Boy, I Sure Screwed That One Up....But ...That Was Last Night. From Zero To Hero And From Chump To Champ In 8 Hours...

"The market is not a sofa, it is not a place to get comfortable."

Chartz And Table Zup.... @ www.joefacer.com

Makes Me Feel Better...

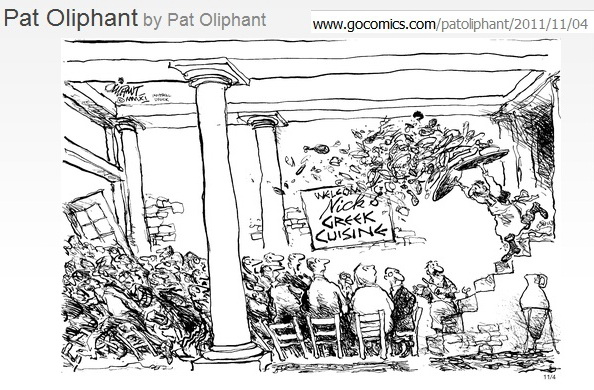

Not Yet Thanksgiving, Yet Holiday Season Heard Just Around The Corner.....Is It Me That's Wrong And Not The Picture?

"Sometimes I lie awake at night, and I ask, 'Where have I gone wrong?' Then a voice says to me, 'This is going to take more than one night.'"

-- Charles M. Schulz

Chartz and Table Zup @ www.joefacer.com

If You're Really Good, Different Gears For Different Jobs Come Naturally...

http://www.youtube.com/watch?v=UvklBbYg ... re=related

http://www.youtube.com/watch?v=Cp9V3D3u ... re=related

http://www.youtube.com/watch?v=KPJgtQwt ... re=related

Saw The Sgt P @ Winterland Back Inna Day. Blew My Mind....

http://www.nybooks.com/articles/archive ... tion=false

http://www.youtube.com/watch?v=qic4pjTE ... re=related

http://www.msnbc.msn.com/id/45277296/ns ... sBDFHKwXbg

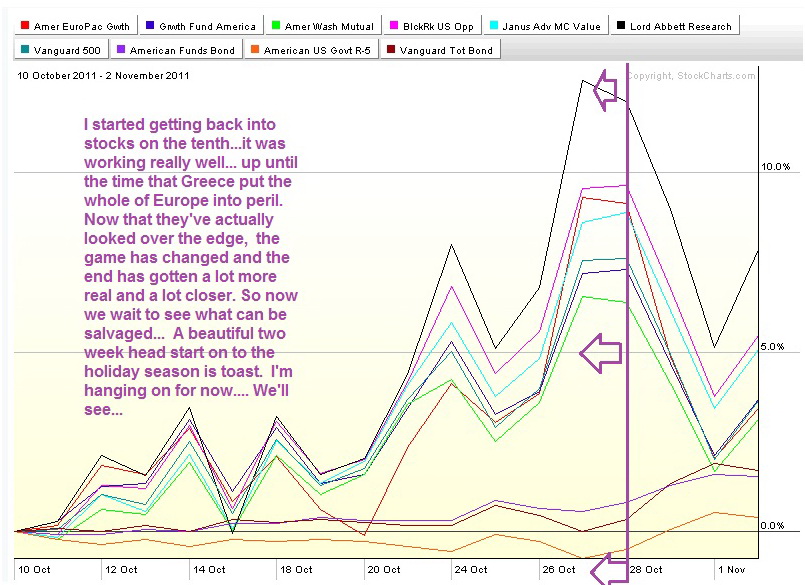

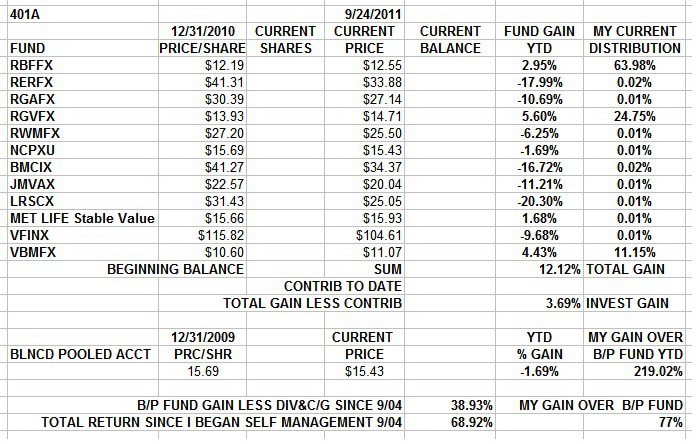

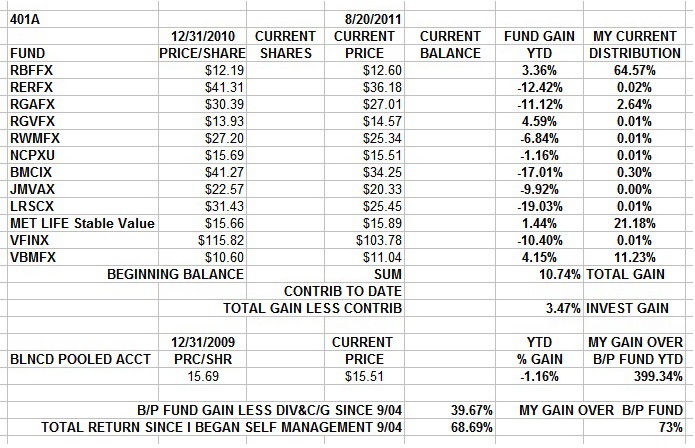

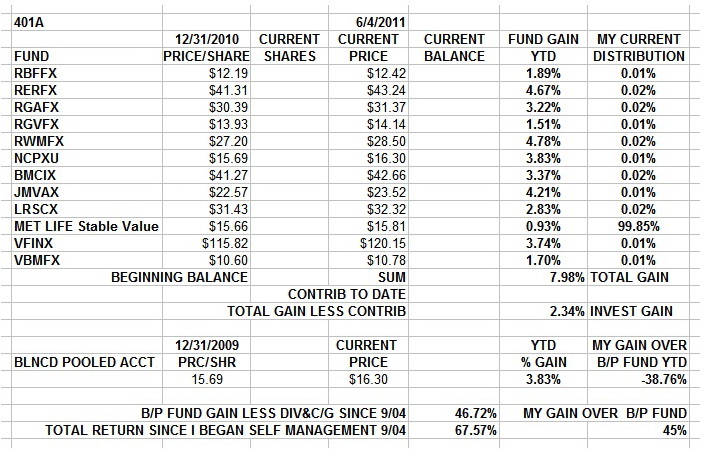

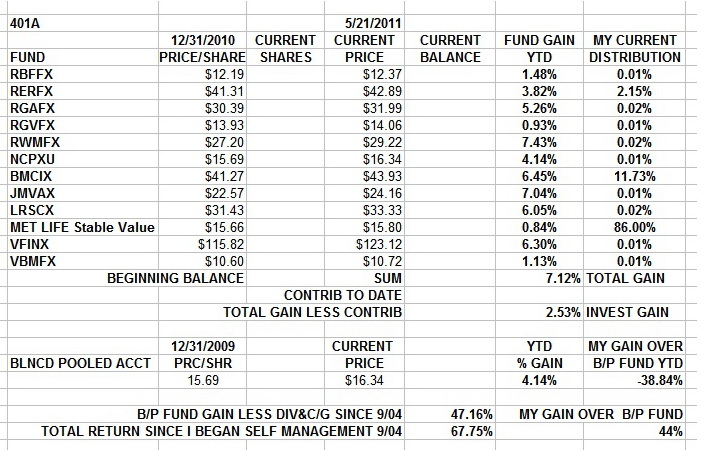

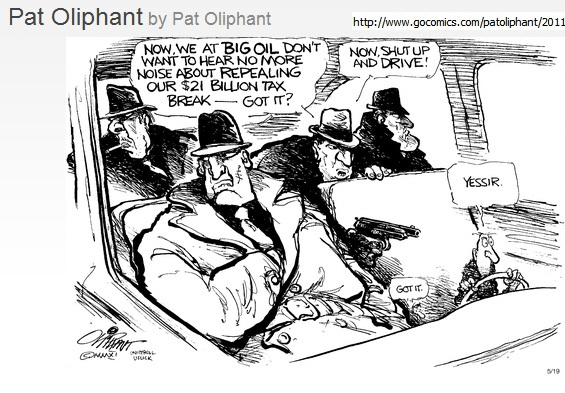

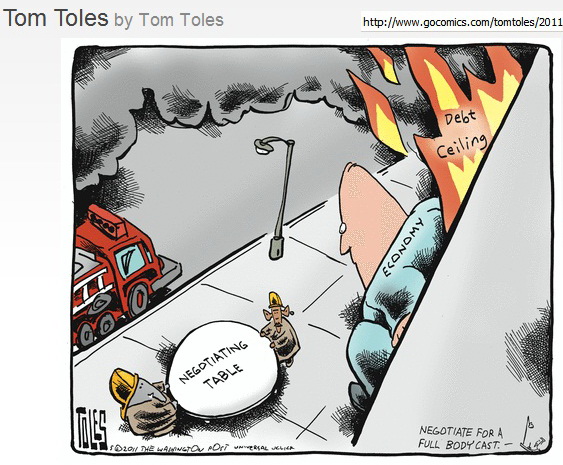

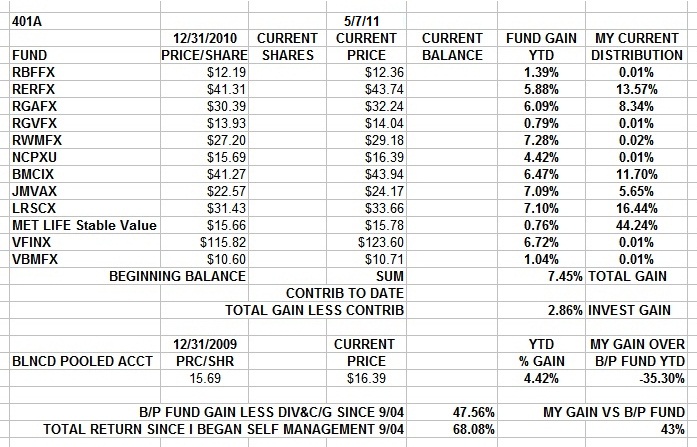

So I'm still carrying way too much stocks in the face of some truly nasty sentiment, nasty potentials, and it's all based on the faith that the market is not the economy and if rich guys need it to be up, it will go up. Fear vs calculation and faith the the game is to some degree rigged. I may be right, I may be wrong, and I may change my mind. Stay Tooned....

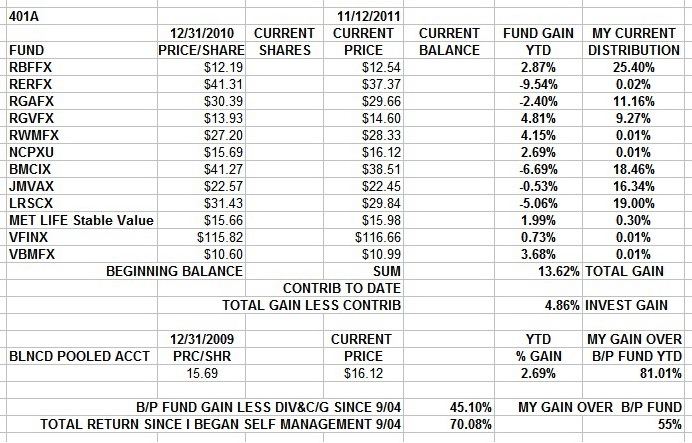

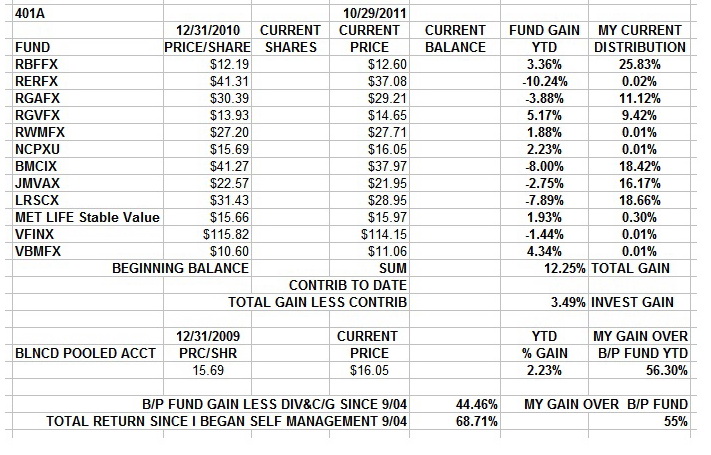

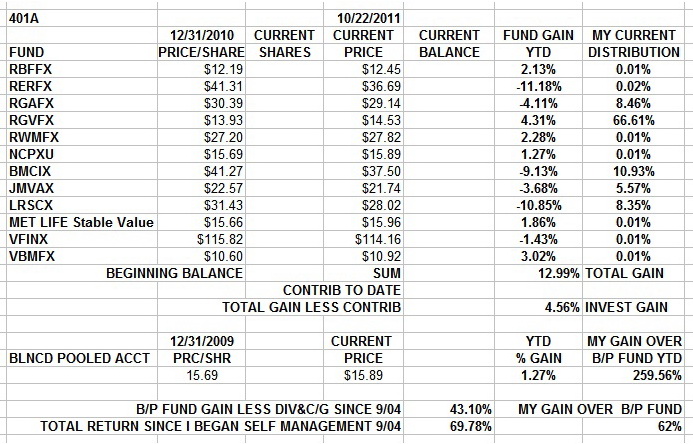

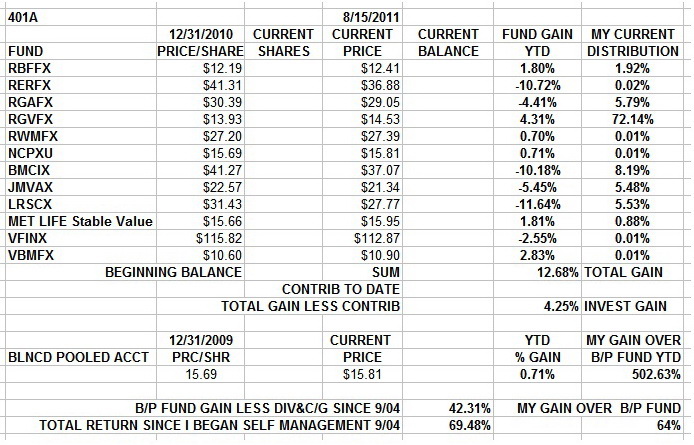

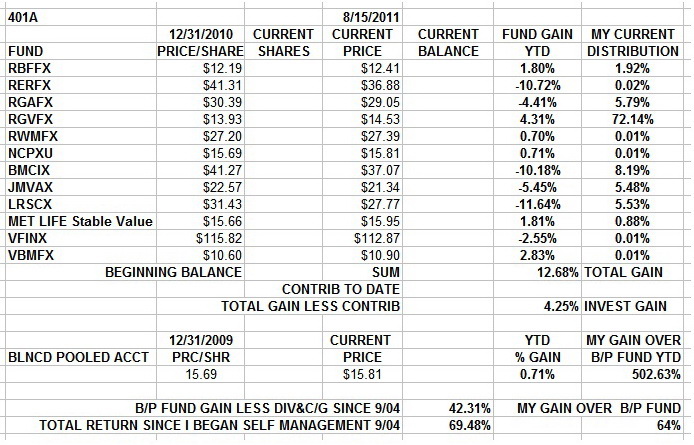

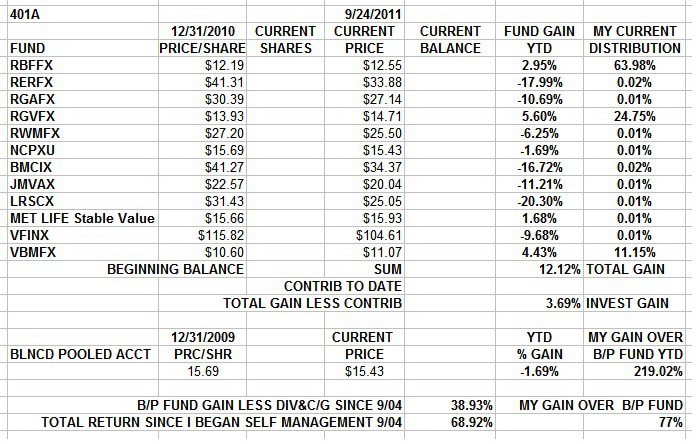

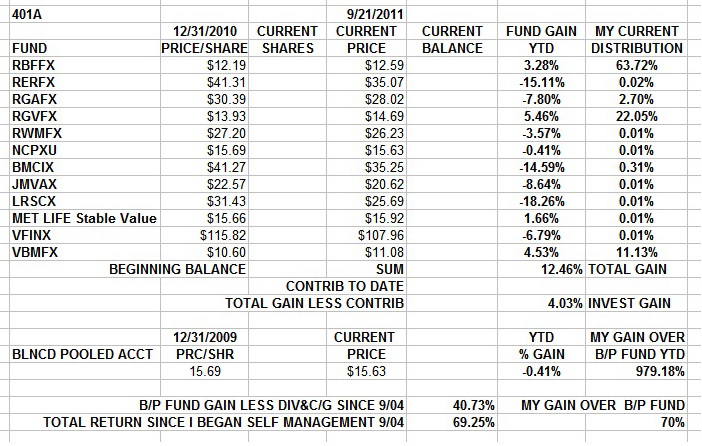

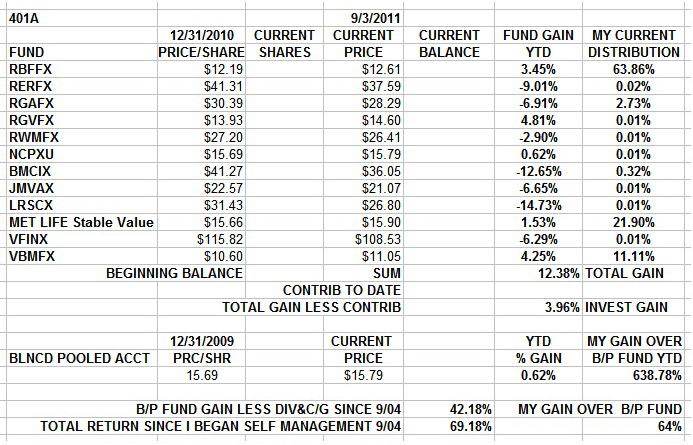

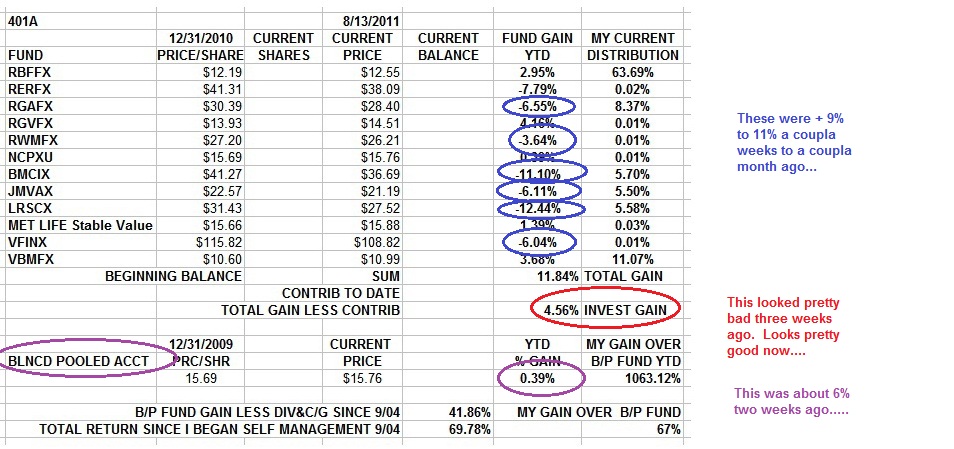

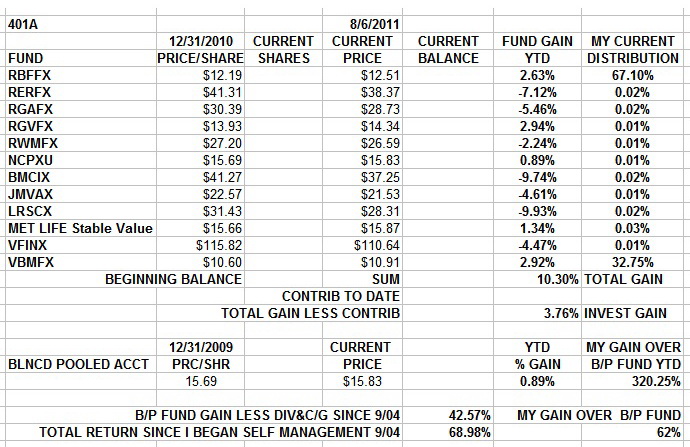

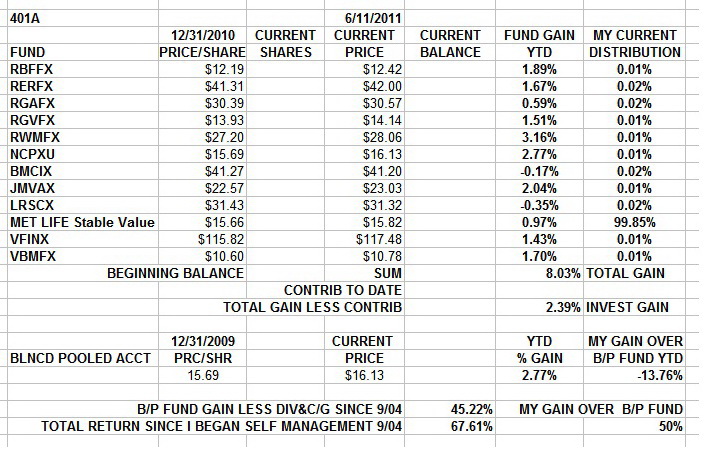

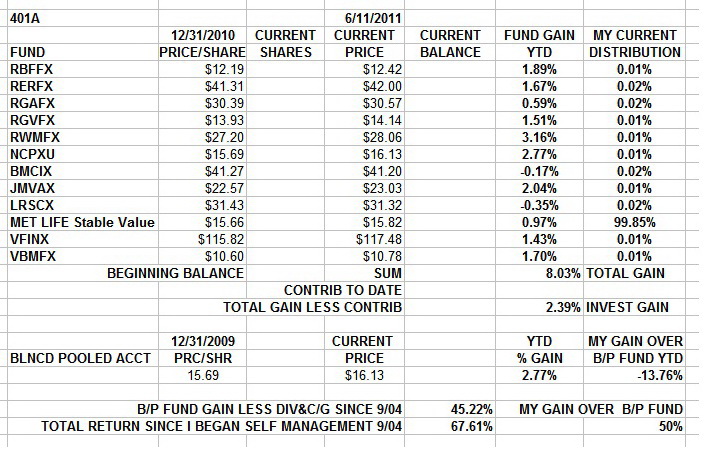

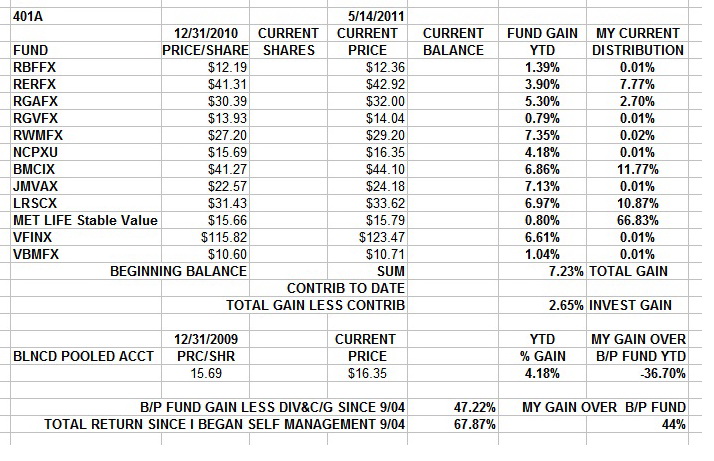

Holding my own for the year vs any and all funds. I can be satisfied with that. Especially in this market...

Ahl Be Bach.......

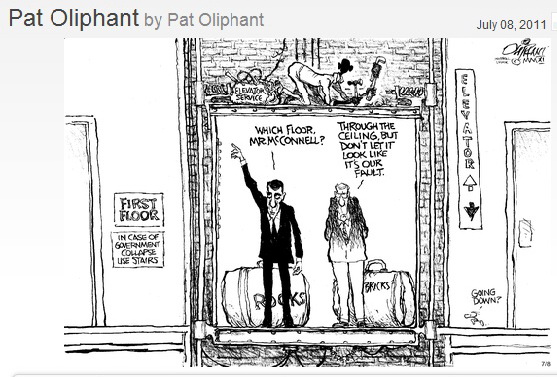

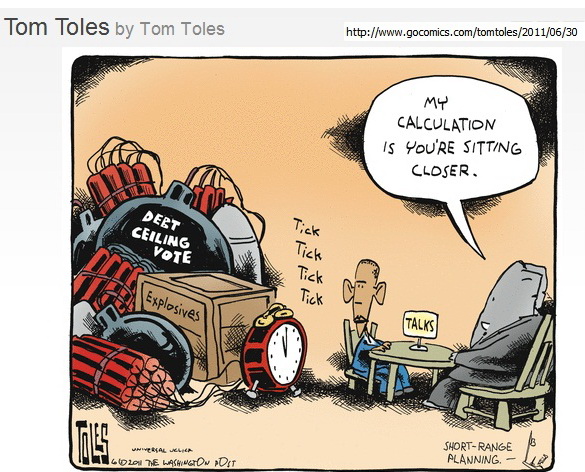

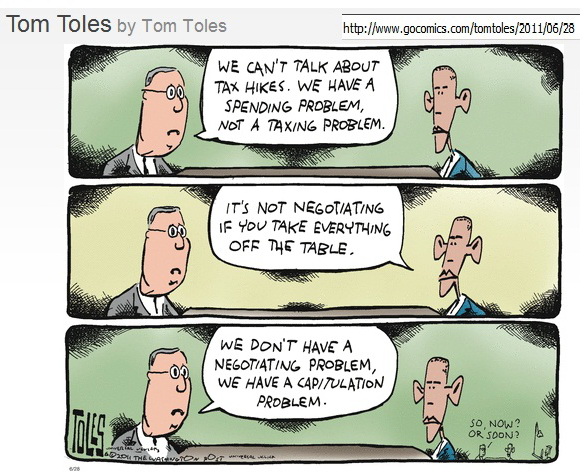

Headline Risk And 95% Correlation Of Stocks With The Headlines; An UnEnding Source Of Amazement And Delight..... Turn Out Delight....

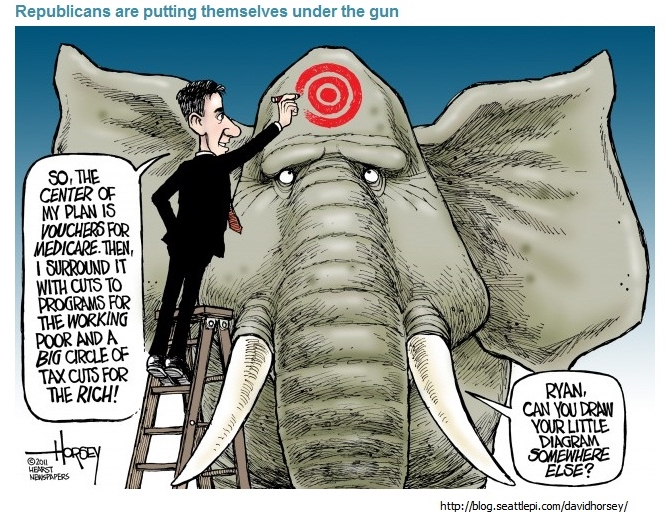

“There are two novels that can change a bookish fourteen-year olds life: The Lord of the Rings and Atlas Shrugged. One is a childish fantasy that often engenders a lifelong obsession with its unbelievable heroes, leading to an emotionally stunted, socially crippled adulthood, unable to deal with the real world. The other, of course, involves Orcs.”

-- John Rogers

Chartz And Table Zup @ www.joefacer.com

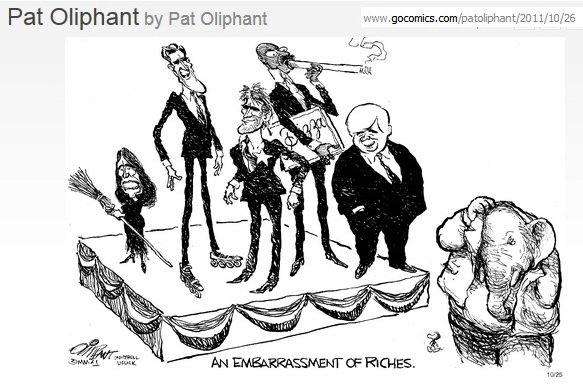

Before and After; ya gotta shelf life; know it or not.

http://www.youtube.com/watch?v=DfSl1KHi ... re=related

http://www.youtube.com/watch?v=pJxfmVT4FJw

http://www.youtube.com/watch?v=weYgSn6b ... re=related

http://www.ritholtz.com/blog/2011/11/th ... ity-circa/

http://www.ritholtz.com/blog/2011/11/mf ... -chutzpah/

http://www.ritholtz.com/blog/2011/11/mf ... %94part-2/

http://online.wsj.com/article/SB1000142 ... 84948.html

http://alephblog.com/2011/11/05/bubbles ... ll-almost/

http://www.ritholtz.com/blog/2011/11/su ... -11042011/

Monday...

http://www.bloomberg.com/news/2011-11-0 ... cohan.html

Tuesday

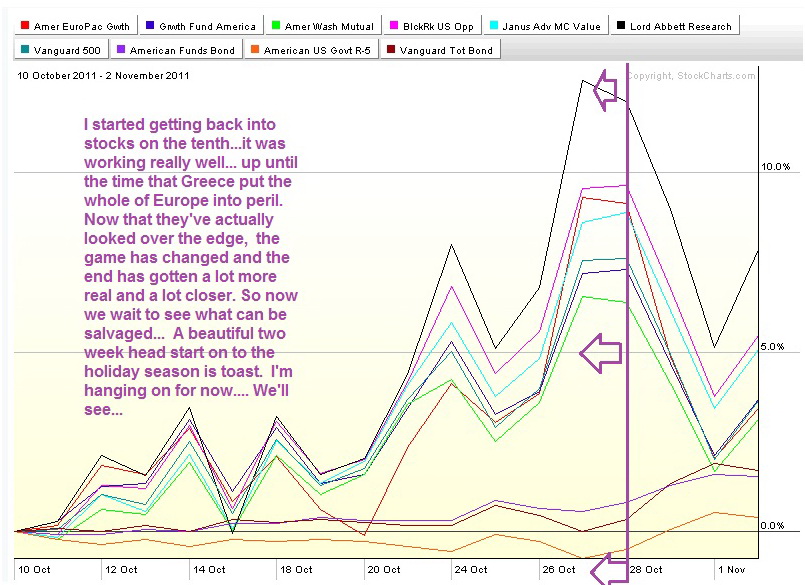

Still about 60% stocks into the year end in the face of whipsaws, daily manic flailing about and darkness and despair in the news. It's working so far.......

Stay Tooned...

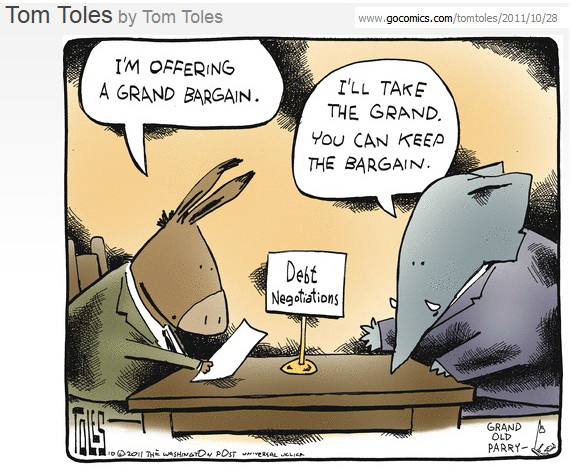

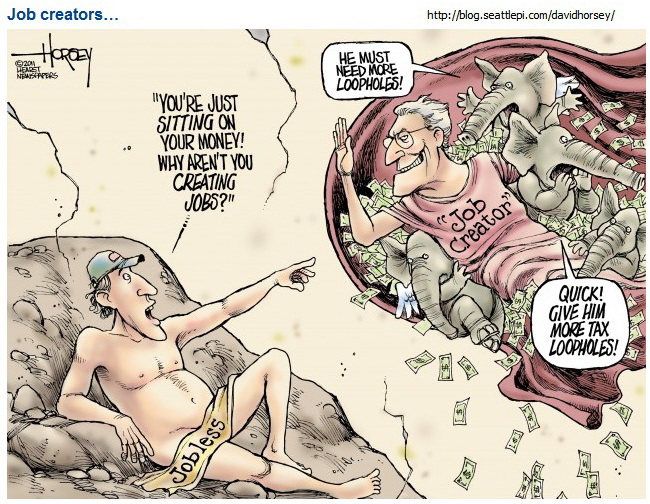

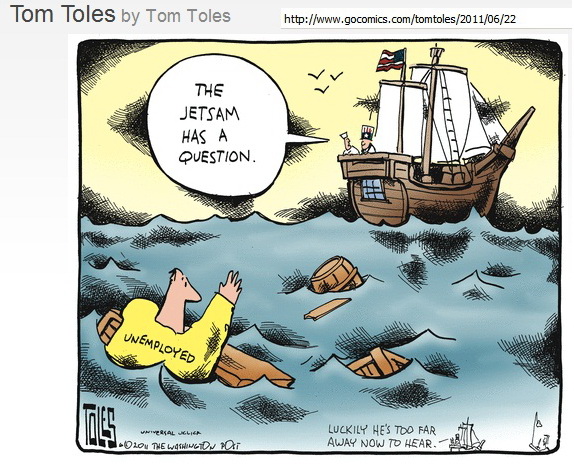

Lindsey Campbell; What do you do to fix the economy?

Barry Ritholtz; I don’t know that the economy needs fixing. What do you do to fix night? You wait and it becomes day.

Charts And Table Zup @ www.joefacer.com

I'd heard that the "hid behind the amplifiers" event occurred at The 'mo East when The Jeff Beck Group was 2nd act prior to the headliners, The 'Dead. The opening act had been boo'd off the stage in minutes. Beck figured that they had one shot and only one shot so they laid it all on the line by opening with their closer, "I Ain't Superstitious.... kinda knocked 'em Dead....

http://www.youtube.com/watch?v=QxYu0IU9gdg

http://www.youtube.com/watch?v=-YxpDEpngko

http://www.youtube.com/watch?v=aIkwAoWq ... re=related

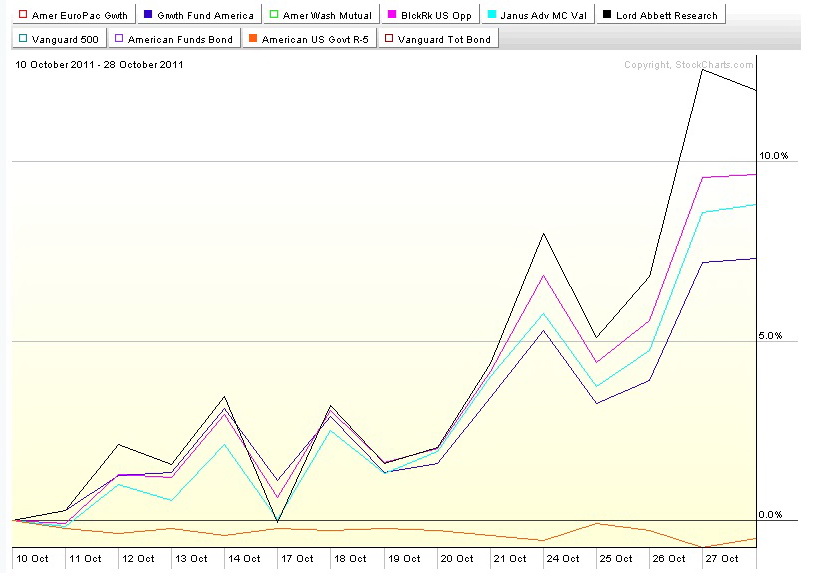

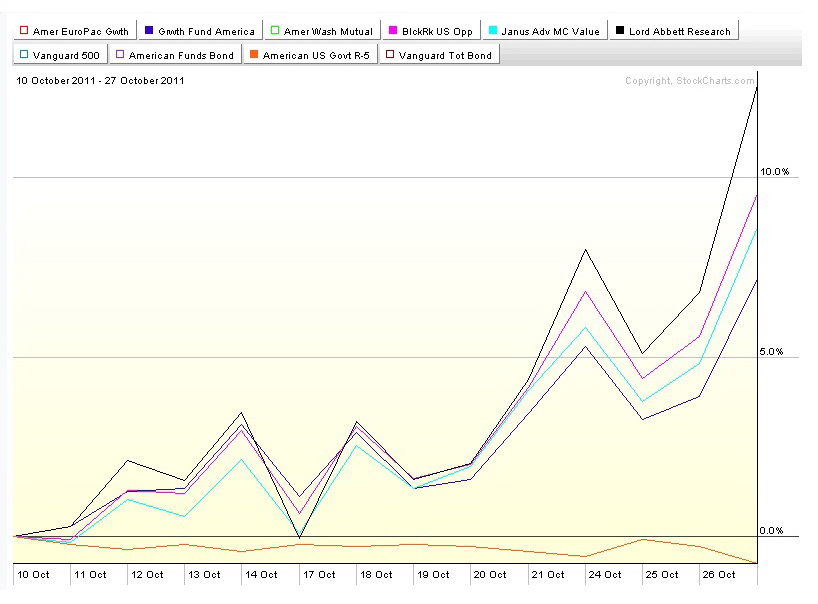

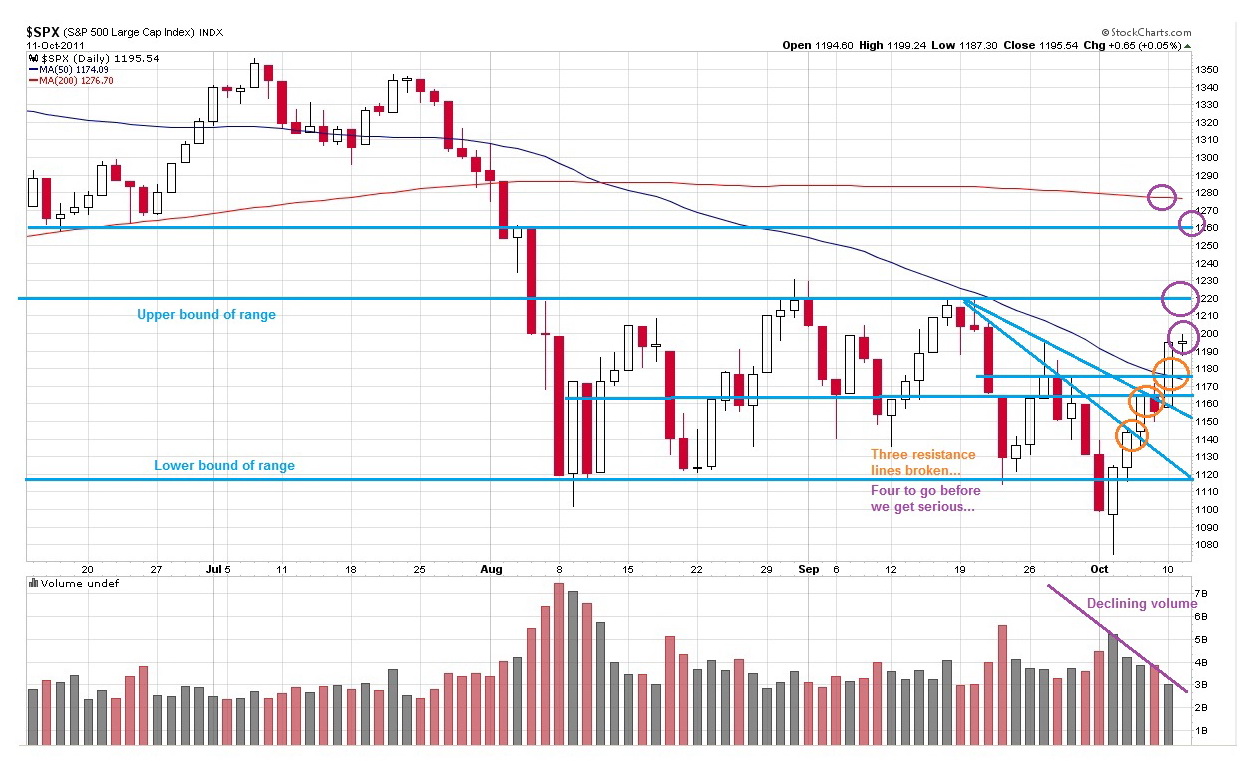

I started to go long onna 10th and I was up to 40% in stocks from zero by the middle of this week. I miskeyed an entry a coupla days ago and I'm way too long stocks now, but that hasn't hurt me....yet. There are cross currents under the surface of the market and I'm big time aware of the conflicts. I'm gonna change some stuff in the 401 and set up some contingencies next week, TBD.

http://www.ritholtz.com/blog/2011/10/su ... -10282011/

http://www.ritholtz.com/blog/2011/10/mr ... ful-blues/

http://www.ritholtz.com/blog/2011/10/as ... ng-crisis/

http://www.ritholtz.com/blog/2011/10/mc ... p-dat-aet/

http://www.bloomberg.com/news/2011-10-2 ... stors.html

http://www.marketwatch.com/story/wall-o ... 2011-10-28

http://nymag.com/daily/intel/2011/10/th ... _of_i.html

http://thetyee.ca/Opinion/2011/10/27/Fi ... y-Bankers/

http://www.nytimes.com/2011/10/26/opini ... odayspaper

http://www.ritholtz.com/blog/2011/10/su ... -10282011/

http://www.ritholtz.com/blog/2011/10/su ... -10282011/

http://www.rollingstone.com/politics/bl ... g-20111025

Monday

http://www.ritholtz.com/blog/2011/10/bo ... 1981-2011/

http://www.bloomberg.com/news/2011-11-0 ... endum.html

http://www.project-syndicate.org/commen ... 10/English

http://www.alternet.org/module/printversion/152897

http://www.bbc.co.uk/news/world-15391515

Explains A LOT....

http://www.moneyweb.com/mw/view/mw/en/p ... pid=287226

http://www.pimco.com/EN/Insights/Pages/ ... eaven.aspx

http://www.forbes.com/sites/kenrapoza/2 ... ed-selves/

http://edition.cnn.com/2011/11/01/world ... index.html

http://www.nytimes.com/2011/11/01/opini ... .html?_r=1

http://www.marketwatch.com/Story/story/ ... 2128040CF6

http://www.washingtonpost.com/opinions/ ... story.html

http://blogs.telegraph.co.uk/finance/ia ... o-incomes/

http://www.bloomberg.com/news/2011-11-0 ... onomy.html

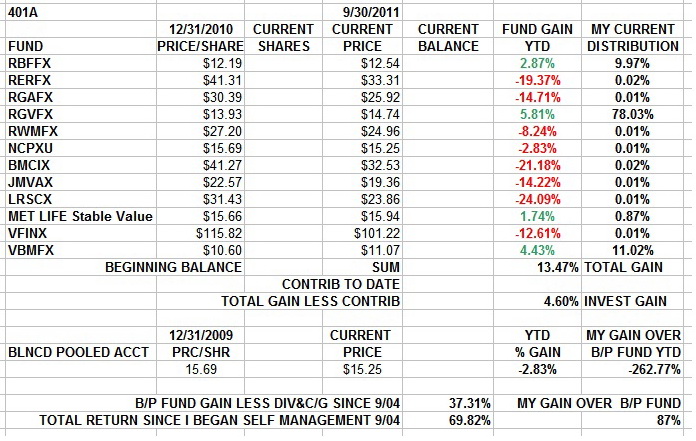

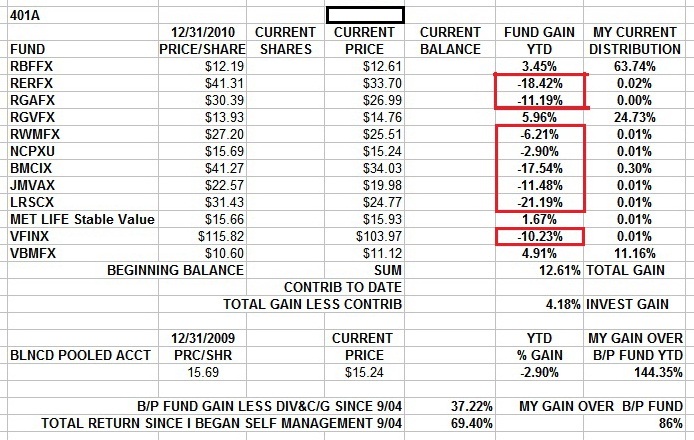

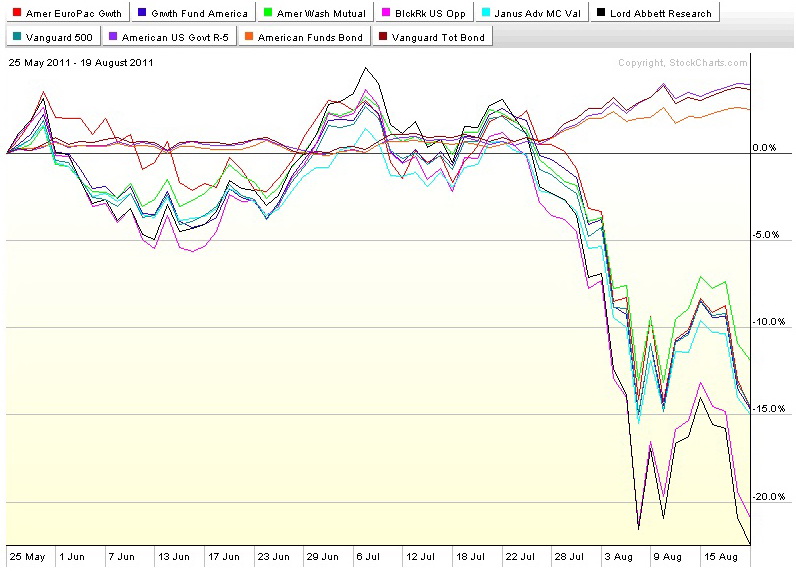

I'm doing better than all but two of the funds out of the ten and I'm in good shape if stocks react well to the end of the year/holidays.

or, I'll have to adjust if that allocation loses me money. Stay Tooned....

http://www.thedailybeast.com/articles/2 ... treet.html

http://www.ritholtz.com/blog/2011/11/ar ... ing-point/

Stay Tooned.....

You Can Lead A Horse To Water, But Unless You Can Teach Him To Swim On His Back, Ya Ain't Showed Me Nothin......

“I’ll believe corporations are people when Texas executes one.”

-- Seen At Occupy Wall Street Rally

Chartz And Table Zup @ www.joefacer.com ...

Every Young Man Has Something He Hopes Never Sees The Light Of Day...Enjoy.

http://www.wolfgangsvault.com/clover/vi ... 81731.html

The two dancin' fools went on to be moderately successful as did one of the guitarists ... Can you figure out where?

I put some money to work this week... maybe some more goin' out on Monday. Details to follow....

http://www.ritholtz.com/blog/2011/10/is ... ust-noise/

http://www.washingtonpost.com/business/ ... story.html

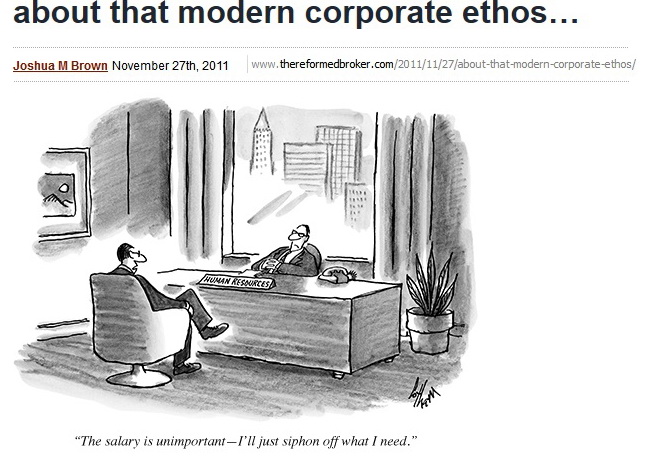

Europe desperately wants the markets to go up. Wall Street NEEDS the markets to go up. The government sure wants the markets to go up. Despite EVERYTHING, the markets look like they want to go up. I sense a theme.... http://www.thereformedbroker.com/2011/1 ... -q4-rally/

I'm edging back in for the year... http://www.thereformedbroker.com/2011/1 ... d-all-out/

JFC!!!!!! http://www.latimes.com/news/nationworld ... 0812.story

http://www.bloomberg.com/news/2011-10-2 ... -says.html

I started to put money to work in stocks on the 10th. I had some in, I coulda had more. But I made a dollar.... I'm thinkin' about what's next.........

Stay Tooned...

Chartz and table zup @ www.joefacer.com

I got some money back in stocks. ma y keep it there, may not. .

Wed...

http://www.bloomberg.com/news/2011-10-2 ... -says.html

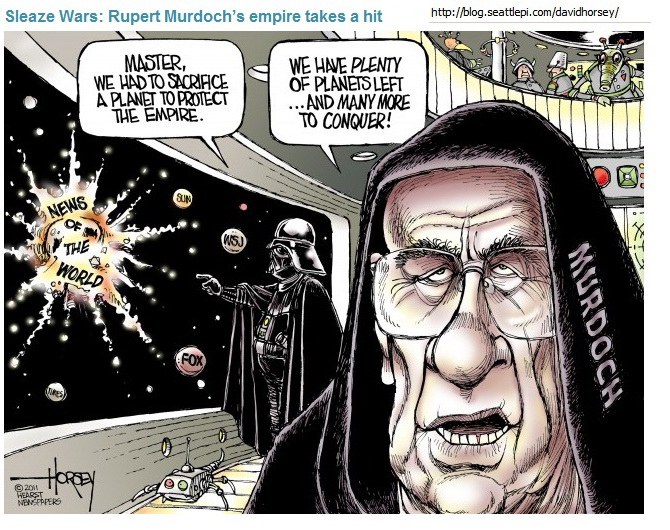

http://www.thereformedbroker.com/2011/1 ... -tatooine/

Stay Tooned...

I got some money back in stocks. ma y keep it there, may not. .

Wed...

http://www.bloomberg.com/news/2011-10-2 ... -says.html

http://www.thereformedbroker.com/2011/1 ... -tatooine/

Stay Tooned...

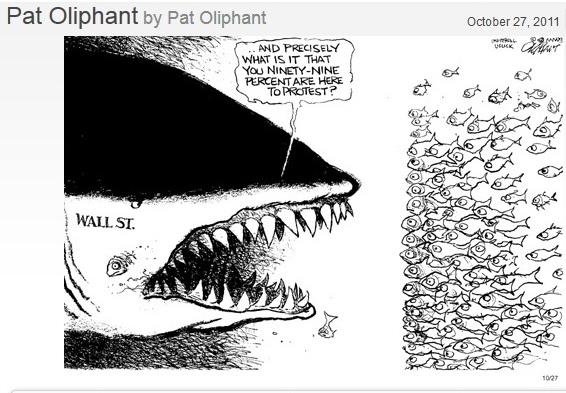

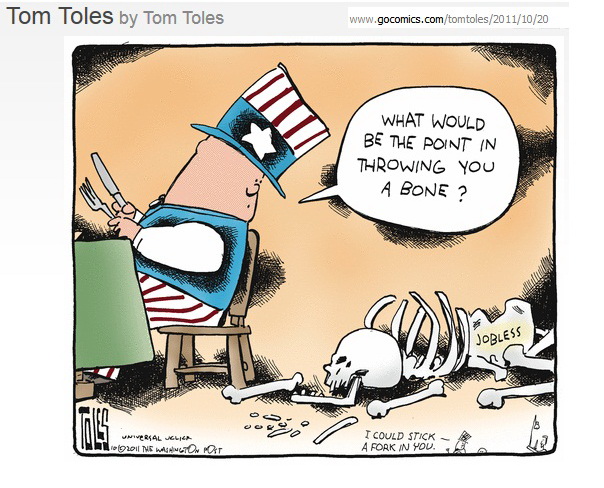

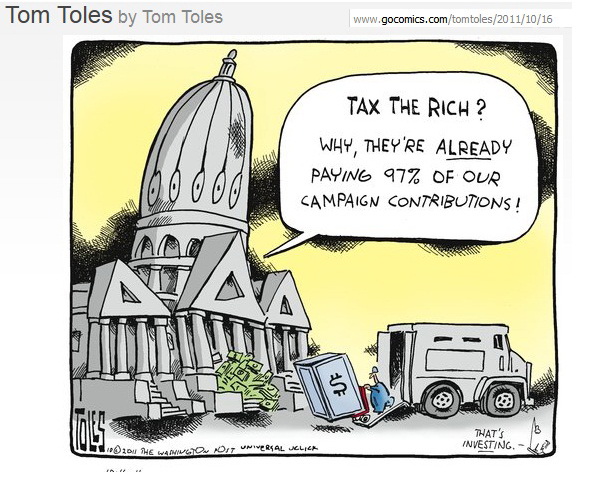

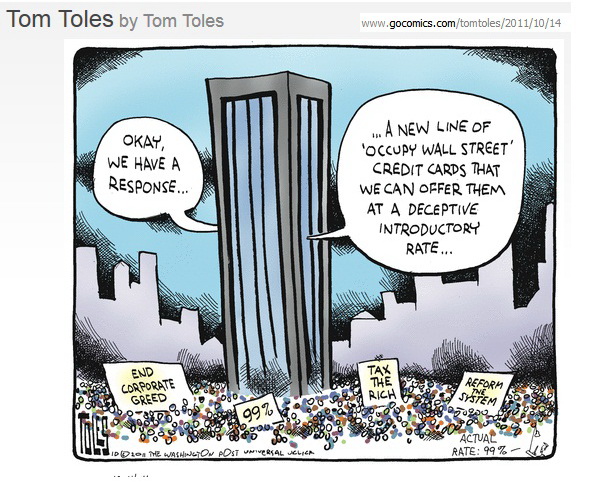

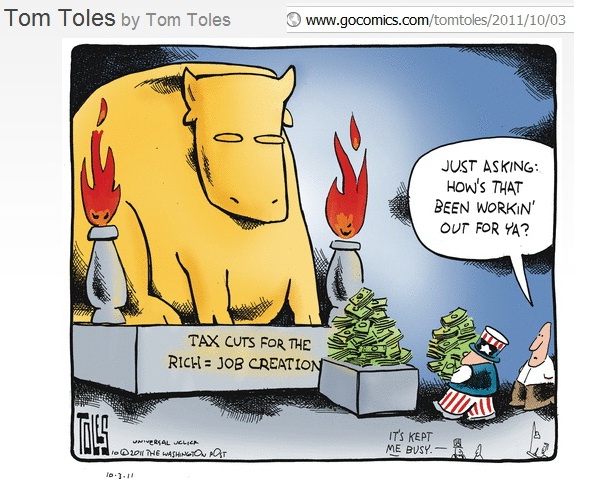

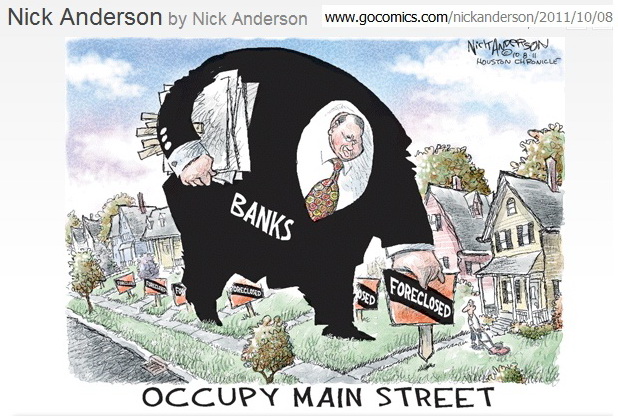

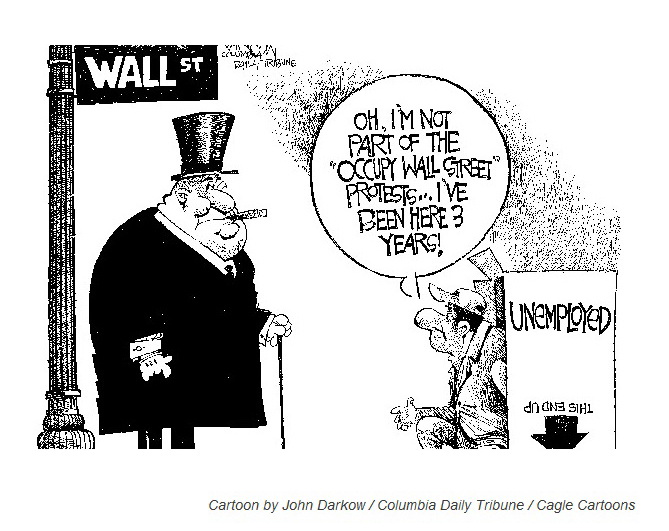

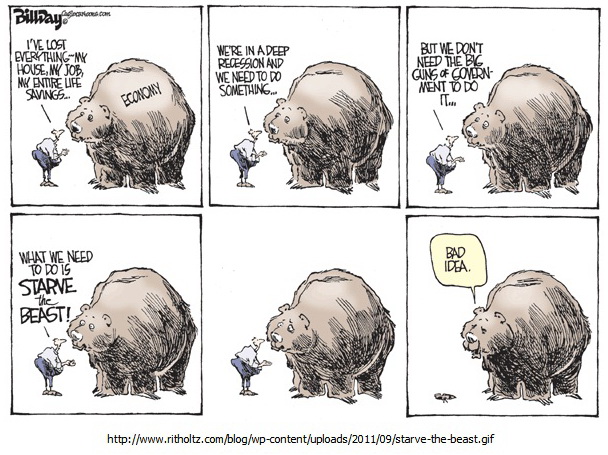

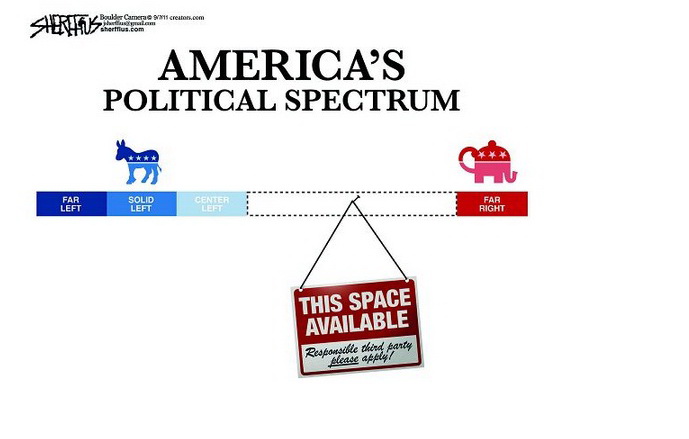

The Tea Party Last Year And The Occupy Wall Street Movement This Year. Shades Of The Sixties And Seventies!!. Maybe A Third Or Fourth Party? Oh Boy! This Generation's Choice Between Perot/Iaccoca And Nader!! Louis Louis..... Me Gotta Go Now ...

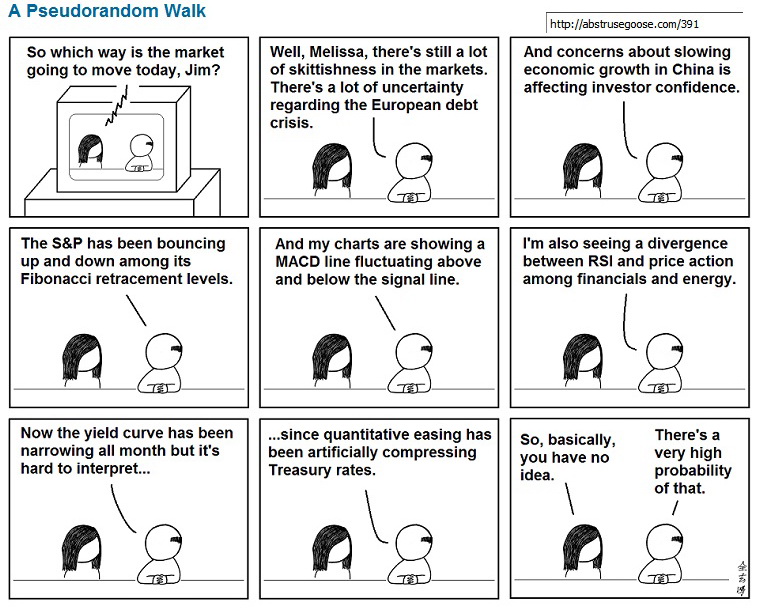

Isn't it strange? The same people who laugh at gypsy fortune tellers take economists seriously.

--Unknown

Chartz and Table Zup @ www.joefacer.com

The original Procul Harum LP was in mono and they waited a year to release the album after the single charted. You wouldn't have believed how the record industry was run in the 60's. We listened to Jimi for 6 months on English imports bootlegged in while they worked out whether or not getting the album in the US was an idea or not. Anyway, here's one of the Haight Ashbury's stoner anthems from Procol Harum.

http://www.youtube.com/watch?v=LjBKu7Wq ... re=related

http://www.bloomberg.com/news/2011-10-0 ... mands.html

http://www.youtube.com/watch?v=LjBKu7Wq ... re=related

http://www.bloomberg.com/news/2011-10-0 ... parts.html

http://www.bloomberg.com/news/2011-10-0 ... parts.html

http://www.bloomberg.com/news/2011-10-0 ... -says.html

http://www.ritholtz.com/blog/2011/10/pa ... nstration/

http://www.ritholtz.com/blog/2011/10/to ... moneyball/

http://online.barrons.com/article/SB500 ... rticle%3D1

http://www.bloomberg.com/news/2011-10-0 ... alter.html

http://www.the-american-interest.com/ar ... piece=1049

http://www.washingtonpost.com/opinions/ ... ory_1.html

http://www.creditwritedowns.com/2011/10 ... overy.html

http://www.ritholtz.com/blog/wp-content ... /OWS-M.jpg

Fuckin' "A" Tweetie Bird!

http://www.thereformedbroker.com/2011/1 ... ou-to-die/

Sign Me UP! Kick Ass Comments When You Scroll Deeper...

http://blogs.reuters.com/alison-frankel ... ted-execs/

http://www.ritholtz.com/blog/2011/10/sp ... -wildfire/

I Don't Like Where We Are, I Don't like The News, I Do Like Bonds And Cash.

We Are Teetering...

If We Make It many Will Never Know How Close We Came. I'd Just As Soon We Make It. I'm On The Side Lines Until We Get Clarity....

Monday

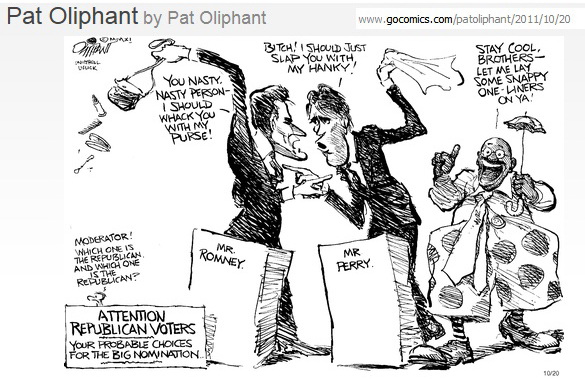

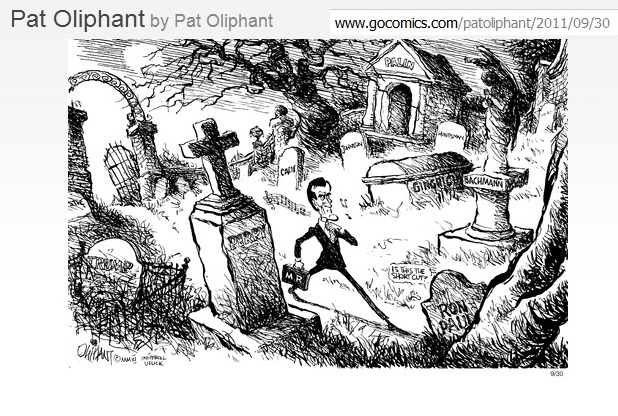

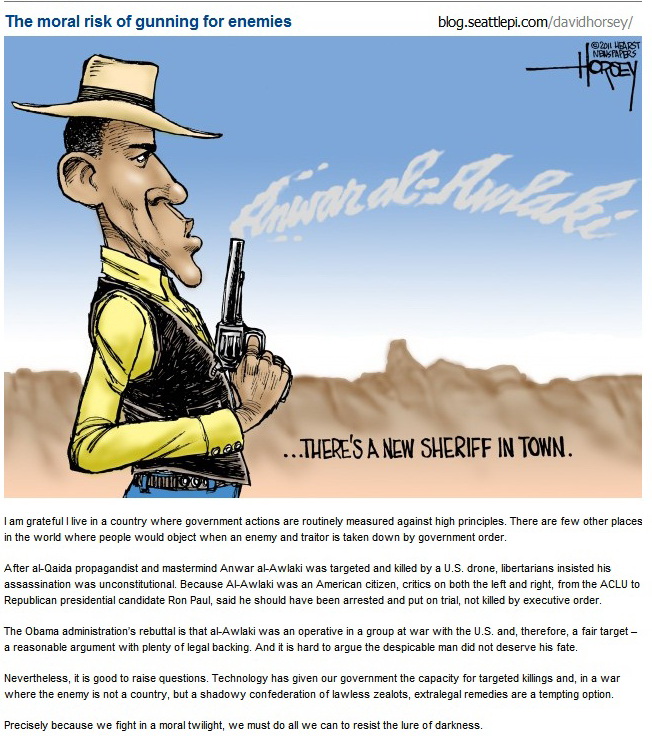

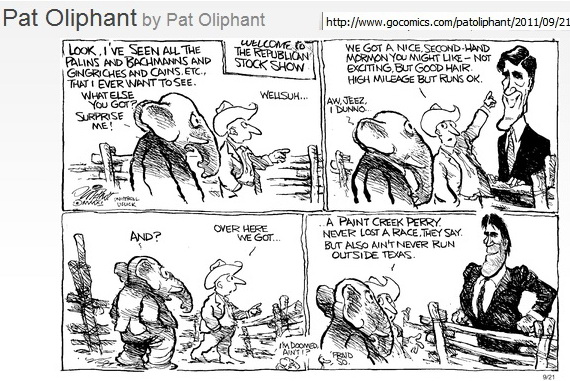

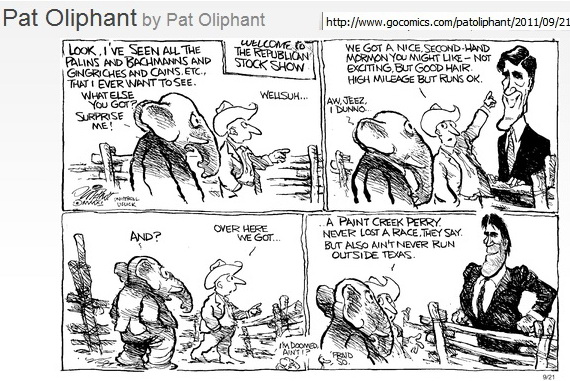

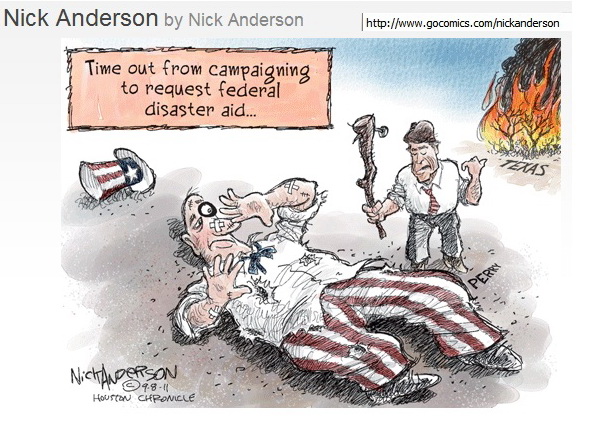

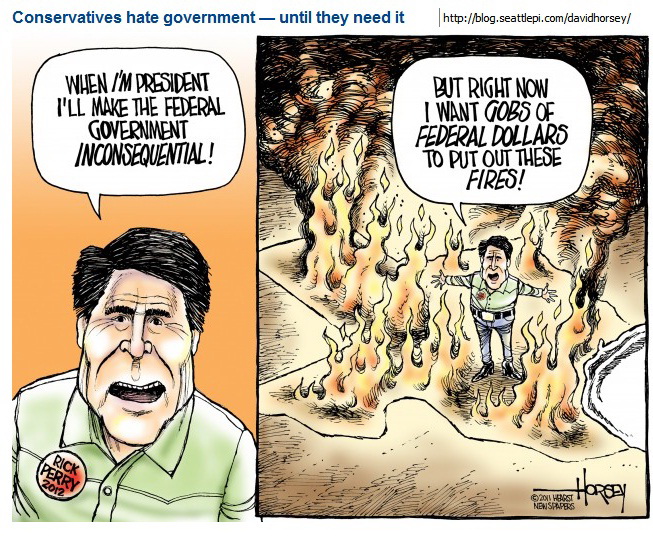

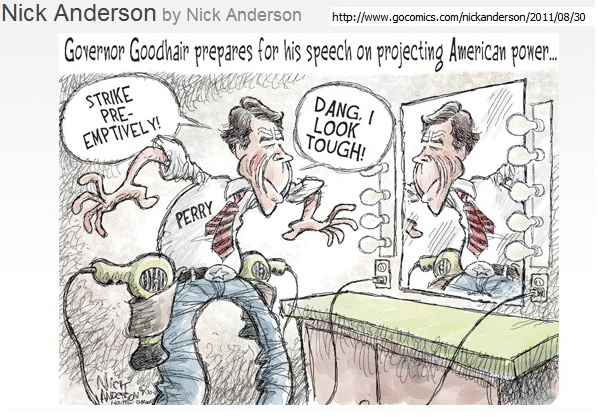

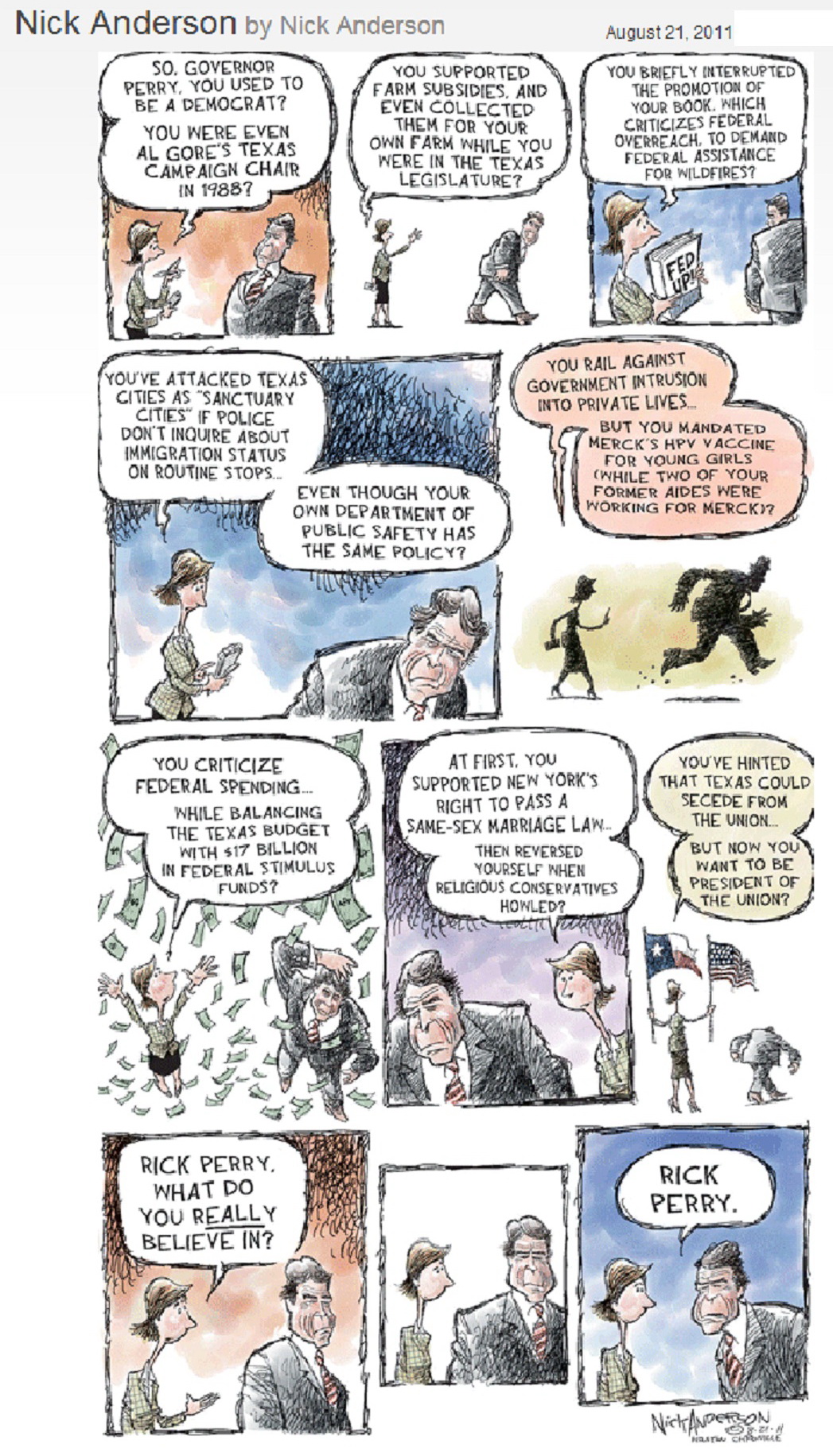

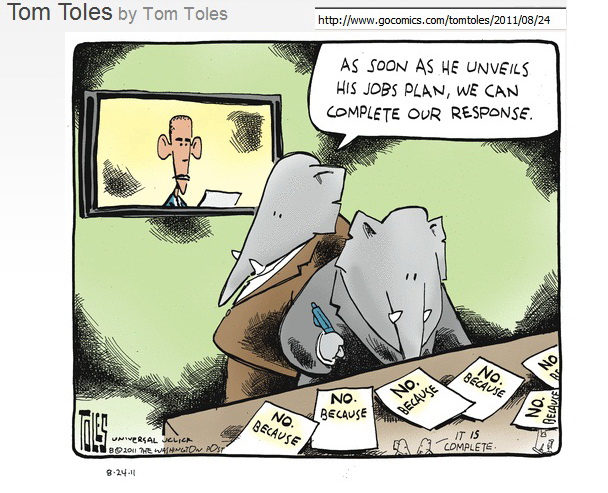

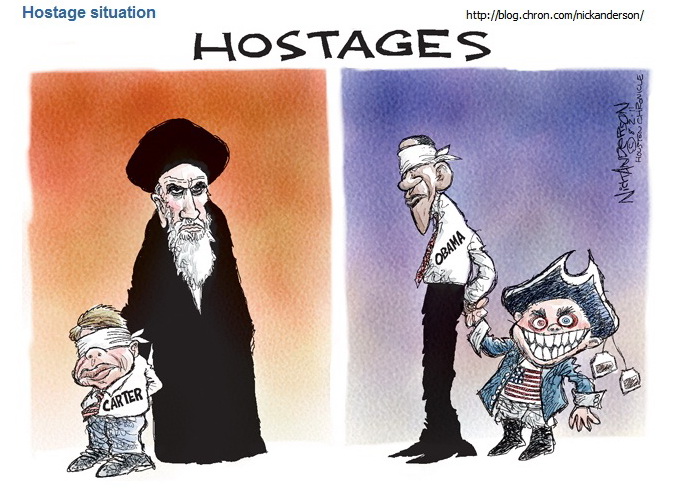

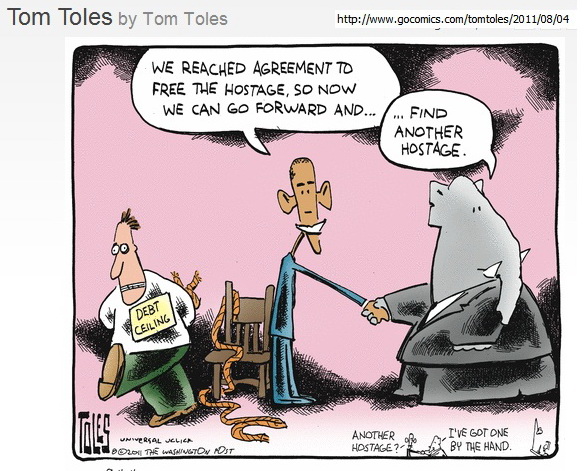

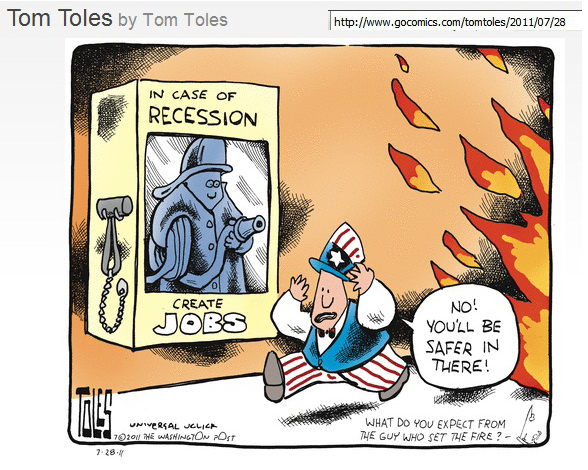

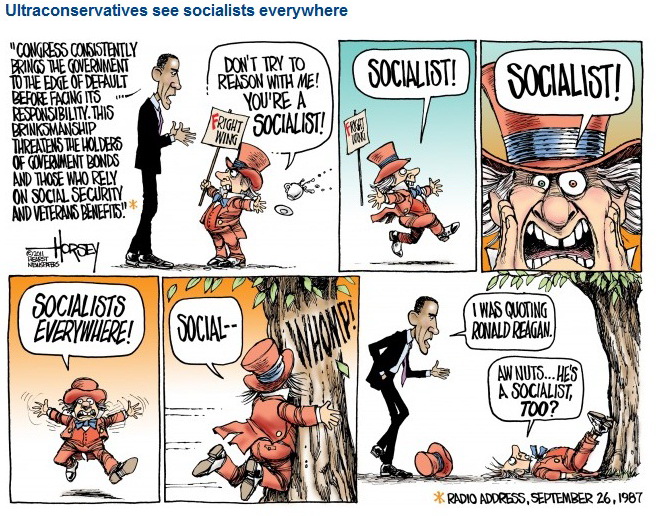

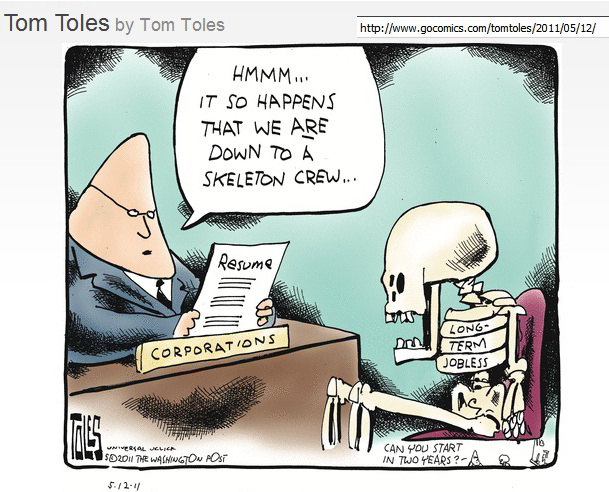

kinda sad... But, its what makes Obama re electable

http://www.frumforum.com/what-romney-gets-right

http://www.ritholtz.com/blog/2011/10/oc ... ows-wants/

http://www.ritholtz.com/blog/2011/10/wh ... out-dexia/

http://www.ritholtz.com/blog/2011/10/hu ... t-roundup/

TUES

http://ftalphaville.ft.com/blog/2011/10 ... t-traders/

http://blogs.reuters.com/alison-frankel ... ted-execs/

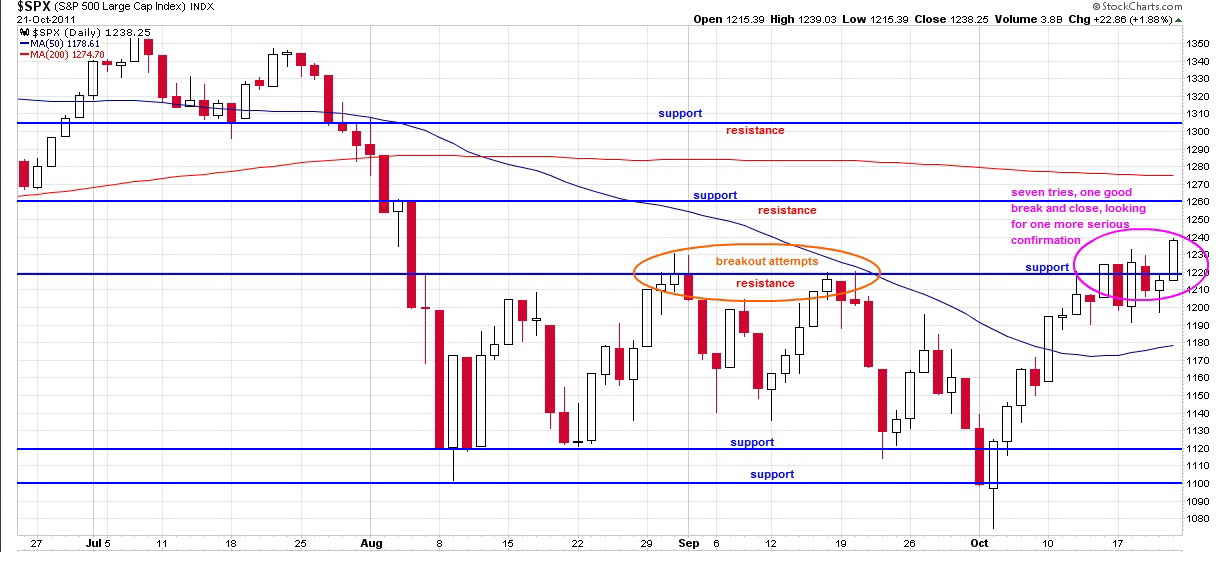

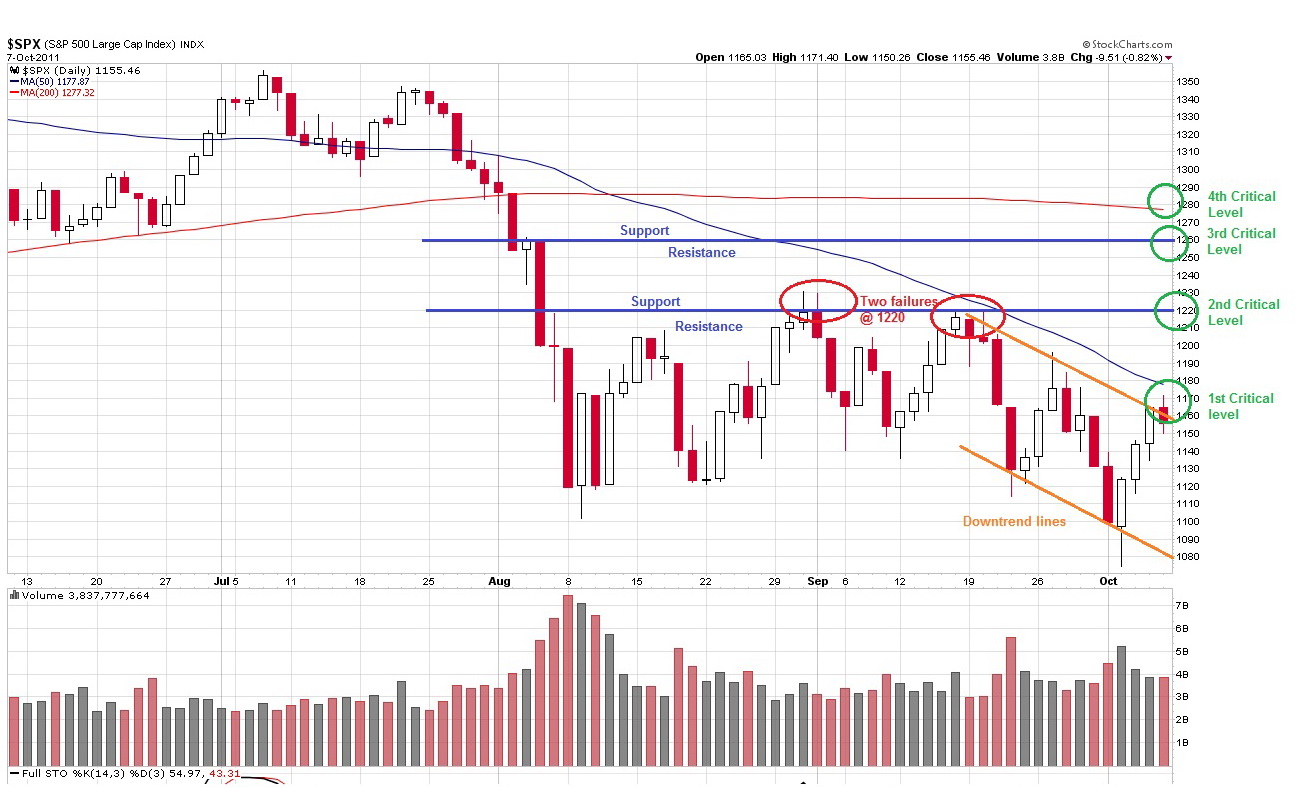

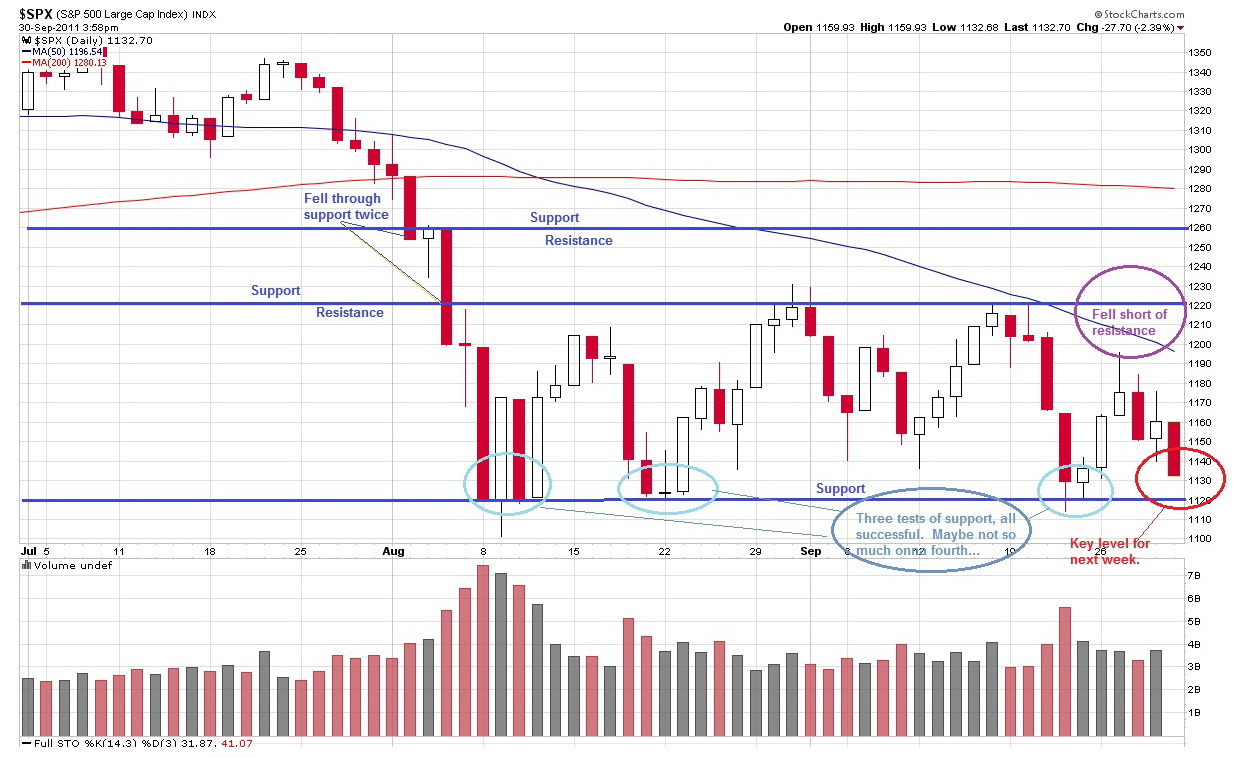

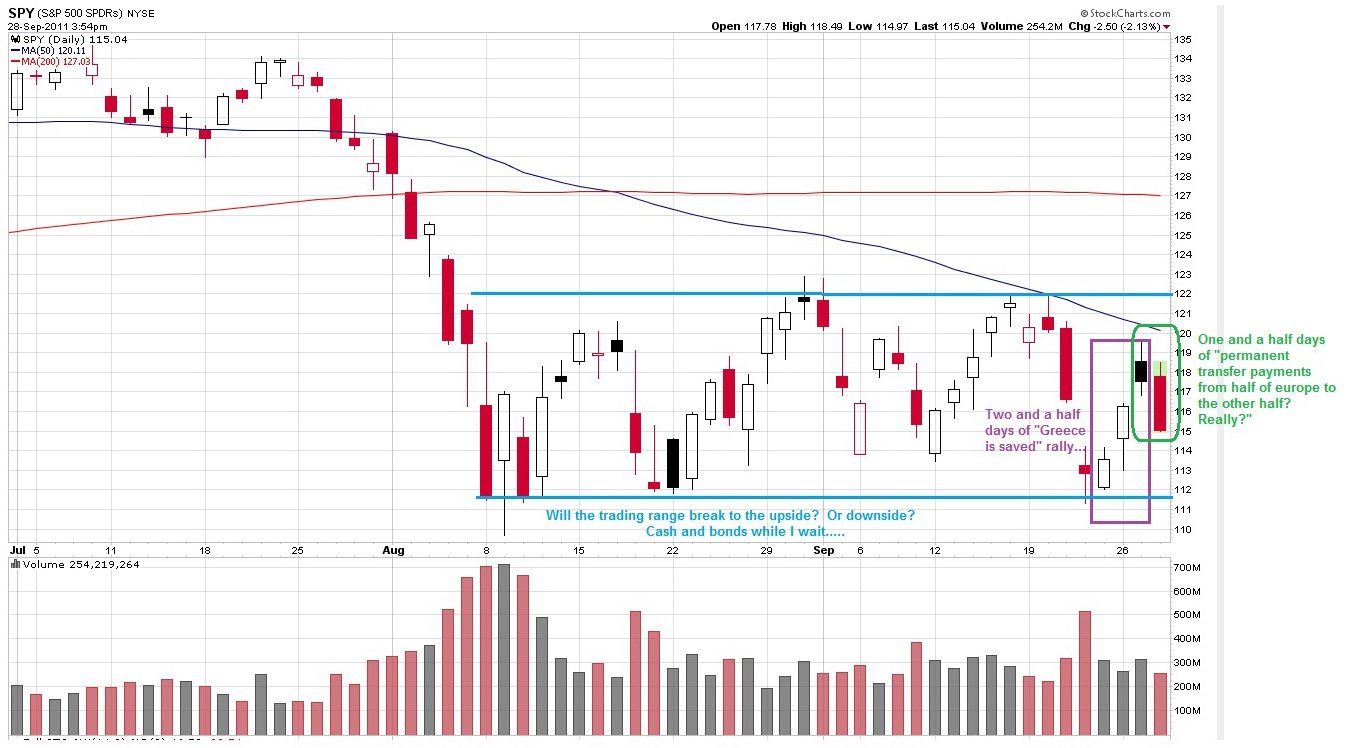

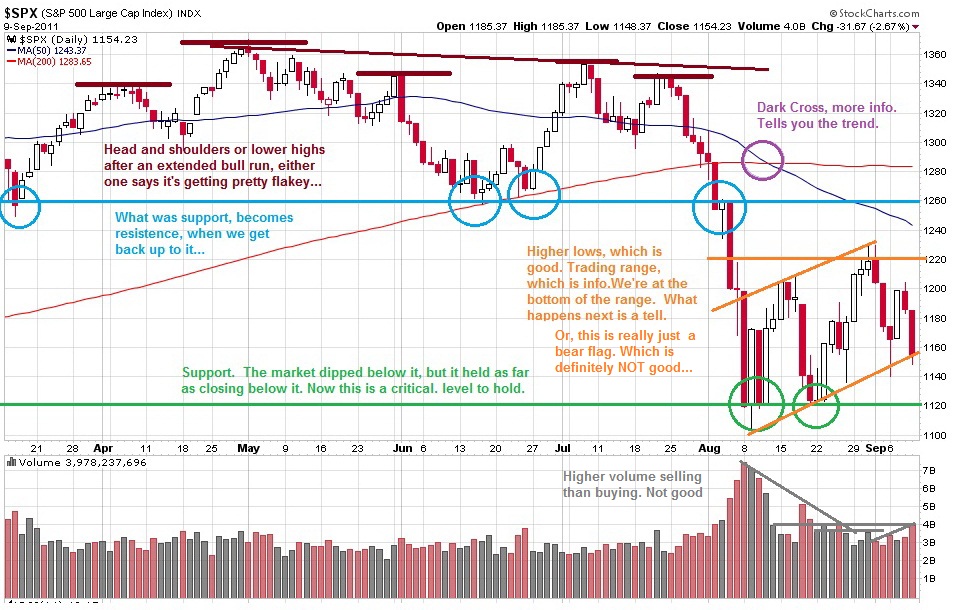

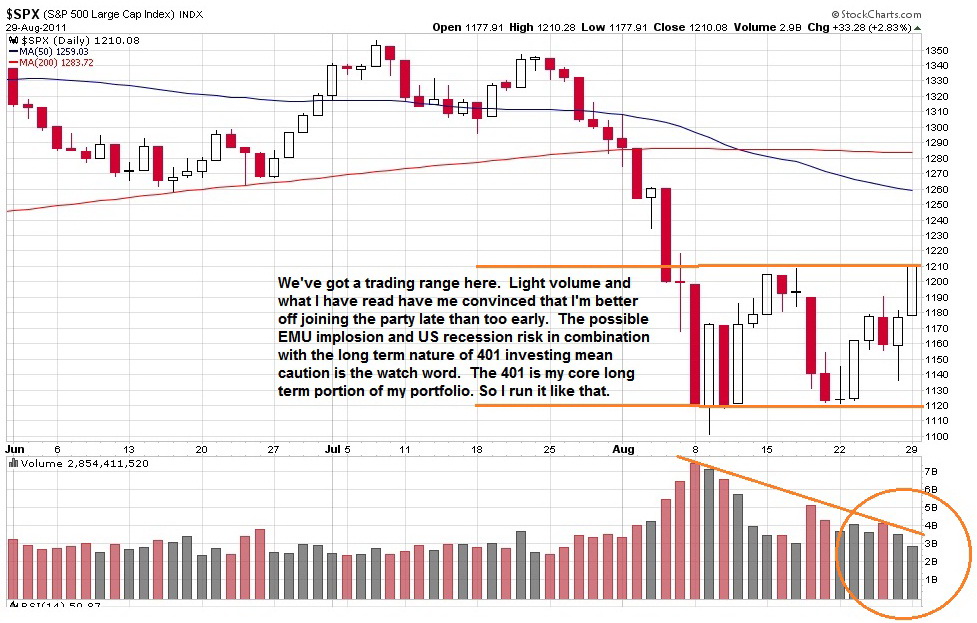

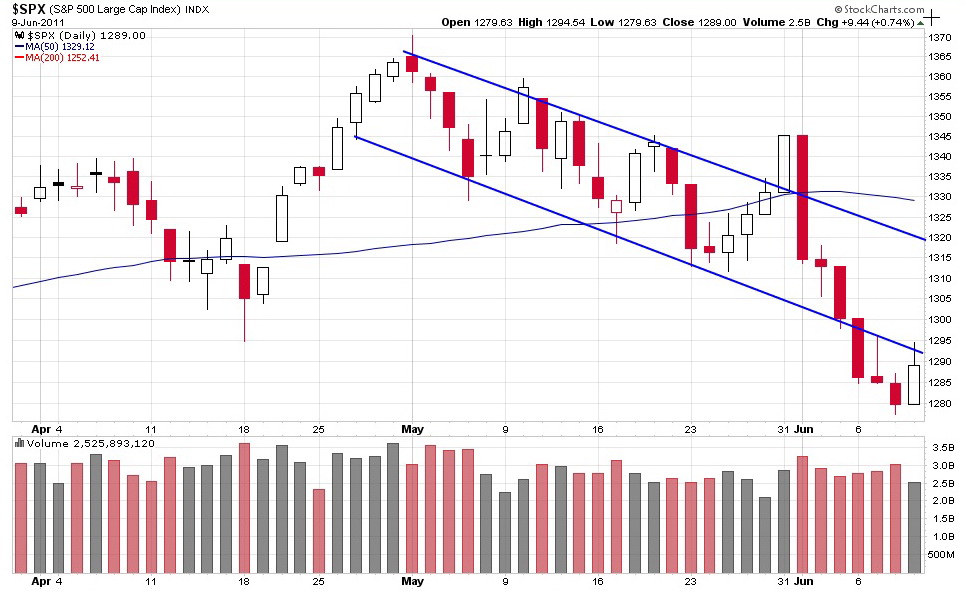

The Chart Don't Look Good... We're still stick inna range, we're just barely 3/4s of the way through the range onna upside, not much upside left, lotsa resistance above, everybody HATES the volatility and a lot of investors have given up. We're prolly going into a recession (40% to 100% plus/minus prob so far)... Europe is gonna implode, China is slowing down, the entire US government is FUBAR, etc...

What the hell, I edged a little money outa bonds and inta stocks...

End of the year coming up... money managers gotta inflate the market if they're gonna be paid and the market ain't the economy. Sooner or later we will go up again, shame not to have a mindset that accepts change and reality when one acts on the other....

I'm started in if we the the usual year end melt up and I'm not so far in that I can't get out with only a little damage.

http://www.ritholtz.com/blog/2011/10/oc ... egativity/

http://www.washingtonpost.com/opinions/ ... ml?hpid=z3

http://www.reuters.com/article/2011/10/ ... 1L20111010

http://ftalphaville.ft.com/blog/2011/10 ... -exposure/

Stay Tooned....

Forty Years Ago, I Didn't Understand Why All The Old Timers Ever Talked About Was Retiring. It Gets Clearer Every Year....

Risk Management and Capital Preservation is often confused with Market Timing, and therefore is frowned upon.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

Marshall Tucker Was A Rock Band Before They Were Country. I Saw 'em Open For The Allman Bros New Years Eve Show Inna 70's. SMOKIN'....

http://www.youtube.com/watch?v=VEOV5vWfSgI

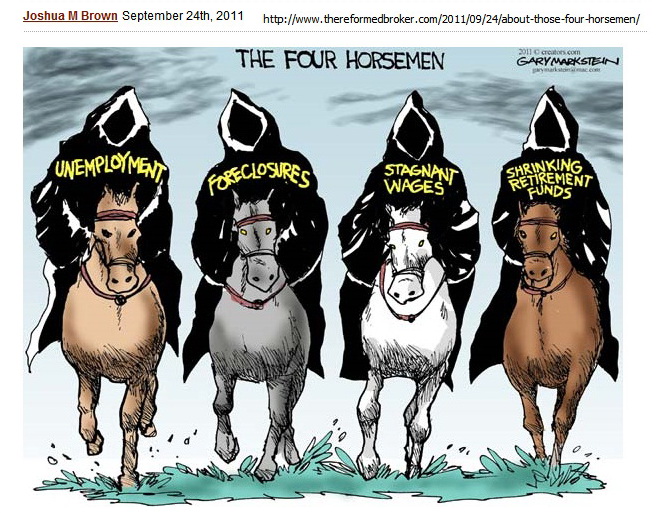

It's Been A Rotten Week Inna Market... But There Is An Answer To The Social Security Problem.

http://www.ritholtz.com/blog/2011/09/so ... e-younger/

I Have half A Dozen Go to Guys...Lakshuman Is One...

http://www.ritholtz.com/blog/2011/09/le ... recession/

http://www.ritholtz.com/blog/2011/10/ec ... escapable/

http://www.ritholtz.com/blog/2011/09/mo ... x-changes/

http://www.ritholtz.com/blog/2011/09/su ... s-9-30-11/

http://www.thereformedbroker.com/2011/0 ... ucktember/

http://www.ritholtz.com/blog/2011/09/mo ... x-changes/

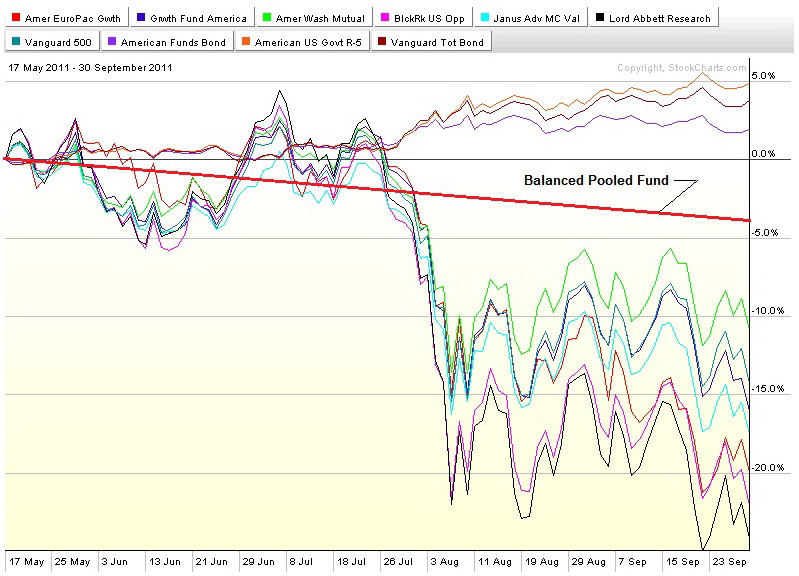

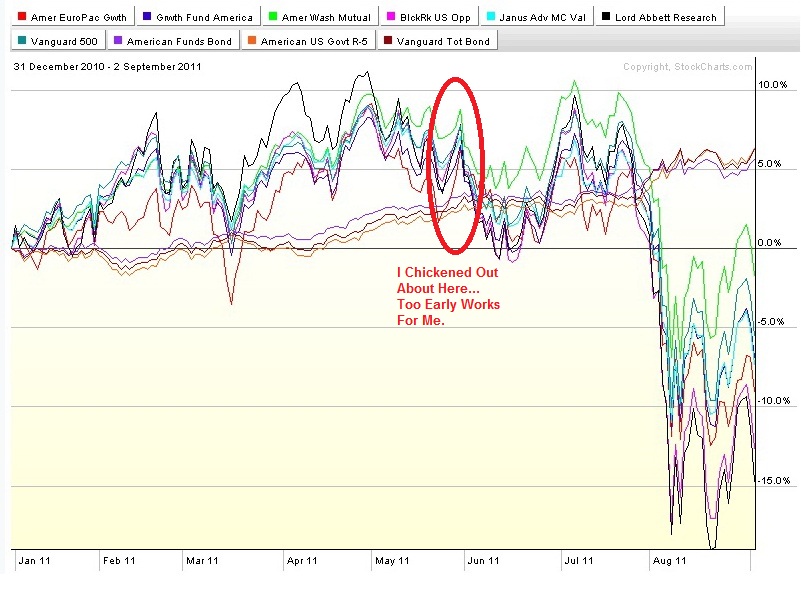

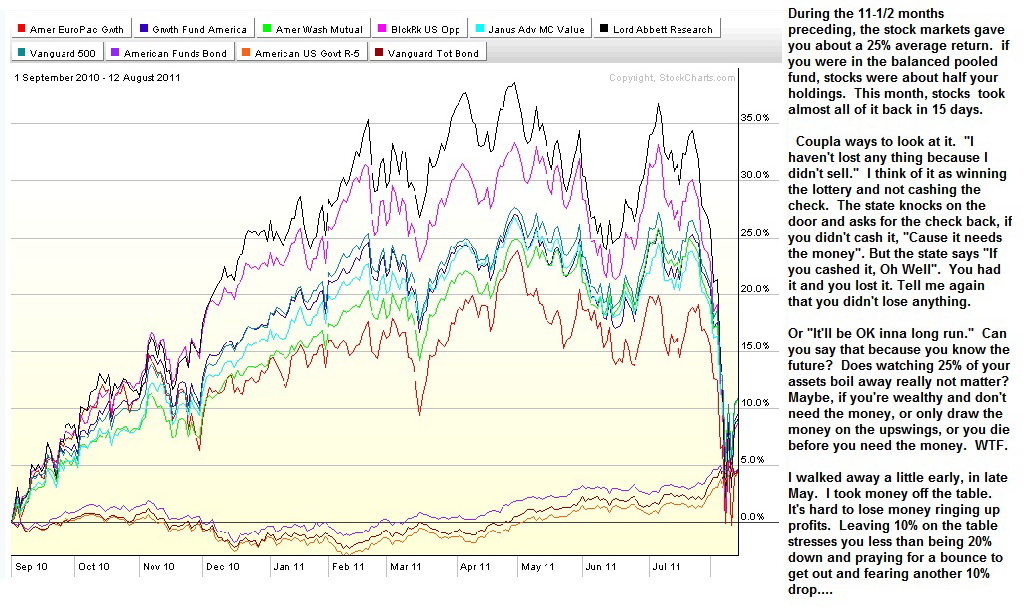

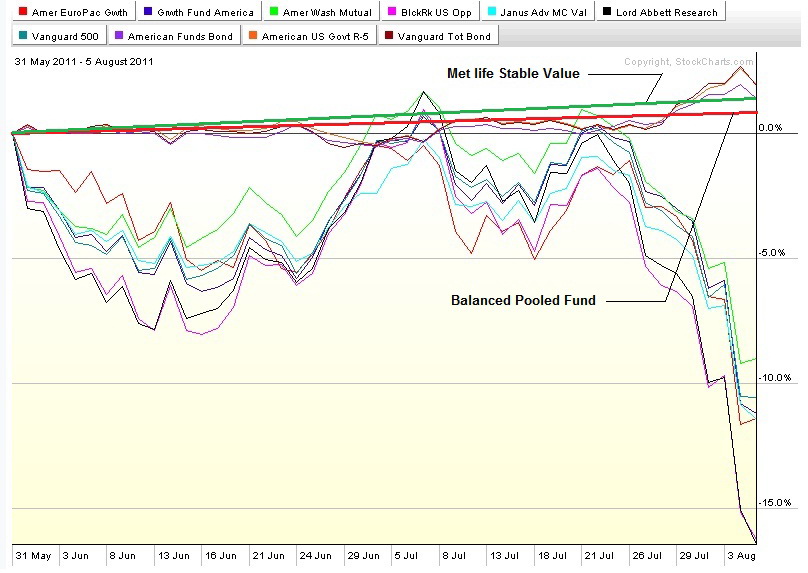

It's complicated. I got outta stocks going into the third week of May. By the end of June,I'd left 4% on the table vs if I'd stayed all in in the best stock funds. By last Friday, I was ahead by about 20% vs if I'd stayed all in in the best stock funds. If I was a set and forget kinda guy inna Balanced Pooled Fund, you could reduce those swings by about 75%, to 1% and -4%.numbers. Sounds like not a big deal. But when the swings are on the upside, those figures work the other way. So it sounds like a big deal. But it depends. Back inna early 90's, the mandatory minimum contribution was less, I was a traveler in another local where money was better, the reciprocity was lower, I contributed the minimum, and the money in the account was not enough to make the swings up and down very significant. Now, I'm back home, I've bumped my contribution up over the years, it's almost two decades later, and I got some coin in the account. Now, when the market is raging up or down, I can make or lose significantly more in a week in the 401 than I can at work. I see why some guys and gals are all in in the Stable Value Fund. They bust their balls and ovaries at work and make or lose in a week twice what they show on the check. Down sides can be vicious and you can lose inna week what took 6 weeks to make onna upside. That can make you crazy. But the swings now are the same as a decade two ago. It's where you are that makes the difference.

And where I'm at, makes me hyper. The wife's retired and I'm last one standing. I've decided to put my head down (motorcycle racing term) because the finish line is in sight. If this was a bull market, I'd check the balances once a week, and once a month, I'd allocate that month's contributions and maybe reallocate between funds a skosh. And if I'd been putting in the max for 20 years, I'd be in maximum conservation mode, maximally risk adverse. I'd have the job done already. But I got stuff left to do. And we're in a bear market. So I watch like a hawk. And like a hawk, I do nothing if there isn't anything there. And there hasn't been, nothing but down side. There will be upside, but I don't want to waste time and energy trying to move on something that is not real. A lotta lookin' and analysing and no action. But I'm months ahead of bein' all in in stocks and when the time comes, if I'm smart and lucky, I'll be all in for the up side. For the 75% greater gain of risk management that you don't think about when you hear the term "risk management".... I'll let you know as it develops...

http://blogs.telegraph.co.uk/finance/am ... cal-union/

Lemme ruin your day...

http://www.vanityfair.com/business/feat ... wis-201111

http://www.chrismartenson.com/page/tran ... -blame-fed

http://krugman.blogs.nytimes.com/2011/0 ... ery-wrong/

More Lakshman Achuthan

http://www.ritholtz.com/blog/2011/10/ec ... escapable/

MONDAY MONDAY....

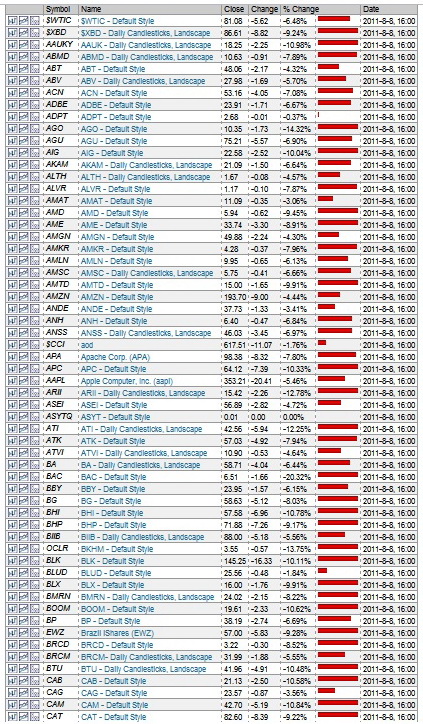

A Most Thoroughly Unpleasant Day.

I HAVE NO REASON TO BELIEVE THAT TOMORROW WILL BE BETTER.....

THIS IS WHY I MANAGE MY SELF MANAGED PLAN MYSELF....

The Upside Can Be Ferocious ....So Can The Downside...

The Goal Is Capture One And Dodge The Other.

http://ftalphaville.ft.com/blog/2011/10 ... ar-market/

http://www.pimco.com/EN/Insights/Pages/SixPackin.aspx

http://davidbrin.blogspot.com/2011/09/c ... story.html

Thursday

Stay Tooned.... And see ya at the hall before the meeting.

“The race is not always to the swift nor the battle to the strong, but that’s the way to bet.”

-- Damon Runyon

Chartz And Table Zup @ www.joefacer.com

http://www.wolfgangsvault.com/link-wray ... 10921video

Coupla Guitarists Always Worth Seein'... RockaWilliam Link And John Cippolina w/his Fender/Horn Stack...

http://www.wolfgangsvault.com/concerts/ ... tTrackID=5

And Link Doin' His Own Thang....

HANG ON!!!!!!!

What Part Of "Self Managed" Do People Not Understand?

"Self Managed" and "Risk Management" Is Like "Carbo-Loading"... Ya

Gotta Pay Attention To The Words....

Tues

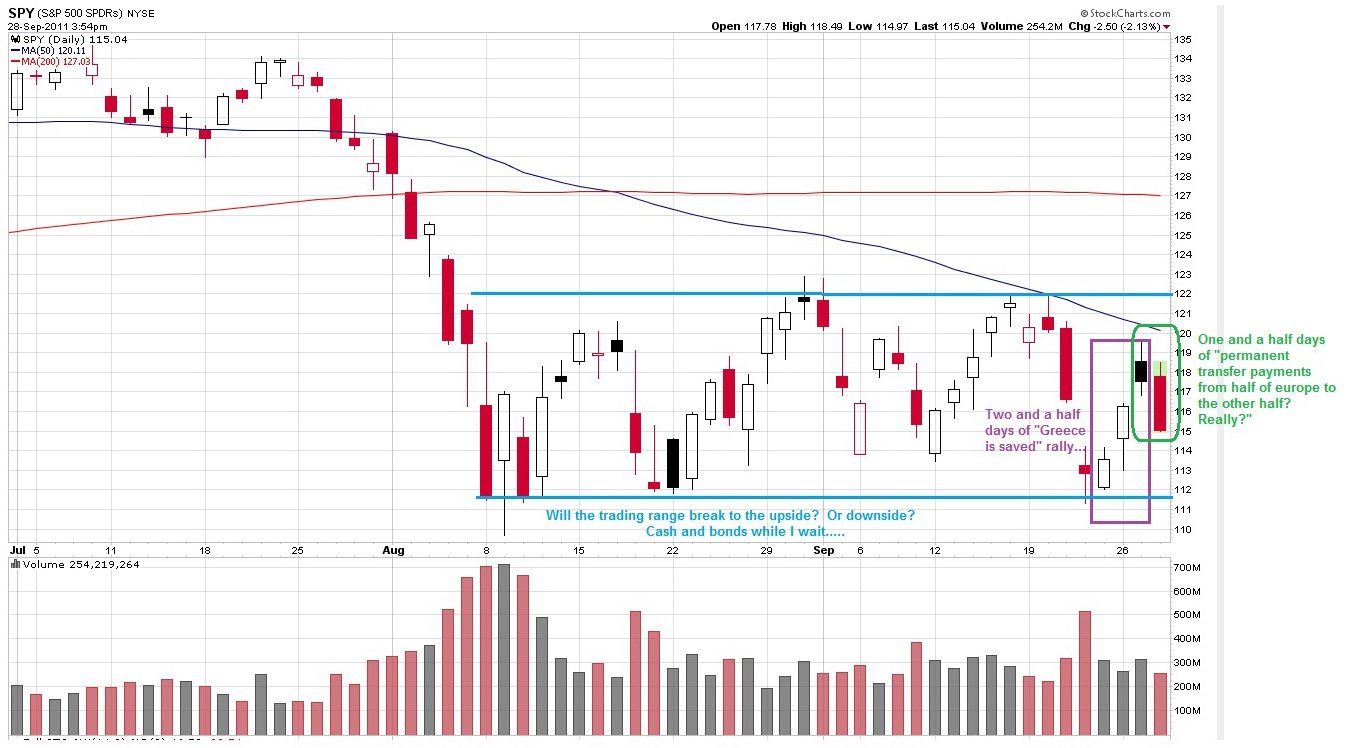

I See A Lotta Downside Risk. And Not Much Upside Risk. We're Inna Trading Range. And I'm In Cash And Bonds...

Wednesday....

Thursday...

I got nervous after I did some reading. I'm still outa stocks. But now I'm 80/20 US Gov paper vs corporate/state/muni...

Stay Tooned

Chartz And Table Zup @ www.joefacer.com

http://www.wolfgangsvault.com/link-wray ... 10921video

Coupla Guitarists Always Worth Seein'... RockaWilliam Link And John Cippolina w/his Fender/Horn Stack...

http://www.wolfgangsvault.com/concerts/ ... tTrackID=5

And Link Doin' His Own Thang....

What Part Of "Self Managed" Do People Not Understand?

"Self Managed" and "Risk Management" Is Like "Carbo-Loading"... Ya

Gotta Pay Attention To The Words....

Tues

I See A Lotta Downside Risk. And Not Much Upside Risk. We're Inna Trading Range. And I'm In Cash And Bonds...

Wednesday....

Thursday...

I got nervous after I did some reading. I'm still outa stocks. But now I'm 80/20 US Gov paper vs corporate/state/muni...

Stay Tooned

If you can't be a good example, then you'll just have to serve as a horrible warning.

-- Catherine Aird

Chartz And Table Zup @ www.joefacer.com

I got this last week from Louisiana Music Factory. SMOKIN'!!!!

http://www.amazon.com/Piano-Players-Rar ... amp;sr=1-2

Something With 'fess's music...

http://www.youtube.com/watch?v=voB6WiP83NU

http://www.ritholtz.com/blog/2011/09/u- ... -thin-ice/

http://www.ritholtz.com/blog/2011/09/th ... ies-ipods/

http://www.thereformedbroker.com/2011/0 ... n-anymore/

Care to juggle nitro glycerine?

http://www.ted.com/talks/misha_glenny_h ... ideo%29%29

http://paul.kedrosky.com/archives/2011/ ... idiot.html

http://oldprof.typepad.com/a_dash_of_in ... e-fed.html

Last week's strength had far more to do with market dynamics than it did with the news flow.

-- Rev Shark

http://thecrosspollinator.wordpress.com ... efinition/

http://www.bloomberg.com/news/2011-09-1 ... -home.html

http://nymag.com/daily/intel/2011/09/ob ... frank.html

Monday Eve...

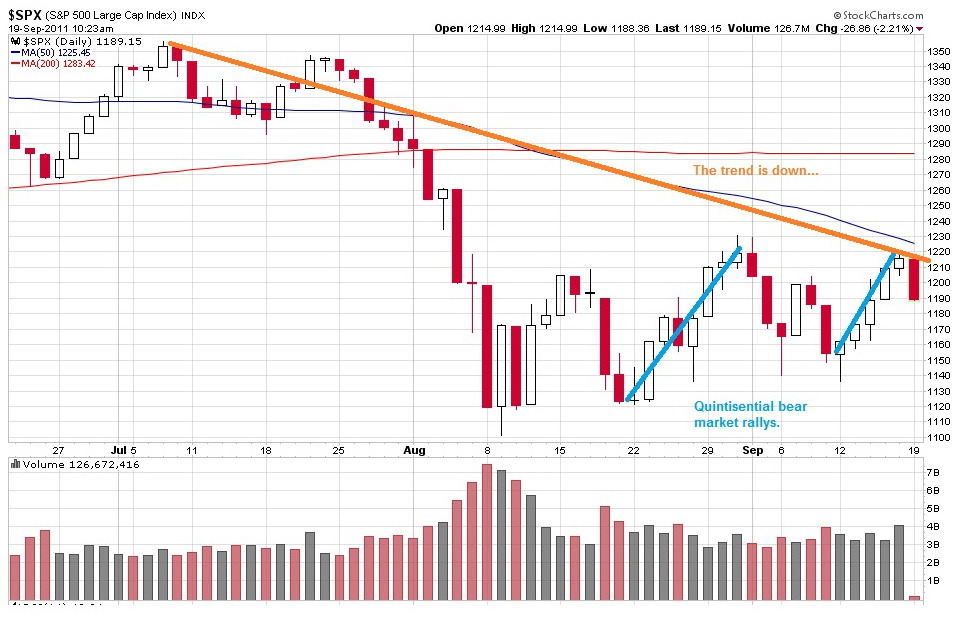

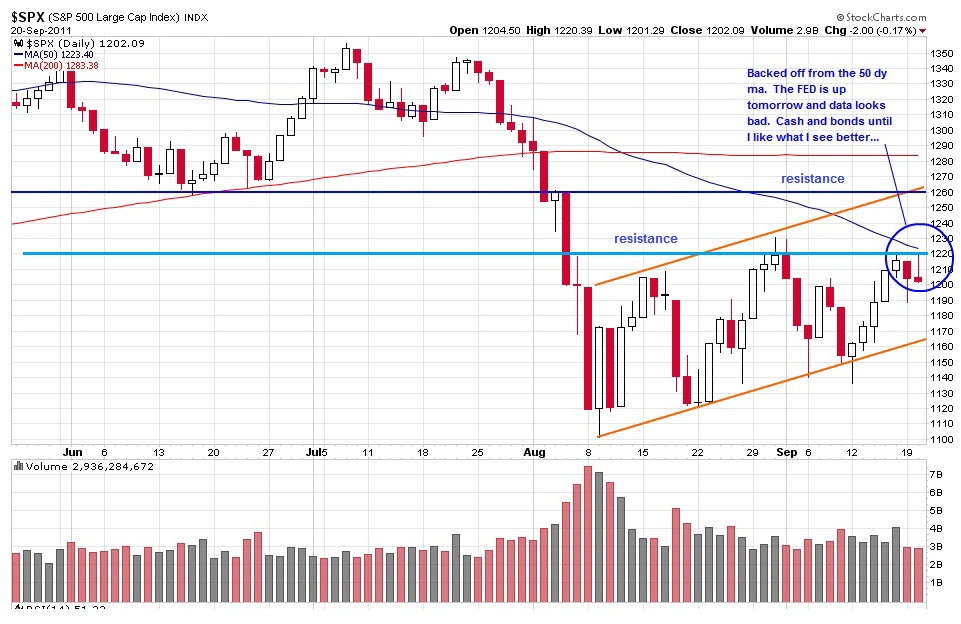

I don't like the news flow, I don't like the breadth, I don't like the macro, I don't like the unfinished business, I don't like the disconnect between Main St and Wall St. I like that bailing out in may was right, if a little early...

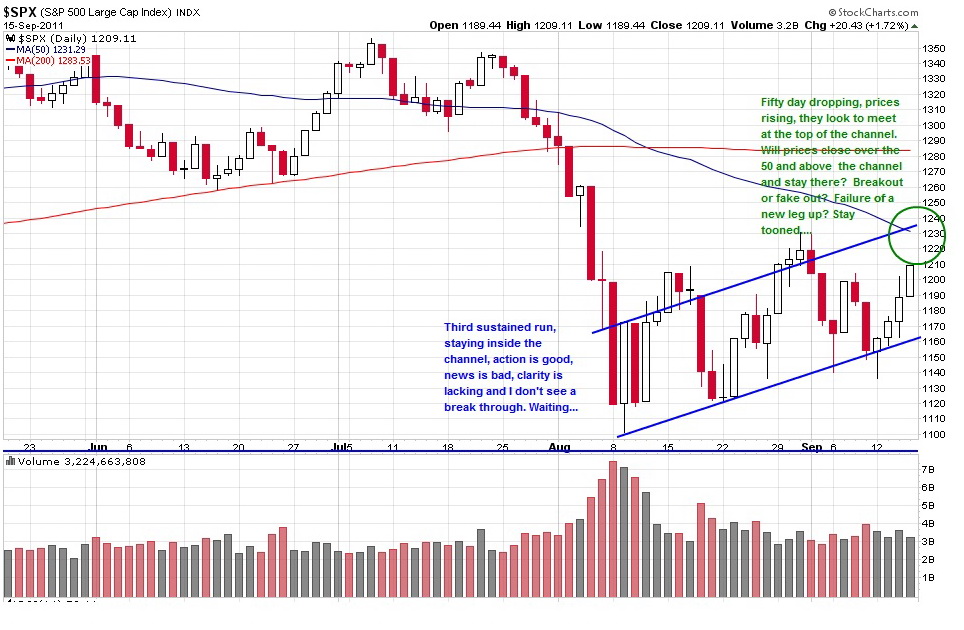

But if we get to 1230 and confirm a breakout, I'll have to figure what I don't like don't matter.....

But regardless of whether or not I end up liking it if and when it happens, I don't like it today.

http://blogmaverick.com/2011/09/19/the- ... -can-do-2/

http://www.addictinginfo.org/2011/05/18 ... not-to-do/

http://www.nytimes.com/2011/09/20/opini ... .html?_r=1

http://www.nytimes.com/2011/09/20/busin ... wanted=all

Tues

IN YO FACE, GOP!!!

http://capitalgainsandgames.com/blog/st ... onomy-fail

http://www.thereformedbroker.com/2011/0 ... -bernanke/

http://graphics8.nytimes.com/packages/p ... 090711.pdf

Wed

Rev Shark and a lotta other guys are of the opinion that if we hit the 1120 to 1105 level hard, it won't hold. The next level of support is a long way down and the drop could be breathtaking... Lotta risk right here... And I don't see the reward.

When I look at returns YTD

I feel better and better to be outa stocks. I will buy some hand over fist at some point... prolly from sellers who wished they had sold them earlier and for more money.... At the right price, almost everything makes sense for a trade. But for a 401, I wanna buy stuff when the charts go from lower left to upper right.

http://oldprof.typepad.com/a_dash_of_in ... ction.html

http://www.thereformedbroker.com/2011/0 ... t-dummies/

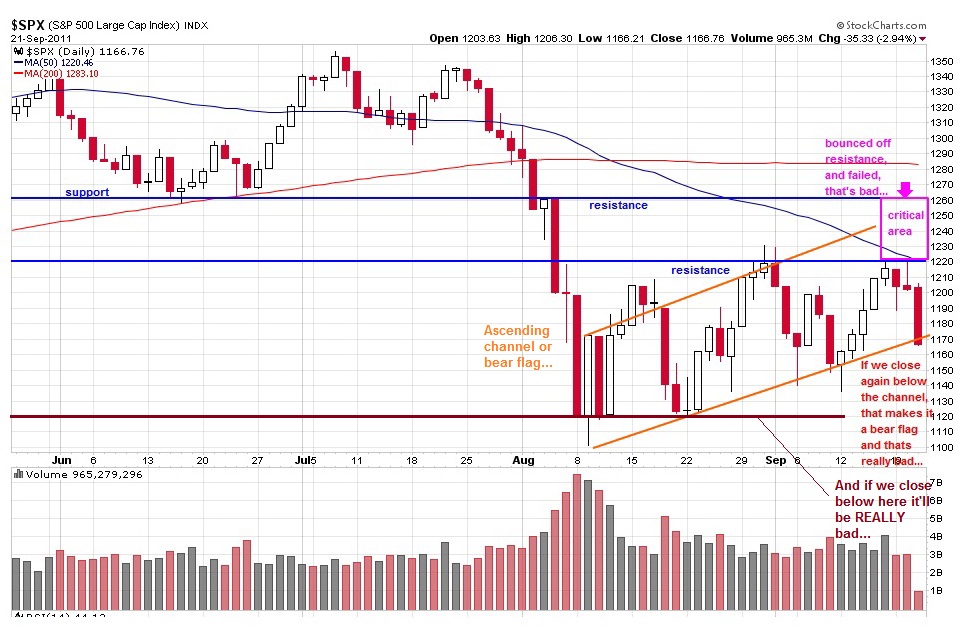

Thursday

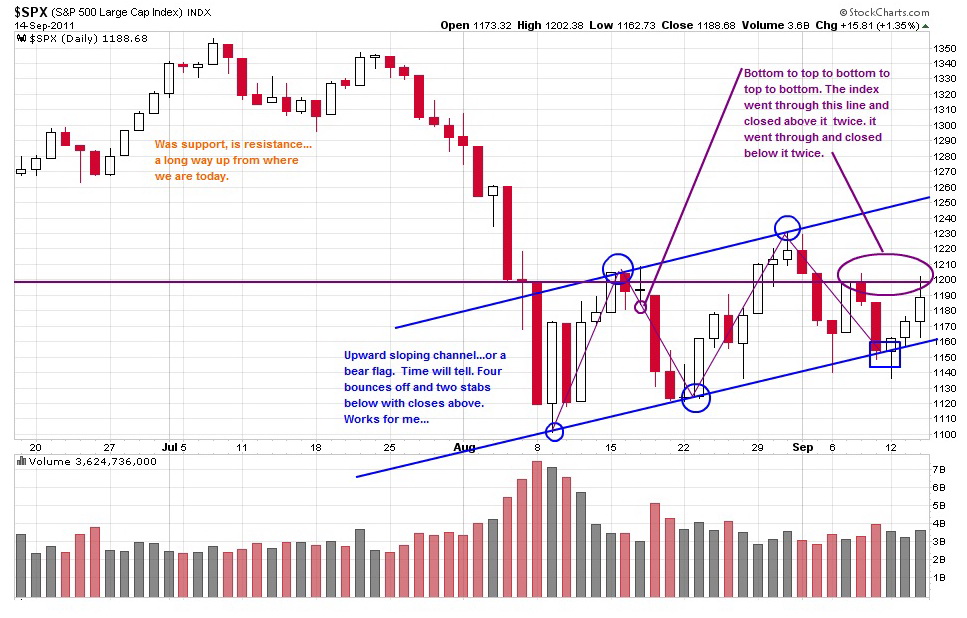

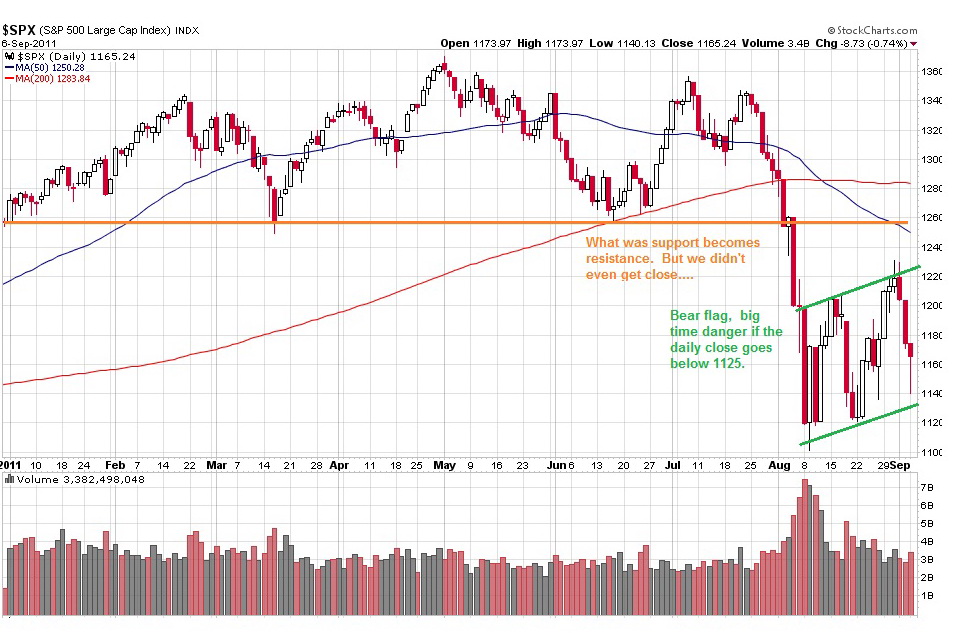

Yup, bear flag in a bear market. Same old nasty downdraft in once again in progress. There is a bottom and the bottom somewhere below.

Hang on.

Closer to buying back in than I was... startin' to begin to think about it....

Rough day. prolly not the last....

I'll be back....

Ya Get One Life. Enjoy It While Ya Got It... Rest In Sobriety And Decorum When Yer Dead. WFO Until You See God, Count Ta Two....And THEN Hit The Brakes.

"The primary objective of leadership is to help those who are doing poorly to do well and to help those who are doing well to do even better."

-- Jim Rohn

Chartz And Table Zup @ www.joefacer.com

Tanqueray Man....

http://www.wolfgangsvault.com/concerts/ ... tTrackID=1

http://www.wolfgangsvault.com/concerts/ ... tTrackID=4

Townsend was right... when he died, it took a bass player and three or four horns and a keyboard to replace him.

http://www.thereformedbroker.com/2011/0 ... consumers/

http://oldprof.typepad.com/a_dash_of_in ... -jobs.html

Bonds and cash inna 401a. Protecting what I got. There are old riders and bold riders. But there ain't no old bold riders. At least not without luck and brains and the experience to know the difference. I'm an old bold rider, and I'm parked under the overpass, waiting out the weather.

In the discussion that followed, the city officials asked a few technical questions, and Arthur Nusbaum expressed concern over a shortage of certified welders who had passed the city's structural-welding test. That would not be a problem, the representatives from the Department of Buildings replied; one of the area's most trusted steel inspectors, Neil Moreton, would have the power to test and immediately certify any welder that Citicorp's repair project required. Nusbaum recalls, "Once they said that, I knew we were O.K., because there were steamfitter welders all over the place who could do a fantastic job."

Before the city officials left, they commended LeMessurier for his courage and candor, and expressed a desire to be kept informed as the repair work progressed. Given the urgency of the situation, that was all they could reasonably do. "It wasn't a case of 'We caught you, you skunk,'" Nusbaum says. "It started with a guy who stood up and said, 'I got a problem, I made the problem, let's fix the problem.' If you're gonna kill a guy like LeMessurier, why should anybody ever talk?"

http://www.duke.edu/~hpgavin/ce131/citicorp1.htm

I pay very serious attention to Rick Bookstaber. Read "A Demon of Our Own Design" To Understand Why.

http://rick.bookstaber.com/2011/08/work ... night.html

http://www.nytimes.com/2011/09/11/techn ... .html?_r=1

http://www.nytimes.com/2011/09/07/opini ... g-but.html

http://www.economist.com/node/21528635

http://www.guardian.co.uk/commentisfree ... xes-growth

Before the city officials left, they commended LeMessurier for his courage and candor, and expressed a desire to be kept informed as the repair work progressed. Given the urgency of the situation, that was all they could reasonably do. "It wasn't a case of 'We caught you, you skunk,'" Nusbaum says. "It started with a guy who stood up and said, 'I got a problem, I made the problem, let's fix the problem.' If you're gonna kill a guy like LeMessurier, why should anybody ever talk?"

http://www.washingtonpost.com/the-magic ... print.html

http://joefahmy.com/2011/09/11/why-i-co ... o-sit-out/

http://blogs.wsj.com/marketbeat/2011/09 ... d-edition/

So far, So good....So What? STILL All Cash and Bonds and Still Feelin' Awright! About It ....

http://www.wired.com/dangerroom/2011/09 ... work/all/1

http://www.truth-out.org/goodbye-all-re ... 1314907779

http://vimeo.com/28940439

WEDNESDAY....

We closed near 1190 onna S&P today. I bailed out 150 points higher about 4 months ago. Resistance is 10 and 70 points higher. Support is 70 and 90 points lower. If that support fails, like onna bad headline plunge, next stop down could be WAY down. And have no doubt; the market is inna headline driven bear market phase. We have to write off Greece. We have to worry about Italy, Portugal, Spain, and Ireland. But see, if I knew enough to worry about Belgium, then I'd really be worried about bad headlines. We're at two and a half bounces. Two and a half.... That rings a bell and it ain't a good one.

I'm in a wait and see mode. In cash and bonds....

THURSDAY

http://www.ritholtz.com/blog/2011/09/at ... -tomorrow/

http://www.ritholtz.com/blog/2011/09/we ... nform-you/

Stay Tooned....

“You have enemies? Good. That means you've stood up for something, sometime in your life.”

--Sir Winston Churchill

Chartz And Table Zup @ www.joefacer.com

Find The Piano Player.....

http://www.youtube.com/watch?v=AzFwJq1B ... re=related

http://www.youtube.com/watch?v=SRpqgAUj ... re=related

http://www.youtube.com/watch?v=bhYyFnFP ... re=related

http://www.youtube.com/watch?v=9VZPjM2e ... re=related

http://www.youtube.com/watch?v=0wAMr3V5 ... nAy1bx4FpW

http://www.youtube.com/watch?v=9VZPjM2e ... st_related

http://www.youtube.com/watch?v=mZSR-Hsz ... playnext=1

http://www.youtube.com/watch?v=UcukJRcm ... re=related

"The market is not a sofa, it is not a place to get comfortable."

Jim Cramer

The Market Gave Four Chances To Get Out Up About 5% For The Year. That's A Ways Back Up.... Hang On. Europe Will Get Messy...

STILL Big Time Risk To The Downside....

Still All Bonds And Cash.....

http://www.ritholtz.com/blog/2011/09/wp ... ay-wealth/

http://www.ritholtz.com/blog/2011/09/wp ... ay-wealth/

http://oldprof.typepad.com/a_dash_of_in ... nment.html

http://www.calculatedriskblog.com/2011/ ... r-2nd.html

http://www.ritholtz.com/blog/2011/09/th ... s-dilemma/

http://www.ritholtz.com/blog/2011/09/ar ... ng-crisis/

TUES EVE...

Bonds and cash...

Stay Tooned.

"An imbalance between rich and poor is the oldest and most fatal ailment of all republics."

--Plutarch

Chartz And Table Zup @ www.joefacer.com

He Was In Fucking Credible in the '60s And He Was Every Bit As Good In The 70's, 80's 90s, And 00's ...

http://www.youtube.com/watch?v=rjdbXwD-xnk

http://www.youtube.com/watch?v=8LE2ccFP ... re=related

http://www.youtube.com/watch?v=WuJWAcQI ... re=related

http://www.youtube.com/watch?v=dm1PKnrm ... re=related

Google Him..... Amazing... And That's Why It's Called A "Whammy Bar".....

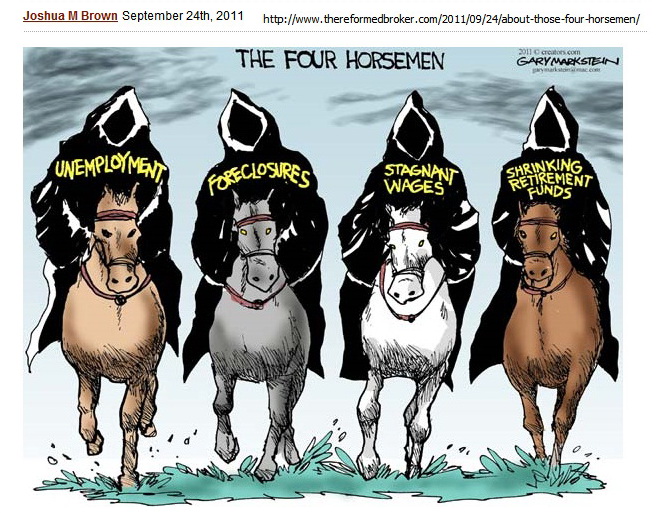

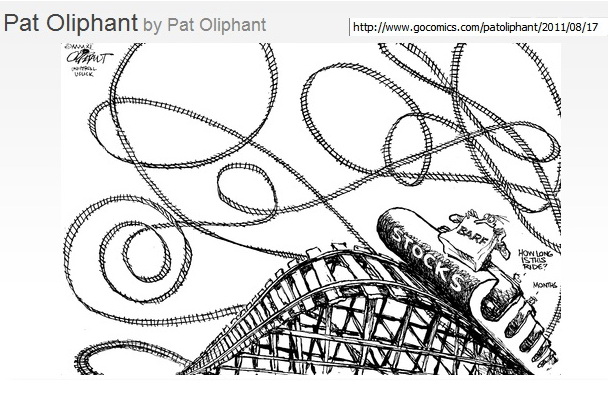

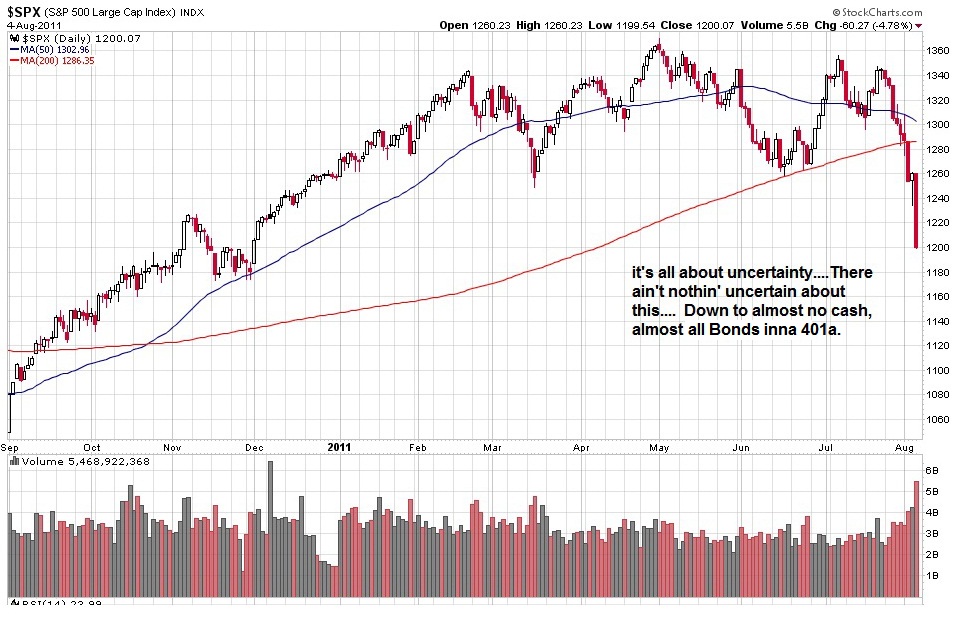

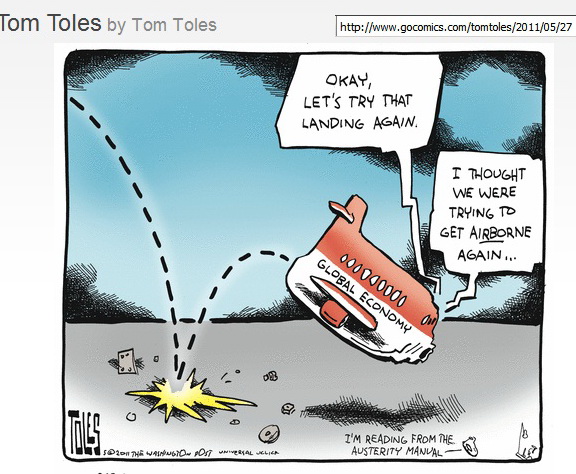

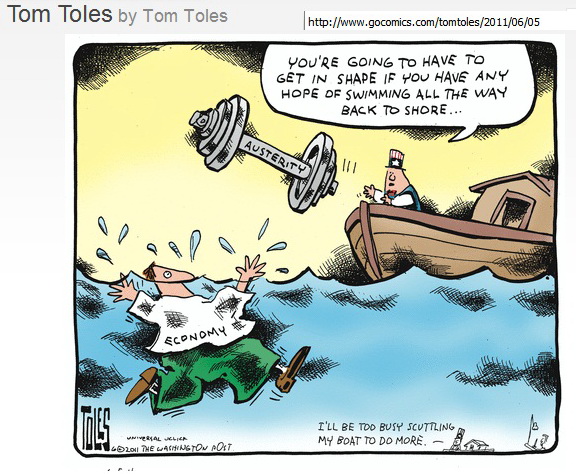

This is you life savings and pension in the current economy....

http://www.huffingtonpost.com/2011/08/2 ... lnk3|89617

http://www.ritholtz.com/blog/2011/08/su ... onal-debt/

http://www.ritholtz.com/blog/wp-content ... k-Gx62.pdf

http://www.ritholtz.com/blog/2011/08/th ... ld-part-1/

http://www.ritholtz.com/blog/2011/08/fr ... -imminent/

http://www.thereformedbroker.com/2011/0 ... valuation/

http://pragcap.com/oversold-all-timeframes

http://www.nytimes.com/2011/08/28/magaz ... 1&_r=1

Monday Evening...

Cash And Bonds For Now....

Tues...

Horrible scary shit....

http://www.ritholtz.com/blog/2011/08/ec ... recession/

http://www.zerohedge.com/news/how-econo ... yroll-numb

http://www.zerohedge.com/news/scariest- ... m-payrolls

http://www.ritholtz.com/blog/2011/08/bi ... %E2%80%9D/

http://www.thereformedbroker.com/

http://www.thereformedbroker.com/2011/0 ... ate-taxes/

Stay Tooned

There Is A Season, Turn, Turn, Turn.... The Quicker You Recognize That, The Sooner You Stop Plowing And Seeding Snow And Start Making Hay While The Sun Shines

“Being wrong and losing money: that is part of the game. Being right and not making money: that is really annoying.”

-- John Hempton,

Chartz and Table Zup @ www.joefacer.com

Find the Guitarist....

http://www.youtube.com/watch?v=TcTOoOlr ... re=related

http://www.youtube.com/watch?v=VEEfDdJyxPY

http://www.youtube.com/watch?v=Wp4BlGXwSew

Ah Ain't Always Right,

But Ah Ain't Got Mahself Confused,

Wit A Deer Inna Headlights.

-- Buck Earl

This's What Situational Awareness, Prudence, And Common Sense Yields.

I Went To Cash And Bonds In Mid-May, Back In @ 25% Stocks Onna Bounce, Back Out Onna Weakness Of The Bounce, Back in Cash And Bonds Today...

Too Much Risk For An Insanely Aggressive Ex Roadracing Sport Bike Rider.

http://www.ritholtz.com/blog/2011/08/th ... more-69145

http://www.ritholtz.com/blog/2011/08/th ... g-america/

http://www.ritholtz.com/blog/2011/08/mi ... ing-point/

I Love What The Internet Brings......

http://www.sec.gov/comments/s7-18-11/s71811-33.pdf

I Really Needed That....

http://www.stockmarketmentor.com/public/3289.cfm

http://www.ritholtz.com/blog/2011/08/ch ... ooms-both/

http://www.washingtonpost.com/smacked-b ... print.html

http://www.thereformedbroker.com/2011/0 ... the-sheep/

http://www.thereformedbroker.com/2011/0 ... ce-is-why/

Uh Oh...

http://ftalphaville.ft.com/blog/2011/08 ... hole-2010/

http://www.ritholtz.com/blog/2011/08/sw ... -pickaxes/

Stay Tooned ...

I Know There's A Lot Of People Out There Who Are Thinking, "Please Dear God, Just Let Me Break Even On My Investments. I've Worked Really Hard And I Could Really Use The Money." Seems Kinda Sad.....

"The truth will set you free, but first it will make you miserable."

--James A. Garfield

Chartz and Table Zup @ www.joefacer.com

Twelve Year Old Joe Bonamassa regularly opened for BB King and held his own with everybody. Like Robben Ford...

http://www.youtube.com/watch?v=9U1lSuEeZPQ

Then He Worked With Tom Dowd...You Couldn't Find A Better Mentor....It Turned Out ALL Right.....

http://www.youtube.com/watch?v=W_9KPUBxd-o

He Tours And Plays About 200 Days A Year. It Shows...

http://www.youtube.com/watch?v=IoG5zSj4 ... re=related

http://www.youtube.com/watch?v=oHGEX8Aa ... re=related

Speaking of A Churnin' Urn Of Burning Funk....

Dylan Goes Postal... And Well He Should.

http://www.ritholtz.com/blog/2011/08/ra ... -congress/

http://www.ritholtz.com/blog/2011/08/im ... about-you/

You Have Bigger Problems Than You Think.....

"Global Economic Downturn: A Crisis of Political Economy is republished with permission of STRATFOR."

http://www.stratfor.com/weekly/20110808 ... al-economy

http://www.ritholtz.com/blog/2011/08/th ... e-endgame/

Very Interesting.....

http://www.ritholtz.com/blog/2011/08/cu ... or-idiots/

http://abnormalreturns.com/swensen-on-t ... -industry/

http://www.thereformedbroker.com/2011/0 ... mr-market/

http://abnormalreturns.com/swensen-on-t ... -industry/

http://pragcap.com/putting-the-correcti ... erspective

http://ftalphaville.ft.com/blog/2011/08 ... quivalent/

http://www.washingtonpost.com/business/ ... ss_economy

http://pragcap.com/3-smart-bears

http://www.theglobeandmail.com/news/wor ... rom=sec431

http://www.washingtonpost.com/opinions/ ... print.html

http://www.ritholtz.com/blog/2011/08/qo ... ate-lobby/

http://nihoncassandra.blogspot.com/2011 ... lshit.html

OUCH!!!!! MY BRAIN....

http://www.bloomberg.com/news/2011-08-1 ... -weil.html

TUES>>>

http://jeffmatthewsisnotmakingthisup.bl ... tting.html

http://www.latimes.com/news/opinion/com ... 3976.story

http://blogs.telegraph.co.uk/news/peter ... he-bottom/

Wednesday...

Obama's in over his head. Perry's pretty clueless too. But I do love what the internet brings us every day....

http://www.ritholtz.com/blog/2011/08/the-texas-miracle/

http://www.scribd.com/doc/61684192/Rick ... Transcript

Thurs....

http://worldblog.msnbc.msn.com/_news/20 ... to-show-up

Stay Tooned

It Looks Like The Next 5 Years Are Going To Be The "Interesting Times" Of The Old Chinese/Jewish/American Saying..... Google It....

It's all fun and games until someone gets hurt.

-- Mom

Chartz And Table Zup @ www.joefacer.com

J Tull started out as a blues band and quickly evolved into Ian Anderson's vision of an rock ensemble. I've always liked Tull, but the early version with so much raw talent and different directions was never equaled.

http://www.wolfgangsvault.com/jethro-tu ... 66284.html

http://www.wolfgangsvault.com/jethro-tu ... 91320.html

http://www.wolfgangsvault.com/jethro-tu ... 83290.html

http://www.performing-musician.com/pm/s ... bunker.htm

Bonds... Check out my website.... Asset allocation will save yer ass at times like this....

I've spent some time corresponding with Dan Fitzpatrick and this is an excellent example of his work. I'm not a regular follower of his service but he's got a lot worth listening to...

http://www.stockmarketmentor.com/public/3264.cfm

So, if the Fed, which doesn’t issue credit and can print money, can be downgraded because it holds AA+ debt, then why and how in hell can the ECB, which holds hundreds of billions of euros of the junk debt of Greece and Ireland and insolvent banks not be downgraded on Monday? And the Bank of Japan? REALLY? What are these guys smoking? Do we now downgrade GNMA? Of course. And the FDIC? What the hell will repos do on market open? The NY Fed says it won’t affect anything. Don’t ask me, I just work here. And how can you rate France AAA? And still give AA or more to Italy when the market is saying they are getting close to junk?

http://www.ritholtz.com/blog/2011/08/th ... than-ever/

http://www.thereformedbroker.com/2011/0 ... e-curtain/

It's all fun and games until someone gets hurt.

-- Mom

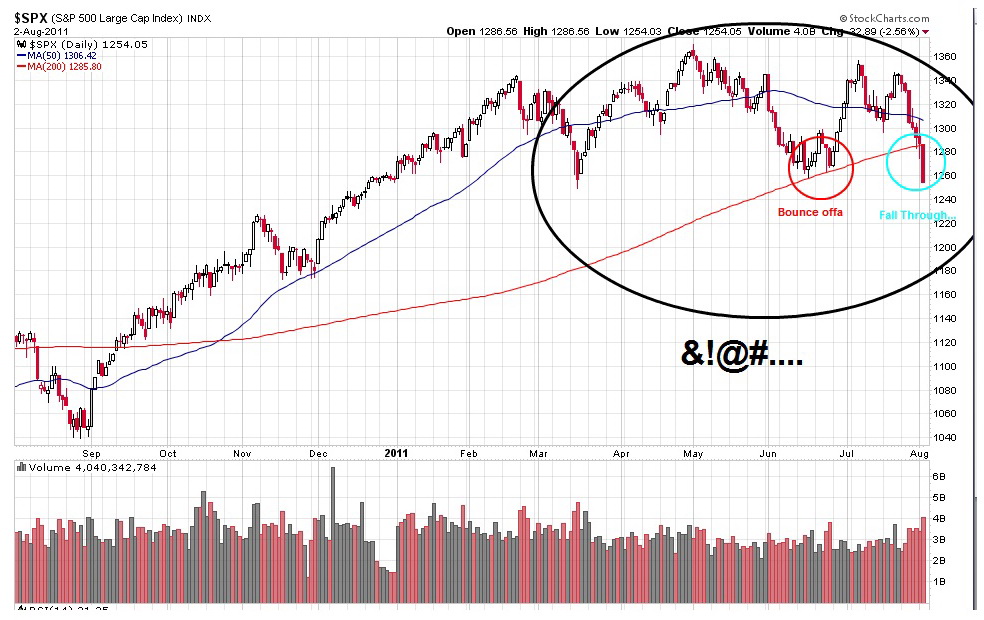

Horrible lookin' returns and chartz. I was all cash in mid May and I'm all bonds now.

I fear almost nothing, but I have a lot of respect for things that are dangerous. When handling guns, riding motorcycles fast, doing heavy rigging way up inna steel, or investing my life savings, fear has no place. Fear eats away at rationality and decision making and the ability to act. Respect the hazards and own the responsibility to do the right thing at the right time because it needs to be done, not because you are afraid.

http://www.thereformedbroker.com/2011/0 ... -a-sudden/

Monday Eve

I Have This List...

...it's of stocks that I've looked at/wanted to track/ held/was gonna get around to eventually/ added and forgot about. I called up the list and today's action this eve to scope out how the day was.

DAMN!!! God help anyone still in the market.....

There's a bottom here someplace. It may be a way's away, it may be only an interim bottom and it may be good for only a short bounce. But stocks can only go to zero and we've come a long way in a short time. So there is the immediate short term relief of the cessation of falling in the near future. Unfortunately coincident to this is the sensation of augering into the ground. Then is the time to do something. That's why I went first to cash and then to bonds

http://www.ritholtz.com/blog/2011/08/on ... f-america/

http://www.ritholtz.com/blog/2011/08/ma ... r-are-you/

TUES

http://www.thereformedbroker.com/2011/0 ... mes-first/

http://www.thereformedbroker.com/2011/08/09/wet-n-wild/

http://www.thereformedbroker.com/2011/0 ... sh-legacy/

http://www.msnbc.msn.com/id/31510813/#44080879

WED EVE...

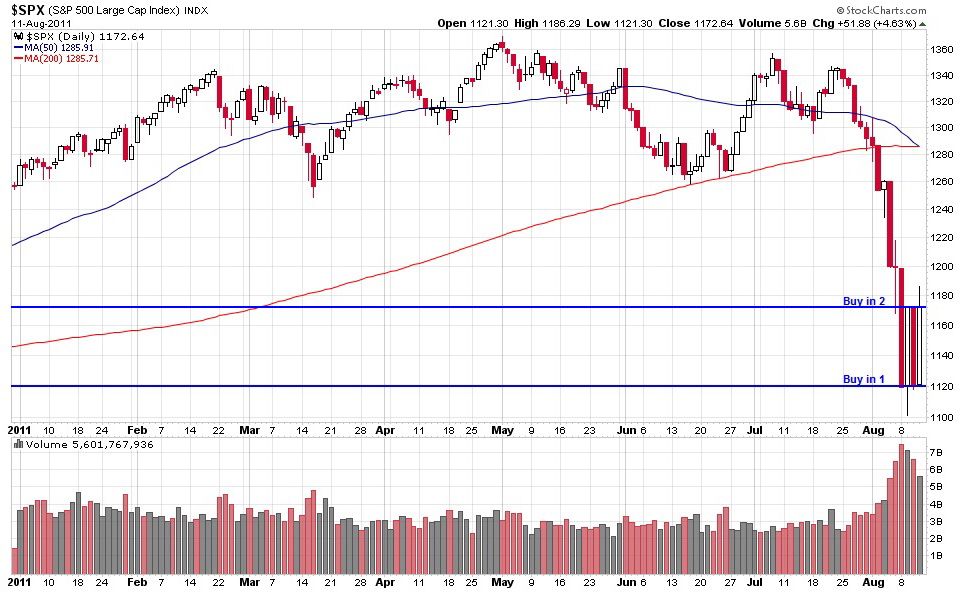

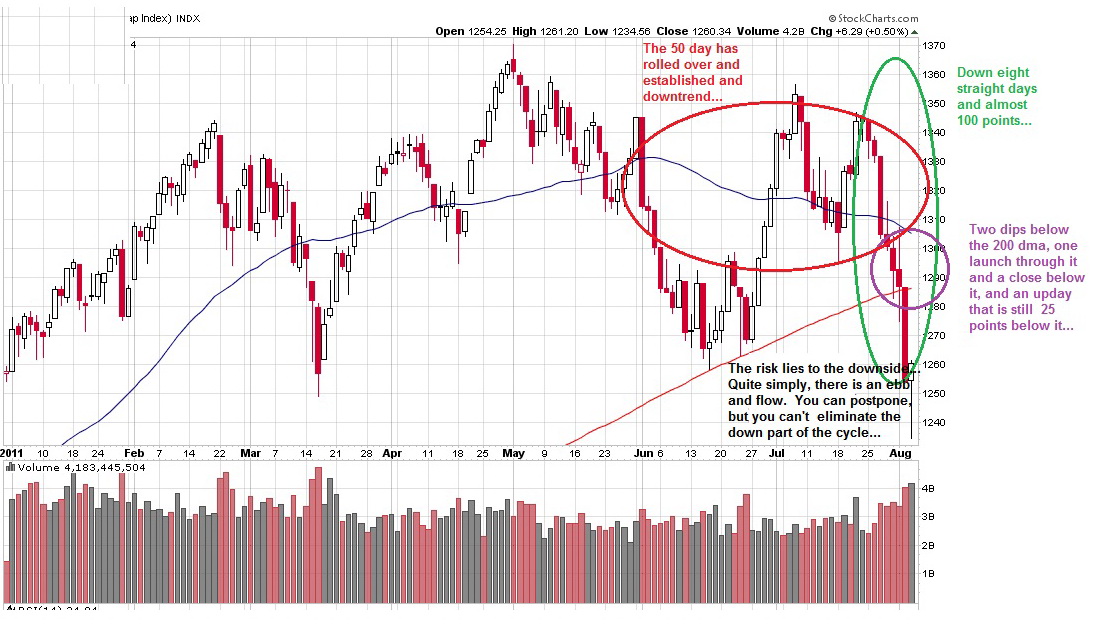

We crashed Monday, Had an intense rally in the last hour of Tuesday, Crashed again Wednesday, And I put 15% of my all cash position back to work in 4 Funds this afternoon. it's an incremental buy at a price a damn site cheaper than back in May when I cleared outa stocks. That's how it is done...

I'll buy more mutual funds inna 401, but I mostly like to buy charts that go from lower left to upper right ala Dennis Gartman.

http://online.wsj.com/article/SB1000142 ... 34052.html

THURS.....

Threw few more dollars at the 401a. I'm up to 25% stocks inna 401. I'm a little nervous about today's buy and I'm ready to stop there or retrench back into bonds/cash depending. The markets are going crazy; Lookit the action for the last four days vs any one day during a non crash day. INSANE.

But if we all don't end up living in lean to's and driving around in Road Warrior vehicles, I'll look back at today's buy as a smart move. I'm just concerned that future buy ins may be a lot smarter. Or may be not....

The Original; Howard Hangs It Out.

http://www.google.com/search?q=i'm ... en___US371

Dylan Goes Postal... And Well He Should.

http://www.ritholtz.com/blog/2011/08/ra ... -congress/

http://www.ritholtz.com/blog/2011/08/im ... about-you/

Stay Tooned.....

"More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly."

-- Woody Allen

Luckily, We Got Congress To Choose our Path For Us As Our Elected Representatives. I'm So Impressed I Could Just Shit.

Chartz and Table Zup @ www.joefacer.com

McKinley...

http://www.wolfgangsvault.com/muddy-wat ... 00374.html

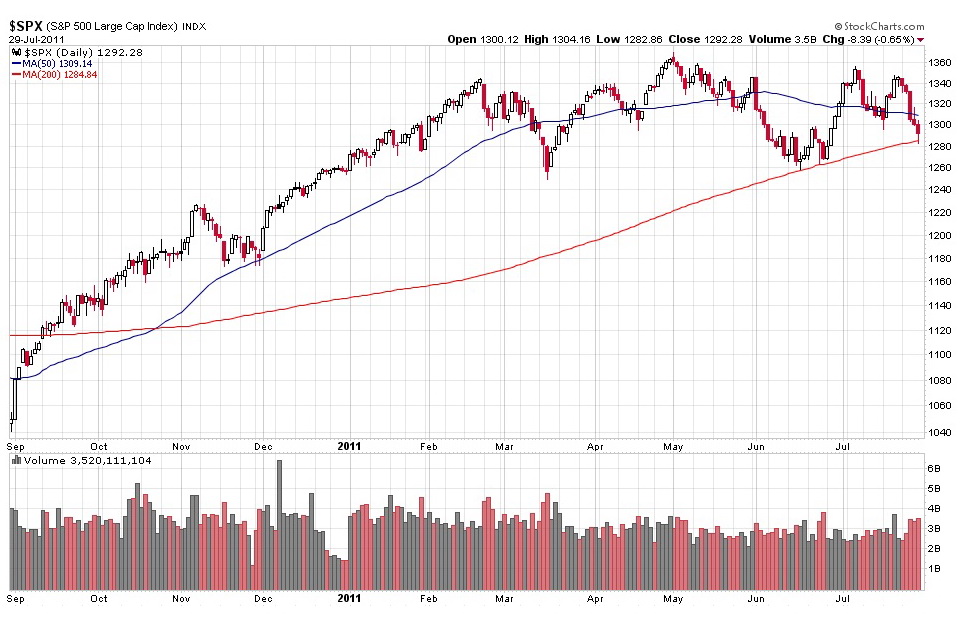

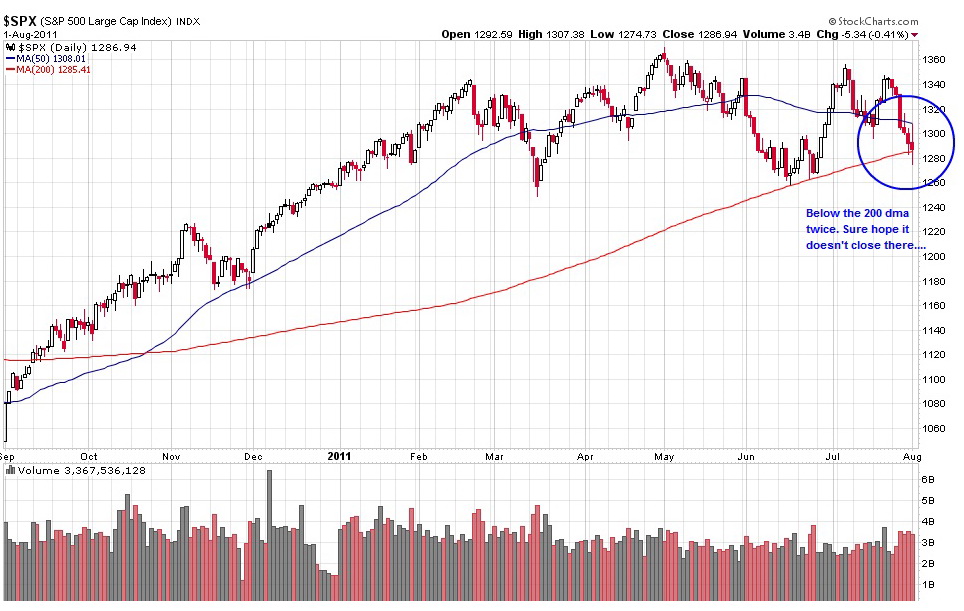

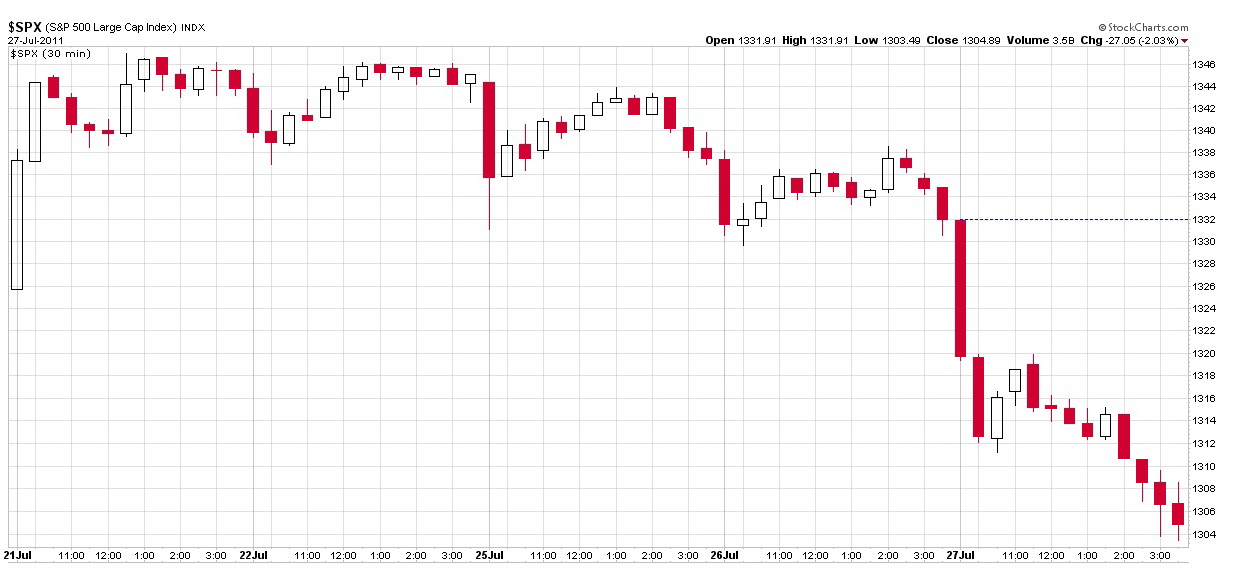

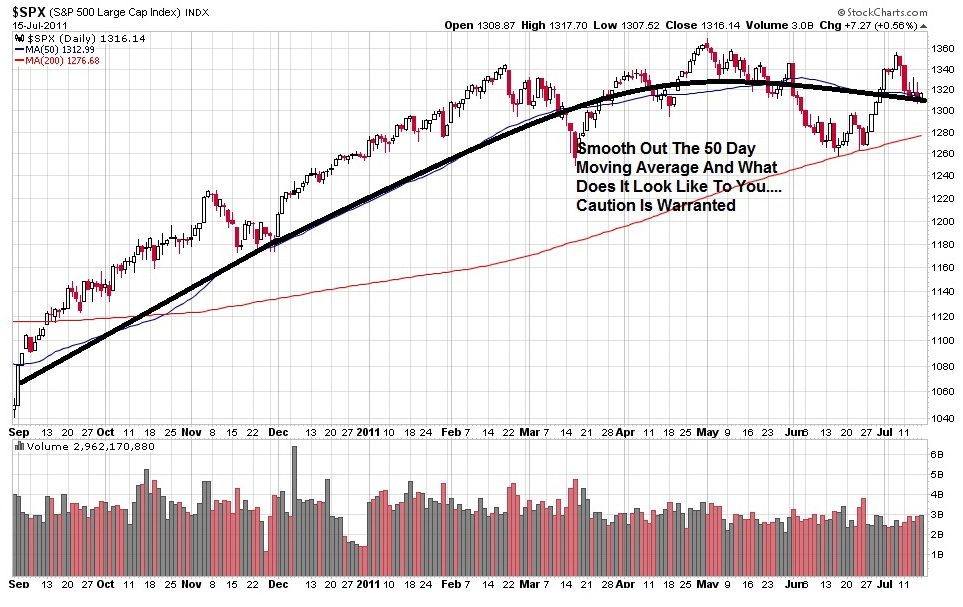

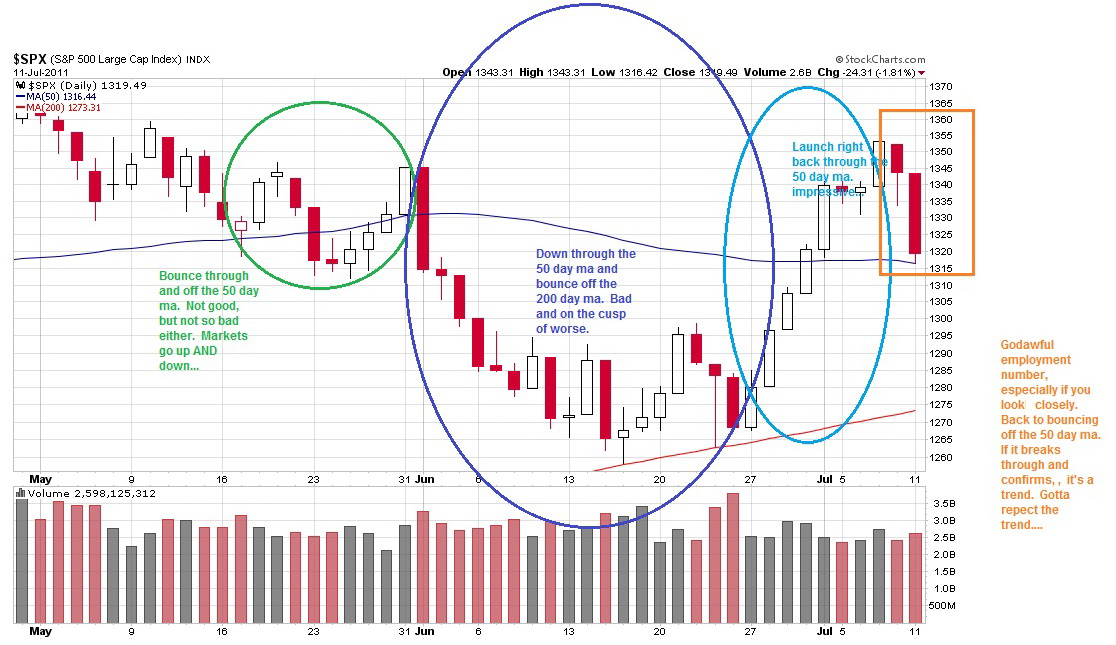

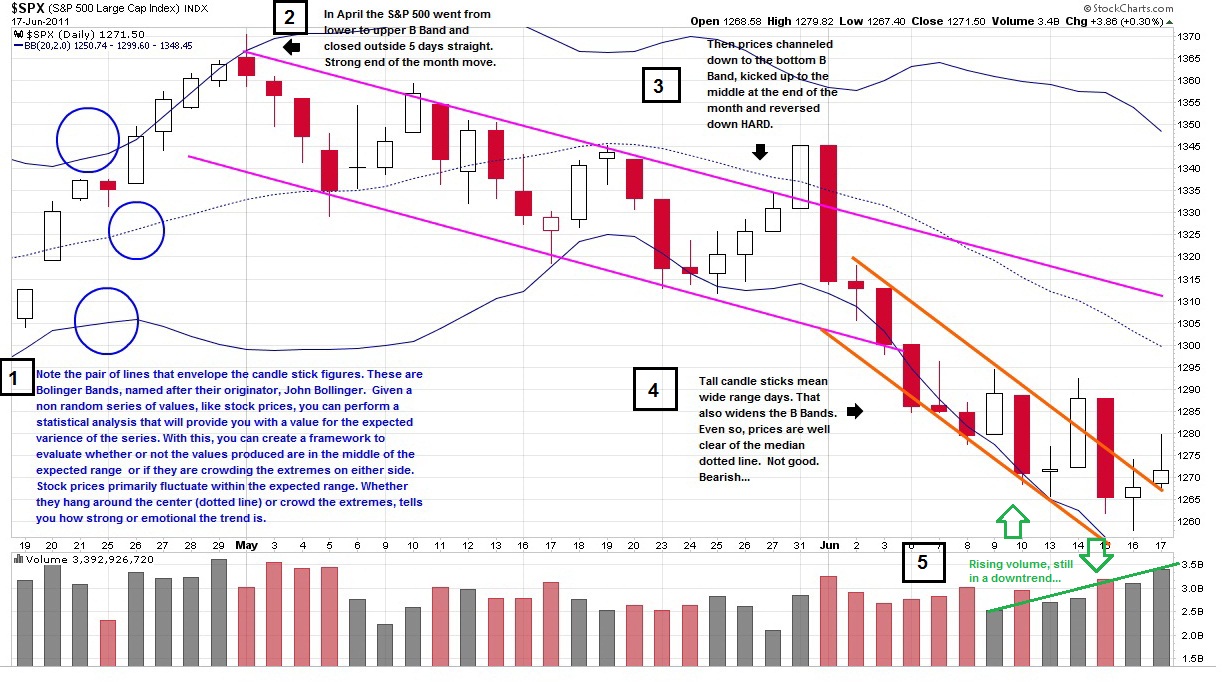

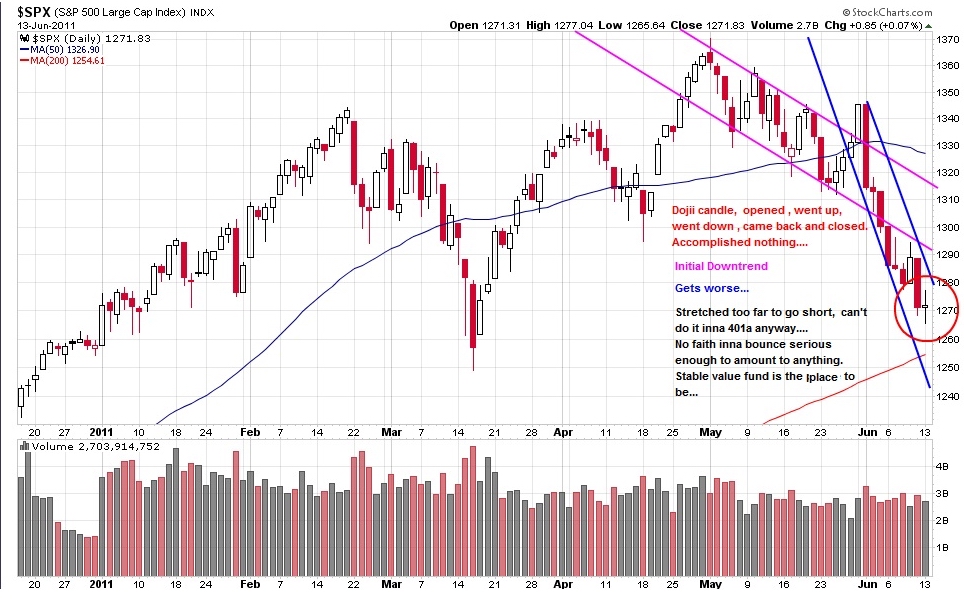

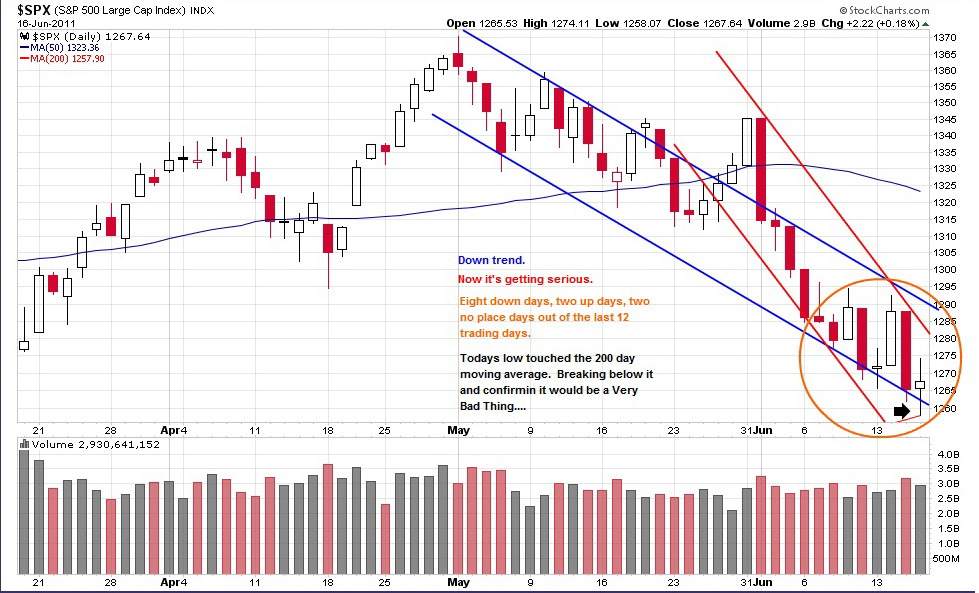

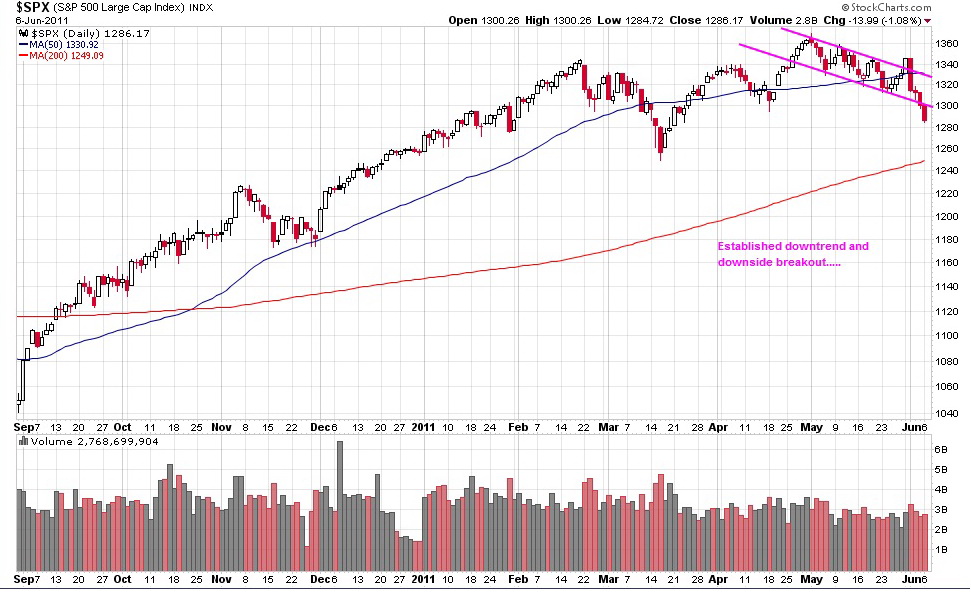

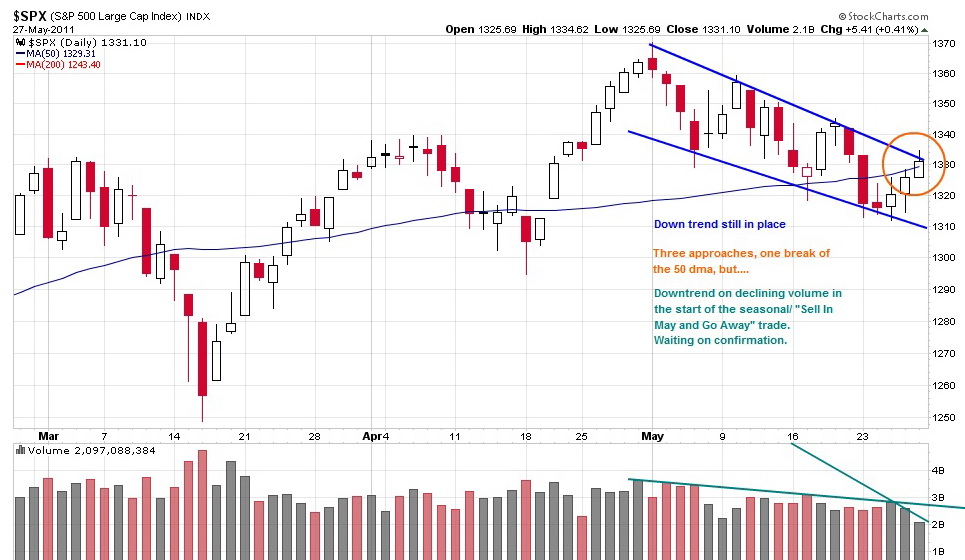

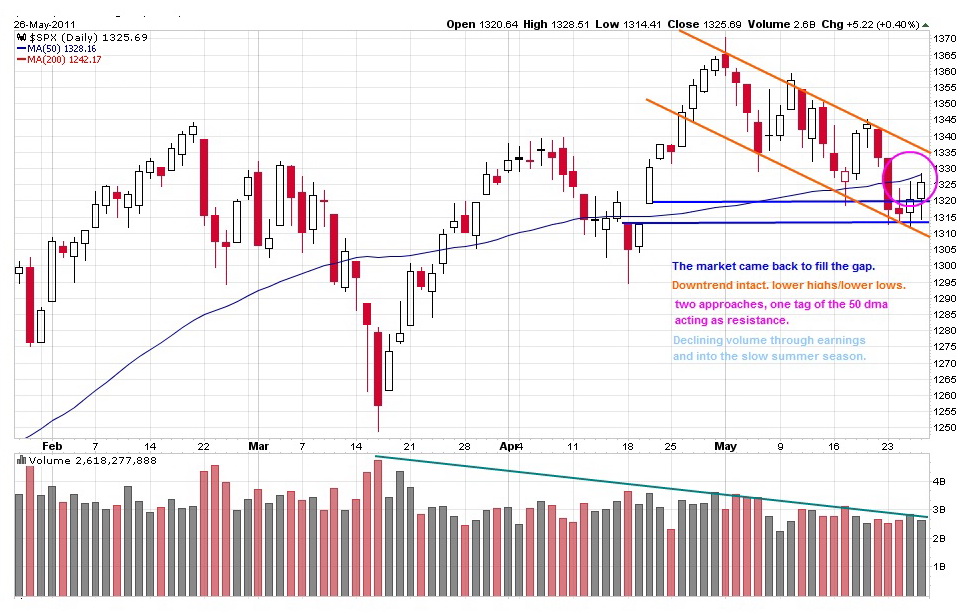

I could draw lines and write stuff and do circles and arrows and numbers and levels and Bollinger Bands and andandand. But, look at the the chart and note the topping, the red bars becoming pre dominant and taller since June, the candlesticks bouncing off the 200 day ma again and the 200 day ma approaching the 50 day ma, the 50 day starting to roll over, declining tops, and the whole ragged last five months. It sez," Caution is the better part of valor....

Bonds and cash....

http://www.stratfor.com/analysis/201107 ... ly-germany

http://www.ritholtz.com/blog/2011/07/an ... all-speed/

http://www.washingtonpost.com/business/ ... story.html

http://www.calculatedriskblog.com/2011/ ... paign=Feed

http://www.thereformedbroker.com/2011/07/31/traitors/

TUESDAY!!!!!

WED...

Thursday

Stay tooned....

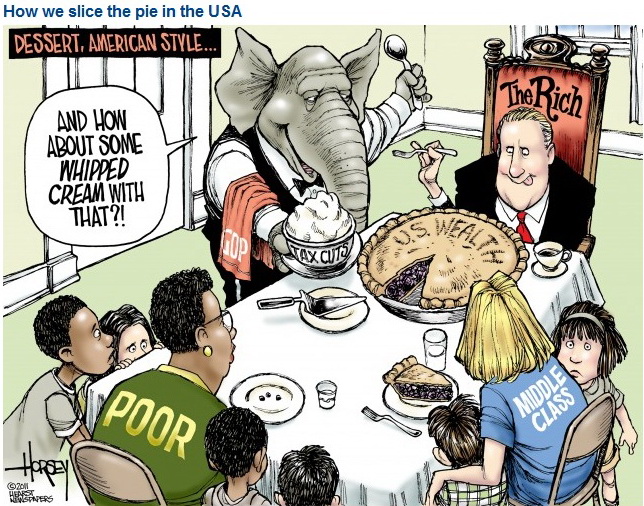

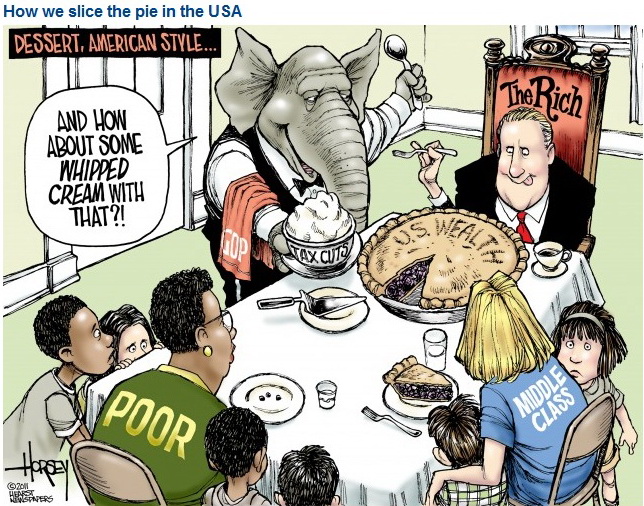

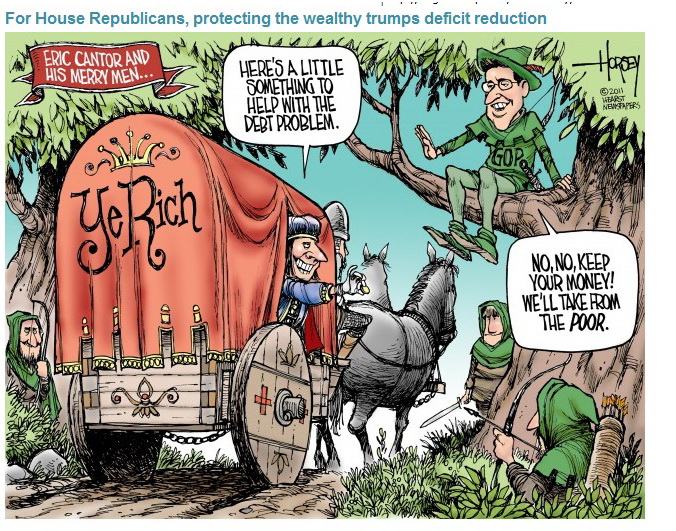

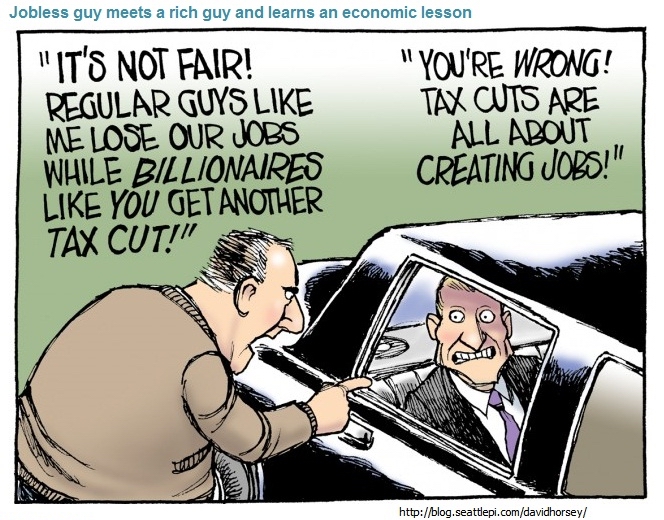

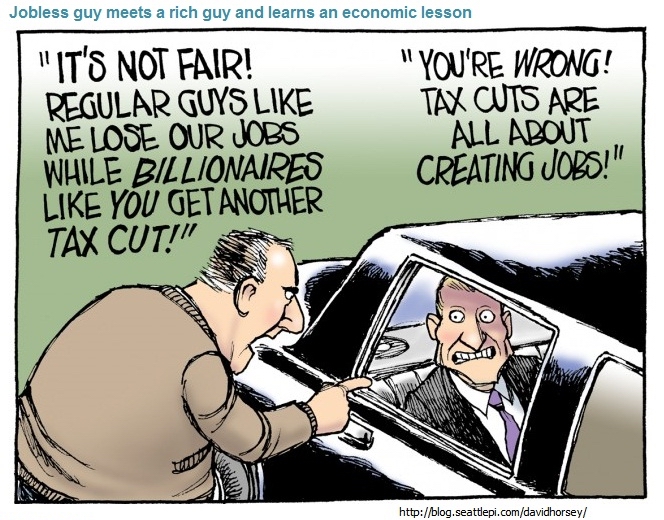

Despite all of the talk about Democratization of investing, Wall Street primarily serves only the very wealthiest Americans. And that is a shame.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

BUTTERFIELD!!!!!

http://www.youtube.com/watch?v=6j9iNV_e ... re=related

http://www.youtube.com/watch?v=Nqa6tMwv ... re=related

And MOTOGP!!!!!!

http://www.superbikeplanet.com/2011/Jul/110713m1s.htm

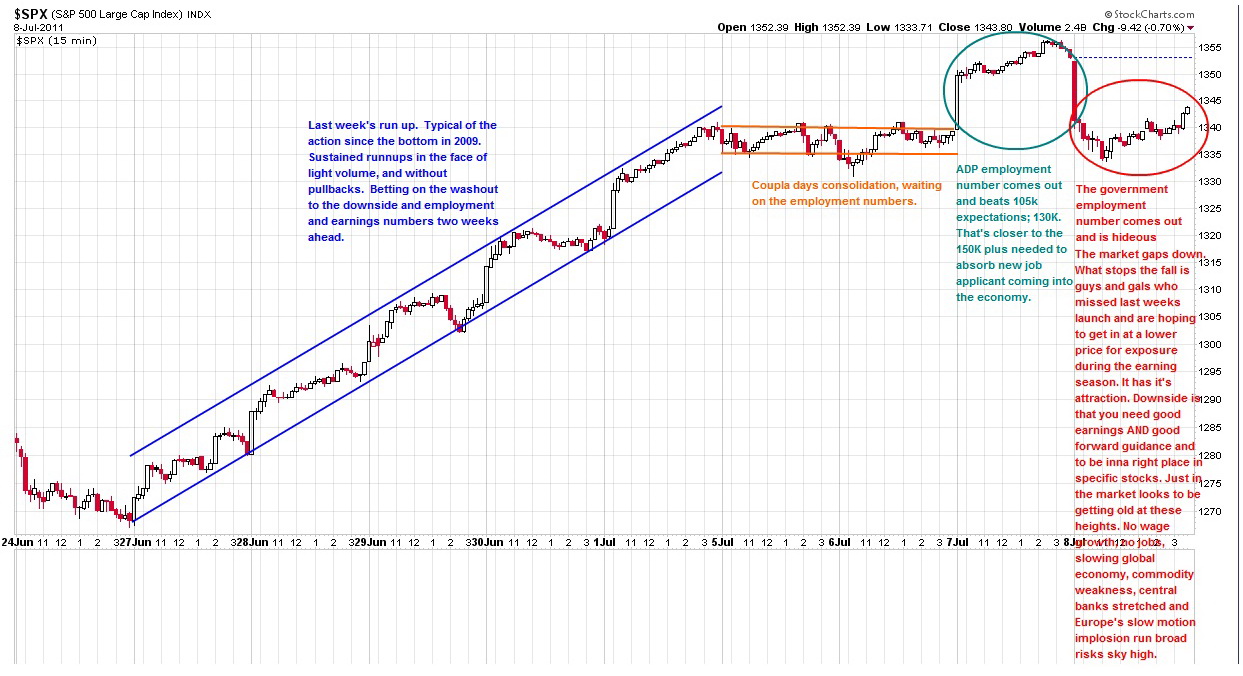

Kickin' Ass in my trading account. I can go where the action is. And it is up high and in the corners. Cash and bonds inna 401a. The markets are squirrely, the economy is crashing after too long on stiimulus, and none on the horizon, and you make money when the risk/reward works for you. That ain't everyplace and all the time.

Waiting for clarity....

Wed Eve....

Clarity.... Seems clear to me....

Stay Tooned....

I Listened To An Ex Senator Alan Simpson Interview On The Bi Partisan Deficit Report....Horrifying...I Think It Is Fixable. I'm Not Sure It Will Be....

Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

— Michael Crichton

Chartz and Table Zup @ www.joefacer.com.

It Starts Like This;

http://www.youtube.com/watch?v=WLB900at ... r_embedded

And Pretty Soon It Gets To This;

http://www.youtube.com/watch?v=Gn09Xn9J ... re=related

http://www.ritholtz.com/blog/2011/07/cl ... n-economy/

http://www.nytimes.com/2011/07/20/opini ... .html?_r=1

http://mobile.theonion.com/articles/con ... obile=true

Stay Tooned....

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

We're All Showin' The Mileage.... But There's Young Guys Inna Wings.

http://www.youtube.com/watch?v=hvNUTqDJ ... re=related

http://www.youtube.com/watch?v=z7vZ6b6j ... re=related

http://www.johnmauldin.com/frontlinethoughts/

http://finance.yahoo.com/blogs/breakout ... 24592.html

Moving over to some funds to bonds. The stock market has been big time decoupled from main street for a coupla years. Profits and prices have been up but I'm feelin' that the risk is to the down side, secularly, seasonally and cyclically. my aggressiveness is sated by what I'm doin' in my trading account and IRA's. I'm too old not to have come to appreciate discretion as the better part of valor when I suspect I may end up pissing into the wind. Let things clarify.....

MONDAY EVE...

Bonds and cash....'Nuff Said.

TUES EVE

The S&P closed below the 50 Day MA. Now let's see if it is confirmed....

http://www.ritholtz.com/blog/2011/07/us ... hijackers/

Thurs Eve...

This could get bad. Not necessarily, .... but the possibility exists.

Stay Tooned...

Death Is Nature's Way Of Telling You To Slow Down. Kinda The Ultimate Excuse. Until Then, No Excuses....

"In theory, there is no difference between practice and theory. In practice, there is."

-- Yogi Berra

Chartz and Table Zup @ www.joefacer.com

Taj and Keef do my two favorite versions of Leaving Trunk. Here's both of them. if only video had been around when Keef's band did Born To Die.... What do Ian Cruikshank and Spit James have in common?

http://www.youtube.com/watch?v=56SHlnUr ... re=related

http://www.youtube.com/watch?v=GIzSy8Ln ... re=related

An' a little Taj Mahal channelin' Howlin' Wolf.......

http://www.youtube.com/watch?v=GyP07ybz ... re=related

An a little Keef Hartley and Spit James....

http://www.youtube.com/watch?v=m6SQ1A0k ... re=related

OUCH!!! OUCH!!! OUCH!!!! Smokin' week inna market. And I was All Cash. It stings, but it still may have been the responsible thing to do. Stay tooned and I'll explain why.....

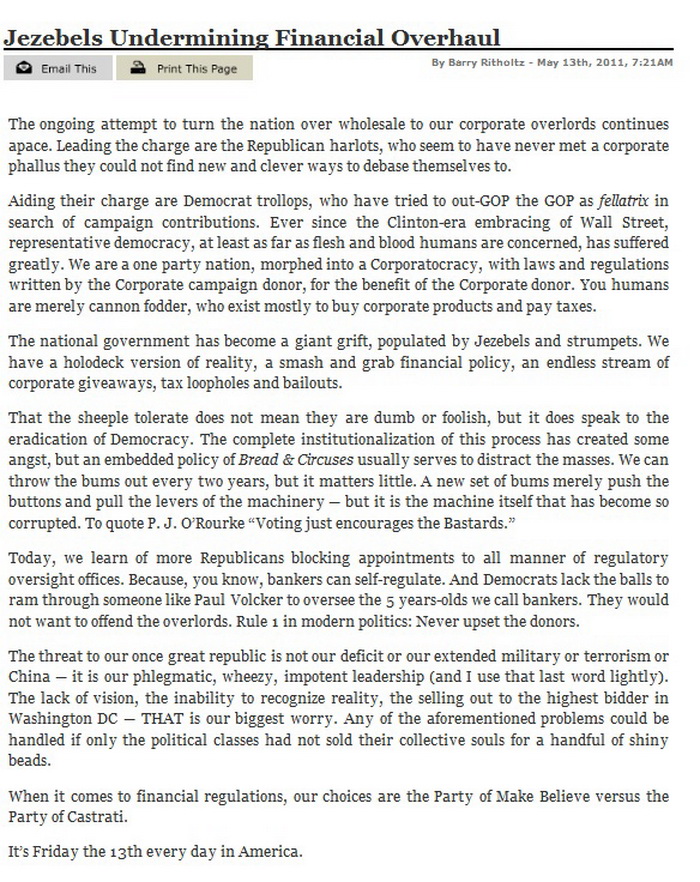

I got out at 1 because the economy sucked, the Fed was through stuffing the bank vaults with cash, ya can't buy houses if yer unemployed, the banks make safer money buying treasuries than loaning money for interest, Greeks were getting their Visa card limits raised so as to borrow to make the monthly, China inflation and GDP was running into a slowing world economy, and the first glimpse of the next recession is occurring with 9% to 17% unemployment today ,depending on what yer smokin'.

It looked as expected at 2 & 3 & 4.

At 5, with everyone leaning the same way after 4 down weeks, the paint the tape game started early because of the end the quarter. Once the buyers lit up the tape, the scramble to get outa shorts and inta longs got frantic. the only red that week was end of the days locking in profits and after lunch onna 30th locking in profits.

So.... Tuesday. A lotta guys show up having missed the run up and waiting on earnings inna week or two. Do they (I) buy at the highs? Or do they say, "Aw RIGHT!!! A chance to unload at the prices I missed last month ...SELL EVERYTHING!! Is the stock market saying "Everything is better, we washed out the timid and it's UP, UP, AN' AWAY. Or is it saying " We brutalized the cautious, now let's break the foolhardy.

See, I just don't see how much has changed inna last month. Greece is patched over, but the German public is less and less sure about floatin' the rest of the EZ. The economy? Wall Street vs Main St? A recession on the horizon? QE3? Do i see the way home?

Dunno. But discipline trumps conviction. Price is truth and in my IRAs and trading account, I'm long and undiversified and even margined in the trading account. I can do what I wanna, when I wanna, All in long to all out in the click of an iphone. Last week was good But that is not the way it is with my 401a. There are rules and restrictions on what, when, and how often. I gotta move deliberately, like moving a building down the street, not a car.

This is the other side of a Bull Market, when I'll go 100% long the most aggressive funds and ride undiversified through the dips and hiccups. The down days or weeks 'll be nothing another few days or weeks of up won't fix.

This is a Secular Bear Market where the news is bad, sell offs are relentless and the updrafts are absolutely vicious. I gotta deal with missing the ups as the price of missing the downs. I'm in cash now and I expect to be in cash until I see a reason not to be...

http://www.msnbc.msn.com/id/43633233/ns ... _business/

http://oldprof.typepad.com/a_dash_of_in ... other.html

The blast back to recent highs left a lot of investors on the outside lookin' in. That is a ready made cabal of dip buyers. The market can work off the overbought condition by going down and letting the left out in all at once at a lower price, or it can chop around and let the left out in a few at a time, correcting in time instead of price.

Or it can run head on into a a horrible jobs report or a Italy/Spain EU conflagration and undo the last week's launch upward all a once and continue down through the 200 day moving average.

Standing by in cash. I missed 80 points in 5 days, I ain't gonna chase it if I don't have any idea where it is going.... The market is going to be open tomorrow, next week, next month and next year too. I'm going to wait to commit until I have some clarity...

http://www.thestreet.com/story/11174104 ... ivity.html

Stay tooned.

"If things go wrong, don't go with them."

--Roger Babson

Chartz and Table Zup @ www.joefacer.com

So much Talent, So much of a Tragedy...Jaco, one from the darker late days,two from when it was all about his present and the bright future, and one of my favorite tribute songs, called "Jaco". Check out "Mr Fats" on the Brubeck "Tritonis" LP to hear how much Jaco influenced contemporary bassists and those to follow....

http://www.youtube.com/watch?v=lwhkPSEX ... re=related

http://www.youtube.com/watch?v=pqashW66 ... re=related

http://www.youtube.com/watch?v=I63bOi47 ... re=related

http://www.youtube.com/watch?v=1qo4RC1Qd2w

Lotta Watchin' Not Much Participation.

Stay The Course......As Long As It Is Working.

Turn Onna Dime.........When It Is The Right Thing To Do.

http://www.ritholtz.com/blog/2011/06/mo ... tion-rate/

http://www.bloomberg.com/news/2011-06-2 ... rowth.html

http://www.bloomberg.com/news/2011-06-2 ... looms.html

http://www.bloomberg.com/video/71458358/

http://thestar.blogs.com/davidolive/201 ... risis.html

http://www.ritholtz.com/blog/2011/06/mo ... d-madness/

Stay Tooned.

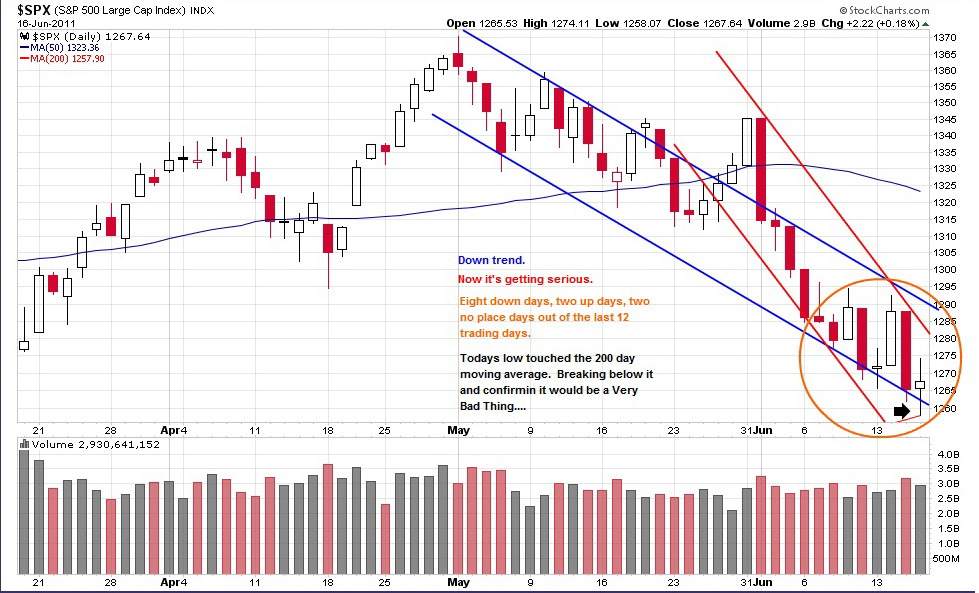

We're Not As Far Down As We Were In March, But It Feels A Lot Worse.... Kinda Like 84 Degrees F at 7:30 AM Feels Different Than 84 Degrees F At 3:30 PM. Feels Like Something Serious Is Onna Way.....

People only accept change when they are faced with necessity, and only recognize necessity when a crisis is upon them.

-- Jean Monnet

Chartz And Table Zup @ www.joefacer.com

Back Inna Day, KSAN was tryin' to stay afloat post Hippie Apocalypse and had tapped the Bay Area music community for an all live music weekend. One of the Fillmore Auditorium regular bands canceled out and Ronnie Montrose, who was putting a band together at the time, filled in on a coupla hours notice. He put on what would be his Montrose Stadium Rock program of the future in a studio using practice amps and borrowed instruments. This was in the pre-box-of-effects, Marshall-in-your-pocket-era. Sounded kinda like this...

http://www.youtube.com/watch?v=tk52nGxF ... re=related

Over the weekend, decisions will be made that will determine whether the world will relive the 2007-08 crash. The odds are not that bad short term. They are horrible long term and the downside outcome is nasty..... Stay tooned.

http://www.comstockfunds.com/%28X%281%2 ... eSupport=1

http://www.bloomberg.com/news/2011-06-1 ... -veto.html

http://www.ritholtz.com/blog/2011/06/we ... -solution/

http://www.ritholtz.com/blog/2011/06/su ... -06-17-11/

http://www.msnbc.msn.com/id/43431407/ns/politics/

http://www.msnbc.msn.com/id/43439252/ns ... _business/

http://www.bloomberg.com/news/2011-06-2 ... hnson.html

http://www.bloomberg.com/news/2011-06-1 ... lment.html

http://www.msnbc.msn.com/id/43456544/ns ... _business/

http://www.msnbc.msn.com/id/43443426/ns ... ws-europe/

http://www.bloomberg.com/news/2011-06-2 ... -debt.html

http://www.ritholtz.com/blog/2011/06/ap ... he-news-2/

http://oldprof.typepad.com/a_dash_of_in ... et-it.html

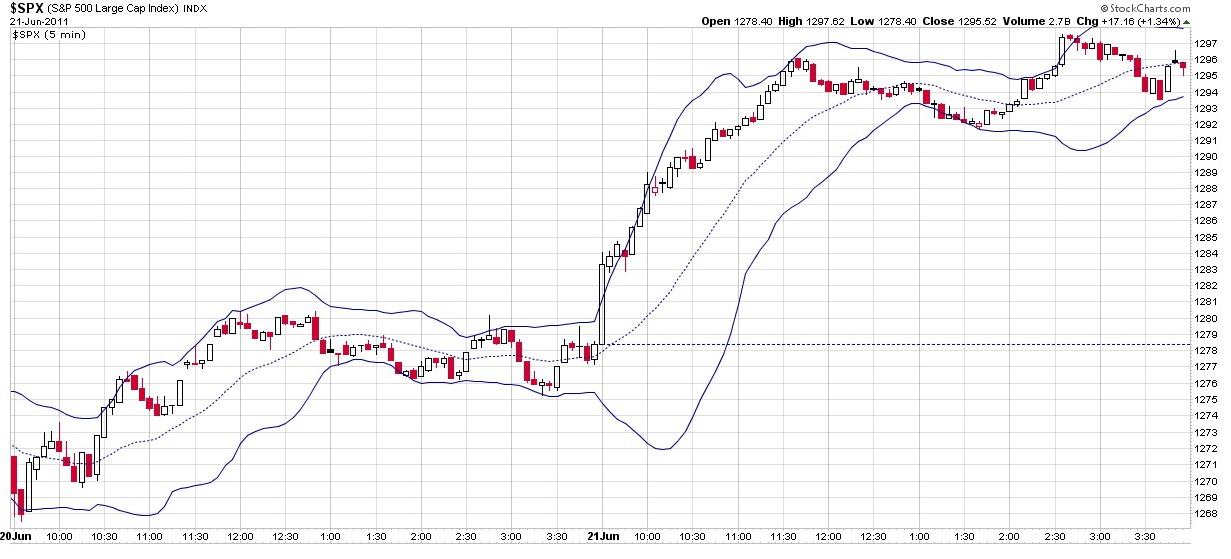

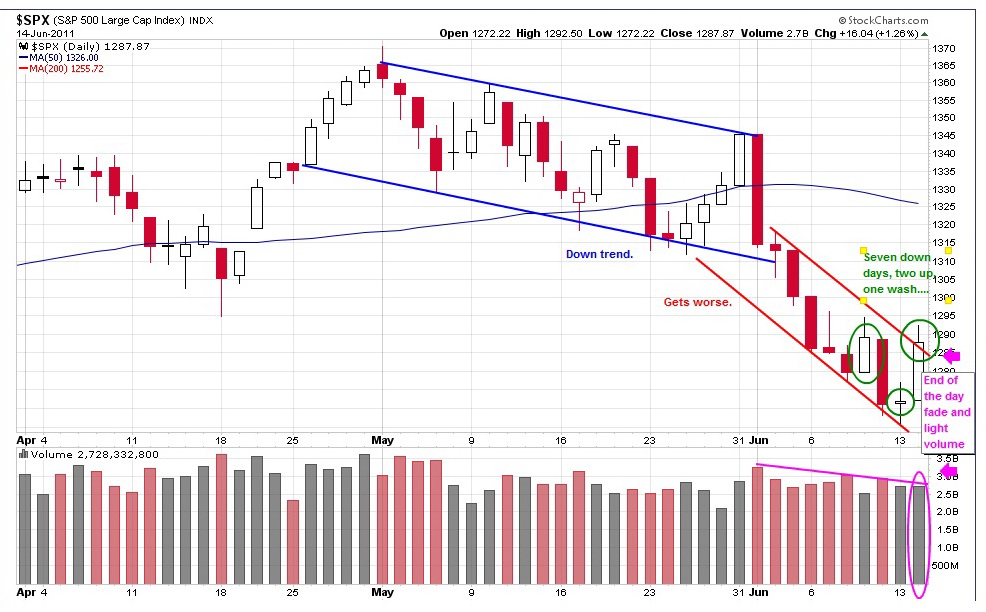

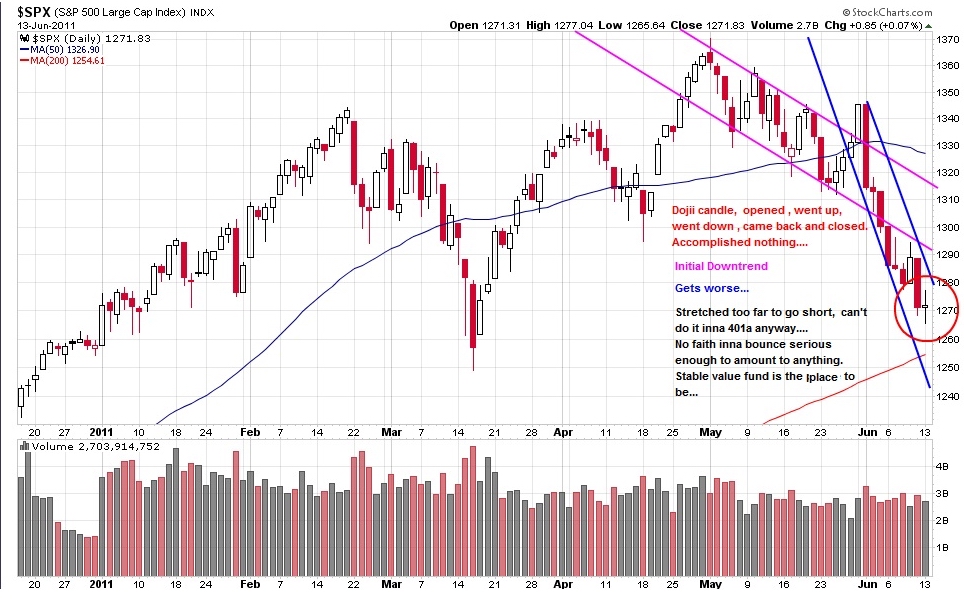

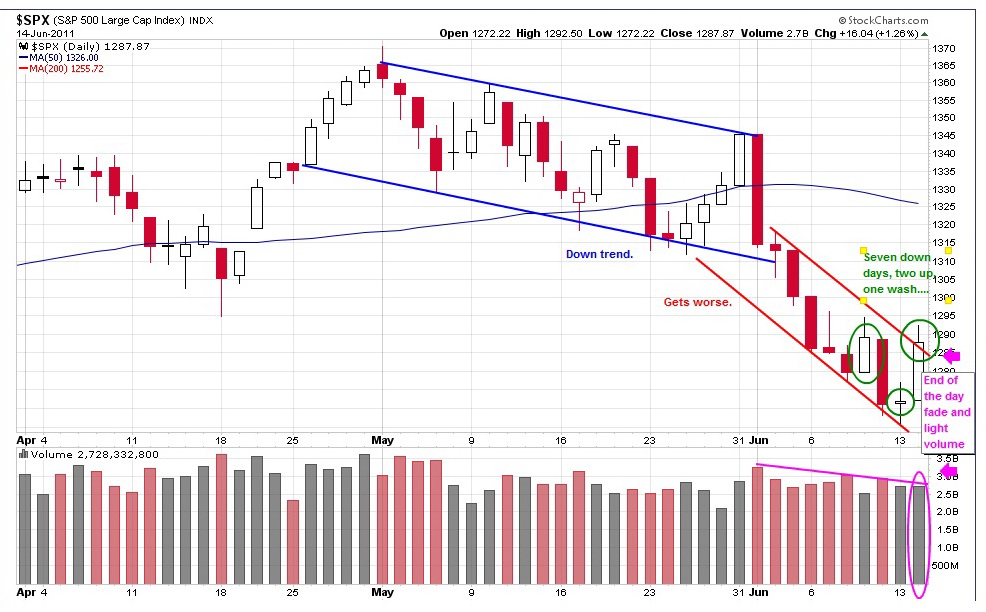

You start with everybody in cash or short. Then someone goes, "Hey, Waidaminute!! Who's left to sell and/or go to cash? What if the only thing left to do is buy?" With everybody leaning the same way, it doesn't take much to ignite a stampede the other way. It looks like a ferocious short covering and chasing runaway stocks rally.

The fundamentals suck. If the market confirms the launch, I will figure out what to do then. Right now, it feels too much like a bear trap....

Still all cash....

Stay Tooned.....

After The Banks In Ireland And Finland Blew Themselves Up Through Too much Leverage And Speculation, The Governments Transferred The Losses To The Citizens. Then The Citizens Voted Themselves A New Government. Stay Tooned....

"The trick is to stop thinking of it as "your" money."

—IRS auditor

Chartz and Table Zup @ www.joefacer.com .........

'Cuz When All Is Said And Done, The Old Songs Bring Back the Old Days, And That's A Very Good Thing...

http://www.youtube.com/watch?v=uHfB63ln ... re=related

http://www.ritholtz.com/blog/2011/06/th ... il-unrest/

http://www.bloomberg.com/news/2011-06-1 ... -says.html

http://www.bloomberg.com/news/2011-06-1 ... x-cut.html

http://www.ritholtz.com/blog/2011/06/af ... nore-them/

http://www.ritholtz.com/blog/2011/06/su ... s-6-11-11/

http://www.nytimes.com/2011/06/10/nyreg ... .html?_r=1

http://www.ritholtz.com/blog/2011/06/ch ... -u-s-debt/

http://www.ritholtz.com/blog/2011/06/th ... -at-stake/

http://www.bloomberg.com/news/2011-06-1 ... ating.html

http://oldprof.typepad.com/a_dash_of_in ... point.html

http://blogs.hbr.org/haque/2011/06/seve ... _wont.html

http://english.aljazeera.net/indepth/op ... 27316.html

http://english.aljazeera.net/indepth/op ... 58458.html

http://online.barrons.com/article/SB500 ... k_magazine

http://247wallst.com/2011/06/13/changin ... b-ire-nbg/

My 401 Is Still Stock Free.

The Trend Is Your Friend...As Long As You Go With What Is Working....And That Is Caution.

Same old same old ......

Sound like an idea?

http://www.theatlantic.com/magazine/pri ... cans/8521/

http://www.ritholtz.com/blog/2011/06/cl ... s-alchemy/

Stay Tooned

http://www.youtube.com/watch?v=uHfB63ln ... re=related

http://www.ritholtz.com/blog/2011/06/th ... il-unrest/

http://www.bloomberg.com/news/2011-06-1 ... -says.html

http://www.bloomberg.com/news/2011-06-1 ... x-cut.html

http://www.ritholtz.com/blog/2011/06/af ... nore-them/

http://www.ritholtz.com/blog/2011/06/su ... s-6-11-11/

http://www.nytimes.com/2011/06/10/nyreg ... .html?_r=1

http://www.ritholtz.com/blog/2011/06/ch ... -u-s-debt/

http://www.ritholtz.com/blog/2011/06/th ... -at-stake/

http://www.bloomberg.com/news/2011-06-1 ... ating.html

http://oldprof.typepad.com/a_dash_of_in ... point.html

http://blogs.hbr.org/haque/2011/06/seve ... _wont.html

http://english.aljazeera.net/indepth/op ... 27316.html

http://english.aljazeera.net/indepth/op ... 58458.html

http://online.barrons.com/article/SB500 ... k_magazine

http://247wallst.com/2011/06/13/changin ... b-ire-nbg/

My 401 Is Still Stock Free.

The Trend Is Your Friend...As Long As You Go With What Is Working....And That Is Caution.

Same old same old ......

Sound like an idea?

http://www.theatlantic.com/magazine/pri ... cans/8521/

http://www.ritholtz.com/blog/2011/06/cl ... s-alchemy/

Stay Tooned

"When the plane is going down and the oxygen masks have dropped and parts of the plane are peeling off as you plummet toward the earth, that’s not the time to pull out the little card in the seat in front of you and say, ‘Gee, where are the emergency exits?' Everybody should have an emergency plan. The time to make these decisions is not when people are running around with their hair on fire."

--Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com ... Check It out ....

I'm Still Shakin' My Head An' I've Owned The DVD For Years...

http://www.youtube.com/watch?v=yNuXO60G ... re=related

It's June An' I'm still 99-44/100's stock free inna 401a. The Ivory Soap riff is kinda my emergency plan...Know What I Mean, Vern? (How soon until NOBODY can relate to a '50s marketing slogan or a Jim Varney reference?)

http://oldprof.typepad.com/a_dash_of_in ... point.html

http://www.ritholtz.com/blog/2011/06/oh ... end-again/

http://www.ritholtz.com/blog/2011/06/su ... s-6-03-11/

http://blogs.the-american-interest.com/ ... n-dream-i/

http://www.gq.com/news-politics/big-iss ... table=true

http://money.msn.com/investing/the-big- ... jubak.aspx

http://online.wsj.com/article/SB1000142 ... 26472.html

http://www.bloomberg.com/news/2011-06-0 ... -view.html

http://www.debka.com/article/21002/

Tues....

It's Not That We're Down 5%, We're Up A Whole Bunch Over The Last Two Years.

It's That Sentiment Has Changed, The Season Is Against Us, And The Leaders And Tells Are Undercutting Our Confidence.

Thurs Eve... Still 99-44/100s % stock free inna 401a. Keep da bounce in perspective......

Stay tooned....

Blogs; A Total Waste of Time? A Source Of Dangerous Mis Information?, Self Centered Self Gratification? A Dangerous Crowding Out Of Real Content? The Descent Of Erudite Intellectual Activity Into the Cacophony Of The Uneducated Masses? The Dilution Of Expertise And Knowledge?..... Pretty Much.

Page after page of professional economic journals are filled with mathematical formulas leading the reader from sets of more or less plausible but entirely arbitrary assumptions to precisely stated but irrelevant theoretical conclusions.

—Wassily Leontief

Chartz And Table Zup @ www.joefacer.com

Comin' Up On SummerTime; Makes Me Wanna Toss The 'board Inna '40 Ford Woodie, Pick Up My Beach Bunny, An' Boogie On Down To Ocean Beach Anna Cliff House. To Watch The Cold Grey Ocean Wash In Under The Cold Grey Fog While I Nurse An Irish Coffee.

http://www.youtube.com/watch?v=GWw55XhTehg

http://www.youtube.com/watch?v=Onqzua4bRHY&NR=1

http://www.youtube.com/watch?feature=pl ... iCXb1Nhd1o

http://www.ritholtz.com/blog/2011/05/su ... s-5-27-11/

http://247wallst.com/2011/05/27/some-re ... abandoned/

http://www.thereformedbroker.com/2011/0 ... s-reprise/

http://www.zerohedge.com/article/guest- ... -now-short

http://www.businessweek.com/news/2011-0 ... 0-01-.html

http://bostonreview.net/BR30.5/warrentyagi.php

http://www.bloomberg.com/video/70223764/

http://www.mediabistro.com/fishbowlny/h ... dia_b36618

http://english.aljazeera.net/news/afric ... 21352.html

http://english.aljazeera.net/news/afric ... 58677.html

http://www.washingtonpost.com/business/ ... video.html

Friday was last day of the month and window dressing on light pre-holiday volume. Tuesday will be 401/IRA inflows and is usually up. It'll be a tell. I do some individual stock trading in a coupla IRA's and I look behind the curtain of the major indexes. I'm Ivory Soap (99-44/100's ) pure Stable Value Fund inna 401a. I figure to spend the weekend re-fettlin' the scooters for commute and Sunday Ride and prolly the track use this Summer/Fall. Less risk there than buy and hold inna 401a through the Summer.

http://blogs.telegraph.co.uk/finance/an ... -defaults/

http://www.johnmauldin.com/frontlinetho ... minefield/

THE REVOLUTION WILL NOT BE TELEVISED

http://www.thegrio.com/entertainment/gi ... of-rap.php

http://www.youtube.com/watch?v=BS3QOtbW4m0

MEMORIAL DAY

http://www.ritholtz.com/blog/2011/05/ho ... -soldiers/

Wed 6/1...

I feel strongly about it both ways... Stable Value Fund is a great place to be when the market craters. But I'd much rather everyone had a job and a house and I could just go 100% in the most aggressive fundz. But ya play the cards yer dealt.....

99 and 44/100s pure stable value....

Stay Tooned.....

Ya Don't Slow Down, Ya Never Grow Old. ----- Tom Petty . . . . I'll Let Ya Know How It Works Out....

"If you keep thinking about what you want to do or what you hope will happen, you don't do it, and it won't happen."

-- Joe DiMaggio

Chartz and Table Zup @ www.joefacer.com

The End Of QE2, Rising Rates In Euro Asia, More Foreclosure Fallout, Lower Highs and Lower Lows Inna Stock Market, I Do Believe This Issa Theme Song For The Summer...

http://www.youtube.com/watch?v=K5IS45jT ... re=related

I'm one day from being out of the markets. What I'm doing is very very specific to my circumstances, personality, and history. Prolly time to write about it since ya can't make sense outta the action without a program.

http://www.ritholtz.com/blog/2011/05/ru ... osecution/

http://www.ritholtz.com/blog/2011/05/su ... events-21/

http://www.ritholtz.com/blog/2011/05/20 ... ng-market/

http://www.ritholtz.com/blog/2011/05/ex ... es-falter/

http://www.ritholtz.com/blog/2011/05/ge ... %E2%80%9D/

http://blogs.hbr.org/haque/2011/04/cutt ... udget.html

http://ftalphaville.ft.com/blog/2011/05 ... -near-you/

http://www.latimes.com/business/la-fi-l ... ull.column

http://www.washingtonpost.com/business/ ... story.html

http://www.ritholtz.com/blog/2011/05/ta ... ll-street/

http://www.ritholtz.com/blog/2011/05/ha ... h-fer-two/

We got a lower high and a lower low and a close under the 50 day MA. And I got to 99+% Met Life Stable Value Fund... Now I wait....

What it all means...

Going from 95 % stock to all cash was a good idea, well timed.

This is an example of having all your boats in the water when the wind and the currents are working for you (9/10 to 5/11) and seeking shelter when conditions get sketchy (last coupla weeks).

I can't tell the future, I'm not privy to the conversations at the highest levels of business and government, I don't have inside information, and I still have title to my soul.

I do, however possess a certain degree of perceptivity and ratiocination such that I can see what is in front of me and figure out what I'm looking at. That's all ya really need...

http://www.theatlantic.com/infocus/2011 ... 071/#img07

http://www.ritholtz.com/blog/2011/05/al ... 0-day-m-a/

http://www.ritholtz.com/blog/2011/05/ne ... more-66061

http://www.investingwithoptions.com/201 ... at-the-sp/

Tuesday Eve...

A "V" Shaped bounce looks less likely. I'm positioned for some serious down side. I may not get it. This might just be a brief pause while some temporary issues or seasonality are worked out. Or it could be the start of a significant down draft ending 10% to 25% down with a huge wash out amid chaos and despair...

Either way, I'll buy when I like what I see.

http://blogs.wsj.com/marketbeat/2011/05 ... defaulted/

As High Frequency Economics says today: “Underlying problems of over-borrowed nations are not fixed by lending them more money.”

Stay Tooned...

What Happens To The Party (The Markets) When The Fed Takes Away The Punch Bowl (Zero Interest Rate Policy [ZIRP] )?

Just remember one thing: there are no good stocks. They all suck. Even those that are making you money are going to turn on you sooner or later. The only stock you should say anything good about is the one you no longer own that made you money.

--Reverend Shark

Chartz And Table Zup @ www.joefacer.com

What Happens When The Fed Takes Away Free Money (ZIRP)? It Really Ain't That Hard To Figure Out...

http://www.youtube.com/watch?v=UtsClj04 ... re=related

http://www.youtube.com/watch?v=K5IS45jT ... re=related

Pretty radical change in posture over the last month:

I'm down from 90% stocks just weeks ago to 33% this weekend, to anywhere from 20% to 0% anytime this week depending on how urgent I feel the need to get ultra defensive is....

It's a risk/reward thing, see? I been way long for a while, since 9/10. I made some serious coin last year. But there's limits. Making money was easy between late '04 and late 2008. I went 100% stocks, checked everything every Saturday morning and every so often trimmed my allocation toward the hot fundz. I was onna sidelines in cash during the 08/09 WHOOSH down. I read enough to make me certain that it was all risk and no reward so I cashed outa stocks into the GIC. I made money by not losing money. I mean I actually made money in 08. Coupla hundred simoleans beats a gaping smokin' pit inna 401a. I was late rejoining the party in the spring of 09. I let a lot of gains go bye bye because caution had served me so well previously. I didn't really understand the new religion of free money from the FED until 9/10. But there ain't no true believer like a recent convert so I got wit it. All stocks alla time.

That was then an' this is now. I'm gonna play onna other side of the street for a while. Yeah, I'm really aggressive when it comes to reachin' out for gains. It's what I do. But I balance that by being really aggressive protecting gains. I risk serious losses by being all the way long when I think the markets are goin' up. If the market turns against me, I can get roughed up onna way out. The rapid trading restrictions means there is a price to bailing out inna hurry. Ya gotta be smart aggressive; listen for the sirens and move closer to the door.

The other side of that is that caution and getting out early can leave you looking in the windows at the party. Coupla three four days of upward whoosh watched through the windows can sting hard enough to make yer eyes water. But, Oh Well! you never go broke realizing gains and booking profits. And a few dollars left onna table can be thought of as insurance premiums or the cost of admission. I can live with that. What's made me cautious over the last six weeks is starting to wear on me. Time for some fresh air and a rest. Nothing clears the head and resets the game like the view from the sidelines.

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

Few things are a bigger waste of time than getting back to even.

http://motherjones.com/politics/2011/05 ... nity-banks

http://www.telegraph.co.uk/finance/econ ... raphs.html

http://www.ritholtz.com/blog/2011/05/lo ... economics/

http://www.msnbc.msn.com/id/42955120/ns ... itol_hill/

http://www.ritholtz.com/blog/2011/05/wh ... d-manager/

http://www.ritholtz.com/blog/2011/05/dodo-bird-bankers/

http://www.latimes.com/business/la-fi-p ... 685.column

http://www.ritholtz.com/blog/2011/05/ho ... -bottomed/

http://www.theatlantic.com/business/arc ... rs/238517/

http://www.ritholtz.com/blog/2011/05/wh ... sa-part-2/

http://www.ritholtz.com/blog/2011/05/ho ... om-bubble/

http://www.rollingstone.com/politics/ne ... -20110511?

http://www.ritholtz.com/blog/2011/05/lo ... economics/

http://alephblog.com/ Check out "The Impossible Dream Part 2"

http://www.irishtimes.com/newspaper/opi ... 23_pf.html

http://www.platts.com/weblog/oilblog/20 ... y_gen.html

Damn!! Meant to lighten up onna stocks today. Forgot to enter the orders. Got 'em entered for tomorrow.

I'm a trend and momentum investor. I see damn little momentum and the trend looks to be rolling over. If I can pick up a majority of the up and miss out on summa da down, I figure that's pretty copacetic. Bull markets are a much easier environment to invest in and I'd rather just go long and hang on. But that's a recipe for disaster during certain times.... like this one.. .

WED EVE

Up day inna market and I'm pretty much a day or two from an all cash position (Met Life Stable Value). I'll write more as to how and why this weekend. For now, I'm banking gains from the first four months of the year, stepping back from risks I identify in the market technicals, acknowledging concerns identified by what I consider to be reliable and informed sources, and taking a breather. Should we get yet another "V" shaped bounce, I'm in a position to go long as fast as I wanna without triggering rapid trading restrictions penalties... If we go down big time, an all cash is a good thing indeed...

A coupla moves still to go, done by next Monday, and then I wait. A day, A week, A month, Or three.

Stay Tooned....

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale."

-- Zig Ziglar

Chartz And Table Zup @ www.joefacer.com.

One Gawdamn Treasure After Another.....

http://www.youtube.com/watch?v=aE0xG7OD ... re=related

http://www.youtube.com/watch?v=9CxVSM6F ... re=related

http://www.ritholtz.com/blog/2011/05/be ... t-be-nice/

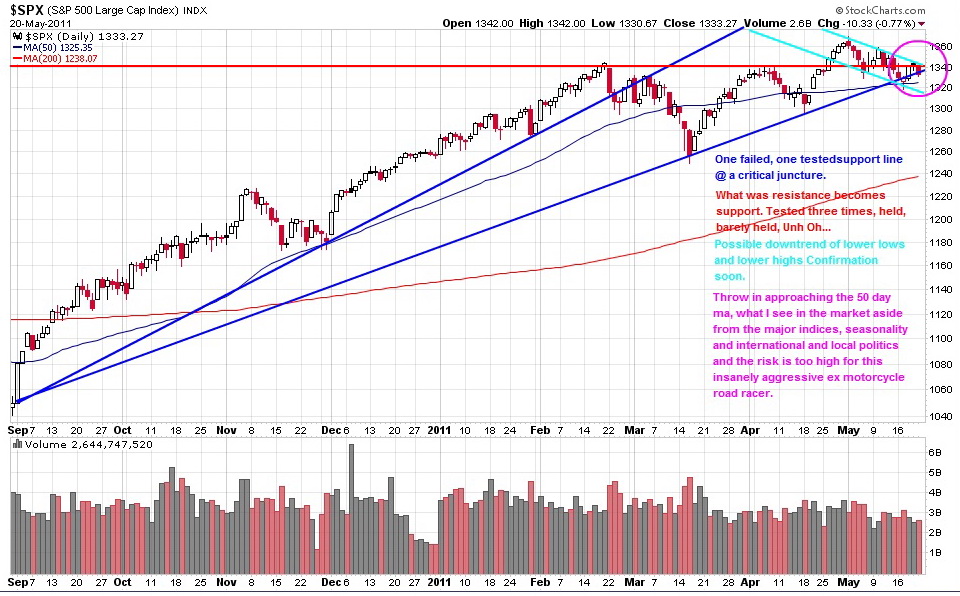

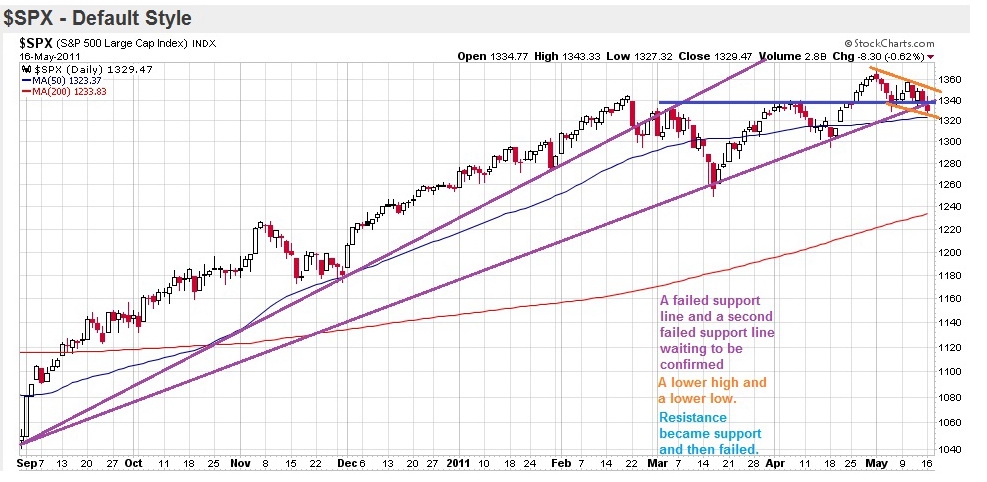

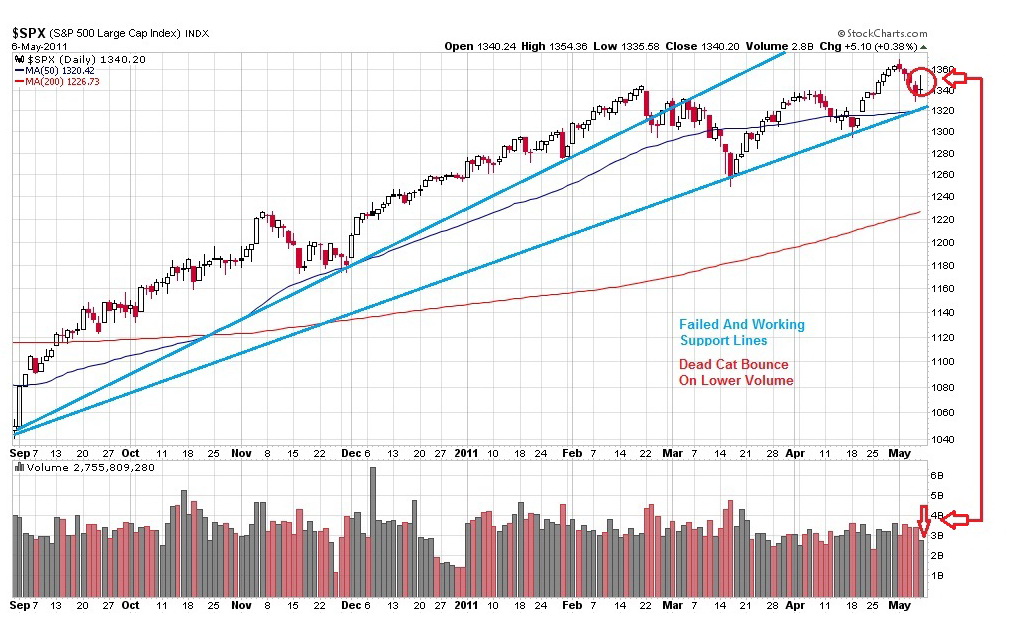

We got higher highs and higher lows. We got a failed support line and a working support line. We got a dead cat bounce on lower volume after four days down from a multi year high. Beneath the indexes we have a WHOOSH down in commodities. We have leading stocks and sectors looking queasy. We got extended stocks without support after serious run ups. We have hot money bailing out of the trade dejour. We have risk vs reward, fear vs greed, and risk management vs asset allocation.

I've pulled back some serious coin. I'm more concerned about the return OF capital than the return ON capital.

If we launch higher Monday and don't look back, I've still got money inna game. just not as much as I like. I can fix that.

If Friday was short covering and bargain hunters seeing bargains compared to a week ago, we might continue/resume falling and this might be the non "V" shaped bounce/correction I've kinda been expecting. In that case, I still have too much money inna game.

I can fix that too.

We'll see.

http://www.debka.com/article/20912/

http://www.bloomberg.com/news/2011-05-0 ... andal.html

http://www.bloomberg.com/news/2011-05-0 ... -bail.html

Big Time Important 401a Investor Stuff

http://www.ritholtz.com/blog/2011/05/wh ... d-manager/

http://money.msn.com/investment-advice/ ... spx?page=0

Stay tooned...

IF YOU ARE GOING TO FIGHT TO SAVE THE AMERICAN MIDDLE CLASS, YOUR FIRST OBLIGATION IS TO SAVE YOURSELF. WE NEED NUMBERS ON OUR SIDE TO BALANCE THE MONEY ON THE OTHER SIDE. START BY MAKING YOUR 401A WORK FOR YOU. YOU FIGHT BEST FROM A FIRM FOOTING ON A SOLID FOUNDATION. HERE'S WHAT I'M DOING...

I am opposed to millionaires, but it would be dangerous to offer me the position.

-- Mark Twain

Chartz And Table Zup @ www.joefacer.com

It's Really Really Fun, Boys And Girls, And So Very Educational Too....

http://www.ritholtz.com/blog/2011/04/fi ... round-two/

http://www.ritholtz.com/blog/2011/04/la ... aventador/

I went deeper into stocks on Friday afternoon April 29th...

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find one despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

Clickit!!!!

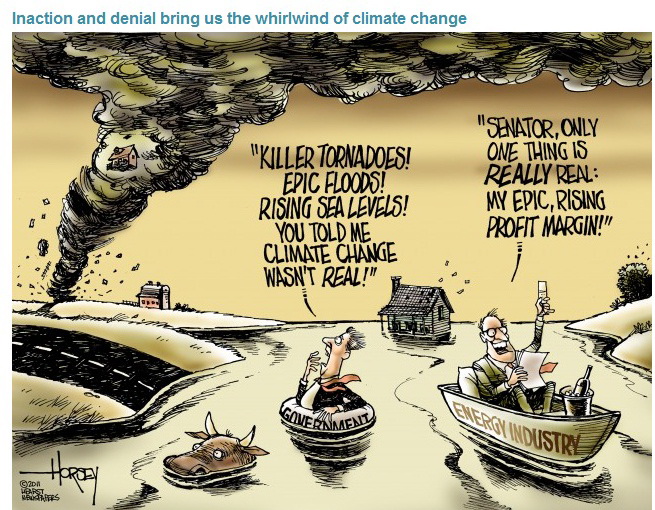

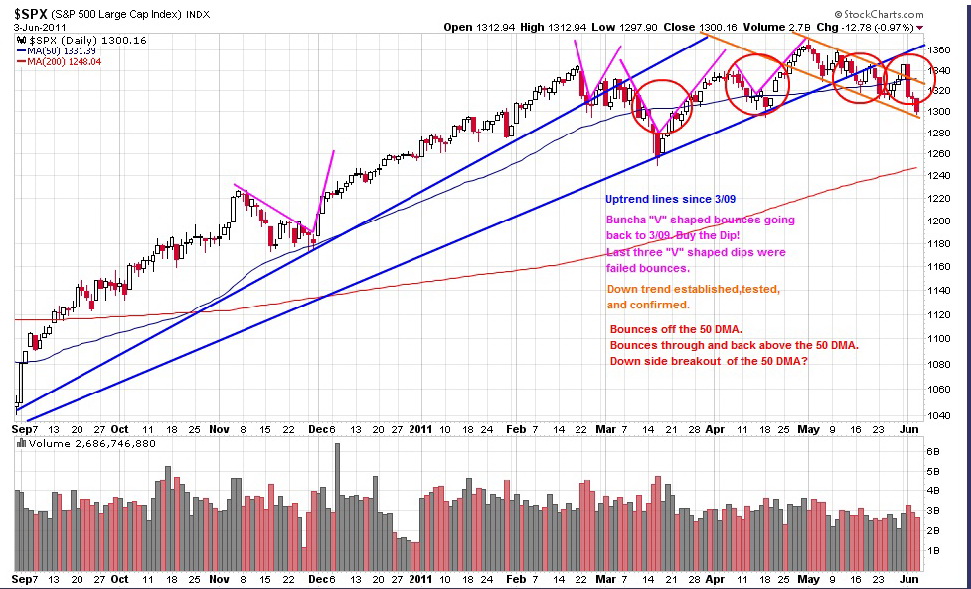

Cup And Handle. Three "V" Shaped Recoveries. One Failed Support Line And One Working Support Line. Two Confirmed Consolidations. These Are Bullish Patterns. The Market Is Soaring, And For For Exactly The Wrong Reason. But They Don't Put An Asterisk On Gains, Take Them Back, Or Discount Them... A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking Why. I'm Tagging Along With What Is Making The Rich Richer. I Feel Strongly About It Both Ways.... But I Can Use The Money.

http://www.ritholtz.com/blog/2011/04/ho ... is-market/

http://www.ritholtz.com/blog/2011/05/se ... %E2%80%A6/

http://www.ritholtz.com/blog/2011/04/th ... mic-facts/

http://www.ritholtz.com/blog/2011/04/su ... s-4-29-11/

http://www.ritholtz.com/blog/2011/04/re ... epression/

http://www.ritholtz.com/blog/2011/04/ha ... mployment/

http://www.ritholtz.com/blog/2011/04/en ... -ritholtz/

http://www.ritholtz.com/blog/2011/04/th ... headwinds/

http://www.ritholtz.com/blog/2011/04/th ... annotated/

http://www.propublica.org/article/all-t ... ing-bubble

Stay Tooned......

I went deeper into stocks on Friday afternoon April 29th...

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find one despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

Clickit!!!!

Cup And Handle. Three "V" Shaped Recoveries. One Failed Support Line And One Working Support Line. Two Confirmed Consolidations. These Are Bullish Patterns. The Market Is Soaring, And For For Exactly The Wrong Reason. But They Don't Put An Asterisk On Gains, Take Them Back, Or Discount Them... A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking Why. I'm Tagging Along With What Is Making The Rich Richer. I Feel Strongly About It Both Ways.... But I Can Use The Money.

http://www.ritholtz.com/blog/2011/04/ho ... is-market/

http://www.ritholtz.com/blog/2011/05/se ... %E2%80%A6/

http://www.ritholtz.com/blog/2011/04/th ... mic-facts/

http://www.ritholtz.com/blog/2011/04/su ... s-4-29-11/

http://www.ritholtz.com/blog/2011/04/re ... epression/

http://www.ritholtz.com/blog/2011/04/ha ... mployment/

http://www.ritholtz.com/blog/2011/04/en ... -ritholtz/

http://www.ritholtz.com/blog/2011/04/th ... headwinds/

http://www.ritholtz.com/blog/2011/04/th ... annotated/

http://www.propublica.org/article/all-t ... ing-bubble

Stay Tooned......

Calendar

Calendar