| |

Just Another Old Broked Down Retahrd Union Pipefitter....

Friday, October 17, 2014, 12:43 PM

"Some men worship rank, some worship heroes, some worship power, some worship God and over these ideals they dispute, but they all worship money."

--Mark Twain

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

CHOOGLIN'...

https://www.youtube.com/watch?v=_43ypnC1oto

WIT' A TATTOO'D LADY...

https://www.youtube.com/watch?v=oMOyrSgas3k

Something to think about....

http://www.cnn.com/2014/10/18/showbiz/j ... ?hpt=hp_c2

I do miss KSAN back inna day....

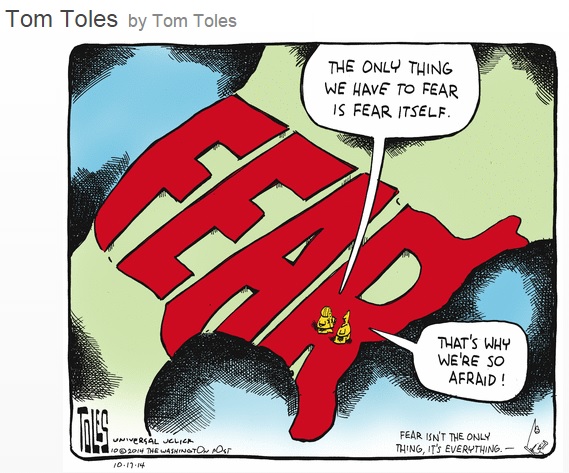

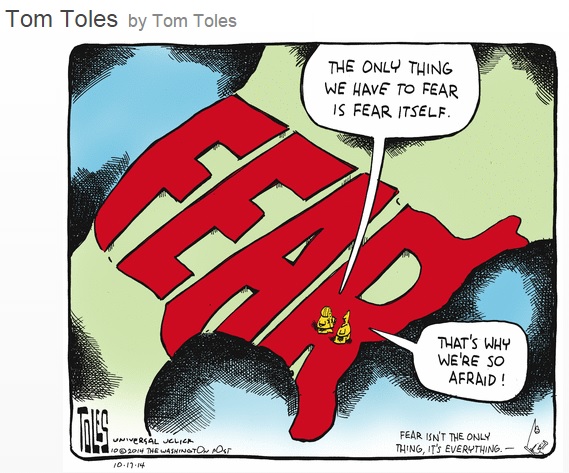

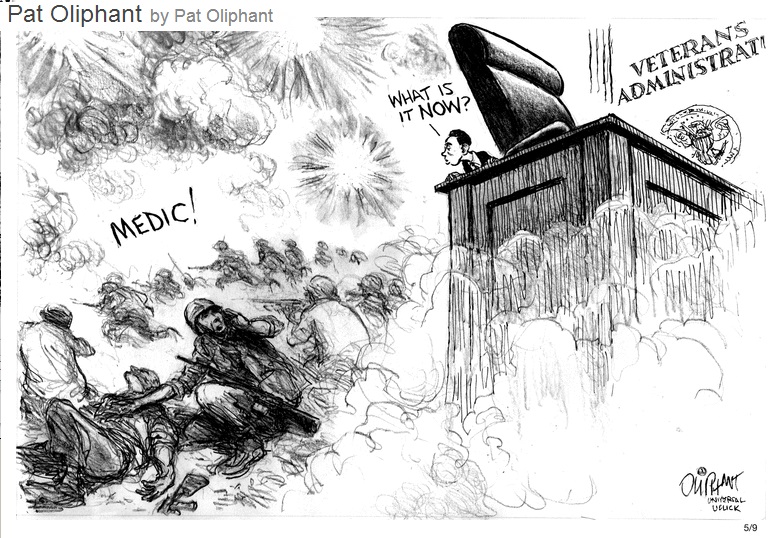

It Ain't Paranoia When It's Much Worse Than You Imagined...

http://www.vox.com/2014/9/24/6837959/ce ... -vs-global

Takin' Care Of Business...

http://www.nytimes.com/2014/10/17/busin ... .html?_r=0

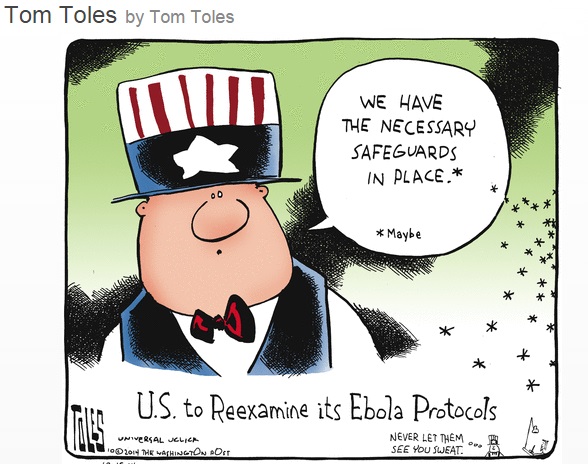

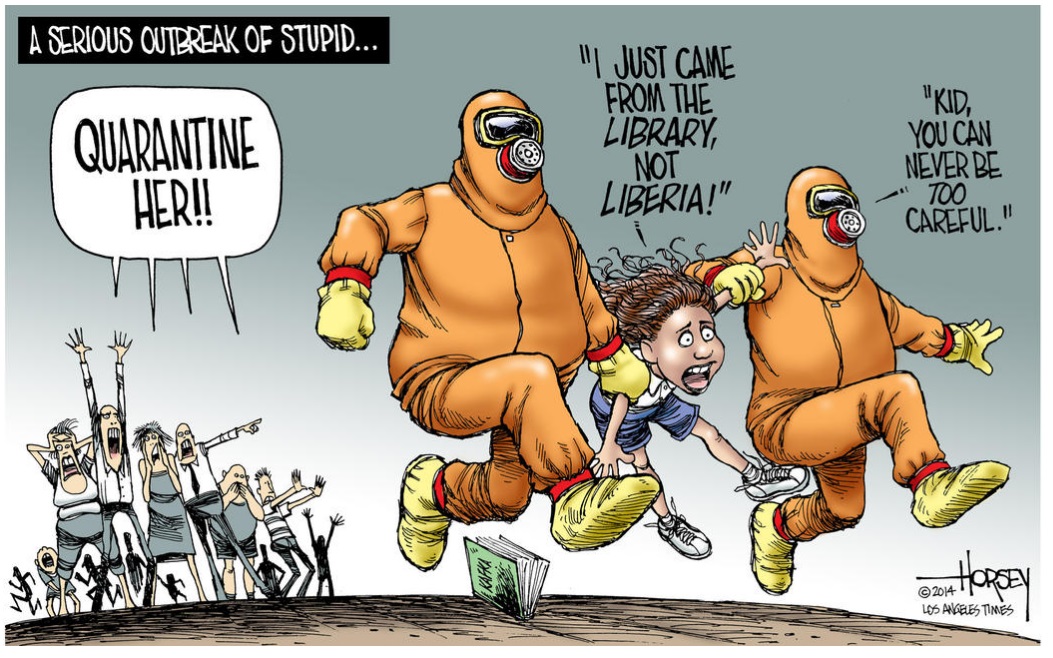

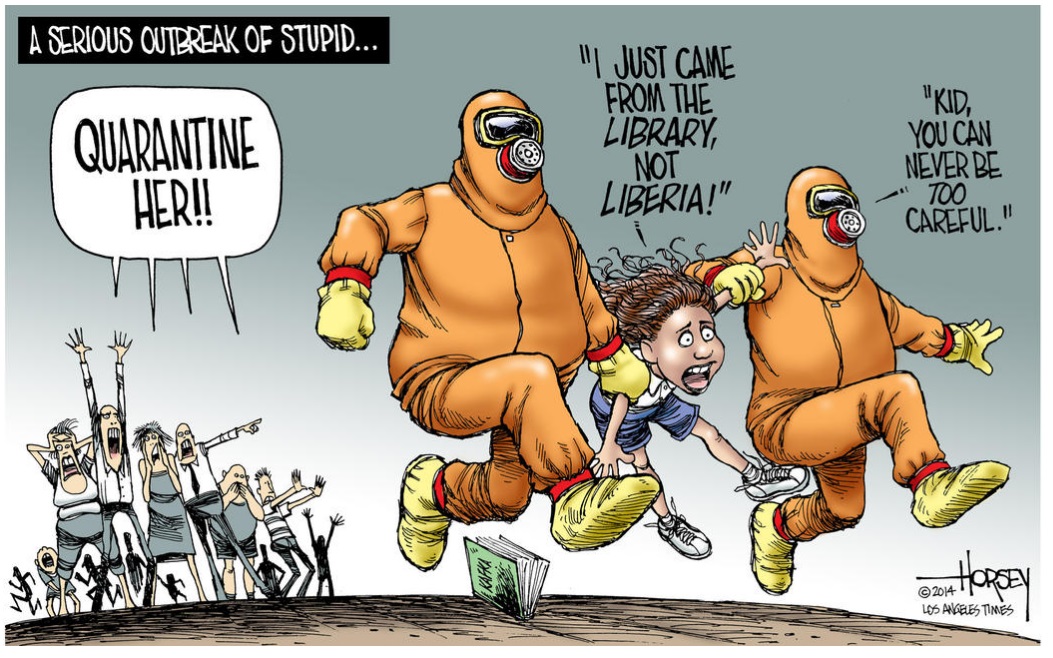

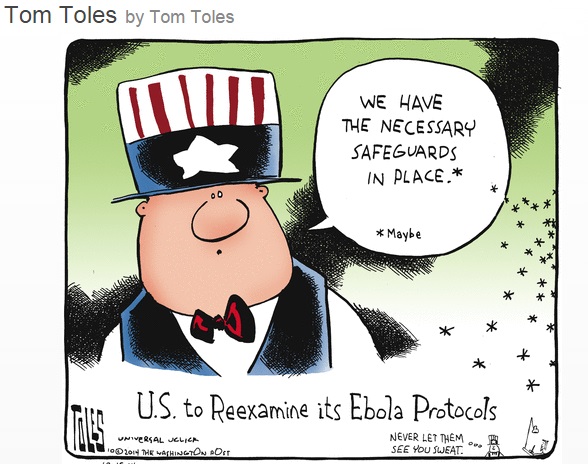

EBOLA PROTOCOL

Actually, this makes sense to me...

I've got 20 years in petrochem/chem heavy process industry and 20 years in wafer fab and biotech and I've been around one breathers and one touchers (lethal at 20-30 parts per million) during both periods. While I was at Intel, I devised a degowning protocol which the contractor I worked for used. It took 100 square feet of space and two persons to help with degowning and created three garbage bags of contaminated material. It was not stone simple or pennys cheap, but it was VERY effective and simple and low cost compared to failure. I don't see something similar being set up for hospitals and Ebola protocol because the experience and mind set aren't there yet.

http://www.businessinsider.com/man-with ... at-2014-10

http://www.businessinsider.com/how-heal ... la-2014-10

Hard eyed look.....

http://www.businessinsider.com/the-ebol ... me-2014-10

Monday...

Something to think about...

http://www.businessinsider.com/andreess ... nt-2014-10

http://www.politico.com/magazine/story/ ... EV8CvnF-So

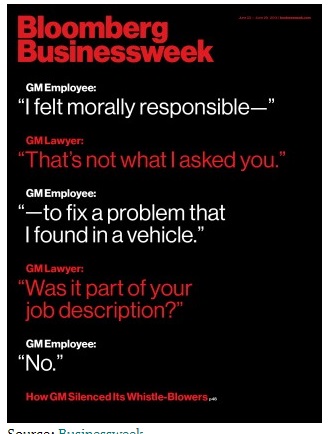

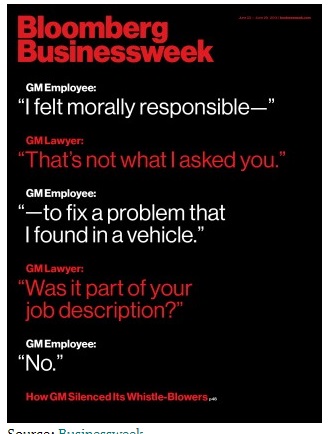

http://pando.com/2014/10/18/gms-hit-and ... n-history/

http://www.bloombergview.com/articles/2 ... -on-losing

Tuesday...

http://www.businessinsider.com/feds-dud ... re-2014-10

Wednesday

Nahhh, It's Paranoia...

http://www.bloombergview.com/articles/2 ... ong-things

Thursday...

http://www.reviewjournal.com/news/vegas ... d-gamblers

http://www.thebaffler.com/blog/ease-burden-1-percent/

http://www.huffingtonpost.com/2014/10/2 ... 14874.html

( 3.1 / 1164 ) ( 3.1 / 1164 )

Been There, Done That. But Ya Can't Prove Nothin'... So Knock It Off With The Empty Threats.

Saturday, September 27, 2014, 04:23 PM

“It isn't necessary to imagine the world ending in fire or ice. There are two other possibilities: one is paperwork, and the other is nostalgia.”

-- Frank Zappa

Between Live Allman Bros @ The 'mo In SF, Live Broadcasts, And The King Biscuit Flour Power Hour, I Heard A Lot Of The Full Allman Bros Band (Duane/Berry) Back Inna Day. EXCEPTIONAL!!!!!

https://www.youtube.com/watch?v=mqNFwx6QQgY

https://www.youtube.com/watch?v=GvH4yA6uflo

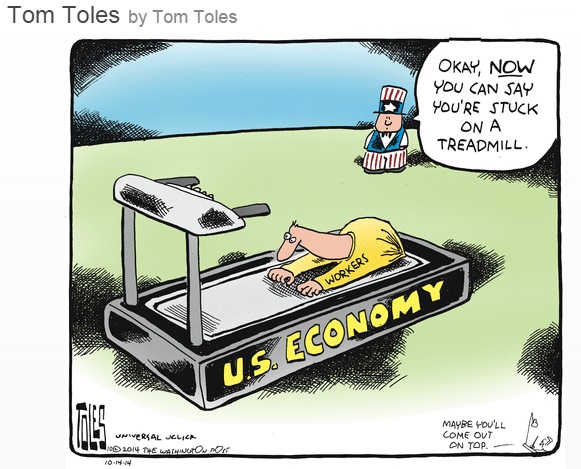

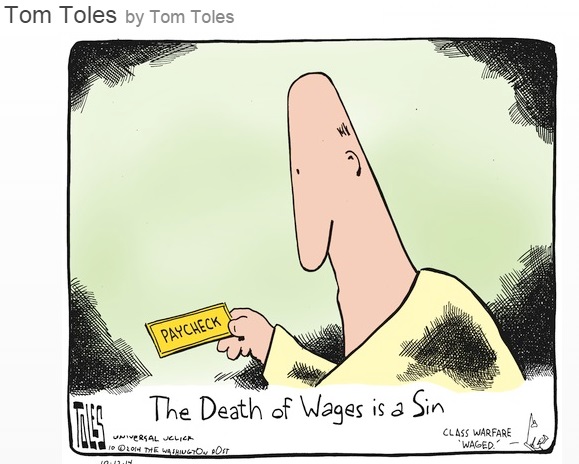

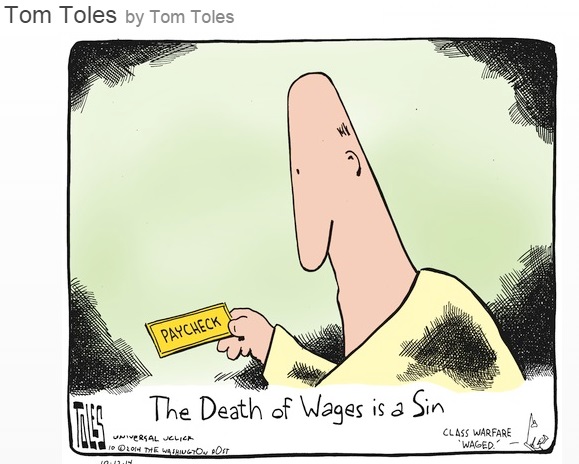

This Here's A Right To Work For Less State....

http://www.cnn.com/2014/09/30/opinion/m ... ?hpt=hp_t3

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

Sometimes Something Happens That Is Against Everything You Hope To Stand For And Is Anethema To How you Hope To Live. That Doesn't Mean You Get Out Of Doing It Nor That You Can Do It With Less Than A Full Heart And Total Dedication. It Is What It Is, Not What Ya'd Like It To Be....

http://www.businessinsider.com/the-figh ... rld-2014-9

http://www.businessinsider.com/obama-th ... sis-2014-9

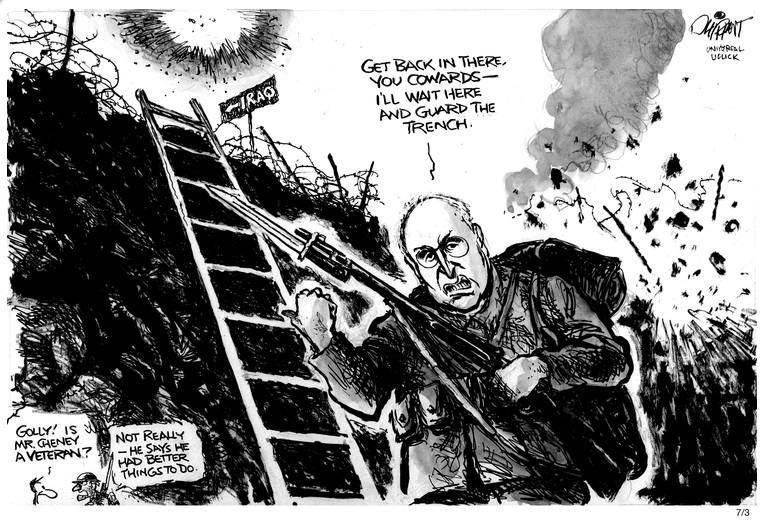

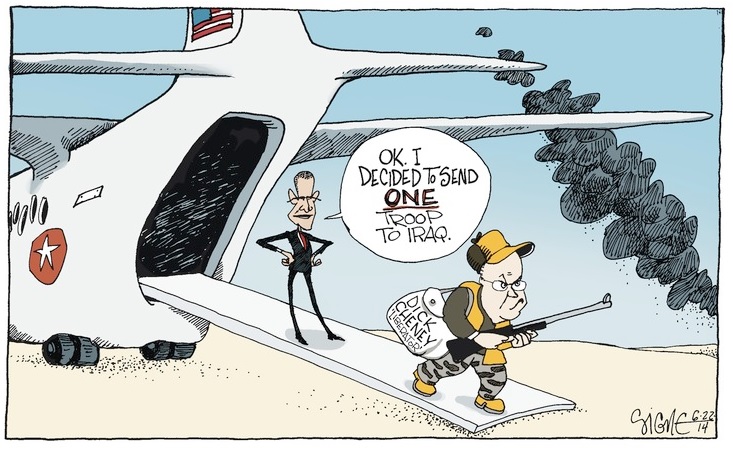

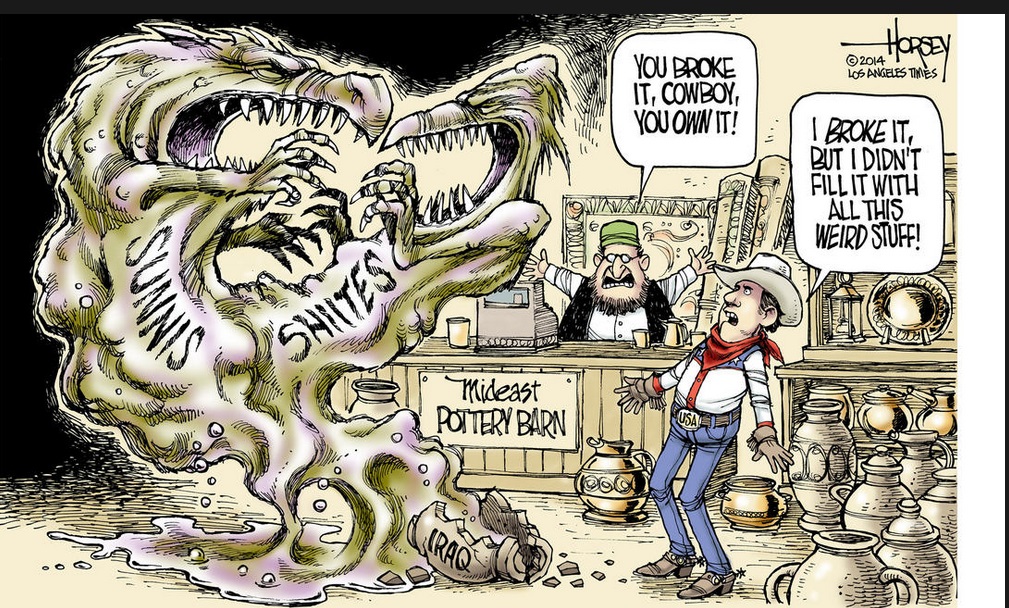

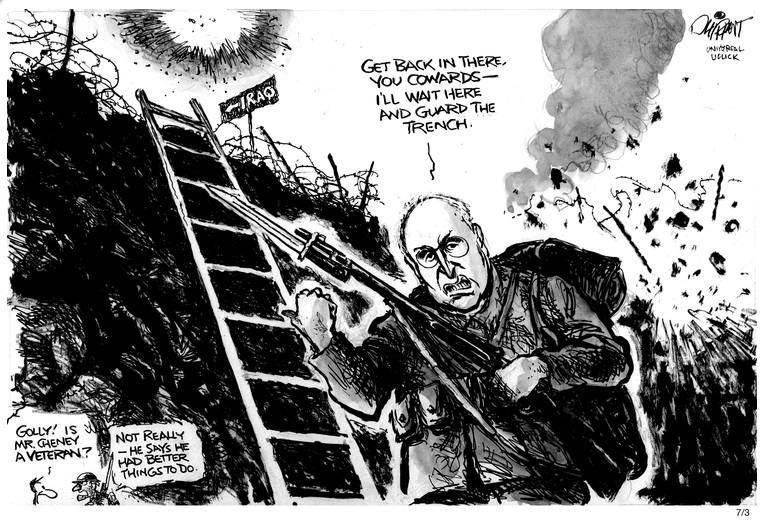

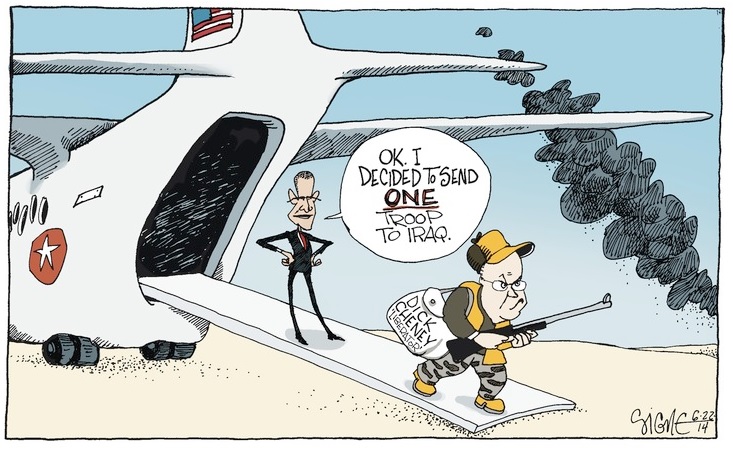

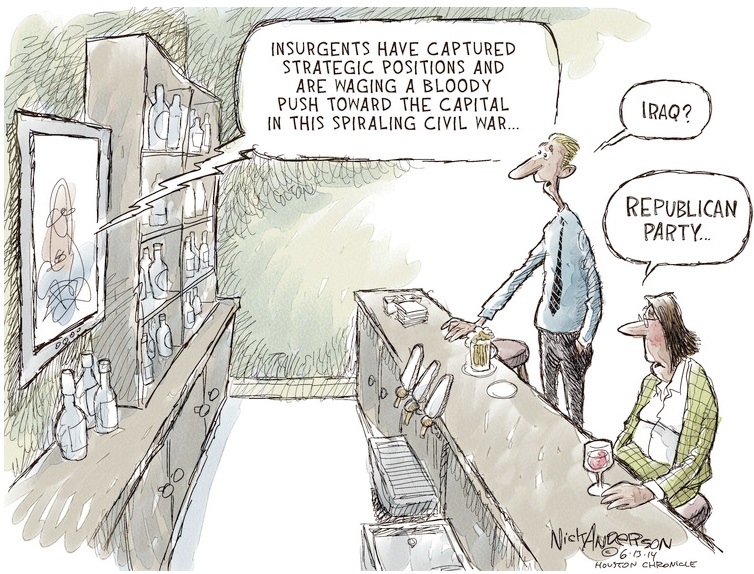

Obama saw himself as the anti Dubbya, a domestic president. It's not working. What he needs to be is a competent Dubbya. That's not working so well either. The 60 Minute show was about a politician more than a leader. And this is from a 1960's/70's UC Berkeley kinda guy.....

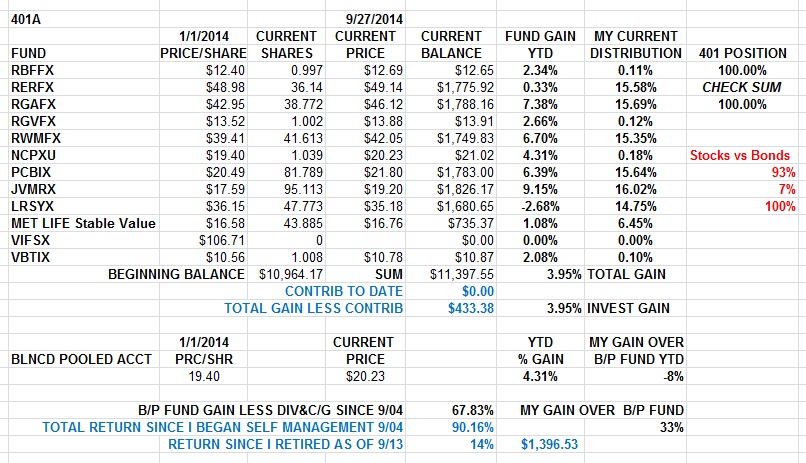

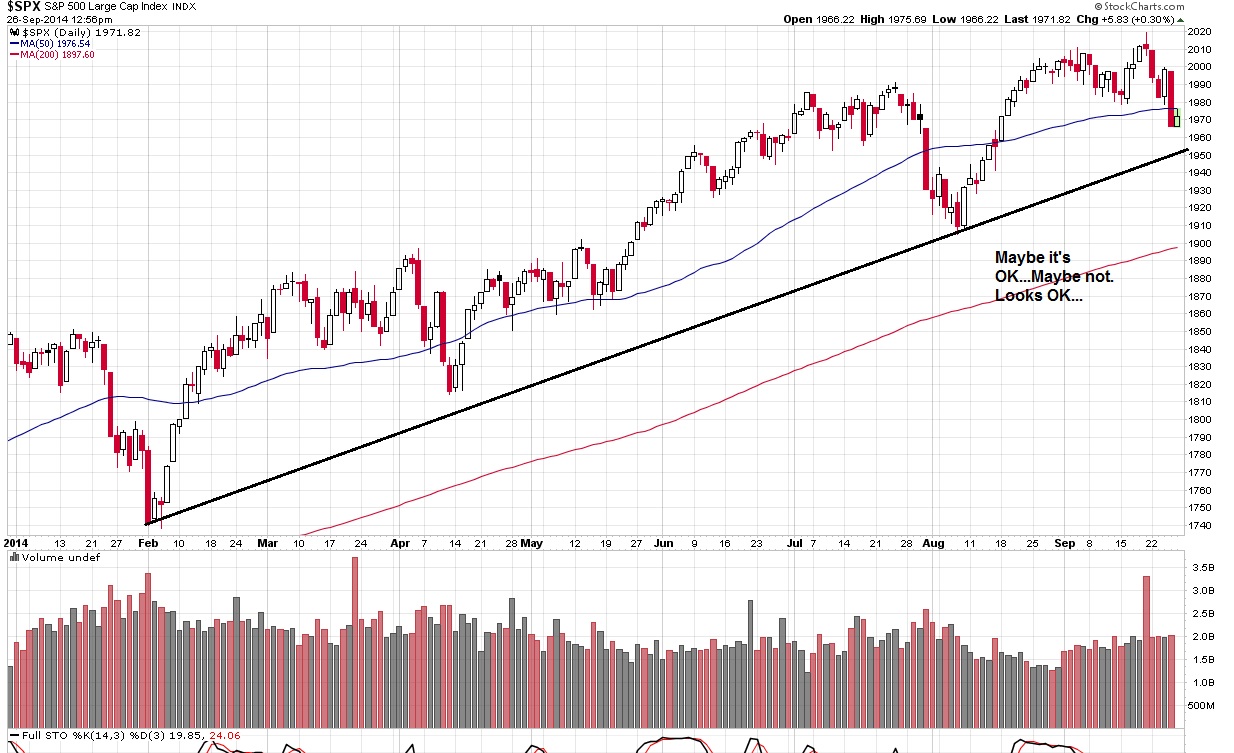

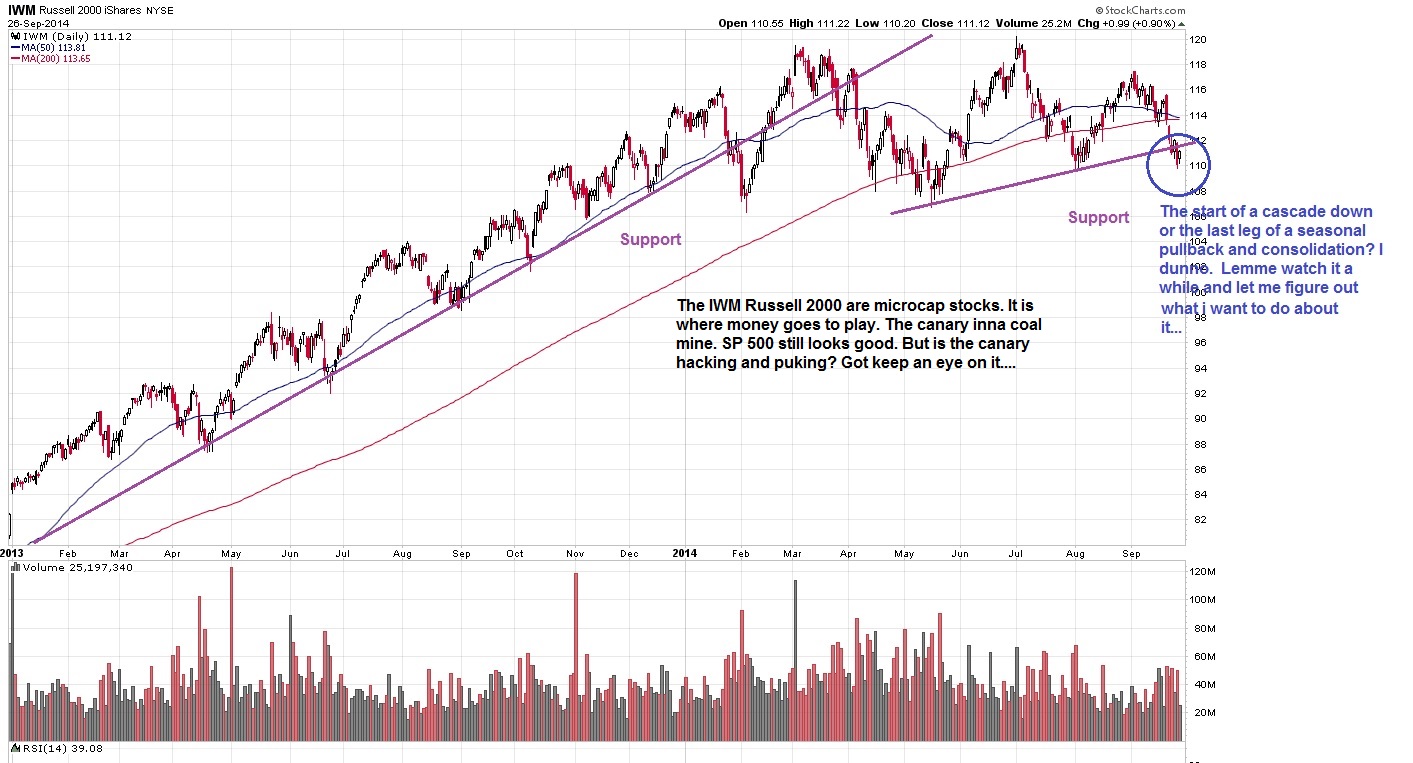

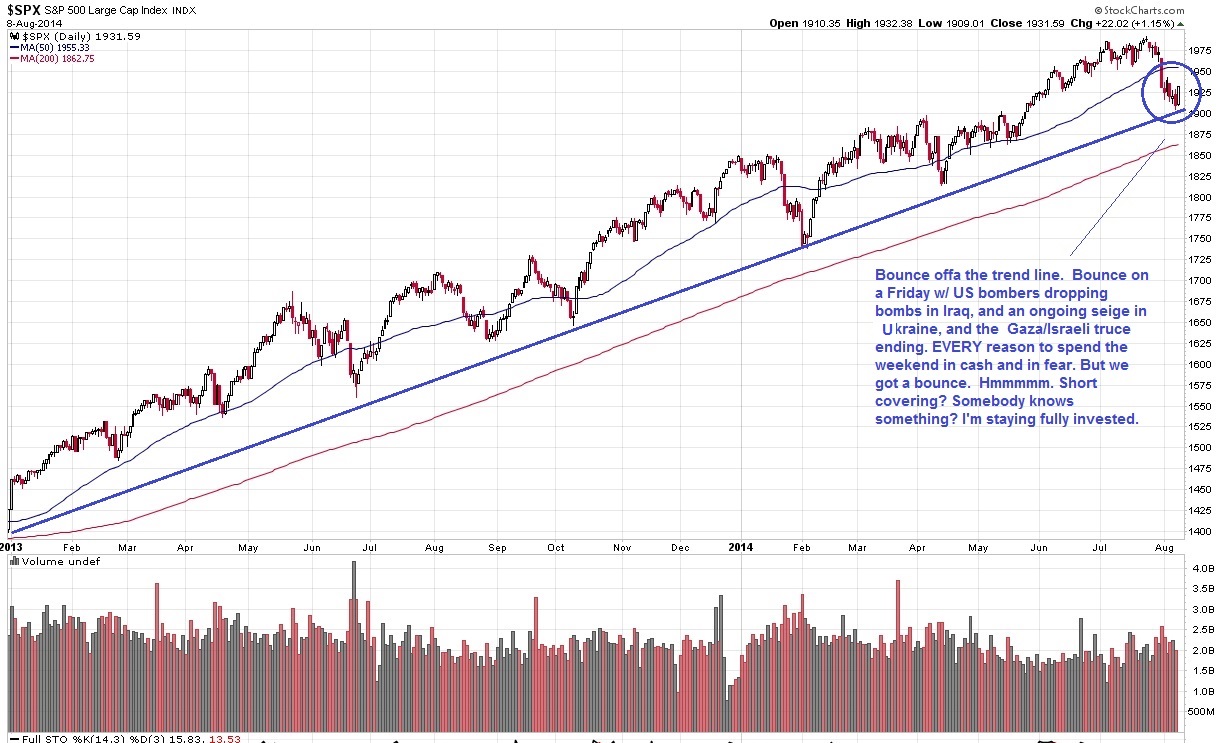

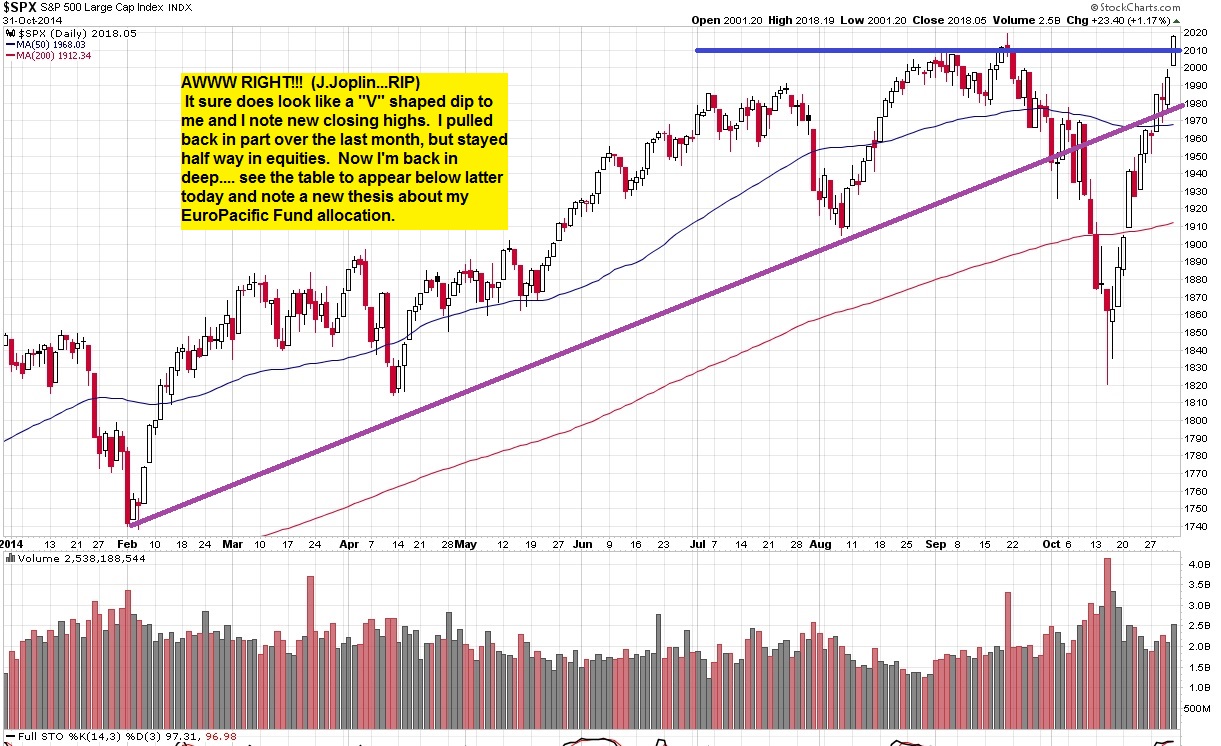

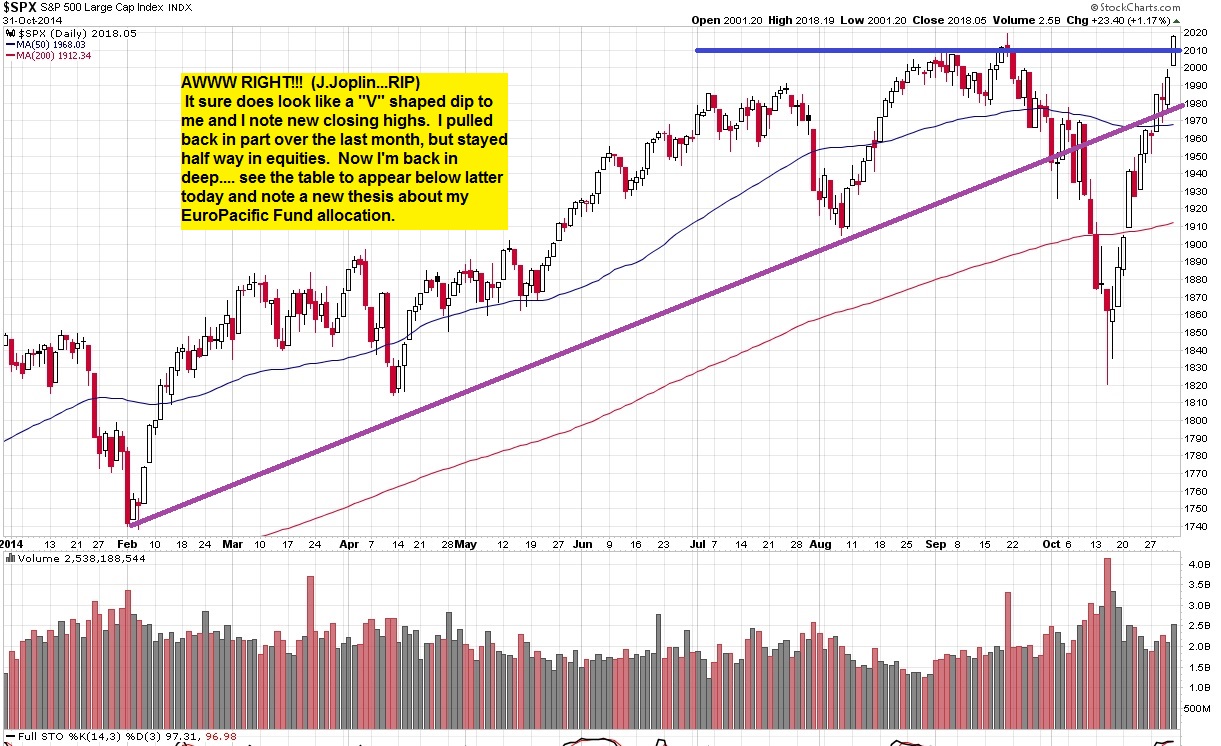

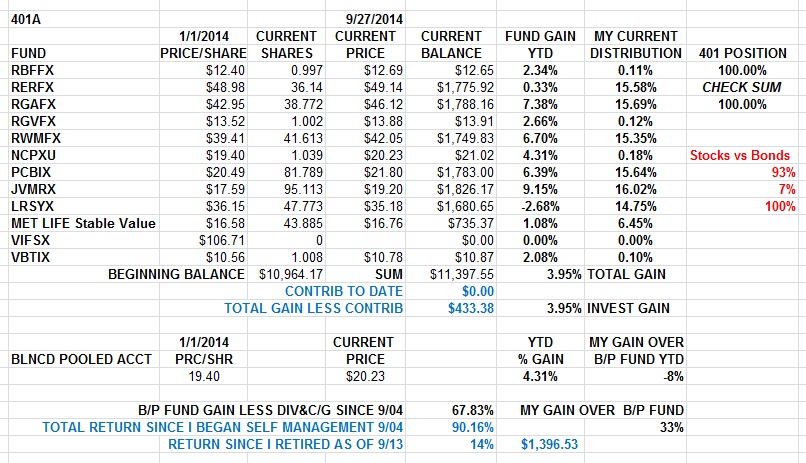

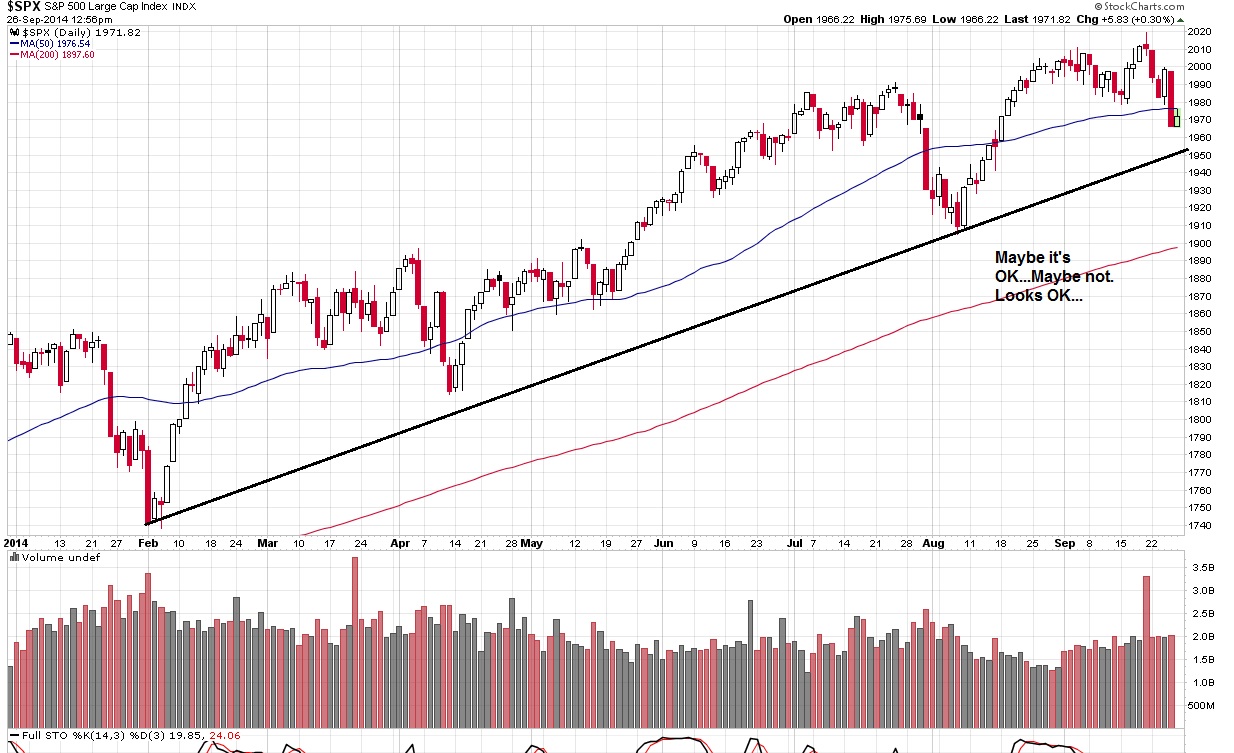

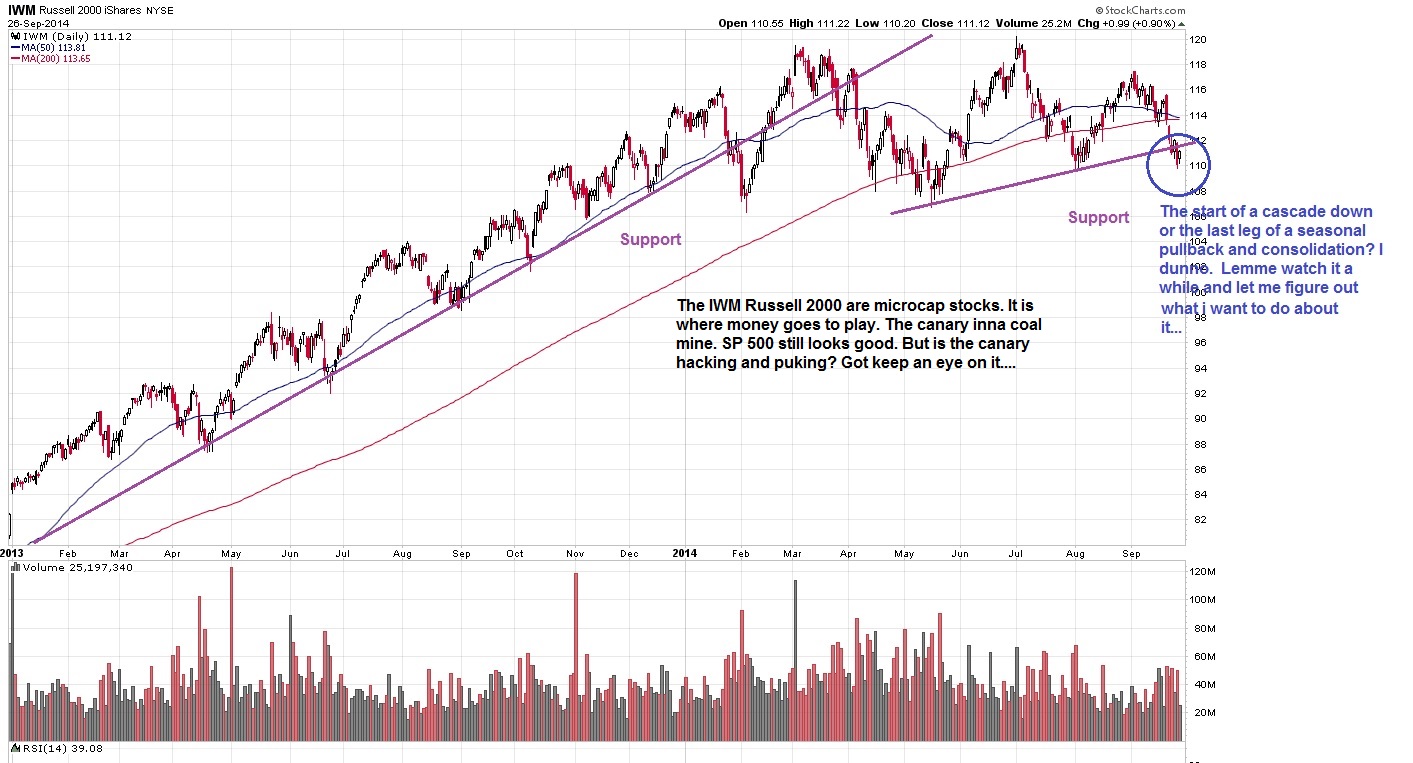

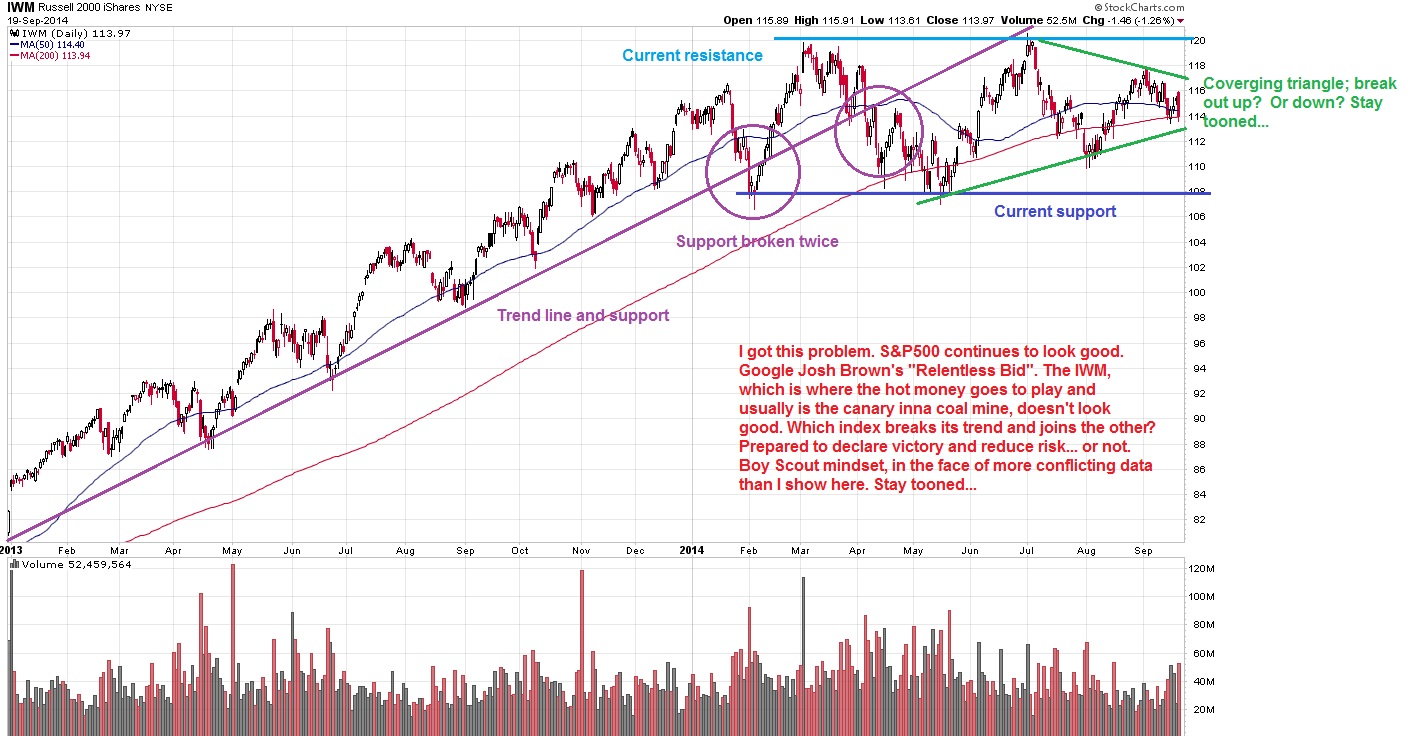

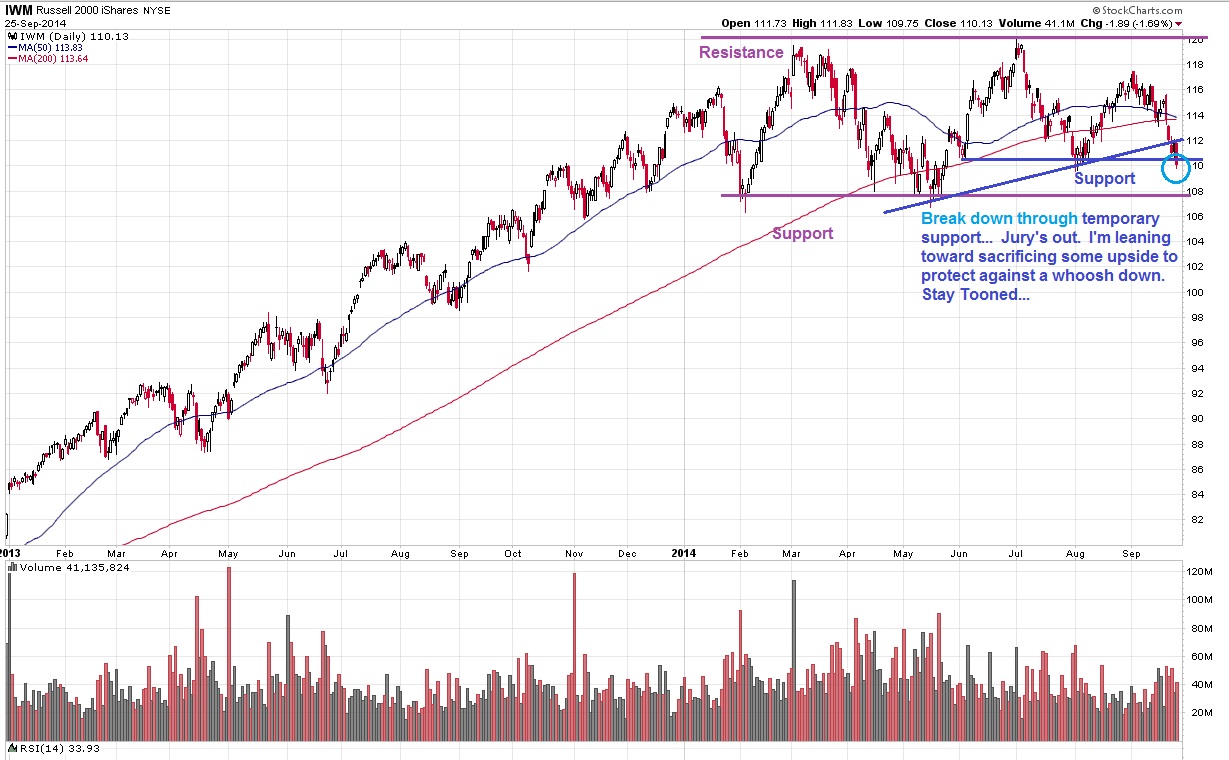

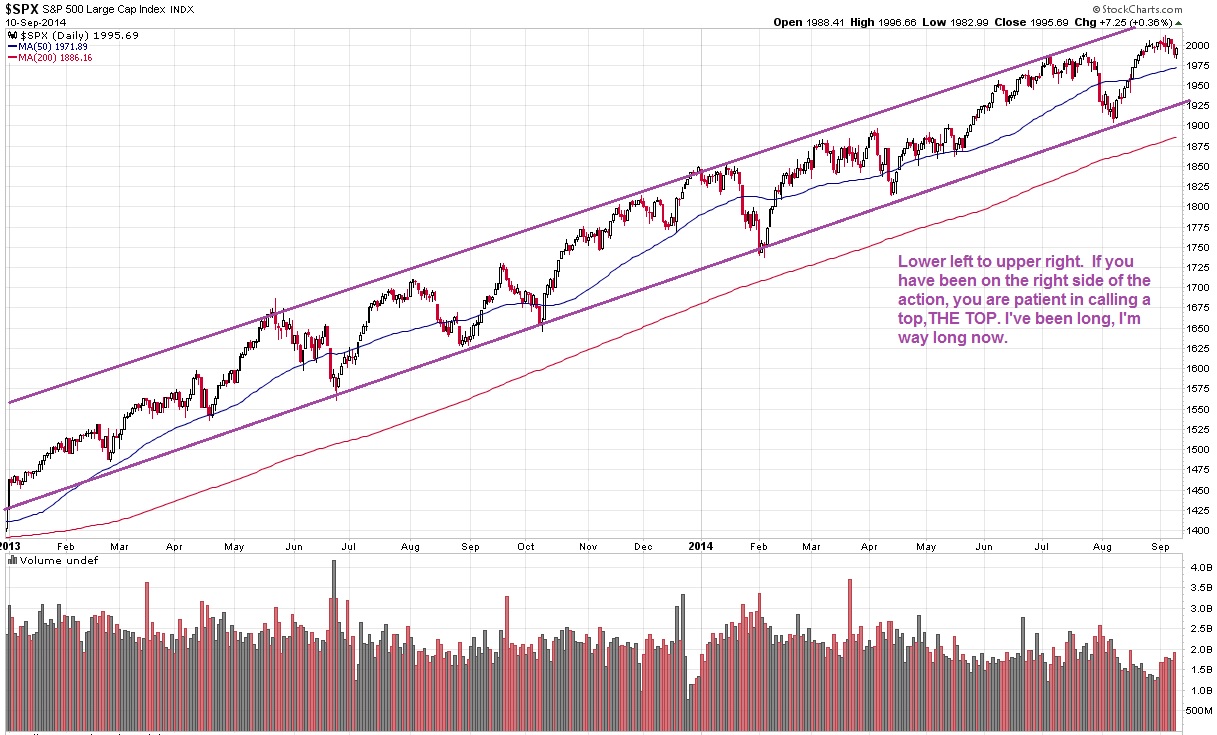

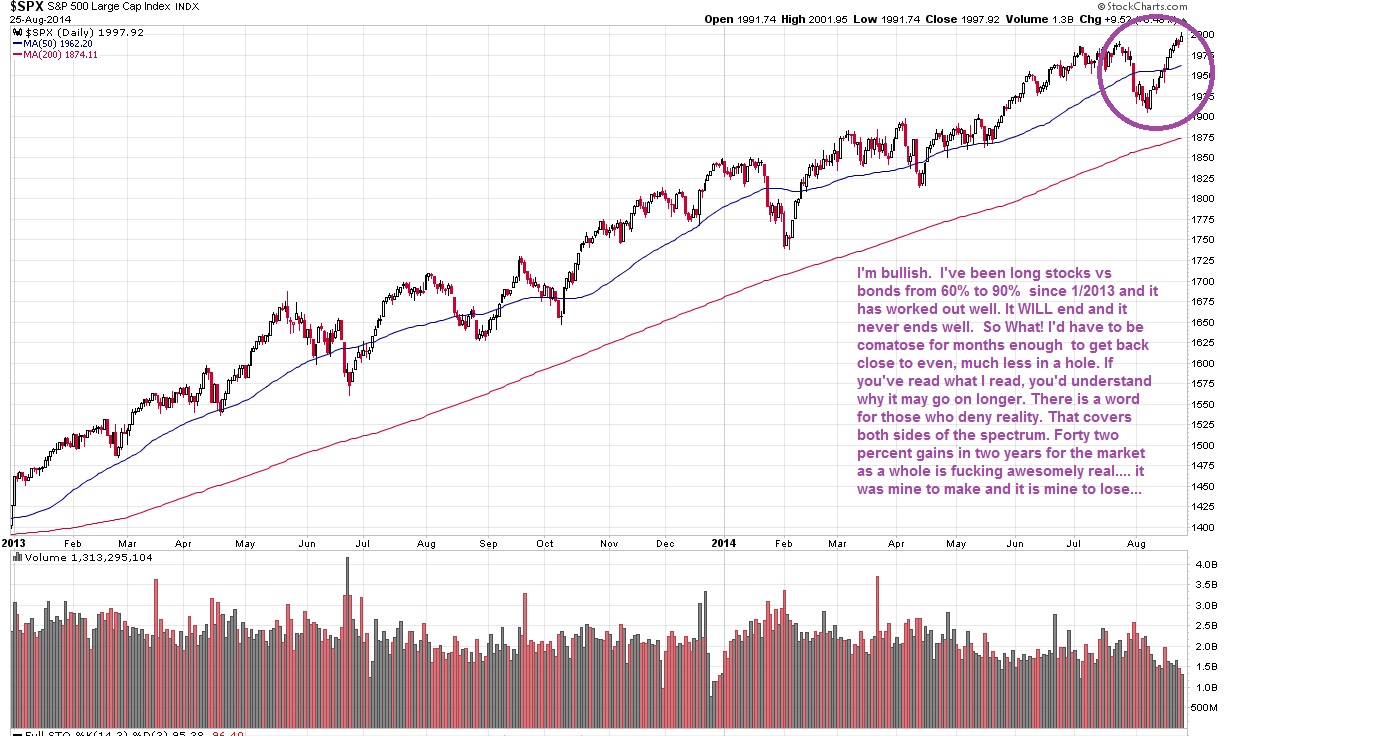

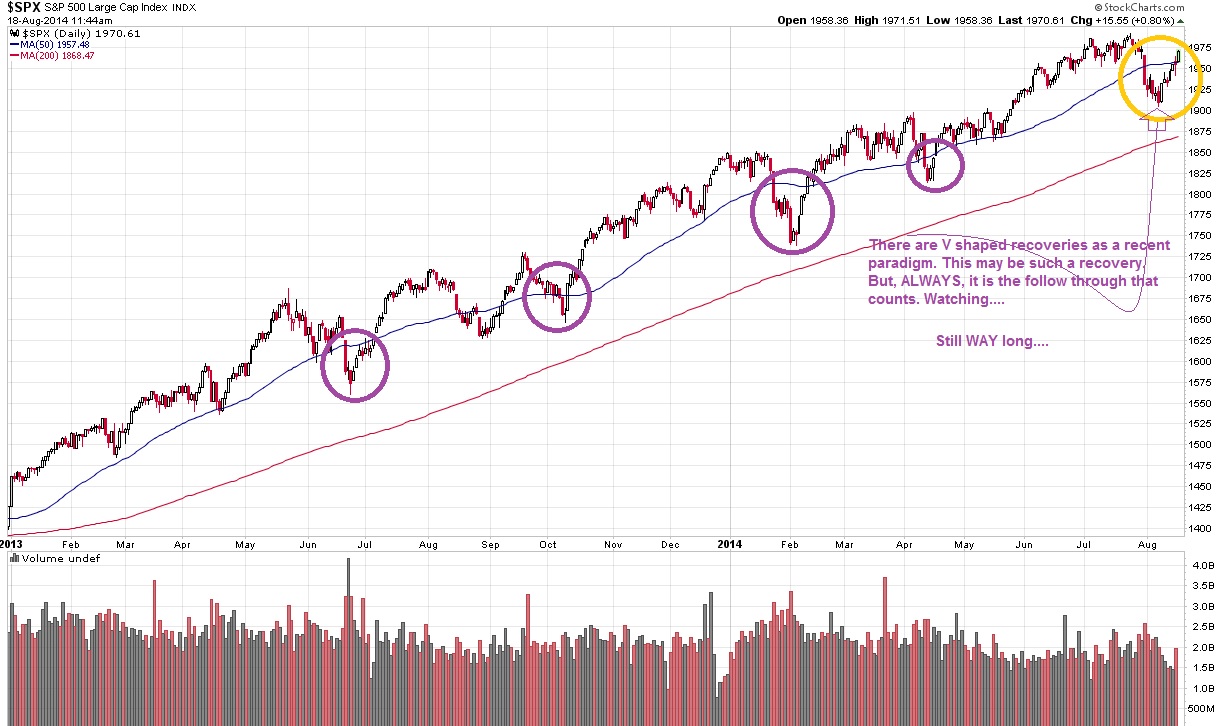

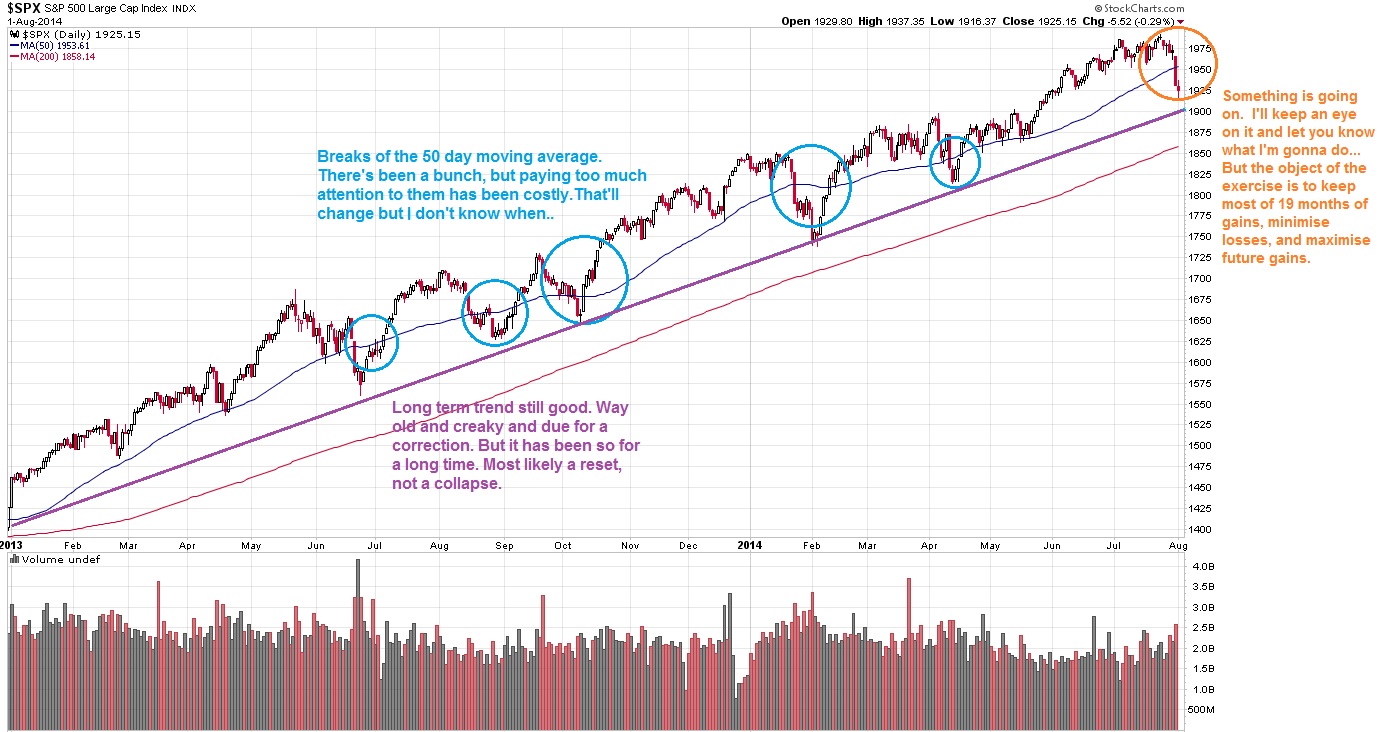

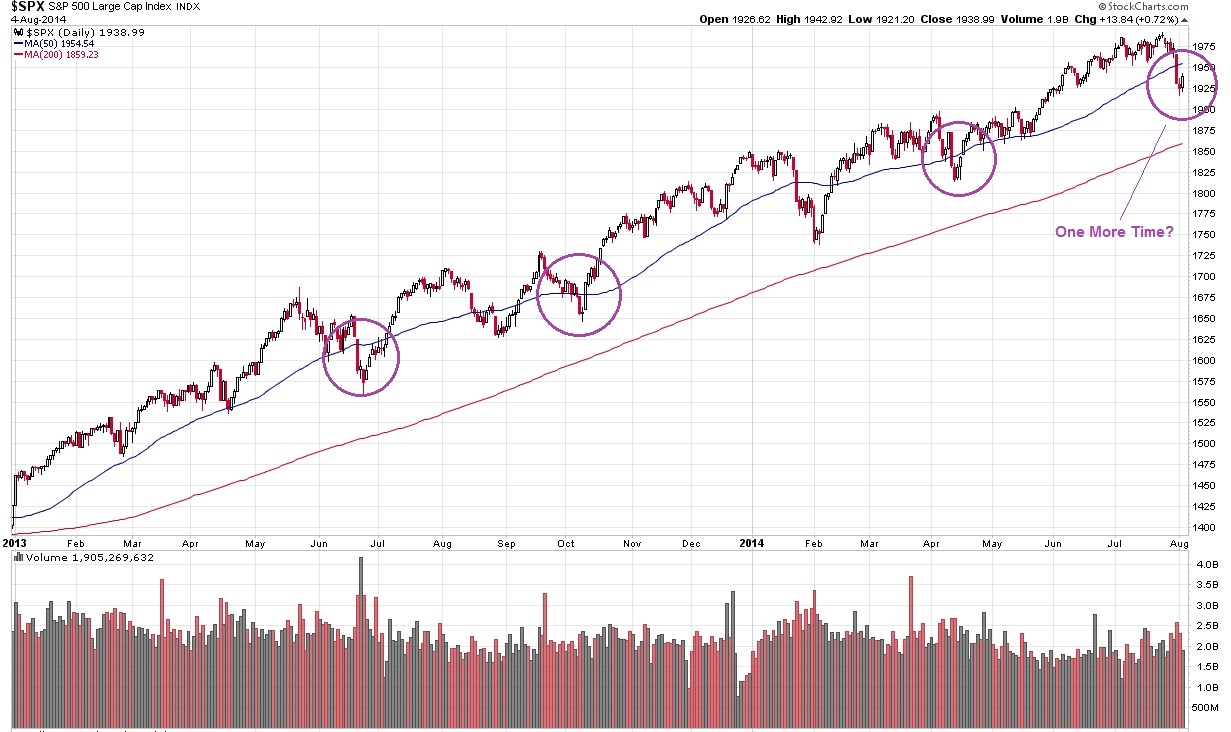

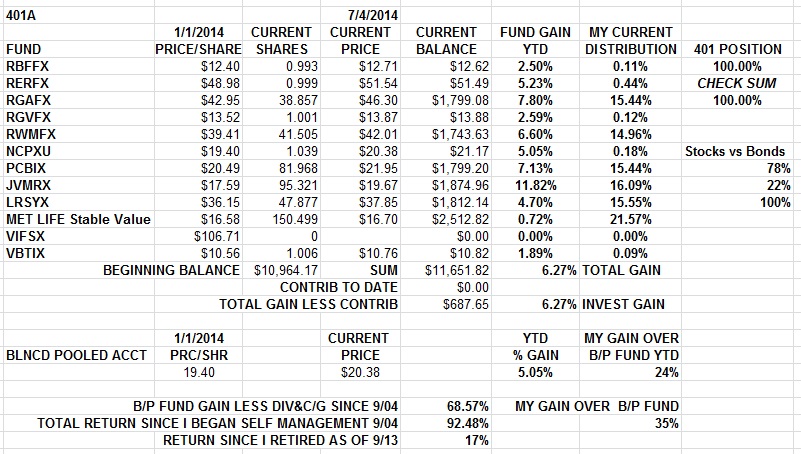

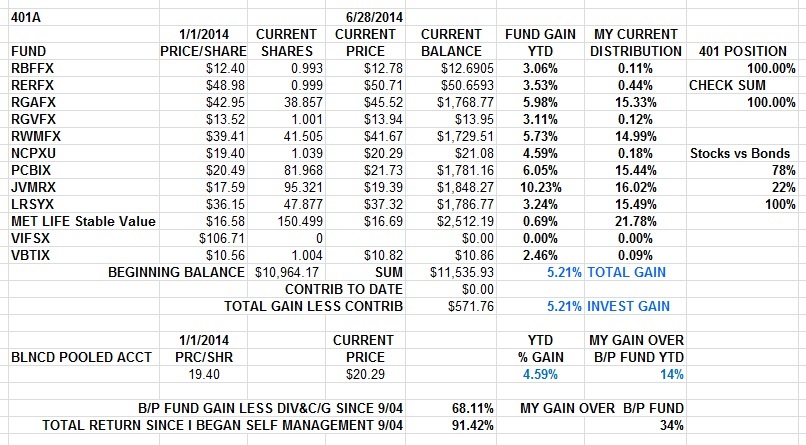

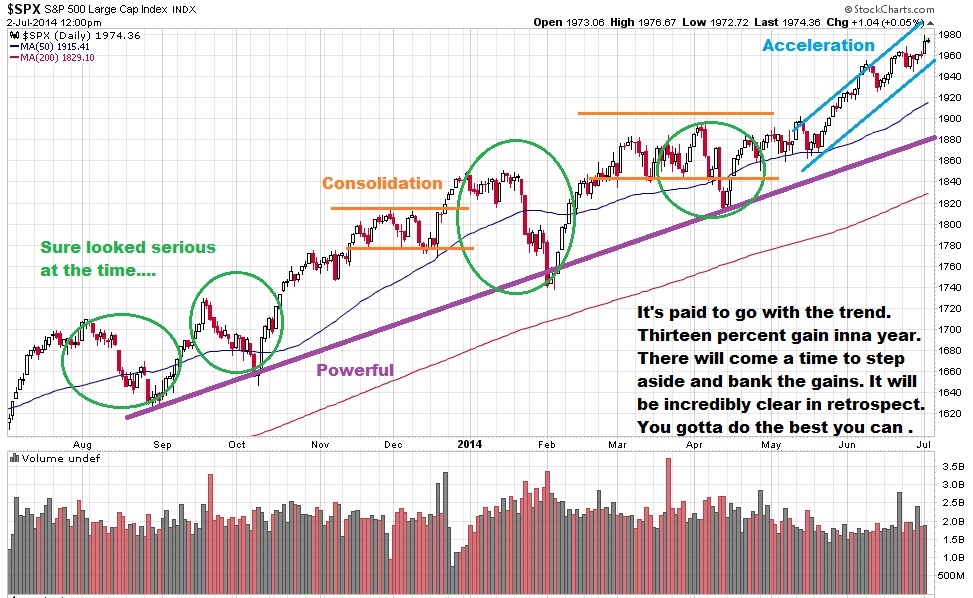

I'm Stayin' Way Aggressive.. Chartz To Follow....

Tuesday...

http://www.bloomberg.com/news/2014-09-3 ... -line.html

http://www.bloomberg.com/news/2014-09-2 ... risis.html

Never get comfortable w/ a number. There's always a way to view it differently...

http://blog.yardeni.com/2014/09/the-wag ... cerpt.html

JUST ABOUT REALLOCATED SOME STOCKS TO CASH...

Not yet. End of quarter, seasonal issues, global issues, Ebola issues, Still way up Year over Year, I got not a huge amount to protect inna 401. moved some from and under performing fund to a better performing one... I'll keep an eye onnit...

( 3 / 1294 ) ( 3 / 1294 )

As I Told My Cousin, "Don't Even Think About Askin' An Old Retired Guy How He's Doin' Unless You Have Something To Eat, Something To Drink, And A Place To Sit Down...

Saturday, September 13, 2014, 05:42 PM

"If, after hearing my songs, just one human being is inspired to say something nasty to a friend, or perhaps to strike a loved one, it will all have been worth the while."

-- Tom Lehrer

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

Can't Top This Truth With Any Lie, No Matter How Outrageous...

http://www.buzzfeed.com/bensmith/tom-lehrer#27vepjj

https://www.youtube.com/watch?v=aPq3SEteEJc

https://www.youtube.com/watch?v=UIKGV2cTgqA

https://www.youtube.com/watch?v=hoEVPtVk9nE

https://www.youtube.com/watch?v=f0Wa_tnvyag

https://www.youtube.com/watch?v=UQfaRSeaMZQ

https://www.youtube.com/watch?v=hf-eIgFJg4w

https://www.youtube.com/watch?v=lZE518O2QRo

https://www.youtube.com/watch?v=puu4cYfohgs

https://www.youtube.com/watch?v=YN0qvNhtGhM

Monday...

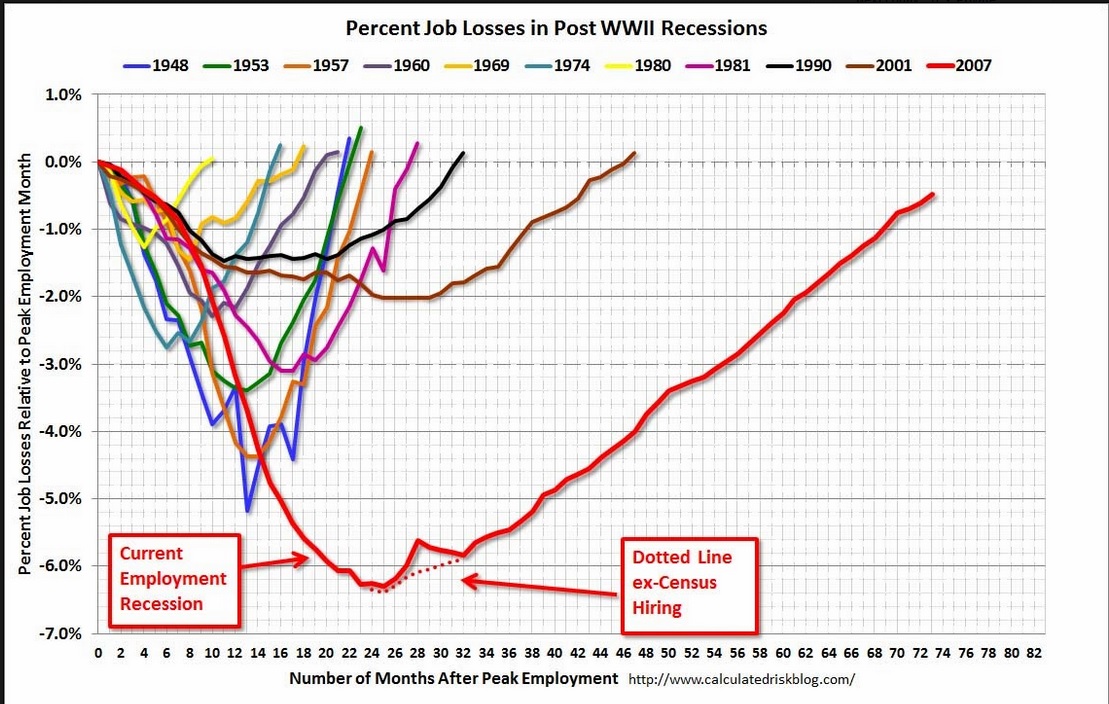

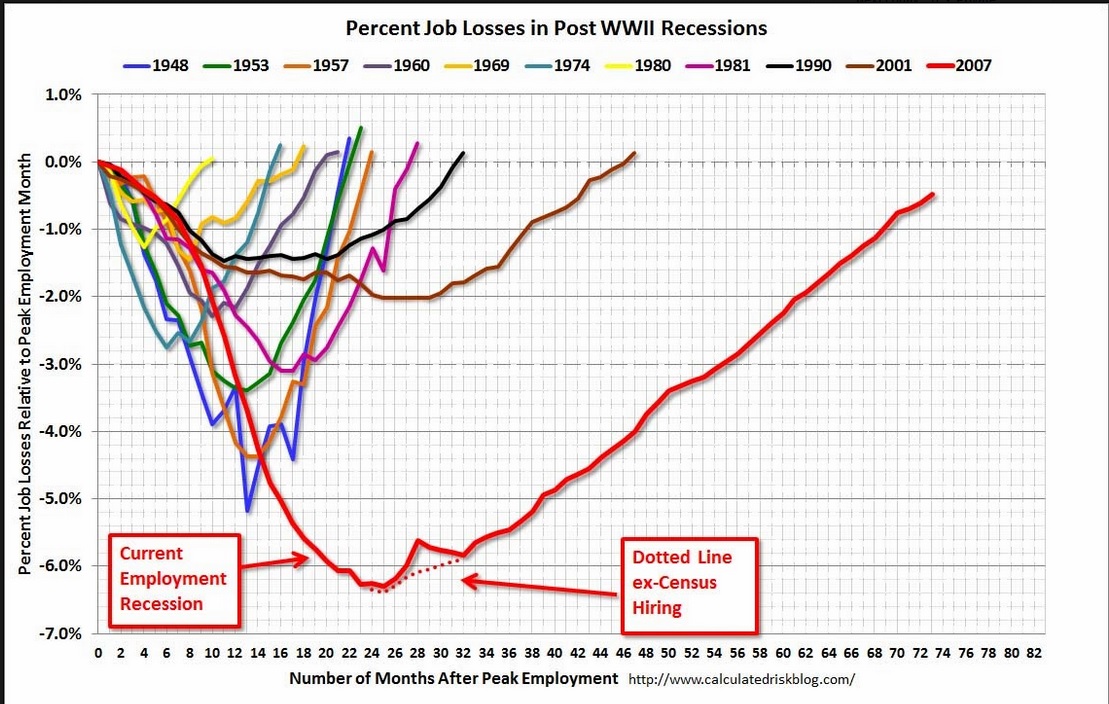

The US was the main driver of the world economy Post WW2.

http://www.businessinsider.com/china-wa ... end-2014-9

In fuckin' credible....

http://newsok.com/why-an-urban-outfitte ... le/5342281

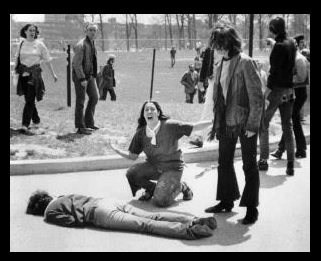

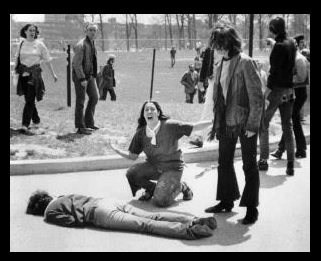

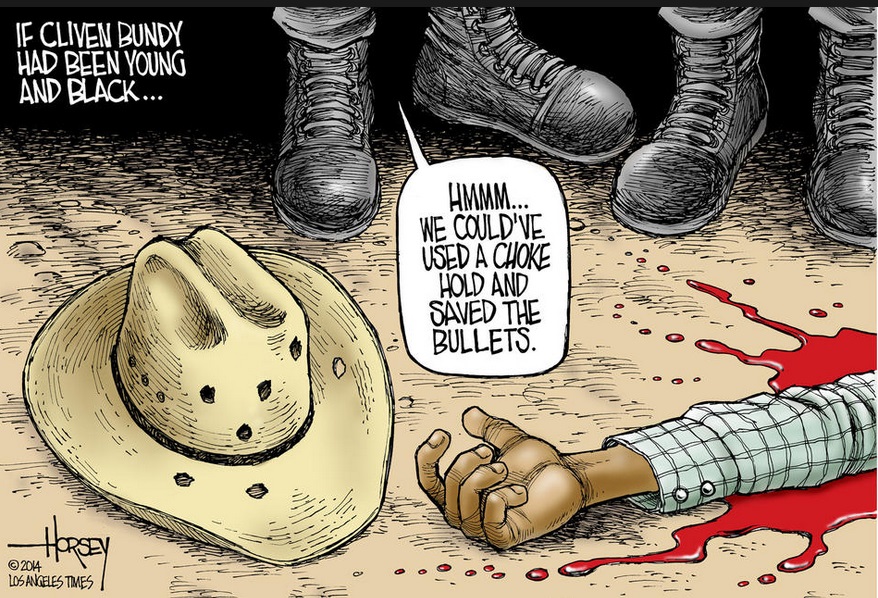

In that era, where lynching was an accepted risk of being involved with civil rights down South, and West Coast Draft Centers and the Berkeley Campus was anti establishment radical hippie pinko shit, and they called out the ' Guard as a matter of form, No one expected a massacre at staid middle America middle class college campus. They followed it up with two more shooting deaths at Jackson State. And it lit a fire for a generation.

Check it out.

http://en.wikipedia.org/wiki/Kent_State_shootings

We were out to change the world, trying to save the heart and soul of America and death or incarceration was Nixon administrations' answer. Nixon had called the protestors "bums", and Allison Krause's father, a conservative middle class mainstream man (Allison was a 19 year old student in good standing at Kent State, one of four who were shot, two for protesting, two for walking in the wrong place) appeared on national TV to state in a voice cracking under the emotion,"My child was not a bum." You could hear gears grinding as some previously closed minds opened up. To say the nation was tense was an understatement. God It Pisses Me Off to this day... That Nixon et al went down in flames didn't redeem much about the darker aspects of the era.

Wednesday...

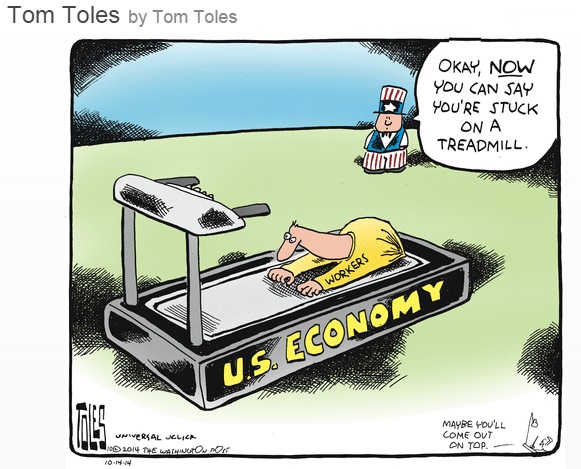

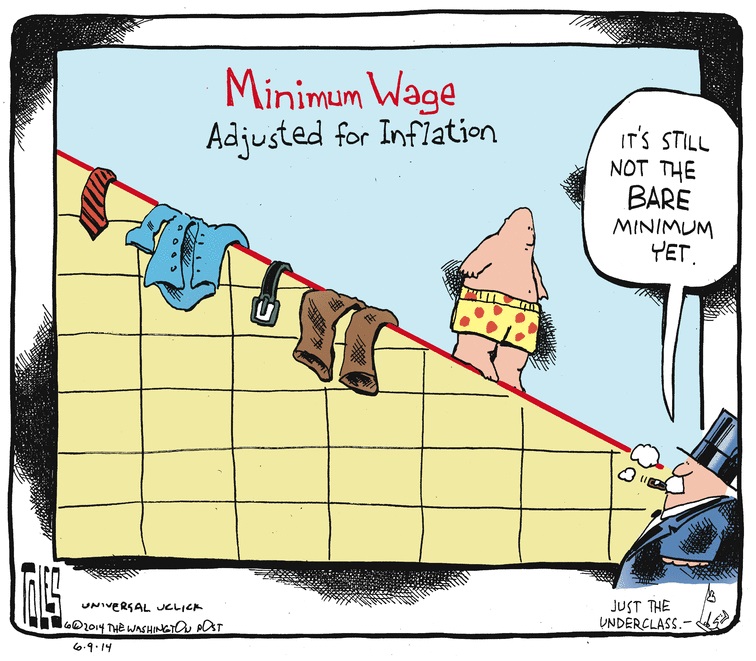

Just to put our coupla three bucks a year contracted raise over the last three years in perspective...

http://www.nytimes.com/2014/09/17/upsho ... &abg=0

Thursday...

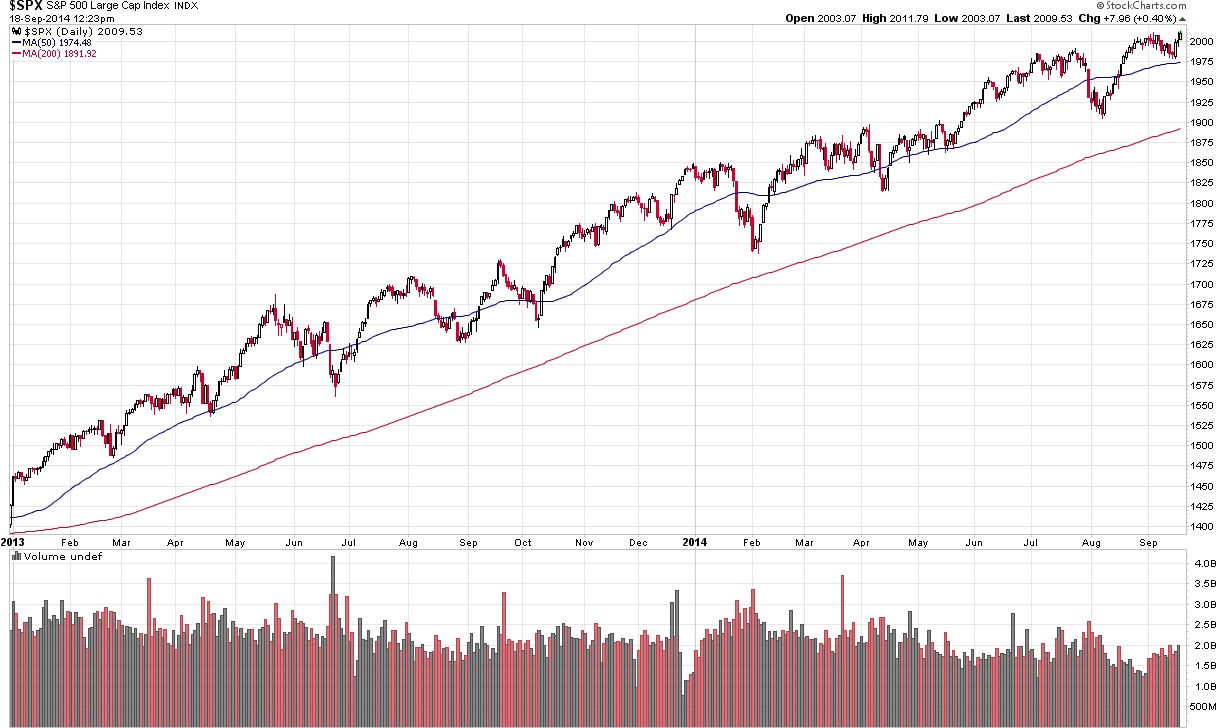

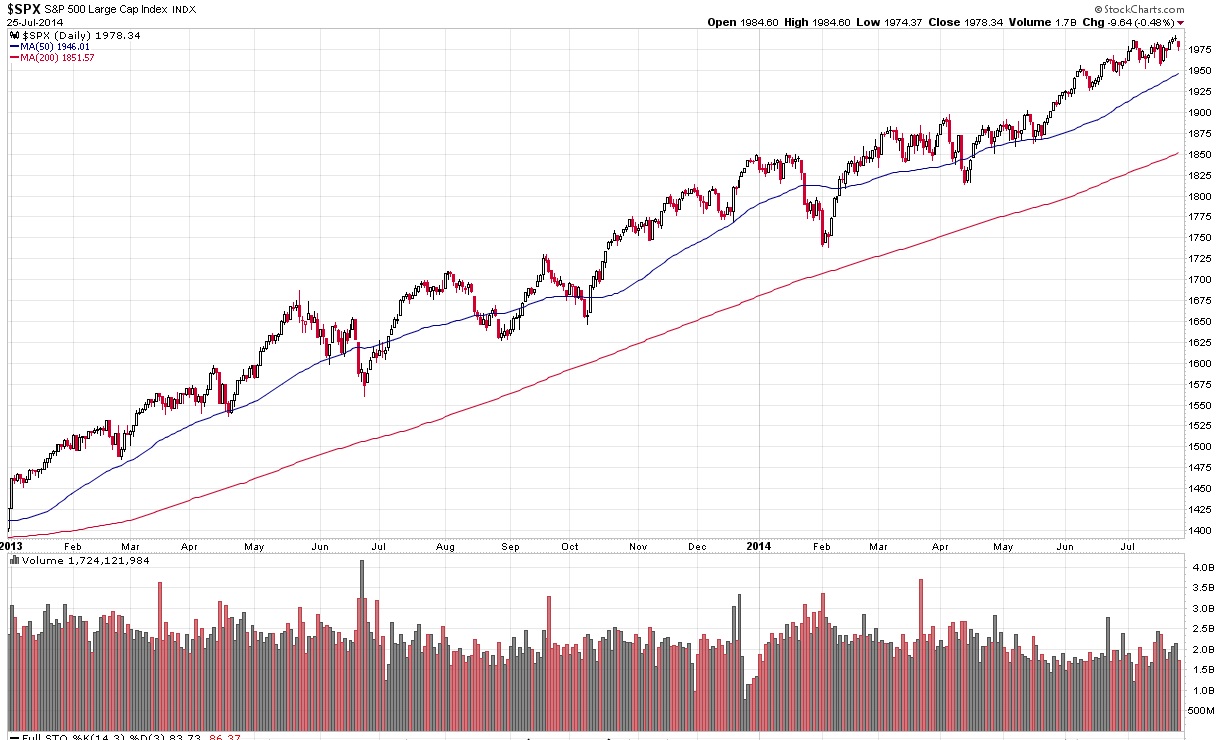

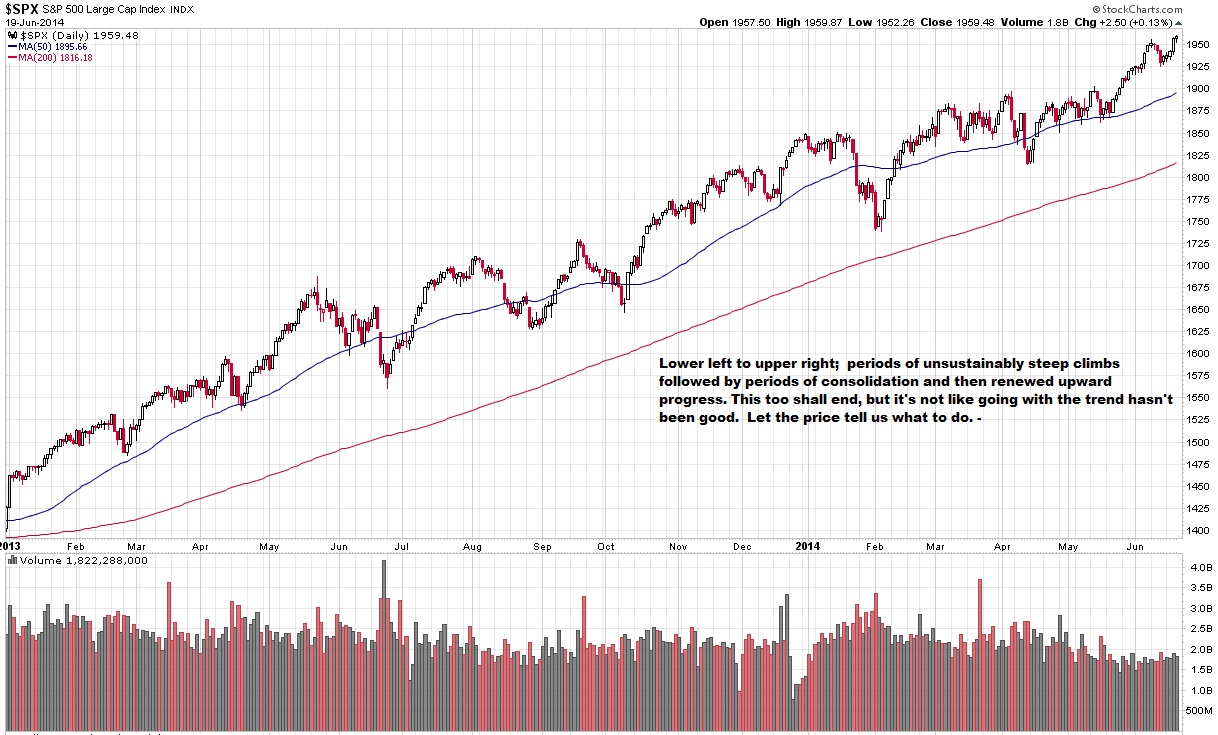

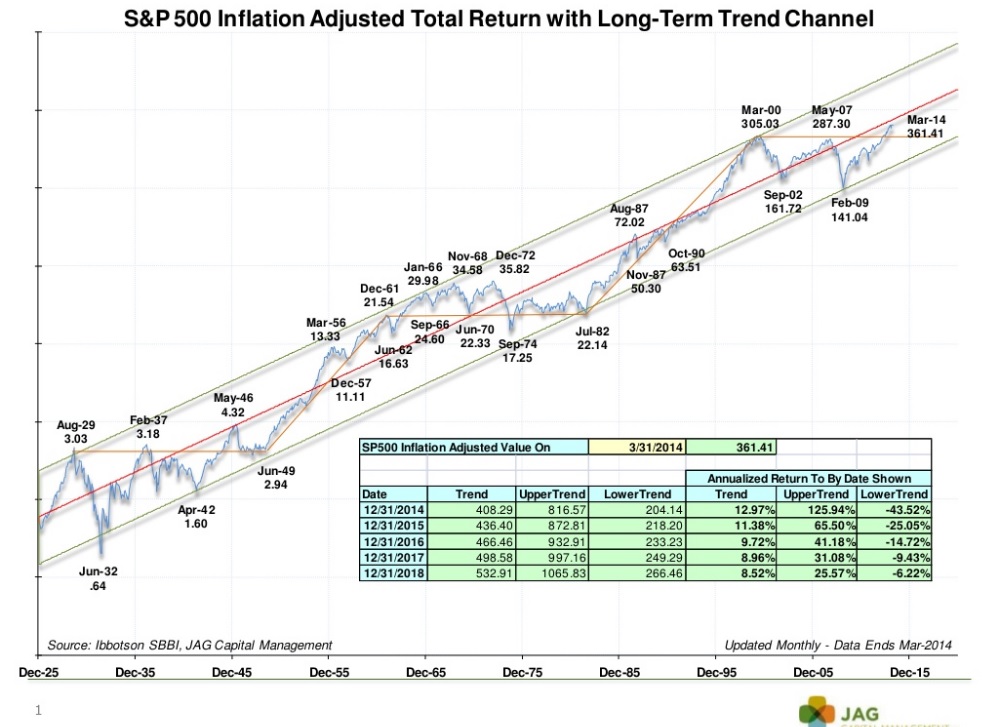

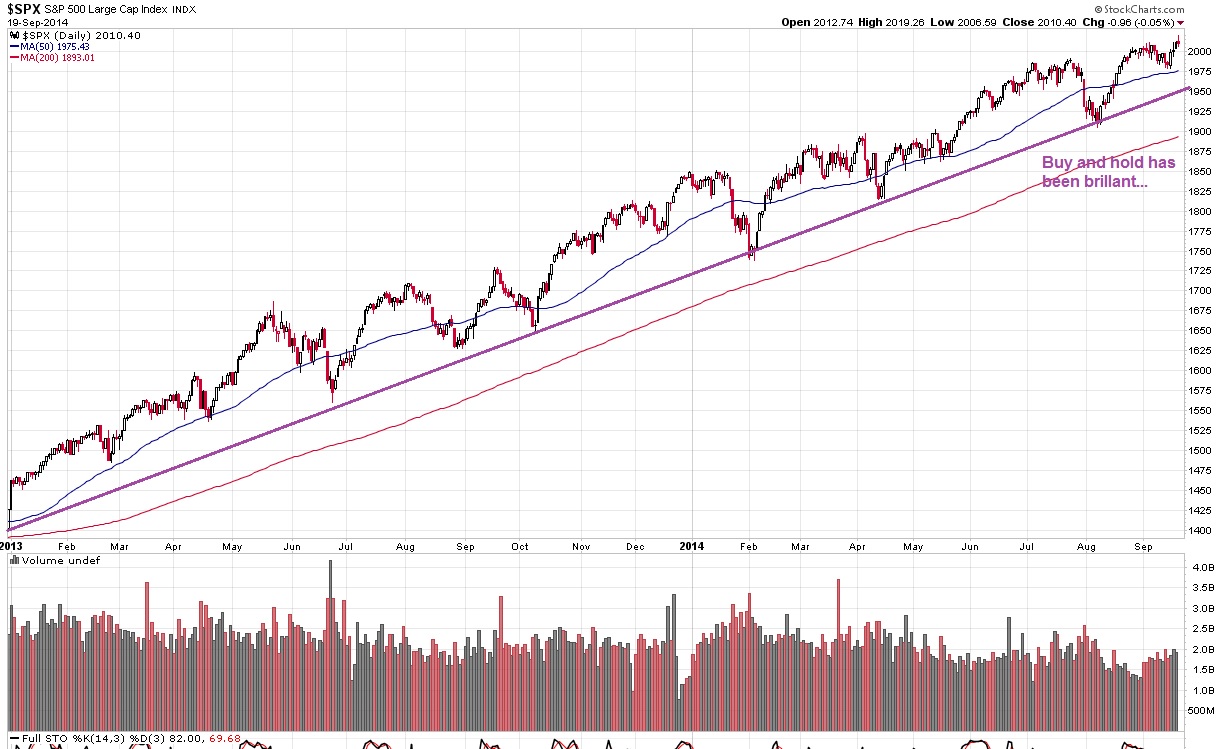

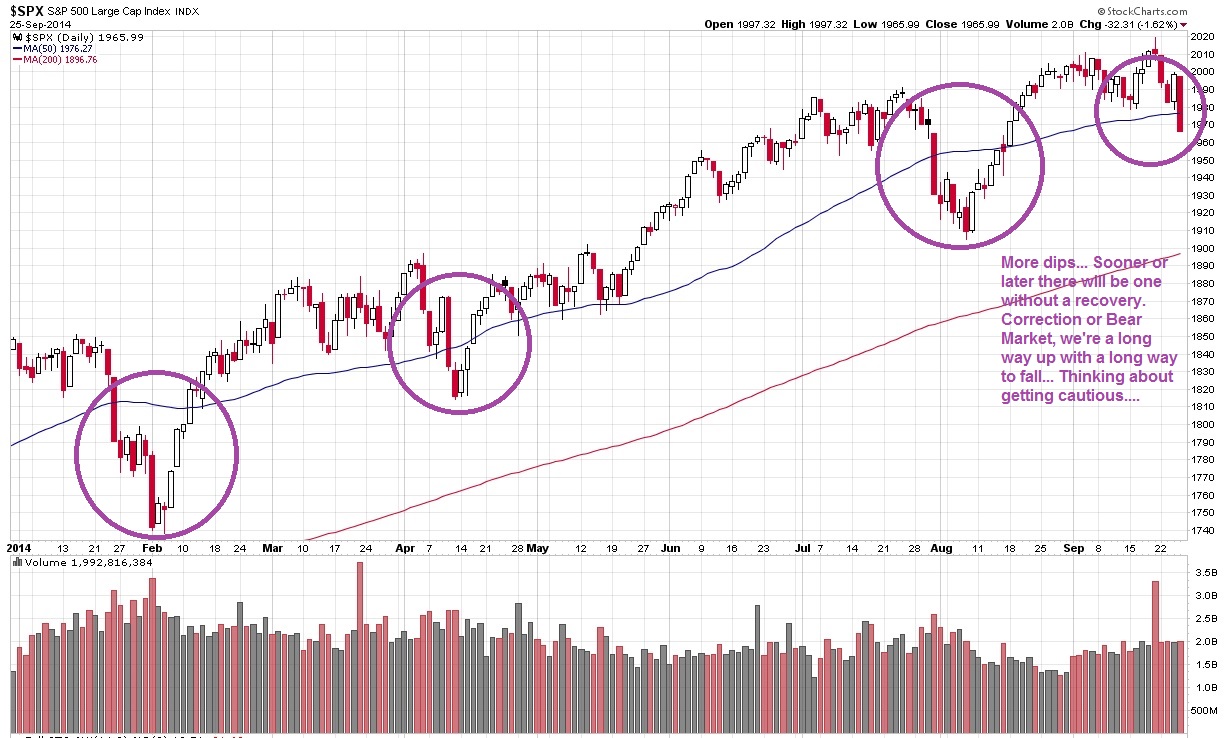

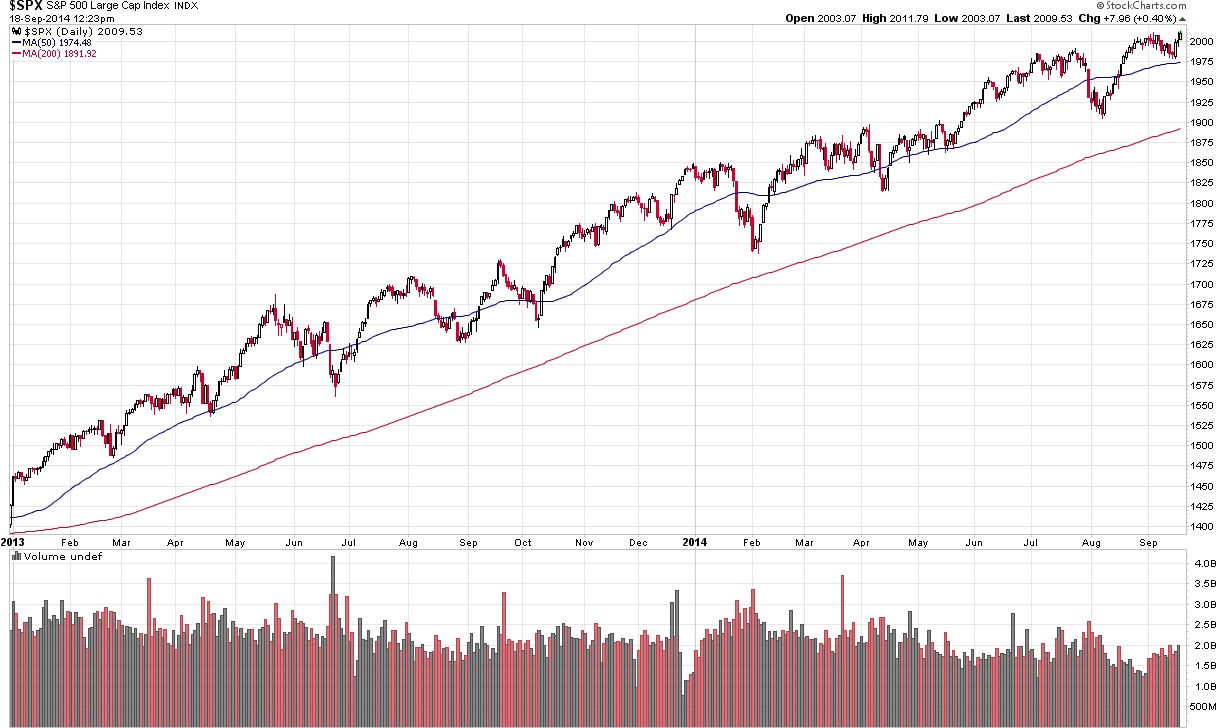

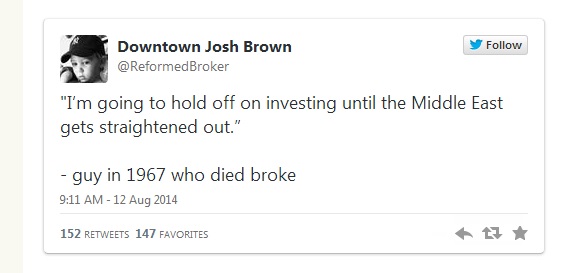

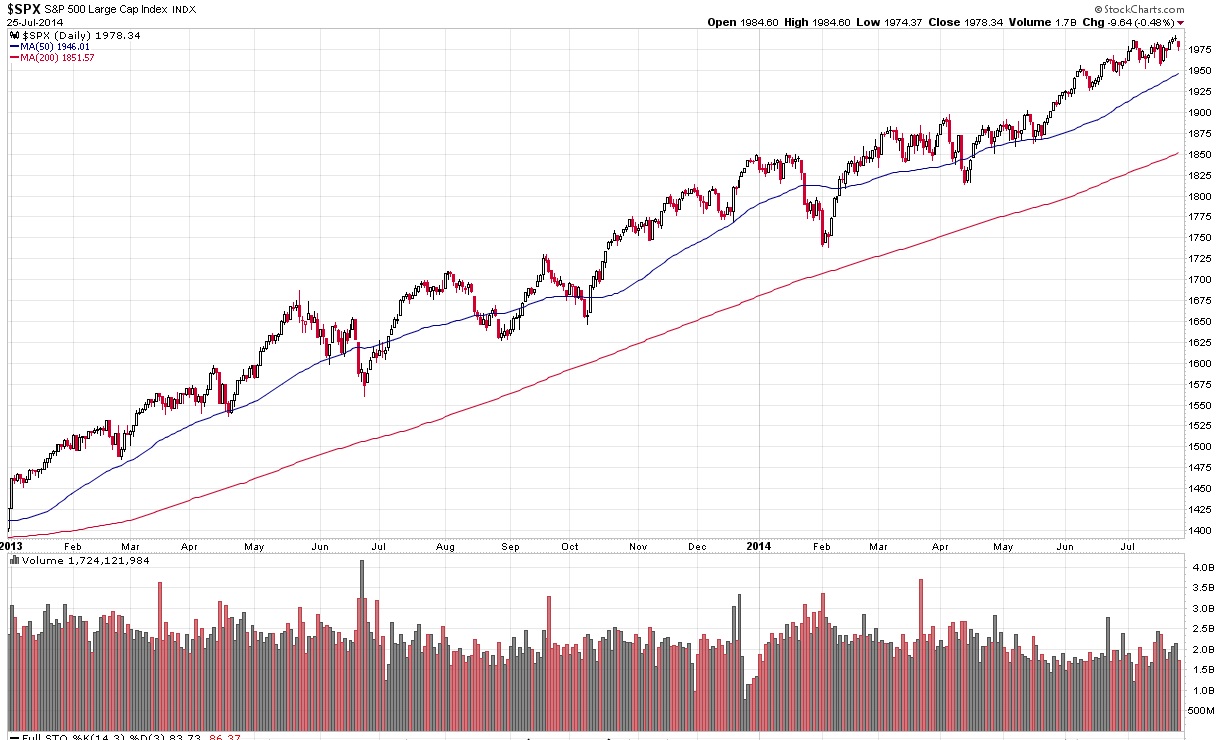

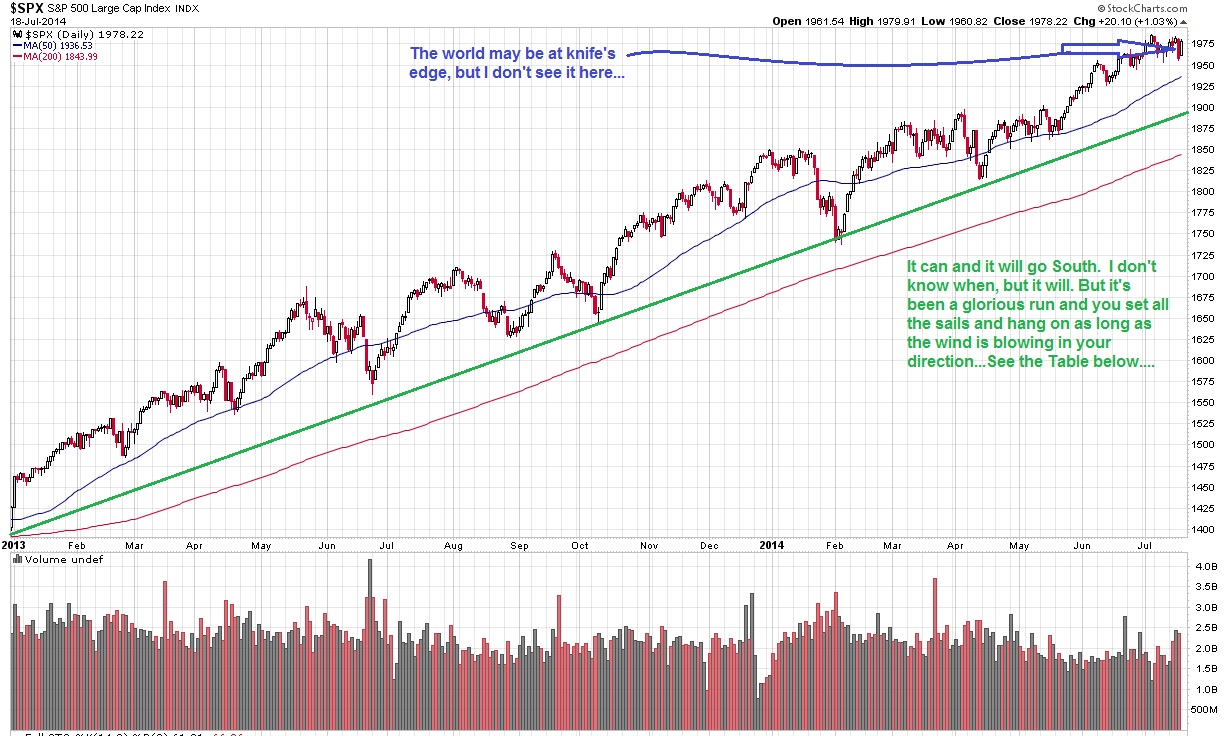

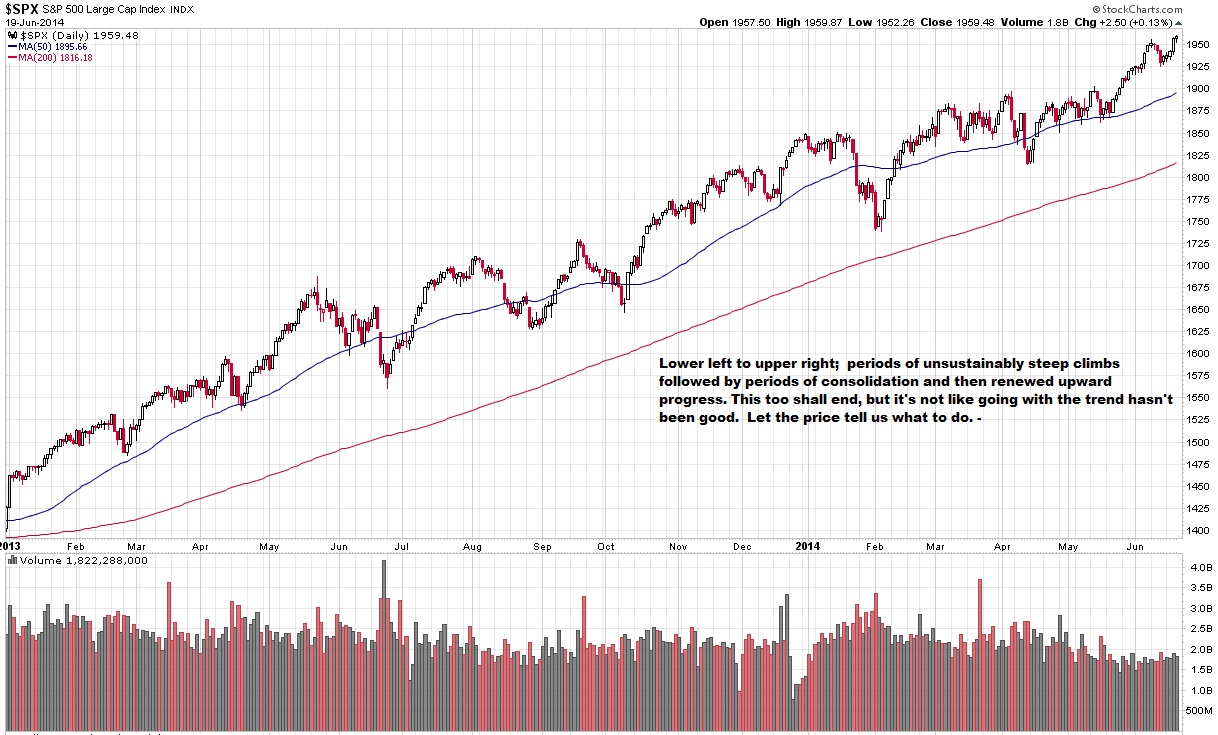

Amazing run; not unprecedented, but getting out there. Still....

I've been way long stocks. Make while you can. This opportunity will go away like they all do.

( 3 / 1301 ) ( 3 / 1301 )

Purple Haze All Around ....

Friday, August 29, 2014, 11:48 AM

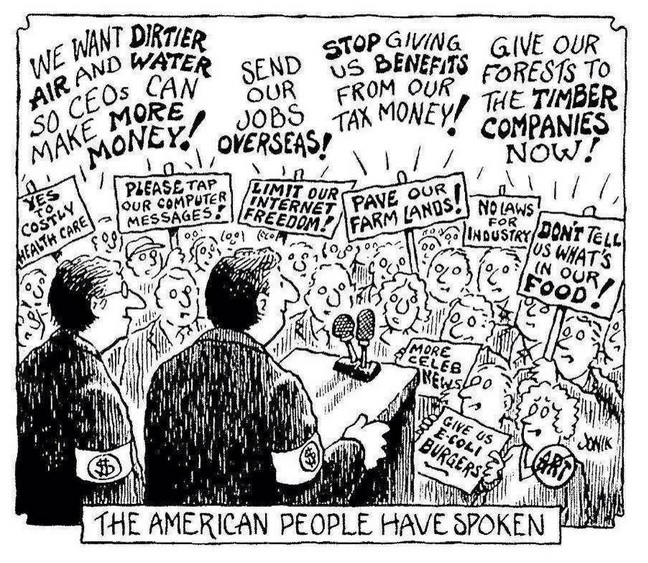

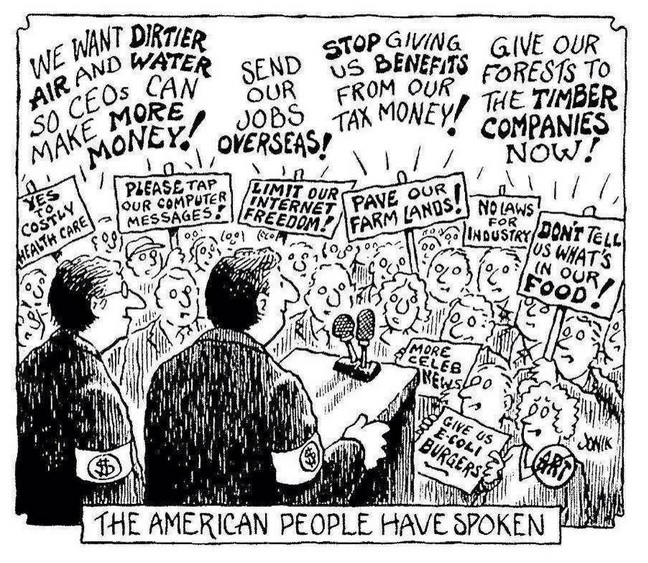

“When you’re young, you look at television and think, There’s a conspiracy. The networks have conspired to dumb us down. But when you get a little older, you realize that’s not true. The networks are in business to give people exactly what they want. That’s a far more depressing thought. Conspiracy is optimistic! You can shoot the bastards! We can have a revolution! But the networks are really in business to give people what they want. It’s the truth.”

— Steve Jobs

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

Darkness and Despair...

https://www.youtube.com/watch?v=kc8H6USGR90

And Now For Something Completely Different...

https://www.youtube.com/watch?v=pvhYqeGp_Do

https://www.youtube.com/watch?v=yhuMLpdnOjY

https://www.youtube.com/watch?v=pIzRGHuJt_I

From Wikipedia...

Lehrer's song "The Old Dope Peddler" is sampled in rapper 2 Chainz's song "Dope Peddler", on his 2012 debut album, Based on a T.R.U. Story. The following year, Lehrer said he was "very proud" to have his song sampled "literally sixty years after I recorded it." Lehrer went on to describe his official response to the request to use his song: "As sole copyright owner of 'The Old Dope Peddler', I grant you motherfuckers permission to do this. Please give my regards to Mr. Chainz, or may I call him 2?"

http://www.businessinsider.com/brad-wil ... tos-2014-8

Gotta respect reality....

http://fundamentalis.com/?p=4037

http://www.businessinsider.com/worst-ca ... ast-2014-8

http://www.nytimes.com/2014/09/01/opini ... =&_r=0

Can you Say,"Dumber Than a Box Of Rocks"?

http://happynicetimepeople.com/republic ... nterprise/

Now Let's Try "Self Serving Wing Nuts" ...

http://www.newrepublic.com/article/feast-the-wingnuts

http://www.bloombergview.com/articles/2 ... ule-of-law

Labor Day

http://www.bloombergview.com/articles/2 ... ght-for-it

http://www.institutionalinvestor.com/bl ... AS82vldWSo

Monday...

http://www.bloombergview.com/articles/2 ... -is-hitler

http://fundamentalis.com/?p=4042

Wednesday...

HUGE

http://www.ritholtz.com/blog/2014/09/ho ... sers-game/

https://www.youtube.com/watch?v=h-Wk4SQ-QBs

Thursday...

http://www.economist.com/news/europe/21 ... and-prayer

http://www.ritholtz.com/blog/2014/09/jo ... rton-show/

( 3 / 1196 ) ( 3 / 1196 )

I Went From A 100MPH WFO Kinda Guy To A "You Kids Get Off My Lawn!" Kinda Guy. It Takes A Lot Of Time And Effort To Get Old. Tires Ya Out...

Friday, August 8, 2014, 02:11 PM

But in a free society, people must be allowed to make choices for themselves that are incomprehensible to others.

-- Jim Norton

Freddie King... 'nuff Said.

https://www.youtube.com/watch?v=ZLTEJQJqGik

https://www.youtube.com/watch?v=xP12Z1X5TEQ

IF YOUR A FIRST TIMER TO THE BLOG, CLICK HERE...

http://joefacer.com/pblog/static.php?pa ... 729-141334

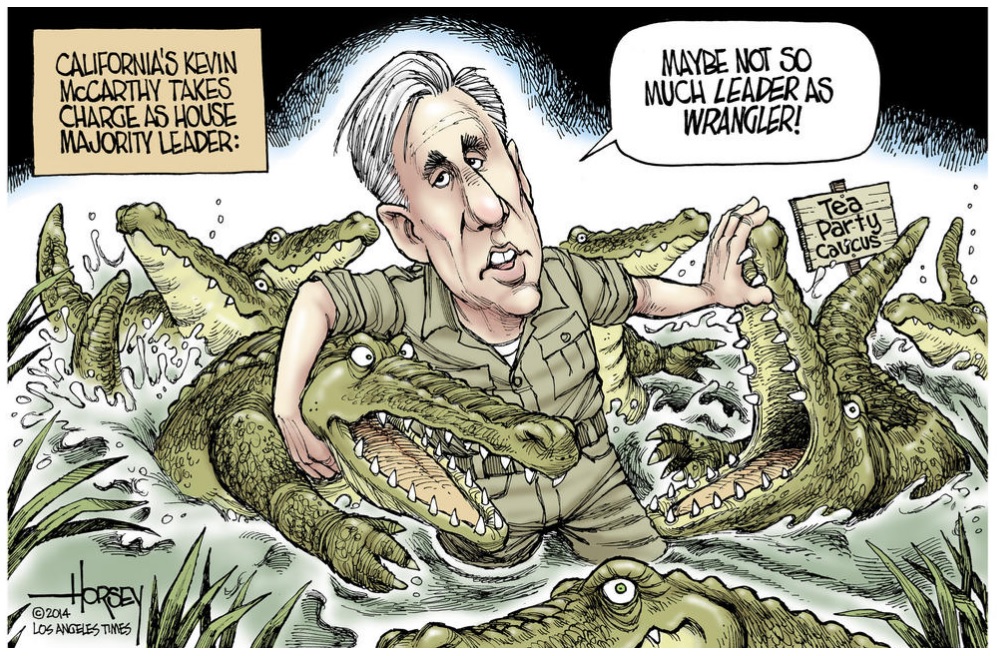

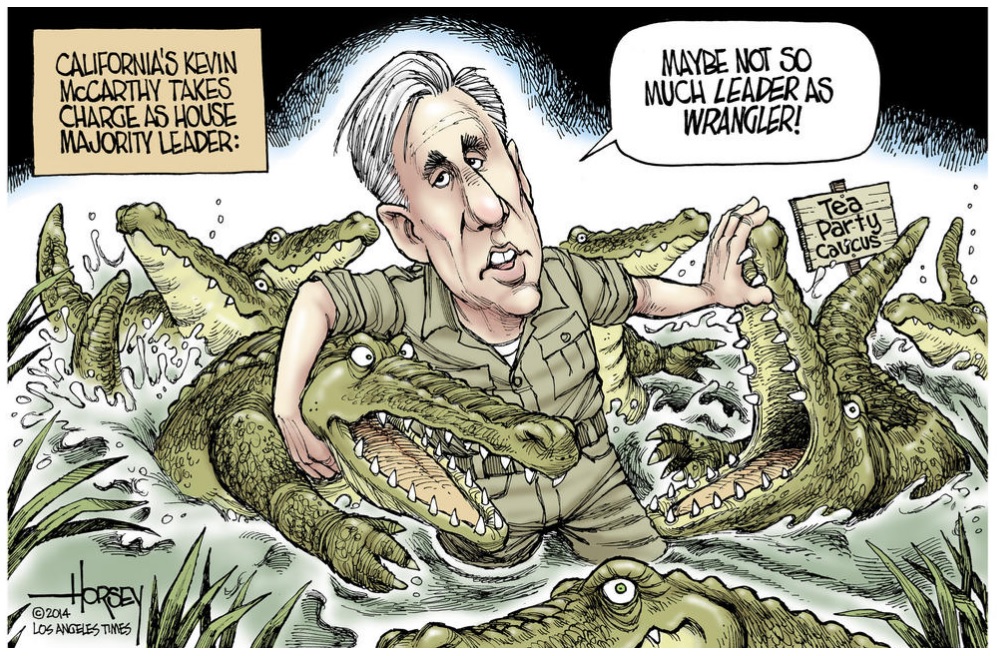

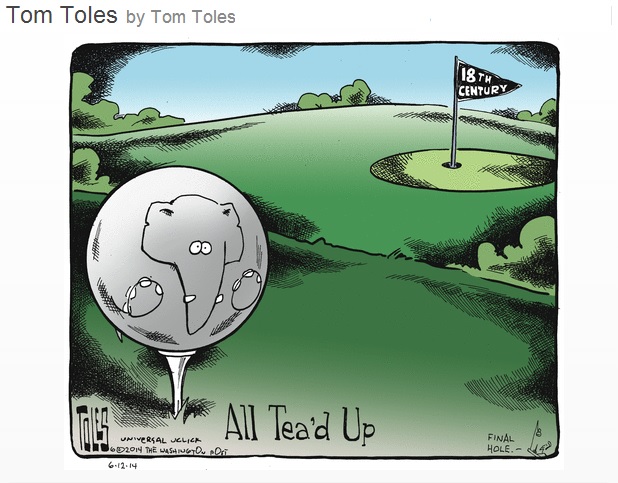

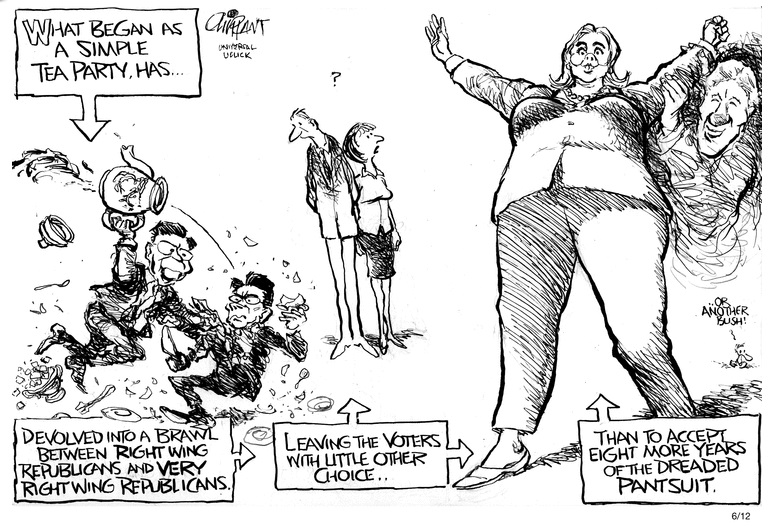

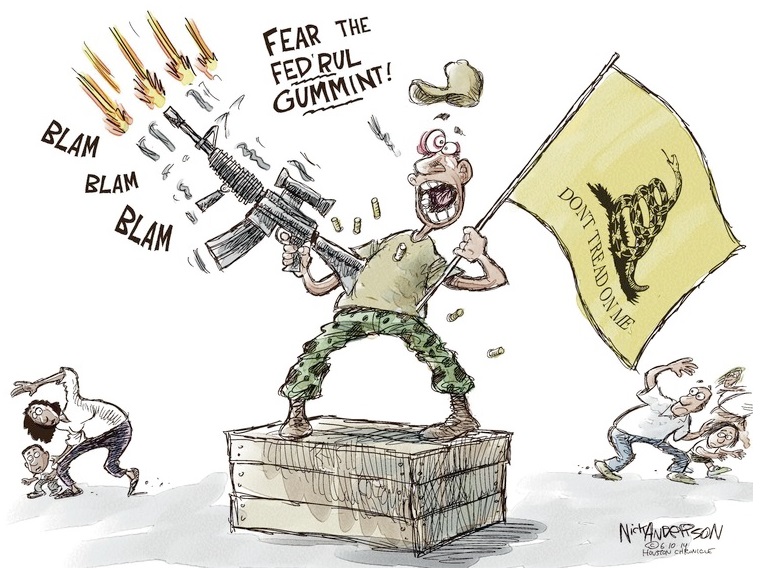

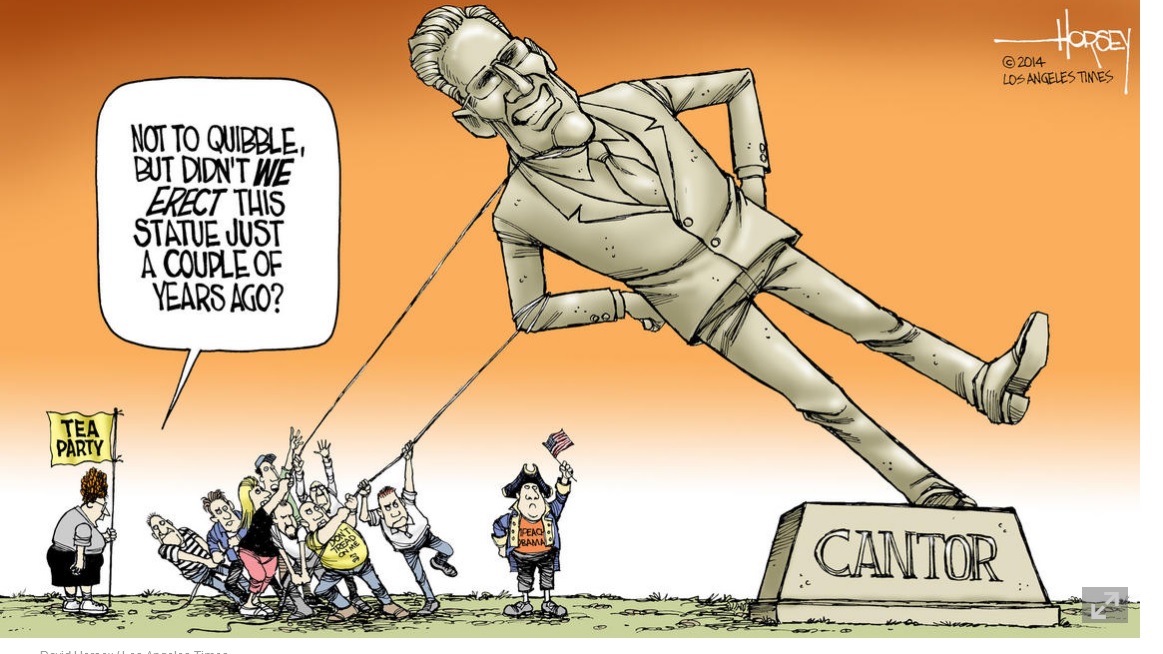

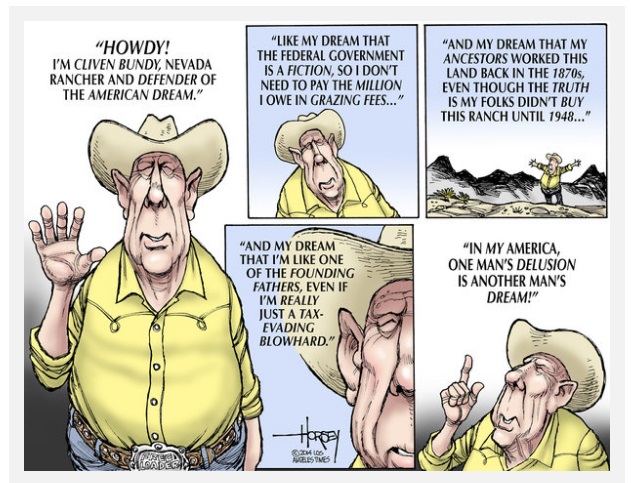

Tea Party Crap...

http://theweek.com/article/index/265958 ... it-loathes

Soul... The great thing about Bay Area radio Top 40 and Free Form FM in the 60's and 70's was the mix of every thing from singing nuns, Dean Martin, Cal Tjader, Roger Miller,Marvin Gaye, Stones, The Dead,Stevie Wonder, Ten Years After, Cream,Hendrix,The Doors, and of course...Jaaames Brown.

http://www.ritholtz.com/blog/2014/08/ja ... n-minutes/

Other People Agree...

https://www.youtube.com/watch?v=bKLihKehg_U

Reads like news from my youth...

http://www.bloomberg.com/news/2014-08-0 ... tions.html

REALLY IMPORTANT FOR 401 INVESTORS...

http://theirrelevantinvestor.tumblr.com/day/2014/08/06

http://www.businessinsider.com/jobless-claims-2014-8

http://www.businessinsider.com/calculat ... ics-2014-8

REALLY IMPORTANT IF YOU'RE NOT PLANNING TO DIE IN A FEW YEARS....

http://motherboard.vice.com/read/if-we- ... matologist

Monday...

http://www.slate.com/blogs/moneybox/201 ... elite.html

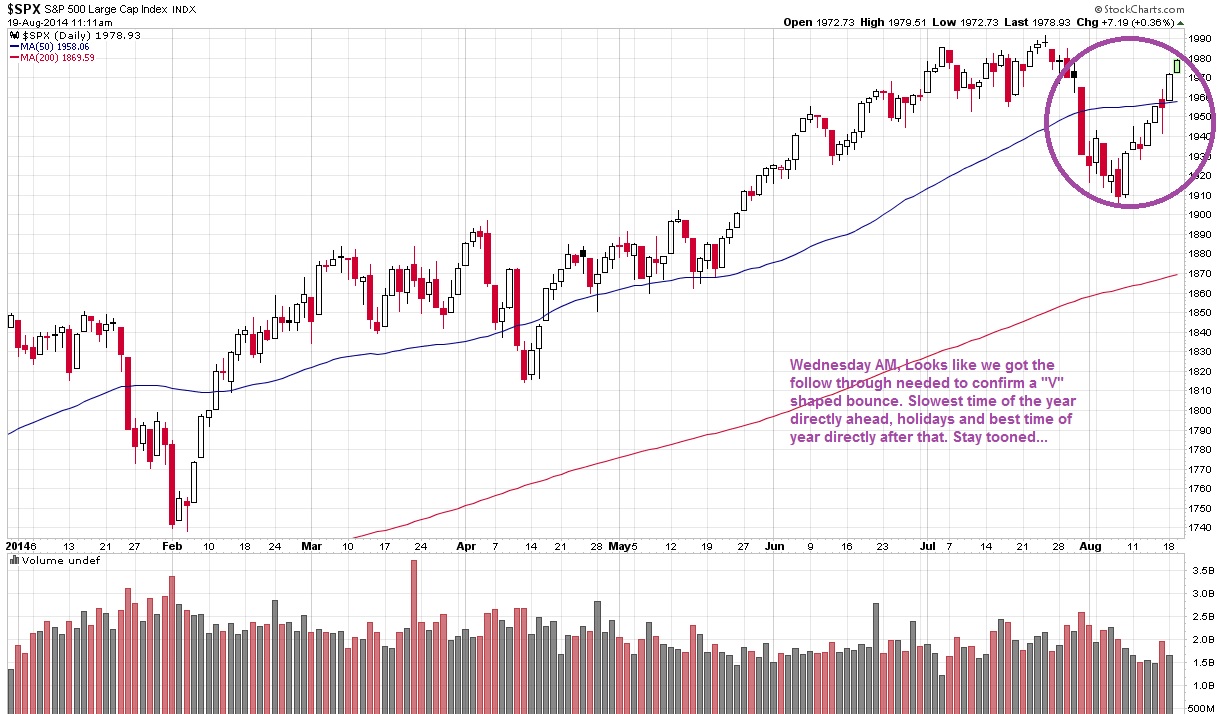

Wednesday

Not As Easy As It Sounds...

http://www.upsidetrader.com/2014/08/12/go-different/

( 3 / 1208 ) ( 3 / 1208 )

Friday, July 25, 2014, 09:47 AM

The world is a dangerous place to live; not because of the people who are evil, but because of the people who don't do anything about it.

-- Albert Einstein

IF YOUR A NEWCOMER, CLICK HERE... http://joefacer.com/pblog/static.php?pa ... 729-141334

There were a lot of iterations of Stoneground back inna day. They were like sex; even the worst were pretty damn good. Here's three without Diedre, Lynn or Sal. But w/ Jo Baker (E. Bishop Group) Sammy Piazza(Hot Tuna), et al.

https://www.youtube.com/watch?v=CpA6J1McjnQ

https://www.youtube.com/watch?v=VYuqeuGzbzU

https://www.youtube.com/watch?v=1pZEXdohCKs

And a coupla three by my most favoritist iteration....

https://www.youtube.com/watch?v=A-Qoom2gvSQ

https://www.youtube.com/watch?v=mfB2N7F7CqY

https://www.youtube.com/watch?v=WWeTt-guQHU

If Sal's voice sound familiar, think Beau Brummels....

http://www.businessinsider.com/mark-cub ... ers-2014-7

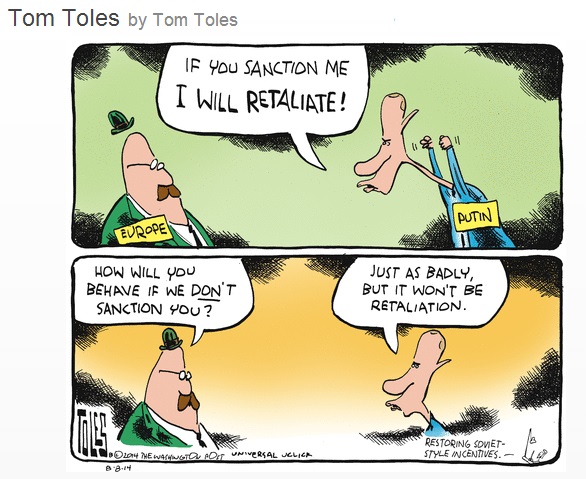

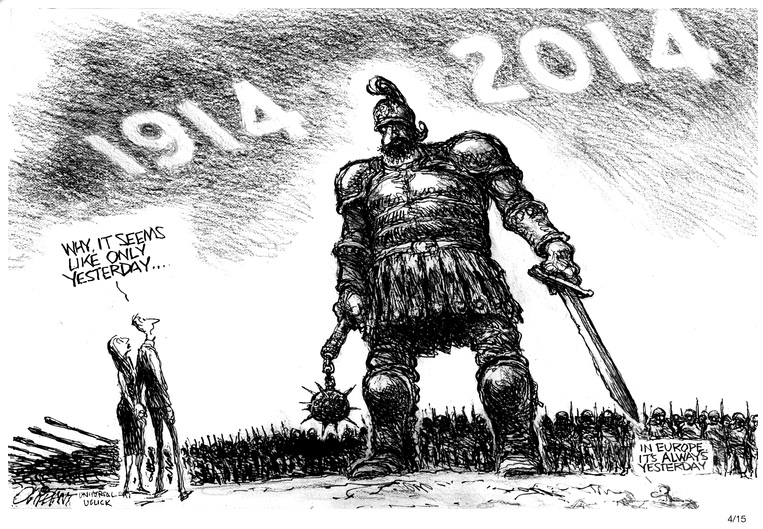

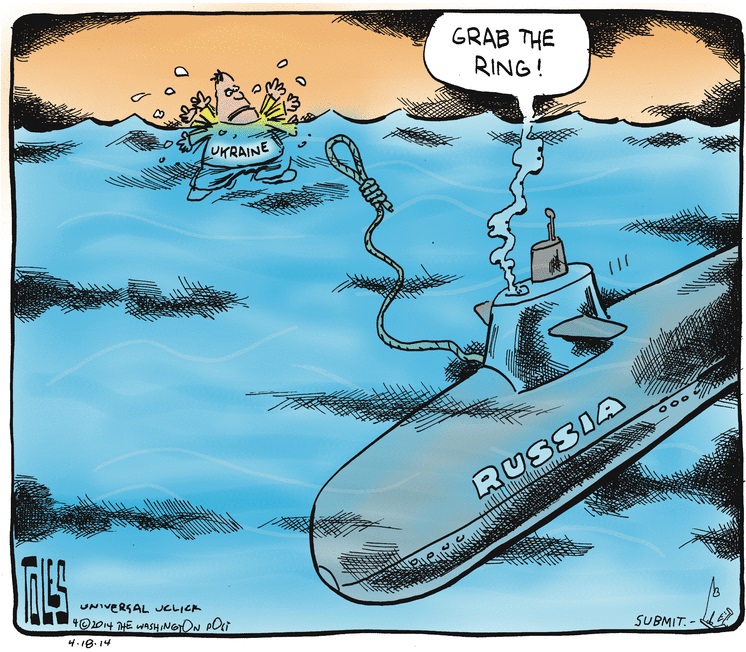

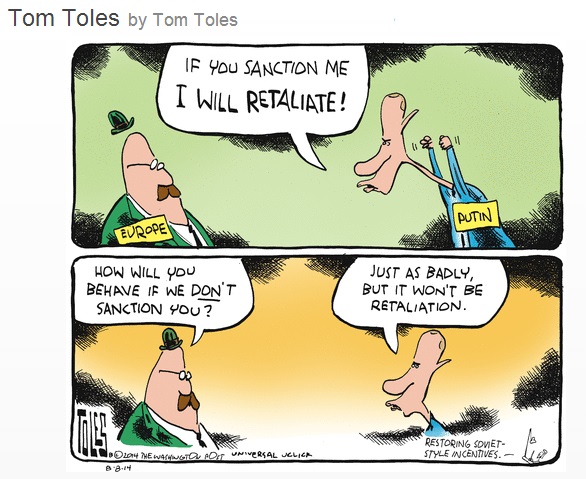

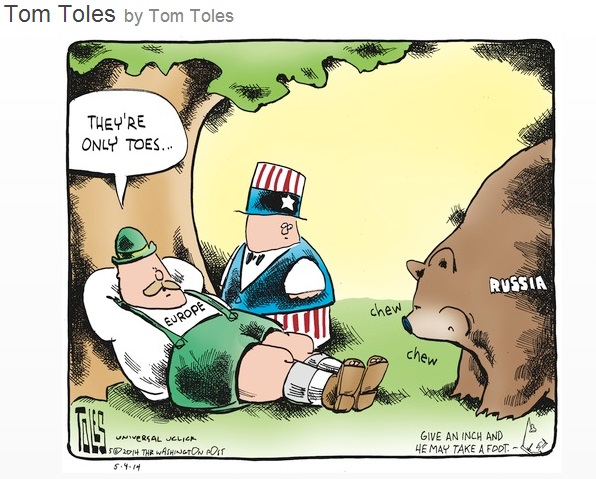

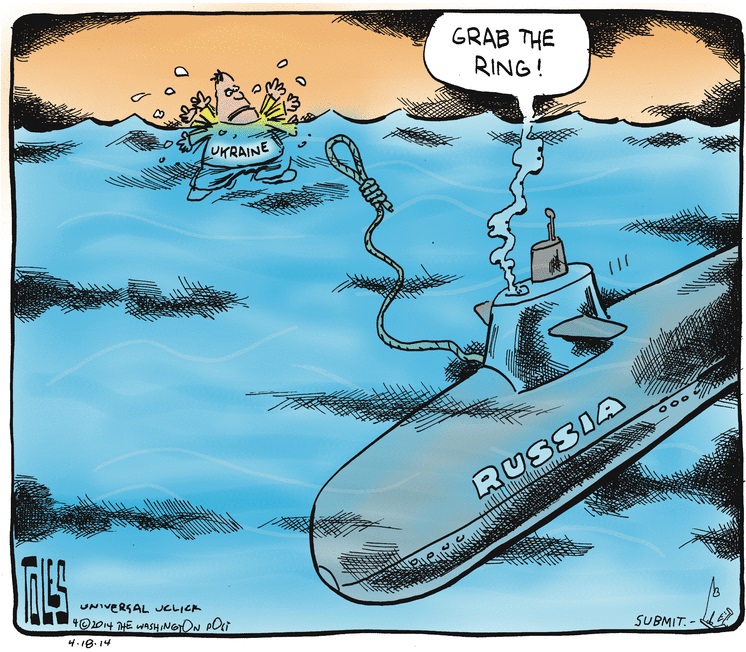

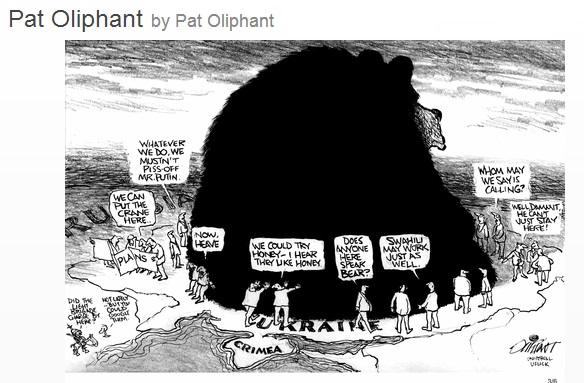

Behind the curtain of the Ukrainian war... Stuff below all over the map. That's the way I see it too...

http://www.businessinsider.com/the-whol ... ine-2014-7

http://www.stratfor.com/weekly/can-puti ... z38hJp6kzj

http://www.businessinsider.com/us-heres ... ine-2014-7

http://www.businessinsider.com/russia-m ... ont-2014-7

http://www.businessinsider.com/battle-f ... sia-2014-7

http://online.wsj.com/articles/russia-d ... 1406573577

http://www.businessinsider.com/mh17-and ... nse-2014-7

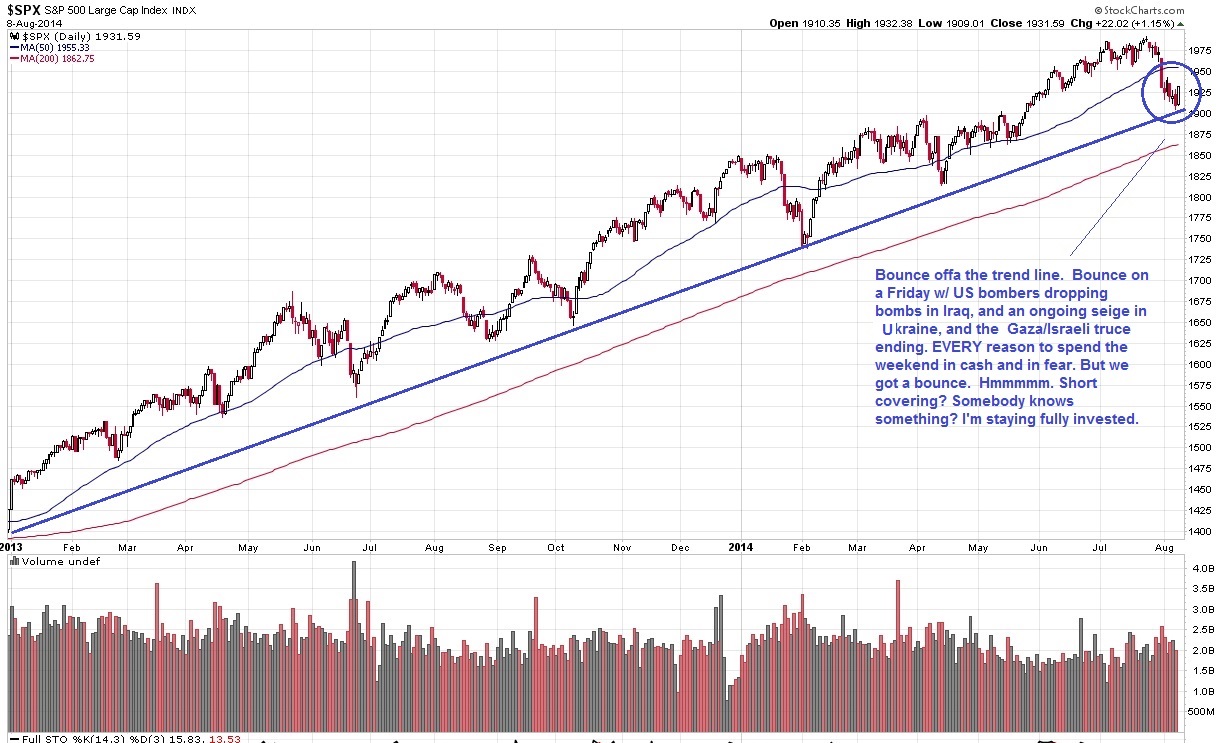

Over 90% stock at this time. It makes sense for me because this is a small part of my portfolio. I can run the risk reward up higher here because stability and income are represented big time elsewhere. That said, I will also be ruthless about protecting these funds. Look at the charts. Straight up 40% in 29 months. This ain't no roller coaster. I don't feel like stepping off near or at the top causes me to miss all the excitement and fun.

If you know me personally, you look at Brian Gilmartin, his business, his politics and his blog, and you think "What The Fuck?" But I started reading Cramer's "thestreet.com" back in the 90's where I encountered the handful of writers who taught me something useful and who I still follow. This is business.

http://fundamentalis.com/?p=3944

WOW! I lived long enough to see this in print...

http://www.nytimes.com/interactive/2014 ... ation.html

Tuesday...

http://www.bloomberg.com/news/2014-07-2 ... nists.html

Wednesday...

Wanna figure it out? Look where the dollars are heading...

http://www.bloomberg.com/news/2014-07-3 ... rings.html

http://www.bloomberg.com/news/2014-07-3 ... -goal.html

http://pragcap.com/dangerous-investment-world

http://www.wired.com/2014/07/keyme-let-me-break-in/

http://www.nytimes.com/interactive/2014 ... .html?_r=0

https://www.youtube.com/watch?v=cwx9fZOL81c#t=434

( 3 / 385 ) ( 3 / 385 )

A Nod's As Good As Wink To A Blind Horse. But I Don't Run In Circles Where That Kinda Thing Is Much Approved Of...

Sunday, July 13, 2014, 06:15 PM

Humility, along with the ability of those who have been wrong to acknowledge their mistakes, are at all-time lows and, sadly, trending lower still. Ideology can apparently hold sway against reason, facts, and data for longer than I’d imagined.

-- Invictus

Then And Now...

https://www.youtube.com/watch?v=Ye3Lk9C-4VA

https://www.youtube.com/watch?v=o1aje4K0TXY

If You Get A Screen Where They Want Ya To DownLoad The Tool, DON'T!! Wait It Out...

I had a hair cut, like Ray Gomez, once upon a time. I can't do it nowadays. Wrong color and not nearly as much as I used to have...

http://www.businessinsider.com/why-the- ... any-2014-7

Part 1 and then Part 2

http://www.latimes.com/business/hiltzik ... olumn.html

http://www.calculatedriskblog.com/2014/ ... rplus.html

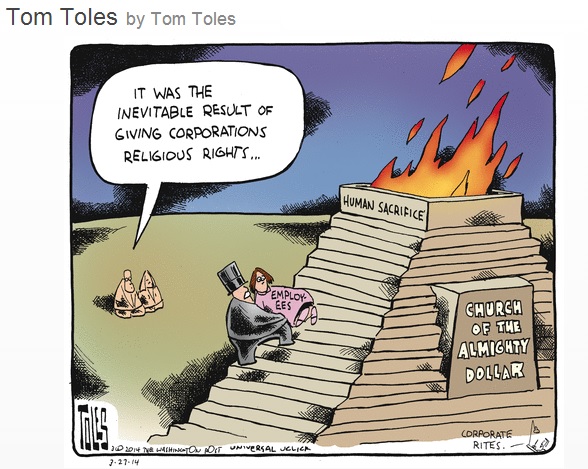

Ideology, faith, and a cheering section allows you to hold a losing position as you run full speed into a brick wall over and over... Santelli is credited with being one of the flash points that started the Tea Party as he predicted the end of civilzation as Obama destroyed the dollar, the economy, and life as we know it.

http://www.businessinsider.com/steve-li ... lli-2014-7

https://www.youtube.com/watch?v=EU9U3ZnAD5E

The Financial Crash... Gotta Plan?

http://www.c-span.org/video/?c4503655/warren-jpmorgan

http://www.businessinsider.com/john-oli ... ery-2014-7

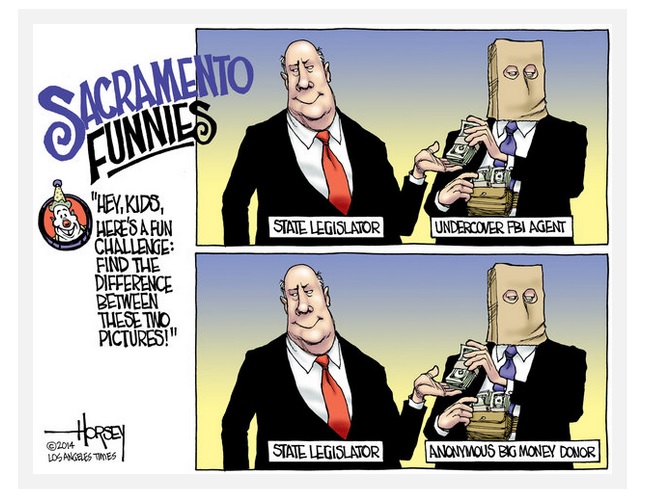

http://www.businessinsider.com/six-cali ... ter-2014-7

[ view entry ] ( 830 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1174 ) ( 2.9 / 1174 )

WELL, THERE'S GOOD NEWS, AND THERE'S BAD NEWS...AND THERE'S SOME GOOD NEWS...AND THEREIN RESIDES A TALE... This is a big one, people...see below

Thursday, July 3, 2014, 10:55 PM

Every so often, I find myself thinking that I've got something to say. Things like the "Mutual Fund Investing" riff on my web page. And 'jes Annuder Old Broked Down Pipefitter" on the blog here. "Easy Now?" part of this post, looks like more of the same. It has changed by the day. it's down to mostly pluperfect subjuntive polishing inna last day or two. I'll repost the final version above in a new post in a day or two. Serious shit... “Buy the ticket, take the ride."

-- Hunter S. Thompson

I've Been Getting Some Serious Work Done On My Retirement... this last week or two. Yeah, I retired the first of Sept 2013. But therein lies the story alluded to, above.

This Is A Work In Progress .....

Easy Now?

Hot Tuna... Easy Now

Saw 'em Back Inna Day. Damn Good Acoustic Sets. SMOKIN' Electric Sets!

http://www.youtube.com/watch?v=cUQm0_cwGL0

EASY NOW? Well, yeah.... the probabilities look.... well, complicated. Here's Where I'm Comin' From...

I've got this spreadsheet... I've had it for a while. It was my touchstone regarding my retirement for the last coupla three/four years. It was in large part an automated matrix of Years/Age x Sources Of Income. I had started a small business back in the 80's just as the IBM Personal Computer was introduced...

NERD ALERT!!! Seriously... Skip This Part.... There were a coupla local stores that would have sold me a PC if they had one. No one did. Hell, one store had one blank floppy disk and everybody else was outa stock. So I bopped down to the IBM corporate headquarters where this eye candy model in a business suit next to a spotlit display of a single nonoperational computer on a pedestal tried to send me up to the 12th floor to sign up with a Corporate New Account Representative. Not likely. (NTFL) So I went home and bought by mail order, a new IBM PC with the latest motherboard (256K bytes memory), dual double sided half height 360K floppy drives, the latest DOS (2.01) and one of the new amber CRT monitors, a dot matrix printer with tractor feed, and a daisy wheel printer, etc... Later, I went back to the local store and convinced the guy onna floor to sell me the only blank floppy disk available in the city since I could use it, and he might as well have no floppies as one. From there, within a coupla years I was using a word processor and Lotus 123 to create my own automated business software.

...so my spreadsheet was set up to automatically tally my prospective post retirement income for current and future years, by monthly cash pension and Social Security payments, and by theoretical income from my investments/savings. I also had a table of my W-2 incomes for the last 10 years set off to the side to give me a reference for the monthly and yearly income, and the matrix was done multiple times on the page with various rates of return on my savings. The whole spreadsheet was interactive and linked to my personal financial spreadsheets, allowing me to update it instantly and track it real time.

The end result was that when I was no longer able to work in 2013, my spreadsheet told me that my pension/Social Security income would give me a livable income and that given a 4% return on my savings, if I withdrew only the income, I could get all the way to what I'd earned in 2010, paying the bills, allowing some discretionary spending, and allowing me to draw principal as required for some inflation protection...

Kool. It was not like I had a choice. Regardless, I was set. I retired. But I was only sure about the here and now.... Where would I stand as the years went by? Would my wife and I be living in a cardboard box in ten or twenty or thirty years? Would I be able to leave the kids anything? Should my wife or I die well before the other one did, how would the survivor get by?

My Union pension is fixed. What about inflation? How fast would my Union pension's contribution to my income shrink? How much other income would be required to replace it and how soon? Can I spend a dollar on fun stuff today with a clear conscience, or will every dollar spent hasten the arrival of the day that I try to convince myself that living with the kids was my plan for my wife and I all along? Will I have to speed up my rehab from my latest knee surgery so I can get a job? Am I doomed to a future with an orange apron in it?

Passive acceptance is not my preferred mode of operation, finding out what's going on and dealing with it is. So I started to get some answers. I began with this table...

http://www.ssa.gov/oact/STATS/table4c6.html

As per the Actuarial Life Table for 2009 from the Social Security Administration, if ya started with a theoretical 100K males, by the time you get to 63 years, my age at my retirement, you'd have 82.6K men left standing. The nominal life expectancy at 63 is 19 years. That gives an average mortality at 82 years old. But that also means that of the 82K men standing with me when I was 63, 41K of them are expected to still be standing when we all hit 82. Hopefully I'll be one of the ones standing. If I am, I'll still need income and with hopefully a lotta good years to go I'll need a handfull. Let's say that my health and luck are good. If so, I have a 1 in 4 chance of still being alive at 89 and still needing income. That's not an outlandish bet. Running out of money and needing to get a job in my 90's worrys me a lot more than leaving my kids with more to inherit than I expected to leave them if I die in my late 70's. So I have to plan for a 30 year long retirement without a brick wall at 92, just in case I make 100 plus years old.

Next I needed an income and expense matrix, including pension income, assets, investment income, taxes, inflation, expenses, a discretionary budget, a bequest number, and all this by a timetable. And I need it in a format that will allow me to track it so I can see if it is working, and give me direction as to what to do to keep it working in the face of the unexpected. If I had this, then I would have a plan.

Well, as per noted elsewhere in my blog, I've sought out investment professionals to handle part of my retirement income and they've been busy doin' what they do. Such as working up the plan I just described. I've been grinding on the finer details for a week...

I'll stop here for now. Mostly. So Far, So Good. I'm retired and the near future is well in hand. And, I've got what I need to evaluate whether I can continue to live comfortably in my current lifestyle, do some fun retired type things, help the kids out along the way, leave them something, and not have to move us old folks in with them for the last decade or two. Hell, my wife and I barely survived the first go round of living with the kids when they were teenagers. The good news is that I can do all that good stuff above. The bad news is that It's not a slam dunk. My pension covers about 55% of our expenses this year. Given historically based projections of inflation, my expenses will be multiplied by about 2.3 times by the time I'm 82. My pension is projected to be 26% of our income at that point, without counting for increased medical coverage costs. If I hit 90, I'll be needing 3 times today's income to maintain my standard of living and my pension is projected to cover only 19% of that cost, again not counting for increased medical coverage cost. The numbers are surprising... and the base reality is not encouraging. My Union Pension is fixed, my medical coverage comes out of the gross sum, and medical costs will grow, reducing my monthly pension payment. Currently only about half our our pension income will be adjusted for inflation. On top of that, Social Security is motivated to fudge on the cost of living adjustment so as to delay going broke, leaving everyone falling slowly behind every year. And, just to pile on when I'm down, my wife's pension's cost of living adjustment is based on the first year's number. That number, (a neglible amount) will follow her to the end of her days... A VERY tricky bit of fine print! And on top of that, she has not yet drawn her Social Security. When she does, her Social Security will be reduced over what she should get because she has a state pension rather than a private one. Bummer. So I'm going to have to do the heavy lifting of our retirement income cost of living adjustments myself. The good news is it looks like I can do it with my savings and investments. I like this plan they came up with. I can make this work.

But It Was A MAJOR Slap Upside The Head to see the numbers and see how much the future will rely on sucessful financial planning and investments.

Uhhh. You got this under control for yourself...right?

STAY TOONED.

And That's How "I Saw The Light"....

http://www.youtube.com/watch?v=qvbLJ6TGepI

"Cuz "Death Don't Have No Mercy In This Land"...

http://www.youtube.com/watch?v=bb8l8MWA7yk

An' 'Cuz It Feels Too Good To Stop...I'll "Keep My Lamps Trimmed And Burning"

http://www.youtube.com/watch?v=XA6mobt0ydw

https://www.youtube.com/watch?v=H76fbU4csRI

RIP George Duke. (Check Out "I Love The Blues, She Heard My Cry." This Was His First Release Post His Time W/ Zappa, A Sampler For What Lay Ahead.)

I Been Listening To Stanley Clarke for 40 years. I Plan To Continue...

https://www.youtube.com/watch?v=qKHeXC7L85s

Sat...

Yup... Born on third base and sure that they are major league hitters...

http://www.newyorker.com/talk/financial ... surowiecki

http://www.forbes.com/sites/timworstall ... -solution/

Monday...

Target Date Funds; Threat Or Menace?

http://pragcap.com/the-target-date-tragedy

http://www.thereformedbroker.com/2014/0 ... -hysteria/

http://www.youtube.com/watch?v=4aRryzzZ ... mp;index=4

Gets To Where A Feller Cain't Go Amblin' Inta Get A Sarsparilla Without Stirrin' Up A Lil' Dust Devil...

Blows My Mind...

https://www.youtube.com/watch?v=AFtUpMTs4vI#t=54

[ view entry ] ( 1337 views ) [ 0 trackbacks ] permalink      ( 3 / 1208 ) ( 3 / 1208 )

Jes' Anudder Old Broked Down Retahred Union Pipefitter.....

Friday, June 20, 2014, 11:25 AM

Ahm jes' anudder ol' broked down retahrd union pipefitter.

I retired in September of 2013 after 40 years in the trade, five years after this picture was taken. At the time, there was only one retired pig inna pichur. Now there would be two...

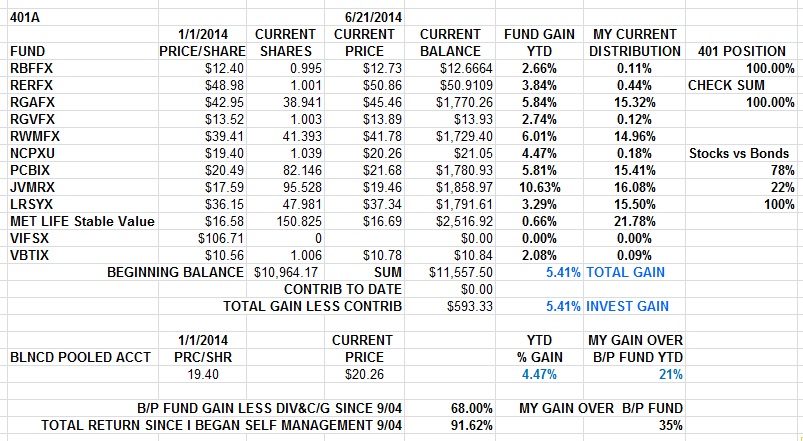

I had started actively managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1991. I was too busy raising a family, building America, and riding, racing and writing about motorcycles to pay any attention to saving for retirement. After all I had my Defined Benefit Plan and an IRA or two. What more could I need? Big mistake. I had contributed the minimum amount to the Defined Contribution Plan and left the funds in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash had crushed them, and as an afterthought, I then applied the same kind of evaluation to my 401 account and to my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story of both my IRA's and 401 are in part on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to save some serious coin and to make serious returns for my retirement. It worked out really well... So far.

I have a nice income from my defined benefit pension plan and Social Security. Today. But my pension plan has no cost of living adjustment.

"What Is Hip Today Might Become Passe'"

-- Tower Of Power

http://www.youtube.com/watch?v=SN8pWdZhVaM

http://www.youtube.com/watch?v=vauqRuvzVgs

Only 30% of my pension income, the Social Security part, adjusts for inflation. Add my wife's pension and Social Security into the mix and we're a little short of 50% of our pension income being inflation protected. The continued wellbeing of my wife and I is dependent on how I handle my retirement savings.

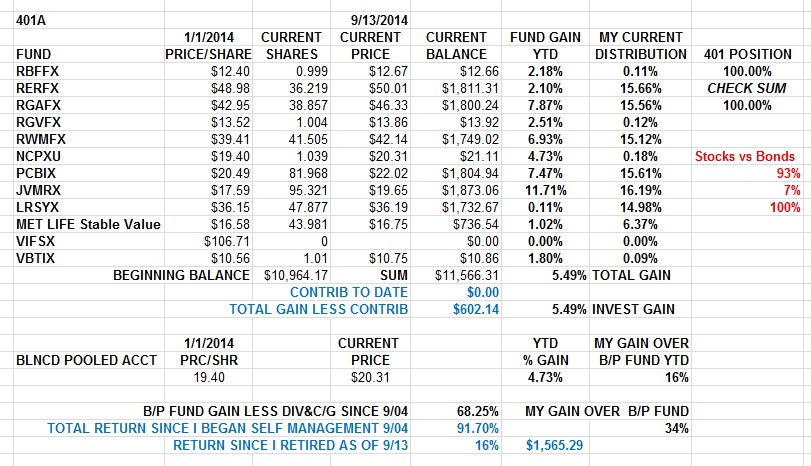

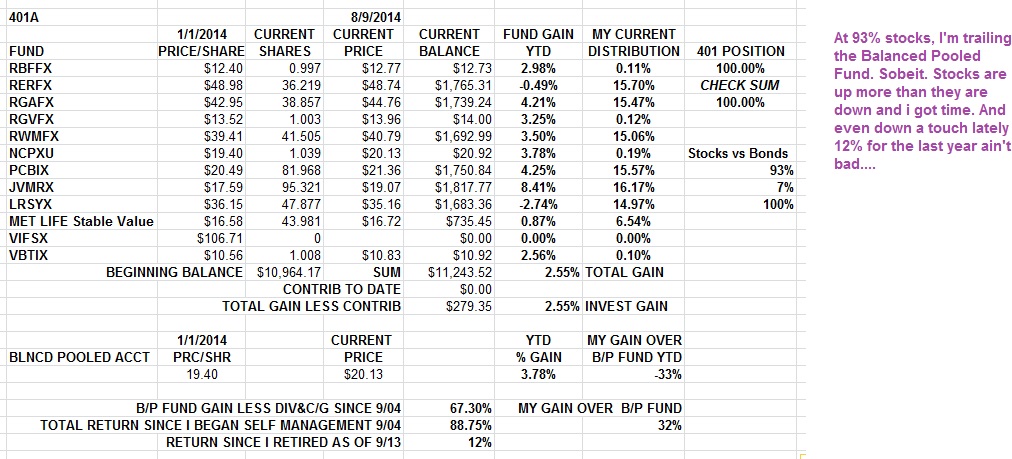

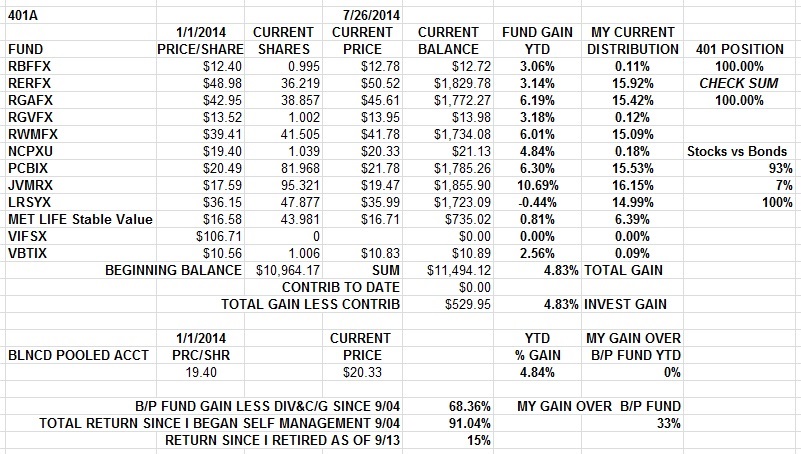

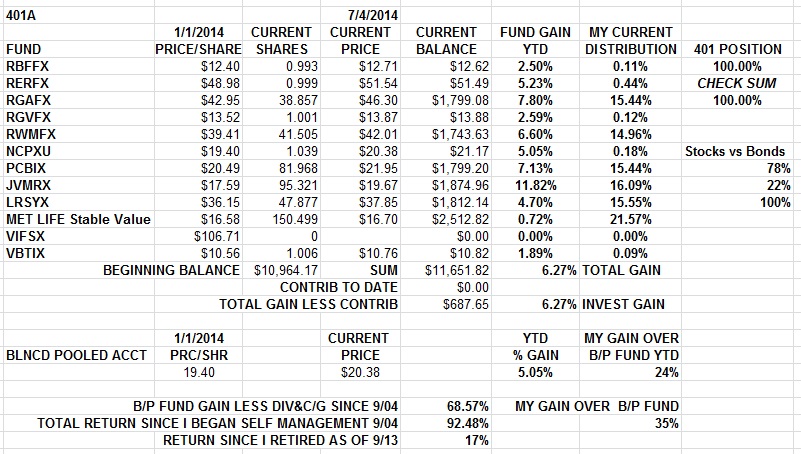

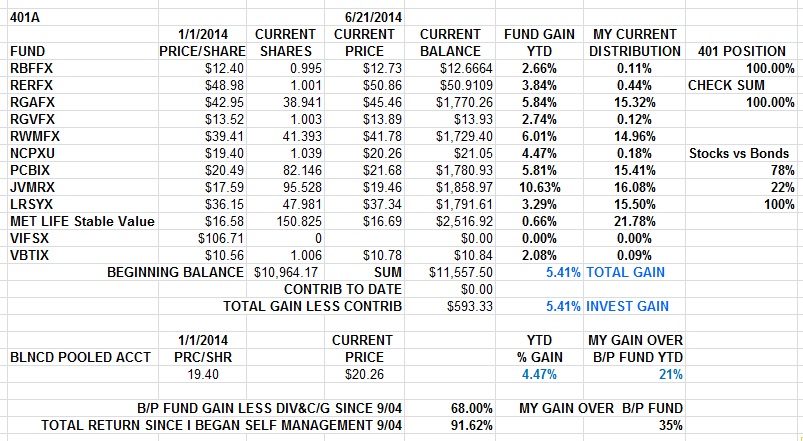

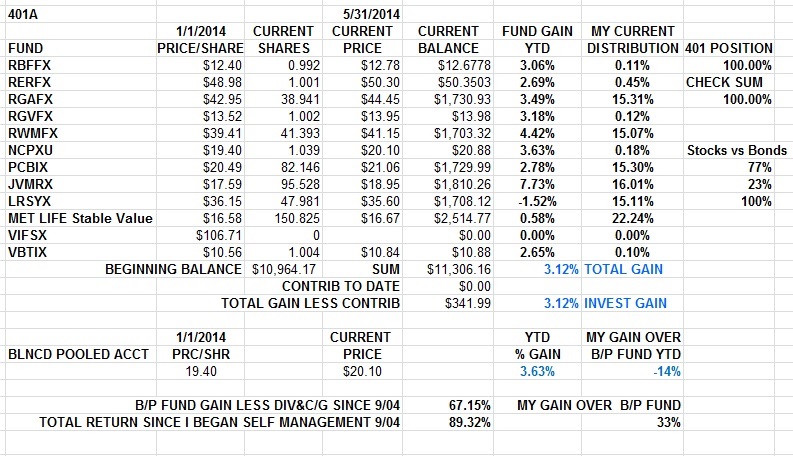

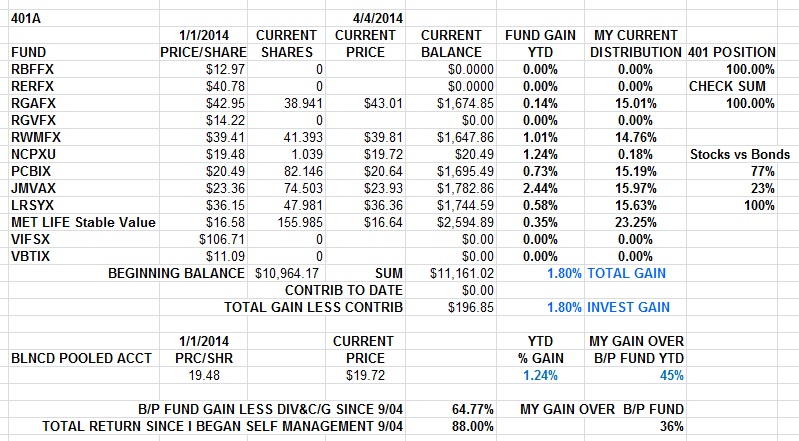

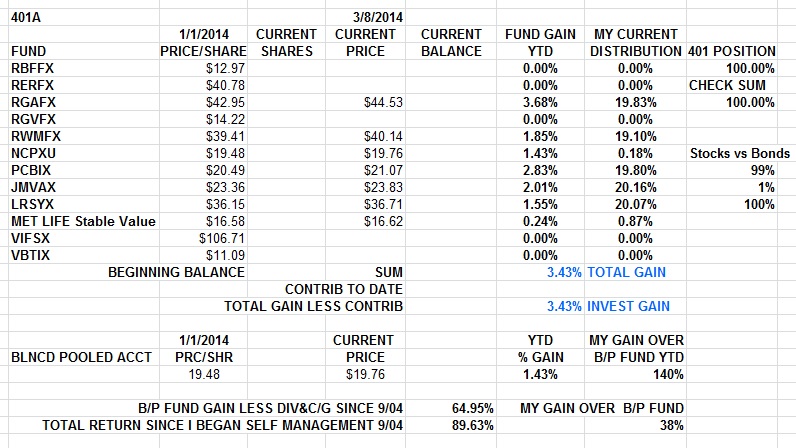

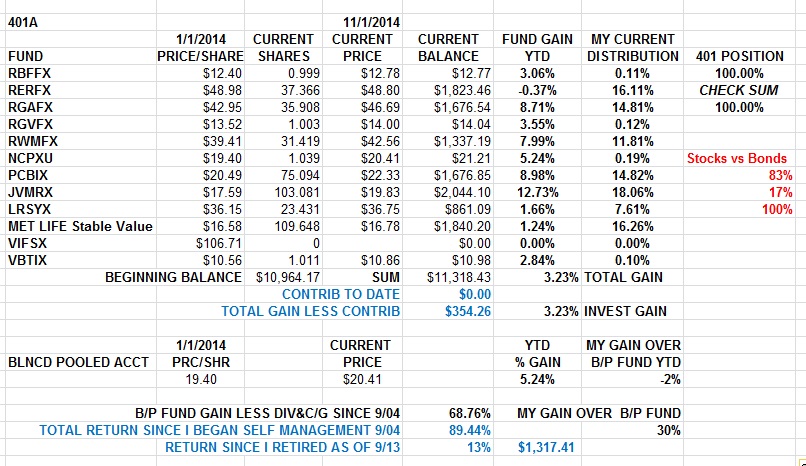

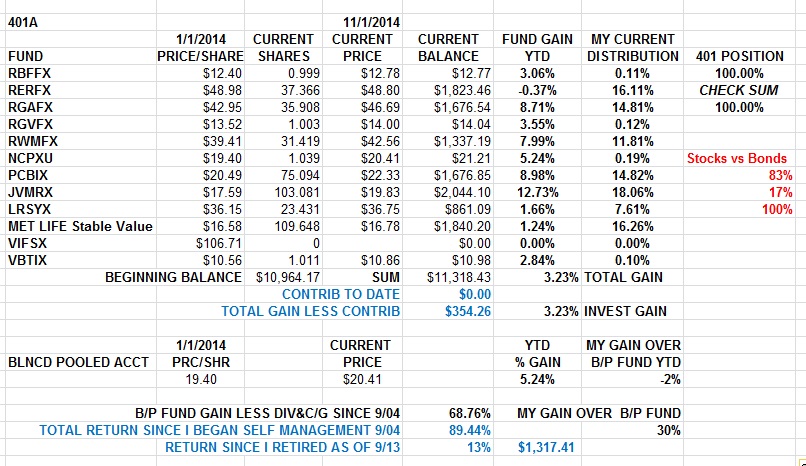

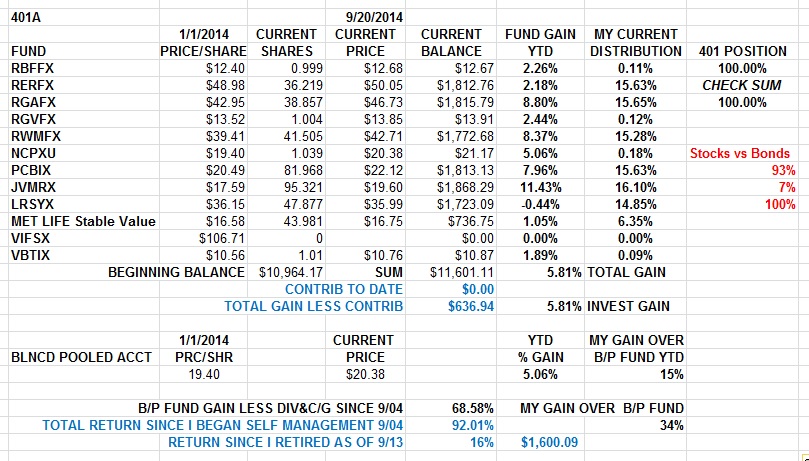

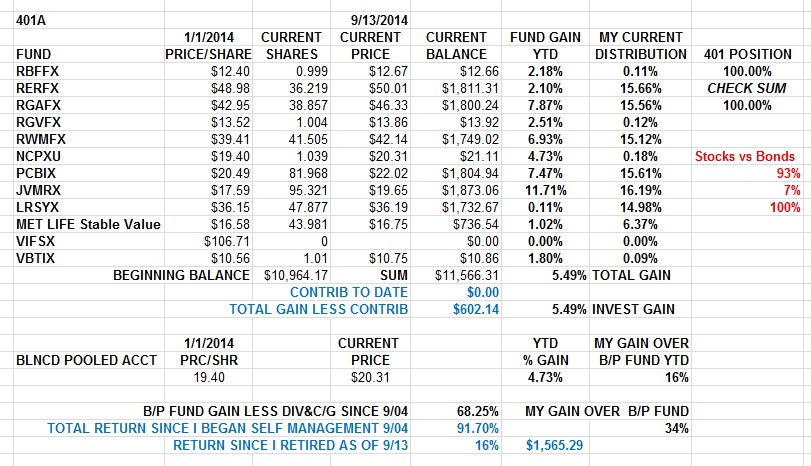

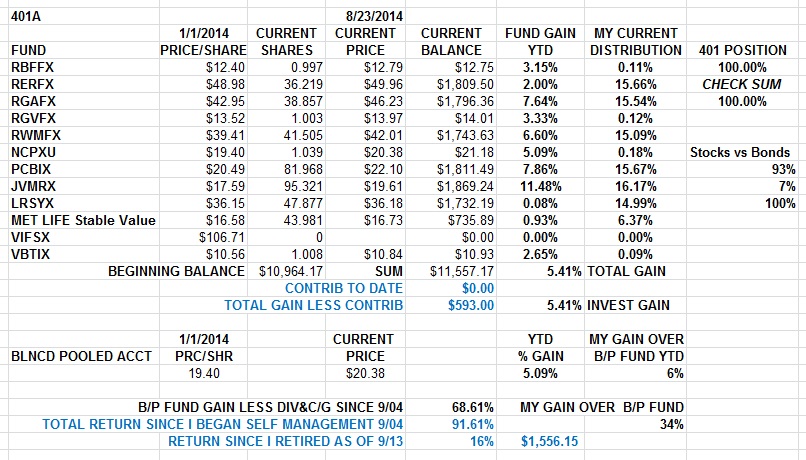

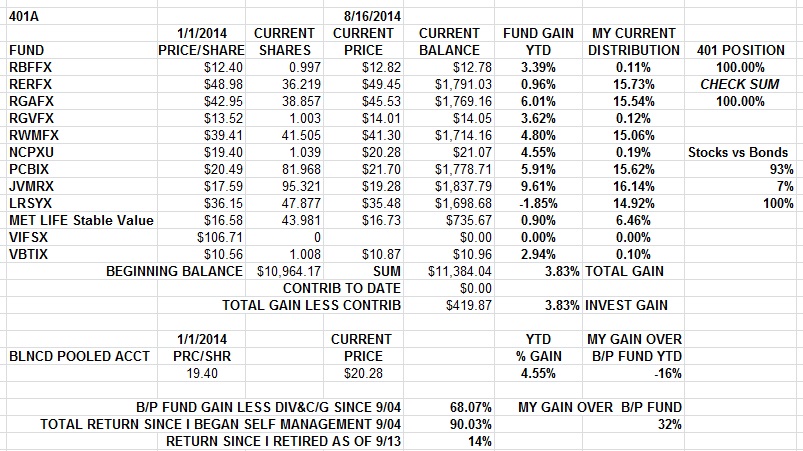

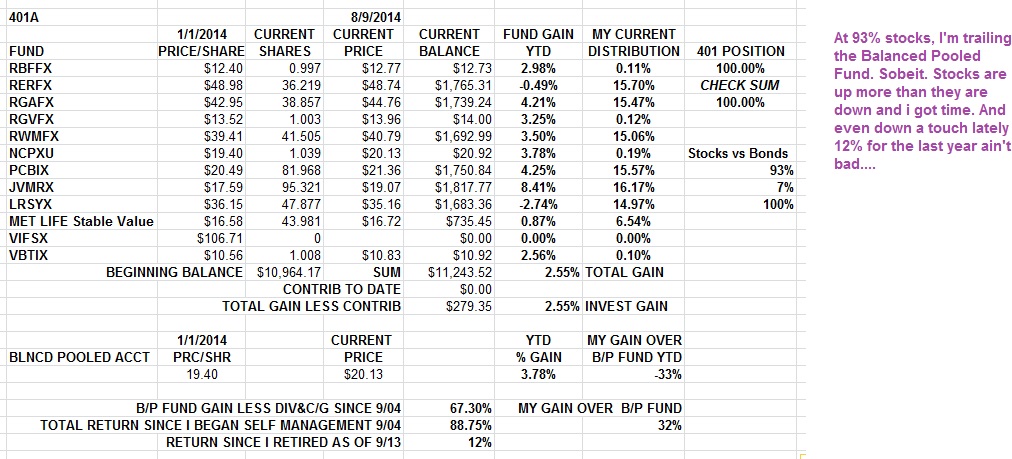

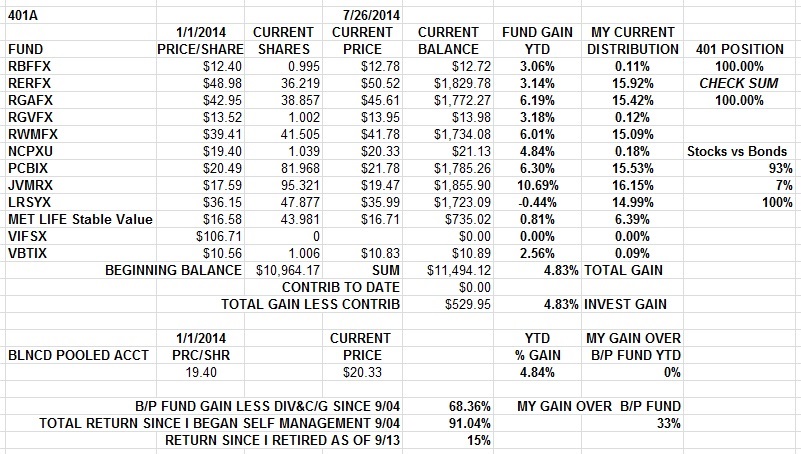

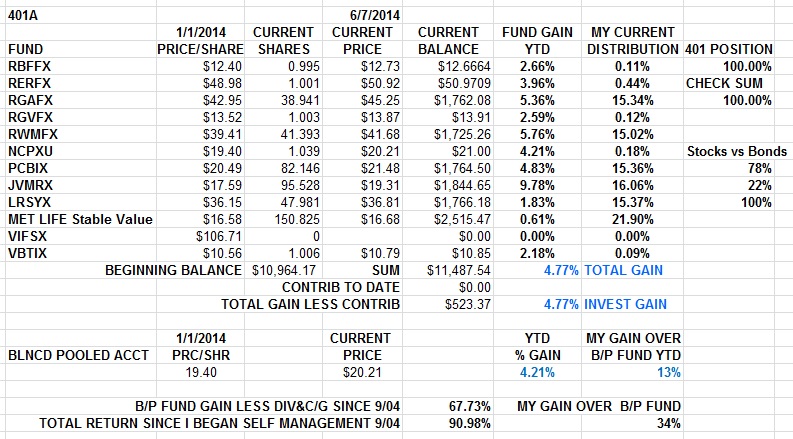

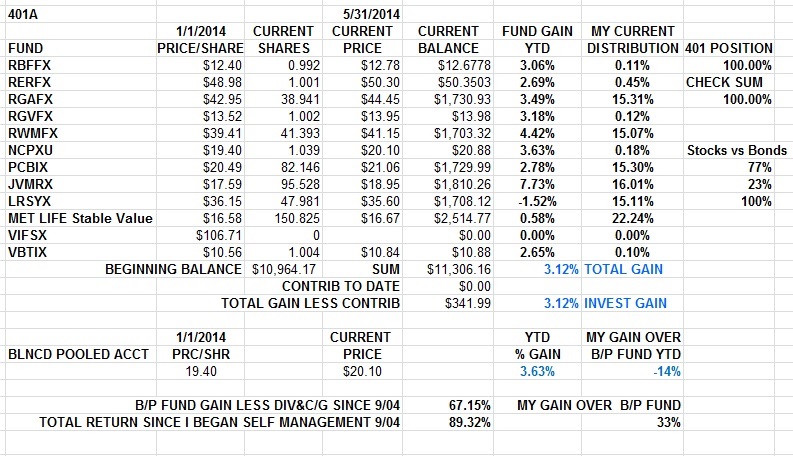

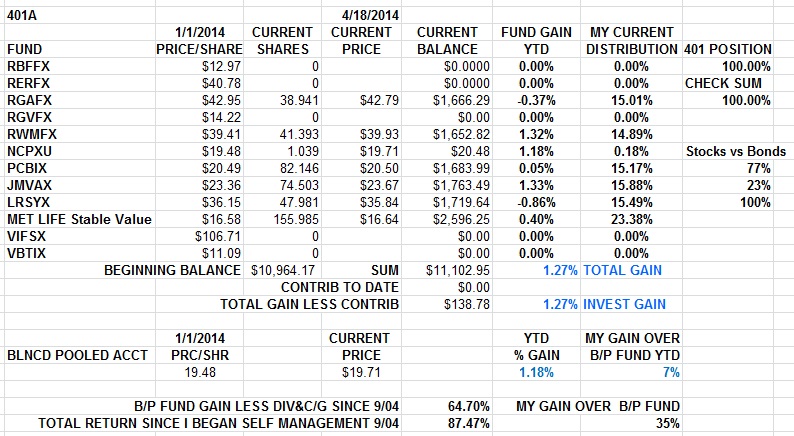

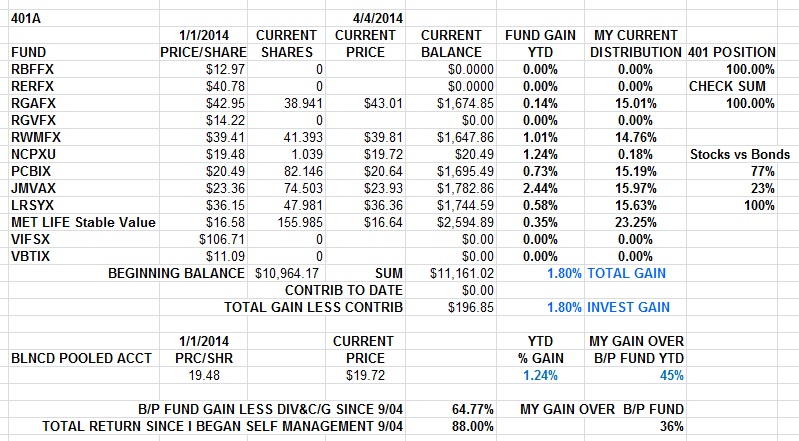

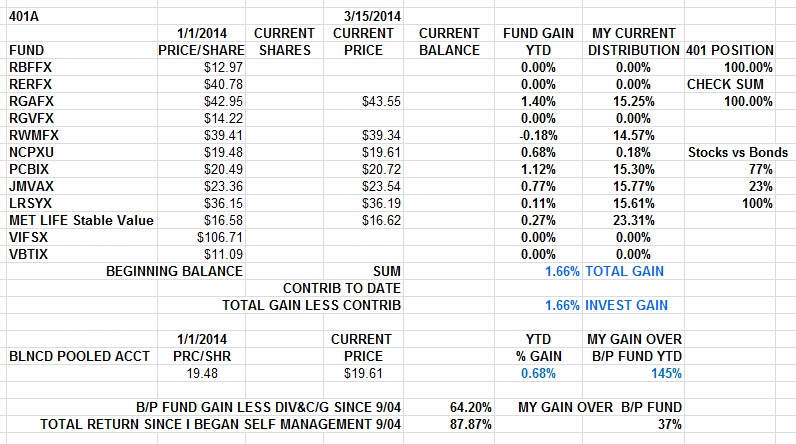

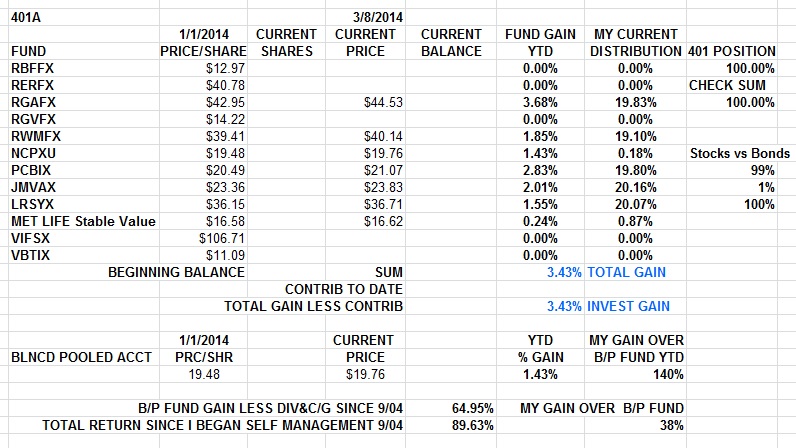

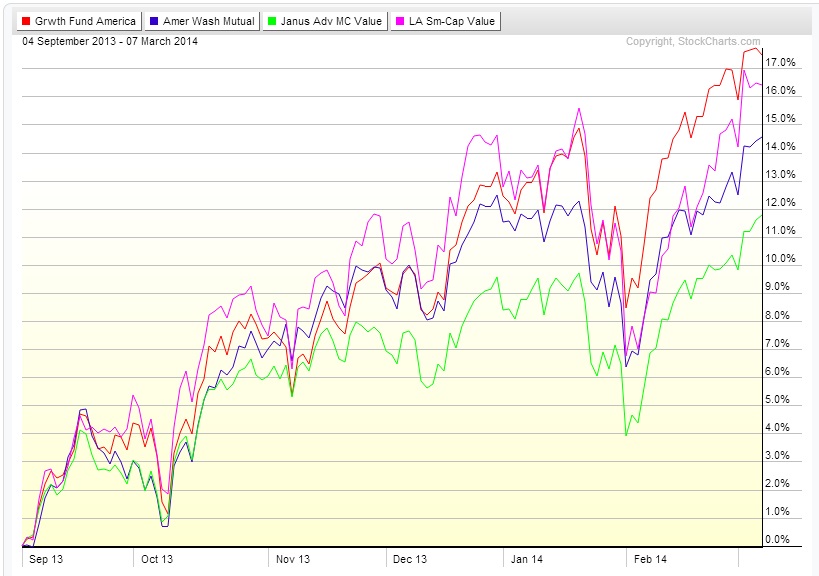

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year and since I started managing my 401(table), and how I've done since I started managing my 401 post retirement in 2013 (chart).

Note that this is my personal 401 account, managed for and by me, as I see fit, for Where my head is at and my perceived needs. I have Social Security and a defined benefit pension for regular income and I am looking to generate serious returns on my retirement savings for future use when my fixed pension income falls seriously behind my cost of living inflated needs. I am aggressive in nature but with three generations (wife and I, kids, and grandkids) to think about, I gotta make the right moves. I can stand the volatility of this approach, the gains are proven, and it is a plan. It's my plan..

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

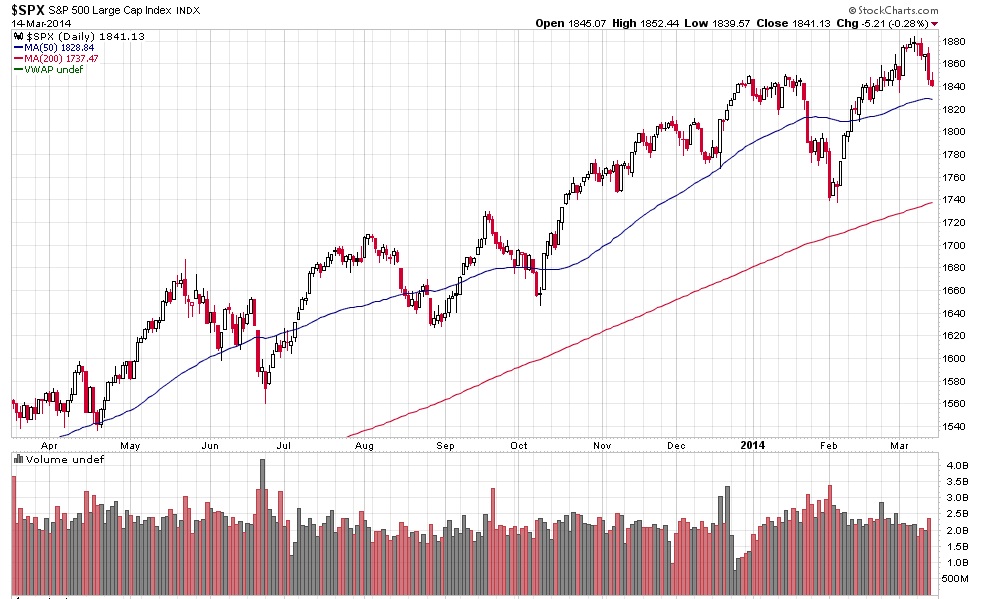

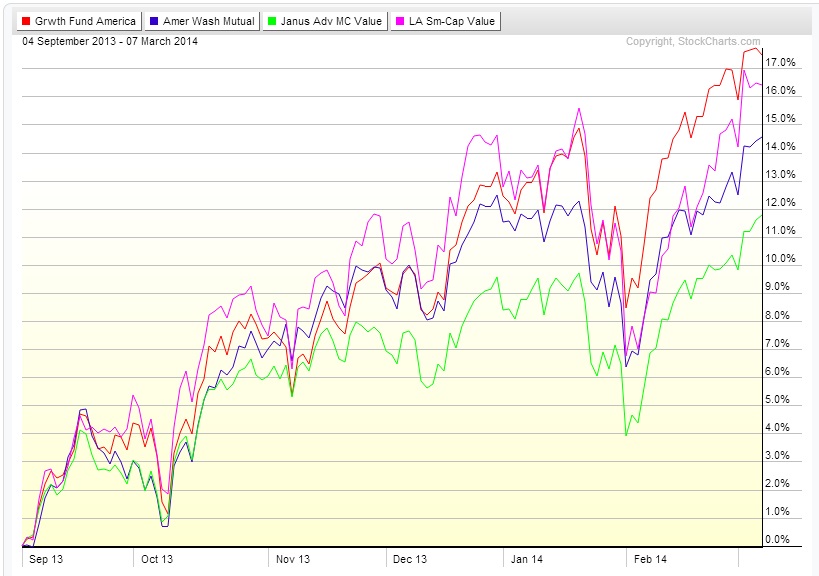

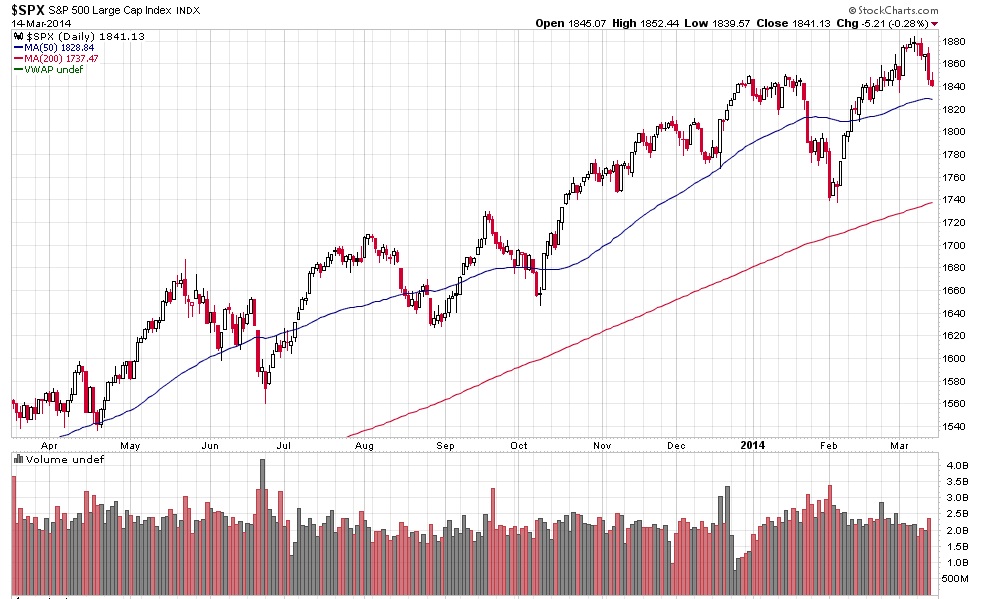

Here's what I see onna chartz..... Thinkin' 'bout upping the stocks vs bonds back up closer to 100%...

BLEAHH.....

http://www.businessinsider.com/iran-ira ... lks-2014-6

One of the financial blogs I follow had a post onna Harley electrical bike prototype. I have been catching up on my gearhead reading and it is plain where we are heading in transportation and motorsports. It is going high tech and green. Think 1950's black bakelite tabletop phone vs iphone/Galaxy. It Is What It Is and with good reason but lookie here...

http://www.ritholtz.com/blog/2014/06/li ... /#comments

I just can't imagine rolling thunder... The electric race bikes at BEST give a whistle like a jet fighter on glide path...

So I stuck my oar inna Comments...

...

Eco Boost three and four cylinder motors and CVT and Stop/Start Idle/Stop motors everywhere?

2014 Harley 500cc and 750 cc beginner bikes and now an electric bike?

Honda crossbreeding scooters (NM 4 and DM-01) with their next generation motorcycles ?

...

It Is The End Of The World As We Know It (Or The Weekend) And I Feel Fine.....

Knee surgery is getting smaller inna rear view mirror...

Saturday...

http://www.businessinsider.com/draper-d ... tes-2014-6

Speaking Of Divided States...

http://www.businessinsider.com/should-i ... art-2014-6

http://www.businessinsider.com/sunni-re ... raq-2014-6

http://www.thereformedbroker.com/2014/0 ... id-assets/

Sunday...

Monday...

http://www.businessinsider.com/markit-f ... 014-2014-6

Boom And Bust; One Decade Finds You As A Master Of The Universe...And The Next One Finds You Out Onna Street.

http://www.businessinsider.com/wall-st- ... mer-2014-6

It's easy to be comfortable with the world as you thought it was. It is less easy to be comfortable with the way it has changed...

http://www.businessinsider.com/john-sch ... ato-2014-6

That's What I'm Talkin' About....

http://www.thereformedbroker.com/2014/0 ... ot-a-plan/

Shack of shit.

http://www.cnn.com/2014/06/23/politics/ ... ?hpt=hp_t2

Tuesday...

http://www.businessinsider.com/zillow-e ... ket-2014-6

Jeesus...

http://www.businessinsider.com/winners- ... sis-2014-6

http://www.businessinsider.com/obamas-i ... ugh-2014-6

Money...

http://pragcap.com/david-andolfatto-get ... risk-right

Make Me A Dollar...

http://lowermytrigs.com/Rick-Story.html

I own shares of amrn.

http://nymag.com/news/frank-rich/iraq-war-2014-6/

Thursday...

In fucking credible... And you think your pension fund is treated any better?

http://www.thereformedbroker.com/2014/0 ... he-drunks/

Kid Dynamite's Take: Ya run a clip joint, you're a crook and your long time customers are idiots or not taking care of their customers...

http://kiddynamitesworld.com/hear-g-sch ... dark-pool/

( 3 / 1180 ) ( 3 / 1180 )

This Gettin' Old Ain't Fer Sissies....... Getting New Knees HURTS!!!!

Saturday, May 31, 2014, 03:45 PM

“I’m always thinking about losing money as opposed to making money. Don’t focus on making money; focus on protecting what you have.”

—Paul Tudor Jones

Ahm jes' anudder ol' broked down retahrd union pipefitter.

I retired in September of 2013 after 40 years in the trade, five years after this picture was taken. At the time, there was only one retired pig inna picture. Now there would be two...

I had started actively managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1991. I was too busy raising a family, building America, and riding, racing and writing about motorcycles to pay any attention to saving for retirement. After all I had my Defined Benefit Plan and an IRA or two. What more could I need? Big mistake. I had contributed the minimum amount to the Defined Contribution Plan and left the funds in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash had crushed them, and as an afterthought, I then applied the same kind of evaluation to my 401 account and to my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story of both my IRA's and 401 are in part on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to save some serious coin and to make serious returns for my retirement. It worked out really well... So far.

I have a nice income from my defined benefit pension plan and Social Security. Today. But my pension plan has no cost of living adjustment.

"What Is Hip Today Might Become Passe'"

-- Tower Of Power

http://www.youtube.com/watch?v=SN8pWdZhVaM

http://www.youtube.com/watch?v=vauqRuvzVgs

Only 30% of my pension income, the Social Security part, adjusts for inflation. The continued wellbeing of my wife and I is dependent on how I handle my retirement savings.

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year and since I started managing my 401(table), and how I've done since I started managing my 401 post retirement in 2013 (chart).

Note that this is my personal 401 account, managed for and by me, as I see fit, for Where my head is at and my perceived needs. I have Social Security and a defined benefit pension for regular income and I am looking to generate serious returns on my retirement savings for future use when my fixed pension income falls seriously behind my cost of living inflated needs. I am aggressive in nature but with three generations (wife and I, kids, and grandkids) to think about, I gotta make the right moves. I can stand the volatility of this approach, the gains are proven, and it is a plan. It's my plan..

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

http://www.politico.com/magazine/story/ ... 4ow0PmICm4

In Fucking Credible... Grrrr.

http://www.washingtonpost.com/sf/nation ... -coverups/

Tuesday...

http://www.businessinsider.com/nra-stat ... ers-2014-6

Wednesday...

http://www.businessinsider.com/shake-sh ... ers-2014-6

http://www.businessinsider.com/when-the ... ded-2014-6

http://pragcap.com/should-you-use-an-au ... nt-service

Thursday...

http://www.businessinsider.com/preet-bh ... ent-2014-6

http://www.nytimes.com/2014/06/04/opini ... .html?_r=0

( 2.9 / 1318 ) ( 2.9 / 1318 )

I've Owned And Run A High End Audio Company, Done Electromechanical Design And Packaging For Consumer Electronics, Project Managed Mechanical, High Purity And Biotech Projects, Helped Put Cold Spring In 14 Stories Of Main Steam Line At A Coal Fired Power Plant, Walked The Steel, Pushed A Broom, And Hung From A Man Basket To Tighten Bolts As Required. But Now I'm Retired.

Saturday, May 10, 2014, 02:15 PM

“I was recently on a tour of Latin America, and the only regret I have was that I didn't study Latin harder in school so I could converse with those people”

- Dan Quayle

Back A'fore Yer Tahm...

http://www.youtube.com/watch?v=cYh5oMDlWwQ

The Rascals Did The First Set At The 'mo In Little Lord Fauntlaroy Outfits. They Looked At The Audience And Did The Rest Of The Engagement In Levi's. VERY Competent Musicians And A Great Show.

http://www.youtube.com/watch?v=xA7CPmNqjek

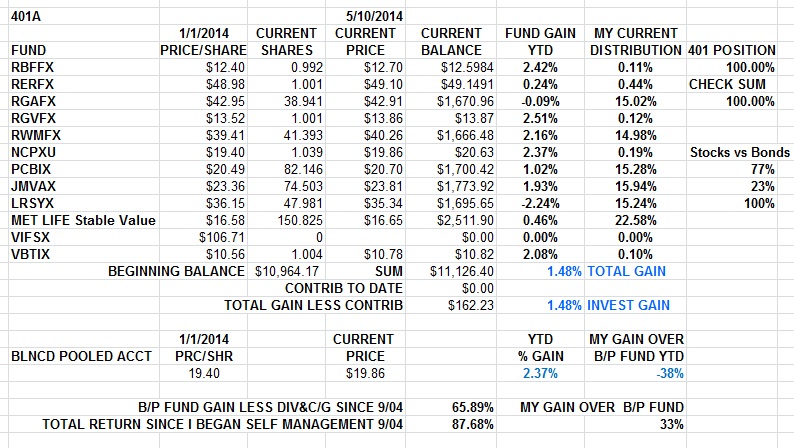

Ahm jes' anudder ol' broked down retahrd union pipefitter.

I retired in September of 2013 after 40 years in the trade, five years after this picture was taken. At the time, there was only one retired pig inna picture. Now there would be two...

I had started actively managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1991. I was too busy raising a family, building America, and riding, racing and writing about motorcycles to pay any attention to saving for retirement. After all I had my Defined Benefit Plan and an IRA or two. What more could I need? Big mistake. I had contributed the minimum amount to the Defined Contribution Plan and left the funds in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash had crushed them, and as an afterthought, I then applied the same kind of evaluation to my 401 account and to my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story of both my IRA's and 401 are in part on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to save some serious coin and to make serious returns for my retirement. It worked out really well... So far.

I have a nice income from my defined benefit pension plan and Social Security. Today. But my pension plan has no cost of living adjustment.

"What Is Hip Today Might Become Passe'"

-- Tower Of Power

http://www.youtube.com/watch?v=SN8pWdZhVaM

http://www.youtube.com/watch?v=vauqRuvzVgs

Only 30% of my pension income, the Social Security part, adjusts for inflation. The continued wellbeing of my wife and I is dependent on how I handle my retirement savings.

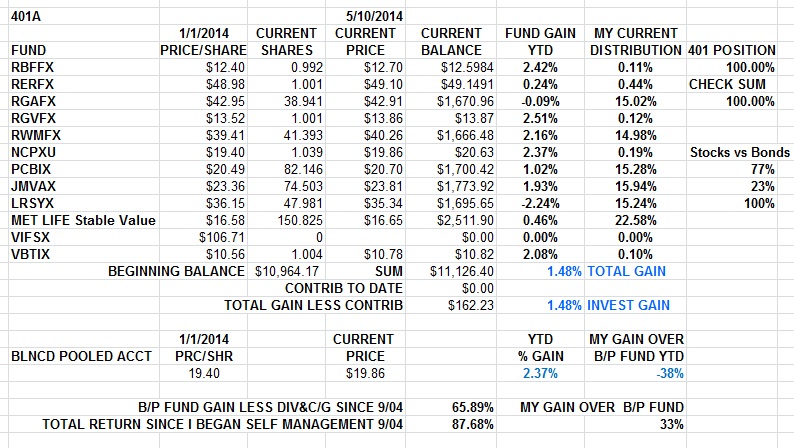

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year and since I started managing my 401(table), and how I've done since I started managing my 401 post retirement in 2013 (chart).

Note that this is my personal 401 account, managed for and by me, as I see fit, for Where my head is at and my perceived needs. I have Social Security and a defined benefit pension for regular income and I am looking to generate serious returns on my retirement savings for future use when my fixed pension income falls seriously behind my cost of living inflated needs. I am aggressive in nature but with three generations (wife and I, kids, and grandkids) to think about, I gotta make the right moves. I can stand the volatility of this approach, the gains are proven, and it is a plan. It's my plan..

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

( 2.9 / 1238 ) ( 2.9 / 1238 )

I'm A Demon Tube Bender, Detailer, Layout Hand, Very Competent Heavy Rigger, Instrument Tech, Copper Hand, And Stick Welder. But Mostly, I'm Retired.

Monday, May 5, 2014, 10:33 AM

[ view entry ] ( 838 views ) [ 0 trackbacks ] permalink      ( 3 / 1247 ) ( 3 / 1247 )

Jes' Another Old Retahrd Broked Down Welder Wanna Be....

Wednesday, April 16, 2014, 01:48 PM

"Some men worship rank, some worship heroes, some worship power, some worship God and over these ideals they dispute, but they all worship money."

--Mark Twain

A Different Interpretation....

http://www.youtube.com/watch?v=DWnE8XzynNg

http://www.youtube.com/watch?v=B19eX3UjqV8

But, Sometimes The Same Ol'Same Ol' Works Jes' Fine.

http://www.youtube.com/watch?v=xuxHvlD1t-c

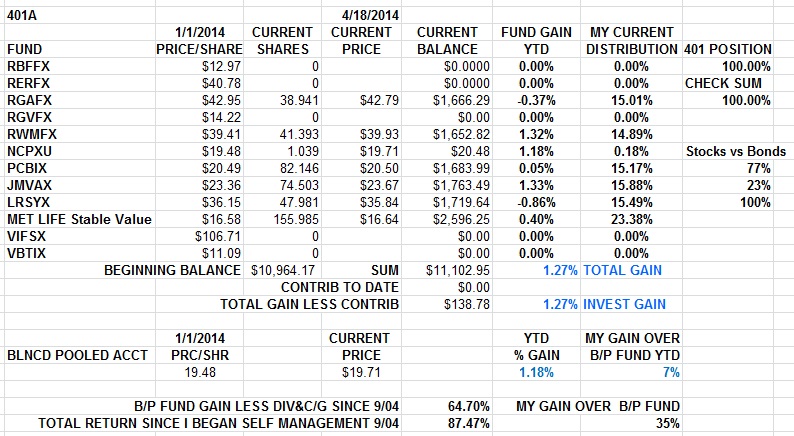

Ahm jes' anudder ol' broked down retahrd union pipefitter.

I retired in September of 2013 after 40 years in the trade, five years after this picture was taken. At the time, there was only one retired pig inna picture. Now there would be two...

I had started actively managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1991. I was too busy raising a family, building America, and riding, racing and writing about motorcycles to pay any attention to saving for retirement. After all I had my Defined Contribution Plan and an IRA or two. What more could I need? Big mistake. I had contributed the minimum amount to the Defined Benefit Plan and left the funds in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash had crushed them, and as an afterthought, I then applied the same kind of evaluation to my 401 account and to my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story of both my IRA's and 401 are in part on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to save some serious coin and to make serious returns for my retirement. It worked out really well... So far.

I have a nice income from my defined benefit pension plan and Social Security. Today. But my pension plan has no cost of living adjustment.

"What Is Hip Today Might Become Passe'"

-- Tower Of Power

http://www.youtube.com/watch?v=SN8pWdZhVaM

http://www.youtube.com/watch?v=vauqRuvzVgs

Only 30% of my pension income, the Social Security part, adjusts for inflation. The continued wellbeing of my wife and I is dependent on how I handle my retirement savings.

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year and since I started managing my 401(table), and how I've done since I started managing my 401 post retirement in 2013 (chart).

Note that this is my personal 401 account, managed for and by me, as I see fit, for my headspace and my perceived needs. I have Social Security and a defined benefit pension for regular income and I am looking to generate serious returns on my retirement savings for future use when my fixed pension income falls seriously behind my cost of living inflated needs. I am aggressive in nature but with three generations (wife and I, kids, and grandkids) to think about, I gotta make the right moves. I can stand the volatility of this approach, the gains are proven, and it is a plan. It's my plan..

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

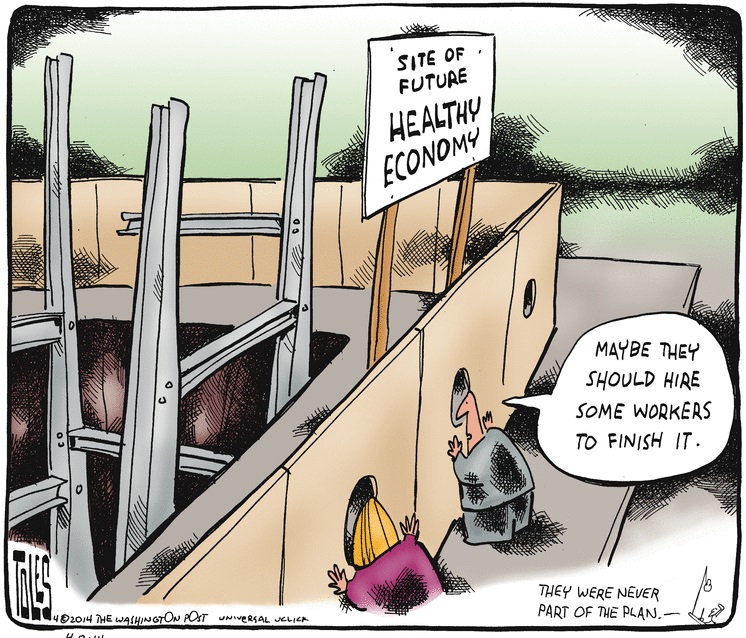

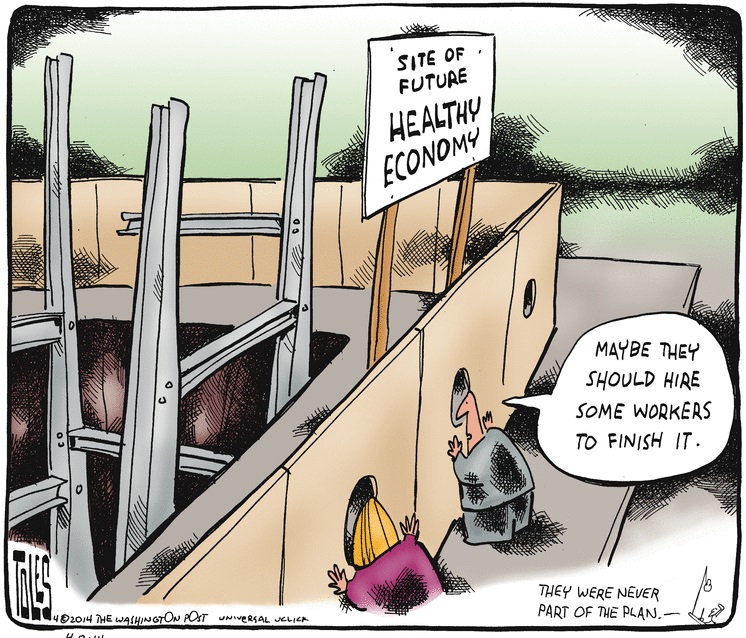

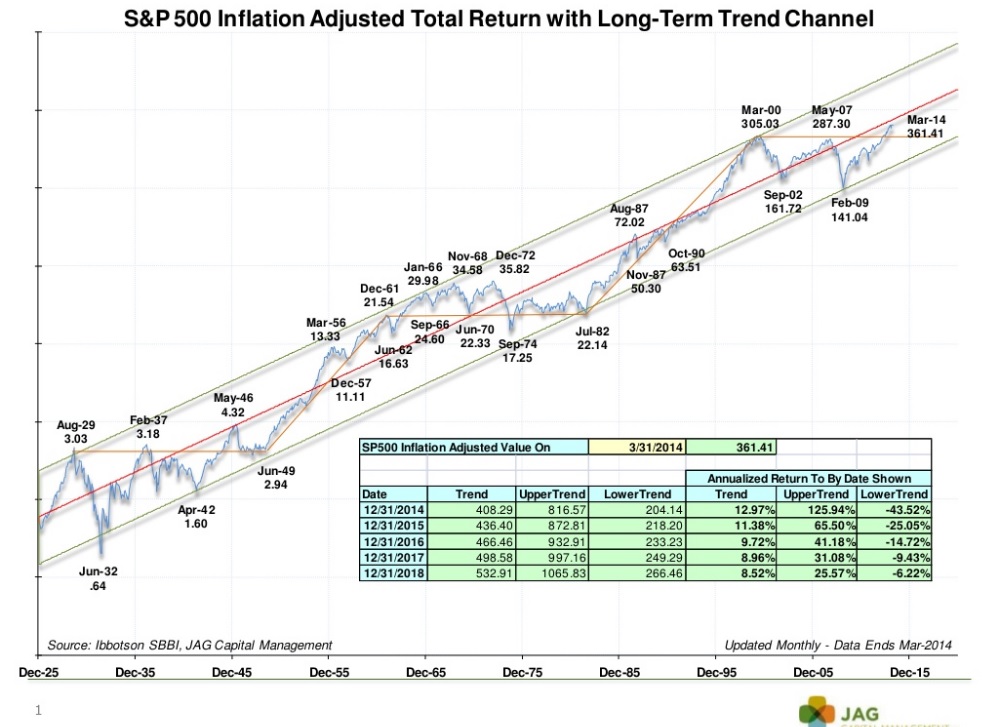

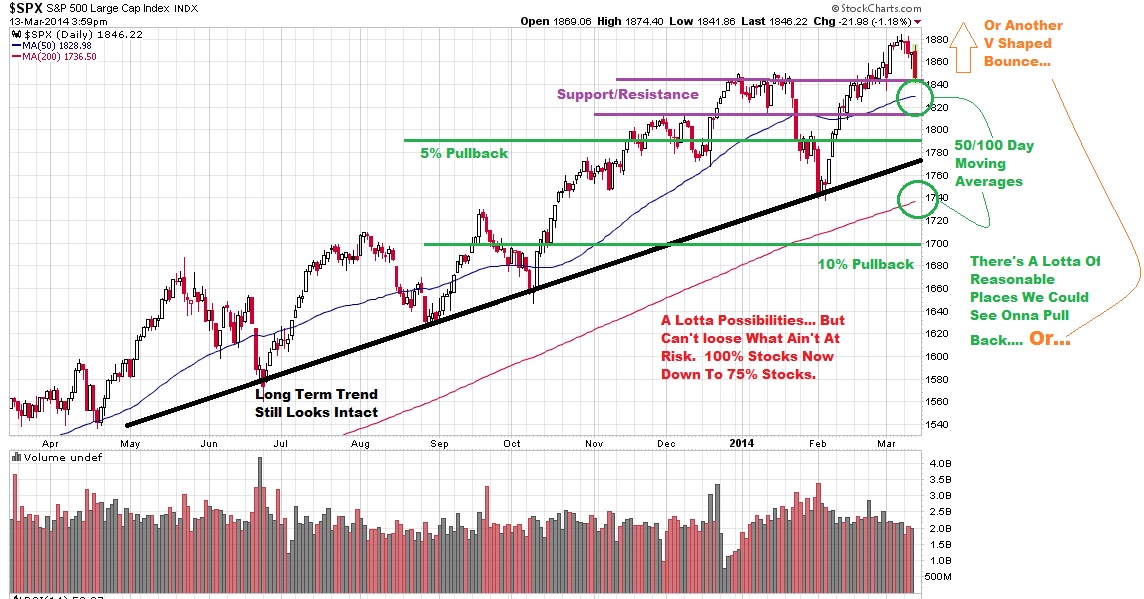

From A Guy Whose Work I Respect... Norm Conley Of JAG Advisors. CLICKONNIT!!

Note The Long Term Nature Of The Chart, The Amber Line, And Where We Are...

Hometown Stuff,

http://www.businessinsider.com/new-hous ... ate-2014-4

HUGE....

http://www.thereformedbroker.com/2014/0 ... ond-rings/

http://www.ritholtz.com/blog/2014/04/4t ... oil-spill/

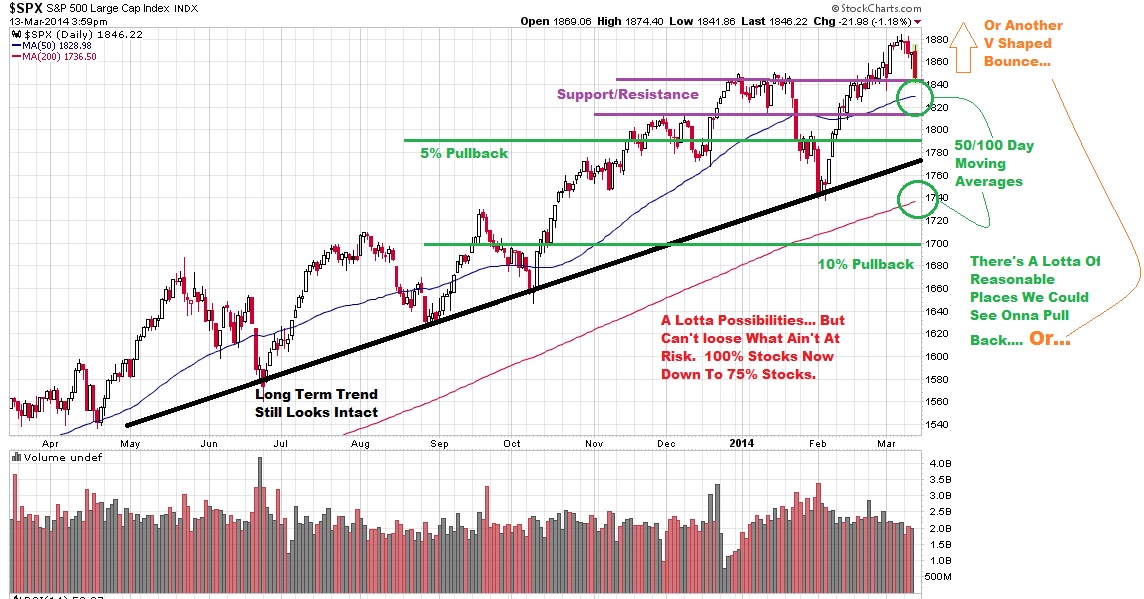

I've been pretty much fully invested in stocks for the last year and a half. I've backed down to 75% recently on increased risk/reduced reward. We will eventually have a more serious correction and also a bear market. At those times I will look at buying the dip for the correction, ror reducing exposure to stocks further for a bear market. I'm staying put for now... Stay tooned....

Good Friday

http://www.calculatedriskblog.com/2014/ ... -year.html

http://www.calculatedriskblog.com/2014/ ... te-in.html

http://blogs.reuters.com/felix-salmon/2 ... z-edition/

Sunday...

http://www.businessinsider.com/american ... ent-2014-4

http://www.washingtonpost.com/business/ ... story.html

http://www.newyorker.com/online/blogs/e ... ld-me.html

Politics...

http://www.newyorker.com/reporting/2014 ... fact_lizza

http://www.njspotlight.com/stories/14/0 ... lly/?p=all

http://www.chicagomag.com/Chicago-Magaz ... ime-rates/

Tower Of Power Tuesday...

http://www.youtube.com/watch?v=XLSS1vq8c4o

Thursday

Gambler's Fallacy.... Yeah, But...

http://www.businessinsider.com/the-gamb ... and-2014-4

Friday

http://www.businessinsider.com/russia-d ... ing-2014-4

http://www.businessinsider.com/russia-downgrade-2014-4

Yep, Seen This Movie Before.....

http://www.cnn.com/2014/04/25/opinion/b ... ?hpt=hp_c2

( 3 / 1272 ) ( 3 / 1272 )

Jes' Anudder Broked Down Ol' Retahrd Pipefighter

Saturday, April 5, 2014, 03:08 PM

Nothing helps a bad mood like spreading it around.

-- Bill Watterson

Low Down Dirty Bloos... Sloe Gin

http://www.youtube.com/watch?v=F1_6yCHnSI4

Ana Chaser...

http://www.youtube.com/watch?v=nbI19ttJqWI

Here's The Dessert...

http://www.youtube.com/watch?v=YnG7SR6kl2w

I retired in September of 2013. I had started managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1993. I was too busy raising a family and building America to pay attention. I had contributed the minimum amount and left in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash crushed them and as an afterthought, I then applied the same kind of evaluation to my 401 and my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story in part is on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to put away some serious coin and to make serious money for my retirement.

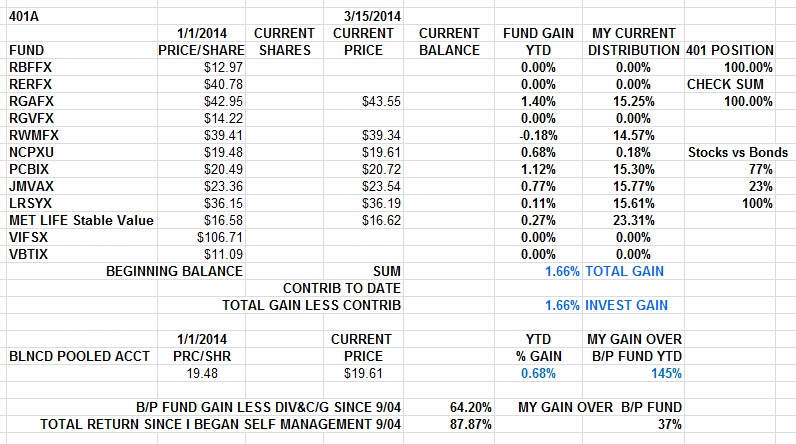

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year, and how I've done since I started managing my 401 in 2003.

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

( 3 / 1213 ) ( 3 / 1213 )

Jes' Another Old Broke Down Retired Pipefitter.....

Thursday, March 27, 2014, 11:18 AM

I am always ready to learn, although I do not always like being taught.

-- Winston Churchill

It May Not Feel Like It, But It's Over....

I retired in September of 2013. I had started managing my 401 in 2004, after leaving it untended and with the minimum contribution since its inception in 1993. I was too busy raising a family and building America to pay attention. I had contributed the minimum amount and left in the default Balanced Pooled Fund. But between 2000 to 2003, I had to straighten out a coupla my IRA's after the dotcom-9/11 financial crash crushed them and as an afterthought, I then applied the same kind of evaluation to my 401 and my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. The story in part is on my website.

Once I was able to get decent returns from my 401, I increased my contributions until I was maxed out and started to put away some serious coin and to make serious money for my retirement.

Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year, and how I've done since I started managing my 401 in 2003.

I've made a copy of the Excel spreadsheet I use to track and manage my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience.

I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination require based on what I read and some professional level subscription data. Running the blog keeps me honest with myself. Putting it in writing makes sure I really have a grip on the handle.

All This New Age Shit.....

http://www.upsidetrader.com/2014/03/27/ ... ype-drive/

Thinking.....

http://www.stratfor.com/weekly/estonia- ... er-ukraine

http://www.slate.com/articles/business/ ... e_fed.html

http://www.stratfor.com/analysis/ukrain ... ses-invade

http://blogs.reuters.com/felix-salmon/2 ... que-album/

Saturday...

http://www.stratfor.com/weekly/ukraines ... -challenge

http://www.stratfor.com/analysis/moldov ... tradiction

http://www.businessinsider.com/russias- ... eak-2014-3

Wu Tang...

http://blogs.reuters.com/felix-salmon/2 ... que-album/

Big Time 401 Shit...

http://www.nytimes.com/2014/03/30/busin ... 1-k-s.html

Nah, It Ain't A Bleedin' Heart, It's My Piles Bleedin' For De Pore Rich Folks...

http://www.nytimes.com/2014/03/27/opini ... akers.html

Happened At Berkeley Too, Big Time Wrong...

http://espn.go.com/video/clip?id=10671809

http://www.sbnation.com/2014/3/30/55635 ... iclebottom

Make It Real...

That's A Republican Political Position, It Has Different Characteristics Than Science...

http://www.latimes.com/business/la-fi-h ... z2xTUxB867

Tuesday

http://www.businessinsider.com/r-west-s ... cs-2014-01

The Issue Is With Inequality Creating A Political Tipping Point...

http://pragcap.com/thoughts-on-thomas-pikettys-capital

My old neighborhood....

http://www.businessinsider.com/noe-vall ... 014-4?op=1

Not my old place...

Wednesday

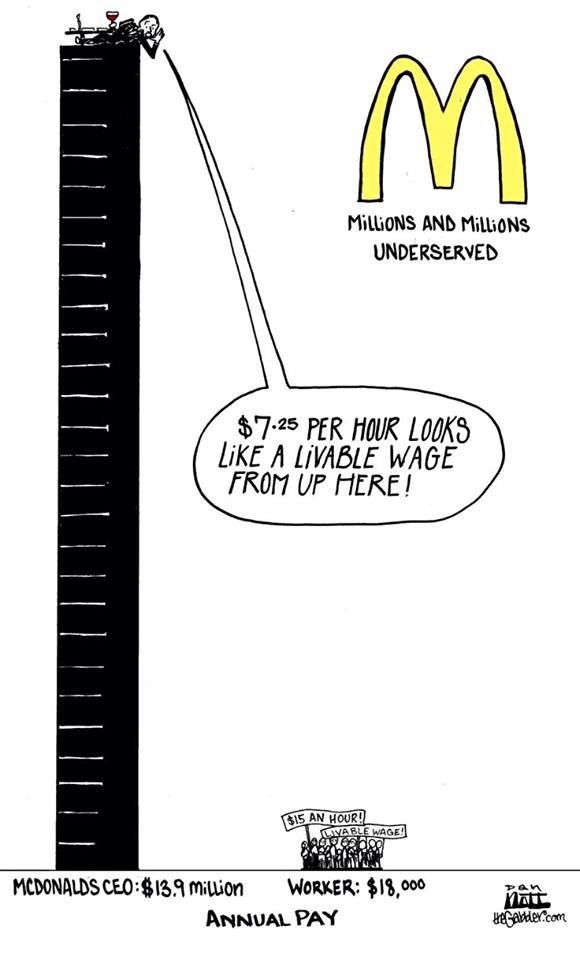

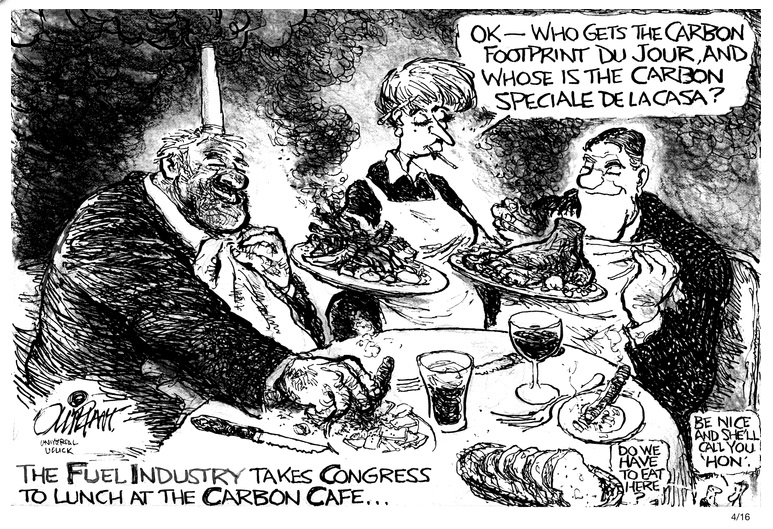

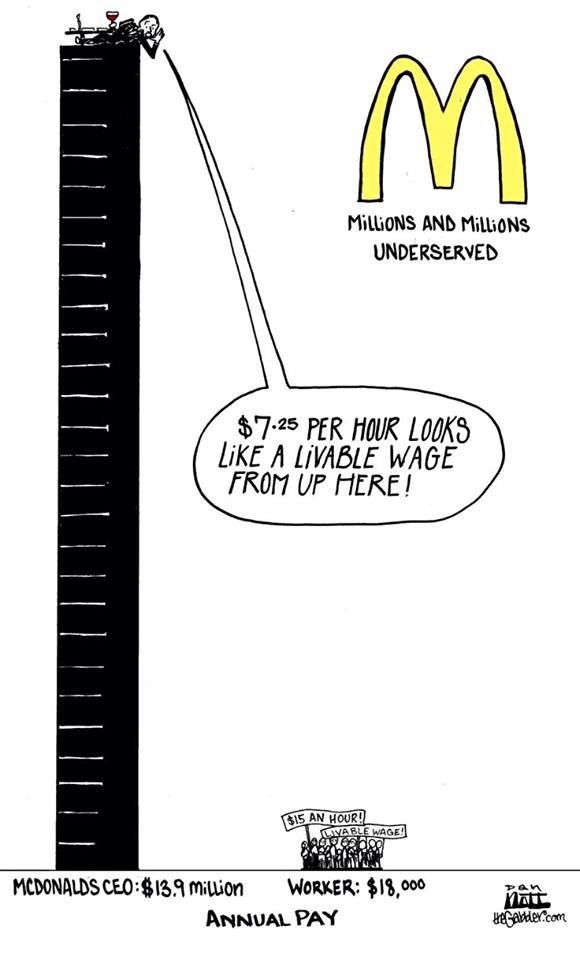

I'm A Union Guy....

http://www.businessinsider.com/mcdonald ... pay-2014-4

Thursday

http://www.businessinsider.com/russias- ... ato-2014-4

( 3 / 1204 ) ( 3 / 1204 )

Jes' Yer Friendly Neighborhood Brokedown Ol' Retahr'd Pipefitter......

Saturday, March 15, 2014, 02:47 PM

A bubble is a bull market in which you don't have a position.

-- Eddy Elfenbein

More 'Fats. Hollywood Fats W/ Canned Heat '79, The First Woodstock Ten Year Reunion. Not The New Improved Marketing Event Version. Blues An' Boogie Like An Old Favorite Shirt. Tattered and Oh So Comfortable.

http://www.youtube.com/watch?v=30Kq_qzdLbo

http://www.youtube.com/watch?v=XezIHzwuF04

http://www.youtube.com/watch?v=z1LGBO4o9sk

I retired in September of 2013. I had started managing my 401 in 2004, after leaving it untended since its inception in 1993. I had contributed the minimum amount and left in the default Balanced Pooled Fund. But in 200 to 2003 I had straightened out a coupla IRA's after the dotcom-9/11 financial crash and as an afterthought, applied the same kind of evaluation to my 401 and my defined benefit pension fund. I found both to be in desperate straights. I was able to help turn both around. That story is on my website. Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I've kept and $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year, and how Ive done since I started managing my 401 in 2003.

I've made a copy of the Excel spreadsheet I use to track my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience. I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination compel based on what I read and some professional level subscription data.

I come from an era of a morning and evening paper and three and a half TV channels.There is so much more available now.... Some ludicrious, some of dubious value, some real actual news, some insightful, some more history than news, Some recycled so much that it is beyond homogenized; Take yer pick.

http://www.debka.com/article/23764/US-R ... t-attack-.

http://www.businessinsider.com/crimea-r ... sia-2014-3

Look At This And See That Not Much Has Changed Since Last Week....

Still...

I don't think that the Ukraine situation will effect the economy that much, but it will affect peoples' mindset. I may lighten up a little more come Monday afternoon. I'm up 11% since 9/1/13 and taking money of the table and getting some fresh air and a walk don't seem like such a bad thing... especially when there is uncertainty inn air.

Alternate View...

http://www.lakeviewasset.com/investment ... n-ukraine/

More Good Investment Advice....

http://blogs.wsj.com/moneybeat/2014/03/ ... -know-now/

Tuesday

Very interesting....

http://www.businessinsider.com/malaysia ... ire-2014-3

http://www.businessinsider.com/mark-gal ... elf-2014-3

Off To De Record Cabinet For Sum R.L. Burnside. I Believe That Is His Grandkids On Drums And Bass...

https://www.youtube.com/watch?v=o9oAAyHrnIs

https://www.youtube.com/watch?v=Nf_nL5KWcWM

https://www.youtube.com/watch?v=54PV_921LtU

From The Same Movie...

https://www.youtube.com/watch?v=yYY06G4R7zY

http://blogs.reuters.com/felix-salmon/2 ... ssia-bond/

( 3 / 1250 ) ( 3 / 1250 )

Jes' Yer Friendly Neighborhood Retahr'd Ol' Pipefitter......

Friday, March 7, 2014, 02:06 PM

Humility, along with the ability of those who have been wrong to acknowledge their mistakes, are at all-time lows and, sadly, trending lower still. Ideology can apparently hold sway against reason, facts, and data for longer than I’d imagined.

-- Invictus

Miles to go. Tutu.

http://www.youtube.com/watch?v=_dq1dv6xY6w

'Masa RCFP

http://www.youtube.com/watch?v=EKnwgPdfeA4

Back Inna Day, We were All Cold Blooded...

http://www.youtube.com/watch?v=cLb6rUZlJ7A

http://www.businessinsider.com/robert-r ... urn-2014-3

http://www.youtube.com/watch?v=cHWLpJRlBYA#t=11 Tha'sjes 'na whayetizzzz..... Greezel.

I retired in September of 2013. I started managing my 401 in 2004, after leaving it untended since its inception in 1993. I had straightened out a coupla IRA's after the dotcom-9/11 financial crash and as an afterthought, applied the same evaluation to my 401 and found it and my defined benefit pension fund in desperate straights. I was able to help turn both around. In part, that story is on my website. Since retirement, I've given almost all of my 401/IRA balance over to professionals. But not all. I'm kept and am managing $10K in my Union 401 account to provide a benchmark for the professionals and to keep the 401 account open should I decide to take management of the funds back. Here's where I have the money allocated, how I've done this year, and how Ive done since I started managing my 401 in 2003.

Here's an Interactive Performance Chart of the funds I have available to me in the 401 and how they've done since 9/1/13.

I've made a copy of the Excel spreadsheet I use to track my 401 available to download on my website. If you are not in my Local, the spreadsheet can be adapted to other 401s and other mutual funds by someone with a modicum of Excel experience. I post here what I read that I find of significance or interest. I allocate funds within the 401 between aggressive and conservative allocations as circumstance and inclination compel based on what I read and some professional level subscription data.

Food fer thought...

http://schaefferstradingfloor.com/why-t ... r-15-years

If Could Only Read And Act On One Post A Week...

http://oldprof.typepad.com/

Major Seriousness About 401's

http://www.washingtonpost.com/business/ ... story.html

Monday

Ya Think????

http://www.businessinsider.com/ponzicoin-2014-3

Thursday.

Nothing is as it seems....

http://www.businessinsider.com/update-o ... ght-2014-3

( 3 / 1194 ) ( 3 / 1194 )

<< <Back | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Next> >>

|

|

Calendar

Calendar