The Big Whoosh Down Is Yesterday's Story. The Death Of Hope Amid The Cold Dark Ruin And The Eventual Recovery Is The Future's Story. Watching Successive Rallys And Faceplants Is What We Do While We Wait...

Our activity as investors is not to try to identify tops and bottoms - it is to constantly align our exposure to risk in proportion to the return that we can expect from that risk, given prevailing evidence.

It Sure Seemed Easy Back In 2003 to 2007... Ride Each Market Advance Up And Be Sure Sell The Top And Catch The Next Wave.

Bank failures are caused by depositors who don't deposit enough money to cover losses due to mismanagement.

-- Dan Quayle

UPDATED 1/27/09

Chartz and Table Zup @www.joefacer.com

Stay Tooned for "How I Run My 401a Part 3"

Stay Tooned for "How I Run My 401a Part 3"

"How I Run My 401a Part One"

is here: http://joefacer.com/pblog/index.php?m=1 ... 107-195005

"How I Run My 401a Part Two"

is here: http://joefacer.com/pblog/comments.php? ... 205-215802

But first scope out this chart of the S&P 500 between 1990 and Today. CLICKIT!!!!

Note that the widely watched index went from 300 to 1500 in ten years, a huge gain. Then it lost half it's value. Then it had a similar cycle but over six years rather than ten. Yes the overall direction is up. So if you have 100 to 200 years to average everything out and you can cash out and retire on a spike up, the spikes up and down over that period don't mean much.

BUT IF YOU DON'T HAVE 100 YEARS TO AVERAGE OUT THE HUGE SPIKES IN BOTH DIRECTIONS AND YOU DON'T HAVE A CHOICE ABOUT WHEN YOU HAVE TO RETIRE, WELL THEN, THE HUGE SPIKES UP AND DOWN ARE INCREDIBLY IMPORTANT.

So you HAVE to keep track of what is happening in the economy and the market. "How I Run My 401a Part Three" is how I do it....

"How I Run My 401a Part Three"

I do a lot of reading. I'm pretty good at it. I'm also intellectually curious (I'm what in motorsports is known as a "gearhead".) It's great that things work and that I can use them. But I enjoy knowing why and how they work and how to tune and fix and improve them as much as I do using them. It happens a lot. When my wife and I did a recent tour of a functional/historical museum of Alaska gold mining/tourist stop/operating gold mine, I ran down the mine manager in the gift shop and got a glimpse of how the real business operates. I've taken my interest in Hi-Fi Stereo and gone into the business as a manufacturer and my interest in motorcycles and become a motojournalist. Since I'm old, going hard of hearing and arthritic, my pension and IRA's have become my center of interest and I'm now a part time stock trader and mutual fund investor. So I've followed through with the paradigm that I used to learn audio, manufacturing, mechanics, race craft and journalism; I read everything I could until I could make sense of what seemed to be important and what was a waste of time. Then I put it into practice to find out what works for me.

Here's what I'm doing, distilled for brevity;

I've keyed in on what Benjamin Graham said, "In the short run, the market is a voting machine. In the long run, the market is a weighing machine." Certain stocks/stocks in general become popular and people buy them, driving the price up and creating a trend. The trend becomes self reinforcing and continues longer than might be expected. As the trend continues, ultimately it comes to rely on the fundamental aspects of the business and the economy; the economics of the business that the stock is in and the economy that it operates in, be it local, national or international. The fundamentals continue to support the stock and the trend continues or the fundamentals fail to support the stock and the trend stops or reverses.

I try to buy and hold stocks and mutual funds that are going up and I sell stocks and funds that are going down. I use charts in part to do that because they tell me the two pieces of data that I absolutely understand as well as anyone ever could; Price and Time. Stocks/funds that have increasing price over time are what I look to accumulate.

I look for changes in the trend. Short term changes in price can be everyday volatility (noise) or the dynamics of a large market made up of individuals (noise). Short term changes in direction or rate of change can become long term changes in direction caused by changes in popularity (emotion) where the fundamentals don't support the stock price, or changes in the fundamentals where they used to but no longer support the stock price. Changes in the trend of sufficient duration to trade are of interest to the trader in me and longer term changes are of interest to the 401a investor in me.

Charts tell me what has happened and is currently happening. Reading gives me in detail information and speculation on what may be happening behind the scenes, what may already be but has yet to be recognized, and what may or may not happen in the future. This may tell me what to watch for or tell me something of the dynamics behind the charts. My reading provides the material to measure my level of confidence in the trends that I follow. I try to expose myself to as much opportunity to profit as I can, within the framework of avoiding losses of any significance. I am greatly inclined to sell to avoid losses. My reading gives me the intellectual framework to judge how great the risk of losses is.

DOES IT WORK?

Pretty much so far. Check out the Chartz and Tablez @ www.joefacer.com.

I post links to what I've read that may be of interest to others. Much of what I read is proprietary and I can't link to it. I subscribe to limited distribution sources and read about 10 to 20 times as much as I link to.

For the interested beginner I recommend

www.thestreet.com

www.marketwatch.com

http://money.cnn.com

and many of the sites I link to.

Let me get back to you about some books....

Here's some links....

http://www.ritholtz.com/blog/2009/01/space-walk/

http://www.investorsinsight.com/blogs/t ... and-4.aspx

http://www.ritholtz.com/blog/2009/01/calpers-bad-bets/

http://online.wsj.com/article/SB123259465468105115.html

http://www.ritholtz.com/blog/2009/01/re ... s-fall-98/

http://www.ritholtz.com/blog/2009/01/fu ... -a-cancer/

http://www.ritholtz.com/blog/2009/01/ti ... f-america/

http://www.ritholtz.com/blog/2009/01/no ... own-money/

http://www.ritholtz.com/blog/2009/01/ma ... er-traded/

http://www.ritholtz.com/blog/2009/01/08 ... e-heatmap/

http://www.ritholtz.com/blog/2009/01/th ... llar-club/

http://www.ritholtz.com/blog/2009/01/wh ... since-911/

http://www.ritholtz.com/blog/2009/01/dr ... on-builds/

http://www.ritholtz.com/blog/2009/01/th ... re-crisis/

http://www.ritholtz.com/blog/2009/01/barrons-mea-culpa/

http://www.ritholtz.com/blog/2009/01/fe ... -decaying/

http://www.ritholtz.com/blog/2009/01/go ... chris-cox/

http://www.ritholtz.com/blog/2009/01/th ... al-crises/

http://www.ritholtz.com/blog/2009/01/tw ... digestion/

http://www.ritholtz.com/blog/2009/01/na ... pitalists/

http://www.ritholtz.com/blog/2009/01/ca ... ic-crises/

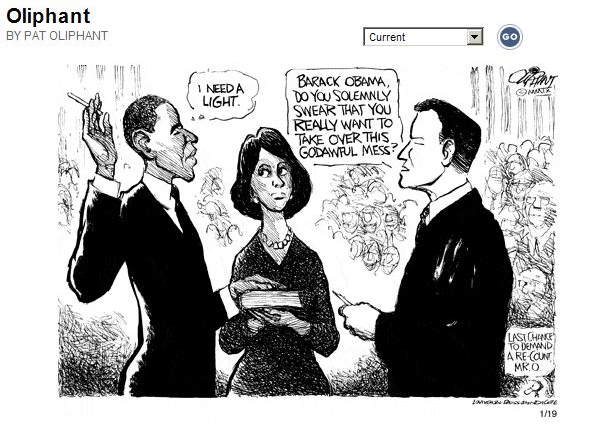

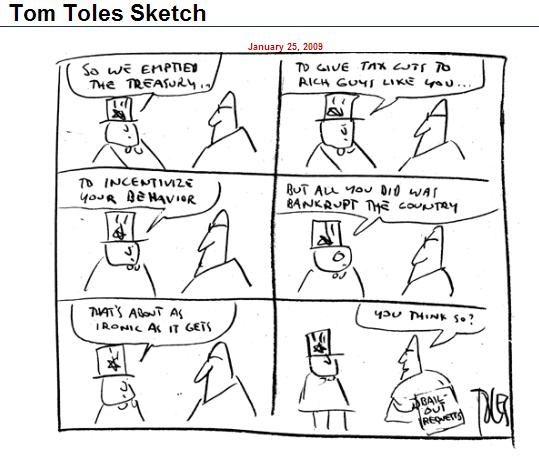

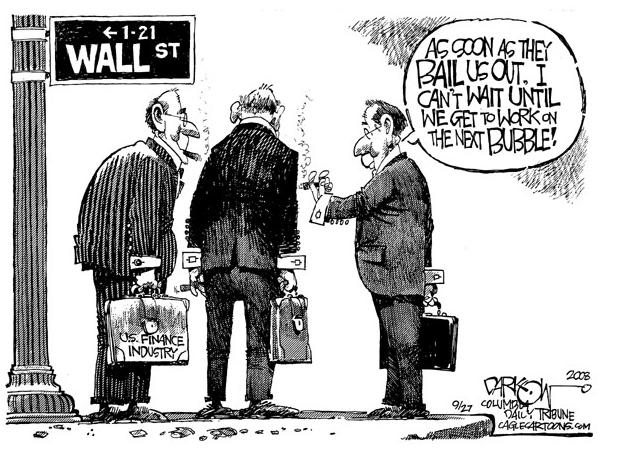

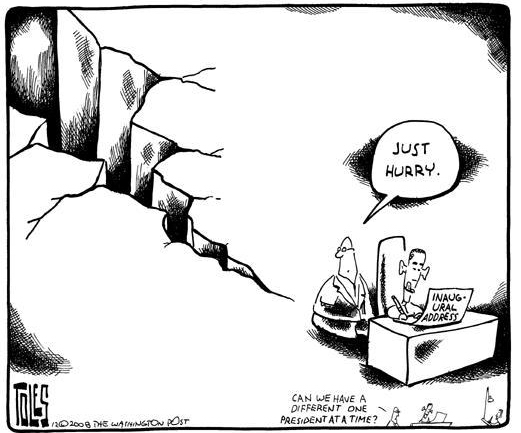

DOWNER; The Bailout Part 1 Was So Poorly Conceived And Executed That We May Not Have It Enough Money Left To Fix It All With Bailouts 2,3,4,5 an' 6,....UPPER; We Scrape Off Dubayuh In A Few Days..... We'll see how it goes on down the line.....

"Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done."

—John Maynard Keynes

Chartz and Table Zup @ www.joefacer.com.

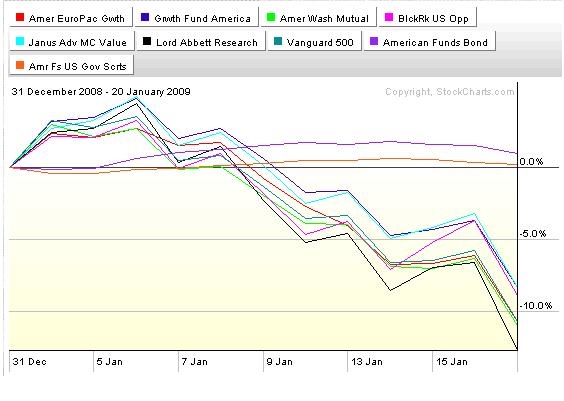

UPDATED 1/20/09

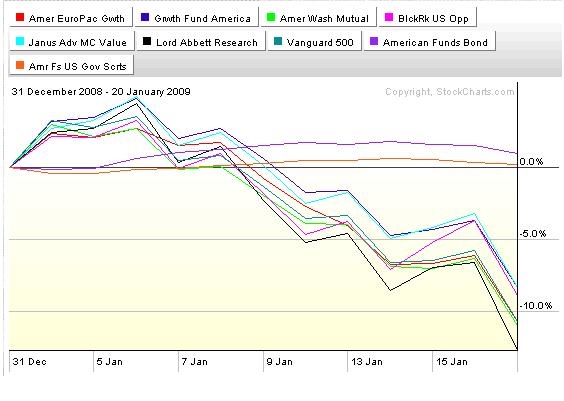

NEW YEAR, SAME DIRECTION....DOWN

We know that the FED and The Treasury are gonna spend every dollar that they can borrow and print to save everyone. What if it is not enough?

Excerpted From Setting the Bull Trap By Bennet Sedacca

Link to the complete article; http://www.investorsinsight.com/blogs/j ... -trap.aspx

Ever since 1995, the Federal Reserve and other authorities have been assisting in the birth of the largest debt bubble in our nation's history. Money supply has grown exponentially, weak businesses have been formed and failed, the consumer is leveraged up to their eyeballs, regulation is poor, and savings have dried up. Further, the brokerage/investment banking industry has been pummeled beyond recognition; lifelines have been given to everyone from poorly run banks to poorly run auto manufacturers. Esoteric securities have been relocated from the balance sheets of reckless banks and brokers to the U.S. Treasury, FDIC and Federal Reserve. Investors worldwide watched $30 trillion of stock market equity disappear in the past year while home prices have cratered by better than 25%. What other goodies do we have?

* Unemployment on every front is rising.

* Tax receipts are down and State Governments are suffering.

* The debt market, except that artificially supported by the Government is closed.

* Earnings estimates for the S&P 500 are down 60% year-over-year.

* Stocks (using the Dow as a proxy) are at the same level they were 10 years ago.

* Industrial Production around the globe is imploding.

[From the Fed]

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

If you read the paragraph from the FOMC statement highlighted in red and add to that all of the new programs and bailouts paid for by "We the People", it leads me to the following questions.

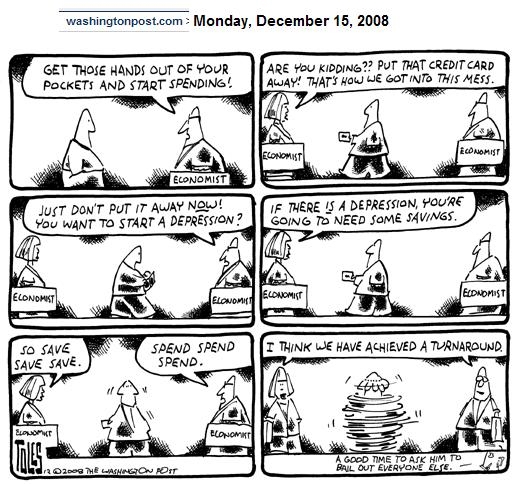

* Shouldn't the consumer, after decades of over-consumption, be allowed to digest the over-indebtedness and save, rather than be encouraged to take risk?

* Shouldn't companies, no matter what state they reside in from a political point of view, if run poorly, be allowed to fail or forced to restructure?

* Should taxpayer money be used to make up for the mishaps at financial institutions or should we allow them to wallow in their own mistakes?

* Shouldn't free markets be free?

* When did Socialism make its way to our shores?

* How do we choose who is bailed out and who loses?

* Shouldn't we place blame on the politicians, bureaucrats and other "decision makers" and put skilled people in place that know how to run the businesses?

* Shouldn't investors, led blindly down the primrose path of "buy and hold, diversify and don't open your brokerage statement except once every 10 years" be allowed to follow the Prudent Man Rule?

Again, there are many questions to be asked, many with answers that no one wants to put in print. When will people stand up like in the movie Network when Howard Beale, played by Peter Finch, screams, "I'm mad as hell and I'm not going to take this anymore

Risk taking, in a laissez faire world should be replaced with risk aversion for a period of time. Consumers that over-consumed should be allowed to strengthen their balance sheets for the next cycle and increase their savings. Companies that have been kept afloat, bailed out, nationalized, stuck in conservatorship, have become part of my national portfolio whether I like it or not, unless it actually poses systemic risk (which I am not at all in favor of), should fail. Period. After all, where is MY bailout?

The picture above is of 30 year Fannie Mae 4 ½% mortgage pools. Note the recent 13% spike as the Fed announced that they would be buying Mortgage Backed Securities in order to stabilize the mortgage market. In a free market, these securities would be many points lower, but because there is an artificial bid (yep, with our money) investors are forced to look elsewhere toward risky assets.

Yes folks, cash is now officially trash. If you buy 1 month Treasury Bills, you are rewarded with a yield of a gigantic 0.02% per year. That's right, 2 basis points per year. I suppose people with more than enough money can keep it invested for an entire year and make nothing or they can succumb to the pressure of, "I can't make zero forever if I want to retire."

Now, imagine that you are a professional money manager that is paid 1% a year to invest other people's money. If you feel that being prudent is to sit in cash, and attempt to charge a fee, the math is simple—0.02% per year minus any reasonable fee is a negative return. This is forcing many people out on the risk spectrum at precisely the wrong moment, when risks are the highest ever.

http://www.youtube.com/watch?v=QMBZDwf9 ... re=related

Excerpted from "Market Vertigo

by Cliff Draughn

http://www.investorsinsight.com/blogs/j ... rtigo.aspx

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

It's not hard for even an old broken down pipefitter to figure out that Citibank is has been undergoing an unannounced liquidation since this article was posted....

More from Mr Draughn;

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

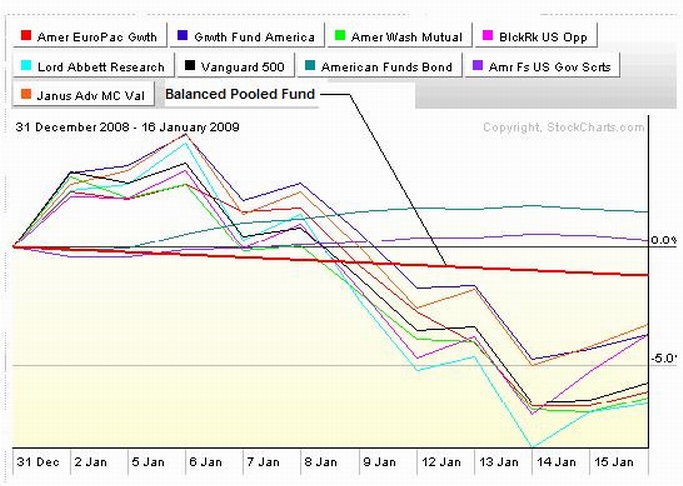

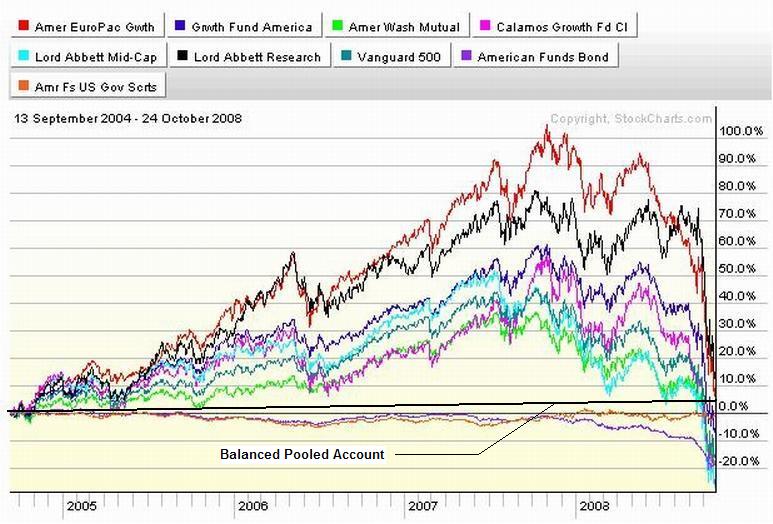

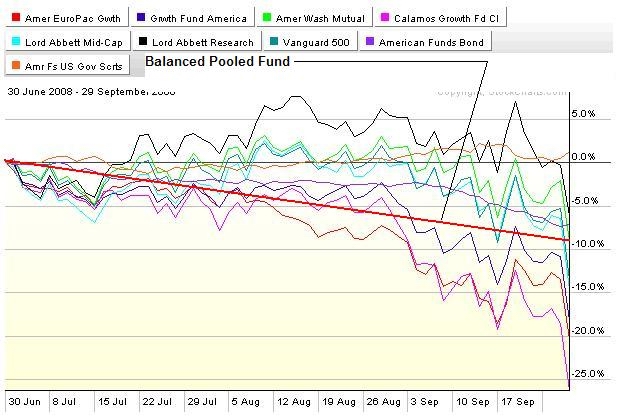

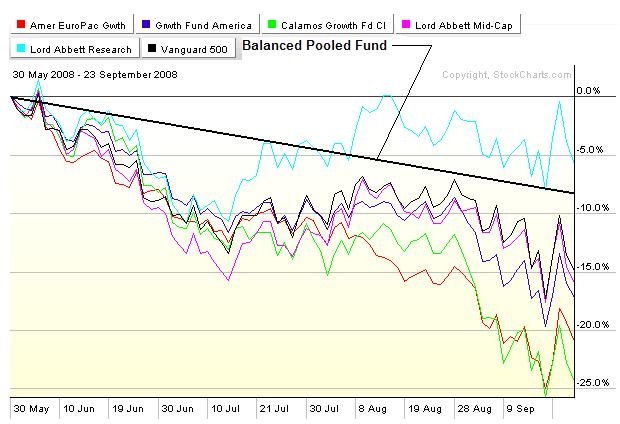

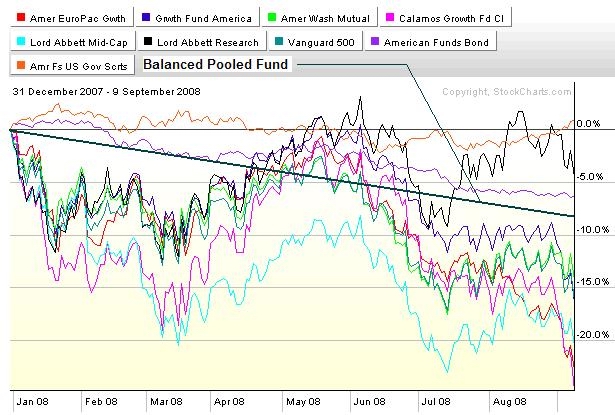

CHEEZUS H. RICE!!!! (Condoleeza's father) IS THERE ANYONE STILL OUT THERE SO NUMB AS TO STILL BE IN THE BALANCED POOLED FUND? DO YOU STILL BELIEVE THAT THE REASON THAT YOU WERE TOLD NOT TO LOOK AT YOUR 401A STATEMENT FOR 10 YEARS WAS BECAUSE IT WAS BEST FOR YOU????

Link to the complete article; http://www.investorsinsight.com/blogs/j ... -trap.aspx

Ever since 1995, the Federal Reserve and other authorities have been assisting in the birth of the largest debt bubble in our nation's history. Money supply has grown exponentially, weak businesses have been formed and failed, the consumer is leveraged up to their eyeballs, regulation is poor, and savings have dried up. Further, the brokerage/investment banking industry has been pummeled beyond recognition; lifelines have been given to everyone from poorly run banks to poorly run auto manufacturers. Esoteric securities have been relocated from the balance sheets of reckless banks and brokers to the U.S. Treasury, FDIC and Federal Reserve. Investors worldwide watched $30 trillion of stock market equity disappear in the past year while home prices have cratered by better than 25%. What other goodies do we have?

* Unemployment on every front is rising.

* Tax receipts are down and State Governments are suffering.

* The debt market, except that artificially supported by the Government is closed.

* Earnings estimates for the S&P 500 are down 60% year-over-year.

* Stocks (using the Dow as a proxy) are at the same level they were 10 years ago.

* Industrial Production around the globe is imploding.

[From the Fed]

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

If you read the paragraph from the FOMC statement highlighted in red and add to that all of the new programs and bailouts paid for by "We the People", it leads me to the following questions.

* Shouldn't the consumer, after decades of over-consumption, be allowed to digest the over-indebtedness and save, rather than be encouraged to take risk?

* Shouldn't companies, no matter what state they reside in from a political point of view, if run poorly, be allowed to fail or forced to restructure?

* Should taxpayer money be used to make up for the mishaps at financial institutions or should we allow them to wallow in their own mistakes?

* Shouldn't free markets be free?

* When did Socialism make its way to our shores?

* How do we choose who is bailed out and who loses?

* Shouldn't we place blame on the politicians, bureaucrats and other "decision makers" and put skilled people in place that know how to run the businesses?

* Shouldn't investors, led blindly down the primrose path of "buy and hold, diversify and don't open your brokerage statement except once every 10 years" be allowed to follow the Prudent Man Rule?

Again, there are many questions to be asked, many with answers that no one wants to put in print. When will people stand up like in the movie Network when Howard Beale, played by Peter Finch, screams, "I'm mad as hell and I'm not going to take this anymore

Risk taking, in a laissez faire world should be replaced with risk aversion for a period of time. Consumers that over-consumed should be allowed to strengthen their balance sheets for the next cycle and increase their savings. Companies that have been kept afloat, bailed out, nationalized, stuck in conservatorship, have become part of my national portfolio whether I like it or not, unless it actually poses systemic risk (which I am not at all in favor of), should fail. Period. After all, where is MY bailout?

The picture above is of 30 year Fannie Mae 4 ½% mortgage pools. Note the recent 13% spike as the Fed announced that they would be buying Mortgage Backed Securities in order to stabilize the mortgage market. In a free market, these securities would be many points lower, but because there is an artificial bid (yep, with our money) investors are forced to look elsewhere toward risky assets.

Yes folks, cash is now officially trash. If you buy 1 month Treasury Bills, you are rewarded with a yield of a gigantic 0.02% per year. That's right, 2 basis points per year. I suppose people with more than enough money can keep it invested for an entire year and make nothing or they can succumb to the pressure of, "I can't make zero forever if I want to retire."

Now, imagine that you are a professional money manager that is paid 1% a year to invest other people's money. If you feel that being prudent is to sit in cash, and attempt to charge a fee, the math is simple—0.02% per year minus any reasonable fee is a negative return. This is forcing many people out on the risk spectrum at precisely the wrong moment, when risks are the highest ever.

http://www.youtube.com/watch?v=QMBZDwf9 ... re=related

Excerpted from

"Market Vertigo

by Cliff Draughn

http://www.investorsinsight.com/blogs/j ... rtigo.aspx

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

It's not hard for even an old broken down pipefitter to figure out that Citibank is has been undergoing an unannounced liquidation since this article was posted....

More from Mr Draughn;

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

CHEEZUS H. RICE!!!! (Condoleeza's father) IS THERE ANYONE STILL OUT THERE SO NUMB AS TO STILL BE IN THE BALANCED POOLED FUND? DO YOU STILL BELIEVE THAT THE REASON THAT YOU WERE TOLD NOT TO LOOK AT YOUR 401A STATEMENT FOR 10 YEARS WAS BECAUSE IT WAS BEST FOR YOU????

Whether it is financial services, autos, transportation, etc., the "top-down" approach of providing more and more taxpayer dollars to weak corporations is ill-advised. In my opinion, if you're using taxpayer dollars, then either nationalize the company or let it fail. And, if you nationalize the company then wipe out the bond holders and shareholders, replace the management and board, sell the good assets to qualified buyers, and then and only then, have the taxpayers eat the remaining deficit. With the current "bailout system" we are merely trying to sustain the status quo, which penalizes those banking institutions that did not make bad decisions while at the same time rewarding poorly managed institutions by handing them taxpayer money. Until you put the stimulus money back in the hands of the private sector (i.e., the individual) you're fighting today's housing/mortgage fires with a garden hose. The bailout funds need to be distributed to the homeowners, not the banking and lending institutions. Banks currently taking the government TARP money (our tax money) are adding it as capital to their balance sheets and then sitting on the funds in anticipation of further losses, rather than lending back into the system. Obama should follow the laws of nature: if you have a herd of animals and some become sick, get rid of the sick. Why continue sustaining the sick animals that will eventually die anyway and at the same time risk the entire herd? A prime example of propping up the status quo occurred in December of this year when Treasury Secretary Paulsen made the unilateral decision to guarantee $306 billion of CitiGroup's assets. The guarantee was in addition to the $25 billion Citi had already received in TARP funding. The $306 billion "guarantee" was not part of TARP and was extended without Congressional approval! $306 billion is equal to what our government spent in 2007 for the departments of Agriculture, Education, Energy, Homeland Security, Housing and Urban Development, and Transportation combined. (The Economist)

One of the great sucker plays since the bear began in 2000 has been the "buy and hold for the long term" mantra that has been chanted by the sages of Wall Street. Simply look at the returns: from 12/31/99 to 12/31/08, if you invested in an S&P 500 index and held for "the long term," then your total return during this time would have been -28.13%, or an annualized rate of -3.6% per year. Small caps were better, with a total return of 11.66% or 1.23% annualized. If you expect to make money in the equity markets in 2009 going forward, then you must be willing to "trade" the volatility while also maintaining a high proportion of income-producing assets.

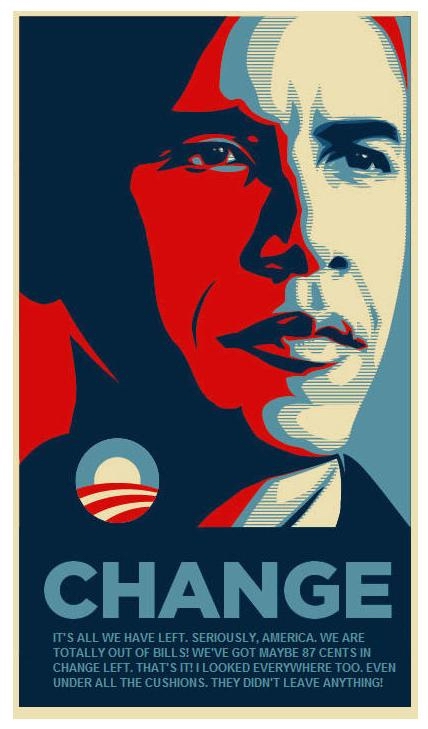

Great Expectations Meets Reality TV. Kinda A Chicago/National Politics Thing... On Both The National And Local Level

That money talks, I'll not deny,

I heard it once: It said, "Goodbye."

--Richard Armour

CHARTZ AND TABLE ZUP @ www.joefacer.com

Stay Tooned......

http://www.shadowstats.com/alternate_data

http://www.bloomberg.com/apps/news?pid= ... refer=home

http://www.bls.gov/

http://www.ritholtz.com/blog/2009/01/report-from-paris/

http://gregor.us/policy/the-obama-planf ... l-is-high/

http://www.ritholtz.com/blog/2009/01/th ... s-of-tarp/

http://www.ritholtz.com/blog/2009/01/oil-speculation/

http://www.ritholtz.com/blog/2009/01/th ... tleblower/

http://www.ritholtz.com/blog/2009/01/mi ... in-crisis/

I can't make it anymore clear than the last link...Talk to someone who stuck with a bad dentist or doctor for years or figured that all tax preparers or medicines (Or financial advisors. Think McMorgan....) were the same and interchangable. Years ago, when I hit my early 20's, I decided to change dentists because I didn't much care for the personality of my family dentist. I saw two new dentists 6 months apart. Each time they got their first look at my teeth, they both said the same thing, "Wow! Who did those fillings? That's beautiful work!" The third visit was back with the original dentist. I had all the experience with new dentists that I needed. Don't EVER settle with "prolly good enough" in terms of life, health, safety, or money. Ain't one of 'em good w/o the others. No Shit.

Time to do another installment of "How I Run My 401a" sometime in the next weekend or three. I got back to even in my investment gains last year and thus, every dollar of contribution dropped to the bottom line and not a penny was lost to making up for losses. Gonna try to do better this year.

Stay Tooned!!

An optimist stays up to see the New Year in. A pessimist waits to make sure the old one leaves.

-- Bill Vaughan

I've gotta lotta spreadsheets/tables/charts/templates/macros an other stuff to update. Then and only then will I be able to say,

CHARTZ AND TABLE ZUP!!! on www.joefacer.com

So I did and I do....

UPDATED 10/5;

I declared victory in my RGVEX trade. I made 5% in two months. So I'm selling roughly half the position to lock in the profit, triggering the rapid trading bad juju. I'm locked out of being able to deposit anything over $5K back into the fund for 30 days.

I still want to stay in cash....corporate earning reports happen in January and unemployment reports and earning statements will prolly be bad enough to gag a maggot. So I'm going into the GIC, risking MET Life's solvency vs the Fed's/Congress/administrations intentions to bail every one out. I believe it is a good move. Or I could be wrong. Ya make yer very best guess based on data, analysis , and evaluation, and temper it with risk control and a plan B and C.

Stay Tooned

"There are three stages of a man's life: He believes in Santa Claus; he doesn't believe in Santa Claus; he is Santa Claus."

-- Author Unknown

“Buy-and-hold has been a jumbo money-loser this year,” argues (Barry) Ritholtz, the subject of a recent Barron’sQ&A (”A Leading Bear Turns Bullish, Sort Of,” Dec. 8). “You can’t just sit around and say, ‘Bear Stearns and AIG are great companies, and I’m a long-term investor.’ ”

Barron's

CHARTS AND TABLE ZUP @ WWW.JOEFACER.COM

I read ....a lot. You shouldn't have to. Barry Ritholtz covers so much in one place (The Big Picture) that I figure that this will get you most of the way across The Street while I'm still busy elsewhere... Here's a pull quote, typical of Barry layin' it down so it stays there.......

Office of Thrift Supervision: Asshat Central

By Barry Ritholtz - December 24th, 2008, 3:30AM

I am trying to figure out who is the biggest jerk in this story. It is a challenge, given the collection of utter clowns and ne’er-do-wells that run that office.

First, you have some moron who helped cost the taxpayers a hundred large ($100B) back in the 1980s. How this idiot ever ended up in a position of responsibility in any regulatory agency again is beyond my comprehension....

http://www.ritholtz.com/blog/2008/12/ot ... t-central/

http://www.bloomberg.com/apps/news?pid= ... ZJOwI&

http://www.ritholtz.com/blog/2008/12/pi ... -treasury/

http://www.ritholtz.com/blog/2008/12/ho ... g-off-106/

http://www.ritholtz.com/blog/2008/12/ny ... ng-things/

http://www.ritholtz.com/blog/2008/12/ji ... deflation/

http://www.nytimes.com/2008/12/26/world ... .html?_r=1

http://www.ritholtz.com/blog/2008/12/cl ... -comments/

http://www.ritholtz.com/blog/2008/12/ch ... pudiation/

http://www.ritholtz.com/blog/2008/12/ch ... deflation/

http://www.ritholtz.com/blog/2008/12/re ... -the-fact/

http://www.ritholtz.com/blog/2008/12/qu ... more-13509

http://www.ritholtz.com/blog/2008/12/se ... ince-2000/

http://www.ritholtz.com/blog/2008/12/au ... ack-dolan/

http://www.ritholtz.com/blog/2008/12/ba ... borrowing/

http://www.ritholtz.com/blog/2008/12/re ... s-weekend/

http://www.ritholtz.com/blog/2008/12/de ... complaint/

http://www.ritholtz.com/blog/2008/12/au ... ack-dolan/

http://www.ritholtz.com/blog/2008/12/ja ... f-meeting/

http://www.ritholtz.com/blog/2008/12/ba ... l-bailout/

http://finance.yahoo.com/news/Whered-th ... 90568.html

CLICKIT....

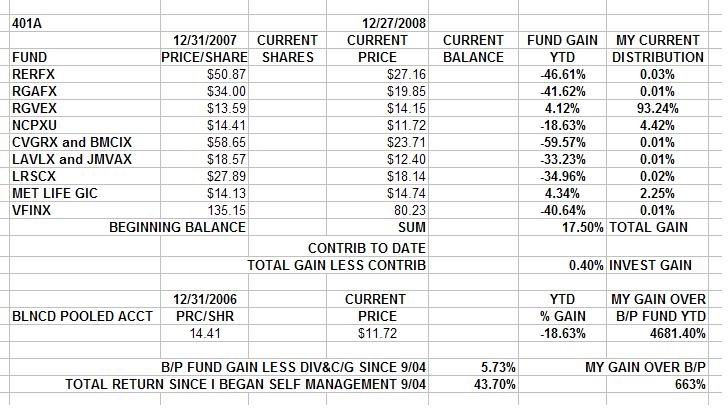

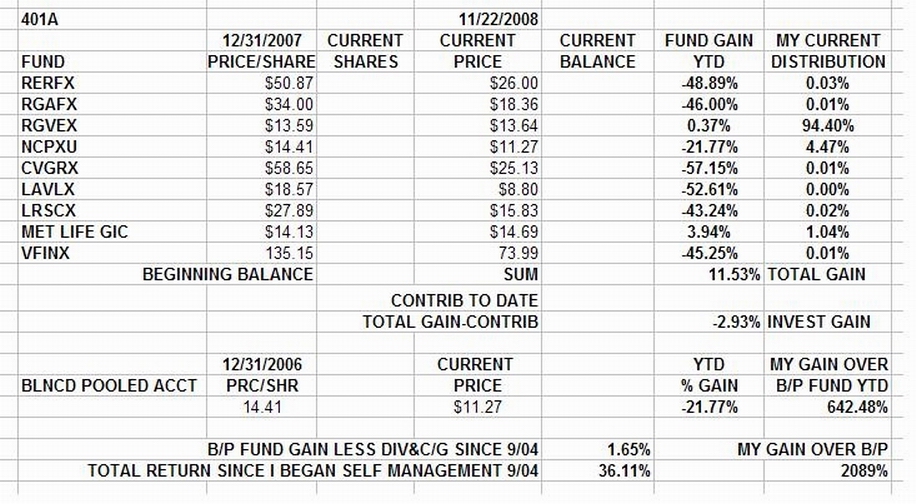

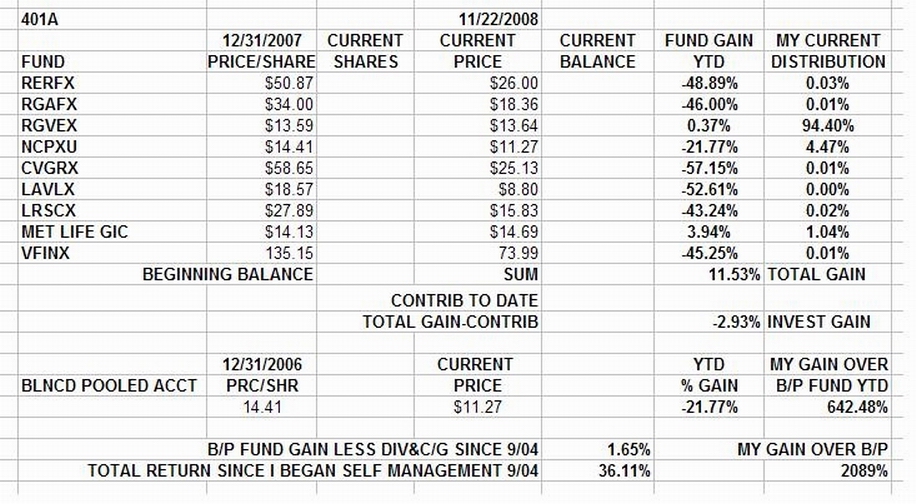

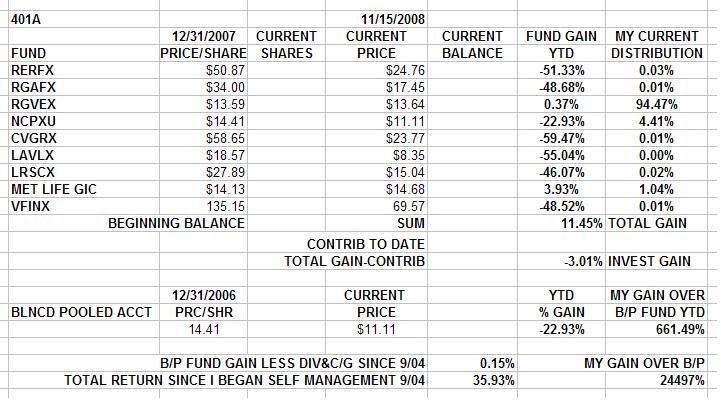

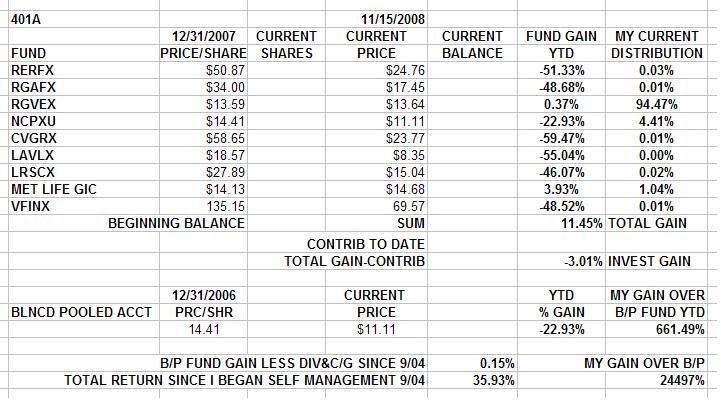

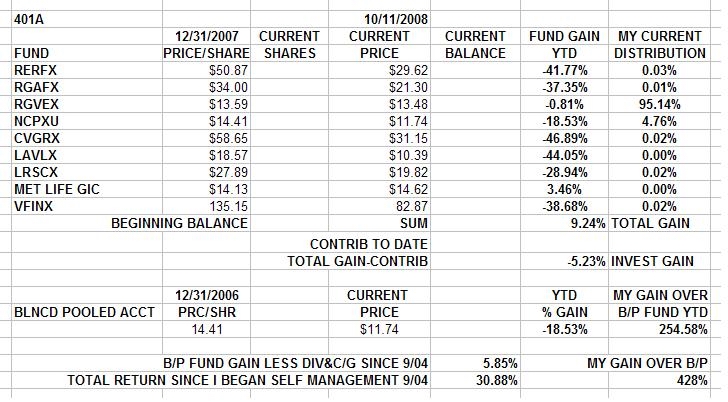

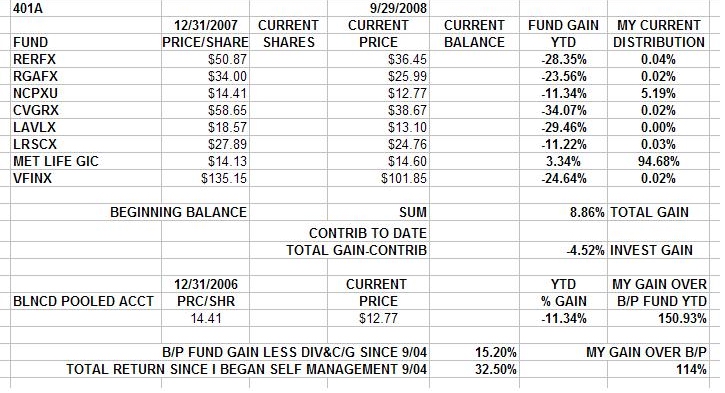

End o' da year. I'd REALLY like to break even, I could use the money. Check out the table above. (Do yer own using the template I got on my site....) AGAIN, ignore percentages when the numbers don't fit. I'm up from 2300% better than the Balanced Pooled Fund last week, to up 4600% plus even though I lost a few dollars last week. Gotta understand how to lie with numbers in order to determine when they are indeed, truthy. Here's what I see in the table....

Nummer one is that like the McMorgan years, contributions pre and tax deferred, are what make the nummers " Awright!" (to channel Janis J.) That is not insignificant, given that I've upped my contribution over the last few years and now have some coin in hand. The biggest return this year was from tax savings on contributions.

Nummer two is that unlike the McMorgan years, havin' the Internet an' all the sites like TheStreet.com,Stockcharts.com, joefacer.com and FundAlarm.com means that I have the tools to know when to step aside when a freight train o' misery is aimed right troo my 401a. The result is not half shabby. When pros are goin' down in flames, for the moment, I, (and those who're doing similar things), are up. Day and a half to go..... I think I'll get there to the end of the year in good shape...... then I'll work on next year.....

Nummer tree, there's more an' one way to cook a goose. (We did our Christmas geese w/ cornbread and sausage stuffin', hickory smoked.) Going to the GIC early woulda got me 4% at the end o' da year. I got there anyway with RGVEX. It's just that I dug myself a hole to climb outa, first. So, it's not all that difficult, I'm up a skosh, an' up a skosh and up 4% look the same compared to stayin in the Balance/Pooled Fund an bein' buried deep inna red......BUT IT IS IMPERATIVE THAT YOU MANAGE YOUR SELF MANAGED RETIREMENT FUND, know what I mean, Vern?

Save de best fer last....

http://www.ritholtz.com/blog/2008/12/so ... -holidays/

http://ie.youtube.com/watch?v=kIjbMRU1EgU

http://themessthatgreenspanmade.blogspo ... mists.html

Office of Thrift Supervision: Asshat Central

By Barry Ritholtz - December 24th, 2008, 3:30AM

I am trying to figure out who is the biggest jerk in this story. It is a challenge, given the collection of utter clowns and ne’er-do-wells that run that office.

First, you have some moron who helped cost the taxpayers a hundred large ($100B) back in the 1980s. How this idiot ever ended up in a position of responsibility in any regulatory agency again is beyond my comprehension....

Hope is a good breakfast but a bad supper.

-- Sir Francis Bacon

He that lives upon hope will die fasting.

-- Benjamin Franklin"

In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing."

-- Theodore Roosevelt

Charts and Table Zup @ www.joefacer.com

We were all given a huge opportunity when we gained control over part of our retirement savings with the advent of the 401a. Then we were lied to about how easy it would be and how much better we would be if we just left it in the hands of and to the judgement of others. We were left hoping it would work out OK. We were told patience was the best strategy, and we were told to fear doing anything since it might be wrong. We were left with the "Deer In The Headlight"(DIH) strategy to fall back on...

IT DOES NOT HAVE TO BE THAT WAY.

You could do what I do instead. I stay informed of the big picture and time the market off the macro news, you know, the headlines. Oh. And I do peek around the corner of the curtain now and then to see what the man behind the curtain is REALLY doin'.

Check dis out....

CLICKIT!!!

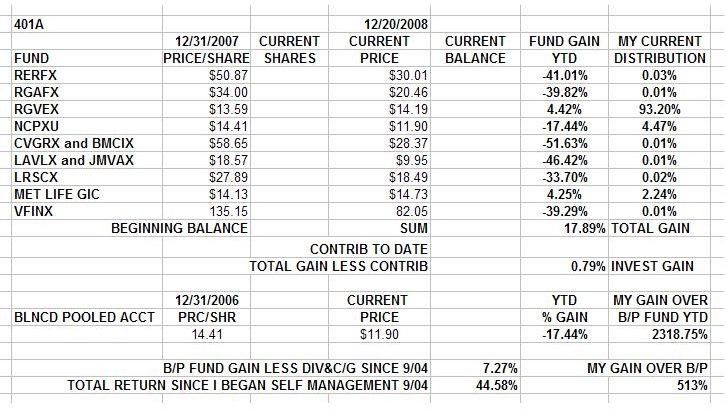

This is my 401a account. If you check the charts on my website, you see that we've hit A bottom in stocks, but prolly not THE bottom. The bounce has been 10% and maybe there is some more to come. You'd think that'd help our returns. But the numbers on the table for the individual stock funds look really terrible regardless of the bounce.

My numbers on the other hand look pretty good. Coupla things of note. I'm showing a 17% TOTAL GAIN for the year and a .79% INVESTment GAIN. The 17% overall gain comes from me contributing near the max for most of the year. I'm old and I gotta save while I can still earn. AND, I save big time on the 401a tax break. I avoid the huge income tax hit. There is NO PLACE ELSE where I can make this much money this easily. Works for me. I have 17% more money at the end of the year than I had at the beginning of the year. Ignore the plus 2300% over the Balanced Pooled Fund. When the difference is this huge, a horrible loss versus a tiny gain, percentages are meaningless. Suffice it to say that it looks like I'll finish the year having not lost any money on my 401a investments and even having made a little on my investing.

The .79% investment gain comes in two parts. First, a small loss comes from staying in stocks too long early in the year, trying to find someplace where money was still being made. When I couldn't make money in stocks anywhere in the 401a, I cut my losses. That put me into the GIC in late spring, a hand full of percentage points in the red. I made a few dollars in the GIC during the summer and clawed back a point or two while things deteriorated all over the world. When things REALLY got bad, I became concerned about MET LIFE and its ability to pay on the GIC. I bailed on MET in early October and went to the FEDS in RGVEX. I got there first and bought in in the first weeks of October. In November, everyone else in the world woke up and followed me into Treasuries, driving up the prices beyond all reason or even imagination. That really worked well. I got back to positive for the year

I'VE MADE 4% IN 6 WEEKS!!! ON HALF TREASURIES AND HALF MORTGAGE BONDS!!!!

This is good.

I can use the money.

THIS IS ALSO VERY BAD!!!

This means smart money is paying $1.05 or $1.10 now to get a 99 cents back later in the year or next year. Either they are in a huge blind reasonless panic, making this a huge opportunity for me... Or, they see something awful beyond comprehension coming up over the horizon. Either the risk/reward of big money panicing is awesome and a godsend especially for this time of the year.... or maybe it's time to relearn how to grow and can food.

Bottom Line; The huge opportunity in the 401a is currently in place and it can be taken advantage of. I've averaged 11% a year return since we've gotten funds in the 401a worth investing in. I've kept my gains through a time period rivaling the depression for investors misery. While our defined benefit fund was stuck on the tracks watching losses come down the line at 100 MPH, destroying the value of the defined benefit pension fund, participants in the 401a could seek a safe haven for their defined contribution pension money. Pretty Kool....

Stay tooned.

http://www.youtube.com/watch?v=90ELleCQvew

more to follow....

Loyal Lifetime Union Member, Father/Grandfather, Taxpayer, Portfolio Manager, Voter, Blogger. Conflicting Loyalites Caused By An All Time Horrendous Godawful Mess. Oh Well. Equal Parts Of Leaving A Mark On The World And The World Leaving a Mark On Me...

"Americans will always do the right thing -- after they have exhausted all other alternatives."

--Sir Winston Churchill

Chartz and Table Zup on www.joefacer.com...

CLICKIT!!!

http://online.barrons.com/article/SB122 ... azine_main

http://www.urbandigs.com/2008/08/peak_c ... _mean.html

Stay tooned. You Know The Drill!!!

Juxtaposition A Descent Into Unemployment And Recession Hell For A Significant Portion Of The Country/World With The Holiday Cheer Of Those Still Well Off; So it Goes.....

"Every banker knows that if he has to prove that he is worthy of credit, however good may be his argument, in fact, his credit is gone."

Walter Bagehot

Chartz and Table Zup at www.joefacer.com

UPDATED 12/9

Part One of How I Run My 401a is Here: http://joefacer.com/pblog/index.php?m=1 ... 107-195005

Let's see if I can lay down Part Two so it stays there....

HOW I RUN MY 401A

PART 2

In Part One, I dissed the American Funds Bond Fund of America. I noted in passing that I considered the Met Life Guaranteed Income Contract (GIC) and the American Fundz Government Securities Fund (RGVEX) to be better choices for me. Is this what I consider to be an unalloyed, no brainer, never look back, believe it bigtime recommendation without reservation or qualification?

GIMME A BREAK!!!!

GIC participants give MET Life a wad of money. In return, MET promises to give it back in part or in total on demand and to pay gains based on what they hold at a guaranteed predetermined annual rate. They earn the gains through investing and keep any earnings that exceed the guaranteed rate. The guarantee is their stated intention to do what they say. No More, No Less.

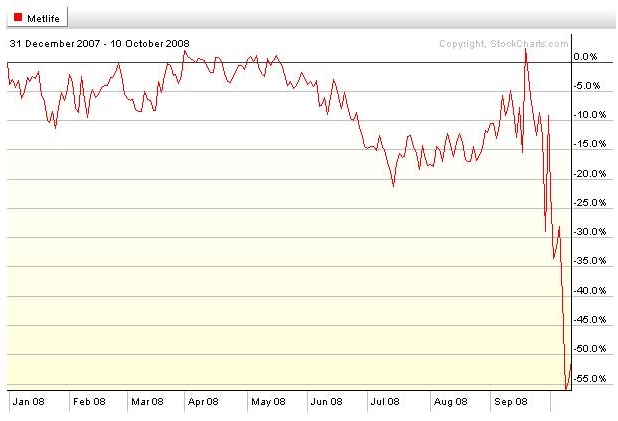

I like the GIC, in principal. The rate of return is attractive and automatic. If they hiccup, they dig into their wallet and make it good. In a normal environment, what's not to like? MET Life is a major player with a history and has economies of scale and is hopefully "Too Big To Fail". But the "Guarantee" is a promise, not insurance from someone with deeper pockets. In exceptional circumstances, the promise and the company can go away. So I carry the responsibility to make sure that they don't lose my money when I'm not looking. Speaking of not looking, here's what I don't not see when I DO look...

HOW I RUN MY 401A

PART 2

GIMME A BREAK!!!!

CLICKIT

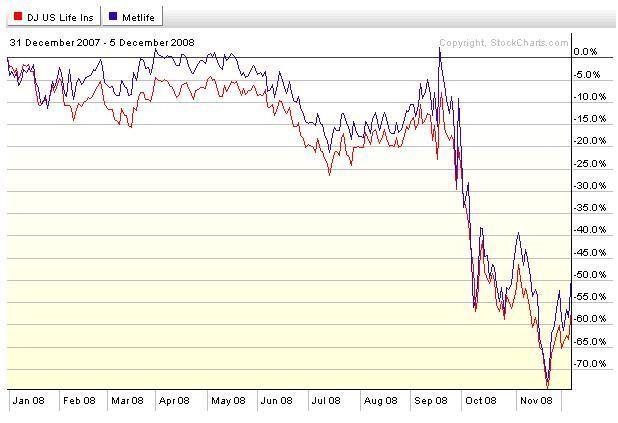

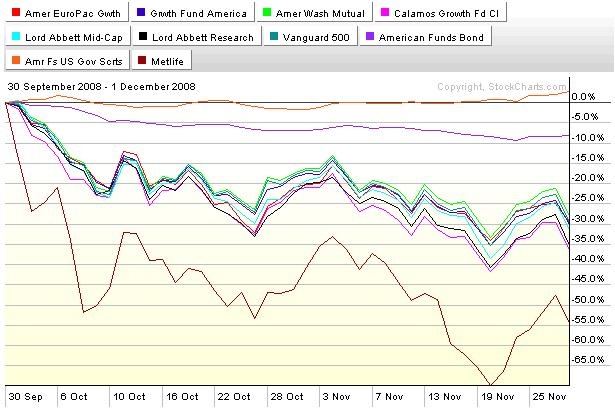

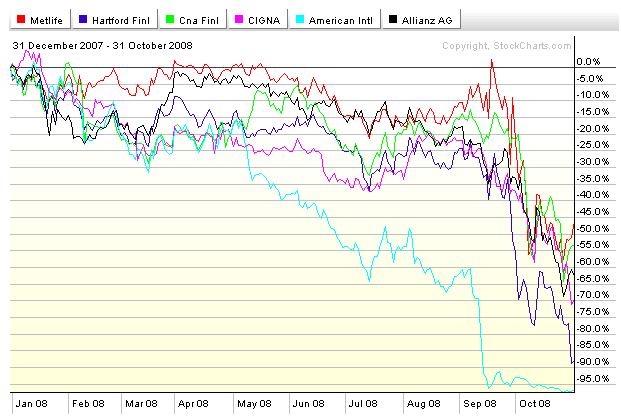

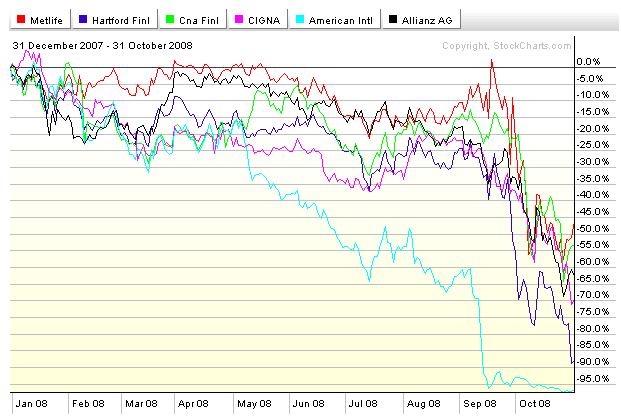

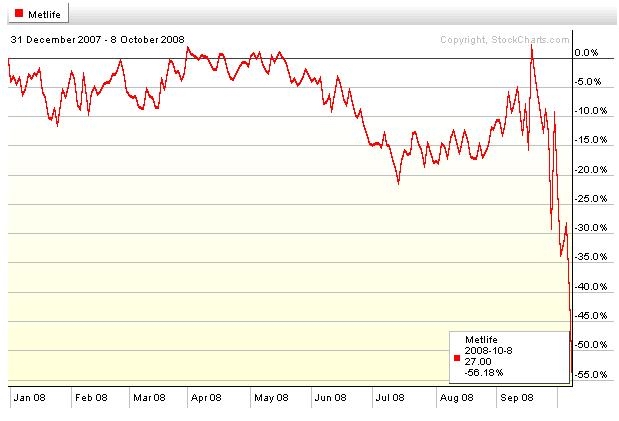

I don't like what I see. Above is a chart of the Dow Jones Life Insurance index and MET Life. MET is in the toilet, so's the rest of the industry. These are pretty exceptional times. It does not appear that there is another company in the industry strong enough to buy out MET and if there were, there are other buyout choices all over the landscape. I don't care how much I like the casino; no matter how good the restaurants or how generous the tables or comps, if it is on fire, I'm out the door. The GIC is a portfolio of investments, probably diverse, prolly "best in class", prolly "good solid companies" and "safe, secure bonds" and maybe goin' down in flames. If it was just one portfolio and MET was going strong, I'd be more confident. But it is, it ain't, and I'm not. I could find out if the portfolio was all treasuries, but if MET Life went down what would happen to the GIC, treasuries or junk, whatever? If the portfolio was half stocks and half mortgage bonds, what then? I could hang around and figure it out, or.....I could bail out.

ADIOS

The GIC may be just fine. I really don't know. I just ain't gonna find out the hard way. I may put all my money back into the GIC in the near future. But that's another story that is being written even as I type. Stay tooned.

The bottom line is that ordinarily, I consider the GIC to be a good alternative to cash, better than bonds for return, and almost as secure ... but these ain't ordinary times. If we had a Federal money Market Fund available to the 401a, I'd be all in in a heartbeat. We should, but we don't. Talk to the Trustees about that.... So I'm elsewhere. And that's another story. Stay tooned.

So that leaves the American Funds Government Securities Fund (RGVEX). I went through some of what we're goin' troo before in the 80's. Chrysler was going belly up, real estate and Savings And Loans were going down in flames and Paul Volker, the same one who is Obama's advisor, had jacked up interest rates to where I was earning 18% in my money market fund and the Federal Government was paying me 12% to hold double tax free bonds. Money cost a fortune and the odds were good that the country would go broke because they couldn't afford to borrow any. I wanted a safe place to put my money. I found it in Franklin Funds Government Money Market Funds. They held T bills and notes and had an average maturity of under a week. An entity with a standing army, guns, tanks, submarines, the need to win elections and the right to tax and print money owed me short term money and was paying me good interest rates. It was far superior to having money buried in the back yard and every bit as safe.

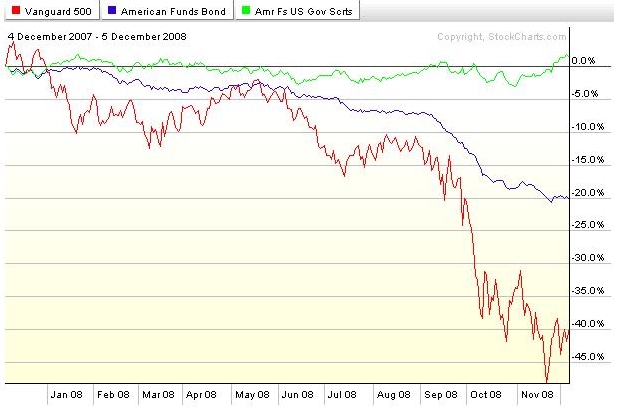

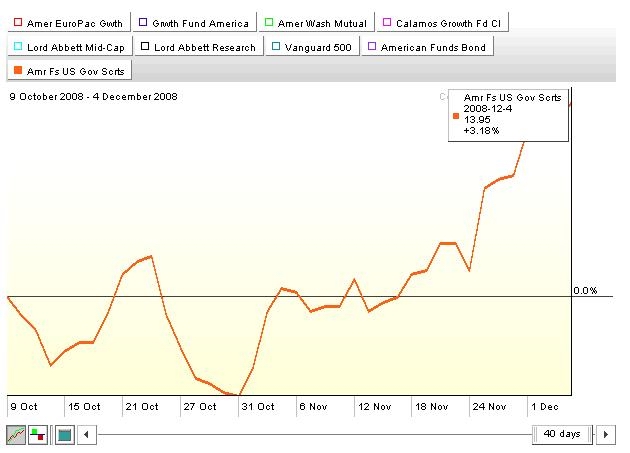

Then we have RGVEX. it is a Government bond fund. Here's a year of chart showing a stock market index fund (VFINX), a corporate bond fund (RBFFX) and RGVEX, all available in the 401a.

CLICKIT!!!!

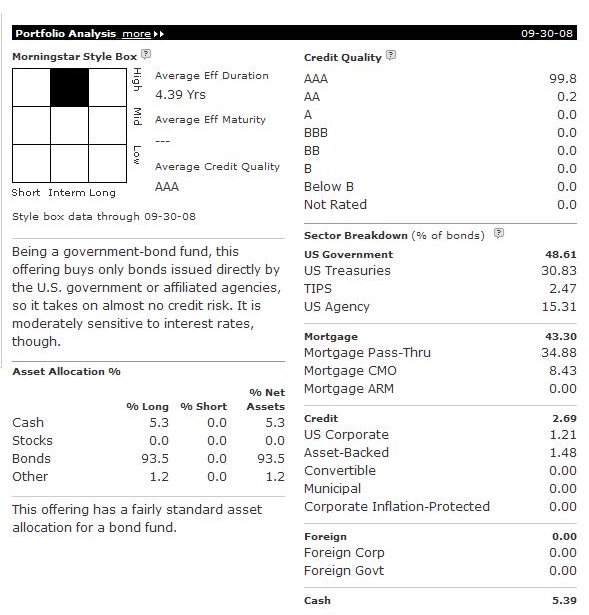

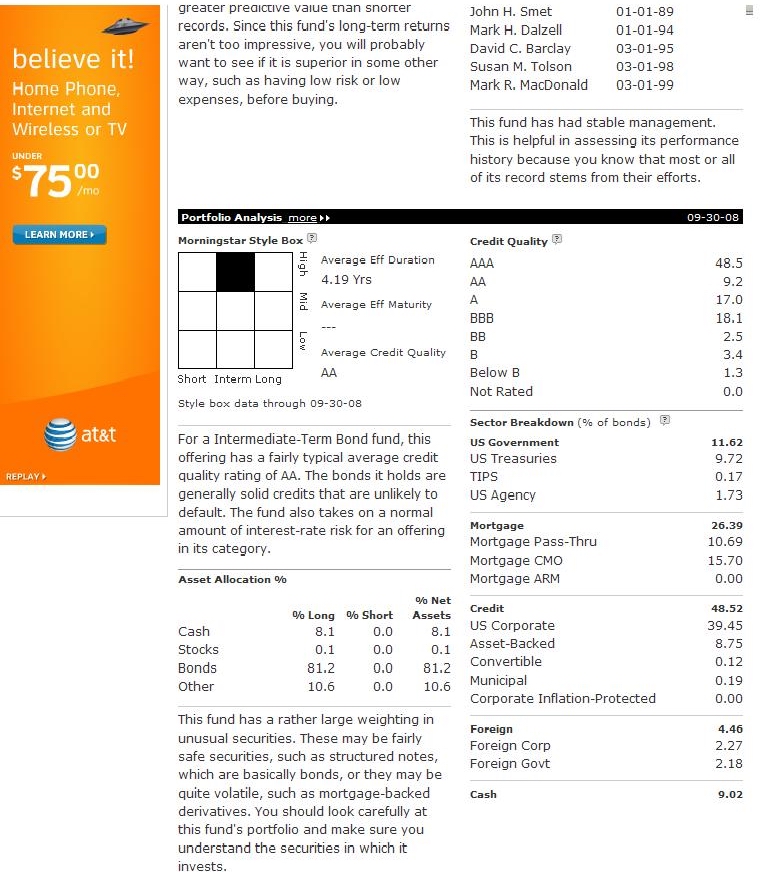

Here's what I find of interest at Morningstar regarding RGVEX

CLICKIT!!!!

and here's the link to the whole Morningstar page.

http://quicktake.morningstar.com/FundNe ... mbol=RGVEX

This is a far cry from my old Franklin Fund. It has almost as much in mortgage bonds as it does in treasuries and it has a little in corporate bonds, just to piss you off. This SUCKS!!

BUT

The FED sez that it will stand behind any and all bonds and bond like things like RMBS, CDO's and CMO's that it decides to and make it all good (except what it doesn't). And it will do so even if it has to create a huge pile of debt that will beggar our children and grandchildren.

Fair enuf.

It's not what I want. But I think that RGVEX and the FED look better than the MET GIC does here and now.... An' "Ya Can't Always Get What Ya Want. But If Ya Try Sometimes, Ya Get What Ya Need."

'Sides lookie here...

CLICKIT!!!!

The TLT has gone parabolic in the last 20 days. Two possibilities. People are bidding up the price of treasuries to where they are paying the face value of the bond AND some years of the interest that the bond will pay. This might mean since financial entities can't hold huge piles of cash in a back room and are scared to death that everything other than treasuries will probably become worthless, that they have to buy treasuries.

OR

The economy is going into such a deep hole without actually blowing up, that zero earnings will look mighty fine in two years compared to what stocks will do, even from these levels.

TUESDAY THE 9TH;

FOUR WEEK T BILLS YIELDING 0.00%

THREE MONTH T BILLS YIELD 0.005%

Smells like fear of a second leg down to me. HANG ON!!!!!!

What it means for me is that I've been in RGVEX for 40 days and I've made 3% in the last 20 days. I'd blow out of RGVEX and into the GIC to lock in the gain in a New York minute, except see above.

Never a dull moment. Stay tooned.

The GIC may be just fine. I really don't know. I just ain't gonna find out the hard way. I may put all my money back into the GIC in the near future. But that's another story that is being written even as I type. Stay tooned.

The bottom line is that ordinarily, I consider the GIC to be a good alternative to cash, better than bonds for return, and almost as secure ... but these ain't ordinary times. If we had a Federal money Market Fund available to the 401a, I'd be all in in a heartbeat. We should, but we don't. Talk to the Trustees about that.... So I'm elsewhere. And that's another story. Stay tooned.

So that leaves the American Funds Government Securities Fund (RGVEX). I went through some of what we're goin' troo before in the 80's. Chrysler was going belly up, real estate and Savings And Loans were going down in flames and Paul Volker, the same one who is Obama's advisor, had jacked up interest rates to where I was earning 18% in my money market fund and the Federal Government was paying me 12% to hold double tax free bonds. Money cost a fortune and the odds were good that the country would go broke because they couldn't afford to borrow any. I wanted a safe place to put my money. I found it in Franklin Funds Government Money Market Funds. They held T bills and notes and had an average maturity of under a week. An entity with a standing army, guns, tanks, submarines, the need to win elections and the right to tax and print money owed me short term money and was paying me good interest rates. It was far superior to having money buried in the back yard and every bit as safe.

Then we have RGVEX. it is a Government bond fund. Here's a year of chart showing a stock market index fund (VFINX), a corporate bond fund (RBFFX) and RGVEX, all available in the 401a.

CLICKIT!!!!

Here's what I find of interest at Morningstar regarding RGVEX

CLICKIT!!!!

and here's the link to the whole Morningstar page.

http://quicktake.morningstar.com/FundNe ... mbol=RGVEX

This is a far cry from my old Franklin Fund. It has almost as much in mortgage bonds as it does in treasuries and it has a little in corporate bonds, just to piss you off. This SUCKS!!

The FED sez that it will stand behind any and all bonds and bond like things like RMBS, CDO's and CMO's that it decides to and make it all good (except what it doesn't). And it will do so even if it has to create a huge pile of debt that will beggar our children and grandchildren.

Fair enuf.

It's not what I want. But I think that RGVEX and the FED look better than the MET GIC does here and now.... An' "Ya Can't Always Get What Ya Want. But If Ya Try Sometimes, Ya Get What Ya Need."

'Sides lookie here...

CLICKIT!!!!

The TLT has gone parabolic in the last 20 days. Two possibilities. People are bidding up the price of treasuries to where they are paying the face value of the bond AND some years of the interest that the bond will pay. This might mean since financial entities can't hold huge piles of cash in a back room and are scared to death that everything other than treasuries will probably become worthless, that they have to buy treasuries.

OR

The economy is going into such a deep hole without actually blowing up, that zero earnings will look mighty fine in two years compared to what stocks will do, even from these levels.

FOUR WEEK T BILLS YIELDING 0.00%

THREE MONTH T BILLS YIELD 0.005%

Smells like fear of a second leg down to me. HANG ON!!!!!!

What it means for me is that I've been in RGVEX for 40 days and I've made 3% in the last 20 days. I'd blow out of RGVEX and into the GIC to lock in the gain in a New York minute, except see above.

Never a dull moment. Stay tooned.

REALLY NICE BEAR MARKET RALLY LAST WEEK.... On Declining Volume During An Inevitably Positive Post Election Season And End Of The Month... with no resolution, upside catalyst or even the wringing out of the last cycle's excess in sight. TRUST THIS RALLY AT YOUR PERIL...

I really don't want to hear about "values." It is meaningless to me if the price action doesn't confirm the fact that something is cheap and people recognize that fact. If a stock really is a good value, then it should start trading up. I don't care what the analysis might be. A stock is not a good value if it doesn't increase in price.

James “Rev Shark” DePorre

UPDATED 12/4

Chartz and Table Zup... Check out my Website.

I'm under the weather..Bleagh. Stay tooned,

In the mean while, check it out....

http://www.stratfor.com/analysis/200809 ... _landscape

http://money.cnn.com/2008/11/30/news/co ... /index.htm

As of Wed last week, there were only 13 stocks in the S&P 500 that were up for the year.

The cost of the bailout to date is between $5 and $7 billion.

The cost of WW II adjusted for inflation was a little over $3.5 billion

PRETTY GOOD CALL IN THE HEADER. BEING ALL CASH PRETTY MUCH TOOK THE STING OUT OF 12/1 IN THE 401A. BEING WAY LEVERED AND DOUBLE SHORT MADE IT GOOD IN THE TRADING ACCT....THIS IS A REALLY GHASTLY 2/3RDS OF A QUARTER.

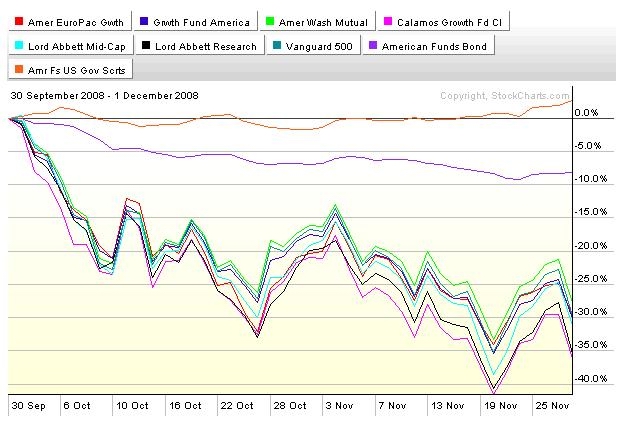

CLICKIT!!!!

NOW LET'S ADD IN MET LIFE AND YOU BEGIN TO UNDERSTAND WHY I'M IN THE GOV SECURITY FUND AND NOT THE GIC...

CLICKIT!!!!

EVERYONE WAS HOPING THAT 10/27 AND 11/12 WERE A DOUBLE BOTTOM AND THAT NOV 20TH WAS A SUCCESSFUL IF ABERRATIONAL TEST OF THE BOTTOM.

HANG ON....WE'RE MAYBE GONNA GET TO FIND OUT IF THAT WAS THE REAL BOTTOM WHEN WE SMASH AGAINST IT AND BOUNCE BACK... OR BLOW RIGHT THROUGH IT....

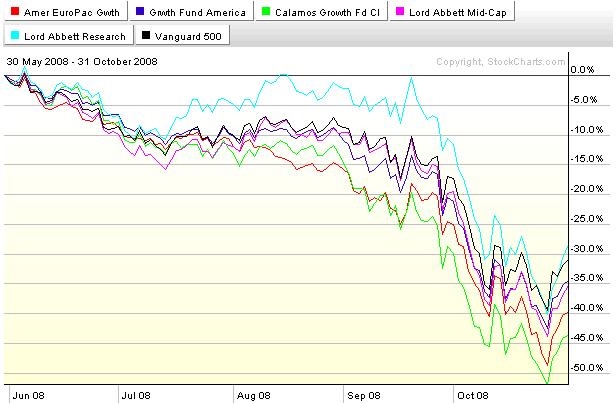

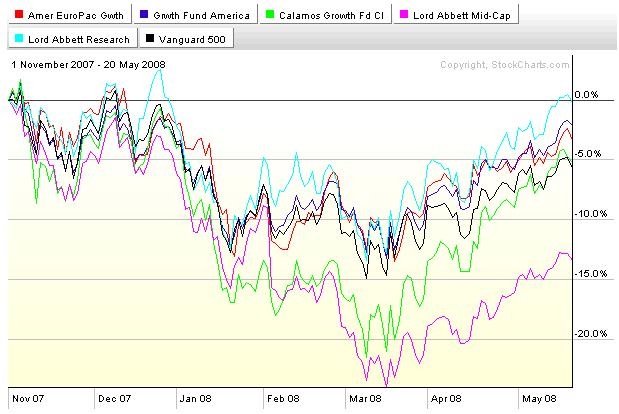

THE BOARD OF TRUST IS REPLACING THE CALAMOS FUND (CVGRX) AND THE LORD ABBETT MID CAP FUND (LAVLX). CHECK OUT THE FUND ALARM PAGE ON MY WEBSITE. LOOK UP THE FUNDZ AND SEE WHAT YA THINK....

http://www.ritholtz.com/blog/2008/12/plan-what-plan/

It's just as good to be lucky as it is to be smart, but if you're smart, the luck follows along. My concerns about the MET LIFE GIC put me into the American Fundz Gov Securities fund (RGVEX) just before everyone either got religion as to how bad things were or got REALLY scared about how bad thing COULD get. Everyone started throwin' money at Treasury bills. Yields get driven way down on newly purchased bills but bills already held get really valuable. Call up a chart of TLT. In two months, the treasury bill part of RGVEX looks like it's paid almost a year's worth of MET LIFE GIC income. KOOL...

CLICKIT!!!!!

Yes, I'll protect my gains if they start to reverse. But I STILL have reservations about the GIC. I'm gonna hafta think about this......

Bear Markets Scare Out The Timid And Wear Out The Tough. The Object Of The Exercise Is To Show Courage And Be Among The Last Still Standing With Plenty Of Capital To Participate In The Next Bull Market. The Rev Is Right. Getting Back To Even Is A Tremendous Waste Of Time And Resources.

The best minds are not in government. If any were, business would hire them away.

-- Ronald Reagan

UPDATED ALL DAY EVERYWHERE 11/23

UPDATED THANKSGIVING (FORGOT TO INCLUDE ONE OF MY FAVORITE YOUTOOBZ)

http://www.ritholtz.com/blog/2008/10/whassup/

Chartz and Table Zup @ www.joefacer.com.

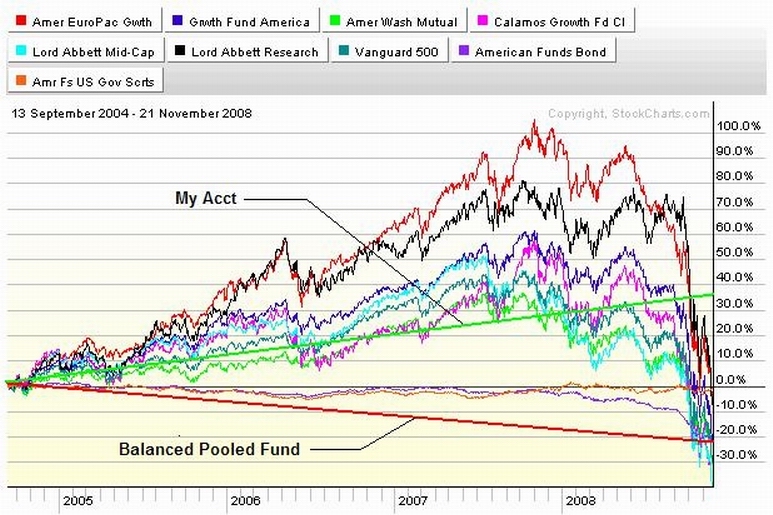

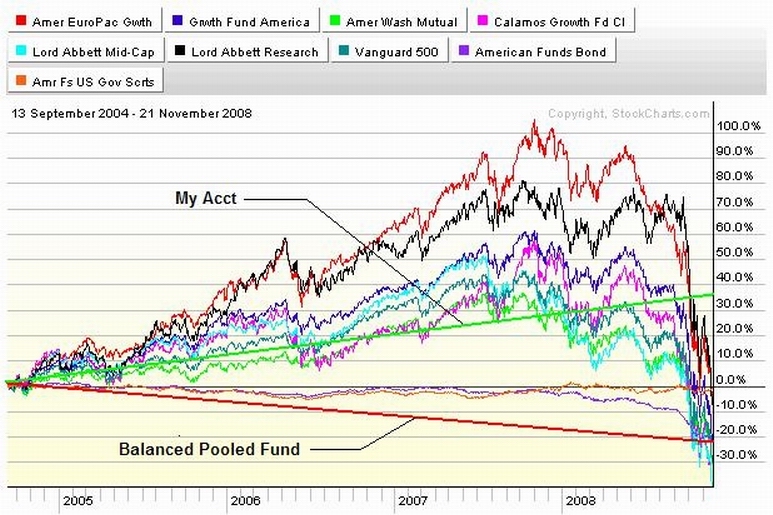

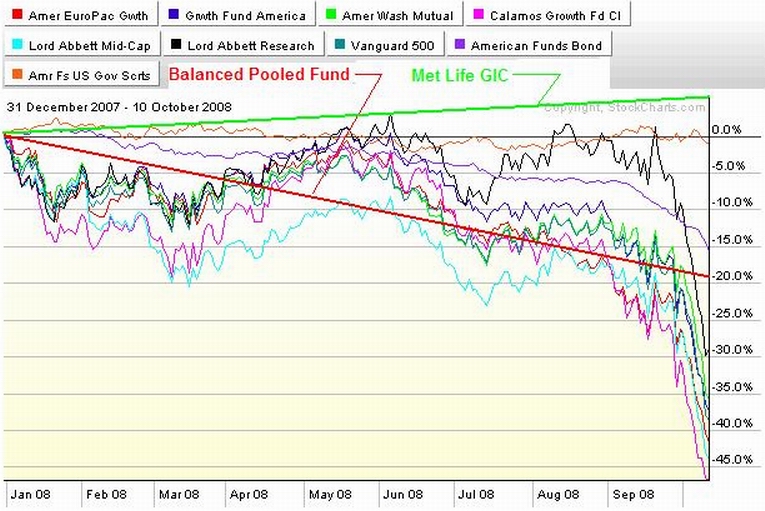

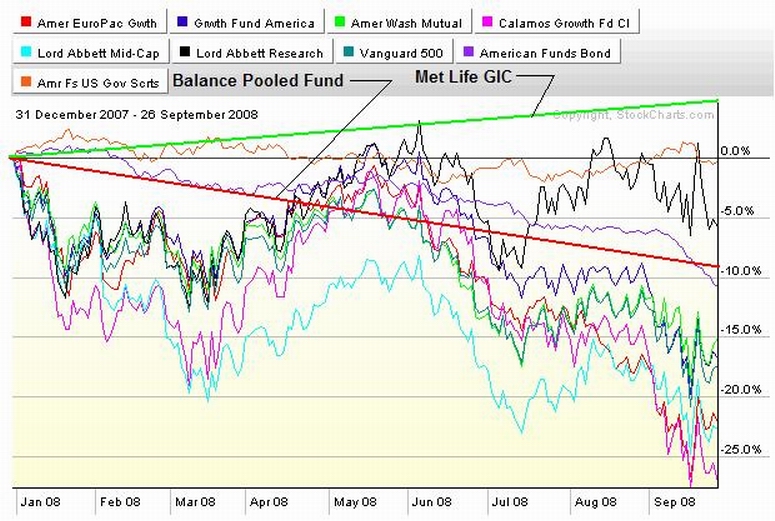

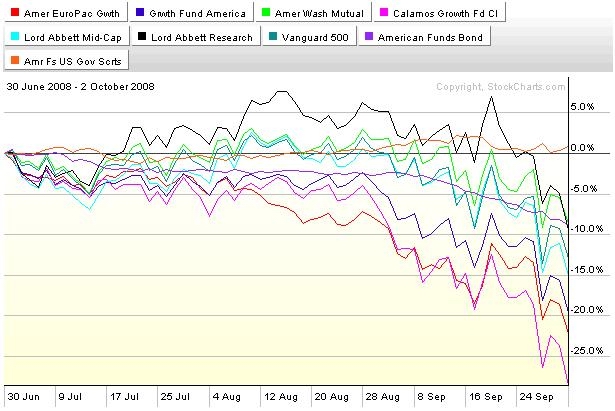

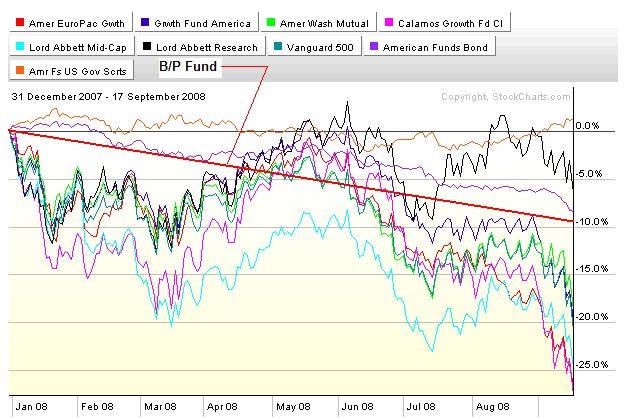

I'm up over 600% Year To Date over the Balanced Pooled Fund and up over 2000% over the B/P Fund since the Trustees provided us with more than one fund to work with as of 9/04.

I was not expecting to do this well, but neither was it an accident. It was/is avoiding an all risk/no gain stupid dangerous market. One hundred fifty plus MPH toward Turn One is big time fun dangerous. I'm down wid' dat. Watching my hard earned retirement money go up in flames hoping it all comes back as fast as it went away is hoping a forest fire burns backward and leaves the forest untouched. That's big time stoopid dangerous.

You can't expect to succeed with a self directed plan unless you actually direct it..... And that doesn't mean flailing away at every twist and turn anymore than it means ignoring everything all the time because someone told you it was at all times and everywhere safe and easy and that trusting everything and everyone and doing nothing was the smart thing to do. Think of it as keeping track of the calender and playing the seasonal weather. I was almost all stocks all the time from 9/04 to 3/08. (A Financial Spring, Summer, and Fall) I've been GIC or gov and gov agency bonds since then.(Financial Winter) I'll be back to stocks when the current financial nuclear winter is over and it's springtime again. (Who knows when? I'll have to keep checking.) It's as simple as THIS:

CLICKIT!!!

Congratulations to those who followed along or did better on their own.

IN THE MEANTIME....

Some old favorites....

http://www.youtube.com/watch?v=90ELleCQvew

http://www.ritholtz.com/blog/2008/11/fo ... ng-hitler/

http://www.youtube.com/watch?v=KycZk1M7g24

http://www.youtube.com/watch?v=1aS3jC_nKW4&NR=1

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://www.collegehumor.com/video:1788161

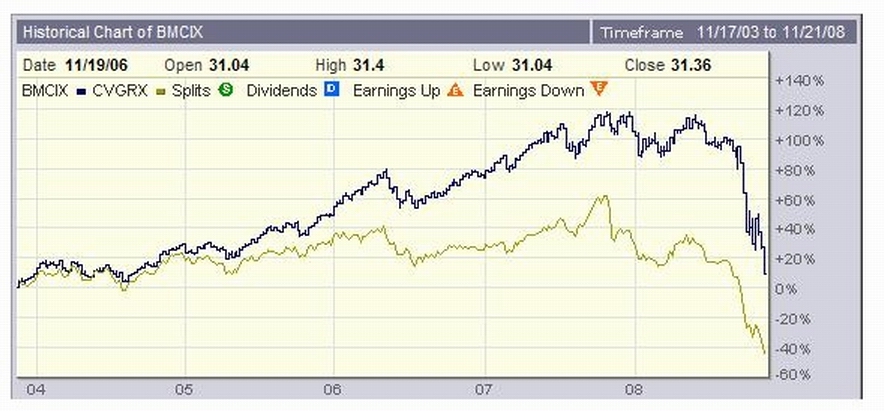

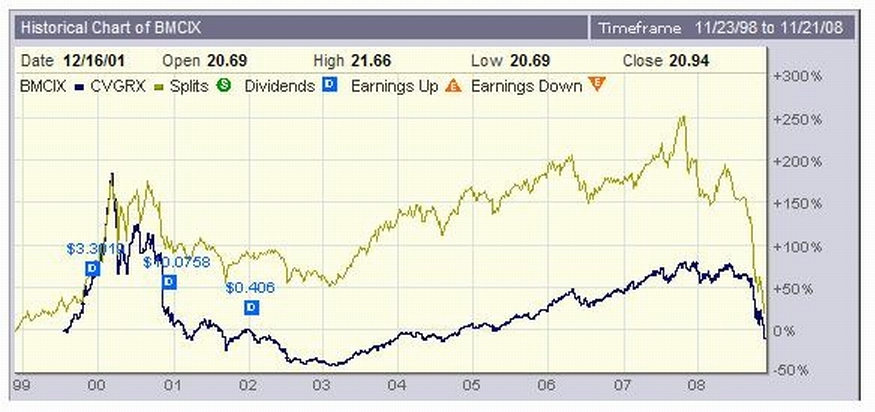

The Board of Trustees are dropping two fundz and replacing them w/ two other fundz. Calamos Growth(CVGRX) is being replaced by Blackrock US Opportunities(BMCIX).

My look at the two fundz on WWW.STOCKCHARTS.COM Perfect Charts shows BMCIX to be the far superior fund. But the Perfect Chart only goes back five years. Lets see what WWW.BIGCHARTS.COM sez.

CLICKIT!!!!

I use BIGCHARTS.COM when and because they offer me options unavailable on my preferred STOCKCHARTS.COM. (Links for both up above.) BIGCHARTS shows me that the picture is a lot less clear if you go back 10 years. Buy and holding in 1999 shows that CVGRX is the far superior fund from '99 up until '08. Buying in '04 and selling at the end of '07 shows that BMCIX is the far superior fund. Either of these fundz will/would've work/worked well with a reasonable investment and money management strategy. I'm ready w/ both.

IT DRIVES ME UP THE WALL WHEN SOMEONE ASKS ME ABOUT A ONE DECISION FUND FOR THEIR 401A. THE 401A IS A HUGE OPPORTUNITY IF YOU FUND IT AGGRESSIVELY TO TAKE ADVANTAGE OF THE TAX SAVINGS AND A HUGELY DANGEROUS THING TO IGNORE ONCE YOU HAVE ANY SORT OF MEANINGFUL BALANCE. YOU HAVE TO MANAGE YOUR 401A TO SOME DEGREE IF YOU WANT TO AVOID THE RISK OF MAJOR BIGTIME GRIEF. THIS YEAR DEMONSTRATES THAT CONCLUSIVELY.

Links

http://www.ritholtz.com/blog/2008/11/gl ... te-ratios/

http://www.ritholtz.com/blog/2008/11/ev ... ost-money/

http://www.ritholtz.com/blog/2008/11/br ... ica-dream/

http://www.ritholtz.com/blog/2008/11/ho ... ome-owers/

http://www.nytimes.com/2008/11/18/busin ... .html?_r=1

http://www.ritholtz.com/blog/2008/11/re ... king-data/

http://www.thetruthaboutcars.com/catego ... out-watch/

http://www.ritholtz.com/blog/2008/11/11 ... lout-plan/

HOW I RUN MY 401A TO RESUME AFTER THANKSGIVING.....

I'm up over 600% Year To Date over the Balanced Pooled Fund and up over 2000% over the B/P Fund since the Trustees provided us with more than one fund to work with as of 9/04.

I was not expecting to do this well, but neither was it an accident. It was/is avoiding an all risk/no gain stupid dangerous market. One hundred fifty plus MPH toward Turn One is big time fun dangerous. I'm down wid' dat. Watching my hard earned retirement money go up in flames hoping it all comes back as fast as it went away is hoping a forest fire burns backward and leaves the forest untouched. That's big time stoopid dangerous.

You can't expect to succeed with a self directed plan unless you actually direct it..... And that doesn't mean flailing away at every twist and turn anymore than it means ignoring everything all the time because someone told you it was at all times and everywhere safe and easy and that trusting everything and everyone and doing nothing was the smart thing to do. Think of it as keeping track of the calender and playing the seasonal weather. I was almost all stocks all the time from 9/04 to 3/08. (A Financial Spring, Summer, and Fall) I've been GIC or gov and gov agency bonds since then.(Financial Winter) I'll be back to stocks when the current financial nuclear winter is over and it's springtime again. (Who knows when? I'll have to keep checking.) It's as simple as THIS:

Congratulations to those who followed along or did better on their own.

IN THE MEANTIME....

Some old favorites....

http://www.youtube.com/watch?v=90ELleCQvew

http://www.ritholtz.com/blog/2008/11/fo ... ng-hitler/

http://www.youtube.com/watch?v=KycZk1M7g24

http://www.youtube.com/watch?v=1aS3jC_nKW4&NR=1

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://politicalhumor.about.com/gi/dyna ... en/805381/

http://www.collegehumor.com/video:1788161

The Board of Trustees are dropping two fundz and replacing them w/ two other fundz. Calamos Growth(CVGRX) is being replaced by Blackrock US Opportunities(BMCIX).

My look at the two fundz on WWW.STOCKCHARTS.COM Perfect Charts shows BMCIX to be the far superior fund. But the Perfect Chart only goes back five years. Lets see what WWW.BIGCHARTS.COM sez.

CLICKIT!!!!

I use BIGCHARTS.COM when and because they offer me options unavailable on my preferred STOCKCHARTS.COM. (Links for both up above.) BIGCHARTS shows me that the picture is a lot less clear if you go back 10 years. Buy and holding in 1999 shows that CVGRX is the far superior fund from '99 up until '08. Buying in '04 and selling at the end of '07 shows that BMCIX is the far superior fund. Either of these fundz will/would've work/worked well with a reasonable investment and money management strategy. I'm ready w/ both.

IT DRIVES ME UP THE WALL WHEN SOMEONE ASKS ME ABOUT A ONE DECISION FUND FOR THEIR 401A. THE 401A IS A HUGE OPPORTUNITY IF YOU FUND IT AGGRESSIVELY TO TAKE ADVANTAGE OF THE TAX SAVINGS AND A HUGELY DANGEROUS THING TO IGNORE ONCE YOU HAVE ANY SORT OF MEANINGFUL BALANCE. YOU HAVE TO MANAGE YOUR 401A TO SOME DEGREE IF YOU WANT TO AVOID THE RISK OF MAJOR BIGTIME GRIEF. THIS YEAR DEMONSTRATES THAT CONCLUSIVELY.

Links

http://www.ritholtz.com/blog/2008/11/gl ... te-ratios/

http://www.ritholtz.com/blog/2008/11/ev ... ost-money/

http://www.ritholtz.com/blog/2008/11/br ... ica-dream/

http://www.ritholtz.com/blog/2008/11/ho ... ome-owers/

http://www.nytimes.com/2008/11/18/busin ... .html?_r=1

http://www.ritholtz.com/blog/2008/11/re ... king-data/

http://www.thetruthaboutcars.com/catego ... out-watch/

http://www.ritholtz.com/blog/2008/11/11 ... lout-plan/

HOW I RUN MY 401A TO RESUME AFTER THANKSGIVING.....

Losing less money is considered a big success on Wall Street. In the world of fund management, relative outperformance vs. a benchmark is the focus, but any individual who is struggling to only lose 30% or so vs. the 37% that the S&P 500 has lost is going to barely survive.

James “Rev Shark” DePorre

Chartz and Table Zup on www.joefacer.com.

Birthday, shutdown @ work and upcoming track day @ Laguna Seca. I'll post when I can.

UPDATED 11/20

LAST WEEKEND WAS A WEEKEND LIKE BACK WHEN I WAS RACIN'. EVERYTHING STOPS AND I PLAY KETCHUP FOR THE NEXT WEEK. I'VE GOTTEN THE LETTER FROM THE HALL ABOUT THE NEW FUNDZ AND THE CHANGES TO THE BALANCED POOLED FUND. IT'LL ALL BE ROLLED INTO "HOW I RUN MY 401a". RESUMING THIS UPCOMING WEEKEND....

Stay tooned for Part 2 of How I Run My 401a

Part 1 of How i Run My 401a is here... http://joefacer.com/pblog/index.php?m=1 ... 107-195005

I'm hearing more and more tales of major damage being done to retirement funds of friends, and brothers and sisters. THAT PISSES ME OFF!!!!! It didn't have to happen.... A buddy who I advised to go to cash in January said he talked with a buddy who lost a huge amount. He told me that, "After hearing how much he lost, I didn't have the heart to tell him I only lost about a thousand..."

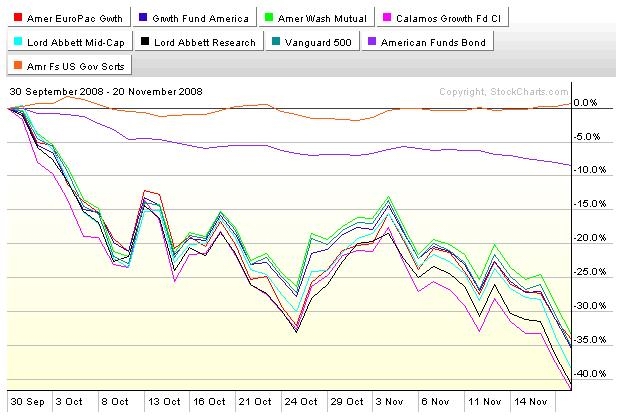

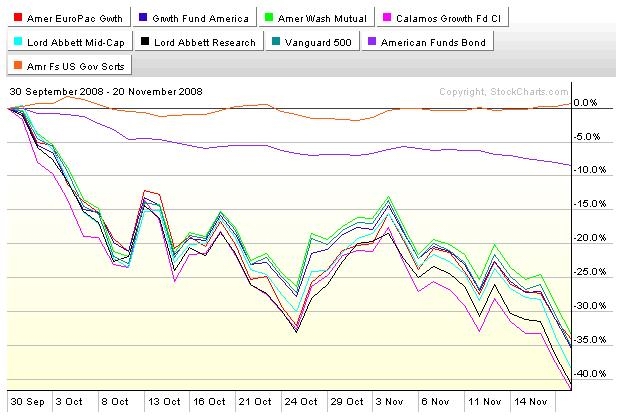

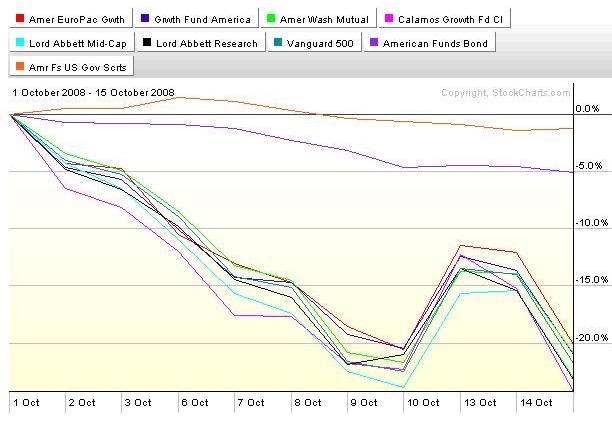

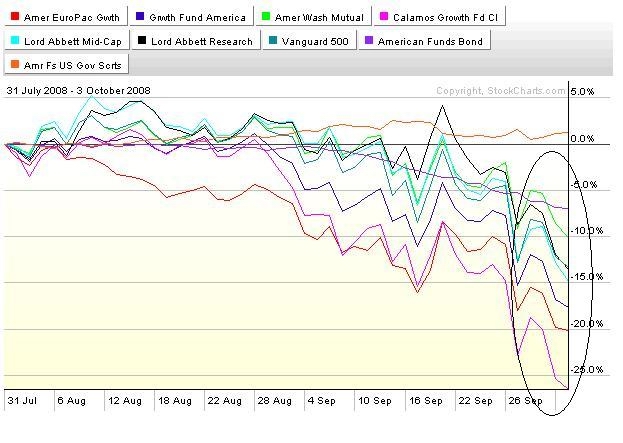

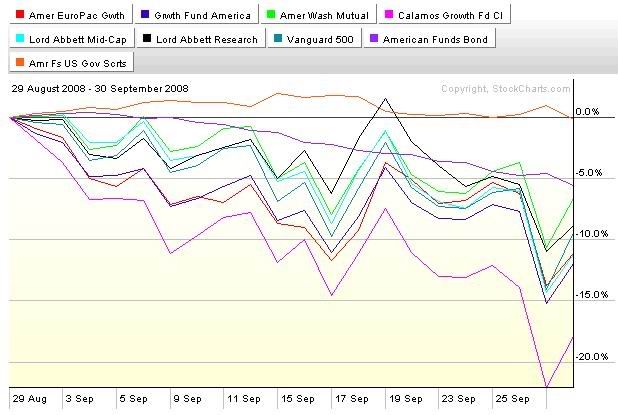

CLICKIT!!!!!

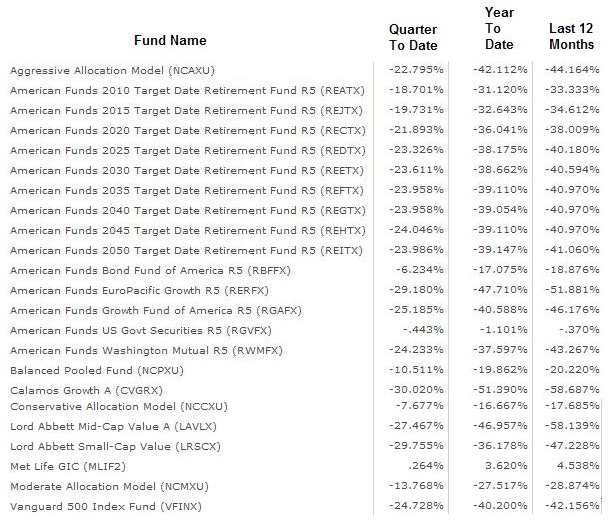

CHECK OUT THE CHARTS ON MY SITE. IF YOU THOUGHT LAST QUARTER WAS BAD, BRACE YOURSELF FOR SOME SERIOUS SHIT. PASTE THE RESULTS ABOVE FOR THIS QUARTER ON YOUR LAST STATEMENT. IF YOUR STRATEGY IS "DEER IN THE HEADLIGHTS", IT MAY BE TIME FOR A CHANGE.

CLICKIT!!!!

THE NUMBERS MAKE YOUR HEAD SPIN. THE BALANCED POOLED FUND HAS RETURNED ZERO FOR THE LAST FOUR YEARS. READ IT AND WEEP SAYS IT ALL. WHO IS GOING TO EXPLAIN THIS TO YOU?

STAY TOONED.......

Chartz and Table Zup on www.joefacer.com.

Birthday, shutdown @ work and upcoming track day @ Laguna Seca. I'll post when I can.

UPDATED 11/20

LAST WEEKEND WAS A WEEKEND LIKE BACK WHEN I WAS RACIN'. EVERYTHING STOPS AND I PLAY KETCHUP FOR THE NEXT WEEK. I'VE GOTTEN THE LETTER FROM THE HALL ABOUT THE NEW FUNDZ AND THE CHANGES TO THE BALANCED POOLED FUND. IT'LL ALL BE ROLLED INTO "HOW I RUN MY 401a". RESUMING THIS UPCOMING WEEKEND....

Stay tooned for Part 2 of How I Run My 401a

Part 1 of How i Run My 401a is here... http://joefacer.com/pblog/index.php?m=1 ... 107-195005

I'm hearing more and more tales of major damage being done to retirement funds of friends, and brothers and sisters. THAT PISSES ME OFF!!!!! It didn't have to happen.... A buddy who I advised to go to cash in January said he talked with a buddy who lost a huge amount. He told me that, "After hearing how much he lost, I didn't have the heart to tell him I only lost about a thousand..."

CLICKIT!!!!!

CHECK OUT THE CHARTS ON MY SITE. IF YOU THOUGHT LAST QUARTER WAS BAD, BRACE YOURSELF FOR SOME SERIOUS SHIT. PASTE THE RESULTS ABOVE FOR THIS QUARTER ON YOUR LAST STATEMENT. IF YOUR STRATEGY IS "DEER IN THE HEADLIGHTS", IT MAY BE TIME FOR A CHANGE.

CLICKIT!!!!

THE NUMBERS MAKE YOUR HEAD SPIN. THE BALANCED POOLED FUND HAS RETURNED ZERO FOR THE LAST FOUR YEARS. READ IT AND WEEP SAYS IT ALL. WHO IS GOING TO EXPLAIN THIS TO YOU?

STAY TOONED.......

The 1971 version of the Allman Bros Band...The sound board tapes from the F'mo East and West are incendiary. You owe it to yourself....

"The market is not a sofa, it is not a place to get comfortable."

Jim Cramer

Chartz and Table Zup on www.joefacer.com....

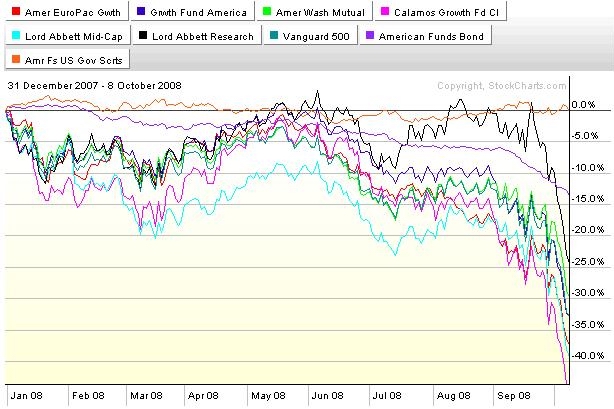

I've been pretty much reporting on what's happening lately. Lots of charts, links, and a table or two. My strategy of riding the market up and standing aside when the market cracked has been pretty successful. It was loaded and cocked back in late '07 and other than trying to pick up pennies in front of a steamroller with small positions until mid June, I was heavily in cash at the end of the first quarter. Charts and tables on my website tell the tale. It is AMAZING how well being cautious has worked out. Risk control is HUGE in a self directed plan.

But Now What? That's EASY!!!

HOW I MANAGE MY 401A

Check out the charts on my site. www.joefacer.com We had a huge earning opportunity from 9/04 until 10/07. During those three years the worst stock fund in the 401a made 11% a year and the best fund returned 30% a year. Since 11/07, all of them except the American Funds Government Securities Fund and the Met Life GIC have gone into the toilet. The economy and financial markets run in cycles. The overall direction is up. But there are pitfalls to be avoided along the way. No shit. So I want to be in the market when the direction is up and out when the direction is down. Furthermore, I want to be in the right places in the market. I'll take what the market gives. Will things be as good as the last time? Doesn't matter. Ya gotta play what yer dealt. we'll see....

What about "Buy And Hold". Is "Buy And Hold" dead?

"Buy And Hold" died for me in 1998. See http://joefacer.com/id18.html for how and why. If you have 40+ years before retirement and in blind faith don't wish to make the effort regardless of the risks , it may still be alive for you. Whatever.

What about "You Can't Time The Market."

That's just dumb. You look at the run up from '98 to '01 and the run up from '03 to '07 and read the papers (the thoughtful articles, not the cheerleaders) and you can't recognize the top? You can't recognize a time to be REALLY cautious? A buddy at work went all cash in December of this year at my recommendation. Earlier, he and his wife had looked at a house they wanted and got all the way to getting qualified for the loan. He looked at the loan and figured the payments were 80% of his take home pay and he walked away. "You Don't Need A Weatherman To See Which Way The Wind Blows." Shit like that ALWAYS goes bad at some point.

Wall Street earns money off your investments. They can't justify fees on cash. They will ALWAYS tell you to "Stay The Course." Furthermore, the big money funds are $100's or $1000's of millions of dollars. They can't turn on a dime. Buy and hold is what it looks like even when they are bailing as fast as they can. I used to be able to turn on a dime. The McMorgan era was so gawdawful that I never contributed over the minimum. I didn't put much in and McMorgan didn't earn me much. When we got the new funds, I could spread my money around a little and get in and out of the market in three days. Now I'm contributing the max and have made a lot on my investments in the 401a. Now it takes some thought, but all the way in and all the way out takes about a week or so at the minimum to about a month at the maximum. If the cat walks on the keyboard and I gotta unscramble the account from some horrible gawdawful allocation, the fix takes a coupla days to get in gear and a week to a month to undo, regardless. No biggie. THIS is what it means to be "In It For The Long Run". If you sell when you shouldn't have, BUY IT BACK! Held on a little too long? Sell it late. Was it a mistake? Fix it! Being wrong by being too cautious or too aggressive for a week or a month is meaningless in the long run. It is not a sin being wrong, positioned either too risky or too safely. Everybody makes mistakes. The sin is to stay wrong long enough to dig yourself a hole you'll never get out of...

So there are two things to be dealt with sometime in the future.

When Is The Right Time To Get Back In? And Where Do I Go?

Well, GM, Ford and Chrysler warn that they see themselves crashing into bankruptcy and taking the economy with them by the end of 2008/2009 GM/Ford Chrysler. So they want the US taxpayer to make $50 to $100 Billion dollars available to them to see if that helps them work things out. AIG has spent the original $85 billion of taxpayer money and is starting in on an additional $36 billion and either wants more or a change of terms so that they are eligible to borrow more. That is only two of the many major problems we face now and in the near future. This looks like it will take time for things to work out if they do work out at all. So I've got plenty of time to look for when to get in and time to write about where to get in.

....In The Meantime...Here

Smokin' synopsis of the election....

http://www.newsweek.com/id/167582

http://www.ritholtz.com/blog/2008/11/fa ... democrats/

Prescient

http://www.theonion.com/content/node/28784

http://www.theonion.com/content/node/89486

http://www.ritholtz.com/blog/2008/11/me ... year-high/

http://www.ritholtz.com/blog/2008/11/un ... eremployed

http://www.ritholtz.com/blog/2008/11/no ... ober-2008/

http://www.ritholtz.com/blog/2008/11/th ... s-is-over/

http://www.ritholtz.com/blog/2008/11/ha ... residency/

http://www.ritholtz.com/blog/2008/11/do ... reclosure/

http://www.ritholtz.com/blog/2008/11/re ... fter-bush/

http://www.ritholtz.com/blog/2008/11/th ... -of-times/

http://www.ritholtz.com/blog/2008/11/ai ... ore-money/

http://www.ritholtz.com/blog/2008/11/th ... -of-palin/

http://www.ritholtz.com/blog/2008/11/th ... untaintop/

http://www.pbs.org/moyers/journal/11072008/watch.html

http://www.ritholtz.com/blog/2008/11/fo ... ng-hitler/

http://www.dailymail.co.uk/news/worldne ... -tale.html

See ya here later this weekend...

LIKE NOW!!!

CLICK THESE IMAGES...

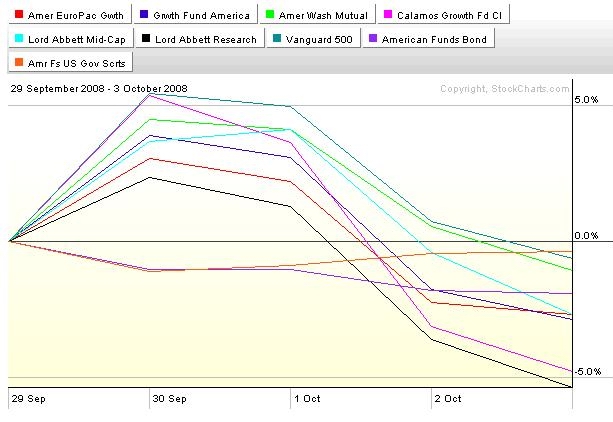

CLICKIT

You know how I feel about bonds if you read this... http://joefacer.com/id11.html . Enuf said. Check out the chart above if that AIN'T enuf. It shows the two bond funds available to the 401a. Ordinarily you'd invest in these bond funds for safety. Check out the charts on my site's chart pages for what the cost of safety was for investing in bonds between 2003 and late 2007. Your performance sucked. Look at the cost of safety after 9/21/2007. It either blew you out of the water or you did OK. Let's see why...

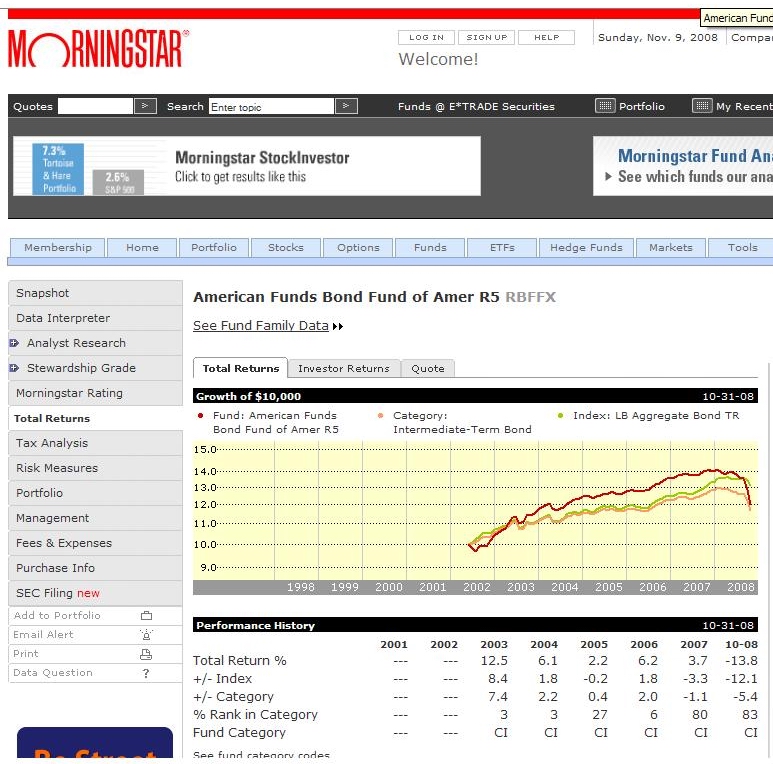

CLICKLIT!!!!

The first image is from MORNINGSTAR for which I have a link up above. It shows part of the RETURNS page for the RBFFX bond fund. The data shows that the fund did really well between 2003 and 2006 compared to the Lehman Bros Index and the category of similar bond funds. However returns in 2005 and 2007 were not as good. Returns in '08 have been disastrous. It is still kind of a respectable showing for a short time period. It is a respectable showing in terms of the category and in terms of realizing not as much gain in return for safety and low investor effort. Still if the safety is not there, especially if the market changes, then you can't make a real serious case for being in the fund even if you didn't want to go through the effort and risk of doing better with stocks. The RGVEX government bond fund and the MET LIFE GIC offered competitive returns in bonds or a cash like fund year over year and maybe more safety. We'll have to look at them next week.

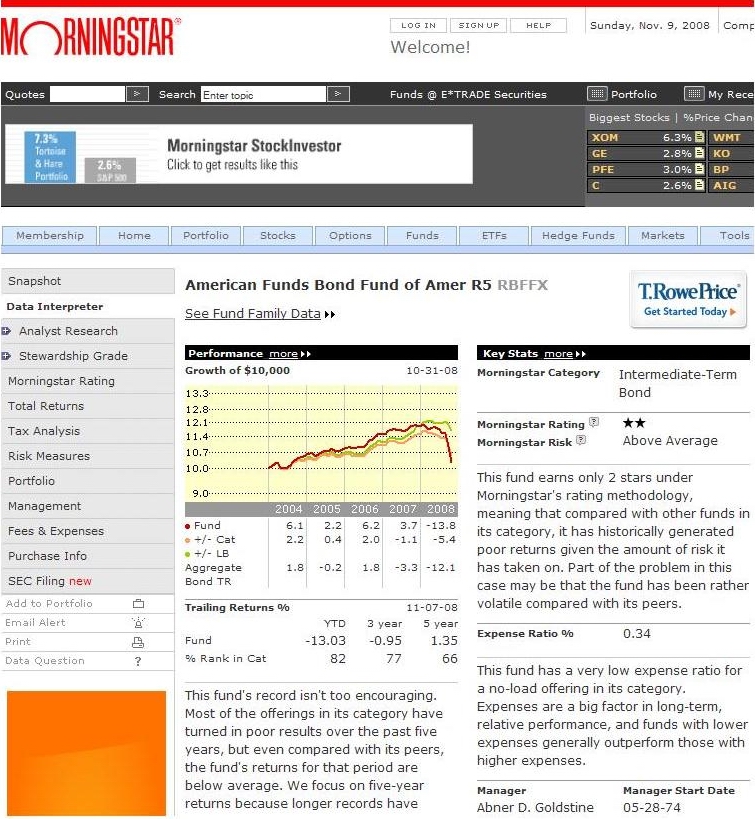

CLICKIT!!!

Above is the MORNINGSTAR DATA INTERPRETER page for the RBFFX Fund. Morningstar looks at the fund from a different view point and puts on its analyst hat. Morningstar is not impressed. Rather than looking at the returns in individual years, it lumps the years together and looks at trailing returns versus other funds. The bad '07 and '08 returns ripped the guts out of the total picture. The safety was not there. The fund had 26% of it's (your) money in mortgages and 48% of the money in corporate bonds. When these sectors went down in flames so did the safety and your money. Returns were low and the risk was high. The worst of both worlds. Add in the "unusual securities" and "structured notes which are basically bonds" (HORSE EXHAUST) and this fund looks like trouble.

The bottom line is TANSTAAFL. There Ain't No Such Thing As A Free Lunch. The word bonds does NOT mean safe and you can never look away from your money or it may go away. When things were good, I never saw the returns from this fund being good enough to make me want to put money in. There were stock funds and the GIC and RGVEX bond fund. Once things went bad, there was too much risk and big losses and only the thinnest illusion of safety in RBFFX. There are auto loans in there along with the mortgages. Check out the Morningstar Portfolio page.

So RBFFX ain't for me. Could that change? Yep. That's why I run the charts weekly for all the Funds and read many more articles than the links I post.

See ya at the hall.

"Fear is an insidious virus. Given a breeding place in our minds it will eat away our spirit and block the forward path of our endeavors."

--James F. Bell

Chartz and Table Zup on

www.joefacer.com

HERE'S WHAT'S ON MY MIND...

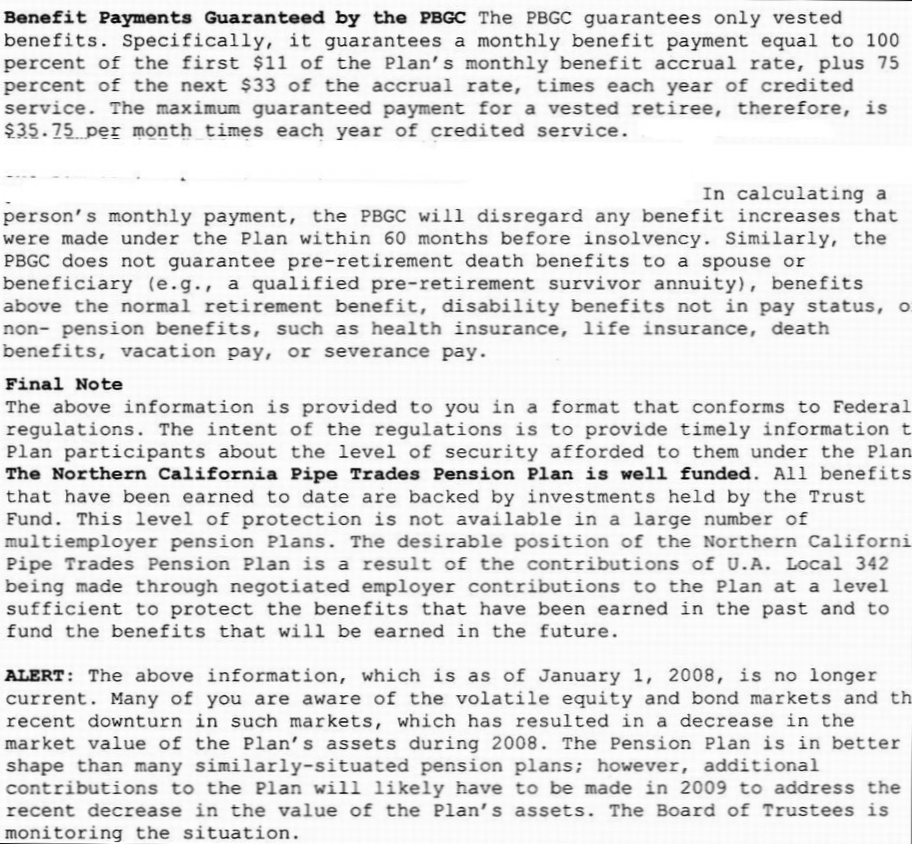

I GOT THE FOLLOWING FROM THE HALL.

CLICKIT!!!!!

THE OTHER SHOE HAS FALLEN. WHAT HAS HAPPENED TO THE 401A HAPPENED TO THE DEFINED BENEFIT (what many call the "real pension")

Here's what I see...

My pension has been poorly managed for over a decade. You know all about that by now. Compared to the better managed pensions of other unions in the area, I don't have nearly what I should have. Therefore it is important to maximize what I do have, and to above all, not put myself further behind than I am already. So I gotta plan to avoid or minimize anything negative that could affect the plan.

What's the worst that could happen? From the mailing from the hall, excerpted above, if the defined benefit pension plan fails, the PBGC will provide roughly a third of my former pension dollars less all other benefits than the monthly check. That's assuming that they are capable of doing so. http://www.bloomberg.com/apps/news?pid= ... w3FJ3Nhf1Q Note that Fed and the treasury are already supporting the housing market, insurers, providing currency swaps to foreign central banks, funds to prime brokers, public corporations, private corporations, insurance companies, investment banks, retail banks, foreign owned banks, individual borrowers, hedge funds, mortgage holders and who the hell knows who else until we read the morning news. If the government is considering floating GM (public corporation) and Chrysler/Cerberus (private company/hedge fund)big bucks to close down half the jobs and support all the pensions of both companies in a bid to avoid the bankruptcy of both parties, which it is, the PGBC is likely going to be under major stress in the near future from this and similar events. If we can't make our defined benefit pension plan work, we'd risk being just another pension plan in a long line of plans in trouble looking for our fraction of a share from the taxpayers through the Fed/Treasury/PGBC.

The health of our defined benefit plan comes FIRST!!! Stay tooned...

Second comes the 401a plan. The defined benefit plan may require more funding to meet what has already been promised us. Greater contributions without increased benefits is a real possibility for the defined benefit plan. However, any additional funds going into the 401a plan go straight to the individual account holder's pocket. In an environment where EVERYTHING is going down, ya start of with a substantial tax savings equal to a coupla VERY good years of investment appreciation. And you have room to maneuver to eliminate or minimize risk. I work with a number of individuals with very substantial balances who lost at most a thousand or two dollars this year because they practiced risk control as I suggested. Being insanely aggressive and an active trader myself, I'm down less than $4K along with keeping my substantial profits from the good years. I practice risk control too. But I do lean to he long side. I'm comfortable with a little more exposure to risk in order to expose myself to a lot more upside.