| |

Watched the Tom Dowd film on IFC. From the Manhatten Project to Coltrane to Charles toFranklin to Pickett to Derrick and Duane. WOW!!! Almost makes me regret the Not Just Another Rennaissance Man riff. HE was an Ren man.

Thursday, February 28, 2008, 07:52 PM

"No emergency can justify a return to inflation. Inflation can provide neither the weapons a nation needs to defend its independence nor the capital goods required for any project. It does not cure unsatisfactory conditions. It merely helps the rulers whose policies brought about the catastrophe to exculpate themselves." -Ludwig von Mises More on Tom Dowd... http://en.wikipedia.org/wiki/Tom_Dowdhttp://mixonline.com/mag/audio_creams_sunshine_love/More to come... http://www.cnn.com/2008/LIVING/personal ... index.html     ( 3 / 1380 ) ( 3 / 1380 )

YouTube and Wolfgang's Vault; it's amazing how much audio/video remains of the SF music scene...

Saturday, February 16, 2008, 02:37 PM

"Don't wait for extraordinary opportunities. Seize common occasions and make them great. Weak men wait for opportunities; strong men make them." -- Orison Swett Marden Charts and Table Zup!

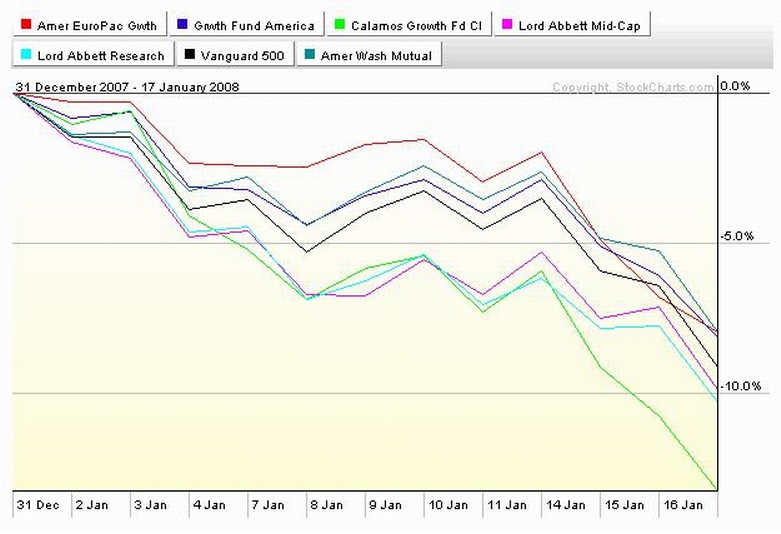

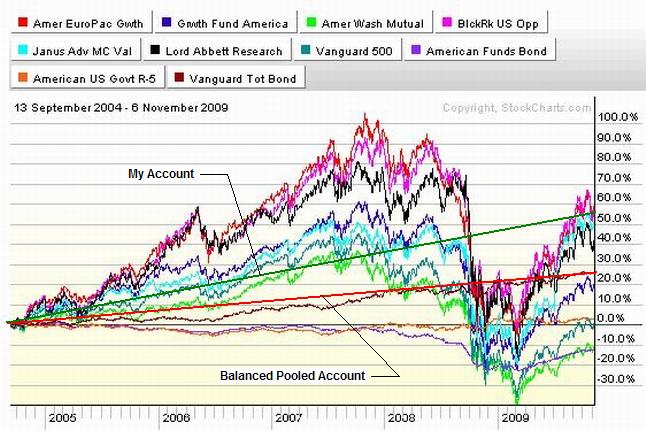

CLICKIT!!!! A 25% swing in 5 months. Pretty impressive. Was this THE subprime correction? Is a support level being put into place? Is this the establishment of a long term trading range? is this the launcing pad for the next move up? Or is this only the first serious crack in post dotcom recovery? Is this a one time opportunity, or the final warning? What do I think and therefore, what will I do? Good questions all. More to come this weekend...like; http://www.nytimes.com/2008/02/17/busin ... vCvYfe6W8Qhttp://www.reuters.com/article/ousiv/id ... 1920080217http://www.reuters.com/article/hotStock ... 2920080215http://www.ft.com/cms/s/9ba3c422-dd6e-1 ... fd2ac.htmlhttp://www.nytimes.com/2008/02/17/busin ... wanted=allhttp://www.ogj.com/display_article/3202 ... hief-says/Yee HAHH!!!! http://bigpicture.typepad.com/comments/ ... me-re.htmlhttp://matrix.millersamuel.com/?p=1430http://bigpicture.typepad.com/comments/ ... are-f.htmlhttp://blogs.wsj.com/marketbeat/2008/02 ... -timeline/http://www.ft.com/cms/s/0/bb7e80c8-d58c ... ck_check=1http://bigpicture.typepad.com/comments/ ... w-wea.htmlVery clear. Very significant. http://www.slate.com/id/2184488Again Very Clear. http://www.bankstocks.com/article.asp?t ... id=9881648Hint. I'm still all cash in the 401a, but I'm weighing the possibilities...      ( 3 / 1414 ) ( 3 / 1414 )

A lot goin' on in the markets. Wild swings, losses, and the slope of hope. I've got a plan.....

Friday, February 8, 2008, 10:46 PM

After all, what is your host's purpose in having a party? Surely not for you to enjoy yourself; if that were their sole purpose, they'd have simply sent champagne and women over to your place by taxi.

P.J. O'Rourke

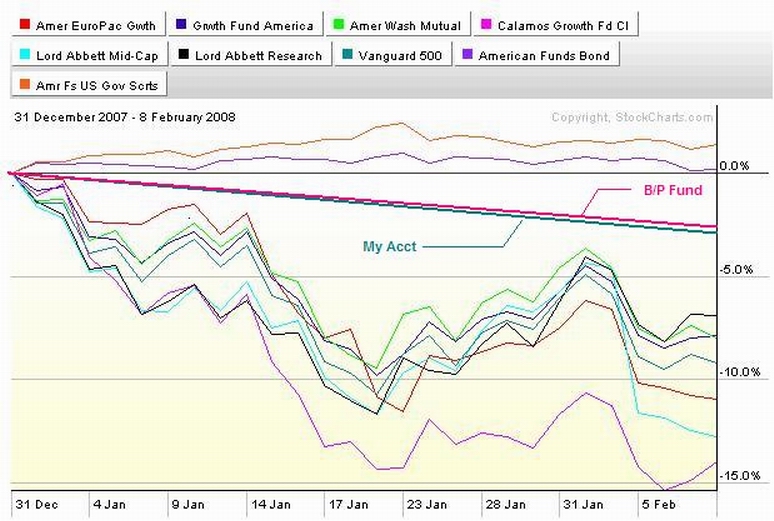

Chartses and Table ZupThe newly revised 401a management site appears to be an all new shell over the original apparatus. It does not light my fire, but it works just fine. I'm all cash on the 401a (again). I tried to play the dead cat bounce of last week this week and I was too late. I paid a rapid trading fee on one fund and triggered trading restrictions on two others to get back to the all cash position, and the price was cheap. Here's what I ended up with, YTD. CLICK THIS!!  Between what I lost and what I paid, it was a major owie. I'm major pissed at myself; I know I gotta be aggressive when the time is right. Like 9/13/04 until 9/07. I did that part OK. And.... looking at the chart above, I haven't done too bad so far this year. But I could have done better. So it goes. Radical shit from the WSJ...Who'd a thunk? How will it affect the pension plan? http://online.wsj.com/article/SB1202433 ... inion_mainhttp://www.businessweek.com/magazine/co ... 384407.htmhttp://www.iht.com/articles/2008/02/08/business/yen.phphttp://www.iddmagazine.com/issues/2008_ ... =thestreethttp://www.iddmagazine.com/issues/2008_ ... =thestreethttp://bloomberg.com/news/marketsmag/mm ... tory2.htmlI'll lay out what I'm thinking about the near and far future of my 401a sometime this week. Stay tooned. Stop in every so often....      ( 3 / 1328 ) ( 3 / 1328 )

Clowns.... nothing but clowns. And it's an ELECTION!!!! NOT a circus!!!!!!!!

Friday, February 1, 2008, 09:05 PM

"Most of the time I don't have much fun. The rest of the time I don't have any fun at all."

Woody Allen

Charts and Table Zup!!!! Like the freaks and bros at Haight and Masonic used to say, "This is some good shit." Worked(s) for me... http://www.thestreet.com/story/10400657 ... s-you.htmlhttp://money.cnn.com/2008/01/28/news/ne ... 2008012909http://bigpicture.typepad.com/comments/ ... secto.htmlhttp://harpers.org/archive/2008/01/hbc-90002258The Subprime Crisis The latest bubble to pop, with potentially calamitous results, is the subprime mortgage market. The U.S. mortgage crisis has been labeled a “subprime mortgage crisis,” but subprime mortgages were only a sideshow that appeared late, as the housing-bubble credit machine ran out of creditworthy borrowers. The main event was the hyperinflation of home prices. Risks are embedded in price and lurk as defaults. Even after the faith that supported a bubble recedes, false beliefs continue to obscure cause and effect as the crisis unfolds. . . The housing bubble has left us in dire shape, worse than after the technology-stock bubble, when the Federal Reserve Funds Rate was 6 percent, the dollar was at a multi-decade peak, the federal government was running a surplus, and tax rates were relatively high, making reflation—interest-rate cuts, dollar depreciation, increased government spending, and tax cuts—relatively painless. Now the Funds Rate is only 4.5 percent, the dollar is at multi-decade lows, the federal budget is in deficit, and tax cuts are still in effect. The chronic trade deficit, the sudden depreciation of our currency, and the lack of foreign buyers willing to purchase its debt will require the United States government to print new money simply to fund its own operations and pay its 22 million employees. http://www.marketwatch.com/News/Story/S ... &lsn=9http://www.thestreet.com/s/what-investo ... 1545.html?http://www.bloomberg.com/apps/news?pid= ... YXs8I&http://online.barrons.com/article/SB120 ... 26743.htmlhttp://online.barrons.com/article/SB120 ... 26743.htmlhttp://bigpicture.typepad.com/comments/ ... tated.htmlhttp://bigpicture.typepad.com/comments/ ... e-day.htmlhttp://online.wsj.com/public/article/SB ... in_tff_tophttp://news.yahoo.com/s/cmp/20080130/tc ... Ffq5EE1vAIS&G's... check out the bottom of the comments.... http://bigpicture.typepad.com/comments/ ... ht-ja.htmlI 'll be writting what I'm doin' w/ my 401a all this week.... Stay tooned.     ( 3 / 1313 ) ( 3 / 1313 )

A STEAMIN' SCREAMIN' SMOKIN' HUNKA BURNING JUNK.... otherwise known as THE FINANCIAL MARKETS....aka YOUR PENSION AND LIFE SAVINGS

Friday, January 25, 2008, 10:53 PM

Nothing is safer or more effective than cash in a poor market. Reverend Shark My mind starts relaxin' when I start seein' pictures o' Jackson. Little Richard Charts and Table Zup

More to come later this weekend.

In the meantime....From Barry Ritholtz' blog @ http://bigpicture.typepad.com/comments/

To wit, a fraudulent series of losses led to a major European bank unwinding a huge trade: Societe Generale Reports EU4.9 Billion Trading Loss....

SG's $7.1 Billion dollar unwinding led to panicked futures selling on Monday and Tuesday. (The market reacted to SG's sales by moving away from them; The more you have for sale and HAVE to dump NOW, the lower the offers. You never know what the loss is until you actually unwind it.Joe Facer)

Société Générale rushed to unwind those trades during Monday’s market plunge, and trading in those futures contracts soared to record levels. The bank’s abrupt reversal contributed to a decline that snowballed into an avalanche of sell orders around the world, some traders said. The ensuing turmoil helped prompt the Federal Reserve to orchestrate the surprise cut in interest rates announced Tuesday...

I have little doubt that Société Générale’s unwinding of those positions absolutely pressured indexes worldwide, And wouldn’t it be embarrassing if the Fed had to make one of the biggest emergency rate cuts ever because of some rogue trader?

From John Mauldin's E Newsletter; JohnMauldin@InvestorsInsight.com.

Granted, fears of a recession in the United States and continuing worries about the spread of the subprime mortgage collapse were also responsible for the market downdraft in the last 10 days. But Mr. Ritholtz argued the rapid move by Société Générale to close out tens of billions in futures positions might have been a major factor in pushing an already nervous market into an outright panic

First, for years one of my central premises has been that we have to remember that when a normal human being is elected to the board of the Fed, he is taken into a secret room where his DNA is altered. Certain characteristics are imprinted. Now, he does not like inflation and hates deflation even more. He sees his role as making sure the financial market functions smoothly. He does not care about stock prices when thinking about rate cuts.

Then what was the reason for the cut if not stock prices? Why an inter-meeting cut much larger than the market was expecting next week, just seven days later? What was so urgent that we needed a shock and awe rate cut a week early?....

I believe the monoline insurance companies like Ambac and MBIA are in worse shape than most realize, the counter-party risk in the $45 trillion Credit Default Swap market is much worse than we realize, and the exposure by various banks to their problems is much larger than currently understood. The Fed understands this, and realizes that they have been behind the curve but need to catch up. Let's go back and look at this quote from my letter just last week:

"If you are a bank or regulated entity, and you have mortgage-backed securities that have been written by a AAA monoline company, you can carry that debt on your books as AAA. But as the companies get downgraded, you have to write down the potential loss. Quoting from a recent note from Michael Lewitt:

" 'MBIA's total exposure to bonds backed by mortgages and CDOs was disclosed to be $30.6 billion, including $8.14 billion of holdings of CDO-squareds (CDOs that own other CDOs, or mortgages piled on top of mortgages, or, to quote Jeff Goldblum's character in Jurassic Park again, 'a big pile of s&*^'). MBIA was being priced as a weak CCC-rated credit when it issued its bonds last week; it is now being priced for a bankruptcy. MBIA's stock, which traded just under $68 per share last October, dropped another $3.50 this morning to under $10.00 per share.

" 'The bond insurers' business model is irreparably broken. In HCM's view, it will be all but impossible for these companies to raise capital at economic levels for the foreseeable future and certainly in enough time to work out of their current difficulties. The performance of MBIA's 14 percent bond issue will prove to have been the death knell for this business. The market needs to come to the realization that the so-called insurance that these companies were offering is not going to be there if it is needed. The fact that these companies were rated AAA in the first place will remain one of the great puzzles of modern finance for years to come.'

"You can bet that the $8 billion in CDO-squareds is gone. It is a matter of time. MBIA's market cap is about $1 billion [it is now at $1.74]. Current shareholders will be lucky if they only get diluted 75%."

Think this through. MBIA is still rated AAA. Ratings downgrades are just a matter of time. Banks that raised $72 billion to shore up capital depleted by subprime-related losses may require another $143 billion should credit rating firms downgrade bond insurers, according to analysts at Barclays Capital.

Banks will need at least $22 billion if bonds covered by insurers, led by MBIA Inc. and Ambac Assurance Corp., are cut one level from AAA, and six times more than that for downgrades by four steps to A, as Paul Fenner-Leitao wrote in a Barclays report published today. Barclays' estimates are based on banks holding as much as 75% of the $820 billion of structured securities guaranteed by bond insurers. (Source: Bloomberg)...

But what if the above-mentioned monolines are downgraded to junk, as was ACA when it could not raise capital? As the downgrades on various mortgage assets and the CDOs continue to increase, the ability of the monolines to deal with the problems is going to come under increasing question. The losses at major banks could be much worse than $122 billion if they are downgraded to the same junk level that ACA was.

Again from Barry Ritholtz' BLOG

Quote of the Day: Ackman on MBIA

Friday, January 25, 2008 | 01:30 PM

in Corporate Management | Credit | Derivatives

Bill Ackman asks if Fitch Ratings should really have a Triple AAA rating on MBIA:

Does a company deserve your highest Triple A rating whose stock price has declined 90%, has cut its dividend, is scrambling to raise capital, completed a partial financing at 14% interest (now trading at a 20% yield one week later), has incurred losses massively in excess of its promised zero-loss expectations wiping out more than half of book value, with Berkshire Hathaway as a new competitor, having lost access to its only liquidity facility, and having concealed material information from the marketplace? Can this possibly make sense?

Ouch!

And that is just the credit default swaps (CDSs) from the monolines. What about the trillions that are guaranteed by banks and hedge funds? There are a total of $45 trillion CDSs outstanding.

No one is really sure who owes what and to whom, and what is the risk that there may be no one to pay that CDS when it comes due? The entire mess is going to have to be unwound in the coming quarters. It may take a year or more.

I think the concern that there is the potential for a much worse credit crisis than we are currently experiencing is what is driving the Fed...

Here is how I think the next few quarters are going to play out. Each new downgrade triggers more losses at financial institutions. You don't write down a bond insured by MBIA as AAA until there is actually a write-down. And then you do, and announce it at the end of the quarter. Along with the rest of the losses caused by new downgrades. We are going to see massive write-offs every quarter by the same financial institutions that have already written off $100 billion. We are only in the beginning innings.

There are very serious suggestions that several extremely large banks (and not just in the US), of the "too big to be allowed to fail" size, technically have negative equity. With each announcement of a new massive write-off, we will see yet another large capital investment announced as well.

And every time it happens, the market is going to be disappointed. And continuing disappointment is what keeps a bear market intact. Couple that with earnings disappointments from companies with exposure to consumer spending, and you have a recipe for a bear market that could linger for awhile.

Time will add clarity. I don't think I'll like the picture, regardless.... but clarity helps with dealing with it.

"The market is not a sofa, it is not a place to get comfortable."

Jim Cramer

Hard lessons; Too real. If you can't handle raw emotion and raw words, don't click the link below.

http://highprobability.blogspot.com/200 ... -life.html

Hard lessons already learned and put into action; I had carried a synthetic 100% short S&P 500 and QQQ for more than a week in my trading account as a hedge for my longs. I closed it out on Friday just in case the Fed eased over the weekend and the market opened up 300 on me Tuesday. I was on the opposite side of the table from this guy and I missed making a pile of money in 5 minutes. Still, it was a lot easier dealing with a missed opportunity than it would have been dealing with a huge loss. You control your risk and backstop everything.

THE WORLD IS WHAT IT IS, NOT WHAT YOU WOULD LIKE IT TO BE.

Things change....

http://www.theglobeandmail.com/servlet/ ... uested=all

http://www.nytimes.com/2008/01/27/magaz ... wanted=all

http://www.reuters.com/article/blogBurs ... YRoUoOjnxK

http://www.bloomberg.com/apps/news?pid= ... cJlQ0&

http://www.sfgate.com/cgi-bin/article.c ... s.mmorford

I know what I want to do with my 401a. Stay tooned...

[ view entry ] ( 1164 views ) [ 0 trackbacks ] permalink      ( 3 / 1406 ) ( 3 / 1406 )

I've had, depending on the fund, 50% to 100% returns in a 3 year period...But markets are cyclical in nature....So, this rough period is the other side of the coin....It's not just what you make...it's what you keep

Sunday, January 20, 2008, 11:42 PM

IT'S 9:00 PM MONDAY EVENING AND THE INTERNET

NEWS AND FINANCIAL SITES ARE TALKING EITHER A

MAJOR DOWNDRAFT OR A WORLD WIDE CRASH IN

THE MORNING. I'M 93% CASH AND NOT BY ACCIDENT.

STAY TOONED.

"It is not the critic who counts, not the man who points out how the strong man stumbles or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who errs and comes up short again and again because there is no effort without error and shortcomings, who knows the great devotion, who spends himself in a worthy cause, who at the best knows in the end the high achievement of triumph and who at worst, if he fails while daring greatly, knows his place shall never be with those timid and cold souls who know neither victory nor defeat"

Theodore Roosevelt

Charts and Table Zup.

I've put my money where my mouth is since mid 2001. You know how that came to pass from reading my website. For the last six years I've spent my money and time learning the important lessons about how to plan and invest for my future. I feel I've I've earned the right to value highly my opinion on what to do with my 401a. If you value my opinion and want it for a damn sight less than it cost me, stay tooned.

I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market, all stocks go down and in a bull market, they go up.

Jesse Livermore

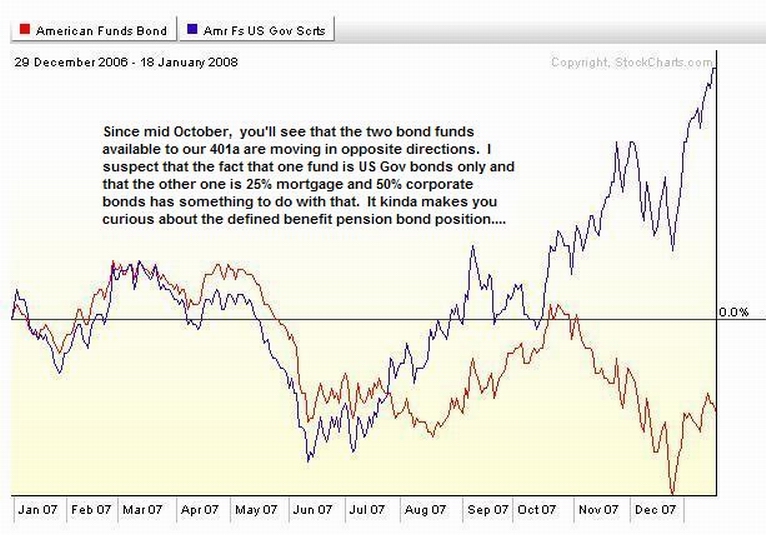

The short version is that I'm over 90% in the GIC (Met Life) and as little in stocks as the rules allow. I'm also staying out of bonds, although I may start to build a position in one of the bond funds while avoiding the other; see below, and CLICKONNIT!!!!

Charts and tables are up later than usual this week and commentary will be posted as time allows. like now....

http://www.nytimes.com/2008/01/12/busin ... ref=slogin

http://bigpicture.typepad.com/comments/ ... ecess.html

http://www.bloomberg.com/apps/news?pid= ... fer=invest

http://www.nytimes.com/2008/01/20/magaz ... gewanted=1

Check out page 8, eighth paragraph. and Cramer @ http://www.youtube.com/watch?v=rOVXh4xM-Ww

I took a trip to Bass lake with my family down Highway 99 through the newly built up Central Valley. I saw auctions for homes and cars on billboards along the way. People don't lose homes without losing their cars and maxing out their home equity and credit cards on the way down. See prior posts on the COFGBLOG on foreign banks/hedge funds cratering on MBS's. I've been through these things since the 70's and the internet allows me to be much better informed this time around.

http://www.nytimes.com/2008/01/20/busin ... oref=login This time the nightmare is real. It's not selling the rubes what only they will buy (Japanese and Rockerfeller Center and Pebble Beach and the yen), this time it is the Chinese and oil exporters and our dollars. Get used to it.

http://bigpicture.typepad.com/comments/ ... rty-r.html

Pay attention to Barry's "Apprentice Investor" series on his blog. His is one of the few blog links on my blog and he has an open invitation for a ride up the coast on his next trip out west. His concerns for the economy are mine.

http://www.bloomberg.com/apps/news?pid= ... 61sYU&

A glimpse behind the cutain... but not behind the curtain behind the curtain.....

http://www.reuters.com/article/reutersE ... 4420071106

If Muni bonds go down, is my pension fund(s) and it's investments somewhere in the chain reaction?

http://www.nakedcapitalism.com/2008/01/ ... lking.html

http://bigpicture.typepad.com/comments/ ... heeee.html

http://www.bloomberg.com/apps/news?pid= ... Z8wwg&

Only 43% of the retail space destined to come online this year is justified?

http://www.mises.org/story/1568

It was a grandkids kinda weekend, ya know. Ya gotta have priorities. See ya at the track.

( 3 / 1356 ) ( 3 / 1356 )

HERE WE GO...... AGAIN!!!!!!

Saturday, January 12, 2008, 01:48 PM

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable. James “Reverend Shark” DePorre Chartses and Table Zup... The markets are a stinking pile of crap. Therefore, so's the 401a. I've long known what I hadda do when the time came and I've long known it would come. And I'm already 90% done doin' it. Get Serious. It Ain't Rocket Science. Know What Ah Mean, Vern? Any Questions? If ya ain't clear on what I'm doin', then see my wesite 401 allocation and below!!!!!!. http://www.sfgate.com/cgi-bin/article.c ... mp;sc=1000http://bigpicture.typepad.com/photos/un ... utlook.gifhttp://tonto.eia.doe.gov/oog/info/twip/twipprint.htmlhttp://www.economist.com/finance/displa ... d=10498937http://money.cnn.com/2008/01/11/news/co ... 2008011115http://money.cnn.com/2008/01/11/news/co ... 2008011115http://money.cnn.com/2008/01/11/news/co ... 2008011115http://bloomberg.com/news/marketsmag/mm ... tory2.htmlhttp://www.economist.com/finance/displa ... d=10498907http://www.ft.com/cms/s/5a5419aa-bd47-1 ... ck_check=1UPDATE!!!! MAXIMUM CASH AS OF WED EVENING!!!!!

CLICKONNIT!!!!

This is clear enough to me.

( 3 / 1406 ) ( 3 / 1406 )

There's always plenty of water....But sometimes its distribution is suboptimal. 'S'cuse me while go I sweep the neighbor's tree outa my front yard.....

Saturday, January 5, 2008, 06:01 PM

=== UPDATED 1/8/08 ===

Lindsey Campbell; What do you do to fix the economy? Barry Ritholtz; I don’t know that the economy needs fixing. What do you do to fix night? You wait and it becomes day. Chartses and Table Zup! Looks like night is fallin'. Here's some of what I'm payin' attention to..... http://www.slate.com/id/2181184http://www.bloomberg.com/apps/news?pid= ... Yb7wU&http://www.reuters.com/article/marketsN ... 104?rpc=44http://bigpicture.typepad.com/comments/ ... 18000.htmlhttp://www.nytimes.com/2008/01/06/business/06count.htmlhttp://www.realestatejournal.com/buysel ... 04-ip.htmlhttp://www.businessweek.com/magazine/co ... 083770.htmhttp://lifehacker.com/339474/top-10-obs ... rch-trickshttp://www.slate.com/id/2181282http://www.bloomberg.com/apps/news?pid= ... iHo4wg_Kakhttp://www.nytimes.com/2008/01/05/busin ... ref=sloginhttp://www.reuters.com/article/ousiv/id ... 04?sp=trueSo's........iffen ya look at the charts and tables on my webpage, you see that ever since I've had something to work with (9/04), I've done pretty well. If I see twice the nominal B/P fund ROR (rate of return) at the end of the year, I'm feelin' allright. This year I had it.... an' I lost it. I started to feel bummed out until I took a closer look at why. The first three quarters of the year, it was because on dips that I saw as hazardous to my money, I bailed out on the way down and I didn't get back in until I saw proof that things really weren't goin' down for the count. That cost me losses on the way down and gains on the way up. That is part of the cost of my investment strategy; Stay heavily exposed in stocks when the market and the funds are goin' up.

Watch for signs that the trend is over and practice selling during times of uncertainty and on corrections.

Reinvest after short term uncertainty and corrections have run their course.

Be prepared to go more sold and stay sold when the short term uncertainty and corrections turn out to be the real deal. Insurance ain't always cheap. But you can't be aggressive without having a plan in place for when the danger greatly outweighs the potential gains. And what use is a great plan if you've never practiced putting it into action? Now there is big time bearosity all over everywhere and the bearishiousness every place else is thick enough to walk on. This may finally be the time to lock up the gains that I made when times were good and hunker down to keep 'em. Gotta have the wherewithal for when times get better investmentwise. Last week I went from 20% cash equivalent to 36% cash equiv, on my way to around 60% cash equiv this week. Stay tooned. If I'm wrong and I miss some upside...again...Oh Well. I'll buy back in. If this IS the real deal, it's not like I'm not prepared. 80% CASH (GIC) AS OF THIS EVENING. IT'S A BEAR MARKET AND THE PRIMARY DIRECTION IS DOWN. CAPITAL PRESERVATION IS THE FIRST PRIORITY. MAKING MONEY ON BOUNCES IS A DISTANT SECOND PRIORITY.See ya at the track.      ( 2.9 / 1411 ) ( 2.9 / 1411 )

Friday, December 28, 2007, 09:34 PM

The price one pays for pursuing any profession or calling is an intimate knowledge of its ugly side. -- James Baldwin Chartses and Table Zup!!! Off work 'till Jan 2nd. I'll be thinkin' thoughts and prolly I'll write about it here sometime this weekend........Until then; http://www.nytimes.com/2007/12/02/world ... ref=sloginhttp://www.iht.com/articles/2007/07/30/business/sub.php     ( 3 / 1341 ) ( 3 / 1341 )

The Cold and Darkness of the CDO blizzard just starting on the outside vs the Warmth and Light of the holidays in full roar on the inside. Go with what you have today. Tomorrow will wend its own way....

Saturday, December 22, 2007, 01:06 PM

Facts do not cease to exist because they are ignored. Aldous Huxley Chartz and Table Zup!!!! Check out the entry below. My 401 figures are suspect and so are yours. The explanation is below. The numbers should be good to go by next year..... Maybe something else here sooner or later... Like this: http://www.businessweek.com/magazine/co ... op+storieshttp://www.washingtonpost.com/wp-dyn/co ... 00088.html     ( 3 / 1393 ) ( 3 / 1393 )

Darkness on the Horizon...

Friday, December 14, 2007, 11:08 PM

When the market starts acting as poorly as this one has, market participants start looking for ways to protect themselves from further losses. The two most talked-about alternatives are buying so called "safe" stocks and hedging....

In a bear market, there really is no such thing as a safe or defensive stock. The logic behind most of these stocks is that certain businesses, such as food, are not affected by the economic cycle. Hence those stocks will hold up better than others.

The problem is that they may have better relative strength, but in a poor market they are still likely to go down....

For a mutual fund that is forced to be invested at all times, that is a benefit, but for the individual investor it is not nearly as good as being in cash. Just keep in mind when the market is acting poorly that almost all stocks will suffer, and there is no requirement that you need to be invested...

Hedging is another approach to staying in the market when things get rough. The idea is to short an index in sufficient quantities that the gains from the short will offset the losses you incur on the long positions you continue to hold...

If you are an individual investor who isn't managing huge sums, you should avoid these complicated approaches to being defensive and simply sell down some long positions. It's safer and easier and can be quickly undone...

Nothing is safer or more effective than cash in a poor market.

Cut and pasted from Rev Shark at www.Realmoney.com I can't short or hedge in the 401 as it is configured now. Neither do I have a "safe, defensive" fund. So whereas "My Cash Wuz Nothin' But Trash" in a bull market, now it's money in the bank in a bear market. "My Mind Starts Relaxin' When I Start Seein' Pictures of Jackson." Long old Rock 'n Roll..... Chartzes and Table Zup!! More to come. Prolly this weekend...Check it out!!! NOTEMy data looks wonky and if you are spread out among different funds, your's does/will too. Here's why...

For those who are unclear on what happened; the typical mutual fund has one portfolio of stocks/bonds but many different classifications. Some investors pay a load (commission) upfront, some pay it later on sales, some pay a higher commission, some pay a lower commision, etc. Some of the holders of the fund have to pay taxes on capital gains and appreciation on sold positions and some don't. Pension funds tend to use the institutional classification shares of the fund and so probably, most likely, pretty much everyone in this "r or x " classification fund, like 342 members, is in a nontaxable income/capital gains situation. But maybe not everyone. To make the whole thing easier and somewhat transparent, especially given that taxable and nontaxable entities may be in every class of fund, every year about this time, the fund takes the capital gains and dividends made over the past year out of each account in each classification, subtracting the value from the NAV (net asset value). So the price per share takes a hit. In the next coupla three or four days after, they rebate the capital gains/dividend taken out of each account back into the same account but in shares instead of dollars, at the price that the fund was when they subtracted the cap gains... After it is all over, you have the same amount of money but in more shares of a less expensive fund and the goverment and you have the capital gains/dividend number reported in terms of a dollars/shares number if you indeed have to pay taxes on it. For the 401a, it ain't no big thing. You pay no taxes, you do nothing. For the taxable accounts, they use the cap gains/dividend number to report. Note it and stay cool. But it'll get your heart pumping the first time you see it, until you look at the calender. Expect to see it happen once in each fund, providing there are indeed capital gains to report

Calamos share price took a hit a week ago as they deducted capital gains/dividends. My account balance took a hit too. Then they paid me the gains and all was well. Now it's American Fundz turn and EuroPacific shares price took a hit as they deducted $3.63 from the price. It'll be paid out to shareholders next week. Watch for this to happen to various fundz between now and Jan 1st. http://www.washingtonpost.com/wp-dyn/co ... 01522.htmlhttp://longorshortcapital.com/lame.htmhttp://www.signonsandiego.com/news/busi ... tlook.htmlhttp://www.rgemonitor.com/blog/roubini/232729Here's where I'm at... Check out the stock charts on my website. We've had the new funds for a little over three years, since late 2004. Hell, we got them about two years late. A bull market started in 2002 and we were stuck with the McMorgan crap. Life has been good ever since with the new fundz. Load up the stocks and ride the slope up. But nothing goes forever. I think the end is here. I've gone to cash a number of times for short periods over the last two years when I thought things got dicey. I did alright, but things turned out OK and I got back into stocks big time an' quick. Here we go again. Is this time different? I know how to get defensive with the 401. I've done a number of times. And I know how to correct it when it's the wrong move to make. So I'm going to start to go to cash like I've done before. I'll watch for signs that it is the wrong move and I'll undo the move quick if/when it makes sense to me to do so. But if things turn to shit long term, getting heavy cash is Just Alright With Me. And I'll expect short, vicious, bear market rallys to appear if/when we get a confirmed bear market. And I'll take advantge of them if I can. I'm in the game for the long haul and ya play what's dealt. Fifteen to twenty percent average gains per year over three years in a bull market is pretty cool. Let's see what I can do if/when they change the game over to bear...      ( 3 / 1392 ) ( 3 / 1392 )

Saturday, December 8, 2007, 02:30 PM

"Democracy is the theory that the common people know what they want, and deserve to get it good and hard." -- H.L Mencken Chartesses and table Zup. There's money being made and lost all the time all around us. With the 401a, we're no longer just spectators, we've turned into participants. An' I'm particpatin' away. Check out my charts and tables and tell me what's not to like about what I'm doin'. But have no fear. Losing money is still an exciting spectator sport we can all participate in. With a significant but still unpublished amount of the union's fixed income assets in mortgages, I can hardly wait to see how things come out. There's more to come. Check the blog out once or twice a week..... Especially check out da Greenberg and Calculated Risk links.... http://www.bloomberg.com/apps/news?pid= ... mw9VQ&http://www.time.com/time/business/artic ... 10,00.htmlhttp://bigpicture.typepad.com/comments/ ... an-se.htmlhttp://www.sfgate.com/cgi-bin/article.c ... amp;sc=958http://www.sfgate.com/cgi-bin/article.c ... e=businesshttp://blogs.marketwatch.com/greenberg/ ... n-insider/http://calculatedrisk.blogspot.com/2007 ... reeze.htmlhttp://www.bloomberg.com/apps/news?pid= ... MhEko&http://www.spinner.com/2007/06/26/video ... ya-boogie/     ( 3 / 1332 ) ( 3 / 1332 )

"Goin' home..." Alvin Lee

Saturday, December 1, 2007, 01:44 PM

"The market is not a sofa, it is not a place to get comfortable." Jim Cramer Chartz and Table Zup. End O' The Year and I'm head down and headed home WFO. Four weeks to go, there are a lot of money managers who got caught leanin' the wrong way through all the volitility this year, and that spells opportunity in the market as the year winds up. It's been a year with a lotta hair onnit and I've been both lucky and smart. I've got a cushion of good results and a suspicion that the underperforming managers mentioned above are gonna gun stocks hard into the end of the year if they get the slightest opportunity. The subprime/"subslime" mortgage crisis and the aging of the market cycle looks to put a lotta Wall Street guys lookin' for work next year or looking for a position in a reorganized/merged organization. They ain't gonna fall into a real estate agent/mortgage specialist jobs if their's goes away. A good last month/yearly bonus would protect a job/grubstake the search for a new one. Smells like race fuel exhaust fumes in the morning to this crusty ol' racer. AND I've got some numbers on the Structured Investment Vehicle/MBS/CDO embroglio that'll be worth relating to 342's Two Pension/Health and Welfare/Apprenticeship Trust Funds. See ya at the end of the weekend.... Which is now. http://www.nytimes.com/2007/11/30/busin ... tadel.htmlhttp://www.bloomberg.com/apps/news?pid= ... NumEnGUQnghttp://www.bloomberg.com/apps/news?pid= ... XVr9s&http://www.bloomberg.com/apps/news?pid= ... 9Os9FYyqX0http://www.investorsinsight.com/otb_va_ ... tionID=619http://www.realestatejournal.com/buysel ... lomon.htmlhttp://money.cnn.com/2007/11/24/magazin ... /index.htmhttp://www.cnbc.com/id/22005529/for/cnbchttp://www.reuters.com/article/ousiv/id ... 5020071202So, here's how I read it. The financial markets partied hard on the real estate bubble and pushed it too far just like they always do. They created a lot of speculative mortgage backed paper, hid it behind ratings that turned out to be bogus, leveraged it out the wazoo, and sold it to their best clients. That would include pension funds and other trust funds. When the music stops there are always patsies, late comers, and the guys throwin' the party gettin' caught. You know what I'm talkin' about. The guy in Modesto with a $700,000 house on $1400 a month income, etc. Citibank, with a huge bridge loan/lending commitment to customers who'd posted MBS's as the security, that Citibank made good on and ended up getting stuck with merchandise that they couldn't move. E Trade and Countrywide buried under toxic mortgages. And the Trust Funds with a quarter to a half of their fixed income portfolios in morgage backed securities. Arabian petro dollars moved in to toss Citibank a life line for a high rate convertable bond. A hedge fund with a vulture fund track record picked up all of E Trades mortgage portfolio for 26 cents on the dollar. Freddie Mac plans to issue $6,000,000,000 in preferred stock to maintain reserves as it expects to have to meet a ton of defaulted mortgage claims. There's going to be mergers and buyouts as companies get out from under and write off the worst of the crap. There's going to be political posturing about keeping people in their homes. Two things concern me. The first is the riff about Wells Fargo reserving for bad HELOCs. Those things are secured by homes and are effectively second mortgages. Some of them were used for down payments and mortgage payments. There are more shoes to drop in the mortgage space. Even in the best of times there are foreclosures on houses and cars. The Fed will gun the economy to keep people in jobs while the real estate market revalues. But the real estate sector will crater. The second thing is mortgages in 342 Trust funds. How exposed is 342 and what can be/is being done to keep us up with the big money trying to maneuver out from under in the same space? We're not gonna be the last to find out again and holding the bag a la our McMorgan equity investments after the crash of 2000 are we? Ya think? From John Maudlin's "Outside the Box" above.... Who's Holding the Bag? One of the uncertainties about risk in this complex system results from the unprecedented degree of financial leverage placed on real economy capital structures. Never before have we entered a downturn of an economic cycle with so much paper riding on the fortunes of companies known to have such poor credit quality. Those left holding the bag will be the sellers of CDS (the insurers), owners of CDOs, financial guarantors of CDOs, and may include another link in the food chain.[xix] Regardless, in the aftermath of the subprime mess, no one will fess up to holding politically toxic securities before they must. In short, the separation of risk production and risk taking makes any definitive assessment of risk in this market unattainable. When subprime mortgage losses surfaced in February and again over the summer, the success of structured finance in dispersing risk was more than offset by the exceedingly high degree of risk taken across the globe. Not only did direct participants like subprime mortgage originators meet their demise, but also U.S. investment banks, European insurance companies, Chinese state-owned institutions, hedge funds promising a low risk profile, and even money market mutual funds suffered write-downs on their balance sheets. Unfortunately for our financial system, the magnitude of risk in corporate credit is a multiple of that in subprime mortgages. Each written CDS exchanges a risk that cannot be eradicated no matter how broadly aggregate risk is dispersed. Sinking valuations of CDOs and a commensurate leverage unwind could trigger a vicious cycle of financial losses. By implication, the problems that might ensue could make the subprime mortgage problem look like a walk in the park. I cannot be sure these assertions are true, but I suspect that it would be just as difficult to provide evidence that they are not. I have listened to arguments against systemic risk, suggesting that the double counting of CDS, matched books of investment banks, and increasing sophistication of risk management techniques make the eye-popping numbers of notional risky debt larger than they seem. Nevertheless, I remain skeptical. We've seen similar movies before, and they don't end well. Smart guys make money. Here's a riff about a really smart guy.... http://www.washingtonpost.com/wp-dyn/co ... 00135.html     ( 3 / 1332 ) ( 3 / 1332 )

A hammer is simple, cheap, easy to use, effective, and reliable. But you can no more paint with it than you can make money owning stocks on the way down.

Saturday, November 24, 2007, 12:24 AM

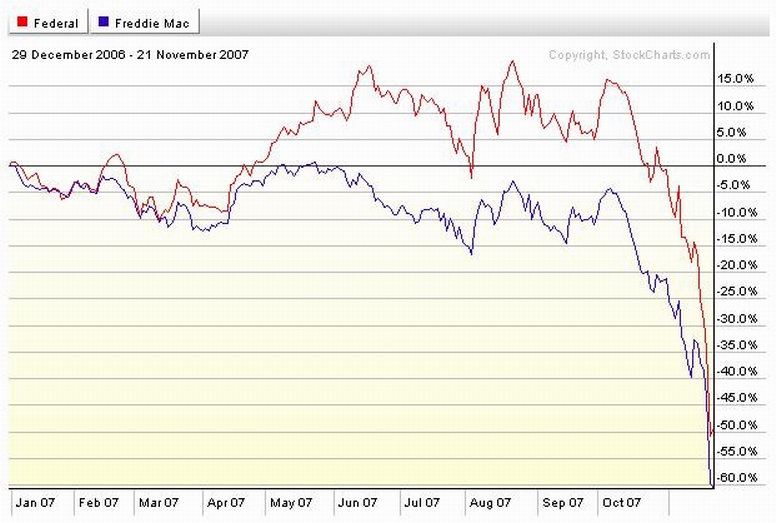

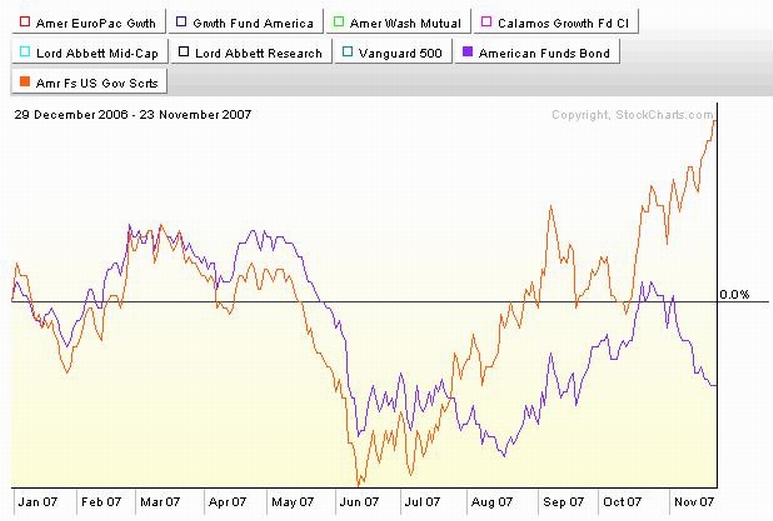

True genius resides in the capacity for evaluation of uncertain, hazardous and conflicting information. -- Winston Churchill Chartz and Table Zup. Click onna charts below.... What the charts are and what it suggests to me latter this weekend... OK, it's later....    The first chart is of banks Bank of America, Citibank,and Wells Fargo, mortgage originator Countrywide Financial, and full service financial/broker E Trade Financial. What we're lookin' at is the kick in the crotch of the subprime/credit crunch of May and August. Countrywide and E Trade are drowning in mortgage debt. Citibank is bowed under way too much mortgage debt and some other credit issues. Bank of America screwed up a good thing by buying a sizeable chunk of Countrywide a coupla months ago, effectively buying into the mortgage disaster. Wells Fargo, a bank that is well run and is currently not deeply involved in the mortgage crisis, is none the less operating in an industry under the strain of mortgage debt. All of these banks, even Wells Fargo, are NOT able to operate as freely as in the past. There is a credit crunch goin' on and it'll cramp the style of the survivors. A recession is looking more likely by the day. The second chart is of Ginne May and Freddie Mac, the Government Sponsored Entities (GSE) that purchase, package, sell and guarantee timely payment of principal and interest on federally guaranteed mortgages and loans. These charts show that the market thinks something very bad is about to happen to these private mortgage insurers/corporations. Think of a currently healthy insurer doing a lot of business in Florida and Louisiana during the beginning of an expected to be horrible hurricane season. The market says Incoming!!!! The third chart is of the two bond funds currently available to 342's 401a plan. Note how well they track together until August, about the time that the smart money figured that the game was up in mortgages. The US government bonds appreciated after August as money moved into them, driving up prices. The nongovernment (more corporate and mortgage securities) fixed income fund fell as people bailed out. This is a trend that may affect fixed income securites in the pension funds, Health and Welfare Trust Fund, and the Apprenticeship Trust Fund. in other words; your money. Stay tooned. I've been rethinking my 401a strategy. I gotta fair grip on how to play it. But there are some bigger fish to fry and everything in due course...o'course. Read about it here; Check out my asset allocation tables, chartz, and maintain a high degree of toonosity. See ya at the track.      ( 3 / 1382 ) ( 3 / 1382 )

Never a dull moment......

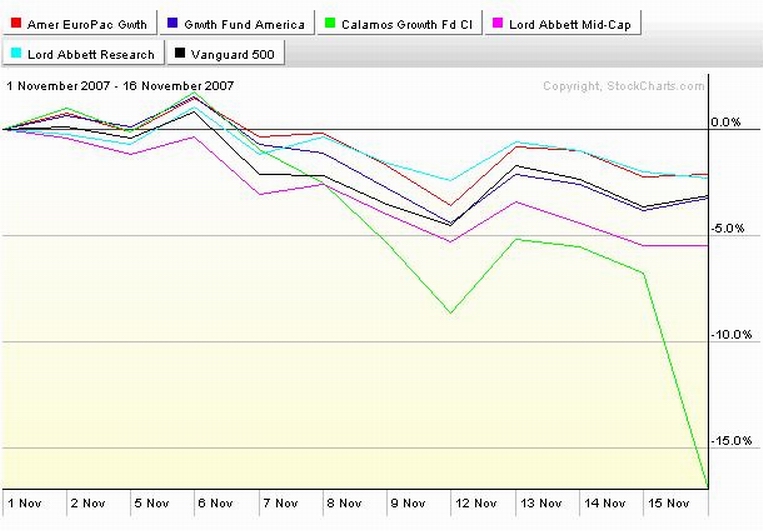

Saturday, November 17, 2007, 03:07 PM

It's all fun and games until someone gets hurt. -- Mom Chartses and Table Zup Check it out. CLICKONNIT!  Either the Calamos Fund blew up and lost 10% of it's value in one day.... or it paid off its Capital Gains and the money that disappeared in share prices on Friday will reappear in shares on Monday. A quick look tells me that they did just that on this week last year. THAT ain't no big thing. THIS is... SAN FRANCISCO (AP) -- Evoking Depression-era memories, Wells Fargo & Co. President John Stumpf on Thursday became the latest banker to predict continuing difficulties in the U.S. housing market as risky mortgages made to overextended borrowers disintegrate into large loan losses. Speaking at an investment conference in New York, Stumpf said the current real estate conditions are the worst he has experienced during his 30-year career. He then punctuated his gloomy assessment by harking back to the deepest downturn of the 20th century. "We have not seen a nationwide decline in housing like this since the Great Depression," he said. http://money.cnn.com/2007/11/15/real_es ... /index.htmThe question is... What am I gonna do about it? Stay tooned....      ( 3 / 1421 ) ( 3 / 1421 )

Stocks go up and Stocks go SPLAT!!!!!!! On the track we call this a "face plant".......

Saturday, November 10, 2007, 01:01 PM

"Concern should drive us into action and not into a depression. No man is free who cannot control himself." -- Pythagoras Chartes and Table Zup!!!! Check out the chart...CLICKONNIT!!!  We had a good year goin' until we had the March subprime/economy hiccup. Then we had a good year goin' until we had the August subprime/economy hiccup. Then we launched off the half point interest rate/discount rate cut of August 15th and had a good year goin' again. What happened this week should look familiar. (Hint; Subprime/economy) The question in front of us is "Will we go up again for the third time? Or is this going down for the third time and stayin' down?" Other questions... This is a mortgage thing. Am I right that we have way too much of the money in our Health and Welfare Trust Fund, Apprenticeship Trust Fund, and Defined Contribution Pension Trust Fund invested in mortgages? Are YOU exposed to this is the 401a? What does it mean that the mortgages are insured? We've watched the progression of housing from "a pause in growth" to "going down in flames". This weekend we are seeing million dollar Vallejo homes auctioned off with starting bids in the $400K range. We've watched the mortgage originators (Countrywide et al)going down in flames. We've seen way too leveraged hedge funds vomiting out mortgage backed securities and closing the doors. Are the mortgage insurers facing a Katrina like Tsunami of claims? Will it overwhelm them? If the mortgage insurers come up short, are we dependent on the PBGC for our pension benefits? Check out the last page of my site for more info on THAT. Banks are writing down much of their exposure to recent mortgages to near zero because they want to get out from under the falling piano. They have investors and an industry that demands that they move and move NOW when things get dicy. And it appears that the problem is growing faster than they can move. The Financial Times estimates $40 billion in additional exposure at risk. Worst case figures are estimated at $250 billion total. And we have Local 342. I've reviewed some recent records. I suspect that we may be exposed to a substantial amount of mortgage backed securities. Are we REALLY aware of it? Are we taking someones uncorroberated word that everything is OK? Are we moving on it if it is a problem? Will we be the last to move? Will we be left holding the bag? In 2003 I got way concerned about the money our pension fund had in stocks. Jesus, was I right to be concerned. Today, I'm concerned about our exposure to the mortgage market. I sense a pattern here.... DON'T GET CAUGHT UP IN THE "SUBPRIME RIFF". There are also the "Alt A" mortgages (nondoc on good credit), prime mortgages with a second mortgage or a "home equity line of credit" (HELOC) on top, mortgages with job loss behind them, and second and third "investment" home mortgages. These are all possible falling pianos and a possibile recession is the triggering event. Billions of dollars are evaporating from the economy as real estate values evaporate. Is the $250 billion worst case estimate accurate? The headlines keep getting worse.... Can all this money disappear, can all the associated jobs and industry fade without precipitating the economy into a recession? Luckily, I got a jump on it this time. I'll keep an eye on this and write about here.... Bummer.... http://www.nytimes.com/2007/11/09/busin ... ref=sloginhttp://bigpicture.typepad.com/comments/ ... -wors.htmlOh, yeah. if you can't face losing a lot of money without laughing about it, you may not be able to hang with me...Clickonnit!!!! http://www.youtube.com/watch?v=SJ_qK4g6ntMhttp://www.youtube.com/watch?v=axAjb6fDsPYhttp://www.youtube.com/watch?v=NAt311OlM7USee ya at the track.      ( 3.1 / 1167 ) ( 3.1 / 1167 )

Damn!!! another year circling the drain...... Christmas presents fer the little Grandkidz. Thanksgivin' Turkey and Christmas goose an' all gonna happen soon....

Saturday, November 3, 2007, 02:26 PM

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

--Herm Albright

Chartzes and table Zup...

Workin' hard to get my Ira's 'n 401 to perform this year in a bidirectional market. It take as much guts as it does brains. Risk vs reward and ya can't surf the investment oceans without gettin' soaked occasionally. And if'n it all works out, the thrill counteracts the chill. Works for me in the long run. Which for me is different from what you think it is. For me, the long run is what you end up with after all the short runs are tallied up.

I've gotten my nose bloodied good learning how to handle my money. Most of the mess was caused by learning why I couldn't just rely soley on putting my money down on something someone identified as a good investment "in the long run", having faith, "taking pain", and hanging on. Successful investing is more complicated than that. If I was dialed in to what was really happening; if I had access to a lot of raw economic data, if I ground the data up myself, if I knew about all the executive suite strategic initiatives, if I had ongoing measures of the success of execution of the initiatives, and if I knew the course changes being put into place at the lower levels of the companies, I could invest for the long run as most everyone understands it. Provided I could change my mind about staying with it at any moment.

Most everyone understands the long run as they would like it to be. You buy once, you stay put, and that's all there is to it. Ya just gotta believe and hang on. I'd have to see it everyday to believe in it. Enron, Microsoft, Apple, Google, Worldcom,and General Electric have had their believers. All of the believers made money. Some of them made a lot of money and still have it. Some of them only made a little money. All the believers lost at least some money and some of them lost all of it. Faith based investing is really hard and dangerous.

It's hard for some people with less faith to believe there are one decision stocks so they are more comfortable looking for one decision investment advisors or mutual funds. Life should be so easy. My life ain't 'cuz I've done the due diligence and looked over the edge. Check out the COFGBLOG Essay pages, the chart pages and the Fund Alarm pages of my site.

There are long term trends. If you can identify them, you can ride them and make some money. The sooner you can identify the end of the trend, the more money you can keep. The sooner you can bail out an investment that was a mistake, the less money you lose. The sooner you get comfortable with playing hardball with your money; grinding out the profits and exterminating losses, the better your results. The key word is soon. Soon is not about faith, it is about getting something done in not much time. Put together successful day, weeks, and months all in a row, a lot of short measures of time, and all of a sudden, ya got a long run.

So I went with the trend in the long run one week, at at time. The charts and tables say it all. Now I'm leery of a trend break, and whereas I weighted some of the 401 fundz pretty heavily, now I gotta weigh weighing heavily in the GIC.

Want some clarity about the past? Check out the Fund Alarm tables and the charts page. There is a pretty important tale to be told there.

Stay Tooned.

[ view entry ] ( 993 views ) [ 0 trackbacks ] permalink      ( 3 / 1069 ) ( 3 / 1069 )

It's Tuesday after work an'....

Tuesday, October 23, 2007, 09:02 PM

I'm toast. It was a super full three day weekend. It was back to the track for a heat check Monday. I wanted to see if I still had the fire inside. Do I sell all the sport bikes and buy a Goldwing w/ an awning and refrigerator 'cuz I'm old? Or do I buy a new ultragnarly crotchrocket sportbike to keep a promise to myself? Besides, my apprentice was talking silly about about riding fast onna street and I ain't gonna put up wid dat.

So I booked us both for the California Superbike School at Sears Point. His first time and my 7th. I ran a tank fulla sour gas outa my 929 on Sat and flogged for 14 Hrs straight Sunday doing what I shoulda had done already. (Just like a real race weekend.) That includeds taking the old tires off the wheels hunkered down on the garage floor with a pair of tire irons and putting the new tires back on in an hour and a half. I got most but not all the stuff done and loaded the bike up with a new Ohlins, fresh unbroken in race tires, and brand new brake pads.

Before I left for the track Monday AM, I lightened up up the 401 to 50% stocks. I pulled the max from each American Funds that the trading restrictions allowed, and half the position in Calamos cuz I could. The American funds dictate what I have to do there and I suspect that Calamos is big in Apple. The order executed after the market closed Monday. I done well as of Tues PM. I cut my exposure to a risky time in the market and still maintained some exposure to some upside. Which we got.... but...

The CSS has a VERY structured curriculum. My first track session was two gears and no brakes. The new SP layout (I last raced in '99) is significantly different. Being an ex racer and being used to scrubbing in my tires on the warm up lap, I got it done easily in the half dozen tiptoe laps of the first session and I got a rough reading on the new sections at the same time. As I started out on my second session, two gears and light brakes this time, the bike felt so goddamned good going up into Turn Two that I dialed it up and started looking for who I used to be right then and there on my out lap. It started to come back a little at a time.... When I got into the pits after the second session, the chief instructor walked past and said, "Joe! You looked like a crusty old racer out there!" I walked past a group of guys my age and one spun around and pointed his finger at me and said, "You! You're that fast guy!" I immediately denied it.

The day was a perfect indian Summer day and I got closer to who I used to be each session. I had a string of totally dialed laps in the last session. The fire inside no longer rages, but it's still hot to the touch. I'm still the COFG! See ya at the track.

Stay tooned about the 401.....

UPDATE!!!!!!!!!!!

I'M SET TO GO TO 95% CASH THURSDAY AFTERNOON...STAY TOONED...

[ view entry ] ( 1069 views ) [ 0 trackbacks ] permalink      ( 3 / 1430 ) ( 3 / 1430 )

Dee Do Do Do, Dee Dah Dah, Is All I Wan WHOOOSH..SPLAT

Saturday, October 20, 2007, 02:02 PM

The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all." -- Harry Schultz Chartz and Table Zup!!!! Check out the chart below. CLICK ONNIT!  " The chart is the performance, year to date, in the funds available to the 401a. There's big time profits here in the 401a as of yesterday and throughout most of the stock market as well. Charts don't lie. But stocks were circling the drain in early August because everybody had all of a sudden finally realized that once the punchbowl of cheap rates and easy money were taken away, that cold sobriety and a godawful hangover were guaranteed to follow. Everybody started puking up stocks and the market was goin' down. So then the Fed put its foot over the drain and announced that there would be money available to keep the economy going, Everybody took a headlong dive in the direction of the punchbowl, ready to party hearty just like it was 1999. The problem is that the Fed intends to salvage only the best, brightest, and most deserving. The soaks and rumdumbs that screwed up the party for everybody else are on their own. And salvage has more to do with a hair of the dog and a breakfast than filling the punchbowl back up so everybody can dive in again. I think that everybodys just figuired that part out. Friday afternoon I blew 90% of the positions in my trading account out at the market. I've gone from fully margined to half cash in the last month as well as from big time options exposure to one position. I've booked one hell of a year. Time to go short runnish, fade the pop, and think about how to pay taxes on the profit. I feel great. But I screwed up bigtime, too. I should have done the same in my 401a. DAMN!!! I expect to do that Monday, a day late. I'll let you know about it then. See, in August it was stocks in the toilet 'cuz the system was breaking down over the subprime mess locking up the credit market. That was the kind of thing that takes the whole system down in flames into a depression. It was time to blow out all your stocks. That got fixed by the Fed. Now we're looking at housing and associated businesses cratering, mortgage outfits going out of business, banks writing down huge amounts of real estate loans and kissing a huge percentage of the mortgage business goodby for upcoming years, the yen arry trade going away, and homeowners looking at the value of their homes withering away. And the rest of the US and the world getting by as long as jobs and employment hold out. That is the kind of thing that could lead to a recession. I think it's time to sell the right stocks. That's easier said than done when all you can do is play a handful of mutual funds. So I gotta substitute the ability to move in time for the ability to move in direction. The first step is to get through the next two weeks. Cash is the place for me. Then I gotta watch for the end of the year bonus riff to show up. Stay tooned. See ya at the track.      ( 3 / 1430 ) ( 3 / 1430 )

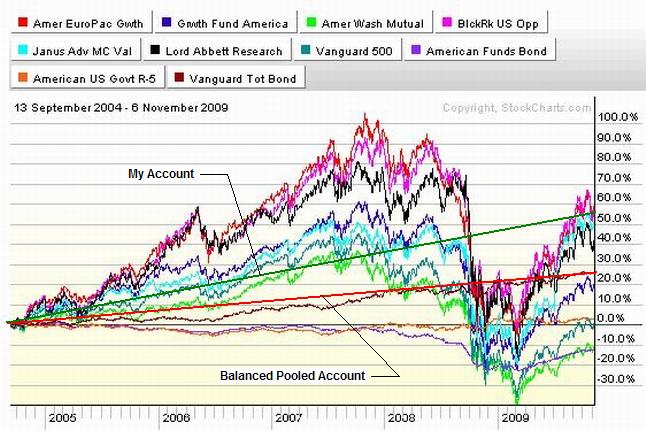

Three years; Up 60%. AGAIN, ya gotta make it when ya can.... Not when you need to. The opportunity ain't necessarily gonna be there just because you need it to be.

Saturday, October 13, 2007, 12:05 PM

"When the facts change, I change my mind. What do you do, sir?" --John Maynard Keynes CHARTZ 'N TABLE ZUP!!!! The charts and tables pretty much tell the tale. CLICKONNIT  Half bonds/half stocks. Brilliant allocation or kinda dumb? Stocks go up and down a lot. Bonds go up an' down a little. Sometimes they work opposite each other... but not always. So you're pretty much half safe, mostly. Or at least half exposed to danger at all times. Think of it like leaving the house in a swimsuit, flip flops, and a fur-lined parka so you can deal with whatever the weather happens to be. Make sense to you? Me neither. I time the market. Ignore the crap you always hear about how it can't be done. It is not in the best interests of the mutual funds for you to think that you can time the market. They earn the most when your money lands and stays put where it landed. They earn fees and the lower the costs and the stickier the money, especially during the years when they can't hit their ass with either hand, the more of your money they earn (keep). Pretty sweet deal. I'd like to have one like that too. But I get paid for what I do that day. If I stick, it's 'cause I perform, not because my employer is waiting for me to turn around "in the long run". It is in my best interests to maximize my earnings. I have a wife and family whose well being supercedes that of the funds I invest in. So I try to put my money where the most money is being/will be made. It's worked for me for three years and counting. It is also in my best interests to minimize my losses. Ya not only gotta make it, ya gotta keep it. There are times when it is/will be very hazardous not to be in cash or cash equivalents, or when bonds will be the best game in town. That's when I go to bonds or cash. That works for me too. I got a fur-lined parka and a swim suit and flip flops. I don't wear them all at once. That would be silly.      ( 3 / 1376 ) ( 3 / 1376 )

Eighty percent of the gains are made in twenty percent of the time. You snooze; you looze. Sleepy is one thing I'm not..The market's smokin' an' I'm hangin' on with a grin so big it hurtz. Christmas looks good already......

Friday, October 5, 2007, 11:53 PM

Trends, like horses, are easier to ride in the direction they are going. -- John Naisbitt Chartz and table ZUP!! More words about what I'm thinkin' about prolly this weekend. Stay tooned...... AND, IF YOU HAVE NOT READ THE POST BELOW (9/28/07)....DO IT NOW!!!!!!!

You know what it is costing our brothers and sisters to be hangin' with the B/P Fund outa ignorance, fear, or inertia. Pretty much 'cuz you're readin' this here an' now. An' it's not like it couldn't be worse. Local 393's B/P fund has returned 2.5% to date vs Local 342's 8.15%. Pretty neat for 342 if that's how you want to benchmark it. But that's not the way it is done aroun' here.

It's a free country an' you can do what ya want with your earnings and savings. That is, provided you have the information needed to make an informed choice. If you don't know what you can do, or why you should or shouldn't do any or all of a number of choices, you aren't really free. Knowledge and the power to choose is freedom. Don't leave a brother or sister out in the dark. Spread the word.

More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1316 ) ( 3 / 1316 )

What do the financial markets have in common w/ The Circus of Dr. Lao?

Saturday, September 29, 2007, 12:24 AM

There is no security on this earth, there is only opportunity."

--General Douglas MacArthur

A hugely significant event has occurred in our 401a plan. This event is absolutely the most important occurance I can imagine for many of the younger members. It is, however, without real significance to me and to many of the older members.

Here's what's goin' down; The default plan for our 401a has been the Balanced Pooled Fund. See all over this site....This is a gawdawful choice for many people. A brand new apprentice/journeyman contributing to the B/P Fund starts off his investing in a vehicle that is 60% bonds.

Kinda.

Actually I suspect he is investing in a 60% bonds/mortgages vehicle. Bummer. He has some security, maybe, which is always nice. But he barely (maybe) breaks even with inflation in bonds.

And, it's not that the jury is still out...we don't even know if there is going to be a jury when the CDO (collateralized debt obligation[subprime/subslime mortgages]) riff finally gets laid down so it stays there. I just don't have the time here to cover this here and now. But I will, elsewhere and later. Stay tooned."

So the young member doesn't make much in the B/P Fund. That's not good. You wouldn't keep your life savings in an interest free savings account... But look up the returns for the 401a bond funds over the last five years. Again, Bummer.

The older member, retired or ready to retire, who has his 401a invested in the B/P Fund, has his 401a savings and earnings in a vehicle that is 40% stocks. Stocks can make you rich and can beggar you...sometimes a coupla times each in the same year. That's called volatility. Why would anyone set up an older member's savings where 40% of the money was on cruise control in a risky investment? Yet that happens to be the case for older/near retirement or retired members, who have all his or her money in the B/P Fund.

So what is needed for Local 342 members is a no hassle/easy/low/maintenance/automatic/rational way to allocate his (or her) funds properly between stocks and bonds, as driven by the member's age and retirement target date. The answer is...

The American Funds Target Date Retirement Fund

At the special called State of the Pension Funds Meeting in November of last year, I suggested that we try to put something like this into place... and it has come to pass.

It's About Time!!!!

Of course, my son has had this kind of fund available to him for at least the last seven years at the last two places where he has worked/works..... But better way late than never.

This is a quantum leap or two better than the B/P Fund and all of the younger members need to check this out.

It is NOT the answer for everybody and it is not the answer for me. And it may not do much for the older members. But it is a DAMN FINE THING THAT THE BOARD OF TRUST HAS DONE. They just needed to be pointed in the right direction and motivated....

The problem (yeah, for all my enthusiasm for the target date funds, there still is a problem...) is that we hemmoraged away money in the 401a and defined benefit plan under the previous financial advisors and participating in the Target Date plan won't help that. But it will get the members who are very new or those who are close to retirement and have a nice nest egg into a more rational allocation plan.

And there are still risks... The Board of Trust added four new financial advisors in 2004 and within a year, two of them were on notice for crappy performance. Not that it was any different from what they had been doing previously and that the Board of Trust had blessed the previous year... But still... the Target Date Funds appear to answer a major need. So I'll be vigilant.

So, bottom line, I'm stoked!. But I've been down this road before... Lemme see about tracking this and getting back to you... Stay tooned...

Oh, yeah...Fixing the damage done to my pension savings is another matter. And one that I'm addressing presently with my 401a. The godawful performance of our prior 401a plan discouraged me from bumping my contribution to the plan. So I'm late taking advantage of the 401a. But now I've got something I can work with and I've got my head down and I'm doin' it. You should make sure you are doing the right thing for your personal circumstances too.....

THAT'S WHAT I'M TALKIN' 'ABOUT!!!!!

See ya at the hall.....

[ view entry ] ( 1074 views ) [ 0 trackbacks ] permalink      ( 3.1 / 1467 ) ( 3.1 / 1467 )

Brave New World of the post Fed interest rate move.... or not.

Friday, September 21, 2007, 10:18 PM

"There are some things which cannot be learned quickly, and time, which is all we have, must be paid heavily for their acquiring." Ernest Hemingway Chartz and table Zup!!!!! So it goes... the year is winding down and it doesn't look like this year is as good recently for my 401a as the last coupla two or three have been. But appearances can deceive... In 2003 and '04, we were coming out of a brutal three/four/five year recession, the Fed had driven rates down close to free as you can get and the system was awash in cash. Very Bad Things were priced in everywhere and it was as if no one expected some parts of the economy to ever sell anything ever again. So when we finally got some reasonable investment vehicles in the 401a in Sept '04, I has a high level of confidence in going major long stocks for an extended period. It's been three years and a week since then and as of two days ago, I'm up 50% over three years. Over 15% a year in tax advantaged investment contributions and tax advantaged returns. Not half shabby. But my personal rate of return has been dropping off lately from what it had been, even though the various mutual funds in the 401a are still performing well. To a small degree, I find that troubling. As is detailed on my web page, I believe that my defined benefit retirement plan has been poorly managed and a huge amount of returns have been left on the table. In addition, the same mismanagement has occurred in the 401a. It's been a double whammy there as the lousy performance of the 401a has not only cost me returns, but it has prevented me from seeing the advantage to investing at a level above the absolute minimum required. So when all is said and done, I hate not being able to wring the last bit of performance out of the 401a. After all, I'm gonna be 57 years old in two months and I've only got a few years left to fit pipe before my career is over. But where I've made less money than I could have, I've done it because I felt the risks were too high to not pull back some money off the table. I've paid in performance for safety. To a large degree, I'm comfortable wid dat. My time horizon is short, my needs are significant, I'm not really good at passive acceptance, I don't ever intend to good at it. My natural aggression level is high, and if my head goes down in the last few laps, that means I gotta be as good on the brakes as I am on the throttle. Ya gotta work on makin' time on the brakes and in the corners too. So.... The game has changed. The prior trend has peaked and is over. The expansion that was post the tech bubble's bursting is over. We gotta new bubble. It's not the tech bubble this time, it's the real estate and structured finance/debt/mbs bubble. This week's developments are: The Fed announced that it would see that the frozen debt markets and banks would thaw out and stay thawed out because they would see to it with money and rate reductions. The Fed does not see inflation as an issue and doesn't appear to be likely to change that mindset in the near future. The dollar has had the rug pulled out from under it and is goin' down. Gold and oil and foreign currencies were the place to be last month because the whole rest of the world sees a cheap dollar and inflation as a real problem. For all the arm waving, I don't see a lotta sub primers or hedge funds getting bailed out here. They're goin' down too. The MBS industry, real estate industry, home builders, title companies, and mortgage brokers are gonna see some serious hard times. Things will go downhill until some of the stresses in place get unwound. There will be a fair amount of pain felt and I believe, ultimately, a bear market in stocks. That said, the quickest hardest, most unforgiving rallies and plunges occurr in bear markets. You can make a lot or lose a lot a lot faster in a bear market. So it's time to take it up a notch. The goal is still to make a dollar with the tools at hand. Sooo... The Fed is cutting. Three percent of assets in the GIC. The rest in stocks proportioned so that I can get mostly clear of stocks in three days time without compromising my ability to get back in. An ear to the market. Time and price will tell me what to do... Yeah, I got a wad of stuff from the Trust Fund Office. There was a huge wad of prospectii full of arcane info and tables and charts and, and, and. I threw it all away. Think of it this way. The stock market is a horse race that started a long time ago, it is ongoing, and won't ever stop. We're allowed to watch the race (which I do with the tools on my website) and place bets every day and collect on them or settle on them when we want to. The paper I threw away tells me all the finer details about how much and how long and when as of last quarter. That kinda stuff distracts me from what's happenin' today. THAT"S what I'M interested in. Know what ah mean, Vern? More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1463 ) ( 3 / 1463 )

"God I hope I break even...I could really use the money." A good sign that you're not gonna make it as either a professional gambler or investor

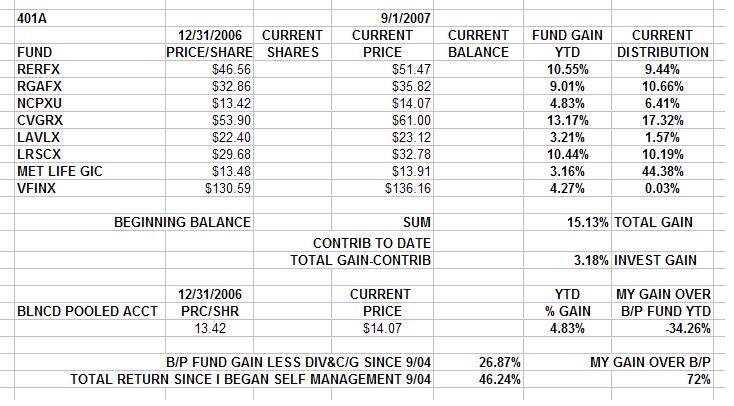

Saturday, September 1, 2007, 01:28 PM

CHARTZ AND TABLE ZUP. Things are not at all what they seem. Film at eleven and a big bin of ones and zero's sent over the pipes of the interweb to magically appear here as arcane financial 401a blather later on this long weekend. I'm told that a number of union locals across the country are rumored to be experiencing major issues with their pension funds. Some have frozen contributions/redemptions/withdrawals until it gets figured out. Kinda not surprising given what's going on at this site and in the mortgage market nationally. We aren't faced with that here currently (although that could change) but eternal vigilence is the price of financial freedom. I've changed my 401a allocation again and again recently because I believe we are in transition between a bull market and a bear market. It won't be neat and discrete. It'll be sloppy and choppy. It'll be more like surfing that like a record run at Bonneville. There'll be a lotta hack and hew as I alternate between making money and not losing it. BUT WAIT!!! THAT'S NOT ALL.........CLICKONNIT!!!  So anyway, Check It Out an' say....WTF? According to the charts on my website, www.joefacer.com, I'm tallying a 45% return over just about three years time, or about 15% per year and around double what the B/P Fund is doing. Yet when you click on the table above, you see that this year I'm showing a pretty limp return of under 4% and trailing the B/P Fund substantially. Also the funds I prefer to invest in are showning returns pretty much between 9% and 13% YTD. Whatzup? Well.....You make hay while the sun shines. When the market is going up and I'm feeling good about it, I'm pretty aggressive. I have no problem w/ going 100% invested in the hottest funds available. On the straights, twist the wrist, stretch the throttle cable, and ride way out on the front end to keep the front tire near the ground... if possible. You don't endure the risk and expense of racing to deliberately finish last. Riding as hard as you can is the only sensible thing to do out on the track. But we're talking championship (and retirement) here, and to finish first, first you have to finish (Get the best return you can and hold any losses to the absolute minimum). So you gotta deal with the turns and investment risks differently than the straights and clear sailing. So when things feel risky to me I can go to 100% cash almost as quickly as I can go to 100% stocks. Two sides to the coin and all that. I've been wrong to get worried and go big time to cash every time I've done it to date. It's cost me significant coin each time. But there is a big difference between making less money than you could have and actually losing money. I'm pretty sure that a big time opportunity to lose money is here and it's made me nervous. As a general rule, you can't short,hedge, or play options with retirement money. There are exceptions, but they're pretty limited. So I answer nervousness and losses by selling stocks and buying cash until I can sleep. Check out the Fundz YTD chart on the Chart page of my site. http://joefacer.com/id10.html and my current allocation http://joefacer.com/id11.html. Down about 4% from the peak of the market during the first week of July and hangin at about fifty percent in cash has me resting comfortably. See ya at the hall.      ( 3 / 1374 ) ( 3 / 1374 )

Thursday, August 30, 2007, 12:04 AM

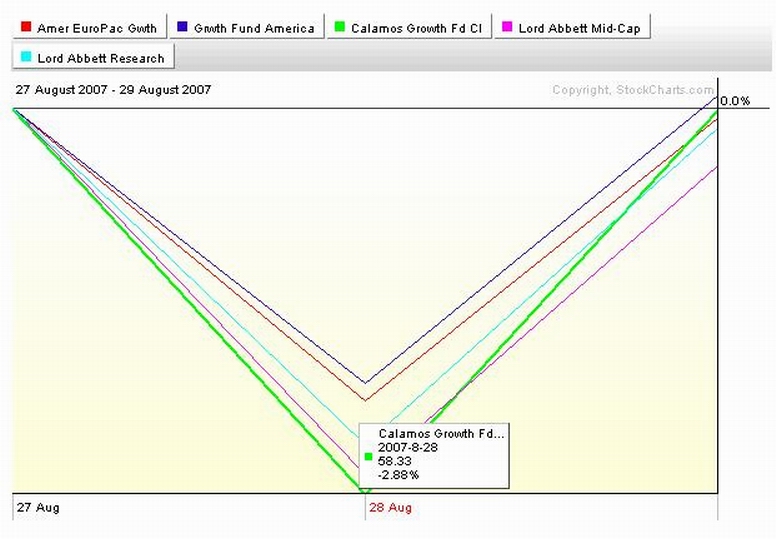

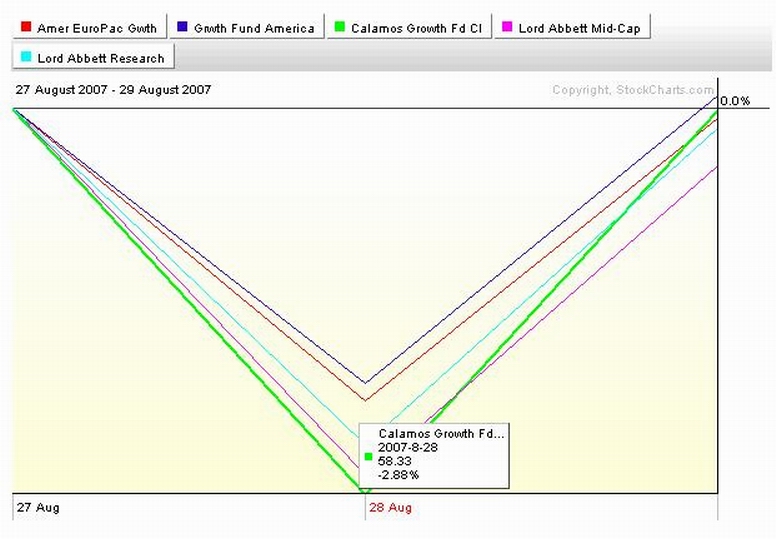

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have it, it requires 10 times as much skill to keep it. -- Ralph Waldo Emerson Volatility up. CLICKONNIT  Three percent down in one day and 3% up the next day. Four up days like that is a good year's gain. Four down days like that is a disaster year. You may see that round trip twice a week for a while.... Think roller coaster. Hopefully you end up where you started instead of puking your cash out at the bottom... The long term direction is down. At the end of the day I went max cash under the rapid trading rules. I may have a few more days of bailing outa stocks to get where I want to go. Buy weakness and sell strength..... Today I sold.      ( 2.9 / 1390 ) ( 2.9 / 1390 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar