Lindsey Campbell;

Yup... Unhuh Uhhuhh. EarlierThis Week I Decided That Knowing Too Much About What A Dire State The World Was In Was Costing Me Profits. I Emptied My Mind Of Caution And Moved To Almost 40% Stocks. Party On, Dood!!!!

If you trade stocks in the short term, one of things that you need to be very aware of is that sometimes the action that seems extremely stupid is the best way to make money.

If a lot of people with a lot of money are chasing grossly overvalued stocks, it can feel pretty dumb to throw caution to the wind and join the party.

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term.

In fact, there can be a complete disconnect between the two for very long periods of time.

If you are going to trade in the short term, you need to decide whether you are willing to do the dumb things that make money or are you going to stick to the "facts" and stand aside while the idiots run prices up and down.

It's all about sentiment, mood and psychology in the short term, and it doesn't pay to think too hard about fundamentals if you are playing in the short term.

James “Rev Shark” DePorre

Charts and Table Zup @ www.joefacer.com

http://www.youtube.com/watch?v=ihvvf1R_vWo

http://www.bloomberg.com/apps/news?pid= ... 6BdHuR9JUU

http://www.bloomberg.com/apps/news?pid= ... E8aZLFuNXo

http://www.bloomberg.com/apps/news?pid= ... M_oxkI3Qkw

http://www.bloomberg.com/apps/news?pid= ... bHcz0ryM_E

http://www.bloomberg.com/apps/news?pid= ... hD2umuVt_c

http://www.ritholtz.com/blog/2009/08/th ... n-history/

http://www.ritholtz.com/blog/2009/08/about-bailouts/

http://www.ritholtz.com/blog/2009/08/ze ... -creation/

http://www.bloomberg.com/apps/news?pid= ... sz8TNju_Zg

http://www.nytimes.com/2009/08/09/busin ... ulson.html

http://www.bloomberg.com/apps/news?pid= ... iLSlGSSoFo

http://www.nytimes.com/2009/08/09/busin ... mp;emc=rss

http://www.bloomberg.com/apps/news?pid= ... 39_VW6pf3U

http://www.bloomberg.com/apps/news?pid= ... gtL5wHZN8k

http://www.bloomberg.com/apps/news?pid= ... BJ8IS3ZImw

http://www.msnbc.msn.com/id/32346408/ns ... gton_post/

http://www.msnbc.msn.com/id/32331691/ns ... gage_mess/

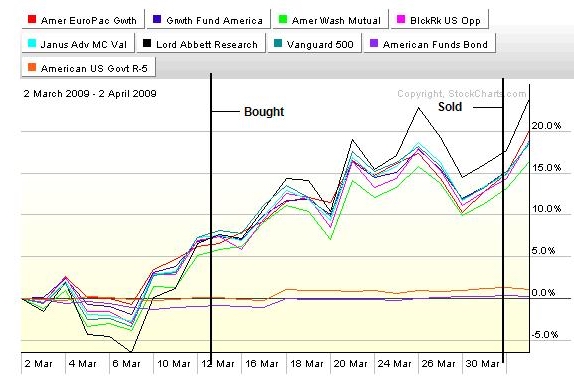

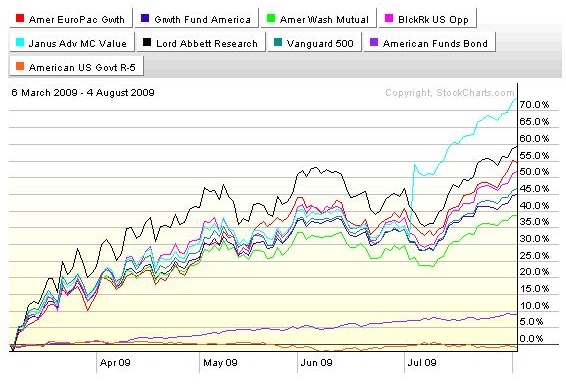

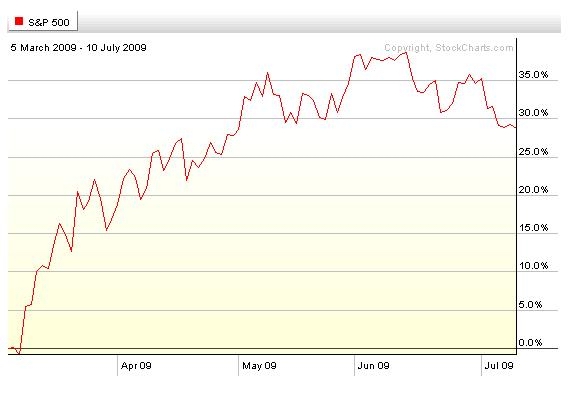

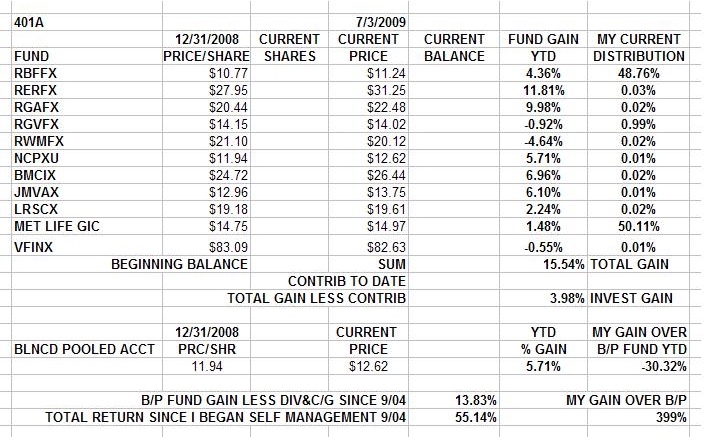

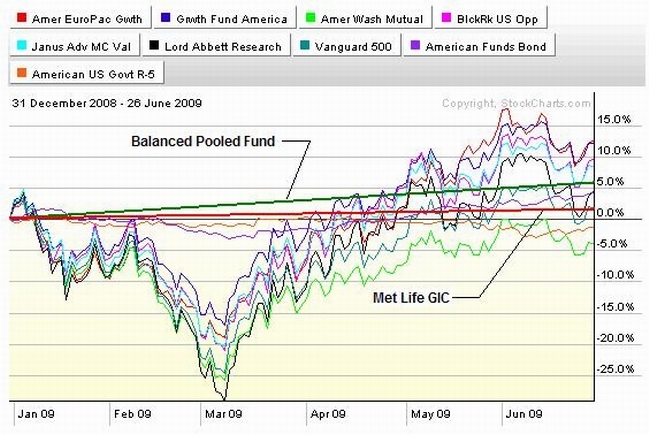

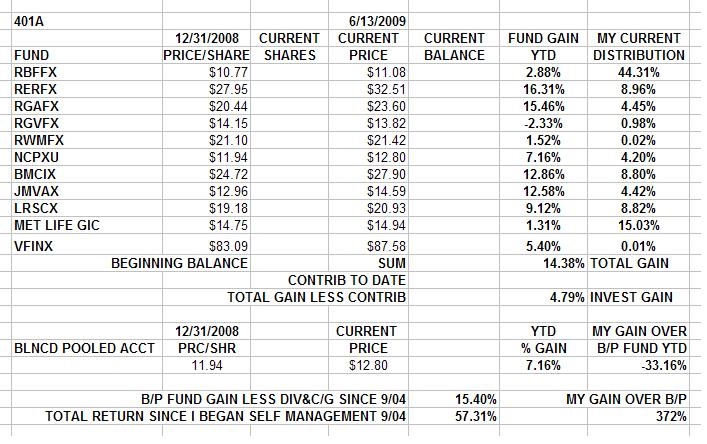

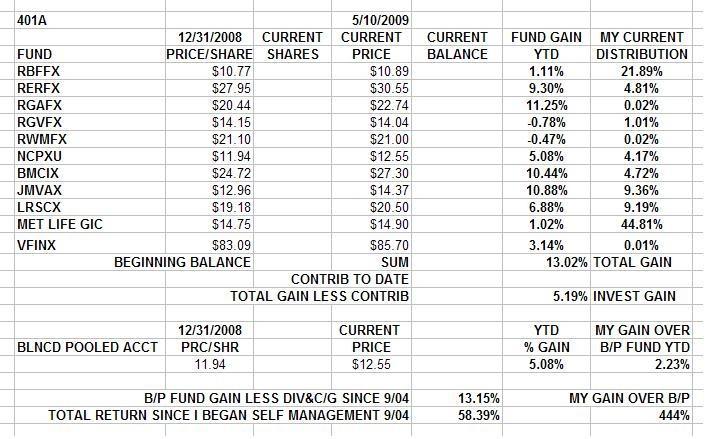

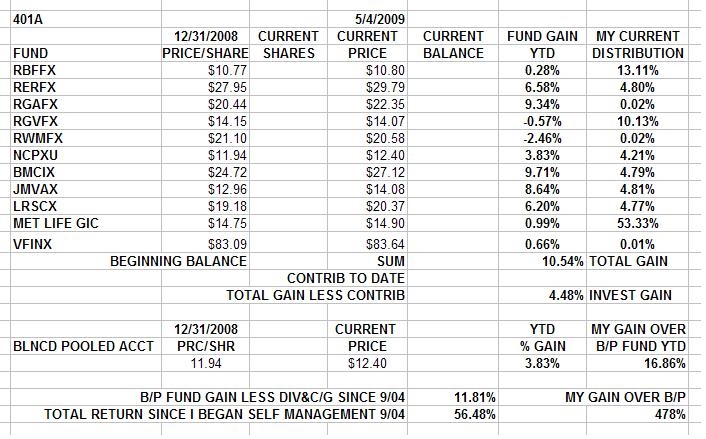

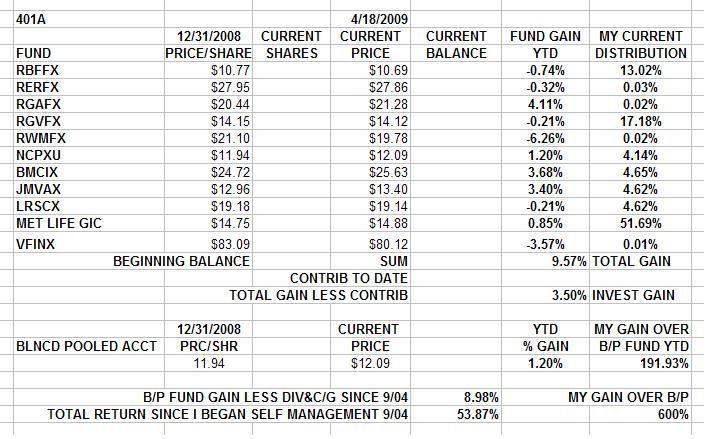

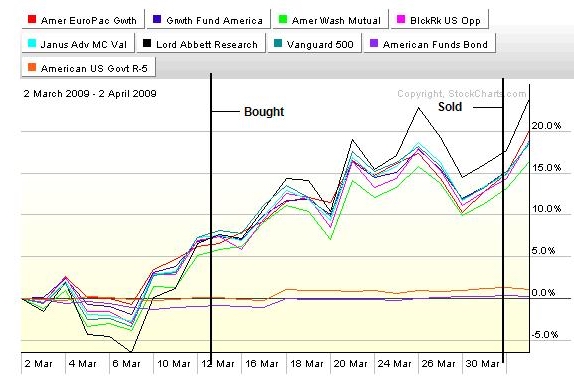

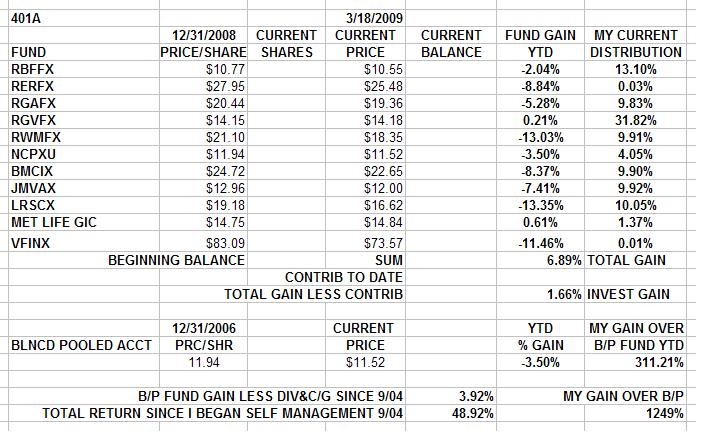

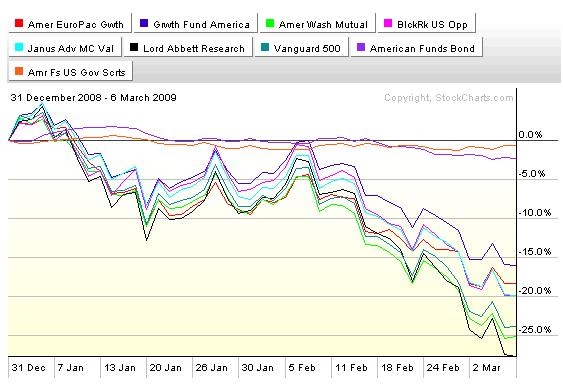

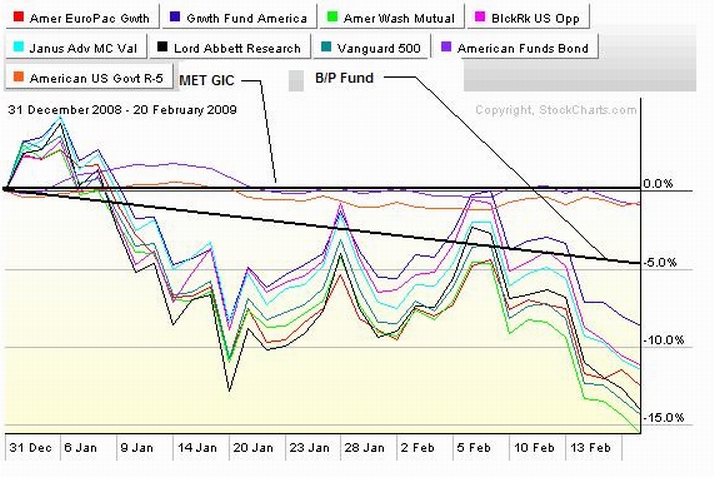

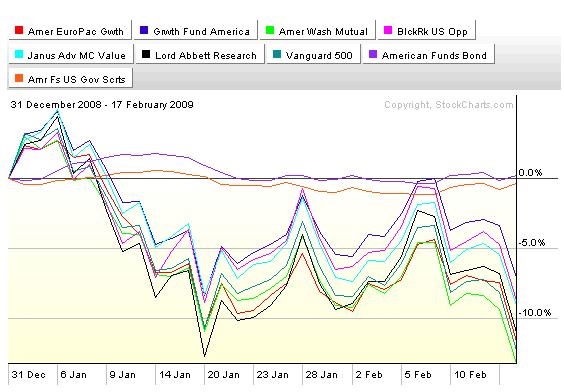

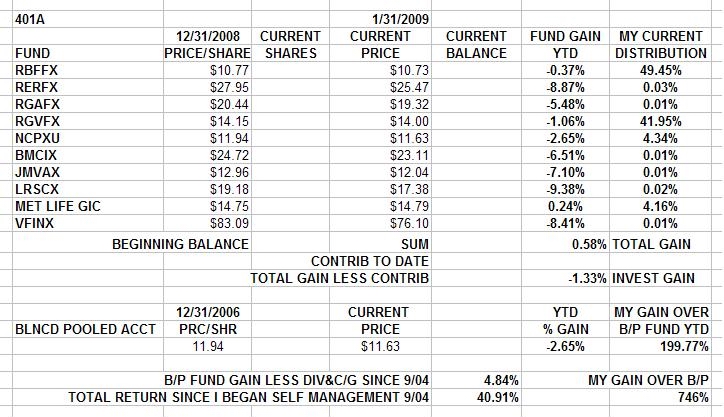

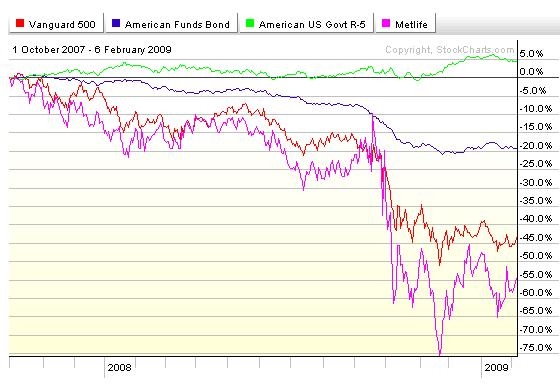

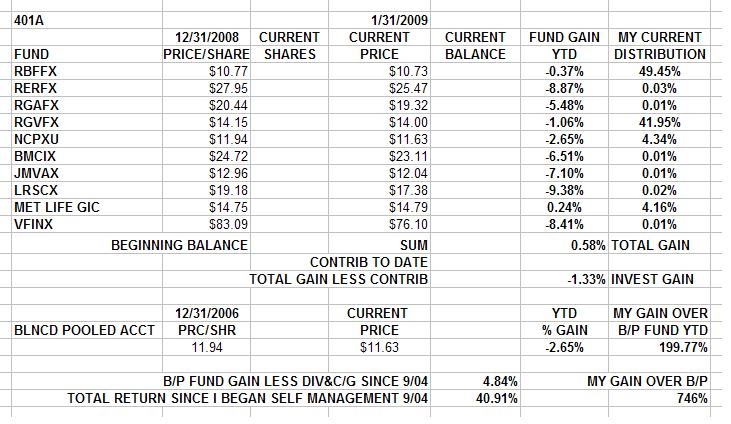

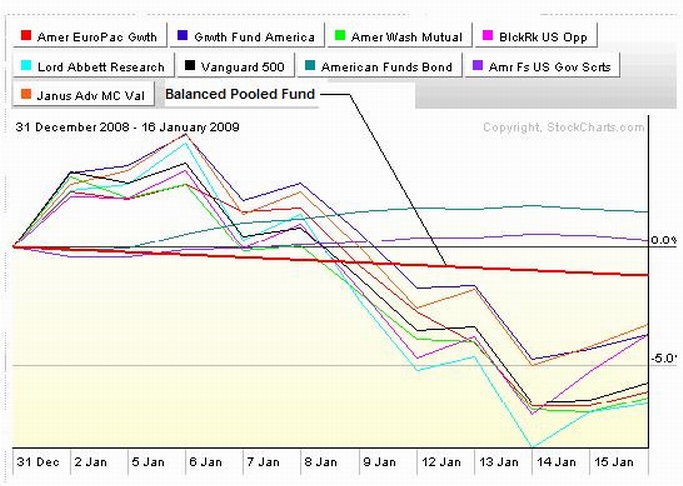

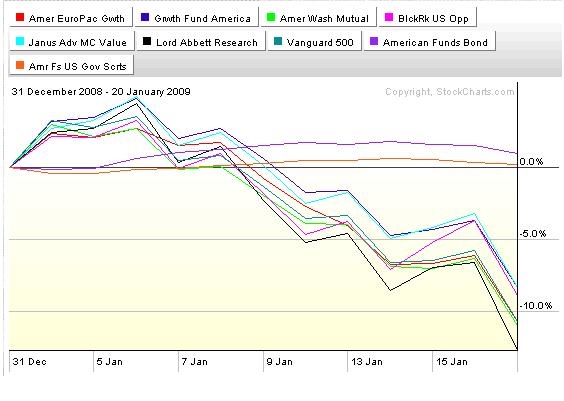

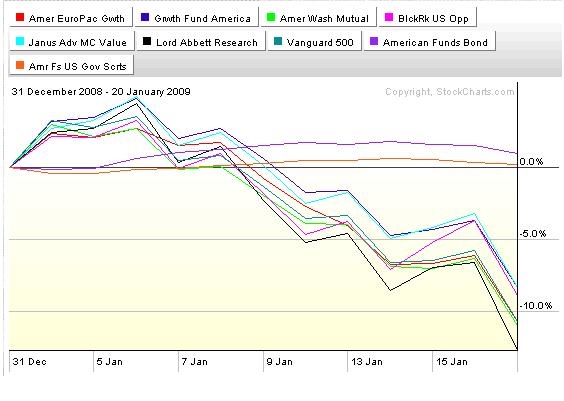

Here's the smart move I made in my 401a on the dates shown.

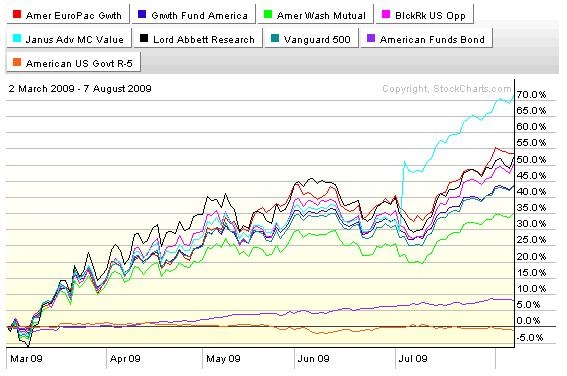

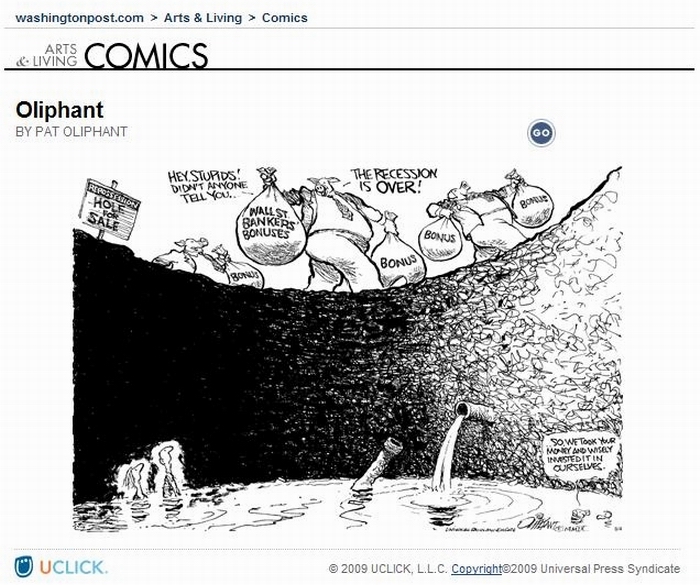

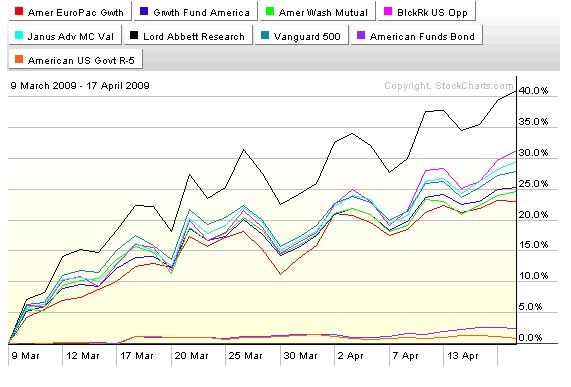

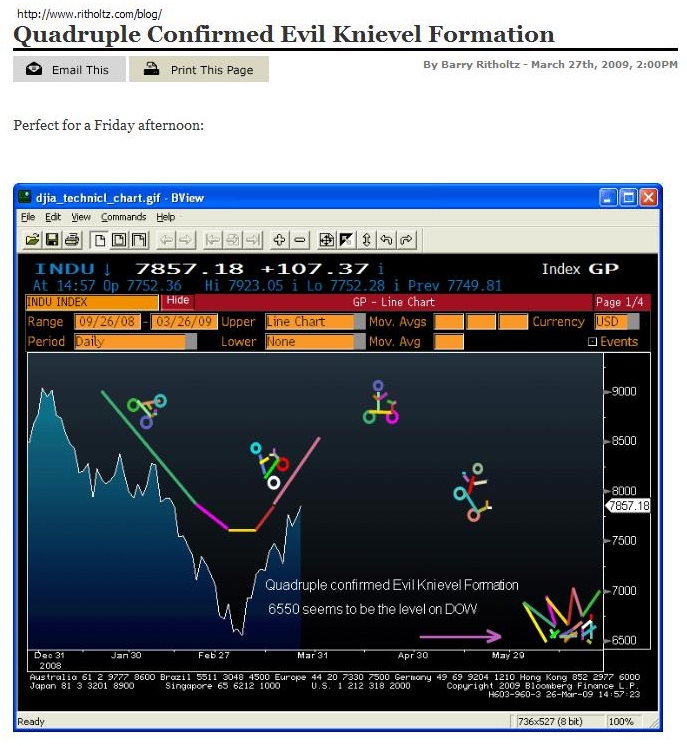

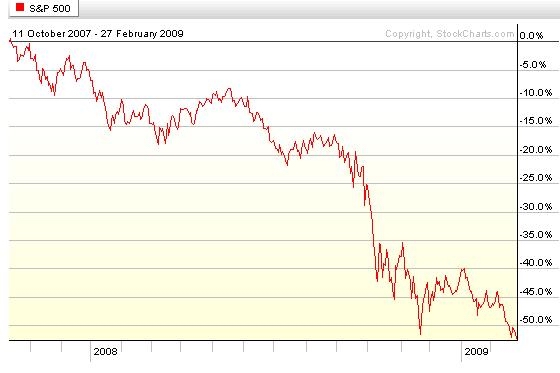

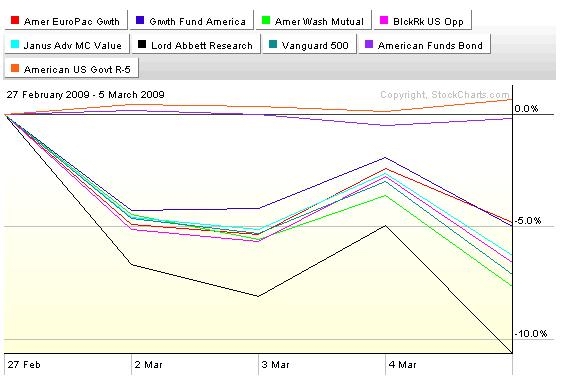

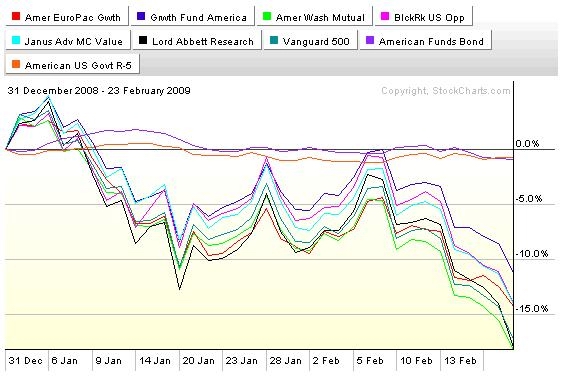

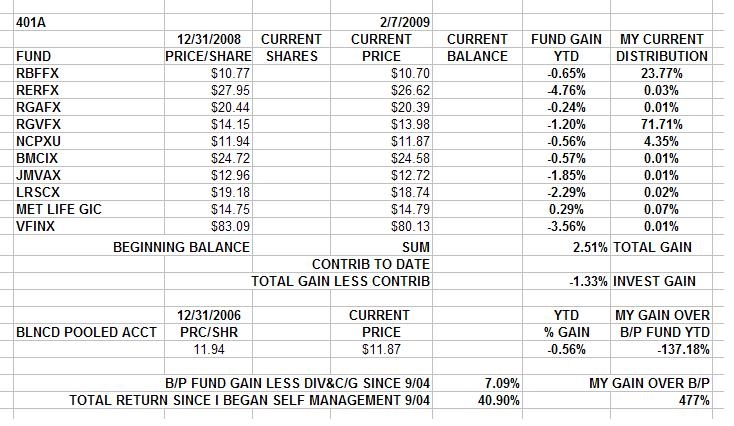

Here's what I missed out on. Ya can't get 'em all right. Rev Shark is right; Trends always move farther than you think they should. I still think there is much more employment misery to come. I still think that there is much more housing misery to come... in time if not in price. And they ain't hirin' everybody back down at the plant fer the Christmas season. As Barry Ritholtz sez "The parachute has opened and we're no longer in free fall. But we're still going down." This is all about the "New Normal." Which I'll write about later.

So I'm chasing a move that has come a long way and can't have much farther to go in its late stages. The upside is limited and the downside is not so much. Hope I get it right..... I'll let you know about it here.

Stay Tooned....

Thursday Evening.....

So far... So good.

Chartz and Table Zup at www.joefacer.com

http://www.youtube.com/watch?v=vdyvPg0c ... re=related

http://www.forbes.com/2009/07/28/gates- ... glate.html

http://www.ritholtz.com/blog/2009/07/ho ... stigation/

http://www.ritholtz.com/blog/2009/07/mo ... ome-sales/

http://www.ritholtz.com/blog/2009/07/in ... -earnings/

http://blogs.wsj.com/developments/2009/ ... inancings/

http://www.ritholtz.com/blog/2009/07/ne ... l-markets/

http://www.salon.com/opinion/greenwald/ ... index.html

http://www.washingtonpost.com/wp-dyn/co ... 03065.html

http://www.msnbc.msn.com/id/21134540/vp ... 8#32203408

http://www.ritholtz.com/blog/2009/08/th ... aborative/

http://www.nytimes.com/imagepages/2009/ ... ready.html

http://www.bloomberg.com/apps/news?pid= ... Zx5kGyDavA

http://www.ritholtz.com/blog/2009/08/ma ... ch-9-lows/

http://www.ritholtz.com/blog/2009/08/lo ... treet-pay/

http://www.bloomberg.com/apps/news?pid= ... Sh0vntimco

http://www.ritholtz.com/blog/2009/08/lo ... treet-pay/

http://www.msnbc.msn.com/id/32255580/ns ... gage_mess/

http://www.msnbc.msn.com/id/32254520/ns ... ork_times/

http://www.nytimes.com/2009/08/02/us/po ... mp;emc=rss

http://www.newsweek.com/id/209829

http://www.bloomberg.com/apps/news?pid= ... Ut41aeqxMk

http://www.bloomberg.com/apps/news?pid= ... gRG8QbeKNY

http://www.charlierose.com/view/interview/10507

http://www.bloomberg.com/apps/news?pid= ... orpZRV0STk

http://www.ritholtz.com/blog/2009/08/ny ... ut-nation/

Tuesday Eve

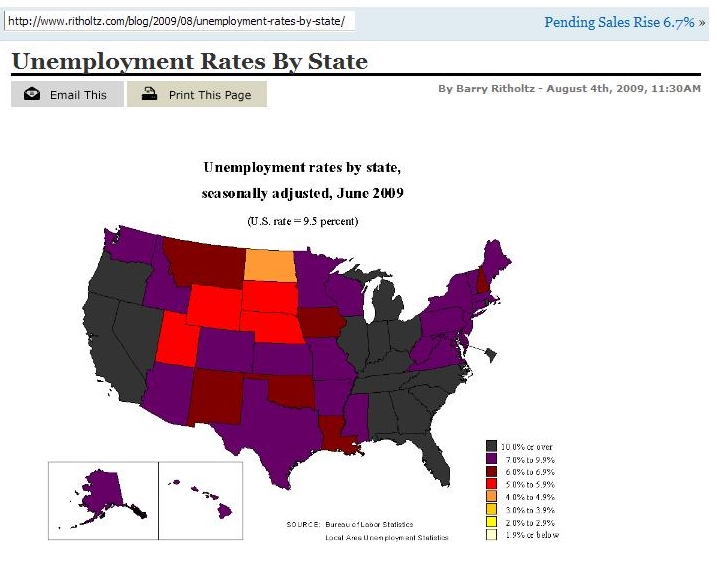

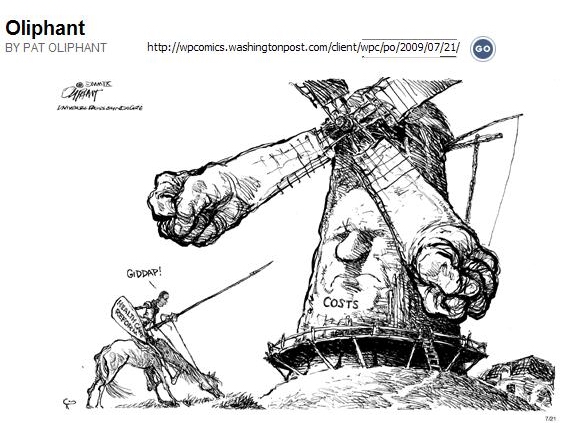

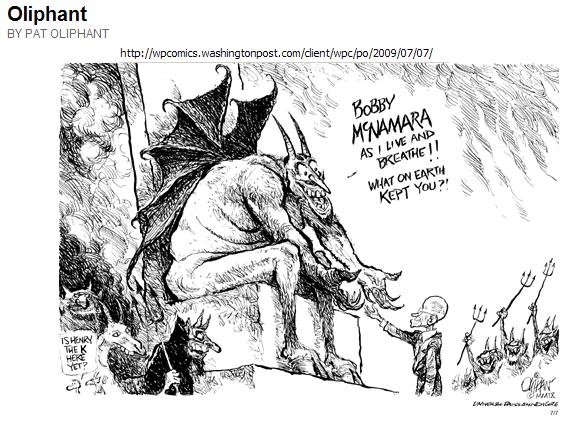

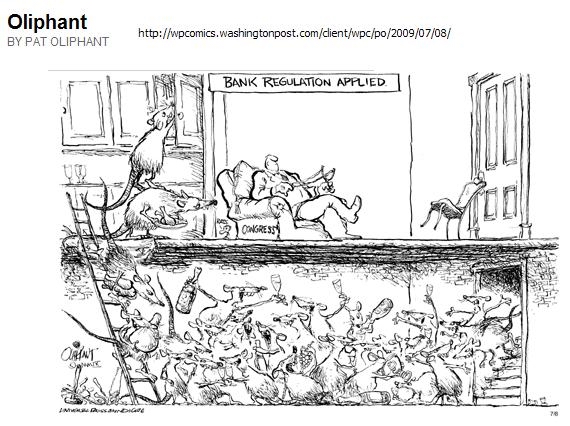

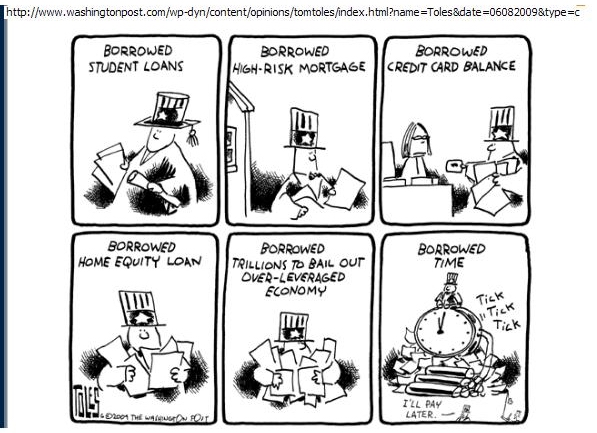

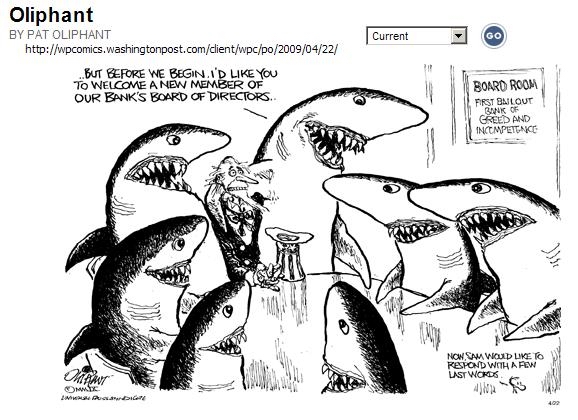

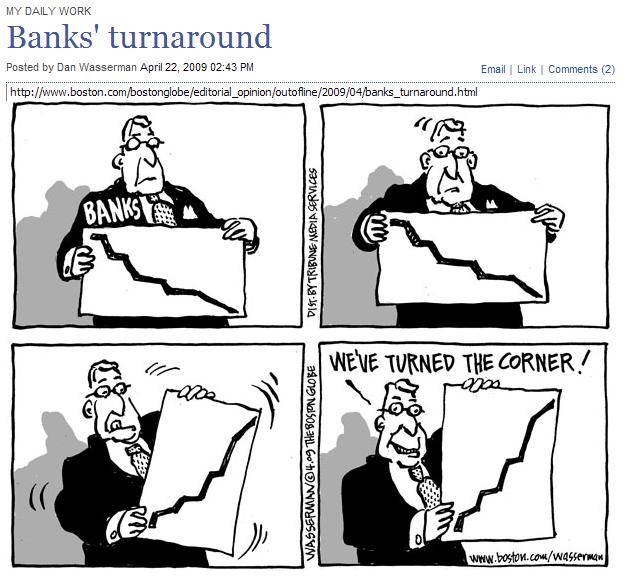

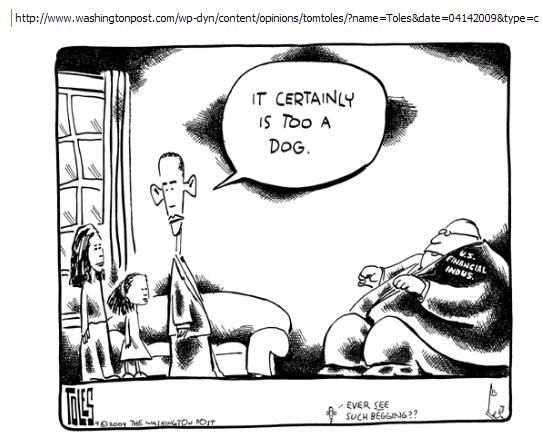

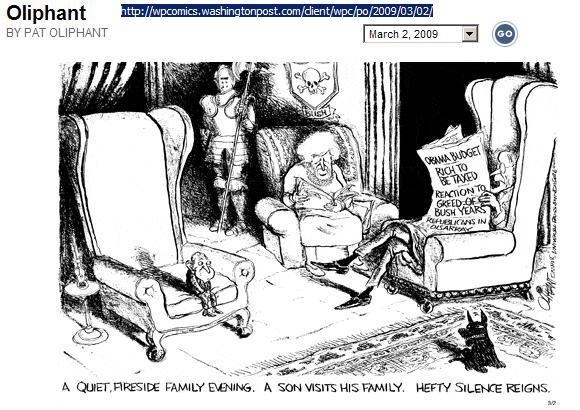

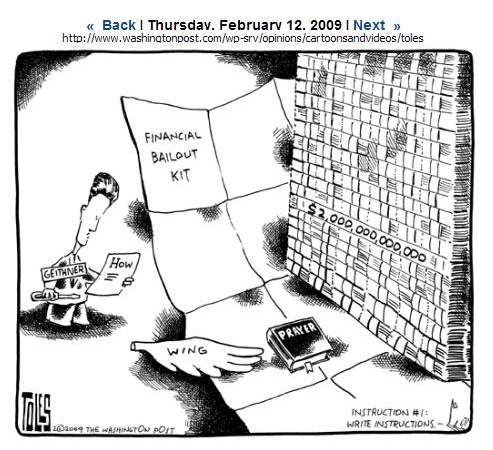

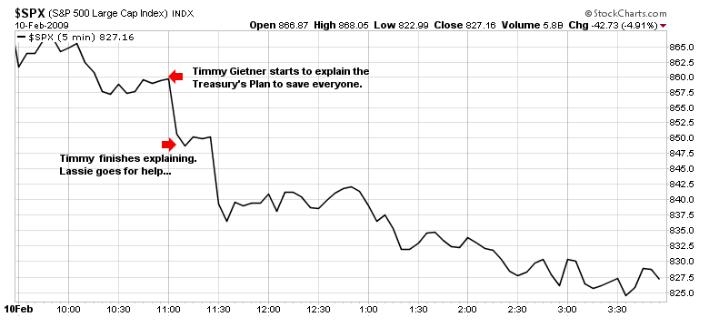

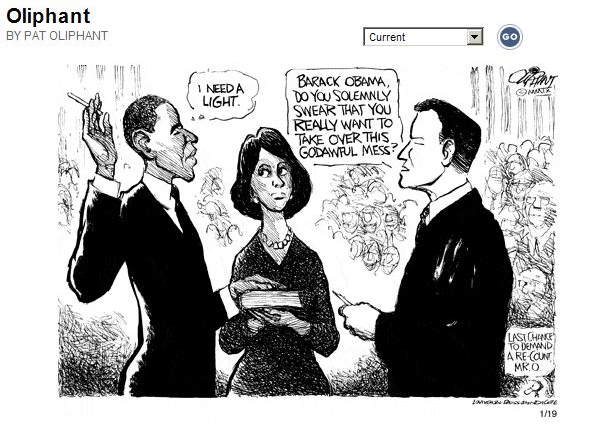

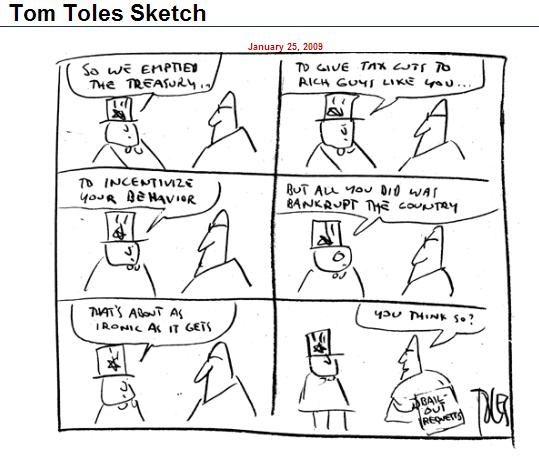

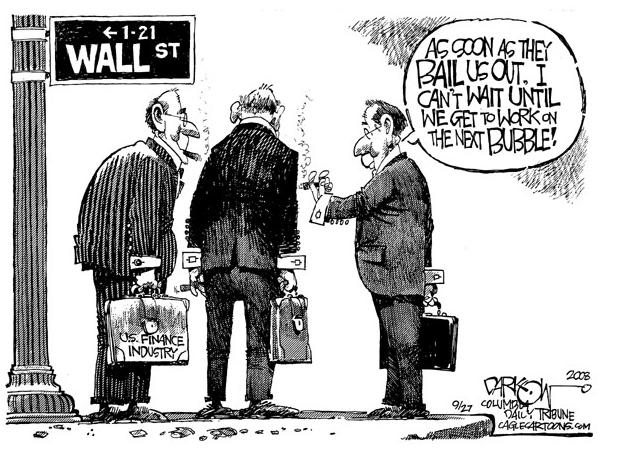

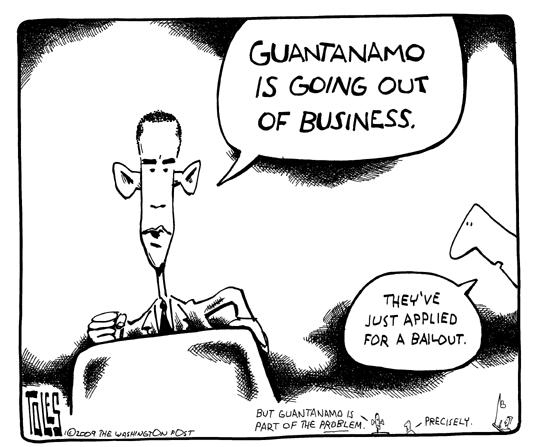

In The Face OF This;

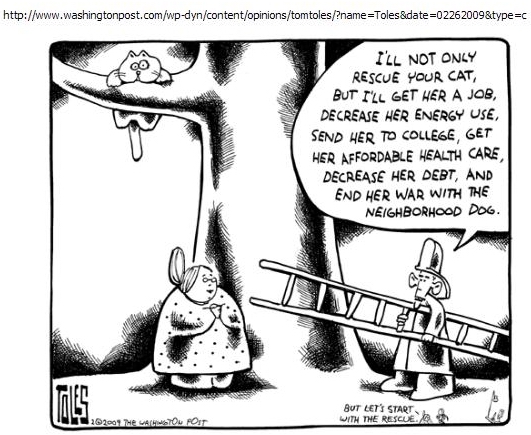

We've Got This;

I caught some of the pop off the bottom in March, but not enough of it. I moved to the side lines. You read the links I post here, you know I see under the covers and through the picket fence and you know why I bailed out. That was a mistake. I looked for a pullback so I could fix it. Another mistake.

I gritted my teeth this morning and I'm about 40% stocks this evening. It is not expected to be a long term relationship. In fact, I'm afraid it'll be way too short. But I gotta party hearty while I can since it looks like the party ain't ever gonna stop. It will.... I just dunno when. "Maybe Tomorrow... Or Until The End Of Time..." Not leaving soon enough would be another mistake. Eventually I'll get it right. The fact that I'm still up 50% over almost 5 years give me a basis for faith... I'm aiming for mostly right. Purt much there fer now.....Know whut ah mean, Vern?

Maybe this upcoming weekend I'll write about it.....

Tuesday Eve

In The Face OF This;

We've Got This;

I caught some of the pop off the bottom in March, but not enough of it. I moved to the side lines. You read the links I post here, you know I see under the covers and through the picket fence and you know why I bailed out. That was a mistake. I looked for a pullback so I could fix it. Another mistake.

I gritted my teeth this morning and I'm about 40% stocks this evening. It is not expected to be a long term relationship. In fact, I'm afraid it'll be way too short. But I gotta party hearty while I can since it looks like the party ain't ever gonna stop. It will.... I just dunno when. "Maybe Tomorrow... Or Until The End Of Time..." Not leaving soon enough would be another mistake. Eventually I'll get it right. The fact that I'm still up 50% over almost 5 years give me a basis for faith... I'm aiming for mostly right. Purt much there fer now.....Know whut ah mean, Vern?

Maybe this upcoming weekend I'll write about it.....

I Mentioned To My Wife That She'd Never Asked Me To Talk To The Kids About Sex And Drugs While They Were Growing Up. "Damn Right!!" She Answered.....

If you trade stocks in the short term, one of things that you need to be very aware of is that sometimes the action that seems extremely stupid is the best way to make money.

If a lot of people with a lot of money are chasing grossly overvalued stocks, it can feel pretty dumb to throw caution to the wind and join the party.

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term.

In fact, there can be a complete disconnect between the two for very long periods of time.

If you are going to trade in the short term, you need to decide whether you are willing to do the dumb things that make money or are you going to stick to the "facts" and stand aside while the idiots run prices up and down.

It's all about sentiment, mood and psychology in the short term, and it doesn't pay to think too hard about fundamentals if you are playing in the short term.

James “Rev Shark” DePorre

Chartz and Table Zup @ www.joefacer.com.

Stay tooned for more this weekend. I've been away for a coupla weeks and time to dial it up. Seeya here later.

http://www.youtube.com/watch?v=guL3xWi6 ... re=related

http://www.newsweek.com/id/206166

http://www.msnbc.msn.com/id/31980862/ns ... ork_times/

http://www.newsweek.com/id/208633

http://www.newsweek.com/id/208164

http://www.msnbc.msn.com/id/31983839/ns ... ite_house/

http://www.ritholtz.com/blog/wp-content ... ebpage.jpg

http://www.ritholtz.com/blog/2009/07/lo ... ome-sales/

http://www.ritholtz.com/blog/2009/07/in ... -earnings/

http://www.ritholtz.com/blog/2009/07/si ... lly-to-64/

http://www.ritholtz.com/blog/2009/07/yo ... -earnings/

http://www.ritholtz.com/blog/2009/07/no ... the-rally/

http://www.ritholtz.com/blog/2009/07/re ... d-to-2002/

http://www.ritholtz.com/blog/2009/07/we ... nkfest-13/

http://www.ritholtz.com/blog/2009/07/th ... more-33370

http://www.ritholtz.com/blog/2009/07/fo ... -regional/

http://www.ritholtz.com/blog/2009/07/ha ... %E2%80%99/

Did We Just Have The Mother Of All Oversold Bounces? Are We Looking At The Mother Of all Jobless Recoveries? MOTHER@*&%$&/*&^##!!!!!!!!

In general, your target is not to beat the market. It is to beat zero. As I have written for years, the investors who win in this market are the ones who take the least damage.

-- John Mauldin

Chartz and Table Zup on www.joefacer.com.

Stay tooned....

In the mean time.... Click here; http://www.youtube.com/watch?v=BHXKlNP4 ... re=related

and here;

http://www.bloomberg.com/apps/news?pid= ... LGZEc7qoqA

http://www.bloomberg.com/apps/news?pid= ... E3j.8n71UQ

http://www.msnbc.msn.com/id/31775881/ns ... umer_news/

http://www.bloomberg.com/apps/news?pid= ... 0_1SlKgIwo

http://money.cnn.com/2009/07/07/markets ... 2009070715

http://www.debka.com/headline.php?hid=6174

http://www.bloomberg.com/apps/news?pid= ... FwADFOsxqQ

UH OH.....

http://www.bloomberg.com/apps/news?pid= ... OrbEKeCVzk

http://www.bloomberg.com/apps/news?pid= ... LGZEc7qoqA

Triple UH OH

http://www.bloomberg.com/apps/news?pid= ... MFuHzp5R9E

http://www.ritholtz.com/blog/2009/07/ho ... mods-fail/

EVEN WORSE

http://www.ritholtz.com/blog/2009/07/je ... good-year/

http://www.nytimes.com/2009/07/10/busin ... .html?_r=1

http://www.bloomberg.com/apps/news?pid= ... RlD846h2XY

http://www.nytimes.com/2009/07/10/busin ... 10fed.html

http://www.nytimes.com/2009/07/10/busin ... 10fed.html

http://www.ritholtz.com/blog/2009/07/th ... eap-money/

Freakin' "A" Tweetie Bird

http://www.ritholtz.com/blog/2009/07/wh ... s-outlook/

http://www.ritholtz.com/blog/2009/07/ma ... time-bomb/

SO MUCH GREAT STUFF THIS WEEK!!!!! Informationwise, I mean.... In one aspect, that this is out there is GREAT. In another.... Not So Much....

http://www.ritholtz.com/blog/2009/07/is ... ading-day/

http://www.ritholtz.com/blog/2009/07/de ... e-summers/

http://www.ritholtz.com/blog/2009/07/pm ... n-2-years/

http://www.economist.com/blogs/freeexch ... less_r.cfm

http://www.economist.com/blogs/freeexch ... less_r.cfm

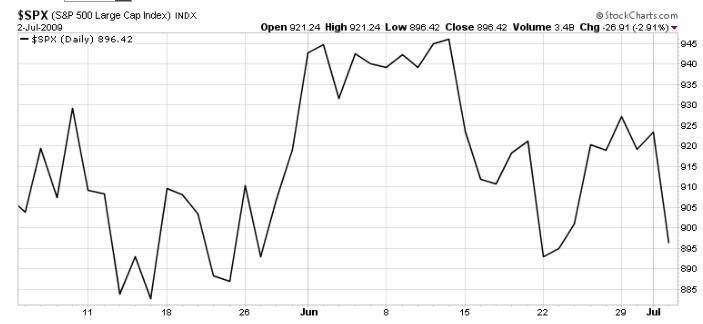

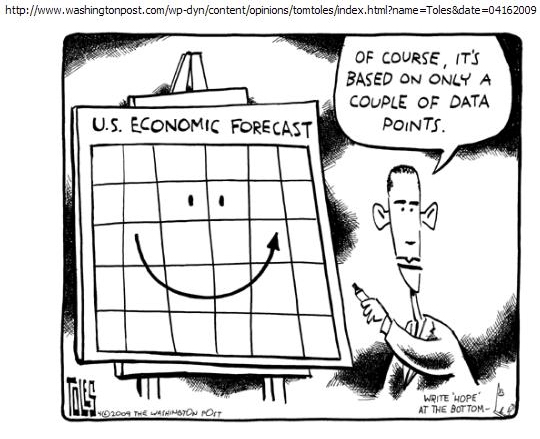

Either the efficient markets are telling us that things are 40% better than 3 months ago....

Or three months ago the emotional markets panicked to the downside and now are where they should really be....

Or We had a hell of an oversold bounce based on "still in business" and cheerleading and hope and we're about to roll over as we come to terms with how bad it really is...

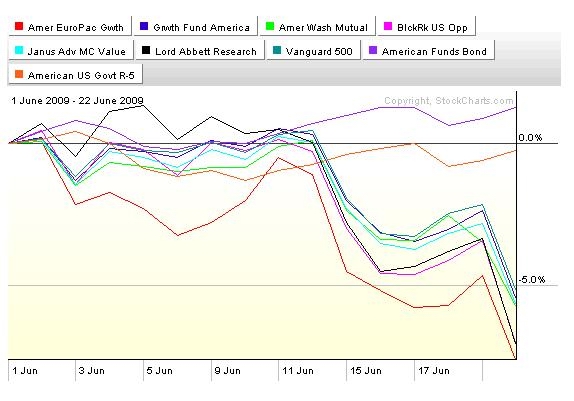

I'm STILL all in in bonds and the GIC and torn between corporates for yield and Govies for safety. Guess what I think.....

The Unemployment Number Wasn't That Bad If You Knew Enough To Expect It And If You Could Play On The Dark Side Of The Street. Otherwise, If You Were Long Stocks In Your 401a, It Was A Big Asphalt Face Plant.

It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.

-- Charles Darwin

Chartz and Table Zup @ www.joefacer.com

http://www.bloomberg.com/apps/news?pid= ... llNt3iGquQ

http://www.bloomberg.com/apps/news?pid= ... obeTB25ZeY

http://www.bloomberg.com/apps/news?pid= ... quXjXBNKo0

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://money.cnn.com/2009/07/01/markets ... 2009070116

http://rothkopf.foreignpolicy.com/posts ... washington

http://www.ritholtz.com/blog/2009/07/un ... more-30927

http://www.bloomberg.com/apps/news?pid= ... WJtkeFK5yU

http://www.bloomberg.com/apps/news?pid= ... cWAOCmAfVo

http://www.nakedcapitalism.com/2009/07/ ... 5-ltv.html

http://www.calculatedriskblog.com/2009/ ... st-95.html

http://www.ritholtz.com/blog/2009/07/up ... ear-chart/

http://www.bloomberg.com/apps/news?pid= ... v4JRht6M4Y

http://www.ritholtz.com/blog/2009/07/th ... or-supply/

http://www.bloomberg.com/apps/news?pid= ... pK3J1JYpXU

http://trueslant.com/matttaibbi/2009/06 ... -a-chance/

http://www.ritholtz.com/blog/2009/07/mi ... the-world/

http://www.bloomberg.com/apps/news?pid= ... RLpgz65Qto

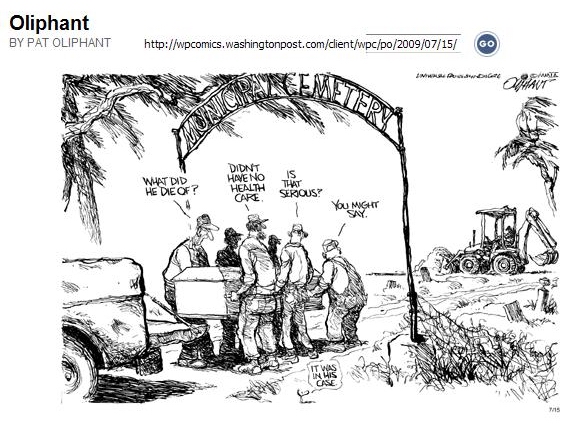

I got my answer. Unemployment re accelerating, work week hours at a record low, U6 unemployment @ 16.5% We've been going sideways and we ain't gonna launch upward in the immediate future. Employment is a lagging indicator, but we've been going up on "green shoots" and the deceleration of unemployment and housing depreciation. There have not been enough green in the shoots to tip consumer's mindset into the positive, unemployment re accelerated and every indication is that the housing workout will take much more time than hoped.

CLICK HERE

http://www.ritholtz.com/blog/2009/07/nf ... issection/

Here's my riff:

Decoupling;

Didn't work. The US sneezes, the rest of the world catches cold. Still true. Especially if they're awash in our mortgage backed securities and mortgages of their own. The reflation trade was just a trade, a headfake. Real economic recovery is still dependent on the consumer and the consumers mainstay is his job.

China will drive the world out of recession;

China is export driven and protectionist. Who are they gonna export to and who are they gonna buy from? Think about it.

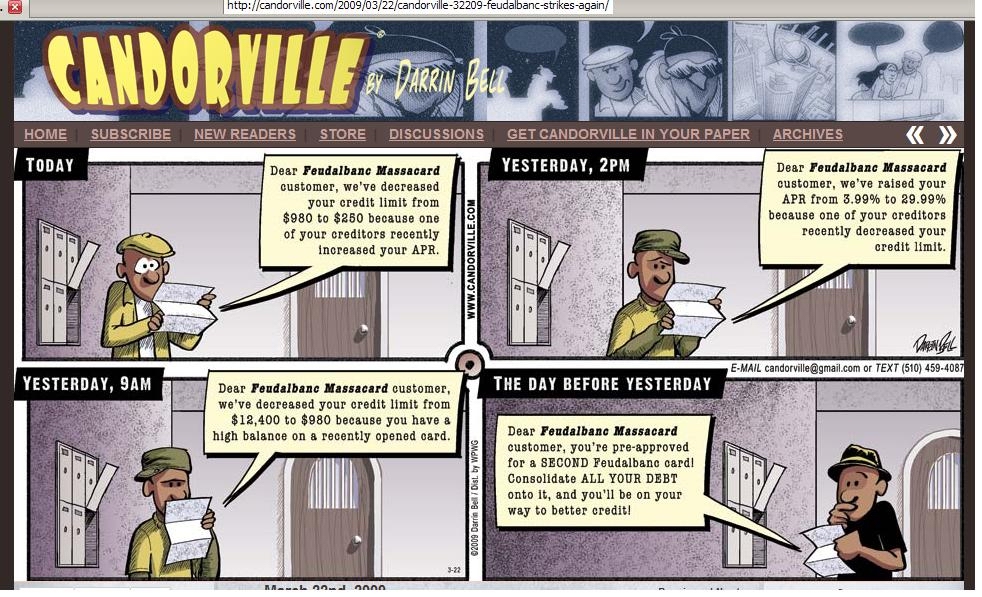

Mortgage workouts;

Gimme a break. Fannie and Freddie can refi 125% LTV. So find me some borrowers who, 1) Need to refi and can/want to qualify for a $400K loan onna house now worth $325K. 2) Are then gonna take a non recourse mortgage and are going to turn it into a refi with recourse and that will require possible years to get them back to even. EVERYBODY WHO COULD FAKE AN APPLICATION, DID! Who's the new home buyers who will qualify under the new reality and bail everyone out at the old prices? This with the U6 measure of unemployment @ 16.5% (includes "discouraged, marginally attached,would like, and part time).

The banks are fixed and getting better;

Great profits with huge amounts of taxpayer supplied almost free money. Where do they put it to work? Does it make more sense to hang on to it and lose less of it while the economy finds the bottom, THEN loan it out?

I dropped into a local High End HiFi shop and mentioned that the week's unemployment figure came in at 467,000 vs the hoped for 325,000. The guy behind the counter went pale. This at a location that, if not recession proof, has the clients the least likely to hit the wall.

Things will eventually get better. But the time to be out of stocks was the 15 months previous to last March. The time to be back into stocks was March to the end of the day, June 30th.

Now we gotta reset reality as driven by 1)last quarters earnings, and 2) next quarters guidance.

Oh yeah, and financial markets news driven by rising unemployment, Iran and North Korea, and auto and manufacturing bankruptcies, municipal bankruptcies, Boeing DreamLiner delays, state bankruptcies and Afghanistan, and, and, and, and to a lesser degree by garden variety investment realities.

This insanely aggressive daytrader and momentum and position investor still has his 401a in the GIC and non governmental bonds. It's more important to keep what I made when times were good than to chase what may be there in a equivocal and possibly dangerous time..... There will be better days somewhere ahead.

AND CLICK HERE: http://www.youtube.com/watch?v=rUtlsk0l ... re=related

SATURDAY EVE

http://www.ritholtz.com/blog/2009/07/as ... ut-theory/

WTF????? Ban Short Selling??????

http://www.ritholtz.com/blog/2009/07/ba ... t-selling/

http://watchingthewatchers.org/indepth/ ... r-restrain

Stay Tooned...

Good Digital Sound (Don' Gimme This "It Sounds Great!!! I Paid More Than $50 For My Computer's Speakers And I Don't Hear Any Problems!!!" Crap) Is Really Really Good... Until You Dig Out A Vinyl Record And Listen To It With A Good Moving Coil Cartridge.

“I label this the "Paradox of Thrift," in that we can't restore our balance sheets without additional savings, and our stock markets cannot recover without consumer spending and corporate profitability.”

-- Cliff Draughn

Chartz and Table Zup @ www.joefacer.com.

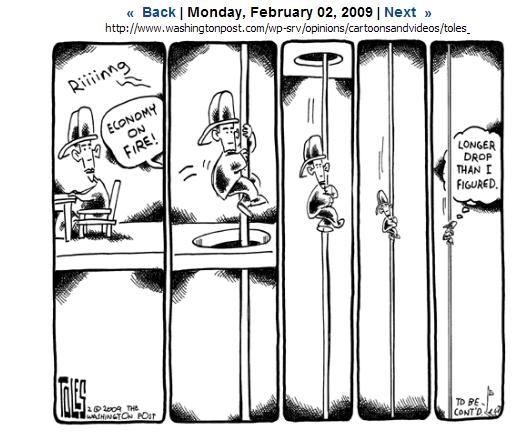

Stay Tooned. We opened the year with the stock market inna near free fall, bounced hard at a ridiculously low level, and ascended back to where we are now.

Where dat? Either at a pause before an ascent higher on better economic conditions... in which case I got time to get way long. Or in an overvalued position based on too much hope and mistaking rotting slower for improving. See coupla three four post down below. In that case I stay in bonds and the GIC.

More to come.

http://www.youtube.com/watch?v=e3LEhfbK ... re=related

http://www.msnbc.msn.com/id/31564752/ns ... _business/

http://www.debka.com/article.php?aid=1396

http://money.cnn.com/2009/06/30/real_es ... 2009063009

http://www.mercurynews.com/topstories/c ... ck_check=1

http://www.ritholtz.com/blog/2009/06/ca ... -falls-18/

http://www.ritholtz.com/blog/2009/06/10 ... challenge/

http://www.ritholtz.com/blog/2009/06/mo ... -adjusted/

http://www.ritholtz.com/blog/2009/06/ai ... on-to-fly/

http://www.bloomberg.com/apps/news?pid= ... Dhz5w8ODrY

http://money.cnn.com/2009/06/26/news/co ... 2009062622

http://www.bloomberg.com/apps/news?pid= ... llNt3iGquQ

http://www.bloomberg.com/apps/news?pid= ... obeTB25ZeY

http://www.bloomberg.com/apps/news?pid= ... quXjXBNKo0

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://www.ritholtz.com/blog/2009/07/usa-spendinggov/

http://money.cnn.com/2009/07/01/markets ... 2009070116

WEDNESDAY Night:

Employment news out Tomorrow AM. We'll see what's up. There is no question that the stock market and stocks have recovered. I'm totally uncertain about the companies and the employees that the stocks represent. Earnings "Better Than Feared" was worth something. "Still in Business" was worth something. Driving down costs by jettisoning expenses, capital projects, charitable contributions, and employees is worth something. And then it is over. That quarters earnings report is history. What is left for the next quarter is growth and revenue and profits. My wife says many small retailers, even the national names are bailing from the mall in my neighborhood. She suspects that much of the rise in school enrollment in her district may be from subprime mortgage holders moving back in with family. If you read the links pn the COFGBLOG, you know what I'm seeing. Banks with great earnings derived from cooked books and taxpayer largesse. Bankrupt manufacturing and employment numbers padded with B/D adjustments. The employment numbers will give me a glimpse and the earnings reports will pull back the curtain.

Meantime, this occasional daytrader and insanely aggressive position trader has his 401a in Bonds and the GIC.

Stay tooned....

"When The World Is Running Down, You Make The Best Of What's Still Around" When " Soul On Ice" is co-oped for a prefab cocktail product and "To Soldier, It's A Kent" only makes ya think of cigarettes, and when "The Revolution Will Not be Televised", doesn't make you think of The Las Poets or Tienamen or Tehran... how much more will be left?

"It's easy to make good decisions when there are no bad options."

-- Robert Half

Chartz and Table Zup On www.joefacer.com

http://www.dailymotion.com/video/xpqut_ ... vise_music

http://en.wikipedia.org/wiki/The_Revolu ... _Televised

http://www.youtube.com/watch?v=Lm6zL9JJckw

http://www.youtube.com/watch?v=8M5W_3T2Ye4

http://www.debka.com/headline.php?hid=6143

http://www.youtube.com/watch?v=Tq3NwCHm-4U

http://www.youtube.com/watch?v=lQsb5u_D ... re=related

Power To The People Of Tehran.

The Revolution WILL Be Televised....And Twittered And YouTubed.

http://www.cnas.org/blogs/abumuqawama/2 ... -hype.html

Revolutions Large And Small, 1776 to Now.

Speaking Of The Revolution...

Figuring out the new landscape of the 401a..

I'm about half in the non gov bond fund, a tad less than half inna GIC and I've got some pocket change in foreign stocks. I'm waiting on the sidelines to get an answer to the questions, "Has the stock market completed a bear market rally and about to roll over and crush the present longs and draw the last of the hopefuls into it's embrace and drag them down?" "Or is it for real and about to digest gains and churn in place over the Summer before it launches upward as is often the case into the shopping season?"

Monday

I'll have my answer(s) pretty quick. I'm as of now, going to all GIC/bonds as of Tues Eve.

Stay Tooned...

Consider This And The Last Two Posts To Be Of a Cloth... Notice How Old Guys Use Archaic Expressions? The Expressions And The Old Guys Didn't Start Out Archaic.....

A man must not swallow more beliefs than he can digest.

-- Havelock Ellis

Chartz And Table Zup @ www.joefacer.com

http://www.msnbc.msn.com/id/31265283/ns ... nd_energy/

http://www.bloomberg.com/apps/news?pid= ... B3ytMcNUW4

http://www.bloomberg.com/apps/news?pid= ... LaaXr3qinM

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.bloomberg.com/apps/news?pid= ... 7aspR9bIz4

http://www.msnbc.msn.com/id/31193659/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

Look about 6 and a half minutes in for a financial commentator revealing stress...

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/nikkei-do-75-off/

http://www.youtube.com/watch?v=2MyToTwa ... playnext=1

http://www.ritholtz.com/blog/2009/06/un ... nt-friday/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/co ... m-problem/

http://www.ritholtz.com/blog/2009/06/io ... al-estate/

http://www.ritholtz.com/blog/2009/06/foreclosure-up-18/

http://www.ritholtz.com/blog/2009/06/we-still-love-you/

http://www.ritholtz.com/blog/2009/06/sc ... communist/

http://www.ritholtz.com/blog/2009/06/vi ... sm-waning/

http://www.ritholtz.com/blog/2009/06/ma ... nvestment/

http://www.ritholtz.com/blog/2009/06/bu ... ventories/

http://www.newsweek.com/id/201523

BLOW YER MIND....

http://www.telegraph.co.uk/finance/fina ... rvive.html

http://www.msnbc.msn.com/id/31354296/ns ... _business/

Wed

http://www.cnn.com/2009/WORLD/meast/06/ ... index.html

http://www.msnbc.msn.com/id/31403377/ns ... al_estate/

http://www.newsweek.com/id/202323

From the 6/13/09 Economist;

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

So it's like this.....ya gotta have a thesis.

Mine is that

the low of March this year was a panic low. The problems of 2007 supposedly had been fixed for good by early 2008 and by the time the Fall of 08 came around and things were headed for hell in a free fall pretty much everywhere, some serious downside momentum was in place. Coupla lower lows washed out all the sellers and left only shorts to sell.

Came the second week of March and people began to realize that even at 10 percent unemployment, 90 percent of the people would still be working, the employed and the unemployed would still be buying stuff, the government was shoveling money out of Ben's helicopters, and at some point inventories would be too low and products would have to be made and sold. Plus profit expectations had been driven into the ground by blind panic. So brave souls bought a little stock and the stretched to the downside rubber band snapped into motion. I caught a little of the move but missed that reality was ahead of expectations and I sold before the 1st quarter reports came out. DAMN!!! The reports were Better Than Expected. Stocks continued up without me and I fought myself over being late to the party vs arriving just as it cratered.

What now?

Well... stocks go too low and then go too high. There is a ton of money on the sidelines that missed the rally so far and CAN NOT MISS ANY MORE. There exist buyers desperate to buy. And interest rates are still fairly low. And the administration is cheer leading and papering over any signs of distress. And some places are still doing business and the rates of decline are slowing, possibly signaling a bottom and the headlines are about the bottom and the turn. But is it THE bottom...? Or just the end of a panic downdraft and the start of a long recession and extended trip across a flat economic landscape?

The rally looks tired. Stock prices pretty much discount a sizeable recovery. But the FED printed money like mad and now it has to borrow to fund what it printed. Bond buyers are offering less, fearing inflation, and that drives interest rates up and makes bonds a harder sell. That means that higher rates are needed on the bonds to raise the desired amount of money. That'll slow down refi's and new mortgages. The Fed will have to print more money and buy bonds to drive prices up and rates down, increasing fears of inflation. Which is the cause and not the cure. The Fed and administration have announced a flurry of plans, most of which are going nowhere. We have a ton of real housing inventory and an unknown amount of shadow inventory. The Fed offers the banks free money to start earning their way out of trouble. But the money is getting more expensive for the Fed to borrow and show me where the new business is for the banks to fund. Housing? Malls? Factories? Energy? Maybe... Wanna loan yourself some money through the government for a voucher to buy a new Chrysler SUV after you loan GMAC some money to fund your loan for the SUV? How about a house? Who's gonna buy your trade in? The Fed has entered into repo agreements with banks, taking toxic assets from them and giving back treasuries/cash. The mechanism by which the Fed can unload or make better the crap on its balance sheet and give it back to the banks/other investors is not apparent to me. The Great Unwind is still gotta happen and we're closer to the beginning than the end of flushing the crap away...

Check it out;

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

BLOW YER MIND...

http://www.telegraph.co.uk/finance/fina ... rvive.html

So my thesis is that we're going nowhere while things play out. I don't see a clearer road substantially up or down and I see a lot of resistance higher and a lot somewhat lower. But markets don't stand still. Fear and Greed and Hope and Despair will cause the markets to slosh around within a range. For how long? A week? A month? A year?

Check it out...

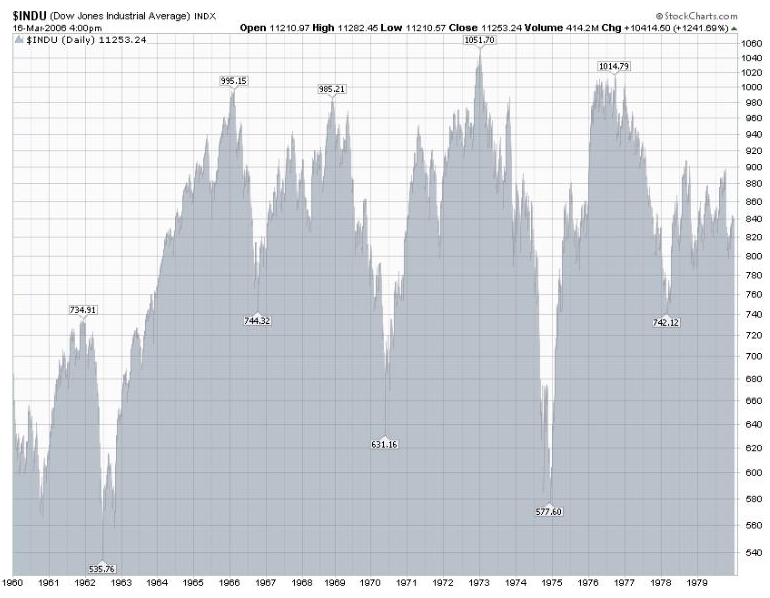

The Dow 30 was at 740 four times in 16 years and a ways above and below it. Buy and Hold? GIMME A BREAK!!!!! Tryin' to work with what the market gives me? Buy the dips and sell the rips? Make money that way? Prolly.... I'm gonna try

I committed a significant amount of my account to stocks earlier in the month to get back inna game. It didn't look that good, but I needed to re-engage my interest. So I made a dollar or two last week. Lately, not so much. I moved some money outa stocks and into the GIC this Friday, leaving some in stocks. There are buyers still trying to get into the party when the door opens for someone to leave... There may be a little more to go. But the easy money and a lot of it has already been made. The resistance seems greater to the upside than the downside and I'm more likely lighten up on stocks than buy more.

All told the outlook is bleak. In a few countries, the financial crisis has badly damaged the public finances. Elsewhere it has accelerated a chronic age-related deterioration. Everywhere the short-term fiscal pain is much smaller than the long-term mess that lies ahead. Unless belts are tightened by several notches, real interest rates are sure to rise, as will the risk premiums on many governments’ debt. Economic growth will suffer and sovereign-debt crises will become more likely.

Somehow, governments have to avoid such a catastrophe without killing the recovery by tightening policy too soon. Japan made that mistake when concerns about its growing public debt led its government to increase the consumption tax in 1997, which helped to send the economy back into recession. Yet doing nothing could have much the same effect, because investors’ fears about fiscal sustainability will push up bond yields, which also could stifle the recovery.

The best way out is to tackle the costs of ageing head-on by, for instance, raising retirement ages further. That would brighten the medium-term fiscal outlook without damaging demand now. Broadly, spending cuts should be preferred to tax increases. And rather than raise tax rates, governments would do better to improve their tax codes, broadening the base and eliminating distortive loopholes (such as preferential treatment of housing). Other priorities will vary from one country to the next. But after today’s borrowing binge, doing nothing is no longer an option.

There is an important story in today's Telegraph about the increasing likelihood that some economically devastated U.S. cities may have to be partially bulldozed in order to survive. With cities like Flint, Michigan, having lost much of their rationale for existence, this should not come as a complete surprise. Nevertheless, this will be a difficult pill for "things will come back" America to swallow.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

BLOW YER MIND...

http://www.telegraph.co.uk/finance/fina ... rvive.html

Tuesday Night

I lightened up some on stocks on Monday and I'm lightening up almost all the way tomorrow at the end of the day.

It's a mind game thing. Know what I mean, Vern?

Being all out of the market worked so well for sooo long that I got way too comfortable. I let waay too much money get away when the market spiked huge for three months and I watched it run away from me. Time to blow out the cobwebs, re-engage my brain, and get to work. I tossed a few dollars into the maw of the beast by committing about half my portfolio to stocks. I knew it was prolly way too late, But I hadda start somehow and somewhere. I watched enough bucks go up in flames to get my attention. Enough of that crap. Lemme see if I can make a dollar in a volatile and directionless market. If that's what we get....

Game on.

Stay Tooned

This Week's Post Is What Shoulda Appeared In Last Week's Post. That's Why The Quote At The Top Is The Same. I Couldn't Find A Better One For The Purpose.

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight.

Reverend Shark

Chartz and Table Zup @ www.joefacer.com

Lemme dig my way from outa a big pile of offput chores/obligations/ behests an' other crap an' I'll tell ya why I've averaged 11% return plus or minus since 9/04 an' why I'm up 55% plus or minus since 9/04 an' why IT PISSES ME OFF!!!!!

From MSNBC, Bloomberg, and Big Picture links below

“I suspect that we will continue to need a trillion dollars' worth of deficit financing, fiscal stimulation, for several years at least," said Bill Gross, managing director of Pimco, which runs the world's largest bond fund. "This economy is still de-levering. It is still at the whim, so to speak, of savings vs. consumption. It is deglobalizing. It is reregulating. These are forces that slow growth."

“I don't see where the second half recovery is coming from,” said David Rosenberg, chief economist at Gluskin Sheff, a Toronto–based investment firm. “Until employment stops falling, this recession is still intact."

The government probably wants to win time for the banks, keeping them alive as they struggle to earn their way out of the mess, says economist Joseph Stiglitz of Columbia University in New York. The danger is that weak banks will remain reluctant to lend, hobbling President Barack Obama’s efforts to pull the economy out of recession.

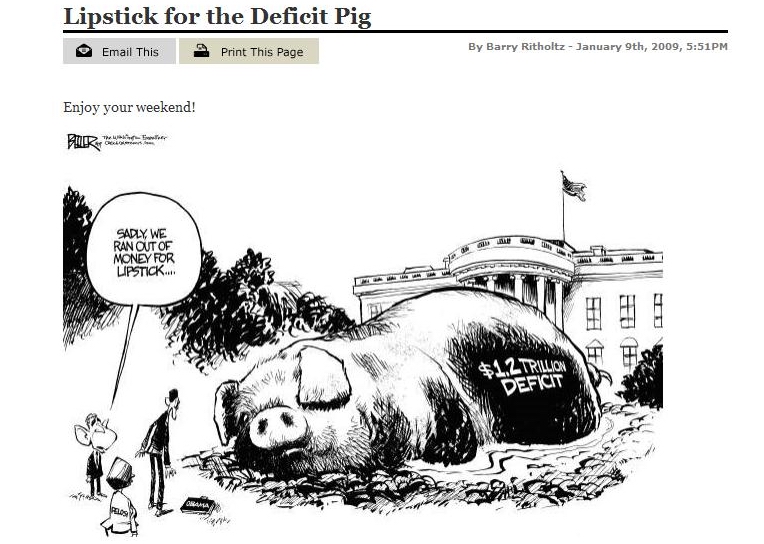

Citigroup’s $1.6 billion in first-quarter profit would vanish if accounting were more stringent, says Martin Weiss of Weiss Research Inc. in Jupiter, Florida. “The big banks’ profits were totally bogus,” says Weiss, whose 38-year-old firm rates financial companies. “The new accounting rules, the stress tests: They’re all part of a major effort to put lipstick on a pig.”

Further deterioration of loans will eventually force banks to recognize losses that their bookkeeping lets them ignore for now, says David Sherman, an accounting professor at Northeastern University in Boston. Janet Tavakoli, president of Tavakoli Structured Finance Inc. in Chicago, says the government stress scenarios underestimate how bad the economy may get.

Citigroup also increased its loan loss reserves more slowly in the first quarter, adding $10 billion compared with $12 billion in the fourth quarter, even as more loans were going bad. Provisions for loan losses cut profits, so adding more to this reserve could have wiped out the quarterly earnings.

Wells Fargo

Without those accounting benefits, Citigroup would probably have posted a net loss of $2.5 billion in the quarter, Weiss estimates. In the five previous quarters, Citigroup lost more than $37 billion.

Wells Fargo also took advantage of the change in the mark- to-market rules. The new standards let Wells Fargo boost its capital $2.8 billion by reassessing the value of some $40 billion of bonds, the bank said in May. And the bank augmented net income by $334 million because of the effect of the rule on the value of debts held to maturity.

Wells Fargo spokeswoman Julia Tunis Bernard declined to comment, as did Citigroup’s Jon Diat.

The higher valuations Wells Fargo put on its securities probably won’t last, as defaults increase on home mortgages, credit cards and other consumer and corporate lending, Northeastern’s Sherman says.

Fed’s Optimism

“These changes will help the banks hide their losses or push them off to the future,” says Sherman, a former Securities and Exchange Commission researcher.

The Federal Reserve, which designed the stress tests, used a 21 percent to 28 percent loss rate for subprime mortgages as a worst-case assumption. Already, almost 40 percent of such loans are 30 days or more overdue, according to Tavakoli, who is the author of three primers on structured debt. Defaults might reach 55 percent, she predicts.

At the same time, the assumptions on how much banks can earn to offset their losses are inflated, partly because of the same accounting gimmicks employed in first-quarter profit reports, Weiss says.

“There’s a chance that it might work,” Columbia’s Stiglitz says of the government’s attempt to boost confidence. “If it does, then they’ll look like the brilliant general. But all these efforts also bank on the economy recovering and housing prices not falling too much further. Those are not safe assumptions.”

The package the White House hammered together to convert big, old, dying Chrysler into a smaller, healthier car company looks a lot like a massive violation of bankruptcy law. A few dissident creditors, namely three Indiana pension funds that banded together, remain defiant enough to say so.

The Chrysler plan “seeks to extinguish the property rights of secured lenders, trampling the most fundamental of creditor rights in disregard of over 100 years of bankruptcy jurisprudence,” the funds argued in bankruptcy court papers.

http://www.msnbc.msn.com/id/31121449/

http://www.newsweek.com/id/200991

http://www.msnbc.msn.com/id/31127909/

http://www.msnbc.msn.com/id/31143910/

http://www.msnbc.msn.com/id/31150694/

http://www.msnbc.msn.com/id/31110346/

http://www.bloomberg.com/apps/news?pid= ... _5hvV_xqHM

http://www.bloomberg.com/apps/news?pid= ... C3LxSjomZ8

http://www.bloomberg.com/apps/news?pid= ... iTT6yxgHSE

http://www.bloomberg.com/apps/news?pid= ... eYe_j75qvM

http://www.bloomberg.com/apps/news?pid= ... 2TV3oJtap4

http://www.bloomberg.com/apps/news?pid= ... tKbzvooAy0

http://www.ritholtz.com/blog/2009/06/it ... one-trade/

http://www.ritholtz.com/blog/2009/06/ho ... d-minuses/

http://www.ritholtz.com/blog/2009/06/pa ... rate-fell/

http://www.ritholtz.com/blog/2009/06/an ... ent-truth/

http://www.ritholtz.com/blog/2009/06/a- ... les-ahead/

http://www.ritholtz.com/blog/2009/06/th ... more-28300

http://www.ritholtz.com/blog/2009/06/tr ... licyuh-oh/

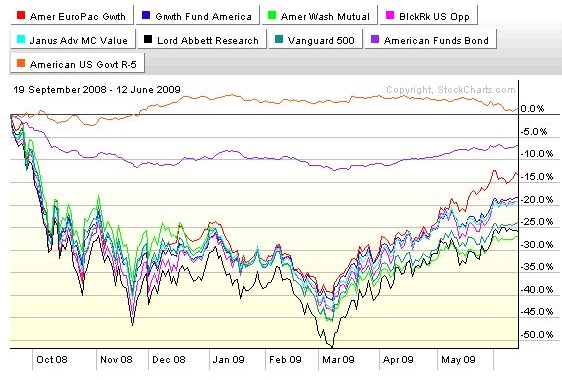

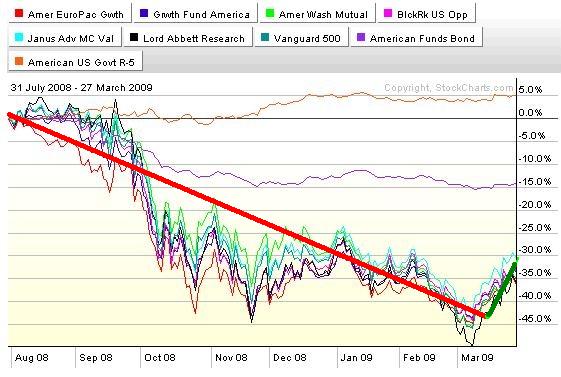

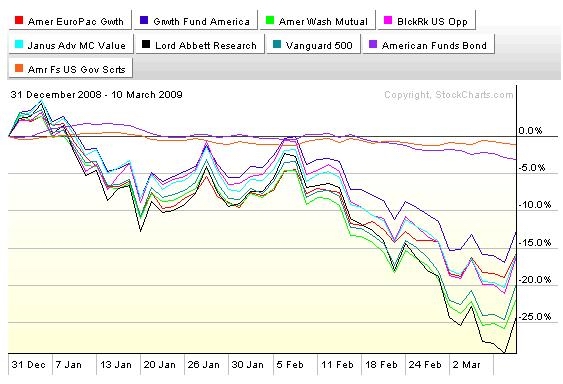

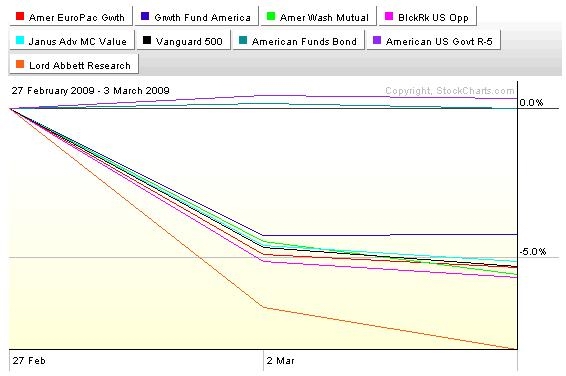

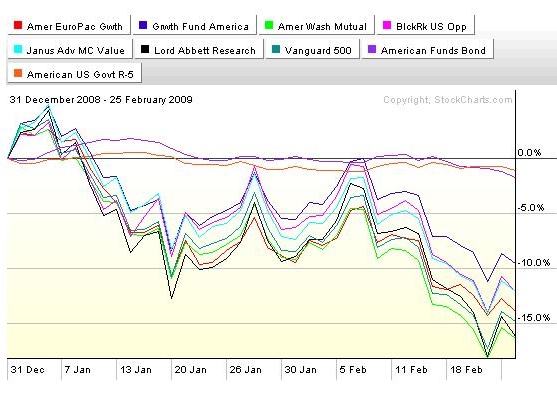

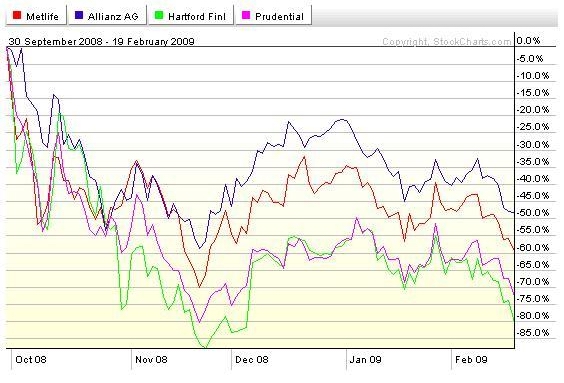

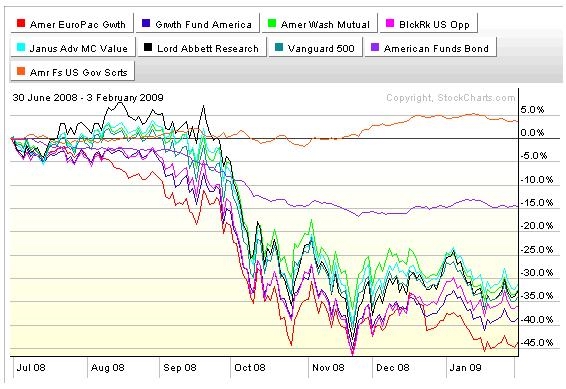

This is what the Funds available to the 401a have done since the time they became available (Since I got serious about 401a investing).

This is the period in which I went long and strong in stocks, at times almost 90% to 95% stocks.

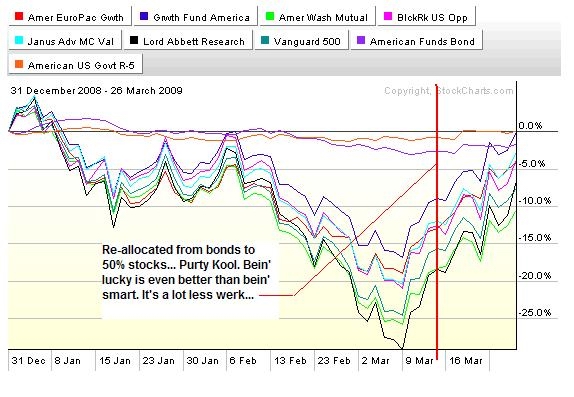

This is the time period during which I was in cash (GIC) or bonds. Pretty kool so far.

This is the three month time period during which I was partially invested in stocks for about 4 or 5 weeks. IT PISSES ME OFF. For a trend follower intent on finding a trend and riding it as long as I could, I left WAY too much on the table when stocks turned up and kept going up. Lesson learned. I just moved a significant amount of my 401a back into stocks. Not because I think that there is a lot left to this move or that the market owes me what I missed out on. Rather, I did really well in a bull market 'cuz ya can't tell the idiots from the geniuses when everything is goin' up. I also did really well in a bear market because when hunkering down and playing possum is a brilliant strategy, it's really easy too. But now I expect a very volatile and range bound market. And that is a very different animal. It might be a bloody and frustrating market for an extended period. It also might offer the opportunity to make some aerious bucks with effort, smarts and luck. So i tossed some serious money into the action. Nothing quite like skin in the game to dial the focus and intensity up.

Stay tooned

“I suspect that we will continue to need a trillion dollars' worth of deficit financing, fiscal stimulation, for several years at least," said Bill Gross, managing director of Pimco, which runs the world's largest bond fund. "This economy is still de-levering. It is still at the whim, so to speak, of savings vs. consumption. It is deglobalizing. It is reregulating. These are forces that slow growth."

“I don't see where the second half recovery is coming from,” said David Rosenberg, chief economist at Gluskin Sheff, a Toronto–based investment firm. “Until employment stops falling, this recession is still intact."

The government probably wants to win time for the banks, keeping them alive as they struggle to earn their way out of the mess, says economist Joseph Stiglitz of Columbia University in New York. The danger is that weak banks will remain reluctant to lend, hobbling President Barack Obama’s efforts to pull the economy out of recession.

Citigroup’s $1.6 billion in first-quarter profit would vanish if accounting were more stringent, says Martin Weiss of Weiss Research Inc. in Jupiter, Florida. “The big banks’ profits were totally bogus,” says Weiss, whose 38-year-old firm rates financial companies. “The new accounting rules, the stress tests: They’re all part of a major effort to put lipstick on a pig.”

Further deterioration of loans will eventually force banks to recognize losses that their bookkeeping lets them ignore for now, says David Sherman, an accounting professor at Northeastern University in Boston. Janet Tavakoli, president of Tavakoli Structured Finance Inc. in Chicago, says the government stress scenarios underestimate how bad the economy may get.

Citigroup also increased its loan loss reserves more slowly in the first quarter, adding $10 billion compared with $12 billion in the fourth quarter, even as more loans were going bad. Provisions for loan losses cut profits, so adding more to this reserve could have wiped out the quarterly earnings.

Wells Fargo

Without those accounting benefits, Citigroup would probably have posted a net loss of $2.5 billion in the quarter, Weiss estimates. In the five previous quarters, Citigroup lost more than $37 billion.

Wells Fargo also took advantage of the change in the mark- to-market rules. The new standards let Wells Fargo boost its capital $2.8 billion by reassessing the value of some $40 billion of bonds, the bank said in May. And the bank augmented net income by $334 million because of the effect of the rule on the value of debts held to maturity.

Wells Fargo spokeswoman Julia Tunis Bernard declined to comment, as did Citigroup’s Jon Diat.

The higher valuations Wells Fargo put on its securities probably won’t last, as defaults increase on home mortgages, credit cards and other consumer and corporate lending, Northeastern’s Sherman says.

Fed’s Optimism

“These changes will help the banks hide their losses or push them off to the future,” says Sherman, a former Securities and Exchange Commission researcher.

The Federal Reserve, which designed the stress tests, used a 21 percent to 28 percent loss rate for subprime mortgages as a worst-case assumption. Already, almost 40 percent of such loans are 30 days or more overdue, according to Tavakoli, who is the author of three primers on structured debt. Defaults might reach 55 percent, she predicts.

At the same time, the assumptions on how much banks can earn to offset their losses are inflated, partly because of the same accounting gimmicks employed in first-quarter profit reports, Weiss says.

“There’s a chance that it might work,” Columbia’s Stiglitz says of the government’s attempt to boost confidence. “If it does, then they’ll look like the brilliant general. But all these efforts also bank on the economy recovering and housing prices not falling too much further. Those are not safe assumptions.”

The package the White House hammered together to convert big, old, dying Chrysler into a smaller, healthier car company looks a lot like a massive violation of bankruptcy law. A few dissident creditors, namely three Indiana pension funds that banded together, remain defiant enough to say so.

The Chrysler plan “seeks to extinguish the property rights of secured lenders, trampling the most fundamental of creditor rights in disregard of over 100 years of bankruptcy jurisprudence,” the funds argued in bankruptcy court papers.

Oops! Just When You're Sure You've Got It Down, It Jumps Up An' Smacks Ya Inna Face. The Markets Do Yield Maximum Pain For The Most Participants And Sometime That Includes Me.

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight.

Reverend Shark

Chartz And Table Zup @ www.joefacer.com

I was really on top of things and knowledge was power. Then i wuz stoopid cuz i knuw to much.

So now I gotta fix it.

Stay Tooned...

One Of The Good Thing About Doin' A Blog Is That You Are Your Own Boss. I Blew Off A Week Of Posts Just On Accounta Cuz. So What!! Talk To My Boss 'bout It.... Oops. I Just Heard Her Key Inna Front Door....

"No emergency can justify a return to inflation. Inflation can provide neither the weapons a nation needs to defend its independence nor the capital goods required for any project. It does not cure unsatisfactory conditions. It merely helps the rulers whose policies brought about the catastrophe to exculpate themselves."

-Ludwig von Mises

CHARTZ and TABLE ZUP @ www.joefacer.com

Stay tooned. I'm back.

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.msnbc.msn.com/id/30929173/

http://www.youtube.com/watch?v=qvrc7x3Amps

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.newsweek.com/id/198220

http://money.cnn.com/2009/05/21/autos/g ... 2009052119

http://abumuqawama.blogspot.com/2009/05 ... -team.html

http://www.ritholtz.com/blog/category/video/

http://www.msnbc.msn.com/id/30893006/

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://money.cnn.com/2009/05/27/autos/g ... /index.htm

http://money.cnn.com/2009/05/27/autos/g ... /index.htm

http://www.newsweek.com/id/199167

http://www.msnbc.msn.com/id/30938307/

http://www.msnbc.msn.com/id/30928251/

http://www.ritholtz.com/blog/2009/05/jo ... eclosures/

Live Every Day Of Your Life Like It's Gonna Be The Last And Your Life Will Be Judged By It. Opportunity Comes Once In A While. Regrets Can Come All Day Every Day.

"The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists."

--Joan Robinson

Chartz And Table Zup on www.joefacer.com

Click Yore Clicker Here, Froggy!!!

http://dilbert.com/strips/comic/2009-05-09/

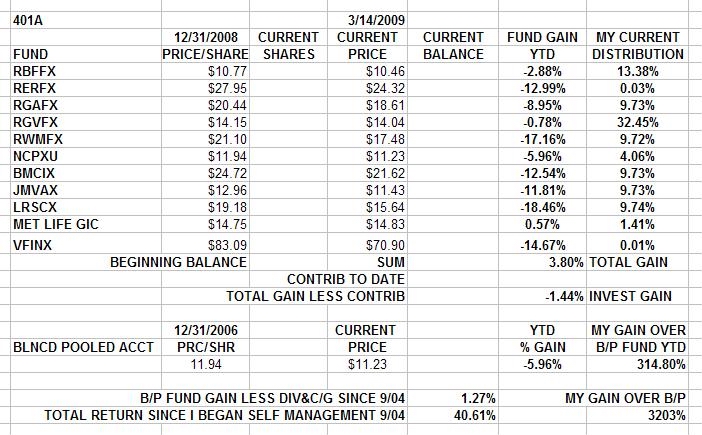

Checkout the table below....

Here's where I am as of this weekend. I've been slow and cautious getting back in on the market. Keeping what I've made between 9/04 and 2008 has been huge. Now, the risk of crashing is greatly reduced, replaced with the risk of inflation, and a weak watery wishy washy economy. The stock market will probably be volatile and offer more and greater swings than the economy and therefore be there to be taken advantage of. Lemme see what I can do...

Stay tooned for some good stuff the rest of this week.

http://debka.com/headline.php?hid=6062

http://www.msnbc.msn.com/id/30648961/

http://abumuqawama.blogspot.com/2009/05 ... al-in.html

http://www.registan.net/index.php/2009/ ... ged-sword/

http://attackerman.firedoglake.com/2009 ... ary-smart/

http://www.slate.com/id/2218160/

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.ritholtz.com/blog/2009/05/pr ... l-changes/

http://www.ritholtz.com/blog/2009/05/mo ... sentiment/

Spiro T. Agnew, Dan Quayle, and now, Joe Biden. VP's who said what they thought. Big mistake. Link below

http://www.nytimes.com/2009/05/02/opini ... .html?_r=1

My friends, no matter how rough the road may be, we can and we will, never, never surrender to what is right.

Dan Quayle

CHARTZ AND TABLE ZUP @ WWW.JOEFACER.COM

MAJOR MAJOR things going on at two Bay Area pension plans. Stay tooned while I do some reading and thinking... AN' THEN SOME WRITIN'; 'AHL BE BACH....

Meantime....

http://www.msnbc.msn.com/id/30536320/

http://www.roadracingworld.com/news/art ... icle=36361

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.msnbc.msn.com/id/30536320/

http://www.msnbc.msn.com/id/30325553/

http://www.latimes.com/business/la-fi-p ... 3869.story

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.nytimes.com/2009/05/03/us/po ... efits.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.msnbc.msn.com/id/30549505/

Sunday Evening....

Stay tooned for further information on a coupla Bay Area defined benefit pension plans. It's amazing how the similar situations can be viewed differently and responded to differently by different administrations. Somebody has it very right and somebody has it very wrong. Or not. How can you be sure without the necessary information? More to come as things become clearer.

Monday

http://www.newyorker.com/reporting/2009 ... table=true

http://www.ritholtz.com/blog/2009/05/se ... d-go-away/

http://www.ritholtz.com/blog/2009/05/mo ... i-blew-it/

http://www.ritholtz.com/blog/2009/05/ar ... ally-over/

http://www.bloomberg.com/apps/news?pid= ... refer=home

There is a lot of risk being in stocks now. I read the links I post here and a whole lot more beside. The risks I see ahead are huge and I'm very wary of the downside risk. I'm expecting a plunge down later in the year as the magnitude of the damage to the economy is finally recognized.

But for now there is a lot of reward to be had by being in stocks; bear market rallies are sudden and vicious and non rational and we got one. I've got a job to do; earn pension money. So below is my latest balancing act between greed and fear. But I'm not losing sight of the fact that this rally has claws and teeth and won't forget where its DNA came from.

Coulda done better; coulda done a WHOLE lot WORSE.

Got the latest pension mailing from the hall. Gimme a little time to do some analysis, then read about it here....

The Eye Of The Storm... Waiting For Your Dad To Get Home Like Your Mom Said You'd Hafta... Free On Bail... Seems Not So Bad At The Moment, But It's Lookin' Bad For The Future. I Think There Is Still Some Serious Shit Gonna Happen Soon Regardless of The Present Calm. What I'm Doin' 'bout It.

Change hurts. It makes people insecure, confused and angry. People want things to be the same as they've always been, because that makes life easier.

--Richard Marcinko

CHARTZ AN' TABLE ZUP @ WWW.JOEFACER.COM

The GM/Ford/Chrysler debacle reverberates through our society. At the end of 2008, Prez Bush signed the Workers, Retirees, Employers Recovery Act of 2008. It was not because Workers, Retirees, and Employers could get something really good for almost nothing. It was because the fecal material hit the rapidly rotating oscillating rotary air mover.

Single employer pension plans were in large part, the sole responsibility of the employer to manage. They had good years and bad years in terms of money going into the plan and gains on the plan's investments. During bad years for the businesses, they wanted to be able keep some of the money that would have otherwise gone into the plan to make the current year's operating results look better. So rules were put in place that allowed them to project better investment gains for the plan in the future and project more contributions to the plan in the future so as to justifying cutting the current year's contributions to the plan.

Voila!!!

The companies books looked better businesswise and you were required to have more faith in the future pensionwise 'cuz you blew off takin' care of business this year. 'Course if and when you push too hard, and the company goes down in flames, the pension plan is really left in a huge hole. Like now. A lot of companies besides the car makers wanted short term relief last year. Last year's once in a lifetime crash (apparently "lifetime" means about 5 years) blew holes in everything financial and business and since the subprime thing was going to be contained to just one company or so, since the price of real estate only goes up, since the rest of the world would keep buying American stuff regardless of what happened here, since we were all safely diversified by being in stocks and bonds, tech and commodities, among different investment plans, since the government would keep everything afloat with the printing press, (pick your favorite discredited mantra) once things picked up by Summer of 09, everything would be kool. Pension funding would look good again and it would be back to business as usual.

It's not. Check out the links I've posted here in the past year.

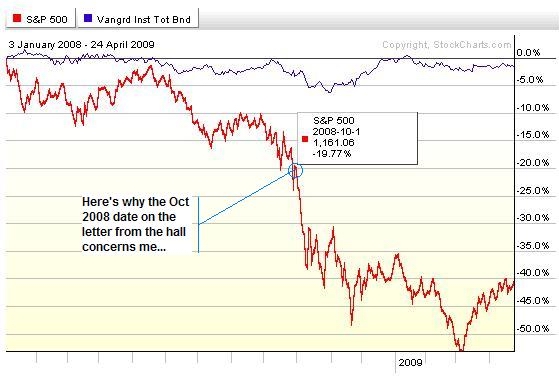

Thursday I received a letter from a pension plan I'm a participant in. It went like this;

Federal Pension law divides pension plans into three categories;

Plans in the "Green Zone" are considered "Healthy". They are 80% or better funded and other conditions in the plan are supportive of the continued health and viability of the plan. All is cool and under control.

Plans in the "Yellow Zone" are "Endangered". They are less than 80% funded and there is nothing positive or supportive about the concept of "Endangered". By my understanding, Federal pension law prior to the Workers, Retirees, Employers Recovery Act of 2008 requires that the Trustees immediately improve the funding status of the plan. This can be done by adopting a higher level of funding (more money from the participants) or cutting the benefit accruals (less benefits allocated per dollar contributed).

Plans in the "Red Zone" are considered "Critical". They are funded at a level of 65% or less. Federal law requiring action in the case of "Critical" is not considered "Improvement", but "Rehabilitation".

If "Endangered" sounds bad, "Critical" sounds worse. Everybody like "Improvement". "Rehab" is pejorative. In both cases, there is a structure and benchmarks that must be met per a timetable to improve the pension plan's conditions until it is again sound.

The pension plan I'm a participant in was certified as "Green Zone" for the 2008 year. Their actuary has certified the plan a "Yellow Zone" plan for 2009.

The Workers, Retirees, Employers Recovery Act of 2008 allows the Trustees to "freeze" a plan's status at the 2008 level for the 2009 year, making this year's problem something that can be legally ignored. Like pinning the thermometer at 98.6. No fever, no problem. The pension fund can wait until 2010 to deal with the issue , if it doesn't go away on its own when you ignore it....

Unless the law is changed. To postpone doing what should be done immediately, which got GM to where it is now. Let's not go there until we get further down the page...

Anyway, the Trustees of the "Yellow Zone" pension plan intend to freeze the status and act on the shortfall in 2010.

In a mailing dated October 2008, I was informed by another pension plan's Trustees, my main pension plan that I participate in, that the 94% funding of the 2007 year was no longer current. It further stated that the situation had deteriorated to the point that additional contributions to the plan would likely have to be made in 2009. I'm gonna guess that the language suggests that the plan went "Yellow Zone" in 2008, possibly earlier than the first plan mentioned. A lot has happened since October 2008 and not much of it has been good. I think I'm ready to hear more specifics from the Trustees on the matter.

A "freeze" in the status of the plan is like a "moratorium" on foreclosures. If things are going to get clearly better immediately, no problem. It's a good thing. If they are not going to get better, there's nothing like letting the problem build some momentum. Kinda like the gazillion dollars of taxpayer money that was shoveled into Wall Street to keep Brokers like Bear Stearns and Lehman Bros and banks like Citibank and Indy Mac and government agencies Ginnie Mae and Freddie Mac and insurance companies like AIG afloat. Uunh... they are still afloat...aren't they??!!? I mean it's not like we poured taxpayer money in and they went belly up anyway, except taking a lot of taxpayer money down with them... Is it???!!??!!?

I feel like I and anyone else like me interested in their pension need some current information from the Trustees.

Now.

Do we have a problem? If we do, how big is it and how do we fix it and when do we start?

It's not like we can rely on anyone else...

$20 Billion Short

$20 Billion Short

...GM’s pension system had a $20 billion shortfall as of Nov. 30, 2008, based on numbers the company provided the PBGC, said Jeffrey Speicher, a PBGC spokesman. (PBGC is the PENSION BENEFIT GUARANTEE CORP...jf) By law, the agency would be able to make up only $4 billion of that, he said.

“The rest would be lost,” Speicher said in an interview....

http://www.bloomberg.com/apps/news?pid= ... zS4bEfFmzs

http://www.1853chairman.com/2009/04/24/ ... ptcy-risk/

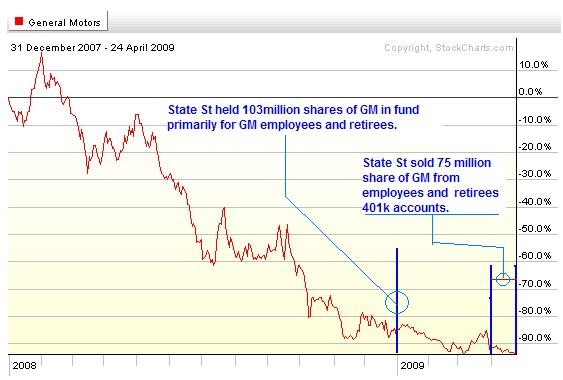

Of course, maybe the GM pension plan is in a lot better shape than it was in Nov 30 2008. Wanna bet that way? Just last week, the Trustee for GM's 401k announced that they had pretty much blown the GM stock from GM employees accounts...

April 25 (Bloomberg) -- State Street Bank and Trust Co., manager of a 401(k) investment fund for General Motors Corp. employees, has sold the majority of its shares in the automaker on concern that the stock could lose all value in a bankruptcy.

State Street sold 75 million shares, or about 12.4 percent of GM outstanding common stock, between March 31 and yesterday, Julie Gibson, a GM spokeswoman, said yesterday in an interview. It held most of those shares in a 401(k) fund for 29,800 employees and retirees. The fund is one of several options available in the GM employee-retirement savings plan.

http://www.bloomberg.com/apps/news?pid= ... 9lbsWMauyw

...GM’s pension system had a $20 billion shortfall as of Nov. 30, 2008, based on numbers the company provided the PBGC, said Jeffrey Speicher, a PBGC spokesman. (PBGC is the PENSION BENEFIT GUARANTEE CORP...jf) By law, the agency would be able to make up only $4 billion of that, he said.

“The rest would be lost,” Speicher said in an interview....

http://www.bloomberg.com/apps/news?pid= ... zS4bEfFmzs

http://www.1853chairman.com/2009/04/24/ ... ptcy-risk/

April 25 (Bloomberg) -- State Street Bank and Trust Co., manager of a 401(k) investment fund for General Motors Corp. employees, has sold the majority of its shares in the automaker on concern that the stock could lose all value in a bankruptcy.

State Street sold 75 million shares, or about 12.4 percent of GM outstanding common stock, between March 31 and yesterday, Julie Gibson, a GM spokeswoman, said yesterday in an interview. It held most of those shares in a 401(k) fund for 29,800 employees and retirees. The fund is one of several options available in the GM employee-retirement savings plan.

http://www.bloomberg.com/apps/news?pid= ... 9lbsWMauyw

DAMN!!! It's like we didn't go through this already with employees of ENRON buried under ENRON stock in their 401k's....

More "Buy and hold for the long run and look at the account no more than once a year"?

Prepare for some heart wrenching tales of misery. Again, rethink the ENRON retiree and 401a story.

Pay attention to your pension and 401k. Vigilance is the price of security.

Stay Tooned....

http://weblogs.newsday.com/news/opinion ... ong_1.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.portfolio.com/executives/200 ... e=2#page=2

http://www.msnbc.msn.com/id/30429089/

http://www.bloomberg.com/apps/news?pid= ... zS4bEfFmzs

http://www.msnbc.msn.com/id/30429089/

http://www.msnbc.msn.com/id/30440950/

http://www.msnbc.msn.com/id/30440734/

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.ritholtz.com/blog/category/video/

"No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some."

-- Ken Keyes, Jr.

Chartz and Table Zup @ www.joefacer.com

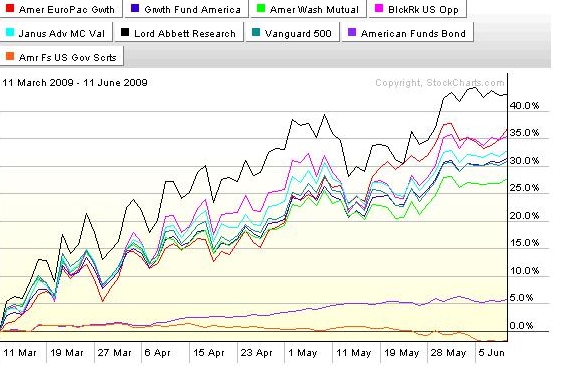

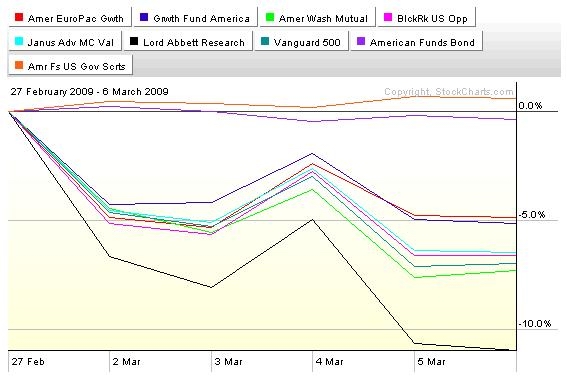

Here's the dilemma; Big Time Caution was big time right onna way down. At some point, that caution would have/ will need to be tempered with aggressiveness, and at some point, my typically overconfident insanely aggressive nature will would have/ will need to be unleashed. In a perfect world, I'd a' gone WFO to the long side on 3/9 to date. Lookie here...

Instead, I was a week late to the party, only partially there and I left at least a coupla weeks early. I got some, but not nearly as much as I'd have liked. On the one hand, that's a little whiney coming from a guy with over 50% returns in his 401a over the last five years. On the other hand, I'm in position to take advantage of some serious compounding of returns and I don't like to watch potential returns fade away into the distance after doing this much work.

So.... 20% to 40% gains is many years worth of very good returns. That happened in 6 weeks. Is the party over? Am I coming out of the kitchen just as the cops come in the front and the flash mob comes in through the back door?

There is a huge amount of institutional managed cash out there that exhibited a lot more caution than I did and managers could be hearing from clients asking "WTF am I paying you fees for when the market is up 50% and I'm not innit??" There's money available on the sidelines to chase the market higher. Will it? Will it chase before or after a correction? Or two? How long will the disconnect between the market and the economy last and how will it resolve? Is this the mother of all bull traps? How much risk is left in a market that's down 50%? Why is everybody getting jiggy over fewer than expected foreclosures when the administration has been beating "voluntary" moratoriums out of the mortgage holders. Why is the administration getting stiff armed on the PPIP? (Hint...'cuz the banks see an "end around" that works better)

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://online.wsj.com/article/SB124016633014432579.html

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.msnbc.msn.com/id/30293461/

http://www.ritholtz.com/blog/2009/04/fo ... ts-ending/

http://www.pbs.org/wgbh/pages/frontline/meltdown/

http://www.ritholtz.com/blog/2009/04/su ... ales-fall/

http://www.ritholtz.com/blog/2009/04/fo ... urnaround/

http://www.ritholtz.com/blog/2009/04/fingering-aig/

http://www.ritholtz.com/blog/2009/04/bo ... t-selling/

http://www.ritholtz.com/blog/2009/04/ar ... reopening/

http://www.ritholtz.com/blog/2009/04/st ... e-summers/

http://www.ritholtz.com/blog/2009/04/gr ... r-suckers/

http://www.ritholtz.com/blog/2009/04/fo ... igh-in-q1/

http://www.ritholtz.com/blog/2009/04/se ... oversight/

http://www.ritholtz.com/blog/2009/04/be ... t-rally-4/

http://www.ritholtz.com/blog/2009/04/sa ... o-frannie/

http://www.ritholtz.com/blog/2009/04/fm ... ve-public/

http://www.ritholtz.com/blog/2009/04/ho ... chs-style/

http://www.ritholtz.com/blog/2009/04/ho ... the-world/

http://www.ritholtz.com/blog/2009/04/wo ... t-decline/

I changed my 401a allocation Friday. What was I thinking?

I was thinking of getting some exposure to the action, late or not, whatever direction it may be. It is DANGEROUS to chase stocks big time after a 25% or 50% move. That is not how the game is played. The last one in is invariably an innocent or a fool. Who'd we sell Rockefeller Center and Pebble Beach to at the top in the late 80's? The Japanese. We quoted the price in yen and it was cheap by Tokyo standards. Who bought PALM at $800 and Enron at $100 in 2000 and rode them down to a dollar or two in 2001? People who planned on selling when it doubled and then waited to get back to even... )Of course, we're not AT a top. And I'm neither an innocent or a fool. And stocks will at some time, go up.

That said.... If ya wanna find darkness and despair, ya can with lookin' too hard. Check out the last 6 weeks links. Eighteen percent unemployment in Elkhart ID. Don't look it as a high paid union worker legacy problem. Most of the RV and industrial shops that have gone down were non union. Jobs didn't go to where labor was cheaper... they ceased to exist. White collar GM employees (clerks and managers) facing losing pensions or reduced pensions. money out of the economy. Seniors scrabbling after Micky D's jobs in competition with the teeny boppers. Autos and real estate and financial and retail and muni and manufacturing jobs gone away. There has been a bounce the last month or so....but last year /first of this year the economy looked down into the abyss. Everyone slammed production and employment and orders down to less than maintenance levels. And like in the 80's, when we had 12% unemployment (apples and oranges, they've since jiggered the numbers) when you subtracted the unemployed from the employed, you still has people with jobs and income to buy with. So we've bounced. Sales and production have picked up and the loss of jobs have slowed. But the direction of the economy is still down. The economy can and will get worse, and there are still jobs and money to be lost and written down.

But the market discounts the present and buys the future. If investors think they see the bottom, or the slope lessening as we approach the bottom, they will look across the valley bottom to the upward slope of the other side. The market CAN go up as things get worse. Or not.

So I've taken a single step into the action. If there is still action to the upside, I'm there. If it shows legs, I can take a second step. If the market does a 100 MPH faceplant well below this years lows, I'm only a step away from the door, and 85% intact for the ride up off the real bottom whenever it happens.

Call it a calculated risk...and make no mistake, the emphasis is on risk.

Stay toooned.....

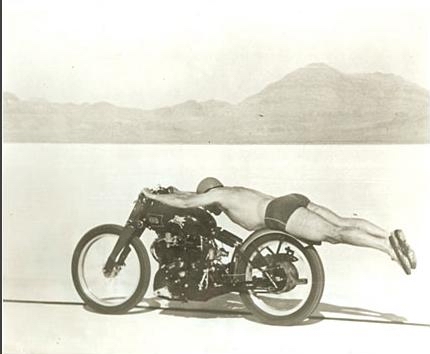

I think of myself as aggressive and focused and I've seen 145 MPH and still accelerating on my street bike running toward Turn One at Thunderhill, and I've run my race bike there even harder .... but DAMN, some of them old guys....hangin' on at 150 MPH through the measured mile after the bike has topped out on a very long run up!!!!!

http://en.wikipedia.org/wiki/Rollie_Free

I've Been Right Not To Trust The Markets For Well Over a Year. Every Bounce Has Betrayed The Believers. Ya Gotta Trust Sometime.... Is Time To Trust Now???

There are several good protections against temptation, but the surest is cowardice.

-- Mark Twain

Chartz and Table Zup @ www.joefacer.com

My 401a performance has been SMOKIN'. At a time when 401a and 'k's have been bleedin' red, I made money on what I had in the account and last year's contributions dropped to the bottom line unmolested.

Kooool.

This year I've made three times the money I made last year in less than one month. Did I make it on a bounce and step aside at the right time? Or did I make it on the turn at the bottom and did I step off the train as it is finally leaving the station?

Damn good questions. I Gotta Think About That.... I'll do it in part right here. And then I'll.....

Stay tooned.

First There Is A Mountain, Then There Is No Mountain, Then There Is. From Donovan to The Allman Bros. Who 'da Thunk?

It is the markets’ job to reallocate money from the ignorant to the intelligent, from the lazy to the hard working and studious; from the naive to the educated, and from the speculator to the investor.

Barry Ritholtz

CHARTZ AND TABLE ZUP @ www.joefacer.com

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight.

Reverend Shark

So maybe we had a bottom or the bottom or whatever and the markets bear market bounced into earnings. I reallocated 50% into stocks to take advantage of the better market conditions and earned some money for my retirement. Then I lightened my stock allocation into earnings season because the risk of holding into what was expected to be gawdawful earnings numbers was too high for my 401a account. I knew I was going to be out of stocks early to stay within the 401a rapid trading restrictions. So being out while the market goes up is part of the game. Sure enough, the market continues to go up. This is my 401a account and I don't like to chase the markets up. The rules of this game do not favor such. But, if I buy back in, would I be chasing the dregs to the drain and goin' down? Or would I be buying into a new long term bull market? Damn good question. It is something to worry about for the next coupla days. But I'll get an answer next week. A little uncertainty about booking profits ain't such a cross to bear. Nobody ever went broke bookin' profits... But a lot of people get their face torn off holding for the long run or waiting to get back to even. Twist the Wrist and ride on.

http://videos.streetfire.net/video/Wing ... 146752.htm

VERY IMPORTANT IF YOU HAVE A PENSION. IF YOU DON'T....WHY ARE YOU HERE?

http://www.ritholtz.com/blog/2009/04/pb ... rporation/

ANOTHER SMOKIN' LINK....

http://www.sfgate.com/cgi-bin/article.c ... 16Q4F5.DTL

Do a google search for "sean olender". it'll give you an interesting perspective on the above link....

http://www.pbs.org/moyers/journal/04032009/watch.html

http://www.ritholtz.com/blog/2009/04/summers/

http://www.ritholtz.com/blog/2009/04/la ... b-part-ii/

http://www.economist.com/world/unitedst ... d=13414116

http://www.economist.com/opinion/displa ... d=13405314

Jeezus!!!

http://www.boston.com/news/nation/washi ... investing/

Yet another smokin' link...

http://www.nytimes.com/2009/04/05/busin ... f=business

http://business.theglobeandmail.com/ser ... Blogs/home

The price one pays for pursuing any profession or calling is an intimate knowledge of its ugly side.

-- James Baldwin

http://www.nytimes.com/2009/04/05/opini ... 8s7M6l8OTA

Stay tooned....

Chaos And Entropy Abound. Planned Events Go Awry and Random Events Effect Change Far Beyond Rational Expectation: Finally!!!! Something I Can Work With......

One of the most difficult investing skills to master is being persistent and confident while not crossing the line to being stubborn and obstinate. It is a very fine line and you will never get it quite right now matter how hard you try.

Reverend Shark

Chartz and Table Zup @ www.joefacer.com

Stay Tooned....

Here's A Good Chart... A Variation Onna Double Top or Rounded Bottom....

Livin' Inna USA.... Somebody Get Me A CHEEZEBurger!!!!!

http://www.ritholtz.com/blog/2009/03/pp ... more-22802

http://www.ritholtz.com/blog/2009/03/kr ... itization/

http://www.ritholtz.com/blog/2009/03/wh ... ith-bonds/

http://www.rollingstone.com/politics/st ... g_takeover

http://www.ritholtz.com/blog/2009/03/ne ... uary-2009/

http://www.ritholtz.com/blog/2009/03/bu ... out-money/

http://www.ritholtz.com/blog/2009/03/in ... d-housing/

http://www.ritholtz.com/blog/2009/03/ho ... tion-work/

http://www.ritholtz.com/blog/2009/03/in ... d-housing/

http://www.ritholtz.com/blog/2009/03/gr ... s-amnesia/

http://www.bloomberg.com/apps/news?pid= ... refer=home

SUNDAY

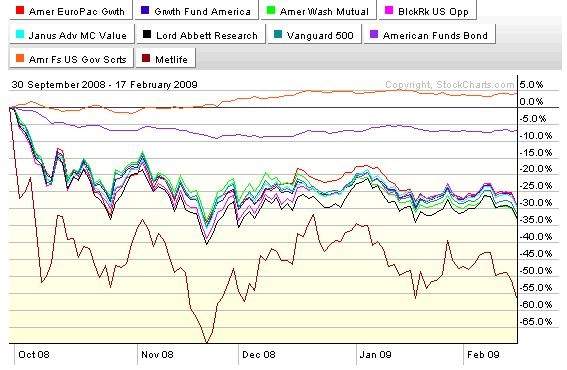

More to come; But for now suffice it to say that investment risk is markedly less than in the recent past. Things have ALREADY gone to hell. We're half way to zero. We've seen a bottom and I reallocated 50% back to stocks. Check it out below in previous week's posts....

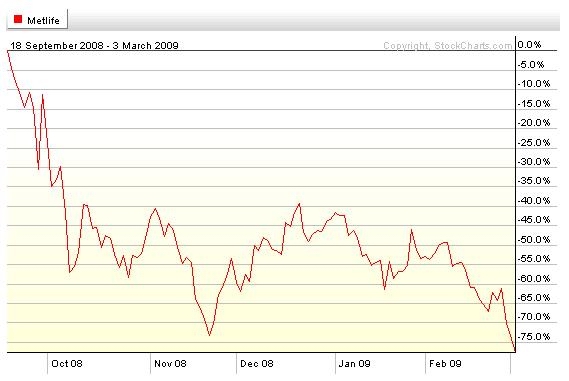

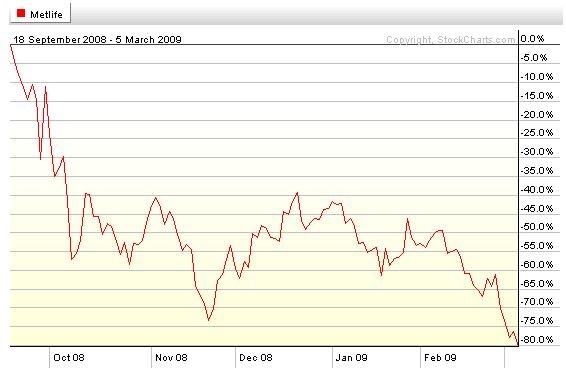

But then on Friday, I pretty much cut my exposure to stocks by 50% to 25% and put my money where I had been very wary of doing so, in MET Life. Here's what it looks like...

We've seen A bottom, but maybe not THE bottom. Earnings will be terrible. The economy is still going down... not as fast as it was, but down is still the direction. There is a bunch of mortgages being applied for.... but they are refi's. The stock of new houses and repos is still huge. The FED is pushing on a string. There are still jobs to be lost. Stimulus dollars to the state are being spent on subsidies to promote social issues and to paper over budget issues; job creation are still hanging fire. The Bad News on GM and Chrysler is gonna hit tomorrow (Monday) and it may not suit Wall St. (or me) This minute I'm more interested in keeping what I made than losing out on further gains. CHECK IT OUT.

The red line is what I've missed by being in cash and the green line is what I've made by being in stocks. CLICKIT!!!! There will be a time and place when I'm looking for more exposure to stocks. Here and now ain't it. I'm still concerned about MET LiFE's safety. But by now I'm willing to bet that the tax payers will back them up.... Stay tooned.....

Oh, yeah....There's two couples that I've been talkin' to that need to pull the trigger on the refi's. You know who you are!!!!!

MONDAY

AMAZING!!!!

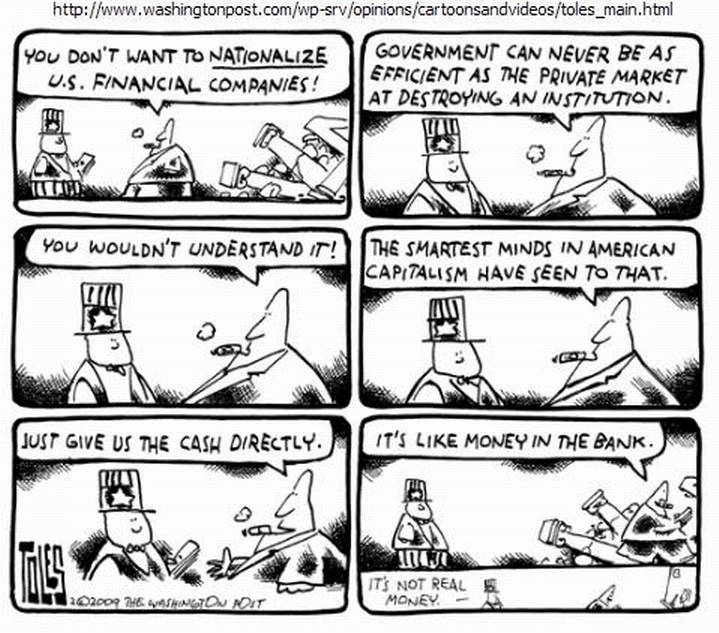

I had no idea we could afford to do this....

http://money.cnn.com/news/specials/stor ... index.html

WEDNESDAY

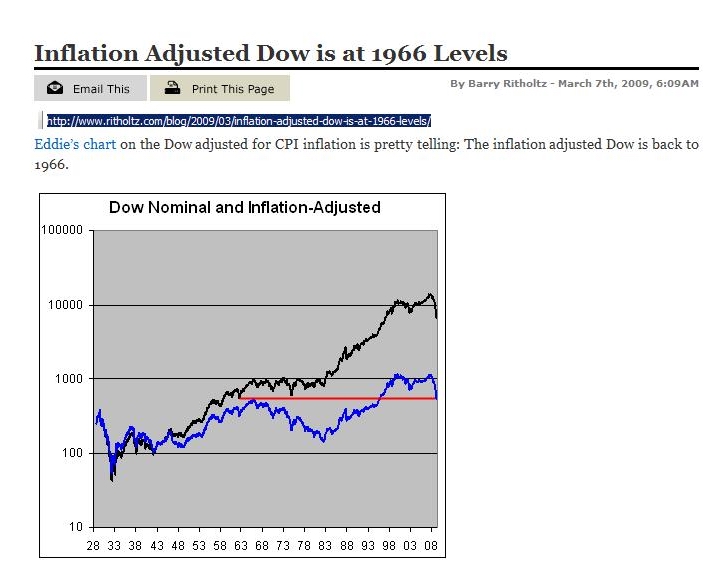

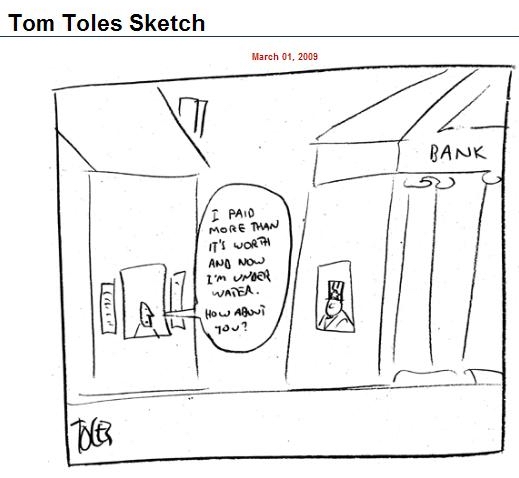

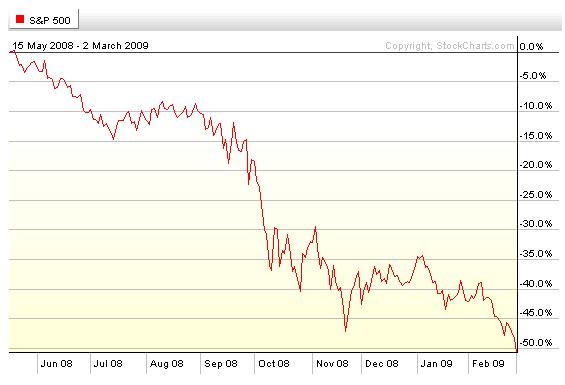

Lookie Where We Came From....

I reallocated further toward a larger cash/smaller stock position today. The trend is still down, the economy is deteriorating more slowly but still deteriorating, the news is still equivocal, there are corporate and employment issues, and although we are getting closer to a bottom and a recovery..... there still is a substantial risk of revisiting recent lows. I've managed to avoid losing a huge percentage of the 401a. I'm gonna go with what has been working.

See how long and far we went down? I don't think we are going back up so fast that I won't be able to reallocate back to stocks in time to make a dollar.

THURSDAY

Look at the chart above. Smokin' upside move in a month. Now look at the same run up onna chart above that. Not so smokin'... What's wid dat? People are giddy over the move. "End of the Bear" an stuff... Or maybe not. Maybe things are still bad and getting worse and this was a bear market bounce. Too much of the move is non-rational in terms of the economy. More unemployment, more retrenching for the consumer, fewer bucks spent, more saved, less produced, less transparency with the relaxing of mark to market, the stimulus money not yet out to the public, and other stuff yet to come.

"Buy the dips and sell the rips"

Easier said than done. That was a BF dip we had goin' for the last year. Buyin' the "dip" too soon woulda ripped your face off and sellin' the "rip" after the long way down woulda left you still buried in a shallow grave.

Easier to buy the start of the rip and lock in some profits while you still have them or cut the losses quick if you were wrong about it beein' a rip.

Should I have held on? Dunno. We'll see. So many stocks up 10%-30% on no good economic news or objective improvement in business conditions. Not that it doesn't make me uneasy to be out of the market. Just not all THAT unesy.

So I'm out for now.

Stay tooned...