| |

A hammer is simple, cheap, easy to use, effective, and reliable. But you can no more paint with it than you can make money owning stocks on the way down.

Saturday, November 24, 2007, 12:24 AM

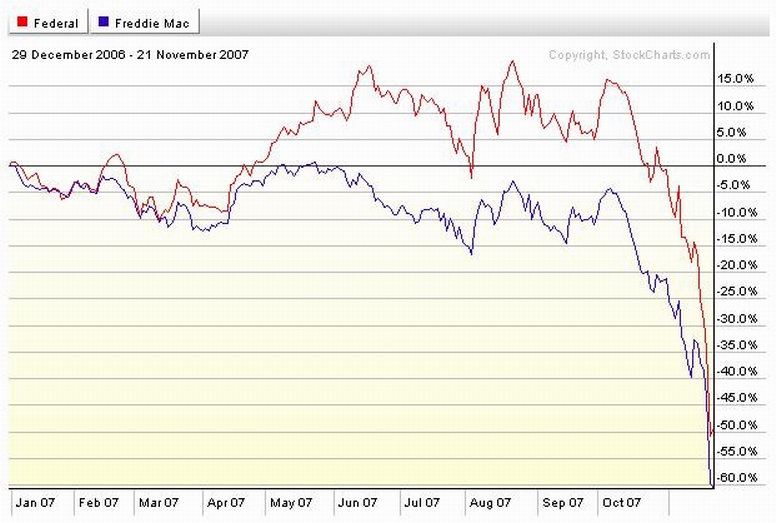

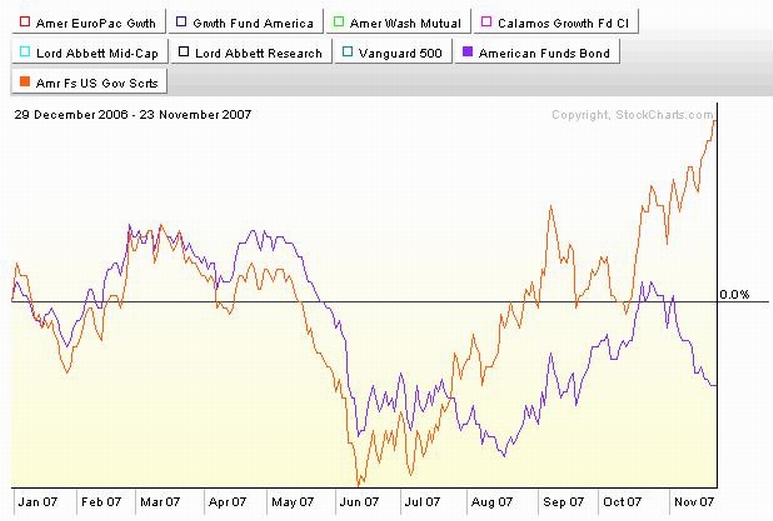

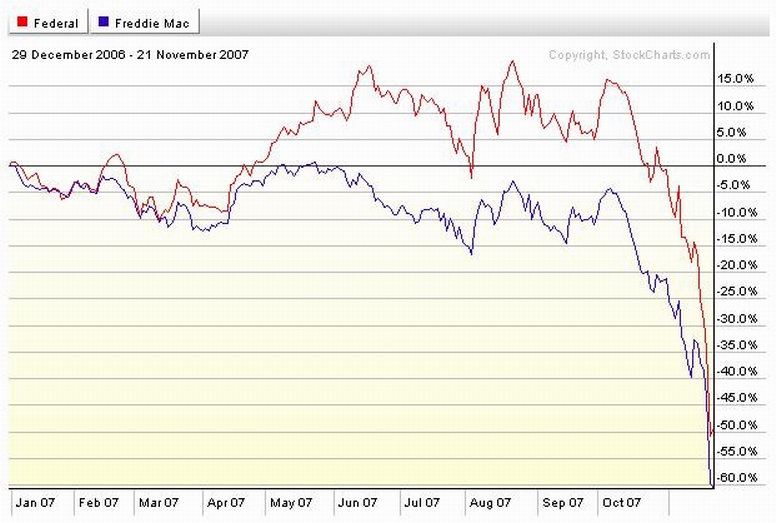

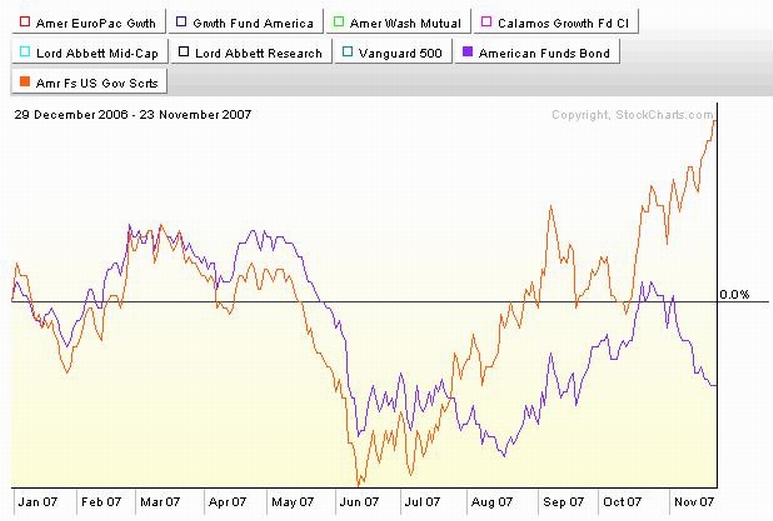

True genius resides in the capacity for evaluation of uncertain, hazardous and conflicting information. -- Winston Churchill Chartz and Table Zup. Click onna charts below.... What the charts are and what it suggests to me latter this weekend... OK, it's later....    The first chart is of banks Bank of America, Citibank,and Wells Fargo, mortgage originator Countrywide Financial, and full service financial/broker E Trade Financial. What we're lookin' at is the kick in the crotch of the subprime/credit crunch of May and August. Countrywide and E Trade are drowning in mortgage debt. Citibank is bowed under way too much mortgage debt and some other credit issues. Bank of America screwed up a good thing by buying a sizeable chunk of Countrywide a coupla months ago, effectively buying into the mortgage disaster. Wells Fargo, a bank that is well run and is currently not deeply involved in the mortgage crisis, is none the less operating in an industry under the strain of mortgage debt. All of these banks, even Wells Fargo, are NOT able to operate as freely as in the past. There is a credit crunch goin' on and it'll cramp the style of the survivors. A recession is looking more likely by the day. The second chart is of Ginne May and Freddie Mac, the Government Sponsored Entities (GSE) that purchase, package, sell and guarantee timely payment of principal and interest on federally guaranteed mortgages and loans. These charts show that the market thinks something very bad is about to happen to these private mortgage insurers/corporations. Think of a currently healthy insurer doing a lot of business in Florida and Louisiana during the beginning of an expected to be horrible hurricane season. The market says Incoming!!!! The third chart is of the two bond funds currently available to 342's 401a plan. Note how well they track together until August, about the time that the smart money figured that the game was up in mortgages. The US government bonds appreciated after August as money moved into them, driving up prices. The nongovernment (more corporate and mortgage securities) fixed income fund fell as people bailed out. This is a trend that may affect fixed income securites in the pension funds, Health and Welfare Trust Fund, and the Apprenticeship Trust Fund. in other words; your money. Stay tooned. I've been rethinking my 401a strategy. I gotta fair grip on how to play it. But there are some bigger fish to fry and everything in due course...o'course. Read about it here; Check out my asset allocation tables, chartz, and maintain a high degree of toonosity. See ya at the track.      ( 3 / 1359 ) ( 3 / 1359 )

Never a dull moment......

Saturday, November 17, 2007, 03:07 PM

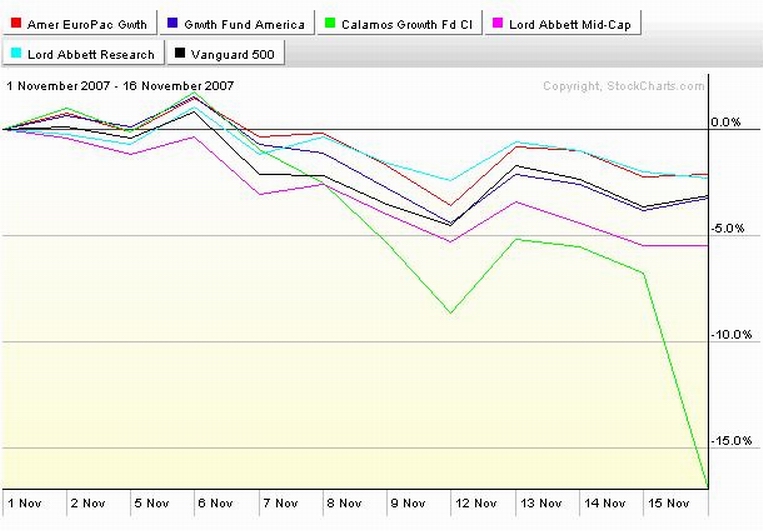

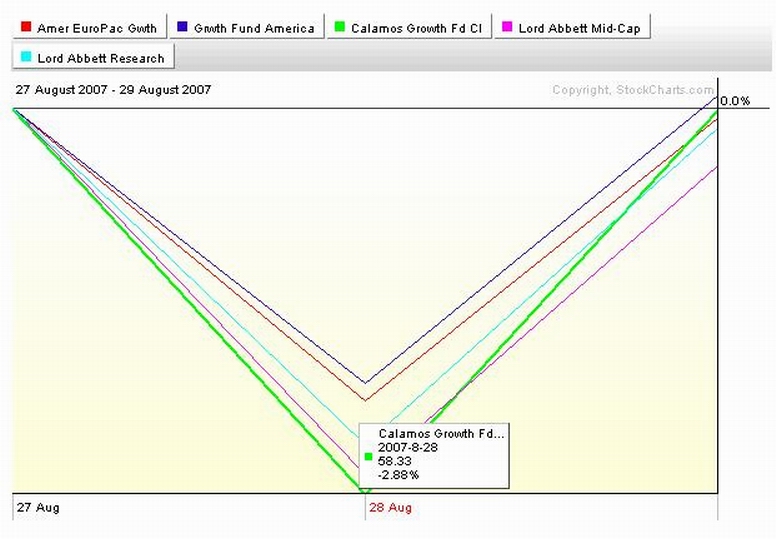

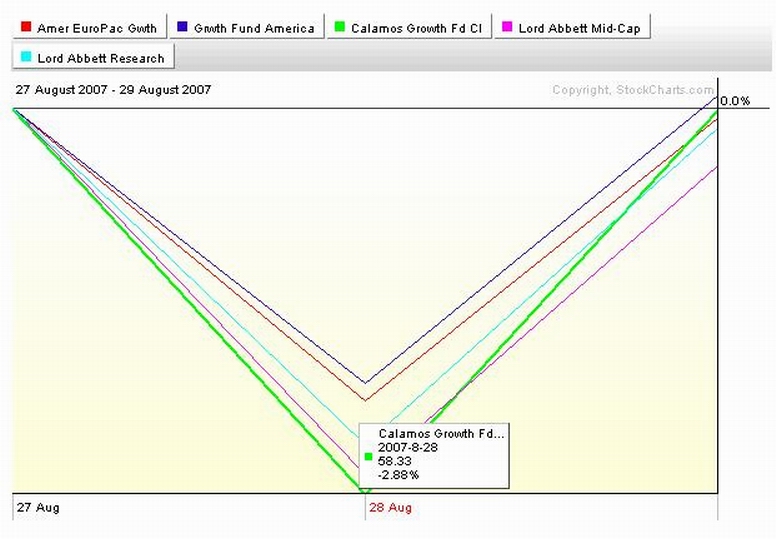

It's all fun and games until someone gets hurt. -- Mom Chartses and Table Zup Check it out. CLICKONNIT!  Either the Calamos Fund blew up and lost 10% of it's value in one day.... or it paid off its Capital Gains and the money that disappeared in share prices on Friday will reappear in shares on Monday. A quick look tells me that they did just that on this week last year. THAT ain't no big thing. THIS is... SAN FRANCISCO (AP) -- Evoking Depression-era memories, Wells Fargo & Co. President John Stumpf on Thursday became the latest banker to predict continuing difficulties in the U.S. housing market as risky mortgages made to overextended borrowers disintegrate into large loan losses. Speaking at an investment conference in New York, Stumpf said the current real estate conditions are the worst he has experienced during his 30-year career. He then punctuated his gloomy assessment by harking back to the deepest downturn of the 20th century. "We have not seen a nationwide decline in housing like this since the Great Depression," he said. http://money.cnn.com/2007/11/15/real_es ... /index.htmThe question is... What am I gonna do about it? Stay tooned....      ( 3 / 1380 ) ( 3 / 1380 )

Stocks go up and Stocks go SPLAT!!!!!!! On the track we call this a "face plant".......

Saturday, November 10, 2007, 01:01 PM

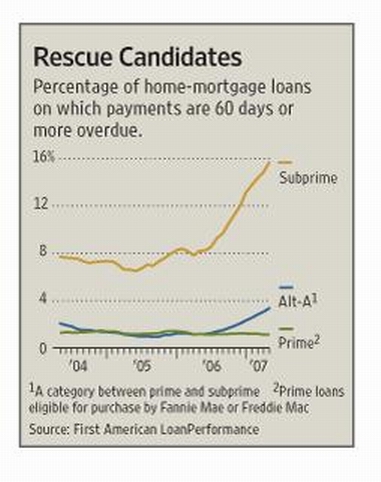

"Concern should drive us into action and not into a depression. No man is free who cannot control himself." -- Pythagoras Chartes and Table Zup!!!! Check out the chart...CLICKONNIT!!!  We had a good year goin' until we had the March subprime/economy hiccup. Then we had a good year goin' until we had the August subprime/economy hiccup. Then we launched off the half point interest rate/discount rate cut of August 15th and had a good year goin' again. What happened this week should look familiar. (Hint; Subprime/economy) The question in front of us is "Will we go up again for the third time? Or is this going down for the third time and stayin' down?" Other questions... This is a mortgage thing. Am I right that we have way too much of the money in our Health and Welfare Trust Fund, Apprenticeship Trust Fund, and Defined Contribution Pension Trust Fund invested in mortgages? Are YOU exposed to this is the 401a? What does it mean that the mortgages are insured? We've watched the progression of housing from "a pause in growth" to "going down in flames". This weekend we are seeing million dollar Vallejo homes auctioned off with starting bids in the $400K range. We've watched the mortgage originators (Countrywide et al)going down in flames. We've seen way too leveraged hedge funds vomiting out mortgage backed securities and closing the doors. Are the mortgage insurers facing a Katrina like Tsunami of claims? Will it overwhelm them? If the mortgage insurers come up short, are we dependent on the PBGC for our pension benefits? Check out the last page of my site for more info on THAT. Banks are writing down much of their exposure to recent mortgages to near zero because they want to get out from under the falling piano. They have investors and an industry that demands that they move and move NOW when things get dicy. And it appears that the problem is growing faster than they can move. The Financial Times estimates $40 billion in additional exposure at risk. Worst case figures are estimated at $250 billion total. And we have Local 342. I've reviewed some recent records. I suspect that we may be exposed to a substantial amount of mortgage backed securities. Are we REALLY aware of it? Are we taking someones uncorroberated word that everything is OK? Are we moving on it if it is a problem? Will we be the last to move? Will we be left holding the bag? In 2003 I got way concerned about the money our pension fund had in stocks. Jesus, was I right to be concerned. Today, I'm concerned about our exposure to the mortgage market. I sense a pattern here.... DON'T GET CAUGHT UP IN THE "SUBPRIME RIFF". There are also the "Alt A" mortgages (nondoc on good credit), prime mortgages with a second mortgage or a "home equity line of credit" (HELOC) on top, mortgages with job loss behind them, and second and third "investment" home mortgages. These are all possible falling pianos and a possibile recession is the triggering event. Billions of dollars are evaporating from the economy as real estate values evaporate. Is the $250 billion worst case estimate accurate? The headlines keep getting worse.... Can all this money disappear, can all the associated jobs and industry fade without precipitating the economy into a recession? Luckily, I got a jump on it this time. I'll keep an eye on this and write about here.... Bummer.... http://www.nytimes.com/2007/11/09/busin ... ref=sloginhttp://bigpicture.typepad.com/comments/ ... -wors.htmlOh, yeah. if you can't face losing a lot of money without laughing about it, you may not be able to hang with me...Clickonnit!!!! http://www.youtube.com/watch?v=SJ_qK4g6ntMhttp://www.youtube.com/watch?v=axAjb6fDsPYhttp://www.youtube.com/watch?v=NAt311OlM7USee ya at the track.      ( 3.1 / 1131 ) ( 3.1 / 1131 )

Damn!!! another year circling the drain...... Christmas presents fer the little Grandkidz. Thanksgivin' Turkey and Christmas goose an' all gonna happen soon....

Saturday, November 3, 2007, 02:26 PM

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

--Herm Albright

Chartzes and table Zup...

Workin' hard to get my Ira's 'n 401 to perform this year in a bidirectional market. It take as much guts as it does brains. Risk vs reward and ya can't surf the investment oceans without gettin' soaked occasionally. And if'n it all works out, the thrill counteracts the chill. Works for me in the long run. Which for me is different from what you think it is. For me, the long run is what you end up with after all the short runs are tallied up.

I've gotten my nose bloodied good learning how to handle my money. Most of the mess was caused by learning why I couldn't just rely soley on putting my money down on something someone identified as a good investment "in the long run", having faith, "taking pain", and hanging on. Successful investing is more complicated than that. If I was dialed in to what was really happening; if I had access to a lot of raw economic data, if I ground the data up myself, if I knew about all the executive suite strategic initiatives, if I had ongoing measures of the success of execution of the initiatives, and if I knew the course changes being put into place at the lower levels of the companies, I could invest for the long run as most everyone understands it. Provided I could change my mind about staying with it at any moment.

Most everyone understands the long run as they would like it to be. You buy once, you stay put, and that's all there is to it. Ya just gotta believe and hang on. I'd have to see it everyday to believe in it. Enron, Microsoft, Apple, Google, Worldcom,and General Electric have had their believers. All of the believers made money. Some of them made a lot of money and still have it. Some of them only made a little money. All the believers lost at least some money and some of them lost all of it. Faith based investing is really hard and dangerous.

It's hard for some people with less faith to believe there are one decision stocks so they are more comfortable looking for one decision investment advisors or mutual funds. Life should be so easy. My life ain't 'cuz I've done the due diligence and looked over the edge. Check out the COFGBLOG Essay pages, the chart pages and the Fund Alarm pages of my site.

There are long term trends. If you can identify them, you can ride them and make some money. The sooner you can identify the end of the trend, the more money you can keep. The sooner you can bail out an investment that was a mistake, the less money you lose. The sooner you get comfortable with playing hardball with your money; grinding out the profits and exterminating losses, the better your results. The key word is soon. Soon is not about faith, it is about getting something done in not much time. Put together successful day, weeks, and months all in a row, a lot of short measures of time, and all of a sudden, ya got a long run.

So I went with the trend in the long run one week, at at time. The charts and tables say it all. Now I'm leery of a trend break, and whereas I weighted some of the 401 fundz pretty heavily, now I gotta weigh weighing heavily in the GIC.

Want some clarity about the past? Check out the Fund Alarm tables and the charts page. There is a pretty important tale to be told there.

Stay Tooned.

[ view entry ] ( 982 views ) [ 0 trackbacks ] permalink      ( 3 / 1044 ) ( 3 / 1044 )

It's Tuesday after work an'....

Tuesday, October 23, 2007, 09:02 PM

I'm toast. It was a super full three day weekend. It was back to the track for a heat check Monday. I wanted to see if I still had the fire inside. Do I sell all the sport bikes and buy a Goldwing w/ an awning and refrigerator 'cuz I'm old? Or do I buy a new ultragnarly crotchrocket sportbike to keep a promise to myself? Besides, my apprentice was talking silly about about riding fast onna street and I ain't gonna put up wid dat.

So I booked us both for the California Superbike School at Sears Point. His first time and my 7th. I ran a tank fulla sour gas outa my 929 on Sat and flogged for 14 Hrs straight Sunday doing what I shoulda had done already. (Just like a real race weekend.) That includeds taking the old tires off the wheels hunkered down on the garage floor with a pair of tire irons and putting the new tires back on in an hour and a half. I got most but not all the stuff done and loaded the bike up with a new Ohlins, fresh unbroken in race tires, and brand new brake pads.

Before I left for the track Monday AM, I lightened up up the 401 to 50% stocks. I pulled the max from each American Funds that the trading restrictions allowed, and half the position in Calamos cuz I could. The American funds dictate what I have to do there and I suspect that Calamos is big in Apple. The order executed after the market closed Monday. I done well as of Tues PM. I cut my exposure to a risky time in the market and still maintained some exposure to some upside. Which we got.... but...

The CSS has a VERY structured curriculum. My first track session was two gears and no brakes. The new SP layout (I last raced in '99) is significantly different. Being an ex racer and being used to scrubbing in my tires on the warm up lap, I got it done easily in the half dozen tiptoe laps of the first session and I got a rough reading on the new sections at the same time. As I started out on my second session, two gears and light brakes this time, the bike felt so goddamned good going up into Turn Two that I dialed it up and started looking for who I used to be right then and there on my out lap. It started to come back a little at a time.... When I got into the pits after the second session, the chief instructor walked past and said, "Joe! You looked like a crusty old racer out there!" I walked past a group of guys my age and one spun around and pointed his finger at me and said, "You! You're that fast guy!" I immediately denied it.

The day was a perfect indian Summer day and I got closer to who I used to be each session. I had a string of totally dialed laps in the last session. The fire inside no longer rages, but it's still hot to the touch. I'm still the COFG! See ya at the track.

Stay tooned about the 401.....

UPDATE!!!!!!!!!!!

I'M SET TO GO TO 95% CASH THURSDAY AFTERNOON...STAY TOONED...

[ view entry ] ( 1062 views ) [ 0 trackbacks ] permalink      ( 3 / 1390 ) ( 3 / 1390 )

Dee Do Do Do, Dee Dah Dah, Is All I Wan WHOOOSH..SPLAT

Saturday, October 20, 2007, 02:02 PM

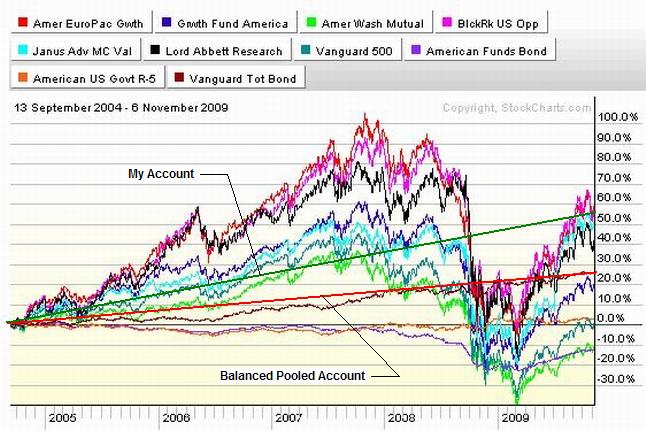

The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all." -- Harry Schultz Chartz and Table Zup!!!! Check out the chart below. CLICK ONNIT!  " The chart is the performance, year to date, in the funds available to the 401a. There's big time profits here in the 401a as of yesterday and throughout most of the stock market as well. Charts don't lie. But stocks were circling the drain in early August because everybody had all of a sudden finally realized that once the punchbowl of cheap rates and easy money were taken away, that cold sobriety and a godawful hangover were guaranteed to follow. Everybody started puking up stocks and the market was goin' down. So then the Fed put its foot over the drain and announced that there would be money available to keep the economy going, Everybody took a headlong dive in the direction of the punchbowl, ready to party hearty just like it was 1999. The problem is that the Fed intends to salvage only the best, brightest, and most deserving. The soaks and rumdumbs that screwed up the party for everybody else are on their own. And salvage has more to do with a hair of the dog and a breakfast than filling the punchbowl back up so everybody can dive in again. I think that everybodys just figuired that part out. Friday afternoon I blew 90% of the positions in my trading account out at the market. I've gone from fully margined to half cash in the last month as well as from big time options exposure to one position. I've booked one hell of a year. Time to go short runnish, fade the pop, and think about how to pay taxes on the profit. I feel great. But I screwed up bigtime, too. I should have done the same in my 401a. DAMN!!! I expect to do that Monday, a day late. I'll let you know about it then. See, in August it was stocks in the toilet 'cuz the system was breaking down over the subprime mess locking up the credit market. That was the kind of thing that takes the whole system down in flames into a depression. It was time to blow out all your stocks. That got fixed by the Fed. Now we're looking at housing and associated businesses cratering, mortgage outfits going out of business, banks writing down huge amounts of real estate loans and kissing a huge percentage of the mortgage business goodby for upcoming years, the yen arry trade going away, and homeowners looking at the value of their homes withering away. And the rest of the US and the world getting by as long as jobs and employment hold out. That is the kind of thing that could lead to a recession. I think it's time to sell the right stocks. That's easier said than done when all you can do is play a handful of mutual funds. So I gotta substitute the ability to move in time for the ability to move in direction. The first step is to get through the next two weeks. Cash is the place for me. Then I gotta watch for the end of the year bonus riff to show up. Stay tooned. See ya at the track.      ( 3 / 1386 ) ( 3 / 1386 )

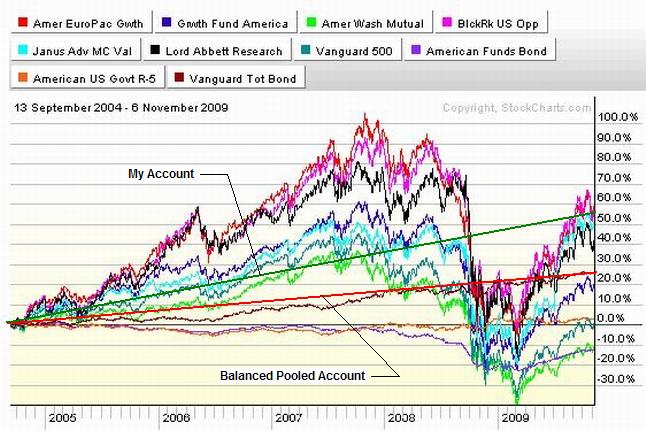

Three years; Up 60%. AGAIN, ya gotta make it when ya can.... Not when you need to. The opportunity ain't necessarily gonna be there just because you need it to be.

Saturday, October 13, 2007, 12:05 PM

"When the facts change, I change my mind. What do you do, sir?" --John Maynard Keynes CHARTZ 'N TABLE ZUP!!!! The charts and tables pretty much tell the tale. CLICKONNIT  Half bonds/half stocks. Brilliant allocation or kinda dumb? Stocks go up and down a lot. Bonds go up an' down a little. Sometimes they work opposite each other... but not always. So you're pretty much half safe, mostly. Or at least half exposed to danger at all times. Think of it like leaving the house in a swimsuit, flip flops, and a fur-lined parka so you can deal with whatever the weather happens to be. Make sense to you? Me neither. I time the market. Ignore the crap you always hear about how it can't be done. It is not in the best interests of the mutual funds for you to think that you can time the market. They earn the most when your money lands and stays put where it landed. They earn fees and the lower the costs and the stickier the money, especially during the years when they can't hit their ass with either hand, the more of your money they earn (keep). Pretty sweet deal. I'd like to have one like that too. But I get paid for what I do that day. If I stick, it's 'cause I perform, not because my employer is waiting for me to turn around "in the long run". It is in my best interests to maximize my earnings. I have a wife and family whose well being supercedes that of the funds I invest in. So I try to put my money where the most money is being/will be made. It's worked for me for three years and counting. It is also in my best interests to minimize my losses. Ya not only gotta make it, ya gotta keep it. There are times when it is/will be very hazardous not to be in cash or cash equivalents, or when bonds will be the best game in town. That's when I go to bonds or cash. That works for me too. I got a fur-lined parka and a swim suit and flip flops. I don't wear them all at once. That would be silly.      ( 3 / 1347 ) ( 3 / 1347 )

Eighty percent of the gains are made in twenty percent of the time. You snooze; you looze. Sleepy is one thing I'm not..The market's smokin' an' I'm hangin' on with a grin so big it hurtz. Christmas looks good already......

Friday, October 5, 2007, 11:53 PM

Trends, like horses, are easier to ride in the direction they are going. -- John Naisbitt Chartz and table ZUP!! More words about what I'm thinkin' about prolly this weekend. Stay tooned...... AND, IF YOU HAVE NOT READ THE POST BELOW (9/28/07)....DO IT NOW!!!!!!!

You know what it is costing our brothers and sisters to be hangin' with the B/P Fund outa ignorance, fear, or inertia. Pretty much 'cuz you're readin' this here an' now. An' it's not like it couldn't be worse. Local 393's B/P fund has returned 2.5% to date vs Local 342's 8.15%. Pretty neat for 342 if that's how you want to benchmark it. But that's not the way it is done aroun' here.

It's a free country an' you can do what ya want with your earnings and savings. That is, provided you have the information needed to make an informed choice. If you don't know what you can do, or why you should or shouldn't do any or all of a number of choices, you aren't really free. Knowledge and the power to choose is freedom. Don't leave a brother or sister out in the dark. Spread the word.

More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1281 ) ( 3 / 1281 )

What do the financial markets have in common w/ The Circus of Dr. Lao?

Saturday, September 29, 2007, 12:24 AM

There is no security on this earth, there is only opportunity."

--General Douglas MacArthur

A hugely significant event has occurred in our 401a plan. This event is absolutely the most important occurance I can imagine for many of the younger members. It is, however, without real significance to me and to many of the older members.

Here's what's goin' down; The default plan for our 401a has been the Balanced Pooled Fund. See all over this site....This is a gawdawful choice for many people. A brand new apprentice/journeyman contributing to the B/P Fund starts off his investing in a vehicle that is 60% bonds.

Kinda.

Actually I suspect he is investing in a 60% bonds/mortgages vehicle. Bummer. He has some security, maybe, which is always nice. But he barely (maybe) breaks even with inflation in bonds.

And, it's not that the jury is still out...we don't even know if there is going to be a jury when the CDO (collateralized debt obligation[subprime/subslime mortgages]) riff finally gets laid down so it stays there. I just don't have the time here to cover this here and now. But I will, elsewhere and later. Stay tooned."

So the young member doesn't make much in the B/P Fund. That's not good. You wouldn't keep your life savings in an interest free savings account... But look up the returns for the 401a bond funds over the last five years. Again, Bummer.

The older member, retired or ready to retire, who has his 401a invested in the B/P Fund, has his 401a savings and earnings in a vehicle that is 40% stocks. Stocks can make you rich and can beggar you...sometimes a coupla times each in the same year. That's called volatility. Why would anyone set up an older member's savings where 40% of the money was on cruise control in a risky investment? Yet that happens to be the case for older/near retirement or retired members, who have all his or her money in the B/P Fund.

So what is needed for Local 342 members is a no hassle/easy/low/maintenance/automatic/rational way to allocate his (or her) funds properly between stocks and bonds, as driven by the member's age and retirement target date. The answer is...

The American Funds Target Date Retirement Fund

At the special called State of the Pension Funds Meeting in November of last year, I suggested that we try to put something like this into place... and it has come to pass.

It's About Time!!!!

Of course, my son has had this kind of fund available to him for at least the last seven years at the last two places where he has worked/works..... But better way late than never.

This is a quantum leap or two better than the B/P Fund and all of the younger members need to check this out.

It is NOT the answer for everybody and it is not the answer for me. And it may not do much for the older members. But it is a DAMN FINE THING THAT THE BOARD OF TRUST HAS DONE. They just needed to be pointed in the right direction and motivated....

The problem (yeah, for all my enthusiasm for the target date funds, there still is a problem...) is that we hemmoraged away money in the 401a and defined benefit plan under the previous financial advisors and participating in the Target Date plan won't help that. But it will get the members who are very new or those who are close to retirement and have a nice nest egg into a more rational allocation plan.

And there are still risks... The Board of Trust added four new financial advisors in 2004 and within a year, two of them were on notice for crappy performance. Not that it was any different from what they had been doing previously and that the Board of Trust had blessed the previous year... But still... the Target Date Funds appear to answer a major need. So I'll be vigilant.

So, bottom line, I'm stoked!. But I've been down this road before... Lemme see about tracking this and getting back to you... Stay tooned...

Oh, yeah...Fixing the damage done to my pension savings is another matter. And one that I'm addressing presently with my 401a. The godawful performance of our prior 401a plan discouraged me from bumping my contribution to the plan. So I'm late taking advantage of the 401a. But now I've got something I can work with and I've got my head down and I'm doin' it. You should make sure you are doing the right thing for your personal circumstances too.....

THAT'S WHAT I'M TALKIN' 'ABOUT!!!!!

See ya at the hall.....

[ view entry ] ( 1063 views ) [ 0 trackbacks ] permalink      ( 3.1 / 1428 ) ( 3.1 / 1428 )

Brave New World of the post Fed interest rate move.... or not.

Friday, September 21, 2007, 10:18 PM

"There are some things which cannot be learned quickly, and time, which is all we have, must be paid heavily for their acquiring." Ernest Hemingway Chartz and table Zup!!!!! So it goes... the year is winding down and it doesn't look like this year is as good recently for my 401a as the last coupla two or three have been. But appearances can deceive... In 2003 and '04, we were coming out of a brutal three/four/five year recession, the Fed had driven rates down close to free as you can get and the system was awash in cash. Very Bad Things were priced in everywhere and it was as if no one expected some parts of the economy to ever sell anything ever again. So when we finally got some reasonable investment vehicles in the 401a in Sept '04, I has a high level of confidence in going major long stocks for an extended period. It's been three years and a week since then and as of two days ago, I'm up 50% over three years. Over 15% a year in tax advantaged investment contributions and tax advantaged returns. Not half shabby. But my personal rate of return has been dropping off lately from what it had been, even though the various mutual funds in the 401a are still performing well. To a small degree, I find that troubling. As is detailed on my web page, I believe that my defined benefit retirement plan has been poorly managed and a huge amount of returns have been left on the table. In addition, the same mismanagement has occurred in the 401a. It's been a double whammy there as the lousy performance of the 401a has not only cost me returns, but it has prevented me from seeing the advantage to investing at a level above the absolute minimum required. So when all is said and done, I hate not being able to wring the last bit of performance out of the 401a. After all, I'm gonna be 57 years old in two months and I've only got a few years left to fit pipe before my career is over. But where I've made less money than I could have, I've done it because I felt the risks were too high to not pull back some money off the table. I've paid in performance for safety. To a large degree, I'm comfortable wid dat. My time horizon is short, my needs are significant, I'm not really good at passive acceptance, I don't ever intend to good at it. My natural aggression level is high, and if my head goes down in the last few laps, that means I gotta be as good on the brakes as I am on the throttle. Ya gotta work on makin' time on the brakes and in the corners too. So.... The game has changed. The prior trend has peaked and is over. The expansion that was post the tech bubble's bursting is over. We gotta new bubble. It's not the tech bubble this time, it's the real estate and structured finance/debt/mbs bubble. This week's developments are: The Fed announced that it would see that the frozen debt markets and banks would thaw out and stay thawed out because they would see to it with money and rate reductions. The Fed does not see inflation as an issue and doesn't appear to be likely to change that mindset in the near future. The dollar has had the rug pulled out from under it and is goin' down. Gold and oil and foreign currencies were the place to be last month because the whole rest of the world sees a cheap dollar and inflation as a real problem. For all the arm waving, I don't see a lotta sub primers or hedge funds getting bailed out here. They're goin' down too. The MBS industry, real estate industry, home builders, title companies, and mortgage brokers are gonna see some serious hard times. Things will go downhill until some of the stresses in place get unwound. There will be a fair amount of pain felt and I believe, ultimately, a bear market in stocks. That said, the quickest hardest, most unforgiving rallies and plunges occurr in bear markets. You can make a lot or lose a lot a lot faster in a bear market. So it's time to take it up a notch. The goal is still to make a dollar with the tools at hand. Sooo... The Fed is cutting. Three percent of assets in the GIC. The rest in stocks proportioned so that I can get mostly clear of stocks in three days time without compromising my ability to get back in. An ear to the market. Time and price will tell me what to do... Yeah, I got a wad of stuff from the Trust Fund Office. There was a huge wad of prospectii full of arcane info and tables and charts and, and, and. I threw it all away. Think of it this way. The stock market is a horse race that started a long time ago, it is ongoing, and won't ever stop. We're allowed to watch the race (which I do with the tools on my website) and place bets every day and collect on them or settle on them when we want to. The paper I threw away tells me all the finer details about how much and how long and when as of last quarter. That kinda stuff distracts me from what's happenin' today. THAT"S what I'M interested in. Know what ah mean, Vern? More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1427 ) ( 3 / 1427 )

"God I hope I break even...I could really use the money." A good sign that you're not gonna make it as either a professional gambler or investor

Saturday, September 1, 2007, 01:28 PM

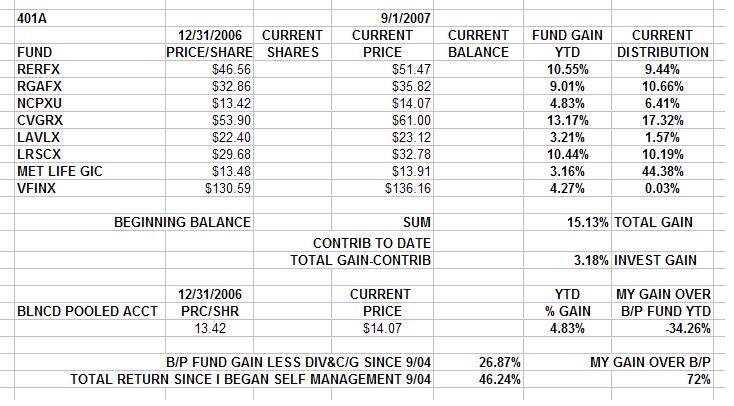

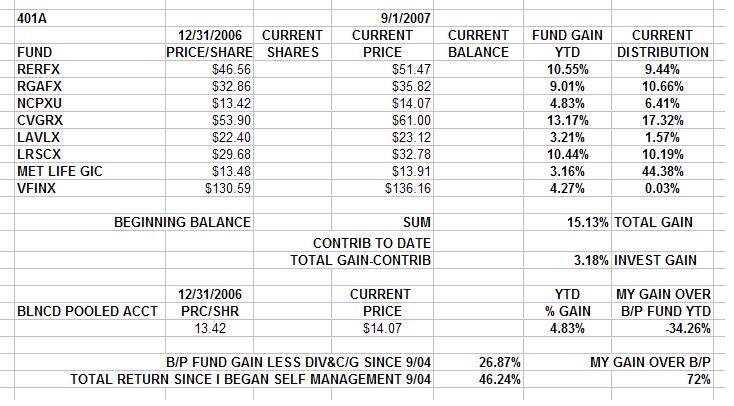

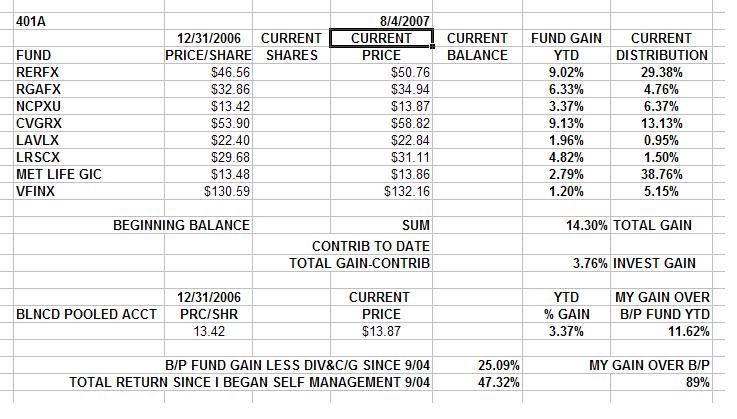

CHARTZ AND TABLE ZUP. Things are not at all what they seem. Film at eleven and a big bin of ones and zero's sent over the pipes of the interweb to magically appear here as arcane financial 401a blather later on this long weekend. I'm told that a number of union locals across the country are rumored to be experiencing major issues with their pension funds. Some have frozen contributions/redemptions/withdrawals until it gets figured out. Kinda not surprising given what's going on at this site and in the mortgage market nationally. We aren't faced with that here currently (although that could change) but eternal vigilence is the price of financial freedom. I've changed my 401a allocation again and again recently because I believe we are in transition between a bull market and a bear market. It won't be neat and discrete. It'll be sloppy and choppy. It'll be more like surfing that like a record run at Bonneville. There'll be a lotta hack and hew as I alternate between making money and not losing it. BUT WAIT!!! THAT'S NOT ALL.........CLICKONNIT!!!  So anyway, Check It Out an' say....WTF? According to the charts on my website, www.joefacer.com, I'm tallying a 45% return over just about three years time, or about 15% per year and around double what the B/P Fund is doing. Yet when you click on the table above, you see that this year I'm showing a pretty limp return of under 4% and trailing the B/P Fund substantially. Also the funds I prefer to invest in are showning returns pretty much between 9% and 13% YTD. Whatzup? Well.....You make hay while the sun shines. When the market is going up and I'm feeling good about it, I'm pretty aggressive. I have no problem w/ going 100% invested in the hottest funds available. On the straights, twist the wrist, stretch the throttle cable, and ride way out on the front end to keep the front tire near the ground... if possible. You don't endure the risk and expense of racing to deliberately finish last. Riding as hard as you can is the only sensible thing to do out on the track. But we're talking championship (and retirement) here, and to finish first, first you have to finish (Get the best return you can and hold any losses to the absolute minimum). So you gotta deal with the turns and investment risks differently than the straights and clear sailing. So when things feel risky to me I can go to 100% cash almost as quickly as I can go to 100% stocks. Two sides to the coin and all that. I've been wrong to get worried and go big time to cash every time I've done it to date. It's cost me significant coin each time. But there is a big difference between making less money than you could have and actually losing money. I'm pretty sure that a big time opportunity to lose money is here and it's made me nervous. As a general rule, you can't short,hedge, or play options with retirement money. There are exceptions, but they're pretty limited. So I answer nervousness and losses by selling stocks and buying cash until I can sleep. Check out the Fundz YTD chart on the Chart page of my site. http://joefacer.com/id10.html and my current allocation http://joefacer.com/id11.html. Down about 4% from the peak of the market during the first week of July and hangin at about fifty percent in cash has me resting comfortably. See ya at the hall.      ( 3 / 1331 ) ( 3 / 1331 )

Thursday, August 30, 2007, 12:04 AM

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have it, it requires 10 times as much skill to keep it. -- Ralph Waldo Emerson Volatility up. CLICKONNIT  Three percent down in one day and 3% up the next day. Four up days like that is a good year's gain. Four down days like that is a disaster year. You may see that round trip twice a week for a while.... Think roller coaster. Hopefully you end up where you started instead of puking your cash out at the bottom... The long term direction is down. At the end of the day I went max cash under the rapid trading rules. I may have a few more days of bailing outa stocks to get where I want to go. Buy weakness and sell strength..... Today I sold.      ( 2.9 / 1352 ) ( 2.9 / 1352 )

Friday, August 24, 2007, 08:37 PM

"There are some things which cannot be learned quickly, and time, which is all we have, must be paid heavily for their acquiring." Ernest Hemingway Charts and Table Zup! If you play the game, you will make mistakes. If you stay in the game, you'll get an opportunity to undo your mistakes. If you let small mistakes become large mistakes, it takes you out of the game. If you ain't making mistakes, you ain't playing the game. If you play the game, you will make mistakes. If you stay in the game, you'll get an opportunity to undo your mistakes. If you let small mistakes become large mistakes, it takes you out of the game. If you ain't making mistakes, you ain't playing the game... SHANGHAI, China -- Chinese banks are just beginning to disclose their exposure to the U.S. subprime mortgage crisis, sending some bank shares plummeting in Hong Kong. Bank of China saw its Hong Kong stock price fall by as much as 8.1 percent Friday in reaction to the bank's report that it holds $9.65 billion in subprime asset-backed securities and collateralized debt obligations. That's 3.8 percent of its total securities investments. http://www.washingtonpost.com/wp-dyn/co ... 00735.html Joe Montana's Firm Says Fund Declined 12% in August (Update4) By Jenny Strasburg Aug. 23 (Bloomberg) -- HRJ Capital LLC, the investment firm whose partners include retired football players Joe Montana and Ronnie Lott, said one of its funds lost 12.3 percent in the first two weeks of August, erasing most of its 2007 gain. HRJ, based in Woodside, California, blamed the decline in its Legends Multi-Strategy Plus Fund on losses as the subprime- mortgage crisis spread to broader credit and equity markets. The investment pool farms out clients' money to hedge-fund managers. HRJ, which also invests in real estate and private-equity funds, oversees $1.75 billion. http://www.bloomberg.com/apps/news?pid= ... refer=homeI've readjust my allocation slightly. I'm evenly dispersed in my favorite funds with about 20% cash (GIC). You know I don't like bonds except under very special circumstances. Under these circumstances, it's RGVEX only. The rest of the stuff is stuft with MBS's and you know about that from my site. I've pretty much got a feeling for what's comin' down the road onna macro level... and I know how I'm gonna play it. I'm not sure just how to write about it. Stay Tooned.... More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1374 ) ( 3 / 1374 )

Friday, August 17, 2007, 09:05 PM

Charts and table Zup. All is not what it seems. I bailed out of the 401a stock funds bit by bit this week according to the rules as the markets cratered. By the selling panic of Thursday AM, I was almost all the way out. By the time the FED blinked and the buying panic of Friday started, I had orders entered to get back in to about half my usual positions in the 401a. The table on my website is what I held on Friday. What will show on Monday is what was bought on Friday after the market closed. What you see here is tamed by the rules and structures of the 401a. Friday morning I was way levered to the indices in my trading account and buying mortgage providers hand over fist this morning 'cuz it was the right thing to do. It helps to have roadraced motorcycles. You flick it in to the corner knowing that you can/ have to catch it when the tires touch the ground and hook up because that is the only way you can get to 150 MPH before you stand it on the front wheel going into the 30 MPH corner with the concrete wall.... kinda like buying a mortgage outfit on margin this morning. Tuesday Aug 21st What happened? http://www.time.com/time/magazine/artic ... -3,00.htmlWhat will happen... Some bad things as the real estate/debt/mortgage thing works itself out. {Don't even THINK it is only about subprime...} There's going to be some serious pain in different areas/sectors. But even in the worst part of the 80's with 12% unemployment and stagflation and 165 car loans from the credit union, life went on and things eventually got better... So here's what I'm gonna do... Here's where I am today and I'm thinking I may buy more stocks for the 401a tomorrow....CLICKONNIT...  More To Come More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1327 ) ( 3 / 1327 )

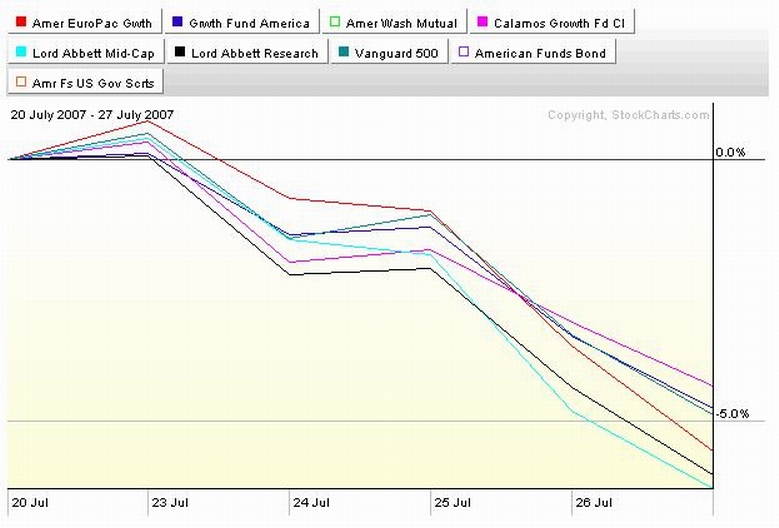

Saturday, August 4, 2007, 05:19 PM

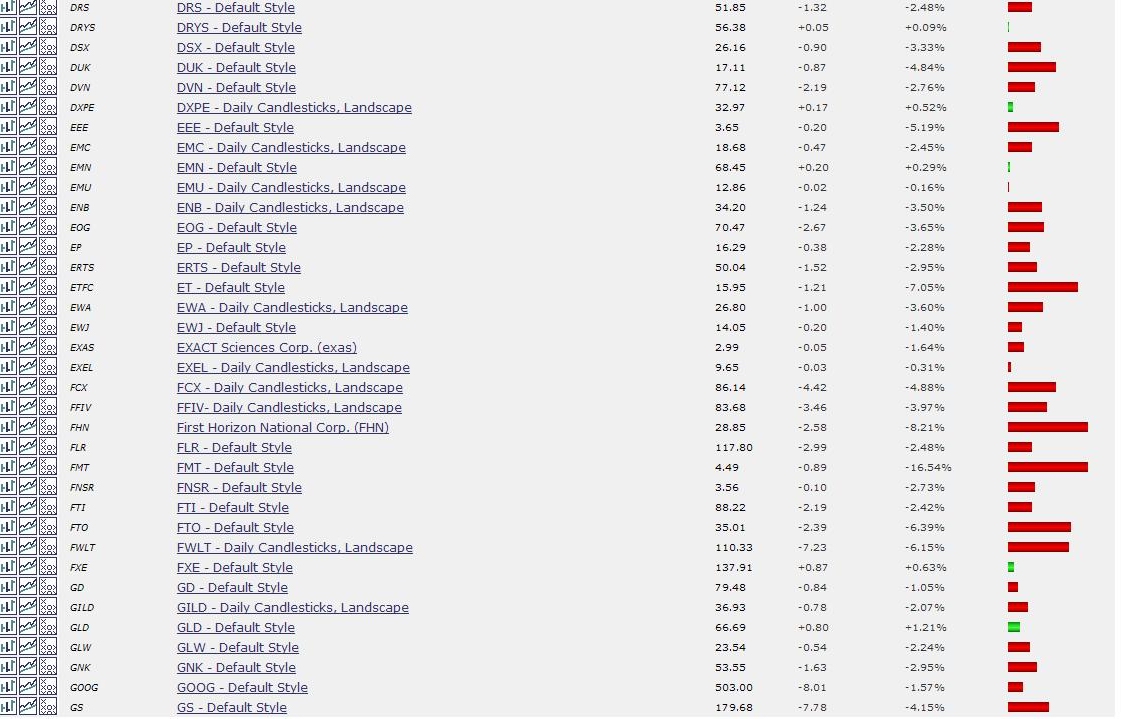

Chartz and table ZUP!!! Bloody week in the market, Behind the indices and headlines, it's a lot worse than that. I use Stockcharts.com to track some stocks I may be interested in. Here's what part of a page looked like.... Clickit!!!  My plan for the 401a and my other accounts is in place, activated and working. Next time, it will work better. Once taught, these lessons stay learned. What started me down this road in the first place was the dotcom crash. The destruction of my IRA's and my mutual fund investment set me off on a search for why and how it happened and how to fix it. That set me up to recognize that there were even bigger problems going on in my pension plan and 401a plan. In large part, some things got fixed on the stock side in time to take advantage of the next cycle up and we've sure as hell been on an upcycle since '03. Now it looks like it may be time for the next cycle down; we may be witness to the Mortgage Backed Security (MBS) crash. And the same outfit that screwed things up in stocks in 2000-2002 appears to have has increased our ownership of MBS's right into the teeth of the crash. What is the quality of the CDO's we've bought and paid for? What is the current market price? Why does McMorgan classify FNMA paper under both Government Agency and MBS? How does the model and the marks square with the market? Inquiring minds wanna know. I read. A lot. Stuff like this... From the Street.com sites: Bill O'Connor; Low grade ABX (asset backed securities) indices all hit new record lows and AHM news came out that they were shutting the doors (7000 employees last week, 700 this week) and i watched as i saw the single biggest one-day drop in AAA MBS bonds i can remember... One final note : For all you youngsters who weren't around back in the late 80's when Drexel Burnham imploded , it was their inability to place their commercial paper that was the coup d'etat . The bulls yesterday claimed that CFC rumors of CP problems was nonsense and just a little haggling between buyers and sellers over a few basis points that delayed paper getting sold . I don't know about you but i would find it virtually irresponsible of any money markets manager to buy CFC 90 day commercial paper for a mere few bps over LIBOR . Speaking of which : how many of you out there have had a good look of late as to what your broker is putting your cash in ? You might be shocked at some of the corporate names you are getting paid 5% to give them short term loans . Buying some 3 month riskless T-Bills at 4.75% area (tax free at state level too) sure sounds smarter to me than giving yourr cash to ANY mortgage lender for the next 90 days . Doug Kass IndyMac (IMB) in a death spiral. (IndyMac is a mortgage originator) Doug Kass …And so did Bear Stearns' (BSC) CFO tell the truth on the conference call. I just got off. He said that the fixed-income markets have seized up and are in the worst condition he has seen in over 20 years. Tom Au As reported on the Street.com site, Bear Stearns finally 'fesses up and says that certain market conditions "are as bad as I have seen in 22 years." … "Subprime" was just the thin end of a mortgage industry that had gotten out of hand. Like games of musical chairs, hot potato, and old [person, usually female], subprime was set up to fail, because inevitably someone would be left holding the bag Some links….. ]pid=20601087&sid=avZr736O8xUw&]

[url=http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&]http://www.bloomberg.com/apps/news?pid=20601087&sid=avZr736O8xUw&News about how the subprime mess will ripple through the economy. http://alephblog.com/2007/07/30/specula ... me-part-3/Check out #7 ,#8,#10 http://epicureandealmaker.blogspot.com/ ... -sand.html“That means that on the rare occasions that instruments (CDO’s,MBS’s) are traded, a large gap can suddenly emerge between the market price and its book value. This week Queen’s Walk Fund, a London hedge fund, admitted it had been forced to write down the value of its US subprime securities by almost 50 per cent in just a few months. That was because when it was forced to sell them, the price achieved was far lower than the value created with the models the fund had previously used – which had been supplemented with brokers’ quotes.” http://www.econbrowser.com/archives/200 ... s_the.htmlMore primer material on CDO’s http://www.msnbc.msn.com/id/20079844London hedge funds AND German Banks? The subslime contagion is NOT contained. http://www.telegraph.co.uk/money/main.j ... ebt103.xmlThe Bear Stearns leveraged subslime hedge funds spreads up into the prime areas of the economy and across the oceans… http://alamedalearning.com/reality/2007 ... is-moment/Rats in the crack house cellars in Watts, rats in the wine cellars of Beverly Hills. If subslime melts away a strata of the economy, will the layers above ignore it? http://www.slate.com/id/2171235/Subprime loans on million dollar houses? Dude….Way!! http://www.bloomberg.com/apps/news?pid= ... 1pp7slShC8Why it's not just a subprime problem....or even just a a housing problem.. dyn/content/article/2007/08/04/AR2007080401418.html?hpid=topnews http://www.nytimes.com/2007/08/05/weeki ... orris.htmlWalking the tightrope. Our pension fund’s commercial paper is industrial properties, retail properties, hotels and resorts, apartment houses and complexes. The economy is what keeps them afloat. Watch where you step…. We've got a lotta money at risk. And it is not unreasonable to ask some questions about it. But first I'm going to do something research into it. I've got a lawyer I'm working with and I'm communicating directly with some Wall Street and CNBC sources on the matter. Second, I'm going to keep on doing something with my 401a account. Here's where I stood on Friday evening... CLICKIT!!!!  The Europacific fund is kinda hanging in there and I'm down with it. The American Growth is down but I'm trimmed pretty tight and watching it closely. We'll see. The Calamos Growth is also kinda hanging in there and I'm down with it too. I'm not so sold on the Lord Abbett Funds so I sold them and I'm an interested bystander. The cash went into the GIC. I hate the rapid trading terms of the Vanguard, I don't have much there and that's OK. If I was a buy and hold, that'd be different. US Bonds go up while bonds in general go down. I like the looks of RGVEX The direction of the US market is down and I've felt the pain and I see more of it. Cash is good. The market HATES uncertainty and I'm irked by it to. It's why if I were to make a move , it would likely be into US Gov bonds. More To Come, here and on my website in Reforming A Pension Plan From The Outside and COFGBLOG ESSAYS .... Did you expect anything less?      ( 3 / 1310 ) ( 3 / 1310 )

Death, Despair, Destruction, Damnation, Disintegration, Defenestration, Desolation, Disintermediation, Disembarkation, and a whole lotta REEEALY BAD STUFF. Now What???? Well..... actually, I have a plan.....

Saturday, July 28, 2007, 02:27 PM

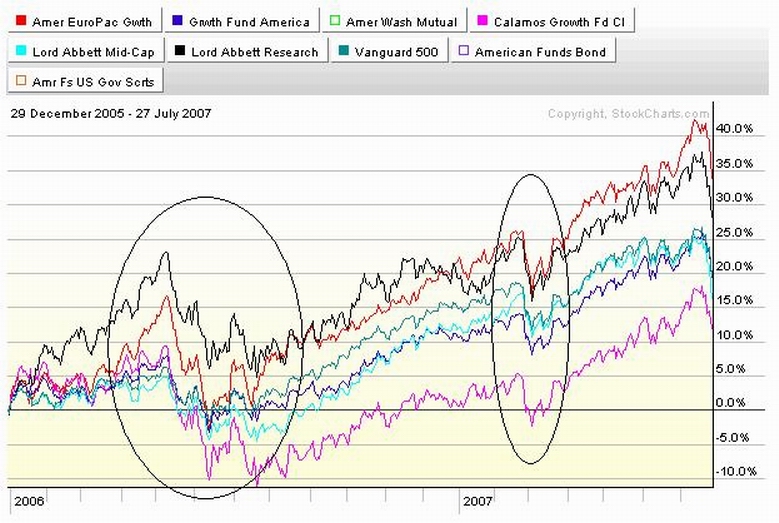

Chartz and tablez up. Gotta full plate doing family stuff this weekend. But I got a head full of stuff that needs to see the light of the internet. The markets got CRUSHED this week and it looks like it's gaining steam on the way down. Now what? Well......I'm fairly sanguine about the whole thing. It's onna counta 'cuz I've seen it before and I've got a plan and I'm ready to act. Here's what I got started on midweek of last week and here's what I'm agonna do on Monday... Check out the chart.... CLICKONNIT...  What we got here is a chart of the last year and a half with the last two seasonal Spring Hiccups elipsed. The '06 one was 10% and two and a half months long and I got in and out in a timely manner and I did well for the year. The '07 one was about three weeks long and I got out late and got back in late and it cost me half the year's gains. Now we have a Summer '07 thing goin'. Is it a hiccup or a blowup? If it's a hiccup, it might be too late to get out and getting out will cost me performance. If it is a blowup, it'll be a long way down and IT'S TIME TO GO!! I won't know which it really is until after it's over. So I gotta decide how I'm gonna treat it. Check out the charts below... CLICKONEM   First off, for all the hue and cry in the media, the first chart sez that we're down 5%. The second chart sez we've still got half the progress we made this year in hand. But it also sez we've got a breakdown/rollover and the direction is DOWN. If Monday morning is a hard bounce off the bottom and we don't look back, that's one thing. But I trade stocks and I acquire a lot of input and what I've read makes me nervous. This one feels different. And if this is the start of a downtrend and we continue the downtrend with a few dead cat/oversold bounces along the way to where we COULD go, the right thing to do is SELL and SELL BIG and SELL NOW. If it's a mistake, I'll buy it all back and it'll cost me some of the profit I made/coulda made. Read all the stuff I've written below to understand what and why I'm thinkin'. And when you've done that, realize that the stock market anticipates and sometime it anticipates what will happen and other times it anticipates what doesn't happen. So what we end up with is based on what other people think will happen. Whether news is good news or bad news is determined by the majority of investors and we gotta either guess or react. I'm reactin'. I'm aware of the stories and I read the charts. I've seen enough. I've gone long and strong when it felt right or a little scary and it worked out. I've also anticipated a few disasters that never happened. Sooner or later, I'm gonna be right. Maybe this is the time I'm right. I'm gonna bail. I'm setting up a big sell order which will execute Monday after the market closes. Depending on what I learn as of lunch on Monday, I'll either let it roll or pull the plug onnit. UPDATE

The market managed a decent bounce and I canceled the trade.

But the details and rational found below make sense to me as a way to deal with what i think is a possible inflection point in the market. So what you see below is is loaded and waiting. I'm thinking that tomorrow will be end of the month markup and I might pull the trigger on the trade or a junior version of it at the end of the day....I moved some money around late last week and ended up with much of it in CVGRX and RERFX. That's a problem, but not a terrible one. There's a ton of US money overseas. When things get hairy, rather than put more money across an ocean, investors'd rather hold cash here. Money coming back home drags down overseas stock prices. Business overseas is still gonna be good. But I own overseas stocks in RERFX, not businesses. I'm outa RERFX bigtime and I can't get back in for 30 days after I do. It'll cost me 2% penalty to sell the recently bought CVGRX shares 5 days early. CVGRX is down almost 6% in the last 5 days. Safety costs money. Oh well. I think the odds say sell. I can raise cash from the rest of the funds without triggering trading restrictions. Except from the Vanguard S&P 500 Fund. Those trading rules SUCK bigtime. We gotta ditch that fund and get an ETF. I'll have to think hard about putting money in VFINX again. It's about overowned big cap stocks now. I'm outa there. If the market is bad at lunch Monday, the trade rolls and I'm big in cash as of that afternoon and I'll still be able to reinvest in 5 funds and three allocation models and I'll be locked out of one fund for 30 days. If I change my mind, my allocation will stay at what I show on my website. We shall see.....And we did. I pulled the trade. But I very well may reinstitute it. Stay tooned. To really get a grip on the situation though, ya gotta know how it came to be... That'll be found on my website in the Reforming A Pension Plan From The Outside page. It's a work in progress. Between there and the COFGBLOG, I'll be covering the why and my strategy as to how to deal with it. This may be the inflection point we all knew was on the way. Or not. Nuclear meltdown or Business As Usual. The market will tell us. Again, stay tooned....      ( 3.1 / 188 ) ( 3.1 / 188 )

MOTOGP At Laguna Seca; Serious Racing By Serious Racers. None Of This Too Hour Too Long Parade Shit Like In F-1 Cage Racing.

Friday, July 20, 2007, 11:12 PM

Charts and Tables Up!

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all."

-- Harry Schultz

More of the same. The 401a funds are doing very well. Being long and strong the best performing fundz and almost all stocks all the time for most of three years has been very good to me. Check the chartz. But, if I'd let the inner cowboy loose...If I hadn't played around trying to be responsible since I play with an open hand... If I hadn't tried so hard at being diversified all the time... if I hadn't gone to cash when I felt uncertain, to cut the risk down when it got too uncomfortable... If I'd ridden only the two best performing funds... If I'd bumped my contribution to the max back in '05....

But that's all a load of crap. This is a 401a and the real world I'm talkin' about and I'm investing in funds that have trading restrictions in place, and funds whose holdings I'm not privy to in a meaningful way, and where I've got a 24 hour trading lag between data and allocation, and where the risk/reward is less quantifiable etc, etc, etc..

So sometimes being smart exacts a price. Some times being stoopid extracts a price too. What about the containment of the subprime real estate loans, the CDO's,CLO's, and MBS's? What about interest rate policies at the other nation's central banks? What about the Alt A subprime loans, How far does the CDO risk reeeally extend? Is Bears Stearns the ONLY house on the street with serious leverage, I mean, (way too)serious leverage in hedge fundz? Will LBO and PE loans still be available in the near future? How many banks/investment houses will have to eat bonds or bridge loans over the next six months if the PE deals go south? Was Fortress and BX the top? What did the principals of BX and Sam Zell see? Will BX and Fortress be the pattern for the IPO's in the wings? These are some questions making me seriously consider unwinding my margin and option leverage in my trading accounts. You know, going to straight up long on my way to 50% cash while I'm thinking I might be on my way to 100% cash. I've made three years in 6 months and it looks way too uphill from here. So why am I not thinking that it'd be pretty dumb not to entertain the same thoughts and questions when it comes to my 401a? Nah, I AM thinking that it'd be pretty dumb not to entertain the same thoughts and questions when it comes to my 401a....

I've gone to cash a coupla three four times in the last three years, needlessly, it turns out. I may go that way again. I'll let you knowif and when and how it turns out.

[ view entry ] ( 1056 views ) [ 0 trackbacks ] permalink      ( 3 / 1288 ) ( 3 / 1288 )

Whoa!!! I sure as hell didn't see THAT comin'.......

Friday, July 13, 2007, 09:23 PM

It is a mistake to look too far ahead. Only one link in the chain of destiny can be handled at a time." --Winston Churchill Charts and tables UP!!!! So's the market. So'm I. YEE HAAA!!!!!Gotta bank this feelin' to savor it when things don't go this well. It's not like I haven't earned it..... and it'll remind me why I have to fight to stay in the game. I'm relearning the lessons of '03 on making money when I can, and not when I have to. The bears have hated this rally all the way up. The bulls have only granted it grudging respect, especially since Feb, when we had a hiccup on rates, real estate, and business. I started to mistrust the market in Feb, and I tried to ring the cash register and go into cash preservation mode. But the market bounced hard and started to leave me behind. I have granted it less and less respect, even after I rejoined the party in March. I've been at the door ready to leave numerous times since then, including a couple of time this week.... But damned if the charts didn't keep me hangin' on. Pretty neat. I've made a lot of money and hopefully you did too. Check out the charts and tables on my site. There's more to come on " REFORMING A PENSION PLAN FROM THE OUTSIDE"". Click it.... and share it with your brothers and sisters. It's the right thing to do.      ( 3 / 1300 ) ( 3 / 1300 )

Onna counta 'cuz, that's why....

Friday, July 6, 2007, 11:14 PM

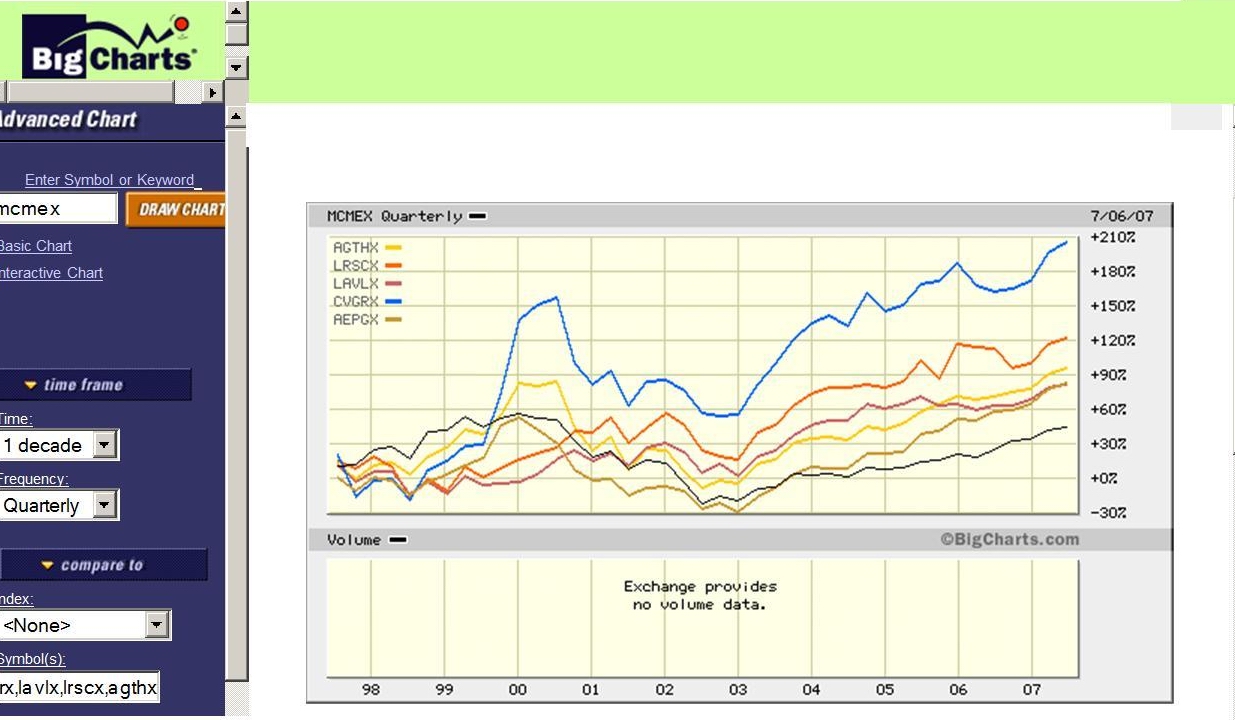

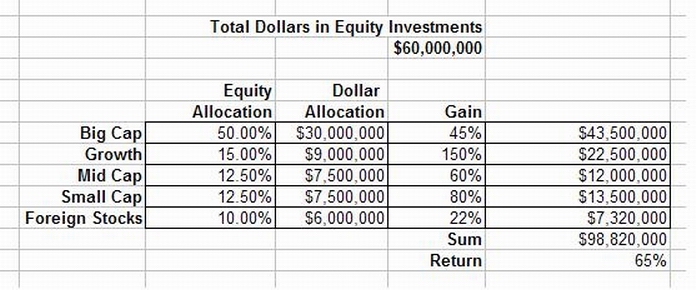

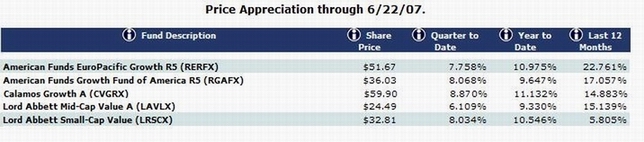

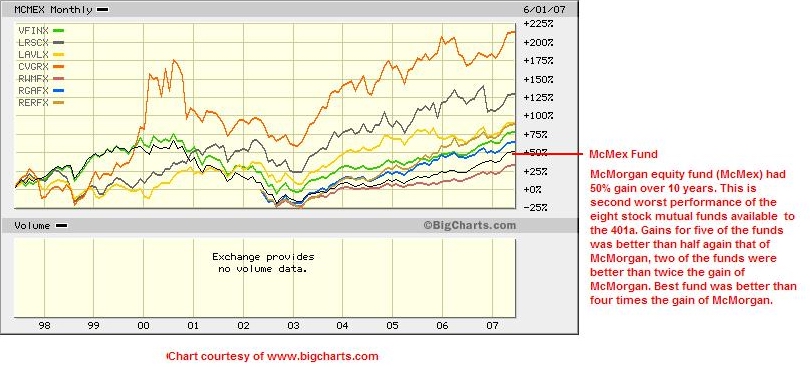

Charts and tables up at joefacer.com. Fund Alarm tables too..... Here's a BIGCHARTS chart showing the past ten years performance of: 1) A McMorgan stock fund (mcmex) representing the performance of the equity portion of our pension funds from '93 to 2005. and 2) The different mutual funds which became available to our 401a in 2004. Clickonnit;  Three sets of questions. 1)What did it cost us to be undiversified with all our equity exposure in both the 401a and the main pension fund limited to one manager and one portfolio? We can do a quick first order estimate from the charts that our equity return from McMorgan was roughly eight percent over the period of mid 1997 to 2005, or about 1% per year. If we had $60 million in the main pension fund invested in equities in '97, that would have given us about $68 million on our original principal plus earnings after 7-1/2 years . The worst performing fund of the group of funds now available to our 401a managed about 20% return during that period, and the best performing fund did about 150%. Again assuming $60 million in pension equity funds and a conventional distribution of the pension monies among funds as shown below and the rates of return on the funds as shown above, we would have had roughly $38 million in earnings as shown below. Or stated another way, we would have had a 65% return instead of a 8% return (eight times better) in both the main pension and the 401a Supplemental pension, with much better diversification and safety. It appears to me as though a case could be made that the cost of an undiversified investment strategy and reliance on a single poorly performing investment manager is approximately 25% to 50% of the amount in your 401a and the defined benefit pension fund. This is only an estimate and a rough one at that, but it certainly justifies looking deeper into this. Clickonnit!  2) Given that the stock funds that the Board of Trust made available to us in 2004 to replace the poorly performing McMorgan Funds were available to us in 1997, why did it take so long to diversify from a single advisor for both stocks and bonds and both the 401a and the main pension? Was this a matter of a single decision being made in 1993 without any subsequent review? Was it consciously and deliberately kept this way? Was this a prudent course of action and fiduciarily responsible? How were these things managed and are they being properly managed now and will they be managed in the future for our interests? 3) What assurance do we have that this is not happening again? As of 2004 we have a new investment arrangement in the 401a Supplemental Pension Plan and as of 2005 we have a new arrangement in the Primary, ie Defined Benefit Pension Plan. Did we choose two severely underperforming investmemt management firms and an unacceptably high cost index fund manager for the defined benefit? Will the 401a arrangement pass review? All good questions. Finally, food for thought; Did the godawful 401a pension performance during the late 90's and early 2000's keep you from allocating more than the minimum amount to the 401a? Did the pension plan's sticking with an underperforming equity manager cost you while they were in place and is it still costing you even after they are long gone from the 401a? About my current asset allocation in the 401a....it's kinda wheels within wheels right now.... My asset allocation is somewhat idiosyncratic. I'm avowedly and demonstratibly aggressive. I'm up 50% in the 401a in three years and 45% YTD in my trading account. And I've little confidence that it can continue. On the one side is my aggressive nature and some luck and smarts. On the other side is what I see as the start of a radical change in the place of the USA in the world. We've gone from the premier manufacturing nation in the world to a place where it's REALLY REALY hard to find something at the store that's not made in China in less than a decades time. We've had a recession in most of the economy in the late 90's disguised by a tech/fraud bubble in a corner of the economy, historically low short term interest rates at 1% in order to save us from worldwide depression, a jobless recovery off of bigtime unemployment, low life lying statistics on inflation about the part of the economy that does not eat or stay warm or stay cool or drive or get sick, full employment without wage pressure, the start of what happened to the air traffic controllers happening to the UAW at Chrysler, the end of Ford and GM as we have known them,and an off budget sheet war we gave away while we won it. There's more, but that's enough for now. Housing, which drove our economy for 5 years, has fallen off the map. The hope is that it won't matter. I'll have to see it to believe it. The USA looks to be on it's way to becoming Britain; a one time numero uno economic and military power caught in the historical imperative of the world around it. Want a taste? Crude prices at the world level are higher than in the US. We have all the crude we can use at the oil terminals in TX/OK. We don't have the refineries to process what we have so the bids are weak for crude. Demand continues to grow so we have to import gasoline. At some point we may have to export low margin crude because we have too much while we import high margin gasoline and refined products because we don't have enough. In the world I knew, the collapse of housing and higher rates would mean lower prices as the word economy chilled 'cuz we cooled. The world goes as the main producer/consumer goes. In this world, China, India , South America, and Eastern Europe could fill in the hole in demand that we leave and prices might not miss a beat. It's called stagflation and I have some very ugly memories of the last time it came around. I'm concerned and I'm staying long and strong in the 401 for now, mostly cuz' I'm ready and capable of stepping aside at the drop of the hat. i just dunno about the hat, who's it is and what direction it's coming from.      ( 3.1 / 1419 ) ( 3.1 / 1419 )

Update(s) for this week...

Monday, July 2, 2007, 09:10 PM

Like so many things in the market, you can embrace the holiday trading phenomena and try to make some money, or try to fight it and hope you don't suffer too much pain while waiting for folks to come to their senses once again.

Rev Shark

It's about reflexivity and being reactionary. There are so many reasons for stocks to mark time or to fall. There are so many reasons to get conservative especially after the big first half, when the many factors that should have sent the market down didn't. There's a lot to fear, especially since what we expected to happen, didn't....yet. BUT

There is what the market does rather than what it should do. Ya gotta watch that if you expect to make some money. I've not got a lot of confidence in the market going up. But the charts don't look bad, liquidity continues to look good and you gotta ask what's the hardest trade? It's to go with what got ya here, to see that for all there is to worry about, not much REALLY bad has happened and to stay long.

And Monday turns out to have been an up day worth 2.4% for my trading account and 1% in the 401a.

[ view entry ] ( 1092 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1452 ) ( 2.9 / 1452 )

A change in the character of the market....Or not. But probably.....

Saturday, June 30, 2007, 12:28 PM

The one great certainty about the market is that things will always change. When we lose sight of that fact and dig in our heels on a particular viewpoint or thesis, it can create tremendous stress as we deal with an environment that may not appreciate our great insight. Reverend Shark Charts and tables up. If you read the entrys below, you have a laundry list of things that I am concerned about. Regardless, the first half of the year, dispite my misgivings, has been smokin'. I went to cash on the 401a in Feb and that was a mistake. It's one I can afford, because THE VERY MOST IMPORTANT THING IN THE WHOLE WIDE WORLD, IS TO KEEP YOUR SAVINGS AND INVESTMENT INTACT. THOU SHALT NOT PISS AWAY YOUR SAVINGS AND INVESTMENT GAINS!! I've had some great gains since we reworked the 401a investment choices in 9/2004 and standing still when I think the risks are large does not hurt at all....as long as I don't leave too much on the table out of a failure to recognize what's in front of me. By mid/late March, my mistake was obvious to me and I got back in. It helps that I am working hard to repair the damage done to my IRA's as well as to my 401a. I'm not as restricted in the IRA's as the 401a and I have no restrictions on my trading account so I get a much better sense of the investment markets since I spend a fair amount of time on it. So I have a definite opinion about my going to cash in Feb. I was either wrong or early..... and I don't now which... So check this out;  I suspect I was early.... Or I may have been wrong. But if we're on our way to hell in a handbasket, it won't happen over night. So, as per the Shark up above, I gotta plan on what to do if only good things happen ever after, and I got a plan if it all turns to shit. I've just got to keep my eyes open and recognize what is going on in front of me. Check this out... it doesn't hurt to be informed. http://bigpicture.typepad.com/comments/ ... ubpri.htmlSee ya at the hall...      ( 2.9 / 1461 ) ( 2.9 / 1461 )

"De do do do, de da da da, Is all I want to say to you".... The Police ...... From the lost episode of DRAGNET

Saturday, June 23, 2007, 03:15 PM

The first step to making money is not losing it." -- Ed Easterling Charts and tables up. More to come, Here and at my wwwebsite, ya know.... There's stuff I gotta think about and I gotta decide what I'm gonna do.....even if I do nothing. Which is a decision and an action , even if it don' look like it. Here's the problem; The market's looks tough if you only look at certain portions of the 401a.CLICKONNIT!  " Up 4.3% YTD by parking in the do nothing Balanced/Pooled Fund. Up .76% YTD in the Conservative (watching your money bleed away while your health, energy, and food costs skyrocket) Model Up 1.7% YTD in the Moderate (I hope nothing bad happens) Model Up 3.76% YTD in the Aggressive (let's jump in the deep end) Model. Four choices. Double the risk and worse results for the Agressive model vs the B/P Fund. A 1.5% projected annual return for 2007 for the conservative model(horrible compared to CD rates). Two moderate allocations (Moderate vs B/P) but with one returning 250% more than the other and neither looking very good compared to CD rates. It looks pretty wacky to me. Especially since we have five funds in the 401 that are showing over 9% return YTD. CLICKONNIT  I know. It's all about the long run and in 20 or 30 years it'll all work out. Sounds good for my grandchildren. Explain to me again why I should wait until I'm 90 for it to work out..... I'm up 31% YTD on my family IRA's and my trading acct at my broker. How can I not go to cash in all those accounts tomorrow? I could then kick back and cherry pick at only the least risky opportunities for the rest of the year during the traditionally difficult summer and fall and then feel like a genius come winter even if things don't pick up... But IF I go to cash in the IRA's and trading account because of the risk, how can I justify leaving my 401a money on the table in stocks? I've just taken advantage of a major rally in stocks in my IRA's and trading account. Being conservative and holding a lot of the Met Life GIC has cost me return YTD in the 401. Going all in now to try to catch up feels like totally the wrong thing to do. Kinda like going down the long dark stairs in the old haunted house to find out what that noise is. The kids used to ask why anybody would do anything that stoopid. I'd say, " 'Cuz it's a movie and it's in the script." In real life, anybody with a functioning brain'd be long gone two reels ago.... Stay tooned...      ( 3 / 1414 ) ( 3 / 1414 )

There is nothing so important, so critical, so meaningful, so vital, that it cannot have the basic principles and tenets of procrasination applied to it....that is, if I could just get around to it.....

Saturday, June 16, 2007, 11:18 AM

Like we say in the sewer, "Time and tide wait for no man." -- Ed Norton Charts and tables up! I'm of the opinion that the members of our local have been poorly served by the Board of Trust(BOT). I believe that over at least the last fifteen years, the BOT has pursued a particularly risky and ultimately costly to the members investment strategy for the pension plans. After meeting with me in 2003, the BOT instituted sweeping changes in both of the pension plans. However, there remain elements to the pension plans that I deem to be consistent with the prior flawed strategy and in need of change. The BOT disagrees with me, and thinks they have been doing a fine job and continue to do a fine job. I am not comfortable with this situation. I've retained a lawyer who is experienced in ERISA law to help me answer the questions that still concern me. The lawyer has reviewed the material which I've presented here and additional material that I have not made public. He has suggested that there is additional material that needs to be reviewed and we are in the process of obtaining that from the pension plans and will be reviewing that material in the near future. I'll keep you updated here and on my website as to the what, whys, and wherefores of what's goin' on... Stay tooned. Here's the chart from a coupla weeks ago. CLICKONNIT!  "It looks at the 10 year performance of the mutual funds available to us now in the 401. This is the kind of data that can be life changing. It's pretty damn obvious that something highly significant is going on and that something needs to be done. It's data like this in this form that got me moving to talk to someone about how BAD the pension situation was, and it was data like this that launched me in the new 401a funds when they became available in 2004. If you can't see the data or can't see the data in a useable format, you stay in the dark. Check out the 4th quarter of 2001 reports for my 401a below CLICKONNIT ================================================================  ================================================================ //////////////AND///////////////// ================================================================  ================================================================ Check out the numbers..... Oh, right, only one report has data in a useable format after my data is stripped out. Again, only one report shows that there is something going on. Thanks to the reforms instituted in 2004 and my website, this issue has gone away for the 401a. Do YOU have all the pension data for the defined benefit plan that you NEED available to you in a useable format? That includes enough data to figure out where you are and how and who got you there? This week's investment data is pretty much on the web site in the charts and tables. I got a full plate and I'm gonna be busy this weekend. Suffice it to say that I'm carrying significant cash (too much by way of a miskey) in the 401 and my trading account and I'm STILL making significant coin. I'm STILL concerned about everything I've written about below. I'm 33% in energy stocks in my trading account because of the Middle East politcal situation and the possibility of a religious war on the Straits of Hormuz. You gotta make money when you can and in the 401 that is reduced to being long when it's good and out when it is bad. But it was a lot easier being 200% long with money borrowed on a credit card in the trading account in 2003 than it is being 80% long in the 401a here and now. Still......      ( 3 / 1322 ) ( 3 / 1322 )

Saturday, June 9, 2007, 08:21 PM

Charts and tables up. more to come....

I'm standing pat for the moment with money allocated as shown in the table on my site. I've got some exposure, 'n some cash, an the exposure is where I'm more comfortable, if not really actually comfortable... I'm expecting more volatility as stocks start to move two directions instead of just up amd investors get vertigo and whipsawed by the boyz in the pits, da big money, and the hit and run artists. In other word , it's gonna be business as usual. I suspect I'll at least start thinking about making the next change in allocation, whatever that is, in the next coupla days.

More to come on what a 401a particpant could 'n shoulda had in his account if the Board of Trust had moved in '97 instead 0f '04-'05.

[ view entry ] ( 1012 views ) [ 0 trackbacks ] permalink      ( 3 / 1389 ) ( 3 / 1389 )

Thursday, June 7, 2007, 10:36 AM

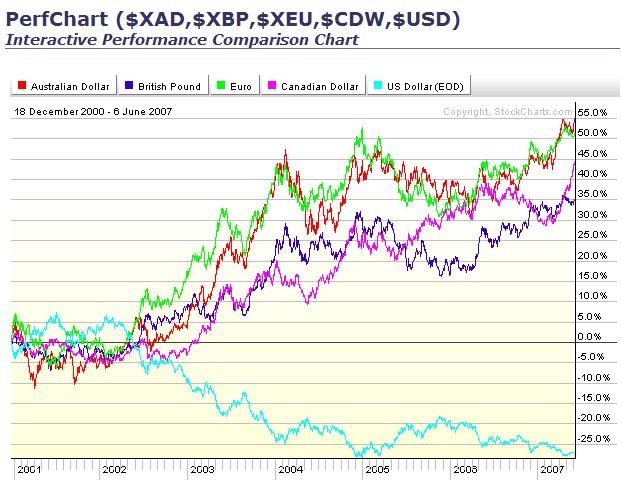

I'm still addin' to last week's post. But this needs to get posted here. Check 'em all out... How Saudi Arabia is running our economyhttp://www.thestreet.com/_tscs/newsanal ... 60736.htmlANDHere's why ya gotta be (shoulda been) thinkin' offshore investments. CLICKONNIT!  . It's great for exporters, it's why we had a greater quarter in the indexes. Our stuff is cheap overseas. The dollar worth o' stuff sent over is sold and if it take 4 months between shipping and payment, the drachmas we get for the merchandise buys more (cheaper dollars)when it comes back to the USA. But it also means that we are buying stuff overseas with constantly depreciating dollars. It makes imports really expensive. Why is oil REALLY at $60 plus and steel so expensive? It also works for investing. It's why I'm/have been overweight euroasia. there's more....but not here not now... Wed the 6th I went to 28% GIC (Met Life)and I may go a lot more. I think stocks are going to be in free fall for a while. A day, a week, a month, a little bit all at once, a lot over a long period. Or maybe not. There is a growing awareness that as rates rise in the rest of the world (ROW) and the dollar depreciates (see the charts above), we're screwed (a technical term that condenses too much stuff to cover here). But it means that we might have to pay the piper for the last 6 years of methamphetamine/monetary run. I'm up 50% over 2-1/2 years and there is a feeling of a seasonal turning point on/over the horizon. There's still the presidential cycle, the inventory cycle, the information revolution, ROW growth etc. But my favorite bright sunny days are in the fall when oncoming winter crispens up the morning and makes for cold clear nights, and it ain't no secret what's on the horizon... Of course I could be wrong and imagining ghosts in the shadows... or not. Heightened caution about whats going on in the other rooms at the party and a heightened awareness of where the door is, is how I'm going to play it.      ( 3 / 1444 ) ( 3 / 1444 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar