| |

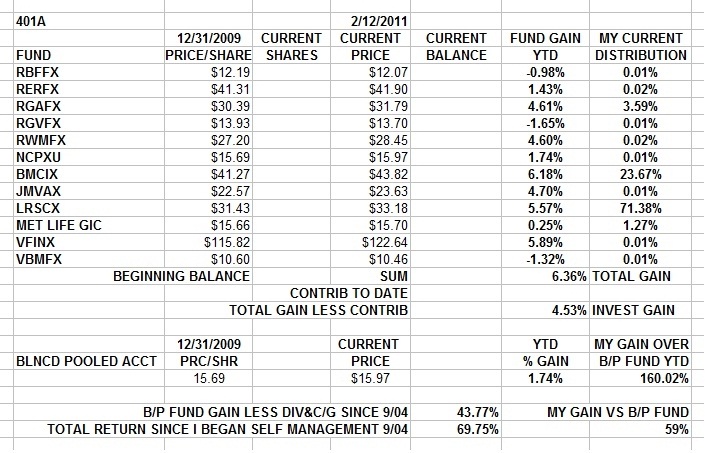

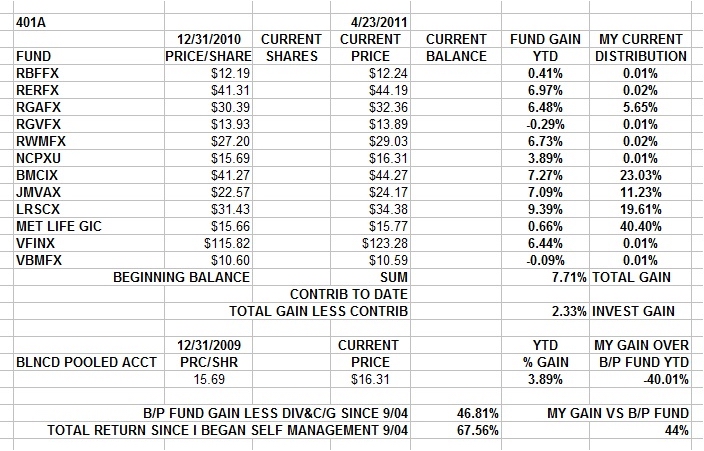

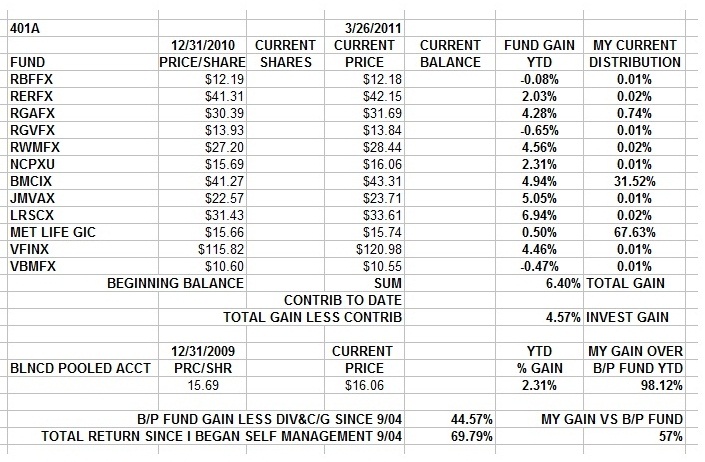

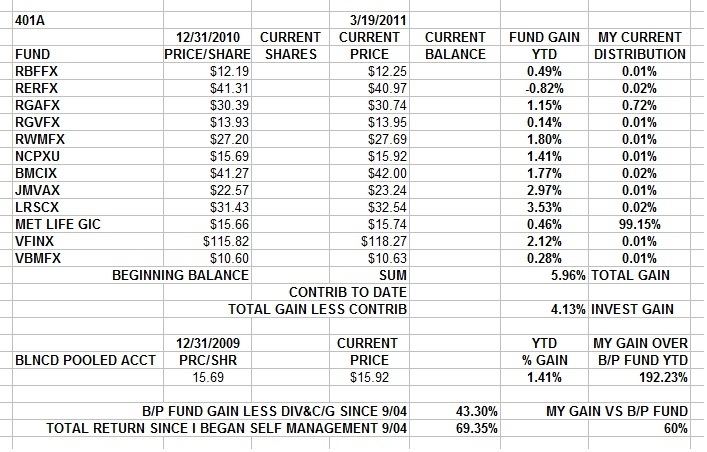

IF YOU ARE GOING TO FIGHT TO SAVE THE AMERICAN MIDDLE CLASS, YOUR FIRST OBLIGATION IS TO SAVE YOURSELF. WE NEED NUMBERS ON OUR SIDE TO BALANCE THE MONEY ON THE OTHER SIDE. START BY MAKING YOUR 401A WORK FOR YOU. YOU FIGHT BEST FROM A FIRM FOOTING ON A SOLID FOUNDATION. HERE'S WHAT I'M DOING...

Saturday, April 30, 2011, 01:33 PM

I am opposed to millionaires, but it would be dangerous to offer me the position.

-- Mark Twain

It's Really Really Fun, Boys And Girls, And So Very Educational Too....

http://www.ritholtz.com/blog/2011/04/fi ... round-two/

http://www.ritholtz.com/blog/2011/04/la ... aventador/

I went deeper into stocks on Friday afternoon April 29th...

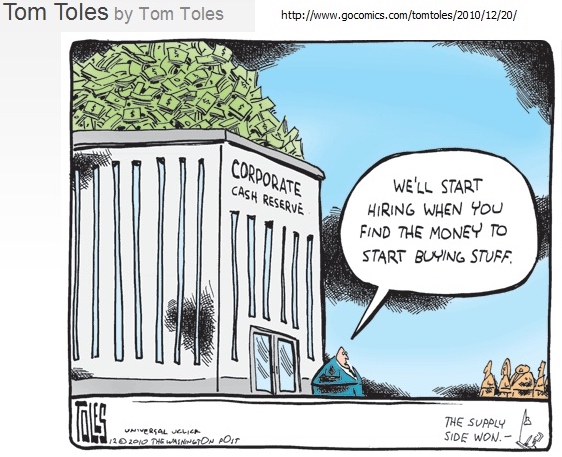

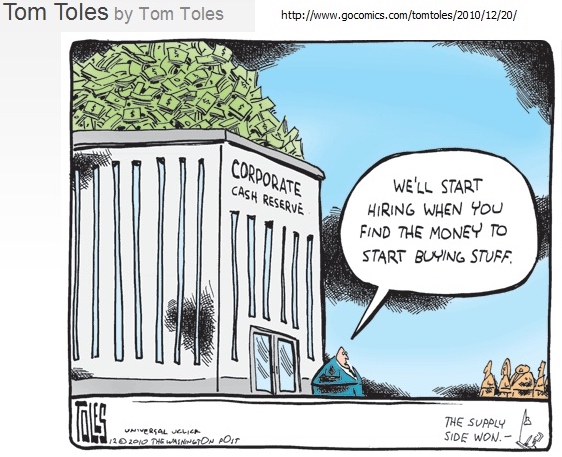

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find one despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

( 3 / 1334 ) ( 3 / 1334 )

Thank God I Grew Up When Honesty Demanded That You Call Them Sugar Pops And Sugar Smacks And Sugar Frosted Flakes. And It Was OK That Quakers Made Puffed Rice And Puffed Wheat For Kids That Were Shot From Guns ....

Friday, April 22, 2011, 03:27 PM

The more you know, the harder it is to take decisive action. Once you become informed, you start seeing complexities and shades of gray. You realize that nothing is as clear and simple as it first appears. Ultimately, knowledge is paralyzing. Being a man of action, I can’t afford to take that risk.

– Calvin

Usually there is some rock 'n roll with a personal link to my life linked here. Here's some radio of a different sort....

http://www.dylanratigan.com/2011/04/22/ ... e-dylan-2/

There are times that I realize just how outa place I am today

http://www.youtube.com/watch?v=zGpS6LHeBC0

"When the facts change, I change my mind. What do you do, sir?" --John Maynard Keynes

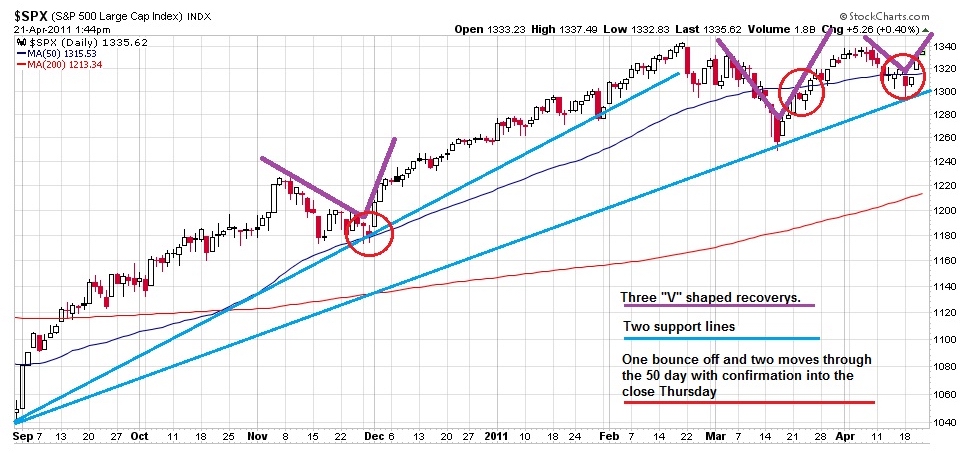

Wednesday (4/20) Action looked good. I changed my mind about risk and added to my stock position at the end of the day.....

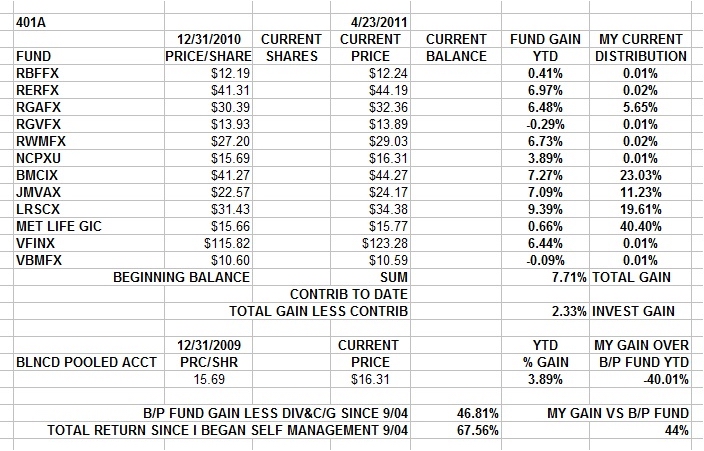

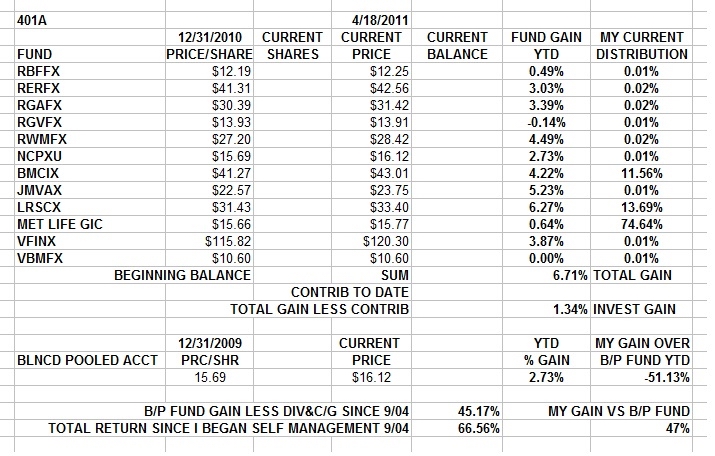

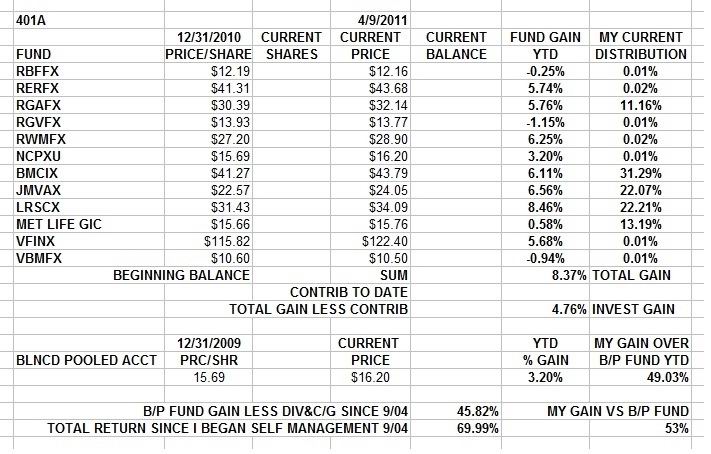

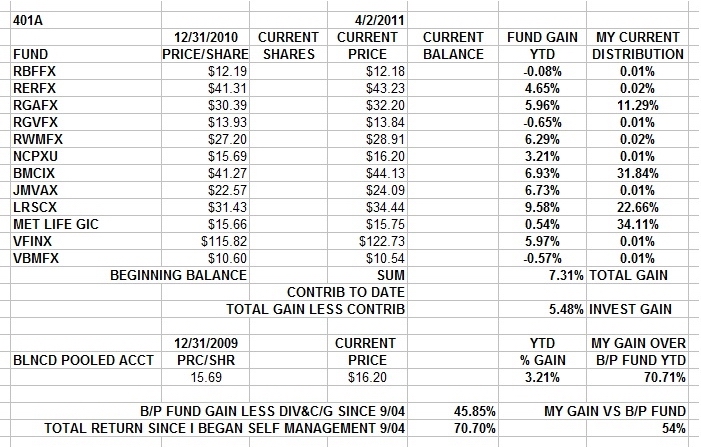

Here's where I stood Thurs AM allocationwise....

I picked up a few bucks onna day and I'm nicely set up for Monday....If the bottom doesn't fall out.

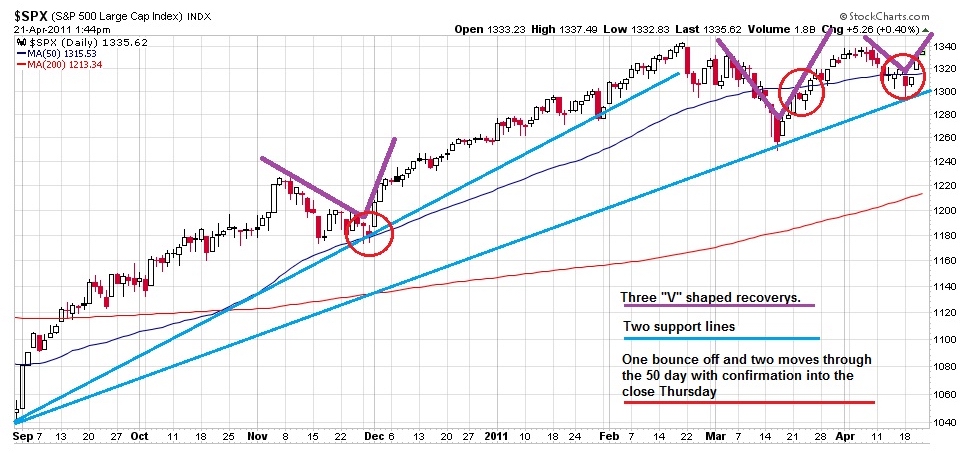

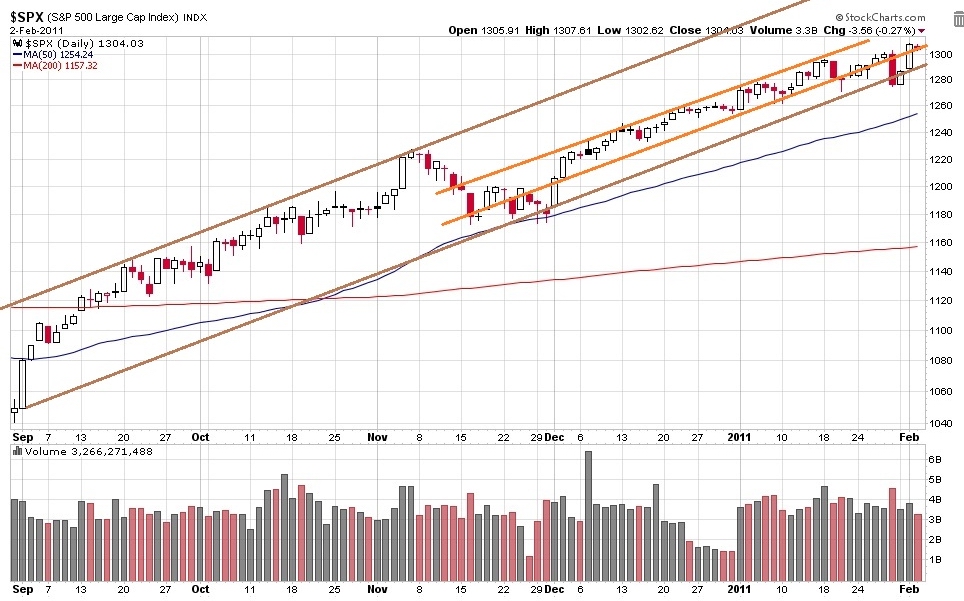

I may go deeper into stocks Monday. Here's why.

My risk management and capital preservation has cost me money every time I've gotten anxious and lightened up since the bottom in 2009. I've gotten back in some distance behind the "close yer eyes and hang on" crowd, but.... It ain't a sin to be wrong, everybody makes mistakes. It IS a sin to stay wrong. So I don't. Of course, my caution allowed me to actually make money in my 401a in 2008 when everybody else was bleeding from the eyeballs. One day it'll save my donkey again. I just gotta keep fear matched against greed an' get the balance right.....

I'm going deeper into stocks on Friday afternoon.

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find ond despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

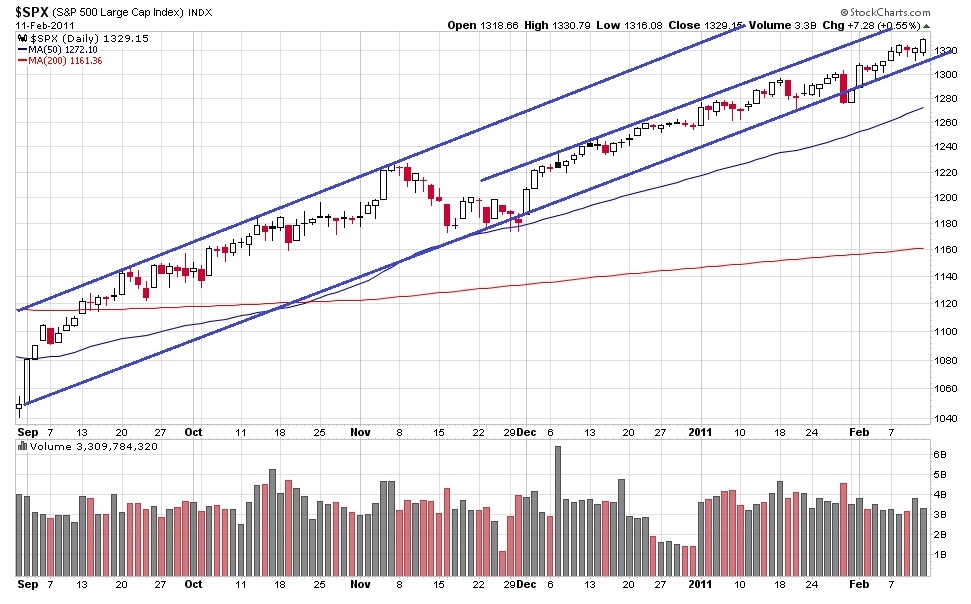

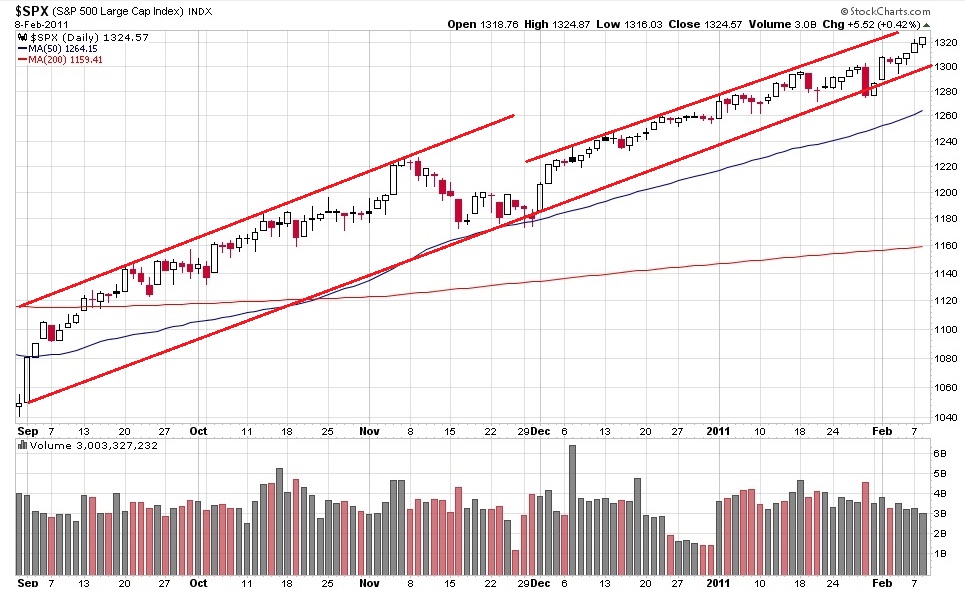

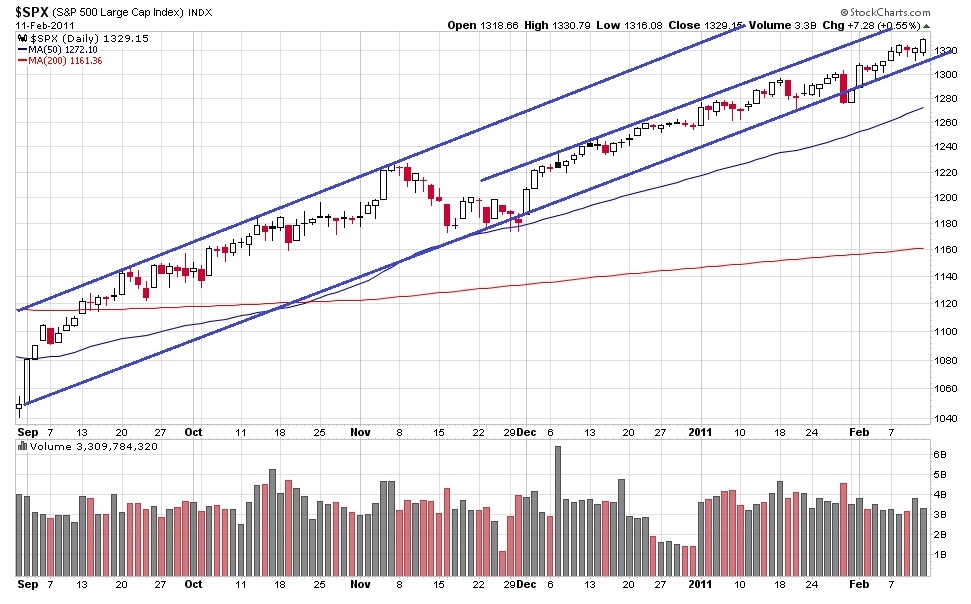

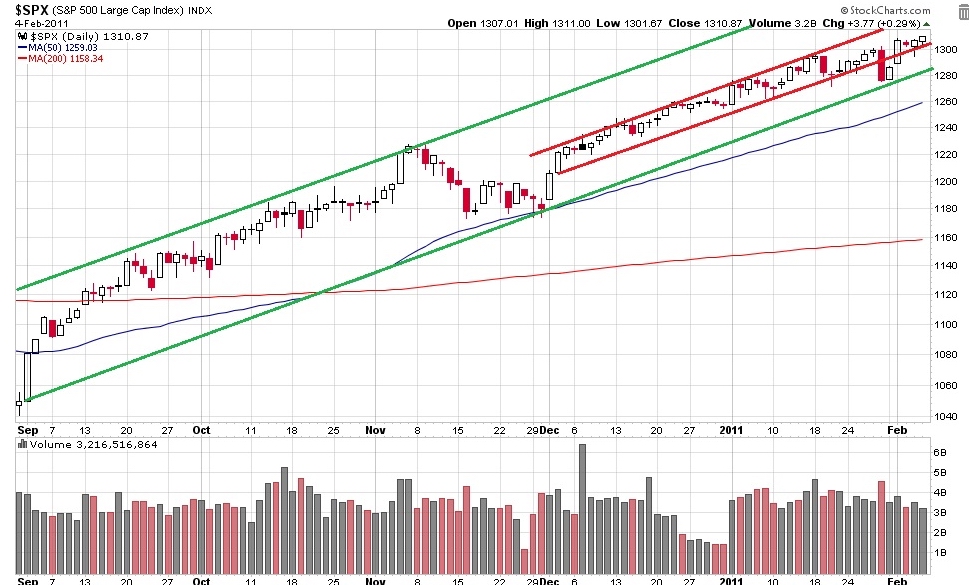

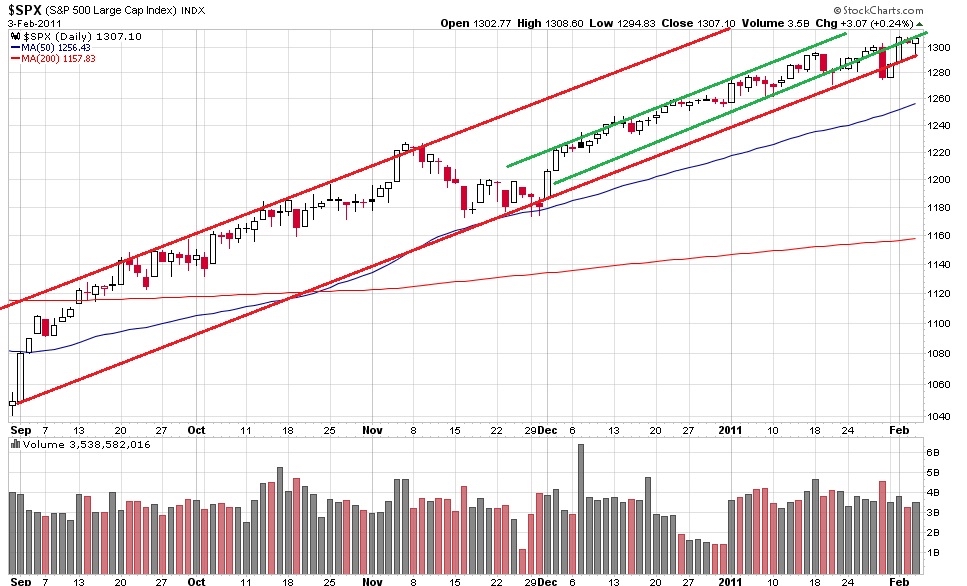

Cup And Handle. Bullish Pattern. The Market Is Soaring For Exactly The Wrong Reason. But They Don't Put Asterisk On Gains. A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking It.

Stay tooned.....

( 3 / 1325 ) ( 3 / 1325 )

"Been Down So Long, It Looks Like Up To Me" That's How You Get Talking Heads Pontificating About A Healed Economy And Business Looking Up. Pay No Attention To What Is Behind The Screen......

Saturday, March 26, 2011, 03:31 PM

"The effect of mobiles, computers, satellites—there is a generation coming that is outside the traditional controls. Normally, generations re-create themselves. But something else is happening."

-- Mohamed Haykal

Trower. Find Something That Works And Keep On Doing It. Kinda Like Investing. Shame To Lose Dewar Along The Way.

http://www.youtube.com/watch?v=bfn6598L ... re=related

http://www.youtube.com/watch?v=R1jZO54m ... re=related

http://www.youtube.com/watch?v=TLHZsK4e ... re=related

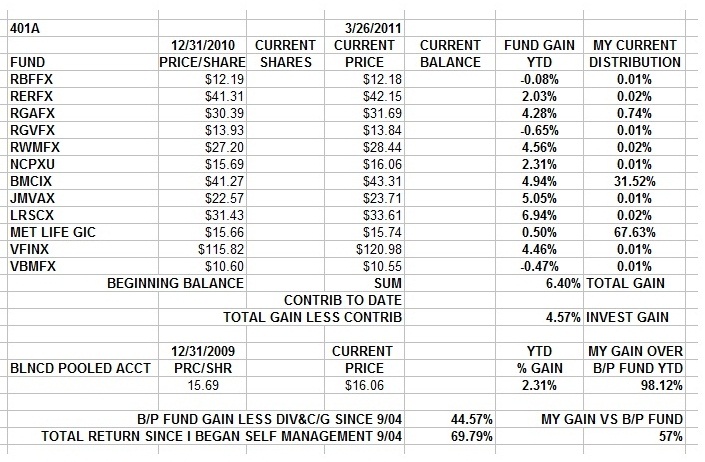

There are things I can't do, like serious fundamental analysis of thousands of companies books and in depth analysis of governmental politics and sociopolitical movements on resource allocation and technological and sociopolitical forces versus the political imperatives in the MENA area. I don't have access to the raw data and I'm too busy laying out and bending high purity gas lines.

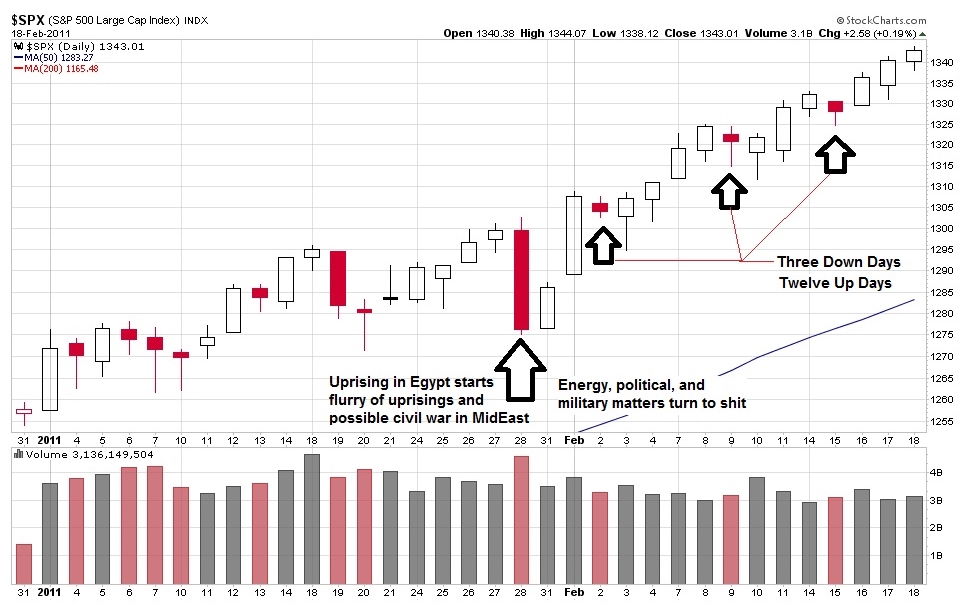

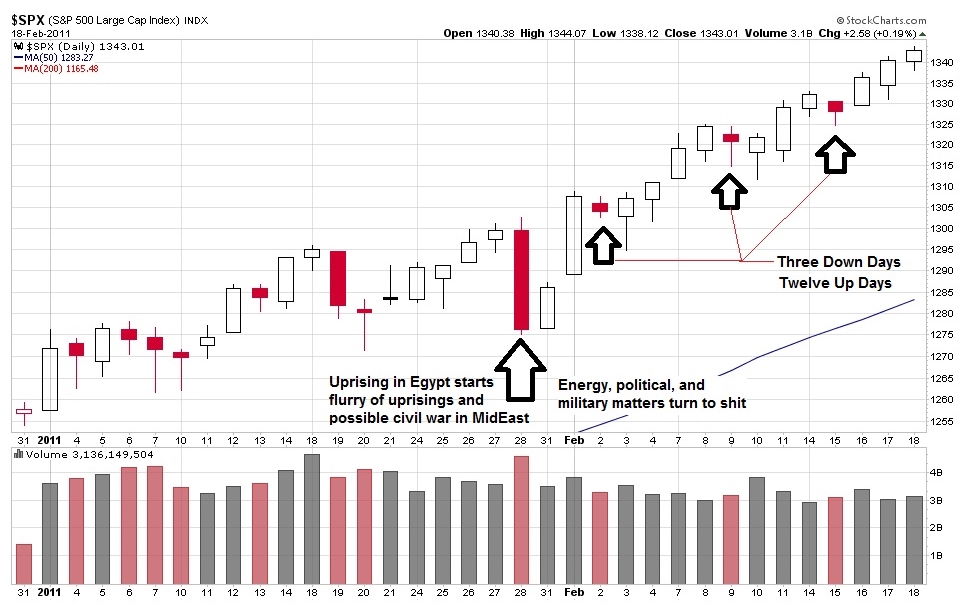

But I can get price vs time on a near instantaneous basis and there is little data available that is more cogent, accurate or determinant. And technical levels left behind mean it's modified risk on with an eye toward how the tenor of the market has changed.

Never mind what makes sense. The market never talks to you more directly than it does with price. Glow inna dark sea food onna West Coast, the Korean war Redux, the risk of Iran and Hamas in Lebanon, the forced retirement of way too many people way too young, major midwest cities drying up and blowing away, very high oil prices, Euro debt issues, etc, if prices go up through resistance and hold, I gotta be thinking, Buy. So I started to scale in last week.

Part way in last week, maybe more this Monday. Maybe.

http://www.ritholtz.com/blog/2011/03/no ... -not-safe/

http://www.ritholtz.com/blog/2011/03/ho ... this-time/

http://www.msnbc.msn.com/id/42258117/ns ... e_economy/

http://www.ritholtz.com/blog/2011/03/pr ... roam-free/

http://www.ritholtz.com/blog/2011/03/ci ... cys-costs/

http://www.stratfor.com/analysis/201103 ... ed-kingdom

Stay Tooned.

( 3 / 1208 ) ( 3 / 1208 )

Life Is About Cycles, Dialectical Materialism And Spiritual Concatenation, Yin And Yang, Secular And Cyclical, Two Stroke And Four Stroke....

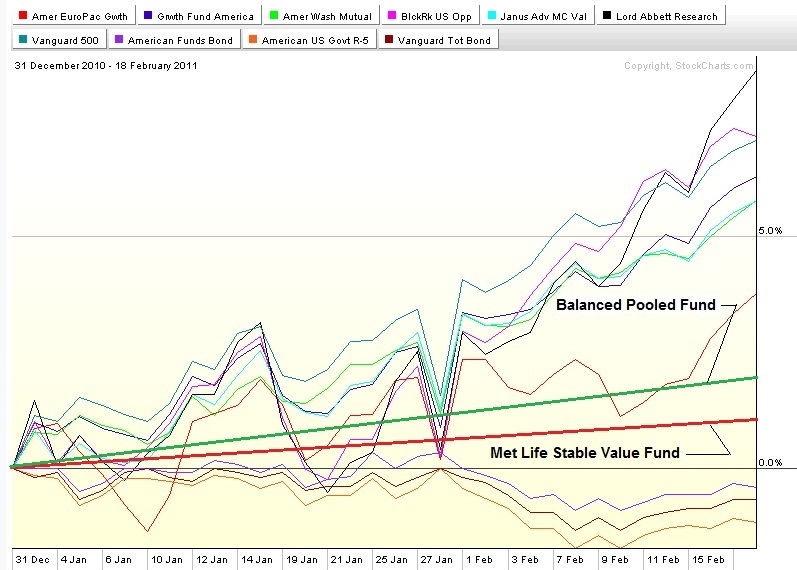

Saturday, February 19, 2011, 04:21 PM

"When the Fed is the bartender everybody drinks until they fall down."

— Paul McCulley

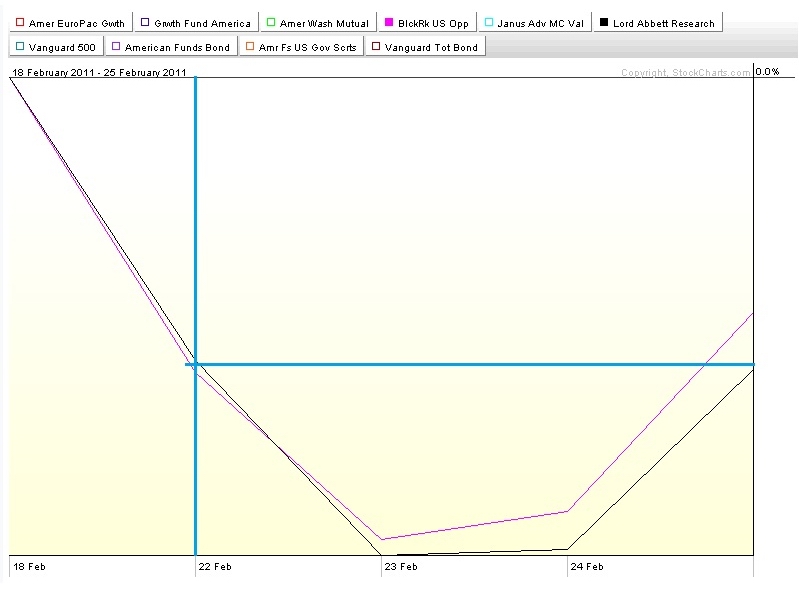

This Is EXTREME And Now I'm REALLY squirrelly about staying long. I've got a lot of gains to keep, and the potential for substantial losses in a short time.

Today was UGLY!!!

Discretion Is The Better Part Of Valor

During lunch I went from 95% Stocks to 99% Cash (Stable Value Fund) with minimal effect from the rapid trading rules. Let's let things settle down. I can get back in in one day, but as the old song goes, "Don't Make Your Move Too soon..."

Stay Tooned....

( 3 / 1153 ) ( 3 / 1153 )

Talked To A Business Agent At The Last Meeting. There Are Four Of My Apprentice Class Still Active. Two Are In The Business Office And Two Are Still Working In The Field. Makes Me Wanna Ride Fast And Take Chances.

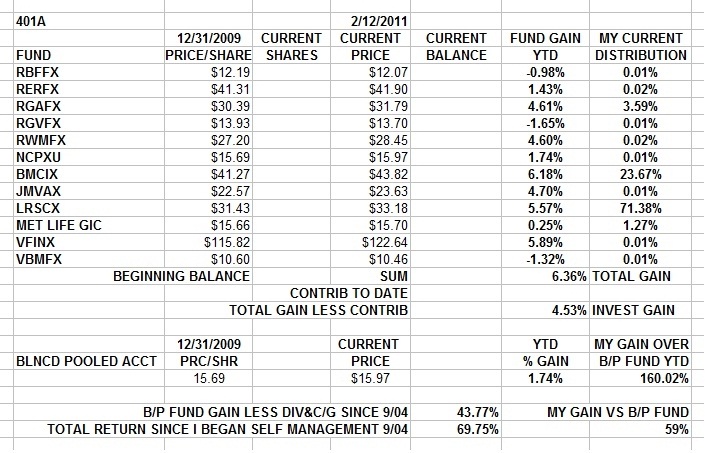

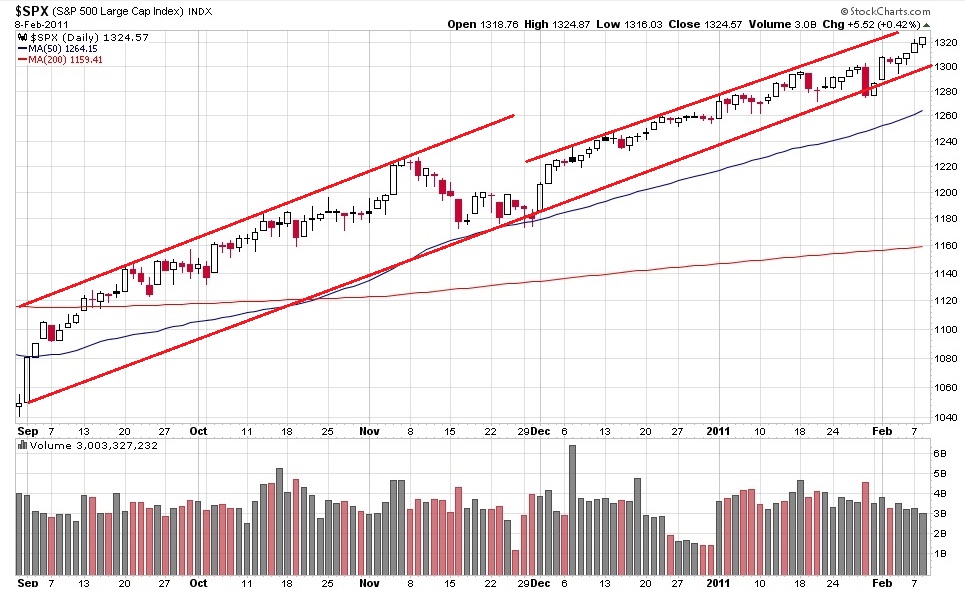

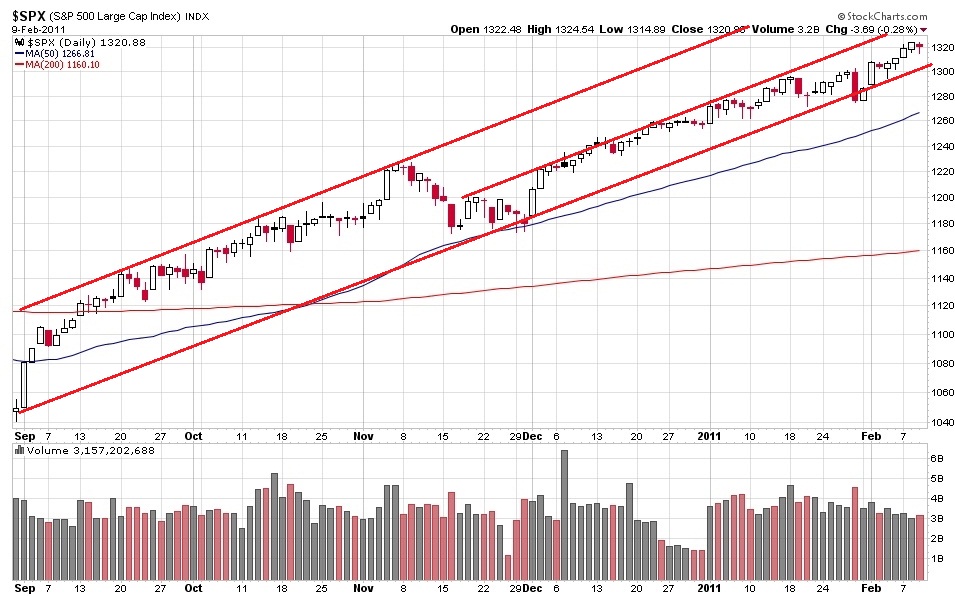

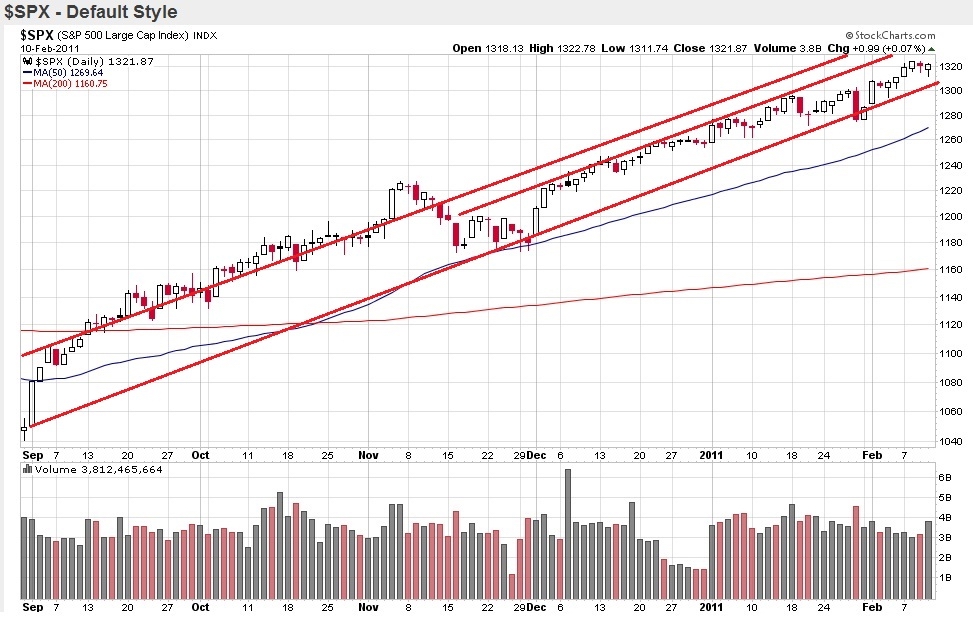

Saturday, February 12, 2011, 12:25 PM

It is not worthwhile to try to keep history from repeating itself, for man's character will always make the preventing of the repetitions impossible.

--Mark Twain

James Cotton had some smokin' performances at the Monterey Jazz Festival's Sat Afternoon Blues Show that are out there waiting to be discovered. They were broadcast live on KJAZ. My tapes were DBX encoded, dubbed to cassette, and long gone. The KJAZ announcer had it right. "These guys could start a riot inna graveyard."

Inna mean time;

http://www.youtube.com/watch?v=XTDpsOY2dX4

http://www.youtube.com/watch?v=GZXMWklGf84

http://www.jamescottonsuperharp.com

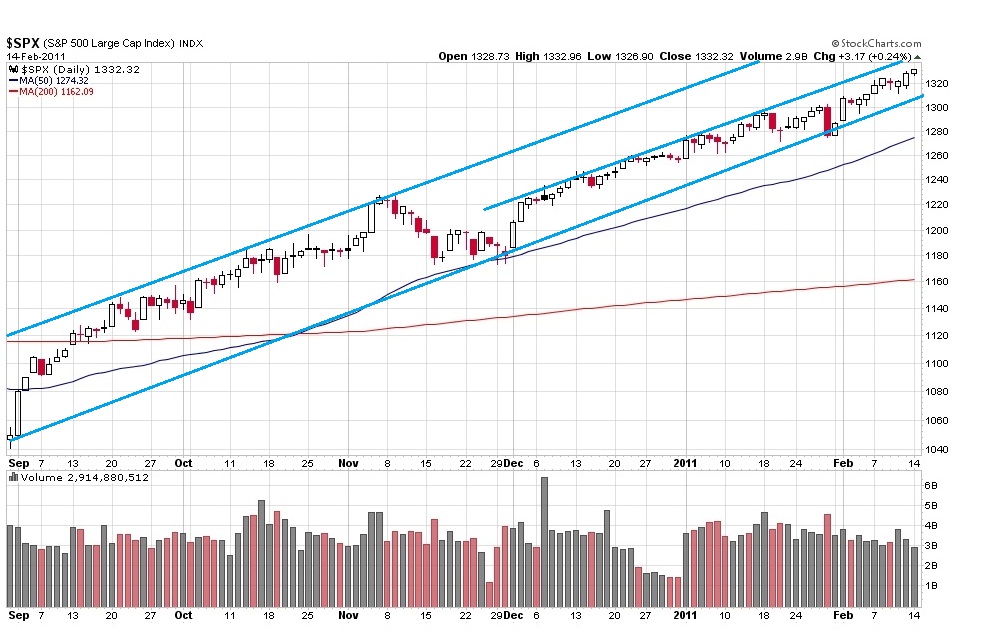

THE MARKET IS A BEAST WITHOUT PAWS...

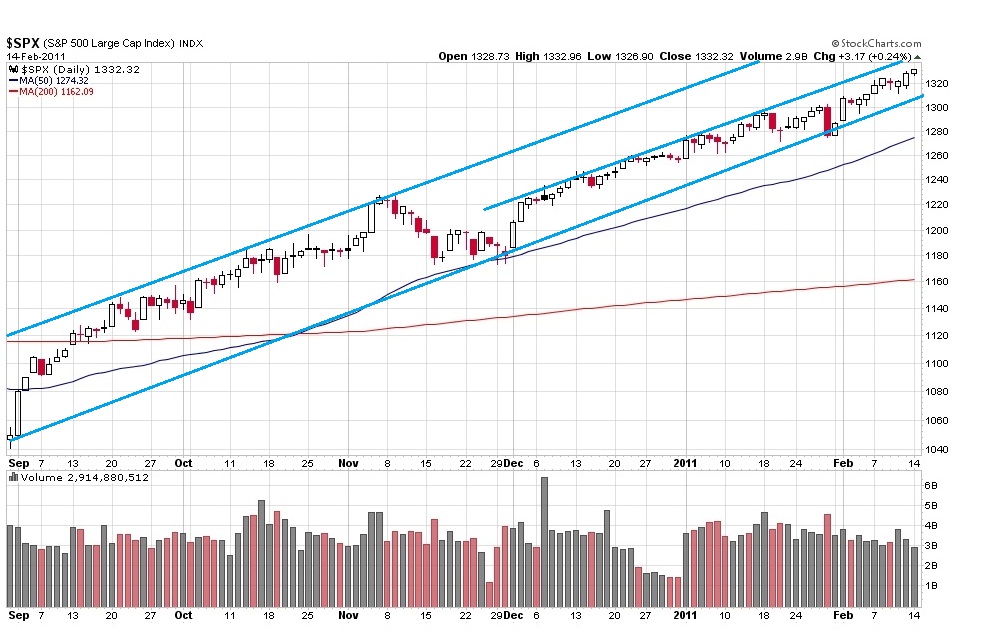

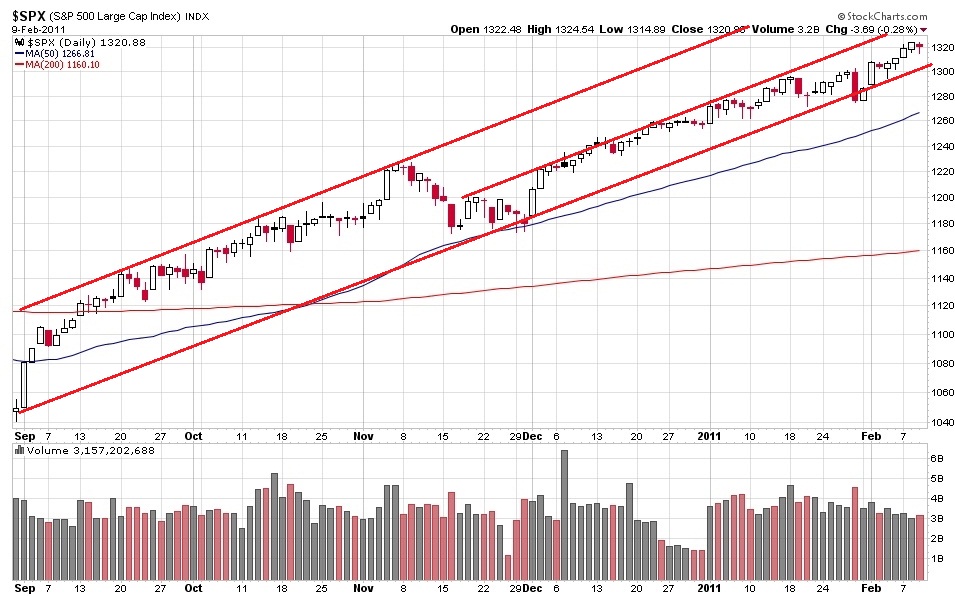

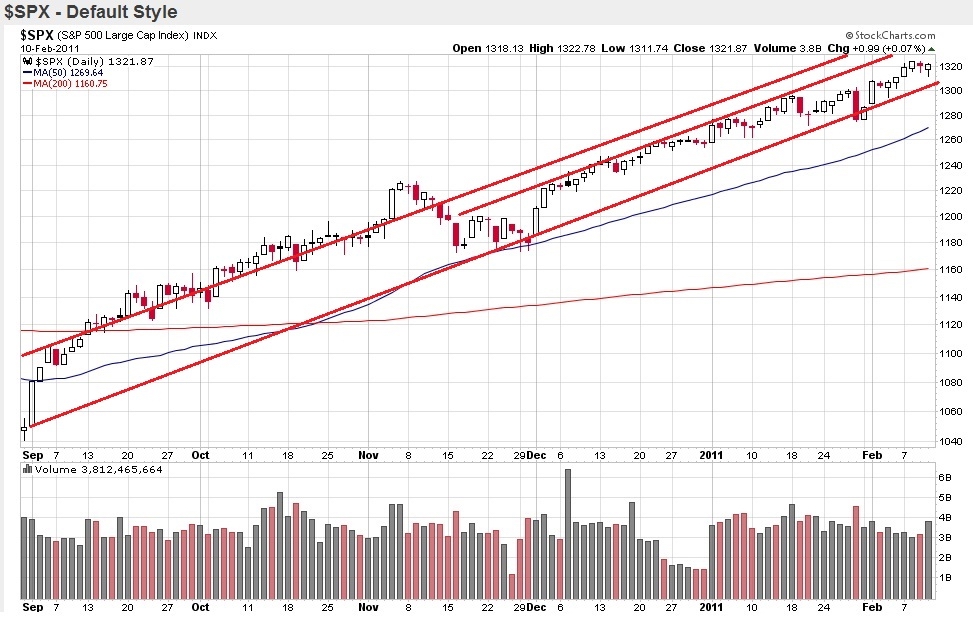

Uptrend still intact... I'm still innit to the hilt, still with the finger onna eject button.

Excellent first six weeks. Gotta think about possibility and advisability of bookin' profits at some point. This is about a third of what I like to see for the year....

Just because it may make sense doesn't mean I'm gonna do it...

MONDAY.

ANOTHER up day

Uptrend STILL intact... I'm STILL innit to the hilt, STILL with the finger onna eject button. I'm STILL big time concerned. But I'm getting pretty jaded and can't see that it is doing me much good...

Still.....

Tuesday...

Still Long. Looks Like A Pause. A little pullback from a long way up there. It's not time yet......

Wednesday

Even more up, blah blah blah,,,,,

Stay Tooned....

( 3 / 1159 ) ( 3 / 1159 )

Nothing Sharpens Your Appreciation Of Life And Clarifies The Difference Between Fear And Respect Like Looking Over The Edge. But That's A Third Beer Story....

Saturday, February 5, 2011, 02:29 PM

"Worry does not empty tomorrow of its sorrow; it empties today of its strength."

Corrie Ten Boom

Now For Something cOmPlEtElY dIfFeReNt....

http://www.youtube.com/watch?v=thWtzBsd ... re=related

Speaking of Fear and Respect...

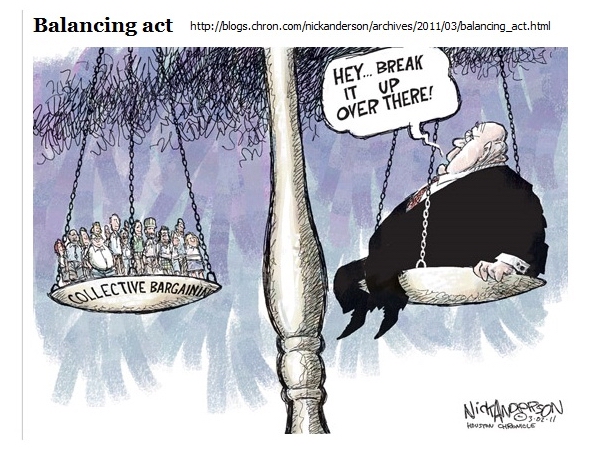

The Markets are always about the balance between Greed and Fear. Lately it is all about greed and the fear of losing out, not losses.

Wall Street always comes back to it's roots... which is Main Street. And Main Street ain't pretty lately. Especially compared to Wall Street. My asset allocation is all about taking what Wall Street offers with an I on the door. Will I get out in time?

I upped my contributions inna 401a when we got some decent choices 6 years ago and that and good and aggressive asset allocation has got the balance and the daily volatility up to where the good days are party hearty and the bad days are like stepping onna rake in tall grass. If I'da had decent choices for the full 20 years of the 401a, now'd be all about nicking some bases on hits on good pitches and I'd have a lot of comfort about retiring is a coupla three or four weeks instead of three or four years after I've run it all the way out...

Oh Well. That's a different life. Somebody else's. So now I gotta get what I can outta what I got inna 401a. Come to think of it, I'm real comfortable with that. YMMV.

So Merrill Lynch’s coverage of Irish banking, before the crisis, was dead on. And they threw their analyst under the bus to whore for more banking fees. Cowards. Criminal toadies. Chickenshit pimps who would sell their mothers into forced prostitution for a buck. That is Merrill Lynch, and the fact that a single goddamned dollar of my tax money went to these spineless, money-grubbing parasites makes my stomach turn. If Goldman Sachs is a vampire squid, then Merrill Lynch is Escherichia coli of banking. Whatever they touch gets sick, and occasionally dies.

http://www.ritholtz.com/blog/2011/02/am ... -to-egypt/

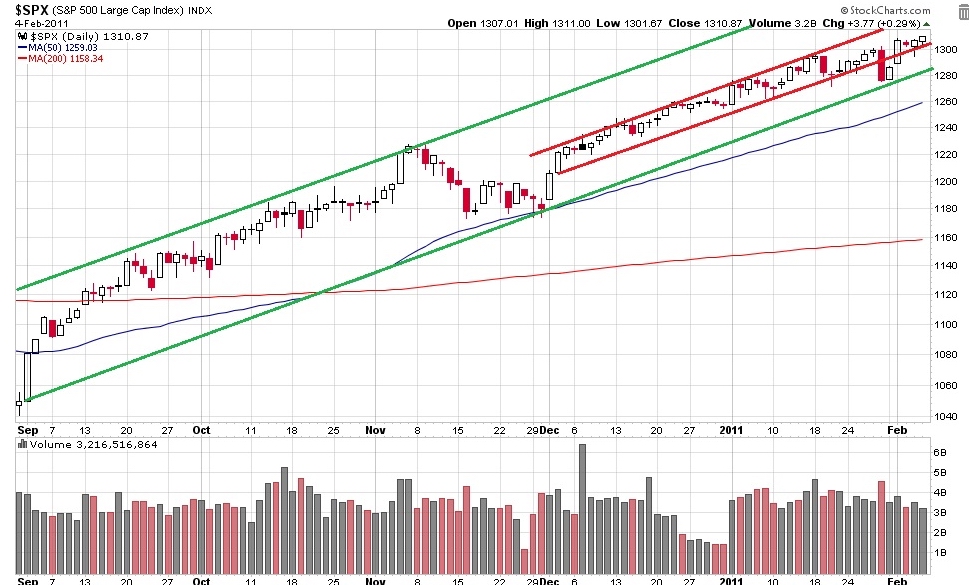

Still long, still concerned, still ready to bail. The broad market is up around 25% since Sept, never mind since March 09. I'm balancing the rapid trading restrictions, the trend, the need to book profits and avoid losses, and squirreliness of losing what has not come easy and won't be easily replaced. A correction of 4% to 10% would not be unexpected. A correction of 10% to 20% would not be beyond the pale. The thought of grinding hard to get back to even from an unexpected flash crash or downside panic is not welcome. Multi year bull markets are a lot more fun. Autopilot up day after day is low stress. Bear market rallys can be viciously explosive to the upside and can be exhilerating, but they can go down farther and faster than they went up too.

Still, I have all the the tools and info I need short of prescience, so WTF.

Monday Eve...

DAMN! One Gawddamn up day after another without surcease. How long can Wall Street dance to the stars in the face of Main Street doin' the Main Street Moan?

I'm Keepin' On Chooglin' with tight stops on the IRA's and Tradin' Account and ready to pull the rip chord on the 401a.

http://www.youtube.com/watch?v=mUzl7_OpVLA

http://www.washingtonpost.com/wp-dyn/co ... 00114.html

Tuesday

Another Day, Another Dollar Or Two.......

The longer it goes higher, the greater the rubber band is stretched, the more violent the snap back will be. The crazier the upside, the sweeter the gains, the greater the pains of giving a substantial chunk of it back.

I don't have a whole lotta fear. But I do have respect for consequences. That translates into a higher state of alertness and a determination to avoid giving ANY more back than what is absolutely unavoidable...

Wed Eve...

More O The Same... Tick, Tick, Tick.....

See Ya At The Hall

Thurs

Even More More Of The Same....

But Is It Rolling Over...?

Stay Tooned...

( 3.1 / 33 ) ( 3.1 / 33 )

It Don't Look That Bad, Really .... It Sure Feels Bad, Though..... Could Feel Worse Tomorrow.

Saturday, January 22, 2011, 04:15 PM

You can't trust anything the government says. Wait, I knew that already. Thanks for nothing, Julian Assange.

-- Paul Vigna

...Then You'll Never Hear Surf Music Again....

--Jimi Hendrix Re; Dick Dale's Critical Illness

Akshully, I Got My Deck Shoe Surfer Tennies and Short Sleeve Madras Shirtz On And Here's Some Surf Music To Go Wit' 'em....

http://www.youtube.com/watch?v=T8__EwAT ... re=related

http://www.youtube.com/watch?v=tqC3BjIy ... re=related

http://www.youtube.com/watch?v=GWw55XhT ... re=related

Yeah That Is Who You Think It Is. And Chris Spedding Too...

I was unaware of the relationships between Dick Dale and Hendrix and Dick Dale, Leo Fender, and JBL.

Bloody Costly Days Continued...

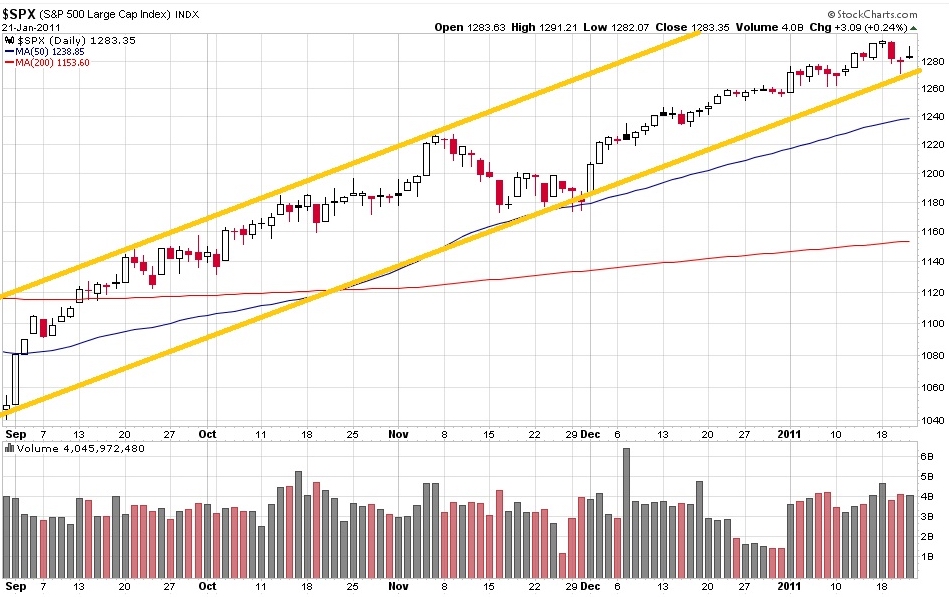

So I'm All In Inna Two Most Aggressive Fundz Inna 401A.

And the post parabolic move/beginning of the earnings reports dollar losses in the account are a kick inna gonads. It brings home to me why so many of the guys I work and hang with are so comfortable with all their money in the GIC/Stable Value Fund. We've got 20-30 years inna trades and some coin inna 401a. We got the possibility of some serious upside moves in a few days or weeks time in the 401a account. But we also got the possibility of some breath taking moves down in a bad week. In the end, we gotta go with what lets us sleep at night. For some, that is the cash equivalent fund in the 401a and a regular coupla percent a year up in the account and no wild and crazy up days and stoopid bleeding from the eyeballs down days. Nothing wrong with recognizing that what you have in the 401a is a significant amount to you and worth being concerned about. Once you see daily or weekly balances bouncing around and gaining and losing you significantly more than you earn at work that week, you are obligated to make a choice about how to deal with it. Eliminating the possibility of losing what you got, making a very modest return and sleeping soundly is a totally acceptable choice. To deny that would be dumber than a box of rocks. Which I ain't.

But I see things differently than most other people. I still have a race bike and I think about track days and racing again. I'm kinda like into action and motion as a life style and a preferred mode of operation. It takes all kinds.... that's why choices exist. And I ain't alone... There are guys I've shown the what and how to who are playing the game the same as I am, for whatever their own reasons are.

So....

I'm getting enough of a balance in the 401a where what was a few dollars move due to everyday ordinary market volatility is now some serious coin up and down. Gotta readjust my concepts here. If I see the huge upside days as part of the process and can work with them, I gotta be able to deal with the other side of the deal too.

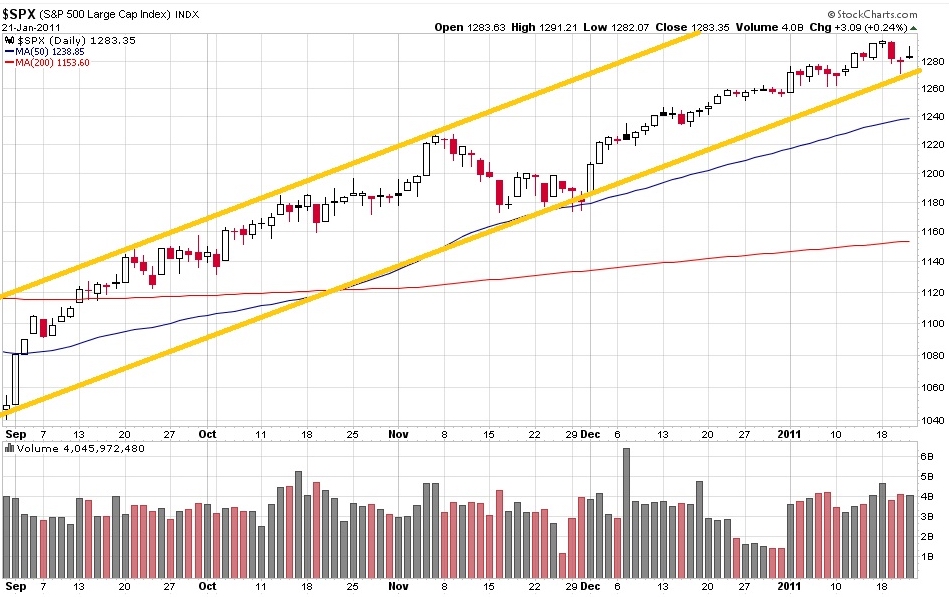

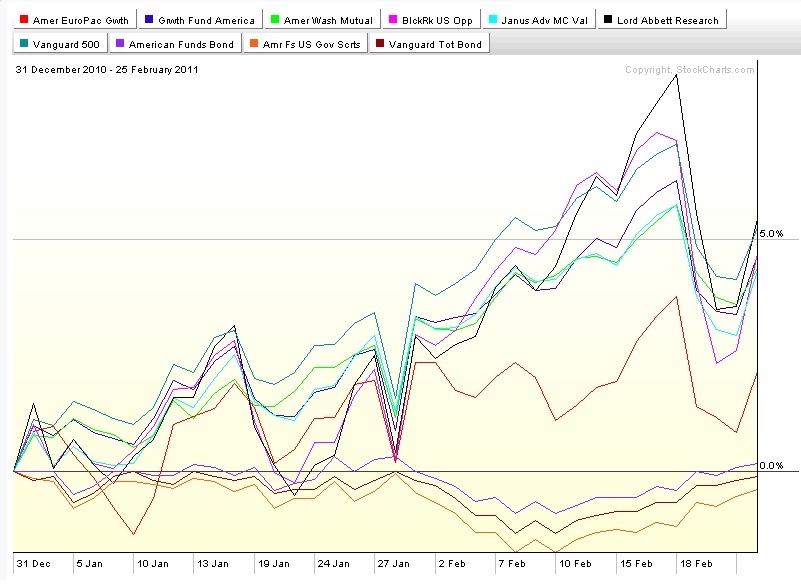

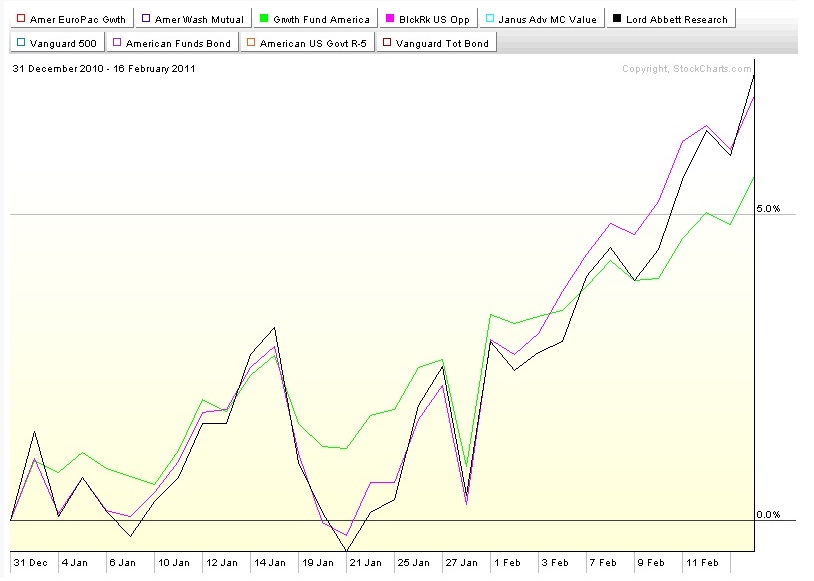

So Check out the chartz.

Looks like a parabolic move up in a short time that paid off big time.

So I'm building my 401a like mad when the weather is good. Sometimes a Summer storm or the first few storms of the Fall soak everything, blow the tarps around and maybe fuck up something badly enough that it takes time and money to fix it. Ain't no big thing. It's the price of getting something done. At least it ain't noo big thing as long as I don't let it become a big thing. I gotta secure everything for the winter when the time comes and react in the case of an unexpected tornado on the horizon...

In the last week, I've lost in my 401a what would have been a totally unacceptable amount of money 15 years ago. Like say the first three years of contributions and investment gains. Or, looked at differently, I've gotten my nose tagged hard enough to remind me that bad things can happen and that the chart above says that bad things might be eminent. The uptrend is just barely intact, is extended and has been unrelenting and parabolic, and has been cruisin' for a bruisin'. The market might be starting to roll over hard after an explosive move up and there are a lot of people with profits to protect and the downtrend could get ferocious. I really haven't been hurt yet. My eyes are watering and there's a spot of blood on my sleeve, but here is not a lot of damage done. But I have been warned.

Staying long in the face of every reasonable appeal to prudence and caution has worked and worked well for the last 90 days. Nothing lasts forever...

http://www.ritholtz.com/blog/2011/01/si ... s-fck-you/

http://www.msnbc.msn.com/id/41188877/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/th ... b-killers/

http://www.msnbc.msn.com/id/41103288/ns ... itol_hill/

http://www.ritholtz.com/blog/2011/01/wi ... kruptcies/

http://www.ritholtz.com/blog/2011/01/qo ... l-economy/

http://www.ritholtz.com/blog/2011/01/market-structure/

http://www.msnbc.msn.com/id/41097319/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/ho ... more-62383

http://www.msnbc.msn.com/id/41043127/ns ... al_estate/

http://debka.com/article/20558/

http://debka.com/article/20558/

http://www.ritholtz.com/blog/2011/01/no ... -long-run/

http://www.msnbc.msn.com/id/41086473/ns ... ork_times/

http://www.ritholtz.com/blog/2011/01/se ... doug-kass/

http://www.ritholtz.com/blog/2011/01/wh ... the-u-s-a/

http://www.ritholtz.com/blog/2011/01/ch ... tail-risk/

http://www.ritholtz.com/blog/2011/01/su ... events-15/

http://www.ritholtz.com/blog/2011/01/gd ... recession/

http://www.ritholtz.com/blog/2011/01/ho ... ck-market/

http://www.ritholtz.com/blog/2011/01/th ... more-62281

http://www.ritholtz.com/blog/2011/01/20 ... more-62271

http://www.ritholtz.com/blog/2011/01/mo ... wine-gold/

Stay tooned.

( 2.9 / 1239 ) ( 2.9 / 1239 )

Startin' Third Week O' The Year.... I'm Busier Than A Long Tailed Cat Inna Rockin' Chair Factory Makin' Retirement Money Inna 401a While I Can And Prepping To Make The Moves To Keep It When It Gets Hard To Do So...

Saturday, January 15, 2011, 04:11 PM

The only thing on the level on Wall Street is the water in the toilet bowl.

Bill Singer

The first is the only instrumental to be banned from Top 40 radio.

The second is 20 years later. Interestin' story. I've got a copy of a live radio broadcast from a recording studio in the 70's in the Bay Area. Nice clean recording of about an hours music. Fabulous Rockabilly...

http://www.youtube.com/watch?v=JEBqpDDc ... re=related

http://www.youtube.com/watch?v=LUHz0i8_ ... re=related

I bailed outa stocks inna 401a two Fridays ago cuz I'm looking for a correction and it sure looked like the start of one. I kept IRA and trading accounts in stocks ona counta cuz o' diversification and greater flexibility in those accounts. False alarm. I was 99% back in stocks inna 401a by last Thursday. I'm now exposed to losses and penalties because of the a rapid trading rules if I bail out again in the next month, but oh well, there is a cost to everything. In this case I have to look at the cost of selling in front of or in the early part of a correction vs the possible cost of holding on deeper into a correction or all the way through one... I figure taking the occasional small hit is the cost of doing business. Taking the big hit going all deer inna headlights is not doing business...

Stocks Go Up On The Escalator. They Go Down By Way Of The Elevator Shaft.

At some point I will sell big time again. I'd rather it happens after rapid trading restrictions no longer apply. If the markets stay up for more than a month, No Problem! But, faced with losses from falling stock prices significantly greater than the losses due to triggering the rapid trading penalties, it'll be a no brainer to bail on a cascade down. No brainers are my specialty. You sell to avoid the wrong risk or to avoid the losses. It's stoopid not to...

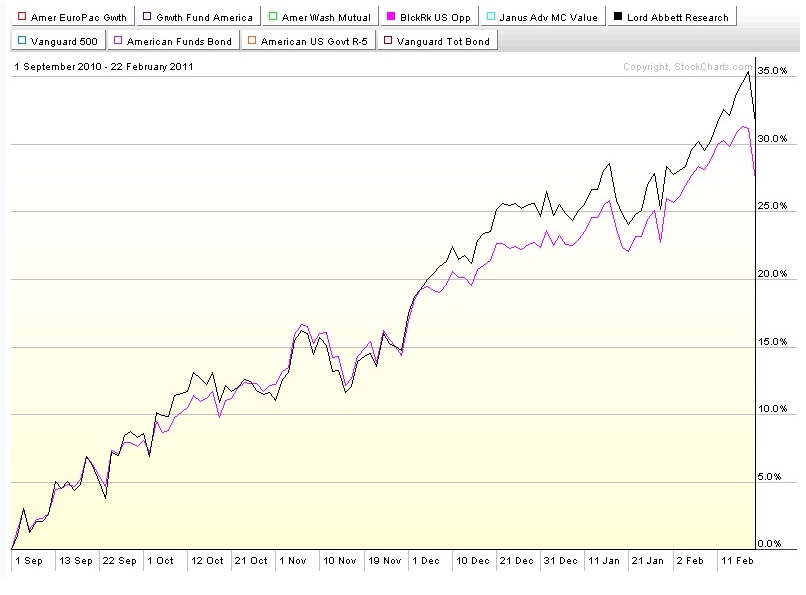

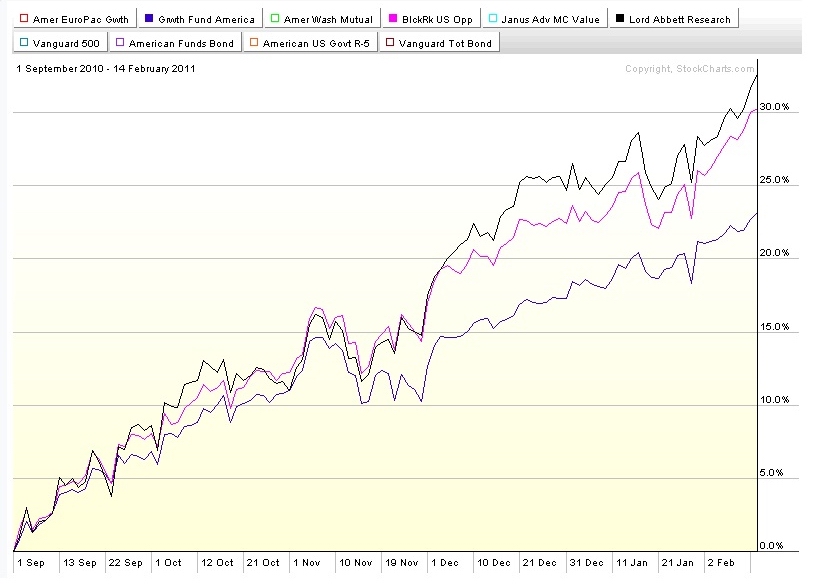

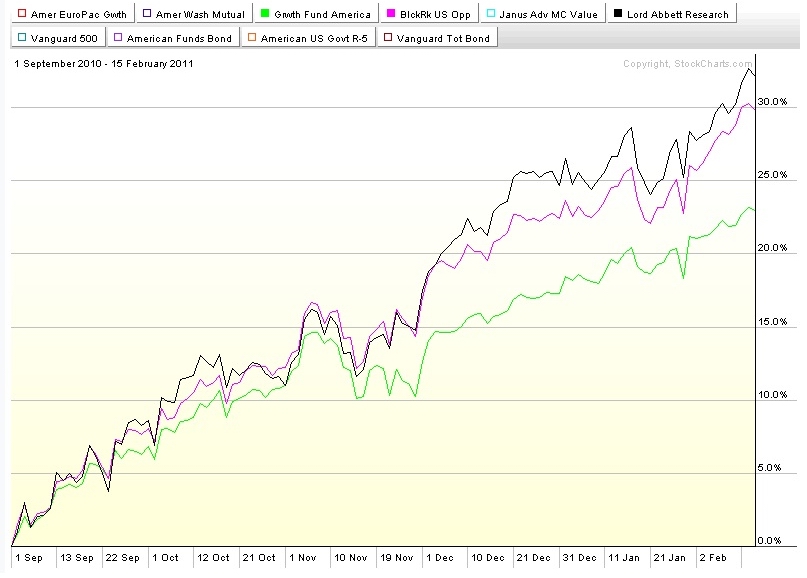

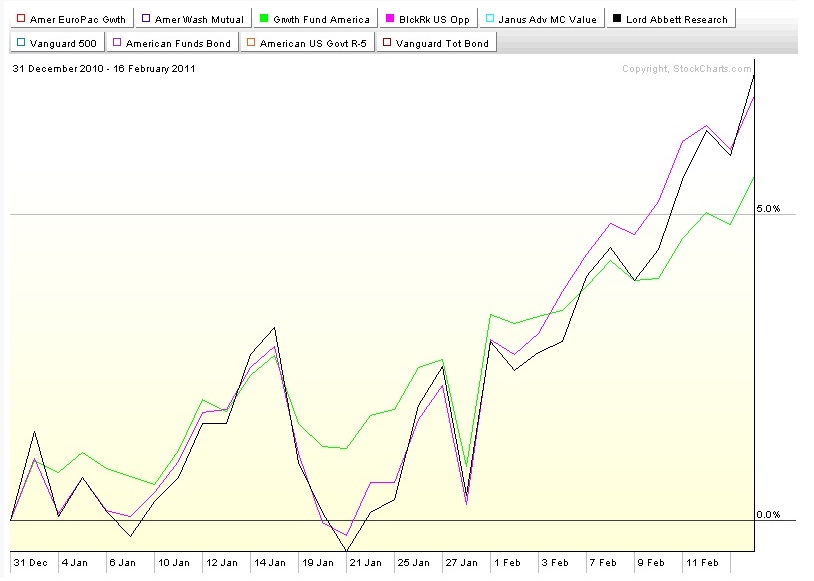

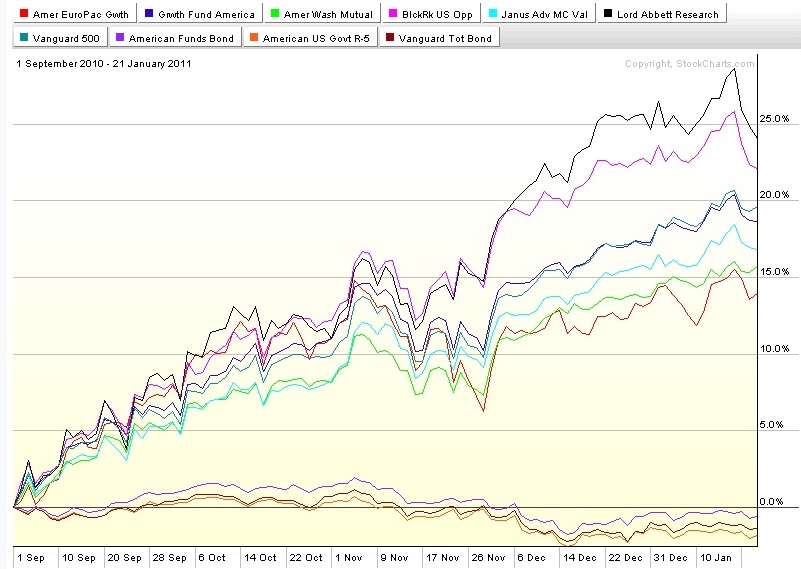

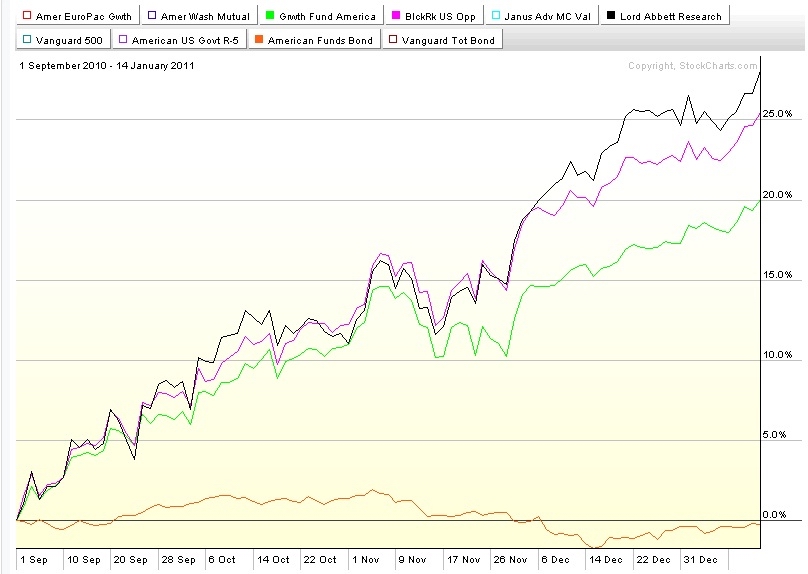

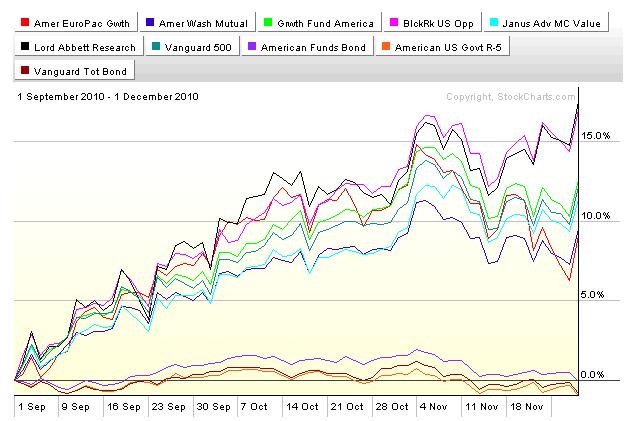

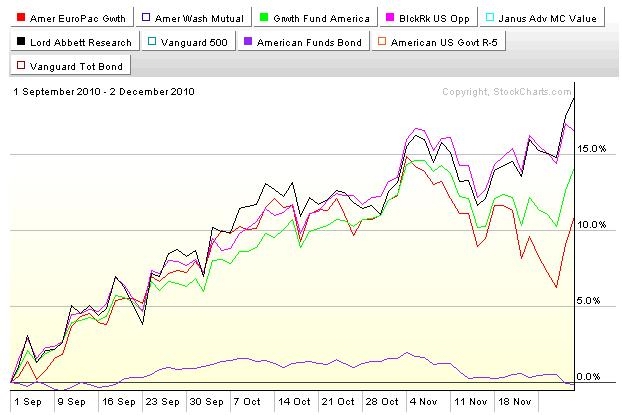

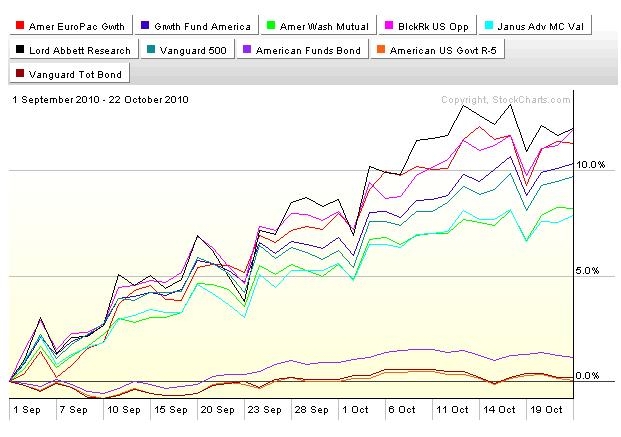

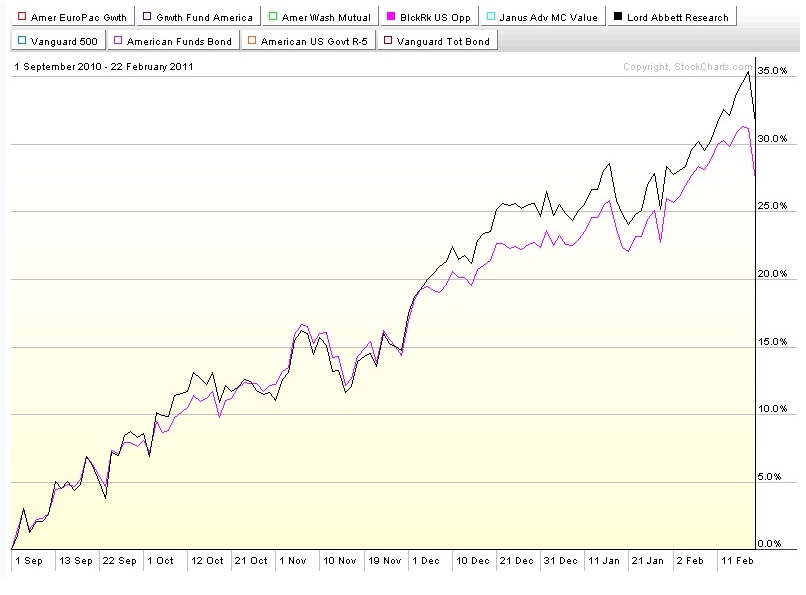

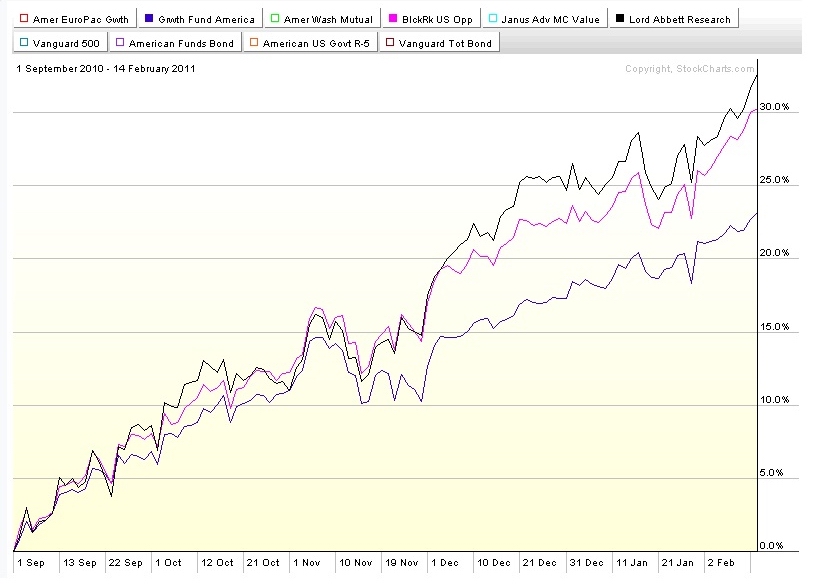

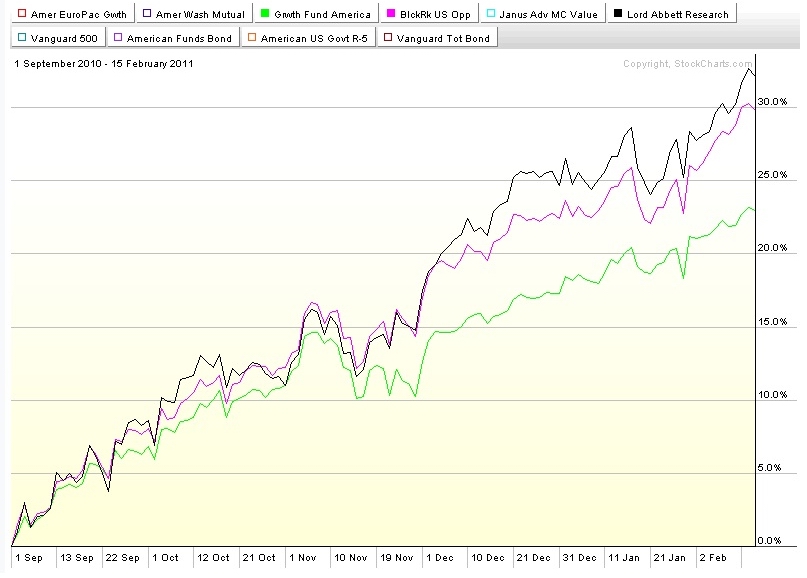

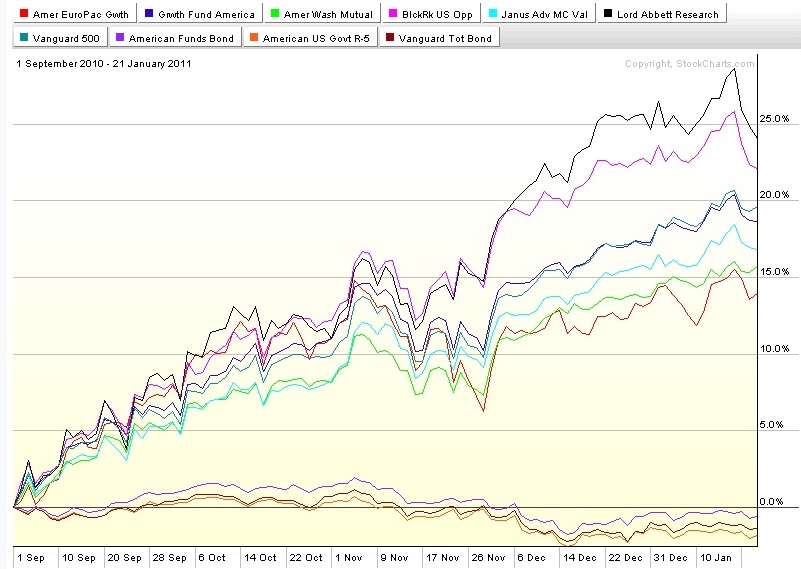

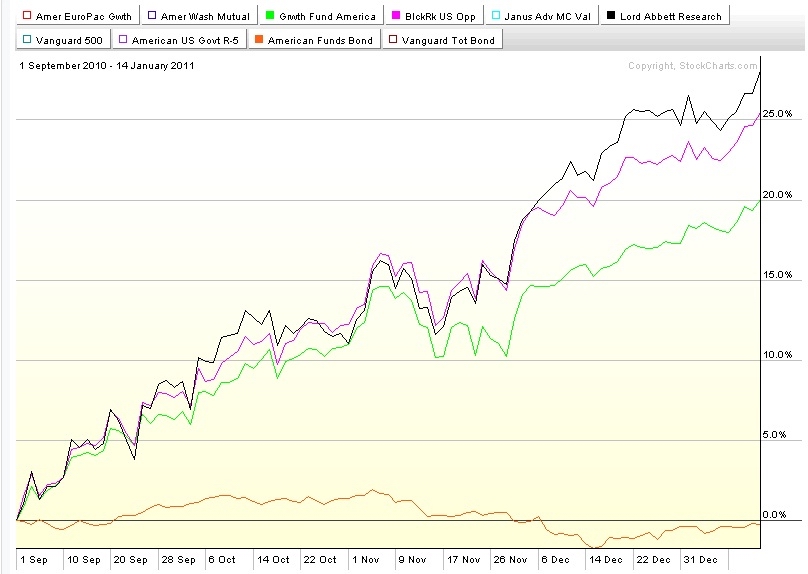

Here's the run from 9/1/10 to now in the funds where I had a significant percentage of my 401a coin.

I jacked the risk way (around 100%) up for the reward. I earned a very good year's worth of returns inna quarter. At some point I'll jack the risk way back down because that is the other side of the coin. When it's summer time and the winds and currents are right, you put everything that floats inna water. When it's all darkness, lightening, and waves and the ocean looks like Gods's blender, you go indoors and wait out the winter.

Pretty simple in the large part...

Ahll Be Baaack.....

Ghastly Bloody Costly Day For Me... 1/19/2011

Well... Not Really....

I did end up the day with a substantial loss in the 401a, my family IRA's, and my trading account. DEFINITELY a substantial loss in terms of pulling that much cash out of my pocket and throwing it away.

But Lookie Here...

Here's where the market has come from and gone to since 9/1/10.

I've been aggressively long for most of that run. What made today so nasty was how WFO I was this AM gathering while the gathering has been good. No Surprise I got my nose bloodied. Should I have been more conservative going into today? Hell yes. Did I think about it? Hell Yesss!

But I've thought of it a buncha times before inna last three months and it woulda been big time wrong not to stay WFO. So I was right a bunch, big time wrong once, and still looking good in the perspective the chart above shows...

Time to pull in the horns a tad. I'll prolly lighten up some in all the accounts tomorrow. I'm still well ahead of where I could have been if I hadn't put and kept it out on the table. > If I can keep most of what I've made in the last four months, that's a not half shabby outcome for less than four months work...

Rev Shark is right; Capital preservation is job #1 and not putting yourself in a position where you have to use all your smarts and luck and three quarters of the next run up getting back to even is job #2,#3,#4,#5,#6,and #7.

Stay tooned.....

( 3 / 1246 ) ( 3 / 1246 )

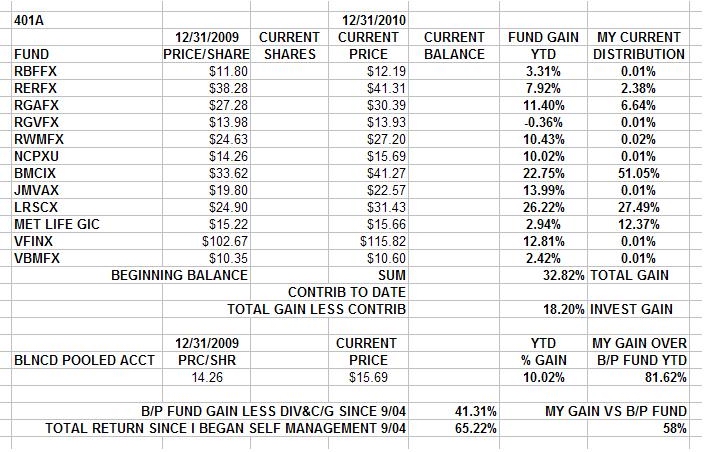

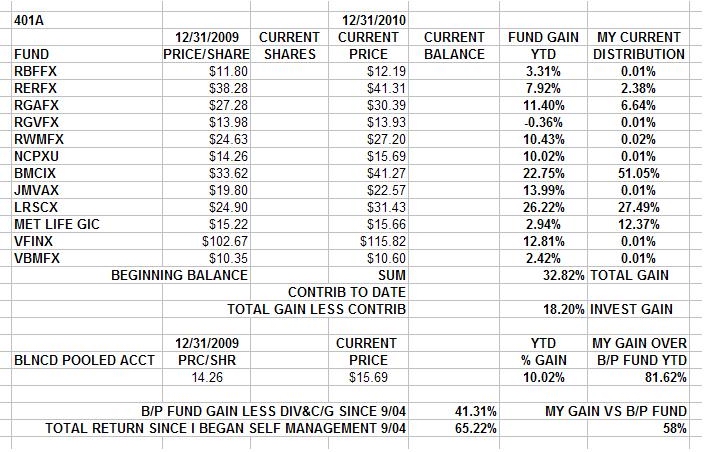

Coupla Things.... Guests For New Year's Dinner, And The 12/31 Data Has Not Posted For My 401a....Despite Being There @ My Brokers And Charting Service...AND The Dividend And Cap Gains Have Yet To Show Either.....

Saturday, January 1, 2011, 12:12 PM

Despite all of the talk about Democratization of investing, Wall Street primarily serves only the very wealthiest Americans. And that is a shame.

-- Barry Ritholtz

No Chartz And Table Zup @ www.joefacer.com Kinda....See da header.... except not not... See Below.....

I got the right prices on the 401a site by entering the wrong dates... But I'm not so sure about the shares/cap gains/dividend reinvestment situation. Prolly close enuf fer what I do, so there ARE chartz. But they'll be even righter next week.

Interesting article in Nat Geo about memory.

http://ngm.nationalgeographic.com/print ... /foer-text

I saw the Yardbirds @ the 'mo during the last tour just before they morphed into Led Zep... Two sets from 20' off the stage. Cream from half way back at the 'mo, Hendrix, A.King, And Mayall @ Winterland, 2 sets and I left at 2:30 and Hendrix was still goin strong... Butterfield w/ Bloomfield and Bishop @ the 'mo and later @ the Carousel ('mo West). J. Tull @ the Berkeley Community Theater after the Benefit album and again on the Thick As A Brick tour.... the Who just after Woodstock was released....GAWD... if I could only replay these note for note/minute for minute... as well as another coupla three four hundred hours... Oh Well....

http://www.youtube.com/watch?v=MLv7viCM ... re=related

I upgraded to Windows 7 this weekend.

I've got this old HP that is my workhorse that predates Vista; I got the Vista upgrade disk that was supposed to come with it a coupla three four months later inna mail. The VERY FIRST ITERATION of Vista. I've never upgraded. Sunday I did so, starting at 2:00 PM. "how hard could it be? What could possibly go wrong?"

I've been a computer user since '82. I'm an old DOS 2.01 Dinosaur and I got my eccentricities... The HP has a lotta stuff... all over it. Rather than lose stuff stuck in an arcane directory associated with a program, I decided to upgrade to Vista and then upgrade to Seven rather than do a clean install. Well....

The Vista upgrade disk didn't recognize my upgraded and patched XP system as anything it expected to see... XP was supposed to be DOA. So I un repatched my OS and beat the computer/disk duo into submission... Then my new version of Vista needed 107 updates to get modern enough to work...and be upgradeable.

At 11:00 Sunday evening I decided to upgrade my seldom used Vista laptop since I sure as hell wasn't gonna need the 7 upgrade disk inna near future. Sure enough, my laptop only needed 50 upgrades prior to Sevening.... Grrrrr.

1:30 Sunday AM, I had a Vista'd PC.

10:00 PM Monday evening I had a Windows 7'd Desktop and Tuesday mid morning I had my W-7 laptop.

To adapt to 7 or adapt it to me... that is the question....

Now a clean W 7 install onna brand new home media server I'm nerding with and I'm home free for a while.....

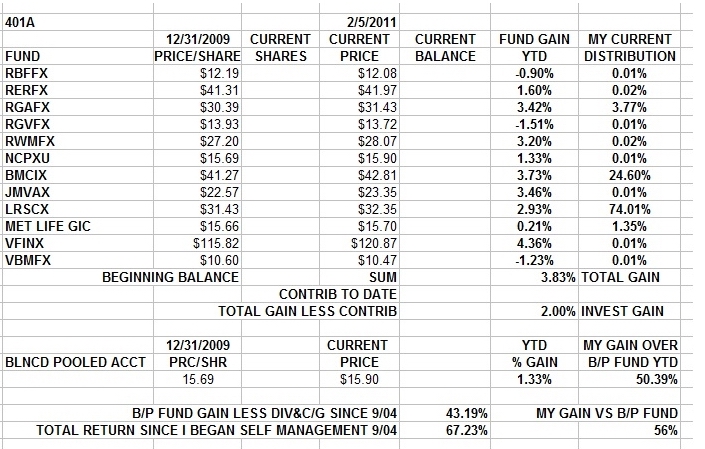

This is what '10 looked like...

I'll prolly write about it later...

http://www.newsweek.com/id/226493

http://www.ritholtz.com/blog/2011/01/fl ... udclosure/

http://www.ritholtz.com/blog/2011/01/bo ... eddie-mac/

http://www.ritholtz.com/blog/2011/01/am ... ing-class/

http://www.ritholtz.com/blog/2011/01/on-mark-to-market/

http://www.ritholtz.com/blog/2011/01/bo ... eddie-mac/

http://www.ritholtz.com/blog/2011/01/wh ... t-in-2011/

http://www.bloomberg.com/news/2010-12-2 ... ubble.html

http://www.ritholtz.com/blog/2011/01/ec ... ettlement/

http://www.ritholtz.com/blog/2011/01/ob ... cal-skill/

http://www.ritholtz.com/blog/2011/01/ca ... o-not-own/

http://www.ritholtz.com/blog/2011/01/fl ... udclosure/

http://www.ritholtz.com/blog/2011/01/cl ... -industry/

http://www.ritholtz.com/blog/2011/01/volcker-resigns/

http://www.ftrain.com/wwic.html

Lookie here.....

I've done my asset allocation with an eye toward two things.... Maximizing profits when the market was going up and being able to step to the side effectively when the market gets dangerous...

That looks like today. The market has been ready to go down for a while. It looks like the court decision in Mass. concerning Wells Fargo and US Bank and the payroll report were a good catalysts/excuses. I loaded up my 'chute and if I don't cancel my pending exchanges at the end of the day, I step off of the escalator big time.

STAY TOONED...

( 3 / 1268 ) ( 3 / 1268 )

Dickens; The Man Who Invented Christmas.... You Have No Idea How Much You Owe This Particular Limey........

Thursday, December 23, 2010, 10:22 PM

"The uniform, constant and uninterrupted effort of every man to better his condition, the principle from which public and national, as well as private opulence is originally derived, is frequently powerful enough to maintain the natural progress of things toward improvement, in spite both of the extravagance of government, and of the greatest errors of administration. Like the unknown principle of animal life, it frequently restores health and vigour to the constitution, in spite, not only of the disease, but of the absurd prescriptions of the doctor."

—Adam Smith

( 3 / 1158 ) ( 3 / 1158 )

Ya Gotchur Church Key, Your Skate Key, Your Line Level RCA Interconnect, An' Ya Got Me. All These Things Are Way Dated, But Not Quite Obsolete, Yet.... I Hope. In The Meantime, I Gotta Get A New Ribbon Fer My Daisy Wheel Printer An' A Roll O' Film Fer My 35mm An' My Wife's 110, An' A Brand New VHS VCR Cuz I Used Up All My Betamax Tapes ......Sure Hope I Can Find A Woolworths Or Monkey Wards Open Onna Sunday.

Saturday, December 18, 2010, 02:52 AM

"Change has a considerable psychological impact on the human mind. To the fearful it is threatening because it means that things may get worse. To the hopeful it is encouraging because things may get better. To the confident it is inspiring because the challenge exists to make things better."

-- King Whitney, Jr.

Chartz And Table Zup @www.joefacer.com

Stay Tooned

( 3.1 / 1060 ) ( 3.1 / 1060 )

All Work And No Play Make Jack A Dull Boy. But All Play And No Work Makes No Jack At All....Gotta Get The Proportions Right. Know What I Mean, Vern? ("KnoWhutImean, Vern?) See below...

Saturday, December 4, 2010, 01:40 AM

We make a living by what we get, but we make a life by what we give.

-- Winston Churchill

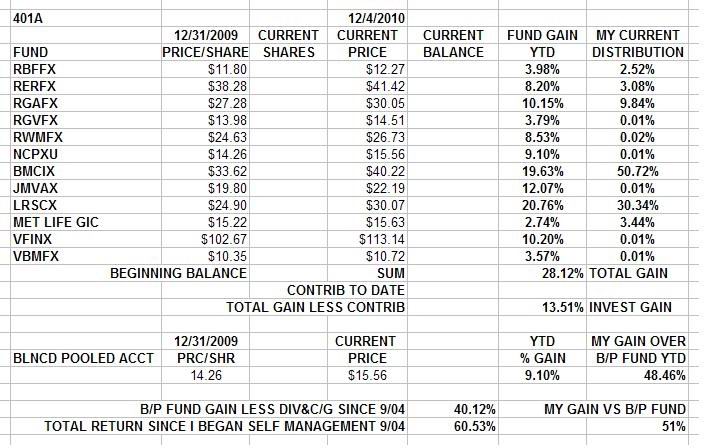

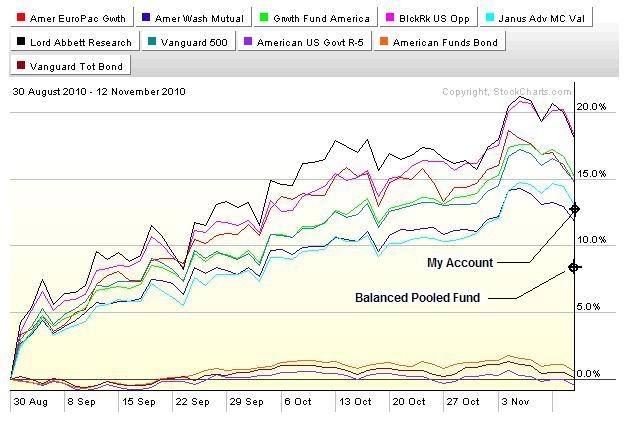

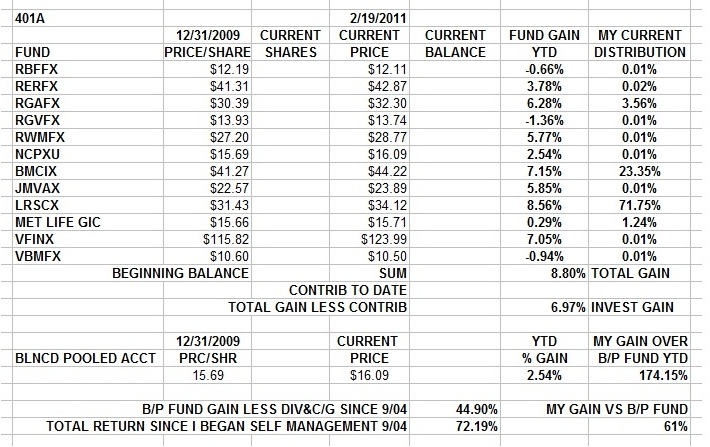

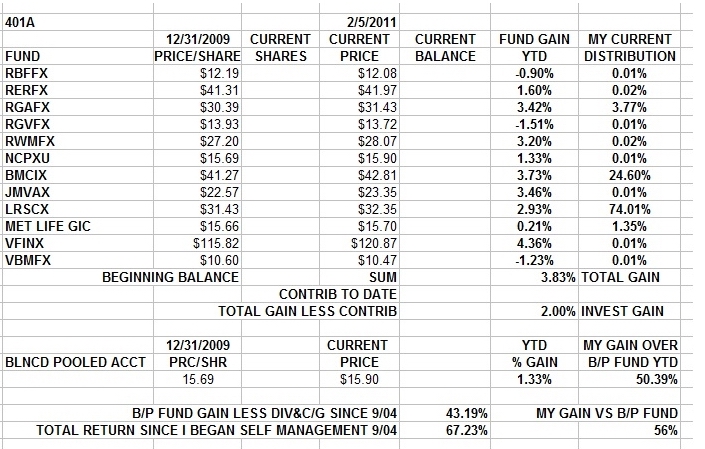

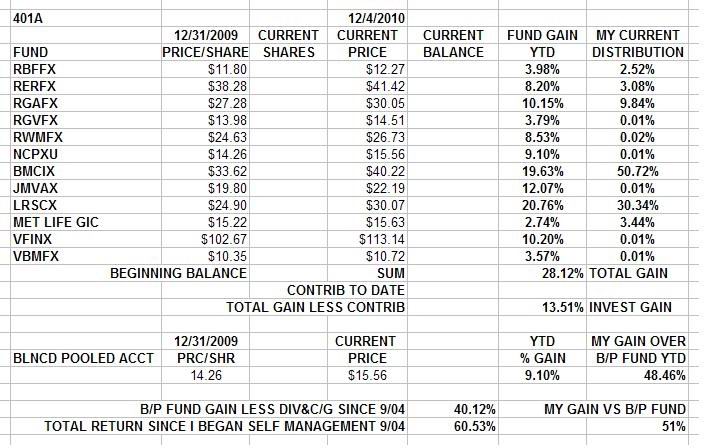

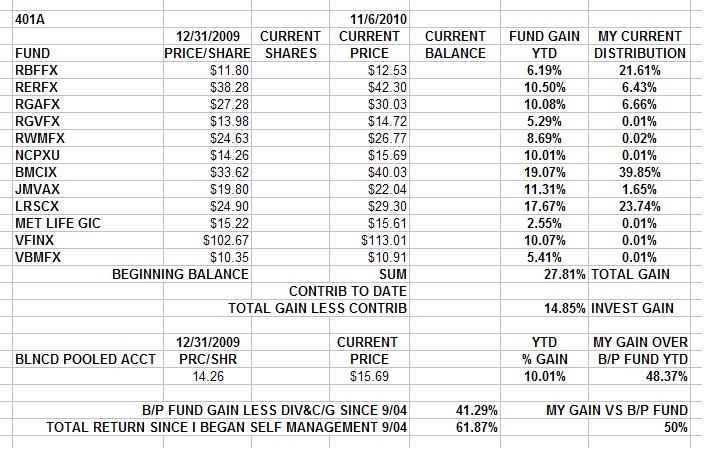

It's a SELF DIRECTED plan, see. Not a self neglected plan. I've long since blown off the Balanced Pooled Fund because I understand that it is the default plan, complete with all de faults anyone needs. I self direct and I went into high gear around 9/1. These are my horses from then until now.

And here is where I am as of 6:00 Friday 12/3 along with my and the B/P Funds returns. Pretty kool. Stay tooned for the rest of the month as I attempt to as I try to nail down gains before they go away and at the same time, not leave the game too soon. YMMV.

Burj Khalifa,

Burj Khalifa, From Space....Here, Hold The Tape, An I'll Walk To The Other End Of The Shadow An We'll Save The Trouble Of Climbing To The Top Of This Building To Measure how Tall It Is.....

Stay Tooned....

( 3 / 1235 ) ( 3 / 1235 )

These Damn Once in A Lifetime Market Crashs, Events, Flash Crashes etc, like '29, '87, '97, '02, '08, '10 And Maybe This Weekend Seem Be To Happening A Lot More Often Than Once A Lifetime.....

Friday, November 26, 2010, 07:16 PM

I am not a Democrat, because I have no idea what their economic policies are; And I am not a Republican, because I know precisely what their economic policies are.

-- Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com

iTunes has da Bee-atles. The COFGBLOG Has the KNICKERBOCKERS!!!!!!

http://www.bloomberg.com/news/2010-11-2 ... bonds.html

http://www.bloomberg.com/news/2010-11-2 ... tners.html

http://www.bloomberg.com/news/2010-12-0 ... -plan.html

http://www.msnbc.msn.com/id/39435196/ns ... ws-europe/

I hung wit the long side an hadda good day.....a really good day.

There is a possibility of a ramp up into year end as those who live by the returns YTD, are lookin at dyin' by the returns YTD, unless they save a mediocre year by goin' all out for the last two weeks. There are fundz who are having visions of their client's bailing out. They will try to manufacture performance and the sharp guys are ready and waiting for it... I stick wit what I got for now..... I'm heavy in the aggressive funds and no place no place else. Let's see if they can pile on to the momentum plays and do me some good. Do I got my mojo workin'?

These are my horses...Ride Sally, Ride.....

Stay tooned....

( 3 / 1143 ) ( 3 / 1143 )

Volatility; The Trader's Friend and the Investor's Nemisis. Here To Stay, Regardless.......

Saturday, November 20, 2010, 05:34 PM

"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around [the banks], will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered."

--Thomas Jefferson

Back Inna Garage Band Day, When You Had No Talent, It Was What You Played. How Could You Sound Good Without A Vox Continental inna band? Didn't a set of Ludwigs make me a drummer and wouldn't I have been even better with a full set of Zildjians? Biff Acne Showing Up With His Fender Jaguar And Vox SuperBeatle Amp Had More Instant Cred Than Eric Clapton Bopping By Lugging A Harmony Guitar And A Silvertone Amp...

Ah, youth....

Another Moldy Oldie.....

http://www.youtube.com/watch?v=F-VFq6nW ... re=related

The market is acting magnetized to a critical technical level. The recent bounce back up to and bumping up and through resistance and falling back through support has stopped my reallocation for now. Data on my website and theo-philisophical discussion and metamatic and cosmic allegorical ruminations to appear here later this weekend.....

Refied this week, just in time... Rates going up inna face of QE, bonds going down... Not expected and not good. Gotta factor this in to the 401a... corporates were good to me for much of this year. Gotta be concerned about giving it back in the market's ebb and flow and give and take... Getting what the market gives is OK. Letting the market take it back does not float my boat...

Pure platinum/diamond/gold on a financial website. Who'da thunk?

http://www.ritholtz.com/blog/2010/11/st ... -way-home/

( 3 / 1234 ) ( 3 / 1234 )

I've spent years and years in a single day waiting to get out of school when I was in 5th grade and about an hour between my 59th and 60th birthdays. The Relativity Of Time Becomes Clearer As I Age....

Saturday, November 13, 2010, 04:32 PM

"...in an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes. What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention and a need to allocate that attention efficiently among the overabundance of information sources that might consume it"

-- Herbert Simon

This always went along whenever somebody got experienced for the first time.....

http://www.youtube.com/watch?v=oxpcZrQQM-4

Tough week. End o' the year levitation vs too far too fast, China's coolin' inflation down and domestic reality setting in.

You gotta front row seat (in the cage) on the cage match between these dead economists...

http://www.ritholtz.com/blog/2010/01/fe ... ap-anthem/

http://www.bloomberg.com/news/2010-11-1 ... ate1-.html

http://www.stratfor.com/analysis/201011 ... r_and_g_20

http://www.msnbc.msn.com/id/40136417/ns ... l_finance/

http://redtape.msnbc.com/2010/11/in-new ... html#posts

http://www.bloomberg.com/news/2010-11-1 ... kfire.html

http://www.bloomberg.com/news/2010-11-1 ... egion.html

http://www.bloomberg.com/news/2010-11-1 ... -says.html

Bloody week in and of itself....in perspective, not so much. I've got friends still 100% inna GIC because they can't deal with the volatility of the markets once they get some serious balances in their 401a. Weekly gains can be overwhelmed and forgotten by serious down days. It can be breathtaking. No knock on them. If you haven't experienced it, you haven't got a glimpse down inta the abyss. Stocks go up on the escalator and can go down like falling down the elevator shaft.....

That said....This week was not good and Friday was a bloody nose. But it was on top of a good two months gains... correction and digestion before the next leg up or change in trend and the start of the markets rolling over?

Now... Don't fight the FED vs domestic reality vs China's interest rate bumps vs end of the year Wall Street money manager contract renewals, vs Holiday spirits vs get the last of what's on the table cuz it's been good so far and more is better vs declare victory and leave the table a guaranteed winner. This ain't an easy choice... Stay long and strong and make some more or lose most or all of what I've made, take half off the table and get 50% of the gains but risk only half losses? Or leave the table and call 12% return a pretty good year, which it really is?

I just don't think the year's highs for the market are in....although they might be. Monday will tell the tale. Standing pat, ready to react, and waiting for the market to tell me what it's gonna do and what I should do...

http://www.ritholtz.com/blog/2010/11/ro ... eposition/

http://www.ritholtz.com/blog/2010/11/fi ... r-the-bar/

http://www.msnbc.msn.com/id/40182444/ns ... l_finance/

Monday night....

TUESDAY

70+% cash and bonds, getting smaller in stocks tomorrow. Locking in profits....reducing risk....

( 3 / 1179 ) ( 3 / 1179 )

Scars Are Tattoos That Are More About Where Ya Been and Less About Decoration. Memories Are Better Than Last Decade's Intentions, Last Decade's Missed Opportunities, And This Decade's Regrets....

Saturday, October 23, 2010, 02:21 PM

"The best way to destroy the capitalist system is to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens."

-John Maynard Keynes

There was always a dichotomy between the Bill Graham/'Mo Auditorium live extended/jam/conceptual compositions/performances and the tight top 40 two minute/plus pop music. De 'Mo Vs Longshoreman's Hall. Sometimes the short stuff said what it had to say and then shut the fuck up. Check out the hair/Höfner bass etc. Way period...

http://www.youtube.com/watch?v=jJR_KGZO4U0

Tom Graff of Real Money sez that the Fed wants to see a little more inflation and to achieve that, they are willing to risk a lot more inflation. That's pretty much what I see. Having lived and worked through a big stagflation episode when the oil companies were throwing money left an' right an' I was there to catch my share, ('80-'85) I'm less than sanguine about doing it over again as a retiree when the banks/government are the ones with the cash (mine and yours used as collateral for loans) and I ain't inna path o' the geyser of cash......

My current 401a riff is still working. Fine tuning it now. Check out the percentages on my website. Buy an' Sell. Nailed one. Hope to nail the other. Tick...Tick...Tick........

http://www.newsweek.com/2010/10/23/a-py ... rance.html

http://www.bloomberg.com/news/2010-10-1 ... vanec.html

http://www.ritholtz.com/blog/2010/10/mo ... -linkfest/

http://www.msnbc.msn.com/id/39801398/ns ... al_estate/

http://www.bloomberg.com/news/2010-10-2 ... -baum.html

http://www.ritholtz.com/blog/2010/10/fo ... re-nation/

http://www.ritholtz.com/blog/2010/10/du ... ng-fracas/

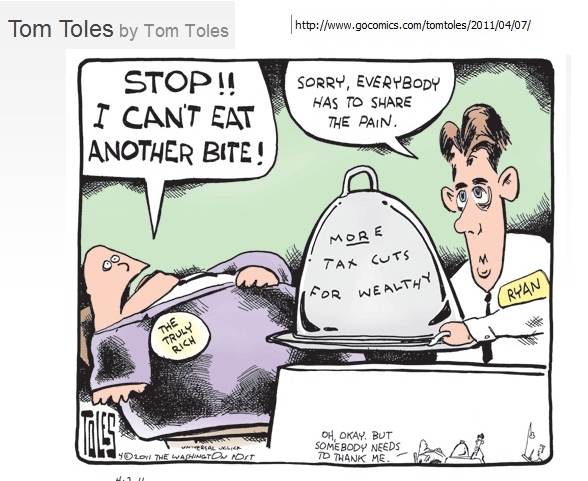

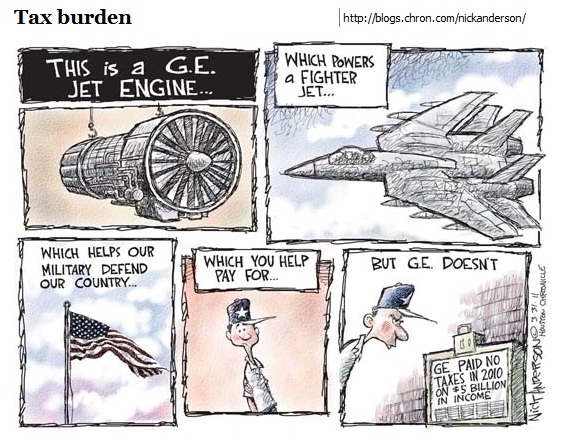

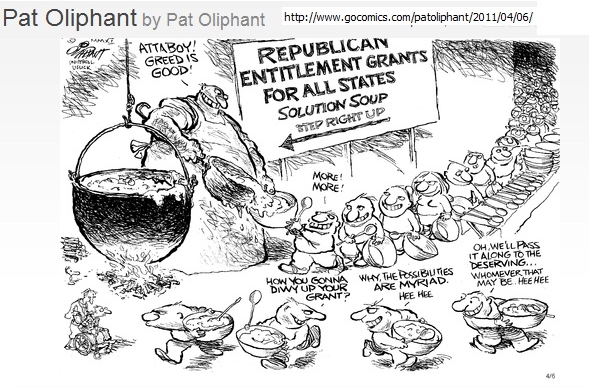

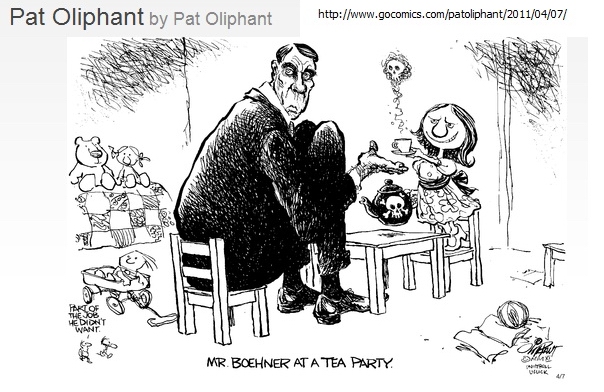

Washington says nothing can be done. There's no money left.

No money? The marginal income tax rate on the very rich is the lowest it has been in more than 80 years.

Robert Reich

http://www.sfgate.com/cgi-bin/article.c ... 1FV3LE.DTL

[/4]

YEEEEEHAA!!!!! GO GIANTS!!!!!!!!!

Stay Tooned.....

( 2.9 / 1281 ) ( 2.9 / 1281 )

So Much Good Music In My Library, So Many Good Musicians Gone. (Listening To Little Feat Late 90's Concerts w/ Richie Hayward) So Greatful For So Many Recordings Available To Fill The Day With Great Music.

Saturday, October 9, 2010, 02:15 PM

"If a man is offered a fact which goes against his instincts, he will scrutinize it closely, and unless the evidence is overwhelming, he will refuse to believe it. If, on the other hand, he is offered something which affords a reason for acting in accordance to his instincts, he will accept it even on the slightest evidence."

-- Bertrand Russell

( 3 / 1237 ) ( 3 / 1237 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar