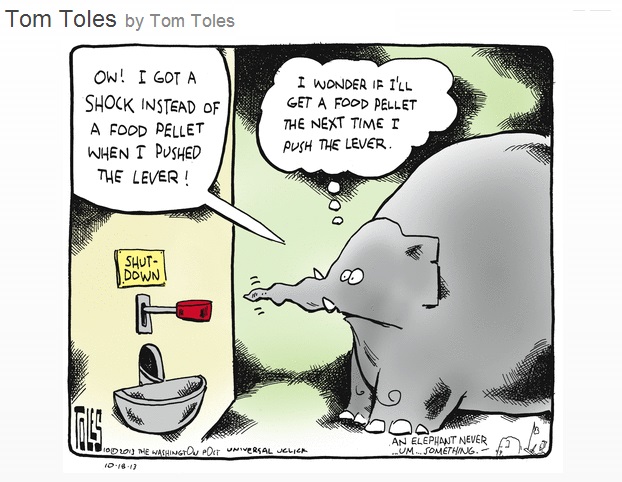

Shutdown/Non Default Porn

http://www.businessinsider.com/debt-cei ... lt-2013-10

Something Pleasant Instead

http://www.businessinsider.com/marvin-g ... on-2013-10

No Shit

http://www.businessinsider.com/mike-row ... on-2013-10

http://pragcap.com/goldman-sachs-shutdo ... gdp-by-0-5

http://pragcap.com/demand-for-a-third-p ... -new-highs

http://www.thereformedbroker.com/2013/1 ... owth-rate/

Huge... http://www.pionline.com/article/2013101 ... etirement#

http://larrysummers.com/the-battle-over ... ong-fight/

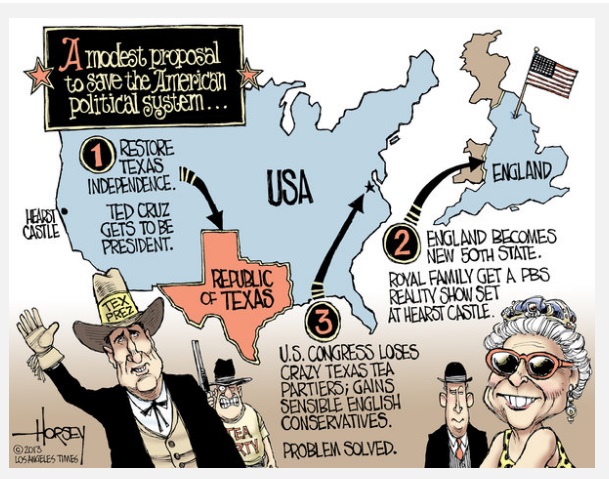

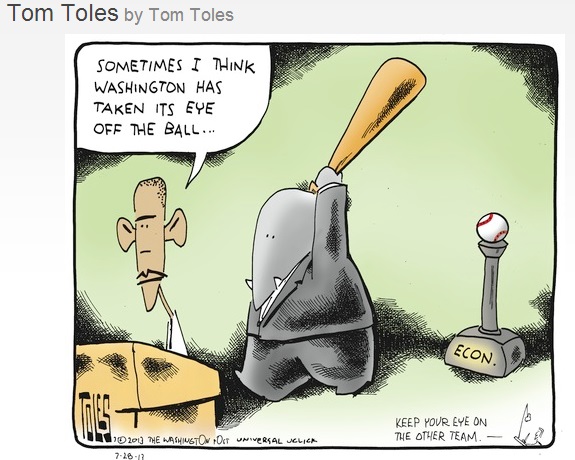

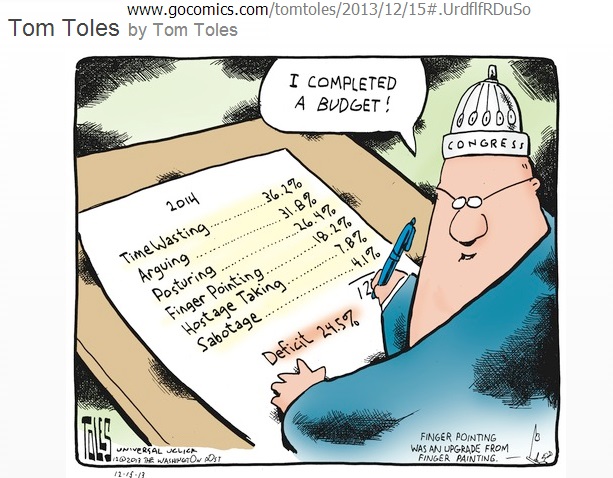

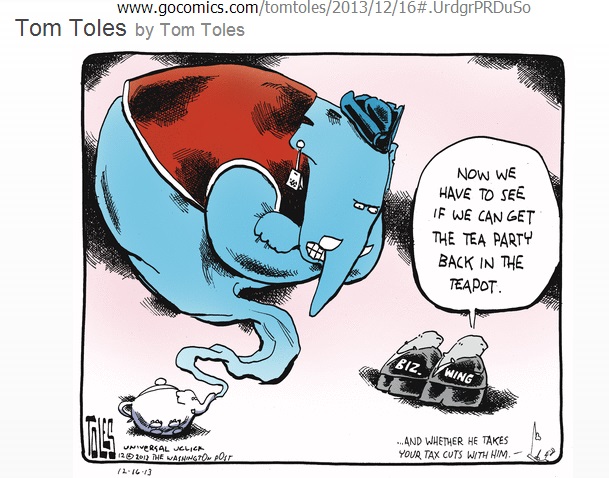

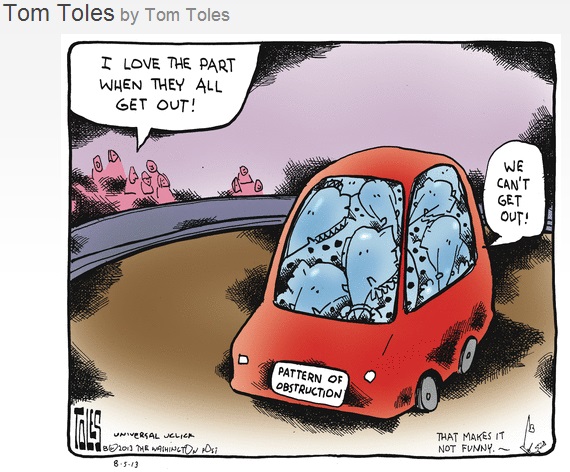

Here's Grover Norquist on Ted Cruz:

"He pushed House Republicans into traffic and wandered away."

WONK WONK...

http://www.washingtonpost.com/blogs/won ... s-failing/

Fires don't reverse and burn backwards...

http://blogs.reuters.com/felix-salmon/2 ... ady-begun/

Wed....

Hmmmm....

http://nbcpolitics.nbcnews.com/_news/20 ... think?lite

http://www.nbcnews.com/business/debt-cl ... 8C11390916

http://www.bloomberg.com/news/2013-10-1 ... dgame.html

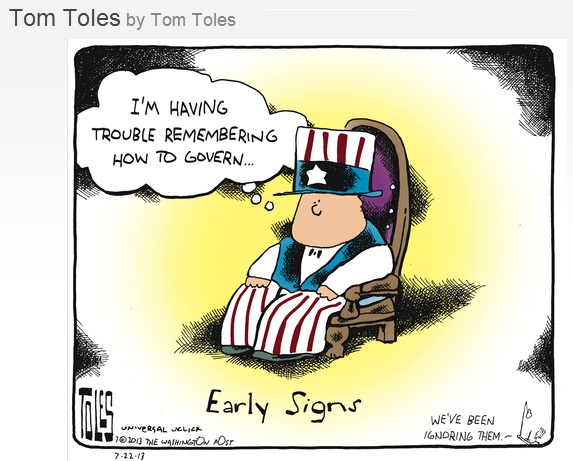

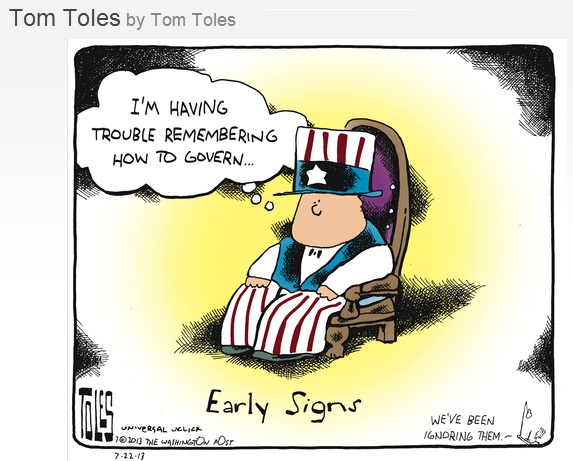

But sometimes, it’s been said, the greatest courage is displayed in standing before a crowd and affirming that two plus two equals four — now the main Republican challenge. Political morality is determined not simply, or even mostly, by intentions, but rather by results. There is a virtue in achieving what is achievable — in actually making things better than they are.

Read more: http://www.businessinsider.com/analyst- ... z2hoSM3GLo

http://www.businessinsider.com/goldman- ... 17-2013-10

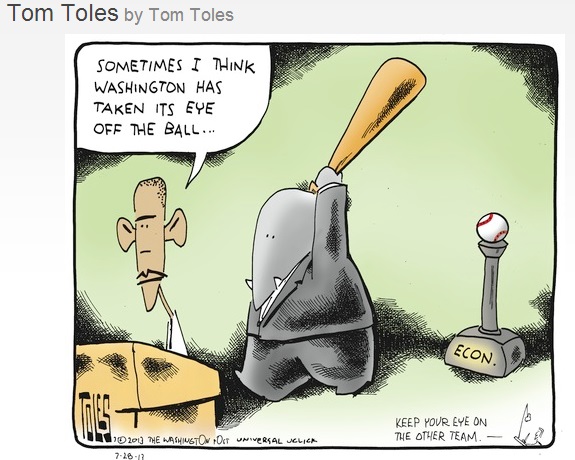

http://pragcap.com/can-we-stop-with-the ... se-already

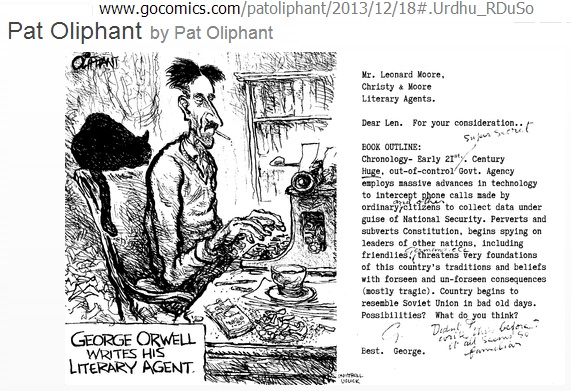

I'm an ex Catholic. And there ain't no ex quite as ex as an ex Catholic. And I can't even imagine what kinda load the enslaved and molested Catholics are carrying. But I check out what's happening every so often... and I find that I like the new Pope's modus operandi.

Boston College theology professor Thomas Groome said, "I think it will be a real test for conservative Catholics," he said. "They have always pointed the finger, quoting the pope for the last 35 years. Suddenly, will they stop quoting the pope? It'll be a good test of whether or not they're really Catholics."

http://www.businessinsider.com/why-cong ... wn-2013-10

http://ibankcoin.com/mr_cain_thaler/201 ... ment-72109

http://www.calculatedriskblog.com/2013/ ... sting.html

http://economix.blogs.nytimes.com/2013/ ... goal/?_r=0

http://economix.blogs.nytimes.com/2013/ ... goal/?_r=0

Thurs

http://www.bloomberg.com/news/2013-10-1 ... -lost.html

( 3 / 1325 ) ( 3 / 1325 )

Saturday, September 14, 2013, 03:17 PM

"However beautiful the strategy, you should occasionally look at the results."

--Sir Winston Churchill

In Yo Dreams.....

http://www.youtube.com/watch?v=CfnLewb7 ... =endscreen

http://www.rickferri.com/blog/

Cheap and Easy Self-directed Investment Options

Congress provides US taxpayers with many different tax-advantaged options for retirement saving. Qualified self-directed employer sponsored retirement plans are some of those options. They included 401(k), 403(b) 457 plans, SEP IRAs, SIMPLE IRAs, and others. There are trillions of dollars invested in these plans. This is a good thing for workers and for America.

What Congress didn’t provide was a short list of investments that plan participants could put their money into. That was a mistake. As a result, many plans are load up the a wide range of costly investment products that pay Wall Street billions of dollars in annual fees and, to make matters worse, kick-back some of those fees to the employers in the form of administrative services.

My radical idea is for Congress to create a very short list of three (3), government approved, low-cost, diversified index fund options for participants in qualified self-directed plans – and that is it. Every plan in the country were employees are able to save tax deferred would be required to offer these three funds, and only these three funds in their plan to keep their tax exempt status:

Conservative growth: 25% total global stock index fund + 75% total US bond index fund.

Moderate growth: 50% total global stock index fund + 50% total US bond index fund.

Aggressive growth: 75% total global stock index fund + 25% total US bond index fund.

The default for all employees would be the moderate growth fund. They would then have the option to invest in Conservative Growth or Aggressive Growth. Fund providers would compete for then qualified plan business on cost only because the funds would be all the same. There would be no incentive to compete based on performance of their funds. This will drive investment costs down to only a few basis points, a level enjoyed by participants in the government’s own Thrift Savings Plan (TSP).

There would be no need for middle-men such consultants who earn fees by recommending investment products. It will also end the flow of cash from fund companies back to plan sponsors. Administrative costs would be paid fully by either the employer or employees. All costs would be fully disclosed. Finally, this idea will end most lawsuits against plan sponsors for impudent investment decisions.

The government created qualified self-directed employer sponsored plans with the thought of helping Americans save and investment for retirement. They did not do it so that Wall Street could get rich. Limiting all plans to these three extremely low-cost portfolios is a prudent move for employees and their beneficiaries, and it’s also prudent for employers who wish to have safe harbor from litigation due to bad investment decisions.

Rick Ferri

Somebody Should Do Something...

More food for thought:

http://www.streettalklive.com/daily-x-c ... g-bet.html

Sunday Night

http://www.ritholtz.com/blog/2013/09/tr ... wing-name/

Here’s what President Barack Obama‘s statement on Lawrence Summers‘s decision to withdraw his name from consideration to be the next chairman of the Federal Reserve would have looked like after 40 milligrams of Sodium thiopental:

“Earlier today, I spoke with Larry Summers and accepted his decision to withdraw his name from consideration for Chairman of the Federal Reserve.

Larry was a critical contributor to the radical deregulation that was one of many causes of the worst economic crisis since the Great Depression. It was in no small part because of his lack of expertise, false wisdom, and inept leadership that the economy crashed and burned and even today is still failing to be to back to its full growth potential.......

Relevant

http://blogs.reuters.com/felix-salmon/2 ... -treasury/

Coming up outa the dark...

http://www.businessinsider.com/obamacar ... nts-2013-9

WED...

http://www.businessinsider.com/the-enti ... aph-2013-9

Thurday... Bummer. Get Used To It.

http://www.nytimes.com/2013/09/19/busin ... l&_r=0

A needed slap up alongside da head. A click whore post.

Huge http://www.institutionalinvestor.com/Ar ... jtEMdKTiSo

http://www.ritholtz.com/blog/2013/09/we ... ns-shadow/

( 3 / 1391 ) ( 3 / 1391 )

De Doh Doh Doh , De Dah Dah Dah , Is All I Want To Say To You....

Friday, August 23, 2013, 08:21 PM

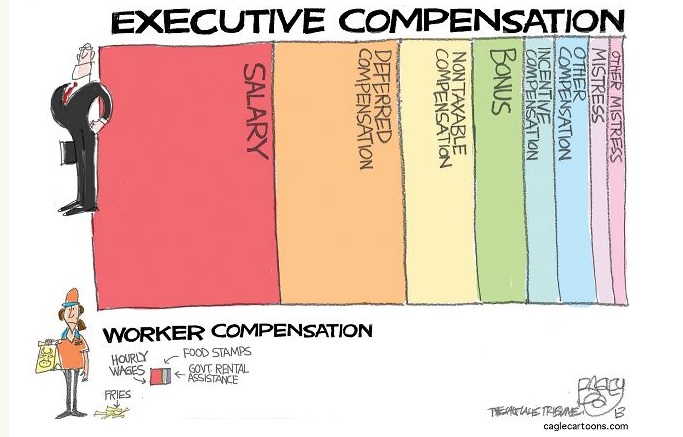

"The salary of the chief executive of a large corporation is not a market award for achievement. It is frequently in the nature of a warm personal gesture by the individual to himself."

-John Kenneth Galbraith

Saw 'em @ The Uptown. Definitely an uptown experience. I ain't the only grey haired geezer still out der...

http://www.youtube.com/watch?v=3W1jn0ZAjU8

http://www.youtube.com/watch?v=MPfgazmuC24

Klick Onna Video Tab. Racer Porn.

http://www.rushmovie.com/

http://www.washingtonpost.com/business/ ... story.html

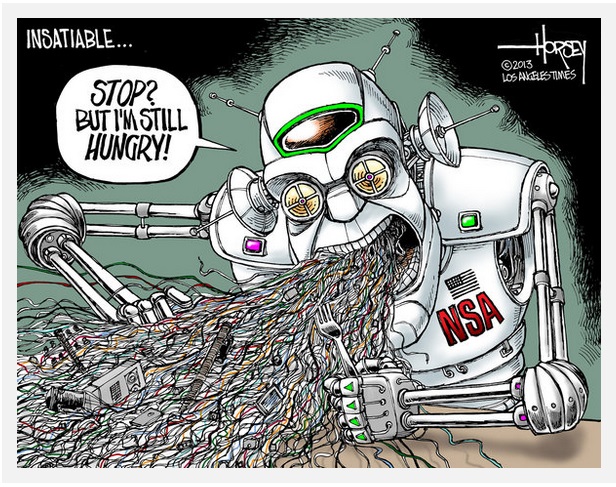

My tax dollar at work;

http://www.bloomberg.com/news/2013-08-2 ... ogram.html

Yours too, if yer old enough....

Syria War 401 news;

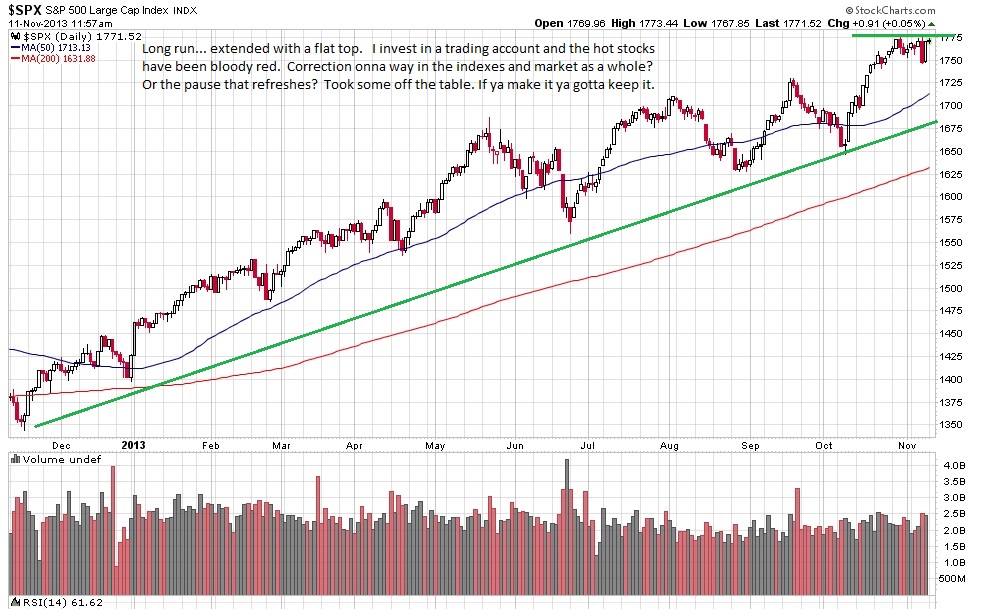

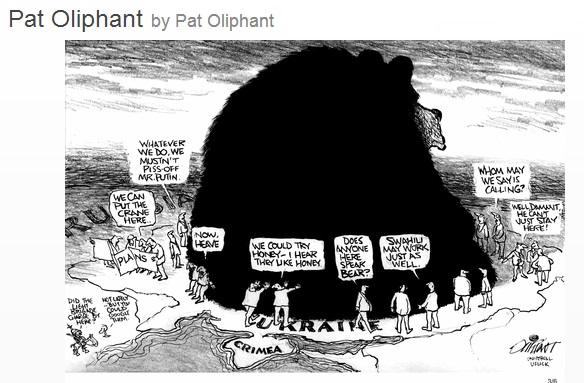

Volatility is gonna be up bigtime. The potential for things to go wrong is huge. Russia and Iran vs Saudi, Israel, France, US, Turkey. The actual arena of war is small and isolated by US standards. But it is in the mideast, there are oil powers involved, chemical weapons too, and it is like a barfight where there exists the possibility of the loser grabbing an oil lamp and screaming "The Guy Next To You Is A Child Molester!!!" and throwing the lamp into a mountain of bottles behind the bar. This could get messy.

That said, going into Labor Day is the slowest time of the year, markets get whipped around, This PROLLY gets dealt wit', and a month down the rad things look cool. That said, ya can take some off the table and get a little conservative, it wouldn't hurt much. But, things stay rocky for a coupla three weeks, then clear up, STAND BACK!!! We come into the end of the year, seasonality is in our favor, Wall Street DESPERATELY needs to run stocks up, and we could come back up like that garden rake you stepped on when you were a kid. Or we go to hell inna handbasket and we got bigger problems than the 401. I'm standing pat. Fer Now...

http://oldprof.typepad.com/a_dash_of_in ... -fear.html

http://www.thereformedbroker.com/2013/0 ... -of-humor/

http://www.ritholtz.com/blog/2013/08/one-party-state/

http://www.mauldineconomics.com/outside ... t-schmexit

Stay Tooned...

( 3 / 1300 ) ( 3 / 1300 )

Dare I Say It Out Loud? ................ Ya Know.....I Really Don't Care Much For Long Emotional Goodbyes........... SO....... ADIOS, MOTHERFUCKERS!! ... THIS IS IT!!!! .....I'M PULLING THE PIN!!!... I'M OUTAHERE!!!!!!! I'm Retiring As Of This Week. The Paperwork Is Inna Works. Now....About The Blog And Whom So Ever Read Or Might Wanna Continue To Read It... Hmmm.... Stay Tooned.

Saturday, August 10, 2013, 01:59 PM

One of the most difficult investing skills to master is being persistent and confident while not crossing the line to being stubborn and obstinate. It is a very fine line and you will never get it quite right now matter how hard you try.

Reverend Shark

Hey! If Yer A Member Of 342 And Need Some Help With The 401, Get In Touch With Me.

If You Are Using The Blog To Run Yer 401 Outa Another Local, And Would Like To See The COFG Continue, Lemme Know Through The "Contact Me" Link Above.

If You Just Like Comics And Music, Lemme Know That Too.

If All These Hits Onna My Blog Are Issues W/ Fat Fingers, And You Don't Give A Fuck.... Turn Around And Go Quietly, Nothing To See Here..... Move On....

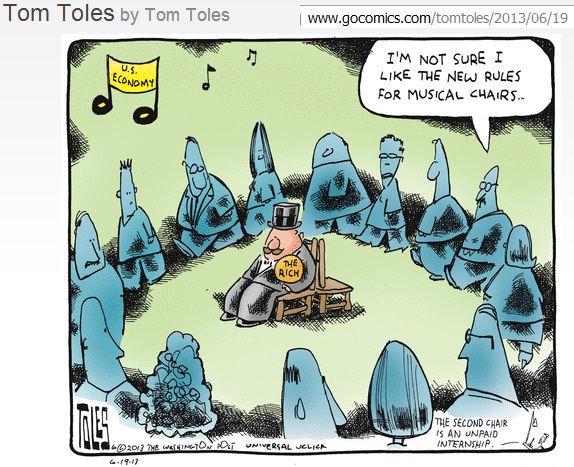

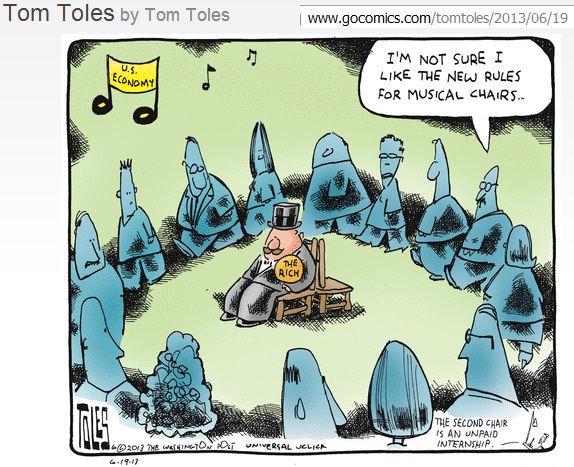

Monetary Musical Hi Jinks.

http://www.youtube.com/watch?v=-xD-XOVUaNQ

http://www.youtube.com/watch?v=jW9mDyFgh1o

http://www.youtube.com/watch?v=3geBEc2cJGs

http://www.youtube.com/watch?v=B8PwqQ5guYk

http://www.youtube.com/watch?v=F-10i8-mtCw

http://www.youtube.com/watch?v=hj86Ysao ... r_embedded

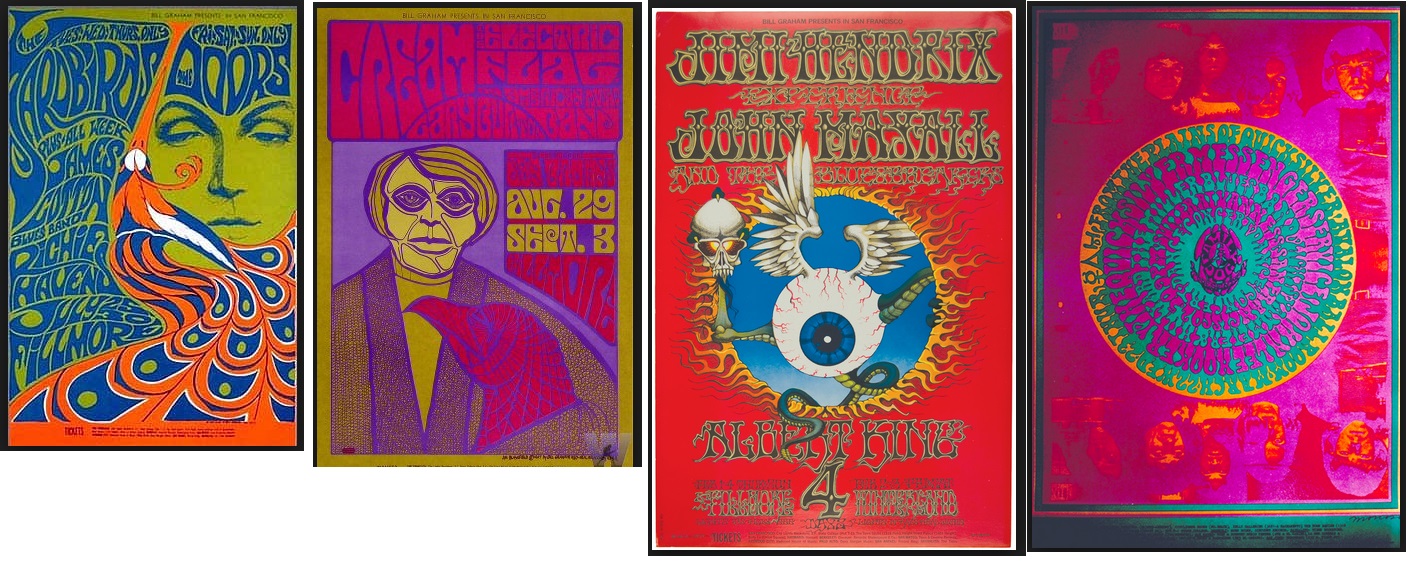

"Are You Experienced?" Have You Seen The "Silver White Light"?

http://www.youtube.com/watch?v=xEkoxVUl2RA

http://www.youtube.com/watch?v=PS1ncEkIeQ8

http://www.youtube.com/watch?v=jnzuyR2iT3I

http://www.youtube.com/watch?v=updTFU9I ... =endscreen

Back Inna Day, It Was All Hair 'N No Studs Or Hoops And Only The Occasional Tat'.

Here's Where I've Gotten To... Grant Me A Victory Lap....

Here's Ever Since I Started Self Managing My Account.

Here's YTD.

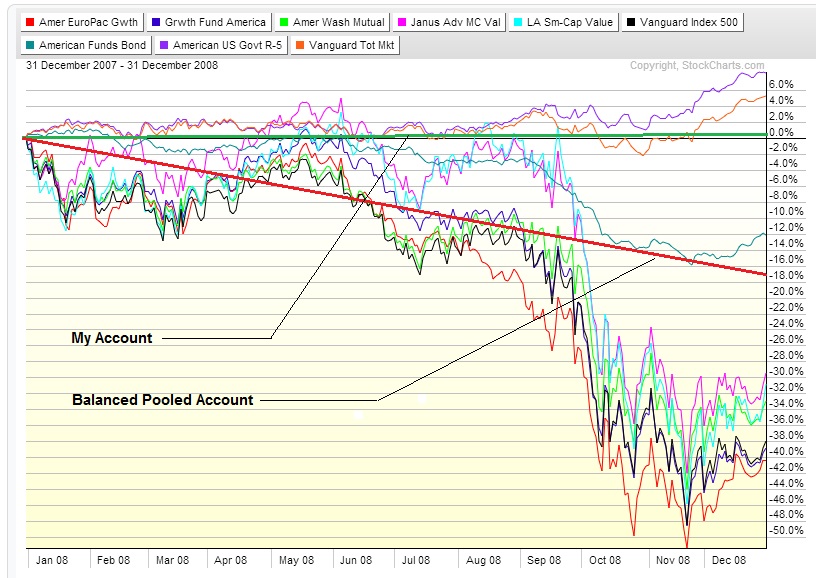

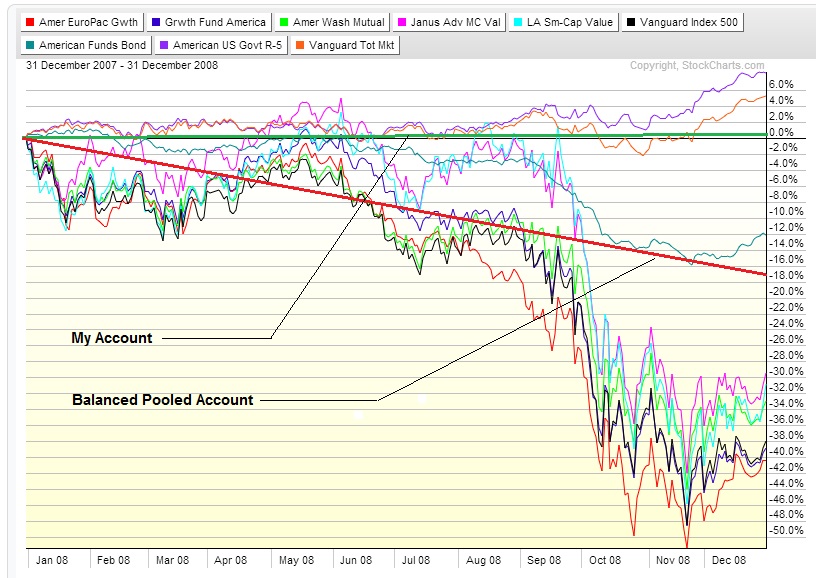

Here's During The Bad Year...

Not A Bad Place To Close De Do'. Up 11% Plus In 8 Months... A Little Short Of 10% A Year Over The Last 9 Years.

Note:

I'm moving a substantial proportion of my money from my 401 to an account managed by a professional money manager in the near future. I will retain money in my 401 account and manage it as I have always done. I will be able to measure what my fees are getting me and roll the money back into the 401 should I decide to. But in the meantime, the distribution of funds among the investment options is mostly about easy tracking and transfer. I'll keep you posted on when that changes.

Don't Tell Me Wells Don't Run Dry An' It's All A Liberal Socialist Conspiracy. I Was On The Sahara Forest Logging Project Back Inna Day....

http://www.stratfor.com/analysis/drough ... us-aquifer

TUESDAY

http://pragcap.com/4-questions-for-a-fe ... y-a-nobody

http://blogs.reuters.com/felix-salmon/2 ... f-the-fed/

http://fundamentalis.com/?p=2378

http://www.businessinsider.com/fred-wil ... ger-2013-8

http://pragcap.com/quite-the-qe-conundrum

Thursday:

http://business.time.com/2013/08/15/ame ... nt-advice/

Stay Tooned...

( 3 / 1427 ) ( 3 / 1427 )

I Do NOT Like What I See Inna Charts.... Been Lookin' At Some Bond Charts. Prolly Cover It At Some Point Below.....

Friday, July 5, 2013, 12:02 PM

It makes me cringe to have 'experts' tell us not to fear the Fed. You don't fear the Fed but you do fear a market that fears the Fed. If the rest of the world is selling because they are afraid, justified or not, you respect the price action and move out of the way.

-- James “Reverend Shark” DePorre

Chartz And Table Zup @ www.joefacer.com

I bought both DVDs.

Clapton said that Freddie was the most challenging to play live with. "He'd tear you up."

http://www.youtube.com/watch?v=mTU6cffChsU

Clapton told JJ Cale that he loved his song, "Cocaine." Cale laughed and said, "You should! It's your song!"

http://www.youtube.com/watch?v=DVl-oXi-TpY

Think "Sunshine Of Your Love".

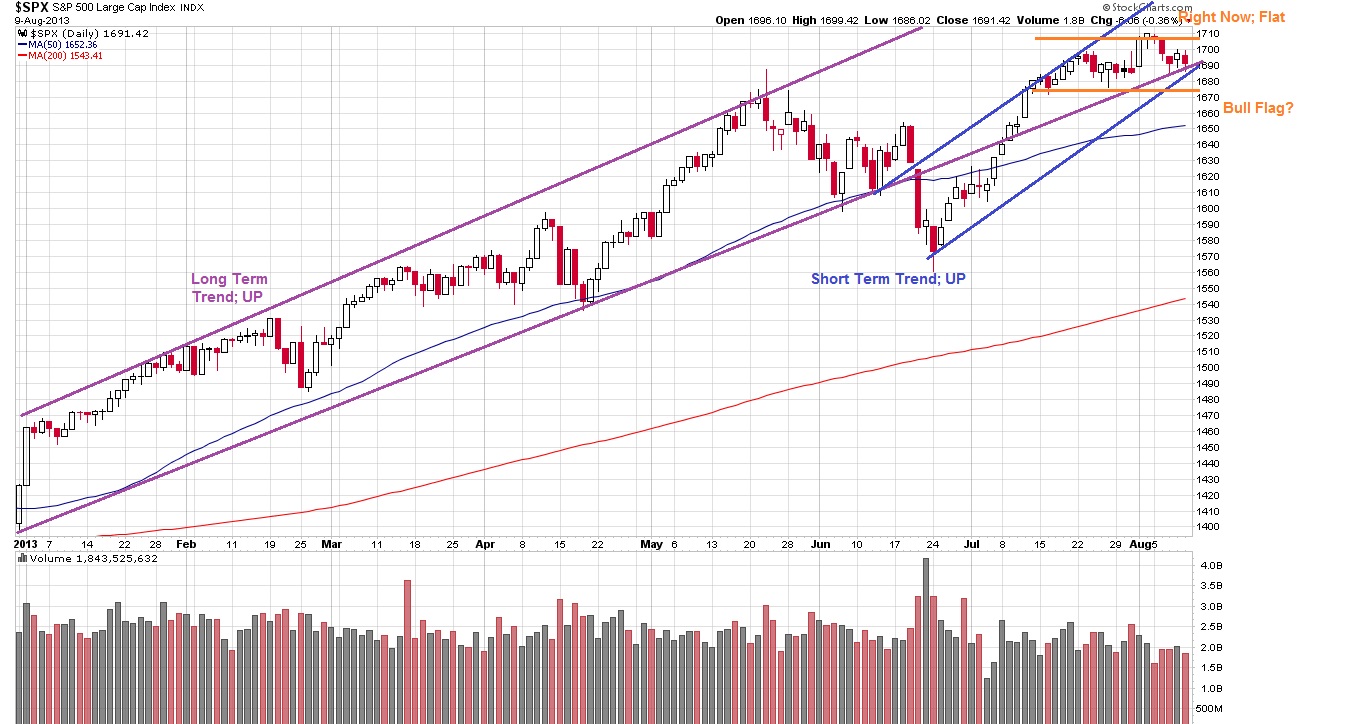

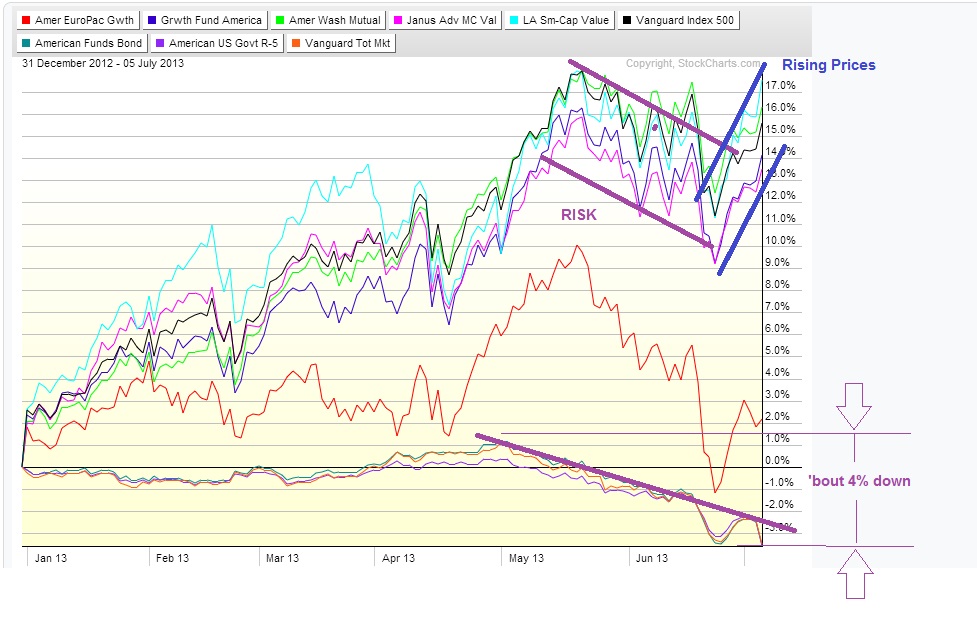

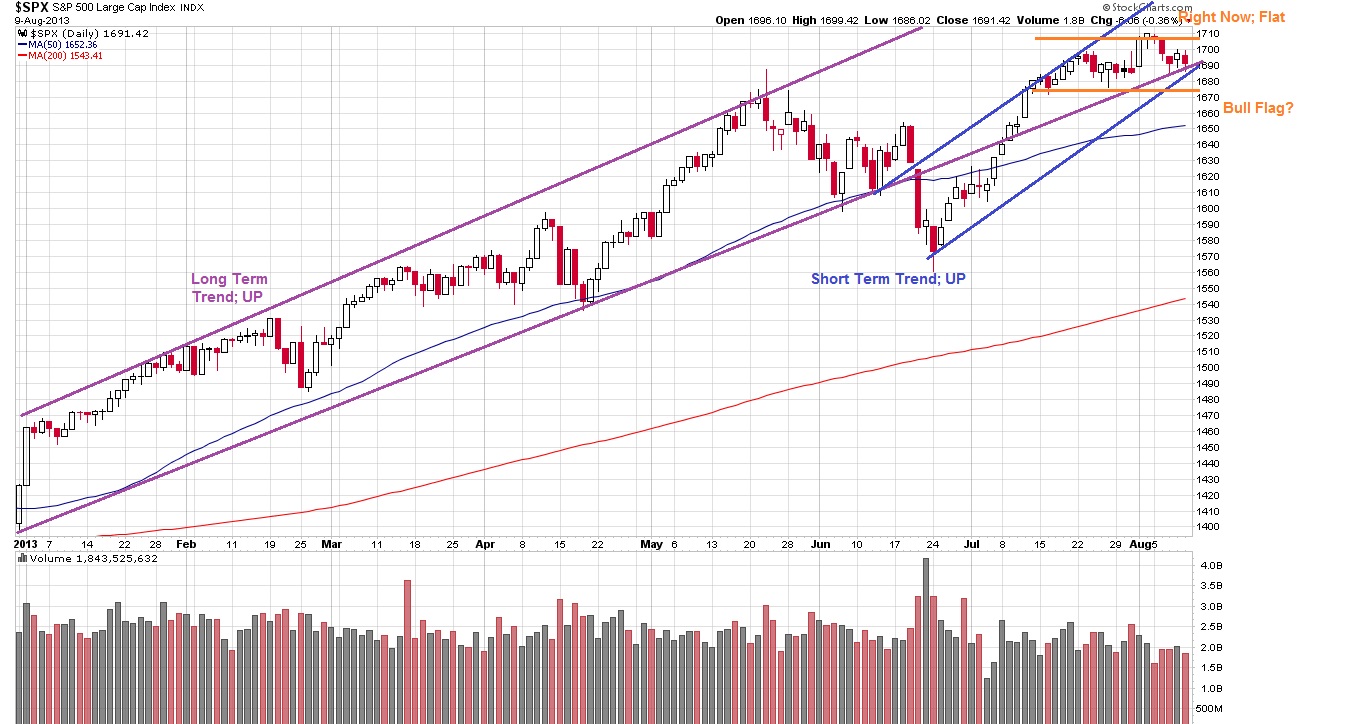

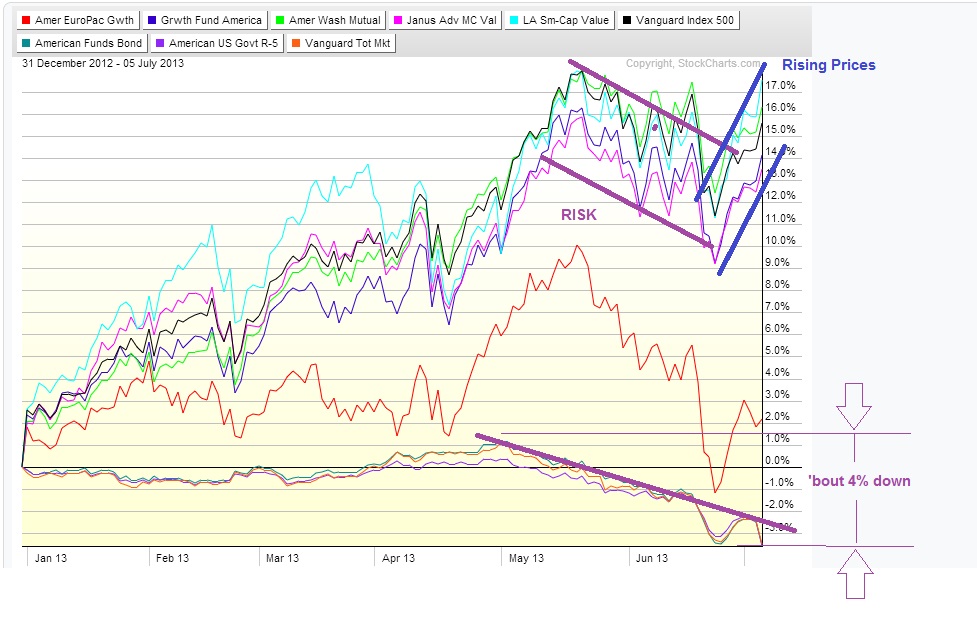

A month or two ago I reduced stock exposure into risk. I reduced bond exposure into risk about 6 weeks ago. I've been re-establishing stock exposure into rising prices. Some of this I got pretty extreme about. It Appears To Be Working. Real Well. I Like The Numbers.

So Far, So Good....

http://www.nytimes.com/2013/07/05/opini ... e&_r=0

http://www.stonekettle.com/2013/07/and- ... ation.html

Here's The Chart Alluded To Inna Title...

This is a 10 year Treasury Note chart. Yields (pay out) have been dropping for the whole duration of the chart. If, in late '94, you'd bought a new 10 Year Note, you'd have gotton a yield of say, 80. By late 2002, the new 10 year yields were down to around 40. Your old note's US government rate was twice the yield of the new notes. That meant that not only was it throwing off interest payments at a fabulous rate, if you had to sell it, it yielded as highly as very risky bonds... with none of the risk. Much higher interest rate than the equivalent 2 year note, which is what ya got left onna original 10 year note.

Now it looks like the run is starting to unwind. Every bond you hold in yer bond fund will prolly yield less or equal to one you can buy next month or next year. Want ta get out of the bonds you hold, like to get into something else that's doin' better or pay the groceries? That means dropping the price you get to where it looks like a value to somebody who will get a better deal the longer they wait. Lookit the first chart.

The best way to invest in bonds is the buy them outright. Which I did inna 80's. I bought bonds paying 12% double tax free. Every year bond interest paid by new bonds dropped and while my bonds became worth less because they got one year closer to being called, they became worth more because they paid better than newer bonds. Pretty cool. I held them until they were called and got all the interest and more than my money back. (I bought them at a discount). When you invest in a bond fund, you go in with all the other investors. If they bail wholesale,the fund sells inventory into a falling market and you lose despite holding firm.

That's why I'm inna stable value. For now... 'Course I'm just an old broke down pipefitter and this is just only what I'm doin' wit my own money. Someone smart 'll tell ya something else. YMMV.

http://www.debka.com/article/23101/Obam ... otherhood-

The pain trade...

http://www.businessinsider.com/treasuri ... ade-2013-7

http://noahpinionblog.blogspot.com.au/2 ... -what.html

http://www.bloomberg.com/news/2013-07-0 ... actor.html

http://www.businessinsider.com/its-up-t ... omy-2013-7

http://www.thereformedbroker.com/2013/0 ... g-volumes/

http://www.businessinsider.com/rosenber ... ger-2013-7

http://www.bloomberg.com/news/2013-07-1 ... sales.html

http://www.bloomberg.com/news/2013-07-1 ... sales.html

http://pragcap.com/so-this-is-happening ... ate-market

http://www.modernluxury.com/san-francis ... -never-get

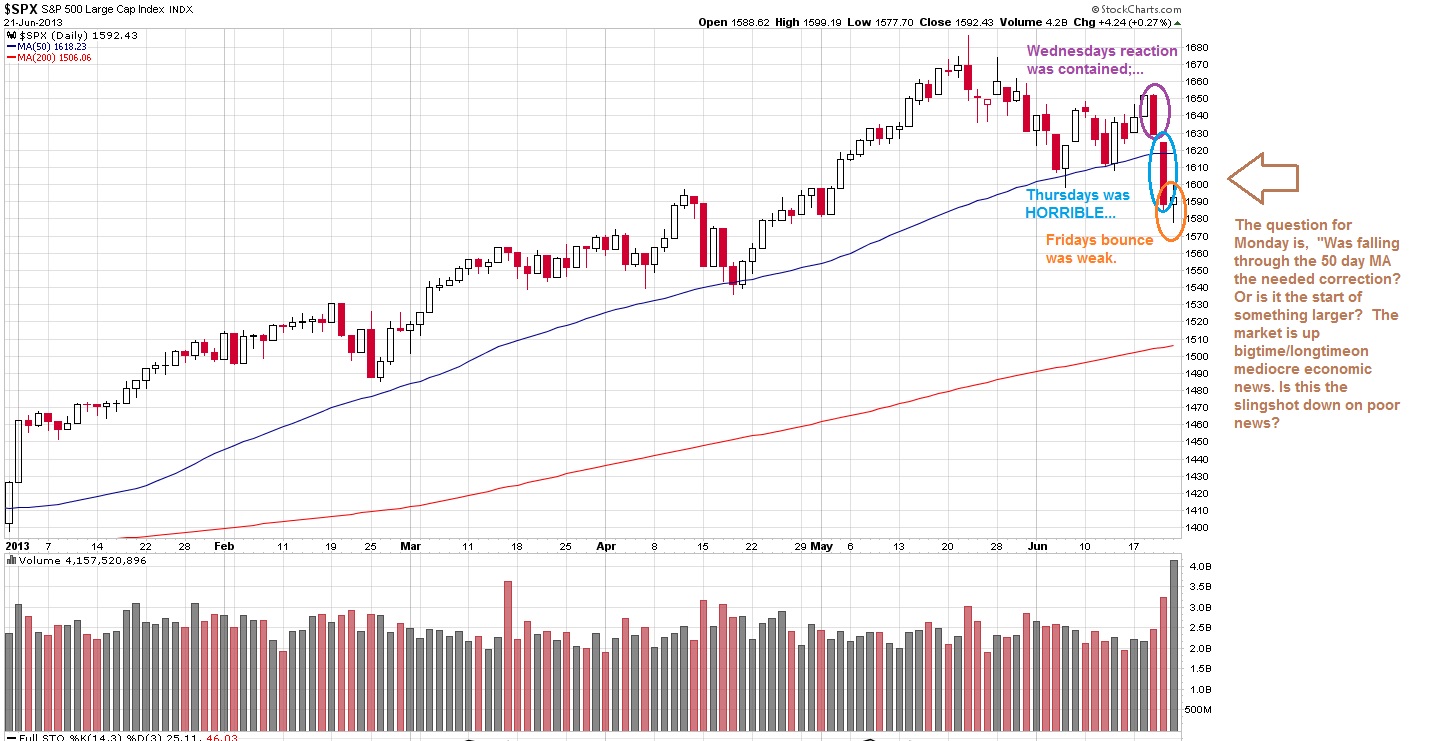

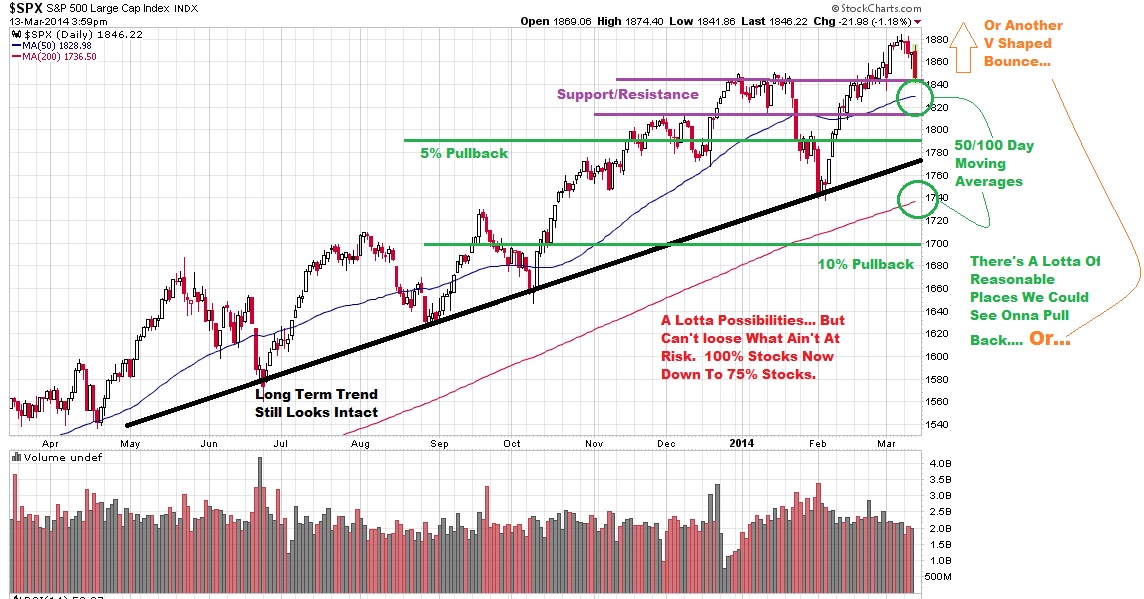

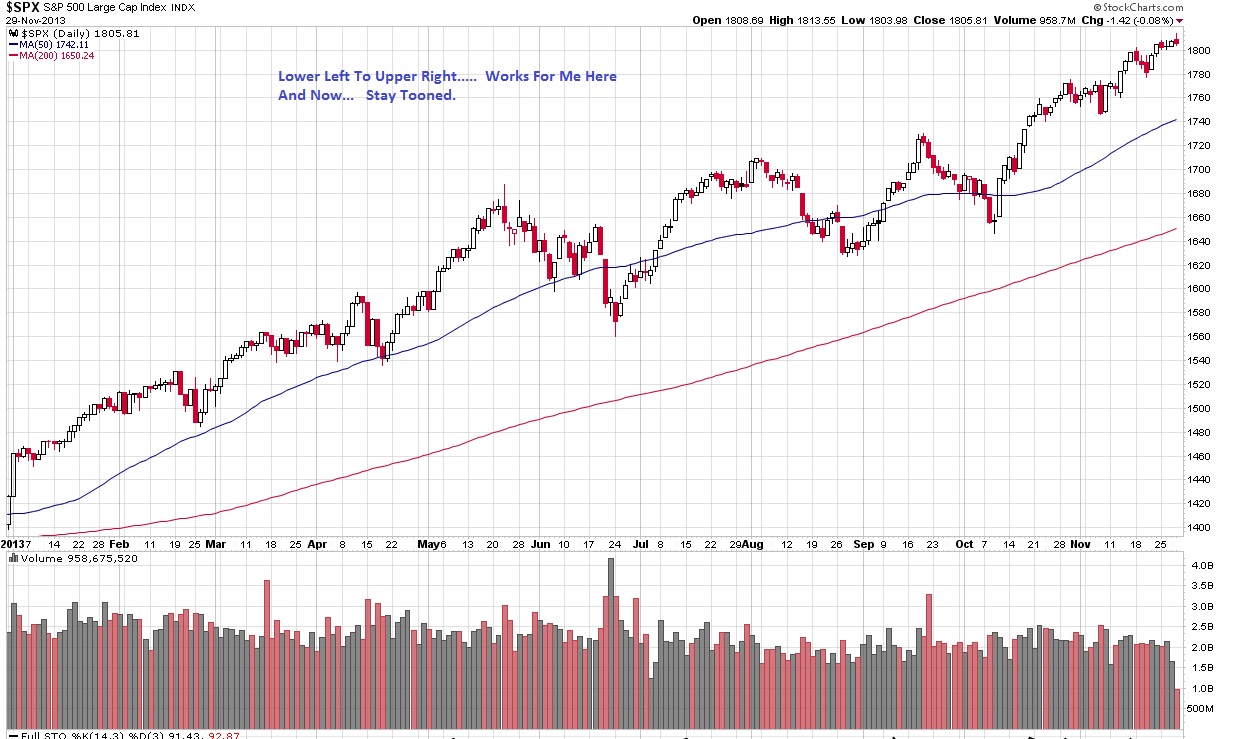

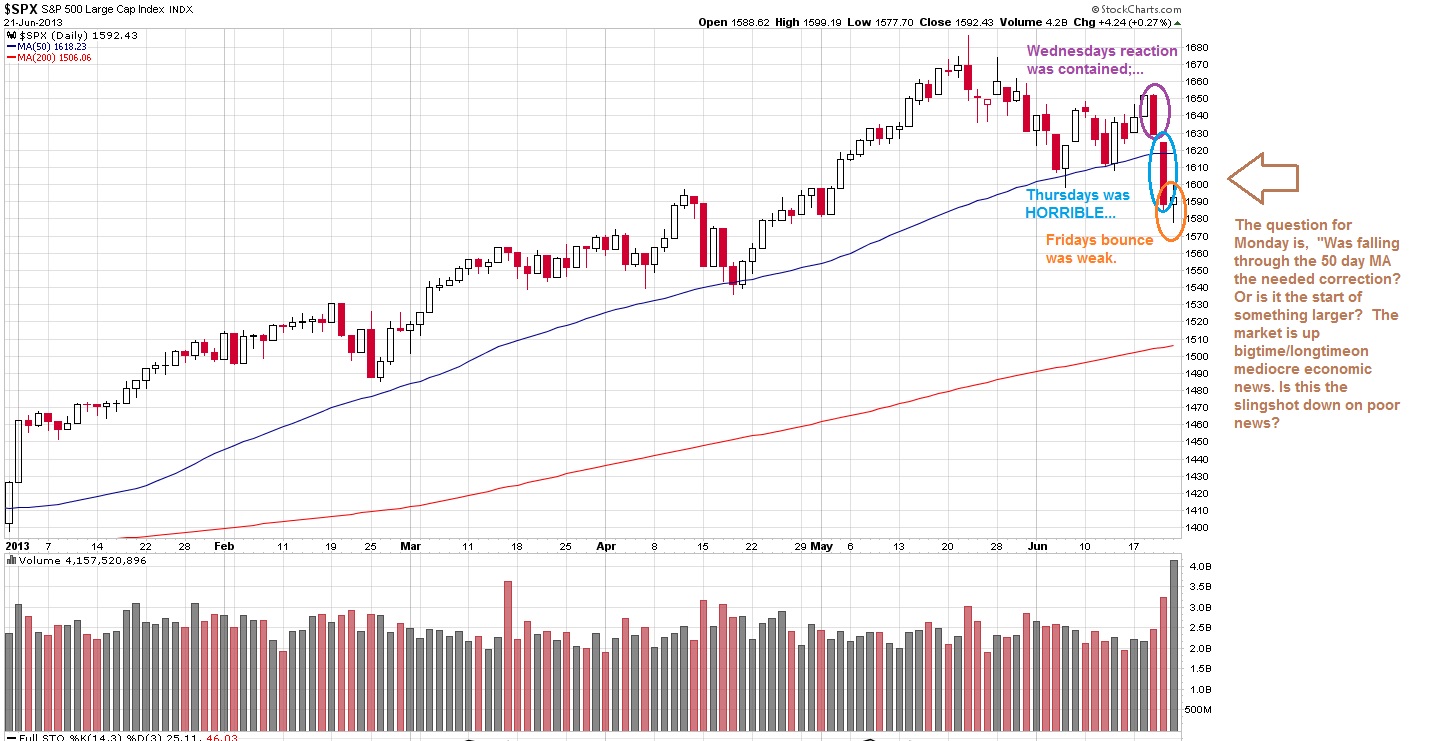

Another "V" shaped recovery. Bounce off the 50 day ma, chatter along it, power dive through it, flush out the cautious and profit takers, drop through another level of resistance, close below it for almost a week, suck in the bears, AND TURN AROUND AND GO ALMOST UP FOR 11 DAYS OUT OF TWELVE. Then to add insult to injury, gap open a buncha days and hold that level all day, so that all the gains come overnight, so they tell you nothing about the health of the market.

The best way to make money in this market is to be insanely aggressive, mostly oblivious of risk, too unsophisticated to realize that markets devour the unsophisticated, and too lazy to take profits on the way up. Sometimes, fate and the markets play into my strengths.

Stay Tooned

( 3 / 1376 ) ( 3 / 1376 )

Somethi' Inna News 'bout Interest Rates Goin' Up... Maybe The 401 Was Payin' Attention.... Check It Out. Ya Think?

Friday, June 21, 2013, 11:53 AM

The purpose of fixed income in a portfolio is for ballast. It is not there to increase returns, it is there to reduce risk, hence you should keep the fixed income portion of a portfolio relatively short term, high quality, and currency hedged (if using international fixed income).

-- David E. Hultstrom

Chartz And Table Zup @ www.joefacer.com

It wasn't a typical week. Kinda exceptional. Like da music...

http://www.youtube.com/watch?v=pP3vlayxGmw

http://www.youtube.com/watch?v=vGWfDkx4zyY

http://www.youtube.com/watch?v=N5WcW7An4u4

He-man adventure with the flavor of white hot steel....

http://www.youtube.com/watch?v=aXR8Df_Bml0

http://www.businessinsider.com/the-infl ... ple-2013-6

http://www.businessinsider.com/we-swear ... ver-2013-6

http://www.businessinsider.com/we-swear ... ver-2013-6

http://blogs.reuters.com/felix-salmon/2 ... -stimulus/

http://www.thereformedbroker.com/2013/0 ... e-factory/

Not A Good Week...Looks Worse If Ya Go Back To Da Start O Da Month...

Lightening Up On Stocks Worked Out OK. Didn't Lose Much. Now I Gotta See Which Way Monday Goes.... Don't Let This Week's Heading Fool Ya. I Paid My Attention During The Last Two Weeks Ratcheting Down Risk... The Balanced Pooled Fund Is My Benchmark. The Work I've Done At Getting A Few Percent Here And There, And Big Numbers Like This Week, Becomes A Serious Advantage The Closer I Get To Pulling The Pin...Especially When It Gets So Crazy That Bonds Act Like Stocks. A Brand New Journeyman W/ $15K Inna 401 Sees 5% As Chump Change. A 40 Year Guys Sees It As A Year's Contribution... I'm Big Time Inna Stable Value. Outta Bonds. Return Free Risk? Thank You, But No Thanks....

http://twl.sh/1053j9Z

This might be right... or it might be wrong... Stay Tooned... If It's Right It's IMPORTANT...

http://www.businessinsider.com/bis-says ... art-2013-6

http://www.businessinsider.com/controll ... ory-2013-6

http://www.businessinsider.com/market-c ... gns-2013-6

Been der, lived troo dat inna 70's...

http://www.businessinsider.com/david-gr ... ime-2013-6

http://www.tennessean.com/article/20130 ... -?gcheck=1

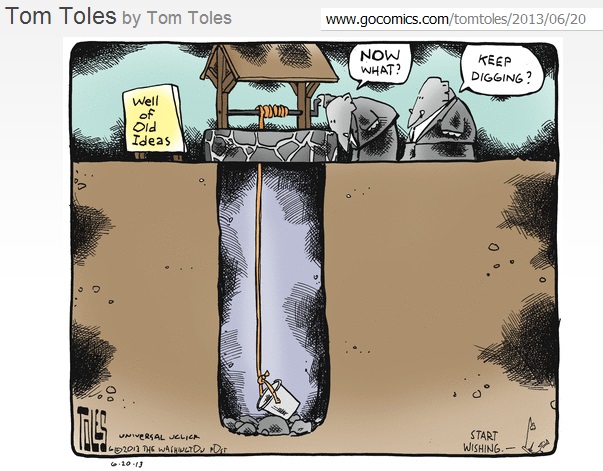

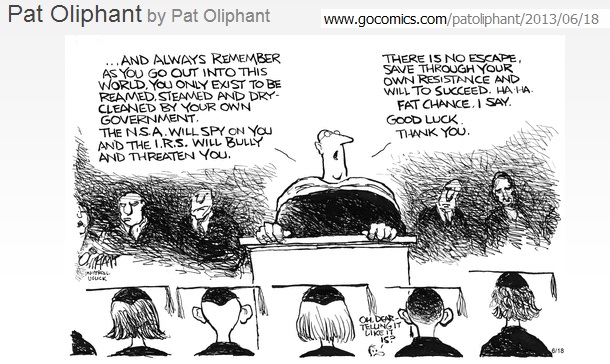

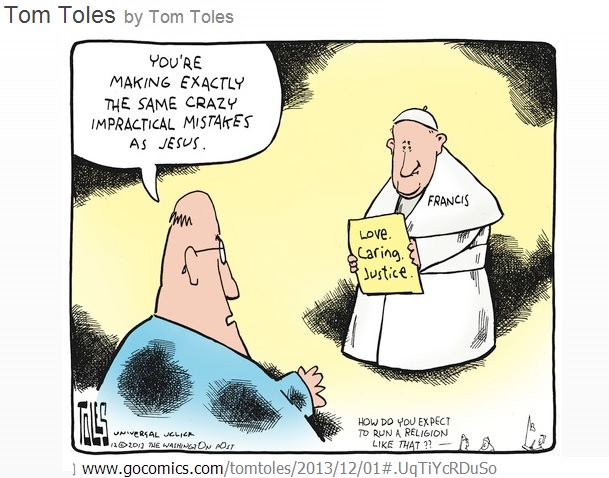

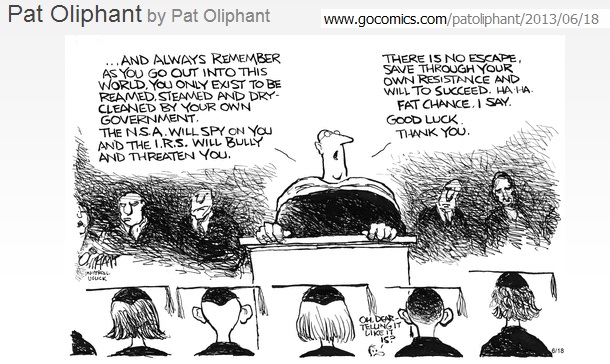

Kinda Nixonian... And I Don't Mean Gary....

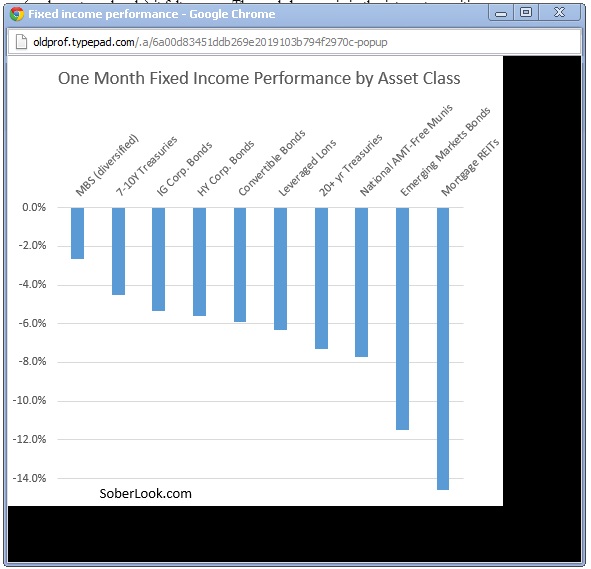

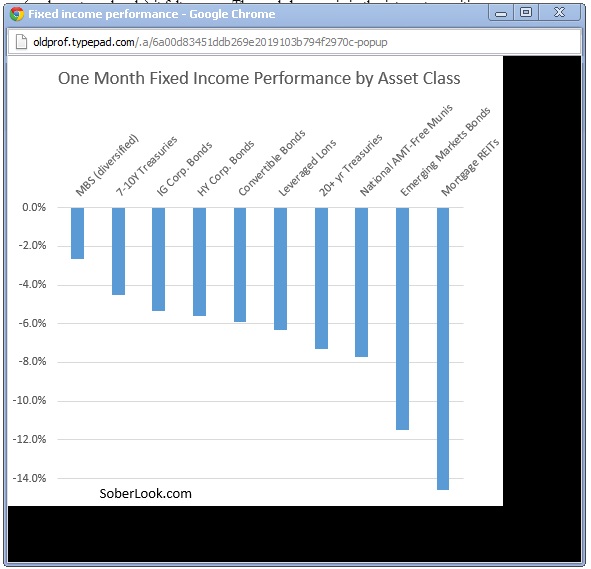

Look At Treasuries; Think Gov Bond Fund Inna 401.

Look At Corp Bonds; Think American/Vanguard Bond Funds Inna 401.

That's Why I'm Inna Stable Value. For Now Anyway...

http://stocktwits.com/message/14250979

http://pragcap.com/qe-myths-and-the-expectations-fairy

WHOA!!!!!! http://www.thereformedbroker.com/2013/0 ... note-ever/

FUBAR. This Will Take Some Some Serious Time And Work To Get Past...

http://www.businessinsider.com/russian- ... nfo-2013-6

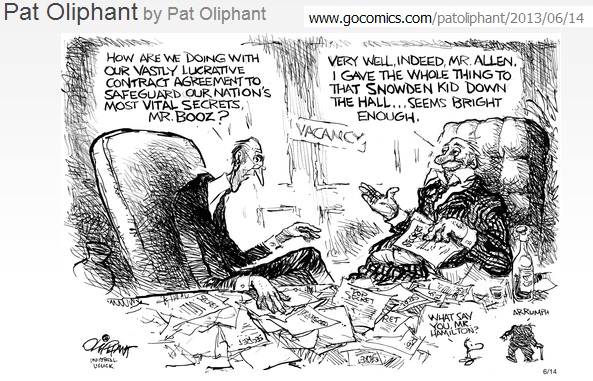

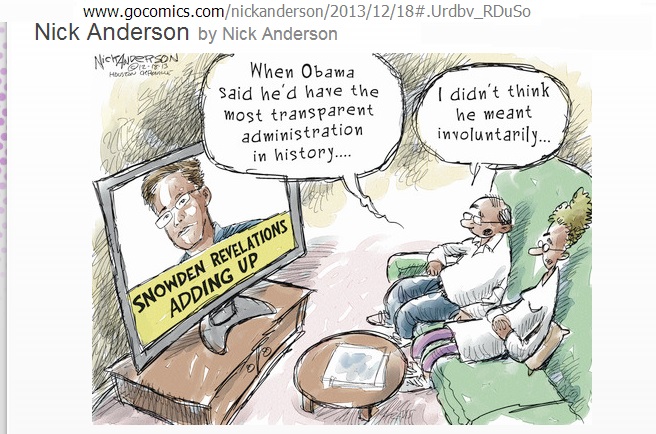

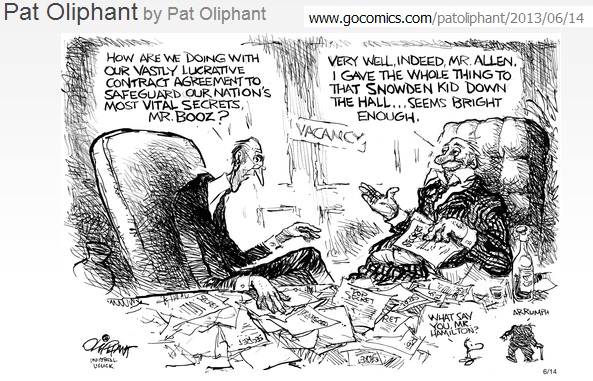

Chapter Two

http://www.businessinsider.com/snowden- ... ple-2013-6

http://www.businessinsider.com/what-too ... arn-2013-6

http://pragcap.com/bursting-bernankes-bubble

http://www.ritholtz.com/blog/2013/06/th ... cal-fable/

Stay Tooned...

( 3 / 1369 ) ( 3 / 1369 )

<< <Back | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | Next> >>

|

|

Calendar

Calendar