Never A Dull Moment.... Events In The World Take Their Own Course... Egyptian Tanks In Cairo Can't Clear This Year's Tiananmen Square, So They Send Jets and Copters?

"Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security,"

You can't trust anything the government says. Wait, I knew that already. Thanks for nothing, Julian Assange.

-- Paul Vigna

Chartz And Table Zup @ www.joefacer.com

...Then You'll Never Hear Surf Music Again....

--Jimi Hendrix Re; Dick Dale's Critical Illness

Akshully, I Got My Deck Shoe Surfer Tennies and Short Sleeve Madras Shirtz On And Here's Some Surf Music To Go Wit' 'em....

http://www.youtube.com/watch?v=T8__EwAT ... re=related

http://www.youtube.com/watch?v=tqC3BjIy ... re=related

http://www.youtube.com/watch?v=GWw55XhT ... re=related

Yeah That Is Who You Think It Is. And Chris Spedding Too...

I was unaware of the relationships between Dick Dale and Hendrix and Dick Dale, Leo Fender, and JBL.

Bloody Costly Days Continued...

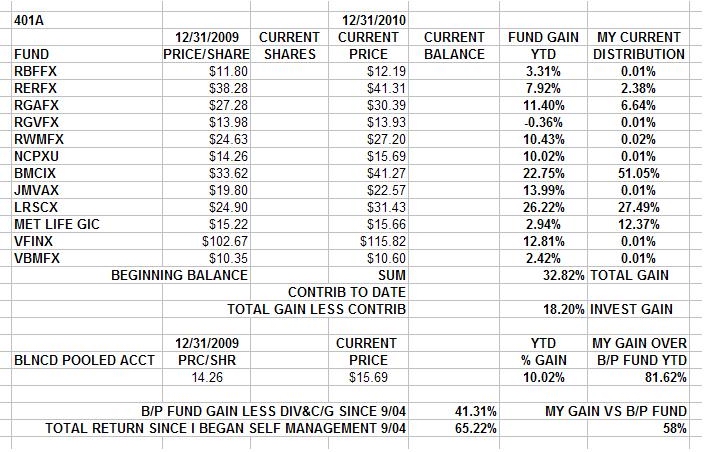

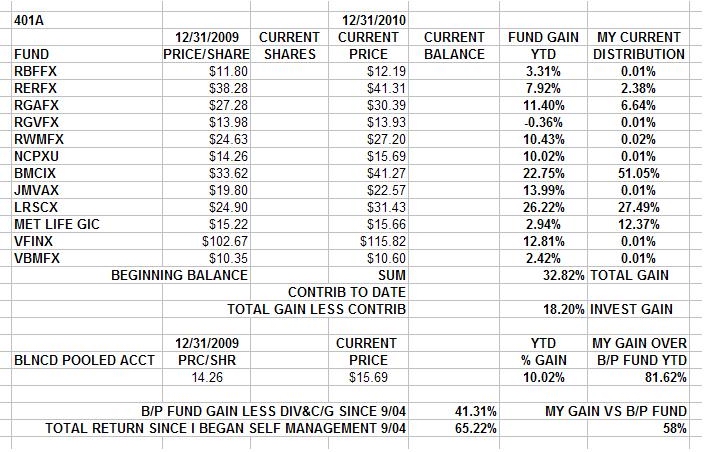

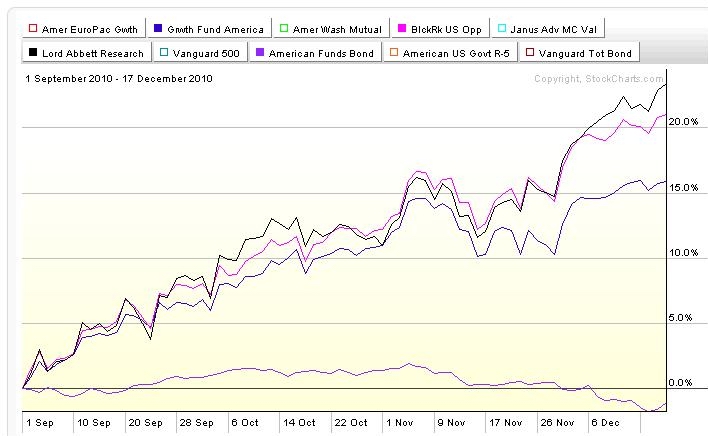

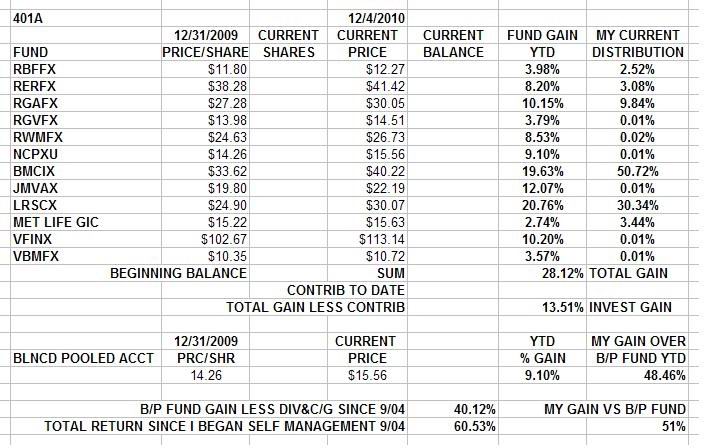

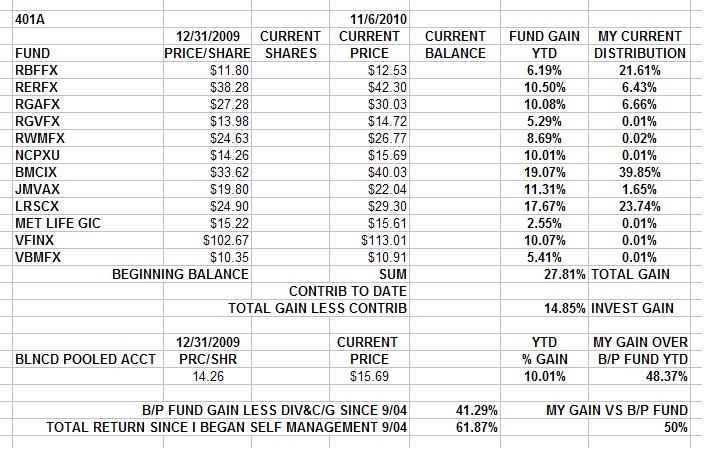

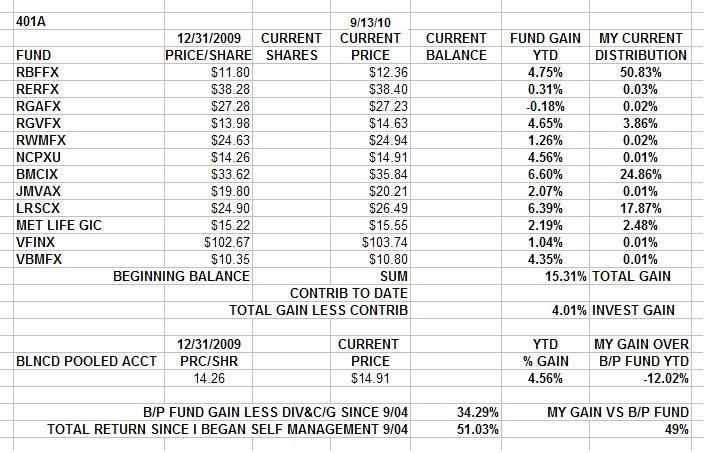

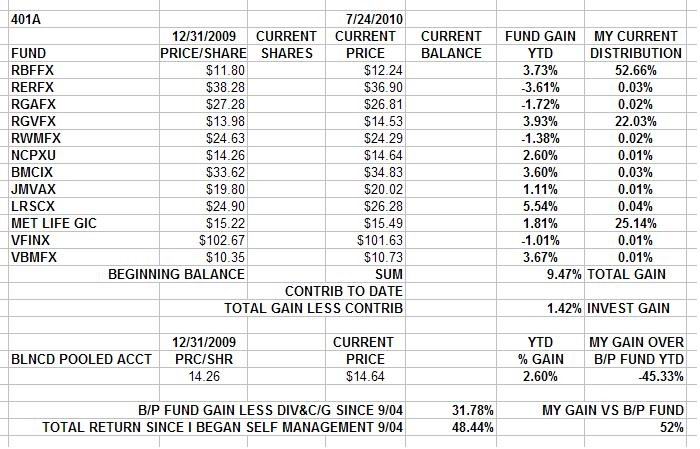

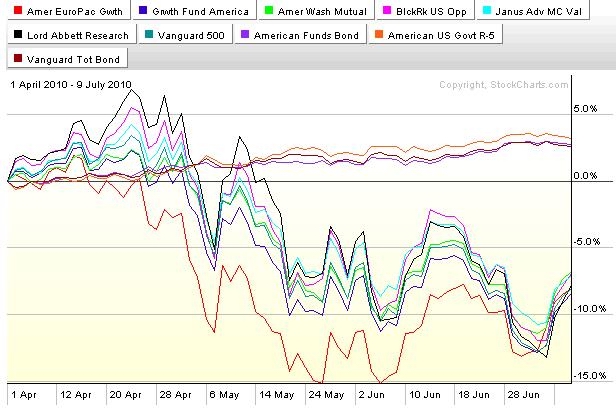

So I'm All In Inna Two Most Aggressive Fundz Inna 401A.

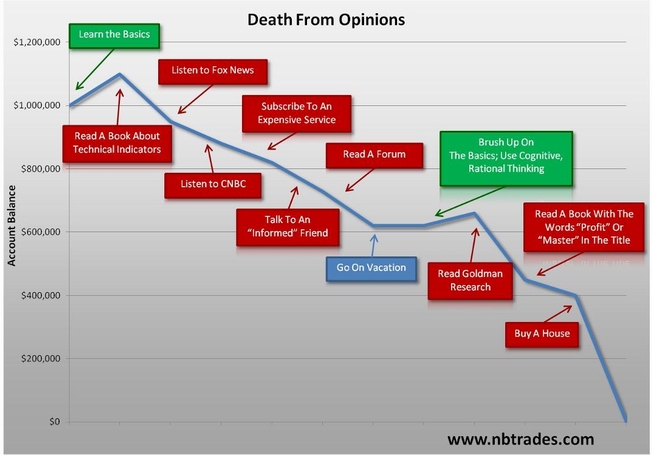

And the post parabolic move/beginning of the earnings reports dollar losses in the account are a kick inna gonads. It brings home to me why so many of the guys I work and hang with are so comfortable with all their money in the GIC/Stable Value Fund. We've got 20-30 years inna trades and some coin inna 401a. We got the possibility of some serious upside moves in a few days or weeks time in the 401a account. But we also got the possibility of some breath taking moves down in a bad week. In the end, we gotta go with what lets us sleep at night. For some, that is the cash equivalent fund in the 401a and a regular coupla percent a year up in the account and no wild and crazy up days and stoopid bleeding from the eyeballs down days. Nothing wrong with recognizing that what you have in the 401a is a significant amount to you and worth being concerned about. Once you see daily or weekly balances bouncing around and gaining and losing you significantly more than you earn at work that week, you are obligated to make a choice about how to deal with it. Eliminating the possibility of losing what you got, making a very modest return and sleeping soundly is a totally acceptable choice. To deny that would be dumber than a box of rocks. Which I ain't.

But I see things differently than most other people. I still have a race bike and I think about track days and racing again. I'm kinda like into action and motion as a life style and a preferred mode of operation. It takes all kinds.... that's why choices exist. And I ain't alone... There are guys I've shown the what and how to who are playing the game the same as I am, for whatever their own reasons are.

So....

I'm getting enough of a balance in the 401a where what was a few dollars move due to everyday ordinary market volatility is now some serious coin up and down. Gotta readjust my concepts here. If I see the huge upside days as part of the process and can work with them, I gotta be able to deal with the other side of the deal too.

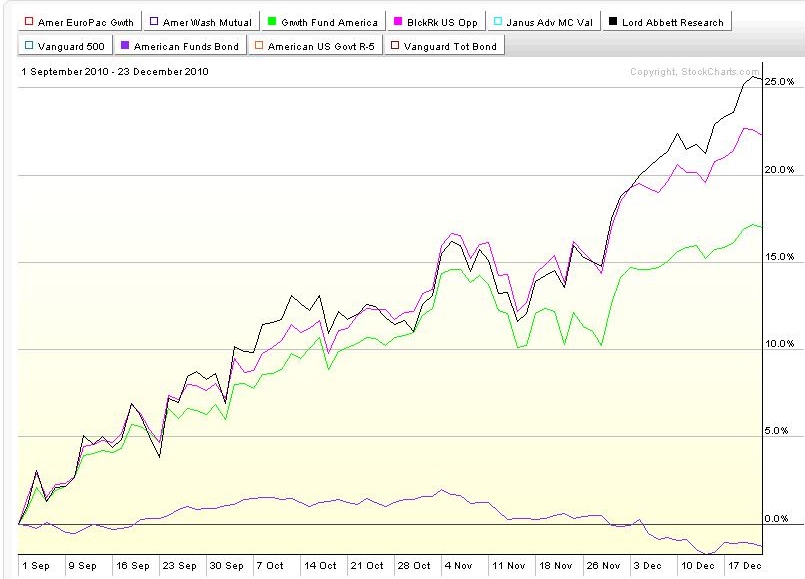

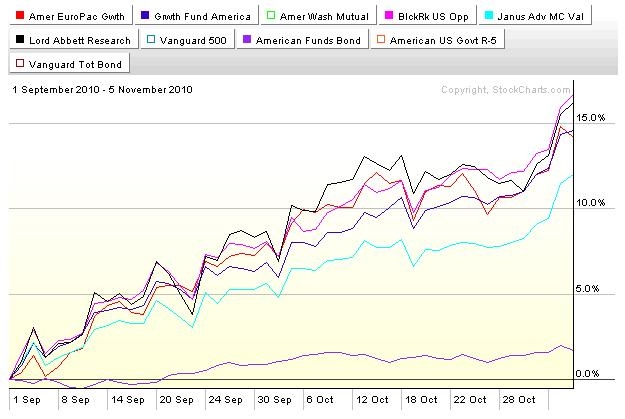

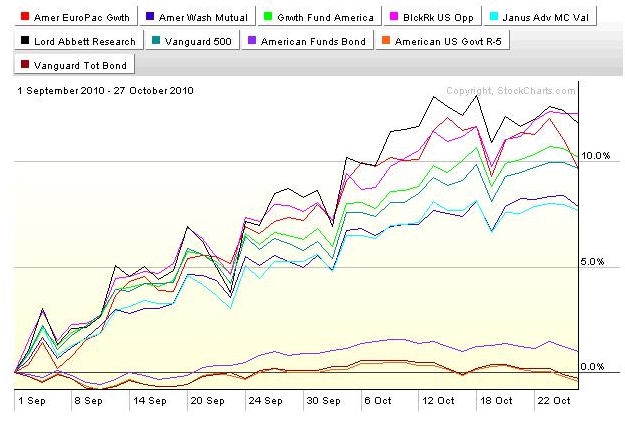

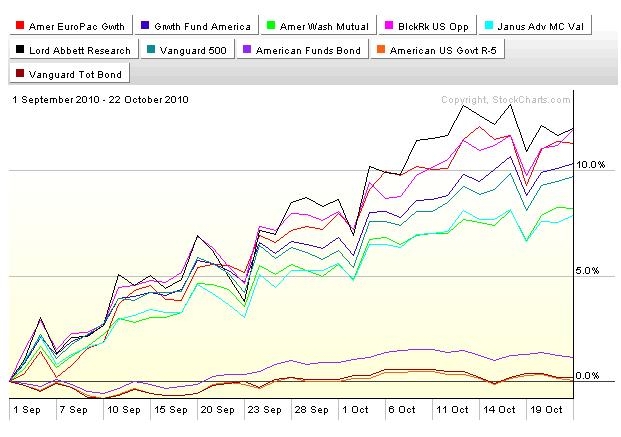

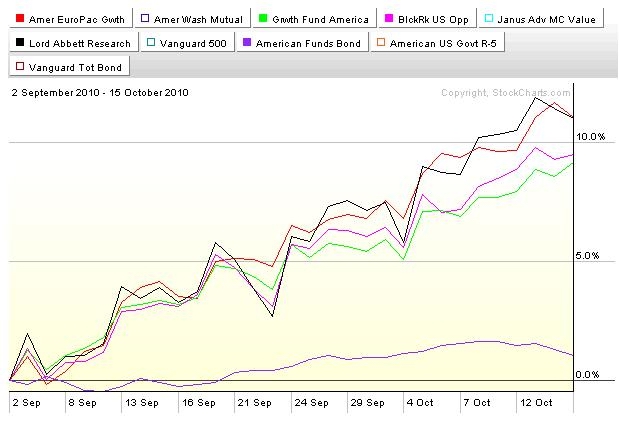

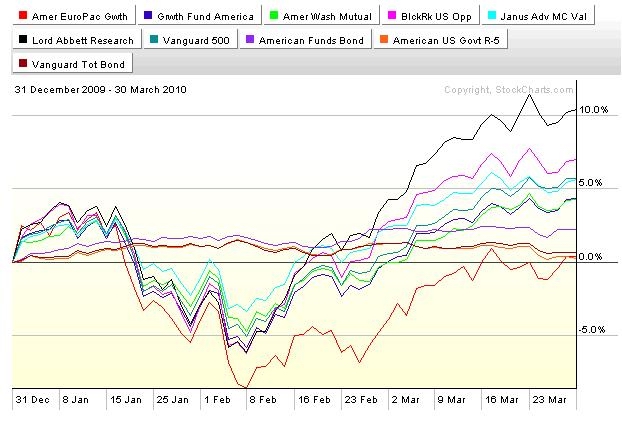

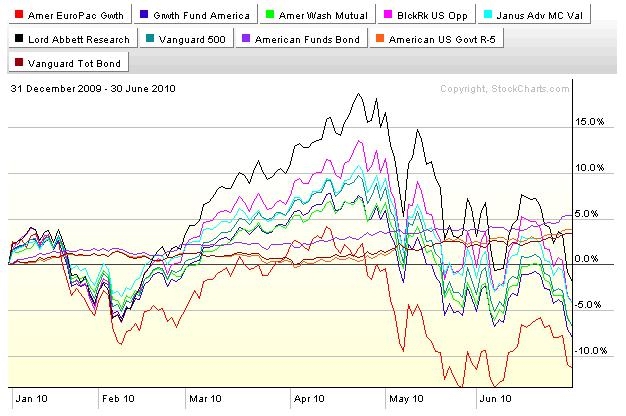

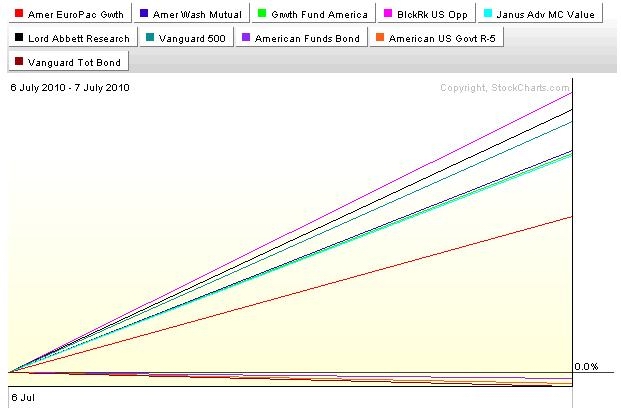

So Check out the chartz.

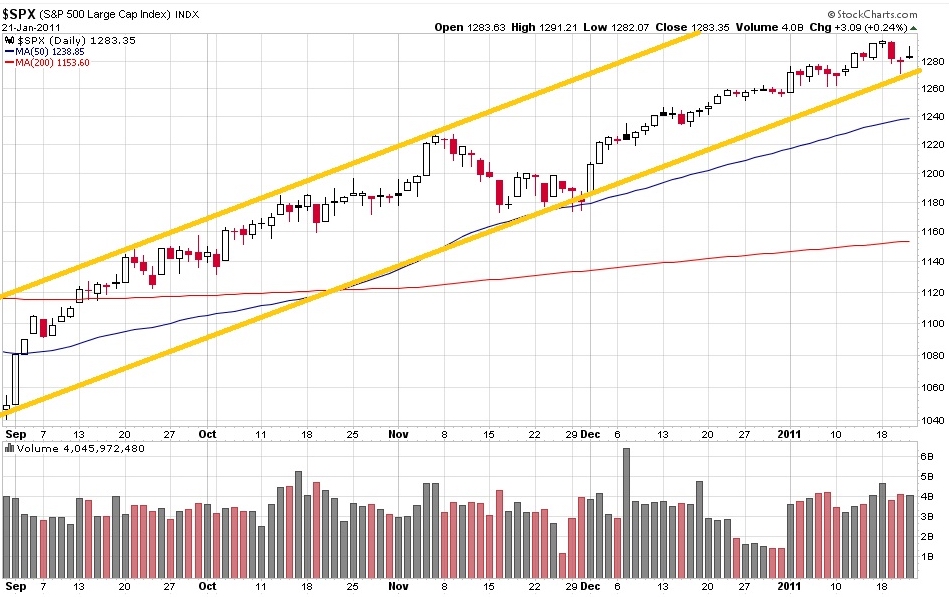

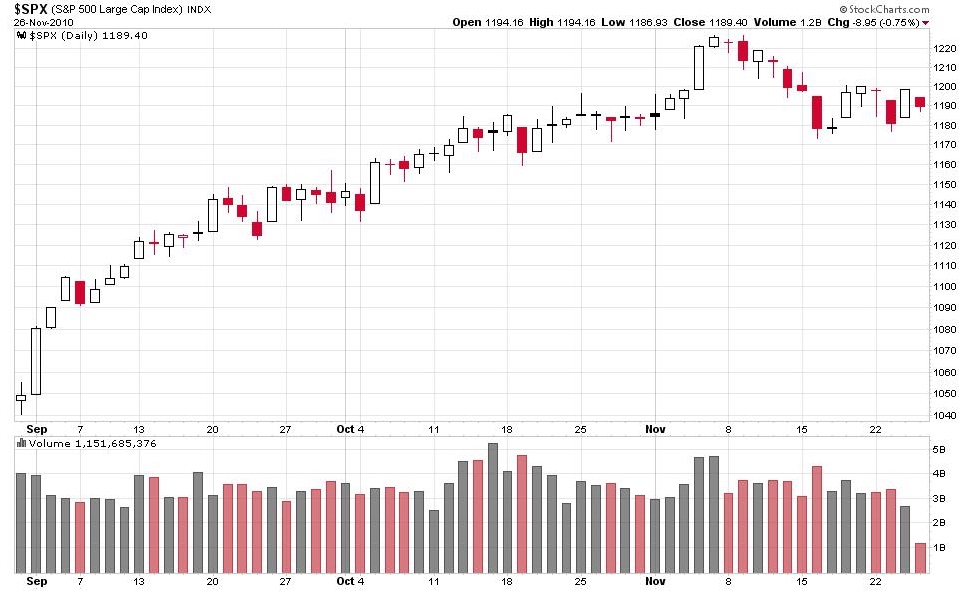

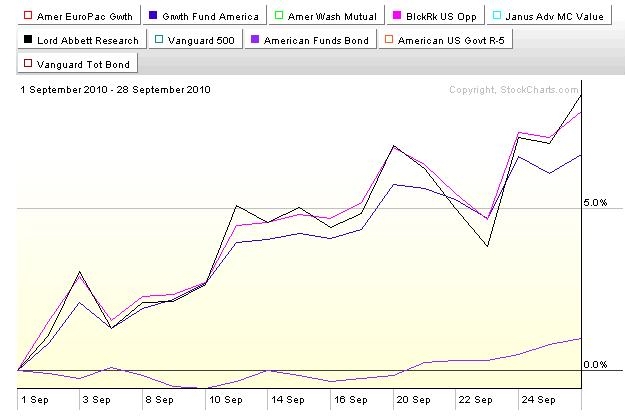

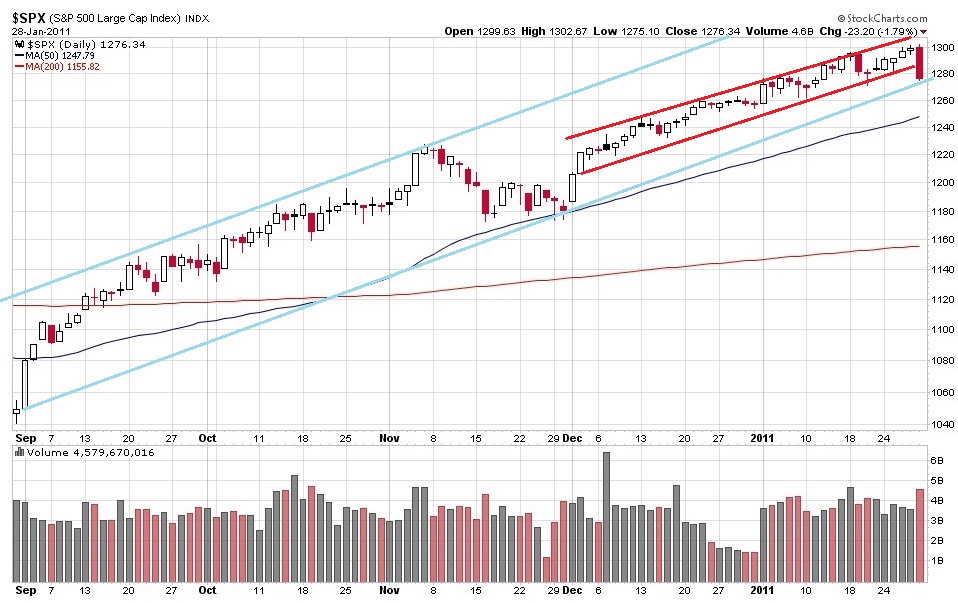

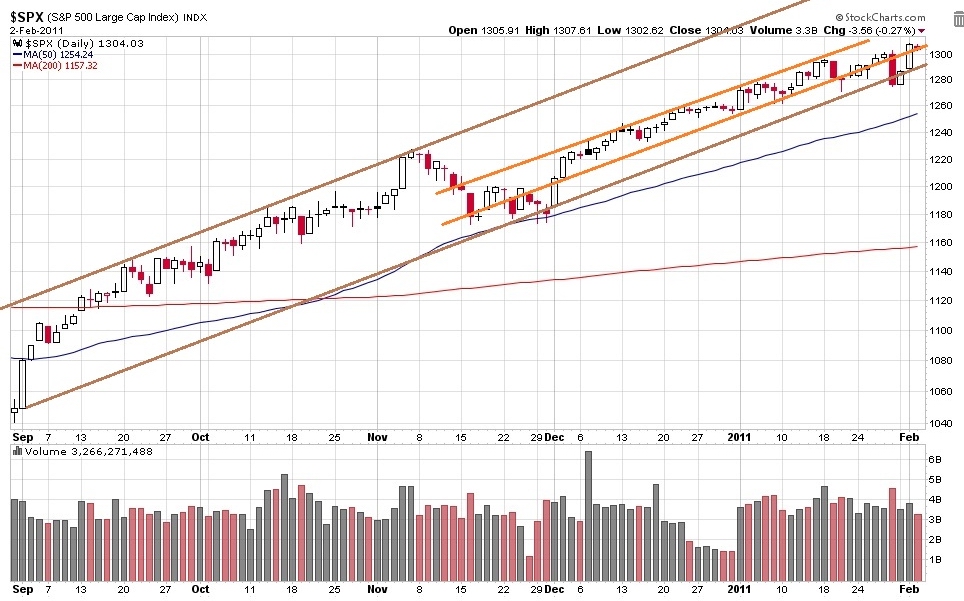

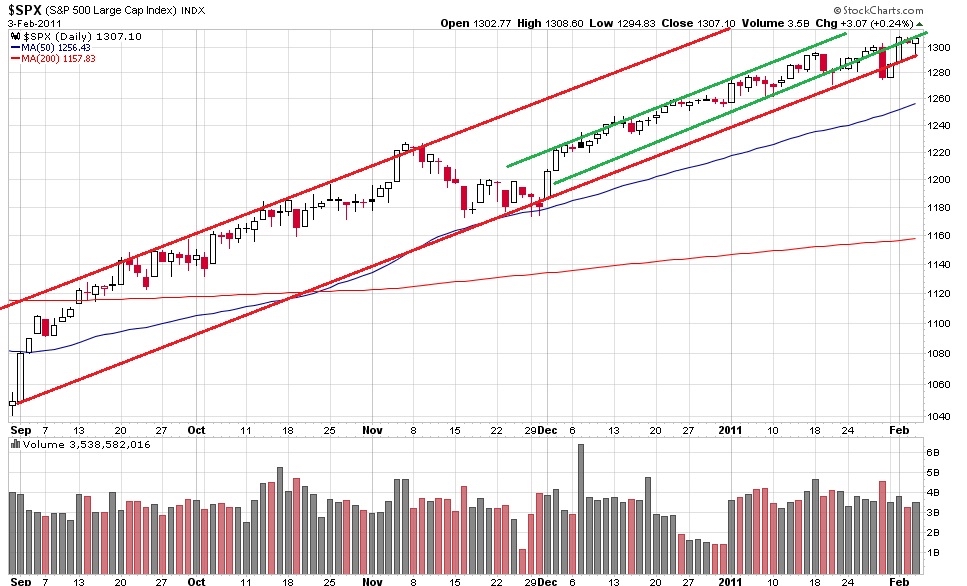

Looks like a parabolic move up in a short time that paid off big time.

So I'm building my 401a like mad when the weather is good. Sometimes a Summer storm or the first few storms of the Fall soak everything, blow the tarps around and maybe fuck up something badly enough that it takes time and money to fix it. Ain't no big thing. It's the price of getting something done. At least it ain't noo big thing as long as I don't let it become a big thing. I gotta secure everything for the winter when the time comes and react in the case of an unexpected tornado on the horizon...

In the last week, I've lost in my 401a what would have been a totally unacceptable amount of money 15 years ago. Like say the first three years of contributions and investment gains. Or, looked at differently, I've gotten my nose tagged hard enough to remind me that bad things can happen and that the chart above says that bad things might be eminent. The uptrend is just barely intact, is extended and has been unrelenting and parabolic, and has been cruisin' for a bruisin'. The market might be starting to roll over hard after an explosive move up and there are a lot of people with profits to protect and the downtrend could get ferocious. I really haven't been hurt yet. My eyes are watering and there's a spot of blood on my sleeve, but here is not a lot of damage done. But I have been warned.

Staying long in the face of every reasonable appeal to prudence and caution has worked and worked well for the last 90 days. Nothing lasts forever...

http://www.ritholtz.com/blog/2011/01/si ... s-fck-you/

http://www.msnbc.msn.com/id/41188877/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/th ... b-killers/

http://www.msnbc.msn.com/id/41103288/ns ... itol_hill/

http://www.ritholtz.com/blog/2011/01/wi ... kruptcies/

http://www.ritholtz.com/blog/2011/01/qo ... l-economy/

http://www.ritholtz.com/blog/2011/01/market-structure/

http://www.msnbc.msn.com/id/41097319/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/ho ... more-62383

http://www.msnbc.msn.com/id/41043127/ns ... al_estate/

http://debka.com/article/20558/

http://debka.com/article/20558/

http://www.ritholtz.com/blog/2011/01/no ... -long-run/

http://www.msnbc.msn.com/id/41086473/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/se ... doug-kass/

http://www.ritholtz.com/blog/2011/01/wh ... the-u-s-a/

http://www.ritholtz.com/blog/2011/01/ch ... tail-risk/

http://www.ritholtz.com/blog/2011/01/su ... events-15/

http://www.ritholtz.com/blog/2011/01/gd ... recession/

http://www.ritholtz.com/blog/2011/01/ho ... ck-market/

http://www.ritholtz.com/blog/2011/01/th ... more-62281

http://www.ritholtz.com/blog/2011/01/20 ... more-62271

http://www.ritholtz.com/blog/2011/01/mo ... wine-gold/

Stay tooned.

Startin' Third Week O' The Year.... I'm Busier Than A Long Tailed Cat Inna Rockin' Chair Factory Makin' Retirement Money Inna 401a While I Can And Prepping To Make The Moves To Keep It When It Gets Hard To Do So...

The only thing on the level on Wall Street is the water in the toilet bowl.

Bill Singer

Chartz And Table Zup @ www.joefacer.com

The first is the only instrumental to be banned from Top 40 radio.

The second is 20 years later. Interestin' story. I've got a copy of a live radio broadcast from a recording studio in the 70's in the Bay Area. Nice clean recording of about an hours music. Fabulous Rockabilly...

http://www.youtube.com/watch?v=JEBqpDDc ... re=related

http://www.youtube.com/watch?v=LUHz0i8_ ... re=related

I bailed outa stocks inna 401a two Fridays ago cuz I'm looking for a correction and it sure looked like the start of one. I kept IRA and trading accounts in stocks ona counta cuz o' diversification and greater flexibility in those accounts. False alarm. I was 99% back in stocks inna 401a by last Thursday. I'm now exposed to losses and penalties because of the a rapid trading rules if I bail out again in the next month, but oh well, there is a cost to everything. In this case I have to look at the cost of selling in front of or in the early part of a correction vs the possible cost of holding on deeper into a correction or all the way through one... I figure taking the occasional small hit is the cost of doing business. Taking the big hit going all deer inna headlights is not doing business...

Stocks Go Up On The Escalator. They Go Down By Way Of The Elevator Shaft.

At some point I will sell big time again. I'd rather it happens after rapid trading restrictions no longer apply. If the markets stay up for more than a month, No Problem! But, faced with losses from falling stock prices significantly greater than the losses due to triggering the rapid trading penalties, it'll be a no brainer to bail on a cascade down. No brainers are my specialty. You sell to avoid the wrong risk or to avoid the losses. It's stoopid not to...

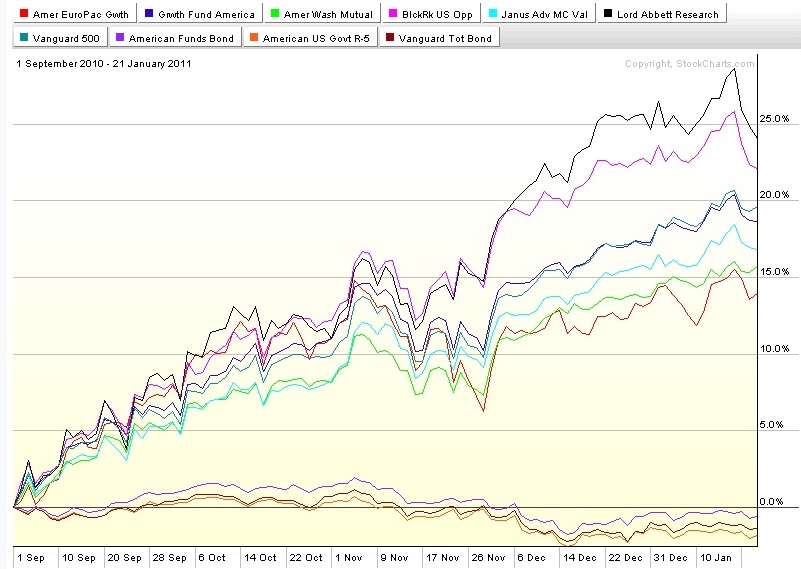

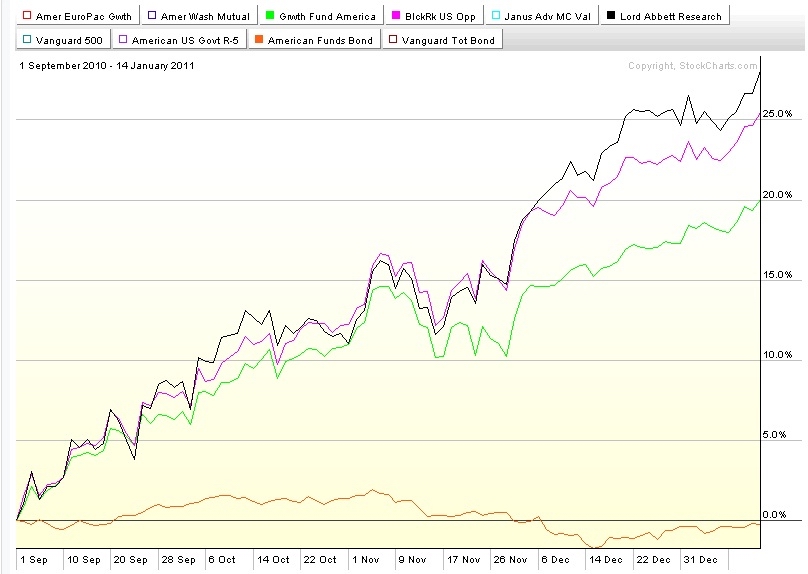

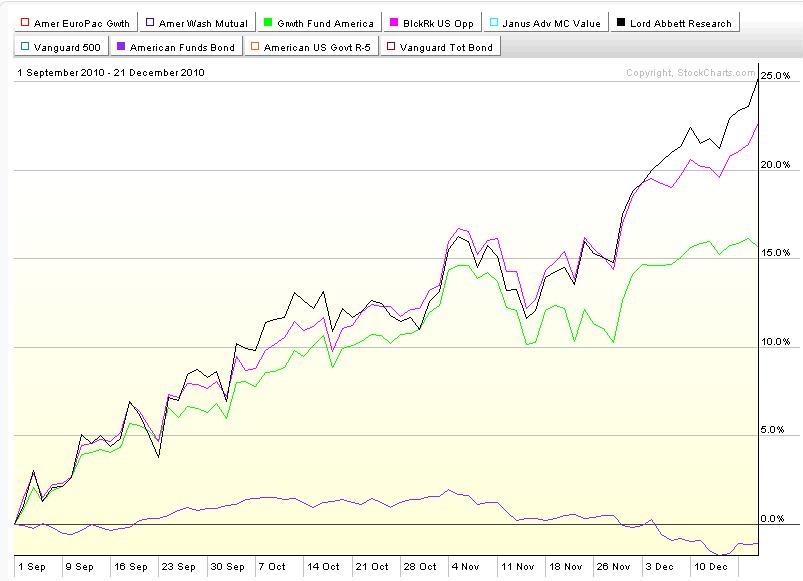

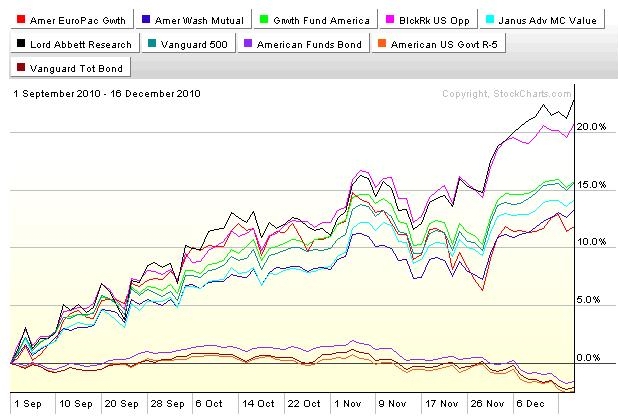

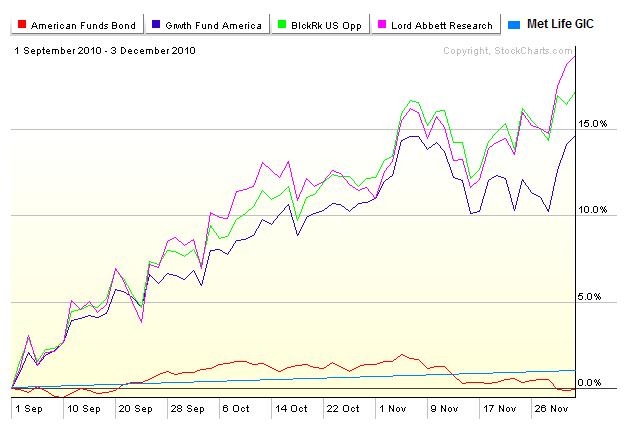

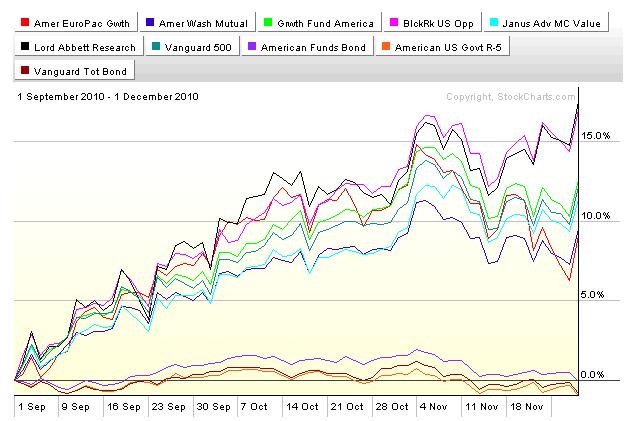

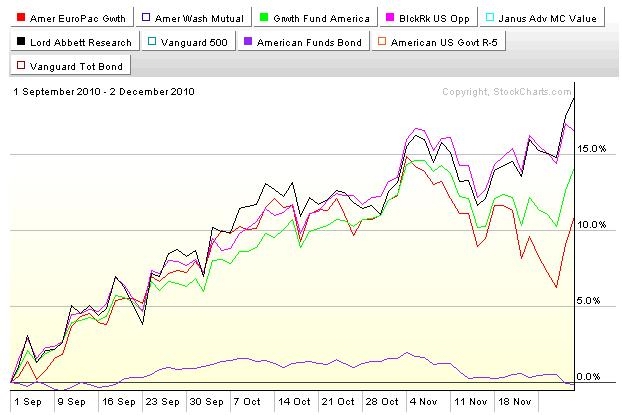

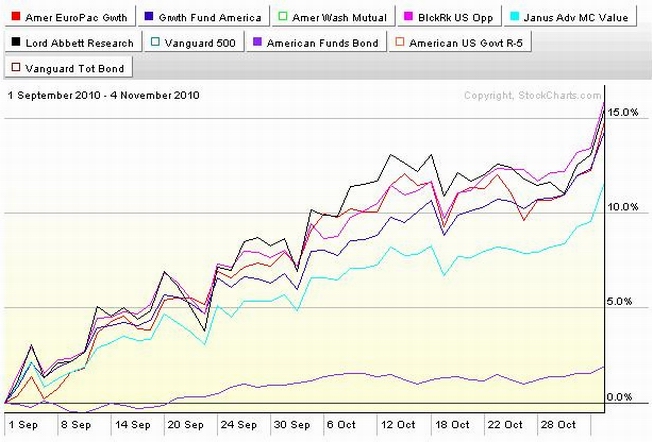

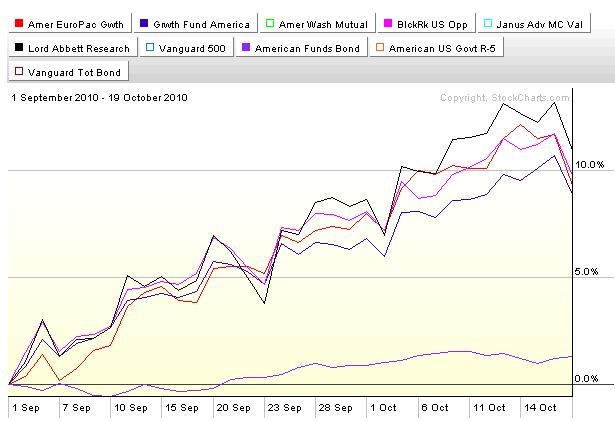

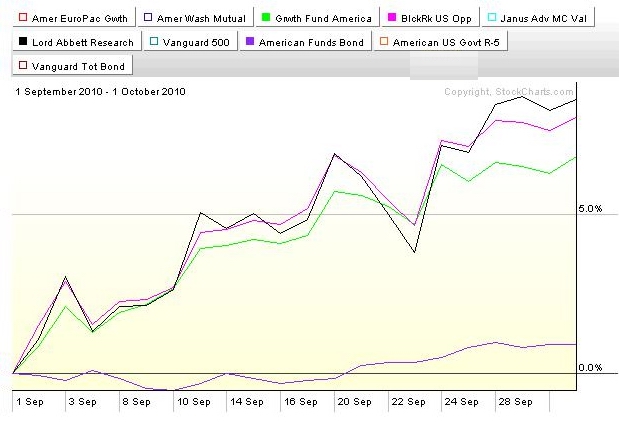

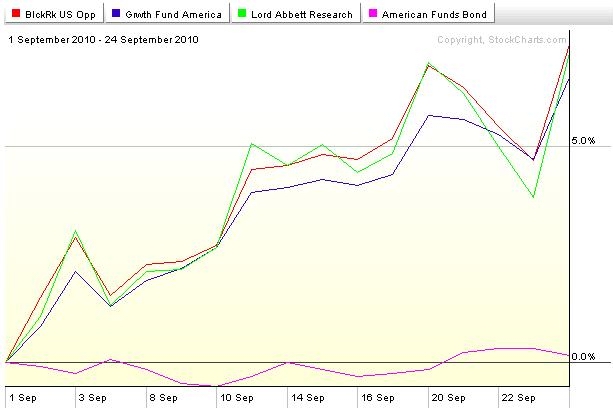

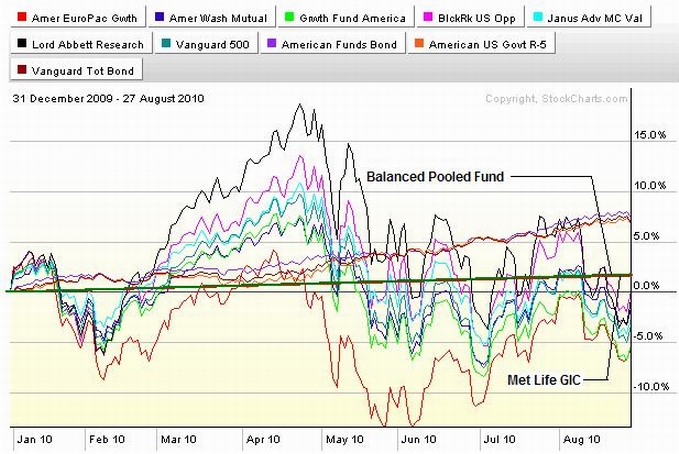

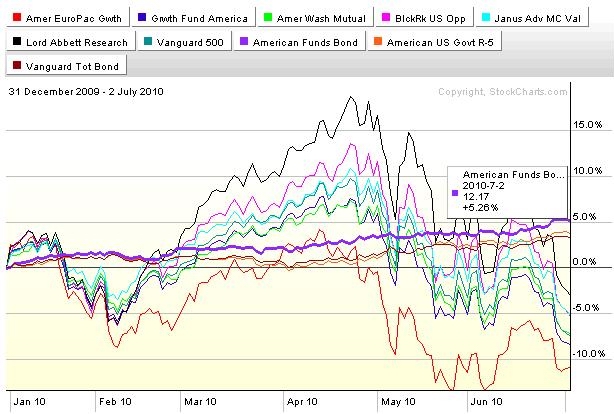

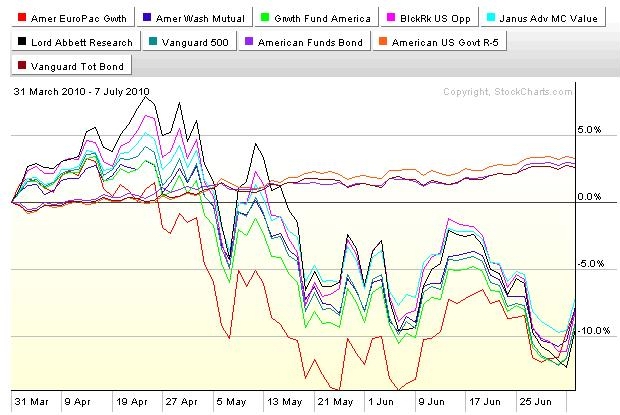

Here's the run from 9/1/10 to now in the funds where I had a significant percentage of my 401a coin.

I jacked the risk way (around 100%) up for the reward. I earned a very good year's worth of returns inna quarter. At some point I'll jack the risk way back down because that is the other side of the coin. When it's summer time and the winds and currents are right, you put everything that floats inna water. When it's all darkness, lightening, and waves and the ocean looks like Gods's blender, you go indoors and wait out the winter.

Pretty simple in the large part...

Ahll Be Baaack.....

Ghastly Bloody Costly Day For Me... 1/19/2011

Well... Not Really....

I did end up the day with a substantial loss in the 401a, my family IRA's, and my trading account. DEFINITELY a substantial loss in terms of pulling that much cash out of my pocket and throwing it away.

But Lookie Here...

Here's where the market has come from and gone to since 9/1/10.

I've been aggressively long for most of that run. What made today so nasty was how WFO I was this AM gathering while the gathering has been good. No Surprise I got my nose bloodied. Should I have been more conservative going into today? Hell yes. Did I think about it? Hell Yesss!

But I've thought of it a buncha times before inna last three months and it woulda been big time wrong not to stay WFO. So I was right a bunch, big time wrong once, and still looking good in the perspective the chart above shows...

Time to pull in the horns a tad. I'll prolly lighten up some in all the accounts tomorrow. I'm still well ahead of where I could have been if I hadn't put and kept it out on the table. > If I can keep most of what I've made in the last four months, that's a not half shabby outcome for less than four months work...

Rev Shark is right; Capital preservation is job #1 and not putting yourself in a position where you have to use all your smarts and luck and three quarters of the next run up getting back to even is job #2,#3,#4,#5,#6,and #7.

Stay tooned.....

Coupla Things.... Guests For New Year's Dinner, And The 12/31 Data Has Not Posted For My 401a....Despite Being There @ My Brokers And Charting Service...AND The Dividend And Cap Gains Have Yet To Show Either.....

Despite all of the talk about Democratization of investing, Wall Street primarily serves only the very wealthiest Americans. And that is a shame.

-- Barry Ritholtz

No Chartz And Table Zup @ www.joefacer.com Kinda....See da header.... except not not... See Below.....

I got the right prices on the 401a site by entering the wrong dates... But I'm not so sure about the shares/cap gains/dividend reinvestment situation. Prolly close enuf fer what I do, so there ARE chartz. But they'll be even righter next week.

Interesting article in Nat Geo about memory.

http://ngm.nationalgeographic.com/print ... /foer-text

I saw the Yardbirds @ the 'mo during the last tour just before they morphed into Led Zep... Two sets from 20' off the stage. Cream from half way back at the 'mo, Hendrix, A.King, And Mayall @ Winterland, 2 sets and I left at 2:30 and Hendrix was still goin strong... Butterfield w/ Bloomfield and Bishop @ the 'mo and later @ the Carousel ('mo West). J. Tull @ the Berkeley Community Theater after the Benefit album and again on the Thick As A Brick tour.... the Who just after Woodstock was released....GAWD... if I could only replay these note for note/minute for minute... as well as another coupla three four hundred hours... Oh Well....

http://www.youtube.com/watch?v=MLv7viCM ... re=related

I upgraded to Windows 7 this weekend.

I've got this old HP that is my workhorse that predates Vista; I got the Vista upgrade disk that was supposed to come with it a coupla three four months later inna mail. The VERY FIRST ITERATION of Vista. I've never upgraded. Sunday I did so, starting at 2:00 PM. "how hard could it be? What could possibly go wrong?"

I've been a computer user since '82. I'm an old DOS 2.01 Dinosaur and I got my eccentricities... The HP has a lotta stuff... all over it. Rather than lose stuff stuck in an arcane directory associated with a program, I decided to upgrade to Vista and then upgrade to Seven rather than do a clean install. Well....

The Vista upgrade disk didn't recognize my upgraded and patched XP system as anything it expected to see... XP was supposed to be DOA. So I un repatched my OS and beat the computer/disk duo into submission... Then my new version of Vista needed 107 updates to get modern enough to work...and be upgradeable.

At 11:00 Sunday evening I decided to upgrade my seldom used Vista laptop since I sure as hell wasn't gonna need the 7 upgrade disk inna near future. Sure enough, my laptop only needed 50 upgrades prior to Sevening.... Grrrrr.

1:30 Sunday AM, I had a Vista'd PC.

10:00 PM Monday evening I had a Windows 7'd Desktop and Tuesday mid morning I had my W-7 laptop.

To adapt to 7 or adapt it to me... that is the question....

Now a clean W 7 install onna brand new home media server I'm nerding with and I'm home free for a while.....

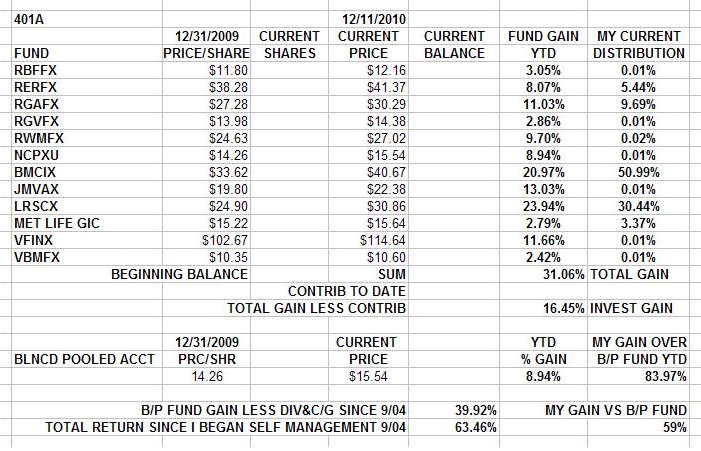

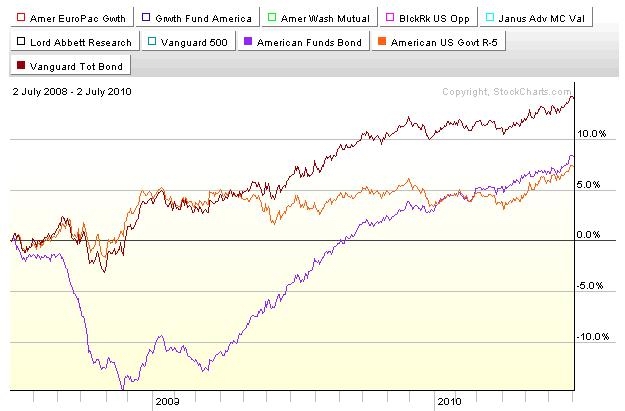

This is what '10 looked like...

I'll prolly write about it later...

http://www.newsweek.com/id/226493

http://www.ritholtz.com/blog/2011/01/fl ... udclosure/

http://www.ritholtz.com/blog/2011/01/bo ... eddie-mac/

http://www.ritholtz.com/blog/2011/01/am ... ing-class/

http://www.ritholtz.com/blog/2011/01/on-mark-to-market/

http://www.ritholtz.com/blog/2011/01/bo ... eddie-mac/

http://www.ritholtz.com/blog/2011/01/wh ... t-in-2011/

http://www.bloomberg.com/news/2010-12-2 ... ubble.html

http://www.ritholtz.com/blog/2011/01/ec ... ettlement/

http://www.ritholtz.com/blog/2011/01/ob ... cal-skill/

http://www.ritholtz.com/blog/2011/01/ca ... o-not-own/

http://www.ritholtz.com/blog/2011/01/fl ... udclosure/

http://www.ritholtz.com/blog/2011/01/cl ... -industry/

http://www.ritholtz.com/blog/2011/01/volcker-resigns/

http://www.ftrain.com/wwic.html

Lookie here.....

I've done my asset allocation with an eye toward two things.... Maximizing profits when the market was going up and being able to step to the side effectively when the market gets dangerous...

That looks like today. The market has been ready to go down for a while. It looks like the court decision in Mass. concerning Wells Fargo and US Bank and the payroll report were a good catalysts/excuses. I loaded up my 'chute and if I don't cancel my pending exchanges at the end of the day, I step off of the escalator big time.

STAY TOONED...

Dickens; The Man Who Invented Christmas.... You Have No Idea How Much You Owe This Particular Limey........

"The uniform, constant and uninterrupted effort of every man to better his condition, the principle from which public and national, as well as private opulence is originally derived, is frequently powerful enough to maintain the natural progress of things toward improvement, in spite both of the extravagance of government, and of the greatest errors of administration. Like the unknown principle of animal life, it frequently restores health and vigour to the constitution, in spite, not only of the disease, but of the absurd prescriptions of the doctor."

—Adam Smith

Chartz And Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=wSksWyHs ... re=related

Rock And Roll Never Forgets. But There IS A Future, Even If It Is 35 Years Inna Past....

Linques.....

http://www.bloomberg.com/news/2010-12-2 ... stein.html

http://lifeinc.todayshow.com/_news/2010 ... s-under-30

http://ronburk.blogspot.com/2010/08/cas ... ne-of.html

My Granddad Said; "If You're Lucky, Shit'll Do For Brains." I'm Down Wid Dat.....I Made A Good Year For The 401a From Three Months In The Right Fundz... Tight Market Stops Float My Boat...

More To Come... Stay Tooned......

Ya Gotchur Church Key, Your Skate Key, Your Line Level RCA Interconnect, An' Ya Got Me. All These Things Are Way Dated, But Not Quite Obsolete, Yet.... I Hope. In The Meantime, I Gotta Get A New Ribbon Fer My Daisy Wheel Printer An' A Roll O' Film Fer My 35mm An' My Wife's 110, An' A Brand New VHS VCR Cuz I Used Up All My Betamax Tapes ......Sure Hope I Can Find A Woolworths Or Monkey Wards Open Onna Sunday.

"Change has a considerable psychological impact on the human mind. To the fearful it is threatening because it means that things may get worse. To the hopeful it is encouraging because things may get better. To the confident it is inspiring because the challenge exists to make things better."

-- King Whitney, Jr.

Chartz And Table Zup @www.joefacer.com

Ya Gotchur Telecaster and Stratocaster Sound, And Yer Humbuckin' Gibson Sound, But All Too Few Remember The Rickenbacker Sound.

http://www.youtube.com/watch?v=xA8tUUrS ... re=related

The Uptrend Is Still Smokin' Hot....And I'm Still Long. This Too Will End. But Until It Does.....

http://www.ritholtz.com/blog/2010/12/pr ... he-crisis/

http://www.ritholtz.com/blog/2010/12/ki ... -the-road/

http://www.ritholtz.com/blog/2010/12/mo ... -run-wild/

http://www.bloomberg.com/news/2010-12-1 ... tered.html

http://www.bloomberg.com/news/2010-12-1 ... ovsky.html

http://www.ritholtz.com/blog/2010/12/wh ... iefreddie/

http://www.ritholtz.com/blog/2010/12/do ... s-reality/

http://www.ritholtz.com/blog/2010/12/su ... ts-121710/

http://www.ritholtz.com/blog/2010/12/th ... -continue/

http://www.ritholtz.com/blog/2010/12/th ... -and-gold/

http://www.ritholtz.com/blog/2010/12/mutual-fund-flows/

http://www.ritholtz.com/blog/2010/12/re ... k-in-2011/

http://www.ritholtz.com/blog/2010/12/se ... -for-rich/

http://www.bloomberg.com/news/2010-12-1 ... ports.html

http://www.sfgate.com/cgi-bin/article.c ... 1GQK86.DTL

Hangin' On And Lookin' Over My Shoulder. This Is A VERY Good Year In 3 Months..... NOT Gonna Give Any More Back Than I Have To.....It's Up So Much, It's Kinda Scary.....

http://www.ritholtz.com/blog/2010/12/bo ... ittle-guy/

Stay Tooned

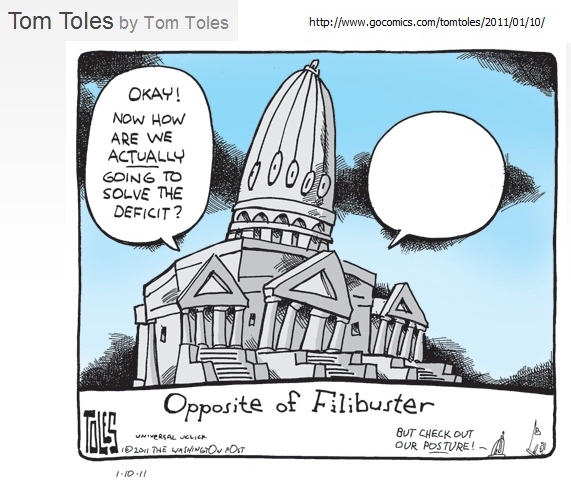

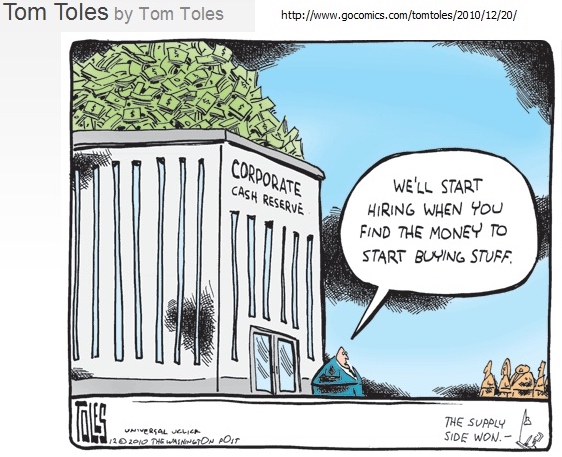

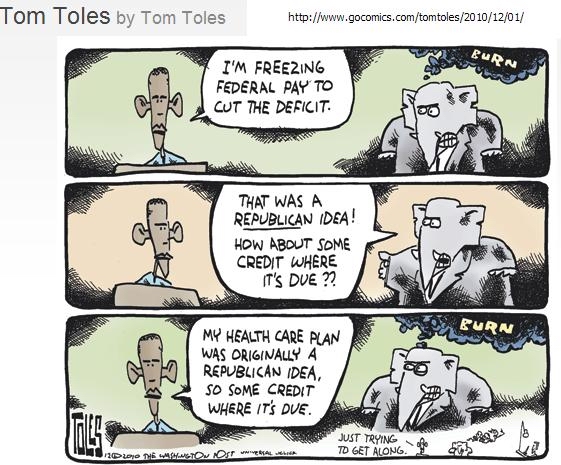

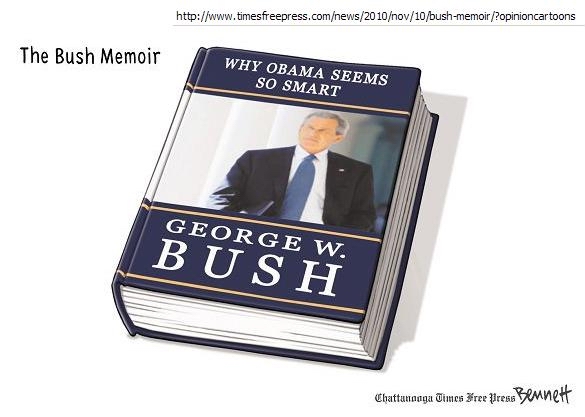

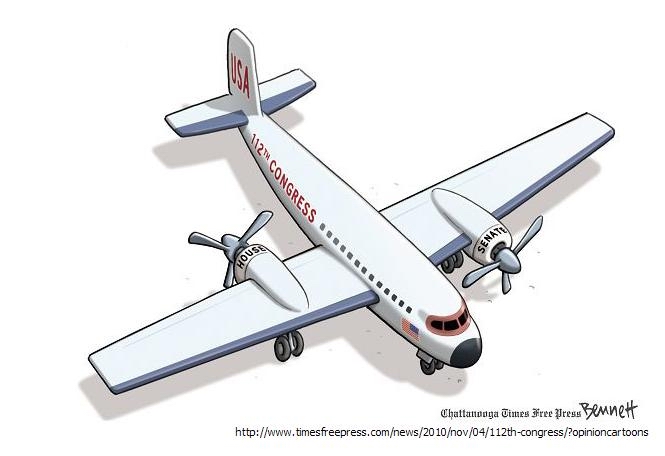

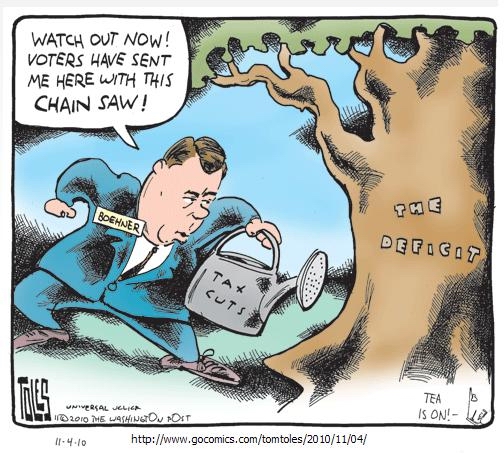

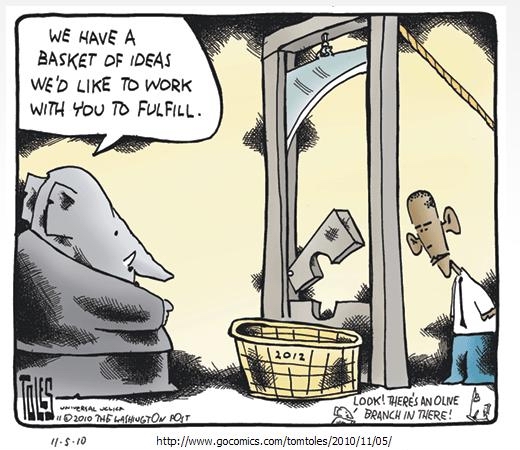

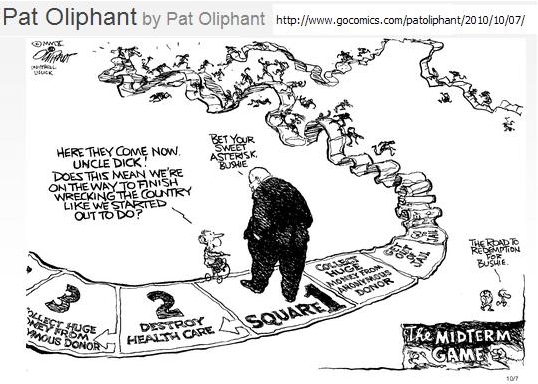

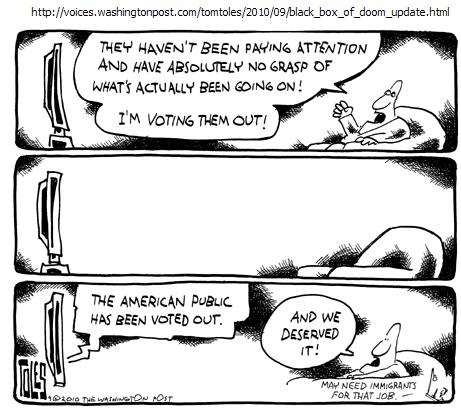

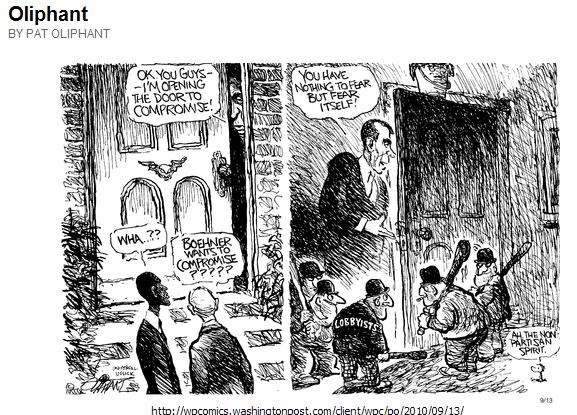

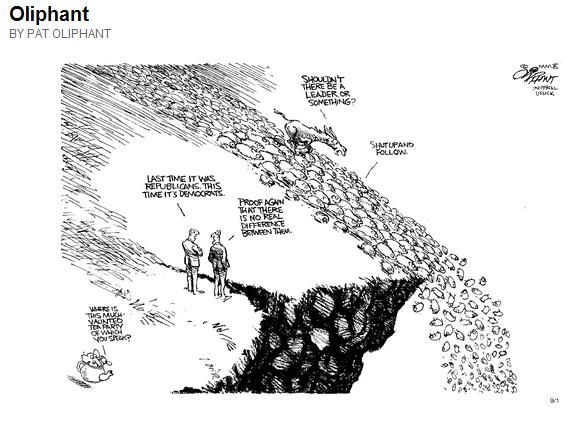

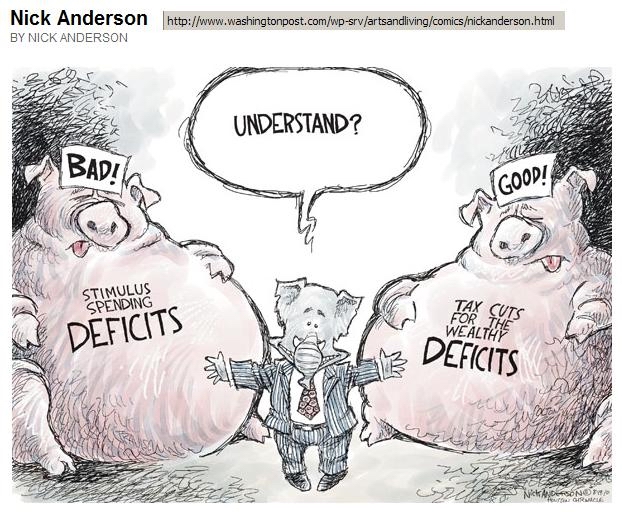

The Demo's Snatched Defeat From The Jaws Of Victory And Resusitated The Republicans From Next Door To Death. THAT SUCKS!!! But The Tax Compromise Is A SMOKIN HUGE Fiscal Stimulus In The Face Of The Tea Partiers. Gonna Be An Interestin' 2 Years....

I've concluded that all statements made by Goldman Sachs make sense if you append on the phrase "so just give us your money".

- George Zachary

Chartz And Table Zup @ www.joefacer.com

Back Inna Day, I Saw The Yardbirds At De 'Mo. Clapton Was Long Gone By The Time They Hit The Charts, And Beck Was Long Gone By The Time I Saw Them At The De 'Mo. But They Had This Guy Named Page Sawin' Onna Guitar Wit A Violin Bow An' He Was Pretty Good In His Own Right...

http://www.youtube.com/watch?v=HTO7WVxj ... re=related

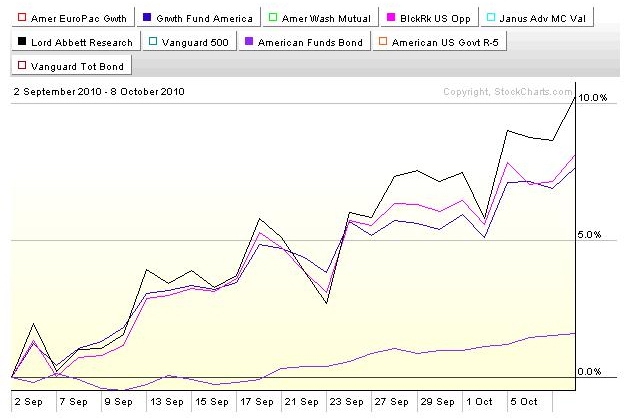

I'm Outa Bonds And WFO In Stocks...How'd That Happen ????!

Here's Why...

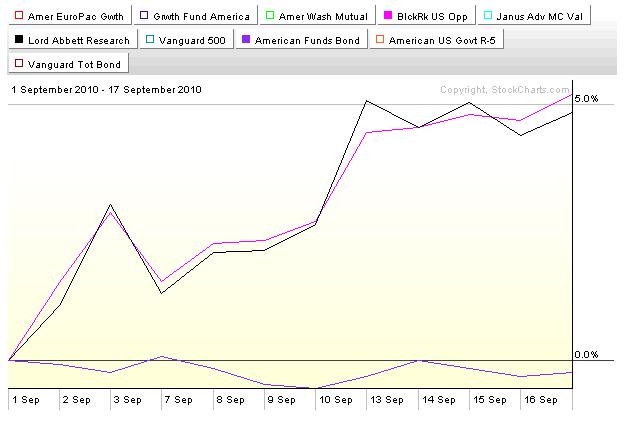

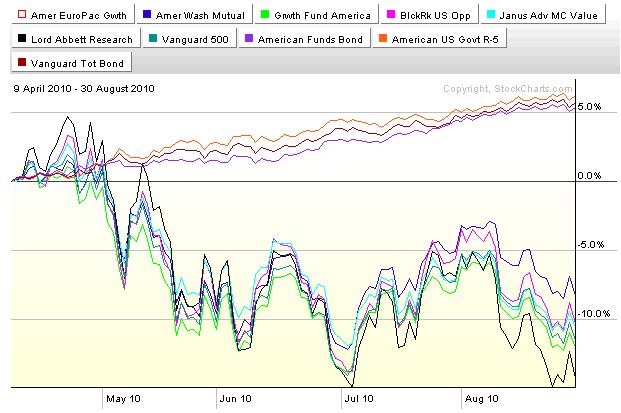

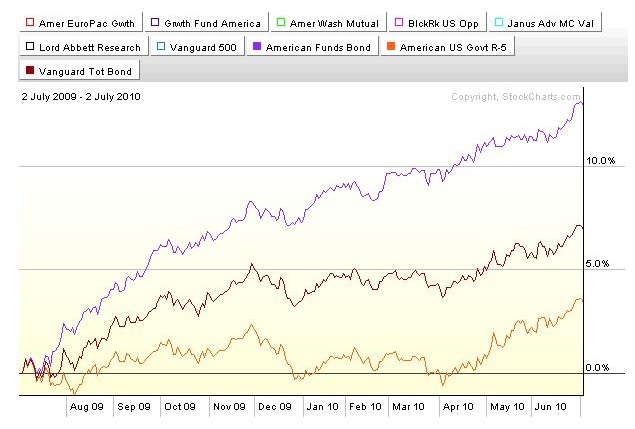

If you were in bonds this year, you looked reeely smart up until the second week of Sept. You were just SMOKIN' Stock's Returns With Corporates and Treasuries.

I Wuz There, Did That. It Worked Reeely Good. Then The Game Changed In Sept And I Changed With It. I Made A Good Year In Three Month's Time.

This Has Been And Is A High Risk And High Reward Moment... And This Too Will Change. Makin' Gains Is Half Of It. Keepin' It Is The Other Half....

Stay Tooned.

Here's What I've Read And Found Interesting...

http://www.ritholtz.com/blog/2010/12/fo ... esnt-work/

http://paul.kedrosky.com/archives/2010/ ... sland.html

http://www.foreignpolicy.com/articles/2 ... _by_carbon

http://paul.kedrosky.com/archives/2010/ ... rcuts.html

http://www.ritholtz.com/blog/2010/12/ap ... ing-ideas/

http://www.ritholtz.com/blog/2010/12/de ... r-lending/

http://nationalinterest.org/print/artic ... nback-3282

http://www.bloomberg.com/news/2010-12-1 ... ldman.html

http://www.ritholtz.com/blog/2010/12/buy-hold-vs-trend/

http://www.ritholtz.com/blog/2010/12/fa ... -problems/

http://www.msnbc.msn.com/id/40643129/ns ... e_economy/

http://www.bloomberg.com/news/2010-12-1 ... ssett.html

http://www.ritholtz.com/blog/2010/12/fo ... nd-blight/

http://www.ritholtz.com/blog/2010/12/wankin-bankers/

Still Long And Strong...Almost All In In Stocks Less A Little In The GIC...I'm Still A Believer, But Every So Often I Draw A Lttle Outa Stocks And Definitely Do Not Put It In Bonds...

Stay Tooned....

All Work And No Play Make Jack A Dull Boy. But All Play And No Work Makes No Jack At All....Gotta Get The Proportions Right. Know What I Mean, Vern? ("KnoWhutImean, Vern?) See below...

We make a living by what we get, but we make a life by what we give.

-- Winston Churchill

Chartz and Table Zup @ www.joefacer.com

Yet ANOTHER moldy oldie from a simpler time.....

http://www.youtube.com/watch?v=30p0PJrH ... re=related

Complete w/ skip.

Know what I mean, Vern?

http://www.youtube.com/watch?v=18i_t20xXDc

http://en.wikipedia.org/wiki/Jim_Varney

Razzie nomination one year, Emmy winner the next.... and a movie that grossed $25 Mill. Ya go as far as ya can w/ whatcha got.

http://www.jimvarney.org/spectrib.html

http://www.ritholtz.com/blog/2010/12/ch ... isclosure/

http://www.msnbc.msn.com/id/40493886/ns ... inessweek/

http://www.ritholtz.com/blog/2010/12/mo ... t-housing/

http://www.ritholtz.com/blog/2010/12/so ... minalized/

http://www.ritholtz.com/blog/2010/12/te ... e-indians/

http://www.ritholtz.com/blog/2010/12/su ... s-12-3-10/

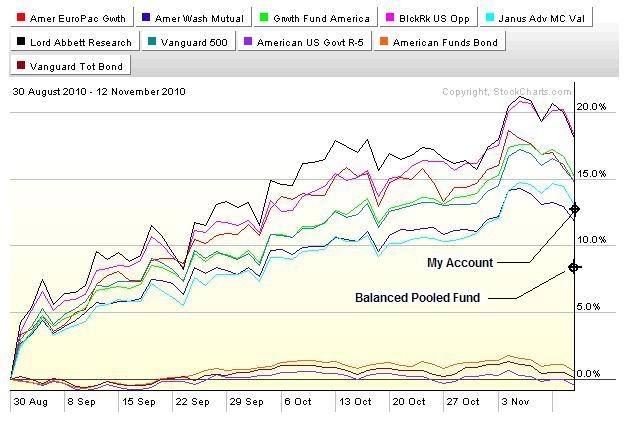

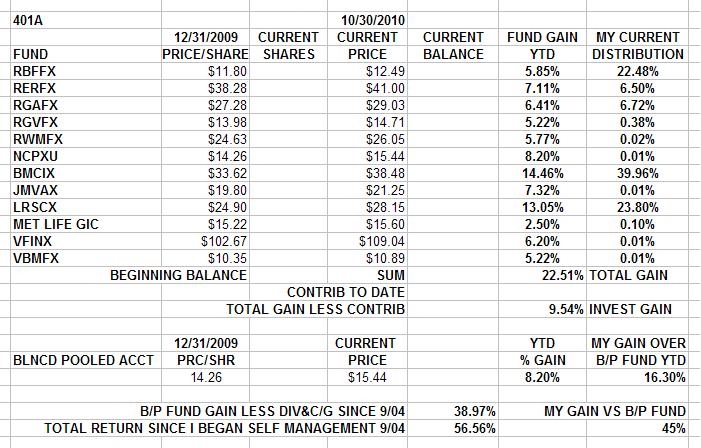

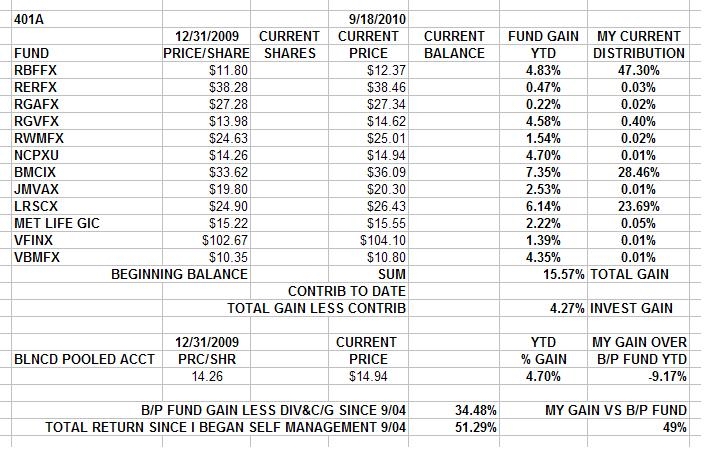

It's a SELF DIRECTED plan, see. Not a self neglected plan. I've long since blown off the Balanced Pooled Fund because I understand that it is the default plan, complete with all de faults anyone needs. I self direct and I went into high gear around 9/1. These are my horses from then until now.

And here is where I am as of 6:00 Friday 12/3 along with my and the B/P Funds returns. Pretty kool. Stay tooned for the rest of the month as I attempt to as I try to nail down gains before they go away and at the same time, not leave the game too soon. YMMV.

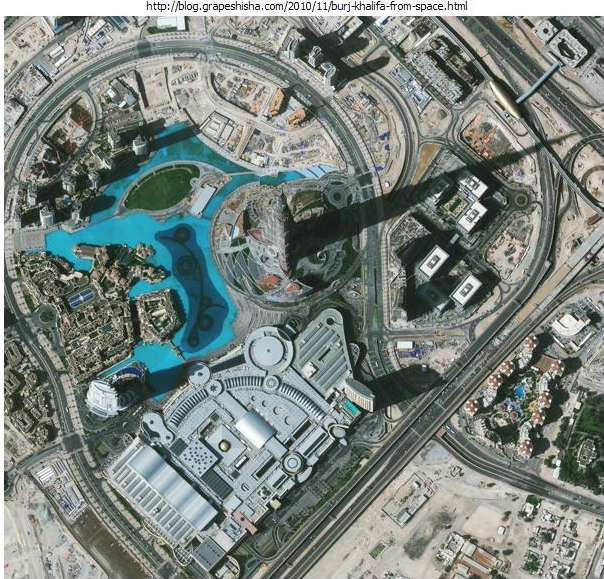

Burj Khalifa,

Burj Khalifa, From Space....Here, Hold The Tape, An I'll Walk To The Other End Of The Shadow An We'll Save The Trouble Of Climbing To The Top Of This Building To Measure how Tall It Is.....

Stay Tooned....

These Damn Once in A Lifetime Market Crashs, Events, Flash Crashes etc, like '29, '87, '97, '02, '08, '10 And Maybe This Weekend Seem Be To Happening A Lot More Often Than Once A Lifetime.....

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

iTunes has da Bee-atles. The COFGBLOG Has the KNICKERBOCKERS!!!!!!

http://www.youtube.com/watch?v=1n03a7cL ... re=related

They were even better Beatles than the English ones!!!

http://www.ritholtz.com/blog/2010/11/fd ... losings-5/

http://www.newsweek.com/2010/11/20/euro ... ivity.html

http://www.newsweek.com/2010/11/19/the- ... obama.html

http://www.ritholtz.com/blog/2010/11/o- ... more-60676

http://www.bloomberg.com/news/2010-11-1 ... ment-.html

http://www.msnbc.msn.com/id/40319525/ns ... vironment/

http://www.bloomberg.com/news/2010-11-2 ... surge.html

http://redtape.msnbc.com/2010/11/sherri ... -grov.html

http://www.bloomberg.com/news/2010-11-2 ... -jobs.html

http://www.msnbc.msn.com/id/40368094/ns ... iapacific/

http://www.bloomberg.com/news/2010-11-2 ... -says.html

http://www.bloomberg.com/news/2010-11-2 ... urity.html

http://www.ritholtz.com/blog/2010/11/pl ... s-economy/

http://www.msnbc.msn.com/id/40381037/ns ... _business/

http://www.bloomberg.com/news/2010-11-2 ... hawks.html

http://www.ritholtz.com/blog/2010/11/ma ... verywhere/

http://steveblank.com/2010/11/24/when-i ... the-stars/

http://www.latimes.com/business/la-fi-p ... ull.column

I started to go way long stocks in my 401a about 9/1. Ya can draw uptrend lines and downtrend lines and resistance and support lines and even bollinger bands and symetrical triangles all over the chart. But what it comes down to is that the easy money was made between 9/1 and 11/7. There is a wall of worry, it goes straight up, and never mind climbing it, it may collapse on me. That said, I'm as long stocks now as I was a month ago, after pretty much lightening up two weeks ago. It's a risky position and I'm ready to abandon it at a moments notice. But we'll see.....

http://debka.com/article/20394/

http://www.ritholtz.com/blog/2010/11/wo ... on-change/

http://www.washingtonsblog.com/2010/11/ ... -what.html

http://www.bloomberg.com/news/2010-11-2 ... bonds.html

http://www.bloomberg.com/news/2010-11-2 ... tners.html

http://www.bloomberg.com/news/2010-12-0 ... -plan.html

http://www.msnbc.msn.com/id/39435196/ns ... ws-europe/

I hung wit the long side an hadda good day.....a really good day.

There is a possibility of a ramp up into year end as those who live by the returns YTD, are lookin at dyin' by the returns YTD, unless they save a mediocre year by goin' all out for the last two weeks. There are fundz who are having visions of their client's bailing out. They will try to manufacture performance and the sharp guys are ready and waiting for it... I stick wit what I got for now..... I'm heavy in the aggressive funds and no place no place else. Let's see if they can pile on to the momentum plays and do me some good. Do I got my mojo workin'?

These are my horses...Ride Sally, Ride.....

Stay tooned....

"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around [the banks], will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered."

--Thomas Jefferson

Chartz And Table Zup @ www.joefacer.com

Back Inna Garage Band Day, When You Had No Talent, It Was What You Played. How Could You Sound Good Without A Vox Continental inna band? Didn't a set of Ludwigs make me a drummer and wouldn't I have been even better with a full set of Zildjians? Biff Acne Showing Up With His Fender Jaguar And Vox SuperBeatle Amp Had More Instant Cred Than Eric Clapton Bopping By Lugging A Harmony Guitar And A Silvertone Amp...

Ah, youth....

Another Moldy Oldie.....

http://www.youtube.com/watch?v=F-VFq6nW ... re=related

The market is acting magnetized to a critical technical level. The recent bounce back up to and bumping up and through resistance and falling back through support has stopped my reallocation for now. Data on my website and theo-philisophical discussion and metamatic and cosmic allegorical ruminations to appear here later this weekend.....

Refied this week, just in time... Rates going up inna face of QE, bonds going down... Not expected and not good. Gotta factor this in to the 401a... corporates were good to me for much of this year. Gotta be concerned about giving it back in the market's ebb and flow and give and take... Getting what the market gives is OK. Letting the market take it back does not float my boat...

Pure platinum/diamond/gold on a financial website. Who'da thunk?

http://www.ritholtz.com/blog/2010/11/st ... -way-home/

I've spent years and years in a single day waiting to get out of school when I was in 5th grade and about an hour between my 59th and 60th birthdays. The Relativity Of Time Becomes Clearer As I Age....

"...in an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes. What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention and a need to allocate that attention efficiently among the overabundance of information sources that might consume it"

-- Herbert Simon

Chartz And Table Zup @ www.joefacer.com

This always went along whenever somebody got experienced for the first time.....

http://www.youtube.com/watch?v=oxpcZrQQM-4

Tough week. End o' the year levitation vs too far too fast, China's coolin' inflation down and domestic reality setting in.

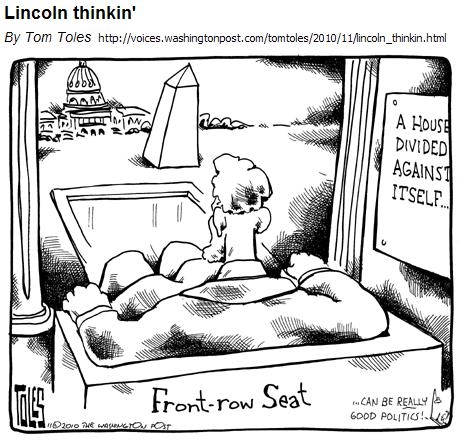

You gotta front row seat (in the cage) on the cage match between these dead economists...

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.bloomberg.com/news/2010-11-1 ... ate1-.html

http://www.stratfor.com/analysis/201011 ... r_and_g_20

http://www.msnbc.msn.com/id/40136417/ns ... l_finance/

http://redtape.msnbc.com/2010/11/in-new ... html#posts

http://www.bloomberg.com/news/2010-11-1 ... kfire.html

http://www.bloomberg.com/news/2010-11-1 ... egion.html

http://www.bloomberg.com/news/2010-11-1 ... -says.html

Bloody week in and of itself....in perspective, not so much. I've got friends still 100% inna GIC because they can't deal with the volatility of the markets once they get some serious balances in their 401a. Weekly gains can be overwhelmed and forgotten by serious down days. It can be breathtaking. No knock on them. If you haven't experienced it, you haven't got a glimpse down inta the abyss. Stocks go up on the escalator and can go down like falling down the elevator shaft.....

That said....This week was not good and Friday was a bloody nose. But it was on top of a good two months gains... correction and digestion before the next leg up or change in trend and the start of the markets rolling over?

Now... Don't fight the FED vs domestic reality vs China's interest rate bumps vs end of the year Wall Street money manager contract renewals, vs Holiday spirits vs get the last of what's on the table cuz it's been good so far and more is better vs declare victory and leave the table a guaranteed winner. This ain't an easy choice... Stay long and strong and make some more or lose most or all of what I've made, take half off the table and get 50% of the gains but risk only half losses? Or leave the table and call 12% return a pretty good year, which it really is?

I just don't think the year's highs for the market are in....although they might be. Monday will tell the tale. Standing pat, ready to react, and waiting for the market to tell me what it's gonna do and what I should do...

http://www.ritholtz.com/blog/2010/11/ro ... eposition/

http://www.ritholtz.com/blog/2010/11/fi ... r-the-bar/

http://www.msnbc.msn.com/id/40182444/ns ... l_finance/

Monday night....

TUESDAY

70+% cash and bonds, getting smaller in stocks tomorrow. Locking in profits....reducing risk....

http://www.ritholtz.com/blog/2010/11/th ... ry-policy/

http://www.bloomberg.com/news/2010-11-1 ... -u-s-.html

http://www.ritholtz.com/blog/2010/11/do ... udclosure/

http://www.bloomberg.com/news/2010-11-1 ... stein.html

http://www.msnbc.msn.com/id/40238859/ns ... l_finance/

http://www.ritholtz.com/blog/2010/11/we ... aggerated/

http://www.ritholtz.com/blog/2010/11/th ... eraging-2/

http://www.bloomberg.com/news/2010-11-1 ... ccord.html

http://www.bloomberg.com/news/2010-11-1 ... rkets.html

http://www.ritholtz.com/blog/2010/11/wh ... -its-debt/

Stay tooned. More To Come Later....

See Ya @ The Hall... I Get A Piece Of Paper Commemorating That 35 Years Ago I Became An Apprentice Steamfitter.... Time Flies When Yer Having Fun....

"One does not leave a convivial party before closing time."

-Winston Churchill

Chartz and Table Zup @ www.joefacer.com

I learned my geography from Top 40 Radio. Fer Instance; Boston is known for it's rivers of frustrated wimmen.....

http://www.youtube.com/watch?v=5apEctKw ... re=related

As per Barry (The MAN) Ritholtz, think of it as asset allocation and risk control instead of market timing.

For the first two thirds of the year I was thinking that the big risk was down and the little risk was missing the upside. I allocated conservatively. I was way bonds and some cash. On or about Sept 1st, my thinking changed and I reallocated and went pretty aggressively into stocks as allowed without tripping the rapid trading penalties inna 401a. It's worked out pretty nicely, so far.... still long, still strong, but now I'm leaning toward reallocating when risks to the downside become predominant. If ya catch my meaning an' get my drift........ Still, I gonna stick wit da trend. It's been workin' so far.....

http://www.ritholtz.com/blog/2010/11/th ... istration/

http://www.ritholtz.com/blog/2010/11/el ... more-60276

http://www.msnbc.msn.com/id/39990043/ns ... d_economy/

http://www.bloomberg.com/news/2010-11-0 ... stove.html

http://www.ritholtz.com/blog/2010/11/su ... vents-115/

http://www.ritholtz.com/blog/2010/11/fo ... s-monthly/

http://www.ritholtz.com/blog/2010/11/ghwb-syndrome/

http://www.ritholtz.com/blog/2010/11/nfp-151k/

http://www.ritholtz.com/blog/2010/11/th ... osure-zoo/

http://www.ritholtz.com/blog/2010/11/el ... e-economy/

http://www.ritholtz.com/blog/2010/11/60298/

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.newsweek.com/2010/11/06/obam ... -awol.html

http://www.ritholtz.com/blog/2010/11/ch ... rey-swans/

http://www.ritholtz.com/blog/2010/11/th ... ity-traps/

Three incredibly accurate and depressing evaluations....

http://www.nytimes.com/2010/11/07/opini ... ef=opinion

http://www.ritholtz.com/blog/2010/11/th ... istration/

http://www.ritholtz.com/blog/2010/11/el ... e-economy/

Stay Tooned....

When it comes to the future, there are three kinds of people: those who let it happen, those who make it happen, and those who wonder what happened."

--Hossein Arsham

Chartz and Table Zup @ www.joefacer.com

Saturday Afternoon TV in black and white....Was There, Watched That...

http://www.youtube.com/watch?v=CyX8j3qQ ... re=related

http://blogs.laweekly.com/westcoastsoun ... bal_he.php

http://www.youtube.com/watch?v=2C_riQMImJM

Pretty sweet 40 days.... However the market is spring loaded. Terrorism/elections/holiday season/earnings/fund managers make or break time/pretty much the kitchen sink. Breakout or breakdown? I'll make a move either way.... when it does.

http://www.sfgate.com/columns/reich/

http://www.msnbc.msn.com/id/39918900/ns ... al_estate/

http://debka.com/article/9114/

http://www.msnbc.msn.com/id/39849329/ns ... inessweek/

http://lifeinc.todayshow.com/_news/2010 ... k-on-a-pig

http://debka.com/article/9117/

http://www.msnbc.msn.com/id/39914211/ns ... inessweek/

http://www.ritholtz.com/blog/2010/10/pe ... e-awesome/

http://www.ritholtz.com/blog/2010/10/st ... cs-game-5/

http://www.ritholtz.com/blog/2010/10/bo ... oceedings/

http://www.ritholtz.com/blog/2010/10/fo ... is-weekly/

http://www.bloomberg.com/video/64100308/

http://debka.com/article/9116/

Pretty Smokin' Day.....Pretty Smokin' Week. I'm buyin' the job lunch tomorrow...

Stay tooned....

Scars Are Tattoos That Are More About Where Ya Been and Less About Decoration. Memories Are Better Than Last Decade's Intentions, Last Decade's Missed Opportunities, And This Decade's Regrets....

"The best way to destroy the capitalist system is to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens."

-John Maynard Keynes

Chartz And Table Zup @ www.joefacer.com

There was always a dichotomy between the Bill Graham/'Mo Auditorium live extended/jam/conceptual compositions/performances and the tight top 40 two minute/plus pop music. De 'Mo Vs Longshoreman's Hall. Sometimes the short stuff said what it had to say and then shut the fuck up. Check out the hair/Höfner bass etc. Way period...

http://www.youtube.com/watch?v=jJR_KGZO4U0

Tom Graff of Real Money sez that the Fed wants to see a little more inflation and to achieve that, they are willing to risk a lot more inflation. That's pretty much what I see. Having lived and worked through a big stagflation episode when the oil companies were throwing money left an' right an' I was there to catch my share, ('80-'85) I'm less than sanguine about doing it over again as a retiree when the banks/government are the ones with the cash (mine and yours used as collateral for loans) and I ain't inna path o' the geyser of cash......

My current 401a riff is still working. Fine tuning it now. Check out the percentages on my website. Buy an' Sell. Nailed one. Hope to nail the other. Tick...Tick...Tick........

http://www.newsweek.com/2010/10/23/a-py ... rance.html

http://www.bloomberg.com/news/2010-10-1 ... vanec.html

http://www.ritholtz.com/blog/2010/10/mo ... -linkfest/

http://www.msnbc.msn.com/id/39801398/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-2 ... -baum.html

http://www.ritholtz.com/blog/2010/10/fo ... re-nation/

http://www.ritholtz.com/blog/2010/10/du ... ng-fracas/

Washington says nothing can be done. There's no money left.

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

http://www.sfgate.com/cgi-bin/article.c ... 1FV3LE.DTL

[/4]

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

"Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing ever happened."

-- Sir Winston Churchill

Chartz and Table Zup @ www.joefacer.com

Every Two Bit Garage Band played Louie Louie, Gloria, The Midnight Hour, And Wipeout, But Ya Had To Have A Keyboard Player W/ A Vox Continetal To Do 96 Tears Justice. You Could Fake It W/A Farfisa... But The Vox Made It Authentic. Speaking Of Authentic, Here's The Original Band.....

http://www.youtube.com/watch?v=XeolH-kzx4c

http://www.youtube.com/watch?v=YrCTgpSP ... re=related

I Went 50% Long Stocks Starting On 9/2. Workin' Pretty Good So Far. Roll Over in Bonds? Anticipating What This Weeks Lousy Numbers Portend?

Stay Tooned... Possible Sea Change Comin'..

http://www.washingtonpost.com/wp-dyn/co ... 06541.html

http://www.nytimes.com/2010/10/17/busin ... .html?_r=1

http://www.newsweek.com/2010/10/17/has- ... ricks.html

http://www.msnbc.msn.com/id/39710702/ns/us_news-life/

http://www.ritholtz.com/blog/2010/10/th ... cle-act-2/

http://www.msnbc.msn.com/id/39648608/ns ... al_estate/

http://www.ritholtz.com/blog/2010/10/th ... n-cowboys/

http://www.bloomberg.com/news/2010-10-0 ... -baum.html

http://www.ritholtz.com/blog/2010/10/in ... n-context/

http://www.ritholtz.com/blog/2010/10/ba ... mortgages/

http://www.msnbc.msn.com/id/39620896/ns ... etirement/

Standing Pat. Market Was Too Far Up Too Fast. Traders Lock In Profits On Any Less Than Stellar Move. Buying Opportunity? Up Trend Prolly Still Intact. We'll See. I'm Still Aheada The Game... Gotta Stay Ahead Though....

More Here Soon....

So Much Good Music In My Library, So Many Good Musicians Gone. (Listening To Little Feat Late 90's Concerts w/ Richie Hayward) So Greatful For So Many Recordings Available To Fill The Day With Great Music.

"If a man is offered a fact which goes against his instincts, he will scrutinize it closely, and unless the evidence is overwhelming, he will refuse to believe it. If, on the other hand, he is offered something which affords a reason for acting in accordance to his instincts, he will accept it even on the slightest evidence."

-- Bertrand Russell

Chartz and Table Zup @ www.joefacer.com

Yet Another Moldy Oldie

http://www.youtube.com/watch?v=_FA85RO8 ... re=related

I Started To Go Long Sept 2nd As Per The Rapid Trading Rules And Restrictions Of The 401a, Based on What I Read, What I Studied, What I Thought, And The Healthy Portion Of Good Luck I Earned By Workin' Hard. Pretty Kool 26 Days, Huh? Let's See If I Can Make Some More If It Stays Strong And Keepmost of It If It Don't....

http://www.msnbc.msn.com/id/39562824/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-0 ... rcome.html

http://www.msnbc.msn.com/id/39592653/ns/politics/

http://www.bloomberg.com/news/2010-10-0 ... chers.html

http://www.bloomberg.com/news/2010-10-0 ... -war-.html

http://www.ritholtz.com/blog/2010/10/pr ... hire-5000/

http://www.ritholtz.com/blog/2010/10/su ... events-10/

http://www.ritholtz.com/blog/2010/10/he ... clawbacks/

http://www.ritholtz.com/blog/2010/10/th ... ial-wmd-2/

http://www.ritholtz.com/blog/2010/10/th ... ring-herd/

http://www.ritholtz.com/blog/2010/10/ex ... amp-usage/

http://www.ritholtz.com/blog/2010/10/ce ... -buy-corn/

Stay Tooned.....

Retail sales themselves are the best indicator of consumer sentiment as no device peers so deeply into the recesses of the human soul as the cash register.

--Howard Simons

Chartz And Table Zup @ www.joefacer.com

Moldy Oldie....

http://www.youtube.com/watch?v=MHF558u6 ... re=related

http://www.bloomberg.com/news/2010-09-3 ... r-coy.html

http://www.bloomberg.com/news/2010-09-3 ... lewis.html

Another Week, Still Moving Inna Right Direction. Still So Far, So Good.....

http://debka.com/article/9061/

http://www.rollingstone.com/politics/ne ... how_page=0

http://www.newsweek.com/blogs/kausfiles ... appen.html

http://www.newsweek.com/2010/10/01/bailout-winners.html

http://www.ritholtz.com/blog/2010/10/tw ... leftovers/

http://www.ritholtz.com/blog/2010/10/fd ... sings-129/

Stay Tooned.

Some people regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon.

—Winston Churchill

Chartz and Table Zup @ www.joefacer.com

Wish I Could Play...

http://www.youtube.com/watch?v=pAf3gqdCrDs

http://www.ritholtz.com/blog/2010/09/su ... -events-8/

http://www.ritholtz.com/blog/2010/09/se ... more-59110

http://www.bloomberg.com/news/2010-09-2 ... rlson.html

http://www.bloomberg.com/news/2010-09-2 ... -baum.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-2 ... worse.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-1 ... -hunt.html

Pretty Good So Far....I Gotta Chart A Course That Balances The Aggressive "Get Some More" And The Conservative "Keep What I Got"....

Stay tooned....

Wuz Werkin'.... Still Is Werkin'.....

Stay Tooned......

Wish I Could Play...

http://www.youtube.com/watch?v=pAf3gqdCrDs

http://www.ritholtz.com/blog/2010/09/su ... -events-8/

http://www.ritholtz.com/blog/2010/09/se ... more-59110

http://www.bloomberg.com/news/2010-09-2 ... rlson.html

http://www.bloomberg.com/news/2010-09-2 ... -baum.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-2 ... worse.html

http://www.bloomberg.com/news/2010-09-2 ... tions.html

http://www.bloomberg.com/news/2010-09-1 ... -hunt.html

Pretty Good So Far....I Gotta Chart A Course That Balances The Aggressive "Get Some More" And The Conservative "Keep What I Got"....

Stay tooned....

Wuz Werkin'.... Still Is Werkin'.....

Stay Tooned......

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz And Table Zup @ www.joefacer.com

Buddy Miles instead of Nick Gravenites. A litle rough....but we all were in those days.

http://www.youtube.com/watch?v=4bdQ5re4 ... re=related

And When It's Dialed In, It's Monsterously Good.

http://www.youtube.com/watch?v=y7hbworRWUg&NR=1

Good month for me so far. I'm half in the high horsepower stock funds inna 401a and the rest is corporates.

I really should write about it, and maybe I will too.

http://www.bloomberg.com/news/2010-09-1 ... o-cut.html

http://www.ritholtz.com/blog/2010/09/pr ... n-payment/

http://www.bloomberg.com/news/2010-09-1 ... looms.html

http://bayarearealestatetrends.com/2010 ... -bailouts/

http://www.newsweek.com/2010/09/15/lehm ... esson.html

http://www.newsweek.com/2010/09/16/our- ... ng-us.html

http://www.msnbc.msn.com/id/39230668/ns ... tn_africa/

CHECK IT OUT

Increased saving is not only being used to repay debt but also to rebuild 401(k)s. Fidelity Investments found that in the second quarter, 5.3% of participants raised their contribution while 2.9% reduced them.... Conventional monetary ease is now impotent with the federal funds rate close to zero , the money multiplier collapsed and banks sitting on hoards of cash (Chart 12) and over $1 trillion in excess reserves. Sure, large banks report to the Fed that they are easing lending standards for small business, but after the intervening financial crisis, many fewer potential borrowers are deemed creditworthy than in the loose lending days. Furthermore, the small business trade group, the National Federation of Independent Business, reports that 91% of small business owners have had their credit needs met or business is so slow that they don’t want to borrow. The Fed is pushing on the proverbial string.

http://www.ritholtz.com/blog/2010/09/58967/#more-58967

<iframe src="http://videos.mediaite.com/embed/player/?layout=&playlist_cid=&media_type=video&content=TD1Z7H1579MF23QC&widget_type_cid=svp" width="420" height="421" frameborder="0" marginheight="0" marginwidth="0" scrolling="no" allowtransparency="true"></iframe>

The Howard Simons mentioned in the post below is a gentleman that I have followed, spoken to, and corresponded with over the last ten years. He has my utmost respect. The report he authored is not directly actionable, but it pretty much confirms what I've seen anecdotally... The Kotok piece is part of my input and IS actionable as part of a strategy. YMMV

http://www.ritholtz.com/blog/2010/09/p-t-f-s-d/

Stay tooned....

Short Sleeve Shirtz, White Belt, Polyester Pantz Pulled Half Way Up My Chest And Driving A Buick? If That's Retirement, Hell No I Ain't Ready!!!!!

"If money is your hope for independence you will never have it. The only real security that a man will have in this world is a reserve of knowledge, experience, and ability."

-Henry Ford

Chartz And Table Zup @ www.joefacer.com

Blue Deck Shoes, White Levi's And Madras Shirts, A Blue Sport Coat And A Pink Crustacean...

http://www.youtube.com/watch?v=T8__EwAT ... xt_from=ML

Whither Goes European Banking?

Is There Yet Another Shoe To Drop In The Millipedian Financial Crisis?

http://www.ritholtz.com/blog/2010/09/be ... fts-bonds/

http://www.newsweek.com/2010/09/12/fine ... -dems.html

http://www.bloomberg.com/news/2010-09-1 ... -debt.html

Lookie Here! Bonds been up and stocks been down. I bin thinkin' that'll change seasonally and cyclically. So i moved some money around.... I'm thinking of these as rented positions and I'm running a cognitive and subjective trailing stop based on holidays and elections and the ebb and flow of the market. This is not without risk. Stay tooned.....

Win as if you were used to it, lose as if you enjoyed it for a change.

-- Ralph Waldo Emerson

Chartz And Table Zup @ www.joefacer.com

One With And One Without

http://www.youtube.com/watch?v=3PBH78ae ... re=related

http://www.youtube.com/watch?v=HF2d8f1w ... re=related

http://www.msnbc.msn.com/id/38941692/ns ... etirement/

http://www.bloomberg.com/news/2010-09-0 ... pesek.html

http://www.msnbc.msn.com/id/38770102/ns ... al_estate/

http://www.bloomberg.com/news/2010-09-0 ... worse.html

http://www.newsweek.com/2010/08/31/ceo-crybabies.html

http://www.ritholtz.com/blog/2010/09/wh ... t-layoffs/

http://www.bloomberg.com/news/2010-09-0 ... -ages.html

http://www.msnbc.msn.com/id/38994476/ns ... e_economy/

http://www.bloomberg.com/news/2010-09-0 ... eport.html

http://www.bloomberg.com/news/2010-09-0 ... eview.html

http://www.bloomberg.com/news/2010-09-0 ... iring.html

http://www.msnbc.msn.com/id/39013379/ns ... ork_times/

http://www.ritholtz.com/blog/2010/09/re ... -agencies/

http://www.sfgate.com/cgi-bin/article.c ... 1F8GEL.DTL

http://www.bloomberg.com/news/2010-09-0 ... -says.html

http://www.bloomberg.com/news/2010-09-0 ... rowth.html

http://www.msnbc.msn.com/id/39055199/ns/business/

http://www.ritholtz.com/blog/2010/09/th ... more-58608

http://www.vanityfair.com/business/feat ... table=true

I put some 401a money to work in stocks this week. More later. But this is part of what I'm thinking.... I'll elaborate later.

http://www.ritholtz.com/blog/2010/09/the-apathy-trade/

Heard On MSNBC: "The Economy Is Down To Seeds And Stems." Proof It's All About MahMahMah Generation......Hope I Die Before I Get Bald.....

"Your last recourse against randomness is how you act -- if you can't control outcomes, you can control the elegance of your behavior. You will always have the last word."

-- Nassim Nicholas Taleb

Chartz And Table Zup @ www.joefacer.com

Friday was a very good day for stocks and a turn down for bonds. The chart puts it in perspective.

I'm still all bonds and a little cash inna 401a. That too will change. Prolly not Monday or Tuesday either. More to come this weekend...

HOW OBAMA GOT ROLLED BY WALL ST.

http://www.newsweek.com/2010/08/29/how- ... treet.html

http://www.bloomberg.com/news/2010-08-1 ... japan.html

http://www.msnbc.msn.com/id/38783832/ns ... etirement/

http://www.bloomberg.com/news/2010-08-2 ... -says.html

http://www.bloomberg.com/news/2010-08-2 ... -says.html

http://www.bloomberg.com/news/2010-08-2 ... -rise.html

http://www.msnbc.msn.com/id/38870575/ns ... e_economy/

http://www.bloomberg.com/news/2010-08-2 ... lbert.html

http://www.bloomberg.com/news/2010-08-2 ... robed.html

http://www.msnbc.msn.com/id/38903955/ns ... tn_africa/

http://www.bloomberg.com/news/2010-08-1 ... y-xie.html

Last 100 days....Don't look too good.......

http://lifeinc.msnbc.msn.com/_news/2010 ... t-exactly-

Market Forces...Like My Daddy Always Used To Tell Me, "Son, The Bigger They Are, The Harder They Hit..."

"The first step to making money is not losing it."

-- Ed Easterling

Chartz And Table Zup @ www.joefacer.com

Open The Doors

http://www.youtube.com/watch?v=ZDN9y2vTdUs

My All Cash/Bonds Low Risk Position Is Back Up Marginally Over Any And All Stocks And The Balanced Pooled Fund Again. I've Been 100% Stocks Before And I Will Be Again When I Get Paid For The Risk. There Is Only One Letter's Difference Between Hero And Zero And Champ And Chump. Safety In The Face Of Risk Is Working For Now.

More Here Later This Weekend.....

“What we had was a government-prescribed course of amphetamines (to keep it up), antibiotics (to prevent infection) and antidepressants (to make it feel better). It endured regular steroid injections from both monetary and fiscal authorities. And it still has no real muscle.”

Caroline Baum: Bloomberg

http://www.ritholtz.com/blog/2010/08/ec ... -fly-list/

http://www.thenation.com/article/153929 ... ut-scandal

http://www.newsweek.com/2010/08/11/is-t ... llets.html

http://www.msnbc.msn.com/id/38695101/ns ... e_economy/

http://www.bloomberg.com/news/2010-08-1 ... ports.html

http://www.bloomberg.com/news/2010-08-1 ... -debt.html

http://www.ritholtz.com/blog/2010/08/ta ... as-of-gdp/

http://www.bloomberg.com/news/2010-08-1 ... -debt.html

http://blogs.wsj.com/economics/2010/08/ ... isnt-free/

http://moneywatch.bnet.com/economic-new ... tural/744/

http://www.newyorker.com/talk/financial ... surowiecki

http://www.ritholtz.com/blog/2010/08/cp ... deflation/

http://www.ritholtz.com/blog/2010/08/co ... jail-time/

http://www.ritholtz.com/blog/2010/08/bo ... tes-11-2b/

http://www.bloomberg.com/news/2010-08-1 ... -weil.html

http://www.ritholtz.com/blog/2010/08/lu ... a-backing/

http://www.msnbc.msn.com/id/38715258/ns ... e_economy/

http://www.msnbc.msn.com/id/38692233/ns ... e_economy/

http://www.ritholtz.com/blog/2010/08/th ... nanke-put/

http://www.ritholtz.com/blog/2010/08/as ... l-economy/

http://www.ritholtz.com/blog/2010/08/the-flations/

http://www.ritholtz.com/blog/2010/08/fo ... on-prices/

http://www.ritholtz.com/blog/2010/08/th ... -disaster/

Now that the value of information has gotten to be about zero, there's an overload, and I think what's gonna be the end result is the value of expertise is gonna go to infinity. Because it's harder and harder for people to digest all these inputs, let alone make sense out of them, let alone translate them into investment decisions.

- Wilbur Ross, CNBC, Dec. 1, 2009

Chartz and Table Zup @ www.joefacer.com

Can't Get Enuf o' Rory..

http://www.youtube.com/watch?v=UozMdhPhS48

http://www.ritholtz.com/blog/2010/08/ho ... the-world/

http://www.brookings.edu/opinions/2010/ ... _gale.aspx

http://www.ritholtz.com/blog/2010/08/un ... boom-bust/

http://www.nytimes.com/2010/08/03/scien ... .html?_r=1

http://www.bloomberg.com/news/2010-08-0 ... louts.html

http://www.ritholtz.com/blog/2010/08/re ... our-brain/

http://www.ritholtz.com/blog/2010/08/fo ... es-hiring/

http://www.bloomberg.com/news/2010-08-0 ... overy.html

http://www.ritholtz.com/blog/2010/08/fe ... more-57983

http://www.scribd.com/doc/34895648/GMO-Montier-26Jul

http://www.ft.com/cms/s/2/1a8a5cb2-9ab2 ... ab49a.html

http://www.ritholtz.com/blog/2010/08/su ... ks-events/

http://www.ritholtz.com/blog/2010/08/dr ... d-meeting/

http://www.newsweek.com/2010/08/09/has- ... tions.html

http://www.newsweek.com/2010/08/09/fann ... nting.html

http://www.msnbc.msn.com/id/38629548/ns ... e_economy/

http://www.newsweek.com/2010/08/11/is-t ... llets.html

Stay Tooned. More to appear later ... Bank Onnit.

Still All In Inna 401a In Corporate Bonds (RBFFX), Federal Securities (RGVFX), An' The GIC (Met Life). Details about Why And How And What'd Make Me Change Dat To Follow....

Chartz And Table Zup @www.joefacer.com

Stay Tooned....

Chartz And Table Zup @www.joefacer.com

Stay Tooned....

Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair

Chartz And Table Zup. @ www.joefacer.com

Have Some More Tuna...

http://www.youtube.com/watch?v=lUseW_yJkpg

http://www.youtube.com/watch?v=ltDMr7IV ... re=related

http://www.youtube.com/watch?v=BFdRSrTJ ... re=related

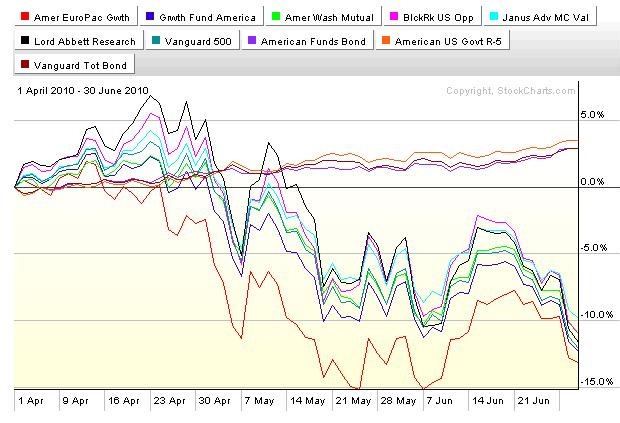

The First Quarter Looked Pretty Good

The Second Quarter Looked Pretty Bad

That's What Your Quarterly Statements Show You. But How Can You Figure Out Where You Stand Over All By Looking At Stills Of The Action Four Times A Year? You Can't See A Cumulative Picture Or A Running Total. You Need To See The Whole Picture And The Bottom Line.

Ya Can See The Whole Picture Or Any Particular Part of It By Using Charts And/or A Worksheet Like The Ones On My Website.... It Makes Decisions On Asset Allocation A Lot Easier...

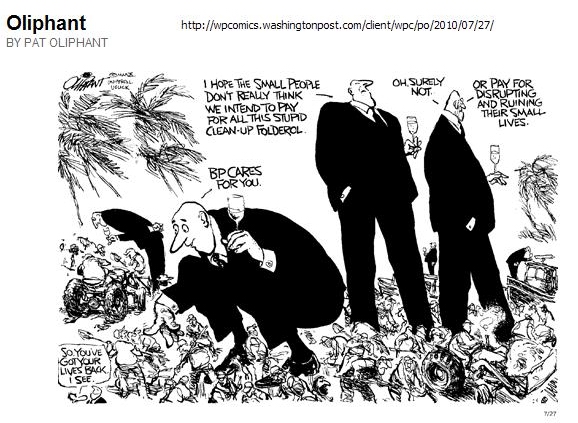

http://www.scribd.com/doc/33784769/BP-Article

http://www.ritholtz.com/blog/2010/07/fd ... n-program/

http://www.ritholtz.com/blog/2010/07/gl ... l-part-96/

http://www.ritholtz.com/blog/2010/07/ja ... no-return/

http://paul.kedrosky.com/archives/2010/ ... ntitl.html

Stay Tooned...

Started At A New Site This Week.... During The 70's and 80's Oil Crisis, I Worked The Refineries And Oil Field Module Sites And Got Some Of My Gas Money Back. Now I'm At A Solar Cell Producer's Facilty And I'm Getting Stimulus (Borrowed) Money From The Feds That I'll Pay For With Higher Taxes/ Higher Inflation/And Higher Bond Interest Inna Future. Whatever Goes Around, Comes Around.....

"More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly."

-- Woody Allen

Chartz and Table Zup @ www.joefacer.com.

It's Not Easy....He Just Makes It Look That Way....

http://www.youtube.com/watch?v=DDOIL5Oq ... re=related

http://www.ritholtz.com/blog/2010/07/li ... th-unites/

http://www.ritholtz.com/blog/2010/07/20 ... n-dollars/

http://www.nytimes.com/2010/07/12/busin ... .html?_r=1

http://www.ritholtz.com/blog/2010/07/fo ... effectual/

http://www.ritholtz.com/blog/2010/07/su ... ic-assets/

http://www.ritholtz.com/blog/2010/07/ly ... about-oil/

http://www.ritholtz.com/blog/2010/07/it ... w-bitches/

http://www.nytimes.com/2010/07/18/magaz ... f=magazine

http://www.ritholtz.com/blog/2010/07/ma ... ty-debate/

Stay Tooned....

Earnings Season!!!! Think A Medieval Castle With A Hinged Corridor. One Moment Everything Is OK, The Next , You're One Step Over Center And Gone....or Not. We'll See

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

- George Soros

Chartz and Table Zup @ www.joefacer.com

Hot Tuna; I saw an acoustic show @ Bimbo's and an electric show at the Hells Angels benefit for the VD Clinic at the Longshoreman's hall. Same band, quite a range of approaches...

http://www.youtube.com/watch?v=mjfhsLuO ... re=related

http://www.youtube.com/watch?v=_rts3noH ... re=related

http://www.musicman.com/rt/hells.html

Was this last week only a typical bear market bounce or the start of a lift off the bottom as the market predicts a solid earning season and good forward guidance?

Stay tooned....

Earning Interest And Clipping Coupons In Bonds And Cash Is Always Better Than Watching Stocks Go Down.... Unless You Can Short.

The ultimate result of shielding men from the effects of folly is to fill the world with fools.

--Herbert Spencer

Chartz And Table Zup @ www.joefacer.com

Freddie King was a favorite of EC's. Not hard to figure out why. The first link can be found on CD too...

http://www.youtube.com/watch?v=7nNYD2LY ... re=related

http://www.youtube.com/watch?v=GGLmZCZ1 ... re=related

REEALY IMPORTANT Links....

http://www.ritholtz.com/blog/2010/07/th ... really-is/

http://www.businessweek.com/magazine/co ... 358596.htm

http://noir.bloomberg.com/apps/news?pid ... .24zLg0I2E

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.ritholtz.com/blog/2010/07/sw ... evolution/

http://www.ritholtz.com/blog/2010/07/sh ... c-outlook/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.nytimes.com/2010/07/04/weeki ... wanted=all

http://www.economist.com/node/16485318? ... extfeature

http://www.businesscycle.com/news/press/1887/

http://www.nytimes.com/2010/07/04/busin ... wanted=all

http://www.ritholtz.com/blog/2010/07/oi ... 93-part-9/

Fun With Chartz....

A year's worth of returns in the bond funds of my 401a. Not half shabby.

Under certain conditions, bond returns can smoke stocks.

But it's never really a no brainer. The corporate bond fund's out performance is rooted in the fact that in late 2008, investors tossed corporate bonds overboard because they feared that corporate America was going belly up. The catchup looked great. Especially if you didn't know that they started the climb inna hole.

http://noir.bloomberg.com/apps/news?pid ... 18JewR.Dag

http://noir.bloomberg.com/apps/news?pid ... &pos=7

http://noir.bloomberg.com/apps/news?pid ... &pos=2

http://www.msnbc.msn.com/id/38034014/ns ... d_economy/

http://www.ritholtz.com/blog/2010/07/economic-data-32/

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://noir.bloomberg.com/apps/news?pid ... &pos=4

http://www.ritholtz.com/blog/2010/07/nf ... -jobs-83k/

http://www.ritholtz.com/blog/2010/07/eu ... erform-us/

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.newsweek.com/2010/07/05/tough-case.html

http://www.ritholtz.com/blog/2010/07/fcic-hearings-2/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.msnbc.msn.com/id/38087780

http://noir.bloomberg.com/apps/news?pid ... amp;pos=15

http://www.latimes.com/news/local/la-me ... paign=Feed:+latimes/mostviewed+%28L.A.+Times+-+Most+Viewed+Stories%29

Pretty really Serious links....

http://www.telegraph.co.uk/finance/comm ... -1932.html

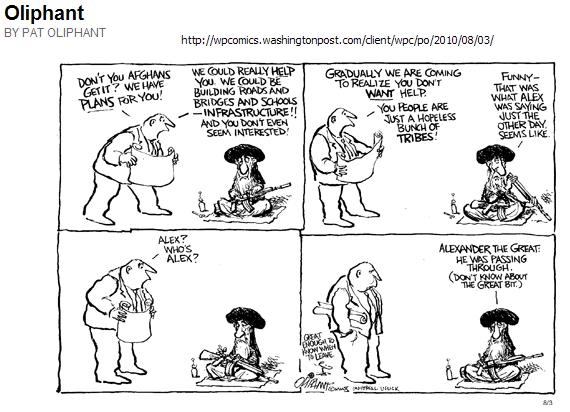

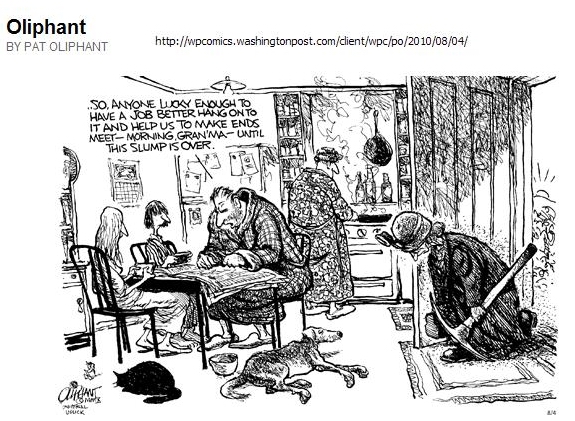

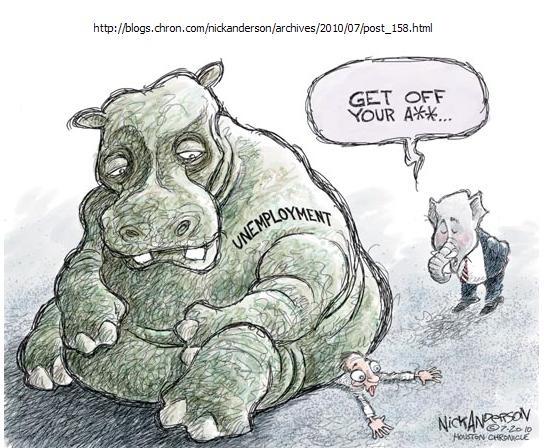

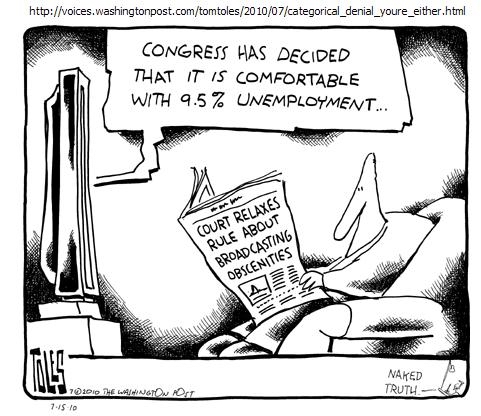

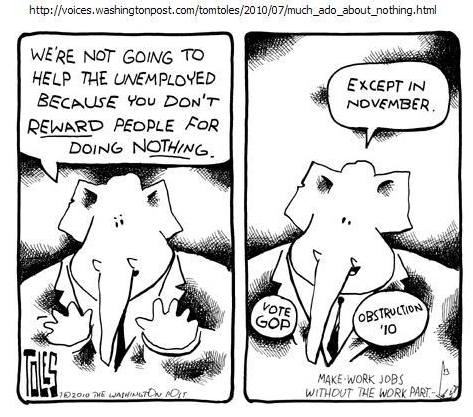

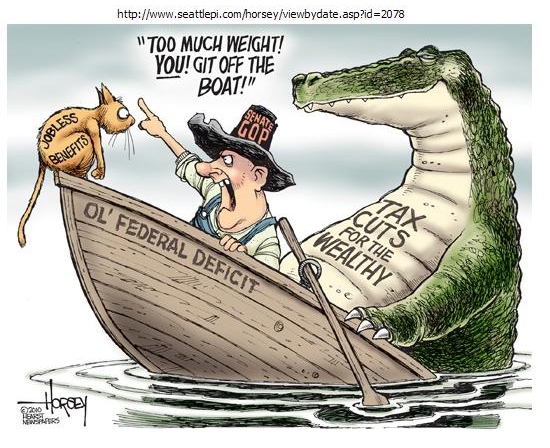

Last week, forty Republican Senators and one Democrat blocked action on extended unemployment benefits. This week, three GOP Senators were absent for the roll call but the end result was the same -- no relief for the long-term unemployed. By the time those 41 lawmakers return from their Fourth of July recess, 2 million Americans will have spent their final unemployment check. Republicans, however, will not shed crocodile tears over the pain inflicted on the jobless. Instead they will cheer every vote cast that diminishes, delays or denies help to the 31 million Americans idled by this Grave Recession. During the Bush administration, those same Republicans supported policies that are the proximate causes of our economic turmoil -- deficit financing of tax cuts for the wealthy, deregulation of the financial market place and the de-industrialization of America in the name of free trade. But rather than accept responsibility for their own disastrous policies, the GOP started a vendetta against the jobless. Republican attacks on America's jobless are neither random acts of meanness nor the ravings of a lunatic fringe. They are hostile acts in a partisan strategy. By attacking the powerless, Republican lawmakers hoped to align their party with the powerful, capture control of the next Congress and, ultimately, win back the White House.

Occasionally, Republican law makers telegraph their deep disdain for the unemployed. Senator Jim Bunning (R-KY) did so with his one-man filibuster against extended unemployment. Senator John Kyl (R-TX) suggested unemployment acted as "a disincentive for them to seek new work." Senator Orrin Hatch (R-UT) felt the jobless should be drug tested in order to qualify for unemployment insurance. And Congressman Dean Heller (R-NV) used the word "hobos" to demean those on unemployment.

http://www.huffingtonpost.com/rick-sloa ... 33217.html

Everything looks awful. And the recent drop and unemployment numbers are fear inspiring. But we've had 9 outta the last ten days down and everybody is leaning the same direction. Look for an oversold bounce/ counter trend move sooner rather than later. It'll sting if you are in cash or bonds. But ask, "Has anything changed? Or is this part of the markets not being simple or easy?" A trend is a trend until it isn't, and I'll have to have a reason before I allocate back into equities. Cash and bonds fer now....

Wednesday.....

That stung..... Smokin' hot upward day....

But on low volume and ya gotta look at it in perspective....

Stay tooned....

Last week, forty Republican Senators and one Democrat blocked action on extended unemployment benefits. This week, three GOP Senators were absent for the roll call but the end result was the same -- no relief for the long-term unemployed. By the time those 41 lawmakers return from their Fourth of July recess, 2 million Americans will have spent their final unemployment check. Republicans, however, will not shed crocodile tears over the pain inflicted on the jobless. Instead they will cheer every vote cast that diminishes, delays or denies help to the 31 million Americans idled by this Grave Recession. During the Bush administration, those same Republicans supported policies that are the proximate causes of our economic turmoil -- deficit financing of tax cuts for the wealthy, deregulation of the financial market place and the de-industrialization of America in the name of free trade. But rather than accept responsibility for their own disastrous policies, the GOP started a vendetta against the jobless. Republican attacks on America's jobless are neither random acts of meanness nor the ravings of a lunatic fringe. They are hostile acts in a partisan strategy. By attacking the powerless, Republican lawmakers hoped to align their party with the powerful, capture control of the next Congress and, ultimately, win back the White House.

Occasionally, Republican law makers telegraph their deep disdain for the unemployed. Senator Jim Bunning (R-KY) did so with his one-man filibuster against extended unemployment. Senator John Kyl (R-TX) suggested unemployment acted as "a disincentive for them to seek new work." Senator Orrin Hatch (R-UT) felt the jobless should be drug tested in order to qualify for unemployment insurance. And Congressman Dean Heller (R-NV) used the word "hobos" to demean those on unemployment.

Calendar

Calendar