| |

Ya Get One Life. Enjoy It While Ya Got It... Rest In Sobriety And Decorum When Yer Dead. WFO Until You See God, Count Ta Two....And THEN Hit The Brakes.

Friday, September 9, 2011, 08:23 PM

"The primary objective of leadership is to help those who are doing poorly to do well and to help those who are doing well to do even better."

-- Jim Rohn

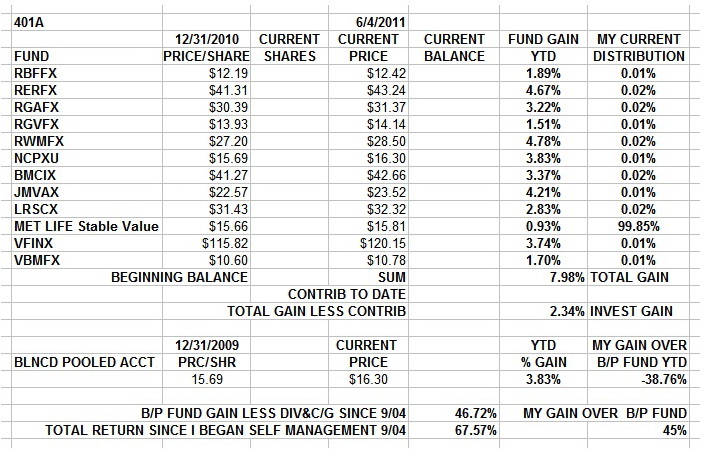

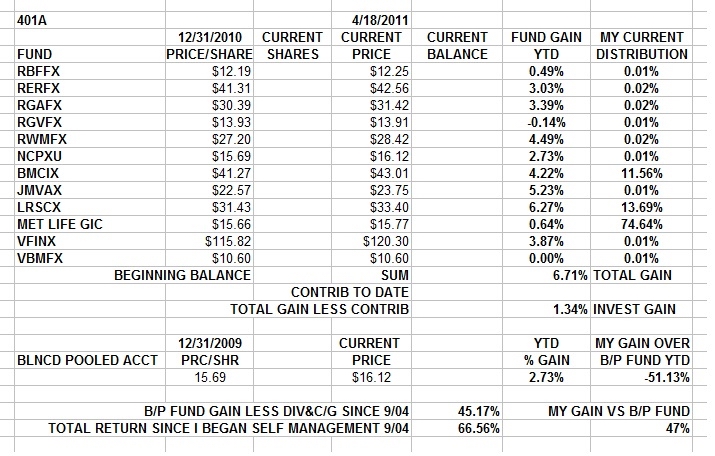

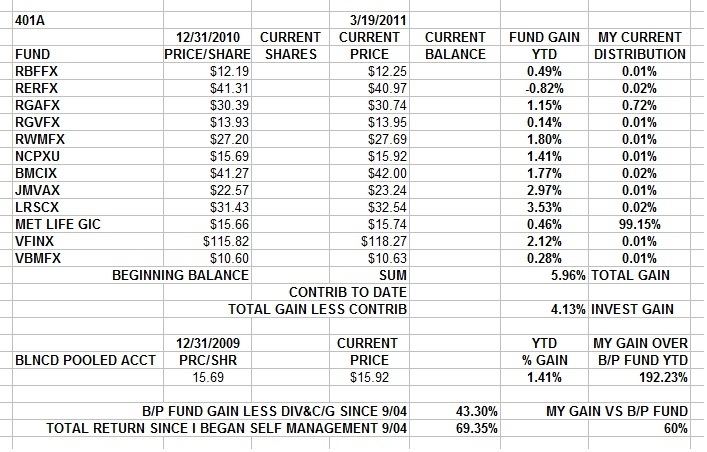

Bonds and cash inna 401a. Protecting what I got. There are old riders and bold riders. But there ain't no old bold riders. At least not without luck and brains and the experience to know the difference. I'm an old bold rider, and I'm parked under the overpass, waiting out the weather.

In the discussion that followed, the city officials asked a few technical questions, and Arthur Nusbaum expressed concern over a shortage of certified welders who had passed the city's structural-welding test. That would not be a problem, the representatives from the Department of Buildings replied; one of the area's most trusted steel inspectors, Neil Moreton, would have the power to test and immediately certify any welder that Citicorp's repair project required. Nusbaum recalls, "Once they said that, I knew we were O.K., because there were steamfitter welders all over the place who could do a fantastic job."

Before the city officials left, they commended LeMessurier for his courage and candor, and expressed a desire to be kept informed as the repair work progressed. Given the urgency of the situation, that was all they could reasonably do. "It wasn't a case of 'We caught you, you skunk,'" Nusbaum says. "It started with a guy who stood up and said, 'I got a problem, I made the problem, let's fix the problem.' If you're gonna kill a guy like LeMessurier, why should anybody ever talk?"

http://www.duke.edu/~hpgavin/ce131/citicorp1.htm

I pay very serious attention to Rick Bookstaber. Read "A Demon of Our Own Design" To Understand Why.

http://rick.bookstaber.com/2011/08/work ... night.html

http://www.nytimes.com/2011/09/11/techn ... .html?_r=1

http://www.nytimes.com/2011/09/07/opini ... g-but.html

http://www.economist.com/node/21528635

http://www.guardian.co.uk/commentisfree ... xes-growth

http://joefahmy.com/2011/09/11/why-i-co ... o-sit-out/

http://blogs.wsj.com/marketbeat/2011/09 ... d-edition/

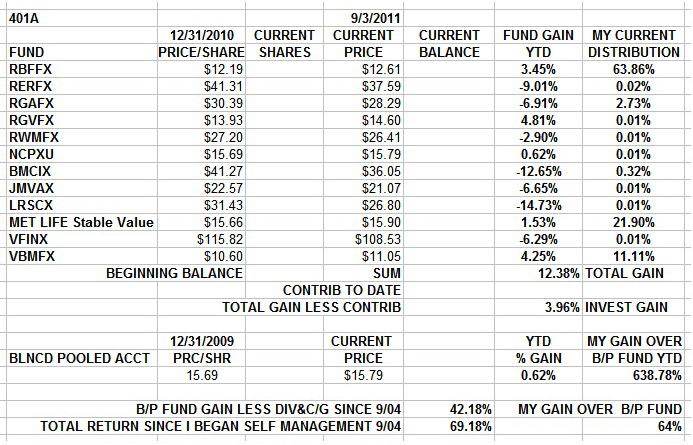

So far, So good....So What? STILL All Cash and Bonds and Still Feelin' Awright! About It ....

http://www.wired.com/dangerroom/2011/09 ... work/all/1

http://www.truth-out.org/goodbye-all-re ... 1314907779

http://vimeo.com/28940439

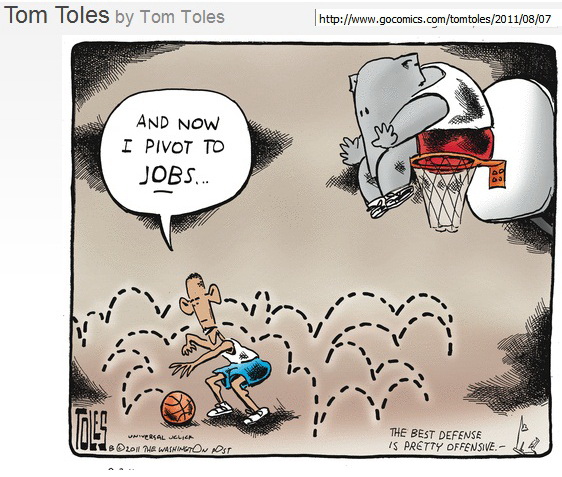

WEDNESDAY....

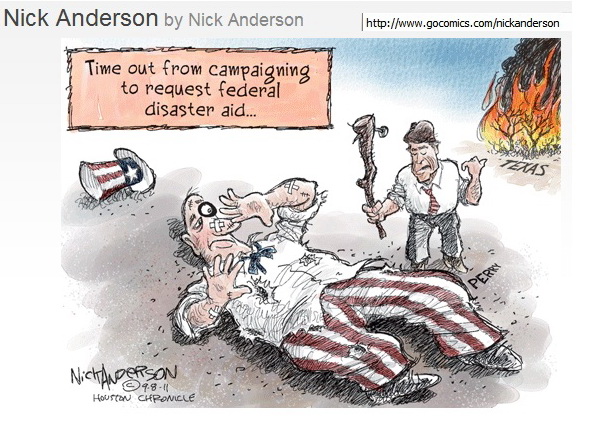

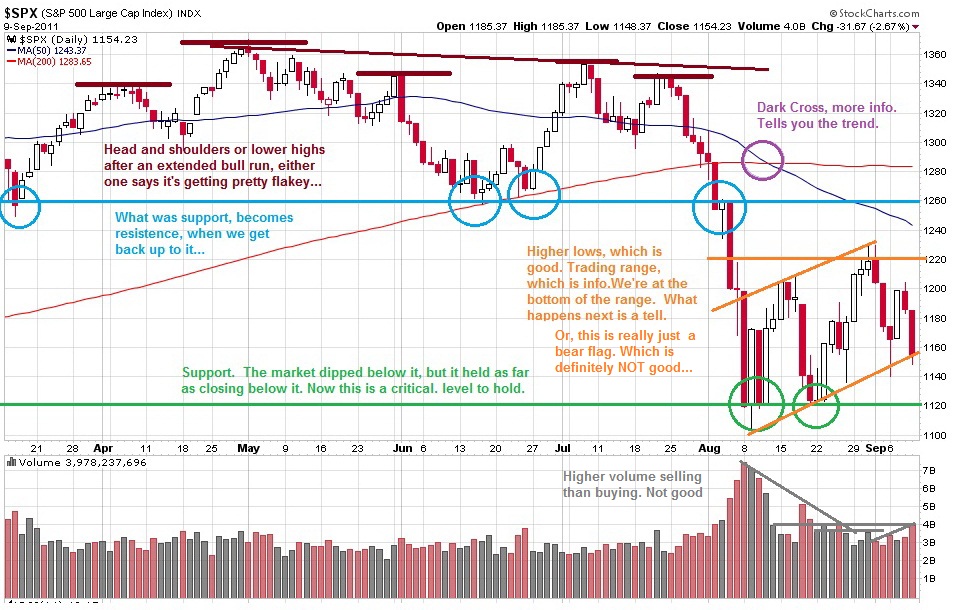

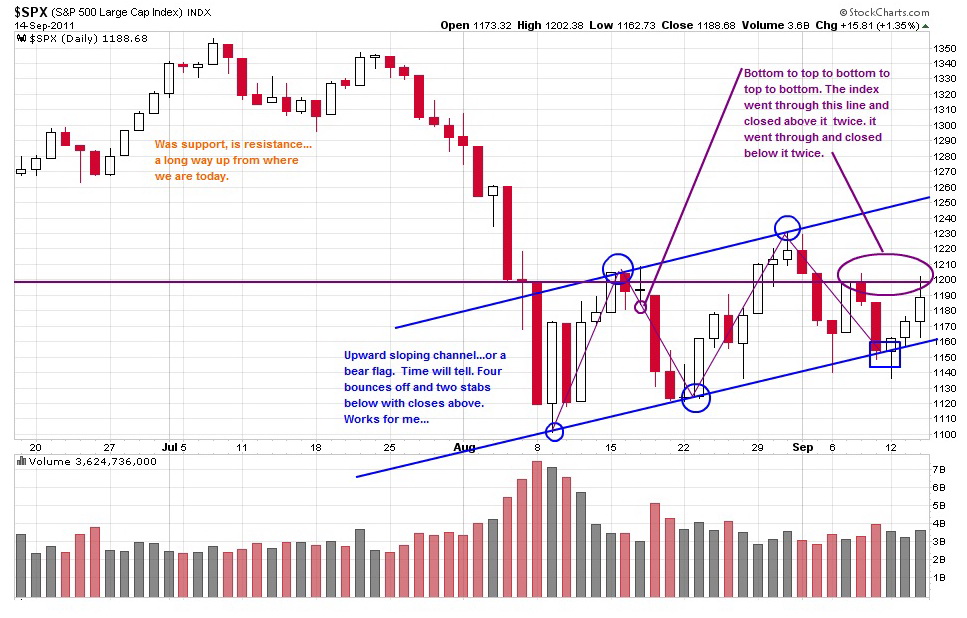

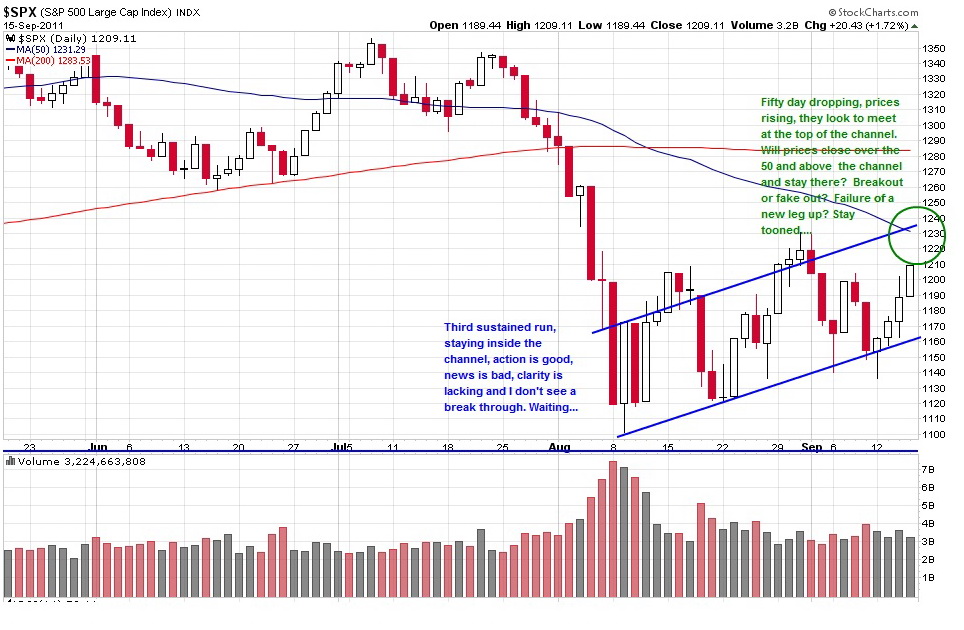

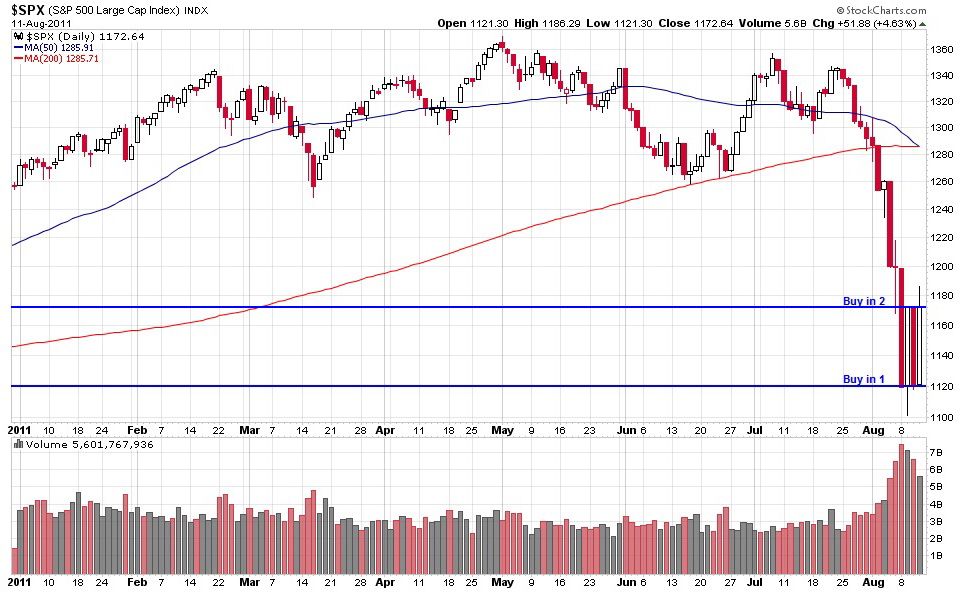

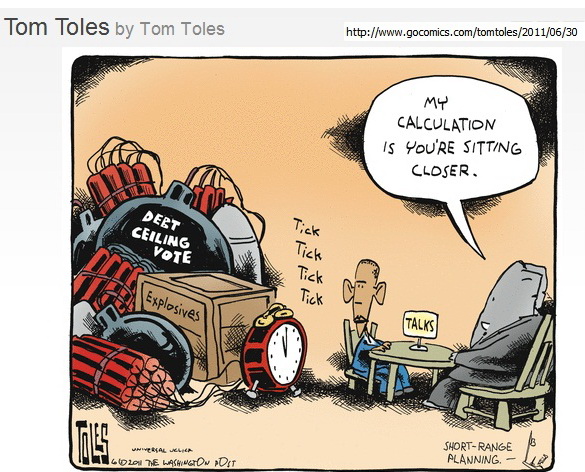

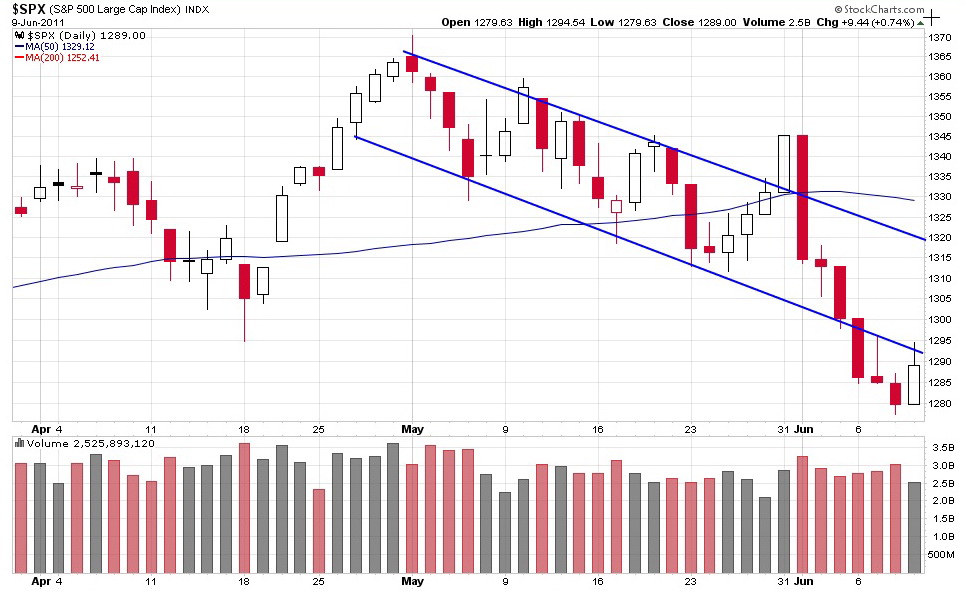

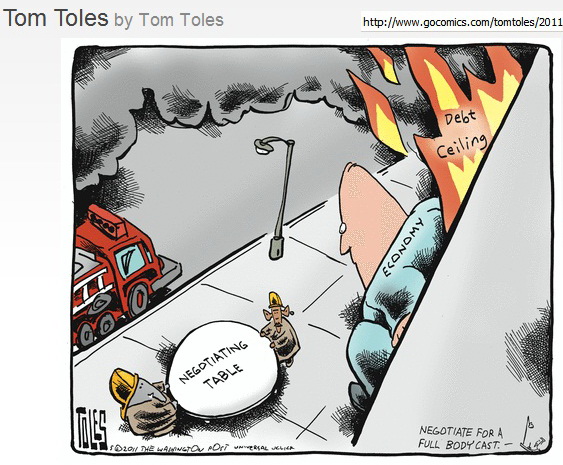

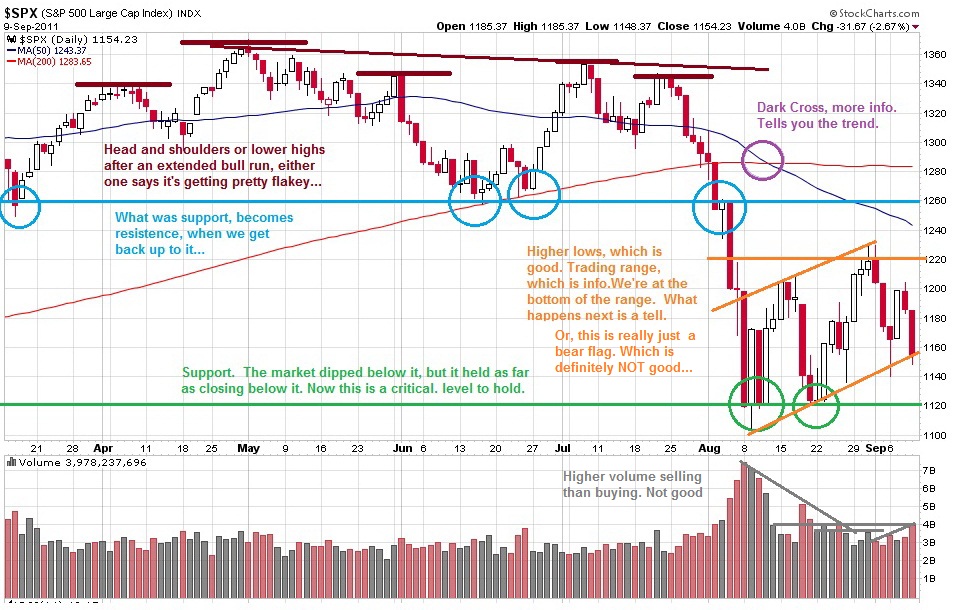

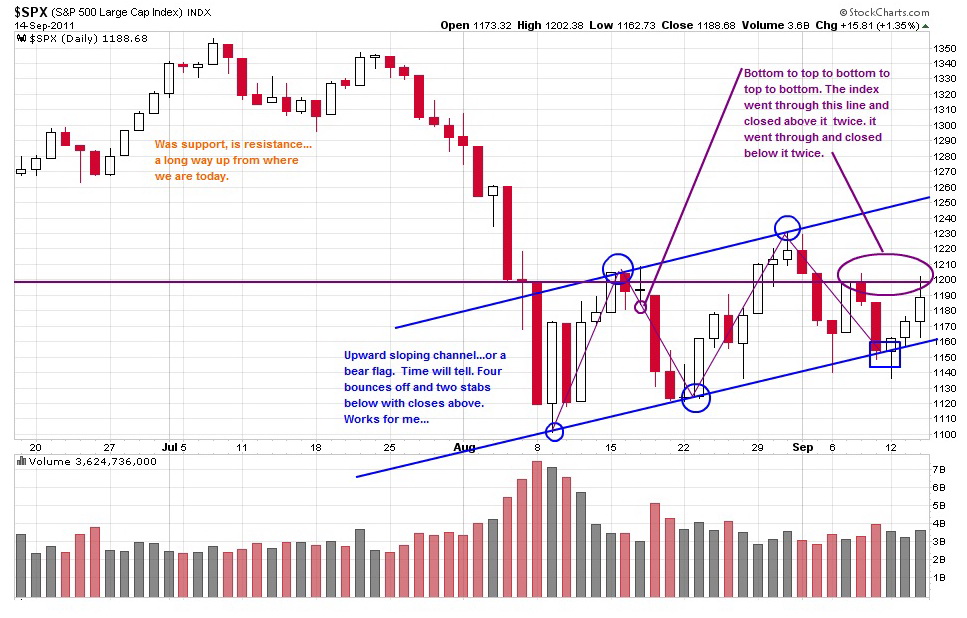

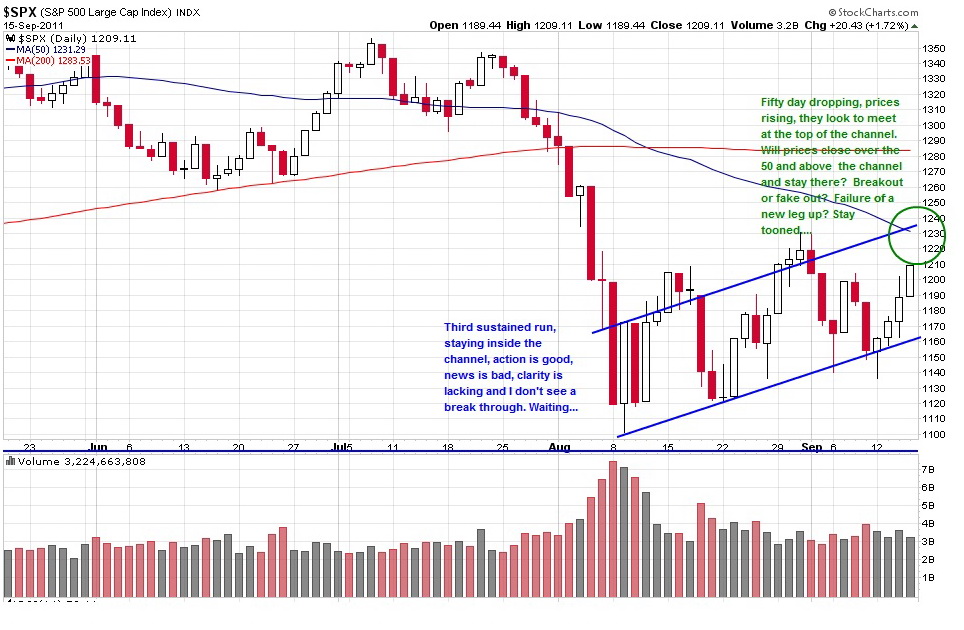

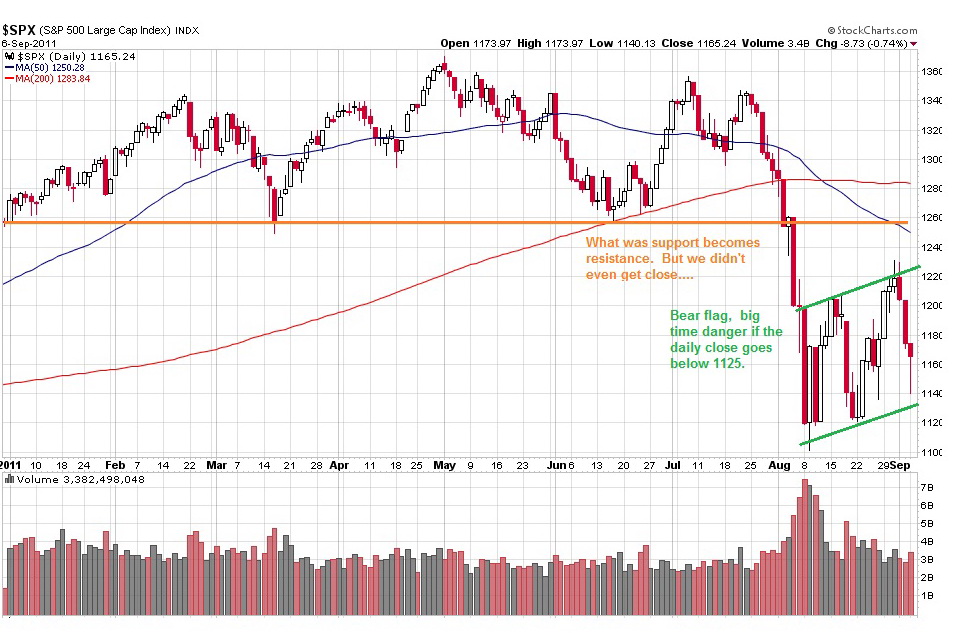

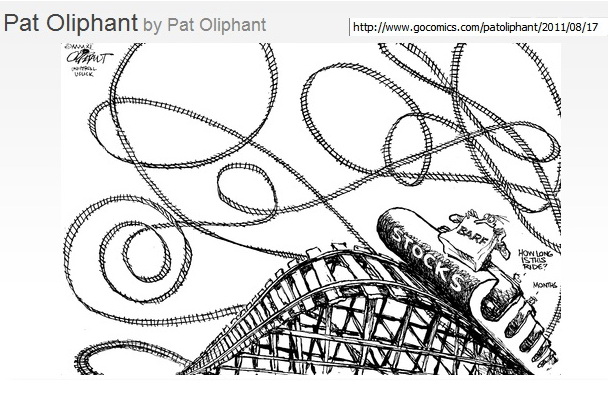

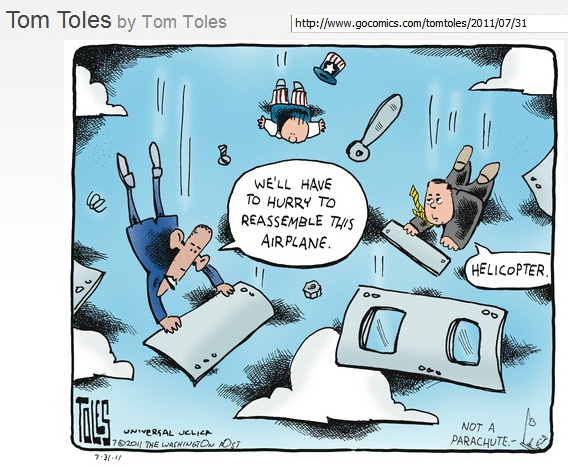

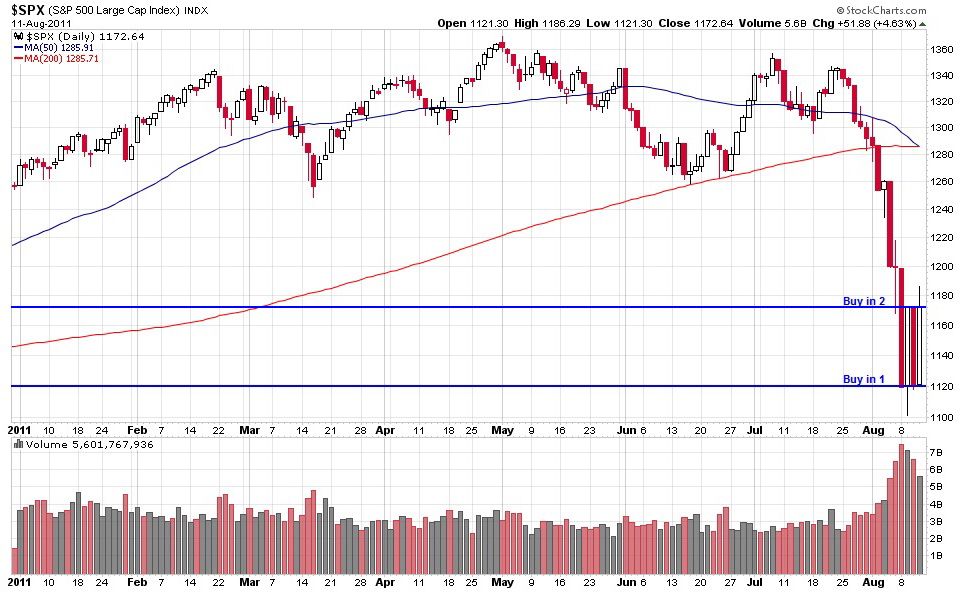

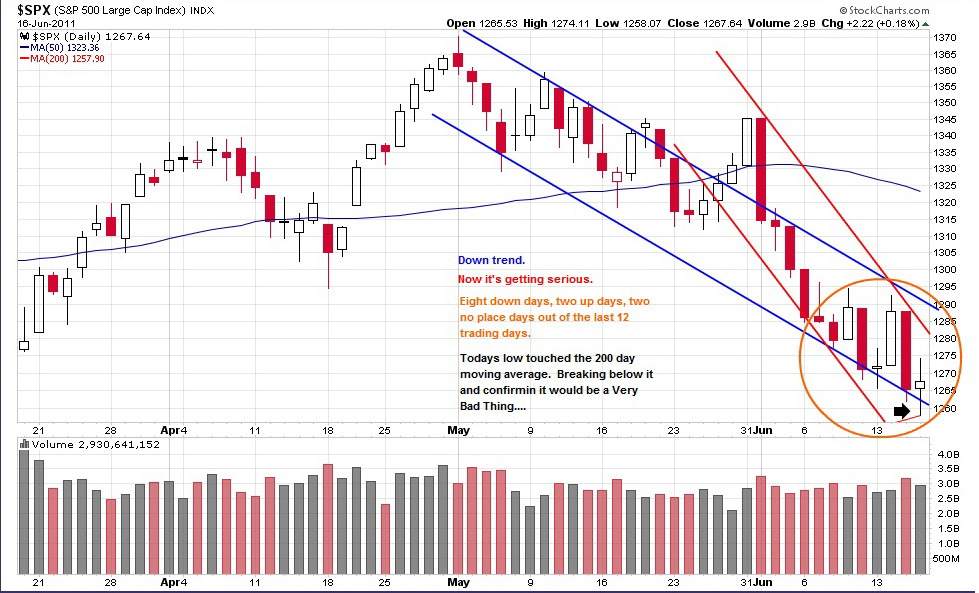

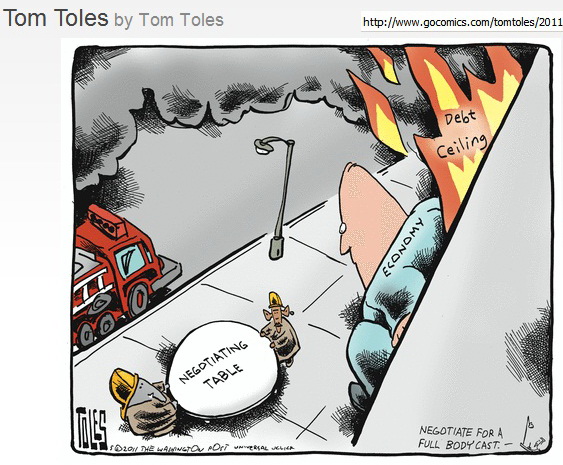

We closed near 1190 onna S&P today. I bailed out 150 points higher about 4 months ago. Resistance is 10 and 70 points higher. Support is 70 and 90 points lower. If that support fails, like onna bad headline plunge, next stop down could be WAY down. And have no doubt; the market is inna headline driven bear market phase. We have to write off Greece. We have to worry about Italy, Portugal, Spain, and Ireland. But see, if I knew enough to worry about Belgium, then I'd really be worried about bad headlines. We're at two and a half bounces. Two and a half.... That rings a bell and it ain't a good one.

I'm in a wait and see mode. In cash and bonds....

THURSDAY

http://www.ritholtz.com/blog/2011/09/at ... -tomorrow/

http://www.ritholtz.com/blog/2011/09/we ... nform-you/

Stay Tooned....

( 3 / 1364 ) ( 3 / 1364 )

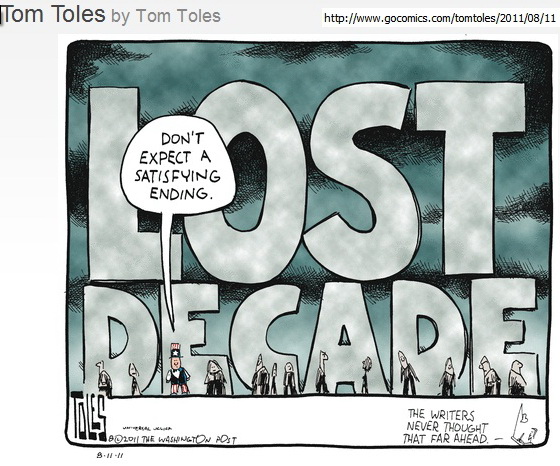

It Looks Like The Next 5 Years Are Going To Be The "Interesting Times" Of The Old Chinese/Jewish/American Saying..... Google It....

Saturday, August 6, 2011, 12:57 PM

It's all fun and games until someone gets hurt.

-- Mom

J Tull started out as a blues band and quickly evolved into Ian Anderson's vision of an rock ensemble. I've always liked Tull, but the early version with so much raw talent and different directions was never equaled.

http://www.wolfgangsvault.com/jethro-tu ... 66284.html

http://www.wolfgangsvault.com/jethro-tu ... 91320.html

http://www.wolfgangsvault.com/jethro-tu ... 83290.html

http://www.performing-musician.com/pm/s ... bunker.htm

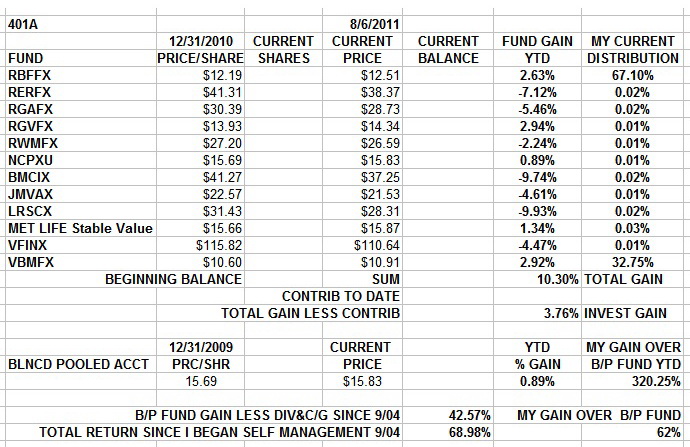

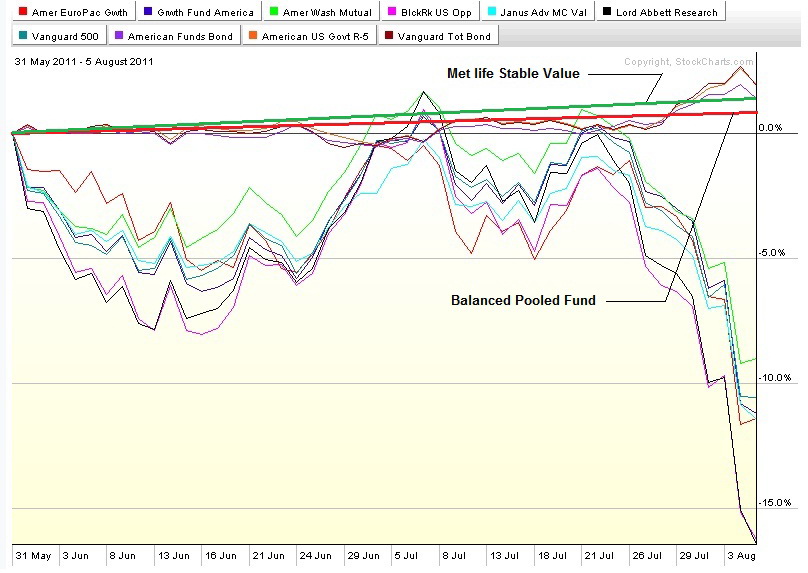

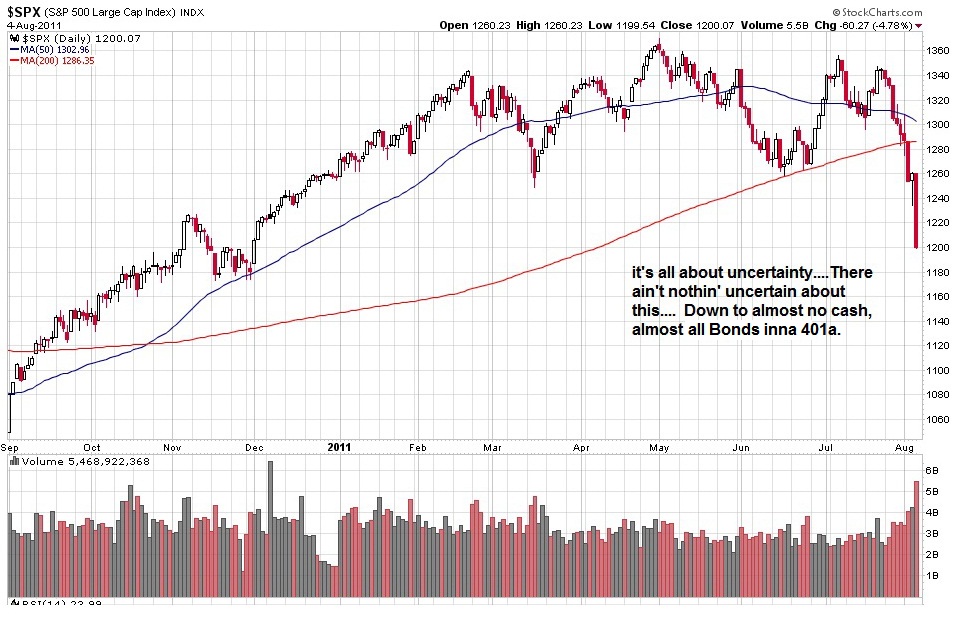

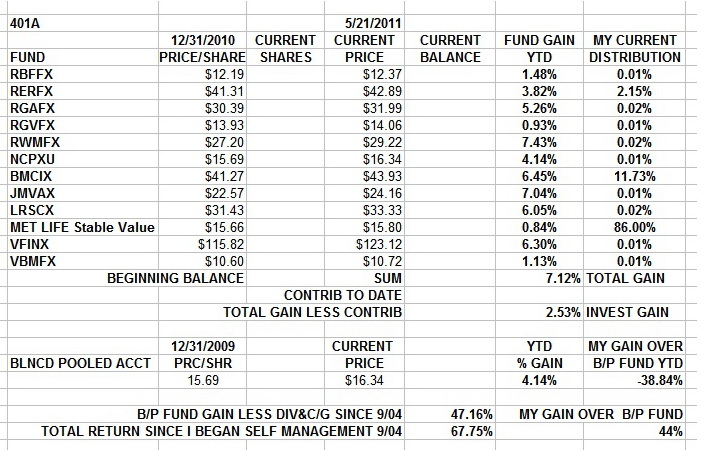

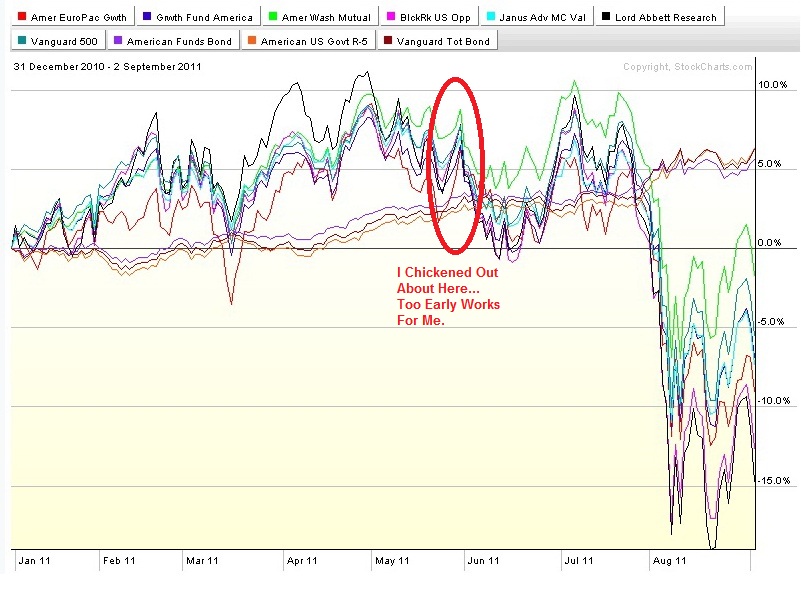

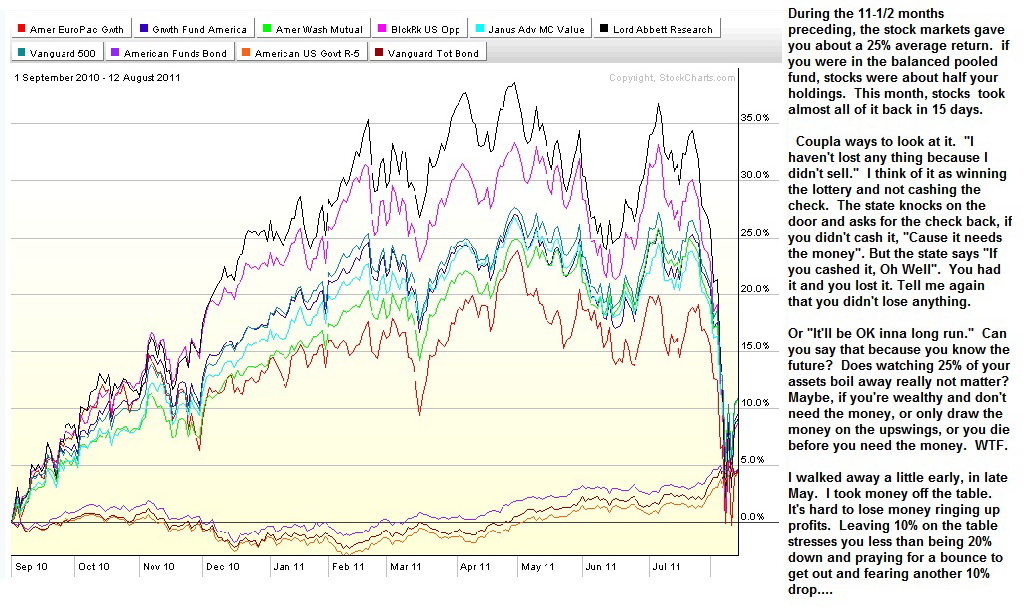

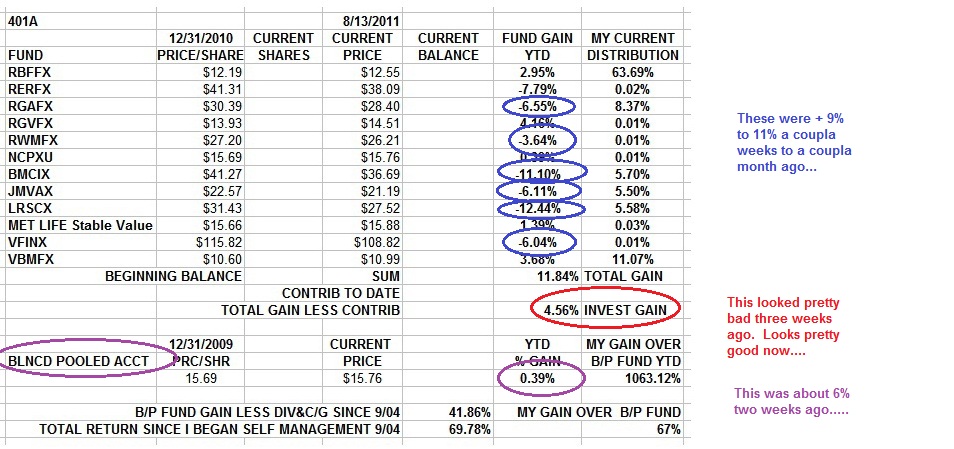

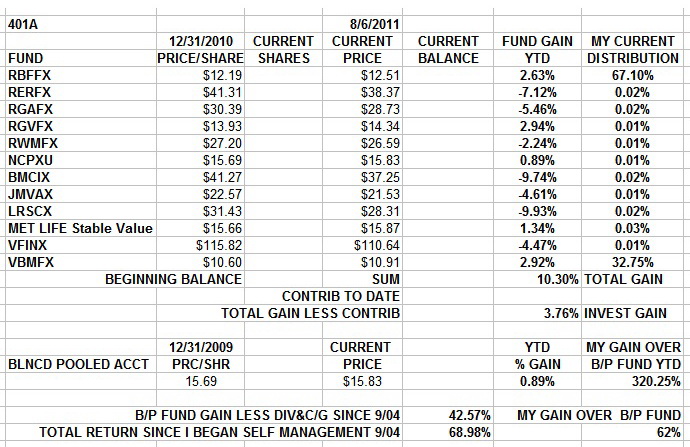

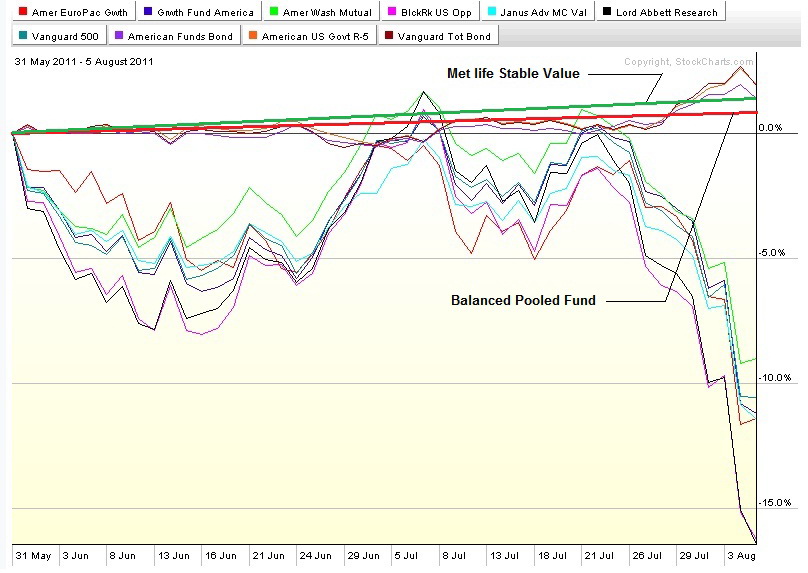

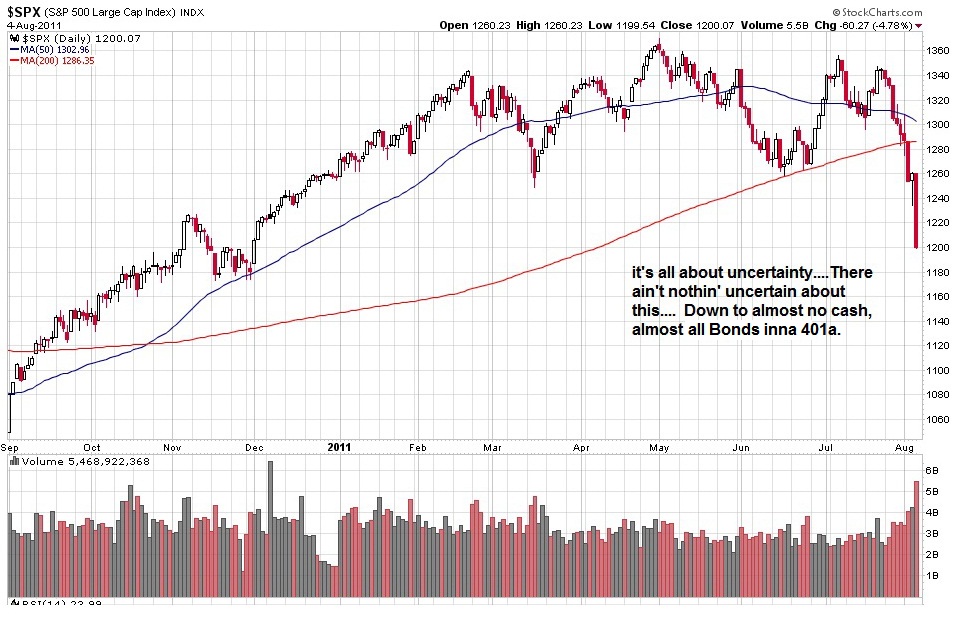

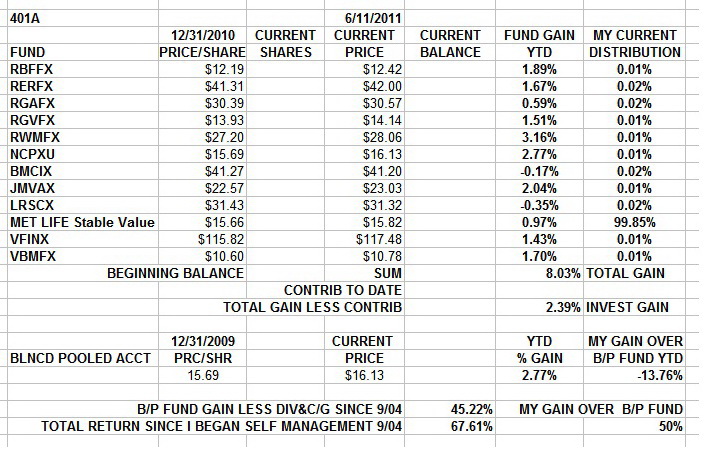

Bonds... Check out my website.... Asset allocation will save yer ass at times like this....

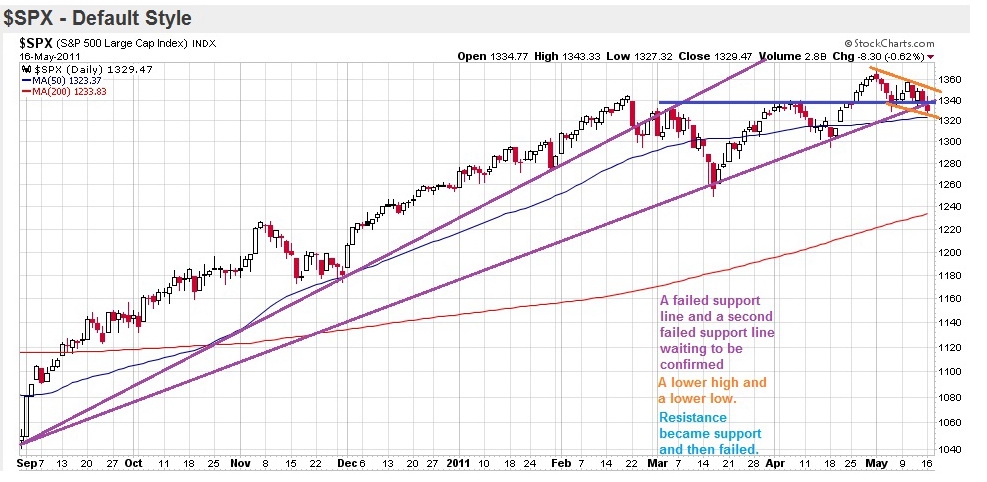

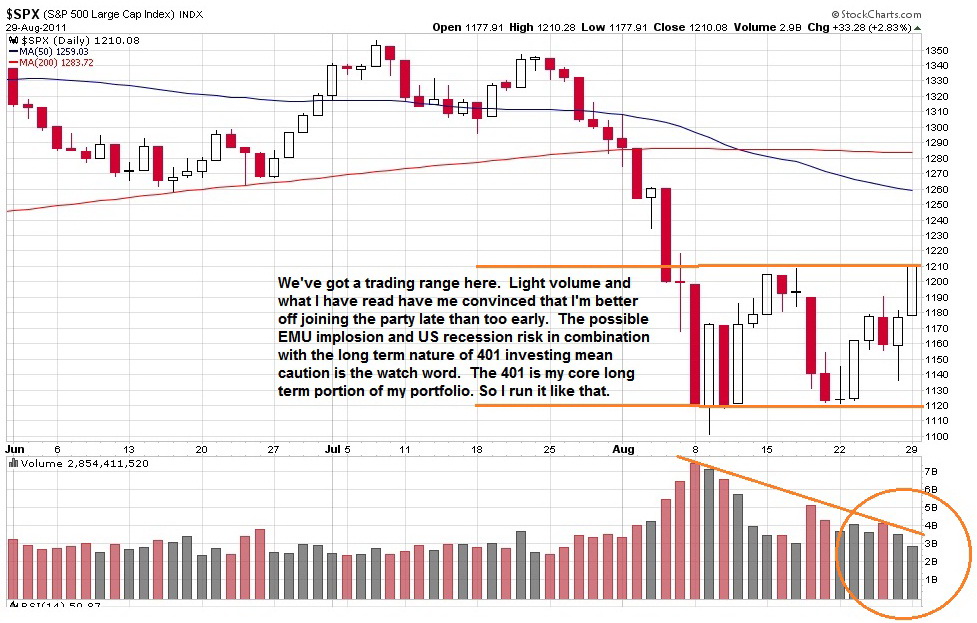

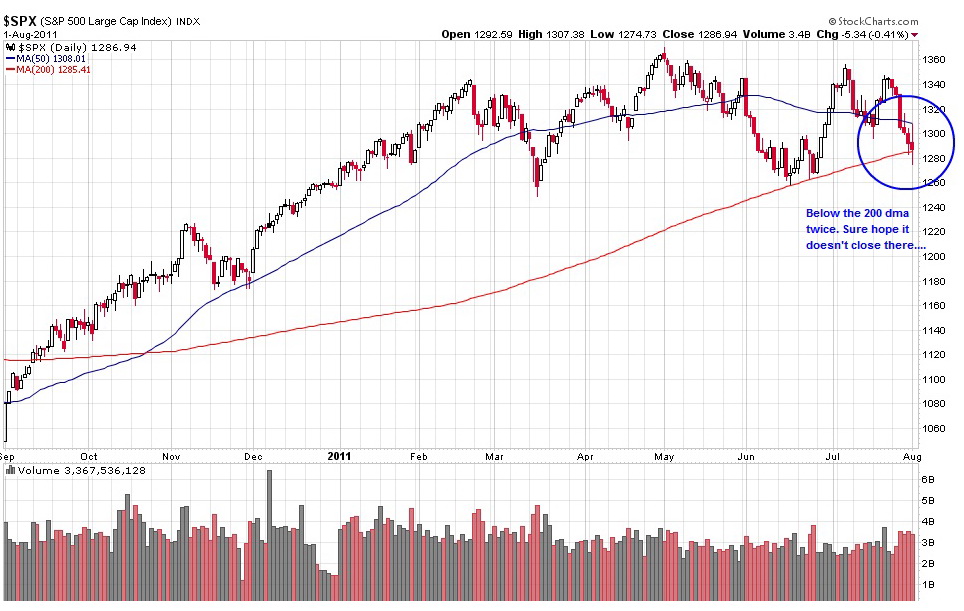

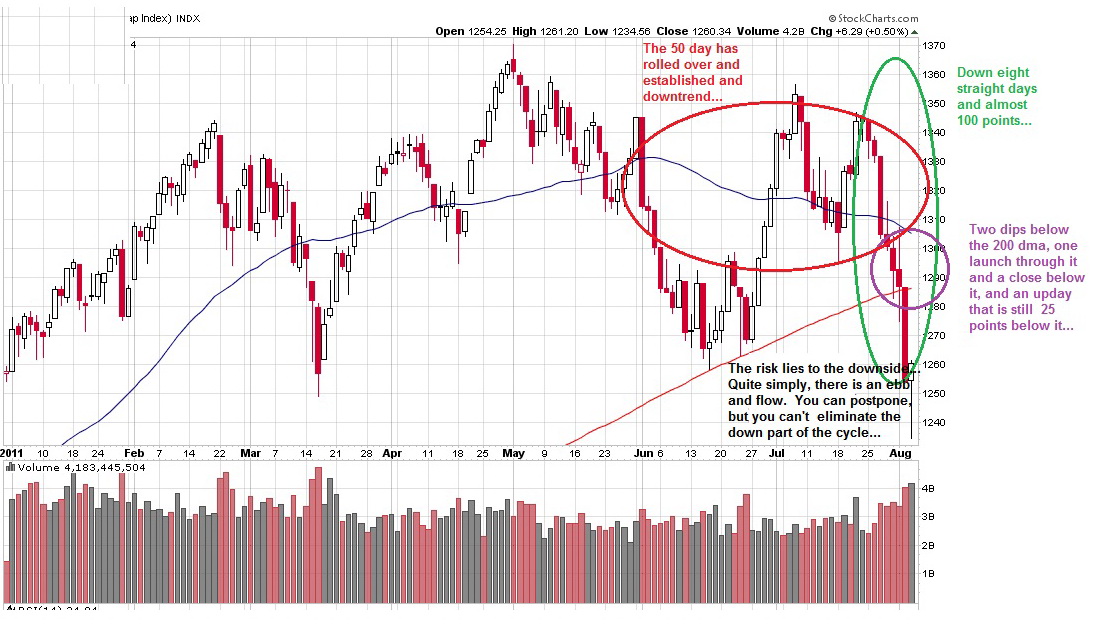

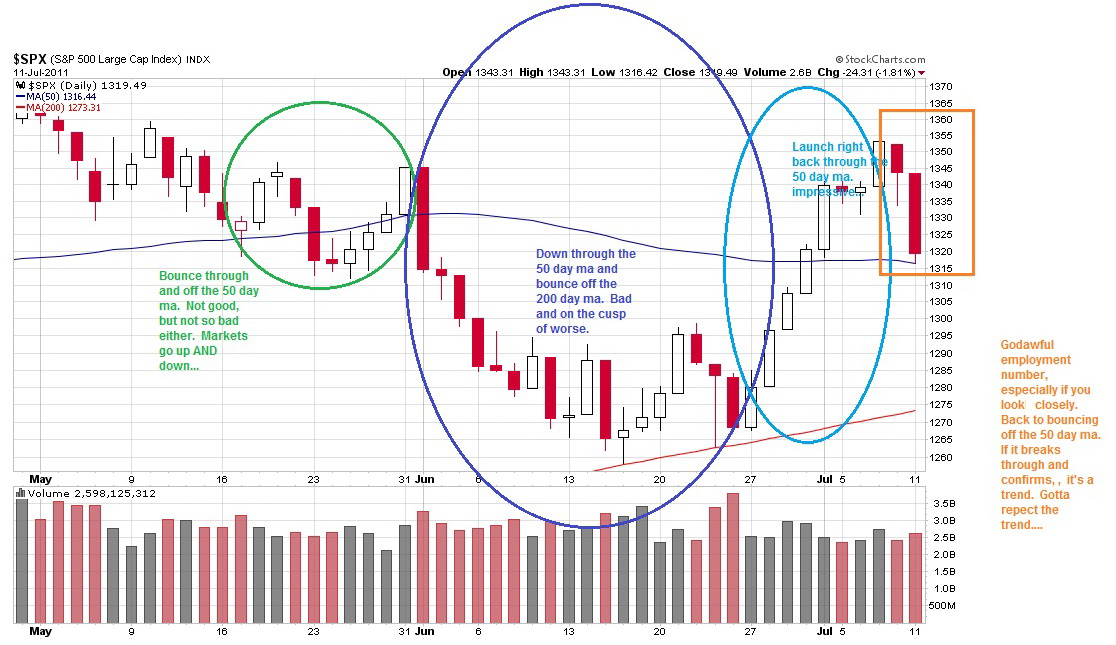

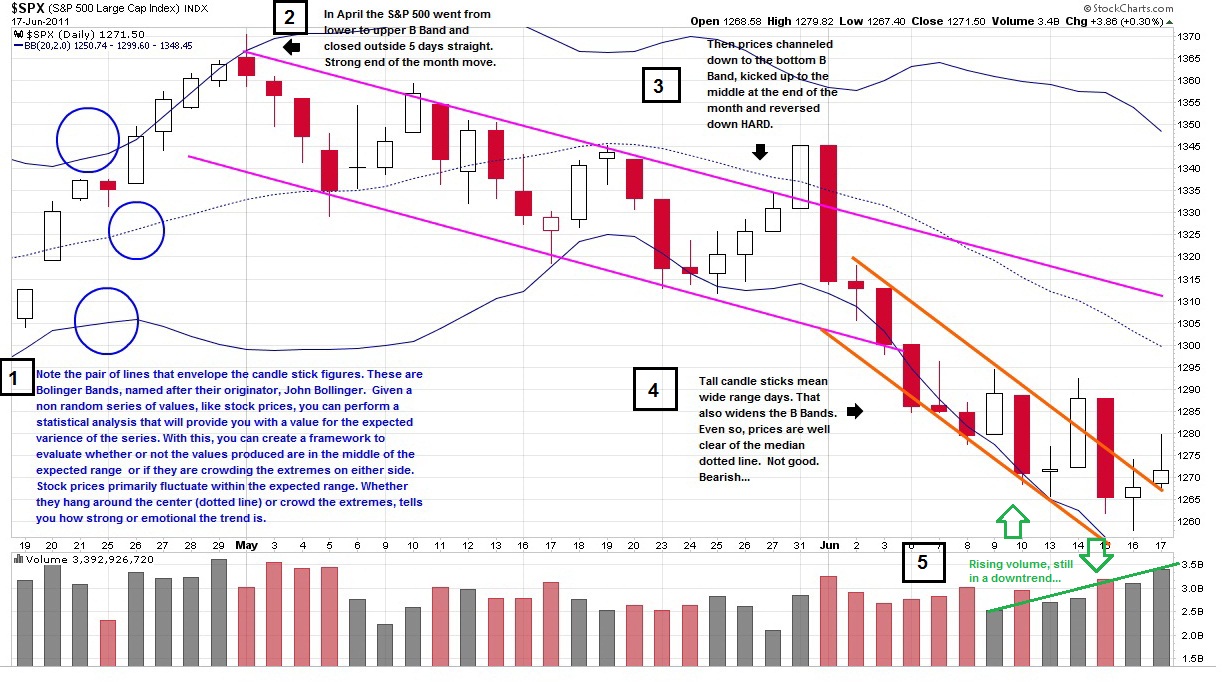

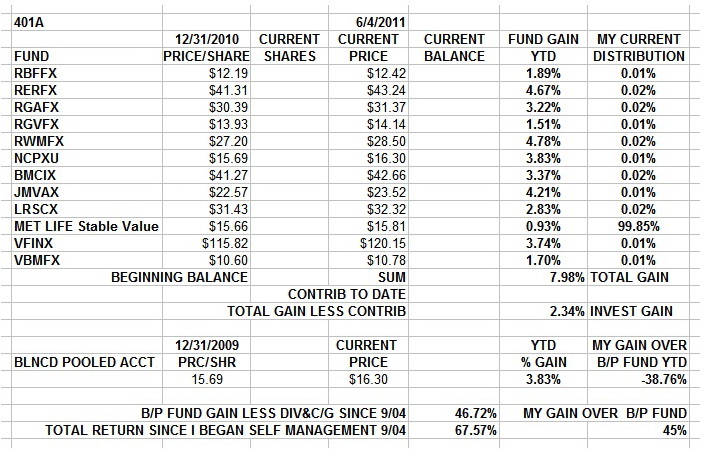

I've spent some time corresponding with Dan Fitzpatrick and this is an excellent example of his work. I'm not a regular follower of his service but he's got a lot worth listening to...

http://www.stockmarketmentor.com/public/3264.cfm

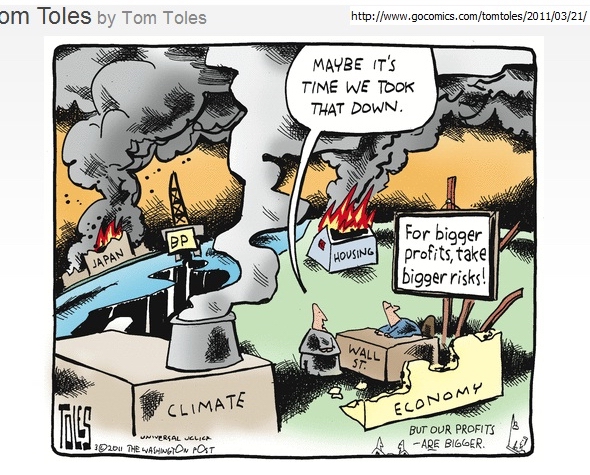

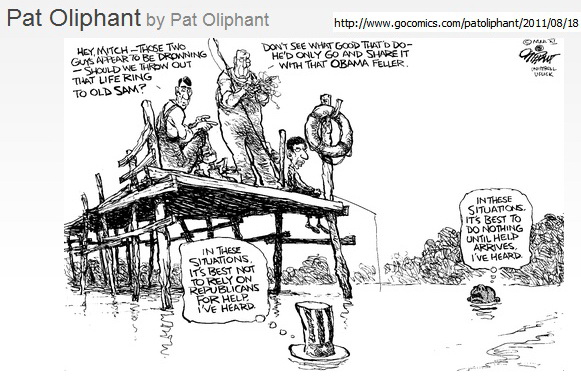

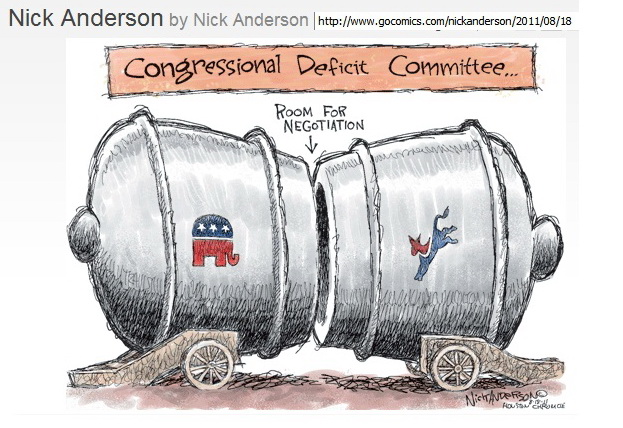

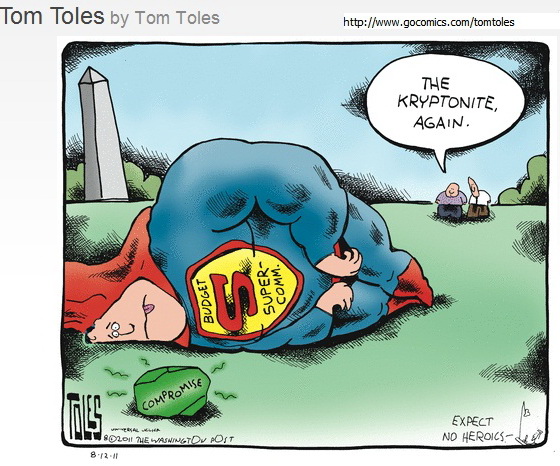

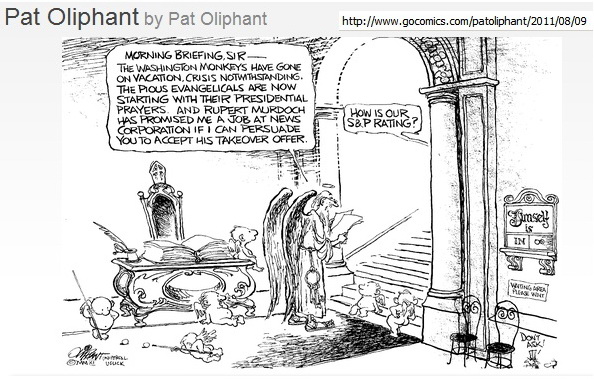

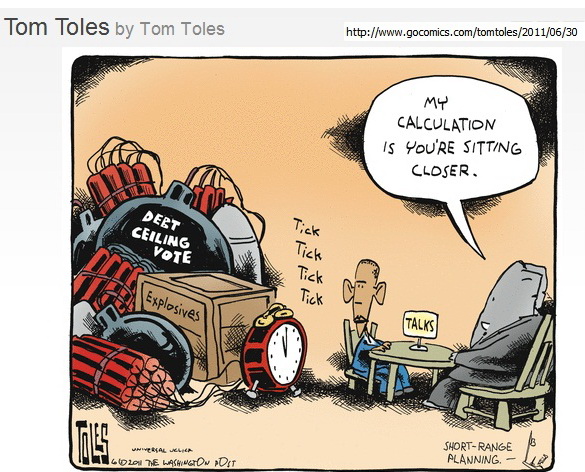

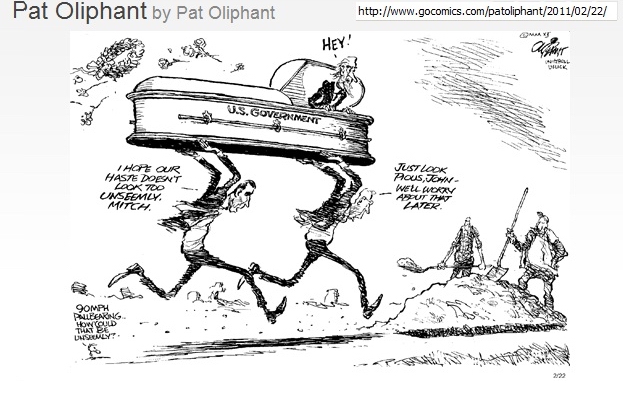

So, if the Fed, which doesn’t issue credit and can print money, can be downgraded because it holds AA+ debt, then why and how in hell can the ECB, which holds hundreds of billions of euros of the junk debt of Greece and Ireland and insolvent banks not be downgraded on Monday? And the Bank of Japan? REALLY? What are these guys smoking? Do we now downgrade GNMA? Of course. And the FDIC? What the hell will repos do on market open? The NY Fed says it won’t affect anything. Don’t ask me, I just work here. And how can you rate France AAA? And still give AA or more to Italy when the market is saying they are getting close to junk?

http://www.ritholtz.com/blog/2011/08/th ... than-ever/

http://www.thereformedbroker.com/2011/0 ... e-curtain/

It's all fun and games until someone gets hurt.

-- Mom

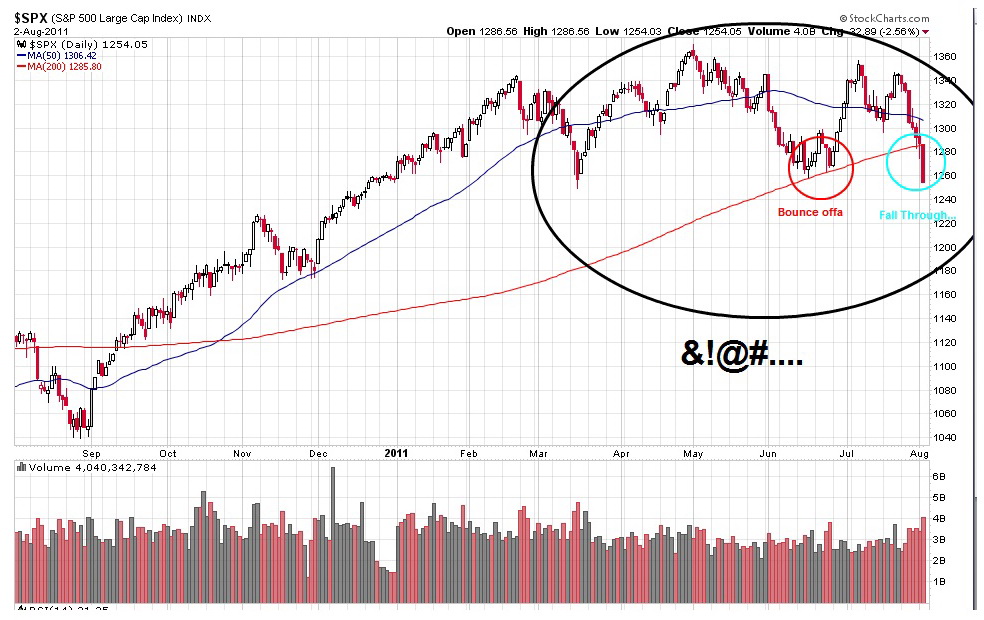

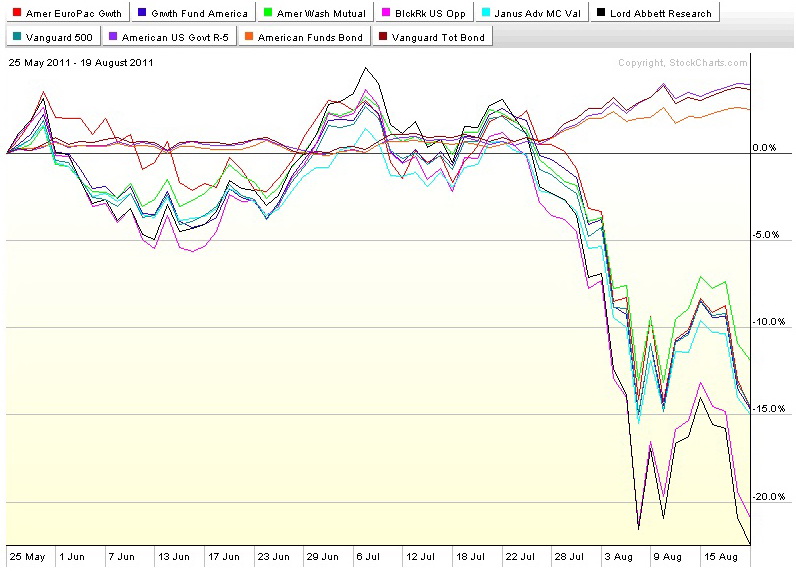

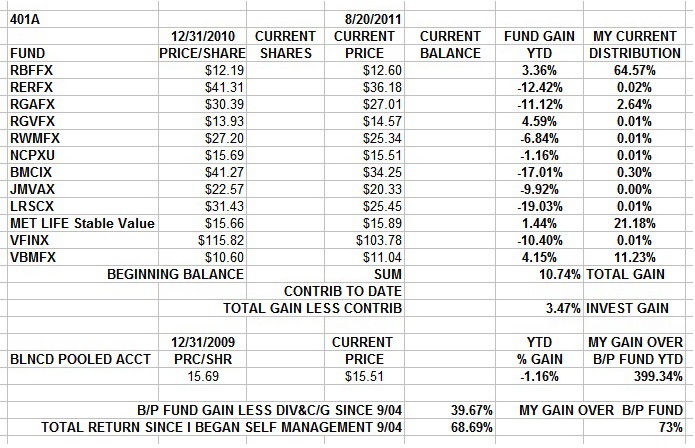

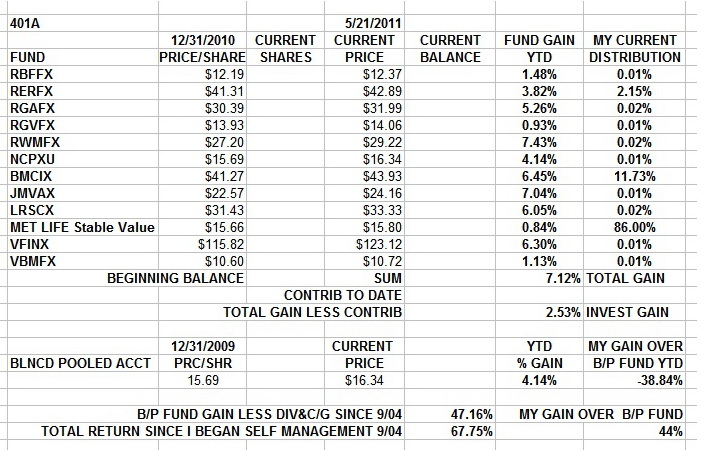

Horrible lookin' returns and chartz. I was all cash in mid May and I'm all bonds now.

I fear almost nothing, but I have a lot of respect for things that are dangerous. When handling guns, riding motorcycles fast, doing heavy rigging way up inna steel, or investing my life savings, fear has no place. Fear eats away at rationality and decision making and the ability to act. Respect the hazards and own the responsibility to do the right thing at the right time because it needs to be done, not because you are afraid.

http://www.thereformedbroker.com/2011/0 ... -a-sudden/

Monday Eve

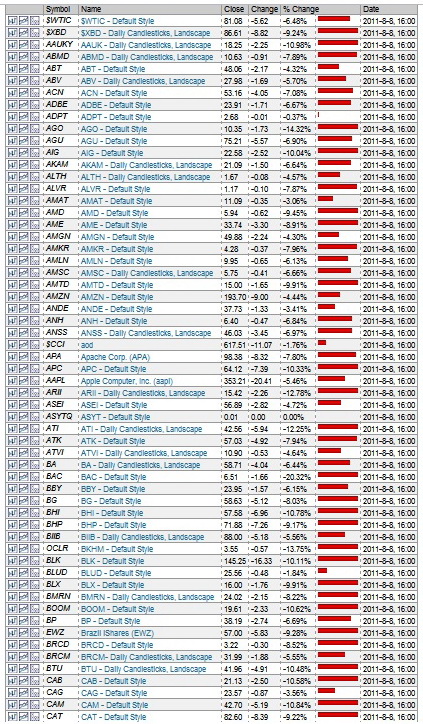

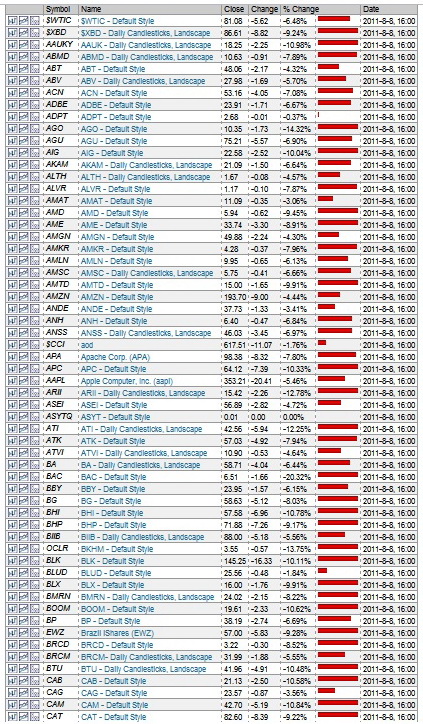

I Have This List...

...it's of stocks that I've looked at/wanted to track/ held/was gonna get around to eventually/ added and forgot about. I called up the list and today's action this eve to scope out how the day was.

DAMN!!! God help anyone still in the market.....

There's a bottom here someplace. It may be a way's away, it may be only an interim bottom and it may be good for only a short bounce. But stocks can only go to zero and we've come a long way in a short time. So there is the immediate short term relief of the cessation of falling in the near future. Unfortunately coincident to this is the sensation of augering into the ground. Then is the time to do something. That's why I went first to cash and then to bonds

http://www.ritholtz.com/blog/2011/08/on ... f-america/

http://www.ritholtz.com/blog/2011/08/ma ... r-are-you/

TUES

http://www.thereformedbroker.com/2011/0 ... mes-first/

http://www.thereformedbroker.com/2011/08/09/wet-n-wild/

http://www.thereformedbroker.com/2011/0 ... sh-legacy/

WED EVE...

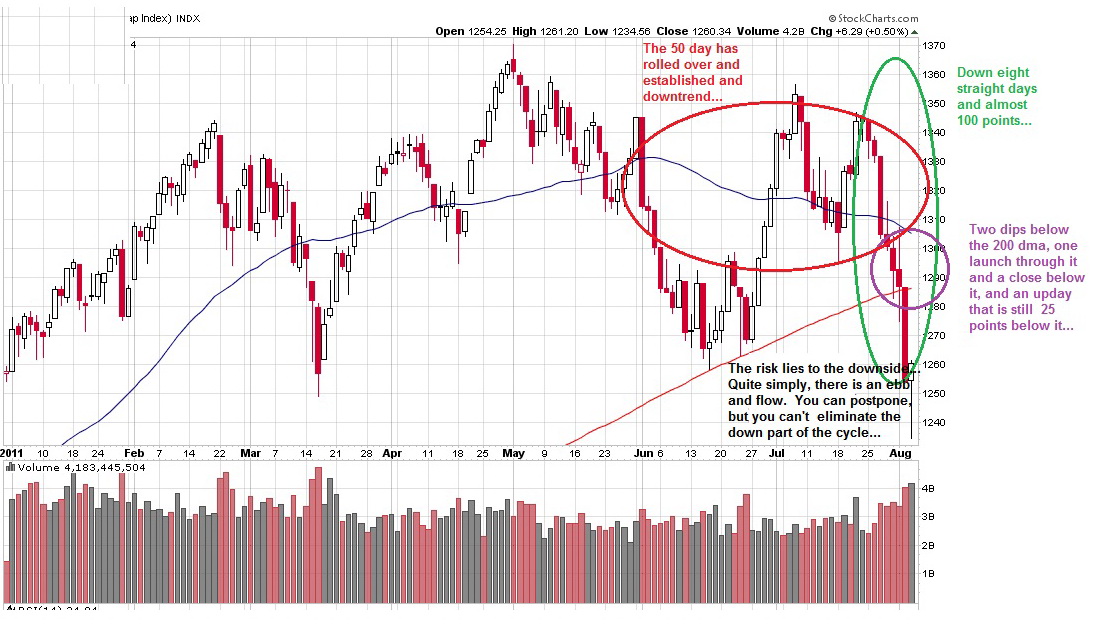

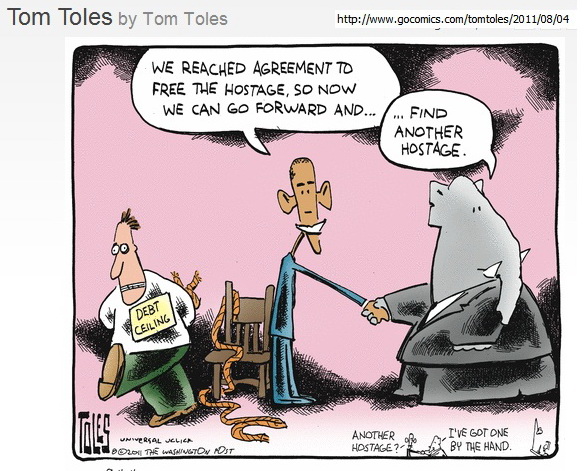

We crashed Monday, Had an intense rally in the last hour of Tuesday, Crashed again Wednesday, And I put 15% of my all cash position back to work in 4 Funds this afternoon. it's an incremental buy at a price a damn site cheaper than back in May when I cleared outa stocks. That's how it is done...

I'll buy more mutual funds inna 401, but I mostly like to buy charts that go from lower left to upper right ala Dennis Gartman.

http://online.wsj.com/article/SB1000142 ... 34052.html

THURS.....

Threw few more dollars at the 401a. I'm up to 25% stocks inna 401. I'm a little nervous about today's buy and I'm ready to stop there or retrench back into bonds/cash depending. The markets are going crazy; Lookit the action for the last four days vs any one day during a non crash day. INSANE.

But if we all don't end up living in lean to's and driving around in Road Warrior vehicles, I'll look back at today's buy as a smart move. I'm just concerned that future buy ins may be a lot smarter. Or may be not....

Stay Tooned.....

( 3 / 1419 ) ( 3 / 1419 )

Got My Mojo Workin'... Got My Mojo Workin'...... Jes' Doan' Work On You. McKinley Morganfield

Friday, July 29, 2011, 11:49 PM

"More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly."

-- Woody Allen

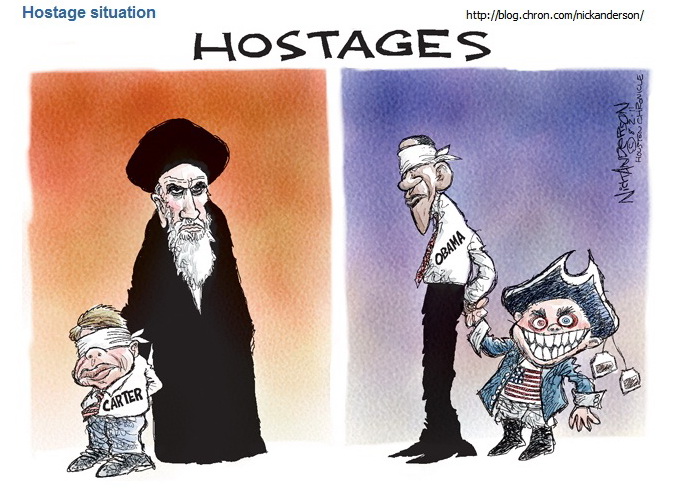

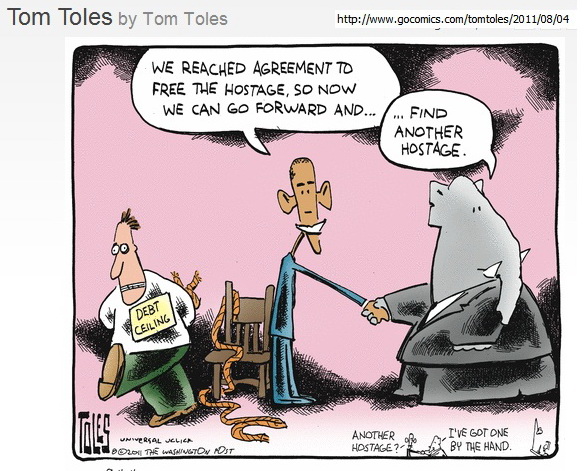

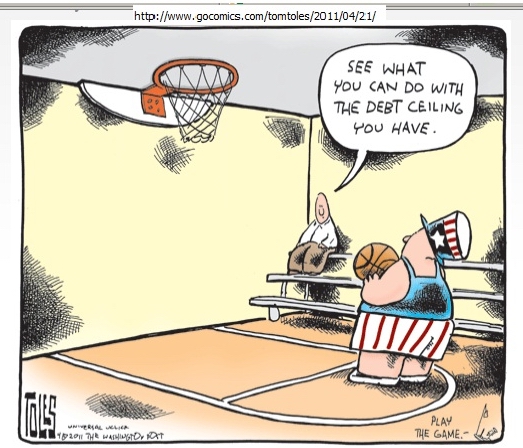

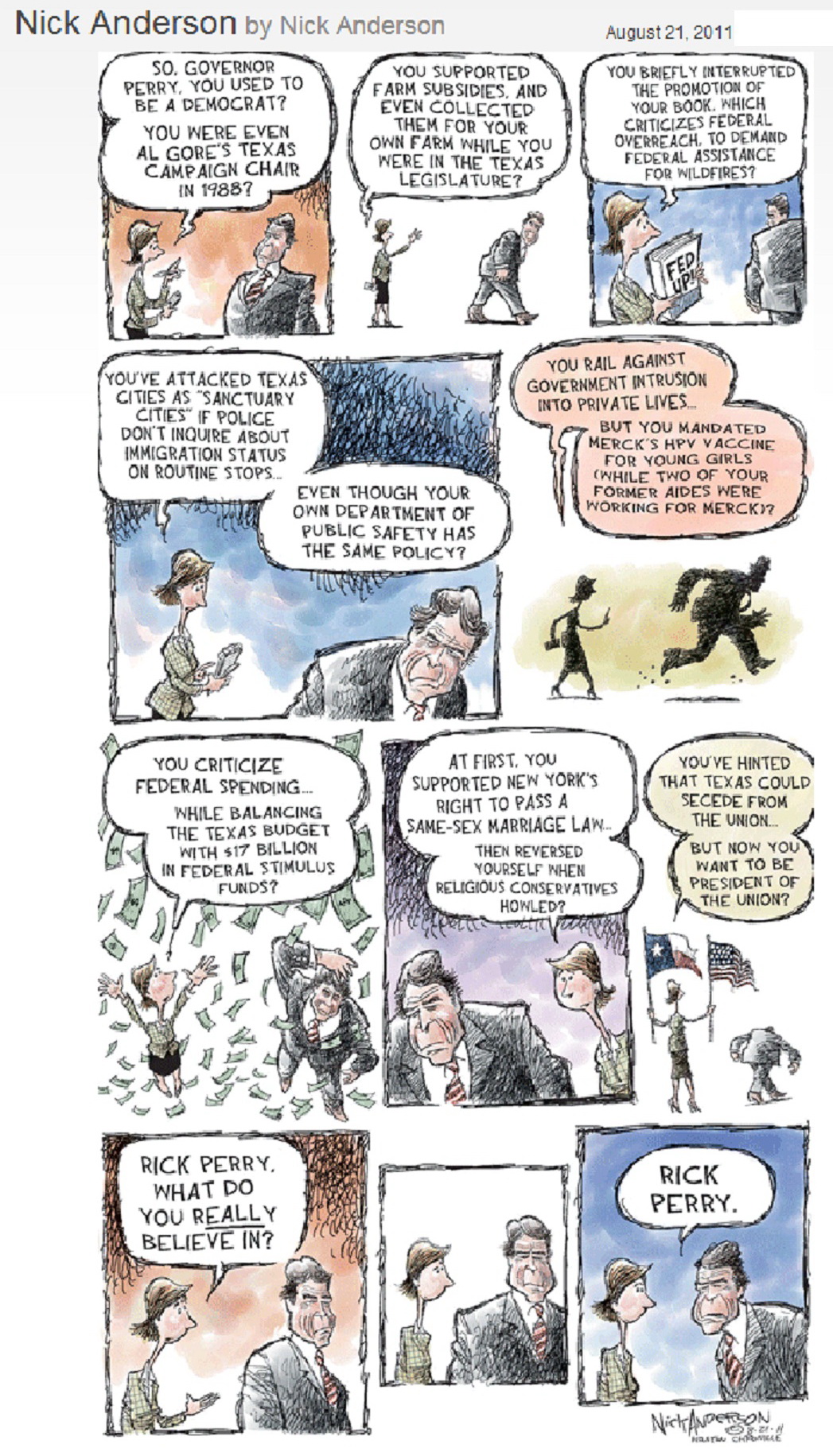

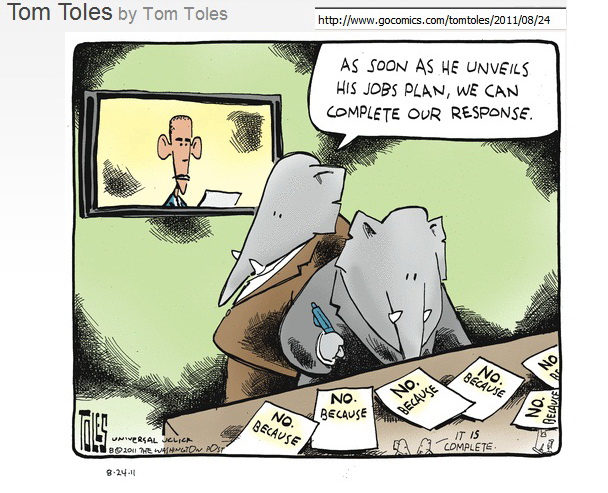

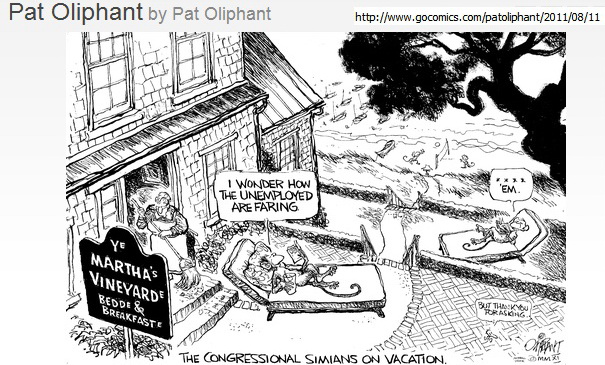

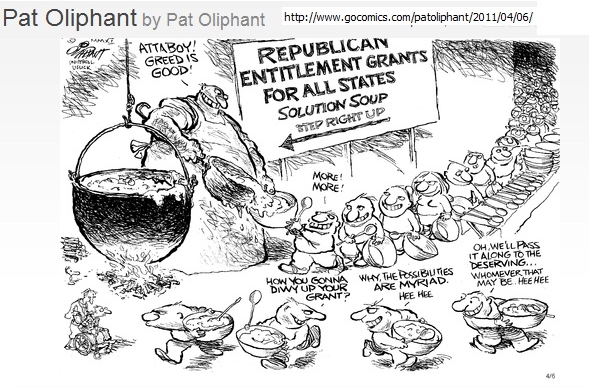

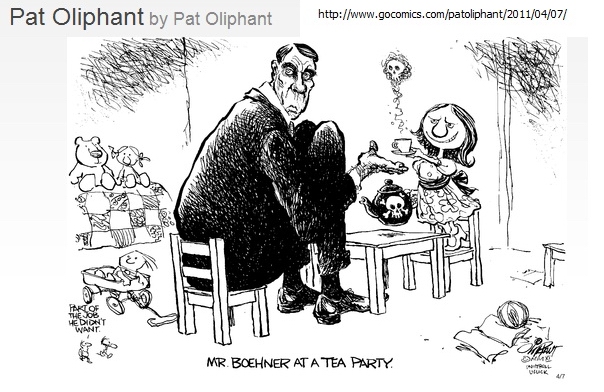

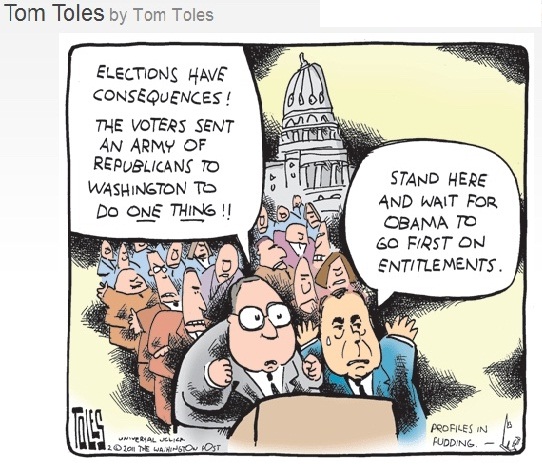

Luckily, We Got Congress To Choose our Path For Us As Our Elected Representatives. I'm So Impressed I Could Just Shit.

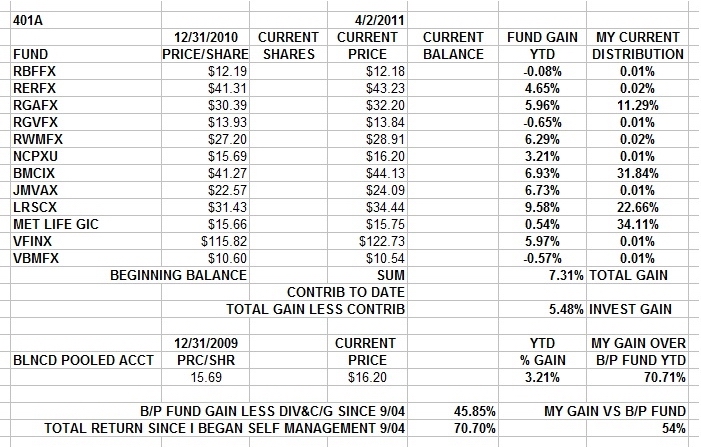

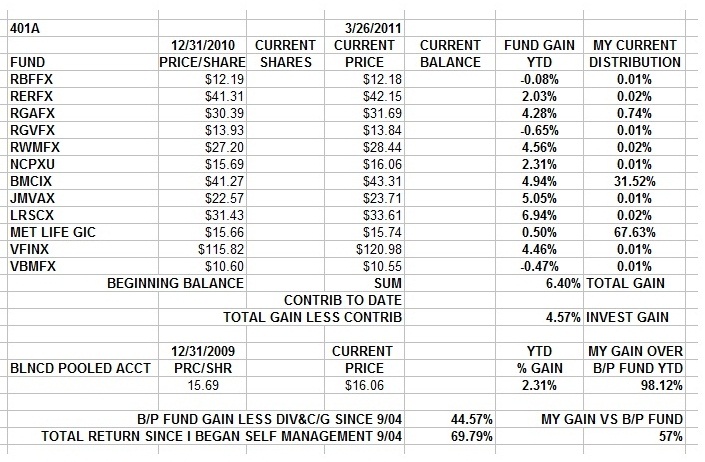

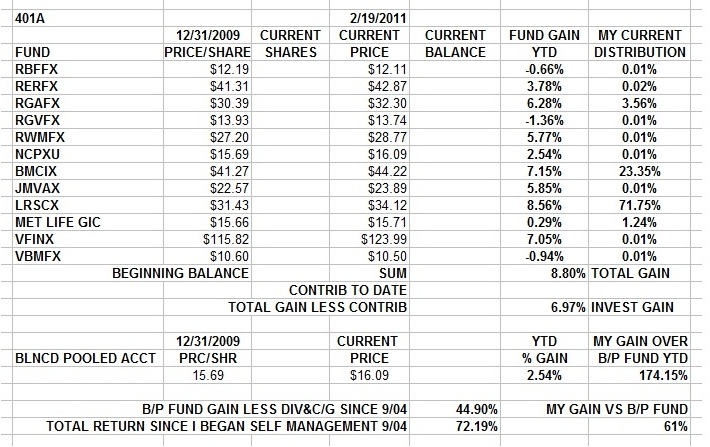

Chartz and Table Zup @ www.joefacer.com

McKinley...

http://www.wolfgangsvault.com/muddy-wat ... 00374.html

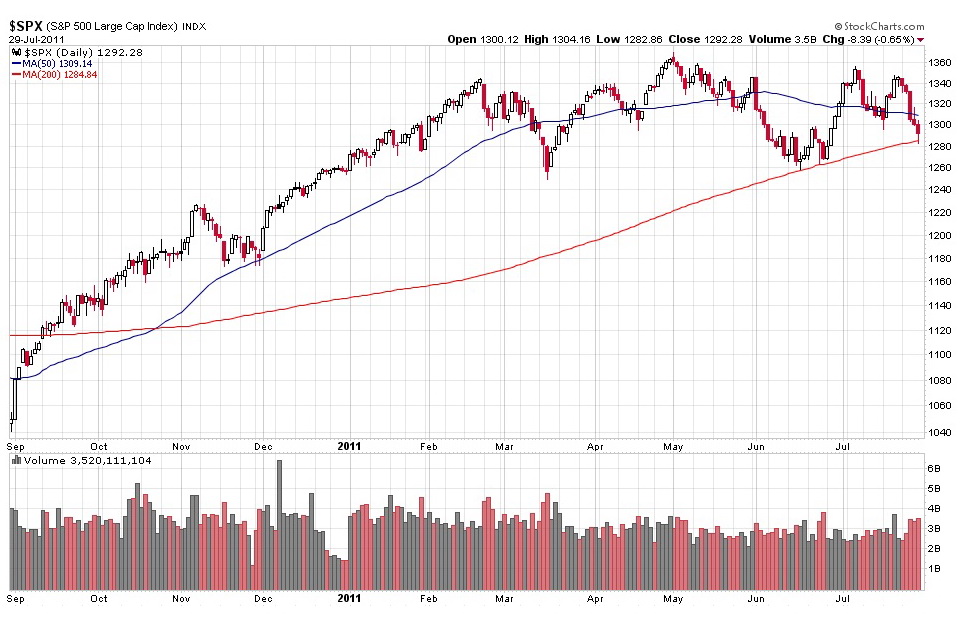

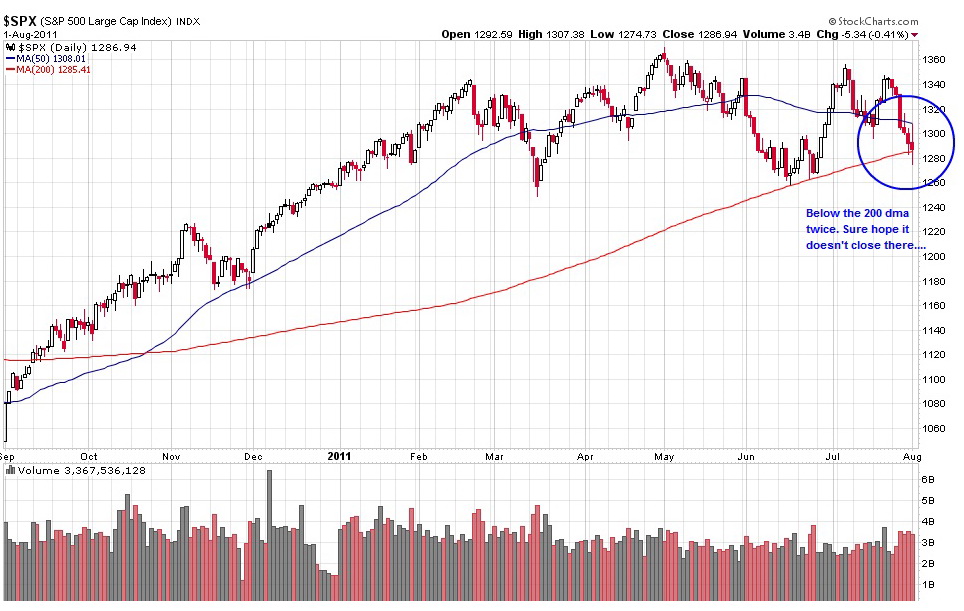

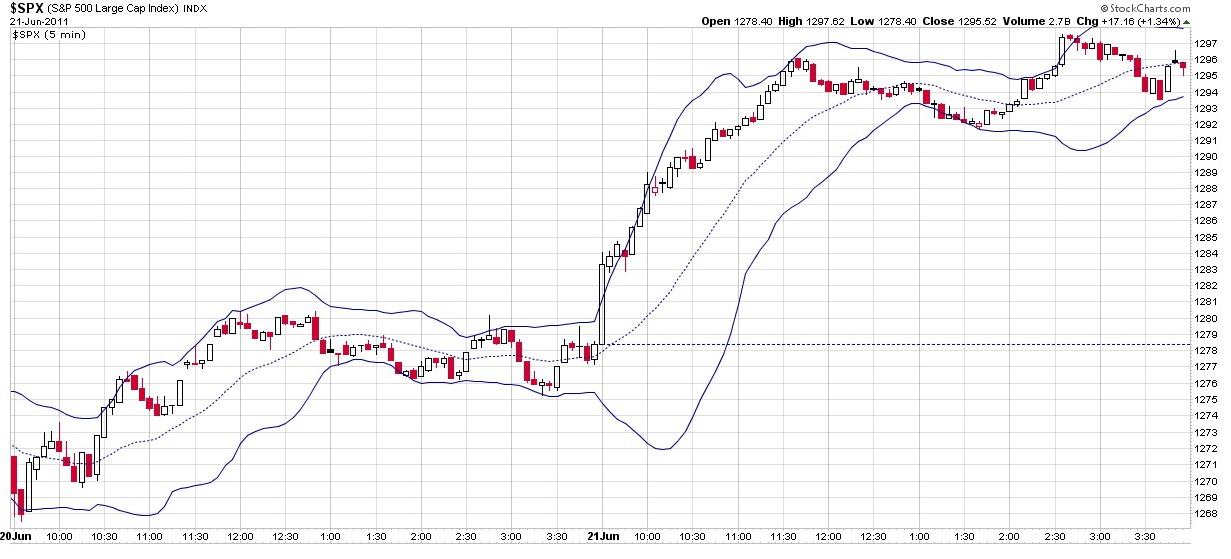

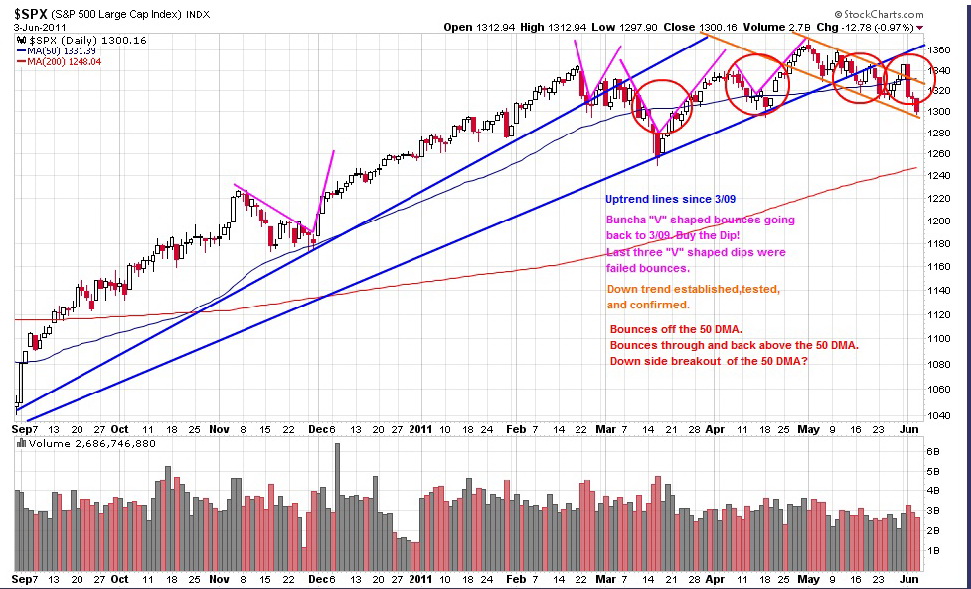

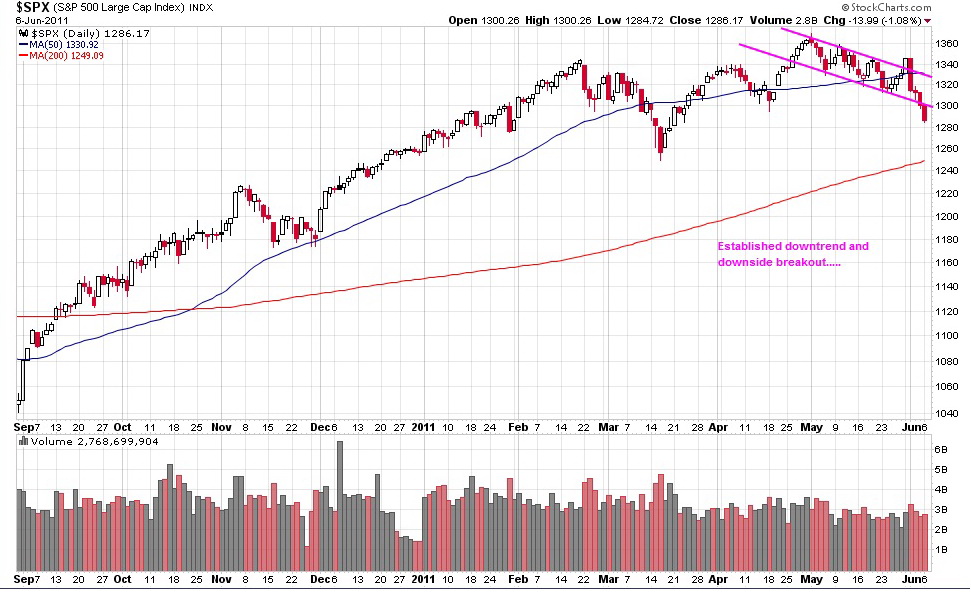

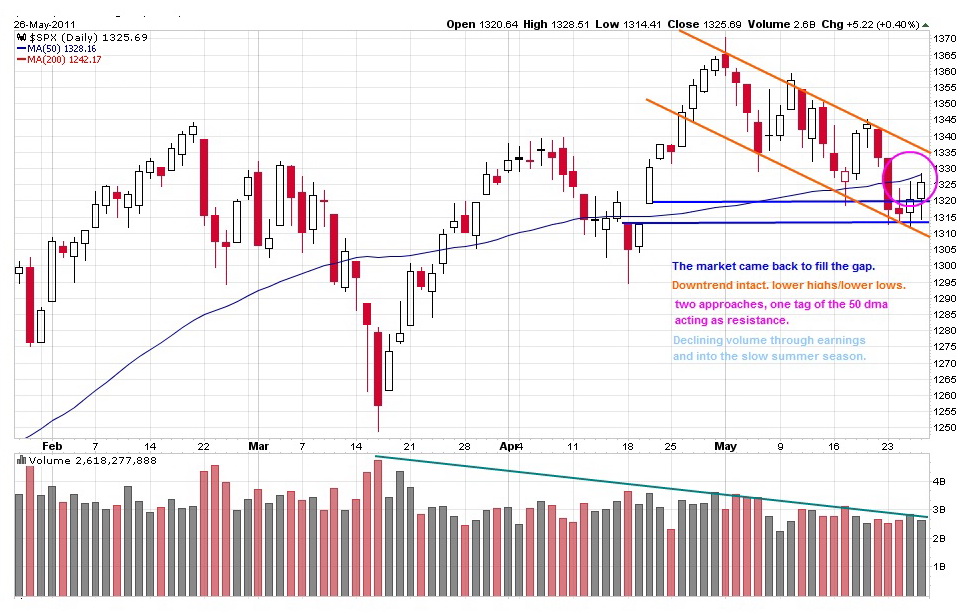

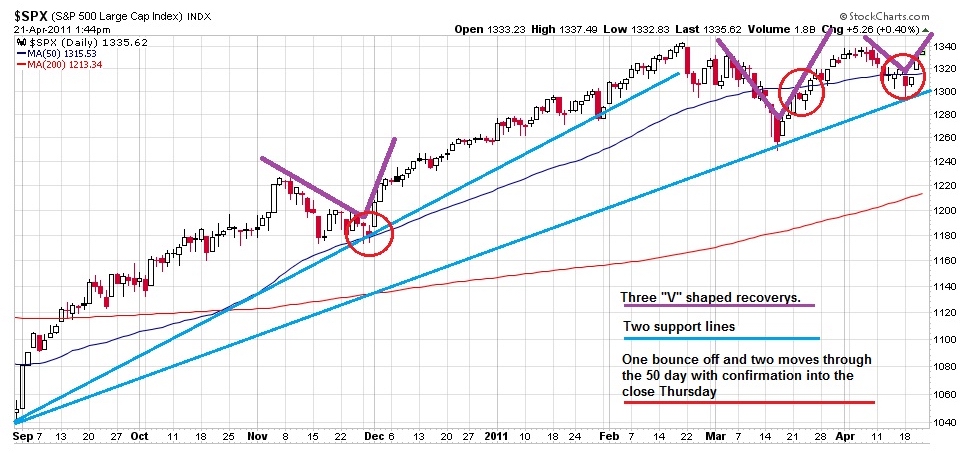

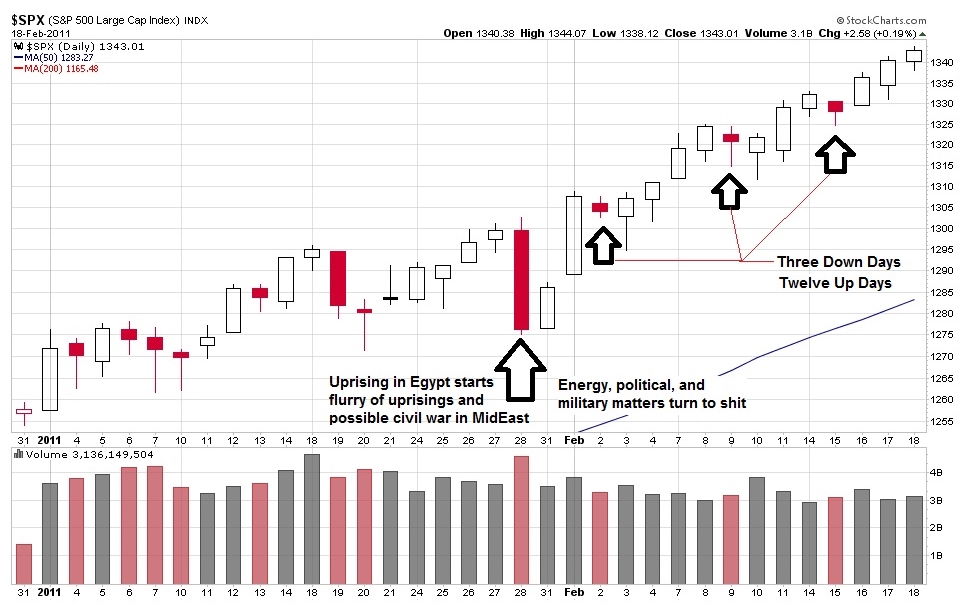

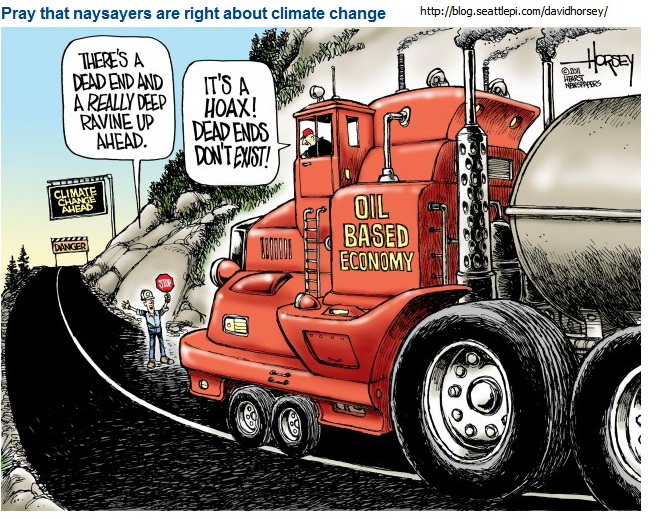

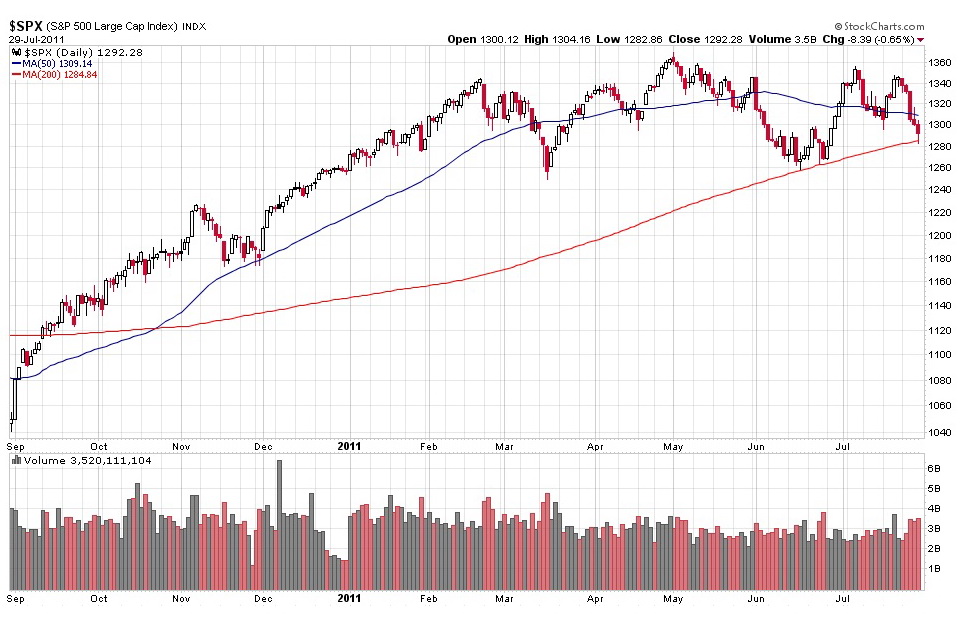

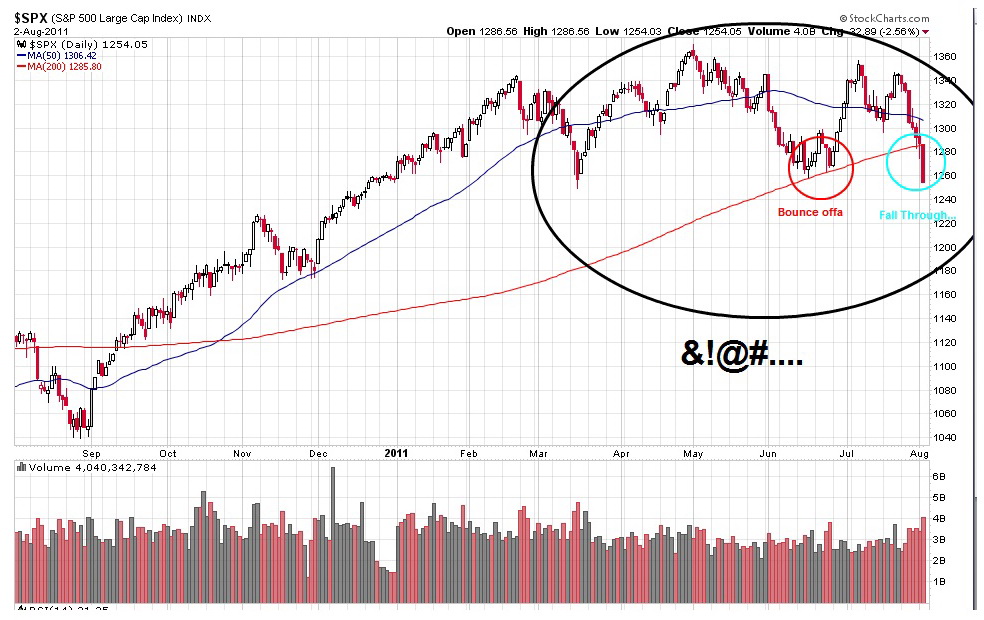

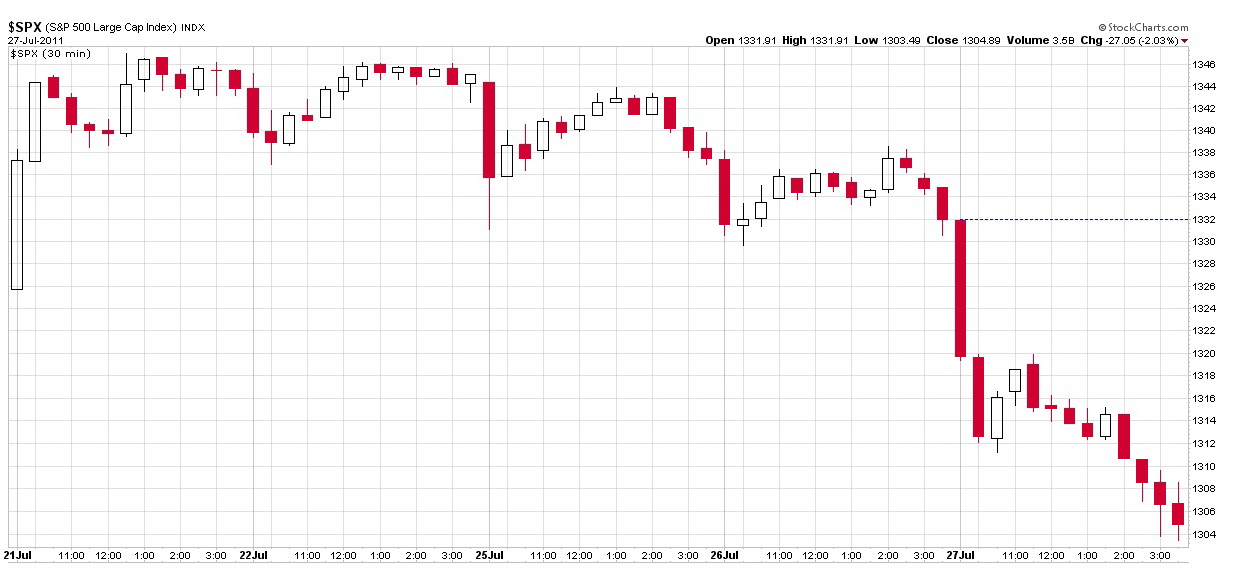

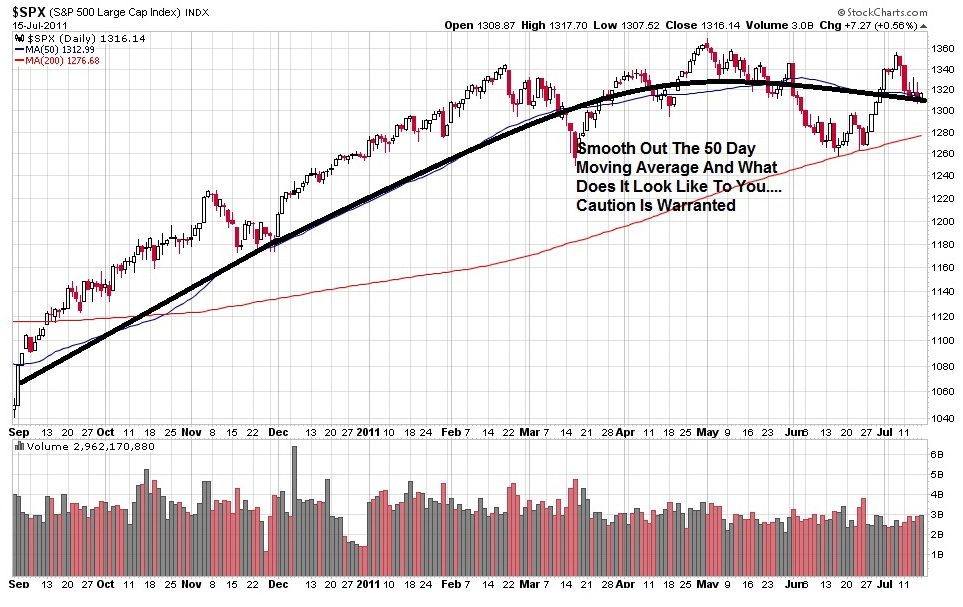

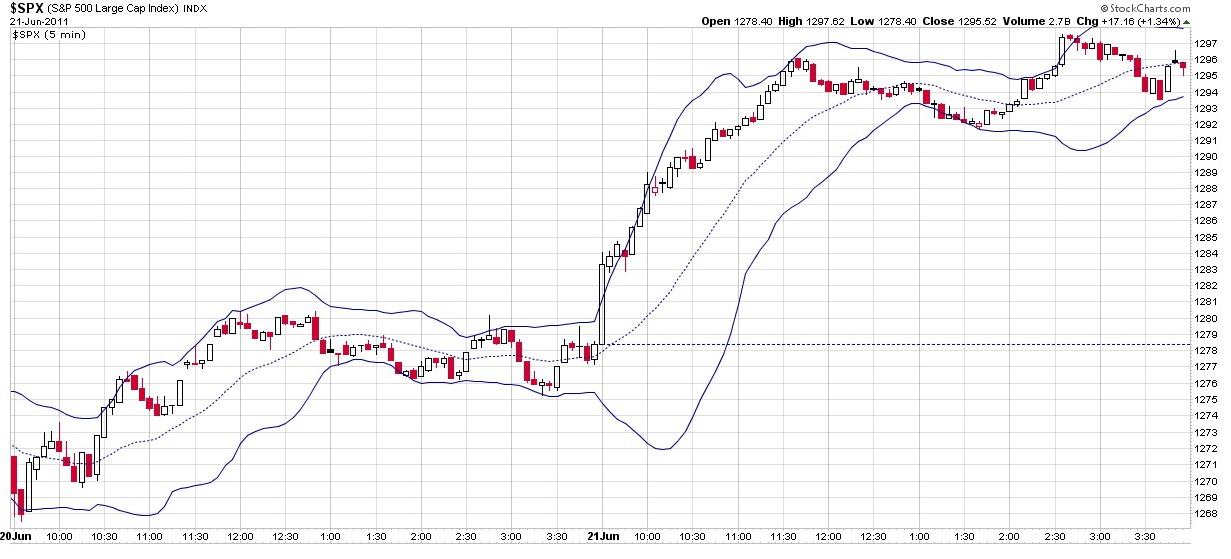

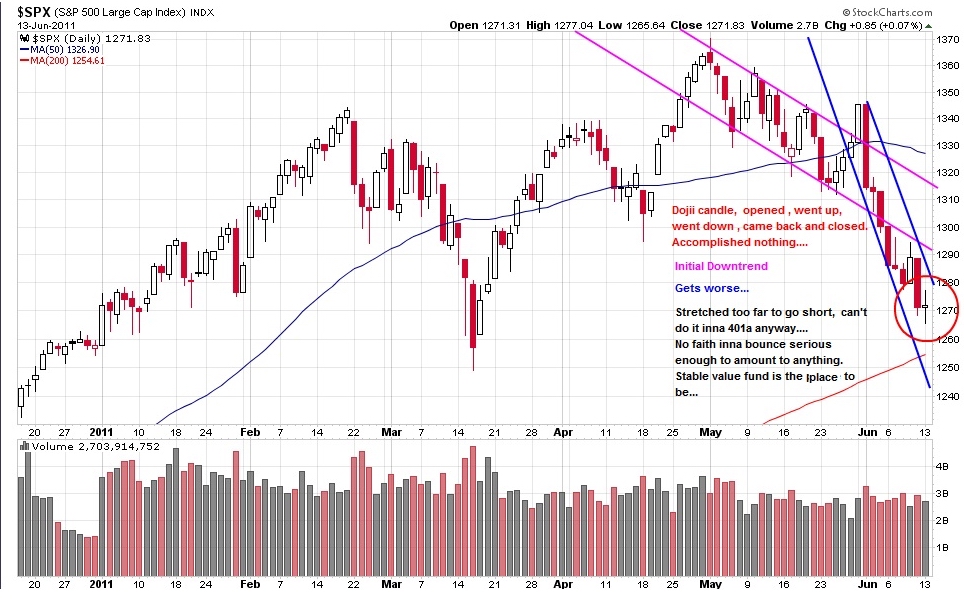

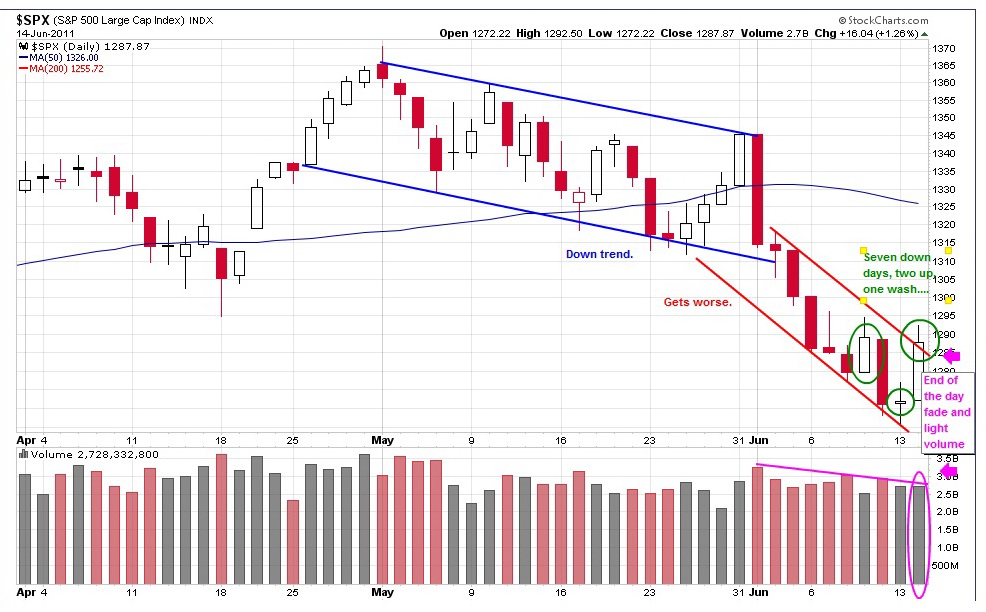

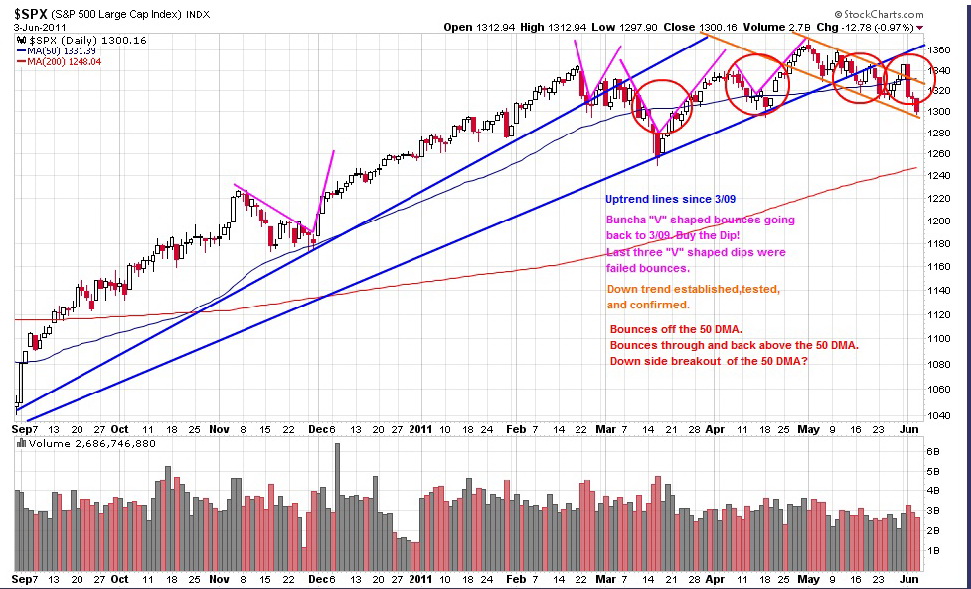

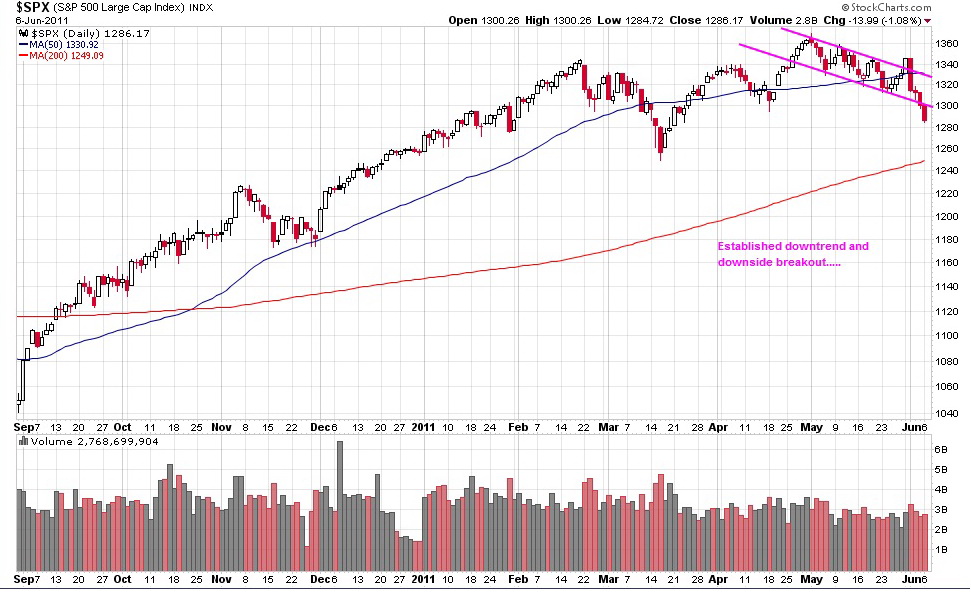

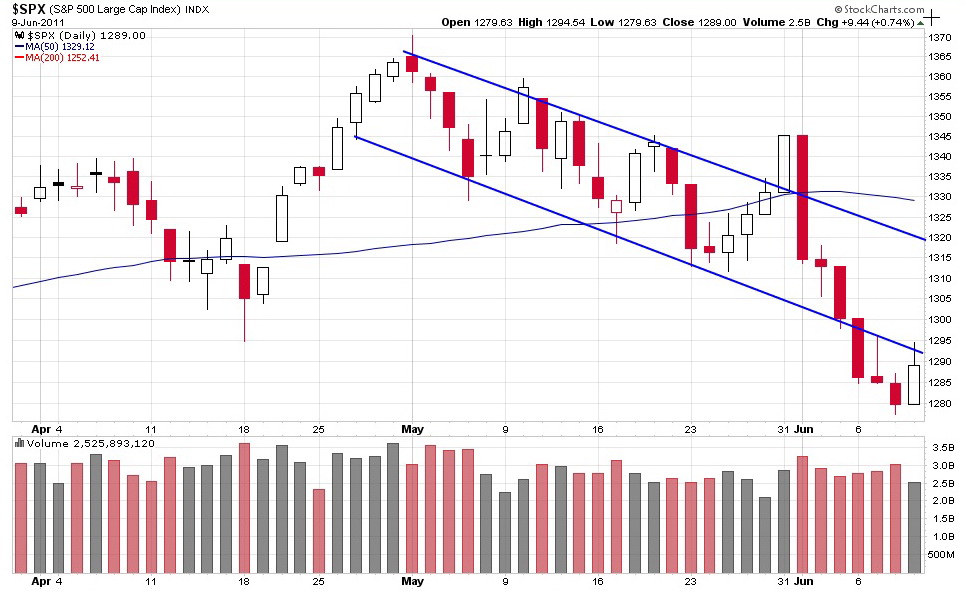

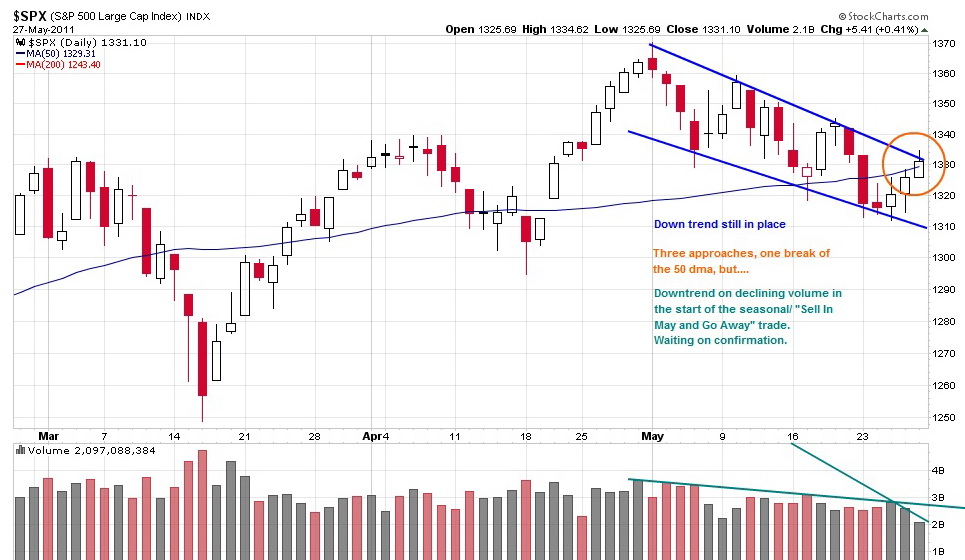

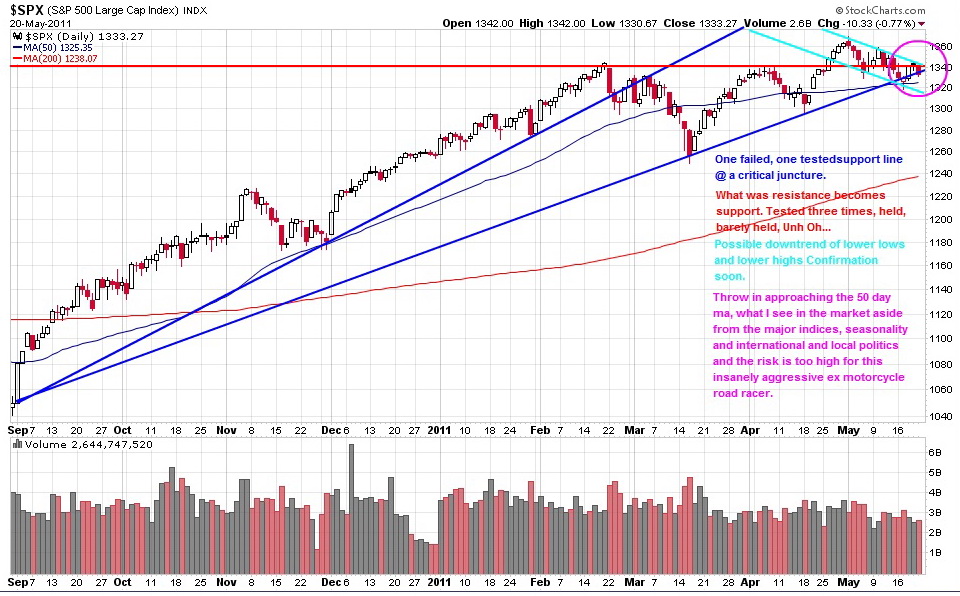

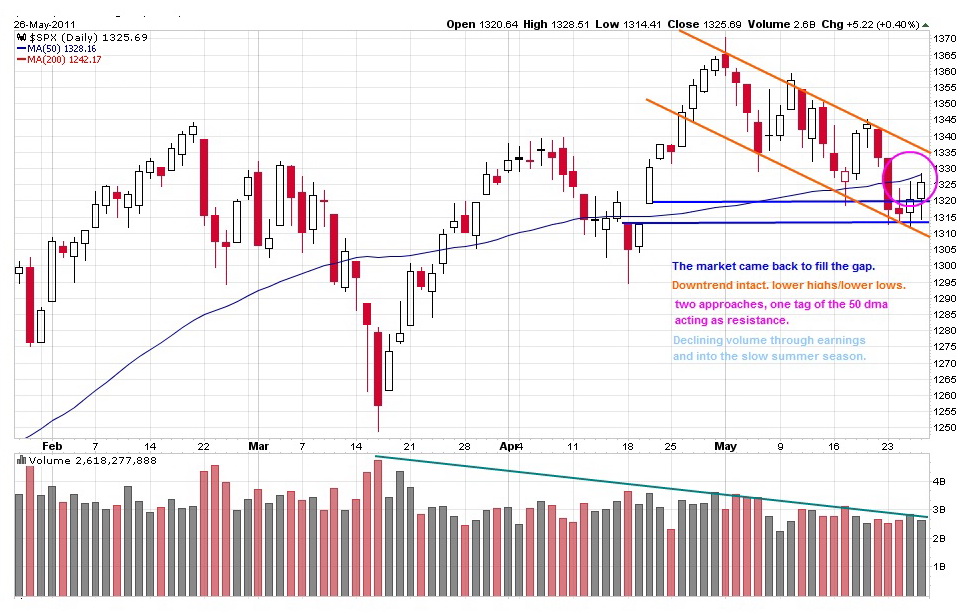

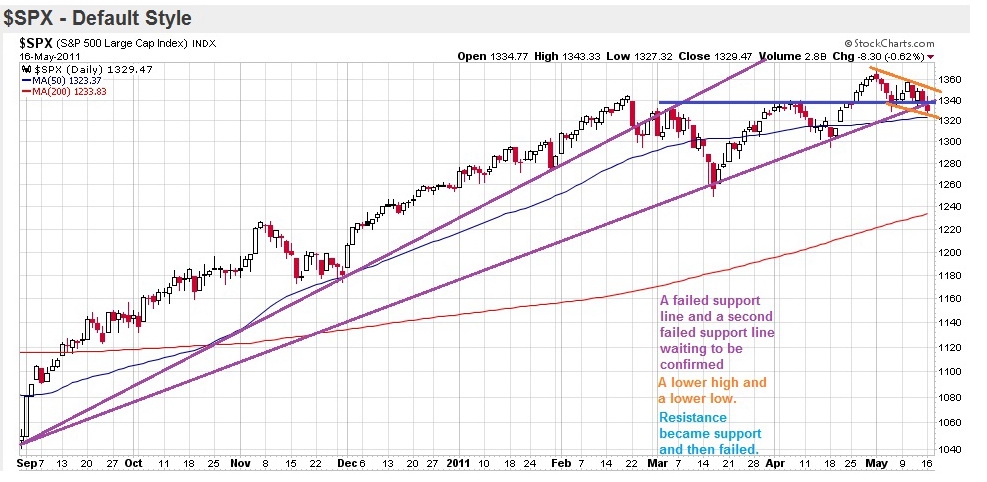

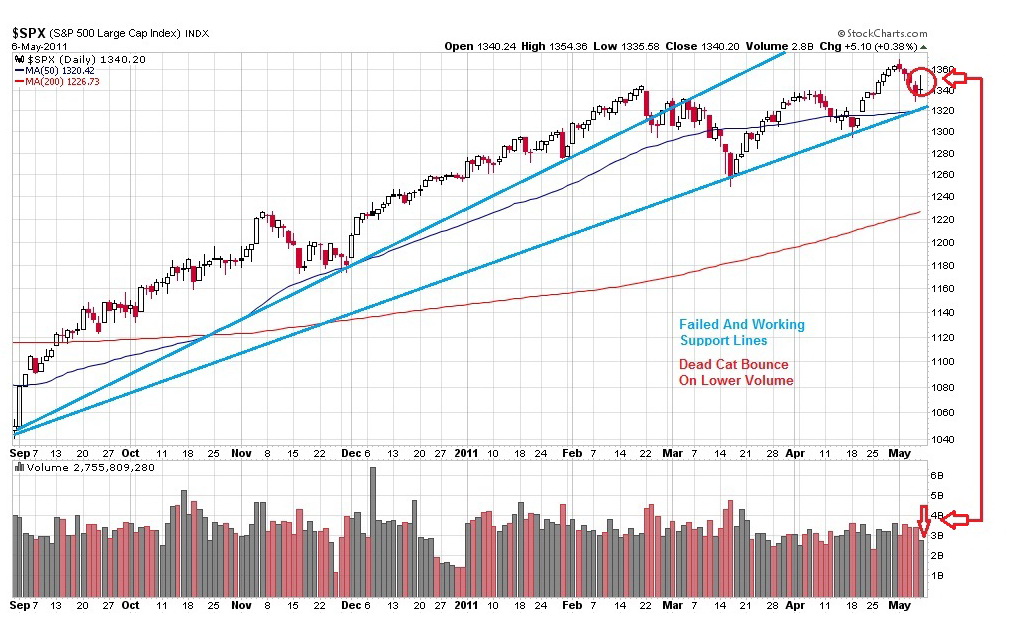

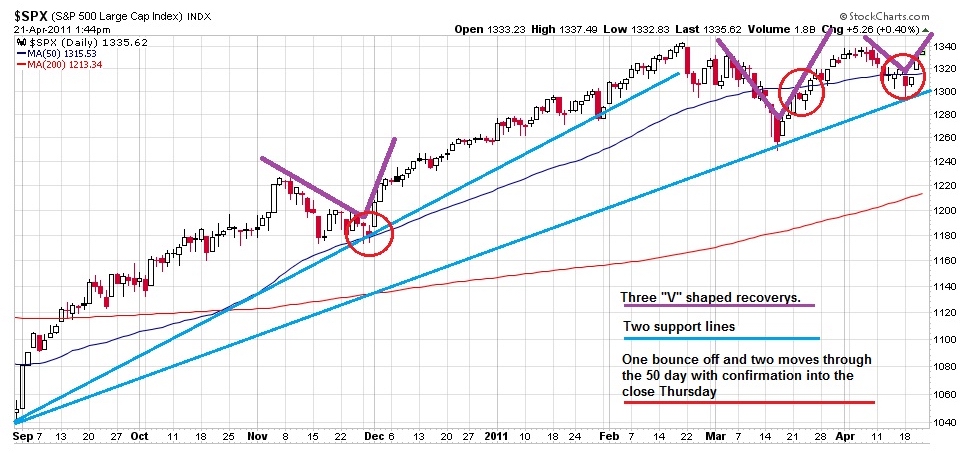

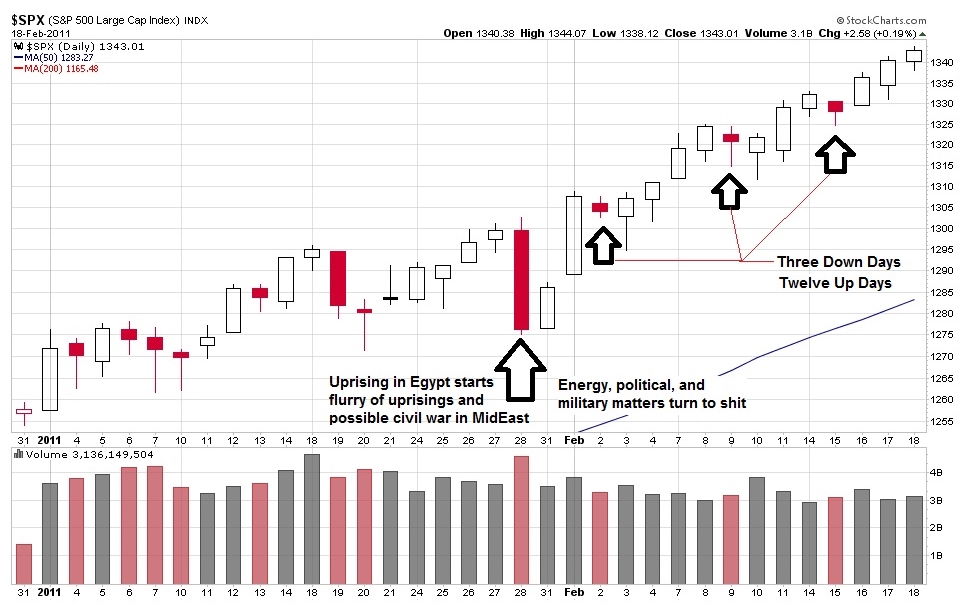

I could draw lines and write stuff and do circles and arrows and numbers and levels and Bollinger Bands and andandand. But, look at the the chart and note the topping, the red bars becoming pre dominant and taller since June, the candlesticks bouncing off the 200 day ma again and the 200 day ma approaching the 50 day ma, the 50 day starting to roll over, declining tops, and the whole ragged last five months. It sez," Caution is the better part of valor....

Bonds and cash....

http://www.stratfor.com/analysis/201107 ... ly-germany

http://www.ritholtz.com/blog/2011/07/an ... all-speed/

http://www.washingtonpost.com/business/ ... story.html

TUESDAY!!!!!

WED...

Thursday

Stay tooned....

( 3 / 1486 ) ( 3 / 1486 )

I Listened To An Ex Senator Alan Simpson Interview On The Bi Partisan Deficit Report....Horrifying...I Think It Is Fixable. I'm Not Sure It Will Be....

Friday, July 15, 2011, 11:45 PM

Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

— Michael Crichton

( 3.5 / 1769 ) ( 3.5 / 1769 )

Death Is Nature's Way Of Telling You To Slow Down. Kinda The Ultimate Excuse. Until Then, No Excuses....

Saturday, July 2, 2011, 03:04 PM

"In theory, there is no difference between practice and theory. In practice, there is."

-- Yogi Berra

Taj and Keef do my two favorite versions of Leaving Trunk. Here's both of them. if only video had been around when Keef's band did Born To Die.... What do Ian Cruikshank and Spit James have in common?

http://www.youtube.com/watch?v=56SHlnUr ... re=related

http://www.youtube.com/watch?v=GIzSy8Ln ... re=related

An' a little Taj Mahal channelin' Howlin' Wolf.......

http://www.youtube.com/watch?v=GyP07ybz ... re=related

An a little Keef Hartley and Spit James....

http://www.youtube.com/watch?v=m6SQ1A0k ... re=related

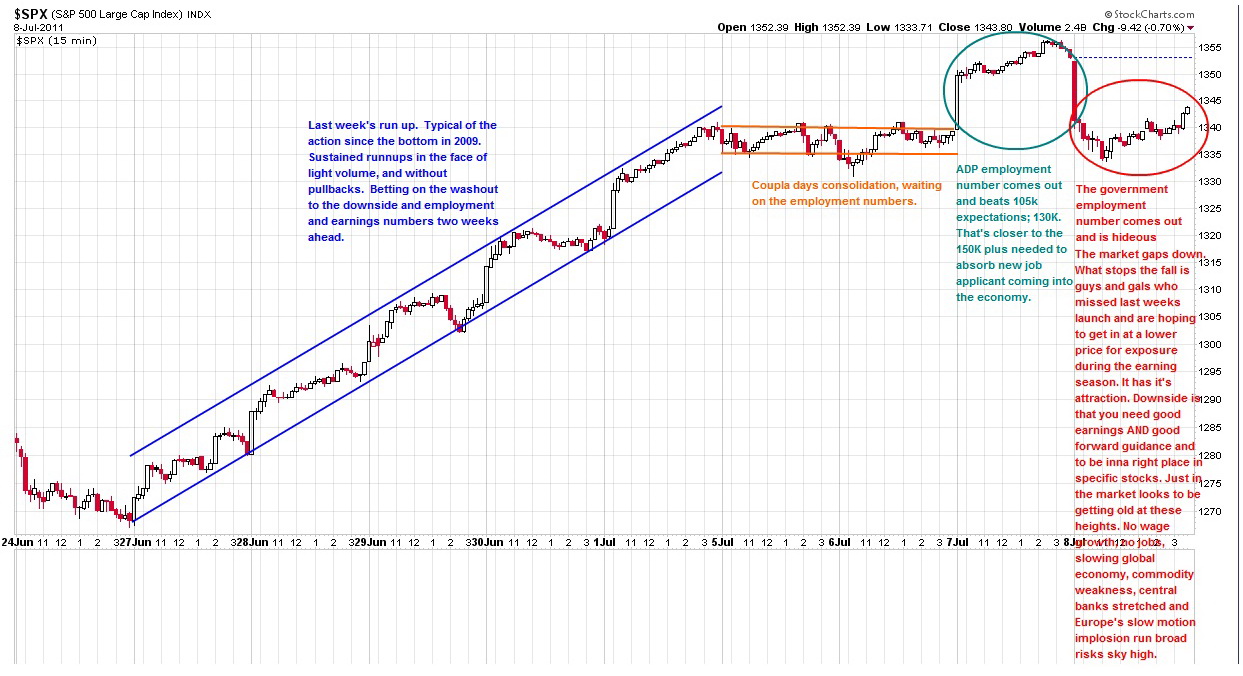

OUCH!!! OUCH!!! OUCH!!!! Smokin' week inna market. And I was All Cash. It stings, but it still may have been the responsible thing to do. Stay tooned and I'll explain why.....

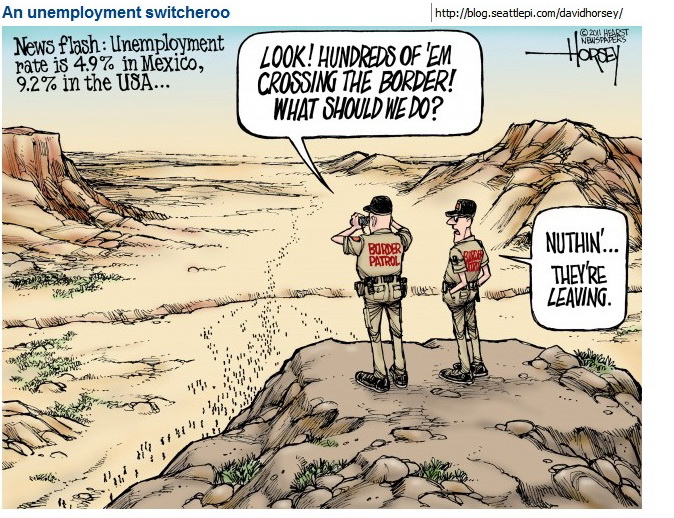

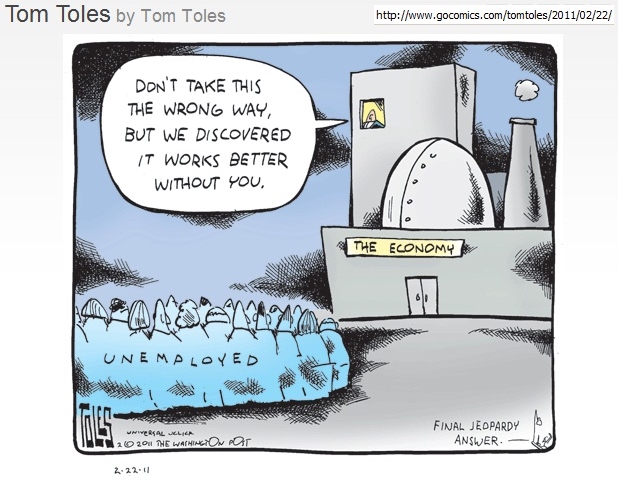

I got out at 1 because the economy sucked, the Fed was through stuffing the bank vaults with cash, ya can't buy houses if yer unemployed, the banks make safer money buying treasuries than loaning money for interest, Greeks were getting their Visa card limits raised so as to borrow to make the monthly, China inflation and GDP was running into a slowing world economy, and the first glimpse of the next recession is occurring with 9% to 17% unemployment today ,depending on what yer smokin'.

It looked as expected at 2 & 3 & 4.

At 5, with everyone leaning the same way after 4 down weeks, the paint the tape game started early because of the end the quarter. Once the buyers lit up the tape, the scramble to get outa shorts and inta longs got frantic. the only red that week was end of the days locking in profits and after lunch onna 30th locking in profits.

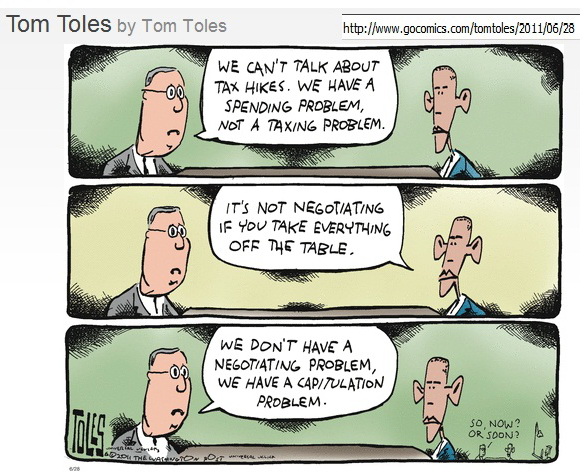

So.... Tuesday. A lotta guys show up having missed the run up and waiting on earnings inna week or two. Do they (I) buy at the highs? Or do they say, "Aw RIGHT!!! A chance to unload at the prices I missed last month ...SELL EVERYTHING!! Is the stock market saying "Everything is better, we washed out the timid and it's UP, UP, AN' AWAY. Or is it saying " We brutalized the cautious, now let's break the foolhardy.

See, I just don't see how much has changed inna last month. Greece is patched over, but the German public is less and less sure about floatin' the rest of the EZ. The economy? Wall Street vs Main St? A recession on the horizon? QE3? Do i see the way home?

Dunno. But discipline trumps conviction. Price is truth and in my IRAs and trading account, I'm long and undiversified and even margined in the trading account. I can do what I wanna, when I wanna, All in long to all out in the click of an iphone. Last week was good But that is not the way it is with my 401a. There are rules and restrictions on what, when, and how often. I gotta move deliberately, like moving a building down the street, not a car.

This is the other side of a Bull Market, when I'll go 100% long the most aggressive funds and ride undiversified through the dips and hiccups. The down days or weeks 'll be nothing another few days or weeks of up won't fix.

This is a Secular Bear Market where the news is bad, sell offs are relentless and the updrafts are absolutely vicious. I gotta deal with missing the ups as the price of missing the downs. I'm in cash now and I expect to be in cash until I see a reason not to be...

http://www.msnbc.msn.com/id/43633233/ns ... _business/

http://oldprof.typepad.com/a_dash_of_in ... other.html

The blast back to recent highs left a lot of investors on the outside lookin' in. That is a ready made cabal of dip buyers. The market can work off the overbought condition by going down and letting the left out in all at once at a lower price, or it can chop around and let the left out in a few at a time, correcting in time instead of price.

Or it can run head on into a a horrible jobs report or a Italy/Spain EU conflagration and undo the last week's launch upward all a once and continue down through the 200 day moving average.

Standing by in cash. I missed 80 points in 5 days, I ain't gonna chase it if I don't have any idea where it is going.... The market is going to be open tomorrow, next week, next month and next year too. I'm going to wait to commit until I have some clarity...

http://www.thestreet.com/story/11174104 ... ivity.html

Stay tooned.

( 3 / 1493 ) ( 3 / 1493 )

We're Not As Far Down As We Were In March, But It Feels A Lot Worse.... Kinda Like 84 Degrees F at 7:30 AM Feels Different Than 84 Degrees F At 3:30 PM. Feels Like Something Serious Is Onna Way.....

Friday, June 17, 2011, 11:33 PM

People only accept change when they are faced with necessity, and only recognize necessity when a crisis is upon them.

-- Jean Monnet

You start with everybody in cash or short. Then someone goes, "Hey, Waidaminute!! Who's left to sell and/or go to cash? What if the only thing left to do is buy?" With everybody leaning the same way, it doesn't take much to ignite a stampede the other way. It looks like a ferocious short covering and chasing runaway stocks rally.

The fundamentals suck. If the market confirms the launch, I will figure out what to do then. Right now, it feels too much like a bear trap....

Still all cash....

Stay Tooned.....

( 2.9 / 1457 ) ( 2.9 / 1457 )

Saturday, June 4, 2011, 12:03 AM

"When the plane is going down and the oxygen masks have dropped and parts of the plane are peeling off as you plummet toward the earth, that’s not the time to pull out the little card in the seat in front of you and say, ‘Gee, where are the emergency exits?' Everybody should have an emergency plan. The time to make these decisions is not when people are running around with their hair on fire."

--Barry Ritholtz

Chartz and Table Zup @ www.joefacer.com ... Check It out ....

I'm Still Shakin' My Head An' I've Owned The DVD For Years...

http://www.youtube.com/watch?v=yNuXO60G ... re=related

It's June An' I'm still 99-44/100's stock free inna 401a. The Ivory Soap riff is kinda my emergency plan...Know What I Mean, Vern? (How soon until NOBODY can relate to a '50s marketing slogan or a Jim Varney reference?)

http://oldprof.typepad.com/a_dash_of_in ... point.html

http://www.ritholtz.com/blog/2011/06/oh ... end-again/

http://www.ritholtz.com/blog/2011/06/su ... s-6-03-11/

http://blogs.the-american-interest.com/ ... n-dream-i/

http://www.gq.com/news-politics/big-iss ... table=true

http://money.msn.com/investing/the-big- ... jubak.aspx

http://online.wsj.com/article/SB1000142 ... 26472.html

http://www.bloomberg.com/news/2011-06-0 ... -view.html

http://www.debka.com/article/21002/

Tues....

It's Not That We're Down 5%, We're Up A Whole Bunch Over The Last Two Years.

It's That Sentiment Has Changed, The Season Is Against Us, And The Leaders And Tells Are Undercutting Our Confidence.

Thurs Eve... Still 99-44/100s % stock free inna 401a. Keep da bounce in perspective......

Stay tooned....

( 3 / 1055 ) ( 3 / 1055 )

Ya Don't Slow Down, Ya Never Grow Old. ----- Tom Petty . . . . I'll Let Ya Know How It Works Out....

Saturday, May 21, 2011, 02:25 AM

"If you keep thinking about what you want to do or what you hope will happen, you don't do it, and it won't happen."

-- Joe DiMaggio

Chartz and Table Zup @ www.joefacer.com

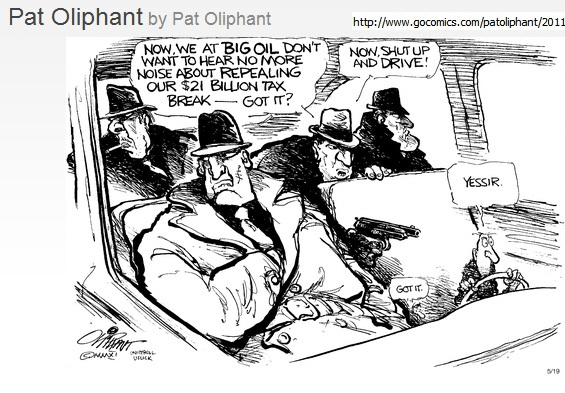

The End Of QE2, Rising Rates In Euro Asia, More Foreclosure Fallout, Lower Highs and Lower Lows Inna Stock Market, I Do Believe This Issa Theme Song For The Summer...

http://www.youtube.com/watch?v=K5IS45jT ... re=related

I'm one day from being out of the markets. What I'm doing is very very specific to my circumstances, personality, and history. Prolly time to write about it since ya can't make sense outta the action without a program.

http://www.ritholtz.com/blog/2011/05/ru ... osecution/

http://www.ritholtz.com/blog/2011/05/su ... events-21/

http://www.ritholtz.com/blog/2011/05/20 ... ng-market/

http://www.ritholtz.com/blog/2011/05/ex ... es-falter/

http://www.ritholtz.com/blog/2011/05/ge ... %E2%80%9D/

http://blogs.hbr.org/haque/2011/04/cutt ... udget.html

http://ftalphaville.ft.com/blog/2011/05 ... -near-you/

http://www.latimes.com/business/la-fi-l ... ull.column

http://www.washingtonpost.com/business/ ... story.html

http://www.ritholtz.com/blog/2011/05/ta ... ll-street/

http://www.ritholtz.com/blog/2011/05/ha ... h-fer-two/

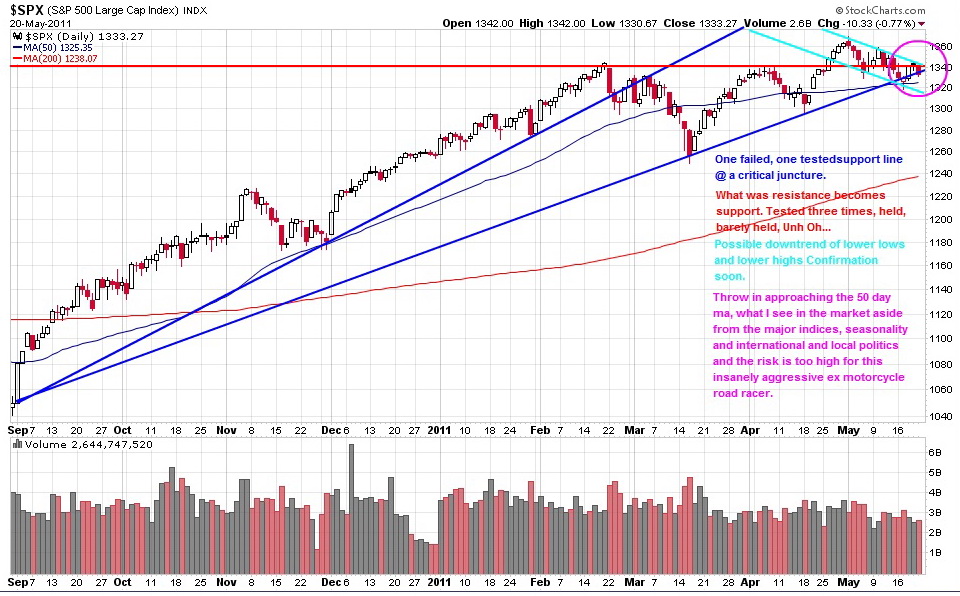

We got a lower high and a lower low and a close under the 50 day MA. And I got to 99+% Met Life Stable Value Fund... Now I wait....

What it all means...

Going from 95 % stock to all cash was a good idea, well timed.

This is an example of having all your boats in the water when the wind and the currents are working for you (9/10 to 5/11) and seeking shelter when conditions get sketchy (last coupla weeks).

I can't tell the future, I'm not privy to the conversations at the highest levels of business and government, I don't have inside information, and I still have title to my soul.

I do, however possess a certain degree of perceptivity and ratiocination such that I can see what is in front of me and figure out what I'm looking at. That's all ya really need...

http://www.theatlantic.com/infocus/2011 ... 071/#img07

http://www.ritholtz.com/blog/2011/05/al ... 0-day-m-a/

http://www.ritholtz.com/blog/2011/05/ne ... more-66061

http://www.investingwithoptions.com/201 ... at-the-sp/

Tuesday Eve...

A "V" Shaped bounce looks less likely. I'm positioned for some serious down side. I may not get it. This might just be a brief pause while some temporary issues or seasonality are worked out. Or it could be the start of a significant down draft ending 10% to 25% down with a huge wash out amid chaos and despair...

Either way, I'll buy when I like what I see.

http://blogs.wsj.com/marketbeat/2011/05 ... defaulted/

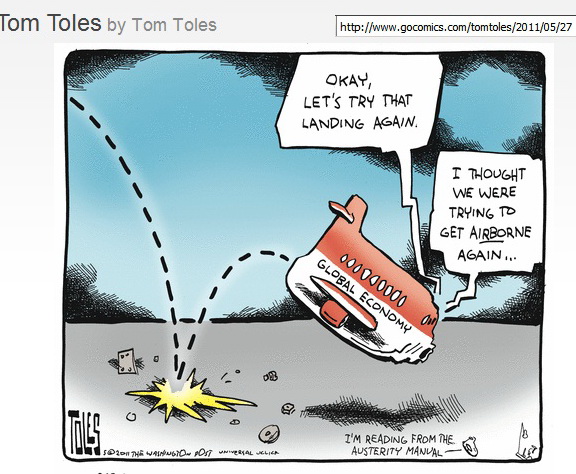

As High Frequency Economics says today: “Underlying problems of over-borrowed nations are not fixed by lending them more money.”

Stay Tooned...

( 3 / 191 ) ( 3 / 191 )

What Happens To The Party (The Markets) When The Fed Takes Away The Punch Bowl (Zero Interest Rate Policy [ZIRP] )?

Saturday, May 14, 2011, 01:51 PM

Just remember one thing: there are no good stocks. They all suck. Even those that are making you money are going to turn on you sooner or later. The only stock you should say anything good about is the one you no longer own that made you money.

--Reverend Shark

Chartz And Table Zup @ www.joefacer.com

What Happens When The Fed Takes Away Free Money (ZIRP)? It Really Ain't That Hard To Figure Out...

http://www.youtube.com/watch?v=UtsClj04 ... re=related

http://www.youtube.com/watch?v=K5IS45jT ... re=related

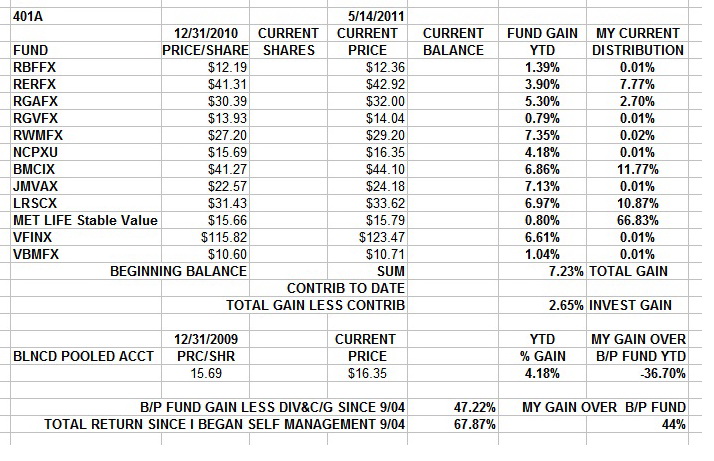

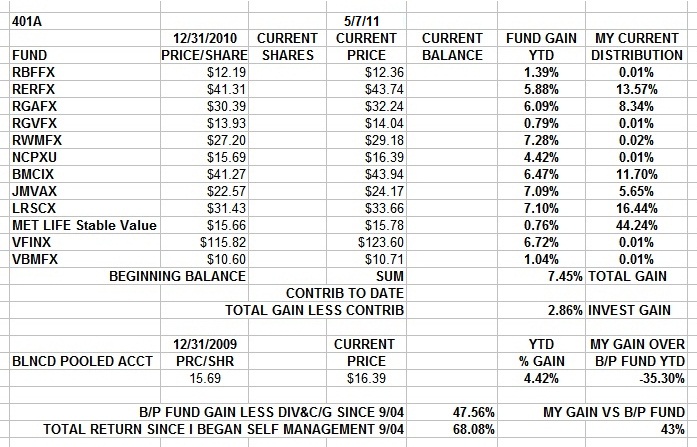

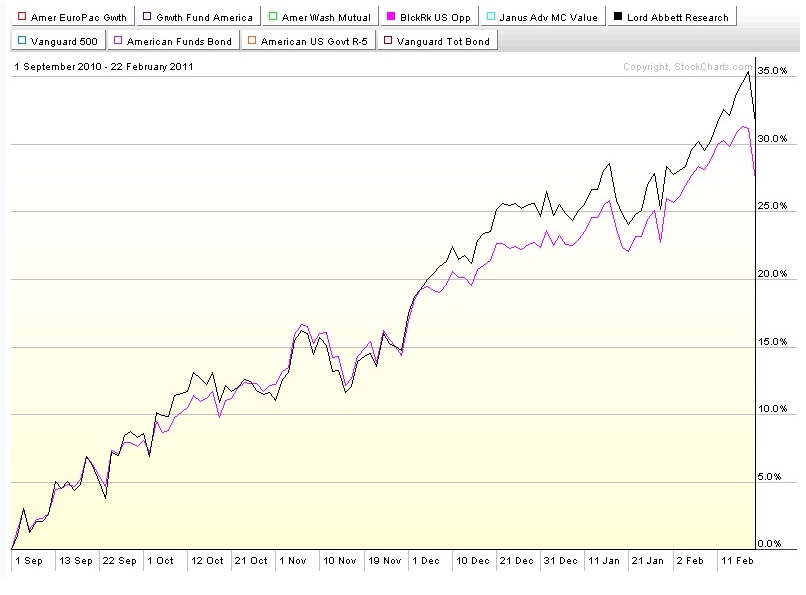

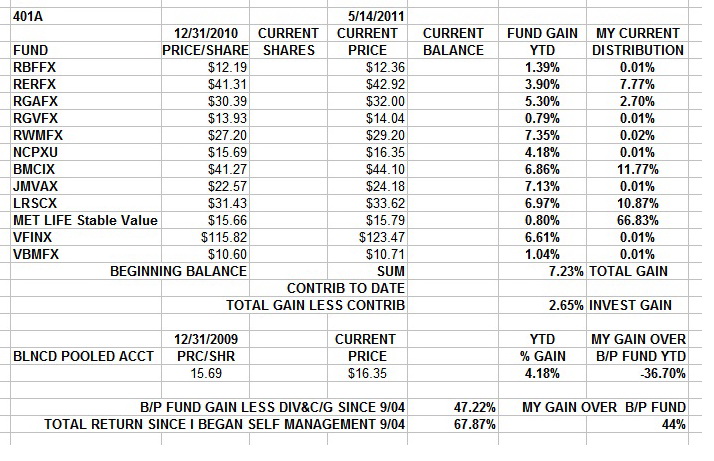

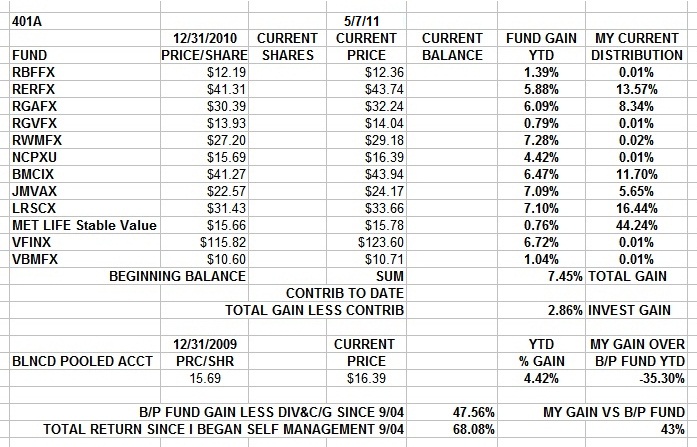

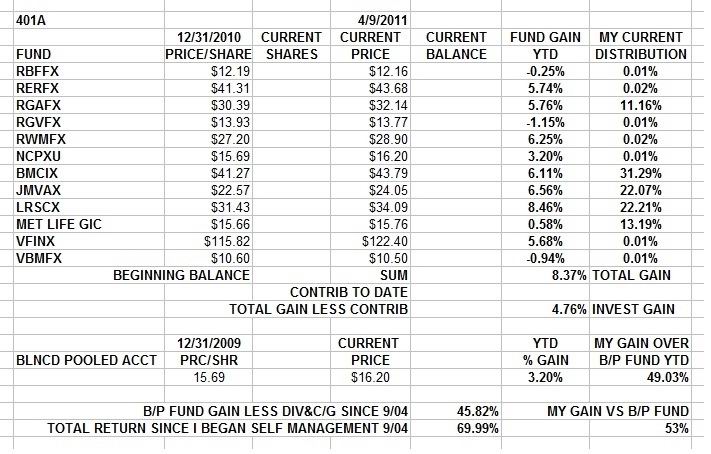

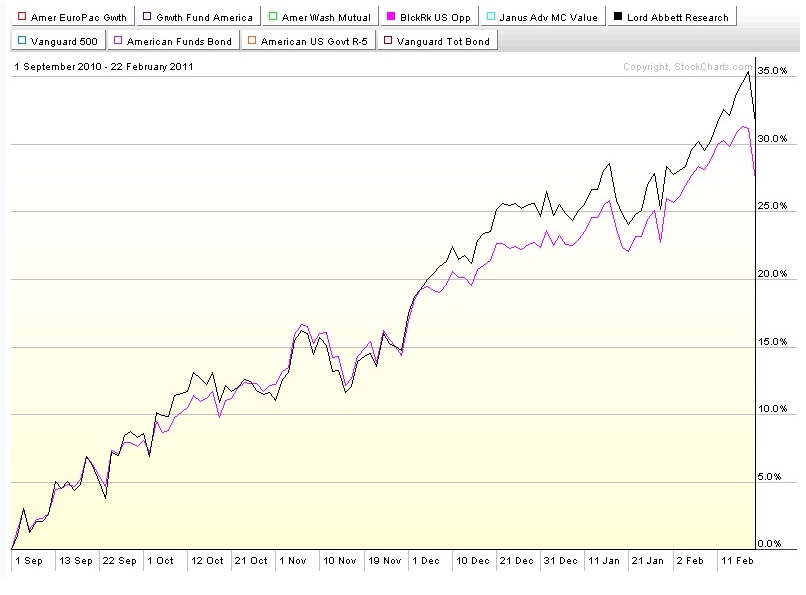

Pretty radical change in posture over the last month:

I'm down from 90% stocks just weeks ago to 33% this weekend, to anywhere from 20% to 0% anytime this week depending on how urgent I feel the need to get ultra defensive is....

It's a risk/reward thing, see? I been way long for a while, since 9/10. I made some serious coin last year. But there's limits. Making money was easy between late '04 and late 2008. I went 100% stocks, checked everything every Saturday morning and every so often trimmed my allocation toward the hot fundz. I was onna sidelines in cash during the 08/09 WHOOSH down. I read enough to make me certain that it was all risk and no reward so I cashed outa stocks into the GIC. I made money by not losing money. I mean I actually made money in 08. Coupla hundred simoleans beats a gaping smokin' pit inna 401a. I was late rejoining the party in the spring of 09. I let a lot of gains go bye bye because caution had served me so well previously. I didn't really understand the new religion of free money from the FED until 9/10. But there ain't no true believer like a recent convert so I got wit it. All stocks alla time.

That was then an' this is now. I'm gonna play onna other side of the street for a while. Yeah, I'm really aggressive when it comes to reachin' out for gains. It's what I do. But I balance that by being really aggressive protecting gains. I risk serious losses by being all the way long when I think the markets are goin' up. If the market turns against me, I can get roughed up onna way out. The rapid trading restrictions means there is a price to bailing out inna hurry. Ya gotta be smart aggressive; listen for the sirens and move closer to the door.

The other side of that is that caution and getting out early can leave you looking in the windows at the party. Coupla three four days of upward whoosh watched through the windows can sting hard enough to make yer eyes water. But, Oh Well! you never go broke realizing gains and booking profits. And a few dollars left onna table can be thought of as insurance premiums or the cost of admission. I can live with that. What's made me cautious over the last six weeks is starting to wear on me. Time for some fresh air and a rest. Nothing clears the head and resets the game like the view from the sidelines.

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

Few things are a bigger waste of time than getting back to even.

http://motherjones.com/politics/2011/05 ... nity-banks

http://www.telegraph.co.uk/finance/econ ... raphs.html

http://www.ritholtz.com/blog/2011/05/lo ... economics/

http://www.msnbc.msn.com/id/42955120/ns ... itol_hill/

http://www.ritholtz.com/blog/2011/05/wh ... d-manager/

http://www.ritholtz.com/blog/2011/05/dodo-bird-bankers/

http://www.latimes.com/business/la-fi-p ... 685.column

http://www.ritholtz.com/blog/2011/05/ho ... -bottomed/

http://www.theatlantic.com/business/arc ... rs/238517/

http://www.ritholtz.com/blog/2011/05/wh ... sa-part-2/

http://www.ritholtz.com/blog/2011/05/ho ... om-bubble/

http://www.rollingstone.com/politics/ne ... -20110511?

http://www.ritholtz.com/blog/2011/05/lo ... economics/

http://alephblog.com/ Check out "The Impossible Dream Part 2"

http://www.irishtimes.com/newspaper/opi ... 23_pf.html

http://www.platts.com/weblog/oilblog/20 ... y_gen.html

Damn!! Meant to lighten up onna stocks today. Forgot to enter the orders. Got 'em entered for tomorrow.

I'm a trend and momentum investor. I see damn little momentum and the trend looks to be rolling over. If I can pick up a majority of the up and miss out on summa da down, I figure that's pretty copacetic. Bull markets are a much easier environment to invest in and I'd rather just go long and hang on. But that's a recipe for disaster during certain times.... like this one.. .

WED EVE

Up day inna market and I'm pretty much a day or two from an all cash position (Met Life Stable Value). I'll write more as to how and why this weekend. For now, I'm banking gains from the first four months of the year, stepping back from risks I identify in the market technicals, acknowledging concerns identified by what I consider to be reliable and informed sources, and taking a breather. Should we get yet another "V" shaped bounce, I'm in a position to go long as fast as I wanna without triggering rapid trading restrictions penalties... If we go down big time, an all cash is a good thing indeed...

A coupla moves still to go, done by next Monday, and then I wait. A day, A week, A month, Or three.

Stay Tooned....

( 2.9 / 1428 ) ( 2.9 / 1428 )

Another Day, Another Drachma... Or Simolean. Whatever....

Saturday, May 7, 2011, 04:13 PM

"Money isn't the most important thing in life, but it's reasonably close to oxygen on the "gotta have it" scale."

-- Zig Ziglar

Chartz And Table Zup @ www.joefacer.com.

One Gawdamn Treasure After Another.....

http://www.youtube.com/watch?v=aE0xG7OD ... re=related

http://www.youtube.com/watch?v=9CxVSM6F ... re=related

http://www.ritholtz.com/blog/2011/05/be ... t-be-nice/

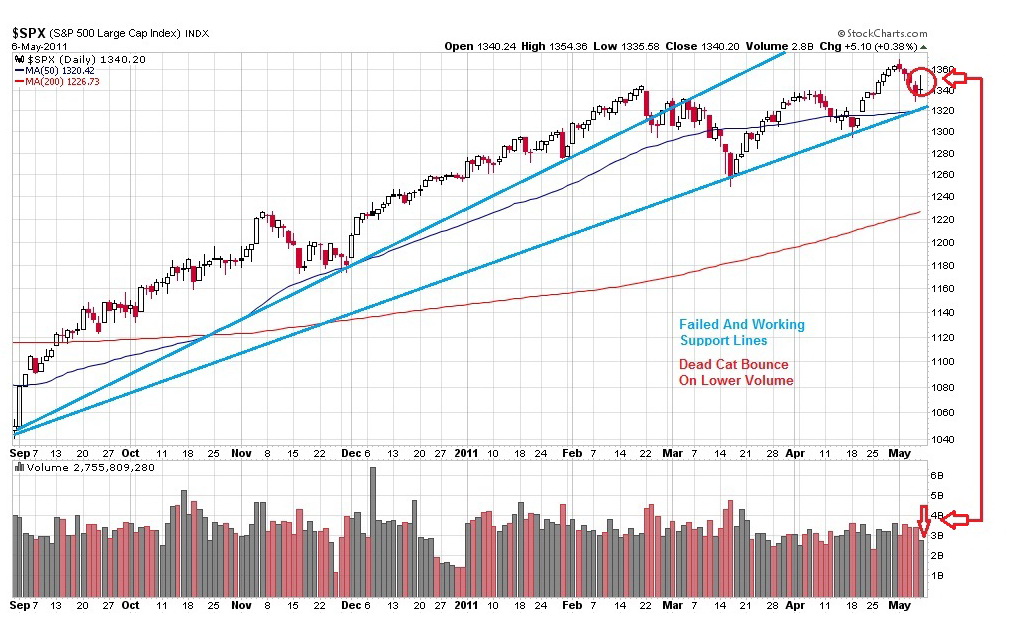

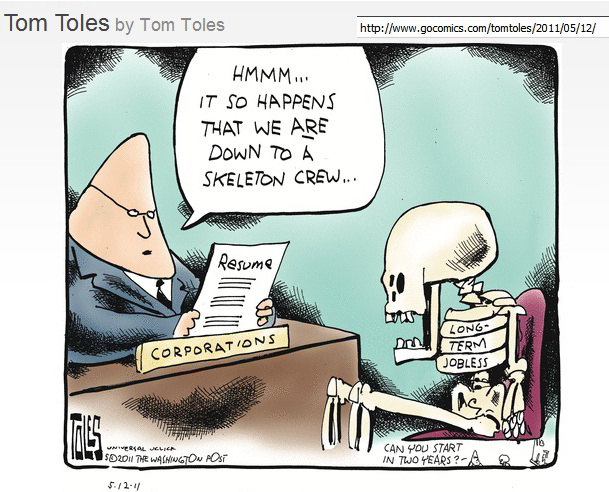

We got higher highs and higher lows. We got a failed support line and a working support line. We got a dead cat bounce on lower volume after four days down from a multi year high. Beneath the indexes we have a WHOOSH down in commodities. We have leading stocks and sectors looking queasy. We got extended stocks without support after serious run ups. We have hot money bailing out of the trade dejour. We have risk vs reward, fear vs greed, and risk management vs asset allocation.

I've pulled back some serious coin. I'm more concerned about the return OF capital than the return ON capital.

If we launch higher Monday and don't look back, I've still got money inna game. just not as much as I like. I can fix that.

If Friday was short covering and bargain hunters seeing bargains compared to a week ago, we might continue/resume falling and this might be the non "V" shaped bounce/correction I've kinda been expecting. In that case, I still have too much money inna game.

I can fix that too.

We'll see.

http://www.debka.com/article/20912/

http://www.bloomberg.com/news/2011-05-0 ... andal.html

http://www.bloomberg.com/news/2011-05-0 ... -bail.html

Big Time Important 401a Investor Stuff

http://www.ritholtz.com/blog/2011/05/wh ... d-manager/

http://money.msn.com/investment-advice/ ... spx?page=0

Stay tooned...

( 3 / 1527 ) ( 3 / 1527 )

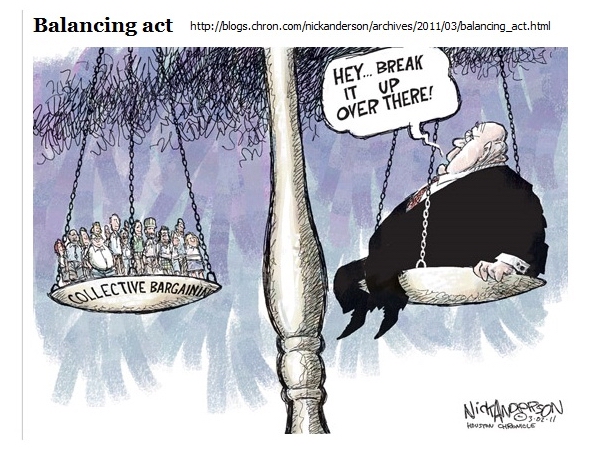

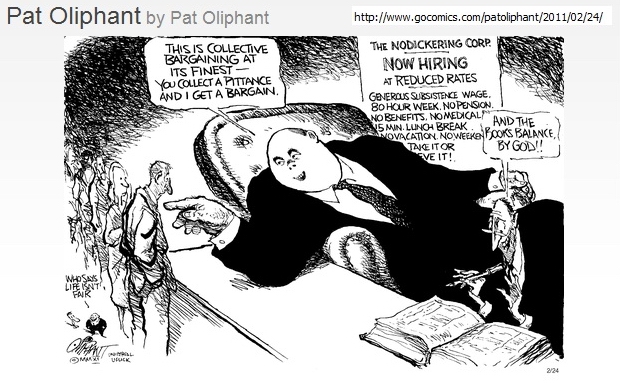

IF YOU ARE GOING TO FIGHT TO SAVE THE AMERICAN MIDDLE CLASS, YOUR FIRST OBLIGATION IS TO SAVE YOURSELF. WE NEED NUMBERS ON OUR SIDE TO BALANCE THE MONEY ON THE OTHER SIDE. START BY MAKING YOUR 401A WORK FOR YOU. YOU FIGHT BEST FROM A FIRM FOOTING ON A SOLID FOUNDATION. HERE'S WHAT I'M DOING...

Saturday, April 30, 2011, 01:33 PM

I am opposed to millionaires, but it would be dangerous to offer me the position.

-- Mark Twain

Chartz And Table Zup @ www.joefacer.com

It's Really Really Fun, Boys And Girls, And So Very Educational Too....

http://www.ritholtz.com/blog/2011/04/fi ... round-two/

http://www.ritholtz.com/blog/2011/04/la ... aventador/

I went deeper into stocks on Friday afternoon April 29th...

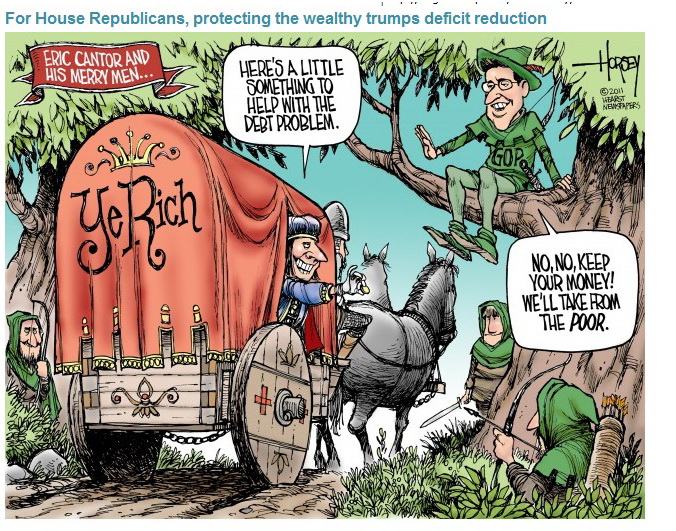

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find one despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

Clickit!!!!

Cup And Handle. Three "V" Shaped Recoveries. One Failed Support Line And One Working Support Line. Two Confirmed Consolidations. These Are Bullish Patterns. The Market Is Soaring, And For For Exactly The Wrong Reason. But They Don't Put An Asterisk On Gains, Take Them Back, Or Discount Them... A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking Why. I'm Tagging Along With What Is Making The Rich Richer. I Feel Strongly About It Both Ways.... But I Can Use The Money.

http://www.ritholtz.com/blog/2011/04/ho ... is-market/

http://www.ritholtz.com/blog/2011/05/se ... %E2%80%A6/

http://www.ritholtz.com/blog/2011/04/th ... mic-facts/

http://www.ritholtz.com/blog/2011/04/su ... s-4-29-11/

http://www.ritholtz.com/blog/2011/04/re ... epression/

http://www.ritholtz.com/blog/2011/04/ha ... mployment/

http://www.ritholtz.com/blog/2011/04/en ... -ritholtz/

http://www.ritholtz.com/blog/2011/04/th ... headwinds/

http://www.ritholtz.com/blog/2011/04/th ... annotated/

http://www.propublica.org/article/all-t ... ing-bubble

Stay Tooned......

( 3 / 1526 ) ( 3 / 1526 )

Thank God I Grew Up When Honesty Demanded That You Call Them Sugar Pops And Sugar Smacks And Sugar Frosted Flakes. And It Was OK That Quakers Made Puffed Rice And Puffed Wheat For Kids That Were Shot From Guns ....

Friday, April 22, 2011, 03:27 PM

The more you know, the harder it is to take decisive action. Once you become informed, you start seeing complexities and shades of gray. You realize that nothing is as clear and simple as it first appears. Ultimately, knowledge is paralyzing. Being a man of action, I can’t afford to take that risk.

– Calvin

Chartz And Table Zup @ www.joefacer.com.

Usually there is some rock 'n roll with a personal link to my life linked here. Here's some radio of a different sort....

http://www.dylanratigan.com/2011/04/22/ ... e-dylan-2/

There are times that I realize just how outa place I am today

http://www.youtube.com/watch?v=zGpS6LHeBC0

"When the facts change, I change my mind. What do you do, sir?" --John Maynard Keynes

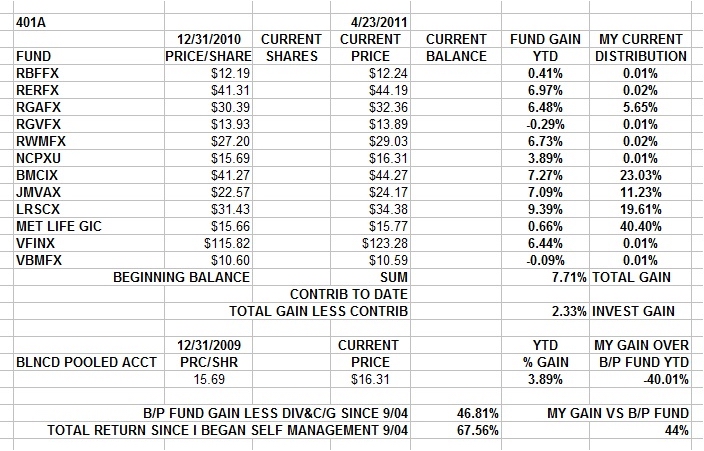

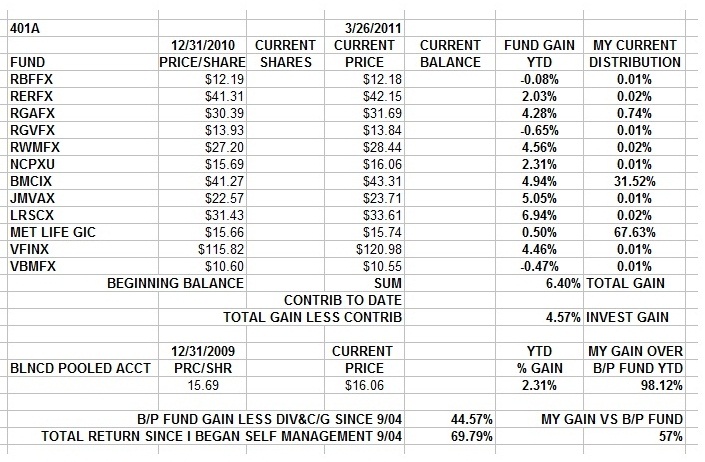

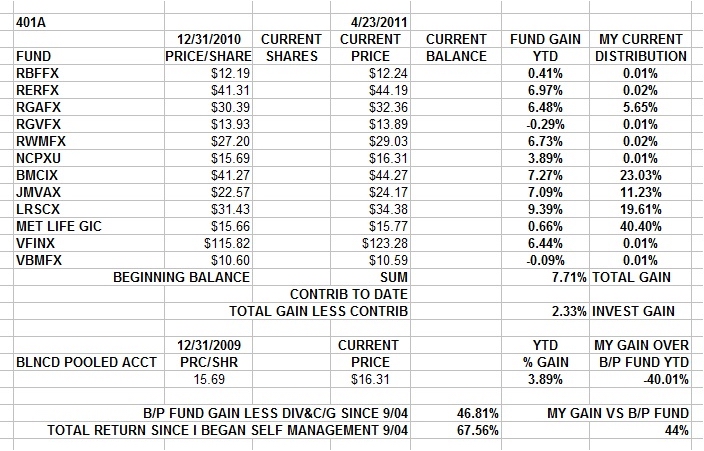

Wednesday (4/20) Action looked good. I changed my mind about risk and added to my stock position at the end of the day.....

Here's where I stood Thurs AM allocationwise....

I picked up a few bucks onna day and I'm nicely set up for Monday....If the bottom doesn't fall out.

I may go deeper into stocks Monday. Here's why.

My risk management and capital preservation has cost me money every time I've gotten anxious and lightened up since the bottom in 2009. I've gotten back in some distance behind the "close yer eyes and hang on" crowd, but.... It ain't a sin to be wrong, everybody makes mistakes. It IS a sin to stay wrong. So I don't. Of course, my caution allowed me to actually make money in my 401a in 2008 when everybody else was bleeding from the eyeballs. One day it'll save my donkey again. I just gotta keep fear matched against greed an' get the balance right.....

I'm going deeper into stocks on Friday afternoon.

“The Fed is still your friend if you are invested in cyclical stocks , commodities, and foreign currencies. If you eat food and run your car on gasoline, the Fed will continue to hurt you. If you are looking for a job, you may be wondering why it is still so hard to find ond despite all the money the Fed has spent so far on QE2.0. If you are retired and living on interest from your CDs, then you are getting really squeezed between rising food and fuel prices and the Fed’s zero interest rate policy. In other words, the Fed seems to be doing everything to widen the gap between the Haves and Have Nots than to lower unemployment and boost economic growth, which remains “moderate” according to yesterday’s FOMC statement.”

-- Ed Yardini

Cup And Handle. Bullish Pattern. The Market Is Soaring For Exactly The Wrong Reason. But They Don't Put Asterisk On Gains. A Dollar Gained Is A Retirement Dollar For Me And My Family Whether I Hated The Economic Conditions That Made It For Me Or Not. So I'm Way Long And Not Liking It.

Stay tooned.....

( 3 / 1509 ) ( 3 / 1509 )

"Been Down So Long, It Looks Like Up To Me" That's How You Get Talking Heads Pontificating About A Healed Economy And Business Looking Up. Pay No Attention To What Is Behind The Screen......

Saturday, March 26, 2011, 03:31 PM

"The effect of mobiles, computers, satellites—there is a generation coming that is outside the traditional controls. Normally, generations re-create themselves. But something else is happening."

-- Mohamed Haykal

Chartz And Table Zup @ www.joefacer.com

Trower. Find Something That Works And Keep On Doing It. Kinda Like Investing. Shame To Lose Dewar Along The Way.

http://www.youtube.com/watch?v=bfn6598L ... re=related

http://www.youtube.com/watch?v=R1jZO54m ... re=related

http://www.youtube.com/watch?v=TLHZsK4e ... re=related

There are things I can't do, like serious fundamental analysis of thousands of companies books and in depth analysis of governmental politics and sociopolitical movements on resource allocation and technological and sociopolitical forces versus the political imperatives in the MENA area. I don't have access to the raw data and I'm too busy laying out and bending high purity gas lines.

But I can get price vs time on a near instantaneous basis and there is little data available that is more cogent, accurate or determinant. And technical levels left behind mean it's modified risk on with an eye toward how the tenor of the market has changed.

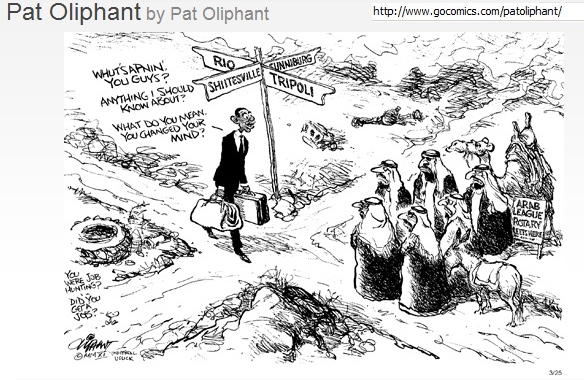

Never mind what makes sense. The market never talks to you more directly than it does with price. Glow inna dark sea food onna West Coast, the Korean war Redux, the risk of Iran and Hamas in Lebanon, the forced retirement of way too many people way too young, major midwest cities drying up and blowing away, very high oil prices, Euro debt issues, etc, if prices go up through resistance and hold, I gotta be thinking, Buy. So I started to scale in last week.

Part way in last week, maybe more this Monday. Maybe.

http://www.ritholtz.com/blog/2011/03/no ... -not-safe/

http://www.ritholtz.com/blog/2011/03/ho ... this-time/

http://www.msnbc.msn.com/id/42258117/ns ... e_economy/

http://www.ritholtz.com/blog/2011/03/pr ... roam-free/

http://www.ritholtz.com/blog/2011/03/ci ... cys-costs/

http://www.stratfor.com/analysis/201103 ... ed-kingdom

Stay Tooned.

( 3 / 1350 ) ( 3 / 1350 )

Life Is About Cycles, Dialectical Materialism And Spiritual Concatenation, Yin And Yang, Secular And Cyclical, Two Stroke And Four Stroke....

Saturday, February 19, 2011, 04:21 PM

"When the Fed is the bartender everybody drinks until they fall down."

— Paul McCulley

Chartz And Table Zup @ www.joefacer.com

Young And Old Is Another Cycle...

http://www.youtube.com/watch?v=Vx606E2O ... re=related

http://www.youtube.com/watch?v=GZXMWklGf84

http://www.youtube.com/watch?v=PEPoCzsj ... re=related

http://www.youtube.com/watch?v=XqSeaoDxGtA&NR=1

http://www.youtube.com/watch?v=NOAcu6vX ... re=related

Speakin' of young, I saw Cotton a coupla times at the 'mo a coupla years after the Howlin' Wolf video. He showed up with a little club set up and mowed the house down. His version of Bobby "Blue" Bland's "Turn On Your Love Light" was a stand out...

Then there some boomin' Harley 4stroke twins and KR's TZ 700 and a Kawi 2 stroke @ Laguna... Cycles......

http://www.youtube.com/watch?v=uesfZUjM ... re=related

http://www.youtube.com/watch?v=q6YkutGxkz4

I used to watch the Warriors until they turned into the Clippers. But now even the Clippers aren't the Clippers anymore...

http://probasketballtalk.nbcsports.com/ ... -for-2010/

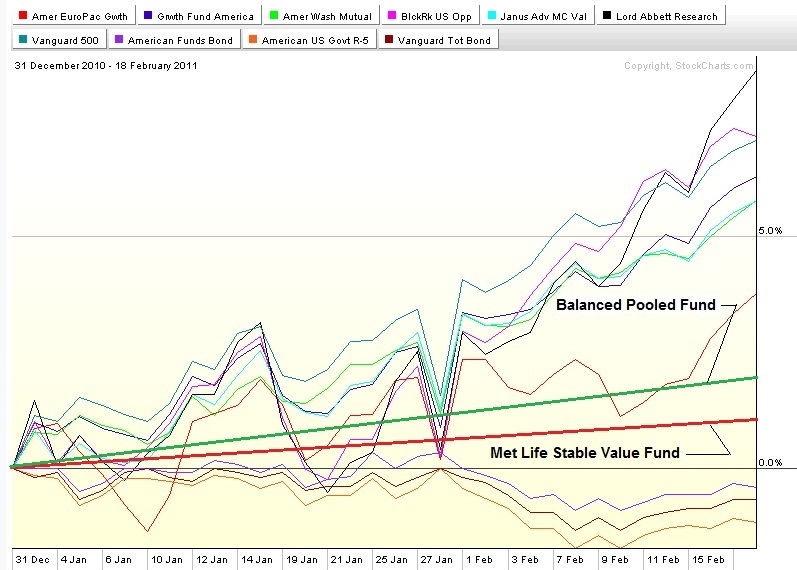

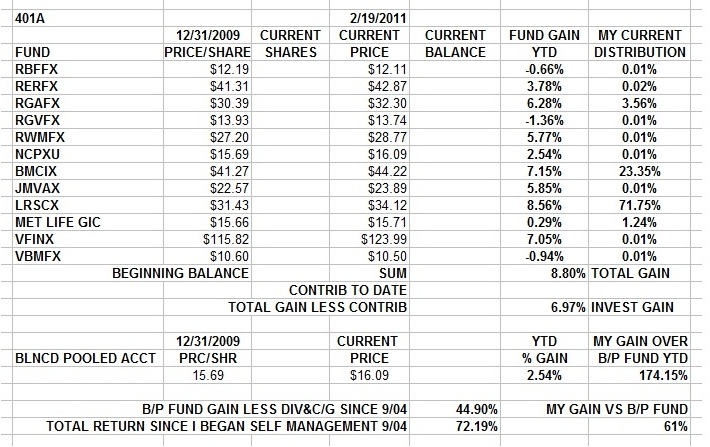

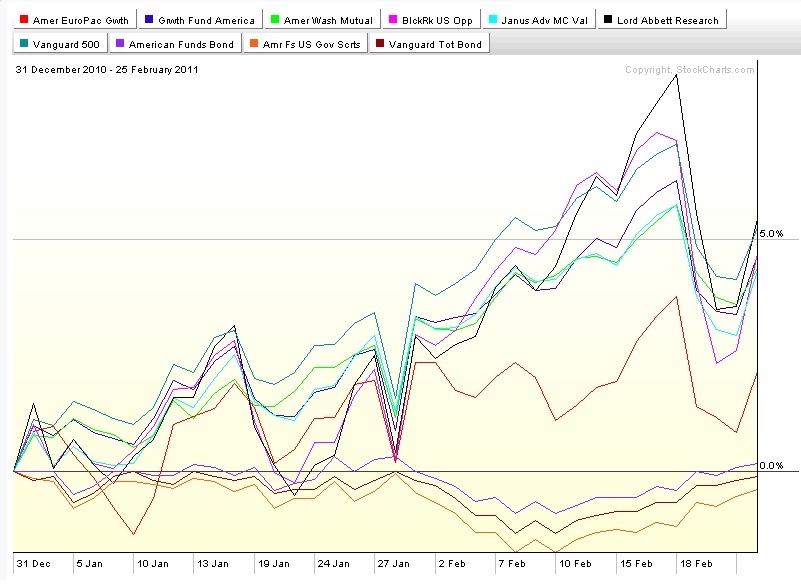

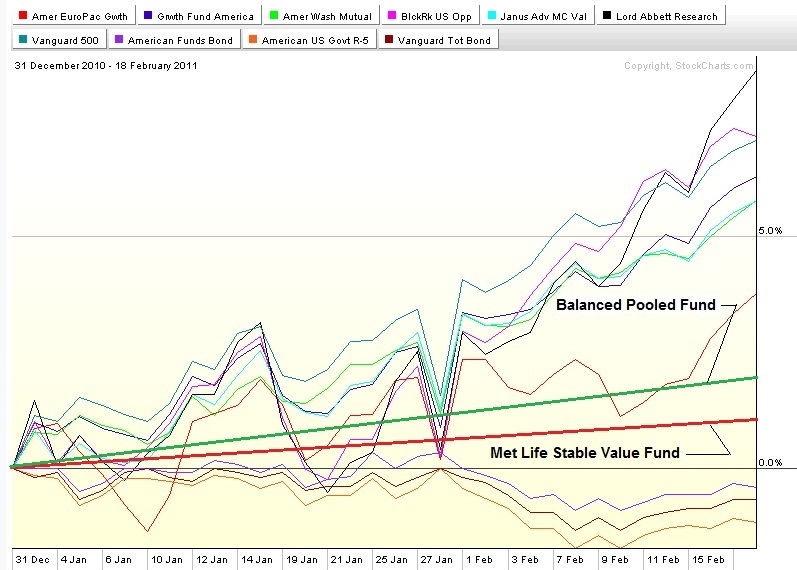

Smokin' Seven Weeks

I Can Bank Half Of A Good Year's Return Monday Or Shortly There After. Or Give It All Back. Or Ride It Farther Downa Road. Thinking......

And Watching With My Finger Onna Eject Button.

http://www.ritholtz.com/blog/2011/02/cycles-sectors/

http://www.ritholtz.com/blog/2011/02/su ... events-19/

http://www.salon.com/news/politics/war_ ... k_bachmann

http://paul.kedrosky.com/archives/2011/ ... n_the.html

http://rortybomb.wordpress.com/2011/02/ ... -recovery/

http://www.ritholtz.com/blog/2011/02/ec ... -is-split/

http://www.ritholtz.com/blog/2011/02/mo ... more-63330

http://www.ritholtz.com/blog/2011/02/an ... k-for-now/

http://blogs.forrester.com/george_colon ... _for_apple

http://www.ritholtz.com/blog/2011/02/go ... nflations/

http://www.ritholtz.com/blog/2011/02/thursday-reads-8/

http://www.ritholtz.com/blog/2011/02/a- ... more-63361

http://www.ritholtz.com/blog/2011/02/me ... s-in-2006/

http://www.ritholtz.com/blog/2011/02/mo ... more-63330

http://www.ritholtz.com/blog/2011/02/fa ... ddle-east/

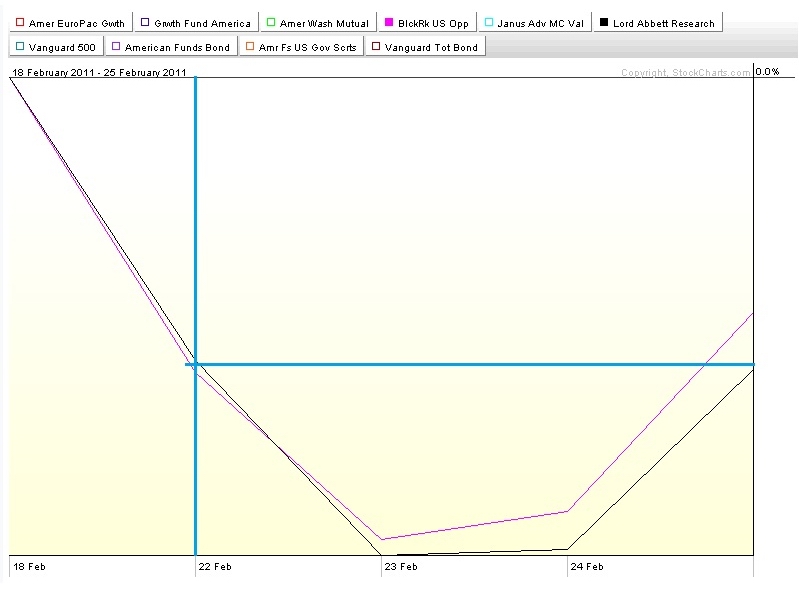

This Is EXTREME And Now I'm REALLY squirrelly about staying long. I've got a lot of gains to keep, and the potential for substantial losses in a short time.

Close Your Eyes Wisconsin, This Is Gonna HURT!!!

http://www.newdeal20.org/2011/02/21/how ... ids-36483/

Today was UGLY!!!

Discretion Is The Better Part Of Valor

During lunch I went from 95% Stocks to 99% Cash (Stable Value Fund) with minimal effect from the rapid trading rules. Let's let things settle down. I can get back in in one day, but as the old song goes, "Don't Make Your Move Too soon..."

Stay Tooned....

( 3 / 1306 ) ( 3 / 1306 )

<< <Back | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | Next> >>

|

|

Calendar

Calendar