| |

Scars Are Tattoos That Are More About Where Ya Been and Less About Decoration. Memories Are Better Than Last Decade's Intentions, Last Decade's Missed Opportunities, And This Decade's Regrets....

Saturday, October 23, 2010, 02:21 PM

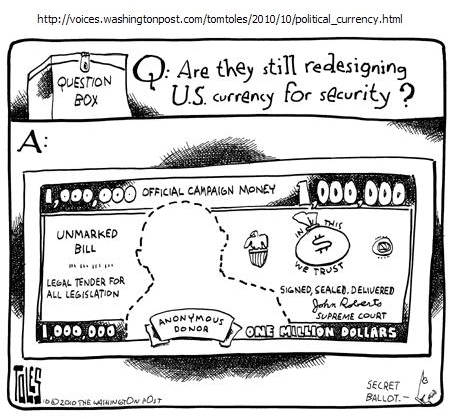

"The best way to destroy the capitalist system is to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens."

-John Maynard Keynes

There was always a dichotomy between the Bill Graham/'Mo Auditorium live extended/jam/conceptual compositions/performances and the tight top 40 two minute/plus pop music. De 'Mo Vs Longshoreman's Hall. Sometimes the short stuff said what it had to say and then shut the fuck up. Check out the hair/Höfner bass etc. Way period...

http://www.youtube.com/watch?v=jJR_KGZO4U0

Tom Graff of Real Money sez that the Fed wants to see a little more inflation and to achieve that, they are willing to risk a lot more inflation. That's pretty much what I see. Having lived and worked through a big stagflation episode when the oil companies were throwing money left an' right an' I was there to catch my share, ('80-'85) I'm less than sanguine about doing it over again as a retiree when the banks/government are the ones with the cash (mine and yours used as collateral for loans) and I ain't inna path o' the geyser of cash......

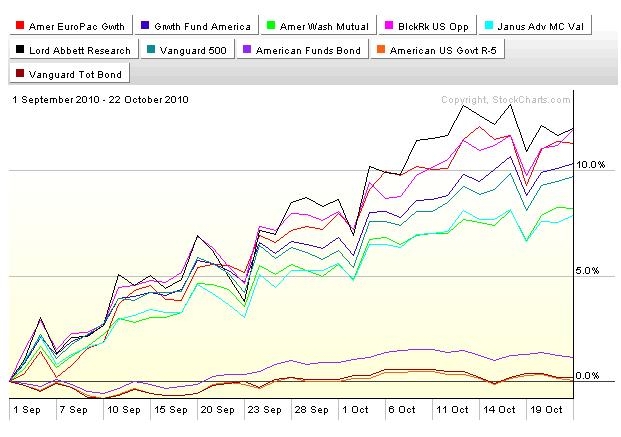

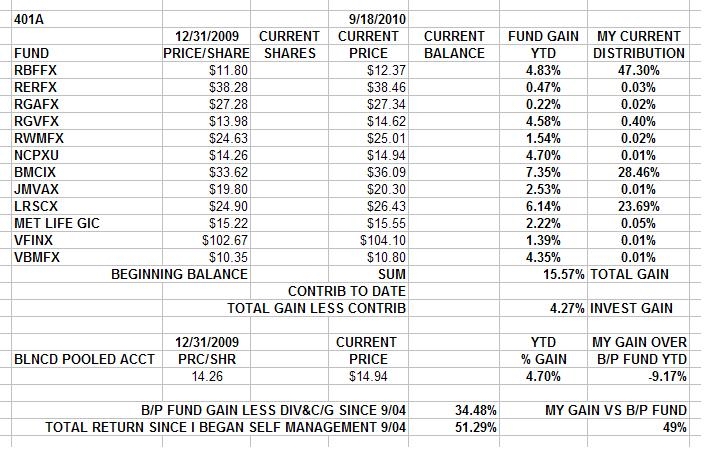

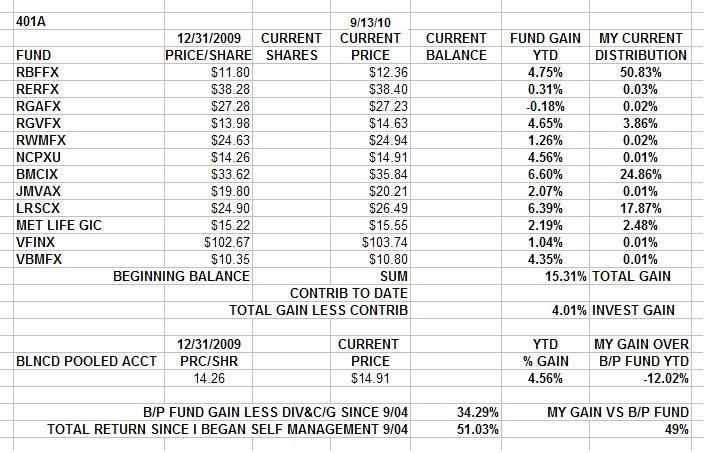

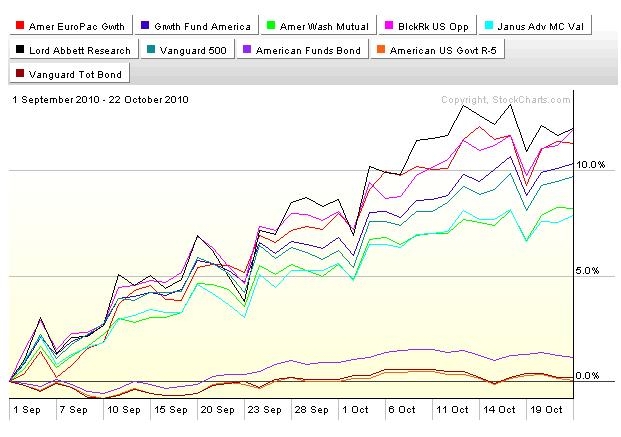

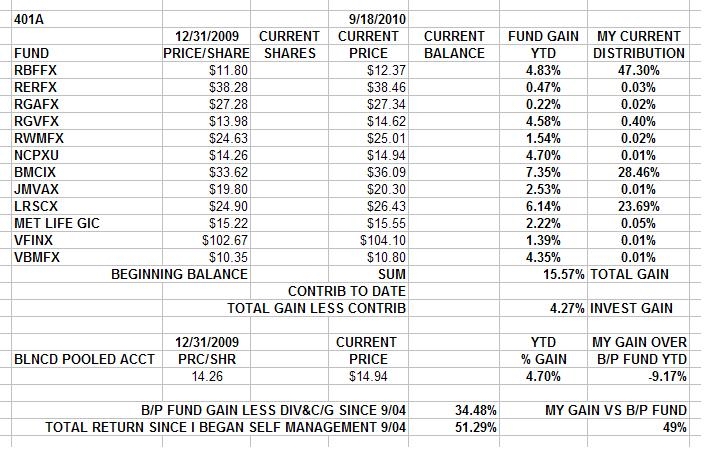

My current 401a riff is still working. Fine tuning it now. Check out the percentages on my website. Buy an' Sell. Nailed one. Hope to nail the other. Tick...Tick...Tick........

http://www.newsweek.com/2010/10/23/a-py ... rance.html

http://www.bloomberg.com/news/2010-10-1 ... vanec.html

http://www.ritholtz.com/blog/2010/10/mo ... -linkfest/

http://www.msnbc.msn.com/id/39801398/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-2 ... -baum.html

http://www.ritholtz.com/blog/2010/10/fo ... re-nation/

http://www.ritholtz.com/blog/2010/10/du ... ng-fracas/

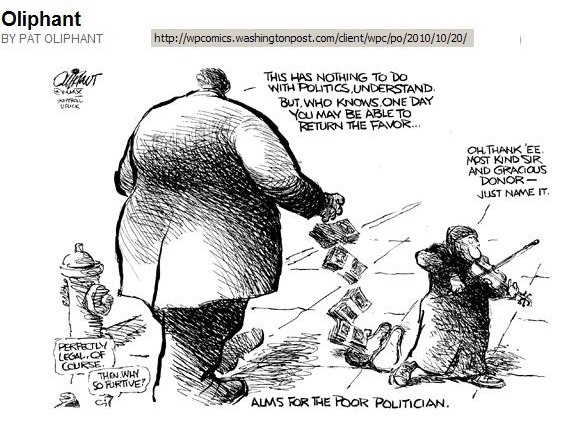

Washington says nothing can be done. There's no money left.

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

http://www.sfgate.com/cgi-bin/article.c ... 1FV3LE.DTL

[/4]

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

( 2.9 / 1291 ) ( 2.9 / 1291 )

So Much Good Music In My Library, So Many Good Musicians Gone. (Listening To Little Feat Late 90's Concerts w/ Richie Hayward) So Greatful For So Many Recordings Available To Fill The Day With Great Music.

Saturday, October 9, 2010, 02:15 PM

"If a man is offered a fact which goes against his instincts, he will scrutinize it closely, and unless the evidence is overwhelming, he will refuse to believe it. If, on the other hand, he is offered something which affords a reason for acting in accordance to his instincts, he will accept it even on the slightest evidence."

-- Bertrand Russell

( 3 / 1243 ) ( 3 / 1243 )

Time And Money. The Trick Is To Have Enough Of Both. Workin' Onnit......

Saturday, September 18, 2010, 03:12 PM

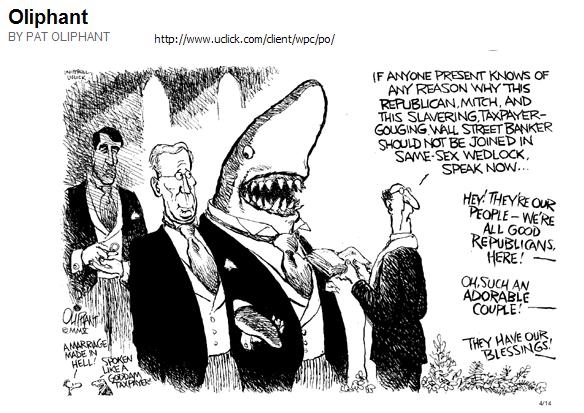

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

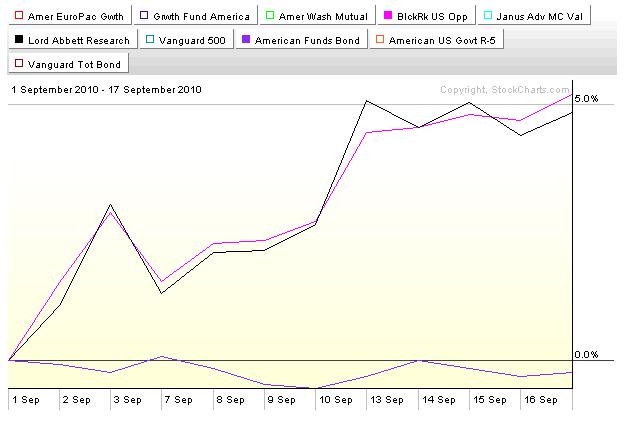

Chartz And Table Zup @ www.joefacer.com

Buddy Miles instead of Nick Gravenites. A litle rough....but we all were in those days.

http://www.youtube.com/watch?v=4bdQ5re4 ... re=related

And When It's Dialed In, It's Monsterously Good.

http://www.youtube.com/watch?v=y7hbworRWUg&NR=1

Good month for me so far. I'm half in the high horsepower stock funds inna 401a and the rest is corporates.

I really should write about it, and maybe I will too.

http://www.bloomberg.com/news/2010-09-1 ... o-cut.html

http://www.ritholtz.com/blog/2010/09/pr ... n-payment/

http://www.bloomberg.com/news/2010-09-1 ... looms.html

http://bayarearealestatetrends.com/2010 ... -bailouts/

http://www.newsweek.com/2010/09/15/lehm ... esson.html

http://www.newsweek.com/2010/09/16/our- ... ng-us.html

http://www.msnbc.msn.com/id/39230668/ns ... tn_africa/

CHECK IT OUT

Increased saving is not only being used to repay debt but also to rebuild 401(k)s. Fidelity Investments found that in the second quarter, 5.3% of participants raised their contribution while 2.9% reduced them.... Conventional monetary ease is now impotent with the federal funds rate close to zero , the money multiplier collapsed and banks sitting on hoards of cash (Chart 12) and over $1 trillion in excess reserves. Sure, large banks report to the Fed that they are easing lending standards for small business, but after the intervening financial crisis, many fewer potential borrowers are deemed creditworthy than in the loose lending days. Furthermore, the small business trade group, the National Federation of Independent Business, reports that 91% of small business owners have had their credit needs met or business is so slow that they don’t want to borrow. The Fed is pushing on the proverbial string.

http://www.ritholtz.com/blog/2010/09/58967/#more-58967

<iframe src="http://videos.mediaite.com/embed/player/?layout=&playlist_cid=&media_type=video&content=TD1Z7H1579MF23QC&widget_type_cid=svp" width="420" height="421" frameborder="0" marginheight="0" marginwidth="0" scrolling="no" allowtransparency="true"></iframe>

The Howard Simons mentioned in the post below is a gentleman that I have followed, spoken to, and corresponded with over the last ten years. He has my utmost respect. The report he authored is not directly actionable, but it pretty much confirms what I've seen anecdotally... The Kotok piece is part of my input and IS actionable as part of a strategy. YMMV

http://www.ritholtz.com/blog/2010/09/p-t-f-s-d/

Stay tooned....

( 3 / 1277 ) ( 3 / 1277 )

Short Sleeve Shirtz, White Belt, Polyester Pantz Pulled Half Way Up My Chest And Driving A Buick? If That's Retirement, Hell No I Ain't Ready!!!!!

Saturday, September 11, 2010, 03:32 PM

"If money is your hope for independence you will never have it. The only real security that a man will have in this world is a reserve of knowledge, experience, and ability."

-Henry Ford

Chartz And Table Zup @ www.joefacer.com

Blue Deck Shoes, White Levi's And Madras Shirts, A Blue Sport Coat And A Pink Crustacean...

http://www.youtube.com/watch?v=T8__EwAT ... xt_from=ML

Whither Goes European Banking?

Is There Yet Another Shoe To Drop In The Millipedian Financial Crisis?

http://www.ritholtz.com/blog/2010/09/be ... fts-bonds/

http://www.newsweek.com/2010/09/12/fine ... -dems.html

http://www.bloomberg.com/news/2010-09-1 ... -debt.html

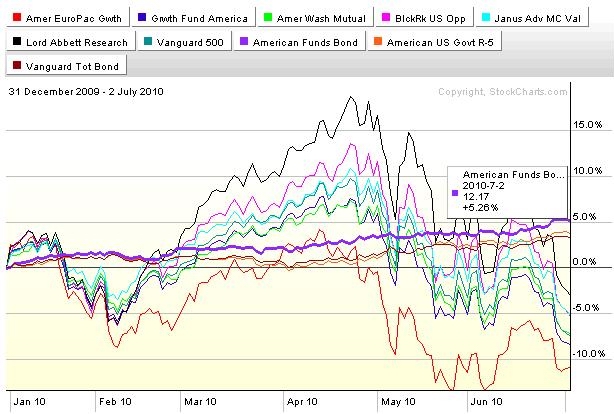

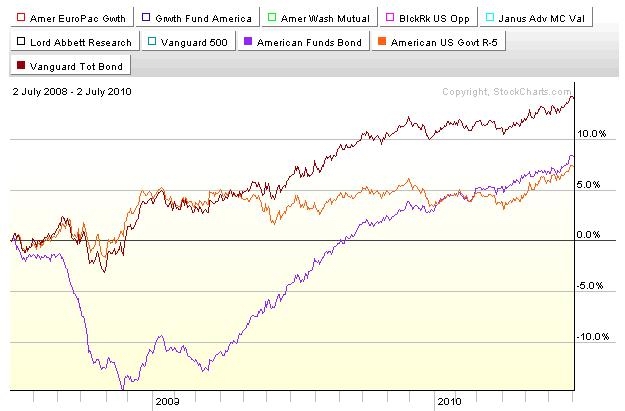

Lookie Here! Bonds been up and stocks been down. I bin thinkin' that'll change seasonally and cyclically. So i moved some money around.... I'm thinking of these as rented positions and I'm running a cognitive and subjective trailing stop based on holidays and elections and the ebb and flow of the market. This is not without risk. Stay tooned.....

( 3 / 1228 ) ( 3 / 1228 )

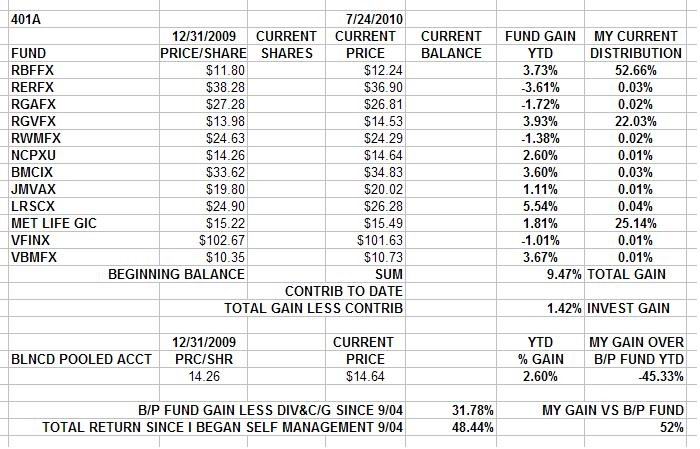

Earning Interest And Clipping Coupons In Bonds And Cash Is Always Better Than Watching Stocks Go Down.... Unless You Can Short.

Friday, July 2, 2010, 10:14 PM

The ultimate result of shielding men from the effects of folly is to fill the world with fools.

--Herbert Spencer

Chartz And Table Zup @ www.joefacer.com

Freddie King was a favorite of EC's. Not hard to figure out why. The first link can be found on CD too...

http://www.youtube.com/watch?v=7nNYD2LY ... re=related

http://www.youtube.com/watch?v=GGLmZCZ1 ... re=related

REEALY IMPORTANT Links....

http://www.ritholtz.com/blog/2010/07/th ... really-is/

http://www.businessweek.com/magazine/co ... 358596.htm

http://noir.bloomberg.com/apps/news?pid ... .24zLg0I2E

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.ritholtz.com/blog/2010/07/sw ... evolution/

http://www.ritholtz.com/blog/2010/07/sh ... c-outlook/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.nytimes.com/2010/07/04/weeki ... wanted=all

http://www.economist.com/node/16485318? ... extfeature

http://www.businesscycle.com/news/press/1887/

http://www.nytimes.com/2010/07/04/busin ... wanted=all

http://www.ritholtz.com/blog/2010/07/oi ... 93-part-9/

Fun With Chartz....

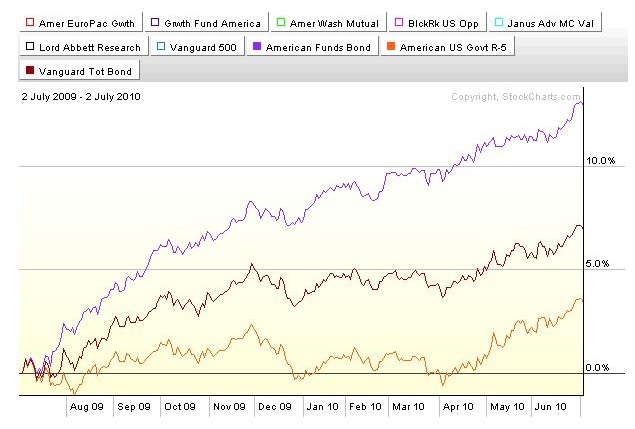

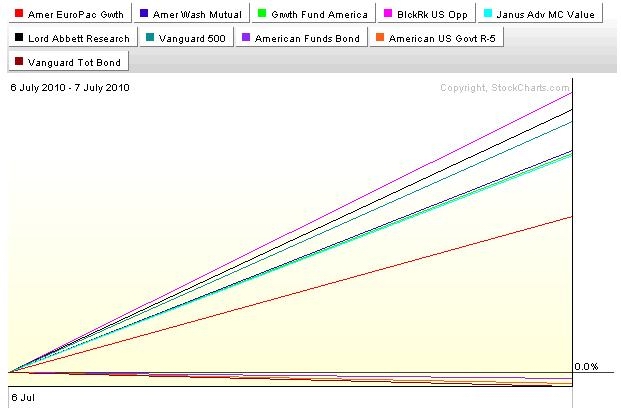

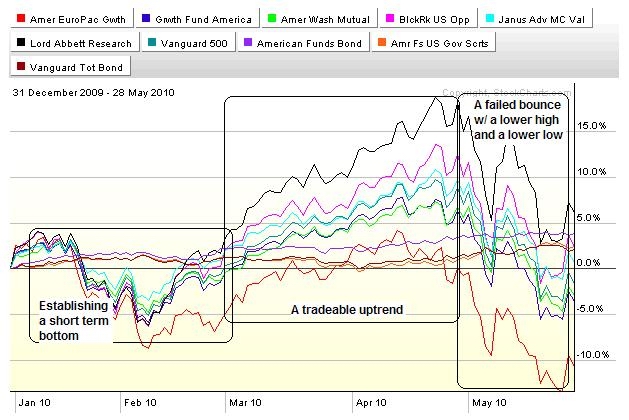

A year's worth of returns in the bond funds of my 401a. Not half shabby.

Under certain conditions, bond returns can smoke stocks.

But it's never really a no brainer. The corporate bond fund's out performance is rooted in the fact that in late 2008, investors tossed corporate bonds overboard because they feared that corporate America was going belly up. The catchup looked great. Especially if you didn't know that they started the climb inna hole.

http://noir.bloomberg.com/apps/news?pid ... 18JewR.Dag

http://noir.bloomberg.com/apps/news?pid ... &pos=7

http://noir.bloomberg.com/apps/news?pid ... &pos=2

http://www.msnbc.msn.com/id/38034014/ns ... d_economy/

http://www.ritholtz.com/blog/2010/07/economic-data-32/

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://noir.bloomberg.com/apps/news?pid ... &pos=4

http://www.ritholtz.com/blog/2010/07/nf ... -jobs-83k/

http://www.ritholtz.com/blog/2010/07/eu ... erform-us/

http://www.msnbc.msn.com/id/38072919/ns ... ork_times/

http://www.newsweek.com/2010/07/05/tough-case.html

http://www.ritholtz.com/blog/2010/07/fcic-hearings-2/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.msnbc.msn.com/id/38090407/ns ... nd_energy/

http://www.ritholtz.com/blog/2010/07/st ... reduction/

http://www.msnbc.msn.com/id/38087780

http://noir.bloomberg.com/apps/news?pid ... amp;pos=15

http://www.latimes.com/news/local/la-me ... paign=Feed:+latimes/mostviewed+%28L.A.+Times+-+Most+Viewed+Stories%29

Pretty really Serious links....

http://www.telegraph.co.uk/finance/comm ... -1932.html

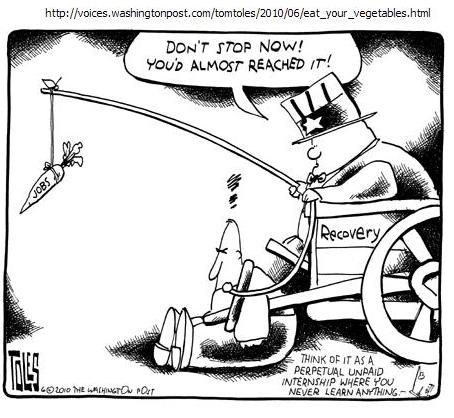

Last week, forty Republican Senators and one Democrat blocked action on extended unemployment benefits. This week, three GOP Senators were absent for the roll call but the end result was the same -- no relief for the long-term unemployed. By the time those 41 lawmakers return from their Fourth of July recess, 2 million Americans will have spent their final unemployment check. Republicans, however, will not shed crocodile tears over the pain inflicted on the jobless. Instead they will cheer every vote cast that diminishes, delays or denies help to the 31 million Americans idled by this Grave Recession. During the Bush administration, those same Republicans supported policies that are the proximate causes of our economic turmoil -- deficit financing of tax cuts for the wealthy, deregulation of the financial market place and the de-industrialization of America in the name of free trade. But rather than accept responsibility for their own disastrous policies, the GOP started a vendetta against the jobless. Republican attacks on America's jobless are neither random acts of meanness nor the ravings of a lunatic fringe. They are hostile acts in a partisan strategy. By attacking the powerless, Republican lawmakers hoped to align their party with the powerful, capture control of the next Congress and, ultimately, win back the White House.

Occasionally, Republican law makers telegraph their deep disdain for the unemployed. Senator Jim Bunning (R-KY) did so with his one-man filibuster against extended unemployment. Senator John Kyl (R-TX) suggested unemployment acted as "a disincentive for them to seek new work." Senator Orrin Hatch (R-UT) felt the jobless should be drug tested in order to qualify for unemployment insurance. And Congressman Dean Heller (R-NV) used the word "hobos" to demean those on unemployment.

http://www.huffingtonpost.com/rick-sloa ... 33217.html

Everything looks awful. And the recent drop and unemployment numbers are fear inspiring. But we've had 9 outta the last ten days down and everybody is leaning the same direction. Look for an oversold bounce/ counter trend move sooner rather than later. It'll sting if you are in cash or bonds. But ask, "Has anything changed? Or is this part of the markets not being simple or easy?" A trend is a trend until it isn't, and I'll have to have a reason before I allocate back into equities. Cash and bonds fer now....

Wednesday.....

That stung..... Smokin' hot upward day....

But on low volume and ya gotta look at it in perspective....

Stay tooned....

( 3 / 1286 ) ( 3 / 1286 )

Life Goes On.... And So Do I.

Saturday, June 26, 2010, 05:44 PM

Let us all be happy, and live within our means, even if we have to borrow the money to do it with.

-- Artemus Ward

Chartz and Table Zup @ www.joefacer.com

Hopefully It Just a Song, Smokin' Though It May Be....

http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

Europe sees it's problem as having borrowed way too much money and spending it on keeping the economy going and raising everyone's standard of living and burying themselves in debt. They see the solution as being to stop spending money that they don't have and to pay down the debt. The unintended result will be a slowing long term economic grind with lost jobs and misery. The bright side will be that the falling value of the Euro will make exports cheaper leading to the inevitable and eventual resolution of the problem.

The US sees it's problem as having borrowed way too much money and burying itself in debt. We see the solution as borrowing more money and spending it on keeping the economy going and maintaining everyone's standard of living so as to avoid a slowing economy and lost jobs. The unintended consequence will be that at some point, borrowing more money will raise the cost of the money making the problem even worse. Of course part of the solution is for Europe to spend money, borrowed money if necessary, on buying our goods so as to allow us to export our way out of the problem.

I see a conflict.

http://www.msnbc.msn.com/id/37954067/ns/business/

I also see the virtue of having my 401a in almost all cash and bonds for much of the near future. I see being able to make a dollar or two on stock market volatility at one time or another some time inna future. What I don't see a a short clear path to a healed economy, plenty of jobs, a new bull market and looking like a genius by buying and holding...

http://www.slate.com/id/2258099/

http://noir.bloomberg.com/apps/news?pid ... &pos=3

http://noir.bloomberg.com/apps/news?pid ... &pos=5

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://www.msnbc.msn.com/id/37827936/ns ... al_estate/

http://mpettis.com/2010/06/what-might-h ... ek-crisis/

http://www.ritholtz.com/blog/2010/06/gr ... ry-reform/

http://www.ritholtz.com/blog/2010/06/wa ... a-suffers/

http://www.ritholtz.com/blog/2010/06/ta ... f-the-day/

http://www.ritholtz.com/blog/2010/06/st ... -last-one/

http://www.ritholtz.com/blog/2010/06/2n ... n-housing/

http://www.ritholtz.com/blog/2010/06/is ... exhausted/

http://www.msnbc.msn.com/id/37953358/ns ... ork_times/

http://www.ritholtz.com/blog/2010/06/th ... ll-street/

http://www.ritholtz.com/blog/2010/06/gr ... n-america/

http://www.ritholtz.com/blog/2010/06/fa ... gislation/

http://www.ritholtz.com/blog/2010/06/ba ... ly-report/

http://www.ritholtz.com/blog/2010/06/do ... escalates/

http://www.ritholtz.com/blog/2010/06/wh ... -of-macro/

http://www.msnbc.msn.com/id/37980441/ns/us_news-life/

http://www.msnbc.msn.com/id/37954067/ns/business/

http://noir.bloomberg.com/apps/news?pid ... &pos=2

http://noir.bloomberg.com/apps/news?pid ... amp;pos=10

http://noir.bloomberg.com/apps/news?pid ... ztsSkSVw_A

http://noir.bloomberg.com/apps/news?pid ... &pos=8

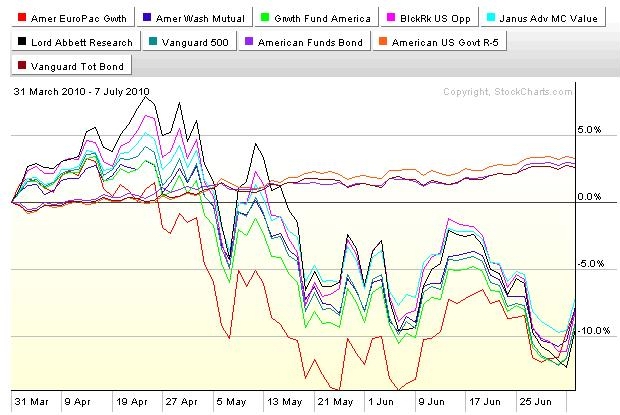

Bond Funds and EuroAsia Fund scrubbed; Cash and bonds inna 401a.

Wed

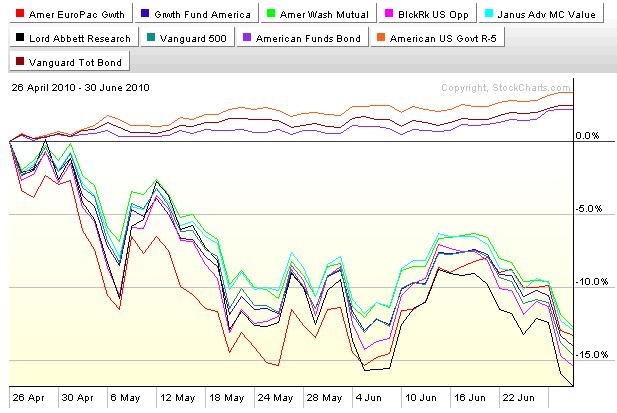

Last 47 days. Cash and bonds inna 401a. Interest beats losing money....

http://noir.bloomberg.com/apps/news?pid ... 18JewR.Dag

http://noir.bloomberg.com/apps/news?pid ... &pos=7

http://noir.bloomberg.com/apps/news?pid ... &pos=2

Stay Tooned....

( 3 / 1259 ) ( 3 / 1259 )

Sell In May And Go Away... Or Not. It Was A Pretty Good Idea... Now What?

Saturday, May 29, 2010, 02:51 PM

The complete lack of evidence is absolute proof that the conspiracy is working successfully.

-- Unknown.

Chartz and Table Zup @ www.joefacer.com

Obligatory Old Fart Music Link: http://www.youtube.com/watch?v=bqVVnExlX9c

John Cipollina's Stack: http://www.johncipollina.com/rockAmpStack.htm

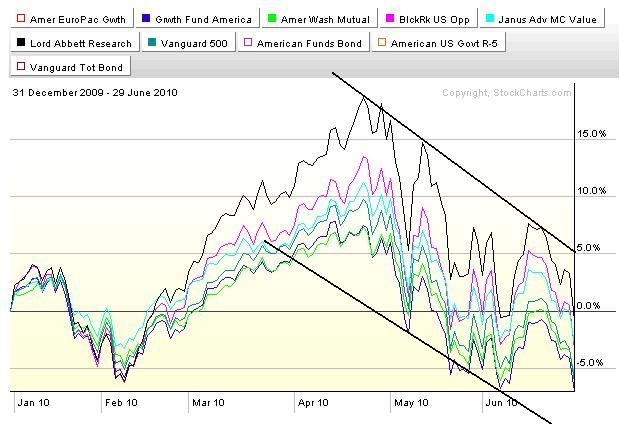

Sell In May And Go Away...Fuckin' "A"!!!

Pretty much self explanatory. The market is NOT healthy and playing the bounces in a down trend (bear market bounces are notoriously viciously fast and steep) can be very profitable IF you are aggressive, quick, nimble, leveraged, selective, and steely eyed. Which I am. But that is NOT a description of something workable with a 401a. I'm still all cash and bonds.

Four BUMMERS, Coupla Laughers

http://www.ritholtz.com/blog/2010/05/si ... -clean-up/

http://www.ritholtz.com/blog/2010/05/oi ... -chutzpah/

http://www.ritholtz.com/blog/2010/05/bp ... on-valdez/

http://www.blacklistednews.com/?news_id=8878

http://www.ritholtz.com/blog/2010/05/co ... y-lost-1m/

http://www.ritholtz.com/blog/2010/05/ne ... -for-ceos/

http://www.ritholtz.com/blog/2010/05/gs ... -millions/

http://www.ritholtz.com/blog/2010/05/un ... linquency/

http://www.ritholtz.com/blog/2010/05/cy ... slation-3/

http://www.ritholtz.com/blog/2010/05/da ... -thoughts/

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://www.ritholtz.com/blog/2010/05/in ... al-crises/

http://www.ritholtz.com/blog/2010/05/wh ... g-and-why/

http://www.ritholtz.com/blog/2010/05/si ... more-56374

Back inna day, we tried the "self regulation" that a lotta "free marketers" rattle on about. It was at a place called "Altamont"....

A MOST MASSIVE MISSIVE: http://www.ritholtz.com/blog/2010/05/th ... trading-2/

Almost as good...

http://www.ritholtz.com/blog/2010/05/ch ... etirement/

http://www.ritholtz.com/blog/2010/05/ja ... reak-free/

So it goes...

http://www.nytimes.com/2010/05/30/us/30 ... wanted=all

As Richard Feynman, the physicist, once observed, “For a successful technology, reality must take precedence over public relations, for nature cannot be fooled.”

Indeed, think of all the planes grounded for nearly a week in northern Europe last month, as a volcano poured ash in the atmosphere. There was no technological fix, and many passengers couldn’t believe it. Said Mr. Kohut, of Pew Research, “The reaction was: ‘Fix this. Fix this. This is outrageous.’ ”

http://www.nytimes.com/2010/05/30/weeki ... l?src=tptw

http://www.msnbc.msn.com/id/37432881/ns/gulf_oil_spill/

http://www.msnbc.msn.com/id/37423584/ns ... tn_africa/

http://www.newsweek.com/blogs/the-gaggl ... ians-.html

http://www.newsweek.com/2010/05/28/the- ... -west.html

http://www.newsweek.com/2010/05/30/in-d ... urope.html

http://www.msnbc.msn.com/id/37435289/ns/gulf_oil_spill/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.bloomberg.com/apps/news?pid= ... &pos=9

http://blogs.reuters.com/great-debate/2 ... t-decades/

http://blogs.reuters.com/great-debate/2 ... t-decades/

This is the second time I've seen this material. It's kinda too scary to contemplate. Black helicopters at Area 51 to the max...

I've seen a lot of this kinda stuff disproved over the years. Hopefully this too is another bad acid trip. Still...

http://www.ritholtz.com/blog/2010/05/se ... e-bp-leak/

http://www.ritholtz.com/blog/2010/05/si ... -clean-up/

http://www.ritholtz.com/blog/2010/05/is ... g-america/

Check out the 2nd comment....

http://www.ritholtz.com/blog/2010/05/oi ... more-56415

http://www.ritholtz.com/blog/2010/05/oi ... more-56415

http://paul.kedrosky.com/archives/2010/ ... roduc.html

TUESDAY

http://paul.kedrosky.com/archives/2010/ ... _goes.html

Ahl Be Back....

( 3 / 1246 ) ( 3 / 1246 )

It's Not A SinTo Be Wrong. It Is A Sin To Stay Wrong.

Saturday, April 17, 2010, 04:25 PM

Surprise, surprise, surprise!

-- Gomer Pyle

Chartz And Table Zup @ www.joefacer.com

The Only Tea Party Stat You Need to Know

http://www.ritholtz.com/blog/2010/04/th ... d-to-know/

This Was NOT A Surprise...

http://www.msnbc.msn.com/id/36612092/ns ... ork_times/

http://blog.newsweek.com/blogs/wealthof ... apiro.aspx

http://www.bloomberg.com/apps/news?pid= ... 2BBUru4.hM

http://www.msnbc.msn.com/id/36603564/ns ... igan_show/

http://www.telegraph.co.uk/finance/econ ... ments.html

http://www.cnas.org/blogs/abumuqawama/2 ... istan.html

http://www.msnbc.msn.com/id/36382787/ns ... ork_times/

http://www.msnbc.msn.com/id/36283460/ns ... e_economy/

http://www.ritholtz.com/blog/2010/04/jo ... waps-tbtf/

http://www.newsweek.com/id/236523

http://www.bloomberg.com/apps/news?pid= ... &pos=5

Hell! Gotta Have Some Fun....

http://www.ritholtz.com/blog/2010/04/pixels/

http://www.ritholtz.com/blog/2010/04/an ... lout-math/

www.ritholtz.com/blog/2010/04/dumb-research-of-the-day-dicks-good-bjs-bad/

http://money.cnn.com/2010/04/15/news/co ... /index.htm

http://www.ritholtz.com/blog/2010/04/qu ... man-sachs/

Interesting and interestinger.....

http://www.ritholtz.com/blog/2010/04/sec-kiss-of-death/

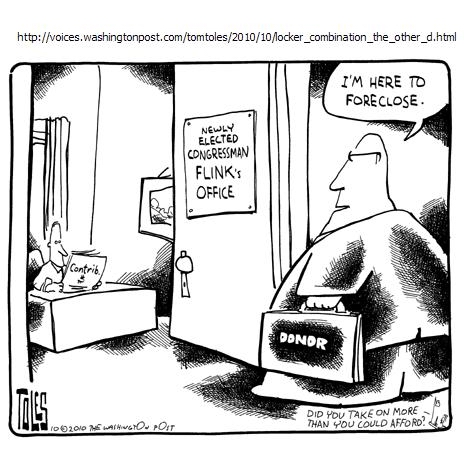

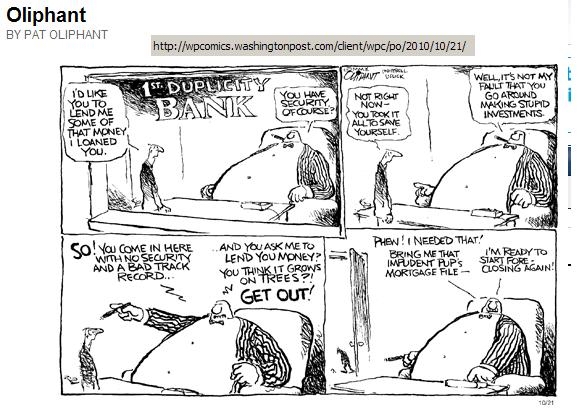

So I gotta deal with reality. Three banks failed in 2007, twenty five failed in 2008, and 140 failed in 2009. Fifty have gone down this year to date. Employment sucks, the European Union may fold and that may drive the dollar up and drive the global economy down. How can the United States become a manufacturer again and export our way to prosperity with a high dollar and massive unemployment and higher interest rates? Good question.

Regardless,the long term market trend is up and overextended or not, anticipating a top has left way too much money on the table...

Goldman Sachs has reintroduced volatility into the market. Time to hold my nose and cautiously buy back in on a drop. It'd a been better if I'd been 100% long and held it since a year ago, but Oh Well! We got problems to work through and I expect the markets to reflect the uncertainty. The markets will go up and down. I gotta match exposure to risk. Starting with a cautious buy This week. Or not. Stay tooned....

CDO 's explained....

http://marketplace.publicradio.org/disp ... king_cdos/

SEC/Goldman explained.....

http://marketplace.publicradio.org/disp ... r-goldman/

Make ya wanna puke....

http://www.ritholtz.com/blog/2010/04/ho ... more-55145

Tuesday

http://www.ritholtz.com/blog/2010/04/ru ... practices/

( 3 / 1244 ) ( 3 / 1244 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar