"Consistency requires you to be as ignorant today as you were a year ago."

-- Bernard Berenson

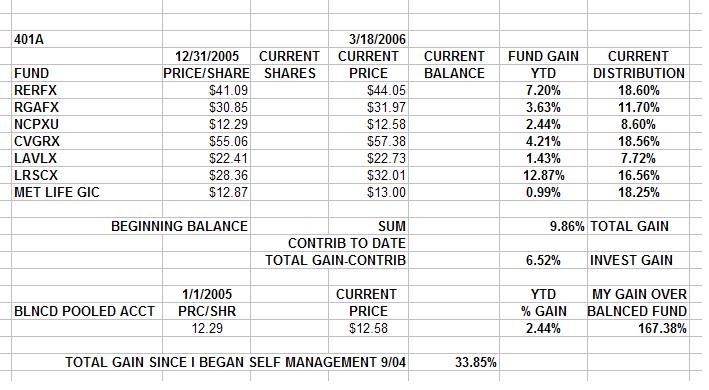

Charts And Table Up. More to come....

-- Bernard Berenson

Charts And Table Up. More to come....

|

"Consistency requires you to be as ignorant today as you were a year ago."

-- Bernard Berenson Charts And Table Up. More to come.... Sat 22nd. Charts and tables up.

Wed 26th. Not much doin'. I'm in the process of being hammered flat by a cold, the market has hit a bottom, just maybe not THE bottom. I'm 80% long and 20% cash in a rising (for the moment) market. I'll expound at length next weekend. "It's tough to make predictions, especially about the future."

Yogi Berra "No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some." -- Ken Keyes, Jr. Sometime things work out your way, sometimes they don't. Oh Well. I did a nice little finesse move; I looked at how long the market had gone without a correction, I listened to the Fed jawbone inflation, I saw the stock market start to break in the second week of May, and I sold. In May I got mostly out and in June/July I got back in. I sold high and bought back lower. Then the deadline for Iran to respond to the UN's ultimatum came up on the calender, and the Iran backed Hezbollah in Lebanon invaded Israel, killed eight Israeli soldiers and kidnapped two soldiers. And now the Israelis are exacting a price from Hezbollah to send a message that the withdrawal from Gaza and a retreat behind the Wall doesn't necessarily mean that it is open season on Israelis. http://www.msnbc.msn.com/id/13884768/ The Iran nuclear issue is now off the front pages and in the back of the paper on the lower half of page 12. What's up on the front page is expanding warfare in the Middle East threatening to spiral out of control and a possible threat to the world's oil supply at a time when prices are already at all time highs. There is a lot of fear and uncertainty and every quick trigger finger near the sell button is now leaning on it. Politics looks dark. Economics don't look that bad. There haven't been much in the way of lowered earnings preannouncements. The economy may be cooling, but business as a whole still looks OK, if not really strong. However our particular business sector looks really strong. And we've got a nice contract. That's encouraging. And the Fed finally sounds like it may be near a pause, if only a temporary one. The Fed is also likely to see the Mid East situation as a headwind to continued economic expansion and may not want to pile on right now. So I have gone to cash with the maximum allowable under the rapid trading rules as of Friday and I'll let the rest ride. Maybe it'll work out. September of '04 was an incredibly right time to go all in in stocks. Now the risks are huge. Forty percent up, to thirty percent up, and back down to 25% up in a month. The Mid East riff came up too fast. These things have come up recently on Union meeting night and I've been a day or two late to move. I've fallen behind the Balanced Pooled Fund for the first time this year. But I'm feelin' OK about what I own right now. I'd rather have bought Friday than two weeks ago... but for the moment, I'm standing pat heading into an earnings season that may surprise to the upside. Let's see if it works. Special Called Meeting going down in September. The Defined Benefit and the Defined Contribution Funds will be discussed at that meeting. I'm going to present some of the information I've developed and shown here as well as additional information regarding our Pension Funds. We will have representatives of the Fund managers available to answer to questions raised by the presentation. See ya there.... Stevie M Says, 'We got work. SaveYour Money'. Hell Yes!!! I've Done It Six Out Of The Last Seven Times.It Didn't Take Me Long To Figure Out How It Always Works...Revised 7/12

Charts and Tables Up.

Not much to post tonight. My 401 is doin' just fine. The extra work is paying off in greater returns and that is gonna get better when it is compounded in future years. I'll move the FPRAX/IDETX Mutual Fund Lessons to the website along with some other stuff yet to come. Eventually I expect to have most of what I cover in my presentations up here.... I think about eight to ten years will be about right. Even so, if that was all there was to it, colleges would only consist of a book store and testing facilities. So talk to me at the Hall if you don't think you have what I'm doing in my account totally figured out yet. I've loaded the move of the last of my cash from the GIC to RERFX into the clip. I'm eligible to do so as of the 9th. So the trigger will get pulled tomorrow at the end of the day. I think the FED's got one to go and maybe two. Either the market will celebrate the end of the interest rate increases or it will look ahead to the next recession. It'll celebrate/respond to what it sees by going up or down. I'm set for it to go up. If the market catches me leaning the wrong way, I'll have to figure out if it's just a hiccup or the bird flu and act accordingly. We'll see... Feelin' Alright.... Put this months contribution into LRSCX. It's that or RGRFX. Why not? The heading says it all. It makes what I'm doing a little harder, but not impossible. See me at the hall. We should talk.

I'd Like To Think I'm Starting To Get Traction On This 401a Thing. Talk To Me About It At The Next Meeting...

"The primary objective of leadership is to help those who are doing poorly to do well and to help those who are doing well to do even better."

-- Jim Rohn Charts and Tables up. The Conclusion of "My Most Gnarley Mutual Fund Adventure" So, to sum up my FPRAX/IDETX affair: 1) No game goes on forever. If you buy, you are almost guaranteed to have to/want to sell given time. It was 12 years for FPRAX and 12 months for IDETX for me. When the game is over, you need to leave the table and go somewhere else or lose what you've gained. 2) It's the manager, not the fund. Or it's the era, not the fund. Or the economy. Or the world economy. Or national politics. Or world politics. Or whatever. Good funds can be totally wrong at any given time for a number of reasons. When things change, you change. Or pay the price. 3) Price and trend are what's important to you. Every day something happens somewhere that can meaningfully affect your investment. Often it can, but it doesn't. Price and trend will always tell you what is really going on. It's the only unequivocal, direct, and elemental information that you can get. Unfortunately, it is about the past and not the future. No one said that this was easy. 3) You need to direct a self directed plan and you need information to do that. Given that there are pro's in place at the funds applying their knowlege, experience, and judgement on your behalf, you still are making a decision every day or every week or every month as to whether or not they will continue to do so. Is what they are doing working? Go back to the chart pages on my web site if you have any doubt that YOU CAN NOT AFFORD NOT TO KNOW THAT ANSWER. There's always something you need to know. You need to learn how to get the information and apply it. Get used to it. 4) No one cares about your money the way you do. The investment industry cares that your money shows up and stays so that it generates the fees to pay their salary. The legal authorities care that laws about managing your money are not broken. There is no law that says it is illegal for you to lose your money in bad investments or for fees and piss poor management to fritter away your future. The market doesn't care about your money, your hopes, or your dreams. It doesn't care about anything, whatsoever, period. You are the only one who REALLY cares about your hard earned money and the return it should earn you. And only you will make the hard choices that need to be made when the time comes. Do you really expect a money manager to fire himself because making you money or stopping you from losing money is more important than him keeping his job? 5) It's not a sin to be wrong. That's why there are erasers and whiteout openly for sale and not behind the counter. I screw up, the President screws up, surgeons and street sweepers screw up, everybody screws up. It IS a sin to STAY wrong. It cost Bill Sams his job and FPRAX and IDETX my money. That's why McMorgan no longer is our only pension fund advisor. Don't let the possibility of being wrong paralyze you. But the idea of being wrong and staying wrong should cause you to break out in a cold sweat. When I look back at the McMorgan era, I do... 6) The investment industry will tell you to stay fully invested at all times; you might miss a money making opportunity and cost them some fees if you don't. Notice how nothing is ever said about missing out on falling into a crater and not losing most of your investment by not being fully invested when it all turns to shit? That would cost the money managers some fees. Besides, you probably may most likely do OK or even well in the long run if you stay long and are lucky and things work out and anyway, they get their fees that way. And besides, they can't charge you fees and take your money if you don't stay the course. It's all about the fees, see... Of course if you look at the charts for FPRAX and IDETX, you'll see that during certain times, having the money in cash in a coffee can or in a money market fund was brilliant investing at its best compared to buy and hold investing. More about this later. The chart is live. CLICKONNIT The chart shows my moves into cash and back into stocks since May 1st. I declared victory a coupla months early in March and went partially to cash and it cost me a little in missed performance. Or not. I really don't know or care. It was not worth tallying up. I declared victory three days too late in May and it cost me substantially; a quarter of my return since 9/04 went away in four days time before I went to mostly cash. But I caught most of the move right and I protected 75% of my profits earned since 9/04. I booked a 30% profit in under two years and smoked what I'da done by staying in the B/P Fund. By the middle of May, the market coulda dropped like a stone and I'd have had it mostly covered. By June 9th, I was totally faded; I was pretty much all cash and maximally protected against losses. I was totally protected from profits on the way back up, but that's the way it goes. As described below, on June 16th I went 50% back in. That worked out OK, and as of Friday afternoon, I'm 80% back in. If you rub your eyeball on the chart above, you see that my moves 1) Bought me piece of mind during a brutal and bloody downdraft that had the pro's bleeding from the gums. The drop was very ugly in terms of the rate of fall and the lack of any respite on the way down. The lack of any short term bounce made it a very unusual occurrance. And I was in cash for almost all of it. 2) It made me a dollar, too. If you postulate that I was equally represented in each fund, then you can estimate that the midpoint of each heavy vertical bars on the chart represents my positions. It looks like I sold most of my positions at about 5% down from the peak in early May and about 2% in the hole in terms of the price as of the 1st of May. It also looks like I bought back half the positions at about 6% below that. It looks like I spent most of the remaining cash getting back in at 3-1/2% below where I sold. Just as an eyeball guess, I'd say that by selling when things got hairy and buying back when things looked better, that I'd bought not only peace of mind and safety in the case of a severe and prolonged crash, but made back some of the money I'd left on the table by not bailing out earlier. Far out. See ya at the Hall. We gotta vote on the contract and money allocation if we pass on it. And of course we've gotta move on a special called meeting on the pension plans.... My motion to do so is still outstanding and it's time to firm the meeting up. Tables and Charts up. I've spent some time polishing the third and sixth pages. They're done for a while. The biggest change is that I finally got around to putting up link to the New York Times "THE END OF PENSIONS" article. I consider it a must read. If the company specific pension system goes down, as taxpayers and participants in a hopefully healthy and surviving pension plan, we might end up picking up some unexpected passengers.

The conclusion of My Most Gnarley Mutual Fund Adventure; The IDETX Chapter. Monetary policy had been loose in the late 90's; cash was there to be had, but the rates were going higher. The market as a whole was not doing well at the end of the nineties. Much of the economy was suffering under the high rates, but most of the loose cash had run downhill and was piling up in the corner that held telecom, tech, and the internet where a good old fashioned stock bubble was underway. So there was this money management company called Janus and one of their funds was called Janus Twenty Fund. It was/is a hard charging, concentrated, high risk fund. It held twenty or thirty of the hottest stocks. No safety in diversification, but a lot of horsepower if they got it right. When the market narrowed in the late 90's and fewer and fewer stock went higher and higher, they were RIGHT. CLICKONNIT! Other funds in the Janus family saw what was going on and bought in to the same scenario. Other funds in other families did likewise. During the last stages of the bubble, it was amazing where you could find those same hot stocks. Sector funds totally away from tech etc held these stocks (very quietly) because it was the only way to show any performance and without performance, the client's money went away. These stocks were bought and bought and bought. Many funds acquired outsized positions because these stocks worked, money came in, and it was a no brainer move to buy more of what got ya there. Enter my position in IDETX. The Idex Fund family runs a lot of funds and contracts with outside advisors. My alternate fund to FPRAX was Idex JCC Growth (IDETX). The "J" stood for Janus. I had traded in my value fund for a ride with the Janus hot money boyz. I rode Idex and their Janus hot money clone fund up to the top along with everyone else who held the same hot money stocks. When we all hit the top as per "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine (Google it), I figured that the Idex managers would step off at the top just as the elevator started to go down. Sell the top, book the profits, and I'd live happily ever after. Instead, the managers at Idex actually were only hired hands who owned the same stocks big time back at the ranch. Actually everybody on the Street owned the same stocks and the doorway out was not wide enough to let everybody out at once. I coulda sold my IDETX in the time it took to get a letter with a signature guaranty downtown. Instead I stood by for part of the ride down as everybody bled their positions into the market, driving the prices lower over more than a year. Opps! I just ran outa weekend. Stay tooned. No change in the 401a portfolio pending developmnents. Fifty two percent cash. Enuf said. Charts and tables up. .

Here's where I was going with the FPRAX and IDETX riff; "Buy and hold", "Be patient, it'll always come back, it always does", "These are world class quality American companies, stay with them, you can't go wrong in the long run," is horse exhaust. CLICKONNIT. Check this out. Above are the Dow Industrials; 30 of the Great American Companies. Over the long run the trend is up. Check the chart. Forty six years of "in the long run" progress is shown. Of course, in the long run we're all dead. CLICKONNIT. Check this out. Above is the Dow between '62 and '88. Check out '66 to '83. Seventeen years and breaking even for the fifth time. Not much to show for buy and hold and having patience. Of course if you sold a little on the highs and bought a little on the lows, you did better. Still... We're currently in another period where we have flat performance;six years and counting... We'll undoubtedly get back to even in the long run. It helps to be 22 and have 40 years to go. That's the long run. But it sucks to be 50 and already thinking about taking the first step out the door to retirement. Six to seventeen years of flat performance? That is way too much of a long run...especially given where I'm coming from and going to. Anyway, think bonds are the answer once you get close to retirement? Check the charts on our bond funds against what fuel/housing/food and medical care inflation have been. So....if not buy and hold or bonds, What? What worked so well for me when Bill Sams was running my money in FPRAX was that he was trading stocks. He ran a small fund, some where about $50-$150 Mil when I started with him in '82 and around $700 Mil in '98, as I remember. In '82 interest rates were sky high. He kept a lot of funds in cash and made a good return on it in the 80's. He had maximum flexibility to roll the money between stocks and cash. He bought when stocks were down and he saw an opportunity and he sold when they went up to where the upside was limited. Then he did it again. You always had to take into account that he was doing very well considering his performance was accomplished with a cash cushion. It was especially good performance once interest rates came down. If stocks went to zero, he'd still have cash to return to investors. Most other funds are 100% invested. Bill Sams had the ability to bail out of either a winning or a losing position quickly because he carried relatively small positions; no bleeding a huge position into the market for many long months along with all the other giant mutual funds, trying to get out as fast as possible without destroying the stock price. He was playing a value game, looking for diamonds in the dirt. He bought stocks that were going down or already down and were going to go up. He was right for years. Then he was not. Due to the Thailand baht crisis, the Long Term Capital crisis, the Russian bond crisis and other financial crises of the 90's, the Fed flooded the market with dollars and lowered rates. Bill saw inflation on the way and set up for it in gold, commodity stocks, and other defensive positions and stayed the course, regardless. Instead of driving gold and oil up, the money went into the "new economy", dot coms, telecoms, etc and it was FPRAX that blew up. There came a time for me to trade the trader. Whether or not Bill Sams was right in the long run was meaningless. He was costing me big time. "It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong." George Soros So I stopped the losses. I moved on. I had bought and so I sold. I got impatient. I got short runnish. Bill stayed the course, sure he was right. He was. Ultimately, gold, oil and metals soared, eight years later in 2005/6. Bill Sams was "retired" shortly after I was out of FPRAX, in 2000, but long before he was proven right. Management of FPRAX was given to the managers of FPA Perennial Fund FPPFX, a fund that was/is run similarly to FPRAX. Hell, Bill may have trained his replacements. Regardless, the market stayed irrational longer than Bill Sams could stay employed. CLICKONNIT. Check this out. Pretty good performance since 2000. Last I looked both FPPFX and FPRAX were carrying about 30% cash. So...FPRAX was right, then it was wrong, and now it's right. What does it mean? YOU CAN'T LOOK AWAY FROM YOUR MONEY. IT'LL GO AWAY IF YOU DO SO LONG ENOUGH. No money manager is always right. No system works all the time under all circumstances. No money manager is above regular review and everyone is subject to replacement if the performance isn't there. It all falls back onto the individual who invested the money. You can't expect a money manager to fire himself. That's your job. There are times when they don't even admit that they've been wrong. Been there. Listened to that on the phone. It's about understanding that it is NEVER a no brainer to give your money to someone else to manage. You have to understand what he is doing, and whether or not it is working. If you get lazy about it, you can end up being the no brainer if/when your money goes away. Can this even be done? Isn't this a huge amount of work? Don't you have to know what your money managers are holding every single day? Isn't it a huge risk? I think so. No. No. I don't think so. In that order I think that I can successfully manage my 401a right here with the tools I've got on this site and reading up on the market and economy. Bill Sams was responsible for making me a dollar. That was very good. Teaching me that it is my responsibility to see that I kept, it that was great. Next week, lessons learned from IDETX. Over the past month, Japan has removed $50 billion of liquidity from the markets. Other central banks are tightening rates or policy or both. The carry trade appears to have been ended. The Fed has sprayed grumpiness from the lip all over the landscape, lobbed threats all over the horizon, and promised the end of life as we know at the very minimum if they eyeball even a trace of pricing power, much less inflation. Markets, portfolio's, and hope have been crushed. My trading account and IRA's are a smoking ruin. Death and destruction and the crimson wing of doom o'er shadowing all, as Darkness and Dispair loom o'er their new domain.... It's Really Very Very Cool. I love the special effects. The Fed has reinstituted fear in the marketplace, hammered speculators flat, flattened out commodities, and served notice, all between meetings and without raising rates. All while I was mostly in cash in the 401a too. It takes the sting out of the other nastiness in my other accounts. The economy still appears to be OK, the cooling of commodities may extend the post dot com/9-11 crash run, and if the political risk comes out of oil, we may just get by quite nicely. Markets backed and filled Friday after two big short squeeze big time up days. Things look brighter in the short run. I put half my cash back in on Friday, pretty much across the board. See the charts and tables. Yeah, it's kinda cowboy. But look at the charts. If everything turn out for the better, I've bought back in at near Jan 1st levels and I've got no obligation to ride the positions down into oblivion. I'm half cash in case it doesn't work out, so my risk is half what it could be. I have cash to commit on a dip if one occurs so I can get in even cheaper. Ammunition is alway a good thing to have plenty of when things are uncertain. If it goes straight up without me and I only got a half a position on, I can live with that. It won't necessarily be easy as it is a new game as of last month. But no one said it would be easy. It's all about the economy. And that it's still strong gives me hope. Understand, hope is not my strategy, it's a result of my observation and judgement. Maximizing my opportunity and controlling my risk is my strategy. See ya at the hall. Contract vote coming up... The title bar says it. Weeping and wailing and gnashing of teeth. I lost too much money Monday for being 75% cash and my only remaining sizeable stock exposure in LRSCX was the culprit. The fear on the Street is huge. Stocks are a sea of red. I suspect that scared investors still holding stocks will shovel them out on any bounce up. Compound that with the typically slow summer season, the withdrawal of liquidity from markets worldwide, and the possibility of a recession and continued high energy prices bleeding away discretionary spending and I'll risk getting stuck in cash if the markets bounce, cuz I don't have any idea how far down a bottom is. I've got the bulk of my remainng stock exposure set to exchange for the GIC Tuesday when the market closes. I check the market midday and if it looks bad, I'll let the exchange happen. I may let it happen regardless. Cash is a good place to be.

6/13/06; It went through: Screw it. Cash is NOT trash. Here's what I've got; I'm holding less than 6% stock funds not including the B/P Fund. I'm at 85% GIC, tracking positions in the investible funds, and the rest is the B/P Fund, which is more bonds than stocks. CLICK ONNIT... I'm just flat ....' amazed. The market is cascading down seemingly without pause. I've been selling losers and holding on to winners in my trading account and I've still been ....' hammered flat. It feels like stocks are going to zero. Check this out; CLICK ON DE CHART Six months to a year's gains gone in almost all the funds in 3 weeks. AMAZING! Bob Mamini was right that RWMFX is stable and highly resistant to price movement under almost any circumstances. I'm still not clear how a stock fund that won't go up OR down is a good thing. Twenty nine percent up in 20 months and feelin' like the work really paid off. Stay tooned.... "No one that ever lived has ever had enough power, prestige, or knowledge to overcome the basic condition of all life -- you win some and you lose some."

-- Ken Keyes, Jr. Charts and Tables up. I talked to some brothers and sisters at the Union meeting and got some input. I've edited some of the pages slightly, no biggie. But the site IS a constantly evolving work. Take a spin through it once in a while and see what's new. Continued from 5/27/06 ..... Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. Every so often, I'd ask Jack if he had any other names like Bill Sams and Paramount. He'd give me the name of a different fund in a different sector, a quality fund from a well known investment house, and I'd put some money in. They'd do OK, Bill'd do as well, they'd have a so-so stretch and I'd put the money back in Paramount. The latest fund was IDEX JCC Growth (IDETX). Suddenly, the money there had doubled. Click on the picture below. Between '96 and '98, IDETX had doubled my money. I took everything out of Paramount and put it in IDEX JCC Growth. Between 1998 and the first quarter of 2000, IDEX made back the money lost in FPRAX and then some; it doubled again. In the meantime I'd read an article called "New Paradigm or Mean Reversion?" by Jeremy Grantham & Jack Gray. Sep/Oct 1999; Investment Policy Magazine. Go ahead and Google it. It's archived and still available and free besides. The article predicted the mechanism of the downfall and end of the dot com era. I'd been around long enough to have witnessed the 1980's end of the energy and real estate/savings and loan eras and I knew that it was only a matter of time until the same thing happened again to the dot coms. Obviously the JCC advisors of the IDEX Fund were smart guys and they would ride the bubble to the top and step off the elevator when it started to go down.(I love to sprinkle mixed metaphors willy skelter.) Here's what happened to my investment in the IDEX JCC Growth Fund, Click onnit; My wife and I took some of the FPRAX/IDETX money and bought our house in mid 2000 on the first leg down of the collapse of the Dot Com bubble. We got a really lucky break on a house and we had the money thanks to IDETX and we moved on it. We weren't about to let that opportunity go away. I rode the rest of the IDETX money part way down and I bailed out of a one time winning mutual fund that was now in the process of destroying my savings. AGAIN. Now I was REALLY pissed. There was something going on that was giving me excellent gains and then taking them away and I didn't understand why. So I got busy. Next week; Some of what I learned about mutual fund investing. (To be continued) This week I went from 60% cash to 76% cash by putting this month's contribution in LRSCX and clearing out of RERFX. Click on the chart. I had pretty much moved to cash except for LRSCX, RERFX, and RGAFX as of 5/15 because: 1)The American Funds have limitations on withdrawals and reinvestments. I withdrew what I could without triggering the rapid trading restrictions. 2)I thought the foreign markets would be insulated somewhat. 3)I think that LRSCX could still do well, relatively. But RERFX reaccelerated down and Friday I bailed out most of the rest of the way, trading restrictions be damned. I suspect that a significant amount of the money out there in euro/asian land may be US in origin and on its way home, markets are determined at the margin and a US slow down may be more feared than I thought, and the foreign markets appear to be going through their own rough patches. So I'm frozen out of the RERFX fund for 30 days as the price of holding on to what I've made in the last 20 months. I can tolerate that. To recap; I've declared victory and gone substantially to cash a second time this year; I was early the first time and close enough the second time. I've got 30% gains over 20 months, 3.86% YTD, and I'm 252% up on the Balanced Pooled Fund. I was up 40% over 19 months and up 11% from Jan 1st YTD, but my inability to predict the future resulted in giving part of my gains back. Again, I can tolerate that. "The first step to making money is not losing it." -- Ed Easterling "It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong." George Soros I currently have residual amounts (tracking positions) in the funds that I see as investable at this time. I'm frozen out of one of the funds for the next 30 days. The economy remains stronger than most people realize and especially strong in the sector we work in. The markets may be predicting a recession. They predict more recessions than occur. This may only be a correction in a demonstably overheated market with a resumption of the market as usual just down the pike. Or not. Regardless, there has been an unholy carnage in the market as a whole that is masked by the popular indices. That will take a while to unwind. Trapped longs, levered positions being unwound by margin clerks, hedge fund closures, and mega mutual fund pull backs and redeployment in alternative sectors accomplished, in process or still to come? You can make a case a buncha different ways. Recession ahead or correction mostly accomplished, I'm way ahead and as safe as I can be. Seventy six percent of my funds earning four percent annual return with no downside has a possible recession covered. The GIC is ahead of the Balanced Pooled Fund at this point. Pretty Cool. I've got time to grab a figurative samich and brew. I've also got the flexibility to watch for the possible end of the short sharp shock of an overdue 10% correction instead of an upcoming recession because I've made five years progress during the last two. What's not to like? Special called meeting very likely in the next three weeks. Contract Time. See ya at the hall. Charts and tables up. The ballad of Bill Sams, Janus International Holdings LLC, and Joe Facer to be continued. It's Sunday really late and I'm way behind. I'll post as time permits. I've reviewed the same charts shown elsewhere on my web sites and I'm gonna push my small cap up even with the foreign equity fund. Unless I cancel it it'll happen Monday evening.

MONDAY EVENING: I canceled it. Damn!!! Charts and my trading account are a smoking red crater. I'll be working on what, if anything I do on this this Monday evening and I'll get back and post as things develop. Union meeting this week.... "It is not how right or how wrong you are that matters, but how much money you make when right and how much you do not lose when wrong."

George Soros Charts and Tables Up. I want to talk about Bill Sams and the FPA Paramount Fund (FPRAX). My buddy Jack Kenny at Investment Investigators turned me on to Bill Sams and FPRAX back in '82. A mutual fund's charter is its foundation. Bill's charter at FPA Paramount was pretty kool and very unusual. He was allowed to hold up to 50% cash and typically held 10% to 30% cash. He was a deep value investor, eclectic and conservative. He had some ideas he believed in and he wasn't interested in having more money than ideas; his fund was closed to new investors for a good proportion of the 80's and 90's. The details and rationale for all this is REALLY important to me but I'm not going to write about it here at this time. The object is NOT to write a book here, so I won't. But I do cover the subject in depth during one of my presentations, so you can still hear about it. Get me a fast internet connection, and 5 to 20 union members and I'll do a two to three hour riff on a Saturday morning. Get hold of me by Email or at or through the Hall. There's a lot to cover that I think is very important to the financial future of our local and the personal finances of our members; Meanwhile, back at the ranch.... Owning FPRAX made investing a no brainer. Look what Bill did for me. CLICK IT! IT'S ALIVE!! It was big time fun from '82 until '98. When the market was hot, I was pretty much fully invested. When things went bad, I was sizeable in cash. My money tripled between '90 and '98. For the early 90's, the challenge to anybody who thought he had it goin' on was "Oh Yeah? Well, how'dja do in '87, Smart Guy?? Here's how the S&P500 did; THIS'S LIVE TOO. CLICK IT! Bill was heavy in cash in October of '87, I think the full 50%. He got hit like everyone else, but only half as hard. Then he turned the cash into stocks and rode the rebound. He and I finished the year up 23%. I got a very good return with a lot of safety and absolutely no work. I'd had a 15 year run riding with a hot hand and the future looked so bright, I hadda wear shades. FPA Paramount had turned a $6K in 1982 investment into a very nice down payment for a really nice house in SF while I just watched the money grow. Then came 1998. All of a sudden, every week I had significantly less money. I'd had draw downs before, but not like this. This was unrelenting, continuous, and painful with no relief in sight. Between mid '98 to mid '99, I lost enough money in FPA to put me back where I was in '94. I'd thought my rate of return had been pretty good, but if I stopped losing money and went back to my previous rate of return, it'd be 2005 just to get back to even and 5 years in the hole at the same time. All of a sudden real estate prices started rising as fast and as hard as my money was going away. Then the landlord started getting wonky about selling the house we were renting. The future didn't look nearly as bright. Whereas hanging on had always been the best answer before, it was killing me now. How could I sell what had made me so much money in the past? How could I sell something that was so far down and admit/accept/lock in the loss? What if it came back after I sold it? What if it came back but it put me 6 years in the hole? WHAT IF IT KEPT GOING DOWN? Then I noticed something very interesting. Maybe the answer to all these questions had been right under my nose all the time. (To be continued.) Here's a chart from elsewhere on my site. Stocks have bounced and so have the funds that are fully invested in them. Is this the all clear for me to pile back in? I dunno. There are always questions about the future and here's some of the ones that are bothering me now. The American Funds are huge. Does the sudden down draft indicate a change of leadership in the market? Can the large funds we have available to us respond quickly if the funds need to change direction? Is that why my two American Funds funds are 10% cash? Or will it take a year to bleed the out of style stocks from the portfolio and replace them with better performing stocks? Is this the beginning of a bear market and will we be faced with a year long erosion of stock prices? Or is/was this just a quick correction and moving stocks from weak hands to strong hands and are prices going back up? Will the government's useless rigged measures of inflation finally start to unwind and show inflation as bad as it truly is? Are interest rates about to spike up and then hang up there? Or not? How will politics affect the economy. I've got a 30% investment return in my 401 in less than two years. Do I really need to make a decision about what to do here and now for my 401a to stay on track? Finally a question I can answer here and now. Nope. The snap decison to sell big time was a good one. I think a carefully considered decision about when and where to reinvest will be a good one too. Stae tooned. Oh yeah. American Funds, provider of some of the funds in our 401a plan , is materially involved in a class action lawsuit. I'll keep you posted about what I find out. Clean rooms start in the dirt, beer and cheese comes from stuff rotting, and you don't wanna hang around where cows become prime rib and steak. Likewise the otherside of 40% up can look NASTY....

"Concern should drive us into action and not into a depression. No man is free who cannot control himself."

-- Pythagoras Charts and tables up. For the past two years, I've been droning on endlessly about the need to get some exposure..ANY exposure...to the stock market. That was then. This is now. There are BIG changes as of Thursday last week. So... I thought I was going to write quite a lot about those changes this evening. But I'm not. Not that much has changed, really. What has changed is that what is going on matters now and it didn't used to. Check out "Ernest Goes High Finance" which I wrote on March 9th. It's as right now as it was too early then. But what was then, still is now. But it's different. Now it scares people. So they bailed out on stocks, driving prices down. So I bailed too and now I'm 60% in the GIC. I got out early enough to feel good about it and it didn't cost me much money. I'm still up 250% over the Balanced Pooled Fund. Enuf said. Still.... What next? Well, the economy is still good, so I've still got a job. So do a lot of other people. And we buy stuff so other people make money too. So there are reasons to still try to invest in the economy. But where? During the dotcom crash, 51% of the companies that make up today's S&P 500 went up. There's always a right place to be once you start to look at time periods longer than a few weeks. I just don't know if the 401 funds or just some of them are the right place to be. So for now I'm gonna watch. See what happens. And make up my mind about whether I'm gonna bail out of what's left or put my money down on what looks like a winner or three or five. I'll be posting about it here. Uhh Oh!!! The markets fell in a hole. How far is down and am I gonna go along for the ride?(Revised 5/15)

Charts and tables up. Fifty percent of my '06 gains gone in two days. Screens bleeding red. My trading and IRA stock accounts with a fair number of momo stocks and my IRA mutual funds just got hammered. The Defined Contribution account lost a fair chunk of gains too. Eleven percent up kicked down to only seven point eight percent up in just two days (Down to 6.8% in three days).

Oh well, stocks go up and stocks go down. I should do something about it, so I will. it's not really that big a thing. I'm still up 35% in less than two years and 255% over what I'd have had if I'd stayed in the default Balanced pooled Fund. I just gotta make sure I keep as much of my gains as possible and give the minimum amount back. So after the market closes Monday the 15th, I'm set to go to over 50% cash. I'm selling what I can without running afoul of the rapid trading rules and putting the proceeds into the GIC. If the market is up during the day, I'll probably cancel the transactions since they happen after the market closes. If the market's down big time, I won't. If it's just a hiccup and done in a day or two, I'll plow the money back in when thing look better. If it is a change of market character and market leaders, it'll take the 401a funds a while to readjust and I'll probably dodge some losses waiting on reinvesting while that happens. Then I'll put the money back in. If the bears are right and the bull market is history, I sell a bunch more and figure that I'm not concerned about getting back in in a hurry so the rapid trading restrictions don't matter. I'll stay out until the bear market is history and it's wrong to be out, then I'll put the money back in. When stocks have gone down long enough, they go back up. I just gotta figure out if that's two hours or two years. Watch this space and check out the tables to see what I do Monday. (The market was down and I went to over 50% cash {almost 60% allocated to the GIC}). Check out the account table for details. And stay tewned. See ya at the hall. YEE HAAA! I'M OVER A 40% RATE OF RETURN SINCE 9/04 AND UP 11% YTD! NOT HALF SHABBY! Getting it is nice. Keepin' it is better.

Charts and tables posted. I moved some more money Friday after the market closed. Markets lookin' choppy and herky jerky. My account lookin' good.

So other than the move of some funds out of the GIC last week and into small caps and foreign, steady as she goes. I'm fully locked into some overdue honeydo's, a car up on blocks, four bikes to get road and track ready, a job, and even some eatin' an sleepin' too. Overtrading/market timing issues aside, catching most of the upside action and avoiding freezing in the headlights is the strategy of choice for Defined Contribution plans. Pretty much what ah bin doin' and ah am continuin' to be doin' Acheving this without much effort, I might add. Pretty kool, Huh? Maybe I'll wax philosophical or educational next week. We'll see...

"You may have a fresh start any moment you choose, for this thing that we call 'failure' is not the falling down, but the staying down."

--Mary Pickford Rough market. Up an' down stocks, rising rates, good earnings, a few blow ups. Rising foreclosures in the midwest, every reason to see the economy falter. Except it isn't. Have I seen an economy that just wouldn't quit before? Yup. I'm putting half the GIC money back into small caps and foreign. Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair 'nother week, 'nother post. Stocks go up/stocks go down. Look at the charts. It was a down 1st half the week and short but up last half of the week. I made back(Wed/Thurs)some of what I lost(Mon/Tues). Taking a step back, the midterm 18 month uptrend still appears intact and built of a buncha zigs up and smaller zags down. Was Thursday's zig up complete or is there more to come Monday? Is it the start of bigger zags down and small zigs up? We'll see. The risk of losing what I've gained so far is greater than it was, but so what? Earnings season is upon us and I think it'll be a good one for the right stocks. A sell the news reaction? Probably. But right stocks might go up after that if the forward guidance is good. We'll see. I've been buying. I'm ready to consider selling. I'm waiting for more information. Will the right stocks go up? Do the 401 fund's own them? Do I own the right funds? I'll let ya know next week. Oh yeah...One more time ya need to see the opportunity cost of the Balanced Pooled Fund. This is the chart from a coupla three weeks ago, so make sure you look on the chart page to see the latest. See ya at the hall. The trouble with opportunity is that it's always more recognizable going than coming.

Jerry Byrne Charts and tables up, They tell the story. Party on. It's getting ugly here and there; somedays are as tough and ugly as other days are easy and mellow. But I subscribe to the philosophy that as much money is missed on the way up by excess fear about buying in as is lost on the way down by freezing in the headlights about bailing out. Avoiding extremes of fear is the way to profit. Steady as she goes. Big in the well performing funds, little or out of the non-performers, always an eye on the door. Somedays it's really hard. There is so much fear out there and so much faith that things'll be alright if you just don't do anything. There is also much ignorance out there about people's own hard earned money, who holds it and how long and what happens to it. Two weeks ago, a union member was blown away when I and another member were talking about last month's money showing up in our accounts this month, He had no clue who held his money and for how long. He also thought that self managing your money meant that we all went home everyday and moved our money around for a coupla hours. It'd be really tough if there weren't offsetting moments like being told last week by someone who attended one of my presentations that he's up $40K since 1/05 when he hosted a presentation on the Defined Contribution plan, despite being out of work for over 6 months. Pretty cool. Oh yeah. I added some more links to the site. Check out the Apprentice Investor series @ TheBigPicture.com. It's in the LINKS. See ya at the hall. Even Republican pundits acknowledge that they are likely to lose the House this year. If the Demo's can't win this year, When can they? And if they can't, do we need to reexamine our political alliances? Appended 4/5

Thoughtless risks are destructive, of course, but perhaps even more wasteful is thoughtless caution, which prompts inaction and promotes failure to seize opportunity.

-- Gary Ryan Blair It's a new month, so there are new Fundalarm.com tables. More about that below. There are also new charts and personal account data tables. (More about that too...) I stood pat last week; I'd gone from 90%/10% stocks and bonds/cash to 70%/30% three weeks ago. Discipline, ya know; Yin/Yang, cycles, Buy/Sell, what goes around comes around, that kinda stuff. I gotta keep my sellin' muscles limbered up; If I am going to go where there is money to be made, I gotta be ready to go away from where there is money to be lost. That said, I'm thinkin' that I'm gonna bleed some cash back to equities. I'm at a new all time high for return (35% since 9/03) and the way I play the game is to go where the action is and stay until the party is over. If I could always call the exact top and bottom, you wouldn't be reading this. So I want to make enough to still have a good return even if I'm late leaving this party and late arriving at the next one. And since 9/03 I HAVE made enough. Go with what got you there until it doesn't work. I'm gonna. More about THAT below... Speaking of thoughtless caution, I went to the 401 meeting a coupla weeks ago with a buddy who I'm mother-henning through the process. I ended up in a shouting match w/ Mike M. over some things. One of them is the Washington Mutual fund which we have in the 401. Check out the chart below; CLICK ON IT, IT'S LIVE! The Fundalarm data tables call RWMFX a Two Alarm fund. I say it's on its way to a three alarmer. It looks and performs like an S&P500 fund only not as well. An S&P500 fund is a nonmanaged fund that represents the market as a whole. We get that currently with the VFINX fund at a VERY low management fee. I don't see paying a higher fee to mirror the Vanguard fund but make less money. Mike M. does. He defended it based on 50 years of good performance and meeting the approval of the PE Teachers of Washington DC retirement association or some other group that I failed to make a note of, based on not recapitulating the crash of '29. Or so I remember. What he said didn't make much sense. If the management team that was in place for the last 50 years is still there, they're really old and I'm not surprised that they aren't doing well. If they are not still in place, why quote what the fund did a lifetime ago with different managers? I can't retire on historical performance, nor relative performance and neither can you. But what really ticked me off was this; Mike spent 45 minutes on identity theft. Granted this is important and very much today. He then crammed the 401 material into half an hour because he promised someone an early out. Then he gave out wrong information on the threshold for market timing in the various funds and suggested looking at the 401 account once year. Here's why this pissed me off. Check out the chart below. CLICK ON IT, IT'S LIVE! This chart shows all the funds available to us. Note that we've lost money being in the bond funds. Less than even after 2-1/2 years? Gimme a break. No reason to be there and I'm not. That's not a safe return, that's bleeding assets. Note also that the Washington Mutual Fund is the worst fund that doesn't lose money. I still think we were sold that fund for a spiff, as part of the American Fund package, or just name recognition. No reason to be there either, and I'm not (kinda). Finally, note the performance of the Balanced Pooled Fund (B/P Fund) that I've penciled in (electrophotonically speaking). I've got an ugly suspicion that the B/P Fund is mostly the bond funds and the WashMu, with a little bit of some funds that are doing well. It sure looks that way. I think I'm in WAMU whether I like it or not and I KNOW I'm stuck in bonds to the extent that I'm in the B/P Fund. Ask Mike M. about it... Here's the big issue for me; I met a buddy at the KJ memorial who works in the next local south. He's retiring next year after 27 years and with $3100 a month to show for it. I know of an individual in the next local west who has 20 years down and $4.5K/month to show for it. The sparky I work next to has 20 years down and $3k/month to show for it. I have a 30 year pin and about $2100/month to show for it. Can I retire successfully on 1/3rd to 2/3 of what other workers in neighboring locals do? Looks like I'll find out. And so will the other members of my local. The 401 is going to be vital in me being able to retire successfully. I've worked hard to get a decent 401 plan into place starting in the fall of 02 because every member including me is going to rely on it more than we ever imagined. That's what is most important to the members of my local, not identity theft. If Mike's tired of giving the same old 401 lecture, I'll need to see that it is no longer needed before I'll back off. And as long as my local's members have a less than adequate defined benefit plan and are thoughtlessly cautious in being in the BP Fund, I'll be there. Show me that the members of the local are knowlegable about and resigned to uncertain and poor future and I'll back off. As for not looking at the 401 but once a year, you see the results of THAT kind of thinking elsewhere on this website. That kinda crap is what got our previous plan advisor bounced out and Mike M. in. As for not knowing the current fund's policies on market timing,.... This month's contribution came in and I put that money and some of the GIC money where the getting is good; the RERFX fund and the LRSCX fund. I'm still makin' money, I'm 14% cash, I'm still one day away from the complete safety of 90% cash if and when, and I've personally confirmed that it is possible to sell as well as buy without the world coming to an end. The personal account data table has been updated to reflect the situation deliniated above. Se ya at the hall... Anyone else get a sense that all of a sudden the next two elections are the Democrat's to lose? And that they are really good at it lately?

Watch this space. I've been busier than a one legged man at an ass kicking contest this weekend and it's Sunday evening and I'm half way through Saturday morning. I'll post this week's entry as soon as I hit the ground again.

Monday evening addenda; Charts and tables for last week posted last weekend. Not doing nothin' allocationwise right now, too busy, go figure. Anyway, it's all about stayin' in touch with medium term trends .... this ain't day trading. It's about being heavy in the best funds and not losing too money in the wrong ones. I can do that by standing pat this week. And standing pat most weeks, actually. I allocate funds 12 times year when new money comes in on the monthly contributions and I rebalance funds maybe one or two additional times a month or not at all. Don't confuse this with active portfolio management, much less daytrading. The funds do that part for us. This is about keeping the best 5 outa twelve players on the floor and letting them play and making sure to watch the clock and the officials. I attended Karl Janosch's memorial last week and talked some with guys I used to work with in the 90's. From that event and some other info I've been developing, I've got some information that I think must be carefully considered by the local members. See ya at the hall. Whoa! Pretty good week all around. Even with close to 30% of my account in the cash equivalent GIC, I'm still at a smokin' 34% gain in 18 months. That's equal to the high water mark of the last coupla weeks. Of course, my performance for the week coulda been a fifth again what it was, if only I'd stayed with 100% stocks. Oh well. I feel strongly about that both ways. Check out the chart below.

So it's all about cyclicality. Life is about seasons and cycles. Things get good and things get bad... Spring to Summer to Autumn to Winter...And then back to Spring... youth to old age to death and rebirth...boom to bust to boom...recession to recovery to recession...there is a season, turn turn, turn ...philosophy kinda like the monologue in the middle of a good ol' fashion Country an' Western song, iff'n ya all know what ah mean... So if there is a time to buy and hold, say like April '97 to say April-October 2000 on the chart above, then there is a time to SELL. Like say July 2000 until April '03 on the same chart. But it's never that easy. If you are used to selling, used to leaving ten or twenty dollars on the table in order to take $100 home, it CAN be that easy. But if you can't do that/never have done that, it's really hard. Say you bought in January '99 at 1200 on the chart above. Say you watched the markets run up and the money roll in. Say that you figured out that all you have to do now to make money is to buy stocks and hold them because it's working so well, and besides that, you heard and believed that it's just a matter of buy and hold because the market always comes back. Say that, based on the above, you decided to hold on to your stocks regardless. Say that you watched the market go to the high of 1500, up 25%, and then watched it go back down to 1200. Say that after a year of watching your profits bleed away , you've had enough. You decide that you finally want out, but not until you see it back near the previous high of 1500 so as to get back what at least some of the profits you've lost. Say that the market goes down even more, to 1100, then bounces hard but only gets to 1150, not even where it was when you decided to sell. Then the market rolls over and keeps going down, but you keep the faith, determined to sell at least near breakeven at 1200. And then it continues down. You've lost the profits that you made between 1200 and 1500 and now you're well underwater. How can you lose your profits AND the money you started with? You can't take the loss and it's drivin you up the wall. Now you're just waiting for a chance to sell anywhere close to 1200, just to kinda sorta break even. But say you see 800 first. It never gets close to 1200 that year or the next. Why, that's when you finally realize you're screwed, but good. You're down 33% from where you started and down almost 50% from the highs. Huge Bummer. Maybe you sell then, at the very worst time; you lock in the losses. Really Huge Bummer. Even if you don't sell and hang on after it finally turns up, you won't get back to even for 2 more years. That's still a bummer, but at least it's only a middlin' size one, compared to bailing out at the very bottom. But suppose you were as practiced at selling as you were at buying. Say you sold a little on the dips on the way up and you bought what you sold back when stocks bounced up. Say you were determined to book part of your profits on a regular basis and cut your exposure when things got bad. Why, then you would have started selling when the market rolled over at 1500 and started down. You might have bought some back on the way down on the bounces, but as the market descended, you'd sell and you'd have less and less stocks and more and more cash the lower it went. You'd have a lot of cash to buy stocks when they finally bottomed and started back up. Eight hundred to 1200 would be up 50%, not finally back to even. Hey! That'd Be Most Excellent. That'd be a good thing indeed. So I'm not that unhappy that I sold earlier this week. I was still 70% invested in stocks, still making good money, and now I've gotten some recent practice selling. And that's a very very good thing indeed. So this Sunday PM late, I moved a little money back into RERFX and LRSCX. After all, RERFX is where a falling dollar and growth outside the US will do me some good, and LRSCX is where I can invest in companies growing 20%-30% unlike Microsoft, GM, and Intel. See below.  But nothing fundamental has changed and I'm still almost 20% cash and ready to get sellicious if and when. If the doom and gloomers are right, it'll be a long ride down over years and I've got the mindset, intention, and tools not to ride my money all the way to the bottom. In the meantime, I'm still earning my retirement. And if it turns out to be sweetness and light and not darkness and despair, I'm dialed in and ready for that too. See ya at the hall this week. We have stuff to do there. BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED.

Time to declare victory and bail outta Dodge. It's Time To Go. To recap for you... Since 9/04 I've been bullish. Once the 401 plan had a decent selection of investment funds to choose from, I availed myself of the opportunities the very same week they became available. I'd chosen to have my monthly contributions deposited in the Balanced Pooled Fund. I'd decided to review my 401 weekly and decide where to put the monthly contributions to work and where to keep the existing funds working. Using some of the same tools shown on my website, I moved my funds into the top four or five stock funds and kept them there. I've also moved money around from fund to fund in conservative increments. Over the last 18 months, some funds got hot and some did not. So I acted accordingly. Nothing radical, just putting the regular monthly contribution where it suits me best and moving 5% to 10% of my total amount as circumstances and inclination permitted and required. (See the charts and tables on my website and read below.) The object of the exercise has been to catch and ride momentum. Interest rates have been at generational lows since the dot.com crash and corporate profitability has been huge as free money sloshed around. Huge factories with huge payrolls manufacturing things have not been part of this recovery, but it has been a recovery none the less. Check out the charts, check out real estate, check out all the Hummers and other big SUV's, check out all the new homes and new toys. Most of all check out my results. As of last week, I had a gain of 34.5% over 18 months. This was an annual gain of over 20%. This is smokin'! This is great! In Mutual Funds no less! This is also absolutely unsustainable. This is just plain an accident waiting to happen. Eighteen months ago, interest rates were still heading down/at rock bottom. Oil was $30+ a barrel, and commodities were cheap. There was little or no political risk to the economy, we were 18 months from the economic bottom, and the Fed was shoveling cheap money out the door to stave off deflation. Now interest rates which have seen 1%, are on their way to 5%+. Japan is about to forego 0% interest rates and rates are rising in Europe. Oil has seen $70 a barrel and may see it again. Iran, Nigeria, and Venezuela are posing a considerable political risk to the energy markets such that storage of oil and gas is way above typical seasonal inventory levels, yet the price won't go down. The energy market is running in place and again, OPEC countries are awash in $$$$. But this time instead of building mansions and buying toys, they're buying up businesses the world over. And we're 39 months into a recovery and recoveries usually last about 36-38 months plus or minus. BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED Here's where I was; (click it...it's live) Here's what I'm lookin' at; (click it...it's live) Time to take some money off the table. Things are probably topped out and rolling over for the moment. Or maybe for longer. Maybe we're replaying last year. Since 3/6 I've been selling winners and losers in my trading account and IRA's and I've made the changes in my 401 allocation now shown back on my worksheet page. I've gone from 0% cash to 28% cash in my 401 and I may not be done with the move to cash. I worked hard, took a risk, did something smart at the right time, hung out there in the breeze a while, and made a dollar BULLS MAKE MONEY, BEARS MAKE MONEY, PIGS GET SLAUGHTERED Now it's time to do something smart again. Ya gotta learn to buy smart. That's the easy part. Ya gotta learn to sell smart. That's really hard. Learning to sell smart is a lot harder because you've got to give up on a winner or take a loss. But it's part of the game. It's defense and it's stepping up to take a charge. YOU are the offense. You are ALSO the defense and you can lose the game for the whole team with lousy defense. The biggest and hardest lesson that I've ever learned about investing is "THOU SHALT NOT LOSE MONEY. If you start with money and lose it all, you're out of the game. If you bleed money all the time or earn money and lose it back, you're wasting your time and money and incidently, your future. It doesn't mean that you sell everything the next day after you drop a little over a few days or weeks. After all, stocks go up and stocks go down. Both sides get a chance at bat, and the forces of darkness and destruction and poverty are going to have good innings too. You just gotta build a lead, maintain it, and add to it as you can. And ya GOTTA keep an eye on the scoreboard. So I'm getting reasonable and pulling back some, and maybe more than some, maybe a lot... I'll think about it. But what if I'm wrong. What if this is only a quick hiccup and stocks continue to climb? What if I'm out of the market for a week, a month, or a month or two and I leave money on the table and everybody else makes money and I don't and and andandand??? Then I lose a week or month or two of performance and I have to put the money back to work. It's not like I'm behind. AND, it'll be good practice for if and when the time comes to grab the parachute and play DB Cooper. That's how the game is played. Know what I mean, Vern? Condolences to friends and aquaintances of Jon Davies. Too often life is a series of intentions left on the table. Jackin' jaws with Jon one of these days is another intention left on the table...

Another week down and another dollar made. Check out the charts and the table for the 401. There's still money to be made but the short term tenor of the markets is undergoing a change. Japan seems to finally be coming out of its depression. Talk is that the 0% interest rates there are coming to an end. Rates also appear to be on the way up in Europe as well as the US and Japan. Falling rates is a tide that raises all boats. Rising rates is a headwind that pushes all but the very strongest stocks back. Hidden in this week's flat to mildly up/down performances of indexes and many funds is a bunch of stocks marking time or bleeding red and a few stocks going ballistic. A few select telecom stocks made my week, and a very nice week indeed, despite the headwinds. Sometimes exposure to the right stocks, or even exposure to any stocks makes you look like a genius. Sometimes an exposure to a couple of the right stocks saves the day. And sometimes you end up stuck with last season's stocks spread out on the driveway in the rain. The hard times separates the good managers from the bystanders. We may be coming up on such a time. Then it will be time to take some money off the table to stay indoors and out of the driveway in the rain. This week that time looks closer. But I'm not there yet.... For me, successful 401 investing is like hunting in a stand. Get it set up and get ready. Then spend hours of watching, being ready for a few seconds of action. Last week I moved a little money around and allocated last month's contribution as noted. Steady as she goes...up 34% in 18 months...but keeping my eyes open and finger near the trigger. Last week I wrote about increasing political and economic dangers. This week Al Queda got way too close to a major source of petro product for much of the world. The world exists in a big tank of oil and if someone pokes a hole in it, all the oil in the tank starts to head for the low spot. Oil prices are up and there is a sea change under way. More and more people know what the Hubbert Peak is. State owned oil companies are buying up fields in foreign countries and it looks like a national security move to me. Major oil companies are starting to unobtrusively count tar sands and liqufiable natural gas as oil reserves. The money and oil industries are chattering about increased drilling but there is not a whole lot of talk about anything but incremental additions to reserves. And the work of fiction that is the Consumer Price Index, that is carefully constructed to delay and minimize signs of inflation, is starting to show signs of inflation as rising energy prices and interest rates begin to leak through the barriers. Finally, the same idiot that told Michael Brown of FEMA that, "You're doing a hell of a job, Brownie." during the Katrina/New Orleans imbroglio, reads in the newspaper about the transfer of administrative control of six of our seaports to an Arab country owned company and rushes to insist that he's satisfied that there are no security risks to the deal. This guy is a uniter, not a divider. He's got all the Republicans and all the Democrats united against him. Will wonders never cease. So what about my 401a?

Steady as she goes. Refer to the charts. ....click on them if ya feel lucky....punk: In the first chart, look at the progress I've made by being in stocks. Last week I made money in my 401a, my IRA's and my trading account by being in stocks, so that's still working for me. So I'm going to stay in stocks. Look at the second chart; big gains in the first two weeks in all the funds, and since then three maintained, one dropped, and one continued to rise. I've picked up some gains in the Balanced Pooled Fund as the stocks in it appreciated. I'm stuck with the $5K minimum there but anything over that can find its way elsewhere. This week I'll shift some of the excess over $5K over to the Calamos Growth fund because I think I'm a little too light there. The Lord Abbett Research Fund guy appears to have the hot hand and it's weighted right about at where I want it to be, so if nothing changes, I'll put next month's contribution there. These are incremental changes, nothing more. I'm still more or less equally represented in four of the five best stock funds available to me and I've got a small stake in the fifth fund as a place holder. I'm one day from safety at any time (see last week's post), I'm making money while I can, and I'm going with what got me here; up 32% in 18 months. See ya at the hall. Opportunity knocks, but it has never been known to turn the knob and walk in."

English Proverb The sellers finished selling and the dip buyers bought when they saw prices stop falling or when they were low enough to look good. So markets went back up. Somewhat. I'm finding that good ideas that can make me money NOW are getting somewhat harder to find or ideas that can make me money later seem to be hard to get comfortable with now. The markets seem to be getting narrow and somewhat herky jerky. So it's time to figure what to watch out for, just to be safe. It's hardly very complicated. I just look for the markets in general and my accounts in particular to start losing money in a sustained and accelerating manner so I can respond properly. I'm back up to 30% plus return over 18 months in my 401a. I've got to be thinking of protecting that as much as I've got to be thinking of continuing to make money. Interest rates are still going up, political and economic strains are getting more pronounced and dangerous, inflation is starting to show through the barrier between energy and food and the core numbers, and seasonality is running against me. Time to visualize the possibility of stepping off the elevator because we may be near or approaching the top. Or maybe not. We might just be near a brief intermediate top. Or an extended period of consolidation. Or the end of the game as we know it, leading to death, darkness, and despair. Or not. The markets might explode up instead of down. What's important is that I am always one business day away from safety. When my concern about risk becomes overwhelming I can transfer everything to bonds or the GIC, except for the $5K that is stuck in the Balanced Pooled Fund (BPF). And only about half of that is in stocks, so I can get big time safe in a hurry. Should it only be a mild case of gas and not the end of time, I can get back in the Lord Abbett Funds and the Vanguard Fund whenever I want to. And the Calamos trading and market timing rules are not overly onerous. And even the American Funds funds can be reentered 31 days after an over $5K withdrawal occurs. Pretty kewl.... I met with some members of the Board of Trust a coupla weeks ago. The comment was made that maybe the way the 401a was set up was cramping my style. I jumped on that; Thirty percent up in 18 months is pretty uncrampy. The comment was made that it'd be nice if I could show how something like that could be done. Fair enough. Here's what I did. I looked up our fund choices in the FundAlarm tables and the Morningstar.com website and used the Stockcharts.com website to evaluate the choices. The chart below is a close approximation to one that I used.... If the chart below is too small to see clearly, try clicking on it. It should be a live link... I decided against the bond funds for reasons I don't care to discuss at length here and now, but that I'll cover in more detail later. Suffice it to say that the time to be in bonds is when stocks are falling and the time to be out is when stocks are rising. Look at the chart. Enuf said. Given that the Vanguard S&P500 fund is a proxy for the market as a whole and a decent actively managed fund oughta be able to do better than that at least some of the time and hopefully most of the time, I rejected it. The washmutt fund wasn't doing nearly as well as the Vanguard Fund, so it got tossed. I had a bad experience with a poorly managed foreign stock fund years ago so I tossed the American Fund foreign stock fund. I put most of my available funds in the remaining choices, with some money in the GIC just because I wanted to be at least a little conservative. When the State Street/Blackrock Fund underperformed, I exited it. When I saw how well the American Fund foreign fund was doing, I put money there. I looked at my account every week to evaluate how I was doing and I shifted a small portion of my funds from time to time. I allocated those funds and my monthly contribution to where I was getting the best performance or where I thought I was a little light and it would be a good idea to even things out. When I was sure the trend was my friend, I pulled most of the money from the GIC and put it into into the best performing stock funds and got from there to here. Of course the saying goes that 80% of the money is made over 20% of the time. When I did the above, interest rates were at all time lows for this era, oil was relatively cheap, Iraq was "mission accomplished", etc. I did some smart stuff at the right time and I got rewarded for it. That was then and this is now. But I think what I described is still a good thing to do. It's just that different circumstances may lead to different decisions and they WILL lead to different results. More to come "However beautiful the strategy, you should occasionally look at the results."

--Sir Winston Churchill Bloody week in the market. For a couple of days my trading screens were bleeding red off the monitor and onto the floor as the momo boyz (momentum traders) blew out of last quarter's red hot stocks, locked in profits, and gave those late to the game a chance to buy stocks low in the morning, lower in the afternoon and even lower the next day. Charts for Apple, Amgen, Genentech, Walgreen, Yahoo, and just about all the housing stocks as well as just about all of the oil and gas stocks looked like hammered horse exhaust. But there is always more than meets the eye. If you were where the action wasn't or in the luke warm stocks or where the story is now rather than then, it wasn't bad at all. Check out the charts for my 401a funds and the table for my account. It's not as good as two weeks ago but it's not bad and it's not even close to making a dent in what I made last year. Stocks go up, stocks go down, and the wiggles are noise. But out of the noise comes the trend. If the trend is up, I stay the course. And if the trend goes down, I cut my exposure. I'll wait and see. Paying attention is what cuts the risk and enhances the reward. I'm standing pat 'cuz I gotta have a trend change proven to me, especially when the trend has been working so well for me since 9/04. Speaking of risk vs reward, I got asked by Kenny P if I was in the aggressive program for the 401. I couldn't even start to answer the question. It was a good question if you got your investing info from a typical investment advisor because it leans on a lot of basic assumptions they start you off with. But it has nothing to do with the world I live in. Check out my site's longest term chart for all the funds. Eyeball the bond funds. The bond funds are "conservative" in that you probably won't lose your principle. There is not much risk. Neither is there much reward. You'll only make the coupon, and if you're really lucky, a dollar or two on appreciation, if they sell the bonds for you at the right time. There's little reward and little risk. And it is totally defensible. But last year you lost the chance to make money if you were heavily in the bond funds. And anybody in the Balanced Pooled Fund was 50% bonds. Most amazingly, you even lost money in bonds when a lot of other investors were making money in stocks. I'm not sure that is conservative. Last year I just didn't see any reason why I should be in bonds and and especially in bond funds. The charts tell you I was right. Set up an opportunity for me to do a presentation to a small group and I'll explain why. Stock funds are considered "aggressive" in that you can make or lose a lot of money. There's CAN be a lotta risk and a lotta reward. But if stocks are in a long term uptrend and you pick the right stocks or funds and keep one eye on the trend and one eye on the exit door, AND you are willing to book profits and step off the elevator near the top, either on the way up or on the way down, the risk goes down. If the reward is high and you lower the risk, I'm not sure that is "aggressive". It's not so much that everything you've been told is wrong, it's just that it's not quite as simple or as direct as you've been told. Or so I believe. Of course I could be wrong. Oh, yeah. I also believe that you get told what serves someone else's purpose and not necessarily your own. What does "Modern Portfolio Theory" and the Modern Jazz Quartet have in common? More than you'd think. See ya at the hall. And it wads too may things into too little time. So it's Sunday evening and the charts and worksheets are current and I still gotta weekend o'stuff to do. But it don't look likely to happen....

Things of note; The run up at the beginning of the year has met with consolidation. I'm up quite remarkably in my trading account and IRA's and if I went 100% to cash after one month, I'd have a respectable year's worth of performance at the end of January. The pro's and hot money boyz think just that way and they are locking in gains and so their selling leads to weakness. I don't run my 401a that way so I'm standing pat. The charts tell the tale; the funds in the 401, less the WashMu, look good. We still may be in an uptrend and there still may be money to be made by being 100% in stocks. I shifted the overweight I had in some of the other funds to Calamos and put the month's contribution in there too. Other that that, it's still pedal to the metal and look through the windshield and not at the tach. See ya at the hall. I trade stocks to make up what I see as a shortfall in my pension plans. And I spend way too much time and money reading about how, why, and what. There is something going on in the semi and telecom supplier and communications industry. I've made a dollar very recently and so has the Calamos Growth Fund that is in our 401a. I hold or have held half the stocks that they list as their top ten on their site and I like that. I'm going to redistribute some money tomorrow by placing an order w/ K&G tonight. Nothing big, just moving a little cash to someplace where I like the action. I'll post the result in a day or three. Stay tuned....

The charts tell the story. The last Friday's big crash lasted as headline material for one day, and the end of life as we know it probably will come to pass, but it didn't happen last week. I stood pat and at 100% invested in stocks in my 401. Last week, and actually all of January were very good indeed. 5.71% gain for the month gives me about half of what I'd call a very respectable year right out of the box. I've regained what last weeks big down Friday took and a little more. The 32% plus up in 17 months since I've been actively managing my 401 continues to give me a cushion of confidence and something to protect at the same time. Maybe I'll get more loquacious about all and sundry in the next post. On the docket is why I'm in only four of six stock funds, why I'm in no bond funds, why I do this website in the first place, what protecting gains means, etc. But that's it for now cuz I'm busier than a long tailed cat in a rocking chair factory. Ya know, if you talk to me and we can set up a face to face rundown for a small group of whatfor and howcome and onaccountawhy interaction it'd be much more to my liking. Writing takes time and effort and talking doesn't. See ya at the hall.

|