| |

Internet Issues..... But the fact that I posted that, means.....

Thursday, May 31, 2012, 03:01 PM

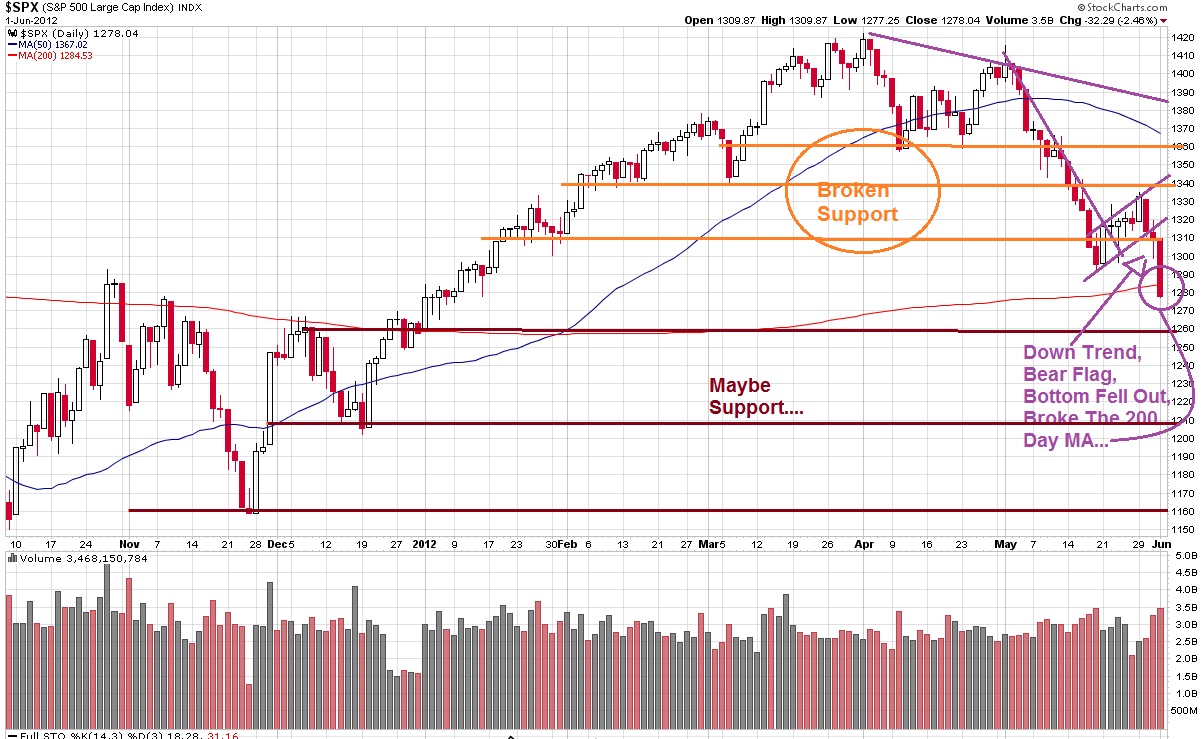

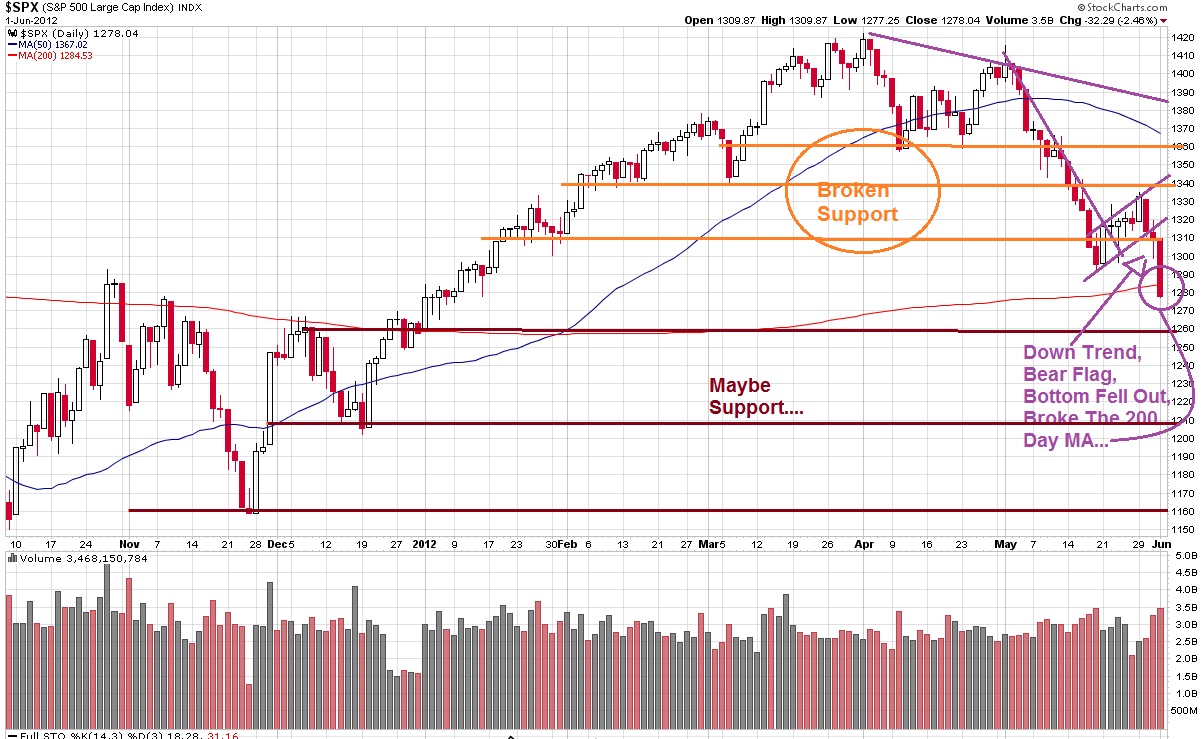

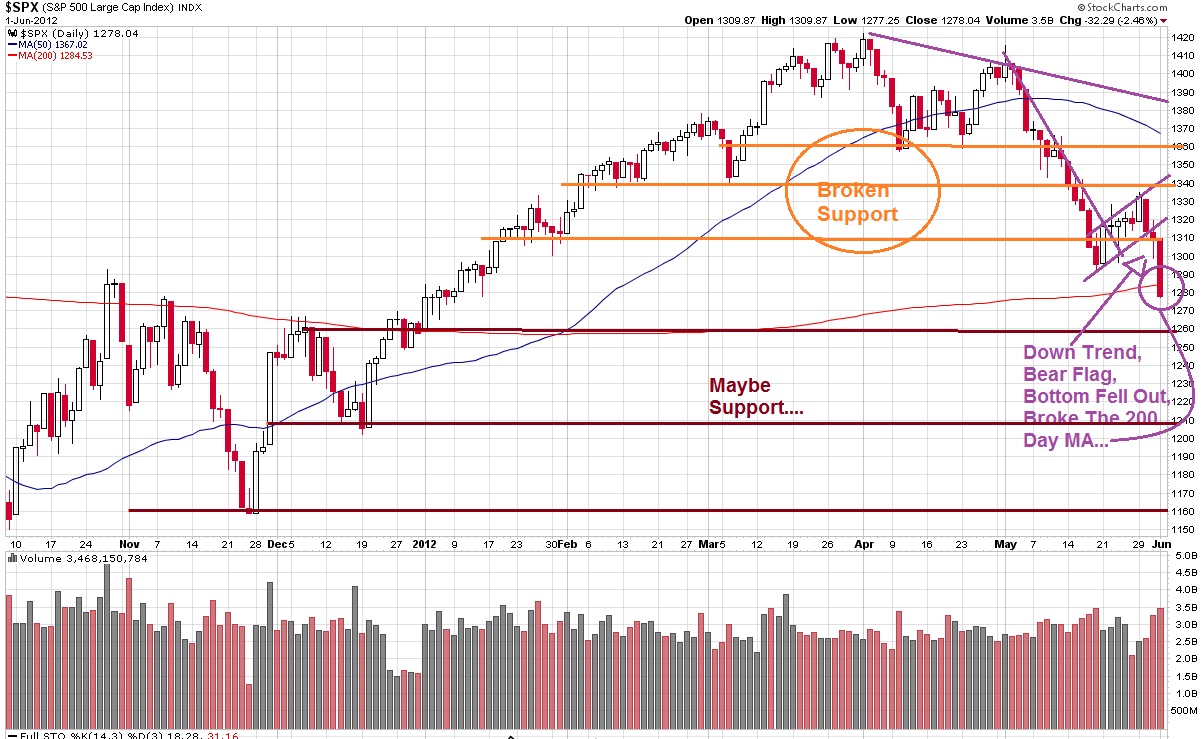

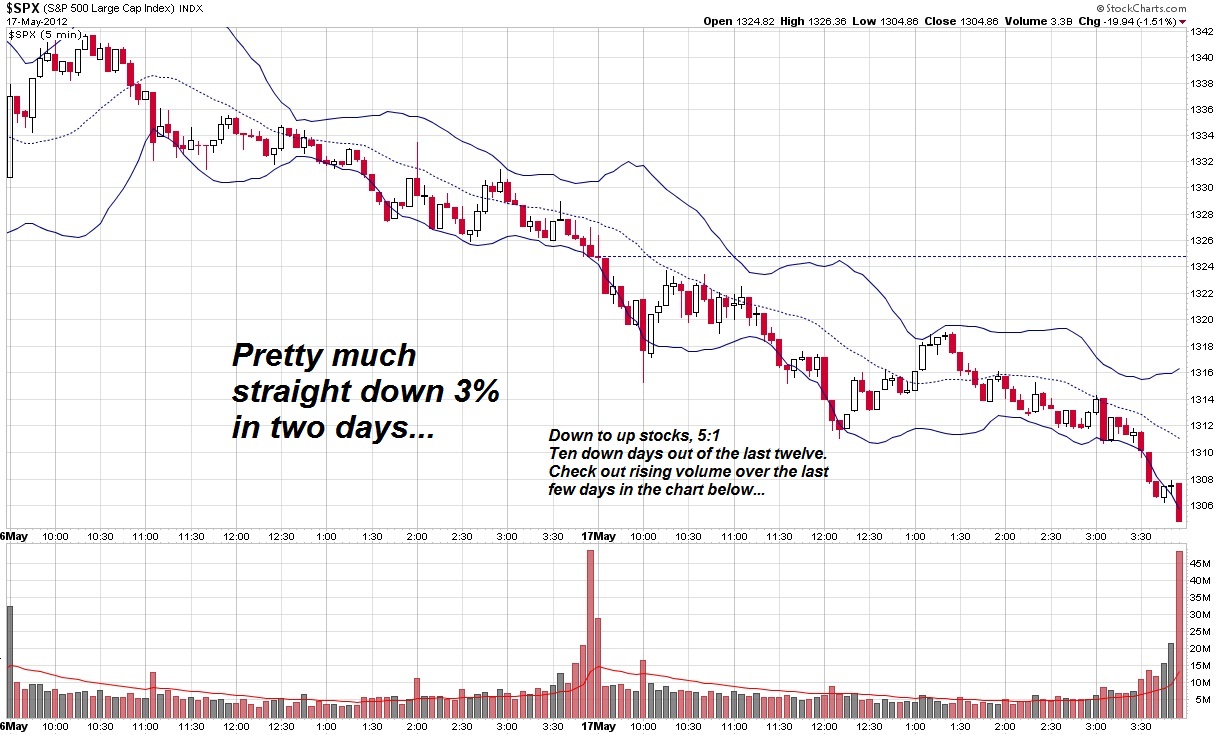

Thursday Not much changed... Lookit da S&P..... Friday, Well... That unemployment report qualifies as a change.... Cash and bonds inna 401 work fo me.... CHECK IT OUT. STAY FLEXIBLE W/ DOUGIE, AND MAKE NO MISTAKE... SOMETIME INNA FUTURE, I WILL GO WAY LONG AGAIN... I DUNNO WHEN, BUT THAT IS THE OTHER SIDE OF BEING 95% CASH/BONDS INTO TODAY's BIG DOWNDRAFT. http://seabreezepartners.net/letters&am ... p;catid=15http://dealbreaker.com/2012/05/warren-b ... ent-ideas/http://www.ritholtz.com/blog/2012/06/contagionex/Don't think for a minute, that with $150,000,000 on the line, your health and well being might not be onna line right next to it.... http://www.bloomberg.com/news/2012-05-3 ... llion.htmlhttp://www.thereformedbroker.com/2012/0 ... s-middles/ 6/4/12 All Bonds And Stable Value. Stay Tooned...      ( 3 / 1415 ) ( 3 / 1415 )

There Is No Point To Making Money In The 401 If After Every Rip, I Give It Right Back On The Next Dip. "Deer In The Headlights" And Passive Acceptance Are Not My Preferred Modes Of Operation....

Saturday, May 19, 2012, 01:07 PM

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

--Herm Albright

Sometimes ya turn yer back onna favorite burger shake and fries and go for some duck breast tangerine ginger Marsala and scallops poached in butter, garlic, and shallots.

http://www.youtube.com/watch?v=p4IMMaF7 ... re=related

http://www.youtube.com/watch?v=Jeq-BTGbJKE

http://www.bloomberg.com/news/2012-05-1 ... ising.html

The more I think about the events of the last two weeks, the more I think that we're simply at an all-time low. The meltdown in Europe, the quick 8% savaging of US stocks after a fairy tale Q1, the utter failure of Facebook's IPO to do a single fucking thing for the markets or the retail investing public...it's all just garbage.

J. Brown http://www.thereformedbroker.com/2012/0 ... -time-low/

Useful input. Valuable with a pull date and a limited area of use. No more. To be looked at through the lens of time and experience accepting that we are in a multi variant reality where reality is a process and value is time and personal space variant.

http://www.forbes.com/sites/philjohnson ... bookstore/

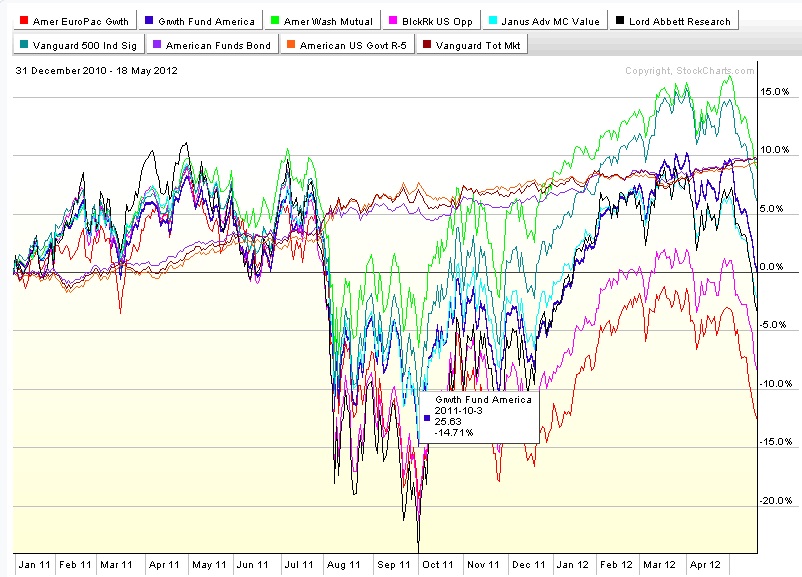

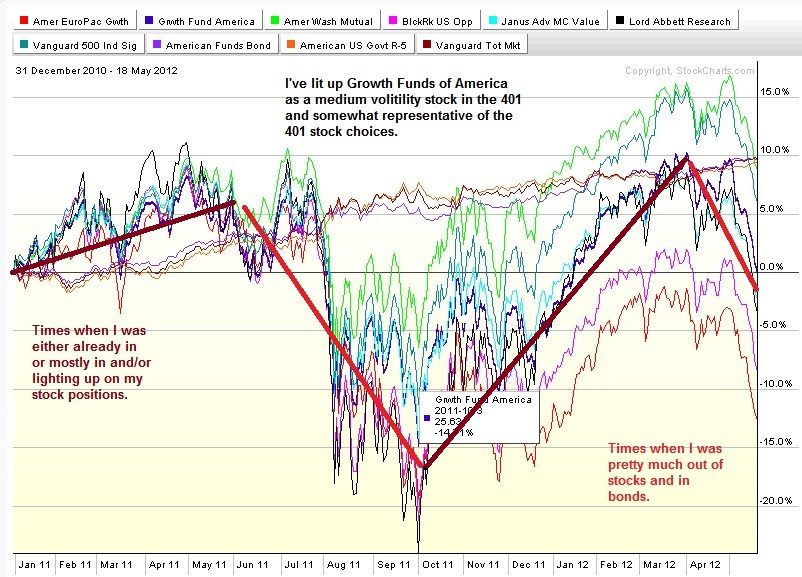

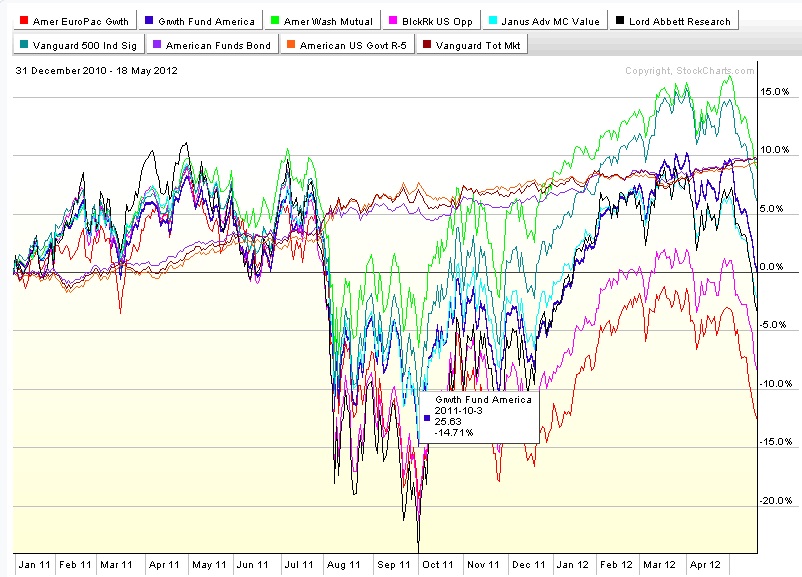

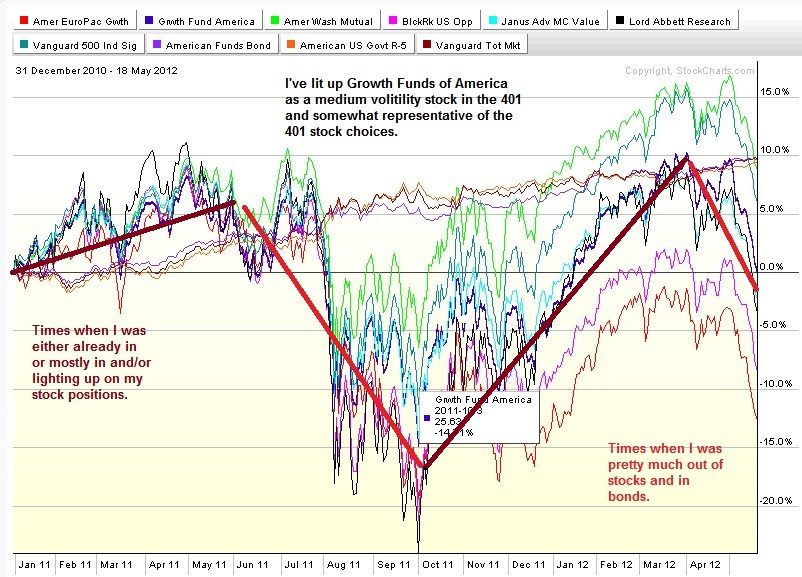

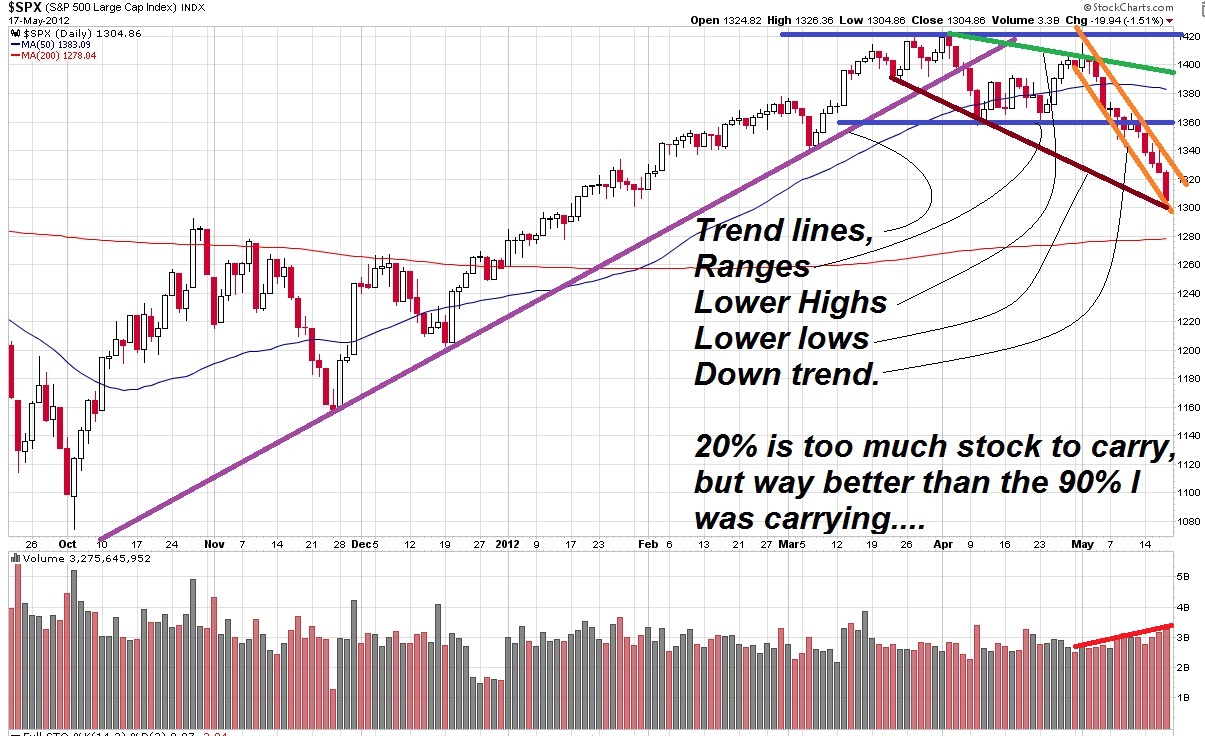

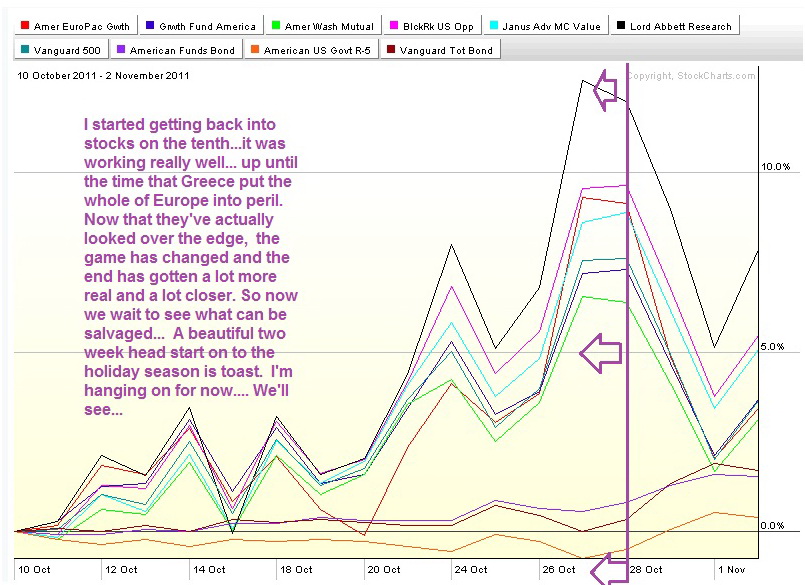

I'm not as good nor is it as easy as it looks. I watch for trends to develop and as Rev Shark says, "You try to catch most of the move." Playing the major trends and ignoring the meaningless noise costs me the start and finish of the major moves while I wait to make sure they are for real. The rapid trading restrictions puts me in partial positions for the start of the up trend as I try to reallocate responsibly within the restrictions, and it makes me way too heavy while I try to get out during the down trend. Still, over the last 17 months, I caught part of a 5% up move, avoided most of a down 20% move, caught part of an up 20% move, and I'm holding 10% stocks and going lighter during the current down trend. It's work, but what was scrambling for pennies in front of a steam roller years ago has now morphed into keeping a significant part of my retirement retirement money from taking a substantial hit on these swoosh downs.

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

-- George Soros

( 3 / 1424 ) ( 3 / 1424 )

For there's a change in the weather, There's a change in the sea, So from now on there'll be a change in me. There's A Change Inna Market, There's A Change In Me, Gonna Try To Keep A Dollar, Just You Wait And See...

Sunday, April 8, 2012, 03:09 PM

"It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong." -- George Soros

http://www.youtube.com/watch?v=DDOIL5Oq ... re=related

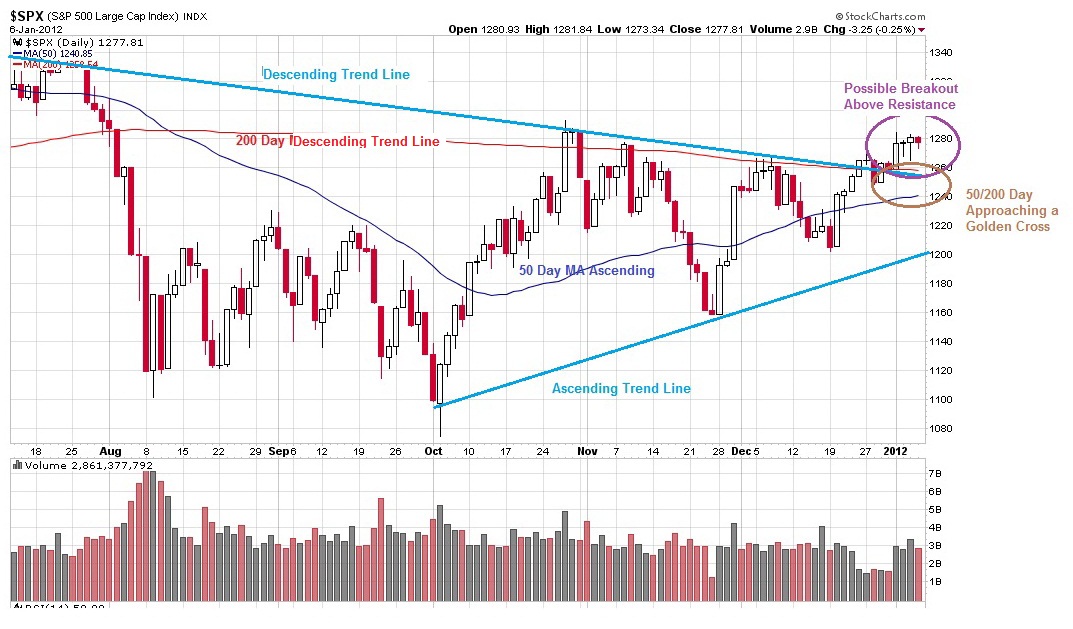

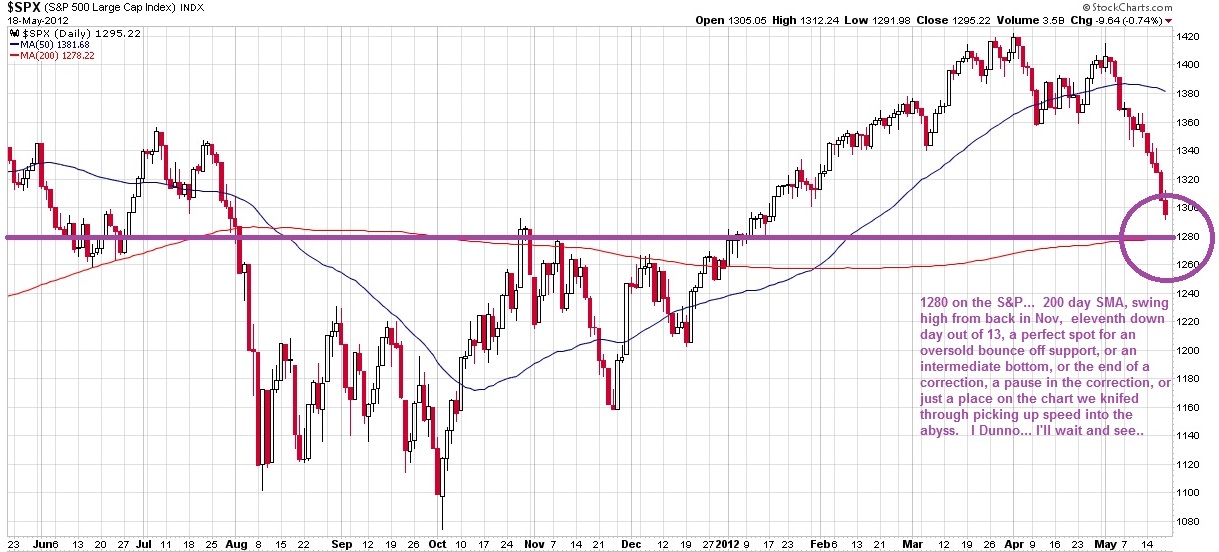

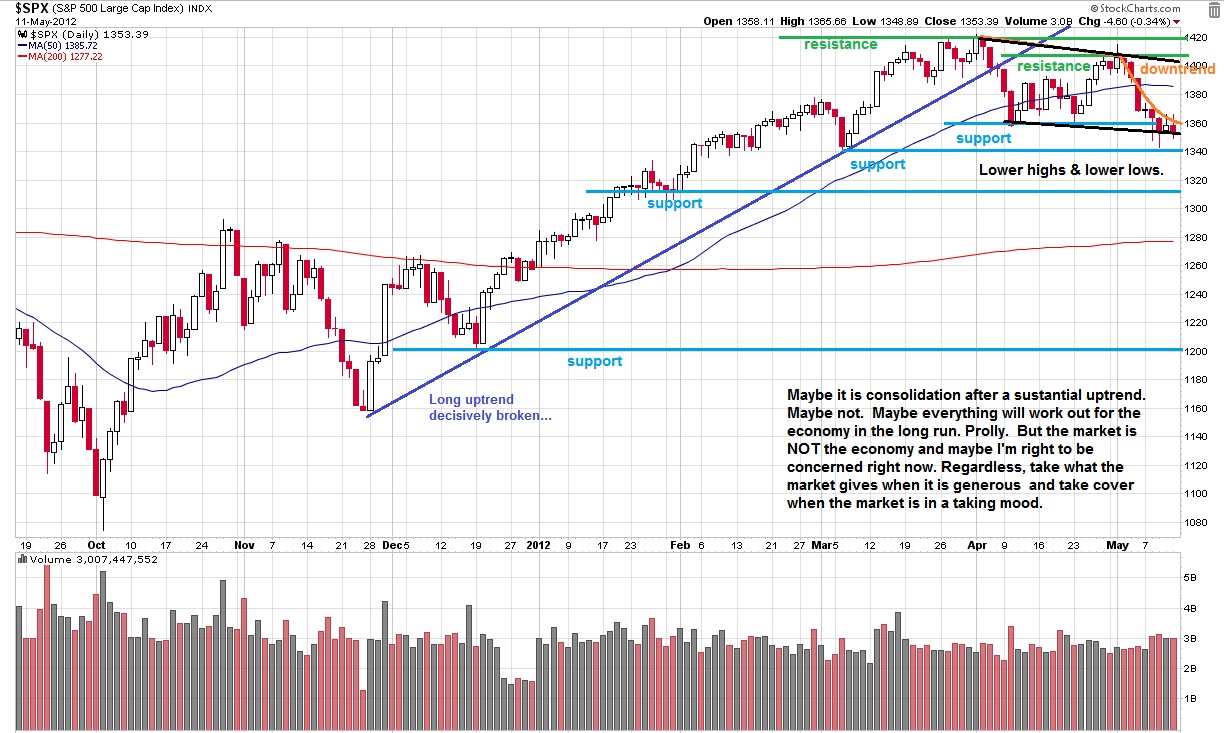

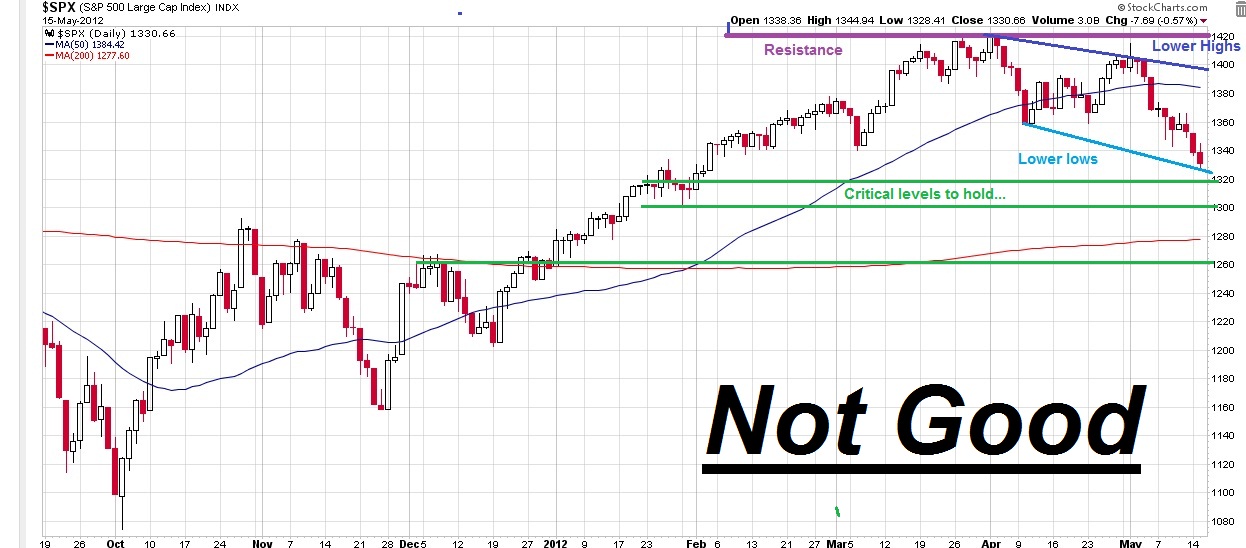

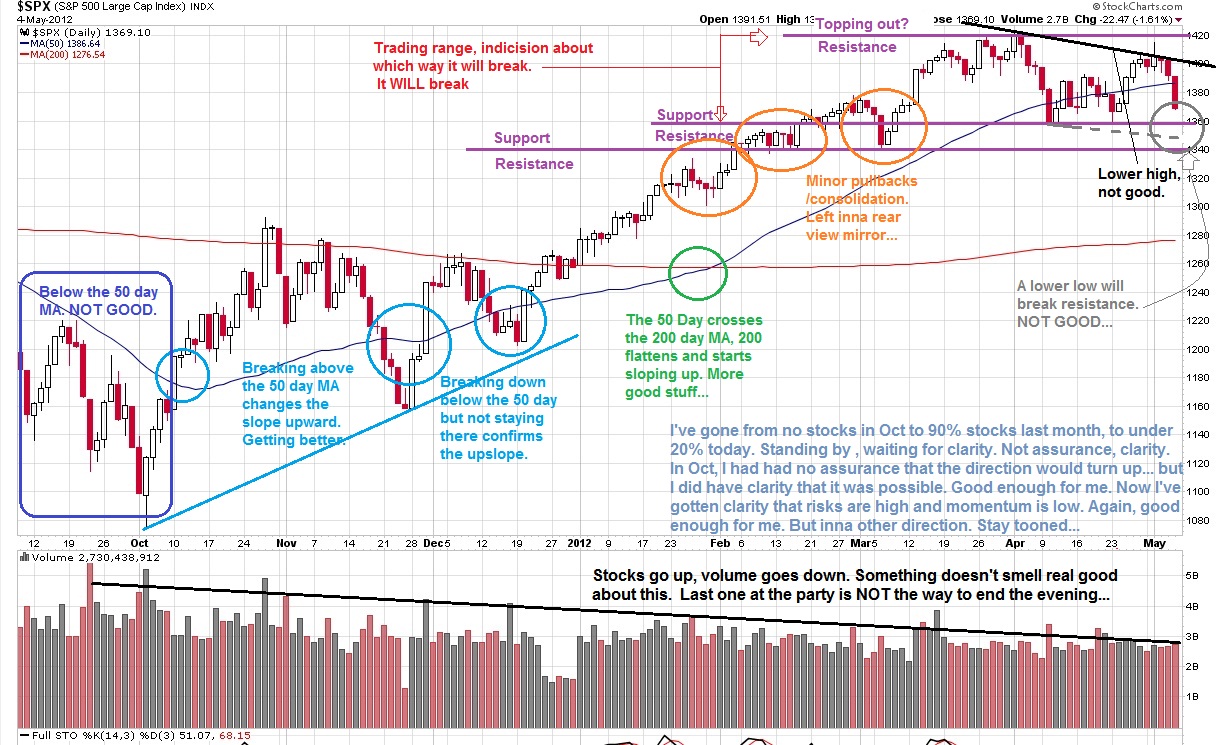

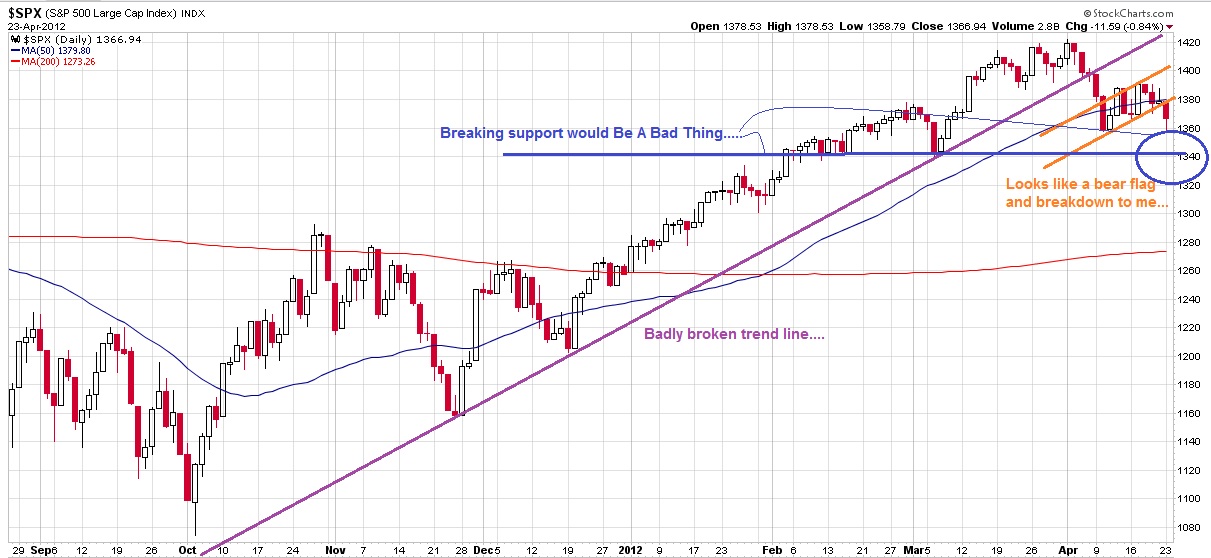

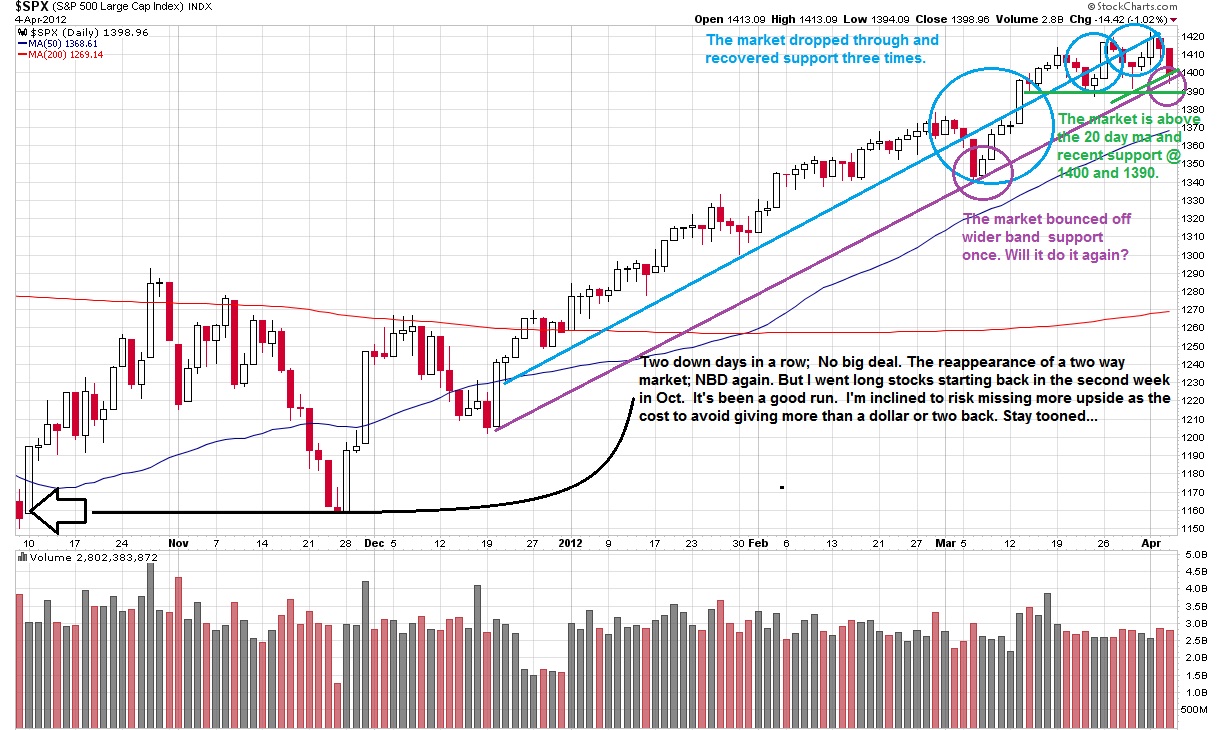

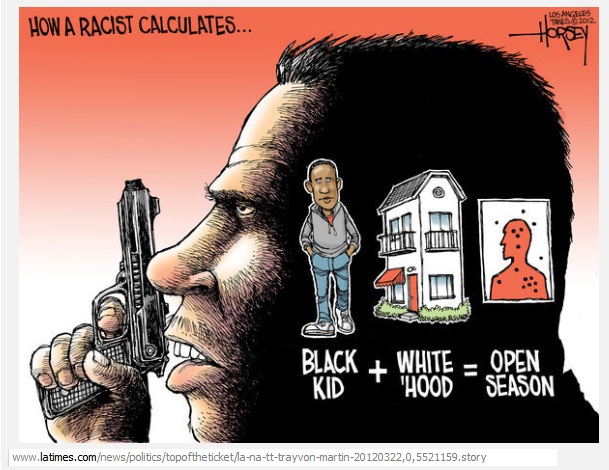

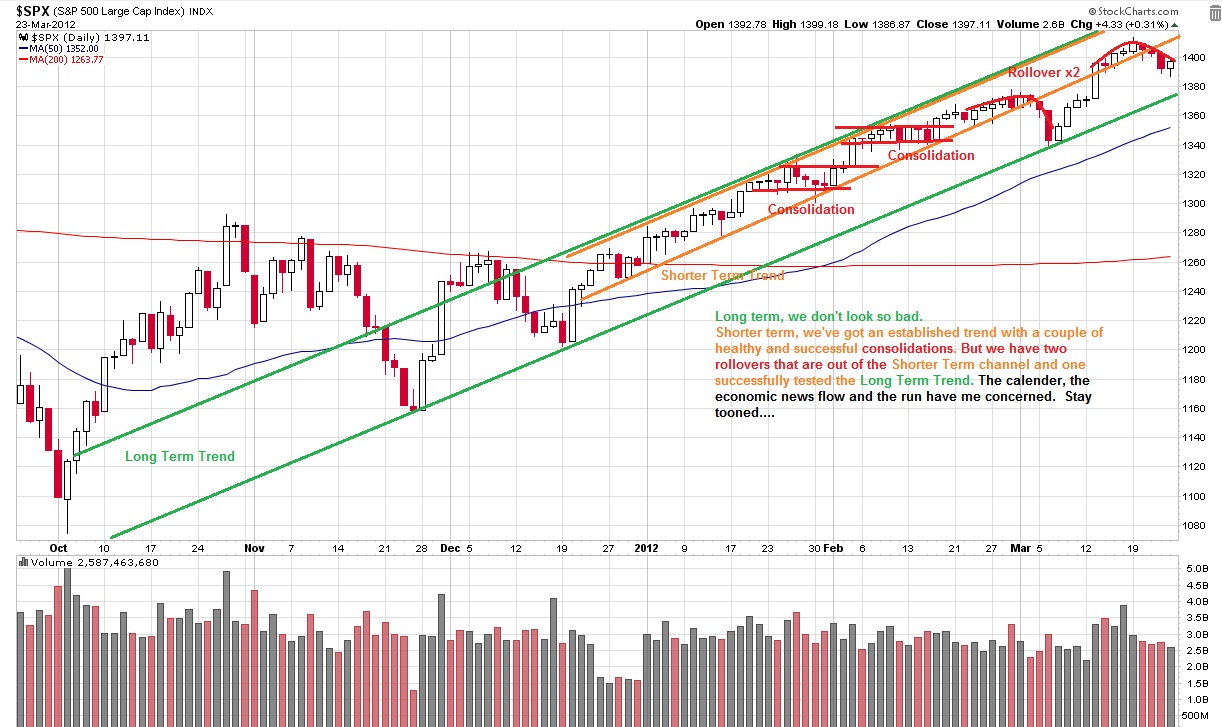

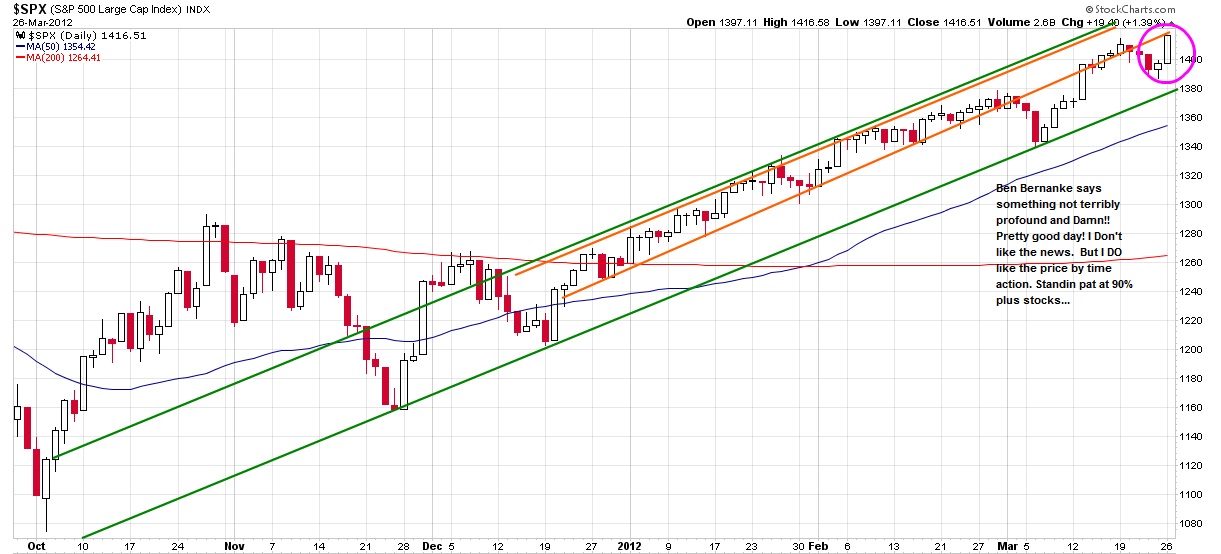

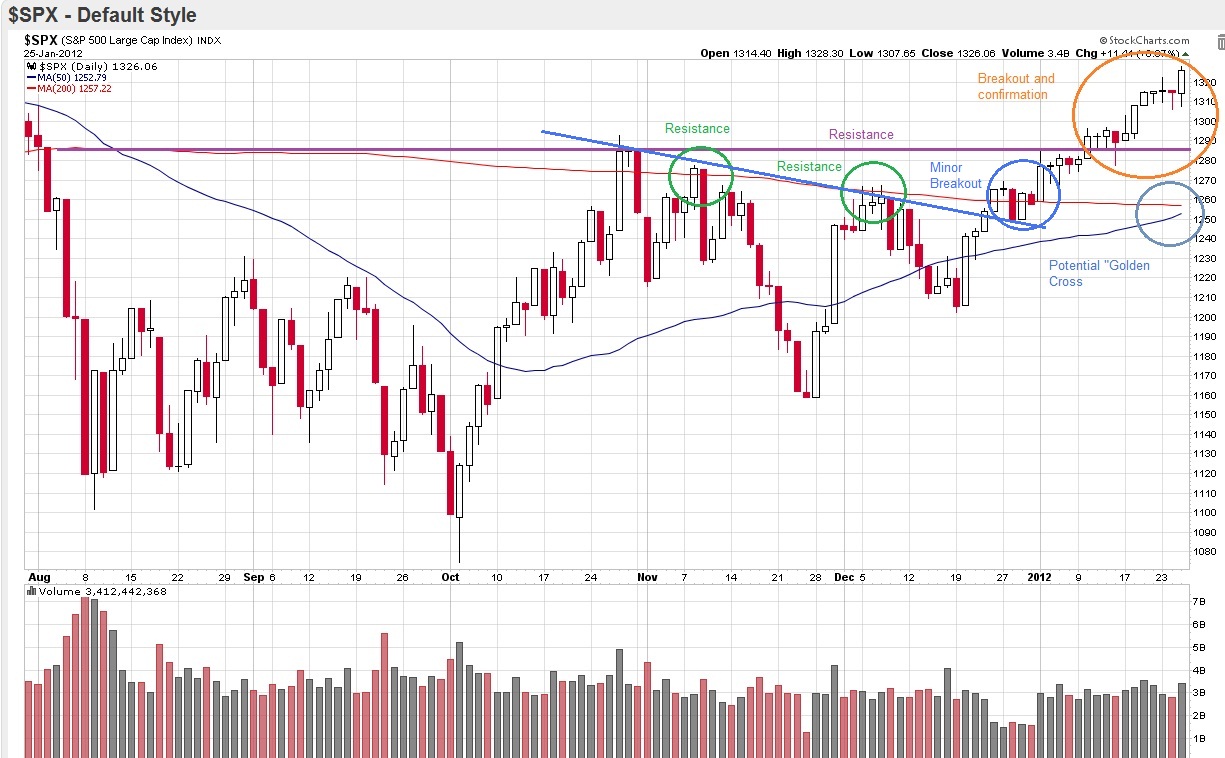

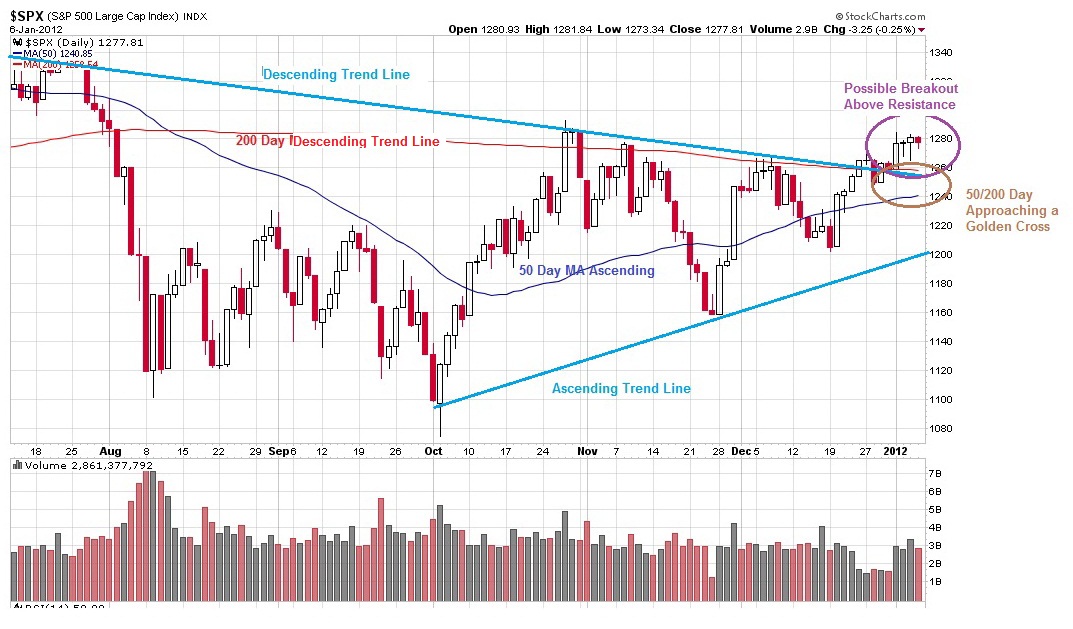

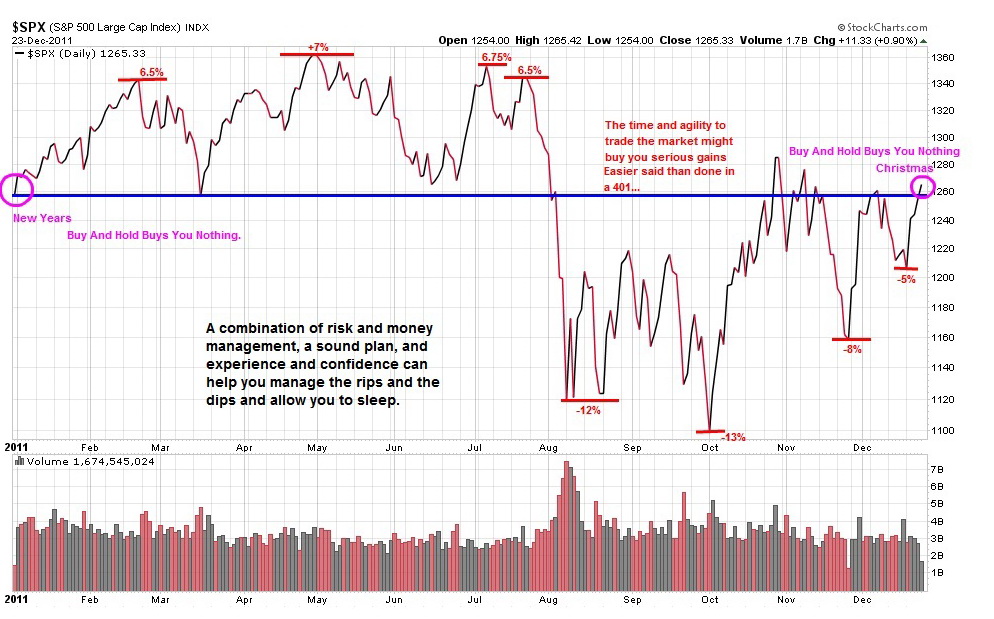

Stocks have hit the same levels three times in January, March, and April. And the news cycle sounds bad. Too much risk for no gains.

I'm reducing exposure to stocks by 50%. Mostly done... but still cutting back as restrictions allow.

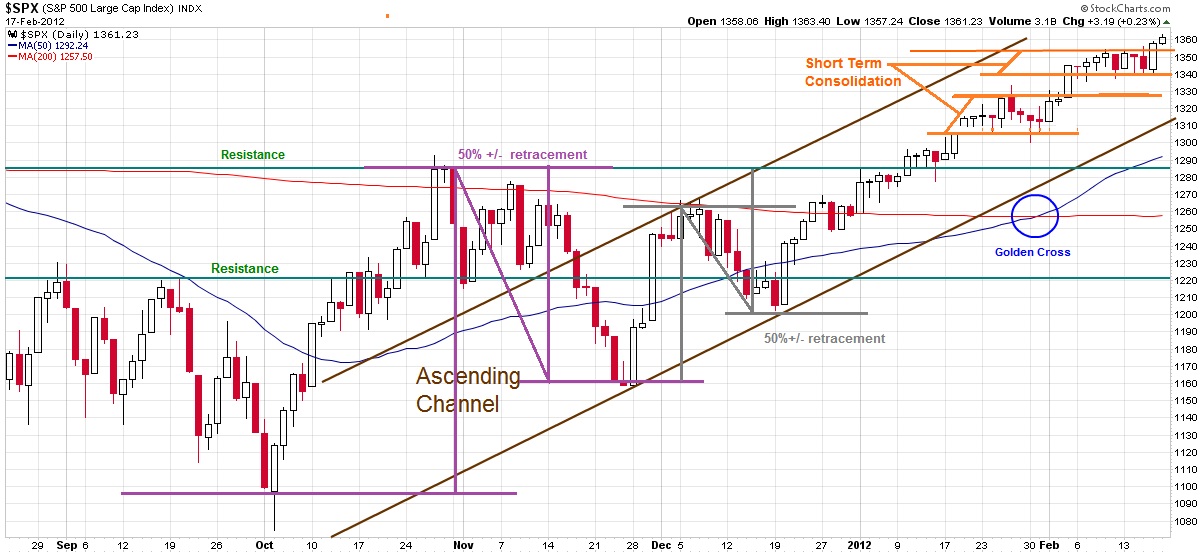

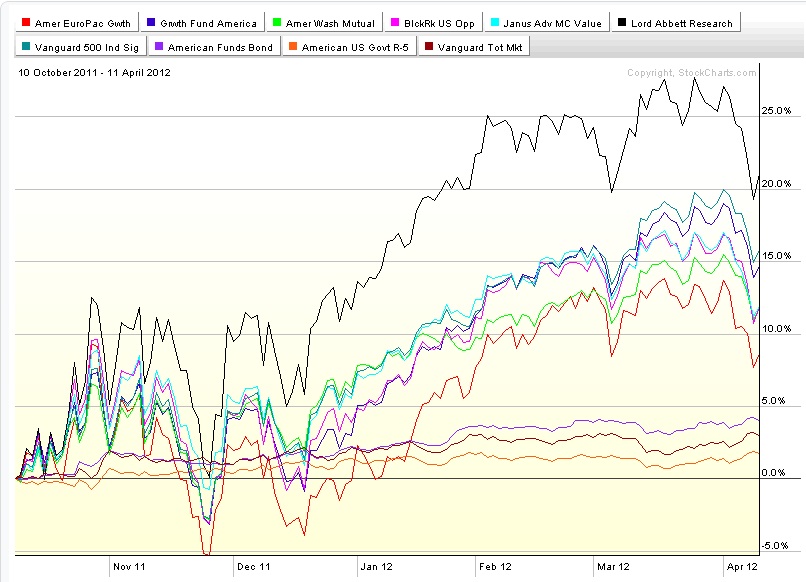

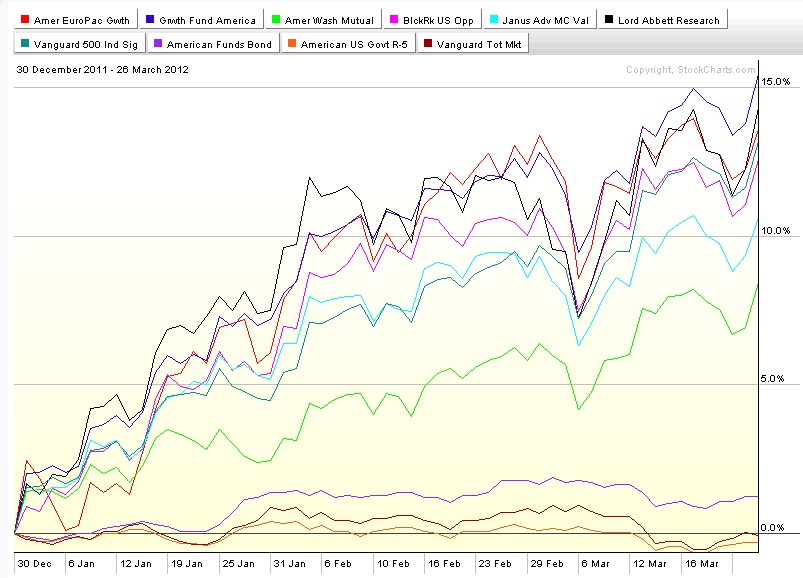

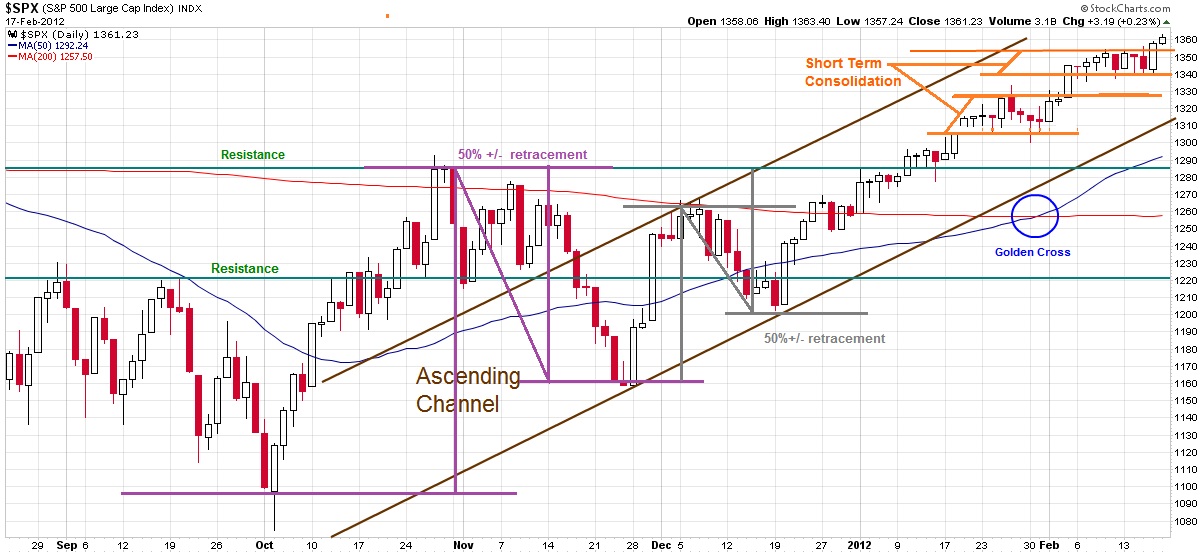

The broad market does not correlate tightly with the funds in the 401 (less VIFSX), but it tells a less noisy story.

Stay tooned....

( 3 / 1252 ) ( 3 / 1252 )

Your Life Is A One Act Play And You Are The Author. I'm Writing My Life As An Adventure and A Light Hearted Comedy. What Choo You Doin' Wit' Your Lifes?

Saturday, February 18, 2012, 02:43 PM

It has always been my view that Technical Analysis is an art, and like art, there are a lot of really bad examples of it out there.

--Rev Shark

Chartz and Table Zup @ www.joefacer.com.

Damn!!

http://www.youtube.com/watch?v=K7r8uxe_ ... re=related

http://www.youtube.com/watch?v=68FP359S ... re=related

http://www.youtube.com/watch?v=4v3PfqEv ... re=related

I GOT to start listening to something beside my Wolfgang's Vault downloads.....

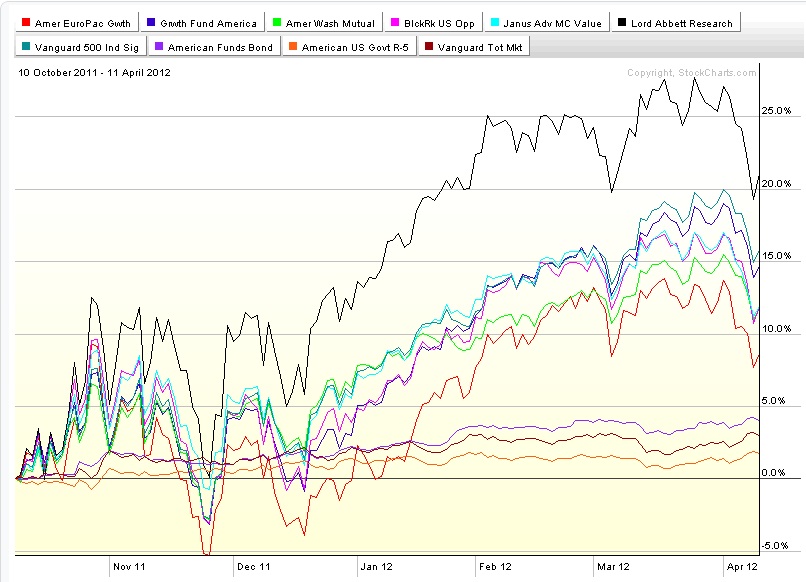

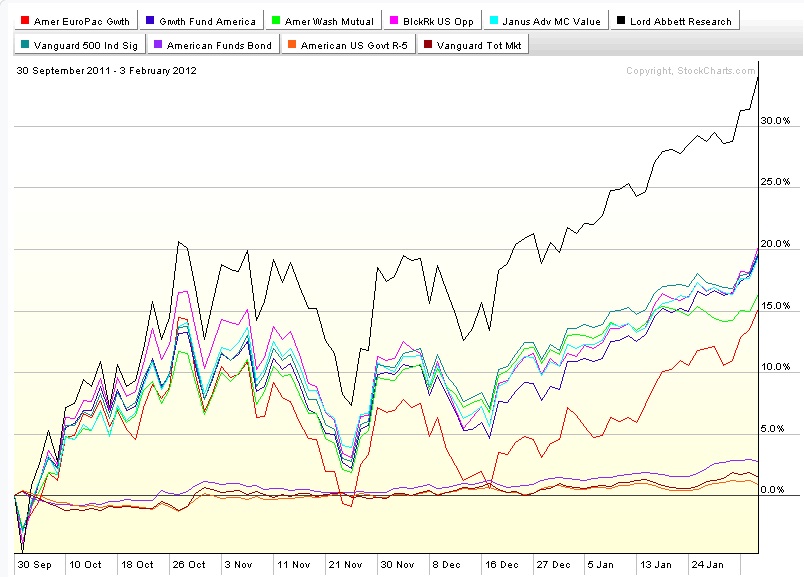

So as of Nov 2011, I was 25% in bonds and 75% in stocks in my 401. I was a mile out there in the face of darkness and despair, listening to Jeff Miller of "A Dash Of Insight". Jeff was saying, "Pay Attention to the data..." "Pay attention to what should happen..." "Government works THIS way..." "Don't extrapolate your fears...".

I decided that there was a significant chance that this data driven assessment was a correct assessment and with a rigorous money management, I could make some money at relatively minimal risk.

Today, I'm down to 13% bonds and 87% stocks. Much of the change is because while bonds haven't gone down much, stocks have gone up a lot. It worked out right for me and it was self reinforcing. I set my allocation strongly in the aggressive direction. I was prepared to admit I was wrong, reverse my strategy, and sell out of the position if it went against me. I was also prepared to accept my stock/bond allocation automatically shifting in the right direction from an already aggressive position as good things happened.

It is said that there is an optimum proportion for a portfolio based on this and that and that you should re balance your portfolio every so often based on this and that so that you get it right back where it is supposed to be. It is also said to "Buy 'em when they're cryin' and sell 'em when they're yellin'".

I lean toward the latter. I'm just a poor ol' pipefitter with one client and one family to answer to, unencumbered by too many expectations and too much conventional knowledge. I just know that stocks and bonds go up and down, and if you work hard enough to have more of what is going up and less of what is going down, and that if you lean harder on not doing anything stoopid than on being too smart, you make money. Kinda what a self directed plan is all about.

I don't spend any time on looking for the one good decision/fund that will be the only thing I'll ever have to do, or the way to avoid having to deal with an ever changing and complicated world. That would be a waste of time.

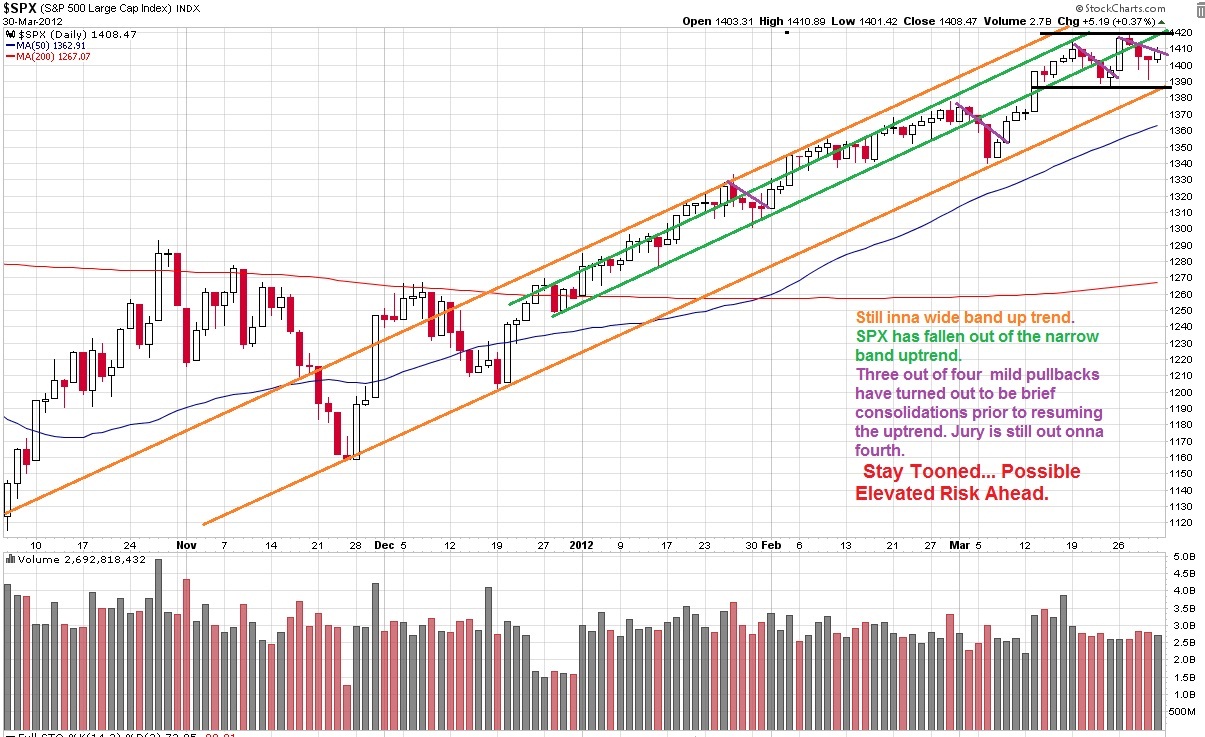

Still running uphill to the right from downhill to the left; still worth more than it used to be a short time ago. Ride this Slow Train until it turns around........ And It Will.

http://gawker.com/5885705/the-to

Fuckin "A" Tweetie Bird!!!!

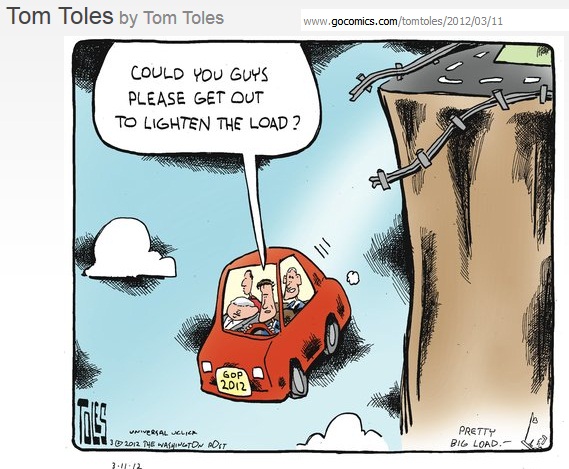

http://tpmdc.talkingpointsmemo.com/2012 ... licans.php

Stay tooned.

( 3 / 1416 ) ( 3 / 1416 )

Superbowl Sunday; Prolly Get To Doin' A Little Work On My Superbike...

Friday, February 3, 2012, 07:03 PM

"There are some things which cannot be learned quickly, and time, which is all we have, must be paid heavily for their acquiring."

Ernest Hemingway

Chartz And Table Zup @ www.joefacer.com

To Choogle, Or Not To Choogle....That Is The Question...

http://www.youtube.com/watch?v=mUzl7_OpVLA

They stopped by the radio station with the acetate off the metal master only hours old and the DJ spun the first two tracks, which were pretty good. Then he looked at the band and said, "The next one is pretty long... The band said,"Play it! It's a GOOD one." He dropped the needle on "Suzie Q". In those days I always had the reel to reel lit and ready to go whenever the radio was on because shit like this happened all the time. I had half of the first Creedence LP months before anyone else.

http://www.youtube.com/watch?v=YJe5sMBpnNY

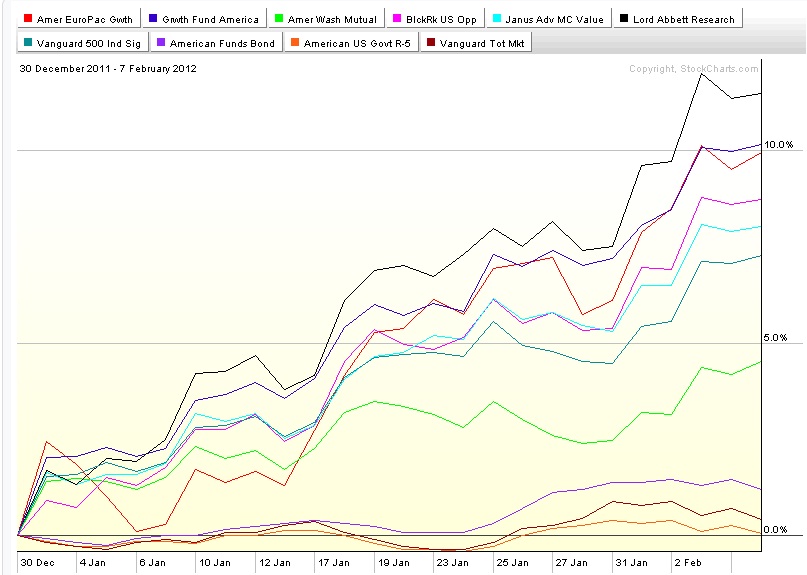

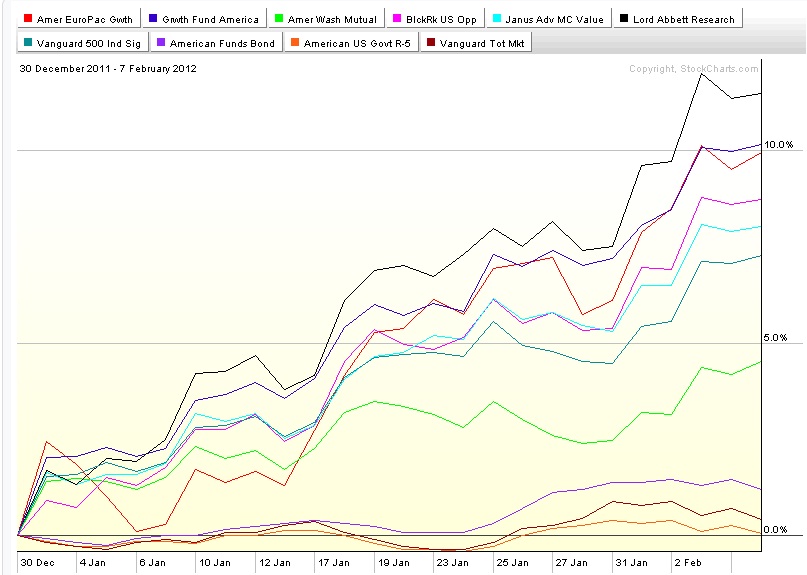

Smoking Year So Far...Made The Most Of It Too.

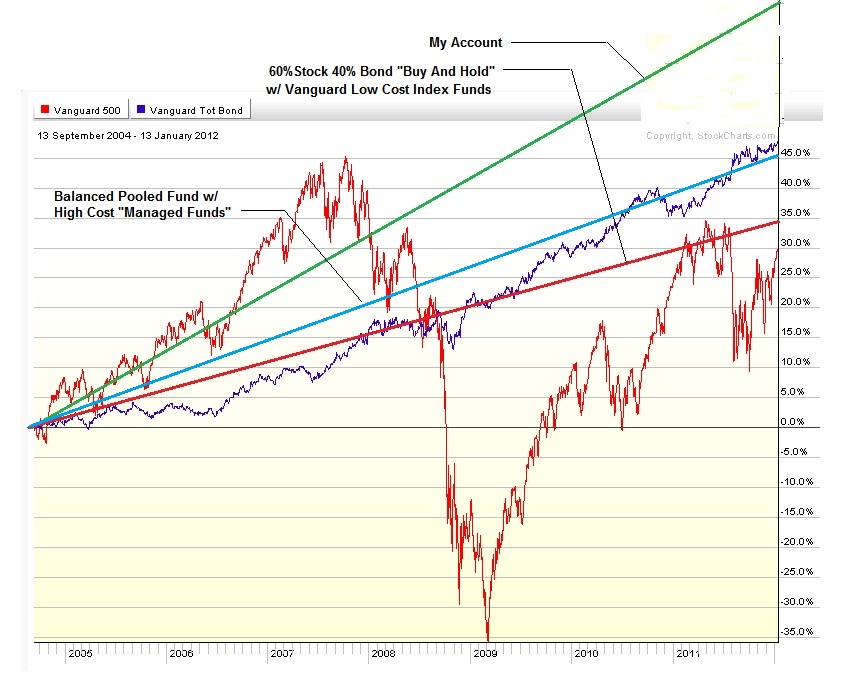

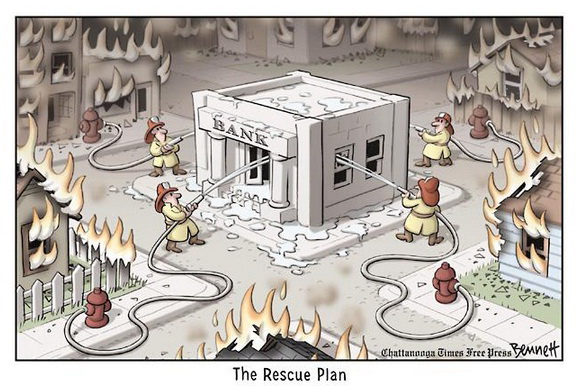

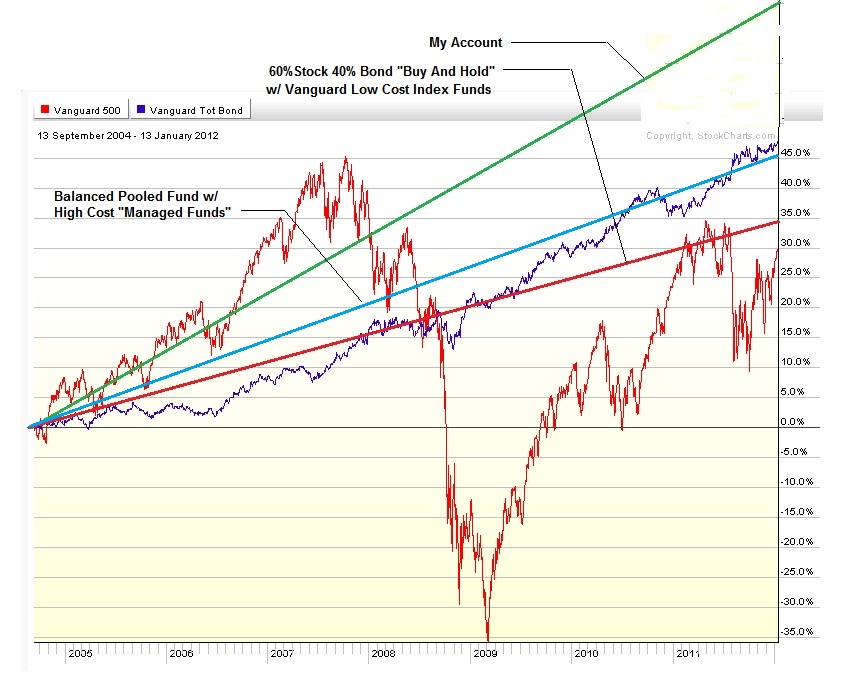

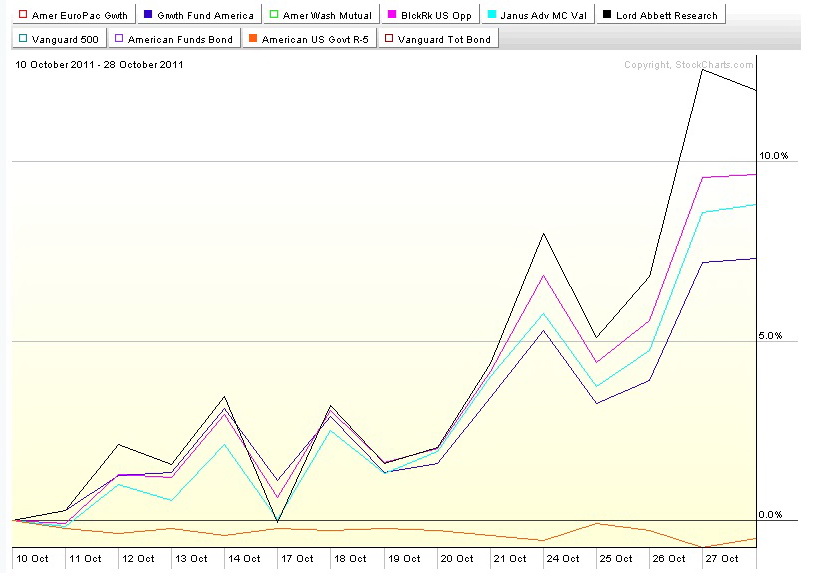

This is the way I see the world. It saved me money and made me money. Bonds last summer and stocks this winter.

http://www.thereformedbroker.com/2011/0 ... ical-rant/

http://www.thereformedbroker.com/2011/07/21/contrition/

http://www.thereformedbroker.com/2012/0 ... both-ways/

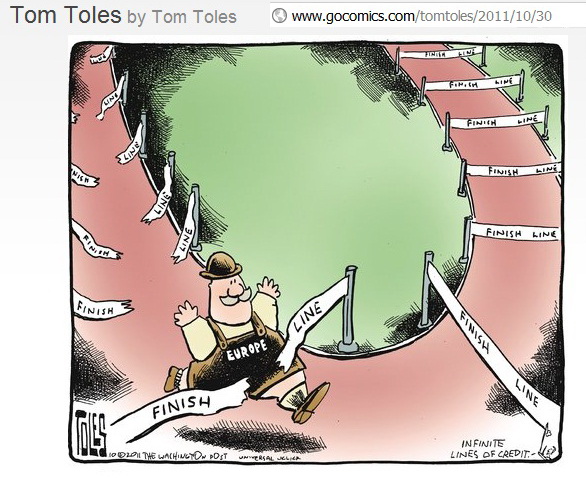

Something is goin' on. The chartz been sayin' so since October. The market has had every opportunity to go south since New Year, and it hasn't. It may be that US structural employment issues to the side, Europe has been in the news long enough for the long and painful and grudging solution to it has been discounted. And that the threatening flameout of China, inevitable or not, is still out on the horizon and still out there somewhere in the future. And that US corporations are as lean as they can get and will have to hire to keep the stellar profits that they have been making, or lose out to someone who will.

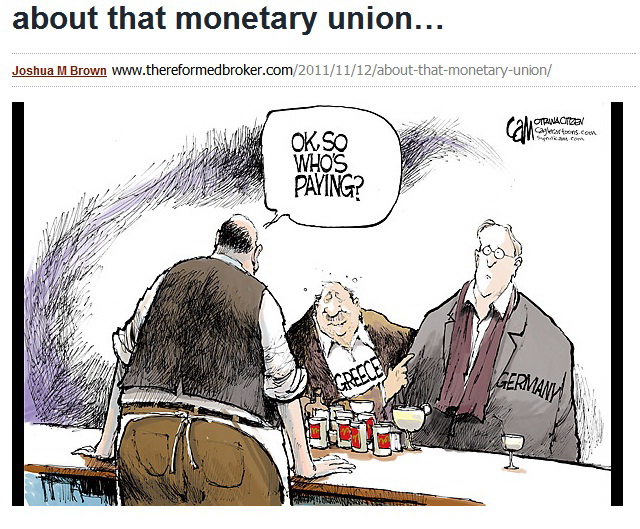

If the above is all true, as of the end of Monday, I'll be at 85% stocks and 15% bonds in the 401 and lookin' good. But, if I'm badly mistaken and Greece goes down in flames with Portugal, Ireland, Spain, and plunges all of Europe into depression, taking down a huge chunk of China's export business with it, and US corporations start firing instead of hiring,well, I will be way too long stocks at the end of Monday.

Nothing that wholesale selling won't fix. I've had a good run since October and I'll move quickly to protect it.

http://www.nydailynews.com/new-york/rap ... -1.1015716

http://oldprof.typepad.com/a_dash_of_in ... ather.html

http://www.ritholtz.com/blog/2012/02/ta ... -nfp-data/

Post October, What's Not To Like? Aside from the 50% correction of the October move in November.... Kinda expect to see another pullback soon. Maybe a big one. If so, I hafta think about getting flat. 1080 to 1350 is a 'ways. Bulls make money, bears make money, pigs get slaughtered. But I'll react to what the market tells me. If the market consolidates on rotation or sideways action, I'll stay put.

http://www.thereformedbroker.com/2012/0 ... -together/

Monday Eve...

http://www.washingtonpost.com/business/ ... print.html

http://www.roadracingworld.com/news/art ... icle=47190

Lemme Go See If It's Where I Parked It....And, Second Place Is First Loser.

Tues Eve

Stocks Holding...Bonds Rolling Over...Stayin' Put.

You Ahl Stay Tooned...Ya Here?

( 3 / 1428 ) ( 3 / 1428 )

Hey!!! Us Northern Californians Would Be Happy To Take Some Of That Rain From Those With Too Much. A Coupla Years Of Brown Hills And Lawns Inna Spring And Yellow Water Inna Toilets All Year 'Round Inna 70's Was Enuff, Thank You.

Saturday, January 28, 2012, 01:01 PM

"The art of investment is the art of selling. Buying is a lesser skill and holding requires no skill at all."

-- Harry Schultz

Chartz And Table Zup @ www.joefacer.com

Dougie Sahm; Long Live Garage Bands And The Razor Sharp Sound Of A Farfisa Or A Vox Continental.

http://www.youtube.com/watch?v=JxsWRDeuxTE

http://www.youtube.com/watch?v=Dx_ln6e4tbQ

http://www.youtube.com/watch?v=a-AWLocy ... re=related

http://www.youtube.com/watch?v=MY0fesM4 ... re=related

http://www.youtube.com/watch?v=-QCe1O6R ... re=related

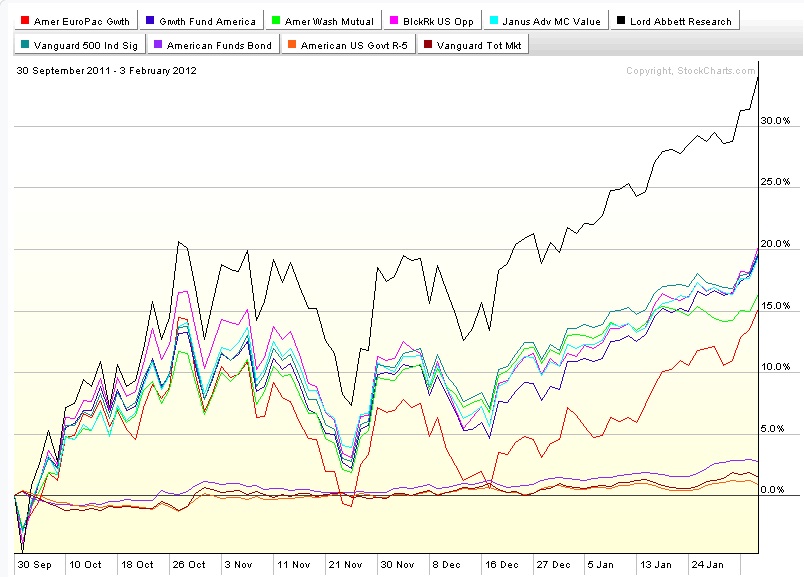

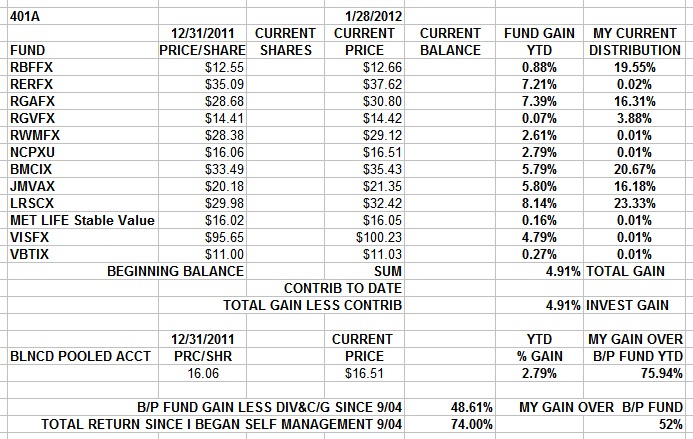

I'm up 28% over all of last year's gains... in the first month of this year. It's a balance of cashing in on the rips and buying the dips vs letting it ride and not making your move too soon. The buying is one part. Selling is the other. Let's see how this year works out.

My original 60/40 from last year is now 76/23 as stocks have gone up. That is way rich for a bear market, which I believe that we are in and will stay in for a while yet. But every hurricane has its eye and ya can't pile water up at one end of the bathtub and expect it to stay there. I'm working with what the markets are offering.

http://www.thereformedbroker.com/2012/0 ... ort-story/

http://www.thereformedbroker.com/2012/0 ... on-abates/

http://www.thereformedbroker.com/2012/0 ... llwethers/

Risk on and risk off. Correlation and widespread investor fear is why I'm bipolar in outlook managing my 401. No matter how good the fund manager may be or where the fund may invest, panic in and panic out overwhelms everything. So that is the overwhelming dynamic and I'm hanging tough despite the surges in and out. The trend is up...pretty much and for now. But I'm STILL stickin' near the door.

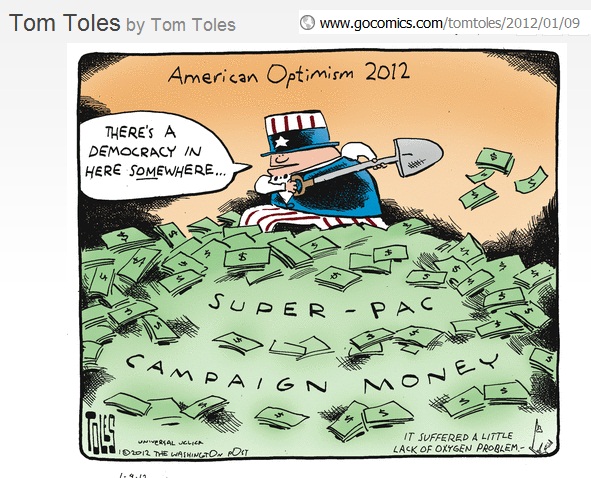

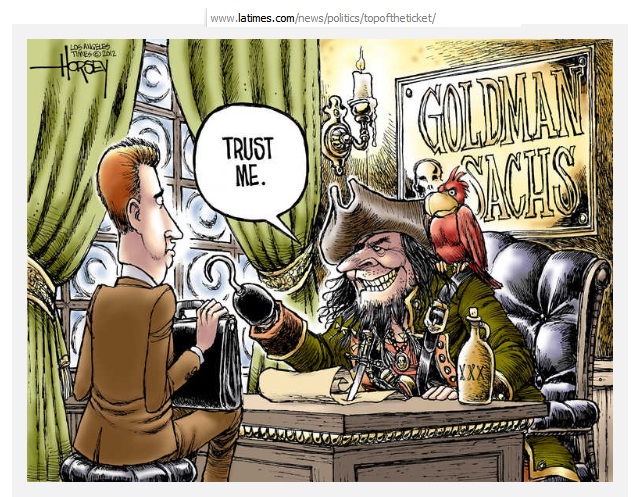

http://dealbook.nytimes.com/2012/01/26/ ... e-thrived/

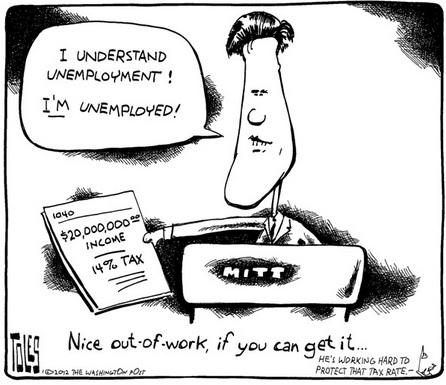

http://www.thereformedbroker.com/2012/0 ... mployment/

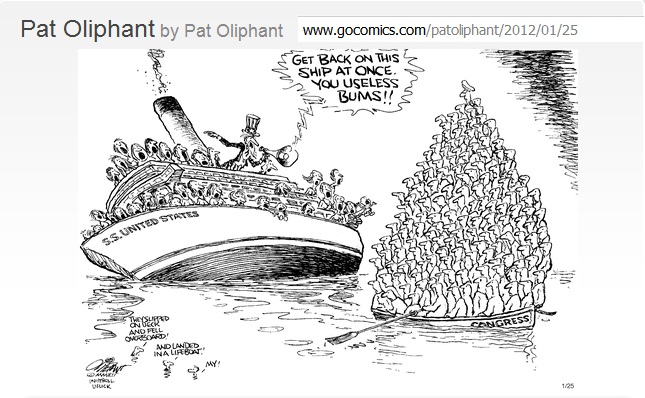

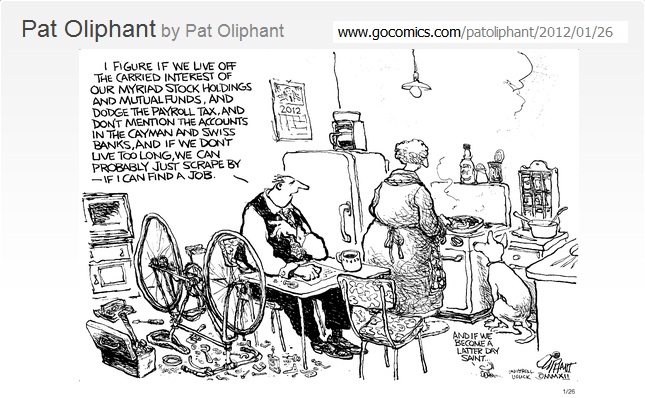

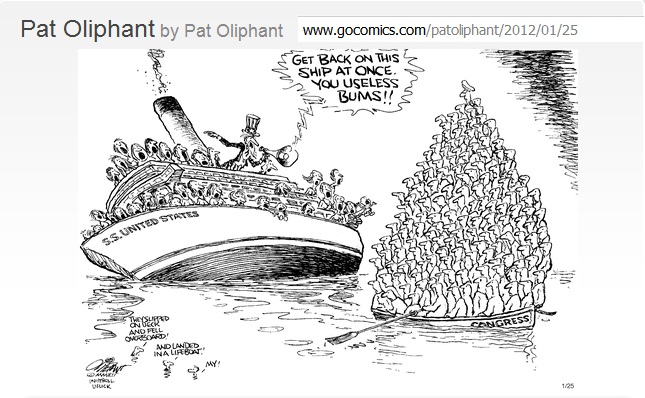

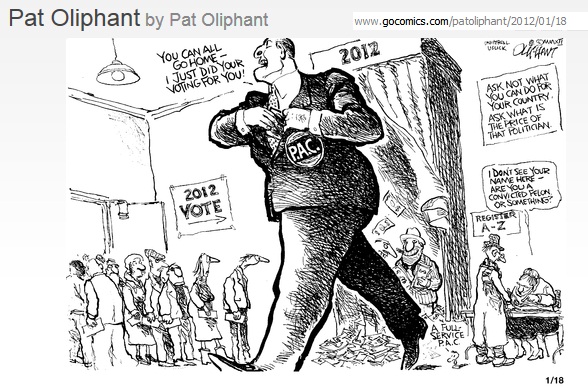

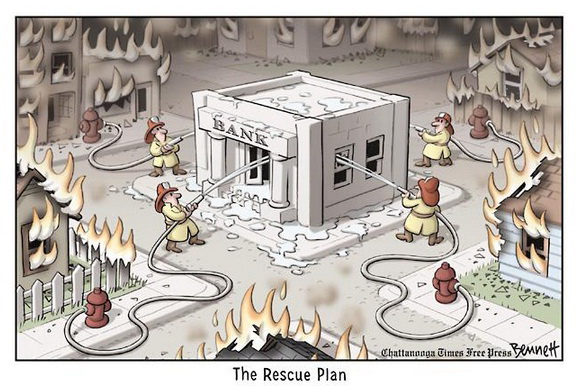

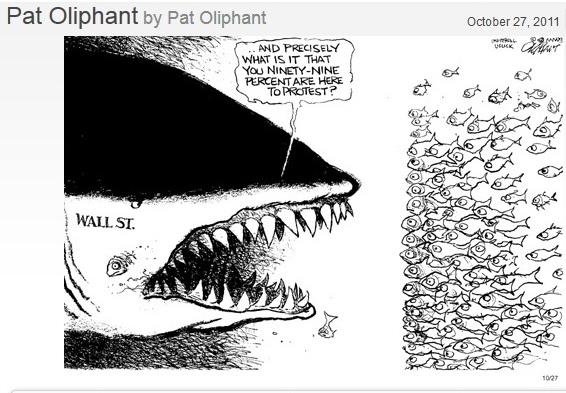

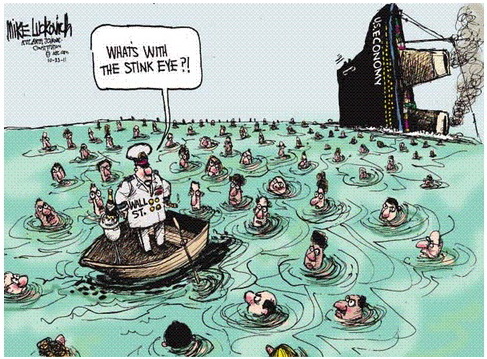

The original 99% movement...Occupy Washington

Patton and MacArthur and tanks vs US citizens in the streets

http://www.ritholtz.com/blog/2012/01/th ... -movement/

http://vimeo.com/30766340

General Butler invoked the 99% movement, telling the veterans:

We are divided, in America, into two classes: The Tories on one side, a class of citizens who were raised to believe that the whole of this country was created for their sole benefit, and on the other side, the other 99 per cent of us, the soldier class, the class from which all of you soldiers came. That class hasn’t any privileges except to die when the Tories tell them. Every war that we have ever had was gotten, up by that class. They do all the beating of the drums. Away the rest of us go. When we leave, you know what happens. We march down the street with all the Sears-Roebuck soldiers standing on the sidewalk, all the dollar-a-year men with spurs, all the patriots who call themselves patriots, square-legged women in uniforms making Liberty Loan speeches. They promise you. You go down the street and they ring all the church bells. Promise you the sun, the moon, the stars and the earth,–anything to save them. Off you go. Then the looting commences while you are doing the fighting. This last war made over 6,000 millionaires. Today those fellows won’t help pay the bill.

http://en.wikipedia.org/wiki/Bonus_Army

Where do you fit?

http://www.americablog.com/2011/01/us-i ... ition.html

http://www.reuters.com/article/2012/01/ ... 2920120127

http://www.msnbc.msn.com/id/46205510/ns ... yiNh8VSQig

}h2]http://www.alternet.org/teaparty/153973/why_we_got_ayn_rand_instead_of_fdr%3A_thomas_frank_on_how_tea_party_%27populism%27_derailed_a_new_new_deal/?page=entire

Stay Tooned...

( 2.9 / 1481 ) ( 2.9 / 1481 )

First Time In Years I've Dug Through The Fusion Section Of The Record Cabinet... AWESOME!!!!!!!

Saturday, January 14, 2012, 04:35 PM

“I like to pay taxes. With them, I buy civilization.”

-- Oliver Wendell Holmes

Chartz And Table Zup @ www.joefacer.com

It's been a few years since I dug through the fusion section and anything vinyl with Al Di Meola on it is amazing with a very good MC cartridge.

http://www.youtube.com/watch?v=n3sT5Ucy ... re=related

http://www.youtube.com/watch?v=6YShQZUM ... re=related

http://www.youtube.com/watch?v=vGWfDkx4 ... re=related

http://www.youtube.com/watch?v=gGHcoeoh ... re=related

This explains my world view;

http://www.thereformedbroker.com/wp-con ... n-fran.png

I can see the Outer Outer Sunset from my front door....

Situation unchanged inna 401a. I may change everything big time next week... Check it out

http://www.johnmauldin.com/frontlinetho ... -of-europe

New Monday Eve

http://www.johnmauldin.com/outsidethebo ... d-outlook1

http://msnbc.msn.com/id/45997416/displa ... ginSlide=1

Book yer crooze inna next few weeks. prices prolly gonna be real reasonable....

The 401 is a "self directed" plan in which the participant applies a strategy and tactics to secure his retirement. Hope is not a strategy and "deer in the headlights" is a piss poor tactic.

Wed Eve...

http://interloping.com/2012/01/18/finan ... ses-point/

Thursday, moved a little money from bonds to stocks. Movin' a little more tomorrow. Stocks are goin' up. Volume, sentiment, news, technicals and fundamentals don't inspire confidence. The only thing I like is the price action.. Still turned toward the door, leaning, with the weight onna back foot. I'm making money inna 401, but even more concerned wit not losing it. Check out this weekends chartz and tablez.

Stay Tooned...

( 3.1 / 1491 ) ( 3.1 / 1491 )

First Week Of The Year. I Gotta Hangover Of Christmas/Holiday Cheer. Not All Hangovers Are Bad....

Saturday, January 7, 2012, 02:24 PM

Many conveniently cite a book that they have not read, covering data that they have not reviewed, employing methodology that they do not understand, and reaching a conclusion that is not shared by many peers. This happens because the conclusions support a viewpoint that they already hold -- quite fervently. As a result, people are willing to bet real money.

-- Jeff Miller

Chartz And Table Zup @ www.joefacer.com

I just found a new one... http://www.youtube.com/watch?v=D1SZfGgZ ... re=related

This stuff comes outa the woodwork. Gawd, to go back to '66-'71 and relive those years with a video camera and DVD audio...

And, just like that, a Rory Gallagher video recording of excellent quality from a superb performance I hadn't seen surfaces and disappears. Oh Well. Here's one I, at least never tire of....

http://www.youtube.com/watch?v=guL3xWi6rmg

http://oldprof.typepad.com/a_dash_of_in ... eview.html

http://www.michaeleisen.org/blog/?p=358

http://www.latimes.com/news/politics/to ... 3054.story

No Change Inna 401...

We still have holiday/1st of the new year sentiment and momentum. I'm up close to last year's high water mark and everything is OK. At least at this very second and at this exact location. I'm concerned , watchful, and less than fully invested and leaning toward the door...

http://www.thereformedbroker.com/2012/0 ... -the-euro/

http://www.thereformedbroker.com/2012/0 ... good-luck/

http://www.crossingwallstreet.com/archi ... -view.html

The Crossing Wall Street link is from an avowed "Buy And Holder". He's right, as is Rev "Saving Souls From Buy And Hold" Shark.

The key is capital preservation and risk management. So far, pretty damn good.

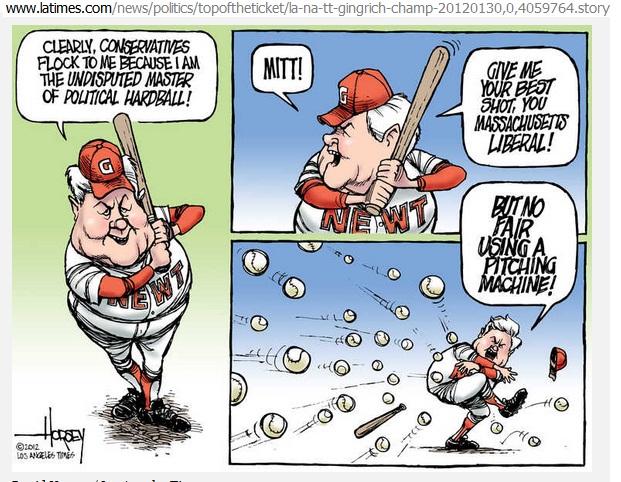

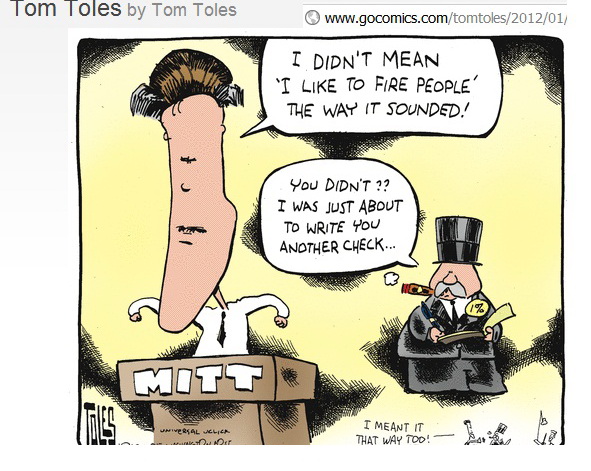

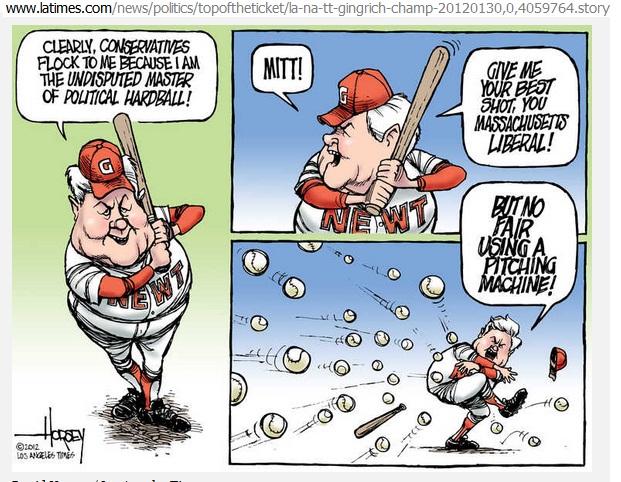

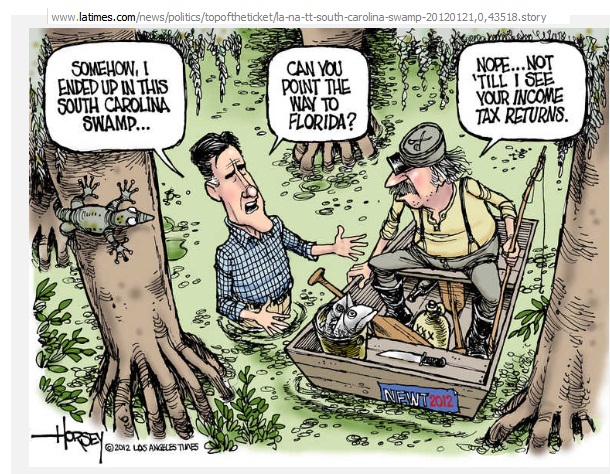

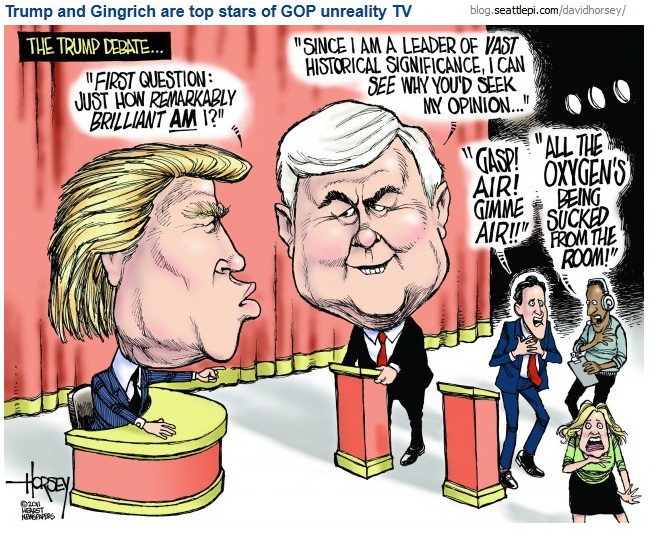

http://kiddynamitesworld.com/gingrich-s ... tball-fail

http://www.usatoday.com/news/politics/c ... match-game

Time and price in the charts say that the bulls/dip buyers are in a place to strike fear into the hearts of portfolio managers over trailing the indexes right off the first few weeks of the year.

Fundamentally, I don't buy it. But standing in front of moving trains is a poor practice, regardless of whether or not they should be there in the first place.

Tues Eve

I'm on that moving train.... Caution is the watchword....

Stay Tooned....

( 3 / 1376 ) ( 3 / 1376 )

I've Had Worse Years....I've Had Better Years Too...

Saturday, December 31, 2011, 03:31 AM

"Character consists of what you do on the third and fourth tries."

-- James A. Michener

Chartz And Table Zup @ www.joefacer.com

Bonamassa. 'nuff said.

http://www.youtube.com/watch?v=sRxqYoZi ... re=related

http://www.youtube.com/watch?v=46UFXQVS ... re=related

http://www.youtube.com/watch?v=l0lIZHsp ... re=related

http://www.youtube.com/watch?feature=en ... vqFY2eM6jA

http://bottomline.msnbc.msn.com/_news/2 ... until-2021

http://www.smartmoney.com/small-busines ... 801218019/

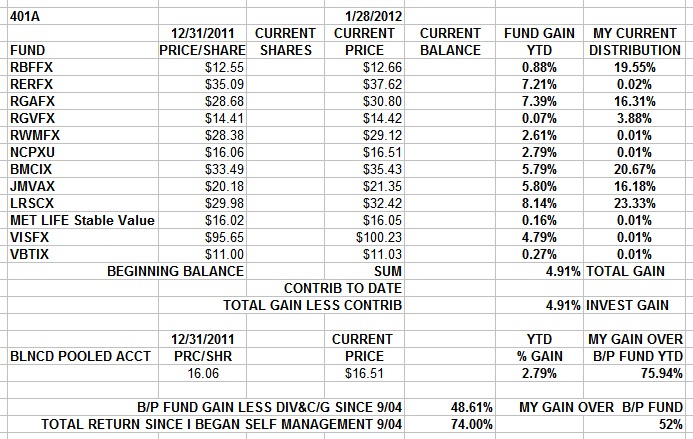

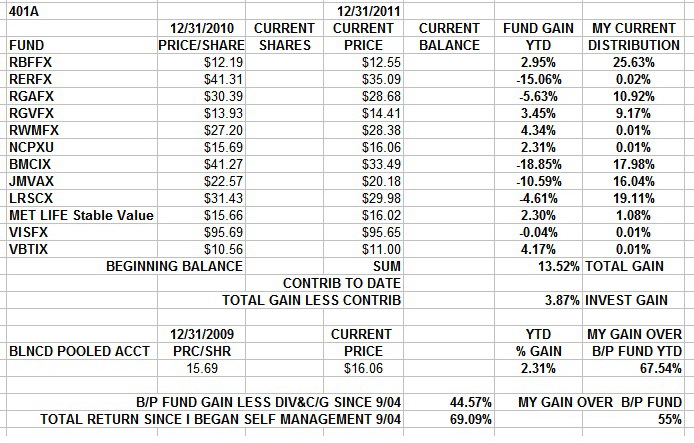

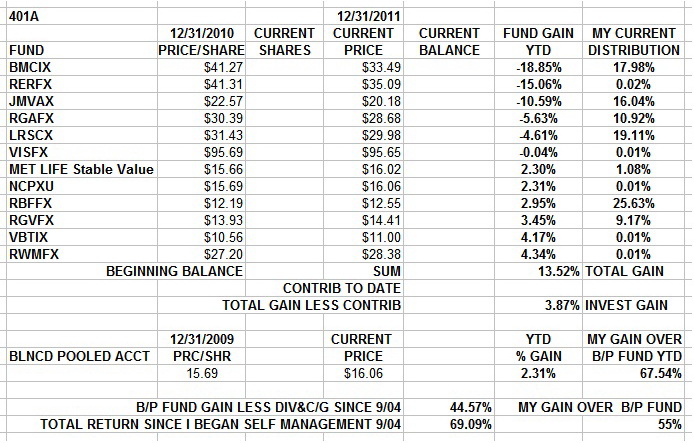

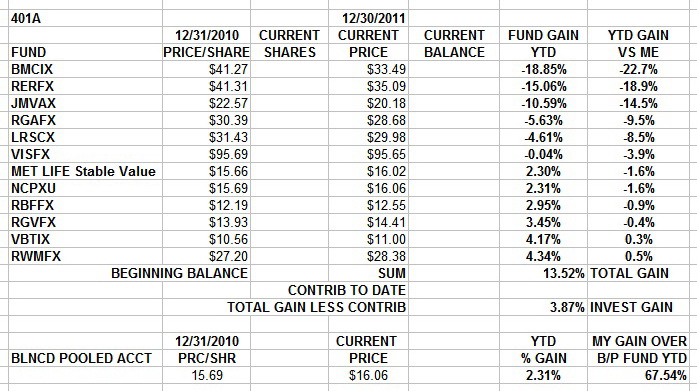

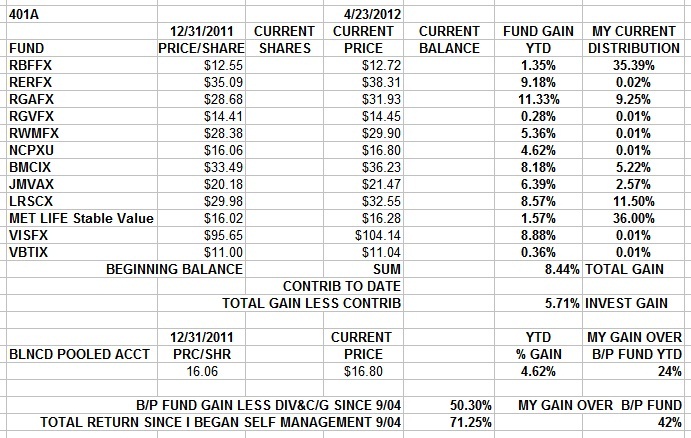

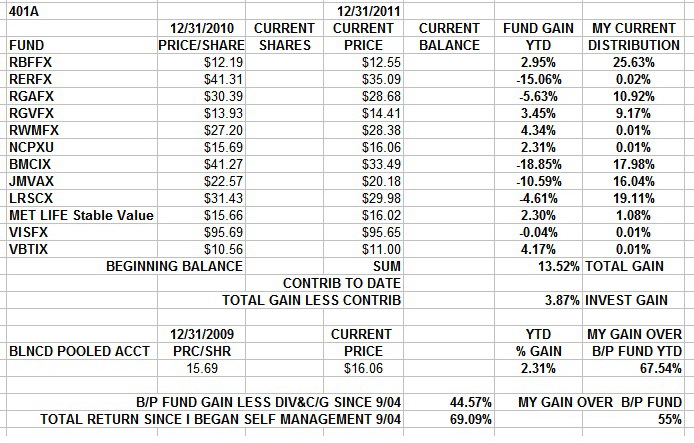

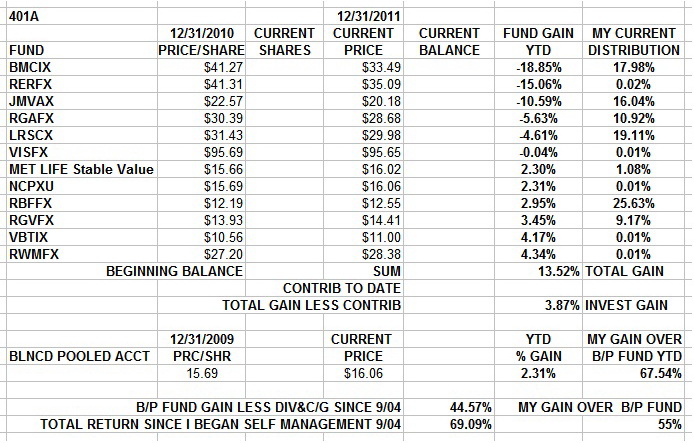

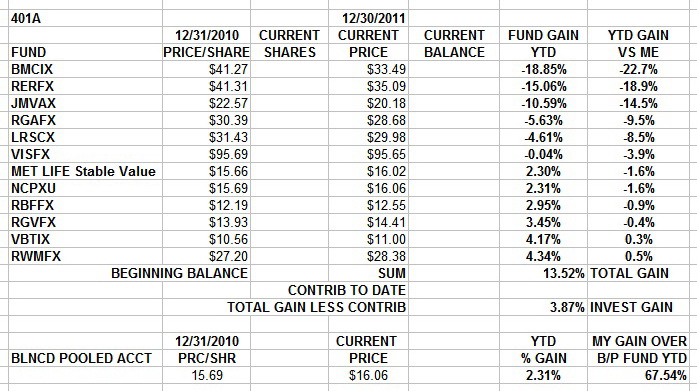

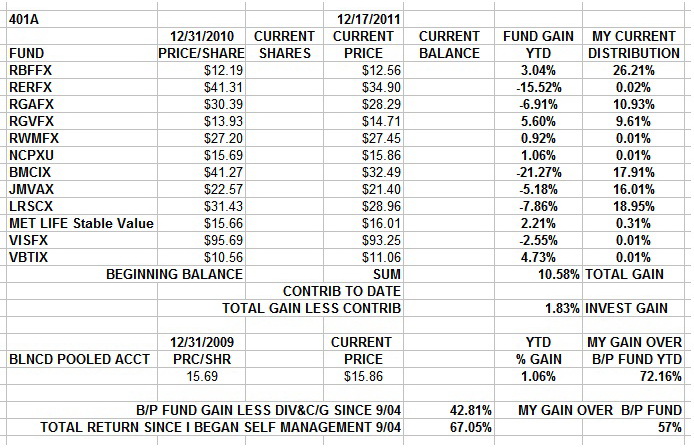

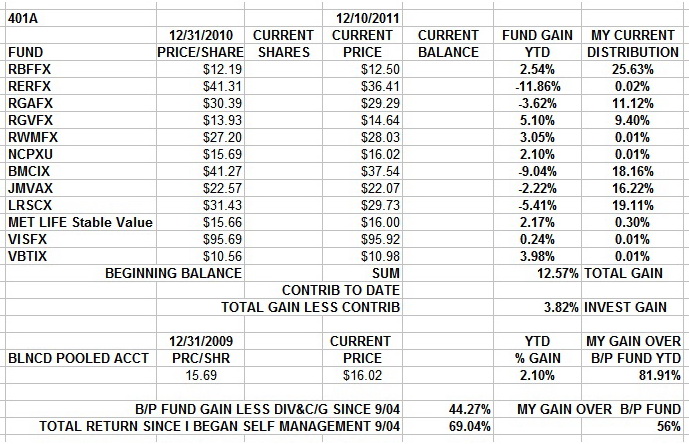

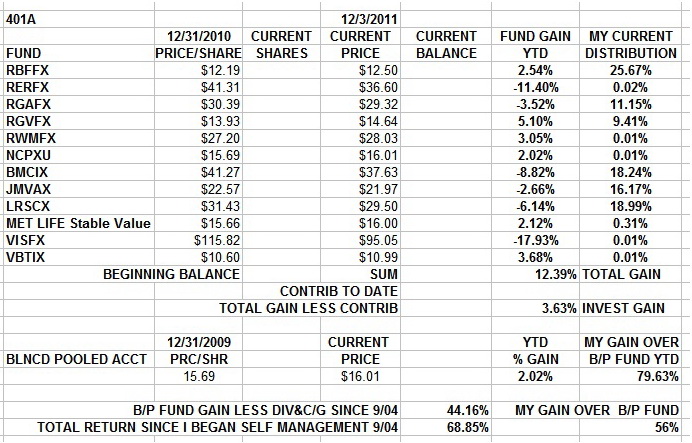

This is one the regular weekly posts on my website... That this is for the end of the year makes this one noteworthy....

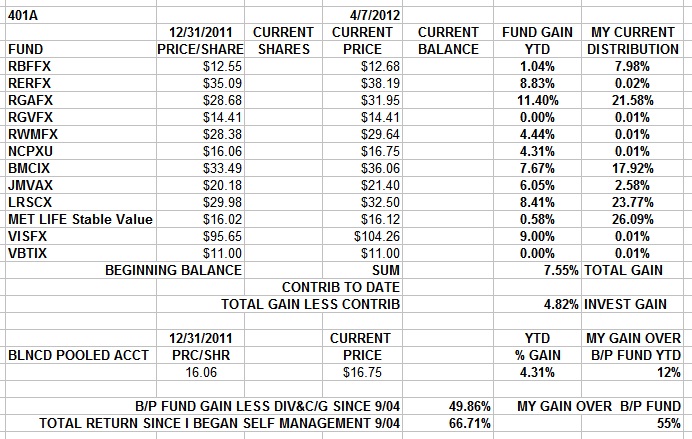

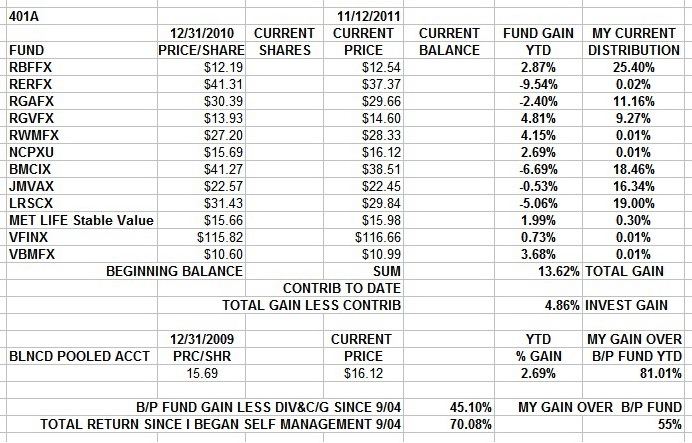

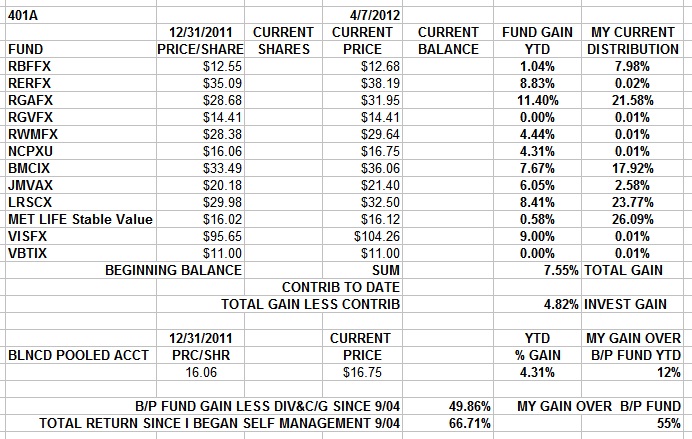

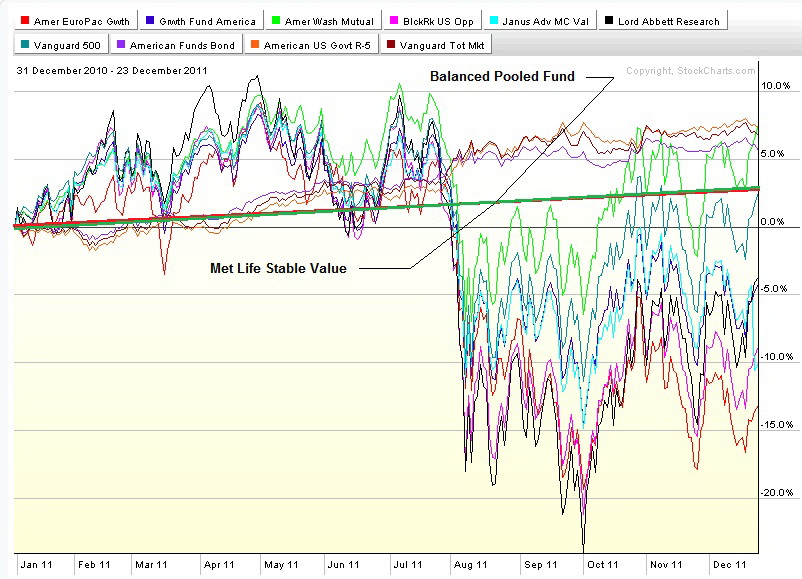

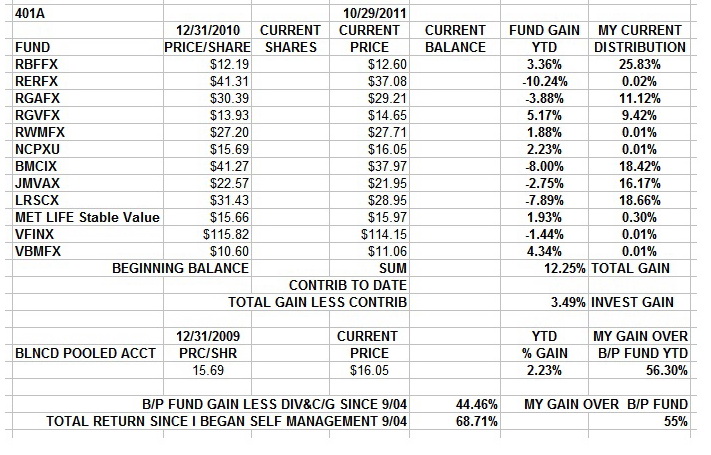

This is the first table above reordered. The first table above is ordered to make data entry easier/match with previous versions/my mind set. This one is ordered by ranking the individual 401 investment funds from most lost over the year to most gained. There is info here.

Cycles, ya know? Lookit the chart below.

This is a fund I've had available in the 401 since late '04. Cycles. When the winds and currents are working for you, even in as treacherous and potentially gawdawful a place as the North Atlantic, you put everything that floats in the water to make what you can when you can. When winter comes, the currents go against you and the wind goes every which way, you take what you've made during the spring and summer and hole up someplace inland that's warm and dry and stay there doing stuff that makes sense until something changes. Look at the chart. You can see multiyear cycles as well as short term cycles. The time to pay attention to both the long term and short term cycles came this year.

So..... What I did this year was go big into stocks when the weather looked OK, like for the first three months. We are in a short term bull market off the financial crisis lows of 2009 and the recent trend is up. But I never got out of sight of the shore. We are in a long term multi-decade bear market. The major trend is down. When things got dark, I went to bonds and stayed there. When the weather looked like it was lightening up, end of the year, I went back to stocks but only part way, again with one eye on the sky and one eye on the shore. This was a short term play as written about over the last few weeks.

Over the course of the year, I exposed myself to the upside and down side and made some and lost some. I was rigorous about cutting losses; the flip side to letting winners run. I gave back some from my high water mark, but ended up positive for the year and ahead of the default position.

Check out the table below.

If I'd picked the right one of the dozen investment funds available to the 401 and went all in at the beginning of the year, I'da made 1/2 of one percent more with much larger drawdowns, i.e. greater risk. The second best fund, I'da made 3/10s of one percent more. My account, managed by "timing the market" with available 401 investment funds (I prefer to think of it as "managed with capital preservation and risk management goals"), would have placed third out of 13, with very low exposure to risk for a good chunk of the year.

I've had better years. I've had worse years too. Not losing money can be really good. Making a handfulla Simoleans or a Drachma or two after the accounts are settled can be a major victory. Like here and now.

But it was a fair amount of work for not much return. Or was it? I have friends who've been in bonds since the crash. This year that worked really well for them. Last year and the year before, it didn't. The year before that, it was un-fucking-believable. Ya gotta view it in the context of your balance in the 401, the demands of life and family, and where you are in life, and what is going on around you. I just did the math and I'm down wid' it. I got some coin outa the 401 when three funds lost more than 10% and the very best fund made a return that looked like a old time passbook savings account.

Pretty cool, huh?

Feelin' Awright, Actually I'm Feeling Pretty Good Myself......

-- TRAFFIC

http://www.youtube.com/watch?v=g3Wk1zmb ... re=related

-- Not Traffic

I think I'll buy some Bonamassa CD/DVD's. I'm pretty sure I made enough to cover that anna piece a pizza anna beer.....

Good To Know

http://rightwingnews.com/election-2012/ ... -semitism/

http://www.dailymail.co.uk/news/article ... veals.html

http://www.newyorker.com/talk/financial ... surowiecki

http://littlegreenfootballs.com/page/26 ... most_a_tot

http://www.ritholtz.com/blog/2011/12/fe ... ut-europe/

Tues

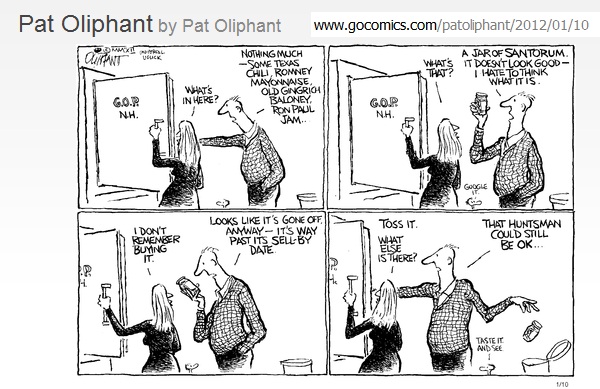

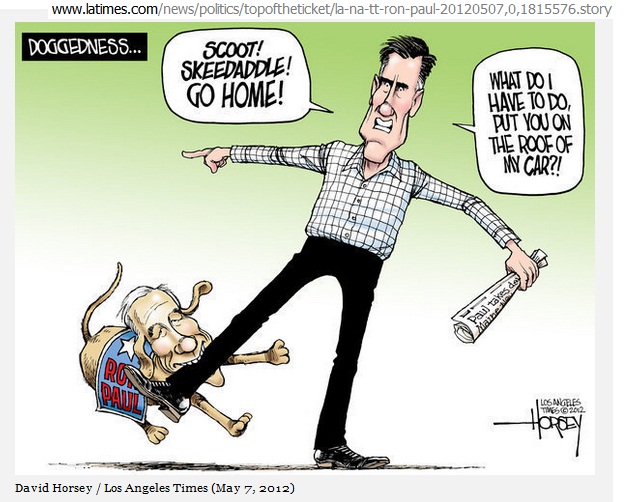

Re Ron Paul

Seventeen years and all of 4 bills made it to the floor and the one on selling a single piece of surplus government real estate passed. What a career.

"The unlikely elevation of a 76-year-old crank, with a few strange views and who has been rejected twice before as a presidential candidate, says a lot about the state of Republican politics."

-- Albert R. Hunt / Bloomberg

http://www.project-syndicate.org/commen ... 21/English

http://www.crossingwallstreet.com/archi ... -view.html

WED

http://dealbreaker.com/2012/01/convicte ... -his-scam/

Stay tooned.....

( 3 / 1512 ) ( 3 / 1512 )

Boy, I Sure Screwed That One Up....But ...That Was Last Night. From Zero To Hero And From Chump To Champ In 8 Hours...

Sunday, November 27, 2011, 07:51 PM

"The market is not a sofa, it is not a place to get comfortable."

Jim Cramer

Chartz And Table Zup.... @ www.joefacer.com

Makes Me Feel Better...

http://www.youtube.com/watch?v=Hs-HwuZw ... re=related

http://www.youtube.com/watch?v=pqashW66D7o

It's been a bad coupla weeks and I've lost concentration and let some things slide due to personal issues. I had some very bad news about one of my favorite persons in my life. And it's cost me concentration and focus on the matters at hand. It couldn't a' happened at a worse time either. My thesis for the year's end looks like it was wrong and I was set up long stocks when the markets cratered on the Euro news. I shoulda cut back or bailed a lot sooner but, knowing that there was gonna be bad news before there was good news, I stayed too long too long based on hope, a poor strategy. Damn.

My losses inna market pretty much pales in comparison to the losses in my personal life. That said, I've got responsibilities to me and my family for the future as well as for what will soon be in the past.....so....

It's Not A Sin To Be Wrong, But It Is A Sin To Stay Wrong.

So How Bad Is It?

I can fix this. In absolute terms I lost a chunk o' money in two weeks. Practically speaking, Not So Much. Year to date, the Balanced Pooled Fund is down a little over 1%, I'm down a little under 2% from up 4%, the best stock fund is down 4%, the worst stock fund is down 15%, and the Stable Value Fund is up 2% and the best bond fund is up 5%. My losses are not even a hiccup on the long term chart and I can fix this.

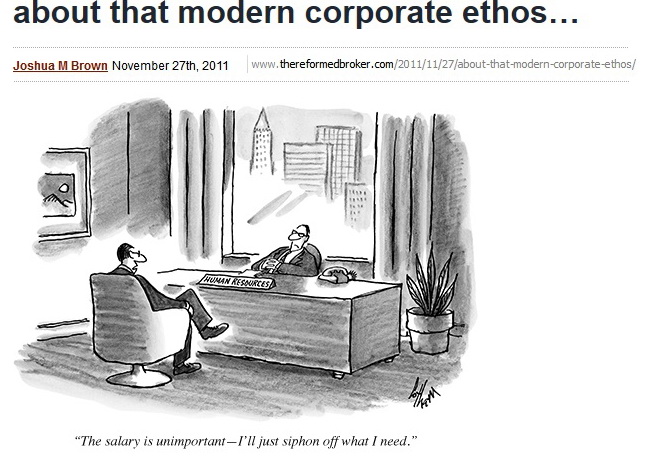

I'm going to cash/bonds and derisking within the restrictions of the 401 and in a market where everyone is leaning the same way and that may provide me an opportunity to undo some damage... Getting less long is the order of the day and the week, and I've never lost money since I began to actively manage my 401 and I'm not going to be stoopid about trying to keep the streak alive. I made money in 2008, but things looked so shitty then, so that going to cash was a no brainer; Hell, no brainers are my specialty. This year was actually a tougher call. Too choppy. But a nine percent annual return '04 to date, down a whole point in 2 weeks still ain't half shabby and I can live w/ that.

http://www.bloomberg.com/news/2011-11-2 ... ncome.html

http://www.thereformedbroker.com/2011/1 ... last-week/

http://www.ritholtz.com/blog/2011/11/ws ... s-deepens/

http://www.nytimes.com/2011/11/25/opini ... .html?_r=1

http://www.cjr.org/essay/confidence_game.php?page=all

http://www.businessweek.com/printer/mag ... 02011.html

http://the-diplomat.com/2011/11/25/the- ... ded-age/2/

Late Sunday Eve:

There is a hot "Italy (Europe) has Been Saved (Again)" rumor on the wires; Futures are raging higher. This may be a chance to get out higher and sooner than I had hoped.

http://ibankcoin.com/flyblog/2011/11/27 ... -dont-die/

I understand where he is coming from....

Monday Eve...

http://www.thereformedbroker.com/2011/1 ... ro-or-dog/

Now all I gotta do is to do the smart thing... whatever that is....

We finally got a turn upward in the market, I'm still thinking of getting less long and doing it during a bounce is a better way to go. I gotta figure this out.

Thurs Eve.

Still long, made a dollar, gave a nickel back... Balancing the possibility of a year end run up against the hopelessness of the confederated states of Yerup, the on going delevering of the population vs the wringing out of the debt excesses.

Tomorrows job #s will tell a tale. I should take the money and run.....

Soon... maybe.

Stay Tooned.

( 3 / 1387 ) ( 3 / 1387 )

Not Yet Thanksgiving, Yet Holiday Season Heard Just Around The Corner.....Is It Me That's Wrong And Not The Picture?

Saturday, November 12, 2011, 12:16 PM

"Sometimes I lie awake at night, and I ask, 'Where have I gone wrong?' Then a voice says to me, 'This is going to take more than one night.'"

-- Charles M. Schulz

Chartz and Table Zup @ www.joefacer.com

If You're Really Good, Different Gears For Different Jobs Come Naturally...

http://www.youtube.com/watch?v=UvklBbYg ... re=related

http://www.youtube.com/watch?v=Cp9V3D3u ... re=related

http://www.youtube.com/watch?v=KPJgtQwt ... re=related

Saw The Sgt P @ Winterland Back Inna Day. Blew My Mind....

http://www.nybooks.com/articles/archive ... tion=false

http://www.youtube.com/watch?v=qic4pjTE ... re=related

http://www.msnbc.msn.com/id/45277296/ns ... sBDFHKwXbg

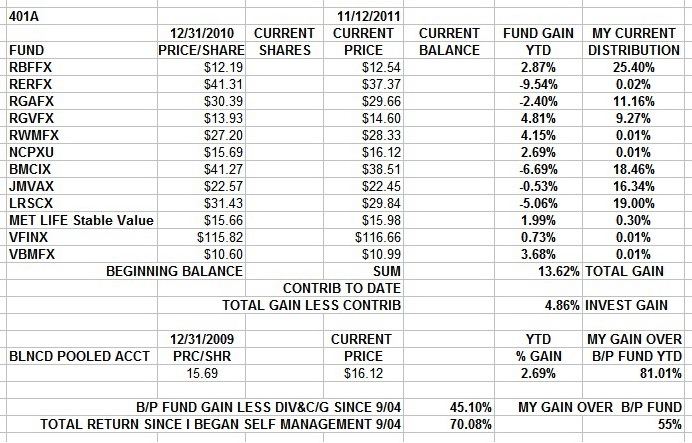

So I'm still carrying way too much stocks in the face of some truly nasty sentiment, nasty potentials, and it's all based on the faith that the market is not the economy and if rich guys need it to be up, it will go up. Fear vs calculation and faith the the game is to some degree rigged. I may be right, I may be wrong, and I may change my mind. Stay Tooned....

Holding my own for the year vs any and all funds. I can be satisfied with that. Especially in this market...

Ahl Be Bach.......

( 3 / 1385 ) ( 3 / 1385 )

<< <Back | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | Next> >>

|

|

Calendar

Calendar