AoxoMoxoA... Palindrome Or Conundrum? Threat Or Menace? Juvenile Jackanapes? Or Is It Just Retibulent Praecidualism?

For a substantial portion of the American business and professional class, a book entitled "Life Without Lawyers" must surely conjure some of the same feelings evoked in faithful readers of the Harlequin romances, a sort of vicarious fantasy filled by the joy of liberation from burdens, strictures, and anxieties that have come to define quotidian existence. Such people are, in my experience, called clients.

The TV business is a cruel and shallow money trench along plastic hallways where thieves and pimps run free and good men die like dogs. There's also a negative side.

Hunter S. Thompson

Chartz And Table Zup @ www.joefacer.com

Real Busy This Week....

Readin' This...

http://www.lala.com/#song/360569479529542632

http://www.bloomberg.com/apps/news?pid= ... amp;pos=15

http://www.npr.org/templates/story/stor ... =121087285

http://www.ritholtz.com/blog/2009/12/th ... more-45426

http://www.nytimes.com/2009/12/06/busin ... .html?_r=1

http://online.wsj.com/article/SB1000142 ... 98298.html

http://www.ritholtz.com/blog/2009/12/sa ... n-version/

http://www.ritholtz.com/blog/2009/12/wh ... us-dollar/

http://www.cnas.org/blogs/abumuqawama/2 ... hower.html

http://www.ritholtz.com/blog/2009/12/sa ... n-version/

http://www.nytimes.com/interactive/2009 ... trics.html

http://www.ritholtz.com/blog/2009/12/be ... more-45383

http://www.ritholtz.com/blog/2009/11/fo ... ord-highs/

http://www.ritholtz.com/blog/2009/12/ji ... -bernanke/

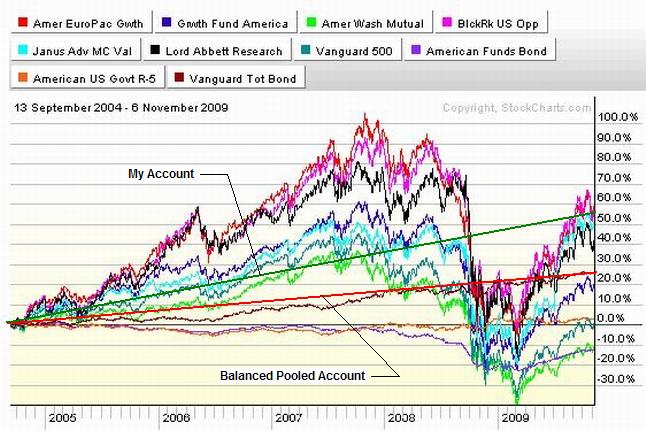

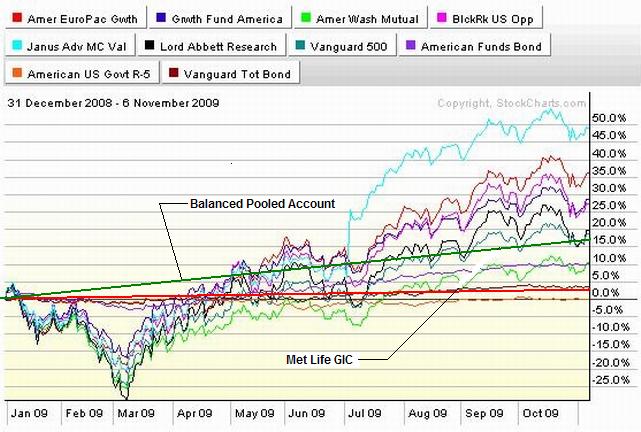

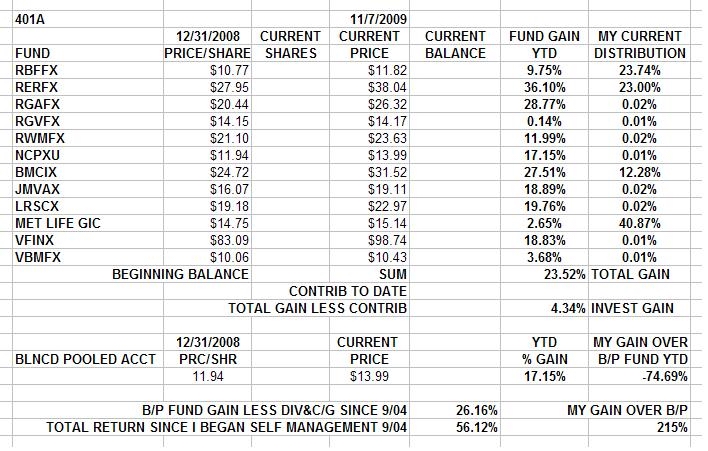

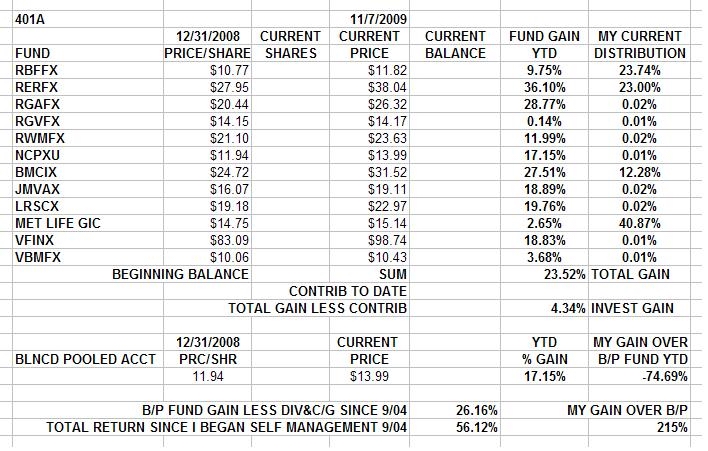

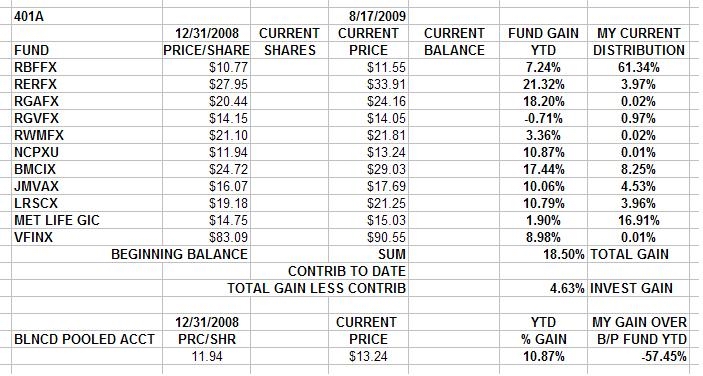

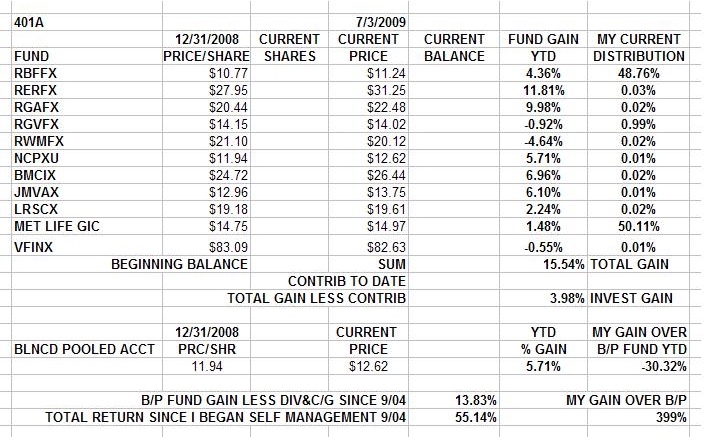

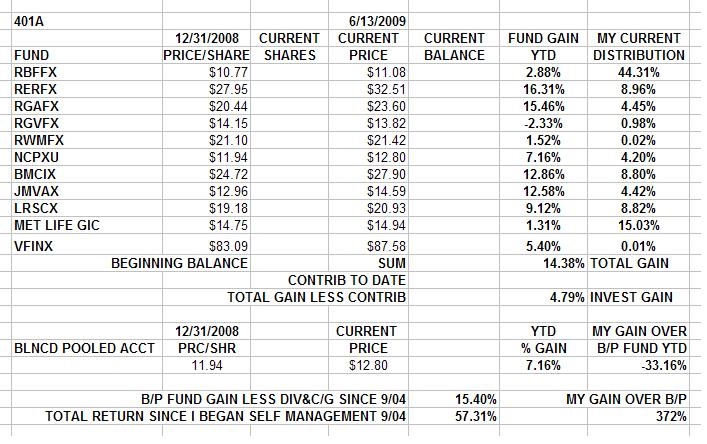

Bob worked along side Bill Sams. Read this and check out Mutual Fund Lessons on my web page....

http://www.bloomberg.com/apps/news?pid= ... QR.jbVgmFE

lookin' at this

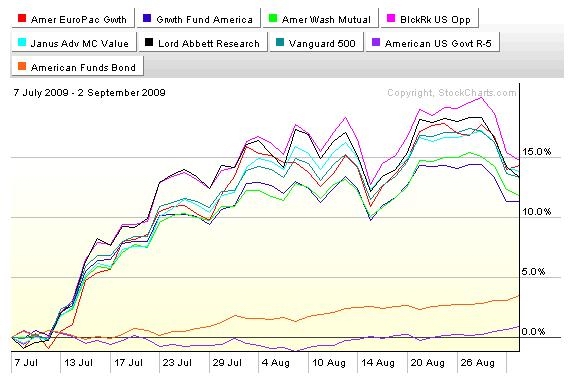

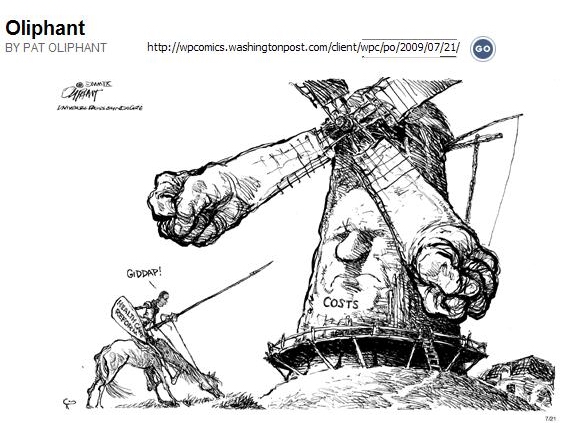

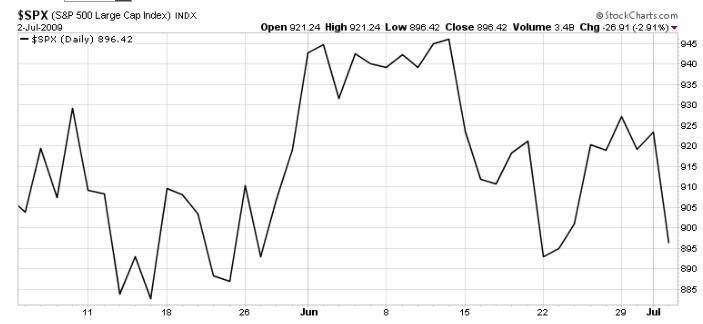

Consolidating for a push higher?

The pause at the end of the bounce before it rolls over and plummets?

I'm lightening up on stocks a little each day.

Stay Tooned.....

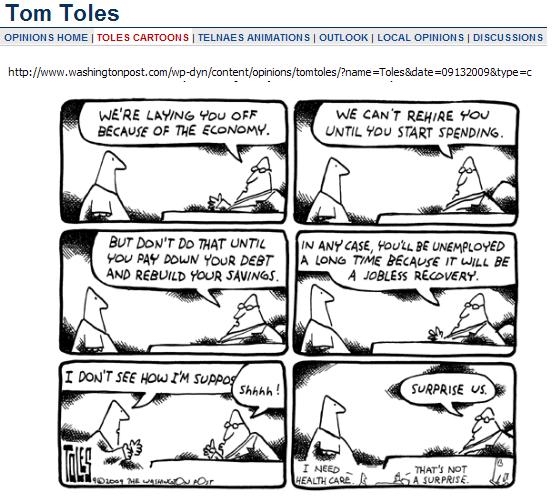

Surprise, surprise, surprise!

-- Gomer Pyle

Chartz and Table Zup @ www.joefacer.com

Another Kick Ass Cover Of A Kick Ass Eddie Cochran Song....

http://www.lala.com/#song/360569479529542632 Click On 20 Flight Rock

http://en.wikipedia.org/wiki/Twenty_Flight_Rock

Click It!!

Three year weekly chart. We just had two weeks where we opened up, went up , and finished the week badly. We've done it before during this rally and then gone higher. But valuations are higher and we are coming to the end of the year, and this market is the most hated rally in memory for a reason. I've been overly cautious for much of the year and I'll be right about it sometime. So the idea will be not to get caught too far extended when it does roll over....

The first three days of the week were up and I pretty much lightened up on stocks in my 401a and went to cash and bonds. I really lightened up in my IRA's and trading account.

It worked out well when I wandered out late in the AM Friday and saw what had happened over Thanksgiving Day. It was all about Dubai and some overdue whackage. I dodged the downdraft sleeping off Thanksgiving and lit up the screens near the top of the bounce. I had time to read enough to develop some ideas about what I wanted to do. So I bought some stocks halfway down the last red bar and some more stocks at the bottom of the bar. I gotta plan...

Stay Tooned. More to come this weekend....

Meanwhile, Back At The Ranch...

http://www.time.com/time/nation/article ... -1,00.html

http://www.debka.com/headline.php?hid=6394

http://www.nytimes.com/2009/11/29/busin ... f=business

http://www.slate.com/id/2236708/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.thestreet.com/story/10634076 ... tdown.html

http://www.msnbc.msn.com/id/34176802/ns ... _business/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.businessweek.com/magazine/co ... op+stories

http://www.unews.utah.edu/p/?r=112009-1

http://online.wsj.com/article/SB125934519959366715.html

http://www.theglobeandmail.com/report-o ... le1380944/

The Holiday Season Starts With Thanksgiving. If You have Looked Over The Edge As Many Of Us Have, You Know That Every Yesterday, Today, And Tomorrow Is a Gift. Get The Most Out Of Them And Spread The Largesse Around. Have A Kick Ass Thanksgiving....

Excuses change nothing but make everyone feel better.

-- Mason Cooley

Chartz And Table Zup @ www.joefacer.com.

Goin Down.....

http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

Lookie Here....

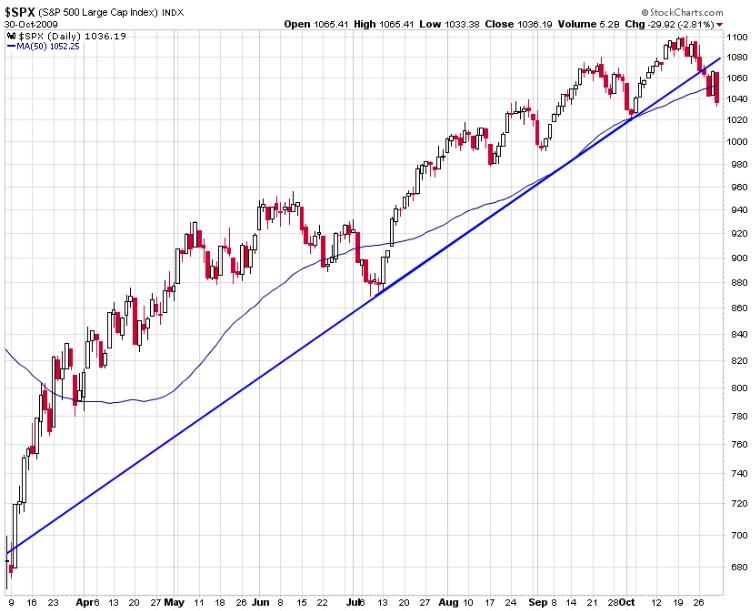

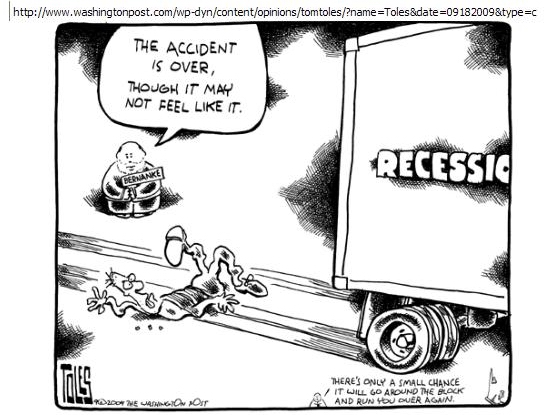

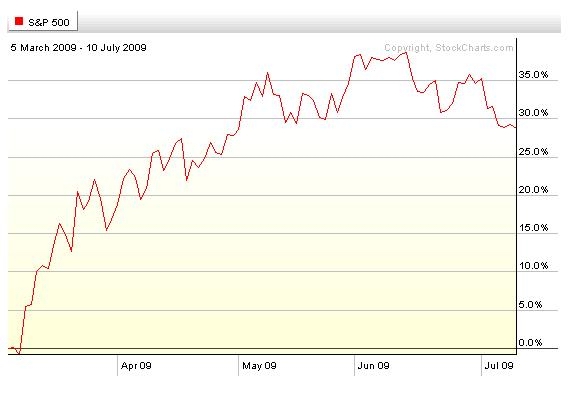

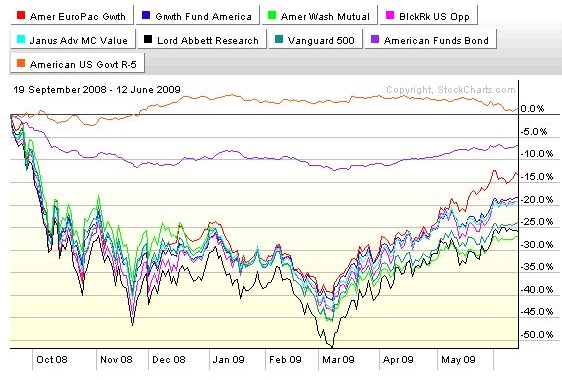

Check out this 3 year weekly chart on the S&P. We established a downtrend in late '07 and then went into a precipitous cascade down starting in October '08. The freefall quickly slowed into a sickening dive that ended in March '09. That was a huge oversold panic drop that led to markets and equities priced for the end of time by the end of '09.

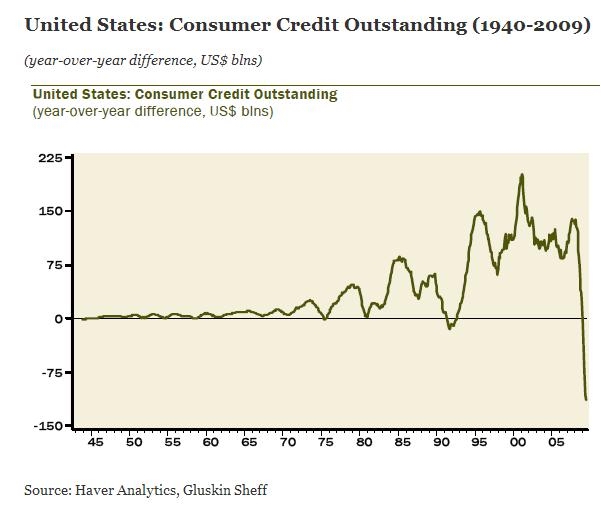

You don't need inventory or employees going into the end of time so businesses got really lean really sudden and the reduced revenues from people who still had jobs, savings, or credit, went straight to the bottom line. There were profits to report. The Fed and the Treasury cranked up the presses and flooded the world with cash at 0%. Nobody wanted to fund businesses or buy real estate so the money went into liquid (financial and commodity) paper assets. Everything got a bid. The markets went up on low volume and in an atmosphere of fear. As markets went up, participants were dragged in kicking and screaming, one at a time, moving the markets up more. Wash,rinse, repeat... It is still ongoing...

The weekly trend is up and continues up. There have been consolidations and corrections, but if you weren't long, you were wrong. I am now pretty much long stocks pretty much late in the year and pretty late in the move...

Check out this 8 month daily chart. The trend is still up, but we have had a coupla touches of the uptrend line with relaunches from there. We've also had a major reset at the end of October. The technicals still look good and Monday we gapped up hard in the AM. The economy hasn't mattered since March. Someday it will matter again. The longer it doesn't, the sooner it will. The reset was a first crack in the wall. The almost daily confirmation that the Fed and Treasury have the economy on a high pressure force fed diet of free cash and is aware of the risk of slowing the flows for even a moment is keeping what launched the economy off the bottom in place. It is The Infinite Intervention vs The Great Unwind at the start of an election year. The risks are huge. I reduced my exposure to stocks Friday and I may do so again even with the markets up.

When it's late and the party is really really wild, ya gotta edge toward the door whether you can hear the sirens yet or not....

Meanwhile, Back At The Ranch...

http://www.bloomberg.com/apps/news?pid= ... sHAD0w1egE

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.istockanalyst.com/article/vi ... id/3633323

http://www.ritholtz.com/blog/2009/11/ho ... of-the-us/

Why I've been in too much cash/bonds and not not enough stock...

http://cohort11.americanobserver.net/la ... final.html

http://www2.debka.com/headline.php?hid=6384

http://www.msnbc.msn.com/id/34067419/ns ... ssweekcom/

http://www.bloombergnews.com/apps/news? ... &pos=7

http://www.dailymail.co.uk/sciencetech/ ... world.html

http://www.bloomberg.com/apps/news?pid= ... tisP2sqI2I

http://www.msnbc.msn.com/id/34103722/ns ... ork_times/

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.ritholtz.com/blog/2009/11/bi ... -failures/

These Links Help You To Understand What I See....

http://www.aspousa.org/index.php/2009/1 ... eally-bad/

http://peakwatch.typepad.com/peak_watch ... round.html

http://www.ritholtz.com/blog/2009/11/do ... s-soaring/

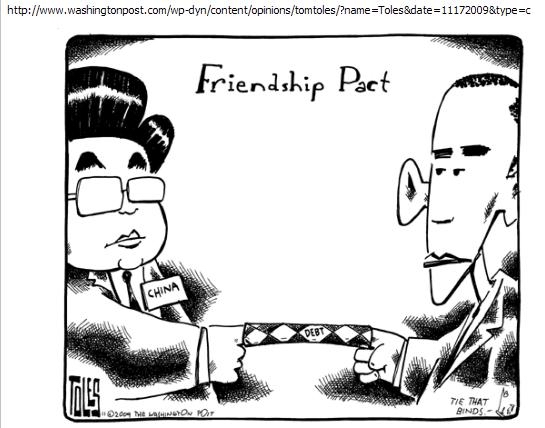

http://mpettis.com/2009/11/lecturing-ea ... -on-trade/

http://www.ritholtz.com/blog/2009/11/ex ... ap-condos/

http://www.ritholtz.com/blog/2009/11/th ... americans/

http://www.ritholtz.com/blog/2009/11/fe ... e-wealthy/

http://www.ritholtz.com/blog/2009/11/im ... ll-hidden/

http://www.ritholtz.com/blog/2009/11/th ... t-veteran/

http://www.marketwatch.com/story/15-sig ... 2009-11-24

Stay Tooned....

I'm Gonna Bop Into The Local Woolworths An' Pick Up A Skate Key An A Handfulla Church Keys For The Be In At The Park This Weekend....

Some people regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon.

—Winston Churchill

Chartz and Table Zup @ www.joefacer.com

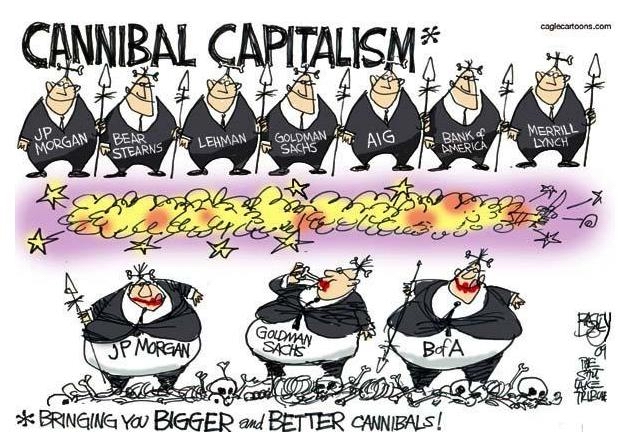

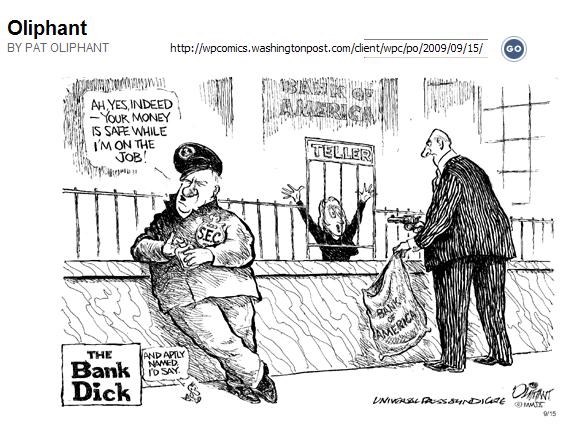

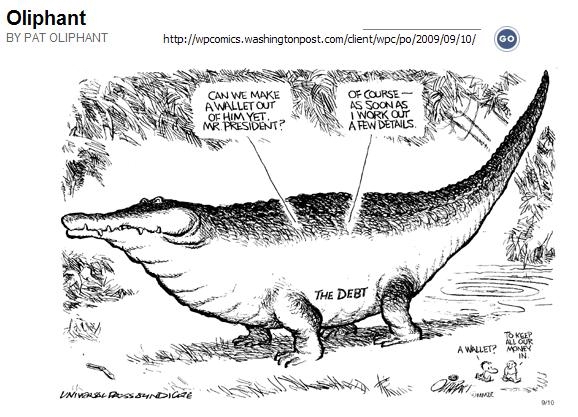

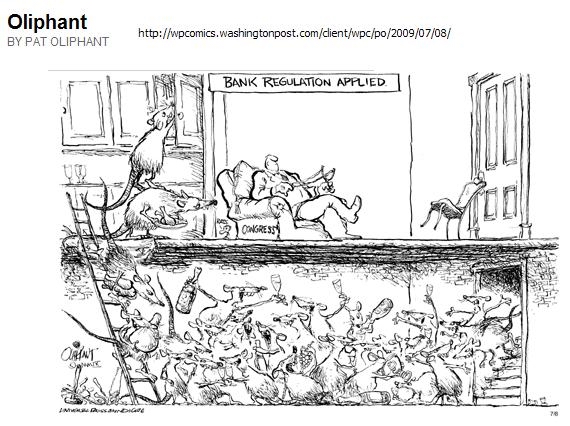

Too Big To Fail; It Ain't Workin' Out like Ya'd Think.....

Spin Yer Down Home MidWestern Salt O Da Earth Head Around....

http://www.washingtonpost.com/wp-dyn/co ... tml?sub=AR

http://labs.timesonline.co.uk/blog/2009 ... e-sharing/

http://www.overthinkingit.com/2008/09/2 ... ood-songs/

http://www.shirky.com/weblog/2009/03/ne ... thinkable/

http://www.ritholtz.com/blog/2009/11/ny ... -buy-hold/

http://www.bloomberg.com/apps/news?pid= ... amp;pos=13

http://www.bloomberg.com/apps/news?pid= ... &pos=6

http://money.cnn.com/2009/11/11/news/ec ... tm?cnn=yes

http://www.bloomberg.com/apps/news?pid= ... S_5nNfZ9WM

http://www.newsweek.com/id/222561

http://www.ritholtz.com/blog/2009/11/st ... s-plummet/

http://www.bloomberg.com/apps/news?pid= ... &pos=2

http://www.msnbc.msn.com/id/33863804/ns ... big_money/

http://www.ritholtz.com/blog/2009/11/ec ... 1964-2009/

http://www.msnbc.msn.com/id/33913477/ns ... l_finance/

http://www.bloomberg.com/apps/news?pid= ... ZgGg448K3E

http://www.bloomberg.com/apps/news?pid= ... FrABqiPBHI

http://www.bloomberg.com/apps/news?pid= ... amp;pos=14

http://www.bloomberg.com/apps/news?pid= ... BXE1cFSiIw

http://www.msnbc.msn.com/id/33766513/ns ... n_turmoil/

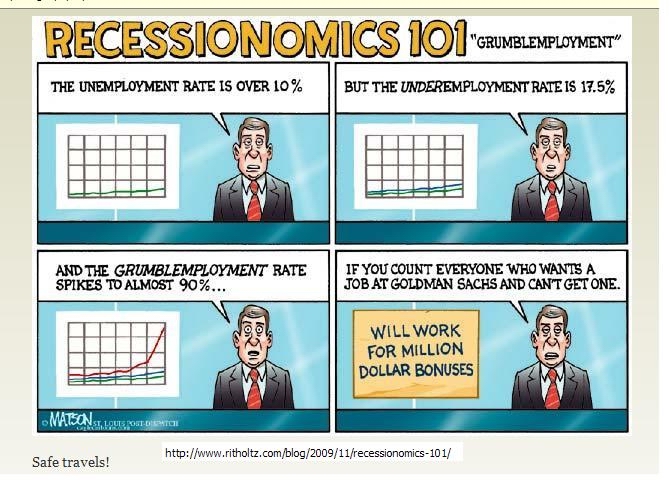

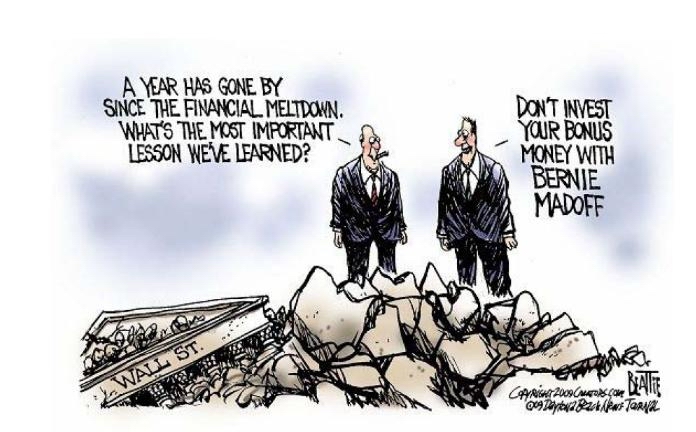

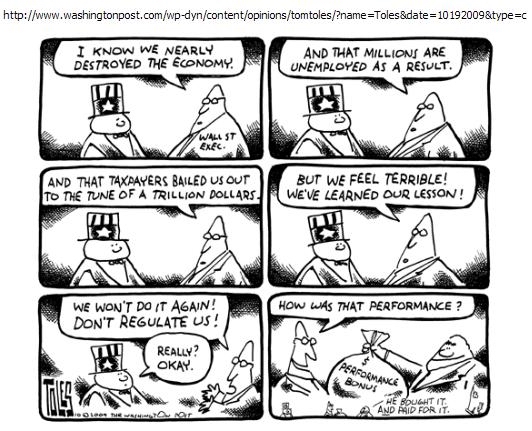

OUCH OUCH OUCH!!!

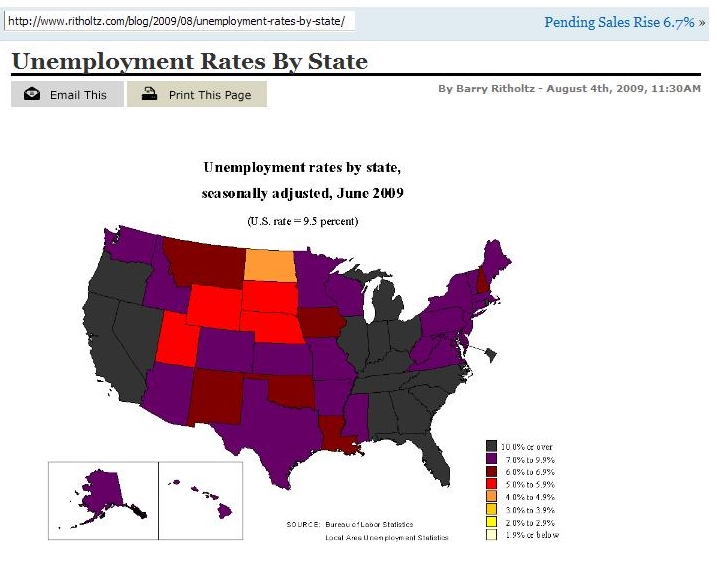

On Wall Street, Unemployment Is A Lagging Indicator.....

On Main Street, Unemployment Is A Leading Indicator.....

http://www.ritholtz.com/blog/2009/11/if ... more-43777

Infuckingcredible.

http://www.youtube.com/watch?v=Zxa6P73Awcg&

Embarrassing and Pathetic"

http://www.ritholtz.com/blog/2009/11/au ... g-bailout/

http://www.ritholtz.com/blog/2009/11/us ... -overseas/

Sez It All....

http://www.istockanalyst.com/article/vi ... id/3646069

http://www.telegraph.co.uk/finance/comm ... onomy.html

http://markettalk.newswires-americas.com/?p=6216

http://www.counterpunch.org/whitney11032009.html

http://online.wsj.com/article/SB125840904423151209.html

http://markettalk.newswires-americas.com/?p=6195

http://www.counterpunch.org/whitney11032009.html

http://www.foreclosuretruth.com/blog/se ... -stimulus/

On this weekly three year chart, I'm looking at possible resistance on the downtrend line.

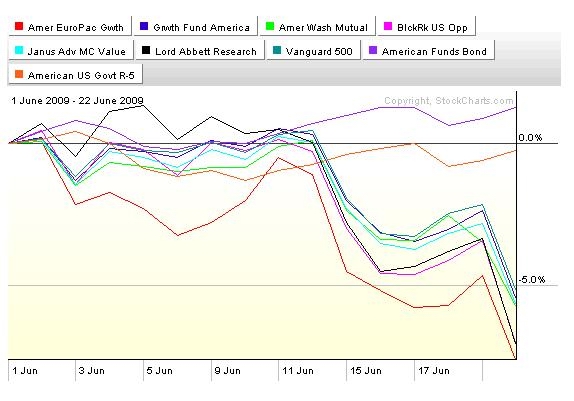

On this daily 8 month chart, I'm looking at repeated drops to support on earnings announcements followed by steep uptrends. Lately I see an up first two weeks of the month and down last two weeks of the months. I'm also seeing a drop through support and and testing resistance. That will resolve soon and determine what I'll do with the 401a. I'm 70%/30% stocks/bonds. At this late date it's got more risk that I'm comfortable with, but asset allocation and risk management means seeking return and matching risk and reward. We'll see.....

http://www.bloomberg.com/apps/news?pid= ... &pos=3

http://www.bloomberg.com/apps/news?pid= ... &pos=4

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://www.ritholtz.com/blog/2009/11/ho ... of-the-us/

Stay Tooned...

My Website Has The Hood Up And Code Layin' All Over Everywhere For A Week As The Host Transmogrifies The Servers From Coal/Water Wheel power To Nuclear/Solar Cogen. The COFGBLOG Is Live During This Time...

Money was invented so we could know exactly how much we owe."

—Cullen Hightower

No Current Chartz And Tablez @ www.joefacer.com For A Week..Or So.

But there will be some to be had here....

http://milwaukee.bizjournals.com/milwau ... ily59.html

http://www.msnbc.msn.com/id/33732266/ns ... d_economy/

http://www.msnbc.msn.com/id/33621222/ns ... l_finance/

Later This Week End; Using Perfcharts to Plan 401a Asset Allocation...

Yesterday is a canceled check; tomorrow is a promissory note; today is the only cash you have -- so spend it wisely.

-- Kay Lyons

Chartz And Table Zup @ www.joefacer.com.

I'm All Hunkered Down. I'm almost outa almost all stocks; see my chartz and tablez on my site. I'm filing outa the RERFX in an orderly manner. For all that it is an off shore fund, It sure tracks US equities closely. I'd sure like to see a counter trend in the future to feel better that it was a good alternative if the US markets are goin' down. Bonds are another problem. More this weekend.

This could get a a lot uglier, real quick....

http://www.lala.com/#song/360569479529542632

Cut 8 "Paper Money"

That said, I'm not in a bad space; I'm still running 11% a year returns since the hall straightened out the 401a options. I coulda done a lot better this year. Can't win 'em all. But I can live with winning most of them.

CLICK THESE

Technical Stuff;

First two chartz;

S&P 500

Nasdaq

Broken uptrend lines

No areas of consolidation support/resistance

Bear Market Bounce? We'll find out.

Third chart

Apple

Most Loved tech and momentum play.

Red circles are start of earnings reports

A is an uptrend off the bottom with a hiccup.

B is a consolidation going into earnings.

C is a steeper uptrend off good earnings.

D is consolidation going into earnings.

E is a spike after good earnings and then running into something bad.

I've posted links to what I'm reading and thinking about.

http://www.thestreet.com/stock-market-n ... ation.html

http://www.bloomberg.com/apps/news?pid= ... g02NI0x4wA

http://www.bloomberg.com/apps/news?pid= ... lpEiqrgpQ#

http://www.ritholtz.com/blog/2009/10/wo ... ng-strong/

http://www.bloomberg.com/apps/news?pid= ... &pos=5

http://money.cnn.com/2009/10/30/news/ec ... 2009103022

http://www.newsweek.com/id/220163

http://www.pimco.com/LeftNav/Featured+M ... vember.htm

Fundamentals and technicals align....

MAXIMUM CAUTION! PROTECT WHAT YOU HAVE!

http://www.mcclatchydc.com/227/story/77791.html

McClatchy's inquiry found that Goldman Sachs:....

The firm benefited when Paulson elected not to save rival Lehman Brothers from collapse, and when he organized a massive rescue of tottering global insurer American International Group while in constant telephone contact with Goldman chief Blankfein. With the Federal Reserve Board's blessing, AIG later used $12.9 billion in taxpayers' dollars to pay off every penny it owed Goldman.

http://www.ritholtz.com/blog/2009/10/jo ... t-on-tbtf/

http://www.msnbc.msn.com/id/33576310/ns ... _business/

http://www.bloomberg.com/apps/news?pid= ... R4KXaGwxd8

http://www.newsweek.com/id/220516

http://www.theglobeandmail.com/blogs/je ... le1343977/

http://www.reuters.com/article/ousivMol ... H420091030

http://money.cnn.com/2009/11/01/markets ... tm?cnn=yes

http://www.bloomberg.com/apps/news?pid= ... &pos=1

http://www.msnbc.msn.com/id/33575706/ns ... _business/

http://www.msnbc.msn.com/id/33573988/ns ... ss/page/2/

http://money.cnn.com/2009/11/01/markets ... tm?cnn=yes

http://www.theglobeandmail.com/blogs/je ... le1343977/

http://tonto.eia.doe.gov/oog/info/twip/ ... print.html

http://www.reuters.com/article/newsOne/ ... 26?sp=true

http://paul.kedrosky.com/archives/2009/ ... th_11.html

http://www.bloomberg.com/apps/news?pid= ... W1nX0i4L40

http://online.wsj.com/article/SB125712303877521763.html

http://www.ritholtz.com/blog/2009/11/is ... g-to-fail/

http://www.ritholtz.com/blog/2009/11/st ... ing-banks/

http://www.ritholtz.com/blog/2009/11/wh ... more-42942

http://www.ritholtz.com/blog/2009/11/am ... t-america/

http://www.ritholtz.com/blog/2009/11/wh ... -the-buck/

http://www.bloomberg.com/apps/news?pid= ... CVGLt3daN8

Stay Tooned. More onna way....

Must Be Gettin' On Later In the Year.... I Find Myself Planking Salmon And Searing Steak Inna Cold And Dark. Real Manly Adventure With The Flavor Of White Hot Coals And Ice Cold Gin.

Retail sales themselves are the best indicator of consumer sentiment as no device peers so deeply into the recesses of the human soul as the cash register.

--Howard Simons

Chartz And Table Zup @ www.joefacer.com

Or They Will Be When I Can Get On To The 401a Site...Is It Me? Or Is it Everybody? Good Excuse To Find Somethin' Else To Do Today....

http://www.youtube.com/watch?v=FMcjPZgK ... re=related

http://www.ritholtz.com/blog/2009/10/an ... more-42096

http://www.ritholtz.com/blog/2009/10/80-oil/

http://www.ritholtz.com/blog/2009/10/fd ... lures-106/

http://www.google.com/hostednews/ap/art ... gD9BI75DO0

http://www.ritholtz.com/blog/2009/10/re ... omed-wamu/

http://www.ritholtz.com/blog/2009/10/n- ... -eye-view/

http://www.msnbc.msn.com/id/33479888/ns ... _business/

http://www.bloomberg.com/apps/news?pid= ... GuYWlHyRDU

http://www.ritholtz.com/blog/2009/10/co ... d-records/

http://www.bloomberg.com/apps/news?pid= ... tUrQ343suM

http://www2.debka.com/headline.php?hid=6341

Stay Tooned.

TUESDAY

I've gone into capital preservation mode. Outside down days in key stocks, interday reversals in key stocks and indices, stocks going down on bad news/good news/no news/first class earnings beats, and then the few stocks that went up on first class earnings end up going down, That's A Deal Breaker.

I'm 73% bonds and GIC and the remainder mostly long AsiaPacific as a materials/growing economy thing. I may get all the way lighter on the little bit of domestic stocks I own in the 401a and lighter yet on the RERFX stuff. Stay Tooned...

My readings as posted here over the last 2 years made me way too cautious way too early and I missed most of the run up. I listened to Main Street and the more cautious parts of Wall Street and I saw the steam roller coming while it was still 8 miles away and I got out of its way. And stood around. I don't have the tools here in the 401a to pick up the few pennies still on the road and expect to get away cuz now I hear the steamroller and feel the rumblings. Man up, face up to a lost opportunity and get back to the curb.

Norway, Australia, Brazil, and India as of this evening seeing the end of the financial crisis on their turf and putting new fiscal and monetary policies in place in the weeks and months ahead. Prolly more nations doing so over the next few months. It is NOT the US leading worldwide policy response to our financial crisis. This is us facing the great unwind of the Money For Nothing , Cash For Free policy in a less benign set of circumstances and less control than we are used to.

I can't think of a lousier set of circumstances to start into the Holiday Season with short of being at war. oh, yeah.....

http://www.manufacturing.net/article.aspx?id=224838

http://www.bloomberg.com/apps/news?pid= ... A4qY0M7Xyw

http://www.theonion.com/content/news/u_ ... e_building

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

http://www.norges-bank.no/templates/art ... 75658.aspx

http://www.ft.com/cms/s/0/38164e12-c330 ... ck_check=1

http://www.bloomberg.com/apps/news?pid= ... T5HaOgYHpE

http://money.cnn.com/2009/10/26/news/co ... tm?cnn=yes

Bad News

Set up for some serious downside. I'm all but out of stocks and getting outa bonds....

Stay Tooned....

There Was A Time When 50% Of America Disapproved Of Rock 'n Roll And Only 5% Listened To It. Now It's Elevator Music. Fifty Percent Of Post WWII Industrial Production Was In America. Then It Was G-3, G5, G7, Now It's G20. Twenty Nations That We Coordinate Our Monetary Policy Wit'. And Australia Raises Rates 1/4% And The US Goes, "Uh-Oh..." Things Change Over Time.. But Now The Changes Are Really Gonna Pick Up Speed...

International diversification, which I recommend for the sheer thrill of losing money around the clock in all sorts of different countries for reasons you cannot articulate, inevitably involves currency risk.

-- Howard Simons

Chartz And Table Zup @ www.joefacer.com

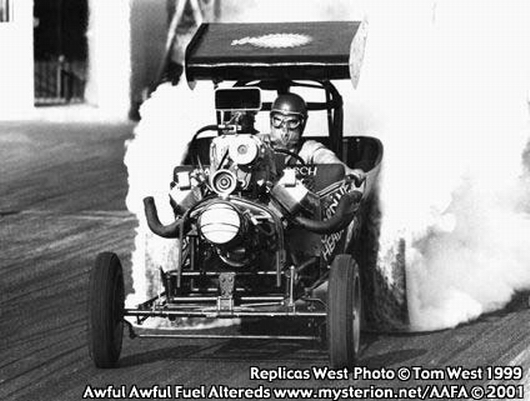

The Original Wild Willie

http://www.rodandcustommagazine.com/the ... index.html

http://www.nhra.net/50th/top50/W_Borsch34.html

A Replica Of The Car That Qualified For Top Fuel At The WinterNationals....

http://www.youtube.com/watch?v=wFOmGkv6Dn8

I got stuff to say about what I've done this week and what I'm gonna do next week w/ my 401a......

It'll start w/ this chart o' the dollar over the last six months.

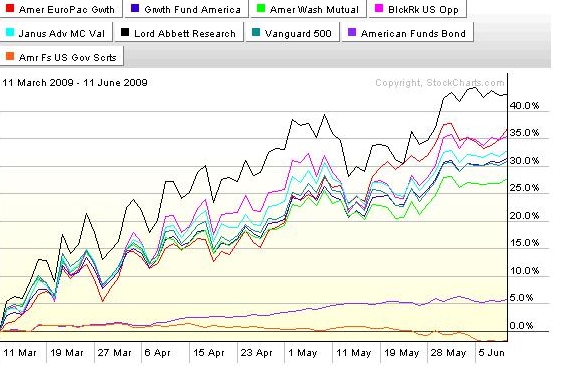

It's value has dropped around 15% in 6 months. Things we buy overseas like oil and metals and finished goods cost more because the dollar is cheaper and buys less. Our stuff becomes cheaper for overseas buyers because their currency buys more. Profits in drachma and simoleons and shekels earned overseas by US companies get inflated when converted back to dollars because they can buy more dollars with the foreign currency than they could six months ago. That is part of the excellent return earned by the EuroPacific Fund recently. A cheaper dollar hurts at the cash register but it can help exporters big time and also investors in the 401a. Gonna have to think about that. And write about it here.

Wed Eve/Thurs....

http://www.ritholtz.com/blog/2009/10/hi ... es-to-lag/

http://money.cnn.com/2009/10/20/real_es ... /index.htm

http://www.msnbc.msn.com/id/33405209

http://www.ritholtz.com/blog/2009/10/we ... er-letter/

http://money.cnn.com/2009/10/21/autos/a ... 2009102109

http://www.bloomberg.com/apps/news?pid= ... g4uV.mo1kw

Tick Tick Tick..... Earning Season Starts Inna Middle O' Da Week. Is My Strategy Deer Inna Headlights? A Rational Approach To A Critical Juncture Of Risk And Reward? Or The Result Of Random Neural Output From The Brain Of An Old Broken Down Pipefitter With Too Many Nights Of Sex, Drugs, And Rock 'n Roll And Too Many Days Of Twistin' The Wrist An' Chasin' Down The Racer Ahead And Runnin' From The Racer Behind...?

It's all fun and games until someone gets hurt.

-- Mom

Chartz An' Table Zup @ www.joefacer.com.

We are half a week from a fulcrum point. Think of a hallway with a door at each end. Ya open the door, walk through to the other door , open it, and walk through. Now think of the hallways set up in haunted mansions as death traps. Hinged in the middle, they are as solid as can be for step after step, until you take the first step past the middle. Then you are fucked. Think of Wednesday as getting close to the middle of the hallway. There are three hinges on the far door. Is there one inna middle of the floor?

Alcoa made 4 cents a share last quarter instead of the 9 cents a share loss that the street expected. The revenue was higher that Wall Street expected by 1.5%. But it was still down by 33% from a year ago. So the profit was made by grinding suppliers, closing plants, and laying people off. There is demand and there is a worldwide recovery under way. China is the difference. There will be more profits and more business done. Demand and prices will rise for raw materials and finished goods. The question is, will there be a national recovery here too and will future business and profits support the current US stock prices? It's a consumer economy (70%) in this country. Do you see a recovery ahead?

What it means here.... http://www.ritholtz.com/blog/2009/10/on ... ntraction/

The writers I read have given up on rationality. It looks like the internet and housing bubble to them. The thoughts are that this will end badly. Or maybe not. Things looked great at the start of 2000 and 2005 and looked like hell in March of 2009. How it looks to you today depends. The question is, is it 1998 or 2000? Is it 2002 or 2006? How long until employment launches skyward or stock prices implode? What would you do if you knew the answer? What would you do if you didn't?

Solid Gold Place To Start For The 401a Participant. http://www.thestreet.com/story/10608336 ... riend.html

http://www2.debka.com/headline.php?hid=6313

http://www.bloomberg.com/apps/news?pid= ... ZfOLKO2Zpk

http://www.msnbc.msn.com/id/33212991/ns ... d_economy/

http://www.cnas.org/blogs/abumuqawama

http://www.jconline.com/article/2009100 ... /910070345

http://www.msnbc.msn.com/id/33157665/ns ... vironment/

http://money.cnn.com/2009/10/08/news/ec ... /index.htm

Pretty much describes where my head is at....

http://www.ritholtz.com/blog/2009/10/th ... t-history/

Extremely thought provoking for the buy and hold 401a participant. It is not without holes, but I've read this book before and I can fill some of them in myself and interpret my way past others.

http://www.ritholtz.com/blog/2009/10/ho ... more-39371

Tick Tick Tick...

http://www.bloomberg.com/apps/news?pid= ... p2WcXs3fP4

http://www.bloomberg.com/apps/news?pid= ... z0hsBTTR4A

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://online.wsj.com/article/SB125530360128479161.html

Main St vs Wall Street

http://www.ritholtz.com/blog/2009/10/li ... nightmare/

I'm watching and waiting....

I've moved my 401a to an outsized position in cash for safety during a potentially very volatile time and for quick deployment back to stocks if an end of year run up starts. I have a smaller proportion in bonds for safety and income. I'm about 1/8 in EuroAsia as a weak dollar/commodity/growth play, and a tag end in small cap cuz I stopped one or two exchanges short. My Website has details to 4 decimal places.

Waiting....

FULCRUM DAY

You better be conservative or ready to turn onna dime.

http://www.ritholtz.com/blog/2009/10/getting-better/

It might be that things "Have Got To Get Better Inna Little While". If so there will be plenty of time for me to get way long then.

WED AM

Intel and JPM report good quarters and good/mixed forecasts. Economically, it is not ragingly bullish. But markets spike up. Fifty percent of S&P 500 revenues come from overseas. There will be profits and revenue. But domestic jobs, government spending, and housing are not going to move strongly in the right direction for a while. I think that realization has yet to be fully appreciated by investors. If the rest of the world raises interest rates or we have a lousy Christmas economy/housing drops another increment when rising rates make the FED/Treasury stop printing money, we could see a serious dip down. The near/long term upside is limited. Downside is less limited. It's about potentials, not imperatives. Listening to what the markets say and being ready to react to protect what you have today is as important as ever. I'm thinking about what to do with the 401a later today.

WED Afternoon....

Definitely feels toppish.

That said, I'm leaning toward tossin' in some 401a

money on the year end run up...

Stay tooned. To be continued....

GAWD!!! This Is A Mess! An Amazing Bear Market Rally, Mutual Funds, Hedge Funds, And Private Investors Who Missed It, End Of The Year Three Months Away, One Last Chance To Look Good, And A Dawning Awareness That 26 Million Unemployed And Underemployed Ain't Gonna Make For A Merry Christmas Shopping Season. Could The Markets Be Up At Years End? We'll See.

"The Financial Instability Hypothesis suggests that over periods of prolonged prosperity, capitalist economies tend to move from a financial structure dominated by hedge finance (stable) to a structure that increasingly emphasizes speculative and Ponzi finance (unstable)."

-- Hyman Minsky

Chartz And Table Zup @ www.joefacer.com

Smokin', Kick Ass, And Just Plain Silly....

http://www.youtube.com/watch?v=wtIJ017J ... re=related

http://link.brightcove.com/services/pla ... 1337502001

http://www.ritholtz.com/blog/2009/10/st ... ty-python/

http://robertreich.blogspot.com/2009/10 ... ember.html

http://www.ritholtz.com/blog/2009/10/th ... -they-get/

http://www.ritholtz.com/blog/2009/10/an ... more-40077

http://www.ritholtz.com/blog/2009/10/th ... ecoveries/

http://www.bloomberg.com/apps/news?pid= ... oQJ14iSlWg

http://www.msnbc.msn.com/id/33135910/ns ... d_economy/

http://www.ritholtz.com/blog/2009/10/we ... ember-200/

http://www.bloomberg.com/apps/news?pid= ... ZinRhF5tlA

http://www.msnbc.msn.com/id/33122449/ns/business-autos/

http://www.msnbc.msn.com/id/33150671/ns ... ork_times/

http://www.msnbc.msn.com/id/33122485/ns ... e_economy/

http://www.ritholtz.com/blog/2009/10/ki ... rns-south/

http://www.bloomberg.com/apps/news?pid= ... owSDAJbML4

http://www.msnbc.msn.com/id/33093637/ns ... d_economy/

http://www.msnbc.msn.com/id/33138126/ns ... d_economy/

http://www.msnbc.msn.com/id/33088930/ns ... al_estate/

I've gone to bonds and cash with a little tag end in the small cap 'cuz I forget to move it and a small chunk in the Euro Pacific option as a weak dollar play. See www.joefacer.com.

The cash is quickly deployable for a yearend run if it comes to that. The bonds is a fear thing. And if you know me, you know I ain't a very fearful kinda guy. But if you read what I do, you understand that I respect the possibilities.

"I can dodge folly without backing into fear."

Nero Wolfe

"I can dodge folly without backing into fear."

Nero Wolfe

Stay Tooned.

Ya Can't Always Be The Best There Is, But If You Can Have A Lot of Fun Doin' It, That Goes A Long Way Too.

"There was a time when a fool and his money were soon parted, but now it happens to everybody."

—Adlai Stevenson

Chartz and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=6DYC61Hz ... re=related

One Of The Most Under Rated Guitarists Ever.

That was Stevie on the first LP, Not Dave Mason.

http://www.newsweek.com/id/216056

http://www.ritholtz.com/blog/2009/09/nukes-war-markets/

http://www.ritholtz.com/blog/2009/09/we ... ew-normal/

http://www.msnbc.msn.com/id/32974781/ns ... forbescom/

http://www.thebigmoney.com/articles/jud ... t-yet-come

http://www.ritholtz.com/blog/2009/09/ho ... -own-risk/

http://worldblog.msnbc.msn.com/archive/ ... 79557.aspx

http://wallstcheatsheet.com/knowledge/m ... s/?p=1959/

http://www.ft.com/cms/s/0/5e449072-a859 ... abdc0.html

http://www.bloomberg.com/apps/news?pid= ... o1J7aDXneM

http://www.thestreet.com/p/_commentary/ ... 952_2.html

http://www.nytimes.com/2009/09/27/busin ... vjaxcqWZLA

http://blogs.reuters.com/great-debate/2 ... r-quietly/

http://www.bloomberg.com/apps/news?pid= ... o1J7aDXneM

http://www.ritholtz.com/blog/2009/09/co ... vid-ellis/

http://www.washingtonpost.com/wp-dyn/co ... tml?sub=AR

http://www.newsweek.com/id/216141

http://www.phillymag.com/scripts/print/ ... idx=257095

Still feelin' concerned and cautious. Standing pat at mostly money and little stock. We'll see.....

Stay Tooned; More To Follow.

Lookie Here Boys and Girls..

CLICKIT!!!!!

We've come a long way in 7 months. We've had our dips and fits and starts, but from way too low, we've steadily gone way too high. Every time the market should have paused and corrected or churned sideways to correct in price or time, it resumed the climb.

Yesterday something changed. See....

Check out this week, especially at 2:15 P.M. Wed Afternoon

CLICKIT!!!

The Fed has been the market's friend. Yesterday it gave a good message to the market and the good news spiked the market up hard...and then the market sold off. And Wednesday was an Outside Down Day. (Ask me when you see me). Over the past 7 months, news, all news, good or bad, pretty much sent the market up. Yesterday's good news sent the market down. Today's bad housing news and good job news sent the market down. Ya gotta watch what the market does with the news it gets. Ya gotta especially watch for a change of character.

I'm now down to about 20% stocks/80% money from 60%/40% and 60% of the 20% is in offshore stocks.

I'm not confident and I'm major getting outa company and economy risk and getting into bonds and the GIC's security. I may go farther that direction Friday.

Thank you America, for the great choice between the spineless left and the lunatic right.

--Alan Farley

Chartz And Table Zup at www.joefacer.com

Stay tooned

http://www.youtube.com/watch?v=f64XZRRs ... re=related

http://www.ritholtz.com/blog/2009/09/wh ... ts-losses/

http://www.ritholtz.com/blog/2009/09/th ... r-sort-of/

http://finance.yahoo.com/tech-ticker/ar ... holtz-Says

My 401a is sixty four percent stocks and the rest in bonds. The market WILL crack. But I dunno when. All the people who mistrusted and hated this rally all the way up are standing by, ready to finally buy any pullback. And they've been waiting for months. But it is easier to plan to buy when stocks are going down than it is when they actually lose value. Some people (like me) gave up waiting for a pullback and bought in on the way up, supporting more upside. More will do so. But there are a lot of profits out there. And everybody who took partial profits on the way up ended up leaving money on the table. So there is a ton of pent up sales to protect profits hanging in mid air. If the whoosh down comes on major non market bad news, it could overwhelm and panic the dip buyers and become a self reinforcing cascade. But the pro's NEED to be up at year end to keep their jobs and they will toss in the kitchen sink to make it so. And the pols NEED to be up at the end of the year and into the '10 elections to be re elected so they will borrow and spend everything available to you, the taxpayer. But at least the money pros can lock the year in early by not waiting until the last week of the year to declare victory. It may end up a competition to sneak out the door early. But if you look at post 2000 to date as a bear market with one complete multi year bear market rally built on private debt and a partially complete bear market rally built on emotion and public debt, you face the possibility that the rally could have a ways yet to go.

Or maybe the PollyAnna's are right and the whoosh up since March is the market being a leading indicator about the bear market being

history and predicting a complete and total recovery in the months ahead.

There's a lot of rationalizations and possible outcomes. But there are two two measures of reality that are unequivocal and that are available to me in instantaneous and raw form; time and price. Markets are in a sustained uptrend after a gawdawful plunge and looking toppish, and I'm partially aboard with my finger on the eject button.

http://men.style.com/gq/features/landin ... tent_10957

Stay Tooned, Same Bat Time, Same Bat Channel.

"You may have a fresh start any moment you choose, for this thing that we call 'failure' is not the falling down, but the staying down."

--Mary Pickford

CHARTZ AND TABLE ZUP @ www.joefacer.com

I kinda went nuclear on dis arm. Posting will be slow and sparse. And painful. That said, if you have been following the links I post here, you know that I think that I can see behind the curtain and see government men pulling the levers trying to prevent the painful deflation of the risk and real estate bubble by creating the third bubble of the decade; the taxpayer's debt bubble. That has kept me out of the market for most of the 50% bounce since the March lows. I'm grudgingly adding exposure now for the possible end of the year run up. My caution will undoubtedly be proven right at some point. But 50% early means the same as WRONG. The fact that '04 to '08s results give me an excellent record does not excuse my substituting my reliance on my intellectual biases for listening what the market has to say. Check out my 401a funds distribution table on joefacer.com for details. And Stay Tooned....

http://www.youtube.com/watch?v=DDOIL5Oq ... re=related

http://www.msnbc.msn.com/id/32722194/ns ... gton_post/

http://www.theonion.com/content/news/na ... nt_outlook

http://www.cnn.com/2009/WORLD/europe/09 ... index.html

http://www.ritholtz.com/blog/2009/08/fdic-low-on-funds/

http://www.ritholtz.com/blog/2009/09/th ... -us-terms/

http://www.bloomberg.com/apps/news?pid= ... gnqYrMSrtI

http://www.bloomberg.com/apps/news?pid= ... gnqYrMSrtI

http://www.bloomberg.com/apps/news?pid= ... UTn7JFw1qk

http://www.telegraph.co.uk/finance/comm ... ssion.html

http://www.ritholtz.com/blog/2009/09/da ... -agencies/

http://www.boston.com/bostonglobe/ideas ... ism_fails/

http://www.ritholtz.com/blog/2009/09/ra ... sner-says/

http://www.ritholtz.com/blog/2009/09/am ... n-hostage/

http://widerimage.reuters.com/timesofcr ... ce=reuters

Only if you have an hour or two to spare and the interest in the minutae....

http://www.forbes.com/2009/09/14/lehman ... ssler.html

http://www.forbes.com/2009/09/14/lehman ... ssler.html

http://www.ritholtz.com/blog/2009/09/da ... -agencies/

http://www.ritholtz.com/blog/2009/09/pe ... ew-normal/

http://www.ritholtz.com/blog/2009/09/a- ... f-bankers/

http://www.ritholtz.com/blog/2009/09/we ... es-we-can/

http://www.boston.com/bostonglobe/ideas ... ism_fails/

http://www.ritholtz.com/blog/2009/09/ra ... sner-says/

[h/4]

I GIVE UP!!! FUNDAMENTALS AND TECHNICALS DON'T MATTER. CHARTS DON'T MATTER. KNOWING WHAT IS REALLY HAPPENING IN THE ECONOMY AND FINANCIAL CIRCLES DOESN'T HELP. WHAT MAKES YOU A GENIUS IS TO BUY SOMETHING THAT IS ALREADY SKY HIGH AND HOLD IT. NEVER LET IT BE SAID THAT I'M TOO OLD AND STOOPID TO LEARN.

Here's where I stand this evening. I'm cultivating obliviousness so's I can make some money.

I ain't gettin' TOO loose, though. My finger is on the eject button and the ripcord is tied to my other wrist...

I ain't happy about leavin' money on the table this year......

But up almost 8% this year and averaging 13% over 5 years is none too shabby either.

Stay tooned....

I GIVE UP!!! FUNDAMENTALS AND TECHNICALS DON'T MATTER. CHARTS DON'T MATTER. KNOWING WHAT IS REALLY HAPPENING IN THE ECONOMY AND FINANCIAL CIRCLES DOESN'T HELP. WHAT MAKES YOU A GENIUS IS TO BUY SOMETHING THAT IS ALREADY SKY HIGH AND HOLD IT. NEVER LET IT BE SAID THAT I'M TOO OLD AND STOOPID TO LEARN.

Here's where I stand this evening. I'm cultivating obliviousness so's I can make some money.

I ain't gettin' TOO loose, though. My finger is on the eject button and the ripcord is tied to my other wrist...

I ain't happy about leavin' money on the table this year......

But up almost 8% this year and averaging 13% over 5 years is none too shabby either.

Stay tooned....

A Nod Is As Good as A Wink To A Blind Horse.... But That Kinda Stuff Is Pretty Much Frowned Upon Nowadays.

A trend is a trend is a trend.

But the question is, will it bend?

Will it alter its course

Through some unforeseen force

And come to a premature end?

-- Alec Cairncross

Chartz and Table Zup @ www.joefacer.com

Stay tooned. More later this weekend.

Indian Summer In SF, 90 Degree an' Sunny, Music Inna Park, Saturday Off, Markets @ Yearly Highs, I'll Worry About Tomorrow Tomorrow...

A knowledge of the path cannot be substituted for putting one foot in front of the other.

- M.C. Richards

Chartz An' Table Zup @ www.joefacer.com

Nice weather, I been ridin' lately an' I got stuff to do... Some of that stuff will appear here later inna weekend.

Stay tooned...

When I'm 64....Kinda. Not Exactly What Paul McCartney Wrote About... Keepin' Busy And Active When Ya Get Old. And Supplementing Yer Life Savin's With A Part Time Job...

http://www.youtube.com/watch?v=fEQ-0-tN ... re=related

AS A TAX PAYER, DOES THE LINK BELOW PISS YOU OFF JUST A LITTLE? HOW ABOUT B OF A HIDING BEHIND THE LAWYERS? THAT LINK IS BURIED BELOW AMONGST SOME OTHERS......

http://www.ritholtz.com/blog/2009/08/fe ... ure-order/

http://www.ritholtz.com/blog/2009/08/ma ... dzon-says/

http://www.nytimes.com/2009/08/27/us/27arms.html?_r=1

http://www.nytimes.com/2009/08/28/world ... amp;st=cse

http://www.jcs.mil/newsarticle.aspx?ID=142

http://www.newsweek.com/id/214036

http://www.msnbc.msn.com/id/32569655/ns ... ssweekcom/

http://www.bloomberg.com/apps/news?pid= ... zycjQjir8g

http://www.bloomberg.com/apps/news?pid= ... zgH4hvhh.g

http://www.theonion.com/content/video/i ... videoembed

http://www.msnbc.msn.com/id/32544485/ns ... g_america/

http://www.washingtonpost.com/wp-dyn/co ... 04193.html

http://www.bloomberg.com/apps/news?pid= ... 7peVQLy6xc

http://www.nytimes.com/2009/08/28/busin ... rowth.html

http://www.theonion.com/content/news/na ... nt_outlook

http://www.nytimes.com/2009/08/29/busin ... sumer.html

Just wait until the payment hangover hits... that should be starting just about now, and continue for the next four to six year. Booya boys - you traded in a paid-off vehicle for a car payment! That ought to do wonderful things for spending in places such as restaurants, vacation spots and the like.

http://market-ticker.denninger.net/arch ... Lying.html

http://www.ritholtz.com/blog/2009/08/fdic-low-on-funds/

And This Explains What The Fed may Have To Hide....

http://www.chrismartenson.com/martenson ... izing-debt

TUESDAY EVE:

Sold some stock today, I'll finish selling tomorrow, leavin' only tag endz in the 401a fer tracking purposes. I'm mostly in bonds and mostly non gov bonds.

Hang On....

WEDNESDAY EVE:

http://www.usnews.com/blogs/flowchart/2 ... etter.html

'bout a month's worth of action. SPECTACULAR gains, a roll over, a pretty good bounce and just the start of a second rollover. But the character of the market has changed. The likelihood of a substantial risk to the downside is substantially greater. I read a lot and trade some two. It's for real, but not a done deal... but I'm lined up that way. Twelve percent stock and the rest bonds and GIC. YMMV.

See ya at the hall.

Lindsey Campbell;

What do you do to fix the economy?

Barry Ritholtz;

I don’t know that the economy needs fixing. What do you do to fix night? You wait and it becomes day.

Chartz and Table Zup @ www.joefacer.com

http://www.bloomberg.com/apps/news?pid= ... mwu6UfHB4o

http://www.bloomberg.com/apps/news?pid= ... Gb2NqN3C_U

http://www.bloomberg.com/apps/news?pid= ... R3wifbUr1w

http://www.bloomberg.com/apps/news?pid= ... SrdZo5NyeY

http://www.bloomberg.com/apps/news?pid= ... TT9jivRIWE

http://www.newsweek.com/id/212143

http://mpettis.com/2009/08/the-usg-does ... -who-knew/

http://blogs.reuters.com/rolfe-winkler/ ... ese-banks/

http://www.ritholtz.com/blog/2009/08/wo ... e-bottoms/

http://www.ritholtz.com/blog/2009/08/clawbacks-coming/

http://www.fastcompany.com/blog/jamais- ... toshop-era

http://www.thedeal.com/dealscape/2009/0 ... ilures.php

http://www.ritholtz.com/blog/2009/08/si ... s-history/

http://www.ritholtz.com/blog/2009/08/ci-loans/

I've been overly cautious and bearish for way too much of the last 4 months. But over the last four years I've got a SMOKIN' hot return, even including the last four months. Will my pessimism be justified by the rest of the year?

See ya here over the next coupla days....

Monday AM...

Unloaded stocks in the 401a as per the rapid trading restrictions. The sidelines is a good place to be.

Tues Eve....

Didn't get my sell order in to lighten up further. Worked out OK since the markets went up. Still thinkin' the market's headed down as I think the anticipation of recovery exceeds the reality. My exposure to the downside is limited. My opportunity to catch the bounce from March is gone. If this IS a new bull market or recovery, I'll have months and/or years to climb aboard. Standing pat....

http://www.youtube.com/watch?v=sP6H6lMC ... re=related

WED EVE...

JUST INSANE.....

http://www.ritholtz.com/blog/2009/08/wh ... nese-ppip/

http://www.ritholtz.com/blog/2009/08/is ... ally-over/

http://www.ritholtz.com/blog/2009/08/si ... s-history/

http://www.washingtonpost.com/wp-dyn/co ... 03655.html

http://www.washingtonpost.com/wp-dyn/co ... 02249.html

http://www.ritholtz.com/blog/2009/08/home-appraisal/

http://www.theatlantic.com/doc/200908u/christopher-hill

http://www.ritholtz.com/blog/2009/08/ci-loans/

http://www.reuters.com/article/newsOne/ ... 9S20090814

Yup... Unhuh Uhhuhh. EarlierThis Week I Decided That Knowing Too Much About What A Dire State The World Was In Was Costing Me Profits. I Emptied My Mind Of Caution And Moved To Almost 40% Stocks. Party On, Dood!!!!

If you trade stocks in the short term, one of things that you need to be very aware of is that sometimes the action that seems extremely stupid is the best way to make money.

If a lot of people with a lot of money are chasing grossly overvalued stocks, it can feel pretty dumb to throw caution to the wind and join the party.

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term.

In fact, there can be a complete disconnect between the two for very long periods of time.

If you are going to trade in the short term, you need to decide whether you are willing to do the dumb things that make money or are you going to stick to the "facts" and stand aside while the idiots run prices up and down.

It's all about sentiment, mood and psychology in the short term, and it doesn't pay to think too hard about fundamentals if you are playing in the short term.

James “Rev Shark” DePorre

Charts and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=ihvvf1R_vWo

http://www.bloomberg.com/apps/news?pid= ... 6BdHuR9JUU

http://www.bloomberg.com/apps/news?pid= ... E8aZLFuNXo

http://www.bloomberg.com/apps/news?pid= ... M_oxkI3Qkw

http://www.bloomberg.com/apps/news?pid= ... bHcz0ryM_E

http://www.bloomberg.com/apps/news?pid= ... hD2umuVt_c

http://www.ritholtz.com/blog/2009/08/th ... n-history/

http://www.ritholtz.com/blog/2009/08/about-bailouts/

http://www.ritholtz.com/blog/2009/08/ze ... -creation/

http://www.bloomberg.com/apps/news?pid= ... sz8TNju_Zg

http://www.nytimes.com/2009/08/09/busin ... ulson.html

http://www.bloomberg.com/apps/news?pid= ... iLSlGSSoFo

http://www.nytimes.com/2009/08/09/busin ... mp;emc=rss

http://www.bloomberg.com/apps/news?pid= ... 39_VW6pf3U

http://www.bloomberg.com/apps/news?pid= ... gtL5wHZN8k

http://www.bloomberg.com/apps/news?pid= ... BJ8IS3ZImw

http://www.msnbc.msn.com/id/32346408/ns ... gton_post/

http://www.msnbc.msn.com/id/32331691/ns ... gage_mess/

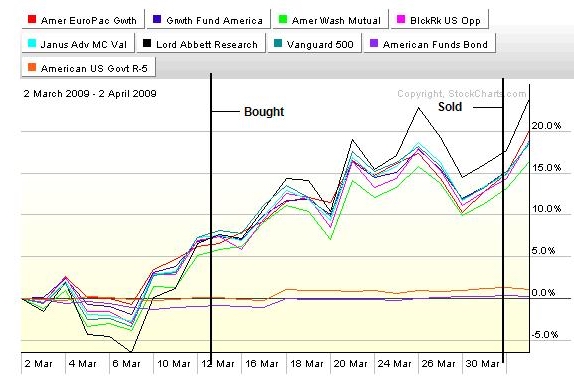

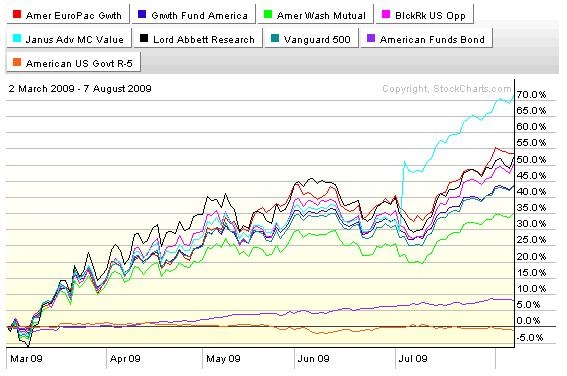

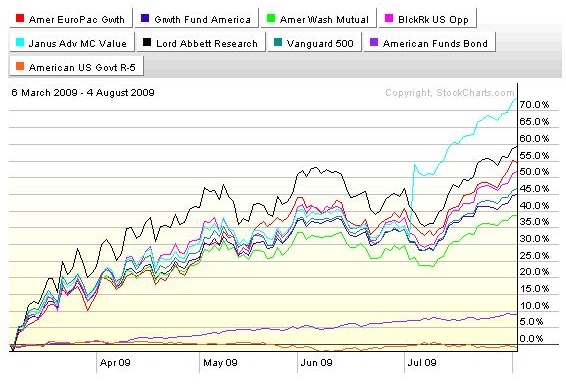

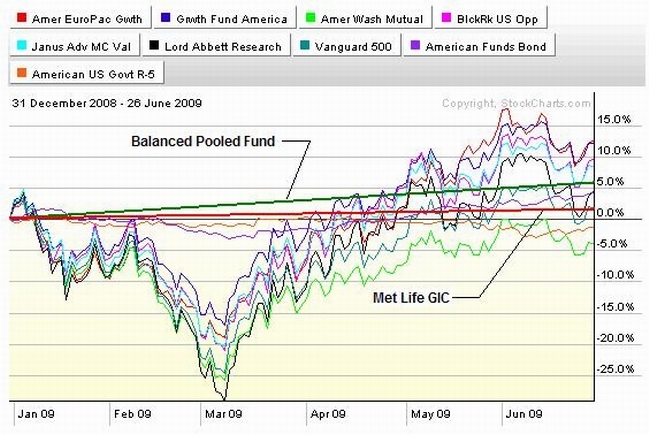

Here's the smart move I made in my 401a on the dates shown.

Here's what I missed out on. Ya can't get 'em all right. Rev Shark is right; Trends always move farther than you think they should. I still think there is much more employment misery to come. I still think that there is much more housing misery to come... in time if not in price. And they ain't hirin' everybody back down at the plant fer the Christmas season. As Barry Ritholtz sez "The parachute has opened and we're no longer in free fall. But we're still going down." This is all about the "New Normal." Which I'll write about later.

So I'm chasing a move that has come a long way and can't have much farther to go in its late stages. The upside is limited and the downside is not so much. Hope I get it right..... I'll let you know about it here.

Stay Tooned....

Thursday Evening.....

So far... So good.

Chartz and Table Zup at www.joefacer.com

http://www.youtube.com/watch?v=vdyvPg0c ... re=related

http://www.forbes.com/2009/07/28/gates- ... glate.html

http://www.ritholtz.com/blog/2009/07/ho ... stigation/

http://www.ritholtz.com/blog/2009/07/mo ... ome-sales/

http://www.ritholtz.com/blog/2009/07/in ... -earnings/

http://blogs.wsj.com/developments/2009/ ... inancings/

http://www.ritholtz.com/blog/2009/07/ne ... l-markets/

http://www.salon.com/opinion/greenwald/ ... index.html

http://www.washingtonpost.com/wp-dyn/co ... 03065.html

http://www.msnbc.msn.com/id/21134540/vp ... 8#32203408

http://www.ritholtz.com/blog/2009/08/th ... aborative/

http://www.nytimes.com/imagepages/2009/ ... ready.html

http://www.bloomberg.com/apps/news?pid= ... Zx5kGyDavA

http://www.ritholtz.com/blog/2009/08/ma ... ch-9-lows/

http://www.ritholtz.com/blog/2009/08/lo ... treet-pay/

http://www.bloomberg.com/apps/news?pid= ... Sh0vntimco

http://www.ritholtz.com/blog/2009/08/lo ... treet-pay/

http://www.msnbc.msn.com/id/32255580/ns ... gage_mess/

http://www.msnbc.msn.com/id/32254520/ns ... ork_times/

http://www.nytimes.com/2009/08/02/us/po ... mp;emc=rss

http://www.newsweek.com/id/209829

http://www.bloomberg.com/apps/news?pid= ... Ut41aeqxMk

http://www.bloomberg.com/apps/news?pid= ... gRG8QbeKNY

http://www.charlierose.com/view/interview/10507

http://www.bloomberg.com/apps/news?pid= ... orpZRV0STk

http://www.ritholtz.com/blog/2009/08/ny ... ut-nation/

Tuesday Eve

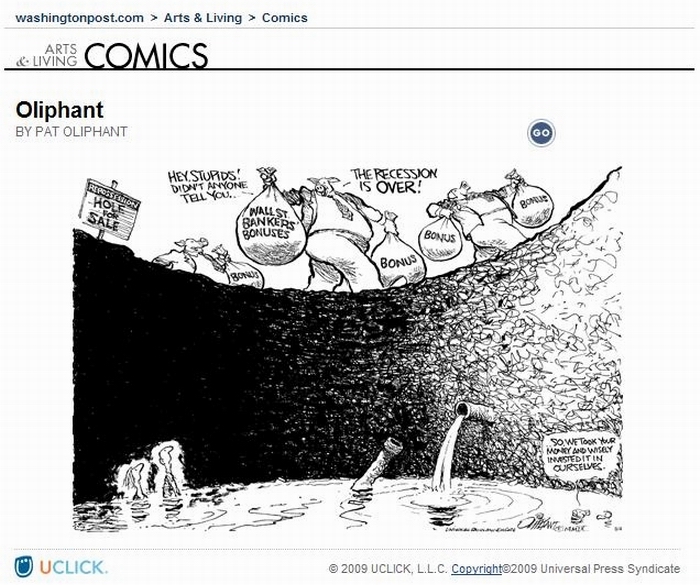

In The Face OF This;

We've Got This;

I caught some of the pop off the bottom in March, but not enough of it. I moved to the side lines. You read the links I post here, you know I see under the covers and through the picket fence and you know why I bailed out. That was a mistake. I looked for a pullback so I could fix it. Another mistake.

I gritted my teeth this morning and I'm about 40% stocks this evening. It is not expected to be a long term relationship. In fact, I'm afraid it'll be way too short. But I gotta party hearty while I can since it looks like the party ain't ever gonna stop. It will.... I just dunno when. "Maybe Tomorrow... Or Until The End Of Time..." Not leaving soon enough would be another mistake. Eventually I'll get it right. The fact that I'm still up 50% over almost 5 years give me a basis for faith... I'm aiming for mostly right. Purt much there fer now.....Know whut ah mean, Vern?

Maybe this upcoming weekend I'll write about it.....

Tuesday Eve

In The Face OF This;

We've Got This;

I caught some of the pop off the bottom in March, but not enough of it. I moved to the side lines. You read the links I post here, you know I see under the covers and through the picket fence and you know why I bailed out. That was a mistake. I looked for a pullback so I could fix it. Another mistake.

I gritted my teeth this morning and I'm about 40% stocks this evening. It is not expected to be a long term relationship. In fact, I'm afraid it'll be way too short. But I gotta party hearty while I can since it looks like the party ain't ever gonna stop. It will.... I just dunno when. "Maybe Tomorrow... Or Until The End Of Time..." Not leaving soon enough would be another mistake. Eventually I'll get it right. The fact that I'm still up 50% over almost 5 years give me a basis for faith... I'm aiming for mostly right. Purt much there fer now.....Know whut ah mean, Vern?

Maybe this upcoming weekend I'll write about it.....

I Mentioned To My Wife That She'd Never Asked Me To Talk To The Kids About Sex And Drugs While They Were Growing Up. "Damn Right!!" She Answered.....

If you trade stocks in the short term, one of things that you need to be very aware of is that sometimes the action that seems extremely stupid is the best way to make money.

If a lot of people with a lot of money are chasing grossly overvalued stocks, it can feel pretty dumb to throw caution to the wind and join the party.

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term.

In fact, there can be a complete disconnect between the two for very long periods of time.

If you are going to trade in the short term, you need to decide whether you are willing to do the dumb things that make money or are you going to stick to the "facts" and stand aside while the idiots run prices up and down.

It's all about sentiment, mood and psychology in the short term, and it doesn't pay to think too hard about fundamentals if you are playing in the short term.

James “Rev Shark” DePorre

Chartz and Table Zup @ www.joefacer.com.

Stay tooned for more this weekend. I've been away for a coupla weeks and time to dial it up. Seeya here later.

http://www.youtube.com/watch?v=guL3xWi6 ... re=related

http://www.newsweek.com/id/206166

http://www.msnbc.msn.com/id/31980862/ns ... ork_times/

http://www.newsweek.com/id/208633

http://www.newsweek.com/id/208164

http://www.msnbc.msn.com/id/31983839/ns ... ite_house/

http://www.ritholtz.com/blog/wp-content ... ebpage.jpg

http://www.ritholtz.com/blog/2009/07/lo ... ome-sales/

http://www.ritholtz.com/blog/2009/07/in ... -earnings/

http://www.ritholtz.com/blog/2009/07/si ... lly-to-64/

http://www.ritholtz.com/blog/2009/07/yo ... -earnings/

http://www.ritholtz.com/blog/2009/07/no ... the-rally/

http://www.ritholtz.com/blog/2009/07/re ... d-to-2002/

http://www.ritholtz.com/blog/2009/07/we ... nkfest-13/

http://www.ritholtz.com/blog/2009/07/th ... more-33370

http://www.ritholtz.com/blog/2009/07/fo ... -regional/

http://www.ritholtz.com/blog/2009/07/ha ... %E2%80%99/

Did We Just Have The Mother Of All Oversold Bounces? Are We Looking At The Mother Of all Jobless Recoveries? MOTHER@*&%$&/*&^##!!!!!!!!

In general, your target is not to beat the market. It is to beat zero. As I have written for years, the investors who win in this market are the ones who take the least damage.

-- John Mauldin

Chartz and Table Zup on www.joefacer.com.

Stay tooned....

In the mean time.... Click here; http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

and here;

http://www.bloomberg.com/apps/news?pid= ... LGZEc7qoqA

http://www.bloomberg.com/apps/news?pid= ... E3j.8n71UQ

http://www.msnbc.msn.com/id/31775881/ns ... umer_news/

http://www.bloomberg.com/apps/news?pid= ... 0_1SlKgIwo

http://money.cnn.com/2009/07/07/markets ... 2009070715

http://www.debka.com/headline.php?hid=6174

http://www.bloomberg.com/apps/news?pid= ... FwADFOsxqQ

UH OH.....

http://www.bloomberg.com/apps/news?pid= ... OrbEKeCVzk

http://www.bloomberg.com/apps/news?pid= ... LGZEc7qoqA

Triple UH OH

http://www.bloomberg.com/apps/news?pid= ... MFuHzp5R9E

http://www.ritholtz.com/blog/2009/07/ho ... mods-fail/

EVEN WORSE

http://www.ritholtz.com/blog/2009/07/je ... good-year/

http://www.nytimes.com/2009/07/10/busin ... .html?_r=1

http://www.bloomberg.com/apps/news?pid= ... RlD846h2XY

http://www.nytimes.com/2009/07/10/busin ... 10fed.html

http://www.nytimes.com/2009/07/10/busin ... 10fed.html

http://www.ritholtz.com/blog/2009/07/th ... eap-money/

Freakin' "A" Tweetie Bird

http://www.ritholtz.com/blog/2009/07/wh ... s-outlook/

http://www.ritholtz.com/blog/2009/07/ma ... time-bomb/

SO MUCH GREAT STUFF THIS WEEK!!!!! Informationwise, I mean.... In one aspect, that this is out there is GREAT. In another.... Not So Much....

http://www.ritholtz.com/blog/2009/07/is ... ading-day/

http://www.ritholtz.com/blog/2009/07/de ... e-summers/

http://www.ritholtz.com/blog/2009/07/pm ... n-2-years/

http://www.economist.com/blogs/freeexch ... less_r.cfm

http://www.economist.com/blogs/freeexch ... less_r.cfm

Either the efficient markets are telling us that things are 40% better than 3 months ago....

Or three months ago the emotional markets panicked to the downside and now are where they should really be....

Or We had a hell of an oversold bounce based on "still in business" and cheerleading and hope and we're about to roll over as we come to terms with how bad it really is...

I'm STILL all in in bonds and the GIC and torn between corporates for yield and Govies for safety. Guess what I think.....

The Unemployment Number Wasn't That Bad If You Knew Enough To Expect It And If You Could Play On The Dark Side Of The Street. Otherwise, If You Were Long Stocks In Your 401a, It Was A Big Asphalt Face Plant.

It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.

-- Charles Darwin

Chartz and Table Zup @ www.joefacer.com

http://www.bloomberg.com/apps/news?pid= ... llNt3iGquQ

http://www.bloomberg.com/apps/news?pid= ... obeTB25ZeY

http://www.bloomberg.com/apps/news?pid= ... quXjXBNKo0

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://money.cnn.com/2009/07/01/markets ... 2009070116

http://rothkopf.foreignpolicy.com/posts ... washington

http://www.ritholtz.com/blog/2009/07/un ... more-30927

http://www.bloomberg.com/apps/news?pid= ... WJtkeFK5yU

http://www.bloomberg.com/apps/news?pid= ... cWAOCmAfVo

http://www.nakedcapitalism.com/2009/07/ ... 5-ltv.html

http://www.calculatedriskblog.com/2009/ ... st-95.html

http://www.ritholtz.com/blog/2009/07/up ... ear-chart/

http://www.bloomberg.com/apps/news?pid= ... v4JRht6M4Y

http://www.ritholtz.com/blog/2009/07/th ... or-supply/

http://www.bloomberg.com/apps/news?pid= ... pK3J1JYpXU

http://trueslant.com/matttaibbi/2009/06 ... -a-chance/

http://www.ritholtz.com/blog/2009/07/mi ... the-world/

http://www.bloomberg.com/apps/news?pid= ... RLpgz65Qto

I got my answer. Unemployment re accelerating, work week hours at a record low, U6 unemployment @ 16.5% We've been going sideways and we ain't gonna launch upward in the immediate future. Employment is a lagging indicator, but we've been going up on "green shoots" and the deceleration of unemployment and housing depreciation. There have not been enough green in the shoots to tip consumer's mindset into the positive, unemployment re accelerated and every indication is that the housing workout will take much more time than hoped.

CLICK HERE

http://www.ritholtz.com/blog/2009/07/nf ... issection/

Here's my riff:

Decoupling;

Didn't work. The US sneezes, the rest of the world catches cold. Still true. Especially if they're awash in our mortgage backed securities and mortgages of their own. The reflation trade was just a trade, a headfake. Real economic recovery is still dependent on the consumer and the consumers mainstay is his job.

China will drive the world out of recession;

China is export driven and protectionist. Who are they gonna export to and who are they gonna buy from? Think about it.

Mortgage workouts;

Gimme a break. Fannie and Freddie can refi 125% LTV. So find me some borrowers who, 1) Need to refi and can/want to qualify for a $400K loan onna house now worth $325K. 2) Are then gonna take a non recourse mortgage and are going to turn it into a refi with recourse and that will require possible years to get them back to even. EVERYBODY WHO COULD FAKE AN APPLICATION, DID! Who's the new home buyers who will qualify under the new reality and bail everyone out at the old prices? This with the U6 measure of unemployment @ 16.5% (includes "discouraged, marginally attached,would like, and part time).

The banks are fixed and getting better;

Great profits with huge amounts of taxpayer supplied almost free money. Where do they put it to work? Does it make more sense to hang on to it and lose less of it while the economy finds the bottom, THEN loan it out?

I dropped into a local High End HiFi shop and mentioned that the week's unemployment figure came in at 467,000 vs the hoped for 325,000. The guy behind the counter went pale. This at a location that, if not recession proof, has the clients the least likely to hit the wall.

Things will eventually get better. But the time to be out of stocks was the 15 months previous to last March. The time to be back into stocks was March to the end of the day, June 30th.

Now we gotta reset reality as driven by 1)last quarters earnings, and 2) next quarters guidance.

Oh yeah, and financial markets news driven by rising unemployment, Iran and North Korea, and auto and manufacturing bankruptcies, municipal bankruptcies, Boeing DreamLiner delays, state bankruptcies and Afghanistan, and, and, and, and to a lesser degree by garden variety investment realities.

This insanely aggressive daytrader and momentum and position investor still has his 401a in the GIC and non governmental bonds. It's more important to keep what I made when times were good than to chase what may be there in a equivocal and possibly dangerous time..... There will be better days somewhere ahead.

AND CLICK HERE: http://www.youtube.com/watch?v=rUtlsk0l ... re=related

SATURDAY EVE

http://www.ritholtz.com/blog/2009/07/as ... ut-theory/

WTF????? Ban Short Selling??????

http://www.ritholtz.com/blog/2009/07/ba ... t-selling/

http://watchingthewatchers.org/indepth/ ... r-restrain

Stay Tooned...

Good Digital Sound (Don' Gimme This "It Sounds Great!!! I Paid More Than $50 For My Computer's Speakers And I Don't Hear Any Problems!!!" Crap) Is Really Really Good... Until You Dig Out A Vinyl Record And Listen To It With A Good Moving Coil Cartridge.

“I label this the "Paradox of Thrift," in that we can't restore our balance sheets without additional savings, and our stock markets cannot recover without consumer spending and corporate profitability.”

-- Cliff Draughn

Chartz and Table Zup @ www.joefacer.com.

Stay Tooned. We opened the year with the stock market inna near free fall, bounced hard at a ridiculously low level, and ascended back to where we are now.

Where dat? Either at a pause before an ascent higher on better economic conditions... in which case I got time to get way long. Or in an overvalued position based on too much hope and mistaking rotting slower for improving. See coupla three four post down below. In that case I stay in bonds and the GIC.

More to come.

http://www.youtube.com/watch?v=e3LEhfbK ... re=related

http://www.msnbc.msn.com/id/31564752/ns ... _business/

http://www.debka.com/article.php?aid=1396

http://money.cnn.com/2009/06/30/real_es ... 2009063009

http://www.mercurynews.com/topstories/c ... ck_check=1

http://www.ritholtz.com/blog/2009/06/ca ... -falls-18/

http://www.ritholtz.com/blog/2009/06/10 ... challenge/

http://www.ritholtz.com/blog/2009/06/mo ... -adjusted/

http://www.ritholtz.com/blog/2009/06/ai ... on-to-fly/

http://www.bloomberg.com/apps/news?pid= ... Dhz5w8ODrY

http://money.cnn.com/2009/06/26/news/co ... 2009062622

http://www.bloomberg.com/apps/news?pid= ... llNt3iGquQ

http://www.bloomberg.com/apps/news?pid= ... obeTB25ZeY

http://www.bloomberg.com/apps/news?pid= ... quXjXBNKo0

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://money.cnn.com/2009/07/01/markets ... 2009070116

WEDNESDAY Night:

Employment news out Tomorrow AM. We'll see what's up. There is no question that the stock market and stocks have recovered. I'm totally uncertain about the companies and the employees that the stocks represent. Earnings "Better Than Feared" was worth something. "Still in Business" was worth something. Driving down costs by jettisoning expenses, capital projects, charitable contributions, and employees is worth something. And then it is over. That quarters earnings report is history. What is left for the next quarter is growth and revenue and profits. My wife says many small retailers, even the national names are bailing from the mall in my neighborhood. She suspects that much of the rise in school enrollment in her district may be from subprime mortgage holders moving back in with family. If you read the links pn the COFGBLOG, you know what I'm seeing. Banks with great earnings derived from cooked books and taxpayer largesse. Bankrupt manufacturing and employment numbers padded with B/D adjustments. The employment numbers will give me a glimpse and the earnings reports will pull back the curtain.

Meantime, this occasional daytrader and insanely aggressive position trader has his 401a in Bonds and the GIC.

Stay tooned....

"When The World Is Running Down, You Make The Best Of What's Still Around" When " Soul On Ice" is co-oped for a prefab cocktail product and "To Soldier, It's A Kent" only makes ya think of cigarettes, and when "The Revolution Will Not be Televised", doesn't make you think of The Las Poets or Tienamen or Tehran... how much more will be left?

"It's easy to make good decisions when there are no bad options."

-- Robert Half

Chartz and Table Zup On www.joefacer.com

http://www.dailymotion.com/video/xpqut_ ... vise_music

http://en.wikipedia.org/wiki/The_Revolu ... _Televised

http://www.youtube.com/watch?v=Lm6zL9JJckw

http://www.youtube.com/watch?v=8M5W_3T2Ye4

http://www.debka.com/headline.php?hid=6143

http://www.youtube.com/watch?v=Tq3NwCHm-4U

http://www.youtube.com/watch?v=lQsb5u_D ... re=related

Power To The People Of Tehran.

The Revolution WILL Be Televised....And Twittered And YouTubed.

http://www.cnas.org/blogs/abumuqawama/2 ... -hype.html

Revolutions Large And Small, 1776 to Now.

Speaking Of The Revolution...

Figuring out the new landscape of the 401a..

I'm about half in the non gov bond fund, a tad less than half inna GIC and I've got some pocket change in foreign stocks. I'm waiting on the sidelines to get an answer to the questions, "Has the stock market completed a bear market rally and about to roll over and crush the present longs and draw the last of the hopefuls into it's embrace and drag them down?" "Or is it for real and about to digest gains and churn in place over the Summer before it launches upward as is often the case into the shopping season?"

Monday

I'll have my answer(s) pretty quick. I'm as of now, going to all GIC/bonds as of Tues Eve.

Stay Tooned...

Consider This And The Last Two Posts To Be Of a Cloth... Notice How Old Guys Use Archaic Expressions? The Expressions And The Old Guys Didn't Start Out Archaic.....

A man must not swallow more beliefs than he can digest.

-- Havelock Ellis

Chartz And Table Zup @ www.joefacer.com

http://www.msnbc.msn.com/id/31265283/ns ... nd_energy/

http://www.bloomberg.com/apps/news?pid= ... B3ytMcNUW4

http://www.bloomberg.com/apps/news?pid= ... LaaXr3qinM

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.msnbc.msn.com/id/31193659/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

Look about 6 and a half minutes in for a financial commentator revealing stress...

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/nikkei-do-75-off/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/un ... nt-friday/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/co ... m-problem/

http://www.ritholtz.com/blog/2009/06/io ... al-estate/

http://www.ritholtz.com/blog/2009/06/foreclosure-up-18/

http://www.ritholtz.com/blog/2009/06/we-still-love-you/

http://www.ritholtz.com/blog/2009/06/sc ... communist/

http://www.ritholtz.com/blog/2009/06/vi ... sm-waning/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/bu ... ventories/

http://www.newsweek.com/id/201523

BLOW YER MIND....

http://www.telegraph.co.uk/finance/fina ... rvive.html

http://www.msnbc.msn.com/id/31354296/ns ... _business/

Wed

http://www.cnn.com/2009/WORLD/meast/06/ ... index.html

http://www.msnbc.msn.com/id/31403377/ns ... al_estate/

http://www.newsweek.com/id/202323

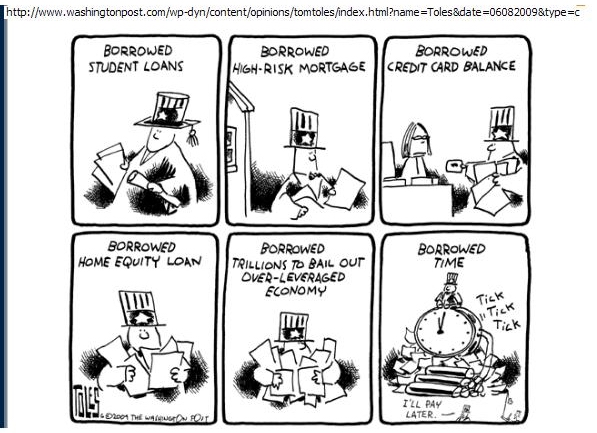

From the 6/13/09 Economist;

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

So it's like this.....ya gotta have a thesis.

Mine is that

the low of March this year was a panic low. The problems of 2007 supposedly had been fixed for good by early 2008 and by the time the Fall of 08 came around and things were headed for hell in a free fall pretty much everywhere, some serious downside momentum was in place. Coupla lower lows washed out all the sellers and left only shorts to sell.

Came the second week of March and people began to realize that even at 10 percent unemployment, 90 percent of the people would still be working, the employed and the unemployed would still be buying stuff, the government was shoveling money out of Ben's helicopters, and at some point inventories would be too low and products would have to be made and sold. Plus profit expectations had been driven into the ground by blind panic. So brave souls bought a little stock and the stretched to the downside rubber band snapped into motion. I caught a little of the move but missed that reality was ahead of expectations and I sold before the 1st quarter reports came out. DAMN!!! The reports were Better Than Expected. Stocks continued up without me and I fought myself over being late to the party vs arriving just as it cratered.

What now?

Well... stocks go too low and then go too high. There is a ton of money on the sidelines that missed the rally so far and CAN NOT MISS ANY MORE. There exist buyers desperate to buy. And interest rates are still fairly low. And the administration is cheer leading and papering over any signs of distress. And some places are still doing business and the rates of decline are slowing, possibly signaling a bottom and the headlines are about the bottom and the turn. But is it THE bottom...? Or just the end of a panic downdraft and the start of a long recession and extended trip across a flat economic landscape?

The rally looks tired. Stock prices pretty much discount a sizeable recovery. But the FED printed money like mad and now it has to borrow to fund what it printed. Bond buyers are offering less, fearing inflation, and that drives interest rates up and makes bonds a harder sell. That means that higher rates are needed on the bonds to raise the desired amount of money. That'll slow down refi's and new mortgages. The Fed will have to print more money and buy bonds to drive prices up and rates down, increasing fears of inflation. Which is the cause and not the cure. The Fed and administration have announced a flurry of plans, most of which are going nowhere. We have a ton of real housing inventory and an unknown amount of shadow inventory. The Fed offers the banks free money to start earning their way out of trouble. But the money is getting more expensive for the Fed to borrow and show me where the new business is for the banks to fund. Housing? Malls? Factories? Energy? Maybe... Wanna loan yourself some money through the government for a voucher to buy a new Chrysler SUV after you loan GMAC some money to fund your loan for the SUV? How about a house? Who's gonna buy your trade in? The Fed has entered into repo agreements with banks, taking toxic assets from them and giving back treasuries/cash. The mechanism by which the Fed can unload or make better the crap on its balance sheet and give it back to the banks/other investors is not apparent to me. The Great Unwind is still gotta happen and we're closer to the beginning than the end of flushing the crap away...

Check it out;

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

BLOW YER MIND...

http://www.telegraph.co.uk/finance/fina ... rvive.html

So my thesis is that we're going nowhere while things play out. I don't see a clearer road substantially up or down and I see a lot of resistance higher and a lot somewhat lower. But markets don't stand still. Fear and Greed and Hope and Despair will cause the markets to slosh around within a range. For how long? A week? A month? A year?

Check it out...

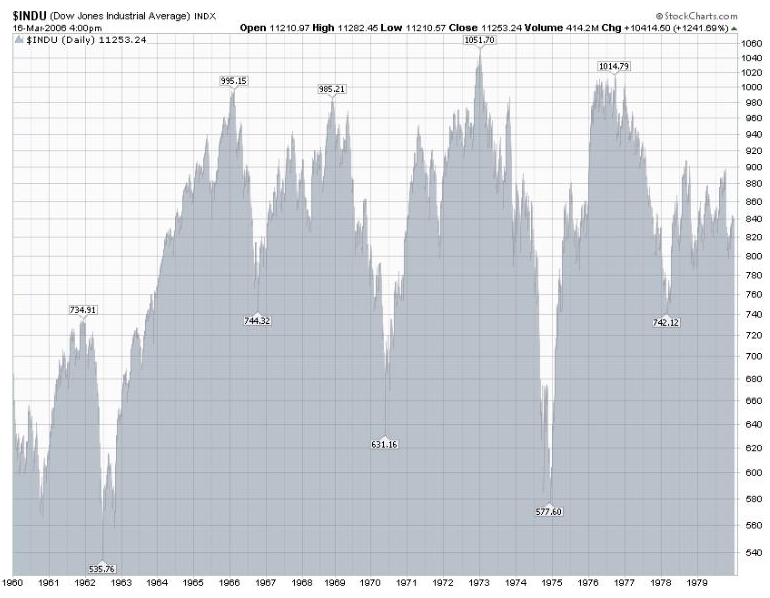

The Dow 30 was at 740 four times in 16 years and a ways above and below it. Buy and Hold? GIMME A BREAK!!!!! Tryin' to work with what the market gives me? Buy the dips and sell the rips? Make money that way? Prolly.... I'm gonna try

I committed a significant amount of my account to stocks earlier in the month to get back inna game. It didn't look that good, but I needed to re-engage my interest. So I made a dollar or two last week. Lately, not so much. I moved some money outa stocks and into the GIC this Friday, leaving some in stocks. There are buyers still trying to get into the party when the door opens for someone to leave... There may be a little more to go. But the easy money and a lot of it has already been made. The resistance seems greater to the upside than the downside and I'm more likely lighten up on stocks than buy more.

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.