| |

One day I sat thinking, almost in despair; a hand fell on my shoulder and a voice said reassuringly, "Cheer up, things could get worse." So I cheered up and, sure enough, things got worse. -- James Hagerty

Friday, September 26, 2008, 11:00 AM

The budget should be balanced, the treasury should be refilled; public debt should be reduced; and the arrogance of public officials should be controlled.

- Cicero, 106-43 B.C.

Charts and Table Zup on my website. There's gonna be a lot more here a for the weekend is over, But in the meantime, here's the moments' major personal concern, followed by some links... which are of incredible value for understanding what is and is not coming down this weekend...

UPDATED 10/2

CHECK IT OUT!!!!

Brothers and Sisters,

I'M CONCERNED AND NOT HAPPY

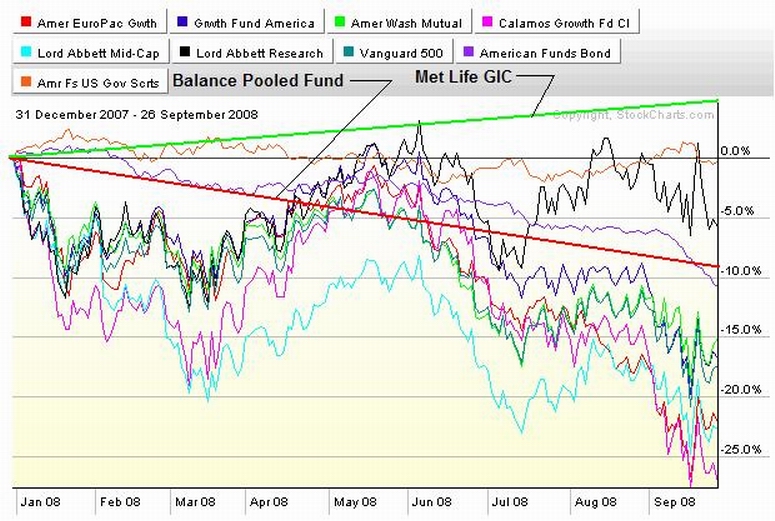

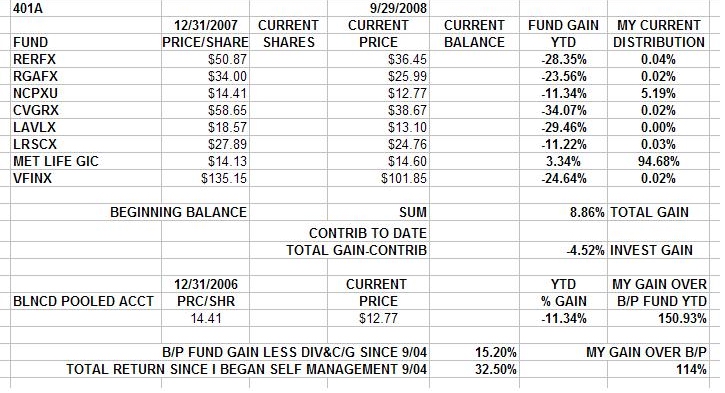

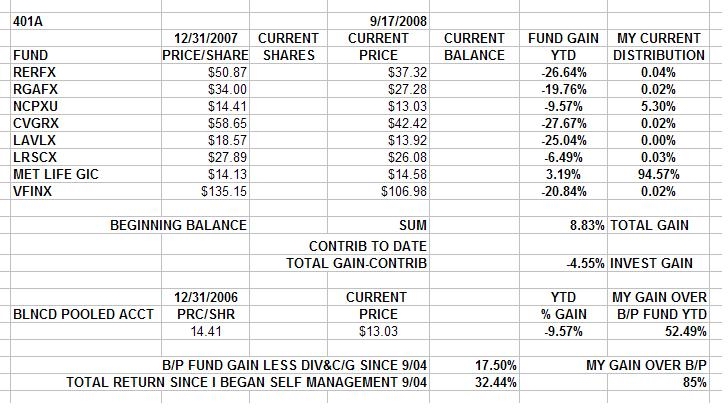

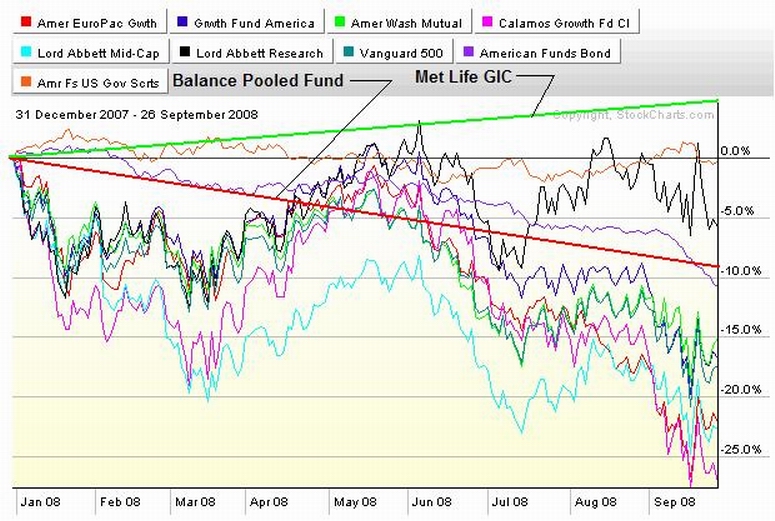

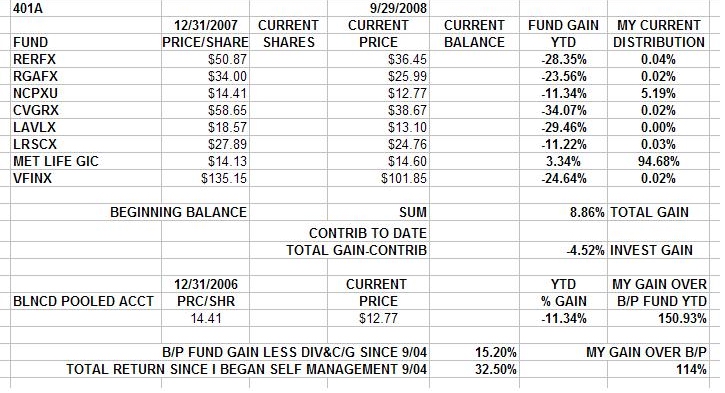

My 401a allocation;

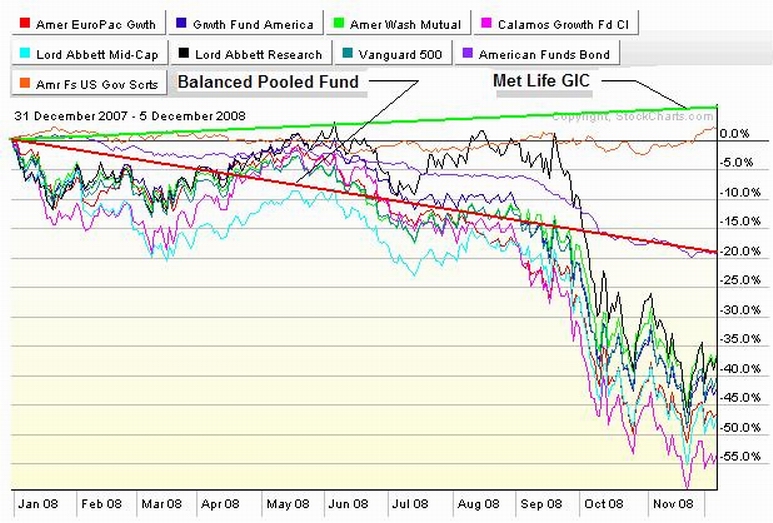

ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GICALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC)ALL CASH(MET LIFE GIC

AND THAT'S THE PROBLEM!

From the K and G website;

The MetLife Stable Value Fund provides a guarantee of both principal and interest for participant-initiated withdrawals.

AND

Guarantees are subject to MetLife's financial strength and claims paying ability.

Met Life's health is a matter of concern to knowledgeable individuals... See last week's COFGBLOG entry.

I've gone to "all cash" and it has been a very good move for me; See the charts on my web site. But I don't really have an insured cash balance like I should have. What I have is basically a solemn assurance from Met Life about the GIC. A qualified promise to pay unless circumstances intervene.

Met life is an insurance company, like AIG was. Is it too big to fail, like AIG? I don't want to find out. AIG has already failed and been rescued by the government and provided with $85 Billion of taxpayer funds. The public is in no mood to keep handing out money and the risk is Met Life might be allowed to fail as Lehman Bros was allowed to fail between the Bear Stearns rescue and the AIG rescue.

I'M CONCERNED.

My family IRA's and my trading account are all cash. As such, the cash balance is held in my broker's money market fund sweep account, where it is SIPC (Security Investors Protection Corporation) insured. The money in the bank savings account is FDIC (Federal Deposit Insurance Corporation) insured. The Federal government has stepped up to insure all the taxable money market funds after the Reserve Funds family "broke the buck". But...

My 401a "cash" is not insured.

But, I do however have a promise worth what a promise is always worth about getting my money back.....

I need an option in the 401a that is insured NOW, and I think you do too.

Call a Trust Fund Trustee in the morning and say so. Ask for an insured money market or insured deposit cash option in the 401a as quickly as possible.

If you agree with me, pass this on to other brothers and sisters in the local and spread the word. This is very important to me and I think it should be to you and all our Brothers and Sisters too.

If you have any questions, email me or check out www.joefacer.com.

Fraternally yours,

Joe Facer

Here's those links...

http://www.cnbc.com/id/15840232?video=868490137

http://bigpicture.typepad.com/comments/ ... he--3.html

http://bigpicture.typepad.com/comments/ ... e-ide.html

http://www.nytimes.com/2008/09/27/busin ... ref=slogin

http://bigpicture.typepad.com/comments/ ... age-c.html

http://www.cnbc.com/id/26888701

Merkel always make a ton of sense and plays in a much tighter, less forgiving kind of arena. This carries a lot of credibility with me...

http://alephblog.com/2008/09/26/let-the ... ilout-die/

An alternative to papering over the problem with our money.....

http://bigpicture.typepad.com/comments/ ... ative.html

Think about how close the FDIC might be to the edge...

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://debka.com/headline.php?hid=5613

Clickit!!!!!

"Careful. We don't want to learn from this."

--Calvin & Hobbes comic strip.

http://bigpicture.typepad.com/comments/ ... street.pdf

http://bigpicture.typepad.com/comments/ ... age-c.html

UPDATED 9/29

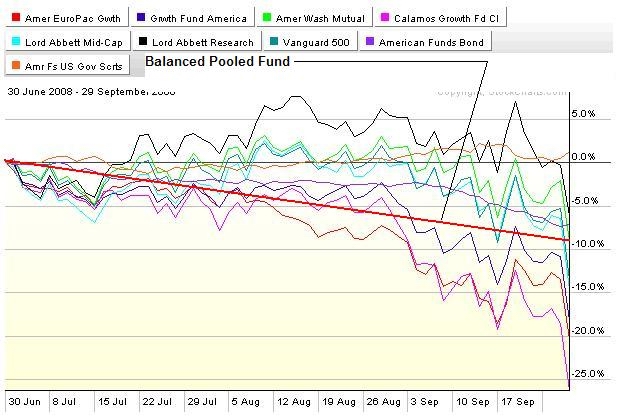

ONE MORE DAY LEFT IN THE QUARTER, THANK GAWD!!!!!

CLICKIT!!!!

I HAVE NO PATIENCE WITH "YOU CAN'T TIME THE MARKET".

I HAVE PROBLEMS WITH "THE LONG RUN" TOO.

I CAN'T AFFORD TO LOOK AWAY.

I WORKED HARD FOR THE MONEY.

NOW I WORK HARD TO KEEP IT.

I'VE SAVED MYSELF A LOT OF "CATCH UP".

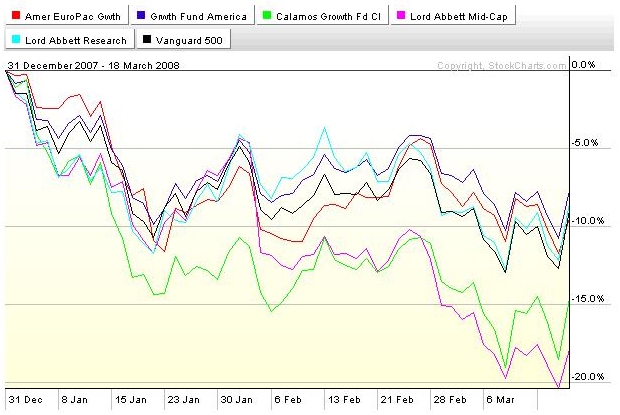

EXACTLY WHAT DID I MISS BY BEING OUT OF THE MARKET?

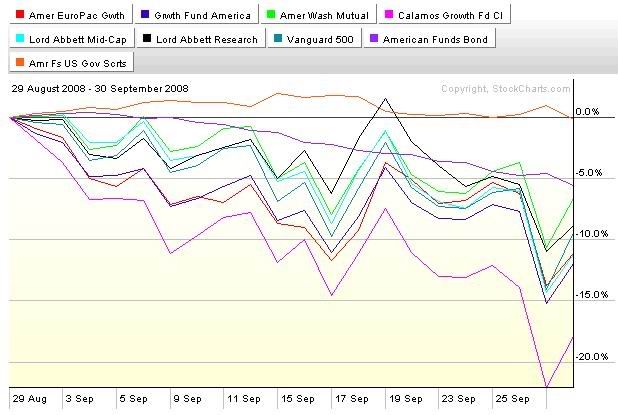

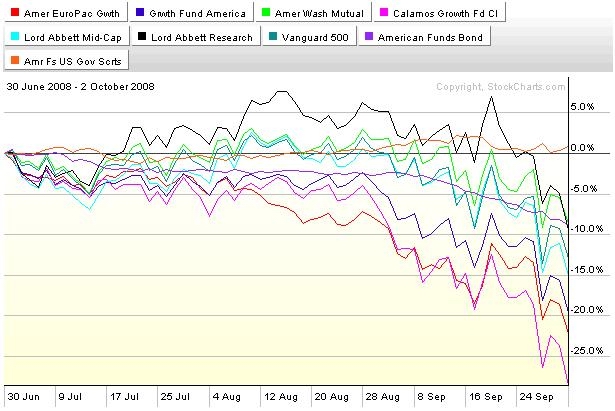

CLICKIT!!!!!

9/30 BETTER, BUT NOT GOOD.......

CLICKIT!!!!!

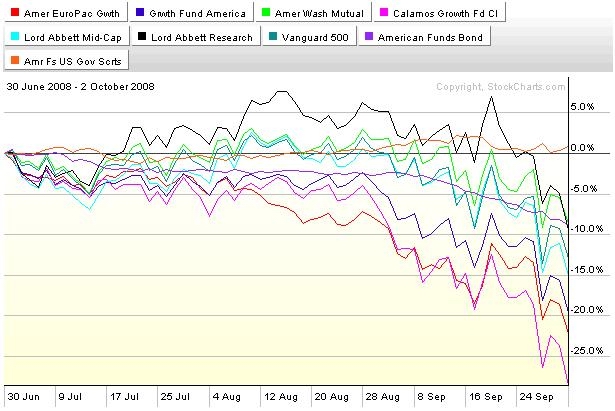

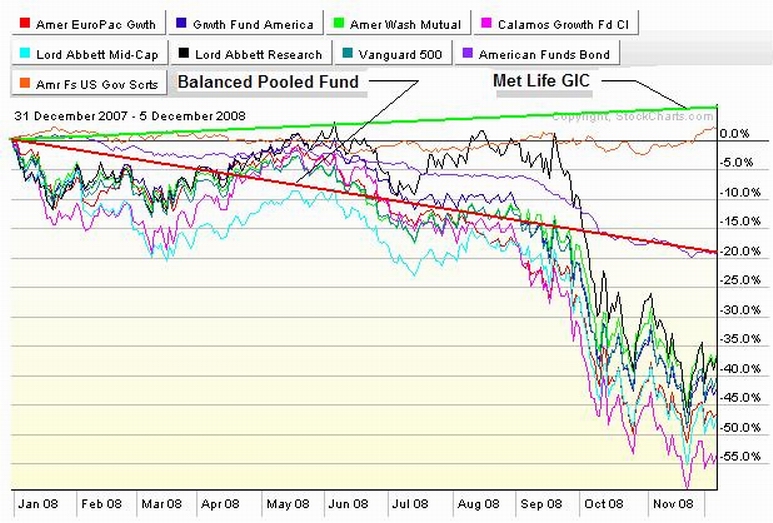

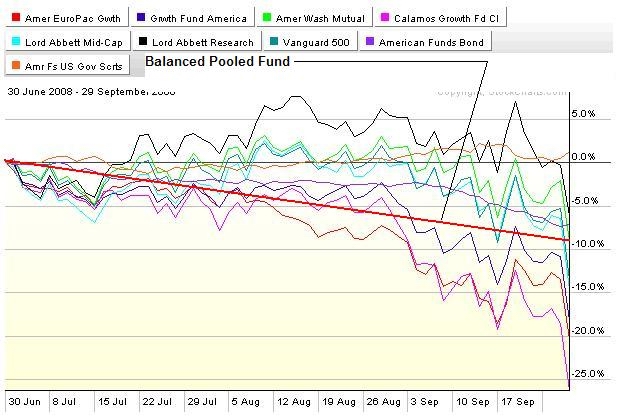

10/2 STILL IN A DOWNTREND... THIS LOOKS LIKE AN UNCONTROLLABLE HEMMORAGE OF FUNDS LEFT IN STOCKS. ONE DAY THIS STUFF WILL BE CHEAP AND BUYABLE. BUT NOT TODAY. PROLLY NOT TOMORROW EITHER. I'LL POST RIGHT HERE WHEN THINK IT'S TIME TO PULL THE TRIGGER ON REINVESTING OUT OF CASH AND INTO STOCKS....

CLICKIT!!!!!

( 3 / 1321 ) ( 3 / 1321 )

Not At All What It Appears To Be....

Friday, September 19, 2008, 10:07 PM

"However beautiful the strategy, you should occasionally look at the results."

--Sir Winston Churchill

401A CHARTZ AND TABLE ZUP ON MY WEBSITE! UPDATED 9/23.....http://bigpicture.typepad.com/comments/ ... ns-sh.htmlhttp://bigpicture.typepad.com/comments/ ... ack-o.htmlhttp://bigpicture.typepad.com/comments/ ... -exem.html Excerpted from the previous link...

The losses incurred by Bear Stearns and other large broker-dealers were not caused by "rumors" or a "crisis of confidence," but rather by inadequate net capital and the lack of constraints on the incurring of debt.

--Lee Pickard, former director, SEC trading and markets division.

>

Is Financial Innovation just another word for excessive and reckless leverage?

Apparently so.

As we learn this morning via Julie Satow of the NY Sun, special exemptions from the SEC are in large part responsible for the huge build up in financial sector leverage over the past 4 years -- as well as the massive current unwind

Satow interviews the above quoted former SEC director, and he spits out the blunt truth: The current excess leverage now unwinding was the result of a purposeful SEC exemption given to five firms.

You read that right -- the events of the past year are not a mere accident, but are the results of a conscious and willful SEC decision to allow these firms to legally violate existing net capital rules that, in the past 30 years, had limited broker dealers debt-to-net capital ratio to 12-to-1.

Instead, the 2004 exemption -- given only to 5 firms -- allowed them to lever up 30 and even 40 to 1.

Who were the five that received this special exemption? You won't be surprised to learn that they were Goldman, Merrill, Lehman, Bear Stearns, and Morgan Stanley.

As Mr. Pickard points out that "The proof is in the pudding — three of the five broker-dealers have blown up."

ROUND TRIP.!!! CLICKIT!!!

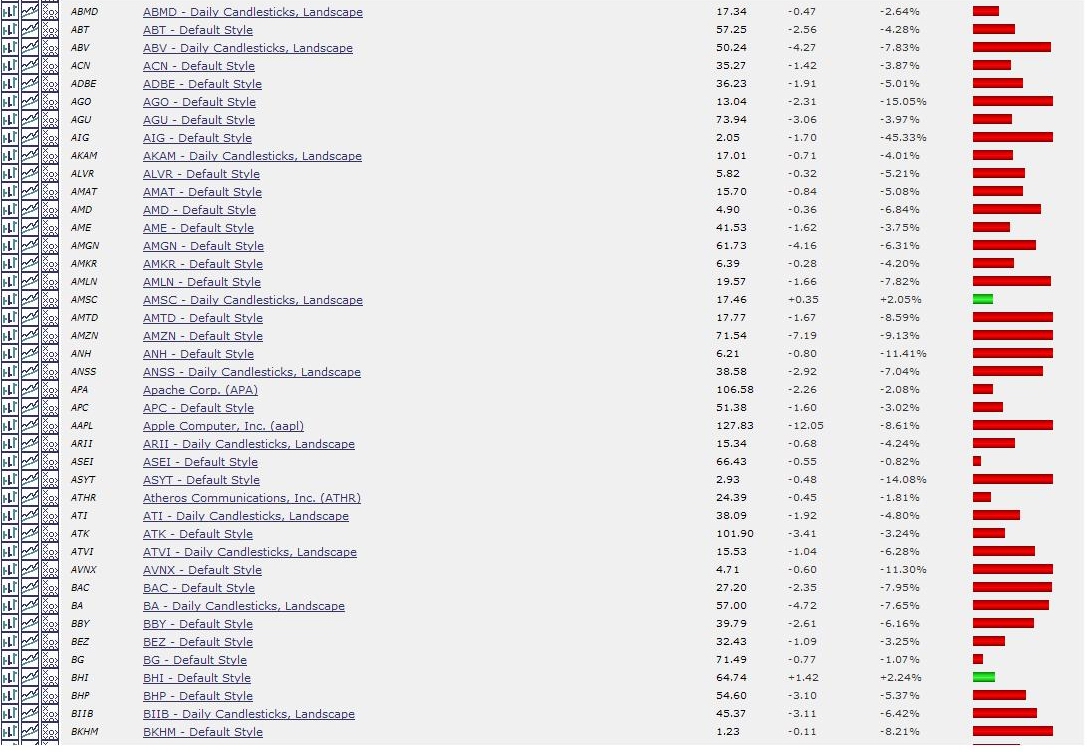

THIS IS WHAT "THE BIGGEST TWO DAY GAIN SINCE 1929" LOOKS LIKE IF YOU ADD IN THE OTHER 3 DAYS OF THIS WEEK....

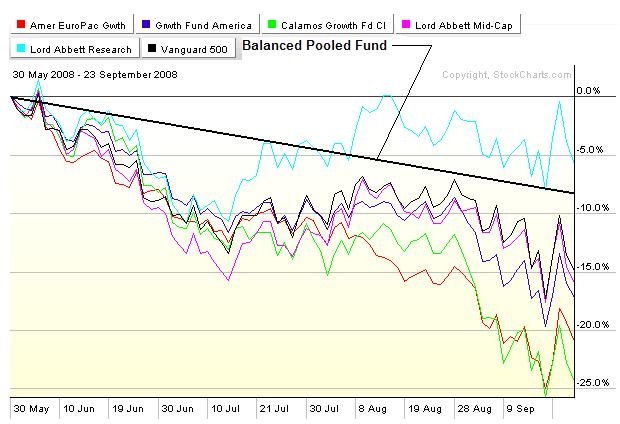

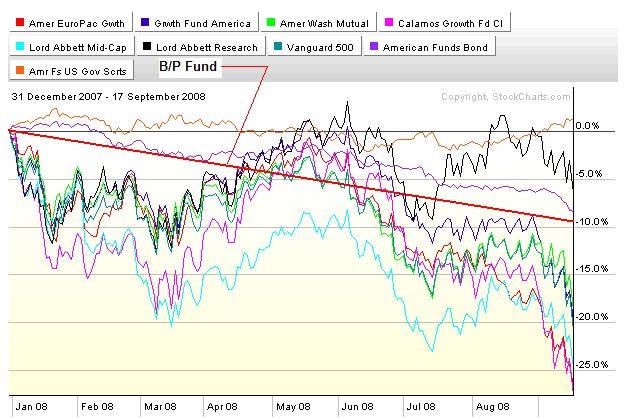

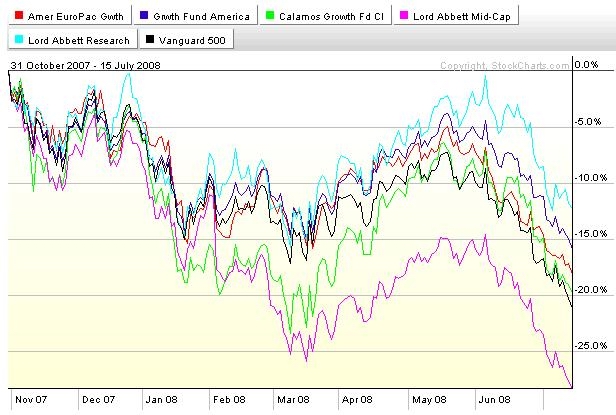

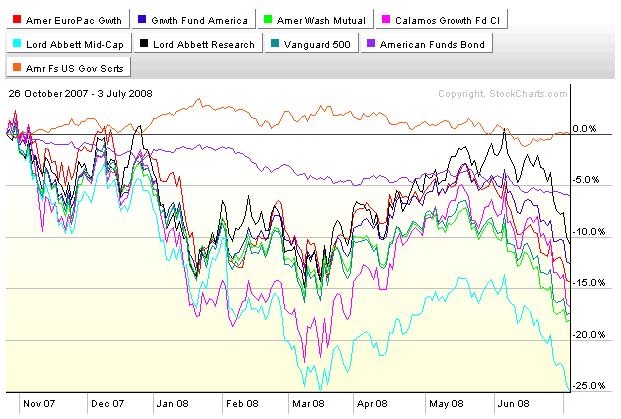

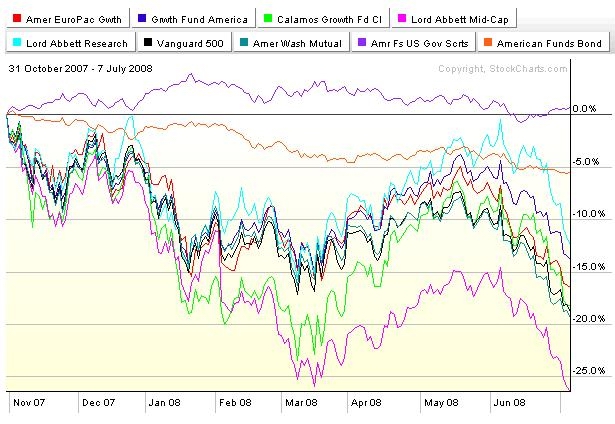

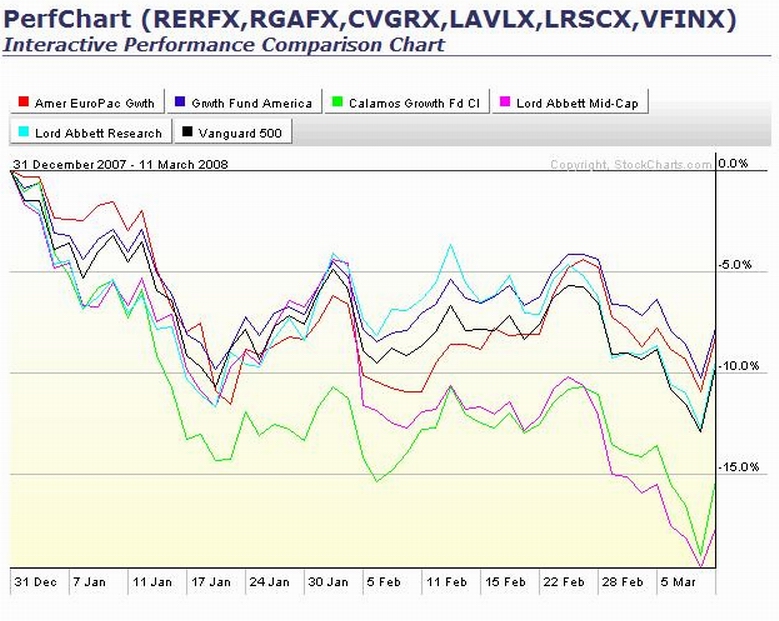

THIS IS WHAT IT LOOKS LIKE IF YOU LOOK AT THE REST OF THE YEAR...

I DON'T FEEL LIKE I MADE A MISTAKE BEING IN CASH FOR MUCH OF THIS YEAR...INCLUDING THIS WEEK.

9/21http://www.sfgate.com/cgi-bin/article.c ... 131A52.DTLhttp://www.nypost.com/seven/09212008/bu ... 130110.htmhttp://money.cnn.com/2008/09/19/news/ec ... 2008091915http://www.politico.com/news/stories/0908/13690.htmlThe Bailout Plan may give a hand to foreign banks.... Holy Shit!!!! http://www.allposters.com/-sp/George-W- ... 46826_.htm http://bigpicture.typepad.com/comments/ ... using.html

Google "Mauldin" and "dead men walking"

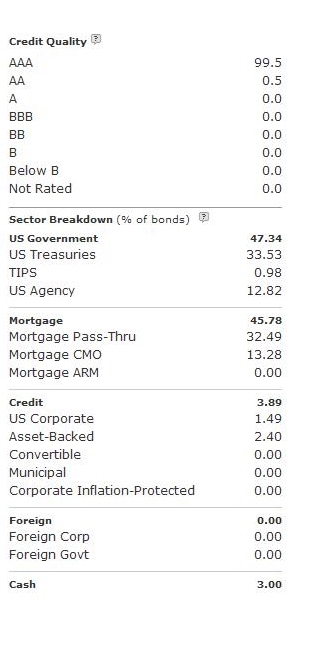

Read the article in light of it being written Aug 25th, a month ago. I'm not happy.In his "Limping But not Dead Men Walking Crowd", among others he has Morgan Stanley,Merrill Lynch, AIG, Prudential, and Met Life. Since then, Morgan Stanley has petitioned to become a bank holding company so that they can get bailout money from the Fed, Merrill Lynch sold itself rather than go down in flames, and AIG has been seized by the government. I've got my money in the 401a in "cash", which is the Met Life GIC (Guaranteed Investment Contract). "Guaranteed" as in Met Life promises to pay off, even if they go bankrupt and don't have any money... Make sense? It's "Cross my heart, PROMISED", not insured. Today, that sucks. In the 80's, when things were REALLY bad also, I had my money in Franklin's Federal Money Market Fund. It held only federal securities and had an average maturity of under a week. THAT WAS SOLID. The closest thing we have in the 401a is the American Funds US Government Securities. This is from Morningstar http://quicktake.morningstar.com/FundNe ... mbol=RGVEXhere's an excerpt  Forty five percent mortgages. This is not even a money market fund which IS government guaranteed now. I sure hope this works out.....

Yeah, it's more work watching your money than not...

But, is it really too much trouble?

It only took four months to lose how much?

Got this in an email....

SUBJECT: REQUEST FOR URGENT BUSINESS RELATIONSHIP DEAR AMERICAN: I NEED TO ASK YOU TO SUPPORT AN URGENT SECRET BUSINESS RELATIONSHIP WITH A TRANSFER OF FUNDS OF GREAT MAGNITUDE. I AM MINISTRY OF THE TREASURY OF THE REPUBLIC OF AMERICA. MY COUNTRY HAS HAD CRISIS THAT HAS CAUSED THE NEED FOR LARGE TRANSFER OF FUNDS OF 800 BILLION DOLLARS US. IF YOU WOULD ASSIST ME IN THIS TRANSFER, IT WOULD BE MOST PROFITABLE TO YOU. I AM WORKING WITH MR. PHIL GRAM, LOBBYIST FOR UBS, WHO WILL BE MY REPLACEMENT AS MINISTRY OF THE TREASURY IN JANUARY. AS A SENATOR, YOU MAY KNOW HIM AS THE LEADER OF THE AMERICAN BANKING DEREGULATION MOVEMENT IN THE 1990S. THIS TRANSACTIN IS 100% SAFE. THIS IS A MATTER OF GREAT URGENCY. WE NEED A BLANK CHECK. WE NEED THE FUNDS AS QUICKLY AS POSSIBLE. WE CANNOT DIRECTLY TRANSFER THESE FUNDS IN THE NAMES OF OUR CLOSE FRIENDS BECAUSE WE ARE CONSTANTLY UNDER SURVEILLANCE. MY FAMILY LAWYER ADVISED ME THAT I SHOULD LOOK FOR A RELIABLE AND TRUSTWORTHY PERSON WHO WILL ACT AS A NEXT OF KIN SO THE FUNDS CAN BE TRANSFERRED. PLEASE REPLY WITH ALL OF YOUR BANK ACCOUNT, IRA AND COLLEGE FUND ACCOUNT NUMBERS AND THOSE OF YOUR CHILDREN AND GRANDCHILDREN TO WALLSTREETBAILOUT@TREASURY.GOV SO THAT WE MAY TRANSFER YOUR COMMISSION FOR THIS TRANSACTION. AFTER I RECEIVE THAT INFORMATION, I WILL RESPOND WITH DETAILED INFORMATION ABOUT SAFEGUARDS THAT WILL BE USED TO PROTECT THE FUNDS. YOURS FAITHFULLY MINISTER OF TREASURY PAULSON      ( 3 / 1341 ) ( 3 / 1341 )

If the next coupla hours are successful, I'M GOIN' RACIN' AGAIN...

Saturday, September 13, 2008, 10:33 AM

The majority of men meet with failure because of their lack of persistence in creating new plans to take the place of those which fail.

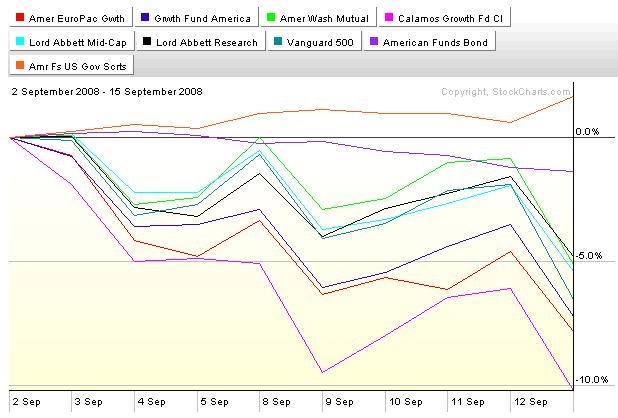

--Napoleon Hill UPDATED 9/17Chartz and Table Zup on my site. http://www.sfgate.com/cgi-bin/article.c ... mp;sc=1000http://www.sfgate.com/cgi-bin/article.c ... 12T0T0.DTLhttp://www.washingtonpost.com/wp-dyn/co ... 02638.htmlhttp://www.msnbc.msn.com/id/26695078/http://www.popeater.com/television/arti ... 1200555738http://www.bloomberg.com/apps/news?pid= ... refer=homeSUNDAY NIGHT: GOIN'DOWN IN FLAMES? GIC...THE PLACE TO BE...

CLICKIT!!!

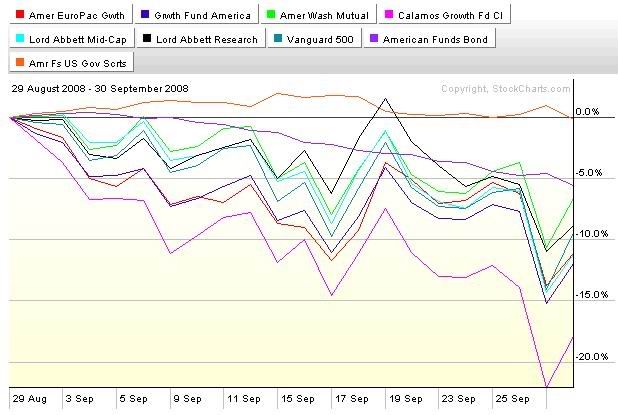

Not a good two weeks... not convinced it's getting any better...

UPDATE 9/17 courtesy of STOCKCHARTS.COM

CLICKIT!! DEFINITELY NOT GOOD!!!!!!!

CLICKIT!

HOLY SHIT...

CLICKIT!!

IN FUCKING CREDIBLE.....

The losses YTD and today are incredible.

Being all cash puts me at arms length. It's still an emotional experience. A lot of peoples' work and savings have been vaporized.

Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair

YOU CAN'T MAKE MONEY IN TODAY'S MARKETS. THE TIME TO MAKE MONEY WAS OVER THREE OF THE LAST FOUR YEARS. NOW IT'S TIME TO WORK ON KEEPING WHAT YOU MADE.

Don't be afraid of missing opportunities. Behind every failure is an opportunity somebody wishes they had missed.

Lily Tomlin

"When the plane is going down and the oxygen masks have dropped and parts of the plane are peeling off as you plummet toward the earth, that’s not the time to pull out the little card in the seat in front of you and say, ‘Gee, where are the emergency exits?' Everybody should have an emergency plan. The time to make these decisions is not when people are running around with their hair on fire."

Barry Ritholtz

NO ONE EVER WENT BROKE TAKING PROFITS.

IT'S NEVER TOO LATE TO SELL.

YOUR FIRST SALE ON THE WAY DOWN IS YOUR BEST SALE.

IF TODAY'S SALE WAS A MISTAKE, BUY IT BACK TOMORROW.

A SALE IS AN INSURANCE POLICY AGAINST LOSS.

This emergency was decades in the making and 12 months from the first wisps of smoke to full blown firestorm. There was time to escape.

Nothing is safer or more effective than cash in a poor market.

Reverend Shark

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all."

-- Harry Schultz

Life teaches hard lessons. This is one.

When the time comes to buy these stinking piles of crap, AND THERE WILL BE A TIME, they'll be cheap and I'll have cash.

THIS TOO SHALL PASS.

http://bigpicture.typepad.com/comments/ ... umber.html     ( 3 / 1386 ) ( 3 / 1386 )

You have $100's of millions of dollars in your Defined Benefit Fund and $10's to $100's of thousands of dollars in in your 401a. Who still thinks that headlines about billions of dollars lost in the financial markets isn't a kick in your crotch?

Saturday, September 6, 2008, 01:34 PM

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have it, it requires 10 times as much skill to keep it.

Ralph Waldo Emerson

Chartz and Table Zup on the main site.In the meantime...I've been adding links here during Sat and Sun. Check it out.... http://www.nytimes.com/2008/09/07/opini ... ef=opinionFood for thought... http://www.time.com/time/nation/article ... ml?cnn=yesJust what we need, MORE real estate problems in Florida.... http://www.bloomberg.com/apps/news?pid= ... refer=homehttp://voices.washingtonpost.com/washbi ... fredd.htmlhttp://www.bloomberg.com/apps/news?pid= ... refer=homehttp://bigpicture.typepad.com/comments/ ... -crat.htmlhouses and cars; a lot of money not changing hands equals jobs lost. http://bigpicture.typepad.com/comments/ ... use-p.htmlI'm a trend follower based on identifying trend changes as early as possible. All cash watching the current trend. http://www.youtube.com/watch?v=rOVXh4xM-WwCramer was almost universally derided as a lunatic when he said what he did in 8/07. A week later the markets tipped over and have gone down since. Since then, Bear Stearns is toast as is Indy Mac and a slew of other mortgage originators and holders. So this weekend the Treasury (the US taxpayer) is effectively buying all the mortgages that Fannie and Freddie hold. Every godawful mortgage to every unqualified or felonious borrower made by a sleazy boiler room mortgage outfit or first line nationwide consumer bank will be backed by the US taxpayer. Or maybe not. The unwind will be huge and will matter big time.... http://money.cnn.com/2008/09/07/news/ec ... tm?cnn=yesSunday AM thoughts on the Fannie and Freddie riff. http://www.bloomberg.com/apps/news?pid= ... refer=homeSunday Evening thoughts on Freddie and Fannie..  CLICKIT!!! Good funds in a bad environment? Or is the total complacency of the McMorgan pension management era still in place? CLICKIT!!! Good funds in a bad environment? Or is the total complacency of the McMorgan pension management era still in place?Depends. A fund can be a stinking pile of crap even while it makes money, and the best fund in the sector can lose money. Prolly time to take a look and see which ones we are stuck with are which....And what about Fannie and Freddie? Stay tooned and see ya here Sunday Eve.      ( 3.1 / 1360 ) ( 3.1 / 1360 )

Labor Day, Back to School For The Kidz, The End of Summer, The Next Leg Down In The Market and The 401a? That's what I expect. Here's why and what I'm gonna do...

Saturday, August 30, 2008, 02:38 PM

"The first step to making money is not losing it."

-- Ed Easterling

CHARTZ AND TABLE ZUP On The Main Site!!! I've revised a few of the chart set ups and I'm happier with them. You may not be, because of what they show. Check 'em out...

Three day weekend and ain't no excuse why I can't write some more here, since this is the weekend I decided I gotta do a top to bottom review of my retirement investing and trading. See ya here at the very end (Late Monday Evening) of the weekend. Stay Tooned But in the mean time... Check it out!!! http://www.marketwatch.com/news/story/o ... 48A50D6%7DHere's an excerpt... SAN FRANCISCO (MarketWatch) -- Out of almost 2,100 diversified retail U.S. stock mutual funds that are open to new investors, just 17 have positive returns for both the past 12 months and year-to-date, according to investment researcher Morningstar Inc. Nancy Tooke runs three of them. Explain why you are STILL invested in ANYTHING stocks. Oh... you see something that leads to a significant and long term turnaround for the economy and financial markets just around the corner. YEAH!!! Like maybe THIS... http://bigpicture.typepad.com/comments/ ... al-ab.htmlExcerpt; What this country really needs is less tranparency in earnings reports, and more wiggle room for corporate reporting:.... We are governed by utter idiots . . . If Barry wants to pick a fight w/ me, he'll have to start with something we disagree about. More links excerpted from Barrys' Blog: http://online.wsj.com/article/SB122005562753985195.htmhttp://www.bloomberg.com/apps/news?pid= ... KBb0Y&http://bigpicture.typepad.com/comments/ ... cks-d.htmlhttp://econompicdata.blogspot.com/2008/ ... ction.htmlhttp://www.bloomberg.com/apps/news?pid= ... 9fzl8&http://www.slate.com/id/2198942/http://bigpicture.typepad.com/comments/ ... asuri.htmlhttp://money.cnn.com/2008/08/12/real_es ... 2008081208http://blogs.wsj.com/economics/2008/08/ ... landscape/http://www.politico.com/news/stories/0808/12997.html

Cell Genesys

If you bought and sold at the right time, say like you bought near the low of 2003 and sold near the high of 2004, that was a 245% swing. Not bad for a year's return. But if you bought and held, or weren't dialed in to the biotech industry with excellent industry and company specific sources, minute to minute information flow, and a day traders mentality and trading style, you could have had your head handed to you at any time. There are places where I WON'T go. You HAVE to have confidence and you have to a damn good reason to be confident to play where the volatility looks like that. Not me, not today, and not tomorrow either... Ya gotta know what your edge is... And working there for a year isn't it. So look back to two years ago when those with big balances in their 401a's and big time exposures to stock were lovin' the up days and there was always a reason to be excited and interested in the markets. That was the easy part. I'm STILL interested in the market and constantly reading and thinking about it. Not because it is easy and fun like it used to be, but because that's what constantly reminds me to focus now on keeping what I made then by avoiding risk. All cash all the time. There will come a time when the market will recognize that it finally understands the current mess and can look ahead and see the resolution clearly enough to discount it it once and for all. It may coincide with mention of stocks resulting in widespread projectile vomiting of the public at large. The very last optimist may have despaired of ever making a dollar in the market again and have flushed his portfolio and gone to cash, thus marking the bottom. Then we'll start another up cycle out of the darkest depths like we always do. Ya gotta be watching to see it and take advantage of it.. And remember; It's Only Money. So for fun, here's something of interest about music..... http://mixonline.com/classic-tracks/Working....

Every so often, I figure it's time to lay something down so it stays there. It's usually something basic that illuminates the Why of what I do and why it's right. I usually grind it out here and post it to COFOG BLOG Essays on the main site later. I got the next riff in my head, When I get caught up on my post vacation stuff, it'll appear here.      ( 2.9 / 1188 ) ( 2.9 / 1188 )

TRANSITIONING BACK TO REALITY..... SUCH AS IT IS....

Saturday, August 23, 2008, 02:57 PM

"The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists."

-Joan Robinson, Charts and Table Zup on the site. I'm back to where I wanna be in the 401a, 10% plus annual rate of return over the last 4 Years. I stayed way too long at the party, I had an almost 14% a year return going. I shoulda tapered off between August and January, but I'm new and self taught at this stuff. Still, ya go with what works and this works for me. I expect to do better when the current fires burn themselves out. The year to date has been a day traders' market and no place for a long term investor. If your investment time period was hours or days, ther was a LOT of money to be made. But I'm just a workin' stiff... Ninety five percent in cash in the 401a and hedged long/short out the wazoo in Ira's and my trading account tell the tale. Check this out!! http://www.bloomberg.com/apps/news?pid= ... refer=home``It's like an ongoing nightmare and no one is sure when we're going to wake up,'' said Thomson, a money manager in Glasgow at Resolution, which oversees $46 billion in bonds. ``Things are going to get worse before they get better.''

In a replay of the last four months of 2007, interest-rate derivatives imply that banks are becoming more hesitant to lend on speculation credit losses will increase as the global economic slowdown deepens. Binit Patel, an economist in London at Goldman Sachs Group Inc., said in an Aug. 21 report that nations accounting for half of the world's economy face a recession.

The premium banks charge for lending short-term cash may approach the record levels set last year, based on trading in the forward markets, where financial instruments are sold for future delivery. Back then, concern about the health of the banking system led investors to shun all but the safest government debt, sparking the biggest end-of-year rally for Treasuries since 2000.

``These problems going into year-end are likely to be worse this time round because of the amount banks have to refinance in December,'' Thomson said, citing a figure of $88 billion. ``The suspicion is that banks are still hiding losses. The banking system relies on trust and at the minute there quite simply isn't any.'' Real estate is in the toilet. The originate to distribute model of mortgages, car and bike loans, and collateralized debt obligations (CDO's) is dead. Money is hard to create and/or borrow and the velocity is gonna be slow. The money roller coaster that has fueled the economy and the financial sector is in the corner S and D ing.What do YOU see that's gonna turn this situation around? Check it out...CLICKIT!!!  Big interday swings, the individual stocks look like death even as the indexes look much less volatile. (There are advantages to diversifying...) A coupla months of "climbing a wall of fear" and then a coupla months of "sliding down the slope of hope". All to get back to the bottom, a long way from where we were last fall. All cash all the time. I'll let you know when I make a move. Don't hold yer breath..... And Finally....

Smart Investors Have to Wonder Who's Dumb Now: Michael R. Sesit

http://www.bloomberg.com/apps/news?pid= ... refer=homehttp://bigpicture.typepad.com/comments/ ... -stat.html      ( 3 / 1346 ) ( 3 / 1346 )

MOTOGP @ LAGUNA SECA THIS WEEKEND; Time presses, a truncated post this week......

Saturday, July 19, 2008, 01:23 PM

Don't worry about genius. Don't worry about being clever. Trust to hard work, perseverance and determination.

-- Sir Thomas Treves

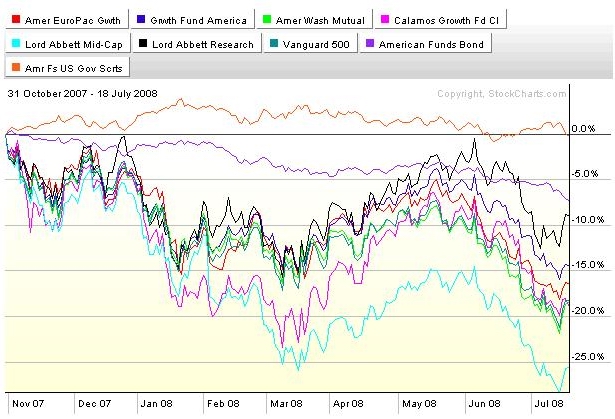

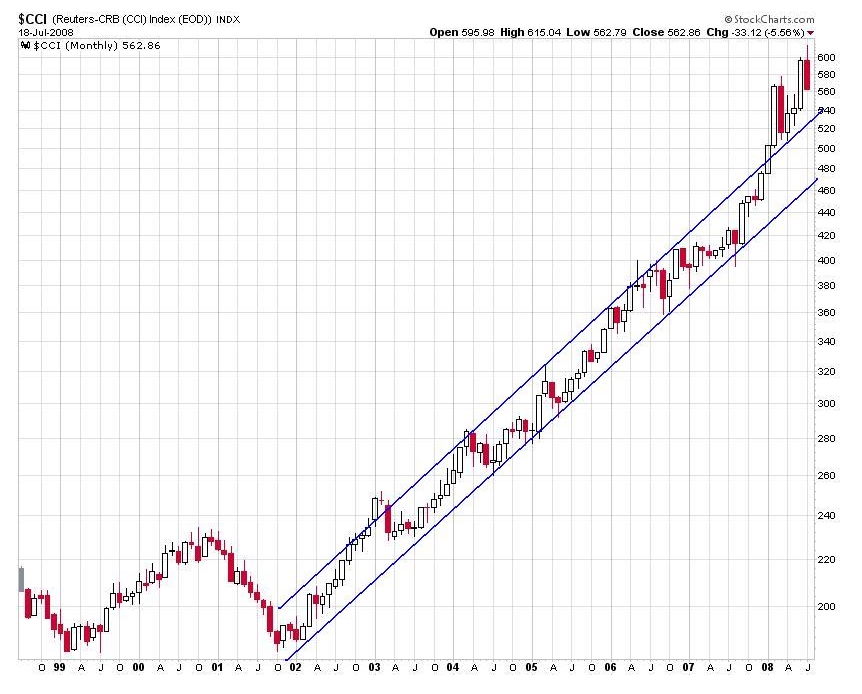

Charts and Table Zup on my site...Good week for headlines. Huge up day or two in the market. The government will back up everything and everybody. There's a mortgage rescue plan. There's a plan to kill all the short sellers and speculators. The price of oil falls precipitiously. The worst is over!!!

NOT!!!

I see it differently. Headlines about huge up days are about today and yesterday and earlier in the week. Lookie here...CLICKIT!!!  Looks to me like if you sold anything or everything somewhere between Halloween and mid June, you'd be ahead and maybe by miles. Even bonds look like crap. So far the reversal barely shows. Yeah, the government has some plans. Plans to float the whole mortgage/credit mess on money taxed from you (out of your pocket) or printed from thin air (welcome to inflation; a more genteel and harder to trace picking of your pocket). Speaking of speculators, Lookie here....CLICKIT!!!  This is a chart of a commodity index. The trend is obvious. So is the cause. The recent speculative spike as everyone rushed to the other side of the boat is obvious too. If you had a dollar and knew how, you HAD to be invested in the last part of the market to go up. Now what is not obvious is how much the demand destruction that high prices cause will deflate the high prices. I'm thinking that prices will sink back to or through the long term trend channel I've drawn. But the reasons and imperatives that created the channel exist even with the speculators slapped back. I think that back to the trend channel is probably where prices will ultimately go. Finally, going short is what is keepin' this poor ol' pipefitter's meager savings working on funding his retirement. I just don't see myself as the cause of the pyramid scheme coming down when the last fool gets sucked in. 401a All cash all the time. Credit card defaults and 401a distress caused by buying gas and groceries on short term credit is the next shoe to drop, joining higher prices and a further drop in the price of homes. We're in the third or fourth inning of the great credit unwind. Stocks and houses don't go from $100 to $1 in a straight line. Look up ENRON. All cash all the time until I see a reason to change. IRA's & trading account I got my nose bloodied by the spike up Tuesday because I was big time short. I did NOT cover my shorts; Wednesday I hedged them with the same amount of longs. The last coupla days I've broke even regardless of the market movement. I expect to dump the longs if/when the market resumes the previous trend down. Ya can't catch interday reversals when you are at work. Ya ride the trend as you see it. See the first chart. If the trend changes I'll go to the long side and put some 401a money to work. First I'll have to see it. Then I'll have to believe it. I just started to check out this link; http://www.nytimes.com/interactive/2008 ... -trap.htmlThe key part is the interactive graphic. No game goes on forever, no tree grows to the sky. Like it or not, like Montana and California, the economy still has a fire ecology. Out of the ashes comes regrowth. http://bigpicture.typepad.com/comments/ ... -plan.html[      ( 3 / 1402 ) ( 3 / 1402 )

"Lower Than Whale Shit" "A Churnin' Urn Of Burnin' Funk" "Hammered Dawg Shit" "A Smoking Crater of Smashed Hopes and Ground up Dreams" "A Soon To Be Over, Slight But Not Totally Unexpected Temporary Pricing Correction"..... These are the entries for the best description of the current financial, credit and housing markets...

Saturday, July 12, 2008, 09:16 PM

There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

James “Reverend Shark” DePorre

Charts and Table Zup on my site.

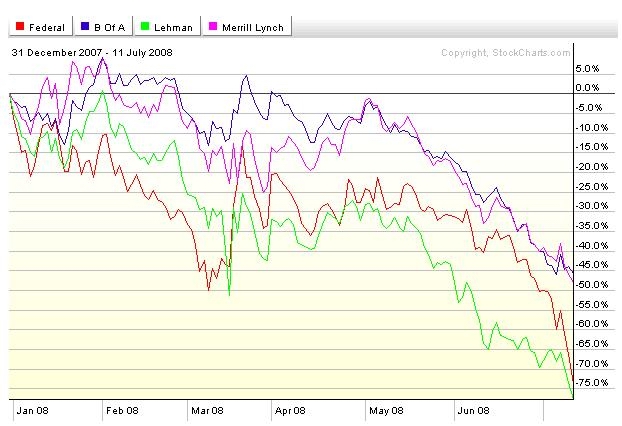

Think about Fannie Mae, Bank of America, Lehman Bros, and Merrill Lynch. Good solid American companies you can trust to put in your retirement portfolio and look away from for a year or two at a time.

CLICKIT!

STAY TOONED...

Fer Stuff Like This...Click onna charts....

http://bigpicture.typepad.com/comments/ ... enial.html

In case ya ain't sure, I'm still cash in the 401a and hedged and levered short in the IRAs and trading account. I trailed the B/P Fund pretty significantly when i tried to get a few last dollars outa a too late/too little attempt to ride the post March bounce. Being all in in the GIC for the lsst month has healed some o' that hurt.

Fanny and Freddie and Indy Mac bank.

Let's look at a banking index. CLICKIT!!

It's prolly gonnna get worse. How much and for how long?

There's the issue...

7/15/08

Everyday, In Every Way, A Little More Worser....CLICKIT!!!!

( 3.1 / 1309 ) ( 3.1 / 1309 )

My Folk Retired In The 80's. My Dad's Pension Had A Cost Of Living Adjustment. Their Savings Were Invested in CD's Paying 10+% And Rental Real Estate. They Did OK. My Pension Does Not Have a COL Adjustment, But I've Got A Plan...

Friday, July 4, 2008, 03:17 PM

For purposes of action, nothing is more useful than narrowness of thought combined with energy of will.

-- Henri Frederic Ameil

Charts and Table Zup On My Site!

This was the week that the world figured out that no game goes on forever and eventually ya gotta tear it down to get at the rot in the walls. Hang on... But CLICKIT first

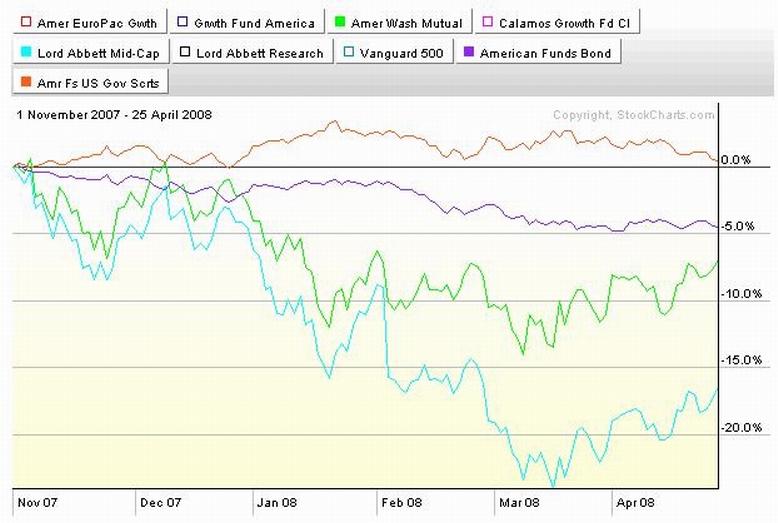

Down 6% in bonds and 25% in the Washington Mutual Fund in 8 months and with more to go. That's just pathetic.

I'm just not totally clear why being defensive and "timing the market", which I do, is the wrong thing to do here. It's not like there was one correct moment to get defensive and that there will be only one correct moment to reinvest in the market. There was/is a certain slow motion aspect to this train crash. Ask the guy's who went to cash before/during/after I did.

Read this!!!

http://www.thestreet.com/files/tsc/land ... pprentice/

But most especially THIS!!!

http://www.thestreet.com/_tscs/comment/ ... 50118.html

And stay tooned 'cuz I might write something here about where my head is at for what comes next. And yeah, cash in the 401 and cash/short the market in IRA's and trading account is a really cool place to watch the crash from. UPDATED 7/7Another Monday. The public gets excited over the weekend with all the "opportunities" of stocks getting cheaper and cheaper. The Pro's sell to the public at higher and higher prices, and then sell some more after the buyers have spent their money. Prices go down, the pro's cover and bank the spread. It looks like this...CLICKIT!!!!  CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash CASH cash That's where I am....      ( 3 / 1486 ) ( 3 / 1486 )

DIT DIT DIT....DOO WAH WAH ... SOMETIME BAD IS BAD....Huey Lewis an' da Gnews.

Friday, June 6, 2008, 09:43 PM

"There is nothing so disastrous as a rational investment policy in an irrational world."

John Maynard Keynes

"Is there a choice in the 401 that I can put my money in and not have to pay attention to it?

Local 342 'fitter

If prices are stable in the short, intermediate and very long term, if society and the economy remain essentially unchanged during your lifetime, if no new technology is ever introduced, if resource availablity and scarcity remains unchanged over centuries, then the whole pension investing thing gets a lot easier. There might be one or more "choose this and look at it again when you decide to retire" choice. But that ain't the world I live in and I suspect it might not be the world you live in either. That leaves us in this world where there is the possibility of major mistakes with catastrophic consequences occurring if we make a bad decision(s) let them run for extended time and and don't bother to fix it (them).

Me

Chartses and table Zup

Prolly some major stuff appearing here by the end of the week end. Bloody week in the stock market, political and economic uncertainty, and the imperative to deal wid' it. Seeya here. Stay tooned...Meanwhile; http://bigpicture.typepad.com/comments/ ... -reba.html     ( 3 / 1456 ) ( 3 / 1456 )

Half theYear Almost Gone. Another Year of Life Slippin' Away. On The Other Hand, BBQ Season is Upon Us. Things Work Out...

Friday, May 30, 2008, 09:42 PM

"Opportunity knocks, but it has never been known to turn the knob and walk in."

English Proverb

Chartz and Table Zup!!I shifted some cash to stocks Friday afternoon. The why and wherefores later this weekend...

UPDATED 6/3 SEE BELOW...

CLICKIT!!

Shown above is the S&P Bank Index. Since 2007, the direction of the index has been down. Since January, the index has found support and has repeatedly bounced off it. Unfortunately, each bounce has been to a lower high. The pattern will resolve at some point. I'm concerned that in light of the oil, economy, debt load, and age of the affluent consumers that the next chapter might be really ugly. Think about it. Yet another crash in the banks. That's why I'm always only 2-3 days away from an "all cash" position in the 401a....See below about the GIC and "cash". So I added some stocks to the 401a. Hey, I'm aggressive by nature and it's a gamble. I think that we're putting in a short term top in the cost of oil tomorrow, next week or next month. I think that there will be a knee jerk reaction to that and the market will spike. So i'll sell if and when that happens. Then I think that hurricane season and damage to the oil infrastructure, the damage already done by credit unavailability (rates don't matter if the bank won't lend), election uncertainty, renewed commodity inflation, things like http://bigpicture.typepad.com/comments/ ... orecl.htmletc, will send the market back down. Call it picking up pennys in front of a steam roller. My situation is somewhat different than many plan participants; I can and have gone leveraged on the short side of the market in my ira's and trading accounts when that's the trend. So down markets can be an opportunity for me overall. YMMV.

5/3 Update;

I reversed the shift from cash into stocks back into cash. I didn't have the conviction to stay put. Gas at $4.60 a gallon is vacuuming away too much money from the consumer. The governments stimulus (giving us back some of our money) is disappearing into the gas tank and groceries and credit card debt. I don't like what I see on main street OR Wall Street. When I gamble, I play craps and I mostly play the place bets with odds. That gives me the closest to straight up odds I can get (50.25% to the house and 49.75% to me). In addition, it is the one bet I can take off of the table at any time. It is the way I invest and trade too. The bet may yet find it's way back to the table. http://bigpicture.typepad.com/comments/ ... a-buy.html Guess What!!!! the offer has been extended until 6/30!!!! Stay tooned.      ( 3 / 1387 ) ( 3 / 1387 )

Never a Dull Moment. Life Is a Never Ending Series Of Thrills Interrupted Only By Moment Of Ecstasy and Bliss.

Saturday, May 24, 2008, 11:52 AM

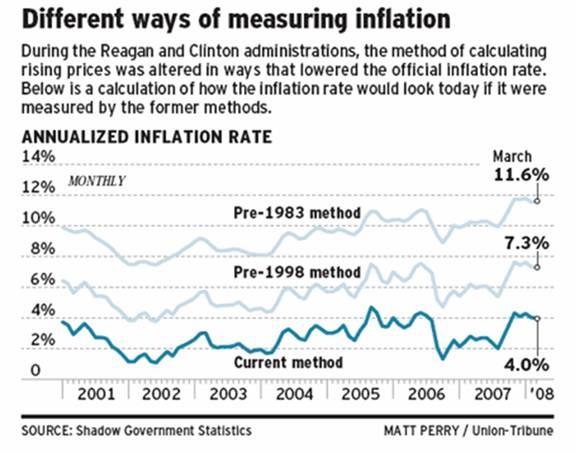

"No emergency can justify a return to inflation. Inflation can provide neither the weapons a nation needs to defend its independence nor the capital goods required for any project. It does not cure unsatisfactory conditions. It merely helps the rulers whose policies brought about the catastrophe to exculpate themselves."

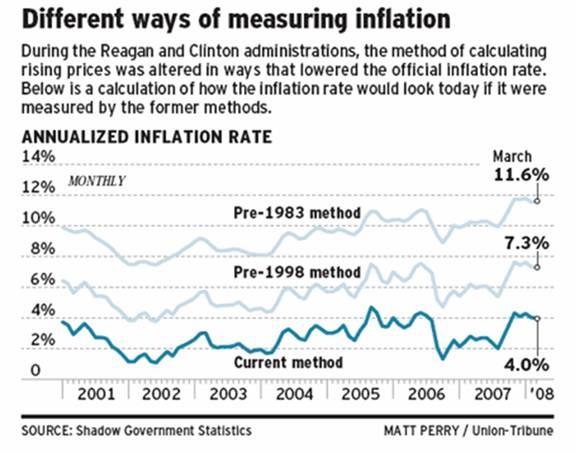

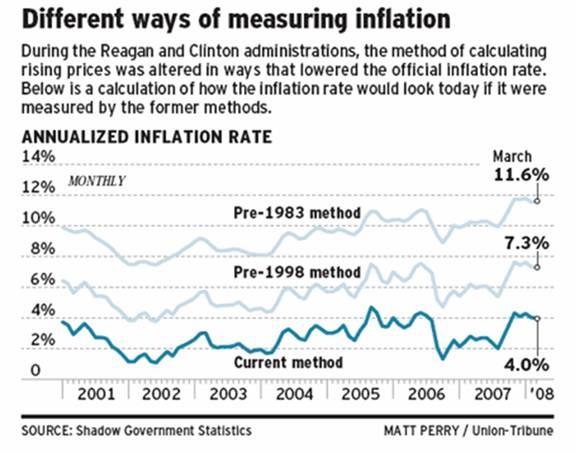

-Ludwig von Mises

CHARTZ AND TABLE ZUP  Our government is less than forthcoming (read "lies")about inflation. To whose advantage do you think the modified statistical measures work out? You know how it goes; Chartz and Table Zup Fri evening or Saturday morning and more here as time an' inclination permit. Long weekend this time around. Ahl prolly take advantage o' it. Know what Ah mean, Vern? Stay tooned....See ya here at the end o' the Memorial Day Holiday. Which is MOST DEFINITELY NOT about the shopping experience many would like it to be. So I'm here and the weekend is over. Log on to the K&G 401a website. Under "My Account" click on "Investment Funds" Click on "Met Life Stable Value" Check out that the "Stable Value" (cash equivalent) fund is actually some equities but mostly bonds and not strictly the highest quality bonds either. Just so you know. As stated and related below, this ain't my first dance and I've seen Chaos and Cratered Financial Markets before. When I "went to cash" on my personal investments in the 80's when things also got gnarly, I went to a Franklin Federal Money Market Fund. The fund held only US Gov securities with an average maturity of less than a week. It held interest paying securities of an entity that had a standing army and the right to tax. THAT was secure. I've currently "gone to cash" for 75% of my 401a in the Met Life Fund. The Met Lfe Fund is secure because they say it is. They "guarantee" (read promise) to pay principal and interest even if they have no money. I'm down wid' dat onna 'counta the Fed. The Fed has said that regardless of the idiocy and self dealing of any and all financial entities, if your big enough, YOU WILL NOT FAIL. Regardless of how much money they have to print or what the inflation rate is. They say that the public will make it good. That's good enuf fer me. So why am I so heavy in cash? We've entered a new phase. Previously; The cratering of financial markets and real estate pretty much left all other areas of the economy unaffected. Now; The cratered financial sector and the cratered dollar and food and oil inflation is affecting the economy. The stock and bond market participants have just figured it out. I'm pretty much set up for the end of a bear market bounce and I may go farther "to cash". I'm thinking "Get Defensive". And this ain't no time for "The best defense is a good offense. Of course, I may be wrong. I'll figure that out pretty quickly once it becomes apparent. Until then...      ( 3 / 1358 ) ( 3 / 1358 )

There are reams of sophisticated fundamental analyses out there that purport to establish what a stock is worth. What you need to realize is that the correlation between a stock's 'value' and the price it is trading at is very loose in the short term. James "Rev Shark" DePorre

Saturday, May 17, 2008, 01:55 PM

Rick: Your cash is good at the bar.

Banker: What? Do you know who I am?

Rick: I do. You're lucky the bar's open to you.

--Casablanca UPDATE; 5/22. I CUT MY EQUITY EXPOSURE IN HALF!!! WAS IT WAS A BEAR MARKET BOUNCE AND NOW IT'S OVER? WE'LL SEE...Chartz and Table Zup!I'm lookin' at buyin' my first $100 tank of gas. I'm lookin' at a coupla dollars change left from a $20 bill to fill up the bike. I'm readin' about the upcoming pass through of food costs to the consumer. I'm reading that Afghan poppy farmers are starting to switch crops. Wheat is commanding a price where growing the feedstock for smack, a long and successful local tradition, is losing it's risk/reward mojo. CLICKIT I'm readin' about the inability of the US Gov to subsidize corn farmers into meeting ethanol production in the upcoming years, no matter how much of my money is spent or borrowed against. Corn into fuel is expected to reach 46% of the US crop in 2015. Which is stoopid. Currently it takes between 3 and 8 pounds of corn to produce a lb of meat animal. What will the subsidy have to be when food costs world wide explode with the emerging of a number of developed markets whose society and eating preferences mirrors the US? See the Afghan farmers above... Currently a barrel of ethanol from corn is $80. A barrel of ethanol from sugarcane is $35. The sugarcane lobby is a lot weaker than the corn lobby. If it wasn't, we'd be growing/importing sugarcane. Any doubt which way US energy production is driving food costs and why it smacks of gasoline on the fire of food cost inflation? Hey, did you know that natural gas and energy are the main feedstocks of fertilizer? So that adding new arable lands from less preferable farmland to replace the good stuff lost to subdivisions built with subprime....nah, not goin' there... costs bigtime in energy and takes years to get up to speed productionwise depending on how much fast costs? Get used to oil/gas/energy and food costs running in parallel for the foreseeable future. Also for productivity to fail to match historical norms. The Sacramento delta farm land is becoming Stockton and ain't comin' back. Think food cost inflation. CLICKIT Maybe this explains why I'm not taking my pension early and locking in a large portion of my future income to a fixed amount for an extended period of time. CLICKIT I can't hardly contain my concern. Maybe being informed is the problem. Maybe if I just trust that other people know better and they will do what is best for me. Ya think? Early retirement does beckon though. If I could predict the future, I'd be a lot more confident about how early is too early. Ya see, I expect to eat, stay warm and cool and drive too. The risks of running out of pension early may be huge. Thanks to John Mauldin and Barry Ritholtz, who like the white rabbit used to do, "feed my head." COFG      ( 3 / 1358 ) ( 3 / 1358 )

There's Something Big On the Horizon...Stay Tooned!!!

Saturday, May 10, 2008, 01:25 PM

Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present. -- Marcus Aurelius

ChartZ and Table Zup!

A New Post Has Appeared On My Website @ The "Reforming A Pension Plan From The Outside" page.

I'm way busy and I wish I could post at length, but it ain't happenin'.

I have gone to 75% cash in the 401. The short version is;

This time it's different

We're about a quarter of the way into a consumer and housing led long and HOPEFULLY shallow recession. We came through a mostly jobless recovery and we're falling from no great height. As long as you aren't a realtor, mortgage broker, or SUV salesman.

Low inventory levels, cautious capital expenditures, the offshoring of manufacturing, and world wide growth are keeping corporate and business activity afloat or in some cases, on fire. And, as long as you don't work in real estate, housing, or Detroit, jobs probably can be kept. Your dicretionary cash may be pretty sparse once you've filled the tank and bought groceries, but life goes on.

The economy is sucky in some spots and surprisingly strong in others.

The same with the market.

Government statistcs on inflation and jobs lie.

Stocks are up on low volume. Up is good. Low volume is not.

We're in a bear market bounce. we're up nicely but downside risks loom large.

I'm 25%/75% stocks/cash based on caution and distrust.

I'm careful. I wanna keep what I got and when I do let my cash out, it's onna short leash. There will come a fabulous time to go back to 95% stocks. It ain't now.

[ view entry ] ( 1014 views ) [ 0 trackbacks ] permalink      ( 2.9 / 1373 ) ( 2.9 / 1373 )

One Step At A Time....Time For The Next Step

Friday, May 2, 2008, 08:21 PM

October: This is one of the peculiarly dangerous months to speculate in stocks in. The others are July, January, September, April, November, May, March, June, December, August and February."

-- Mark Twain

ChartZ And Table Zup!

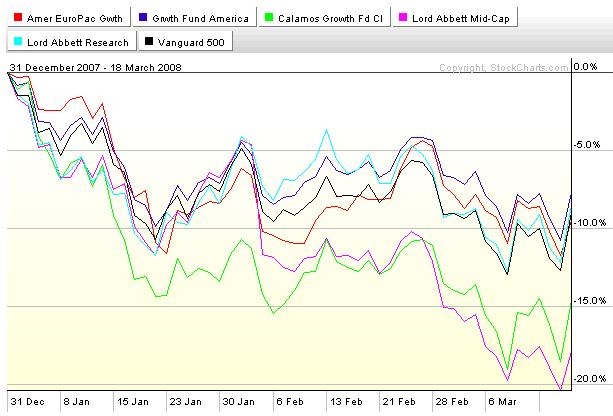

Updated 5/5

So... Got my '07 pension statement and I'm distinctly unimpressed. I work across from too many participants in other locals and other trades who have a lot more to show for a lot less money contributed for a lot less years. But then you know that. Hell, check out the benefit rate earned in the mid 80's on this year's defined benefit statement. It was over $100 for a number of years. Also check out the rates earned in the 90's... especially 1996. In 1996 we earned $40 pension credit for a year's work. That's 1/3rd what we earned in 1984. And today we still earn a skosh less than what we earned in 1984. Is that totally reasonable? I'd have to see it to believe it....Wait, I DID see it. I just don't believe it So what I gotta do is clear to me. I gotta work the money in my 401a extra hard 'cuz there was too much opportunity lost over too many years in both the defined benefit and the defined contribution not to... Check dis out....CLICKONNIT   The first chart is first of the year to the most recent bottom. Below are posts explaining why and how we got there. BUT, something kinda unexpected happened after that. The Fed did not slash interest rates to the bone, cratering the dollar, and setting up the next bubble. Instead, they cut interest rates just about as much as the currency markets could handle and then started exchanging treasuries for toxic paper from everyone that they thought were worth saving. So..... the daily market volume has been anemic in the extreme 'cuz the big money is standing by waiting to see what happens. The quick money has been buying and selling and the dumb money has been buying, both together driving the market up a wall of worry and burying the shorts on low volume squeezes. As posted below, I'm exremely cautious and I've got a coupla three years profit to protect. But the recent runnup is a trend... but it's a mature trend that has risen without much of a break or consolidation, and it's approaching resistance. So, do I chase the market after it's already made it's move, or do I sit out the rest of the move and hope the rest of the move is measured in days, not years? Trends persist far longer than is reasonable or expected... and the market works to pull in all the innocents and suckers so the smart guys can load them up and then pull the rug out from under them.... What to do?

I used to think I was indecisive, but now I'm not so sure....

Tomorrow I might put a little more money back to work in the good funds, not much mind you. No more money than I can get out in a day or three if I tick the top.... or I might not cuz it's late in the rally and there will be a better time to buy.. I'll let you know. http://bigpicture.typepad.com/comments/ ... check.htmlhttp://bigpicture.typepad.com/comments/ ... trend.htmlUPDATE;I've gone from 7% stocks to 30% stocks this afternoon. We'll see....      ( 3 / 1311 ) ( 3 / 1311 )

MONEY WON'T BUY HAPPINESS, BUT IT SURE DOES FACILITATE IT......

Friday, April 25, 2008, 10:34 PM

Chartz and Table Zup.

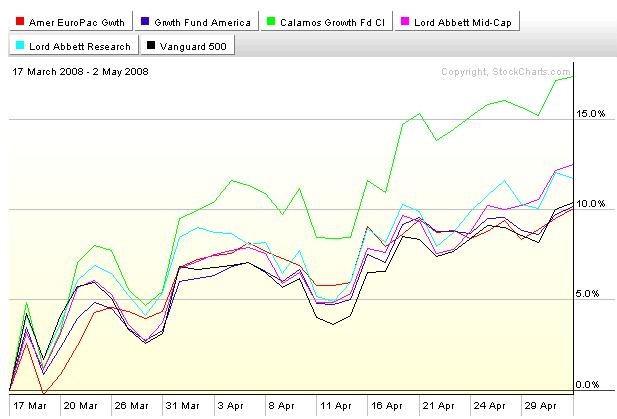

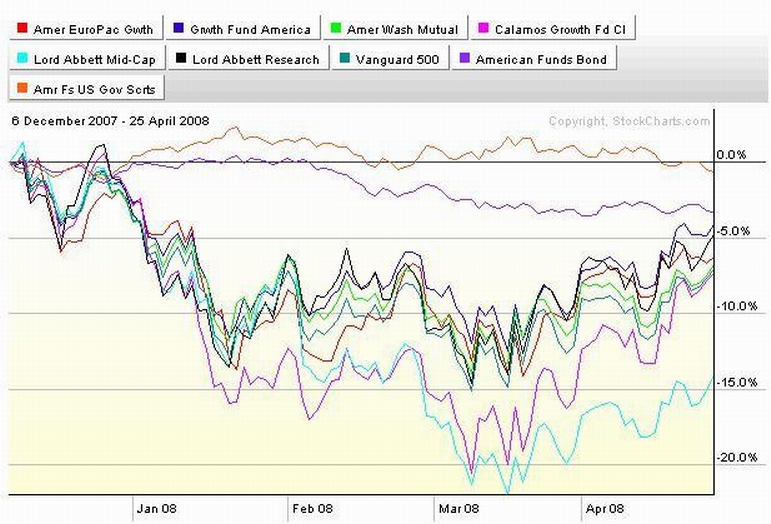

"The market is not a sofa, it is not a place to get comfortable."

Jim CramerYou know about clickin' on these....right?  an' this  The first chart is what I, in part, dodged by going/being ready to go to cash when the multi year upcycle/debt and mortgage bubble bull market ended in Nov 07-Jan 08. You make money if your investments go up, or if your investments hold their own as everybody else's goes down. That said, is the upturn in the 401a fundz that started in mid March a bear market rally or a dead cat bounce off a short term bottom, interupting a multyear downtrend? Or is showing clear sailing up and away now that we've corrected and hit THE longterm bottom? I suspect that there is more ugly to follow. So I got a plan for it in place; big time cash in the 401a Met Life GIC for the foreseeable future. But I'm also readin' an' chartin' to see what actually happens when the future gets here. If I'm wrong about predictin' the future, that means being ready to bail on one plan and put another in place, if that's what's called for. The second chart shows two 401a stock fundz that I've identified as really dumb places to put my money. I've made money anytime I didn't put money in these two fundz. The chart also shows the performance of a 401a bond fund that illustrates that if you don't check things out, you can match limited upside performance with significant downside risk and get exactly that in a really short time. The second chart also shows the performance of the ultimate fear fund, the American Funds US Gov Securities Fund. I've got a huge proportion of my 401a currently in the Met Life GIC. That is a bet, nothing more or less, that Met Life won't blow up. It is based on the ongoing Fed bailout of the overleveraged financial system. My position in the GIC is owning an x dollar promise from Met Life to pay me x dollars on demand, and nothing else. I believe that the Fed sees that Met Life not keeping that promise to me as the financial equivalent of nuclear winter. So I believe that the Fed WILL see that a Met life default won't happen...... well, prolly won't happen. On the other hand, a position of x dollars in the US Gov Securities Fund is owning x dollars of the securities of a financial entity with huge financial and real estate assets, guns, soldiers, police, tanks, bombers, and a treasury with the right to tax and print money. THAT'S a SAFE place to put your money. But the US Security Fund doesn't pay much. In the 80's, when things got REALLY bad, I had my cash in a US Gov Securities Money Market fund where the average maturity of the holdings (100% US gov securities) was under a week. That's as close to cash in hand as you get and payed just about as much. Been there, done that. So I'm in the GIC because it earned 4.75% last year vs the Fed Security Fundz' 1.2%. I'm rollin' the dice 'cuz I'm not that scared yet. YMMV cuz' we only share certain goals/mindsets/risk vs rewards tolerance etc... See ya at the hall....      ( 3 / 1405 ) ( 3 / 1405 )

Your government lies to you. Does inflation seem under control to you? You do drive and eat...right?

Friday, April 18, 2008, 10:03 PM

"Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless."

Milton Friedman

I don't make this up about your government lying to you. Check this out... http://bigpicture.typepad.com/comments/ ... ng-ec.htmlAND http://bigpicture.typepad.com/comments/ ... sions.htmlAND http://www.nytimes.com/2008/04/19/business/19chart.htmlAnyway... ChartZ and Table Zup.http://www.sfgate.com/cgi-bin/article.c ... 106LQH.DTLLocal inflation... So I'm short of time lately, but here's what I got.... The market has looked like hammered dog shit this year. Check out the 401 mutual funds and other stock charts. For the last three years, I've been riding stocks up in my 401a. In January I started to step to the side and told some co workers about it. They bailed out into the GIC and they look real smart/lucky. I tried to pick up the last few pennies in front of the steam roller and I'm a little flatter for the experience, but I've done good since 9/04. There is smoking ruin at the banks and financial companies, and it's much worse than you've been lead to believe. The Fed finally figured it out and has let the markets and companies know that; 1) They will engineer a coverup as needed. Bear Stearns didn't go bankrupt and have to open their books to a judge, The Fed gave(loaned) JP Morgan enough money to buy them over the weekend. The public didn't see the books. There's more, but time and space....ya know. Anyway, the Fed will keep the banking system afloat until they've earned/written off enough over a long enough period of time to put the problems in the rear view mirror. 2) They will shift the burden of paying for it onto the public by engineering inflation. Money will be printed to paper it over. You HAVE read the links above, right? Got it? Business is gonna suck. Hugely over leveraged credit blew up this year. Read prior posts below... So these credit cowboy guys are gone. Some hedge funds/banks/SIV's etc were levered up 5 to 30 times. A billion dollars was behind as much as 30 billion of loans and business. Thirty billion of loans is left suspended as the billion dollars is vaporized. Even if the Fed turns a blind eye/floats/postpones/papers over these loans, ya ain't gonna have the credit cowboys anymore to support new loans. Welcome to deleveraging. Ya got roughly 3 million too many homes (1 million of them empty) to get rid of. Whose gonna throw good money after bad when the bank examiner may come knocking?Get used to houses going for so little that even a recently singed loan officer has gotta realize that there is little risk to a loan. Energy and food are getting bought away from us by the rest of the world as the dollar falls. The rest of the world has figured out that the printing presses are gonna go 24/7. Well, it's bad. But not without hope. This is not a manufacturing/inventory issue like we used to have. No wholesale layoffs in manufacturing; that happened years ago. There's WAY better inventory control; this is the other side of computer based inventory control/just in time manufacturing. What jobs we have are in parts of the economy that MAY stay good. The dollar's cheap, we're able to export big time to the rip roaring material and manufacturing economies elsewhere. I own Catapiller in an IRA. They reported earnings last week. WAHOO!!!! 'Sides, I'm a pipefitter and the oil companies got bucks, like in '75 and the early 80's. Been there/done that, it worked out pretty well. So. here's the way I'm gonna play it. Certain stocks will do well. Others will suck bigtime. Markets will be REAL volatile. There will be a year long or multi year bear market as things work themselve out. There will be vicious bear market rallys as the boyz in the pits stampede the rubes when everybody gets comfortable on the downslope. We'll go down for three weeks/months into a big hole and a two/ten day rally will get us halfway out of the hole. And then we'll go down again..... Sounds like the safest play is cash in the 401a to me. I'll keep what I got saved/made. I'll worry about making more money when the market starts going up on more than short covering panics and dead cat bounces. Or I'll try to make some money in my trading account where I don't have rapid trading restrictions and I can look for things like oil trusts, MacDonalds, and CAT. Of course I could be wrong. It's hard to predict the future and you can't always be right. Maybe it's straight up from here starting now/three/six months from now. It's not a financial sin to be wrong when you try to put a strategy in place for the future. The sin is committed by staying wrong when the future gets here and isn't what you've expected it to be. Stay tooned...      ( 3 / 1330 ) ( 3 / 1330 )

Tuesday after lunch...sidereal time.

Saturday, April 12, 2008, 01:29 PM

The ultimate result of shielding men from the effects of folly is to fill the world with fools.

--Herbert Spencer

Chartz and Table Zup!!Been gone. Not Long Gone. Just work and taxes and personal stuff. And a 95% cash position frees up the mind and shoulders remarkably effectively. If that 95% doesn't square with what you see on my 401 worksheets, itz cuz I've got a pair of IRA's and a trading account as well as a 401a. They are each way cash. And the 401 is gonna get cash heavy too. CHECK THESE OUT; CLICKON 'EM   Gary Dvorchak at Realmoney.com notes that if you invested $1000 in the Russell 1000 Growth Index (American growth stocks) in 1999, you'd have $947 today. He notes that this is BEFORE the big 2000 run up for a real, fair, no cheatin' view of what big cap American passive growth stocks investing looks like. My chart service allowed me to look at the Russell 1000 Mutual Fund and the S&P 500 Fund from May 26th 2000 to now. Same thing. A lot of exposure to risk and breaking even or looking like a turd in a punch bowl to show for it. Gary also looks at what you'd have if you just picked out great stocks of great companies like Intel, Motorola, EMC, AIG, and Microsoft. That's the second graph. Gary says that there are times when "Buy great stocks of great companies and hold them or buy the stock market because long term, stocks do really well." just doesn't work. See our experience with McMorgan Funds. If you are gonna work for 100 years, and retire for 10, buy the market. That's a long enough "long term" and short enough retirement for you to ignore your retirement money. If you aren't going to work for 100 years and retire for 10, ya GOTTA watch what's happening. That's why I've taken care of business for myself since 9/04 and why I'm protecting what I got to show for my work. Check out my worksheets. THAT'S WHAT I'M TALKIN' ABOUT.... Speaking of going down in flames, look at the first chart for the time period of 2000 to 2003. That's what a bear market looks like. The trend is down and periodically it gets overdone. Someone yells "Fire" in the crowded theater and everybody blows out short positions and loads up on stocks. Ya get a vicious bear market rally that gets the serial bottom callers foaming at the mouth. The sharp guys short stocks to retail buyers, the little guys load up, the boyz at the pits jam the market down and cover the shorts with stock that the retail investor blows out at a loss.. And then the bear market that was in progress, continues down. I spend a lotta time reading arcane investment stuff in order to learn enough to avoid doing stupid things and to occasionally do the right thing. It's way too much and way too dynamic for me to synopsize here on a regular basis. But I'm not shy about telling you what I'm doin' with my retirement money based on what I think. And that's to be BIG TIME and going bigger in cash for the 401a. I reserve the right to try to pick up pennies in front of steamrollers in my trading account, but that's because don't race motorcycles anymore and I fill my quota o' crazy in a different way. That's not food and shelter money for when I'm old that I'm riskin'....      ( 3.1 / 1408 ) ( 3.1 / 1408 )

The smoking wreckage of the financial markets....Hm.... Smoke? Springtime sunny weather?....Time for a BBQ? I'll go buy the beer and I got charcol and hickory and cherry already....

Saturday, March 22, 2008, 02:07 PM

"Panics do not destroy capital; they merely reveal the extent to which it has been previously destroyed into hopelessly unproductive works."

John Stuart Mill,

Charts and Table Zup...

Time to do the deed;

Way past actually;

Here's whatzup;

UPDATED 3/23

The dotcom crash happened. Lots of smart guys with money took a big hit, but they had money left over that they needed to do something with. Alan Greenspan never saw anything unpleasant that couldn't be papered over with more money and lower rates so he flooded the market with liquidity and squashed rates JUST LIKE HE ALWAYS DID. There was money to loan everywhere almost for free. The post dotcom recession was almost played out when 9/11 happened. Lower rates and more money was an easy answer. Rates gor down to 1% for the banks and 0% for me. The economies of Brazil, Russia, India and China (BRIC) started to take off. They had resources, and educated populations and the need to develop. Worldwide, other nations realized that once the BRIC nations joined the US as economic super powers, they would be reduced to economic and political footnotes. So they kicked it up and the world finds itself with a multitude of nations in a race to develop from a resource and labor rich economies into a modern comsumption based societies. Now everyone was joining in the new millenium economic revolution. So there was money everywhere for free, and there was worldwide development leading to worldwide consumption and it was gaining speed.

So individuals in the US started to borrow cheap money to buy a house or to refinance their homes and take money out and spend it or invest it. Financial markets have a component called velocity. A financial entity loans out all its money in real estate 30 year loans, gets fees, and collects payments. New money like new deposits make new loans possible, but existing mortgages lock money up until they are paid off in 30 years or when the current mortgage is replaced when a owner moves or dies. you make money, then you wait. There is little velocity. So what if you could unlock the money by selling the mortgage? Then you could loan the money out again, get another round of fees, sell the mortgage and do it again. Money velocity is hugely multiplied. Every house sale now longer locks up capital for longer than a few months. The money starts to slosh around and chase assets higher. Housing valuations took off.

But who ya gonna sell the mortgages to? Enter the rich guys burned by the dotcom crash but with money to invest. These guys want 15+% a year with perfect safety. How ya gonna sell these guys a buncha 6% mortgages? Here's how. You give the appearance of diversifying for safety. You package a buncha mortgages from different areas and different quality together. Prime mortgages in Detroit, subprime from San Diego, Alt A mortgages from Key Largo. See, they all can't go down at the same time. Ya got a $100 mil package of mortgages that yield 6% overall with the prime giving you security and the subprime giving you the 9% pizazz. Default rates are low 'cuz ya got a lotta money chasing prices higher. Can't make the mortgage? Refi at a higher price and lower rates and take money out. Defaults are an opportunity to resell the property at a higher price and charge a new round of fees. These are can't lose assets for 5 years. So why not leverage these "can't lose" assets to boost the yield; Use the $100 mill package of mortgages as collateral to borrow another $100 mil. Buy some more mortgages. And some GMAC paper, and some Winnabago paper, and some Harley Davidson paper. Leverage those loans to buy some more mortgages and some....... Now ya got $100 mil holding $300 mil of paper yielding 18% on the original $100 mil cash investment and paying only 15%, just in case. You also sell these packages to pension plans and to municipalities and anyone who would otherwise buy a bond.

The only problem with this is, "What if the assets held drop?" Ya got $100 mil of cash backing up $200 mil of loans. That's a 1:2 leverage. If the $300 mil of assets drops 15%, that $45 mil of money evaporated. That's almost half the actual money backing up the holdings. If I was the source of the loan, I'd want to see $50 mil more in cash to replace what was lost and I'd ask to see $100 mil of the portfolio sold to reduce the leverage from 3:1 to 2:1. Say it takes selling 40% of the portfolio to sell $100 mil rather than 33% 'cuz it's not worth what it used to be.. Now the investors find themselves not with a one time payment of $100 mil to get 15% return on a SAFE investment, but having paid $100 mil plus $50 mil to keep a $150 mil portfolio afloat that pays 10% and furthermore is the source of rumors of defaulting, suspending payments or cutting the payout to 5% or lower. The call goes out to "GET ME OUTA HERE", and the market is flooded with inventory that can be bought ever cheaper the longer you wait. Think death spiral.

To be continued this week as time and circumstances permit.....

[ view entry ] ( 1068 views ) [ 0 trackbacks ] permalink      ( 3 / 1408 ) ( 3 / 1408 )

Saturday, March 15, 2008, 10:16 PM

Charts and Table Zup... The table's got issues but I'll fix it later.... CLICKIT!! Bear Stearns. I owned some in an IRA account last year at around $150 a share. I bought it cheaper. It traded down to $30 Friday and BSC was sold to JP Morgan this weekend for about $2 a share. That's one seventy fifth what it was worth 10 months ago and one fifteenth what it was worth Friday. It's not a sale, it's a liquidation and some kind of under the table guarantee of debt. Gonna be a bloody market on Monday....BSC loaned a huge amount of their and other peoples money to heavily leveraged funds who've gone belly up. The question is who and how many Ibanks, funds or banks are going down with them.... The non government bonds in the pension funds will probably get hammmered at least temporarily. The stocks will crater. By now you will know what you should have done. I'm; 75% GIC Met Life 16% going to 10% in RERFX, I was in the offshore fund as a weak dollar play. Offshore markets collapsing this evening. It sounded like a good idea at the time and was in theory. But it wasn't much at risk, I pulled some out last week, and I'm looking for the all clear to go back in at some point. That points way way closer than it was Friday.... I'm tellin' ya what I'm doin' but I'm too busy and it is moving too fast for me to find the time to tell you why. So it goes. Too many hours trying to get the job done to tell the story. Soon.... 3/18/08 CLICKIT!!!!!

TREMENDOUS UPWARD MOVEMENT, EXPLODING UP, WAHOOO!!!!

That gets us up to where we were a week ago....     ( 3 / 1400 ) ( 3 / 1400 )

Tuesday, March 11, 2008, 08:16 PM

"Do not dwell in the past, do not dream of the future, concentrate the mind on the present moment."

--BuddhaCLICKIT!!!!!  March Eleventh 08 "ROCKET UPSIDE FABULOUS DAY!!!! AKA plain ol' short squeeze... Made it all the way back to even w/ five days ago. Still inna hole.... Still all in GIC. Even sold some more tag end stock funds. More after the upcoming weekend.      ( 3 / 1338 ) ( 3 / 1338 )

Watched the Tom Dowd film on IFC. From the Manhatten Project to Coltrane to Charles toFranklin to Pickett to Derrick and Duane. WOW!!! Almost makes me regret the Not Just Another Rennaissance Man riff. HE was an Ren man.

Thursday, February 28, 2008, 07:52 PM

"No emergency can justify a return to inflation. Inflation can provide neither the weapons a nation needs to defend its independence nor the capital goods required for any project. It does not cure unsatisfactory conditions. It merely helps the rulers whose policies brought about the catastrophe to exculpate themselves." -Ludwig von Mises More on Tom Dowd... http://en.wikipedia.org/wiki/Tom_Dowdhttp://mixonline.com/mag/audio_creams_sunshine_love/More to come... http://www.cnn.com/2008/LIVING/personal ... index.html     ( 3 / 1388 ) ( 3 / 1388 )

<< <Back | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | Next> >>

|

|

Calendar

Calendar